Abstract

In the presence of incomplete risk attitudes, choices between noncomparable risky prospects are random. A random choice model advanced by Karni (Incomplete preferences and random choice (unpublished manuscript), 2021) includes the hypothesis that choices among noncomparable risky prospects are prompted by signals drawn from personal distributions. This paper introduces a scheme designed to elicit subjects’ assessments of their personal likelihoods of choices among noncomparable risky prospects and describes experiments designed to test the aforementioned hypothesis.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Decision makers are sometimes confronted with the need to choose among alternatives that, because of their complexity or novelty, make them impossible to compare. von Neumann and Morgenstern, recognized this possibility, admitting that “it is conceivable—and even in a way more realistic—to allow for cases where the individual is neither able to state which of two alternatives he prefers nor that they are equally desirable” (von Neumann and Morgenstern 1947). Aumann questioned not only the descriptive validity of the completeness axiom but also its normative justification. “ Of all the axioms of utility theory,” he wrote, “ the completeness axiom is perhaps the most questionable. Like others of the axioms, it is inaccurate as a description of real life; but unlike them, we find it hard to accept even from the normative viewpoint” (Aumann 1962).Footnote 1

In the context of decision making under risk, the source of incompleteness is the decision maker’s risk attitudes. Specifically, because of either the complexity of the alternatives or the ambiguity about her own attitudes, the decision maker lacks a clear sense of how to assess the risks associated with the prospects in the choice set.

The representations of incomplete preferences under risk, dubbed expected multi-utility representations, were characterized by Shapley and Baucells (1998), Dubra et al. (2004) and Galaabaatar and Karni (2013). In all these instances, risky prospects are represented by probability measures on the set of outcomes and the representation involves a set, \(\mathcal {U}\), of utility functions. Specifically, one risky prospect is preferred over another if and only if the expected utility of the former exceeds that of the latter according to each and every function in the set \(\mathcal {U}\). When two risky prospects are noncomparable, one has higher expected utility according to some elements of \(\mathcal {U}\) and lower expected utility according to other elements. In such cases, the aforementioned models do not yield predictable choice behavior.

Karni (2021) proposed a model of stochastic choice behavior that is attributable to preference incompleteness. Applied to the case of incomplete preferences under risk, this model advances the proposition that decision makers are characterized by the set of utility functions \(\mathcal {U}\) and a personal probability measure \(\lambda ,\) on \(\mathcal {U}\). When facing a choice among noncomparable risky prospects, decision makers behave as if a function in the set \(\mathcal {U\,}\) is drawn randomly, according to \(\lambda \), and the prospect that attains the highest expected utility according to that function is chosen.

The random choice model is tested by the accuracy of its predictions. Making predictions based on the random choice model requires the elicitation of the range of incompleteness represented by \(\mathcal {U}\) and \(\lambda .\) These predictions may then be compared to observations of actual choice behavior in an experimental setting. This paper addresses these requirements. The main novelty is the introduction of an incentive-compatible elicitation scheme by which the range of a decision maker’s incomplete risk attitudes and personal perception of the measure \(\lambda \) are identified and on the basis of which predictions of the model are quantified. As far as I know, this is the first incentive-compatible scheme designed to elicit decision makers’s beliefs about the likely realizations of their own risk attitudes. In this sense, this work complements the elicitation mechanism of decision makers’ second-order beliefs proposed by Karni (2020). In addition, this paper outlines experimental designs by which observations of actual choice behavior in the presence of incomplete risk attitudes are generated.

Recent years witnessed increasing interest in modeling stochastic choice behavior.Footnote 2 With few exceptions, however, these studies do not attribute this behavior specifically to preference incompleteness. One exception is Ok and Tserenjigmidz (2020), who introduced random choice functions, which they define and characterize for stochastic choices induced by indifference, indecisiveness, and experimentation. Their axiomatic characterization of stochastic choice functions induced by lack of strict preference asserts merely that the maximal elements of the menu will be chosen with positive probability. Karni (2021) complements this work by proposing a random choice model that predicts the likelihoods of the choices of the alternatives in the maximal sets.

