Abstract

The introduction of dynamic spectrum access (DSA) technologies in mobile markets faces technical, economic and regulatory challenges. This paper defines industry openness and spectrum centralization as the two key factors that affect the adoption of DSA technologies. The adoption process is analyzed employing a comprehensive System Dynamics model that considers the network and substitution effects. Two possible scenarios, namely operator-centric and user-centric adoption of DSA technologies are explored in the model. The analysis indicates that operator-centric DSA technologies may be adopted in most countries where spectrum is centralized, while end-user centric DSA technologies may be adopted in countries with decentralized spectrum regime and in niche emerging services. The study highlights the role of standards-based design and concludes by citing case studies that show the practicality of this analysis and associated policy prescriptions.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The mobile data traffic is expected to grow nearly ten-fold between 2014 and 2019, while mobile devices were expected to exceed worldwide population by the end of 2014, reaching 1.5 devices per capita by 2019 [1]. Radio spectrum is an essential scarce resource for the provisioning of mobile services. While the demand for wireless services is rapidly growing, the capacity and efficiency of networks has also been increasing, thanks to evolving technologies. Dynamic spectrum access (DSA) technology is one such case that aims to improve capacity of mobile networks by defining a set of protocols and standards allowing end-users, mobile network operators (MNOs) and other types of operators such as local area operators (LAOs)Footnote 1 to dynamically access unused or underutilized spectrum bands.

Though coined by Mitola way back in 2000 as Cognitive Radio [3] and despite large efforts in R&D, DSA technologies have not been successfully introduced into the mobile market, even though several standards already exist and others are under development. Several technical, economic and regulatory challenges have been identified for this slow deployment.

First, industry structure has a definitive impact on the adoption of new technologies [4–6]. The type and number of MNOs and the existing entry barriers determine the competition level in the industry and consequently the motivation of the firms in the industry to adopt new disruptive technologies such as DSA. On the other hand, the adoption of such technologies in turn affects the industry structure, due to possible entry of new firms or incumbent firms exploiting technologies to increase market share.

Second, spectrum management is the core of DSA technologies, since they radically change the method for accessing the radio spectrum. The traditional exclusive licensing provides a MNO access to an entire spectrum band. The usage rights of the spectrum are often stringent, for both allocation and assignment. Under a flexible spectrum regime which allows spectrum sharing, DSA technologies enable end-users and operators to dynamically access different spectrum bands that are not exclusively assigned [7–11]. Realizing the need for efficient use of radio spectrum, National Regulatory Authorities (NRAs) have started to adopt flexible spectrum policies including the creation of a spectrum market and the deployment of associated mechanisms. However, changes require high coordination of all stakeholders; including end-users, mobile device manufacturers, network equipment manufacturers, MNOs, other spectrum holders, standard developing organizations (SDOs) and finally NRAs and policy makers.

Given the extant industry structure and spectrum management regime, this study considers industry openness and spectrum centralization as the two main factors impacting the adoption of DSA technologies. Rogers [12] defines adoption as the process by which an innovation is communicated through certain channels over time among the members of a social system. The author in [13] extends the adoption process to organizations, caused by an innovation which can be internally generated or purchased device, system, policy, program, process, product, or service that is new to the adopting organization. Thus, in the case of DSA technologies, the innovation can be adopted by operators and impact an internal process or can be adopted by the end-users and provide a new service or functionality.

Consequently, DSA technologies allow two possible adoption scenarios: (i) user-centric and (ii) operator-centric. In a user-centric adoption, the device adopted by the end-user decides which spectrum band to access by means of DSA technology. The mechanism for the same and consequent standard decision is made by the mobile handset manufacturer. This form of DSA represents the original concept of Cognitive Radio introduced by Mitola [3]. In the alternative approach, operators adopt DSA technologies to make a more efficient use of the spectrum by sharing spectrum. The DSA standard and related technology is incorporated by the network equipment manufacturer in the Radio Access Network (RAN) elements.

As per previous adoption definitions and related work, there are two effects that determine the extent of adoption of technologies. Firstly, the network effect explains the value generated to the user when adopting a new technology, considering the number of users that have already adopted such technology. Secondly, the substitution effect describes the behavior of the adopter of a new technology as a replacement of another, often an older technology.

Along with technology development, new licensing schemes [14–16] have emerged to provide more flexibility, allowing spectrum holders to share a frequency band. From a general perspective, DSA can enable three types of spectrum sharing [17]: (i) dynamic exclusive sharing, in which the incumbent operator employs the exclusively assigned spectrum with certain flexibility, including reselling rights of the whole or part of the assigned band; (ii) hierarchical access sharing, in which one user group has priority access to spectrum while the other group accesses opportunistically with secondary rights as defined by policies and (iii) open sharing, in which all users accessing the shared spectrum enjoy equal priority.Footnote 2

This paper analyzes those DSA technologies which enable any of the three above mentioned types of sharing. Spectrum sharing is defined as two or more parties accessing a spectrum band either at different time or place, executed through an economic transaction or as a free access without monetary value. This paper aims to model the adoption of DSA technologies, addressing all the above factors (industry openness and spectrum centralization), effects (network and substitution effects) and scenarios (operator and user centric adoption scenarios).

The paper is organized as follows: Sect. 2 presents a literature review on DSA standards and the main issues affecting their adoption process; Sect. 3 describes and justify the employed method; Sect. 4 develops the adoption model by means of System Dynamics; Sect. 5 presents the analytical results; Sect. 6 illustrate the applicability of the analysis by different country cases; and finally Sect. 7 concludes.

2 Literature review

This study focuses on the adoption of DSA technologies which enable a dynamic access of the spectrum by the end-user device or the operator network. The following section presents an overview on the main issues impacting the adoption process. The adoption of DSA technologies has not been extensively studied in the extant literature. A number of authors have identified DSA adoption as challenging [19]. Others have studied the diffusion of a particular protocol [20], services [21, 22] or network technologies [23, 24]. However, DSA technologies constitute a group of standards, which may affect the industry differently. In fact, DSA impacts directly the way spectrum is managed and, at the same time, the market structure. Therefore, this study starts by focusing on the industry openness and spectrum centralization as key factors involved in the DSA adoption. Secondly, this section describes how a DSA standard competes against another when being adopted by the corresponding stakeholder (i.e. it can compete with network or substitution effect). Finally, an overview is given of the existing DSA standards to describe the two possible adoption scenarios: user and operator centric.

