Abstract

This study simulates the economy-wide effects of introducing new water pricing systems in Israel. A Computable General Equilibrium (CGE) model, STAGE_W, is used that includes multiple water commodities produced from different water resources. The current water pricing scheme supplies potable water to municipalities at fees above the supply costs and subsidizes water delivered to the agricultural and the manufacturing sectors. Due to limited freshwater resources, climate change and population growth, water scarcity is an increasing problem in Israel. Therefore, pricing systems which lead to a more efficient allocation of water are intensely debated. This study analyzes two alternative pricing schemes under discussion in Israel: price liberalization, which unifies the prices for all potable water consumers at cost recovery rates, and marginal pricing that lifts the potable water price to the cost of desalination. Both schemes reduce water demand with limited economic costs. Price liberalization is the more favourable option from a national welfare perspective, while marginal pricing allows for larger water savings and, in the long run, independence from fresh water resources.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

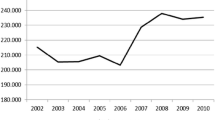

Water in Israel is a very scarce resource (Fleischer et al. 2008): the annual supply of less than 250 m3 per capita is 50 % below the threshold of severe water scarcity according to the Falkenmark indicator (Tal 2006). The long-term sustainable average annual renewable supply of freshwater from natural sources is estimated at about 1800 million m3 including aquifers shared with the Palestinian Territories (Weinberger et al. 2012). This matches only about 80 % of the total Israeli water consumption. However, the actual supply is highly variable (Fleischer et al. 2008). In recent years, Israel faced almost seven consecutive years of drought (Lavee and Ash 2013) and replenishment rates of aquifers have been as low as 1091 million m3 in 2008 (Weinberger et al. 2012). This, together with an increasing demand for potable water, due to economic growth and immigration, has led to a situation of overexploitation of renewable water resources in the country.

To mitigate this problem and meet the annual demand of about 2130 million m3, alternative water sources have been explored in recent years. In 2010, about 450 million m3 of reclaimed wastewater and 300 million m3 of desalinated water were supplied in addition to natural sources. At the same time, 174 million m3 of brackish groundwater were extracted. Agriculture is the main user of water at 1044 million m3 per year (more than 50 % is recycled wastewater and brackish water), followed by municipalitiesFootnote 1 at 764 million m3 and industry at 120 million m3. 143 million m3 are diverted to Jordan, as agreed in the 1994 peace treaty, and to the Palestinian Water Authority, while 60 million m3 is reserved for the rehabilitation of natural habitats (IWA 2012).

The problem of water scarcity is expected to become more severe in the future (Kislev 2011): domestic water demand in Israel is predicted to rise with population growth, increases in temperature and changes in the amount and distribution of rainfall (Fleischer et al. 2008). Moreover, the supply of water to the Palestinian National Authorities is expected to increase in the future (Kislev 2011).

Water prices are set by a governmental agency, the Israeli Water Authority (IWA), which established an agreement with farmers in 2007 stipulating a gradual shift to cost recovery prices. However, in 2010 the agricultural sector still received potable water at subsidized prices (Kislev 2011). The same holds true for the manufacturing sector, though to a lesser extent, which contradicts the declared aim to restrain water consumption (NIC 2010). This situation continues till today: the IWA suggests that potable water prices in the agricultural sector still would need to be raised by close to 40 % to achieve cost recovery rates (Reznik et al. 2015).

Because the current pricing system is heavily debated domestically, this study estimates the implications that different pricing regimes might have on water use, welfare and economic performance in Israel. As changes in the water policy have economy-wide effects, a water focussed Computable General Equilibrium (CGE) model, such as STAGE_W (Luckmann and McDonald 2014), which is used in this study is well suited to evaluate these effects. While CGE-models have been applied to analyse water policies in different contexts before (e.g. Briand 2006; Letsoalo et al. 2007; Solís and Zhu 2015), the novelty of our approach is that it considers different water qualities produced with different cost-structures linked to different water-resources and for which a differentiated pricing system applies.

2 The Israeli Water Economy

According to the Israeli law, all domestic water resources are state property. The IWA was established to implement the water law, govern water resources and determine water prices (Kislev 2011).

The exploration of new water sources has been encouraged by the effects of a lasting drought: by 2010 about 75 % of all wastewater produced in Israel was reclaimed and used. Due to the growing municipal potable water consumption, the IWA aims to provide about 600 million m3 of reclaimed wastewater mainly to the agricultural sector by 2020 (IWA 2012; Lavee and Ash 2013). Further, several reverse osmosis seawater desalination plants have been constructed on the basis of Build-Operate-Transfer (BOT) contracts by private companies. The installed capacity is expected to reach 750 million m3 per year by 2020 (IWA 2012), to cover most of the municipal demand.