Karni and Safra (2016) study stochastic choice under risk and under uncertainty based on the notion that randomly selected states of mind determine decision makers’ actual choices. They provide axiomatic characterization of the representation of decision makers’ perceptions of the stochastic process underlying the selection of their state of mind. In the context of decision making under risk with incomplete preferences, the states of mind are depicted by the utility functions in \(\mathcal {U}\). Hence, the work of Karni and Safra may be regarded as providing axiomatic foundations of representation of a decision maker’s perception of the probability distribution on \(\mathcal {U}\) by the probability measure \(\lambda \) and the hypothesis that the probability of choosing a risky prospect P out of the set of risky prospects \(\{P,Q\}\,\ \)is the value assigned by \(\lambda \) to the subset of functions in \(\mathcal {U}\ \)whose expected utility of P exceeds that of Q.

2 Incomplete risk attitudes and random choice behavior

Let X be a compact interval in \(\mathbb {R},\) and denote by \(L\left( X\right) \) the set of Borel probability distributions on X endowed with the topology of weak convergence. Elements of \(L\left( X\right) \) are risky prospects. A preference relation, \(\succ ,\) is a binary relation on \(L\left( X\right) \). For any risky prospects \(P,Q\in L\left( X\right) ,\) \(P\succ Q\) has the usual interpretation, namely, P is strictly preferred over \(Q\,,\) which is taken to mean that facing a choice between P and Q, a decision maker whose preference relation is \(\succ \) chooses P.

The strict preference relation \(\succ \) induces four derived relations on \(L\left( X\right) \). For all \(P,Q\in L\left( X\right) ,\) the induced weak preference relation \(\succcurlyeq \) is define by \(P\succcurlyeq Q\) if \(\lnot \left( Q\succ P\right) ;\) the GK-weak preference relation \(\curlyeqsucc \) is defined by: \(P\curlyeqsucc Q\) if, for all \(R\in L\left( X\right) \,,\) \(R\succ P\) implies that \(R\succ Q\); the induced indifference relation \(\sim \) is defined by \(P\sim Q\) if \(P\curlyeqsucc Q\) and \(Q\curlyeqsucc P;\) and the noncomparability relation \(\bowtie \), defined by \(P\bowtie Q\) if \(\lnot \left( P\succ Q\right) ,\) \(\lnot \left( Q\succ P\right) \) and \(\lnot \left( Q\sim P\right) .\)Footnote 3

Following Dubra et al. (2004), I assume that the weak preference relation is reflexive and transitive; continuous (that is, for any convergent sequences \(\left( P_{n}\right) \) and \(\left( Q_{n}\right) \) in \(L\left( X\right) \), \(\lnot \left( Q_{n}\succ P_{n}\right) \) for all n imply \(\lnot (\lim _{n\rightarrow \infty }Q_{n}\succcurlyeq \lim _{n\rightarrow \infty }P_{n})\)); and satisfies the independence axiom (that is, for any \(P,Q,R\in L\left( X\right) \) and \(\rho \in (0,1],\) \(P\succcurlyeq Q\) if and only if \(\rho P+\left( 1-\rho \right) R\succcurlyeq \rho Q+\left( 1-\rho \right) R\,\)).Footnote 4 I also assume throughout that \(\succ \ne \varnothing .\)

By Dubra et al. (2004), \(\succ \) on \(L\left( X\right) \) has an expected multi-utility representation. Formally, there exists a set, \(\mathcal {U}\), of continuous real functions on X such that, for all \(P,Q\in L\left( X\right) ,\)

Moreover, if there is another set, \(\mathcal {V}\), that represents the preference relation in the above sense, then \(\langle \mathcal {V}\rangle =\langle \mathcal {U}\rangle ,\ \)where \(\langle \mathcal {U}\rangle \) denotes the closed convex cone generated by \(\mathcal {U}\) and the set of all constant real-valued functions on X.

