Abstract

In regulated industries it is important to identify appropriate performance benchmarks to incentivize companies’ performance. This study applies a stochastic metafrontier approach to estimate the cost efficiency of the English and Welsh Water and Sewerage companies (WaSCs) and Water only companies (WoCs) over the period 1998–2009. The results indicate that the UK water industry is a mature and efficient sector in which WaSCs perform more efficiently than WoCs since cost efficiency scores are 0.965 and 0.958 on average, respectively. We found that water companies can become more cost efficient by managing assets more efficiently, extracting water from reservoirs, and investing in technologies that reduce water leakage and predict more accurately bursts in networks. The results of our study should be of great interest to water regulators and utility managers who want to make more informed management decisions to minimize costs, allocate resources efficiently and improve environmental performance. Future research will extend the years considered to assess the impact of recent regulatory reforms in the cost efficiency of the English and Welsh water companies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The water industry is a network-type industry embodied by two main structures, vertical and horizontal integration, with neither form predominating in the industry. The structural configuration of the water industry in any given country depends on how various factors interacted during the development of their water infrastructure, such as whether economies of scale and scope were possible, how long ago sewer services were first implemented, the type of ownership (public or private) involved, and the regulatory framework in which the industry formed (Marques 2010).

The water industry of England and Wales was the first to be fully privatized and regulated with price caps. Several studies have employed benchmarking methods to estimate both components of the adjustment factor of the English and Welsh water and sewerage companies (WaSCs) and water only companies (WoCs). However, evaluating the efficiency of WaSCs in conjunction with WoCs requires making the assumption that both types of water companies (WaSCs and WoCs) use the same production technology. In reality, production technologies of WaSCs and WoCs are likely to differ, as they do in the England/Wales water industry (Molinos-Senante et al. 2015, 2017).

Studies conducted by Molinos-Senante et al. (2015, 2017), which compared the relative efficiencies of WaSCs and WoCs, were based on the premise that technological differences between WaSCs and WoCs skew results of efficiency assessments, which in turn limit a direct cross-comparison among the two types of water utilities. This problem of having to compare heterogeneous units is common to efficiency studies of the water industry, which is why many studies have employed the metafrontier approach, first proposed by Hayami (1969), to overcome difficulties involved with comparing water companies that use different technologies (De Witte and Marques 2009, 2010; Molinos-Senante et al. 2015, 2017; Suárez-Varela et al. 2017). A metafrontier represents an overarching frontier of all possible efficient frontiers for a heterogeneous group (Wang et al. 2013). The metafrontier approach has been used to compare efficiencies of various segments of the water industry, including water companies from different countries; fully privatized vs. concessionary water companies; private vs. public water companies; and WaSCs vs. WoCs (e.g., De Witte and Marques 2009, 2010; Suárez-Varela et al. 2017; Molinos-Senante et al. 2015, 2017).

Several non-parametric approaches have been used to approximate metafrontiers. De Witte and Marques (2009, 2010) employed the order-m approach, which is based on the Free Disposal Hull (FDH) approach, whereas other researchers have used various Data Envelopment Analysis (DEA) techniques (Suárez-Varela et al. 2017). However, such non-parametric approaches do not allow to directly integrate exogenous and quality-of-service variables in efficiency assessments. In contrast, parametric methods, like Stochastic Frontier Analysis (SFA), have the advantage of not only being able to directly integrate exogenous variables, but they can also account for statistical noise, which distorts most efficiency evaluations. In spite of the advantages of parametric methods (SFA and others) in evaluating efficiency frontiers, to the best of our knowledge, to date no studies have used parametric approaches to evaluate and compare efficiencies of water companies using the metafrontier framework.

To overcome limitations of non-parametric approaches used previously to compare water companies efficiencies, in this paper we obtain parametric estimates of the metafrontier to assess and compare cost efficiencies (including exogenous and quality-of-service variables) of WaSCs and WoCs. Our empirical application examines the cost-efficiencies of WaSCs and WoCs in England and Wales over the period 1998 to 2009. This comparison provides insights into the relationship between the cost efficiencies of water companies within the regulatory environment specific to England and Wales.

This manuscript contributes to the current vein of literature on the performance measurement of water utilities by estimating a metafrontier to compare the cost efficiency of WaSCs and WoCs using a parametric approach. Beyond the methodological novelty of this approach, our approach further allows for the integration of several exogenous and quality of service variables in the estimation of cost efficiency. Hence, the approach is more robust and reliable than non-parametric methods which typically used to evaluate and compare cost efficiencies among different types of water companies. The results of our study should prove particularly useful for water regulators under price cap regulation. The method applied in this study allows us to compute the efficiency component of the adjustment factor when integrating exogenous and quality-of-service variables, which is essential for promoting efficiency and innovation via regulating the CPI (Consumer Price Index) or adjustment factors while also including the operational environment in which each water company operates.