The IWA is also seeking to reduce potable water consumption, particularly in the agricultural sector, where it aims at a higher usage of reclaimed wastewater, which is made more attractive by a lower price (Kislev 2011). However, sanitary restrictions limit its irrigation use to non-food and tree crops. In addition, the use of brackish water, mainly for the irrigation of salt tolerant crops (e.g. cotton and tomatoes) has been fostered and reached 174 million m3 in 2010 (IWA 2012). These supplies are from fossil aquifers in the Negev in the south of Israel.

The IWA operates a pricing regime whereby prices are differentiated according to user-group (municipalities, industry, and agriculture) and water qualities (brackish, reclaimed, and fresh) (Fig. 1). The taxes and subsidies in the water sector are not explicitly identified but can be calculated as the difference between the costs of water provision and the fee charged to each consumer group. The IWA guarantees prices to the operators of the desalination plants, but the costs of provision of potable water by seawater desalination are far higher than the costs of fresh water purification. Therefore, there is an implicit production subsidy for desalination. However, the IWA sets the final consumer price independent of the costs of supply. This results in an implicit consumer subsidy for potable water consumption in the agricultural and manufacturing sectors, and an additional tax levied on wastewater and brackish water consumption, as well as on potable water consumption of the municipal sector.

The National Investigation Committee report on the water economy in Israel recommended introducing a water pricing scheme, which reflects total average water supply costs including extraction, transportation, and environmental costs, to limit water extraction to a level below the average annual recharge (NIC 2010). Alternatively it has been argued that the water price should equal the marginal cost of potable water, i.e., the cost-level of desalination, since at this price, all water demands could be supplied (Kislev 2011). Marginal cost can be considered the benchmark price on efficiency grounds. These water pricing strategies are the basis for the analyses reported in this paper.

3 Methodical Background

CGE models are often applied to study the economy-wide effects of changes in exogenous factors such as policy. The advantage of this class of models lies in their ability to capture feedbacks within the economy and thus allow for the assessment of second round effects (Logar and van den Bergh 2013). Especially for analyses regarding the water sector, CGE models are suitable because water is used across the economy in production and by households while the sector is often managed by the government and subject to complex policies. Thus, changes in the water sector affect many economic agents directly (e.g. if water prices increase) and indirectly (e.g. increasing prices of agricultural products if water prices increase). Therefore, this model class is well suited to analyse the potential effects of a change in water-related policies (Logar and van den Bergh 2013). CGE models require a large data-base, usually compiled in a Social Accounting Matrix (SAM), which captures all economic interactions within an economy, together with a set of assumptions regarding the behaviour of the different economic actors. A recent overview on water related CGE approaches is provided by Dinar (2014).

With respect to Israel, limited water related CGE studies have been conducted. Yerushalmi (2012) investigated the efficiency of the administrative water allocation in Israel. The database was highly aggregated and included three productive sectors, two factor accounts (labour and capital), and one representative household-government account. While analysing social welfare effects of the introduction of a water market, Yerushalmi (2012) did not consider distributional effects and consequences for different household groups or limited domestic water resources and the use of desalination to preserve those resources. The STAGE_W model has been used by Luckmann et al. (2014) to investigate effects of increasing the desalination capacity to alleviate water scarcity and to demonstrate the importance of considering the freshwater and reclaimed wastewater supply as an interlinked system. They concluded that the social benefits of water supplied from additional desalination facilities may be negative due to the current pricing policy, which involves large subsidies. Their finding motivates further analysis of the current pricing system and provision of possible alternatives, which is addressed in the present study.

4 Data and Model

This study is based on a 2004 SAM by Siddig et al. (2011), which is the most recent and detailed available SAM for Israel. This SAM is further updated and expanded to depict details of the Israeli water sector. Accounts for four water resources (groundwater, seawater, wastewater, and brackish groundwater), four related activities and three water commodities (potable water, reclaimed wastewater and brackish water) have been included using data from the IWA (in Zaide 2009), FAO (2009) and CBS (2009; 2011). Additional satellite accounts record the use of physical water quantities. Detailed information on costs of water supply and fees is sourced from the 2006 Satellite Account of Water in Israel (CBS 2011) and summarized in Fig. 1. Moreover, a pre-simulation is implemented to update the water accounts of the SAM to the situation in 2007, such as to capture the increasing contribution of desalination after the opening of the Ashkelon desalination plant in 2005.