2.1 Operator-centric versus user-centric DSA

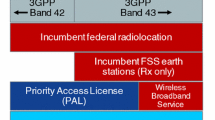

Presently, there are several DSA standards already developed or under development, intended for different use cases, as presented in Table 1.

DSA standards can be classified by several criteria. For this analysis, the most important one is whether the functionality implementing the standard is adopted by the end-user or the operator. If the functionality is developed by the device manufacturer, the end-user will take the decision on whether to adopt such device or not. On the contrary, if it is developed by the network manufacturer, the operator will take the decision on adoption. In any case, some DSA functionalities should be supported by both devices and networks. This table also describes the stakeholder who has driven the standard, which may explain the most important design and architectural decisions. In addition, standards can support either wide area (i.e. cellular) or local area deployments; and can be modular or integral in their design. Standards have modular design if they are replacing and improving an older functionality within an existing system as an evolution of the same; and they have integral design if they are intended to develop a new system. Finally, this table indicates the target frequencies; for instance, some standards were initially developed to transmit in the TV white spaces (TVWS), even though that standards as such do not necessarily imply a certain frequency, while others standards were developed for the mobile licensed or license-exempt frequencies. As follows, this section describes the most important standard developments.

The IEEE standard series (IEEE 802.11af, 802.16h, 802.19) has defined the operation in TVWS, allowing systems to coexist in that band [25]. These standards enable, for instance, the operation of Wi-Fi in TVWS (super Wi-Fi) [26]. An alternative standard developed by the IEEE is the 802.22 which focuses on rural broadband through a wide regional area network (WRAN) and may be also applied to Device-to-Device (D2D) communication [27]. Finally, a more recent effort is IEEE 802.11ah designed to operate in the license-exempt bands below 1GHz to extend the Wi-Fi operation to machine-to-machine (M2M) applications including home networks, industrial process automation, video surveillance, and smart grid communications [28]. After IEEE, the IETF initiated the standardization of a protocol to allow the communication between mobile devices and a white space database referred to as Protocol to Access White Space (PAWS), at the beginning of 2012 [29]. Such database contains the availability information of frequencies and places in which an accessing device can transmit [30, 31]. Simultaneously, ETSI Radio Reconfigurable Systems (RRS) has several ongoing standardization efforts [32]. ETSI RRS aims at providing mobile devices (MD) additional radio functionality (e.g. extra coverage at indoor or outdoor locations) through radioapplications. In addition, ETSI RRS provides licensed shared access (LSA) functionality [33] by which a MNO may temporally acquire additional spectrum from another spectrum holder. Finally, ETSI is also focusing on database standardization to allow white space devices, such as Programme Making and Special Events (PMSE) and Manually Configurable White Space Devices (MCWSD), to transmit in the TVWS band. On the other hand, 3GPP is aiming to improve spectrum efficiency through LTE Carrier Aggregation (CA) [34] that creates virtual wideband carrier from segments of spectrum across licensed [35] or license-exempt [36] bands. Additionally, 3GPP is including D2D functionality in the license-exempt bands in LTE (3GPP Release 12) [37]. Finally, Weightless [38] has been developed by Neul (UK based company) as an open standard and currently it has been applied for some Internet of Things (IoT) applications, such as machine-to-machine (M2M) and smart cities.

In a user-centric adoption scenario, the end-user device accesses the available spectrum space through a DSA functionality on a dynamic basis. The end-user device or an application in the device decides to some extent on the spectrum and the time of access. Most of the logic will be based on the DSA capability of the end-user device. In this case, spectrum sharing is performed between the end-users and the spectrum holder (MNO or other type of operator) or in some cases the end-users can freely access the license-exempt spectrum. For instance, the work in [39] describes how multi-SIM handsets in markets such as India have initiated cognitive-like responses from the end-user, even though cognition relies still on the end-user with low level of automation. Though, in this case spectrum is not shared among different parties, multi-SIM capabilities decrease end-user switching costs and impact competition and industry openness in a similar fashion than a user-centric DSA adoption. On the other hand, in an operator-centric adoption, the DSA functionality and the associated dynamic spectrum management are provided by the MNO to employ spectrum more efficiently. In this case, spectrum sharing is performed between the involved operators.

The user-centric DSA adoption scenario is analogous to unbundled handsets that can be purchased directly from a retailer without the mediation of a MNO. In an operator-centric adoption model, the practice is analogous to bundling of handsets with associated contract for services that is being practiced today in many markets, most notably in Japan and USA. In the first case, the end-user device decides on accessing the spectrum, while in the second case, the MNO controls the location and time for accessing the spectrum. However, in both scenarios, the underlying DSA technologies enable to exploit spectrum more efficiently. The adoption scenarios are summarized in Table 2.

While standards on DSA are still evolving, standards such as 3GPP CA and ETSI RRS LSA provide operator-centric solutions, while IEEE and IEFT provide user-centric solutions. Also ETSI WSD and Reconfigurable MD and 3GPP D2D provide user-centric solutions.

2.2 Network and substitution effects

Be it an operator or user-centric adoption, the total number of innovation adopters is expected to increase, as a function of time, forming an S-curve. This adoption process has two distinct phases namely the critical mass beyond which innovation exponentially diffuses and the saturation point at which the adoption rate stabilizes and the adoption attains saturation levels. The literature often refer to the pattern of diffusion in mobile telecommunications as being characterized by an S-shaped curve and by positive network effect [40, 41], in which the benefits of consumers and producers are positively affected by the number of end-users and operators adopting a certain technology. There are a number of studies analyzing the adoption of products and services in networked environments by means of network effect and diffusion models. For instance, in reference [23], authors explain the dynamic adoption of network technologies by means of Bass diffusion model.Footnote 3 Other authors compare the adoption patterns of Internet Protocol (IP)-based services, network-based services and durable goods [22], and finally the work in [43] analyzed the adoption of BITNET in computer networks. There are a number of studies focusing on critical massFootnote 4 requirements in mobile industry [24, 45]. Based on the cited literature, this study assumes that network effect is equally applicable to DSA technologies.

The second element is the substitution effect, wherein a newer technology replaces an older one, typically near the end of its life [46]. This happens normally at the saturation level of the S-curve of the incumbent technology. For example, in reference [23], authors describe the substitution effect of two competing mobile generations, validating this model with the historical cellular data of 2G and 3G. In general, there are six types of interaction between an old and a new technology (pure competition, predator-prey, mutualism, commensalism, amensalism and neutralism) [47]. Technology substitution and consequent innovation adoption have been modeled as a predator-prey competition model in various research studies [21, 48, 49]. Such model describes the competition of two species for a common resource and explains survival, extinction and coexistence of technologies.