2 Methodology

To integrate exogenous and quality-of-service variables when comparing cost efficiencies among WaSCs and WoCs using a parametric approach, two main steps are required. The first step involves estimating the cost efficiency for a group (WaSCs and WoCs) and then identifying its cost frontier function. The second step consists of estimating the stochastic metafrontier and its cost gap ratio (Huang et al. 2014). In doing this, the cost frontier for the group is estimated again by recognizing that the dependent variable for the group frontier is the predicted cost rather than the observed cost (Nguyen et al. 2016). Importantly, the resulting estimates combine data from both data sets of both types of water companies being compared (e.g., WaSCs vs. WoCs), rather than employing separate datasets for each type of water company.

To estimate the group cost efficiency for group j (i.e., WaSCs or WoCs) consisting of N water companies in the tth period, the cost frontier modelled is:

where \( {C}_{it}^j \) is the operating cost of water company i in year t for group j, \( {X}_{it}^j \) is a vector of the output and input prices of the ith water company in the tth year associated with the group j, βj is a vector of parameters of the cost frontier for the group being estimated, \( {V}_{it}^j \) is a statistical noise component, which according to previous studies (Huang et al. 2014; Mellah and Ben Amor 2016) it is assumed to be independent and identically distributed as N(0, \( {\sigma}_{\nu}^{j2} \)), and \( {U}_{it}^j \) is the non-negative inefficiency component drawn from the exponential distribution \( {U}_{it}^j\sim \exp \left(\theta \right) \) (Saal and Parker 2006).

Following methods of previous studies (Nguyen et al. 2016; Li et al. 2017; Chen et al. 2018), we assumed that the cost function is a translog function. Hence, a group’s cost efficiency (\( {CE}_{it}^j \)) relative to the group j frontier is the cost efficiency for water company i in group j in the tth year, which is calculated as the ratio between the group’s frontier cost (\( {e}^{X_{it}{\beta}^j} \)) [adjusted by statistical noise (\( {e}^{V_{it}^j} \))] and its observed cost (Cit) (Nguyen et al. 2016):

After estimating group cost frontiers, we needed to test whether the two groups (WaSCs and WoCs) used the same technology. In accordance with past practices of Nguyen et al. (2016) and Li et al. (2017), we conducted a log-likelihood test, with the log-likelihood test statistic defined as LR = 2 × |LR(H1) − LR(Ho)|, where LR(H1) is the sum of the values of all the log-likelihood functions of the stochastic frontier models for the sub-groups, and LR(Ho) is the value of the log-likelihood function for the pooled model. Under the pooled model, a single cost frontier is formulated and so the pooling estimate is produced with an implicit assumption of unequal group variances for the composite error terms. As Nguyen et al. (2016) noted, if the null hypothesis is not rejected, the cost efficiency of the two groups can then be compared directly and so there is no need to estimate the metafrontier. If the null hypothesis is rejected, estimates under the group frontiers will differ from those estimated by the metafrontier. In this case, the metafrontier model proposed by Huang et al. (2014) can be used to estimate the cost efficiency and cost gap ratio between WaSCs and WoCs type utilities.

Once a group’s cost efficiency (\( {CE}_{it}^j \)) is estimated, the next step is to compute the metafrontier cost efficiency (\( {CE}_{it}^{\ast } \)). Due to the presence of a non-negative cost gap ratio (\( {U}_{jit}^{\ast } \)), Huang et al. (2014) proposed that the relationship between a group’s cost frontier (\( {C}_{it}^j \)) and the meta-cost frontier (\( {C}_{it}^{\ast } \)) is:

According to Huang et al. (2014) and Nguyen et al. (2016), the difference between the predicted cost at a group’s frontier \( \left(\hat{C_{it}^j}\right) \) and the group’s cost frontier (\( {C}_{it}^j \)) is random. Hence, the error term for a group’s cost frontier is defined as the random noise component of the meta-cost frontier (\( {V}_{jit}^{\ast } \)):

Combining Eqs. (3) and (4), we can calculate the predicted cost at a group’s frontier as:

Equation (5) is the standard stochastic cost frontier model, where β∗ is a vector for the meta-cost frontier parameters that are to be estimated. By applying a standard SFA estimator to the equation, the stochastic cost gap ratio (\( {CGR}_{it}^j \)) can be estimated as follows:

As in previous studies (Battese et al. 2004; O’Donnell et al. 2008), a metafrontier cost efficiency (\( {CE}_{it}^{\ast } \)) is the product of a group’s cost efficiency (\( {CE}_{it}^j \)) and the cost gap ratio (\( {CGR}_{it}^j \)) wherein:

As illustrated by Eq. (6), the computation of the stochastic cost gap ratio involves an estimate of β∗ parameters. In doing so, we employed the translog cost frontier model as is shown in Eq. (8).

