Abstract

Lithium-ion batteries (LIBs) pose a significant threat to the environment due to hazardous heavy metals in large percentages. That is why a great deal of attention has been paid to recycling of LIBs to protect the environment and conserve the resources. India is the world's second-most populated country, with 1.37 billion inhabitants in 2019, and is anticipated to grow by 273 million people by 2050, according to the United Nations. The biggest obstacles for India's sustainable development will be reducing \({CO}_{2}\) emissions and satisfying the energy requirements of such densely populated country. The electric vehicle (EV) and renewable energy sectors have benefited as a result of this. Indian government wants to achieve 100 percent electric transportation by 2030, and the country's EV battery market is estimated to expand by $300 billion between 2017 and 2030. Batteries, on the other hand, are linked to a slew of difficulties, including their disposal as municipal solid hazardous waste at the end of their useful lives. Waste batteries, when properly utilised, can create several beneficial economic opportunities as well as jobs. This paper highlights India's lithium-ion battery market current scenario, potential, opportunities and various challenges associated with recycling procedures. The study of foreign market regulatory structures on recycling and management of lithium-ion battery waste is also being done, and few regulatory guidelines are being suggested that would improve the Indian battery recycling industry.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Lithium-ion batteries (LIBs) are energy storage systems for converting energy from chemical to electrical form [1]. There are two electrodes in each battery cell namely cathode and an anode. A separator layer consisting of an electrolyte allows electrons or ions to move in between the two electrodes. There are two kinds of batteries i.e. primary and secondary. Primary batteries are also termed as non-rechargeable batteries suitable for single-use purpose. Lithium-ion batteries belong to the category of chargeable and rechargeable secondary batteries. Demand for lithium-ion batteries has gained significant momentum over the past few years across several sectors, including portable devices and electric vehicles (EVs) [2]. The demand accreditation is due to various advantages associated with these batteries in comparison to the other battery types. Some of the advantages are ability of lithium ion batteries to tolerate a large number of regeneration cycles and temperatures; high energy efficiency that can be used for a longer duration for powering electronic devices; favourably discharge resistance; high voltage per cell ratio; the environmental impact is relatively low as compared to lead-acid batteries. Lithium batteries were commonly used in mobile computing applications, and later as energy storage systems in EVs and renewable resources, such as solar and wind [3]. The success of lithium-ion batteries in renewable energy applications will depend mostly on various factors such as safety, cost, cycle life, energy, and power, which are further dependent on the component materials used in the batteries. LIBs are well-thought-out as the battery of choice for driving the next generation of hybrid electric vehicles as well as plug-in hybrids, given that efficiency, cost, and safety improvements can be achieved [4, 5]. India's demand for LIBs is estimated to rise considerably in subsequent five years [6]. Two of India's major ingenuities to boost the market are the National Electric Mobility Mission Project 2020, with an estimate of bringing approximately 7 million EVs on Indian streets by the year 2020 and achieving a clean energy aim of 175 GW by the year 2022 [7]. Indian government wants to achieve 100 percent electric transportation by 2030, and the country's EV battery market is estimated to expand by $300 billion between 2017 and 2030. Recycling industry growth in India is anticipated to be approximately 23 GWh in 2030 representing a $1 billion opportunity.

This paper presents a draft estimate of India's yearly lithium-ion battery demand to surge from 2.9 GWh in 2018 to 132 GWh in 2030 at 37.5% Compound annual growth rate. This scenario would, in turn, increase the volume of ‘spent’ batteries in the environment and can turn into severe health and environmental hazard if left untreated [8]. The best means of handling these untreated batteries efficiently is by utilising various mechanical and metallurgical methods to extract natural ores and metals that can be reused to generate more batteries [9]. As most of the natural metal reserves are located outside India, the manufacturers of Indian batteries are heavily reliant on imports. Recycling of spent batteries is the sole solution to reduce this dependence [10]. This reliance on imports is the prime reasons that India is still not a battery manufacturer and there is urgent need to invest in large-scale recycling set-up to reduce dependence on imports and for sustainable battery production. The only obstacle in achieving India's ambitious electric mobility target for the EVs is the high cost associated with them, out of which, about 40–50 percent, is only contributed by the batteries. Indian government should adopt suitable policy measures for sustainable and certified ways to recycle the used lithium-ion batteries constituent materials. Indian government in order to safeguard this, announced in October 2019, a recycling policy for LIBs. The policy is in the drafting phase and levies accountability upon manufacturers to gather consumed batteries under included in Extended Producer Responsibility (EPR) standards. Martinez et al. 2019 [11] discussed the current practices and popular recycling techniques for LIBs. Wang et al. 2014 [12] analysed the profitability of recycling facilities and also discussed the commodity market prices of the materials recovered from recycling batteries. In addition this study also gives an insight on end-of-life battery management and relevant policymaking for spent LIBs. King et al. 2019 [13] covered the current and future scope of the LIB recycling industry in Australia. Steward et al. 2019 [14] discussed the current and future recycling methods for consumed LIBs. Also, insights and directions for future applications on the basis of supply chain are presented in this paper. Further this study provides the techno-economic analyses of LIBs.