The final SAM has 46 activity accounts, 45 commodity accounts, 40 factor accounts, and 11 tax instruments. Distributional issues are addressed by 10 representative household groups, categorised by ethnic background (Jewish and non-Jewish) and income (5 quintiles).

Agriculture is the largest user of water in Israel; the use of water by the different agricultural activities identified in the SAM is reported in Fig. 2. Within the cropping sector, vegetable and fruit plantations are by far the largest water users followed by “other crops”, including cotton, sunflowers, and other field crops. The usage of brackish water is limited to these two classes of crops as only these two groups include plants that are tolerant of elevated salinity levels. Similarly, recycled wastewater can only be used by these crops in addition to “mixed farming and forestry” due to sanitary regulations. Data on the use of marginal waterFootnote 2 by different agricultural activities is limited and hence the use of brackish and reclaimed water is split between activities that allow their use according to their shares in total water consumption. Moreover, Fig. 2 reports the cost shares of water in total production costs.

Water use in the Israeli agricultural sector in 2004. Source: Luckmann et al. 2014

The model, STAGE_W (Luckmann and McDonald 2014), is a water focused CGE model development of the STAGE model (McDonald 2009). Changes in the behavioural relationships are concentrated on production and consumption relations and water specific tax instruments. For this study the model is adapted to capture the particular structure of the water sectors in Israel, described above. The model encompasses four water (re-)sources which are linked to four related activities, each with different cost structures that produce three water commodities (Fig. 1). Freshwater purification and desalination produce the same output: potable water that is distributed via a single network. Consequently a homogenous commodity is produced by two activities with different costs structures. Therefore, the desalination activity is implicitly subsidised, which reduces the output price of desalination to the one of freshwater purification.

The seven water resources, by-products and commodities, form the lowest level of the production system (see Appendix 1), and constitute the potential components of water-aggregates that are specific to the activity that uses that aggregate. The composition of this aggregate is governed by each activity: each water activityFootnote 3 requires a specific resource, whereas for non-water activities the water-aggregate can be formed from up to three different water commodities.

The four water activities employ fixed proportions of capital, labour, and intermediates. All non-water activities are modelled with more flexibility. Agricultural activities, which allow for the consumption of all three different water commodities, can substitute these water commodities with a medium to low substitution elasticity (σ4) of 0.8 (Sadoulet and de Janvry 1995). This rather low substitutability reflects the fact that not all components of the aggregated activities can use marginal water qualities and that the option to use marginal water does not exist in all localities, although there is an extended supply network for recycled wastewater in Israel. On the third level of the production function, water and land form a CES-aggregate, whereby the substitution elasticity (σ3) is 0.3 following estimates of irrigation-land substitutability by Faust et al. (2015). The land-water aggregate is then combined with labour and capital at the second level of the production function. Given the prevalence of drip irrigation systems in Israel which increase the water use efficiency at the cost of the investment required, the substitution elasticity (σ2) is set at 0.8 (Berck et al. 1991). The top-level combines the value added and water aggregate with aggregate intermediate inputs with an elasticity (σ1) of 0.5.

Two water specific tax/subsidy instruments allow differential pricing of water according to water type and user. The (implicit) commodity tax and a user specific subsidy result in three different prices for potable water according to user group: agriculture, manufacturing and municipalities. This is illustrated, with the applied rates for Israel, in Fig. 1.

5 Water Policy Scenarios

5.1 Scenarios

This study evaluates the implications of two alternative water pricing strategies on the Israeli economy with a focus on the different end users of water commodities: price liberalization for potable water and marginal cost pricing for potable water. These pricing regimes are depicted in three scenarios and the outcomes are presented against the current pricing system, which is a differentiated pricing structure for potable water where agricultural and manufacturing use are subsidized and municipalities are taxed.

5.1.1 Lib: Liberalization of the Potable Water Sector

This scenario estimates the economic costs of the current Israeli water policies relative to a free-market scenario, i.e., all taxes and subsidies on potable water are removed, so that the final price paid by all consumer groups is equal to the producer price plus the value added tax which is held constant. Thus consumers of water cover the full costs of provision, which is a major policy objective of the IWA (Rejwan 2011). Taxes on marginal water commodities are not altered in this simulation, since they are not under debate, which allows the simulation to capture the outcomes of a policy change solely in the potable water sector.