In reference [19], authors identify two main steps in the adoption process from research and development to adoption of DSA technologies. The first step is the technology-push, which is related to technology development and evolution of standards. The type and process of standardization defines the potential of this technology to substitute a previous one or to remain as a smaller niche catering to a limited market. The relation between standardization with network and substitution effects have been studied by many authors. For instance, the coordination game on standards and the presence of complementarity and compatibility of products is modeled by [40]. In fact, in the case of GSM, technology harmonization and associated standardization played a very relevant role in its widespread adoption for mobile services [50]. There are several ongoing standardization efforts in DSA technologies as indicated in Table 1, such as those related to Internet Engineering Task Force (IETF), Institute of Electrical and Electronics Engineers (IEEE), Third Generation Partnership Project (3GPP) and European Telecommunications Standards Institute (ETSI). Thus, the final winning standard(s) for DSA may emerge from the cellular (3GPP, ETSI) or Internet (IEFT, IEEE) world. While internet technologies typically coexist with cellular technologies thus providing complementarity and associated network effects, cellular technologies may replace previous ones initiating substitution effects or compete against established networks with high network effects. Thus, the standardization bodies play an important role in the adoption of a new technology, since their decisions impact the type of effect a technology will face.

The second step is the market-pull, which includes the regulatory decisions and the characteristics of the market. The regulatory decisions related to a flexible spectrum regime enable a critical mass of spectrum available for sharing and provides the required impetus for a spectrum market and the corresponding adoption of DSA technologies. For example, the feasibility of business models for service providers participating in the spectrum market, determine whether it is mature enough to adopt DSA technologies.

Depending on the type of technology development, a standard may support modular or integral designs. Integral designs are common in vertically integrated markets, exemplified by the Japanese mobile market. A change in an integral design demands high coordination between the involved actors (i.e. network manufacturers, device manufacturers, and MNOs). In this case, standards offering new holistic solutions (e.g. IEEE 802.22, ETSI WSD, IEFT PAWS or Weightless) present an integral design. Both, the inability to agree on integral standards and the existence of closed systems have a negative impact on reaching a critical mass, as indicated by [51]. On the other side, if the industry is not vertically integrated, much like open systems, modular designs evolve that plugs within an existing integral architecture. These standards take typically the form of an evolution of a previous system (rather than a revolution) by replacing or adding a new functionality without requiring major changes to the existing system. In top of that, new DSA technologies can present high network effect, if they are competing against each other as an integral design, or they can present substitution effect, if a new technology is replacing an older one in a modular way.

Following Table 1, this analysis identifies technologies competing with high network or substitution effects. Technologies with modular design, which can act as an enabler by replacing an older module or process, typically exhibits substitution effect. This is the case of 3GPP CA, ETSI RRS LSA and IEEE 802.11af; since they are substituting an older mechanism by adding a new functionality (the capability of aggregating different frequencies, of communicating with a spectrum database or transmitting in a new frequency band). A substitution may happen as an internal process of the operator, as the case of 3GPP CA, or it may happen as a service offered to the end-user. For instance a M2M or D2D service based on DSA functionality may replace an older similar service based on older technology; or a small cell indoor coverage facilitated by DSA may substitute a macro cellular coverage which does not support DSA. In other words, even though the substitution happens at process level, the end-user may see a concrete offer at service level and thus the adoption in this case still happens at the end-user. In case there are several standards offering a similar functionality, they may compete against each other based on network effect (for instance, IEEE 802.11af with IEEE 802.22; and 3GPP D2D or 3GPP CA with ETSI RRS Reconfigurable MD). Finally, in case of newer technology deployment as an integrated systems (as the case of ETSI WSD with PMSE devices or Weightless with M2M), they may compete with established older technologies based on network effect.

2.3 Industry openness

The industry structure can be characterized through several parameters such as size, number of firms, market concentration, and entry and exit barriers. In the case of mobile industry, many authors have focused on the number and types of MNOs. For instance, the work in [4] studied the mobile industry structure from a transaction economic perspective, concluding that competition between vertically integrated MNOs would induce more investment and competition compared to a vertically separated market. Others studied the case of Mobile Virtual Network Operators (MVNOs) [5], and suggested that while they increase competition in the mobile industry, the mandated provision of access lowers the investment intensity of MNOs. In addition, while some authors postulate that a market with horizontal structure facilitates the adoption of MVNOs [52]; others showed that the number of networks and the history of the industry affect the speed of service adoption [6]. Besides vertical integration, the more the number of MNOs, the more intensive is the competition.

To be more specific, and to separate spectrum management issues from others affecting the industry structure, this study focuses on industry openness defined as the level of entry and exit barriers. Thus, the industry is open if entry barriers are low and vice-versa. As per Stigler [53],Footnote 5 entry barriers are cost advantages of the incumbent against competition from new entrants. In general, the indicators of entry and exit barriers may include: (i) transaction costs between firms (i.e. operators) in the market and (ii) switching cost of subscribers [56]. As per Coase theorem [57], higher transaction costs lead to vertical integration, and hence increase asset specificity, causing appropriable quasi-rentFootnote 6 and giving room to individual opportunistic behavior. If transaction costs are low, the industry is more open, with many competing MNOs, and the asset became less specific [58]. Switching costs are those incurred by the end-user when she/he changes from one service provider to another and they are often related to the degree of competition [59]. Higher switching costs constitute an entry barrier, since they give incumbent firms significant market power over their existing customers. Under high switching costs, firms compete under a multi-period problem, in which a provider decreases prices to attract the customer in a first period to build the required critical mass and then increase prices in a second period after locking-in the customer.

As depicted in Appendix 3, switching and transaction costs change from one market to another. For instance, subscriber switching costs are relatively high in Japan and USA (in terms of churn rate, mobile ARPU, etc.), while they are considerably lower in India and in Finland. In addition, Japan and USA shows a highly integrated industry with high transaction costs while in India and Finland these costs are lower (as they exhibit higher cooperation between MNOs in infrastructure sharing, national roaming, etc.).

2.4 Spectrum centralization

Spectrum management has a significant impact on the mobile industry, as spectrum assignment has implicitly affected the number of MNOs. The academic literature often assumes a tight link between spectrum and market concentration [60–62], and thus spectrum management affects market competition. However, the introduction of new DSA technologies and the new related spectrum regimes enable more flexible business models, and considerably decrease the importance of holding spectrum as a condition for market entrance. Therefore, this study considers spectrum centralization as a separate factor.