1.1 Motivation and Scope

Most of the studies are focused on the description of recycling processes and also not covering the important aspects linked with recycling of lithium ion batteries in context to Indian market scenario such as the current state of Indian industry, potential, opportunities and challenges associated with recycling. The aim of this work is to provide analysis of recycling technologies from an economical perspective This paper thus highlights all the above mentioned aspects clearly highlighting the India's lithium-ion battery industry's current state, recycling potential, and the linked opportunities and challenges with that. It also focuses on the recycling processes that have been adopted worldwide, along with the recycling applications and benefits. Last but not least, the paper examines the international market regulatory mechanisms for recycling and handling lithium-ion battery waste and recommends a few policy recommendations to the Indian government that would improve the battery recycling industry.

The paper is organized as follows: Sect. 2 describes the essential metals, costs of critical raw materials used in LIBs and also covers different types, specifications, uses and performance metrics for LIBs. Lithium-ion market size globally and in India is covered in Sect. 2; in Sect. 3, the need for recycling and different applications of LIBs are presented. Solutions for reuse and recycling LIBs namely closed loop recycling and second life use are discussed in detail in Sect. 4. Section 5 describes the different recycling challenges associated with closed loop recycling. Section 6 discusses in detail the battery recycling market opportunities in India. Section 7 presents International regulations for disposing of lithium-ion batteries in different countries like Europe, the United States of America, China, Japan, and India. Section 8 gives opinion based policy recommendations for recycling LIBs. Lastly, conclusion is given in Sect. 9.

2 Critical Metals used in Lithium-Ion Batteries

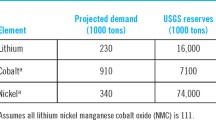

LIBs mainly comprise of 5 principal metals namely cobalt, iron, aluminium, copper, and lithium [15]. Figure 1 depicts the general structure of a lithium-ion battery pack. Usually, the anode comprises of copper foil enclosed with a fine coat of carbon, whereas the cathode includes metals such as cobalt, aluminium, and lithium. Nickel and cobalt are rare metals with minimal availability across the world. Table 1 displays the main characteristics of metals/materials used in lithium-ion batteries. These five primary metals usually reflect 50–60 percent of lithium-ion battery costs [16]. Thus, any variation in the cost of these metals will significantly affect the batteries' total cost. This price variance depends on various economic parameters and are covered in subsequent section.

2.1 Price Trends of Critical Raw Materials

The prices of critical metals that constitute lithium-ion batteries have fluctuated over the last ten years, due to increasing demand and the anticipated boom in the EV market. As is evident from Fig. 2, of all metals, cobalt is the most expensive. Since 2012, there is a rise of 3–4 percent in cobalt demand annually. In December 2017, the electric vehicle industry's anticipated boom led to the cobalt price peaking at $79,000 per tonne on the commodity market. This increase was short-lived, and since then, prices saw a sharp decline of more than 30 percent due to surplus supply and a lower than anticipated demand for EVs. Nickel and lithium, too, saw a considerable fluctuation in prices. Nickel prices peaked at about $19,000 per tonne in 2012 but later saw a dramatic decline. There has been a steady rise in nickel prices since 2016 and stood at $16,000 per tonne in July 2021. Whereas, Lithium prices surged considerably from $7,000 per tonne to $17,000 per tonne from 2012 to 2021. Aluminium has demonstrated average price stability in the last ten years within $1,700–2,300 per tonne. This cost variance contributes to the creation of specific lithium-ion battery chemistries to reduce the cost by decreasing the cobalt share and finding the best combination of comparable benefits. The next subsection describes the different lithium-ion battery types based on the different metal combinations and their global adoption share.

2.2 Classification of LIBs

LIB is a general name for dry lithium, nickel, cobalt, copper, and aluminium batteries. Table 2 offers descriptions of various lithium batteries, and these batteries vary in percentage compositions of different metals. Thus, the various types of commercial batteries offer capacity, protection, lifespan, cost, and efficiency. Lithium Cobalt Oxide (LCO), and Lithium Nickel Manganese Cobalt Oxide (NMC) are the most common types of LIBs currently in use. LCO accounts for 37 percent market share (highest in the market), primarily due to its applications in portable devices, namely, cameras, cellular phones, laptops. With a market share of 29 percent, Nickel Manganese Cobalt is ranked second highest primarily due to its usage in EVs and medical devices. The most commonly used batteries in India are NMC with an average life of two to three years and LFP with five to seven year lifespan [6]. NMC batteries have gained momentum in the last 3–4 years, primarily in Electric vehicles, street lights, and storage applications. LFP batteries, however, have now begun to gain more popularity in India. Scientists are currently exploring NMC batteries 8:1:1 chemistry ratio to reduce the battery costs by decreasing the share of cobalt in the battery mix. As is evident from Fig. 3, recycling may play a significant part as the cobalt quantity recovered from NMC battery in the chemistry ratio of 1:1:1 can energize three NMC batteries with a chemistry ratio of 8:1:1 in the coming years.

2.3 Battery Parameters

Some battery parameters that are used to characterise batteries are discussed in this section.

