Abstract

This empirical study investigates the impacts on economic growth of reduced fiscal freedom from both the taxing and spending sides. After controlling for nominal long term interest rates, net exports, federal government budget deficits, and other factors, panel two stage least squares estimations using a 4-year panel data set for the OECD nations as a group reveals that reduced fiscal freedom leads to a reduced rate of economic growth; furthermore, it is found that reduced freedom from excessive government size also leads to a reduced rate of economic growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The 2012 budget proposed by United States President Barack Obama resembles that for 2011 in several respects. Total projected outlays of $3.73 trillion are proposed (roughly the same as in the 2011 proposed budget), with a projected federal budget deficit of $1.1 trillion. Moreover, in view of the December, 2010, passage of the Middle Class Tax Relief Act of 2010 (hereafter MCTRA) and the expressly temporary extension of the Bush-era tax cuts included in this legislation, the 2012 budget speaks repeatedly of future federal income tax increases (as well reduced tax deductions), especially for the rich, in the U.S. In other words, despite passage of the MCTRA (and perhaps because of the passage of the MCTRA), it remains noteworthy that imbedded in the Administration’s 2012 budget, and, implicitly, anticipated future budgets, are (a) increased federal government spending levels, (b) significantly increased taxation (through higher tax rates, more taxes, and reduced tax deductions and other means), and (c) accompanying continued high budget deficits.

The 2012 budget proposal, which was rejected by the U.S. Senate, retains many of the Bush tax cuts, but not for single taxpayers earning over $200,000 ($250,000 if married filing jointly) once the MCTRA has expired. Thus, the Obama administration has an agenda in which the proposed level of federal government outlays (nearly 27% of GDP) are reported to be accompanied by future personal marginal income tax increases (along with diminished tax deductions) that will begin as soon as 2013. Of course, the latter policy outcome will require reversal of many of the election losses the Democratic Party suffered in November of 2010.

In addition to the above, the health care/insurance bill, also known as The Patient Protection and Affordable Care Act (HR 3590), is projected to elevate taxes sufficiently to raise an additional $409.2 billion for the U.S. Treasury by 2019. Indeed, according to Kiplinger (2010, pp. 1–2), there are 13 federal tax changes integrated into this health care reform legislation, 10 of which constitute tax increases.

Within the context of the global economic and financial crisis, several distinct policy concerns of the OECD have surfaced. One of these concerns is reflected in the words of OECD Secretary-General Angel Gurria (OECD, 2009a, p. 1), who has stressed that “[w]e must ensure that today’s policies to manage the crisis not be the source of tomorrow’s problems…” The OECD has been working with its own members and, to a degree, with non-member governments and other organizations, to get economies back on the path of economic stabilization and expansion. Interestingly, as a central part of this effort, the OECD (2009a, p. 1; 2009b, p. 1) advocates the position that governments must be cautious not to jeopardize or sacrifice economic freedoms as they pursue policies to strengthen and revitalize their economies.

This study begins with the observation that, based on proposed government economic policies as summarized above for the U.S., what is referred to as fiscal freedom in the U.S. appears destined to decrease. Fiscal freedom (hereafter FF) is a measure of freedom from the tax burdens of government. Technically, as constructed by the Heritage Foundation (2009, p. 14), FF is an index that reflects freedom from government tax burden, both in terms of the income tax rate imposed on individuals’ incomes, and the overall amount of tax revenue as a percentage of a nation’s GDP. Thus, a higher tax burden reduces fiscal freedom. Furthermore, given (a) the record federal government outlays currently proposed for the U.S., (b) the high ratio of federal government spending-to-GDP in the U.S., (c) the impending emergence of the baby boomer generation, with its growing demands on the Social Security and Medicare systems, and (d) the passage of HR 3590, it is clear that the category of economic freedom referred to as freedom from excessive government size (hereafter GSF) will decrease as well in the U.S. This index of economic freedom (Heritage Foundation 2009, pp. 13–14) reflects the degree of freedom in an economy from the burden of excessive government size in terms of expenditures. Furthermore, to the extent that reductions in these two economic freedoms are accompanied by large federal budget deficits, reduced economic growth through crowding out is highly likely (Carlson and Spencer 1975; Cebula 1978; 1995; Guseh 1997).