Karni’s (2021) proposed a model of irresolute choice behavior as a set \(\{\trianglerighteq ^{\alpha }\mid \) \(\alpha \in \left[ 0,1\right] \}\) of binary relations on a set, A, of alternatives, dubbed random choice relations. Given any \(a,a^{\prime }\in A,\) the interpretation of \(a\trianglerighteq ^{\alpha }a^{\prime }\) is that, facing a choice between a and \(a^{\prime }\), a is chosen with probability \(\alpha .\) This depiction of random choice behavior is based on the idea that when facing a choice between two, noncomparable, alternatives, the decision maker awaits a randomly selected third alternative, dubbed mental decoy, which serves as a reference point that the decision maker relies upon to resolve his indecision. If the third alternative is weakly inferior to one of the two alternatives and is noncomparable to the other, then the former alternative is chosen. Otherwise, the decision maker procrastinates while waiting for another mental decoy to appear that would allow him to resolves the indecision along the lines indicated above.

Applied to decision making under risk, the random choice model has the following representation: Let the set \(\mathcal {U}\) be endowed with the supnorm topology and denote by \(\mathcal {B}\) the Borel \(\sigma \)-algebra on \(\mathcal {U}\). Let \(\lambda \) be a probability measure on the measurable space \((\mathcal {U},\mathcal {B}),\) representing the decision maker’s perception of the likelihoods of the sets in \(\mathcal {B}\). In other words, \(\lambda \) quantifies the decision maker’s idiosyncratic belief that a function u be selected. If u is selected then and P is chosen over Q if and only if \(\int _{X}udP\ge \int _{X}udQ\).

Karni (2021) showed that the random choice behavior of a decision maker characterized by \(\left( \mathcal {U},\lambda \right) \,\)has the following representation: For all \(P,Q\in L\left( X\right) ,\)

The set \(\mathcal {U}\) may be regarded as a canonical signal space, and the decision maker’s behavior may be interpreted as if he is waiting for a signal, \(u\in \mathcal {U}\), to determine his choice among risky prospects.

3 Experimental tests

I discuss next experiments designed to test the hypothesis that when facing a choice between two noncomparable risky prospects, a utility function, u, is drawn at random from \(\mathcal {U}\) according to a distribution, \(\lambda \) , and the risky prospect that is represented by the highest expected utility according to u is chosen. The presumption is that \(\mathcal {U}\) and \( \lambda \) are the decision maker’s private information. To test this hypothesis, it is necessary to elicit \(\lambda \) jointly with the range of incompleteness, represented by \(\mathcal {U},\) that determines its support. I describe below experiments designed to test this hypothesis.

3.1 The elicitation scheme

A subject’s type is a pair \(\left( \mathcal {U},\lambda \right) .\) Subjects are characterized by their types. The following mechanism is designed to elicit the probability measure \(\lambda \) on \(\mathcal {U}\).

the elicitation mechanism: Fix a fair lottery

(that is, \(\ell \left( \varepsilon \right) \) pays off \(\$\left( w+\varepsilon \right) \) and \(\$\left( w-\varepsilon \right) \) with equal probabilities). At time \(t=0,\) the subjects are asked to report a function \(\alpha \left( \cdot ;\varepsilon \right) :[0,\varepsilon ]\rightarrow [0,1]\) and a number, z, is drawn at random from a uniform distribution on \([0,\varepsilon ].\) In the interim period, \(t=1,\) the subject is offered the choice between the lottery

and the sure payoff

In the last period, \(t=2,\) the outcome of the lottery is revealed, and all payments are made. The delay \(\Delta t:=t_{1}-t_{0}\) is fixed, (e.g., \(\Delta t\) is 15 or 30 min).