-

(1)

Voltage The minimal voltage at which the battery is supposed to function is the battery's voltage rating. The nominal voltage may not be the same as the actual voltage. This is mostly determined by the battery's State of Charge (SoC) and temperature.

-

(2)

Capacity In context of batteries the term capacity denotes the quantity of charge that a battery can supply at its rated voltage. The amount of electrode material in the battery has a direct relationship with the capacity. \({C}_{bat}\) refers to capacity measurement in ampere-hours (Ah). A battery's energy capacity is easily calculated by multiplying the rated battery voltage in volts by the battery capacity in Amp-hours.

$$E_{bat} = C_{bat} V$$(1) -

(3)

C-rate

C-rate is measurement of the battery's discharge rate in relation to its capacity. It's defined as the current multiplied by the discharge current the battery can sustain for an hour.

-

(4)

Battery efficiency

Battery round trip efficiency is defined as the ratio of the total storage output to the total storage input,

$$\eta_{bat} = \frac{Eout}{{Ein}}$$(2)

The round-trip efficiency of batteries consists of two efficiencies namely the voltaic efficiency and the columbic efficiency. The first one is the ratio of the average discharging voltage to the average charging voltage whereas columbic is the ratio of capacity discharged over capacity charged.

The battery efficiency is the product of voltaic and columbic efficiencies,

3 State of Charge and Depth of Discharge

The State of Charge (SoC), is another significant battery metric and is the proportion of the battery capacity accessible for discharge,

Another key indicator is the Depth of Discharge (DoD), which is referred to as the proportion of the battery capacity that has been discharged.

The fraction of power that can be extracted from a battery is determined by its Depth of Discharge. For example, if the manufacturer specifies a battery's DoD as 25%, the load will only be able to consume 25% of the battery's capacity. The DoD is the percentage of the battery's capacity that can be utilised, as indicated by the manufacturer.

3.1 Market size of Lithium-Ion Battery

3.1.1 Market Size of Lithium-Ion Battery Globally

Bloomberg New Energy Finance (BNEF) projected the LIB market growth to rise ten times from approximately 180 GWh in the year 2018 to 2000 GWh in 2030 globally, as shown in Fig. 4. By 2030, EVs alone will hold about 85 percent of the lithium-ion battery market. Battery costs alone account for 50 percent of the electric vehicle cost. Thus, the battery demand will also expand with growth in EVs. Main reasons accounting to this demand are the declining prices of battery and global demand boom in EV segment. This boom at a global level will also impact the Indian lithium-ion battery market scenario in the coming decade.

3.1.2 Lithium-Ion Battery Market Growth in India

Our paper forecasts that India's annual lithium-ion battery demand will increase by 37.5 percent at a CAGR to hit 132 GWh in 2030, as shown in Fig. 5. The projected growth in the lithium-ion battery's total market share is approximately 2.9 GWh to about 800 GWh from the year 2018–2030. Roughly 65 percent of lithium batteries are primarily utilized in the telecom industry and data centres, whereas the outstanding 35 percent demand is occupied by EVs. By the year 2030, on the pretext of government pushing towards electric mobility, electric vehicles' share is expected to be about 80 percent.

Figure 6 is depicting the price variation of Lithium ion battery pack over the last ten years and it has shown a considerable drop in the price of lithium ion battery pack.

Hypotheses for estimating market size:

-

1.

Other storage applications refer to data centres, consumer electronics, and telecom sites.

-

2.

For EV's, capacity for 2, 3 and 4 wheelers is 2 kWh, 5 kWh, 15 kWh and 250 kWh for electric buses.

-

3.

Electric vehicle sales are expected to see a rise of 0.2–128.5 million from the year 2018–2030, with a CAGR of 71 percent.

Some of the Indian government's significant initiatives planned to boost India's lithium-ion battery industry's growth are:

-

Electric Mobility Mission Plan 2020, forecasting 6–7 million EVs in India by 2020;

-

One hundred seventy-five gigawatts of renewable energy capacity addition by 2022 and the long-term goal of 450 GW by 2030.

Also, over and above these initiatives, the Indian government has approved National Mission on Transformative Mobility and Battery Storage in March 2019 to set up integrated batteries and manufacturing plants in India on a large scale by 2024. The main motive is to improve lithium batteries' domestic production, as the Indian electric vehicle industry depends totally on imported batteries from China [17,18,19]. The government of India in July 2018 directed Hindustan Copper (HCL), National Aluminium Company (NALCO), and Mineral Exploration Corporation Limited (MECL), the three state-owned mineral companies for exploring and acquiring the mineral resources overseas to ensure strategic access to lithium and cobalt.

Some of the other announcements are:

-

Panasonic Corporation is considering possibilities to set up the module's assembly plant for lithium batteries in India.

-

Amara Raja Batteries Ltd and Exide Industries Ltd are in the process of jointly venturing battery assembling with overseas companies.

-

Indian Oil Corporation Ltd. announced a partnership with an overseas start-up to establish a 1-gigawatt manufacturing plant.

-

LG Chemical Limited of South Korea and Toshiba of Japan have also formed partnerships with Mahindra and Mahindra (M&M) Limited to assemble battery packs.