In this work, spectrum centralization refers to the mode of allocation and assignment of spectrum, associated usage rights, and consequent spectrum concentration. On one hand, NRAs can allocate and assign spectrum in a centralized way, with the objective of harmonizing spectrum usage, thereby defining the service and the technology to be deployed. In this regime, the industry structure depends on the decision of the NRA on the number of MNOs and the amount of spectrum to be assigned to each MNO. On the other hand, the usage rights specified in the license can be flexible with respect to its access, allowing spectrum trading and sharing [63], and thus creating a decentralized spectrum market. A flexible spectrum regime allows spectrum sharing by enabling two or more parties to coexist in same frequency band at different time or place. Spectrum sharing can happen between operators in a coordinated manner, or it may happen between the access provider and the end-users in an ad-hoc mode. The initial concentration of spectrum of each market has a significant impact in facilitating centralized or decentralized spectrum sharing.

Countries have taken varied positions with respect to spectrum centralization. For example, most European countries have assigned larger blocks of spectrum amongst a selected set of three or four MNOs to favor industry coordination and harmonization [64]. On the other hand, countries such as India have favored competition in the market place, by assigning the available spectrum amongst many MNOs (as high as ten or more per service area), leading to a very high spectrum fragmentation. There is a trade-off between competition and economies of scale effect of spectrum holding; a high spectrum concentration or a very high spectrum fragmentation beyond a threshold limit induces industry inefficiencies [65].

Several markets are gradually moving towards flexible spectrum regimes. In USA, MNOs are able to trade spectrum from each other as well as from broadcasters and other niche spectrum holders. Some authors affirm that such spectrum market is already positively impacting the mobile industry [66]. In Europe, though spectrum trading studies were initiated around the turn of the millennium, it is only recently that country regulators have allowed MNOs to trade spectrum. OfCom, the national regulatory authority in the UK, allowed spectrum trading in 900 MHz, 1800 MHz and 2100 MHz in 2011 followed by a more recent announcement in 2013 for including the 800 MHz and 2600 MHz bands. Many other European markets are introducing similar policies; however, not much action has taken place as yet. In India, spectrum trading is being discussed since 2012, and recently the Indian regulator, announced guidelines on spectrum trading [67] and sharing [68]. Some authors suggest that spectrum trading is beneficial especially in a market with high spectrum fragmentation, such as India [69]. Table 3 illustrates the differences between the traditional approach and a flexible regime of spectrum management. This Table indicates that DSA requires a flexible spectrum regime to allow spectrum sharing.

3 Note on research methods

The ICT ecosystem has become a complex dynamic system, consisting of several interacting agents [70], which evolves through incremental and radical innovations achieving periodically revolutionary changes or redomainings [71]. The above sections illustrate these complex relationships between technology, market structure, and regulatory decisions on the success of adoption of DSA standards, technologies and associated services. System Dynamics is intended for analyzing the dynamic behavior of complex systems, such as the mobile market, by modeling the relations between different interacting factors.

System Dynamics is a simulation technique developed by Jay Forrester in the 1950s [72]. Even though early applications focused on modeling corporate systems and control engineering, it is being widely applied in various areas including techno-economic, socio-economic and public policy studies. The feedback loop is the most significant modeling element in System Dynamics, which exists whenever decision made by agents in a system affects the overall state of the system.

System Dynamics has been proven to be a valid method for understanding the behavior of complex telecommunication markets and associated policies. For instance, some authors studied the adoption of broadband in remote and rural Scotland using this method [73]. Others described the cause-effect relationships relating to spectrum management and associated market developments and policy decisions [39], while the study in [74] performs a similar analysis for describing the competition in the mobile industry. Finally, other authors analyzed the adoption of mobile voice [50]. In all these cases, a System Dynamics approach successfully identified the most relevant relations of a system consisting on multiple interacting factors.

On the other side, other authors studied technology adoption by analyzing historical data. For example, the reference in [75] identifies the determinant for broadband adoption in the OECD countries by employing regression analysis. Other author employed a regression model to study the adoption of mobile telephony [76]. In these cases, authors employed rich panel data sets for their analysis. The work in [77] studies mobile subscriber churn by means of regression and Bayes analysis with smaller samples. Data analysis is usually a much more precise method when the required data is available, which this is not the case of future technological deployments. In System Dynamics, the causality is understood through feedback loops and thus the whole system structure causes the analyzed behavior. In a regression analysis, and more generally in the traditional view, the causality is explained through independent and dependent variables. Thus, while in the traditional view causality is exogenous, in System Dynamics causality is endogenous.

Finally, other authors studied the spectrum market by means of Agent-based modeling, by simulating spectrum holders as interacting agents [9, 11]. Even though this method also captures the dynamic behavior of a complex system, it does not address well enough the characteristics of adoption, such as critical mass and network effect. From this perspective, the top-down modeling approach of System Dynamics aggregates better the overall behavior of a system rather than analyzing the behavior of particular agents.

Both Agent-based and System Dynamics modeling aim at analyzing the dynamics of complexity [78] in a wide range of fields; however, through opposite approaches. While Agent-based modeling focuses on agent rules and their resulting emerging dynamic behaviors, System Dynamics focuses on the system structure consisting on feedback loops at an aggregate level. Thus, while Agent-based modeling is unable to study the overall structure without knowing the agent rules, System Dynamics cannot reach credible results if the notion of circular causality and its underlying feedback structure is subject of controversy. The extensive study of prior literature combined with the expertise of the authors on mobile markets of various geographies provide the basis for reaching credible results in the System Dynamics models developed herein.

4 Adoption model

The adoption model of this section includes all the variables of interest, described by the previous sections, to analyze the dynamics of DSA adoption. The main contribution of this model is to bring together as a synthesis the previous work of other authors, regarding spectrum centralization [39], industry openness [74], network [79] and substitution [48] effects, with the understanding on DSA technologies and standards previously presented in this paper.

System Dynamics employs causal loop diagrams, as shown in the following Figs. 1, 2, 3, and 4, to visualize how different variables are interrelated in a system. The diagram consists of a set of nodes and edges. Nodes represent the variables and edges describe the relation between two variables. An edge with positive sign (“\(+\)”) indicates a positive causal link, i.e. the two nodes change in the same direction. An edge with negative sign (“\(-\)”) indicates a negative causal link, i.e. the two nodes change in opposite directions. The closed cycles or loops in the diagram are very important in System Dynamics. A loop is reinforcing (“R”) if the effect of a variation in any variable propagates through the loop and returns to the initial variable with the same direction, further stimulating the initial variation. A loop is balancing (“B”) if the effect of a variation in any variable propagates through the loop and returns to the initial variable with the opposite direction, and thus causing the contrary effect of the initial variation.