According to Saal and Parker (2006), the error term has two components: (1) νit (which represents statistical noise and is assumed to be independent and identically distributed, νit\( N\Big(0,{\sigma}_{\nu}^2 \)) and (2) uit [which accounts for non-negative cost inefficiencies and is drawn from the exponential distribution uit exp(θ)]. We incorporated p exogenous variables (\( {\chi}_p{\delta}_{it}^p \)) into Eq. (8) to more accurately estimate efficiency because exogenous variables impact input requirements (Maziotis et al. 2017; Pinto et al. 2017). Moreover, we also included firm-specific dummy variables (αiDi) to control for unobserved heterogeneity among utilities. However, one firm-specific dummy was deleted to avoid a multicollinearity problem (Kumbhakar et al. 2015).

We estimated parameters of the metafrontier model based on the approach of Huang et al. (2014), which involves applying a stochastic frontier approach to estimating model variables. We did not follow the two-stage deterministic approach, exemplified by Battese et al. (2004) and O’Donnell et al. (2008), because such an approach would have required that we develop both metafrontier and group frontier models deterministically (based only on initial conditions), whereas we decided that inherent randomness should be integrated into the development of both of our models (i.e., we chose to develop both metafrontier and frontier models stochastically even though metafrontier models are usually developed deterministically).

Huang et al. (2014) proposed developing a stochastic metafrontier model where SFA is used in both stages of development. As a result, the group cost frontier, cost gap ratio, and cost metafrontier are left-censored at 0.0 and right-censored at 1.0, fitting the usual demarcation of efficiency scores (Honma and Hu 2018). Moreover, because the metafrontier parameter of Battese et al. (2004) and O’Donnell et al. (2008) is estimated by using linear programming techniques, no statistical inferences (such as confidence intervals, significance level, or standard error) can be directly obtained, whereas by using the Huang et al. (2014) approach, we could indirectly obtain those inferences via the estimation process. Moreover, metafrontier cost efficiencies and cost gap ratios may be contaminated by statistical noise in the linear programming approach because techniques used to estimate these parameters is incapable of isolating statistical noise from real variation in the data (Nguyen et al. 2016). Therefore, from a methodological perspective, we concluded that the approach proposed by Huang et al. (2014) would be more reliable than the approaches proposed by Battese et al. (2004) or O’Donnell et al. (2008).

3 Sample and Data Description

This study focuses on the water industry in England and Wales, which was privatised in 1989. Several mergers and acquisitions occurred among WaSCs and WoCs since privatization. Therefore, our sample consists of an unbalanced panel of 272 observations over the 1998–2009 period. Our source of the data were the June reports for water and sewerage companies and water-only companies in England and Wales, published by Ofwat on its website, and the companies’ statutory accounts (i.e., annual reports mandated by UK law). We did not extend the dataset beyond 2009 because Ofwat required new accounting procedures for the water companies after 2009 (Molinos-Senante and Maziotis 2017).

Following the approach of prior studies, we used two inputs and two outputs to estimate costs for groups and at the metafrontier (Molinos-Senante and Maziotis 2017). We used capital and labour costs as inputs to the model and volume of water delivered and number of water-connected properties as outputs. Following the approach of Saal and Parker (2001), capital inputs were based on current estimates of the cost of modern equivalent assets (MEA), defined as the replacement cost of each company’s existing physical capital. The cost of capital approach was used to estimate total capital costs (defined as the sum of the opportunity cost of invested capital and amount of capital depreciated relative to the value of MEA assets) and construction costs (costs associated with replacing physical capital divided by the MEA assets) (Stone and Webster consultants 2004; Porcher et al. 2017; Molinos-Senante and Maziotis 2017). Company-specific labour cost was determined from total labour costs for each company divided by the average number of full-time employees (FTE) in its payroll (obtained from each company’s statutory data) (Saal and Parker 2001; Maziotis et al. 2014). The cost of labour was used to normalise total costs and input costs.