Define \(\underline{z}=\inf \{z\in [0,\varepsilon ]\mid \) \(\ell \left( \varepsilon \right) \succ \mathbf {1}_{w-z}\}\) and \(\bar{z}=\sup \) \(\{z\in [0,\varepsilon ]\mid \) \(\mathbf {1}_{w-z}\succ \ell \left( \varepsilon \right) \},\) where \(\mathbf {1}_{w-z}\) is the degenerate distribution that assigns to outcome \(w-z\) the unit probability mass. Under the proposed elicitation mechanism, if the lottery \(\ell \left( \varepsilon \right) \) and the sure outcome \(\$\left( w-z\right) \) are noncomparable then \(\bar{z}> \underline{z}.\) Clearly, \(\ell \left( \varepsilon \right) \curlyeqsucc \mathbf {1}_{\left( w-z\right) }\) for all \(z\ge \bar{z}.\) Since \(\ell \left( \varepsilon ;1\right) =\ell \left( \varepsilon \right) ,\) by reporting \(\alpha \left( z;\varepsilon \right) =1\) the subject is assured to be awarded the lottery \(\ell \left( \varepsilon \right) .\) Similarly, for all \(z\le \underline{z}\,,\) \(\mathbf {1}_{\left( w-z\right) }\curlyeqsucc \ell \left( \varepsilon \right) \). Since \(\ell \left( \varepsilon \right) \succ \ell \left( \varepsilon ;0\right) ,\) by reporting \(\alpha \left( z;\varepsilon \right) =0\) the subject is sure to be awarded the sure outcome \(\$\left( w-z\right) .\) If \(\ell \left( \varepsilon \right) \) and \(\mathbf {1}_{\left( w-z\right) }\) are noncomparable, reporting \(\alpha \left( z;\varepsilon \right) \in \left( 0,1\right) \) the subject pays a price for the option of delaying the choice in the expectation of receiving a signal, \(u\in \mathcal {U}\), that will resolve his indecision.

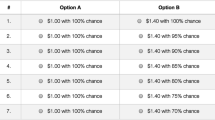

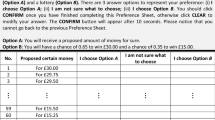

In the mechanism the domain of \(\alpha \left( \cdot ;\varepsilon \right) \) is a continuum. To implement the elicitation scheme, the domain \([0,\varepsilon ]\) may be discretized by replacing it by the set of points \( Z=\{z_{i}=i\varepsilon /n)\mid i=0,1,\ldots ,n\}\) for some \(n\ge 2\). To induce the subject to report the required information, the question may be posed as follows: For each \(z_{i}\in Z\) indicate how likely are you to choose the lottery \(\ell \left( \varepsilon \right) \) over the sure outcome \(\$\left( w-z_{i}\right) .\) If you are sure that you prefer the lottery, it is in your best interest to report \(\alpha \left( z_{i};\varepsilon \right) =1,\) and if you are sure that you preferred the sure outcome it is in your best interest to report \(\alpha \left( z_{i};\varepsilon \right) =0.\) If \(z_{i}\) is such that you are not sure which alternative you prefer, please indicate how likely you think you will choose the lottery.

The idea underlying the mechanism is that the reported \(\alpha \left( z;\varepsilon \right) \) is an estimate of the subject’s perceived probability that in the interim period he will receive a signal, \(u\in \mathcal {U}\), on the basis of which he will choose the lottery \(\ell \left( \varepsilon ;\alpha \left( z;\varepsilon \right) \right) \) instead of the sure outcome \(\$\left( w-z-\varepsilon \alpha \left( z;\varepsilon \right) ^{2}\right) .\) In other words, \(\alpha \left( z;\varepsilon \right) \) is intended to capture the subject’s belief that the utility function that will govern his choice belongs to the subset of such functions that yield higher expected utility under the lottery \(\ell \left( \varepsilon ;\alpha \left( z;\varepsilon \right) \right) \) than the sure outcome \(\$\left( w-z-\varepsilon \alpha \left( z;\varepsilon \right) ^{2}\right) \).

To analyze the working of the elicitation scheme, I introduce the following notations and definitions: For each \(z\in [0,\varepsilon ]\) let

For each \(u\in \mathcal {U}\) define \(\pi ^{u}\left( w,\varepsilon \right) \) by the equation

Then, by Pratt (1964),

Let

A subject is said to display weak risk aversion if \(\underline{\pi } (w;\varepsilon )\ge 0\).

The theorem below asserts that the elicitation mechanism is incentive compatible in the sense that, acting in his best interest, a risk-averse subject should indicate how likely he is to choose the lottery \(\ell \left( \varepsilon \right) \) over a sure outcome \(\$\left( w-z\right) .\) Responding to the elicitation scheme the subject reveals, to any desirable level of precision, the degree of his preference incompleteness and his subjective assessment of the likelihood that the resulting indecision will be resolved in favor of the lottery.