5.1.2 Marg-sav: Marginal Price Scenario Without Redistribution of Additional Government Revenue

This scenario simulates the declared objective of the IWA to reduce dependency on natural fresh water resources (Rejwan 2011). It imposes the marginal price for potable water in Israel on all consumers, which is the full cost of desalination inclusive of capital costs of building desalination plants and delivery (Kislev 2011). This increases all consumer prices. In the long-run, any quantity of potable water can be supplied at this price since it includes investment costs for further desalination plants. Therefore, this scenario allows for independence from natural fresh water resources in the long-run. Again, policies on marginal water commodities are not altered.

5.1.3 Marg-trans: Marginal Price Scenario with Redistribution of Additional Government Revenue

The shock for this scenario is the same as in the previous scenario, but it further assumes that government savings are fixed and transfers to households are flexible. Due to the shock, government expenditures on water subsidies decline and the government’s budget surplus is redistributed to households as transfers that change equiproportionally, which has different distributional implications.

Because simulation results in terms of quantity and price changes differ only very slightly between the two marg-scenarios, they are jointly reported, except for the welfare analysis.

5.2 Macroeconomic Closure and Factor Market Clearing

Israel is a small country, therefore in the model world market prices are fixed. It is also assumed that the external balance is fixed, reflecting the large current account transfers received by Israel. The external account is cleared by variations in the exchange rate. The real value (volume) of investment is fixed and government savings are flexible (except for the last scenario): the saving rates of domestic non-government institutions (households and enterprises) adjust to clear the capital account. Government account transfers to enterprises and tax rates remain constant with the exception of the subsidy to the desalination activity, which endogenously adjusts to balance changes in production price differences between the two potable water producing activities. The other water tax instruments are exogenously adjusted in the simulations. Transfers to households are fixed in the first two reported scenarios but are flexible in the third.

All factors of production are fully employed and mobile between activities, such that the model results reflect a long-term perspective. Exceptions are the water resources and by-products, which have fixed values per unit while the quantities used are flexible to allow for changes in water consumption.

The potable water price shifts in the simulations cause a reduction in demand. It is a political decision whether supply from natural fresh water or from desalination should be reduced. It was decided here to reduce primarily the desalination supply, due to the higher provision costs. As this is not sufficient, also the supply from natural fresh water resources is reduced. This approach has the additional advantage, that it removes the distortive subsidy on the desalination activity.

6 Simulation Results

6.1 Water Prices and Production Costs

In all simulations applied in this study, potable water prices are unified. In the lib-scenario, this results in a price reduction for municipalities and a price increase for agricultural and industrial users, whereas in the marg-scenarios this results in a price increase for all user groups. The largest changes occur to the agricultural sector, where the price of potable water increases by 159 % in the lib-scenario and quadruples in the marg-scenarios (Table 1).

In all scenarios, price changes are predominantly caused by the abolishment of taxes and subsidies on potable water. Yet, part of the price changes stem from second round effects since water price changes also have economy-wide effects: due to unified pricing, water is shifted to activities in which it is used more efficiently. As potable water becomes cheaper for the services sector in the lib-scenario, this sector expands and uses additional production factors coming from reduced agricultural and industrial activities. Due to higher demand for factors and intermediate inputs motivated by the increased overall production, most factors of production and intermediary inputs become more expensive and, therefore production costs for potable water increase by 0.7 % in the lib-scenario. In the marg-scenarios, water becomes more expensive for all sectors, hence, slightly affecting the whole economy negatively. Therefore, all factors of production and most non-agricultural intermediate inputs become cheaper and thus production costs of potable water decrease by −0.3 %.

The production costs of both marginal water commodities are affected similarly in the different scenarios. Since the respective tax instruments are not altered in the simulations, these changes directly translate into consumer price changes (Table 1).

6.2 Agricultural Sector

In all scenarios, the agricultural sector experiences the highest potable water price increase. Consequently, the use of potable water in agriculture declines sharply. As marginal water commodities become cheaper in relation to potable water in all scenarios (Table 1), the usage of these water types slightly increases, which mitigates the reduction in the overall consumption of water in agriculture (Table 1, lower section). The increase in demand for marginal water commodities is not larger because its use is limited to only a few agricultural activities and therefore, the substitution-elasticities are low. Furthermore, prices of marginal water commodities are influenced very little in view of the fact that the marginal water sector is small and reacts in a relatively unresponsive manner.