Looking at the strategic investment scales to start battery manufacturing in India, it is sure that the products running on these batteries would become more reasonably priced. This scale of development will also give rise to questions regarding safe disposal and recycling of spent batteries. The subsequent section reflects these issues and suggests an action plan to protect the environment from heaps of spent batteries.

4 Recycling Need and its Industrial Applications

The battery manufacturers are methodically planning to set up huge plants for manufacturing reasonably priced batteries considering the limited life and safe disposing methods once they are spent. Usually, it takes around 500–10,000 cycles for a lithium-ion battery to charge and discharge depending on specific parameters such as the purpose, size of battery, and chemistry. Hence application area of a lithium-ion battery will decide the pace at which batteries reach end-of-life. So far, the batteries that have reached the end of life are the ones with vast applications in laptops and tablets, telecom, satellites, aviation, cell phones, automotive, railway, UPS and switchgear and controls [20]. Lithium batteries also has applications in critical devices such as pacemakers and other implantable electronic medical devices. Besides these, a large amount of lithium-ion battery scrap is piling up at the telecommunication sites. Furthermore, with the whole world’s attention is now shifting towards Electric vehicles utilizing lithium-ion batteries, the demand for these batteries is thus expected to increase enormously. Materials recovered from recycling LIBs will become economically profitable in time if production of these batteries increases as projected. Lithium products, Cobalt, Manganese and Nickel recovered at scale will have larger concentrations of the element than native ores. Recycling lithium ion phosphate is projected to play a significantly important role in electric vehicles and in energy storage applications in the near future, as it is currently the only product that offers a financial incentive for recycling. As a result, technologies based on directly recycled materials, such as lithium ion phosphate, should be encouraged. Finally, the short-term battery life would simultaneously increase the number of spent batteries requiring an efficient recycling process. The main factors responsible for driving recycling of lithium batteries are discussed below:

4.1 Shortage of Metals and Other Resources

According to Bloomberg New Energy Finance (BNEF), it is projected that consumption of metals utilized in lithium-ion batteries such as lithium, copper, and cobalt will increase globally by the year 2030, as shown in Fig. 7. The raw materials stocks and supplies are primarily based outside India. Therefore, lithium-ion batteries' recycling is essential to lessen reliance on imports of critical metals and avert environmental and health hazards.

Also, the varying political relationships with countries that own natural reserves of these primary metals and fluctuating raw material prices on global markets may affect India's battery prices. Considering that LIBs currently account for approximately 40–50 percent of the cost of EV, a rise in battery costs could raise the already high cost of electric vehicles and hinder the selling of EVs.

4.2 Environmental Hazards

Disposal of heavy metals used in lithium-ion batteries such as nickel, copper, and organic chemicals with municipal waste can lead to soil and water pollution and can negatively affect the environment. Moreover, toxic gases are released due to incinerating lithium-ion batteries, thereby causing air pollution.

4.3 Health Hazards

A tremendous amount of careful handling is required for lithium-ion batteries due to several health risks to human beings. Lithium can easily be absorbed in edible plants leading to various reproductive, genetic, and gastrointestinal problems, thereby entering the food chain.

4.4 Reduction of Green House Gases emission

The battery raw materials are obtained from selected terrestrial locations, and their transportation to various parts of the world for lithium-ion batteries manufacturing can raise their carbon footprint, leading to greenhouse gas emissions. It has been shown that recycling batteries is beneficial to the environment. Using recycled materials will eliminate up to 90 percent of CO2 emissions from the manufacturing cycle [21]. Thus, recycling of spent batteries to extract precious metals used in lithium batteries is the essential requirement to reduce India's reliance on imports of these metals. Also, mandating appropriate battery disposal should be strictly enforced to shield the environment and human beings from the various risks associated with lithium-ion battery waste.

5 Lithium-Ion Battery Waste Management

The solutions for the reuse and recycling of used LIBs are:

-

Closed-loop recycling Recycling of Lithium-ion battery aids in recovering different metals like nickel, cobalt, and lithium.

-

Second Life uses Once the EV battery's drop-in potential is below 70 to 80 percent, it still can be utilized in households or energy backups.

5.1 Second Life Use (Short Term Solution)

Lithium-ion batteries used in electric vehicles have less than ten years of shelf life. The life-cycle of the electric vehicle battery is shown in Fig. 8. After 5–8 years, the battery’s power-producing capacity is not sufficient for an Electric vehicle to give desired results. Such ‘spent’ batteries can thus be utilized for secondary applications as they still maintain 70 percent—80 percent of their initial capacity and can be used for few more years [22]. Some second-life-uses of lithium batteries are listed below:

-

Managing electricity for residential and C&I (Commercial and Industrial) units.

-

Strengthening the peak power capacity or stabilization of the power grid.

-

Firming of renewable energy systems by storage.

In the short term, a second life-use solution for managing battery waste will be economically and environmentally beneficial, until a large number of lithium-ion batteries are ready for recycling. These advantages include an extended battery life by up to 5–10 years after serving its fundamental purpose, reducing the waste, and the amount of energy essential for producing new batteries. In European countries, many vehicle manufacturers are utilizing these 'spent' batteries for energy storage applications in residential and providing large scale grid solutions. Table 3 describes some of the Second Life Strategies as embraced by leading car companies. According to an E &Y report [23], the collective capacity availability of "spent" batteries globally is likely to be 1000 GWh by the year 2030, at a rate of 80 percent for reuse applications.