Interestingly, sharp declines in the major equity markets across the U.S. and beyond during and following the U.S. debt crisis of the summer of 2011 may well have resulted from the internationally-held view that the U.S. government is becoming too large and unwieldy.Footnote 1 Part of the sharp decline in equity markets is also likely a result of somewhat gloomy economic news for the U.S. and Europe, along with impending deficit/debt crises in Italy and Spain. Although an apparent short-term solution to the European debt/default crisis in the form of willingness on the part of the European Central Bank (hereafter ECB) to purchase government bonds issued by the central government of Italy (and Spain) in exchange for certain structural changes in the pursuit of austerity (including consideration of a balanced budget amendment to the Italian Constitution, labor reforms, welfare reforms, and so forth), the budget deficit problem remains and will not disappear soon or easily.

Within this framework, this study empirically investigates the impact of federal government tax-induced decreases in fiscal freedom on economic growth. In addition, this study also investigates the impact on economic growth of increased federal government outlays that lead to diminished freedom due to excessive government size. Furthermore, the economic growth impact of federal budget deficits (expressed as a percent of GDP) is to be investigated. The background for the empirical framework is provided in the next section of this study. The empirical model and data are described in the section thereafter, and the empirical analysis, which is provided in the form of P2SLS (panel two stage least squares) estimates using recent data from the OECD nations, appears in the subsequent section. The conclusions are provided in the final section.

Background for the Analysis

During the past 15–20 years, numerous studies have expressly investigated the potential linkage between economic growth and economic freedom. Most of these studies conclude that there exists a strong, positive impact of economic freedom, especially a measure of overall economic freedom, on the rate of economic growth (Ali 1997; Ali and Crain 2001, 2002; Clark and Lawson 2008; Cole 2003; Dawson 1998, 2003; De Haan and Siermann 1998; De Haan and Sturm 2000; Gwartney et al. 2006; Hechelman and Stroup 2000).

One of the best known series for measuring economic freedom by nation is the composite measure of economic freedom developed by Gwartney and Lawson (2008). Caudill et al. (2000) show, however, that the concept of economic freedom is not one dimensional, and thus should not be used in composite forms. They argue that empirical studies should instead make use of the individual items or components in the various composite indices of economic freedom. Thus, this study adopts two of the components of economic freedom developed by the Heritage Foundation (2009) that are introduced above, namely, the indices of fiscal freedom and freedom from excessive government size.

This empirical portion of the study focuses principally on the relationship between economic growth on the one hand and fiscal freedom and freedom from excessive government size on the other hand. As observed above, the OECD has been working with its own members, as well as with non-member governments and other organizations, to restore economic stabilization and expansion, with a central part of this effort including the position that governments must be cautious not to reduce economic freedoms as they seek ways in which to strengthen and revitalize their economies. Indeed, nations are strongly encouraged to continue to support and promote economic freedom while implementing domestic economic policies. Clearly, the concern of the OECD (2009a, p.1; 2009b, p.1) in this context is that a reduction in economic freedoms will result in diminished economic growth over time.

The Empirical Model

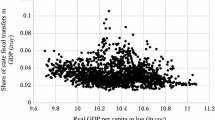

The focus on economic growth in OECD nations for the years 2004 through 2007 reflects the fact that the above concerns were expressed by the OECD per se and also were very recently conveyed in 2009. Given that the OECD is expressly concerned with achieving economic growth without compromising economic freedom, the framework for the study consists solely of the nations that comprise the OECD. Following conventional procedures that deal with growth rates among different nations, this study measures economic growth as the percentage change in a country’s purchasing-power-parity adjusted per-capita real GDP. This variable is referred to here as PCHRPCY. The value of PCHRPCY is made comparable across nations by PPP (purchasing-power-parity) adjustments. In turn, following a number of studies that focus on economic growth (Tortensson 1994; Cebula 1978, 1995; Goldsmith 1995; Ali 1997; Dawson 1998, 2003; Cole 2003; Gwartney et al. 2006), it is hypothesized in our eclectic model that economic growth depends upon (a) economic freedom (FREEDOM) as well as (b) purely economic factors (ECON), such that:

where PCHRPCYjt is the percent change in the purchasing-power-parity adjusted per capita real GDP in OECD nation j in year t, FREEDOMjt refers to the values of economic freedom measures (indices) in nation j in year t, and ECONjt refers to the values of economic factors in nation j in year t.

The Heritage Foundation (2009) has developed 10 measures of economic freedom, two of which are especially relevant to the present analysis. The first is fiscal freedom, or FF (Heritage Foundation 2009, p. 13), wherein the higher the FF index, the greater the freedom from government on the tax/revenue side. Fiscal freedom reflects the freedom of individuals and firms to keep and control their income and wealth for their own use and benefit. A government can impose fiscal burdens on economic activities by generating revenues for itself—primarily through taxation (but also from debt that in theory must ultimately be paid off, and that in fact must also be serviced in order to avoid financial crises). Fiscal freedom, then, is a measure of freedom from the burden of government from the revenue side. Technically, FF includes freedom from the tax burden, both in terms of personal income tax rates and in terms of the overall amount of collected tax revenues as a percentage of a nation’s GDP. The underlying idea is that higher tax rates and tax burdens interfere with the ability of individuals and businesses to pursue their goals in the marketplace, and, at least to some degree, reduce the incentive to work, save, and/or invest.

The second economic freedom index from the Heritage Foundation (2009) stressed in this study is freedom from excessive government size, or simply government size freedom, GSF (Heritage Foundation 2009, pp. 13–14). This index of economic freedom reflects the degree of freedom in an economy from the burden of excessive government expenditures. Alternatively stated, it reflects the degree of freedom from excessive government on the expenditure side. Government outlays necessarily compete with private agents and interfere with natural market processes and prices by over-stimulating demand, potentially diverting resources through a crowding out effect (Carlson and Spencer 1975; Cebula 1978, 1995; Guseh 1997). The higher the GSF index, the greater the freedom from excessive government size on the expenditure side.

The Heritage Foundation (2009, p. 15) weights each economic freedom measure equally so as to prevent bias toward any given freedom or policy. Each of the economic freedoms is graded using a scale ranging from 0 to 100, with 100 being the maximum freedom. The higher the numerical value of any one of these economic freedom indices, the greater the degree of that corresponding economic freedom. An index score of 100 indicates an economic environment or set of public policies that is the most conducive to and compatible with economic freedom. Paralleling the related literature to date, it is hypothesized (ceteris paribus) that per capita real economic growth is an increasing function of each of the economic freedom measures considered here.

Following the previous literature, the eclectic model employed herein controls for purely economic determinants of growth by adopting three separate economic variables: (a) net exports, expressed as a percent of GDP, NETXY; (b) the federal budget deficit as a percent of GDP, DEFY; and (c) the percentage nominal long term interest rate, INTRATE. Conventional wisdom suggests that a higher NETXY implies a higher rate of growth of real domestic production, ceteris paribus (Ogbokor 2005; Arora, and Vamvakidis 2006; Contessi 2008; Chen 2009; Dube 2009). Furthermore, the higher the level of DEFY, the greater the degree of crowding out, and the slower the economic growth rate (Carlson and Spencer 1975; Cebula 1978, 1995; Guseh 1997; Dawson 1998), ceteris paribus. In addition, a higher INTRATE, which has numerous systematic causes, including inflation, international capital flows, and monetary policy (Cebula 1998), reduces investment in new plant and equipment and purchases of new housing and other durables, thereby resulting in less economic growth, ceteris paribus (Cebula 1978, 1995; Dawson 1998; Ogbokor 2005; Gwartney et al. 2006; Arora and Vamvakidis 2006; Contessi 2008; Chen 2009; Dube 2009).