The changes in water use by the agricultural sector are shown in detail in Fig. 3a. The consumption of potable water by agricultural activities declines by up to 54 % in the lib-scenario and up to 69 % in the marg-scenarios. On the other hand, the share of marginal water use increases in the production of “vegetables and fruits” and “other crops” by 17 and 24 % in the lib- and marg-scenarios, respectively, as well as in “mixed farming” by 19 and 27 %, respectively, since marginal water becomes relatively cheaper. The overall water-balance is negative for all activities, and especially the production of water intensive commodities declines (compare Fig. 3a and b). Moreover, water is substituted by land and other factors of production which become cheaper. The absolute quantity of marginal water used in the production of “other crops” declines because of the comparatively strong decrease in the production of this activity (Fig. 3b). This decline results from its high export dependency and the pronounced reductions in exports due to rising production costs in combination with constant export prices.

The increased prices of water inputs cause higher producer prices for all domestically produced agricultural commodities. The highest increase occurs for “other cereals” for which the producer price rises by 9 and 14 % in the lib- and marg-scenarios, respectively. Due to higher production costs, it becomes less profitable to export agricultural commodities at fixed world prices in all scenarios, while imports become comparatively cheaper and thus slightly increase. Taken together, composite consumer prices do not increase as much as consumer prices for domestic supply of agricultural goods (Fig. 3b). The magnitude by which the consumer prices for domestic supply of agricultural goods increase is mostly correlated with the water use intensity of the respective activity.

Domestic demand for all agricultural commodities decreases due to increasing prices. Most strongly affected are “other cereals”, for which demand is reduced by 13 and 20 % in the lib- and marg-scenarios, respectively. Export quantities are reduced even more than supply to the domestic market. The total effect on domestic production can be seen in Fig. 3b. Since in all scenarios potable water becomes more expensive while export prices remain stable, the output is particularly reduced for commodities which have a high share of water in their input costs (Fig. 2) and which are to a large extent exported.

6.3 Manufacturing and Municipalities

Because of the higher price in all scenarios, potable water consumption is reduced in the manufacturing sector by up to 45 % in the marg-scenarios. Although this seems high, such a reduction could be achieved through internal water recycling, which allows for saving rates of up to 95 % (Levine and Asano 2002). The magnitude of the reduction in individual activities is correlated with the increase in overall production costs, which are caused by the rise of the potable water price. The same holds true for service activities, though at a lower magnitude (0.9 % on average), as the potable water price for municipalities increases by 0.8 % only. Households also reduce potable water consumption slightly (−0.3 % on average) By way of contrast, the lib-scenario causes potable water prices to decrease for municipalities and therefore consumption increases. However, total potable water consumption still decreases since this is outweighed by the reduction of potable water consumption of the other sectors (Table 1).

Producer and consumer prices of all non-agricultural commodities also rise in the lib-scenario. For the manufacturing sector, the price increase is mainly due to the higher potable water prices as well as the increase in agricultural commodity prices which raises the costs of inputs in food processing activities. However, because of the low share of water in the production costs and the moderate price increase of agricultural commodities, prices of manufactured goods increase by no more than 2 %, with the largest increases in the output prices of food processing activities.

The decrease in the price of potable water for municipalities in the lib-scenario has two effects: first, it decreases household expenditures for water and second, it reduces water costs for the service sector. Nevertheless, output prices in the service sector rise by about 0.7 % due to the price increase of industrial products. As intermediary inputs, these make up for a higher share in production costs in the service sector compared to water. Additionally, household demand for services increases since household expenditures on water declines, which allows for additional consumption of other goods.

In the marg-scenarios, on the other hand, prices of services and of most manufacturing goods drop slightly (by about −0.3 %), only products of the food industry become more expensive (by about 0.7 %) due to the increase in the prices of agricultural commodities. The reason for the general price decrease, despite even stronger price increases for potable water compared to the lib-scenario, is the reduced production of agricultural and most industrial goods, which frees up labour and thereby lowers the wage rate. The lower wage rate overcompensates for the effect of increasing water prices and thus results in a lower output price. Household income declines as a result of the decrease in wages, while consumer prices of water and foodstuff increase. The result is a lower domestic demand for these commodities. However, demand for other commodities increases slightly due to household substitution and the expanding production of marginal water which requires additional intermediary inputs.

Overall household demand increases by 0.21 % in the lib-scenario and 0.07 % in the marg-scenarios. In the marg-scenarios this additional demand is largely fulfilled by imports (+0.21 %) which, due to a slight appreciation of the Israeli currency (0.3 %) become cheaper.