5.1.1 Various Challenges in using the Battery for the Second Life

There are several challenges and issues responsible for not picking up of lithium-ion battery recycling such as:

-

Absence of standardized policies and protocols for battery reuse in energy storage. Currently, the consumers are not assured of the reliability of the life span provided by these second-life batteries. Moreover, they are also unsure whether these batteries are being supplied from a reliable and certified distributor.

-

Lack of proper methodology about the reliable reuse of batteries reaching end-of-life and whether the waste products from these batteries are handled and disposed of with utmost care to prevent hazardous effects.

Regardless of the above apprehensions, the rising prospects to reuse batteries by vehicle manufacturers are likely to increase continually. Also, with the increasing number of EVs on the streets in the future, the prospects of reusing end-of-life batteries would simultaneously rise.

5.2 Closed Loop Recycling (Long Term Solution)

Second life battery has to undergo closed-loop recycling for extracting useful battery elements [24]. The various processes involved in closed-loop recycling are as follows:

-

1.

Mechanical Process or direct recycling Crushing and physical component separation, as well as black mass recovery, are all examples of direct recycling. Comminution is usually the first step in mechanical processes, with the goal of liberating the materials/components. The materials/components are then sorted based on physical qualities including particle size, shape, density, and electric and magnetic properties.

-

2.

Hydro-Metallurgical recycling Chemicals and liquids are used in this process. Three primary phases are involved in hydrometallurgical processes. The first is leaching, which is the process of dissolving metals with acid, base, or salt in most circumstances. Purification is the second phase, which involves specific chemical processes to separate the metals. Solid–liquid reactions, such as ion exchange and precipitation, as well as liquid–liquid reactions, such as solvent extraction, are included in the third phase. By crystallisation, ionic precipitation, reduction with gas, electrochemical reduction, or electrolytic reduction, the metals of interest must be recovered. Because of their ability to create high-quality products, hydrometallurgical operations are frequently used as refining steps. High treatment capacity, low temperature operation, and high impurity removal efficiency are all advantages of hydrometallurgical recycling. The disadvantages of this process include product toxicity, waste stream difficulties, high chemical consumption, and high temperature operation.

-

3.

Pyro-Metallurgical recycling The spent lithium-ion cells are processed at high temperatures in this process, which uses heat and flames. No prior pre-treatment mechanically is required, and the batteries go straight into the furnace. Pyro-metallurgy covers high-temperature procedures for winning and refining metals, such as roasting or smelting. Roasting is a phrase used to describe operations that use a gas–solid reaction, such as oxidative roasting, to purify ore or secondary raw materials. Smelting is a chemical operations to recover metals and secondary raw material. Smelting decomposes secondary raw material using heat and a chemical reducing agent, releasing other elements as gases or slag and leaving the metal base behind. The reducing agent is usually a carbon source. Pyro-metallurgy offers a number of benefits, including high reaction rates, compact plant space for a given throughput, and high overall efficiency. On the negative side, these methods frequently yield intermediates that require additional hydrometallurgical refinement, and they are uneconomic for low-grade concentrates. The existing recycling processes can only recover around half of the economic value. The percentage of different elements recovered in various industrial processes is shown in Table 4.

A recent study found that more than 90 percent of a spent lithium-ion battery economic value comprises seven prime components. These components are nickel, lithium, cobalt, aluminium, graphite, manganese, and copper [25]. The existing recycling technologies can only recover 50 percent of the economic value from present recycling systems. Before subjecting the lithium-ion batteries to recycling processes, the first step was to separate plastics, aluminium, and copper [26]. The cost of recycling Lithium-ion batteries depends on several factors such as battery chemistry, operation scale, volume, and cost of raw materials.

6 Recycling Challenges

Closed-loop recycling of lithium-ion batteries presents a lot of challenges and risks, and few of them are:

-

Battery recycling is an incredibly complex process. Continuous variations in the research methodologies and designs by manufacturers to increase the battery efficiency have led to creation of batteries with varying compositions and designs. Such variations make it very hard to adopt a standardized recycling procedure, and also reduces efficacy. The average recycling output of approximately 50 percent of the financial value and high costs associated with recycling, makes the entire recycling process an expensive affair. Recycling will not be very economical on the current scale.

-

High recycling costs- In India, the cost involved in recycling a LIB is around INR 90–100/kg according to industry sources. A Lithium battery recycling unit requires high investment in management, resource acquisition and transportation, though the margins are small. Recovering expenses and booking profits takes at least five years.

-

In India, lack of awareness is another crucial problem for battery manufacturers and end consumers. Although the recyclers are still struggling even in the Business to Business (B2B) market, Business to Customer (B2C) will continue to be a distant possibility for the coming few years.

-

Tapping the recyclers onto the B2C segment is also a logistically implausible idea.

-

Safety concerns- The health risks associated with collecting, storing, and transporting waste lithium batteries may be a concern. The residual energy can be emitted rapidly and may result in fire if the disposed battery is short-circuited.