Theorem 1

Consider a subject whose random choice behavior is characterized by \(\left( \mathcal {U},\lambda \right) ,\) displaying weak risk aversion. Then, given the elicitation mechanism described above, for every \(\delta >0\) there is \(\beta >0\,\) such that for each \(\varepsilon \in \left( 0,\beta \right) \) the subject’s report, \(\alpha \left( \cdot ;w,\varepsilon \right) ,\) satisfies \(\mid \alpha \left( z;w,\varepsilon \right) -\lambda \left( \mathcal {U}\left( z;\varepsilon ,w\right) \right) \mid \le \delta ,\) for all \(z\in [0,\varepsilon ].\) Moreover, \(\alpha \left( z;w,\varepsilon \right) =1,\) for all \(z\ge \bar{\pi } (w;\varepsilon )\) , and \(\alpha \left( z;w,\varepsilon \right) =0,\) for all \(z\le \underline{\pi }(w;\varepsilon ).\)

Proof

Fix \(w>0\). According to the random choice model, in the interim period, \(t=1\), the subject receives a signal \(u\in \mathcal {U}\ \) drawn from the distribution \(\lambda .\) At the same time a number z is drawn from a uniform distribution on \([0,\varepsilon ].\) Given his report \(\alpha (z;w,\varepsilon )\), the subject chooses the lottery \(\ell \left( \varepsilon ;\alpha \right) \) if

Otherwise he chooses the sure payoff \(\$\left( w-z-\varepsilon \alpha \left( z;w,\varepsilon \right) ^{2}\right) \).

Denote by \(\mathcal {U}\left( z;w,\varepsilon \right) \) the subset of functions in \(\mathcal {U}\) that satisfies (2). At time \(t=0,\) anticipating his choice behavior, for every given z, the subject reports \(\alpha ^{*}\left( z;w,\varepsilon \right) \) that maximizes

By weak risk aversion, for \(\alpha ^{*}\left( z;w,\varepsilon \right) \in \left( 0,1\right) ,\) the necessary and sufficient condition is:

Equivalently,

Thus,

where

The inequality is an implication of the weak risk aversion.

Invoking the uniqueness of \(\mathcal {U\,}\), normalize the utility functions so that \(u^{\prime }\left( w\right) =1\) for all \(u\in \mathcal {U}\) to obtain:

Since \(z\in [0,\varepsilon ],\) we have

Hence, for every \(\gamma >0\) there is \(\beta \left( \gamma \right) >0\) such that \(\mid k\left( z,w,\varepsilon \right) -1\mid <\gamma ,\) for all \(\varepsilon \in (0,\beta \left( \gamma \right) ).\) Thus,

Fix \(\delta >0\) and let

and let \(\beta \) denote the corresponding \(\beta \left( \gamma \right) .\) Then, for all \(\varepsilon \in \left( 0,\beta \right) ,\)

Hence,

If \(z>\bar{\pi }(w;\varepsilon )\) then

for all \(u\in \mathcal {U}\). Thus, \(\lambda \left( \mathcal {U}\left( z;w,\varepsilon \right) \right) =1\) and reporting \(\alpha ^{*}\left( z;w,\varepsilon \right) =1\) the subjects is rewarded with the lottery \(\ell \left( \varepsilon \right) .\) But \(\ell \left( \varepsilon \right) \succ \left( w-z\right) \) and, by first-order stochastic dominance, \(\ell \left( \varepsilon \right) \succ \) \(\ell \left( \varepsilon ;\alpha \left( z;w,\varepsilon \right) \right) \) for all \(\alpha \in [0,1).\) Thus, reporting \(\alpha ^{*}\left( z;w,\varepsilon \right) =1\) is optimal.