6.4 Macro and Welfare-Effects

The effect on the total output of the Israeli economy in the lib-scenario is positive due to the removal of distortions in the water sector. In the marg-scenarios a price increase for all water users is added to this, which has an adverse effect. The overall welfare effects of the two simulations are small since the share of the water sector in the Israeli economy is small (about 0.7 % of total domestic production in the base situation) and all household groups spend less than 1 % of their income on water. Therefore, real GDPFootnote 4 increases by only 0.12 % in the lib-scenario. Also, the effect of marg-scenarios on real GDP is still positive (+0.03 %) driven by the slight increase in private consumption.

The effects on household welfare, measured as changes in equivalent variation (EV) relative to household consumption expenditure, are also small for similar reasons.Footnote 5 In the lib-scenario, the EV shows a clear trend in favour for richer households and it is negative for the two poorest quintiles of both ethnic groups. Changes in EV range from −0.2 % for the poorest quintile of Jewish households to +0.8 % for the richest non-Jewish households (Fig. 4). The reasons for this are the opposing effects of decreasing water prices charged to municipalities. While the decreasing prices make water and service commodities cheaper, they also increase the price of agricultural commodities and decrease wages in the agricultural sector. The latter affects the poorer households disproportionately, as they derive a relatively high share of their income from employment in the agricultural sector and at the same time spend a comparatively high share of income on agricultural and food-commodities.

In the marg-sav-scenario, when the government saves its additional income, the welfare effects are exaggerated, whereby additional household groups are negatively affected (Fig. 4). This is due to the rising prices of water and food-commodities. Only the top Jewish and the top two non-Jewish household quintiles still profit from this situation, mainly because of the high share of income from enterprises of these household-groups, which increases by 2.7 % in this scenario. Moreover, prices for services fall, which especially benefits the richer quintiles. In the marg-trans-scenario, where additional water tax revenue is transferred to households, distribution is more equal and welfare effects are minimized. Thus welfare losses are mostly converted to gains, which reach a maximum of 0.2 %. Only the third non-Jewish quintile still experiences a very small loss of 0.03 % as the gains from the additional government transfers cannot completely compensate the losses caused by the price increases in this case.

7 Discussion and Conclusions

The non-sustainability of the current water supply scheme in Israel is widely recognised and the current political debate has emphasised price-based policy reforms. This analysis assesses two core options for a more efficient water policy: price liberalization and marginal cost pricing for potable water.

Both pricing options reduce the demand for potable water to an extent that make desalination schemes unnecessary and at the same time relieve the pressure on aquifers. Therefore, instead of further extending desalination capacity, installed desalination capacity could be used flexibly as a buffer against shortages and droughts as suggested by Goldfarb and Kislev (2005).

The costs of the current water pricing scheme are harmful to the Israeli economy. They result in an annual GDP loss of 0.12 % (equivalent to about 150 million USD) compared to a market based approach in which prices are unified and cover the full costs of water supply. If the water pricing schemes were reformed as envisaged by the liberalization scenario, demand for potable water would reduce to a level that makes desalination unnecessary and additionally saves 12 million m3 of natural fresh water annually.

The analyses show that both pricing scenarios result in substantial reductions in the demand for potable water. These reductions in demand are noticeable for the liberalization scenario, but even more for the marginal cost pricing scenarios (297 million m3). Under the marginal cost scenarios, the aquifers could be protected from overexploitation even at their low replenishment rates from recent droughts by providing some 100 million m3 of potable water through desalination.

In both marginal pricing scenarios the economic costs are low. Caused by the reductions in taxes, real GDP, private consumption and welfare of many household groups actually increase. In all scenarios government funds increase, mainly due to the reduced expenditure, owed to the removal of the desalination subsidy and in the lib-scenario, because of the overall increase in economic activity generating additional tax revenue. The increase in government revenue could be used to fund investments in the development of alternative water facilities and technologies. These investments could include: improving access to the reclaimed water network and upgrading the quality of reclaimed wastewater so as to allow for a wider use in the agricultural sector and also in some industrial processes. Additionally, transfer payments could be made to those households that experience reductions in welfare as demonstrated by the marginal cost pricing scenario with compensating redistribution. This would mitigate the negative effects of a potable water price increase and further reduce the pressure on freshwater resources.