-

Storage and transportation of unused waste batteries is a demanding task. Presently, only 5 percent of spent lithium-ion batteries are being collected. These challenges would eventually subside with the standardization of the LIB market composition and growth.

7 Market Opportunity: Battery Recycling in India

Globally, only about 50 percent of spent batteries find their way to recyclers [20] [27]. Multiple reasons contribute to this situation, such as:

-

Hoarding or storage of batteries

-

Second life usage in other applications

-

Waste disposal of batteries

According to our study, it is expected that the recycling market pace will pick up from 2022 onwards in India. The annual demand for recycling is predicted to be about 22–23 GWh in 2030, which is a $1,000 million potential, as shown in Fig. 9. Between 2022 and 2030, electric vehicle batteries will majorly contribute to the recycling market, with 75 percent of the overall recycling market will be led by public transport. This growth is predicted on the fact that such batteries are subject to hundreds of partial cycles each year, intense operating temperatures, and rising discharge levels, resulting in high lithium-ion degradation.

*Others denotes batteries utilized in stationary storage applications, telecom sites, and portable devices.

The assumptions on which this scenario is presented are as follows:

-

This data consists of batteries available for recycling as well as for second life use.

-

Majority batteries used in electric vehicles will be used for second life while, on the other hand, closed-loop recycling will be suitable for other applications.

-

Each year a certain proportion is presumed from EV’s and others for second life use/closed-loop recycling, which will steadily rise till 2030. For EV's, this is expected to be 40 percent from the year 2021, while for ‘others," only 1% from 2021 can be expected.

-

Life of battery: Buses- 4 years, four-wheelers-8 years, 3-wheeler-3 years, two-wheelers-5 years, and Storage- 8 years.

-

As per the battery production goals set under the Energy Storage Mission by NITI Aayog, the goal of 160 GWh of battery recycling by 2030 is anticipated. The manufacturing waste can be used for recycling soon if cell manufacturing units are set up in India. Many Indian companies are eyeing this profitable prospect and already announced plans to develop recycling projects. The specific significant recycling players are as follows:

-

Mahindra Electric plans to enable EV battery recycling, like the cell phone batteries recycling.

-

Attero Recycling is an important player and has set a commercial, operational recycling plant in India.

-

Raasi Solar is in the process of setting up a 300 MW recycling plant along with cell manufacturing and battery assembling.

-

Tata Chemicals unveiled its battery recycling operations at Mumbai in August 2019 and intended to recycle 500 tons of spent batteries.

Lithium-ion battery recycling is a laborious and expensive affair and can only be sustained by long-term focussed players. With mounting capacities, profits will also escalate for them. Besides these significant firms, other companies who manage electronic waste and have LIB recycling plans in India are shown in Table 5 below:

8 International Regulations: Recycling and Disposal

While there is awareness about battery reusability and recyclability, this market will only gain momentum with a clear policy structure on the government end. The number of spent LIBs will also be growing with the rise of the EV industry. Globally, spent LIBs and their waste are categorized as ‘Dangerous Goods.' Lack of proper and standardized battery disposal and recycling regulations can lead to improper handling of spent battery waste and can pose hazardous effects on the environment. Presently, the regulations governing the disposal of spent LIBs differ considerably across countries. Specified battery disposal regulations in some of the leading countries are outlined in Table 6 and listed below:

-

(i)

European Union

The European Union (EU) established a Battery Directive in 2006 to help EU members to protect, conserve, and enhance environmental quality by reducing the adverse effects of waste batteries, including LIBs. The European Union had set a timeline for recycling spent lithium-ion batteries by battery producers and importers. The EU's "Batteries Directive" has the following requirements:

-

Used battery collection rates will be 25 percent by 2012 and 45 percent by 2016.

-

For battery recycling in order to manufacture identical products had to be 65 percent in terms of weight for Lead Acid batteries, 75 percent of Nickel–Cadmium batteries, and 50 percent of remaining types of batteries.

-

Prohibition of automotive, industrial batteries, and accumulator’s disposal to landfill or burning.

Studies [28] suggested that most EU members achieved the 2012 goals, but the 2016 goals were too optimistic. In 2014, while seven Member States had already met the 45 percent goal for 2016, four Member States had yet to meet the 25 percent goal for 2012.

-

(ii)

United States of America

LIBs are considered harmful in USA and are governed under the Standards for Universal Waste Management (Electronic Code of Federal Regulations, Title 40, Sect. 273, US Environmental Protection Agency). This legislation mandates the processing of waste batteries as hazardous waste and should be sent for recycling. The directive forbids landfills explicitly for disposing of the batteries. However, no directive on resource recovery from lithium-ion battery waste is included in the Federal Government standards. Some US states such as California, New-York, New-Jersey, Florida, and Maryland are implementing their regulations that require manufacturers to provide or fund the recycling of batteries.