Given the relevance of exogenous and quality-of-service variables as input constraints, both types of variables were integrated into the assessment. Exogenous variables for each company were represented by (1) number of people/area (000 s/km2) with access to drinking water (Molinos-Senante et al. 2017), (2) average head height attained by pumping, and (3) percentage of water obtained from reservoirs (Porcher et al. 2017). Quality-of-service variables included in the model were: (1) the number of bursts in water mains per water-connected property (CEPA 2014) and (2) amount of water lost during its distribution (leaks) (as percentage of total amount produced). Descriptive statistics for variables used in the assessment are provided in Table 1.

4 Results and Discussion

4.1 Group Cost and Metafrontier Cost

In order to compare cost efficiencies among groups (WaSCs and WoCs), both group costs and metafrontier costs must be estimated. Table 2 shows parameter estimates for the stochastic cost frontier models relative to sub-group frontiers [i.e., a model for only WaSCs, a model for only WoCs, and model for the metafrontier (for both groups together)]. All sampled variables were standardised relative to their average values. By standardising, first-order coefficients could be directly interpreted as cost elasticities evaluated at mean values (Arocena et al. 2012). Table 2 provides cost estimates of coefficients and other parameters for the various models, illustrating that the estimates satisfy various properties relative to the signs of the numbers (positive or negative) and the magnitude of values. Firm-specific dummy variables in the models were all statistically significant, but data on them are not provided for space reasons.

We applied a likelihood ratio test to test the null hypothesis that WaSC and WoC use the same technology (Li et al. 2017; Nguyen et al. 2016). Because the Chi-square statistic value (237.25) was significantly (p < 0.01) larger than the critical value (48.26), we inferred that the metafrontier approach predominated over the conventional, pooled-stochastic frontier approach. This statistical results suggests that WaSCs and WoCs use different technologies, a results consistent with past studies (Saal and Parker 2006; Bottasso et al. 2011; Molinos-Senante and Maziotis 2017) Therefore, any comparison of cost efficiencies between WaSCs and WoCs should be carried out using the metafrontier approach.

Our results show that the elasticity of total costs relative to outputs is positive and statistically significant under the WaSCs, WoC and for the metafrontier model. This is a property that occurs for all observations in the sample under the various models. Our results suggest that, on average, a 1% increase in the amount of water delivered by a WaSC will raise its total costs by 0.495%, whereas a 1% increase in the number of additional properties it has to connect to its distribution system will raise its total costs by 0.577%. For a WoC, a 1% increase in the amount of water delivered will increase its total cost by 0.804%, whereas a 1% increase in the number of properties it has to connect to its distribution system will raise its total costs by 1.254%. For the metafrontier model, a 1% increase in the amount of water delivered will increase total costs by 0.587%, whereas a 1% increase in the number of water-connected properties will raise total costs by 0.352%.

Because the sum of output elasticities for the sub-group frontier models exceeded 1.0, we determined that both WaSCs and WoCs operate under diseconomies of scale, a result that is consistent with a study by Stone and Webster Consultants (2004) for water utilities in England and Wales. In contrast, the sum of output elasticities described by the metafrontier model did not exceed 1.0, indicating that the water industry as a whole in England and Wales operates under an economy of scale. This finding is consistent with the study by Molinos-Senante and Maziotis (2017), wherein the authors reported increasing economies of scale for both WaSCs and WoCs over the 1993–2009 period. Therefore, we concluded that on average, a 1% increase in the volume of water delivered or a 1% increase in the number of additional properties connected to water distribution networks should result in a 0.93% increase in total costs to water utilities.

The parameter estimate for input price was positive, as expected, and statistically significant for all observations. A 1% increase in capital price will generate a 0.59–0.70% increase in total costs, depending on the model used to estimate costs. Results of our metafrontier model show that price elasticity of capital is statistically significant, positive, and increases over time, thus suggesting that technological improvements may have been responsible for increasing the capital of water utilities in England and Wales. The interaction term between volume of water delivered and number of water-connected properties is statistically significant and positive only for the WaSC and metafrontier models. This finding indicates that cost discomplementarities may exist between outputs from these two types of utilities; that is, the production and delivery of drinking water increases the cost of connecting properties and vice versa. Based on the positive and significant second order time coefficient in our models, we conclude that the total costs of operating water utilities in England and Wales have slowly increased over time. The statistically significant parameter theta, a measure of the relative importance of inefficiency in the industry-wide variance in error terms, suggests that cost inefficiencies exist in all modelled utilities.