4.1 Modeling network and substitution effects

This section describes the modeling of network and substitution effects, based on previous work by [79] and [48]. Fig. 1 depicts the System Dynamics models of these effects.

Figure 1a depicts a causal loop diagram of the path dependence of two competing technologies [79] which generates the network effect. In this figure, the variables adoption of user-centric devices and adoption of operator-centric devices describe the performance (i.e. sales) of each type of devices. The accumulation of the adopted devices constitutes the installed base of such devices; the higher the installed base, the higher the level of compatibility for new adopters,Footnote 7 which attracts more adoption from stakeholders (end-users or operators); and this in turn increases the market share of the adopted devices. This closed loop creates a spiraling network effect (depicted by reinforcing loops R1 and R2).

In addition, the increase in adoption and attractiveness of user-centric devices (or operator-centric devices) decreases the market share of the other type of devices. This slows down the rate of adoption of the last type of devices, since they become comparably less attractive, which finally affects the chain of causal links leading to another closed loop depicted as share saturation (balancing loops B2 and B1). The system of equations that describe the mathematical formulation of the network effect and saturations as postulated in this model is presented in Appendix 1.

Figure 1b illustrates a causal loop diagram of the substitution effect employing a predator-prey competition model, which is described by the so-called Lotka-Volterra equations [48] and represents a technological substitution. These equations can be represented in a causal loop diagram, as exemplified by [80]. This model presents a logic similar to the competition model with network effect, except that the growth of user-centric devices, also referred to as predators, leads to the substitution of operator-centric devices, also referred to as prey. Hence the reinforcing loops R1 and R2 are offset by the balancing effect (B1) of substitution. See in Appendix 1 a mathematical formulation of the substitution effect.

4.2 Modeling industry openness and spectrum centralization

Figure 2a depicts an adaptation of the model of [39]. This model explains that a centralized spectrum management incentivizes a wholesale spectrum market, this leading to the adoption of operator-centric DSA by MNOs.Footnote 8 However, it does not encourage user-centric adoption in the retail market. On the other hand, a market driven and decentralized spectrum assignment incentivizes user-centric adoption of DSA technologies by end-users. These are captured through two reinforcing loops starting from spectrum centralization, R3 (wholesale) and R4 (retail). In the wholesale loop, an initial efficient harmonization of the spectrum allocation induces high spectrum concentration and stimulates operator-centric sharing that subsequently stimulates high spectrum concentration, without requiring major changes to the spectrum regime. In loop R4, lower spectrum concentration induces end-users to access the available spectrum, which in turn promotes user-centric devices to be deployed thus promoting spectrum de-centralization further together with a flexible spectrum regime. The reinforcing loops R5 and R6 indicates how the growth in one type of spectrum sharing reduces the demand for the other type of spectrum sharing. Figure 2b depicts an adaptation of the model of [74] that explains the dynamics of market behavior. This model describes how low entry barriers (i.e. open industry) favored by regulators to incentivize competition can have a negative impact on investments due to a decrease in MNO profits.Footnote 9 In a similar manner, increasing entry barriers makes the industry closer and incentivizes operator-centric investments. In Fig. 2b, decreasing entry barriers leads to price competition that decreases the level of prices and opens the industry further; depicted in the Fig. as reinforcing loop R7. In the other reinforcing loop (R8), an increase in barriers to entry, caused by a regulatory effort to improve Quality of Service (QoS), provides market participants incentives to invest in operator-centric infrastructure. This leads to improvements in QoS, which decreases industry openness and hence acts as disincentive for providing user-centric technologies. The reinforcing loops R9 and R10 illustrate how lowering entry barriers (and opening the industry) decreases the willingness of MNOs to invest in operator-centric infrastructure and makes the user-centric proposition attractive, for both incumbent and new entrants.

4.3 Integration of industry openness and spectrum centralization into the adoption models

This section integrates the previous diagrams depicted in Figs. 1 and 2 into the adoption models, by including the industry openness and spectrum centralization as main factors affecting the competition based on network or substitution effects.

The integrated diagrams are presented in Figs. 3 and 4. These models assume a flexible spectrum regime allowing spectrum sharing, which can be centralized or decentralized, as referred by the variable spectrum centralization. If the spectrum regime is centralized, spectrum sharing is performed in an operator-centric fashion, for instance by allowing the participating MNOs to share or trade their spectrum. If the spectrum regime is decentralized, spectrum sharing is performed in a user-centric fashion, by allowing the DSA capable user devices to access the available spectrum. Thus, the variable amount of spectrum available for user access describes the amount of available spectrum for end-user access. If spectrum is decentralized, end-users have more choices of access networks, and thus the operators have more incentives to provide end-user centric access through DSA. This in turn stimulates the adoption of user-centric devices while correspondingly decreasing operator-centric devices.

Figure 3 depicts the integrated diagram that describes the DSA adoption based on competition with network effect. This model merges Figs. 1a, 2a, b. The additional reinforcing loops are discussed below. The numbers of the loops maintain the numeration of the previous figures.

-

R3 and R4 (Reinforcing loops): An increase in the adoption of user-centric devices increases the level of spectrum sharing at retail level and thus it further incentivizes a lower spectrum concentration, which in turn fuels the adoption of user-centric devices. Following the same logic, an adoption of operator-centric devices maintains high spectrum concentration and stimulates a wholesale spectrum market between MNOs. These loops corresponds to R3 and R4 of Fig. 2a and are based on [39].

-

R5 (Reinforcing loop): A lower spectrum centralization, indicative of high spectrum fragmentation, increases the available spectrum for end-user access, which in turn stimulates retail spectrum sharing and lowers the centralization further. Thus, a decentralized spectrum will get more decentralized under the adoption of user-centric DSA. On the contrary, operator-centric spectrum sharing is more probable under a centralized spectrum market. This loop includes R5 and R6 of Fig. 2a and is supported by [39].

-

R8 (Reinforcing loop): An open industry, with low entry barriers, results in lower revenues for the MNO and less incentives to invest in operator-centric DSA technologies [81–84]. At the same time, the incentives for investing in user-centric DSA technologies are increased along with a decrease in the incentives for investing in operator-centric DSA technologies. This loop includes R7 and R8 of Fig. 2b and is supported by [74].