-

(iii)

China

In 2017, the Ministry of China released draft regulations holding automobile manufacturers accountable for the recovery of new energy vehicle batteries. It also requires these manufacturers to create networks for recycling and providing service outlets for collecting, storing, and transferring old batteries to specialized recyclers. The automotive manufacturers have to set up a replacement service system for efficiently fixing or swapping the old batteries. Auto manufacturers will now have to set up a traceability system to locate owners of the batteries that have been discarded. The battery makers are encouraged to follow standardized designs to simplify the recycling process. Battery manufacturers must provide the automobile makers with technical training to store and uninstall old batteries.

-

(iv)

India

At present, India has no policy structure or mechanism for recycling lithium-ion batteries and the demand for a second use. However, the Indian government declared in October 2019 that recycling policy for lithium-ion batteries is in the drafting phase, in which the recyclers are given tax Standard Operating Procedures (SOPs). This strategy also places responsibility on battery manufacturers to recover used batteries under the EPR requirements. Also, the proposed policy would provide incentivized motivation for firms setting up recycling facilities and make the processing of used batteries incumbent on producers [29]. The e-waste management and handling regulations notified in 2011 declared all the batteries as e-waste, except lead-acid batteries. However, these laws do not explicitly address disposing the batteries safely. Few states and Union Territories issued directives for handling e-waste collection, thereby mentioning the authorized collection centres by the state agencies. However, the enforcement of these guidelines remains a problem at the root level. In 2001, a notification was issued by GoI ‘The Batteries Management and Handling Rules’ for lead-acid batteries, to channelize consumed lead-acid batteries [30, 31]. To date, however, it has been a challenge to implement these rules. Approximately 85 percent lead-acid batteries undergo recycling in India according to data collected from various sources. Although the formal sector recycles 40 percent of the batteries, the rest is recycled informally [33, 34].

9 Policy Recommendations for Recycling LIBs: Opinion

In our opinion, the main policy recommendations that are needed to be implemented at the government level are discussed below:

-

The labelling of lithium-ion batteries should be made a guideline that would help distinguish them from other types of batteries.

-

Battery disposal into landfills must be punishable offence.

-

Policies for establishing a comprehensive incentive system such as incentives for establishing tax holidays and income tax deductions for the establishment of lithium-ion battery recycling plants in India have to be framed.

-

Legislation is needed to facilitate storage and proper disposal of spent batteries.

-

The government will consider developing an environmentally friendly research program for more effective direct recycling processes. In order to make it attractive to academicians and researchers, recognized research centres should be well funded.

-

The government should aim at closed-loop recycling, where products are recycled directly from spent batteries, reducing energy usage and waste by removing mining and processing measures.

-

Finally, Extended Producer Responsibility (EPR) should be developed by the government to safeguard battery manufacturers' responsibility for recycling the batteries sold by them in the market. It involves that all the EV manufacturers will take back used LIBs and allow second-use of these batteries before they are handed over for disposal to some authenticated recycler. For making EPR effective, consumers may be charged a small battery fee.

If taken now, all these steps will help India streamlining and formalizing the methodologies to ensure that lithium-ion batteries are appropriately disposed of and recycled safely and cost-effectively.

10 Conclusion and Future Scope

Recycling and reusing lithium-ion batteries has become more than an option, and it is the need of the hour. This will help India address end-to-end battery manufacturing issues and ensure avoiding pollution, safeguarding less waste, and reducing costs. It also addresses the scarcity of absolute mineral reserves in India by reusing them primarily to reduce imports. This paper highlights India's lithium-ion battery market current scenario, potential, opportunities and various challenges associated with recycling procedures. The study of foreign market regulatory structures on recycling and management of lithium-ion battery waste is also being done, and few regulatory guidelines are being suggested that would improve the Indian battery recycling industry. With time, new business models are likely to emerge that provide better solutions such as battery leasing, in which the batteries are returned after lease is over, and manufacturer is responsible for reuse and recycling. India's battery suppliers have already begun selling with an option to buy back. While there is cognizance towards battery recyclability, still this market will only gain momentum with the implementation of standardized policy guidelines and regulations. Clear guidelines for collection, storage, and transportation of recycling waste batteries need to be laid out. Detailed instructions must also be laid out and implemented for consumers as well as for battery suppliers.

Data Availability

Data sharing not applicable to this article as no datasets were generated or analysed during the current study.

References

Swain, B. (2017). Recovery and recycling of lithium: A review. Separation and Purification Technology, 172, 388–403.

〈http://batteryuniversity.com/learn/article/types_of_lithium_ion〉

Lv, W., Wang, Z., Cao, H., Sun, Y., Zhang, Y., & Sun, Z. (2018). A critical review and analysis of the recycling of spent lithium-ion batteries. ACS Sustainable Chemistry & Engineering, 6(2), 1504–1521.

Ordoñez, J., Gago, E. J., & Girard, A. (2016). Processes and technologies for the recycling and recovery of spent lithium-ion batteries. Renewable and Sustainable Energy Reviews, 60, 195–205.

Zheng, X., Zhu, Z., Lin, X., Zhang, Y., He, Y., Cao, H., & Sun, Z. (2018). A mini-review on metal recycling from spent lithium ion batteries. Engineering, 4(3), 361–370.

Martin, G., Rentsch, L., Höck, M., & Bertau, M. (2017). Lithium market research–global supply, future demand and price development. Energy Storage Materials, 6, 171–179.