Access to drinking water (number of people/km2) is a negatively related to cost and was significant first-order term in all models, suggesting that an increased density of service recipients reduces unit utility costs, which can probably be explained by the fact that a service area with high population density (with more people served per unit pipe length) will have lower distribution costs per unit volume of water (Torres and Morrison 2006; Molinos-Senante and Maziotis 2017). In general, a 1% increase in population density will decrease total costs by 0.133–0.217%, based on the various models we examined. This information is very useful for urban planners since it evidences that densification processes in cities would reduce the costs of supply drinking water. As expected, the parameter related to the average head achieved by pumping is positively related to the cost per unit volume of water, meaning that the cost of supplying drinking water becomes more inefficient as water is pumped to higher average head heights (Molinos-Senante et al. 2017). This issue is very relevant in the context of the water-energy nexus because the greater amount of energy required to pump water higher not only involves higher costs to water companies, but the pumping also creates higher greenhouse gas emissions.

The coefficient associated with the amount of drinking water removed from reservoirs was negative and statistically significant for the WoCs and metafrontier models. Because our sample included both WoCs and WaSCs, this means that each company differed in the proportion of its water received from various sources, such groundwater vs. surface water/reservoir sources. For example, in the south of the country water companies rely more on groundwater and rivers for water rather than on reservoirs (the predominant source of water for northern utilities). In all models, increases in water distribution losses resulted in higher costs per person for drinking water and therefore, higher inefficiencies. Our results show that a 1% increase in water distribution loss increases costs by 0.169–0.259%. This predicted increase supports conclusions reached by previous studies (Britton et al. 2013; Amoatey et al. 2014; Jang et al. 2018), which emphasized that water losses in pipelines (slow leaks) constitute an economic (and environmental) inefficiency for water companies. The estimate of bursts per connected property is negative and significant for the WoC and metafrontier models. This suggests that costs and inefficiencies could be reduced by investing in technologies that more accurately predict where and when water mains are likely to burst. This finding evidences the benefits of reducing water leakage from an economic and environmental point of view.. Hence, the water regulator should introduce incentives to water companies to promote investments that reduce water losses.

4.2 Group and Metafrontier Cost Efficiency

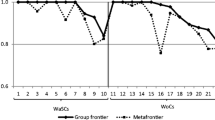

Estimates of group-frontier and metafrontier costs allowed us to compute cost efficiencies for both WaSCs and WoCs. Table 3 provides a summary of the estimated cost efficiencies relative to group cost frontiers (CE group) for WaSCs and WoCs and relative to the metafrontier cost efficiency (CE meta) and the cost gap ratio (CGR).

Because CGR reflects the extent of the cost gap between a group’s cost frontier and its metafrontier costs, all else being equal, the higher the CGR, the closer group’s cost frontier will be to the metafrontier cost and the lower the group’s frontier costs will be. CGR equals 1.0 at the point where the group-cost frontier coincides with the metafrontier costs (Li et al. 2017).

Based on cost efficiency scores for the two groups, we conclude that WaSCs and WoCs exhibit high levels of cost efficiency within their groups. On average, the cost efficiency of WaSCs and WoCs is 0.965 and 0.958, respectively, suggesting that costs could be reduced by 3.5% for WaSCs and 4.2% for WoCs, all while maintaining the same magnitude of output. This result suggests that although WaSCs and WoCs’ efficiency scores are high, there is room for further reduction in their costs. Because our data show that efficiency scores for water companies do not vary much, this suggests that both groups of water companies are homogeneous relative to performance. This convergence in performance characteristics may be attributable to the fact that water and sewerage regulations in England and Wales require companies to compare (benchmark) their performance relative to that of all other water companies. This regulatory focus is different from other regulatory models (e.g., the Chilean model), where water companies are compared with the most efficient company rather than against one another (Donoso 2018).

A comparison of group cost efficiency scores illustrates that WaSCs perform slightly better than WoCs, which is consistent with previous studies by Saal and Parker (2006); Portela et al. (2011), and Molinos-Senante et al. (2015). Table 3 shows that the overall CGR of WaSCs (0.969) is slightly higher than the CGR for WoCs (0.961). This suggests that cost-reducing techniques employed by WaSCs may be slightly more technologically innovative than those employed by WoCs. In other words, on average WaSCs can reduce their costs by 3.1% by moving from using WaSC’s technology to the technology available to both WaSCs and WoCs. The relative figure for an average WoC is 3.9%. As a result, WaSCs are also the most cost-efficient when compared against the metafrontier, with an average metafrontier cost efficiency of 93.5%, whereas the average metafrontier cost efficiency for WoCs was 92.1%. This implies that an average WaSC and WoC can further reduce its costs by 6.5 and 8% respectively. (Appendix I provides a table with the average group efficiency score, cost gap ratio scores, and metafrontier cost efficiency scores, by company).