-

R9 and R10 (Reinforcing loops): the adoption of user-centric devices has a positive impact on industry openness, because these devices offer low switching costs, by allowing end-users to change easily from one network to another. This has a spiraling effect on investment in user-centric devices, which further propagates to an increased market share of such devices. Consequently, an adoption of operator-centric devices has a negative impact on industry openness, since such devices have higher switching costs, and it incentivizes MNOs to invest further in operator-centric infrastructure. These loops corresponds to R9 and R10 of Fig. 2b and are based on [74].

The other loops are those related to network and saturation effects (reinforcing loop R1 and balance loop B1 respectively), as explained in Sect. 4.1. The variable amount of spectrum available for user access affects the level of compatibility, since devices become more compatible with the available network access if the amount of spectrum increases. Similarly, the incentives for investing in one type of technology positively affect the attractiveness of adopting such technology, as depicted in the diagram.

Figure 4 presents the integrated diagram that describes the DSA adoption based on predator-prey competition, which embeds the substitution effect (Fig. 1b) with the dynamic of industry openness and spectrum centralization (Figs. 2a, b). This model considers the user-centric devices as predator and operator-centric devices as prey (this relation is defined in the competition effect variable, see Appendix 1 for further details). Due to the modular design, diverse functionality, and its attractiveness to end-users, it is more likely that a user-centric device can potentially substitute an operator-centric device.Footnote 10 The growth rate of these technologies is determined by the variables related to industry openness and spectrum centralization. For instance, the author in [85] suggests that the rate of technology adoption is directly proportional to the expected profitability and it is a decreasing function of the investment size. Based on this, the model indicates that the level of saturation of a type of device is inversely proportional to the amount of spectrum available for that type of device, since the availability of spectrum increases the potential for that technology. On the other hand, the incentives for investing in one type of technology positively affect the growth rate of that technology, and at the same time, they positively affect the saturation of that technology, since its growth potential is reduced.

Note that the adoption model with substitution effect follows a similar logic than the one with network effect. Therefore, the reinforce loops of Fig. 4 (R3, R4, R5, R8, R9 and R10) behave in a similar way than those of Fig. 3. As in the previous model, industry openness forms the reinforcing loop R8, while the spectrum centralization forms the reinforcing loop R5. Finally, the adoption of devices originate the reinforcing loops R3, R4, R9 and R10.

The main difference between these two models is the interaction between the competing technologies. Figure 4 represent a situation wherein the two technologies compete with each other, and thus the growth of each technology disincentivize the growth of the other technology. Figure 5 represent a situation wherein one technology substitutes the other; and thus the installed base of one technology stimulates the adoption of the other technology.

5 Results

The System Dynamics models described by Figs. 3 and 4 were simulated using Vensim PLE \(\circledR \). The parameters of the model are summarized in Appendix 2. Spectrum centralization, industry openness and investment incentives are parameterized in a scale from 0 to 1, where 0 is the minimum and 1 is the maximum. In spectrum centralization, the value 0.33 represents the average value of market concentration in the mobile industry (equivalent to an HHI index of 0.33), under which spectrum is decentralized. For industry openness (and consequently for investment incentives) the average value is 0.5. Over this value, the industry is open, and bellow this value it is closed. The amount of spectrum available for user access is initially set to 5 % of the total spectrum. This does not consider the whole license-exempt spectrum, but only the portion of the licensed and license-exempt spectrum which has been gradually dedicated for user-centric DSA access. When this amount has achieved a threshold of 25 %, the economies of scales pushes towards a positive feedback loop which stimulates user-centric devices. On the contrary, bellow this threshold, the feedback loop stimulates operator-centric devices. For the model with network effect, the initial amount of user-centric devices is the same than operator-centric ones. If one technology has considerable higher amount of initial installed base, it will dominate. For the model with substitution effect, the simulation assumes that operator-centric devices start with 90 % of the installed base, while user-centric devices start with 10 %. This is to illustrate a case, in which user-centric devices are initially substituting operator-centric ones, since they offer a new or improved functionality. Finally, the competition effect coefficient is -0.02 for user-centric devices and 0.02 for operator-centric devices, meaning that user-centric devices substitute operator-centric ones.Footnote 11 Table 4 shows the four simulated scenarios with different initial values for spectrum centralization and industry openness, which represent four different markets. Scenario A refers to a country such as India or until certain extent UK, where spectrum is highly fragmented and the industry is highly open; scenario B is indicative of the situation in Nordic countries such as Finland or Sweden, where the number of MNOs are few, partly due to limited number of subscribers with an open industry presenting low switching costs for end-users; scenario C represents to some extent the situation in USA, which has decentralized spectrum and a bundled service offer (and hence closed industry); and finally scenario D refers to Japan or China, in which there are few MNOs and the entry of firms is very difficult or even strictly controlled by the government (as in China).

Figure 5 illustrates the simulation results for the competition model with network effect described in Fig. 3. Note that the adoption of user-centric devices is successful only under open industry and decentralized spectrum (i.e. scenario A). In all the other conditions, operator-centric scenario dominates. Industry openness which reduces entry barriers together with low spectrum concentration and a flexible spectrum regime allowing spectrum sharing, lead new entrants to invest, along with the incumbents, in user-centric DSA technologies. Thus, under high network effect, both spectrum decentralization and industry openness enable user-centric DSA to reach economies of scale and critical mass required for its successful adoption. However, not many countries possess these characteristics. One peculiar case is that of India, with highly fragmented spectrum assignment and very low price and investment indexes (indicative of an open industry). In most of the cases, for instance most European countries, US, Latin America and Asia (such as Japan, China and Korea), spectrum evidences high concentration and industry openness varies from country to country.

Figure 6 depicts the simulation results for the competition model with substitution effect described in Fig. 4. They indicate that a successful adoption of user-centric devices requires only a decentralized spectrum and therefore it can happen more often; however, the adoption process is slower as compared with the one with network effect. In fact, in a centralized spectrum regime (scenarios B and D), both operator- and user-centric devices coexist, with operator-centric devices dominating. However the substituting technology or predator (i.e. user-centric devices) dominates when the spectrum is decentralized (scenarios A and C). The adoption of user-centric devices over time substitutes the operator-centric devices. In most of the cases, the competition model with substitution effect allows a certain level of coexistence for both technologies during several years, until one dominates over the other. The time period of replacement depends on the competition effect between the technologies. Tables 5 summarizes the simulation results for both models and Table 6 provides examples of associated dominant standards, which illustrate possible adoption patterns.