If \(z<\underline{\pi }(w;\varepsilon )\) then

for all \(u\in \mathcal {U}\). Hence, \(\lambda \left( \mathcal {U}\left( z;w,\varepsilon \right) \right) =0\) and reporting \(\alpha ^{*}\left( z;w,\varepsilon \right) =0\) the subjects is rewarded with the lottery the sure outcome \(\left( w-z\right) .\) But \(\left( w-z\right) \succ \ell \left( \varepsilon \right) \) and \(\left( w-z\right) \succ \) \(\left( w-z-\varepsilon \alpha ^{2}\right) \) for all \(\alpha \in (0,1].\) Thus, reporting \(\alpha ^{*}\left( z;w,\varepsilon \right) =0\) is optimal.\(\blacksquare \)

Remark 1

Because \(\alpha ^{*}\left( z;w,\varepsilon \right) \approx \lambda \left( \mathcal {U}\left( z;w,\varepsilon \right) \right) ,\) by (1) the elicited values of \(\alpha ^{*}\left( z;w,\varepsilon \right) \) constitute the empirical counterparts of the values of the theoretical parameter \(\alpha \) of the random choice model. As such they represent the subject’s beliefs that he will end up choosing the lottery \( \ell \left( \varepsilon \right) \) over the sure outcome \(\$\left( w-z\right) .\)

3.2 The experimental design

The experiment consists of two parts. In the first part a small \(\varepsilon >0\) is fixed and the mechanism is applied to obtain the range \(\left[ \underline{\pi }(w;\varepsilon ),\bar{\pi }(w;\varepsilon )\right] \) of incompleteness at \(\ell \left( \varepsilon \right) \) and the function, \(\alpha \left( \cdot ;w,\varepsilon \right) .\) In the second part observations of actual choice behavior are generated.

Observations may be generated using two methods, repeated individual choices from a set \(\{\left( z_{i},\ell \left( \varepsilon \right) \right) \mid z_{i}\in [0,\varepsilon ],\) \(i=1,\ldots ,m\},\) of sure outcomes and \(\ell \left( \varepsilon \right) \) or single choices of a group of subjects.Footnote 5

In the former case, let \(n_{i}\) denote the number of repetitions of choice between \(w-z\,_{i}\) and \(\ell \left( \varepsilon \right) ,\) and let and \(r\left( z_{i}\right) \) be the number of times that a subject chooses the lottery \(\ell \left( \varepsilon \right) \) over \(z_{i}.\) Then, for each subject the empirical distribution \(r\left( z_{i}\right) /n_{i}\), \(i=1,\ldots ,m, \) can be compared to the distribution, \(\alpha ^{*}\left( z_{i};w,\varepsilon \right) ,\) \(i=1,\ldots ,m,\) predicted by the random choice model.

In the case of single choice, the experiment requires the recruitment of n subjects. Let J denote the set of subjects. For each subject \(j\in J,\) elicit the noncomparability range \(\left[ \underline{\pi }_{j}(w;\varepsilon ),\bar{\pi }_{j}(w;\varepsilon )\right] .\) Fix \(z\in \cap _{j\in J}\left[ \underline{\pi }_{j}(w;\varepsilon ),\bar{\pi }_{j}(w;\varepsilon )\right] \) .Footnote 6

Let \(\mathbb {P=}\{\varsigma _{1},\ldots ,\varsigma _{n!}\}\) be the set of all the permutations of \(\left( 1,2,\ldots ,n\right) \). For each \(k=1,\ldots ,n,\,\ \)let \(J\left( k;\varsigma _{i}\right) :=\{j\in J\mid \varsigma _{i}\left( j\right) \le k\}\) be the set of subjects who under the permutation \(\varsigma _{i}\) are assigned the first k positions on the list. Then,

is the probability that exactly k subjects choose the lottery \(\ell \left( \varepsilon \right) \) over the sure outcome \(w-z.\) Then, \(\bar{\kappa }:=\Sigma _{k=1}^{n}k\xi \left( k\right) ,\) is the model’s predictions of expected number of subjects who chose the lottery \(\ell \left( \varepsilon \right) .\) Let r be the number of subjects that choose the lottery in the experiment. Then, the hypothesis to be tested is that, for large n, \(r/n\approx \bar{\kappa }.\)