Our results show that the most cost-efficient WoC is also efficient relative to its CGR score. This implies that it uses best available technology from both WaSCs and WoCs. In contrast, the cost efficiencies for the bottom four WoCs are inefficient relative to their CGRs, making their metafrontier cost efficiency scores low (< 0.8), meaning that these four low-scoring companies could potentially reduce their input costs by >20%. The most cost-efficient WaSC is also efficient relative to CGR. One of the two least efficient companies was ranked as having a relatively high CGR ranking. However, the metafrontier cost efficiency scores for both of them were low (i.e., input costs could be reduced by 7–15%). When a water utility’s group cost efficiency score is lower than its CGR score, it is crucial for it to use existing available technologies to improve its capital and labour inefficiencies.

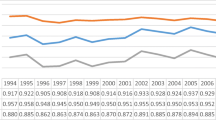

4.3 Cost Efficiency of Water Companies and Regulatory Cycles

Given that the dataset examined in this study covers a 12-y period from 1998 to 2009, we were able analyze the impact the regulatory cycle on cost efficiencies for both WaSCs and WoCs. Table 4 summarizes group cost efficiencies, by industry group, metafrontier cost efficiency (for all groups) and CGR for three sub-periods (based on water price data from Ofwat). Additional figures that show trends in the efficiencies are depicted in Appendix I.

In the first sub-period (1998–2000) both WaSCs and WoCs were extremely cost efficient relative to the group cost frontier, with WaSCs being more cost efficient than WoCs. This finding is consistent with previous studies by Saal and Parker (2006) in which the authors suggested that because average efficiency levels of the water companies they examined were relatively high before they were privatized, it was difficult to achieve substantial efficiency gains after privatization. The 1999 price review was the first review where Ofwat imposed tougher adjustment factors in their price cap formula to encourage water companies to improve their efficiencies (by introducing incentive schemes). One incentive of Ofwat involved increasing cost-reduction targets to 2.4% (more strict than the 2% after the 1994 price review), allowing companies to retain gains from efficiency cost savings for 5 years (a rolling incentive mechanism) regardless the year in which the gains were attained (Ofwat 2003). Moreover, Ofwat employed the Overall Performance Assessment (OPA) method to measure improvements in quality-of-service. [OPA is a composite measure of a company’s quality-of-service, comprised of customer service and environmental performance (Ofwat 2004)]. Water companies that outperformed in efficiency gains relative to incentive schemes were awarded with price limits, whereas under performing companies were penalized.

The introduction of the incentive schemes during the period 2001–2004 encouraged the water industry to become more innovative and cost efficient, based on changes we observed in CGR and metafrontier cost efficiency scores, with WoCs outperforming WaSCs. During that 3-y period, both WaSCs and WoCs attained higher efficiency scores than they did during the other two time periods we examined (1998–2000 and 2005–2009).

The third sub-period (2005–2009) we examined covered the time frame after the price review procedure was first introduced in 2004. As part of its price review, Ofwat retained the rolling incentive mechanism and OPA targets, but reduced cost reduction targets and subsequently, price caps (Ofwat 2004). As a result, water companies did not have a strong incentive to improve in efficiency, which is reflected in the downward trend of CGR and meta-efficiency scores after 2004. This downward trend in efficiency is consistent with studies conducted by Maziotis et al. (2017), in which the authors reported that the 2004 price review did not stimulate an increase in productivity or quality-of-service. However, the authors suggested that there might have been external factors (unrelated to relaxing of regulatory mandates) that could also have influenced efficiencies. For example, dry winters in 2005 and 2006 and severe flooding in 2007 negatively impacted the security of water supply. Another possible reason for reduced efficiency scores is that the water industry of England and Wales implemented costly measures to reduce leakages to improve quality-of-service to its customers, improve drinking water quality, and meet environmental standards, costs which probably resulted in increased costs of operations and capital expenditures, and thus, lower efficiency scores. Leakage declined from 228 l/property/day in the 1994–1995 period and to 141 l/property/day in the 2006–2007 period. Moreover, many water companies reduced their water losses to the economic level of leakage (Walker 2014). Improving customer service, encouraging innovation to reduce costs, and keeping customers’ bills affordable was of outmost importance to the water industry prior to subsequent price reviews (Ofwat 2017). Our results show that differences in cost efficiencies between WaSCs and WoCs companies were highest in the first period of study (1998–2000), but differences between the two types of companies have become less over time, with cost efficiency scores converging (at 0.929) for the last period evaluated.