One possible concern with the model developed here thus far is whether the presence of the G8 nations in the study dataset might somehow bias the results. To account for this, a binary (dummy) variable, G8DUMMY, is introduced into the model. The variable G8DUMMY is equal to one for each nation G8 nation observation, and zero otherwise. Ceteris paribus, it is expected that the coefficient on this variable is positive, as a reflection of the infrastructure, educational, technological, and other advantages enjoyed by G8 nations vis-à-vis other OECD nations.

Finally, as a safeguard against potential omitted variable bias, the model is amended to include the variable PROPRITF. The variable PROPRITF is an index, also ranging from 0 to 100, measuring the degree to which the property rights of a nation’s citizenry are protected. The capacity to accumulate private property and wealth is arguably one of the primary motivating forces in a market economy (Tortensson 1994). Secure property rights provide both citizens and firms the confidence and ability to undertake commercial activities, take risks, save the rewards of their efforts, and both to formulate and execute long-term planning because of the knowledge that their income, savings, and property accumulation are safe from expropriation by government or other economic agents, as well as from outright theft (Heritage Foundation 2009, pp. 14–15). Presumably, the greater the degree of property rights freedom, the greater the extent of free-market activities, and the greater the pace of real economic growth, ceteris paribus.

Empirical Analysis: Panel Two Stage Least Squares (P2SLS) Estimations

Substituting FF, GSF, and PROPRITF for FREEDOM, and substituting NETXY, DEFY, and INTRATE for ECON in eq. 1, and including the G8DUMMY, yields:

where it is hypothesized that:

Given the variables identified in eqs. 1–3, the following initial equation is to be estimated by P2SLS:

where:

- PCHRPCYjt:

-

the percentage growth rate of the purchasing-power-parity adjusted real per capita GDP in nation j in year t

- a 0 :

-

constant

- FFjt:

-

the value of the fiscal freedom index in nation j in year t

- GSFjt:

-

the value of the freedom from excessive government size index in nation j in year t

- PROPRITFjt:

-

the value of the property rights freedom index in nation j in year t

- NETXYjt:

-

the ratio of net exports to the GDP in nation j in year t, expressed as a percent

- DEFYjt:

-

the ratio of the central/federal government budget deficit to the GDP in nation j in year t, expressed as a percent

- INTRATEjt:

-

the nominal average long term interest rate in nation j in year t, expressed as a percent per annum

- G8DUMMY:

-

the binary variable for a G8 nation, as described above

- u:

-

stochastic error term

and where t = 2004, 2005, 2006, 2007 and j = 1,…,29

Data were available across the study period for 29 of the 30 OECD members; only Iceland had an incomplete dataset, and therefore is excluded from the analysis. In each of the estimates, n = 116 (29 nations, a 4-year panel). The data sources for the variables in the analysis are as follows: PCHRPCY: IMF (2008, Table 1); the freedom indices, FF, GSF, and PROPRITF: Heritage Foundation (2009, pp. 13–15); and the explanatory economic variables, NETXY, DEFY, and INTRATE: OECD (2010, Table 1).

The dependent variable reflecting real economic growth per capita, PCHRPCYjt, is treated as contemporaneous with the nominal long term interest rate, INTRATE, as well as DEFY and NETXY. Thus, the possibility of simultaneity bias arises. Accordingly, within the context of a random effects model, the system is estimated by P2SLS (Kennedy 2003) The instruments include the lagged values of the unemployment rate, the interest rate on long-term central government debt, and net capital inflows (OECD 2010, Table 2). The instruments were chosen because they were found to be highly correlated with INTRATE, DEFY, and NETXY, respectively, while not being correlated with the error terms in the system.

The P2SLS estimate of eq. 4 is provided in column (a) of Table 1. In this model, all seven of the estimated coefficients exhibit the expected signs, with four explanatory variables statistically significant at the 1% level, and two statistically significant at beyond the 5% level. Furthermore, the F-statistic of 23.47 is statistically significant at far beyond the 1% level, attesting to the overall strength of the model.