4 Concluding remarks

The search for elicitation schemes of private information has been a major preoccupation for more than half century. Most of this effort focused on the elicitation of subjective beliefs using the scoring rules method pioneered by Brier (1950) and Good (1952) and followed by Savage (1971), Kadane and Winkler (1988) and others. The scoring rules method applies when decision makers display expected value maximizing choice behavior and provide good approximations when the decision maker’s objective function takes the form of subjective expected utility. More recently, Offerman et al. (2009) generalized the scoring rules method to included nonexpected utility theories of decision making under risk and under uncertainty. Abdellaoui et al. (2011) introduced beliefs elicitation method based on the distinction among sources of uncertainty. Grether (1981) and Karni (2009) proposed incentive-compatible schemes that are not of the scoring rules class and are applicable to nonexpected utility models that satisfy probabilistic sophistication. Chambers and Lambert (2021) introduced an incentive compatible protocol that induces dominant strategy revelations of decision makers prior assessments of both the final outcome and the information flows they anticipate receiving and, subsequently, what information they privately receives. The present work differs from the aforementioned contributions in two important respects. First, its objective is the elicitation of decision makers subjective tastes (i.e., their risk attitudes) rather than their beliefs. Second, its emphasis on the elicitation of decision makers perceptions of their own random choice behavior due to incomplete tastes.

The Arrow-Pratt measure of absolute risk aversion “ in the small” is a local property that is measured by the curvature \(-u^{\prime \prime }\left( w\right) /u^{\prime }\left( w\right) \) of the utility function at w. The variable w represents the decision maker’s level of wealth or income. Risk attitudes may vary with wealth. Consequently, the measure \(\lambda \) may vary with the decision maker’s wealth. If, for instance, the preference relation displays decreasing absolute risk aversion, then \(\underline{\pi }(w^{\prime };\varepsilon )\le \underline{\pi }(w;\varepsilon )\) and \(\bar{\pi }(w^{\prime };\varepsilon )\le \bar{\pi }(w;\varepsilon )\) for \(w^{\prime }>w.\) Repeating the experiments with different w would permit the testing of hypotheses such as constant, increasing, or decreasing risk aversion.

Karni and Vierø (2020) introduced an incentive-compatible scheme designed to elicit the boundaries of the range of incompleteness represented by the set of utility functions \(\mathcal {U}\). It depicts these lower and upper bounds in terms of the minimal and maximal certainty equivalences corresponding to the most and list risk averse functions at a point. Their measure should coincide with the interval \([w-\bar{\pi }(w;\varepsilon )\), \(w-\underline{\pi }(w;\varepsilon )].\) Hence, the measure of incompleteness of Karni and Vierø coincides with \(\bar{\pi }(w;\varepsilon )-\underline{\pi }(w;\varepsilon )\). This hypothesis can be tested by comparing the range of incompleteness obtained by the applications of the two elicitation schemes.

Notes

The weak preference and indifference relations defined here were introduced in Galaabaatar and Karni (2013) (thus the GK in the definition of \(\curlyeqsucc \)). Karni (2011) investigates the significance and implications of the weak preference relation. In particular, Kanri showed that the weak preference relations \(\succcurlyeq \) and \(\curlyeqsucc \) on \(L\left( X\right) \) agree if and only if \(\succ \) is negatively transitive and \(\curlyeqsucc \) is complete. Note that \(\succ \) is not the asymmetric part of \(\curlyeqsucc \) and that the indifference relation is equivalent to that in Eliaz and Ok (2006).

The analysis is restricted to expected utility theory in anticipation of the use, below, of modified scoring rules in the elicitation scheme.

If \(\cap _{j\in J}\left[ \underline{\pi }_{j}(w;\varepsilon ),\bar{\pi } _{j}(w;\varepsilon )\right] \ne \varnothing \), choose a subset \(J^{\prime }\subset J\) such that \(\cap _{j\in J^{\prime }}\left[ \underline{\pi } _{j}(w;\varepsilon ),\bar{\pi }_{j}(w;\varepsilon )\right] \ne \varnothing .\)

References

Abdellaoui, M., Baillon, A., Placido, L., & Wakker, Peter P. (2011). The rich domain of uncertainty: source functions and their experimental implementation. American Economic Review, 101, 695–723.

Aumann, R. J. (1962). Utility theory without the completeness axiom. Econometrica, 30, 445–462.