5 Conclusions

Given the relevance of using appropriate performance benchmarks for evaluating and comparing the performance of water companies, this study estimates cost efficiencies of English and Welsh WaSCs and WoCs using a stochastic metafrontier cost approach, over the period 1998–2009. The main findings are as follows: (1) WaSCs and WoCs operate under different technologies and so any cost efficiency comparison across both types of water companies should be carried out using the metafrontier approach, (2) the water industry of England and Wales operates under economies of scale, (3) it is more efficient to serve densely populated areas; increased volume of leakages and pumping head elevation increase cost inefficiencies, whereas water abstracted from reservoirs and investments in technology to reduce bursts in water mains both reduce long-term cost inefficiencies, (4) WaSCs perform more efficiently than WoCs (based on cost gap ratio and metafrontier data), and (5) the more stringent 1999 price review requirements encouraged water companies to be more cost efficient and innovative, whereas the less stringent 2004 price review requirements did not provide strong enough incentives to improve efficiency and quality-of-service in the industry.

Our results should be of great interest to policy makers and researchers in the water industry. First, our parametric metafrontier approach would enable water companies to identify factors that negatively impact their costs, and then aid them to make more informed decisions about where and how to improve performance. Second, results of this study evidenced that the water regulator cannot compare the performance of WaSCs and WoCs using a single cost frontier but the metafrontier approach is required to avoid biased conclusions. Finally, the identification of variables that impact the cost efficiency of water companies sheds light on potential causes of cost inefficiency differences among water companies that are beyond management issues. Since some of these factors are not controllable by water companies, they should be considered by the water regulator when setting water tariffs.

In spite of the usefulness of the conclusions of this study, a limitation is that the available data do not allow us to evaluate the impact of Ofwat’s most recent price reviews on the cost efficiency of water companies. Future research will focus on extending the dataset by including information from the 2009 and 2014 price reviews. Moreover, the study could be repeated by integrating additional and/or alternative exogenous and quality-of-service variables to assess their impact on the cost efficiency of water companies in England and Wales. Finally, alternative stochastic frontier models such as a true-fixed effect or true random effects model can be used to provide cost efficiency estimates.

References

Amoatey PK, Minke R, Steinmetz H (2014) Leakage estimation in water networks based on two categories of night-time users: a case study of a developing country network. Water Sci Technol Water Supply 14(2):329–336

Arocena P, Saal DS, Coelli T (2012) Vertical and horizontal scope economies in the regulated US electric power industry. J Ind Econ 60(3):434–467

Battese GE, Prasada Rao DS, O'Donnell CJ (2004) A metafrontier production function for estimation of technical efficiencies and technology gaps for firms operating under different technologies. J Prod Anal 21(1):91–103

Bottasso A, Conti M, Piacenz M, Vannoni D (2011) The appropriateness of the poolability assumption for multiproduct technologies: evidence from the English water and sewerage utilities. Int J Prod Econ 130(1):112–117

Britton TC, Stewart RA, O'Halloran KR (2013) Smart metering: enabler for rapid and effective post meter leakage identification and water loss management. J Clean Prod 54:166–176

CEPA (2014) Cost assessment—advanced econometric models. Cambridge Economic Policy Associates Ltd Report prepared for Ofwat

Chen C-Y, Lin S-H, Chou L-C, Chen K-D (2018) A comparative study of production efficiency in coastal region and non-coastal region in mainland China: an application of metafrontier model. J Int Trade & Econ Dev 27(8):901–916

De Witte K, Marques RC (2009) Capturing the environment, a metafrontier approach to the drinking water sector. Int Trans Oper Res 16(2):257–271

De Witte K, Marques RC (2010) Incorporating heterogeneity in non-parametric models: a methodological comparison. Int J Oper. Res. 9(2):188–204

Donoso G (2018) Water policy in Chile. Springer, New York

Hayami Y (1969) Sources of agricultural productivity gap among selected countries. Am J Agric Econ 51(3):564–575

Huang CJ, Huang TH, Liu NH (2014) A new approach to estimating the metafrontier production function based on a stochastic frontier framework. J Prod Anal 42:241–254

Honma S, Hu J-L (2018). A meta-stochastic frontier analysis for energy efficiency of regions in Japan. Journal of Economic Structures. 7:21.