Based on these initial P2SLS results, the per capita real economic growth rate in OECD nations over the 2004 through 2007 study period is an increasing function of both of the primary forms of economic freedom included in the model. The estimated coefficient on FFjt is positive and statistically significant at the 2.5% level, whereas the estimated coefficient on GSFjt is positive and statistically significant at the one percent level. Thus, an increase in either fiscal freedom or freedom from the burden of excessive government size on the expenditure side results in an increased growth rate of per capita real GDP. Of course, these findings also imply that reduced levels of FF and/or GSF lead to decreased per capita real economic growth rate. In principle, these two outcomes might be expected in light of previous studies (Ali 1997; Ali and Crain 2001, 2002; Dawson 1998; De Haan and Siermann 1998; De Haan and Sturm 2000; Gwartney et al. 2006; Gwartney and Lawson 2008; Hechelman and Stroup 2000), although the latter use different (i.e., much more aggregated) economic freedom measures. Furthermore, in this initial estimate, economic growth is shown at the 1% statistical significance level to be an increasing function of property rights freedom and being a G8 nation. In addition, economic growth is shown to be a decreasing function of the government budget deficit as a percent of GDP (at the 1% statistical significance level) and the nominal long term interest rate (at the 3% statistical significance level). The latter two results are consistent with Carlson and Spencer (1975), Cebula (1995), Ogbokor (2005), Arora and Vamvakidis (2006), Contessi (2008), Chen (2009), and Dube (2009), among others.

As a test of robustness, re-estimating the model by P2SLS with the statistically insignificant NETXY variable excluded yields the results in column (b) of Table 1. As shown in column (b), all six of the estimated coefficients exhibit the expected signs, with four statistically significant at the 1% level and two statistically significant at the 5% level. The F-statistic of 25.75 is statistically significant at far beyond the 1% level, attesting to the overall strength of the model. The findings in column (b) indicate that the per capita real GDP growth rate once again is positively impacted both by fiscal freedom and freedom from excessive government size, with the estimated coefficient on FF positive and statistically significant at the 3% level, and the estimated coefficient on GSF positive and statistically significant at the 1% level. These findings, like their counterparts in column (a), are consistent in spirit with nearly all of the existing literature on the relationship between economic growth and general/aggregate economic freedom (Ali 1997; Ali and Crain 2001, 2002; Dawson 1998; De Haan and Siermann 1998; De Haan and Sturm 2000; Hechelman and Stroup 2000; Ogbokor 2005; Arora and Vamvakidis 2006; Contessi 2008; Chen 2009; Dube 2009). Finally, the per capita real GDP growth rate again is also shown to be positively impacted by the property rights variable, and negatively impacted by both the government budget deficit (DEFY) and nominal long term interest rate (INTRATE) variables. The estimated coefficient on the G8DUMMY variable is positive and statistically significant at the 1% level, attesting to the higher real economic growth rate experienced by G8 versus non-G8 nations.

As yet further evidence of the strength of the above conclusions, the reader is directed to the models in columns (c) and (d) of Table 1, which serve as tests of robustness of the basic conclusions stressed above. In these P2SLS estimates, the trade freedom index is included. The trade freedom index (TRADEF) is a composite measure of the absence of tariff and non-tariff barriers to imports and exports of goods and services (Heritage Foundation 2009, p. 16). As expected, in addition to confirming results in columns (a) and b) of Table 1, the P2SLS findings in columns (c) and (d) demonstrate that an increase in trade freedom also elevates economic growth.