Brier, G. W. (1950). Verification of forecasts expressed in terms of probabilities. Monthly Weather Review, 78, 1–3.

Chambers, C. P., & Lambert, N. S. (2021). Dynamic belief elicitation. Econometrica, 89, 375–414.

Cettolin, E., & Riedl, A. (2019). Revealed preferences under uncertainty: incomplete preferences and preferences for randomization. Journal of Economic Theory, 181, 547–585.

Danan, E., & Ziegelmeyer, A. (2006). Are preferences complete?: An experimental measurement of indecisiveness under risk. In Mimeo, Max Planck Inst. of Economics.

Dubra, J., Maccheroni, F., & Ok, E. A. (2004). Expected utility theory without the completeness axiom. Journal of Economic Theory, 115, 118–133.

Eliaz, K., & Ok, E. A. (2006). Indifference or indecisiveness? Choice-theoretic foundations of incomplete preferences. Games and Economic Behavior, 56, 61–86.

Fudenberg, D., Iijima, R., & Strzalecki, T. (2015). Stochastic choice and revealed perturbed utility. Econometrica, 83, 2371–2409.

Galaabaatar, T., & Karni, E. (2013). Subjective expected utility with incomplete preferences. Econometrica, 81, 255–284.

Good, I. J. (1952). Rational decisions. Journal of Royal Statatistical Society Series B (Methodological), 14, 107–114.

Grether, D. M. (1981). Financial incentive effects and individual decision making. Cal Tech, Social Science Working Paper, p. 401.

Gul, F., Natenzon, P., & Pesendorfer, W. (2014). Random choice as behavioral optimization. Econometrica, 82, 1873–1912.

Kadane, J. B., & Winkler, R. L. (1988). Separating probability elicitation from utility. Journal of the American Statistical Association, 83, 357–363.

Karni, E. (2009). A mechanism for eliciting probabilities. Econometrica, 77, 603–606.

Karni, E. (2011). Continuity, completeness and the definition of weak preferences. Mathematical Social Sciences, 62, 123–125.

Karni, E. (2020). A mechanism for the elicitation of second-order beliefs and subjective information structures. Economic Theory, 69, 217–232.

Karni, E. (2021). Incomplete preferences and random choice. (Unpublished manuscript).

Karni, E., & Safra, Z. (2016). A theory of stochastic choice under uncertainty. Journal of Mathematical Economics, 63, 164–173.

Karni, E., & Vierø, M.-L. (2020). Comparative incompleteness: measurement, behavioral manifestations and elicitation. (Unpublished manuscript).

Loomes, G., & Sugden, R. (1998). Testing alternative stochastic specifications for risky choice. Economica, 65, 581–598.

Loomes, G., Moffatt, P. G., & Sugden, R. (2002). A microeconometric test of alternative stochastic theories of risky choice. Journal of Risk and Uncertainty, 24, 103–130.

Luce, D. R. (1959). Individual choice behavior: a theoretical analysis. Wiley.

Offerman, T., Sonnemans, J., Van De Kuilen, G., & Wakker, P. P. (2009). A truth serum for non-Bayesians: correcting proper scoring rules for risk attitudes. The Review of Economic Studies, 76, 1461–1489.

Ok, E. A., & Tserenjigmidz, G. (2020). Indifference, indecisiveness, experimentation and stochastic choice. Theoretical Economics. (Forthcoming).

Pratt, J. W. (1964). Risk aversion in the small and in the large. Econometrica, 32, 122–136.

Savage, L. J. (1971). Elicitation of personal probabilities and expectations. Journal of American Statatistical Association, 66, 783–801.

Shapley, L. S., & Baucells, M. J. (1998). Multiperson utility. Working paper.

Sautua, S. I. (2017). Does uncertainty cause inertia in decision making? An experimental study of the role of regret aversion and indecisiveness. Journal of Economic Behavior and Organization, 136, 1–14.

von Neumann, J., & Morgenstern, O. (1947). Theory of games and economic behavior. Princeton University Press.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Karni, E. Incomplete risk attitudes and random choice behavior: an elicitation mechanism. Theory Decis 92, 677–687 (2022). https://doi.org/10.1007/s11238-021-09829-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-021-09829-w