If the government of Israel aims at saving even more natural fresh water or providing additional potable water, e.g. to meet rising demand due to population growth, these requirements can be supplied by desalination, which would operate cost-neutral in the marginal pricing scenarios.Footnote 6 In the longer-term, the marginal cost pricing scenarios would allow the Israeli economy to be completely independent from natural fresh water resources. The water fee in these scenarios covers the costs of desalination, which include the capital costs for investing in new desalination plants. That way, any quantity of potable water could be provided independently from aquifer replenishment rates. This becomes even more feasible if technological progress is considered, which is expected to further reduce desalination costs (by up to 50 % in the next 20 years) (Ziolkowska 2015). As a result, desalination in Israel would become competitive enough (compare Fig. 1) to produce potable water without being subsidized. In this case economic indicators would be similar to the scenarios described in this paper and not be affected negatively (see footnote 6).

In general, this analysis shows that a more market oriented/liberal water policy improves welfare, a finding that is in line with other research (e.g. Solis and Zhu 2015). Further, it suggests that a smart water policy yields a double dividend by saving water on the one side and increasing economic growth on the other, which coincides with findings from South Africa (Letsoalo et al. 2007). Even a triple dividend (reduction of poverty) would be possible, depending on the redistribution policy of budgetary revenue from increased water fees. Thereby, the increasing use of marginal water resources contributes to mitigate the negative outcome for the agricultural sector.

The substitution elasticities and market clearing conditions for this analysis are set up to report effects for a medium- to long-term time horizon. A sensitivity analysis shows that with halved production elasticities most economic indicators develop in the same direction, whereby most outcomes are more negative or less positive due to the lower flexibility in the short-term, which is expressed by the reduced substitution elasticities (Appendix 2).

For a long-term analysis, in order to consider the growth of water demand due to economic and population growth and to depict the time path of adjustment, future research could apply a dynamic CGE model similar to the approach by Briand (2006). Another potential avenue would be to evaluate the implications of further treating the wastewater, which would increase the costs, but at the same time allow it to be used by a much wider range of activities. That way shocks in the potable water sector could be absorbed more easily. Further, it would be an option to link STAGE_W to an agent-based model in order to better capture the quota and block rate pricing system for potable water in Israel.

The model is formulated in a generic way and therefore can be expanded or adjusted to diverging conditions. Presuming the availability of an appropriate database, and carefully re-evaluating the assumed substitution elasticities, it can be applied to other countries in which a different set of water qualities and resources might be used and alternative pricing schemes might be applied.

Notes

Municipalities include the service sector and households.

In this paper, the term marginal water refers to reclaimed wastewater and brackish water.

This is an activity which produces a certain water commodity from a water resource or by-product with the help of labour, capital (value added) and intermediate inputs.

Measured from the expenditure side.

It should be noted that welfare benefits resulting from positive externalities due to lower fresh water consumption (e.g. positive environmental effects or economic benefits for future generations) are not taken into account in the EV.

A simulation in which desalination capacity is fixed at the current level, such that the reduction occurs to the usage of fresh water resources, yields very similar results in terms of water usage and production. Due to the higher costs of desalination, which is subsidized, the change in real GDP turns negative (−0.01 %). The equivalent variation is slightly more negative, but income distribution more balanced.

References

Berck P, Robinson S, Goldman GE (1991) The use of computable general equilibrium models to assess water policies. In: Dinar A, Zilberman D (eds) The economics and management of water and drainage in agriculture. Springer, New York, pp 489–509

Briand A (2006) Marginal cost versus average cost pricing with climatic shocks in senegal: a dynamic computable general equilibrium model applied to water. FEEM Working Paper No. 144.06. doi: 10.2139/ssrn.946177

CBS (2009) Statistical abstract of Israel 2008, No. 59. The Israeli Central Bureau of Statistics (CBS), Jerusalem

CBS (2011) Satellite account of water in Israel 2006. Publication No. 1424. The Israeli Central Bureau of Statistics (CBS), Jerusalem

Dinar A (2014) Water and economy-wide policy interventions. Found Trends® Microeconomics 10(2):85–165. doi:10.1561/0700000059

FAO (2009) Irrigation in the Middle East region in figures. FAO water reports 34. In: K Frenken (ed). Food and Agricultural Organization of the United Nations (FAO)

Faust A-K, Gonseth C, Vielle M (2015) The economic impact of climate-driven changes in water availability in Switzerland. Water Policy 17(5):848–864. doi:10.2166/wp.2015.064

Fleischer A, Lichtman I, Mendelsohn R (2008) Climate change, irrigation, and Israeli agriculture: will warming be harmful? Ecol Econ 65(3):508–515. doi:10.1016/j.ecolecon.2007.07.014

Goldfarb O, Kislev Y (2005) Water management and policy: rules vs. discretion. Discussion paper 12.01. The Hebrew University of Jerusalem, Israel