Finally, although the exact mechanisms for interaction are not easily identifiable (Heritage Foundation 2009, pp. 11–12), economic freedoms can interact. Thus, the correlation matrix among the explanatory variables in the basic model is provided in Table 2. Among all of the correlation coefficients, that between FF and GSF is perhaps most pertinent. In this case, r = 0.709, implying that the fiscal freedom (FF) and freedom from excessive government size (GSF) indices developed by the Heritage Foundation (2009) are rather highly correlated, a result consistent with the observation above. Nevertheless, the size of this correlation coefficient is not of great concern because the P2SLS estimates on both FF and GSF are statistically significant. This result confirms the conclusions provided in Caudill et al. (2000) regarding the absence of multicollinearity issues in regressions using subcomponents of economic freedom indices.

Overview and Conclusion

As a central part of its economic and policy efforts in the recent economic climate, the OECD (2009a, b) strongly takes the position that governments must be very cautious not to jeopardize economic freedom as they seek ways in which to strengthen and revitalize their economies. A major concern in this context is that the abandonment of economic freedoms will ultimately result over time in diminished real economic growth. The econometric estimations provided in this study constitute strong empirical support for this perspective. In particular, the P2SLS findings strongly imply that pursuing a set of policies that promotes, or is at least consistent with, greater fiscal freedom (FF) and greater freedom from excessive government size (GSF) is fundamentally compatible with propelling the economies of the OECD (including that of the U.S.) down the road to a full and sustainable economic recovery. An interesting additional finding in this study is that governments must be wary of policies that generate large, persistent budget deficits, as well as undertaking other policies that lead to higher long term nominal interest rates. The results obtained in this study provide clear evidence that such policies would exercise deleterious impacts on real economic growth.

Prospective tax and spending policies in the U.S. appear poised to reduce fiscal freedom and freedom from excessive government size. The results of the present study suggest that such policies, along with the huge federal budget deficits and higher interest rates that are being forecasted for the U.S. in coming years, will decrease the rate of per capita real GDP growth in the U.S. Clearly, the latter will compromise U.S. living standards. Interestingly, Cebula and Coombs (2009) indicate that federal tax collections could even be jeopardized by such policies because they might encourage increased income tax evasion.

Notes

The deficit/national debt problem in the U.S. became so bad during the summer of 2011 that Standard & Poor’s downgraded U.S. Treasury debt from AAA to AA + with a negative outlook; this negative outlook carries with it the prospect of a further downgrade in the future, possibly to AA, absent substantive progress at controlling deficits in the U.S.

References

Ali, A. (1997). Economic freedom, democracy and growth. Journal of Private Enterprise, 13(1), 1–20.

Ali, A., & Crain, W. M. (2001). Political regimes, economic freedom, institutions and growth. Journal of Public Finance and Public Choice, 19(1), 3–22.

Ali, A., & Crain, W. M. (2002). Institutional distortions, economic freedom and growth. Cato Journal, 21(3), 415–426.

Arora, V., & Vamvakidis, G. (2006). The impact of U.S. economic growth on the rest of the world: how much does it matter? Journal of Economic Integration, 21(1), 21–39.

Carlson, K. M., & Spencer, R. W. (1975). Crowding out and its critics. Federal Reserve Bank of St. Louis Review, 60(12), 1–19.

Caudill, S. B., Zanella, F. C., & Mixon, F. G., Jr. (2000). Is economic freedom one dimensional? A factor analysis of some common measures of economic freedom. Journal of Economic Development, 25(1), 17–40.

Cebula, R. J. (1978). An empirical analysis of the crowding out of fiscal policy in the United States and Canada. Kyklos, 31(3), 424–436.

Cebula, R. J. (1995). The impact of federal government budget deficits on economic growth in the U.S.: an empirical investigation, 1955–1992. International Review of Economics and Finance, 4(3), 245–252.

Cebula, R. J. (1998). The relative efficiency of alternative expected inflation measures in predicting long term nominal interest rates in the United States. Review of Financial Economics, 7(1), 55–64.

Cebula, R. J., & Coombs, C. (2009). Do government-spending induced federal budget deficits ‘crowd out’ tax compliance in the U.S.? Tax Notes, 125(9), 1007–1012.

Chen, H. (2009). A literature review on the relationship between foreign trade and economic growth. International Journal of Economics and Finance, 1(1), 127–139.