Deshwal, D., Sangwan, P., & Dahiya, N. (2021). How will COVID-19 impact renewable energy in India? Exploring challenges, lessons and emerging opportunities. Energy Research & Social Science, 77, 102097.

Hill, M. K. (2020). Understanding environmental pollution. Cambridge University Press.

Yun, L., Linh, D., Shui, L., Peng, X., Garg, A., & LE, M.L.P., Asghari, S. and Sandoval, J.,. (2018). Metallurgical and mechanical methods for recycling of lithium-ion battery pack for electric vehicles. Resources, Conservation and Recycling, 136, 198–208.

Liu, C., Lin, J., Cao, H., Zhang, Y., & Sun, Z. (2019). Recycling of spent lithium-ion batteries in view of lithium recovery: A critical review. Journal of Cleaner Production., 228, 801–813.

Velázquez-Martínez, O., Valio, J., Santasalo-Aarnio, A., Reuter, M., & Serna-Guerrero, R. (2019). A critical review of lithium-ion battery recycling processes from a circular economy perspective. Batteries, 5(4), 68.

Wang, X., Gaustad, G., Babbitt, C. W., & Richa, K. (2014). Economies of scale for future lithium-ion battery recycling infrastructure. Resources, Conservation and Recycling, 83, 53–62.

King, S., & Boxall, N. J. (2019). Lithium battery recycling in Australia: Defining the status and identifying opportunities for the development of a new industry. Journal of Cleaner Production, 215, 1279–1287.

Steward, D., Mayyas, A., & Mann, M. (2019). Economics and challenges of Li-ion battery recycling from end-of-life vehicles. Procedia Manufacturing, 33, 272–279.

Placke, T., Kloepsch, R., Dühnen, S., & Winter, M. (2017). Lithium ion, lithium metal, and alternative rechargeable battery technologies: The odyssey for high energy density. Journal of Solid-State Electrochemistry, 21(7), 1939–1964.

Wentker, M., Greenwood, M., & Leker, J. (2019). A bottom-up approach to lithium-ion battery cost modeling with a focus on cathode active materials. Energies, 12(3), 504.

A report on India roadmap has electric vehicle value-chain in its sights by Global Data Energy.(https://www.power-technology.com/comment/electric-vehicles-in-india-2019)

Olivetti, E. A., Ceder, G., Gaustad, G. G., & Fu, X. (2017). Lithium-ion battery supply chain considerations: Analysis of potential bottlenecks in critical metals. Joule, 1(2), 229–243.

A report on Panasonic may set up li-ion battery module assembly unit in India. (https://www.livemint.com/companies/news/panasonic-may-set-up-lithium-ion-battery-module-assembly-unit-in-india-1565895588828.html)

Melin, H.E., 2018. The Lithium-Ion Battery End-of-Life Market—A Baseline Study. In World Economic Forum: Cologny, Switzerland (pp. 1–11).

Ellingsen, L. A. W., Hung, C. R., & Strømman, A. H. (2017). Identifying key assumptions and differences in life cycle assessment studies of lithium-ion traction batteries with focus on greenhouse gas emissions. Transportation Research Part D: Transport and Environment, 55, 82–90.

Zubi, G., Dufo-López, R., Carvalho, M., & Pasaoglu, G. (2018). The lithium-ion battery: State of the art and future perspectives. Renewable and Sustainable Energy Reviews, 89, 292–308.

Report on “Electrifying India: building blocks for a sustainable EV ecosystem”, May 2018

Gratz, E., Sa, Q., Apelian, D., & Wang, Y. (2014). A closed loop process for recycling spent lithium ion batteries. Journal of Power Sources, 262, 255–262.

Pagliaro, M., & Meneguzzo, F. (2019). Lithium battery reusing and recycling: A circular economy insight. Heliyon, 5(6), e01866.

Ramoni, M. O., & Zhang, H. C. (2013). End-of-life (EOL) issues and options for electric vehicle batteries. Clean Technologies and Environmental Policy, 15(6), 881–891.

Report on the implementation of EU waste legislation, including the early warning report for the Member States at risk of missing the 2020 preparation for reuse/recycling target on municipal waste.

Status Review Report on Implementation of Batteries (Management and Handling) Rules, 2001 (as amended thereof) - Report published by CENTRAL POLLUTION CONTROL BOARD in 2016.

Joshi, R., & Ahmed, S. (2016). Status and challenges of municipal solid waste management in India: A review. Cogent Environmental Science, 2(1), 1139434.

Report on “LITHIUM-ION BATTERY RECYCLING IN INDIA- Opportunities and challenges” by Agnes Richard, July 2019.

Sun, S. I., Chipperfield, A. J., Kiaee, M., & Wills, R. G. (2018). Effects of market dynamics on the time-evolving price of second-life electric vehicle batteries. Journal of Energy Storage, 19, 41–51.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No conflict of interest in authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Deshwal, D., Sangwan, P. & Dahiya, N. Economic Analysis of Lithium Ion Battery Recycling in India. Wireless Pers Commun 124, 3263–3286 (2022). https://doi.org/10.1007/s11277-022-09512-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11277-022-09512-5