6 Discussion

The models and results presented in this paper provide useful references and guidance to policy makers while introducing DSA technologies in different markets. The developed models focus on market dynamics. They do not consider issues such as technical feasibility of the frequencies to be employed or demand for new services, which also determine the success of adoption.

Table 6 provides examples of dominant standards based on the obtained results and thus it illustrates that different markets may adopt different standards. In fact, given that most countries have a centralized spectrum, in which few operators hold most of the available spectrum, an operator–centric adoption of standards such as ETSI RRS LSA, 3GPP CA and open standards like Weightless offering specific IoT integral solutions may dominate. For those markets with decentralized spectrum, both user-centric and operator-centric standards may be adopted. If the industry is open, standards having modular design may be adopted, such as 3GPP D2D, ETSI Reconfigurable MD, IEEE 802.11af and 802.11ah. If the industry is closed, standards with integral design (operator centric adoption) may dominate together with a user-centric adoption based on standards with modular design.

This work is the first in studying the adoption of DSA technologies in concrete, bringing together previous work on spectrum management [39], industry dynamics [74], and adoption modeling [48, 79] with an analysis of the state-of-the-art of DSA standardization. The results are relevant especially for policy makers and they urge them to analyze the spectrum concentration and industry openness of their markets.

As follows, this section briefly discusses some selected market cases, to illustrate the possible applicability of the results as presented in the previous section. Statistical information on the analyzed markets is gathered in Appendix 3.

6.1 Case of operator centricity and industry openness in Finland and other EU markets

Finland, much like most of the Nordic countries was an early adopter of mobile technologies. It was the first country to operate a GSM network in 1991, and had continued to play an early adopter role in the deployment of latest cellular generations. In spectrum policy, the Finnish authorities have aimed at stimulating the deployment of latest technologies rather than collecting revenues from auctions [88]. In fact, MNOs had typically paid only nominal administrative charges for spectrum [89]. Over a period of time, most the European countries including Finland have adopted technology and service neutral spectrum policies and started allowing flexible use of spectrum [64]. MVNOs were allowed in Finland as early as 2003, this affecting on industry openness and competition. In addition, Finland has a long tradition of handset unbundling indicative of industry openness and bundling was only allowed for the 3G services in 2006 [90]. However, due to its limited subscriber base, the government has consciously allowed a limited number of MNOs (currently three). Hence Finland represents a case where the spectrum is concentrated in the hands of three MNOs and it is likely that MNOs may adopt operator-centric DSA technologies. Recent efforts for infrastructure and spectrum sharing are indicative of this trend [91], which evidence the willingness of MNOs to cooperate and develop operator-centric mechanisms. In addition, Finland has being testing LSA which is an operator-centric DSA solution [33]. Thus, end-user centric DSA adoption may remain in niche and emerging services, without playing a major role in the mobile market, if spectrum centralization policy remains unchanged by the authorities.

6.2 Case of multi-SIMs in India and other emerging markets

India has a mobile a market with high levels of spectrum decentralization and a very open industry. In fact, there are about 10 to 12 MNOs in each service area. With a spectrum HHI of 0.13, India enjoys one of the lowest spectrum concentration in the world [92]. In addition, not all the MNOs hold countrywide spectrum and are able to provide coverage in all locations, especially in remote and rural areas. Moreover, MNOs often have congested network conditions, especially in dense urban areas and they face capacity and coverage limitations. Handsets are unbundled though not dictated by regulation, but due to industry structure. The prepaid subscriber base constitute about 80 percent of the total subscriber base. With Mobile Number Portability in place, the switching cost to subscribers is very minimal indicative of the industry openness.

Due to intense competition, MNOs in India release many tariff plans for subscribers. Subscribers and local mobile handset manufacturers found a way to tackle the problems described above through multi-SIM handsets [92]. It is reported that the share of multi-SIM phones is increasing, especially within the young population [93]. The subscribers manually optimize their usage taking into account price, coverage and capacity of networks by activating corresponding SIMs in the phone. More interesting is the latest development towards an automated multi-SIM functionality, the so-called embedded SIM (eSIM) [94]. This is akin to user-centric spectrum access, where the eSIM enabled device executes a policy defined beforehand to access different networks. Moreover, penetration of wired broadband is very low (about 5 percent of households), which also stimulates the growth of mobile broadband subscriptions. Thus, terminals with user-centric capabilities such as eSIM or DSA are likely to be adopted better in markets such as India. As per this analysis, countries with these characteristics are suitable candidates for the adoption of user-centric DSA technologies, as well as alternative user-centric solutions such as eSIM. As indicated in Table 6, most DSA standards seems to suit especially well to such markets, except ETSI RRS LSA and 3GPP CA. This Table further suggests that standards from the cellular world (ETSI, 3GPP) may coexists with those from the internet world (IEEE, IEFT).

6.3 Case of operator centricity and closed industry in the US and Japan

In the USA, handset bundling is the norm and it enables vertical integration of MNOs and application content providers, which causes high switching cost for the end-user [95]. Similarly in Japan, the MNOs closely work with selected handset vendors and provide bundled service offerings. The price and investment indices in these countries are high; which indicates a closed industry structure. While spectrum is fragmented amongst several MNOs in USA (spectrum concentration of 0.287), Japan is a highly concentrated market and spectrum is in the hands of mainly three MNOs (spectrum concentration of 0.347). These countries are evident of closed markets with decentralized or centralized spectrum regime.

According to our analysis summarized in Tables 5 and 6, the most probable scenarios for USA, Japan and other countries with similar industry structure, is that the strong role of MNOs continues with an operator-centric development of DSA. The alliances and partnerships occurring in USA amongst MNOs for spectrum sharing and trading are indicative of this possibility [92]. In addition, countries such as USA, which evidence decentralized spectrum, can also adopt modular user-centric DSA solutions, both in emerging service areas (M2M) and as an extended functionality of the mobile services (D2D). For example, Google has started a MVNO in some regions of USA in cooperation with MNOs to provide seamless access to Wi-Fi networks. The fact that spectrum is decentralized provides incentives for both MNOs and new entrants such as Google to cooperatively deploy DSA technologies, for example in the license-exempt band. These trends are supported by this model and analysis.

6.4 Case of Wi-Fi adoption and the license-exempt band

Wi-Fi is an excellent case where under the conditions of industry being open and spectrum decentralized (i.e. license-exempt), technology adoption by user-centric devices became dominant. Modular design and standardization efforts through IEEE enabled Wi-Fi capabilities to be included in almost all wireless and mobile end-user devices. Therefore, under a decentralized spectrum regime, standards such as IEEE 802.11af, IEEE 802.11ah and IEFT PAWS are a good candidate for end-user adoption. On the other hand, operator-centric standards may be expanded to the license-exempt band, by considering this possibility already in the standardization stage, as it happens with 3GPP CA. The fact that license-exempt frequency bands provide free access, make that operator-centric standards may also include user-centric functionality.