Clark, J. R., & Lawson, R. A. (2008). The impact of economic growth, tax policy, and economic freedom on income inequality. Journal of Private Enterprise, 24(1), 23–31.

Cole, J. H. (2003). The contribution of economic freedom to world economic growth, 1980–99. Cato Journal, 23(2), 189–198.

Contessi, S. (2008). Net exports’ recent (and surprising) contribution to GDP growth. Federal Reserve Bank of St. Louis Review, 93(11), 1.

Dawson, J. W. (1998). Institutions, investment, and growth: new cross-country and panel data evidence. Economic Inquiry, 36(4), 603–619.

Dawson, J. W. (2003). Causality in the freedom-growth relationship. European Journal of Political Economy, 19(3), 479–495.

De Haan, J., & Siermann, C. L. J. (1998). Further evidence on the relationship between economic freedom and economic growth. Public Choice, 95(3–4), 363–380.

De Haan, J., & Sturm, J. (2000). On the relationship between economic freedom and economic growth. European Journal of Political Economy, 16(2), 215–241.

Dube, S. (2009). Foreign direct investment and electricity consumption on economic growth: evidence from South Africa. International Economics, 62(2), 175–201.

Goldsmith, A. A. (1995). Democracy, property rights and economic growth. Journal of Development Studies, 32(2), 157–174.

Guseh, J. S. (1997). Government size and growth in developing countries: a political-economy framework. Journal of Macroeconomics, 19(1), 175–192.

Gwartney, J., & Lawson, R. A. (2008). Economic freedom of the world: 2008 Annual Report. Available from: http://freetheworld.com/. [Accessed March 2, 2009].

Gwartney, J., Holcombe, R., & Lawson, R. A. (2006). Institutions and the impact of investment on growth. Kyklos, 59(2), 255–276.

Hechelman, J. C., & Stroup, M. D. (2000). Which economic freedoms contribute to economic growth? Kyklos, 53(4), 527–544.

Heritage Foundation. (2009). Economic freedom indices. Available from: http://www.heritage.org/Index/Explore.aspx. [Accessed March 24, 2010].

International Monetary Fund. (2008). Economic growth data. Available from: http://www.imf.org/external/pubs/ft/weo/2008/02/weodata/weoselser.aspx?c=512%. [Accessed February 2, 2009].

Kennedy, P. (2003). A guide to econometrics (5th ed.). Cambridge: M.I.T. Press.

Kiplinger. (2010). Health care reform: 13 tax changes on the way. Available from: http://www.Kiplinger.com/businessresource/forecast/achive/health-care-reform-tax-hikes-on-the-way.html. [Accessed August 31, 2010].

Newey, W. K., & West, K. D. (1987). A simple positive semi-definite heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica, 55(4), 703–708.

O.E.C.D. (2009a). The crisis and beyond. Available from: http://www.oecd.org/document/57/0,3443,en_21571361_41723666_42942201_1_1_1_1,00.html. [Accessed December 20, 2009].

OECD. (2009b). For a better world economy. Available from: http://www.oecd.org/document/24/0,3343,en_2649_34487_41707672_1_1_1_1,00.html. [Accessed December 20, 2009].

OECD. (2010). Labor: labor force statistics. Available from: http://www.oecd.org/document/13/0,3343,en_2649_33733_44938317_1_1_1_1,00.html. [Accessed March 15, 2010].

Ogbokor, C. A. (2005). Time-series evidence for the export-led paradigm: a case study of Zimbabwe. Journal of Social Sciences, 1(2), 77–80.

Tortensson, J. (1994). Property rights and economic growth: an empirical study. Kyklos, 47(2), 231–247.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Cebula, R.J., Mixon, F.G. The Impact of Fiscal and Other Economic Freedoms on Economic Growth: An Empirical Analysis. Int Adv Econ Res 18, 139–149 (2012). https://doi.org/10.1007/s11294-012-9348-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-012-9348-1