Jang D, Park H, Choi G (2018) Estimation of leakage ratio using principal component analysis and artificial neural network in water distribution systems. Sustainability (Switzerland) 10(3):750

Kumbhakar SC, Amundsveen R, Kvile HM, Lien G (2015) Scale economies, technical change and efficiency in Norwegian electricity distribution, 1998–2010. J Prod Anal 43(3):295–305

Li H-Z, Kopsakangas-Savolainen M, Xiao X-Z, Lau S-Y (2017) Have regulatory reforms improved the efficiency levels of the Japanese electricity distribution sector? A cost metafrontier-based analysis. Energy Policy 108:606–616

Marques RC (2010) Regulation of water and wastewater services: an international comparison. IWA Publisking, London

Maziotis A, Saal DS, Thanassoulis E, Molinos-Senante M (2014) Profit change and its drivers in the English and welsh water industry: is output quality important? Water Policy 18(4):1–18

Maziotis A, Molinos-Senante M, Sala-Garrido R (2017) Assessing the impact of quality of service on the productivity of water industry: a Malmquist-Luenberger approach for England and Wales. Water Resour Manag 31:2407–2427

Mellah T, Ben Amor T (2016) Performance of the Tunisian water utility: an input-distance function approach. Util Policy 38:18–32

Molinos-Senante M, Maziotis A (2017) Estimating economies of scale and scope in the English and welsh water industry using flexible technology. J Water Resour Plan Manag 143(10):04017060

Molinos-Senante M, Maziotis A, Sala-Garrido R (2015) Assessing the relative efficiency of water companies in the English and welsh water industry: a metafrontier approach. Environ Sci Pollut Res 22(21):16987–16996

Molinos-Senante M, Maziotis A, Sala-Garrido R (2017) Assessing the productivity change of water companies in England and Wales: a dynamic metafrontier approach. J Environ Manag 197:1–9

Nguyen TPT, Nghiem SH, Roca E, Sharma P (2016) Efficiency, innovation and competition: evidence from Vietnam, China and India. Empir Econ 51(3):1235–1259

O’Donnell CJ, Rao P, Battese GE (2008) Metafrontier frameworks for the study of firm-level efficiencies and technology ratios. Empir Econ 34:231–255

Ofwat (2003) Setting water and sewerage price limits for 2005-10: framework and approach. Office of Water Services, Birmingham

Ofwat (2004) Future water and sewerage charges 2005–10: final determinations. Office of Water Services, Birmingham

Ofwat (2017) Delivering water 2020: our final methodology for the 2019 price review. Water Services Regulation Authority, Birmingham

Pinto FS, Simões P, Marques RC (2017) Water services performance: do operational environment and quality factors count? Urban Water J 14(8):773–781

Porcher S, Maziotis A, Molinos-Senante M (2017) The welfare costs of non-marginal water pricing: evidence from the water only companies in England and Wales. Urban Water J 14(9):947–953

Portela MCAS, Thanassoulis E, Horncastle A, Maugg T (2011) Productivity change in the water industry in England and Wales: application of the Meta-Malmquist index. J Oper Res Soc 62(12):2173–2188

Saal DS, Parker D (2001) Productivity and Price performance in the privatized water and sewerage companies in England and Wales. J Regul Econ 20(1):61–90

Saal DS, Parker D (2006) Assessing the performance of water operations in the English and welsh water industry: a lesson in the implications of inappropriately assuming a common frontier. In: Coelli T, Lawrence D (eds) Performance measurement and regulation of network utilities. Edward Elgar, Cheltenham

Stone & Webster Consultants (2004) Investigation into evidence for economies of scale in the water and sewerage industry in England and Wales; final report, Report prepared for and published by Ofwat

Suárez-Varela M, de los Ángeles García-Valiñas M, González-Gómez F, Picazo-Tadeo AJ (2017) Ownership and performance in water services revisited: does private management really outperform public? Water Resour Manag 31(8):2355–2373

Torres M, Morrison PC (2006) Driving forces for consolidation or fragmentation in the US water utility industry: a cost function approach with endogenous outputs. J Urban Econ 59(1):104–120

Walker G (2014) Water scarcity in England and Wales as a failure of (meta) governance. Water Altern. 7:388–413

Wang Q, Zhang H, Zhang W (2013) A Malmquist CO2 emission performance index based on a metafrontier approach. Math Comput Model 58(5-6):1068–1073

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

None.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

ESM 1

(DOCX 482 kb)

Rights and permissions

About this article

Cite this article

Molinos-Senante, M., Maziotis, A. Cost Efficiency of English and Welsh Water Companies: a Meta-Stochastic Frontier Analysis. Water Resour Manage 33, 3041–3055 (2019). https://doi.org/10.1007/s11269-019-02287-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11269-019-02287-8