IWA (2012) Long-term master plan for the national water sector part A – policy document version 4. The Israeli Water Authority, Tel-Aviv

Kislev Y (2011) The water economy of Israel. Policy Paper 2011.15. Taub Center for Social Policy Studies in Israel, Jerusalem

Lavee D, Ash T (2013) Wastewater supply management. In: Becker N (ed) Water policy in Israel: Context, issues and options. Springer, Dordrecht, pp 83–99

Letsoalo A, Blignaut J, de Wet T, de Wit M, Hess S, Tol R, van Heerden J (2007) Triple dividends of water consumption charges in South Africa. Water Resour Res 43(5), W05412. doi:10.1029/2005WR004076

Levine AD, Asano T (2002) Water reclamation, recycling and reuse in industry. In: Lens P, Pol LH, Wilderer P, Asano T (eds) Water recycling and resource recovery in industry: analysis, technologies and implementation. IWA Publishing, London, pp 29–52

Logar I, van den Bergh JCJM (2013) Methods to assess costs of drought damages and policies for drought mitigation and adaptation: review and recommendations. Water Resour Manage 27:1707–1720. doi:10.1007/s11269-012-0119-9

Luckmann J, McDonald S (2014) STAGE_W: an applied general equilibrium model with multiple types of water: Technical Documentation, STAGE_W Version 1: March 2014, Agricultural Economics Working Paper Series 23, Inst. of Agric. Policy and Markets, University of Hohenheim

Luckmann J, Grethe H, McDonald S, Orlov A, Siddig K (2014) An integrated economic model of multiple types and uses of water. Water Resour Res 50(5):3875–3892. doi:10.1002/2013WR014750

McDonald S (2009) A static applied general equilibrium model: technical documentation STAGE Version 1: July 2007 Department of Economics & Strategy, Oxford Brookes University

NIC (2010) Committee’s Report Abstract. National Investigation Committee on the subject of the management of the water economy in Israel (NIC), Haifa

Rejwan A (2011) The state of Israel: national water efficiency report. Israeli Water Authority, Planning Department, Tel-Aviv

Reznik A, Feinerman E, Finkelshtain I, Fisher F, Huber-Lee A, Joyce B (2015) How much it costs to cover costs: an economy-wide model for water pricing. Discussion Paper No. 5.15, Department of Environmental Economics and Management, The Hebrew University of Jerusalem, Rehovot

Sadoulet E, de Janvry A (1995) Quantitative development policy analysis. The John Hopkins University Press, London

Siddig K, Flaig D, Luckmann J, Grethe H (2011) A 2004 social accounting matrix for Israel. Agricultural Economics Working Paper Series 20, Inst. of Agric. Policy and Markets, University of Hohenheim

Solís AF, Zhu X (2015) Water markets: insights from an applied general equilibrium model for Extremadura, Spain. Water Resour Manage 29:4335–4356. doi:10.1007/s11269-015-1063-2

Tal A (2006) Seeking sustainability: Israel’s evolving water management strategy. Science 313(5790):1081–1084. doi:10.1126/science.1126011

Weinberger G, Livshitz Y, Givati A, Zilberbrand M, Tal A, Weiss M, Zurieli A (2012) The Natural Water Resources Between the Mediterranean Sea and the Jordan River. Israel Hydrological Service, Governmental Authority for Water and Sewage. Jerusalem

Yerushalmi E (2012) Measuring the administrative water allocation mechanism and agricultural amenities. Warwick economic research papers. No. 992. Department of Economics, University of Warwick

Zaide M (2009) Drought and Arid Land Water Management. United Nations Commission on Sustainable Development (CSD)-16/17 National Report Israel

Ziolkowska JR (2015) Is desalination affordable? – regional cost and price analysis. Water Resour Manage 29:1385–1397. doi:10.1007/s11269-014-0901-y

Acknowledgments

The authors thank the German Research Foundation (DFG) for partial funding of this research and two anonymous referees for their constructive comments which substantially improved the quality of the paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Production system for activities in STAGE_W. Source: modified from Luckmann et al. 2014

Appendix 2

Rights and permissions

About this article

Cite this article

Luckmann, J., Flaig, D., Grethe, H. et al. Modelling Sectorally Differentiated Water Prices - Water Preservation and Welfare Gains Through Price Reform?. Water Resour Manage 30, 2327–2342 (2016). https://doi.org/10.1007/s11269-015-1204-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11269-015-1204-7