7 Conclusions

As policy makers and NRAs move towards a flexible spectrum regime, the DSA technologies that allow spectrum sharing are moving from test labs to commercial deployment. In this scenario, this paper aims to understand how DSA technologies and standards diffuse through the mobile ecosystem for a successful adoption. In general, DSA is either adopted by operators or by end-users. This paper analyzes such adoption under varied conditions of industry openness and spectrum centralization, by employing System Dynamics models grounded on network and substitution effects.

The main contribution of this paper is to make a synthesis of the previous literature by modeling and analyzing the adoption of DSA. This work gathers together stakeholders and factors impacting DSA adoption to illustrate the challenges of such a process. Moreover, this study provides a deeper understanding on the relationship between mobile market and the adoption of DSA in different types of markets.

As a result of this modeling exercise, this paper has identified four types of standardization efforts in the DSA area: (i) user-centric with modular design; (ii) user-centric with integral design; (iii) operator-centric with modular design; and (iv) operator-centric with integral design. For each case, this paper describes the conditions for a successful adoption in Tables 4 and 5. The above mentioned standards interact between them. In a case of substitution, a new modular technology replaces an older one. In a case with network effect, two integral systems or modular designs compete against each other. In each case, the characteristics of a particular market (industry openness and spectrum centralization) affect the standard suitability and the adopted standard in its turn affects the industry structure.

As illustrated, under the presence of high network effect, user-centric devices are expected to dominate only under an open industry and a decentralized spectrum regime. Under substitution effect, a decentralized spectrum is enough to promote the adoption of user-centric devices. Operator-centric DSA is therefore expected to dominate in countries with centralized spectrum, which in practice is the case for most markets. On the contrary, user-centric DSA may be adopted in countries with decentralized spectrum regime and in niche emerging services (e.g. IoT). In general, a successful adoption of user-centric devices requires modularization, standardization, backward compatibility and horizontalization of the ecosystem. This is a relevant observation, since most of the standard efforts are user-centric. With current market conditions (centralized spectrum), standards such as 3GPP CA and ETSI RRS LSA possess higher probability of adoption and user-centric standards may remain in niche areas.

By analyzing the current status of their markets, NRAs and interested stakeholders can study the adoption behaviors of different technology standards. The NRAs can also simulate the adoption profiles for various standards based on the existing market and spectrum conditions and can make policy decisions accordingly. An operator-centric adoption may provide MNOs a means to increase their network efficiency; but may not necessarily increase the level of competition. On the other hand, a user-centric adoption may stimulate further competition; however, the incumbent incentives for investing in such technologies remain uncertain and the role of new entrants becomes more important. This model provide NRAs understanding on how their policy decisions affect the adoption of standards which consequently impact the level of competition and investments in the market. Moreover, the model developed herein might help all stakeholders (i.e. NRA, MNOs, spectrum holders, device and network manufacturers) to better understand the implications of introducing DSA technologies and services.

Future research for this area may include a more detailed analysis on particular sharing models, such as licensed shared access (LSA) in Europe and spectrum access system (SAS) in the USA. In addition, it may be useful to compare DSA technologies against other competing technologies which are not related to spectrum access, but are pushing mobile markets towards an operator-centric or user-centric evolution, such as national roaming or end-user multihoming.

Notes

Operator providing wireless internet access in a local basis, such as described in [2].

This framework has been adopted by the US and the EU as a three tiered framework authorization [18].

For Bass model description and application, see [42].

Critical mass is the “minimum network size that can be sustained in equilibrium” [44].

According to [54], spectrum license is an entry barrier according to Bain’s definition, but not according to Stigler’s definition. Considering that currently spectrum licenses have reselling rights and spectrum regimes are becoming more flexible, this study follows Stigler’s definition. Therefore spectrum licenses is not part of industry openness, but it is considered in a separate variable (spectrum centralization). A similar situation happens with taxi licenses, as explained by Demsetz [55].

Quasi rent is a return of a firm, which is temporal in its nature due to e.g. temporal entry barriers. Appropriable quasi rent arise from a vertical integration or a transaction-specific investment.

Under network effect, the number of adopters increases the value of a new adopter, since there are more connected devices to interact. In DSA, compatibility issues are relevant at both device and network sides.

Low market concentration increases the probability of having spectrum transactions at retail level, since it provides the end-user buying power and increased service offer. If market concentration (and spectrum concentration) is higher, there will be less transactions at retail level (less switching possibilities for end-users), but operators instead may develop a wholesale market, through cooperative or market based mechanisms, if they see it beneficial. Note that under dominant position (i.e. monopoly), the probability of having transactions decreases at both levels.

This exercise models user-centric devices substituting operator-centric devices. However, it may be easily extrapolated to include other scenarios, such as an operator-centric DSA process substituting an older process without DSA.

The value of a network can be described as \(N^{2}\) by Metcalfe’s law or as \(e^{N}\) by Reed’s law.

References

Cisco. (2015). Cisco visual networking index: Global mobile data traffic forecast update, 2014–2019

Markendahl, J., & Casey, T. R. (2012). Business opportunities using white space spectrum and cognitive radio for mobile broadband services. In 2012 7th IEEE international ICST conference on cognitive radio oriented wireless networks and communications (CROWNCOM) (pp. 129–134).

Mitola, J. (2000). Cognitive radio: An integrated agent architecture for software defined radio, Doctoral thesis, KTH. Scientific American. 294(3) (pp. 66–73).

Howell, B., Meade, R., & O’Connor, S. (2010). Structural separation versus vertical integration: Lessons for telecommunications from electricity reforms. Telecommunications Policy, 34(2010), 392–403.

Kim, J., Kim, Y., Gaston, N., Lestage, R., Kim, Y., & Flacher, D. (2011). Access regulation and infrastructure investment in the mobile telecommunications industry. Telecommunications Policy, 35(2011), 907–919.

Li, Y., & Lyons, B. (2012). Market structure, regulation and the speed of mobile network penetration. International Journal of Industrial Organization, 30(2012), 697–707.

Freyens, B. P., & Yerokhin, O. (2011). Allocative versus technical spectrum efficiency. Telecommunications Policy, 35(4), 291–300.

Crocioni, P., & Franzoni, L. A. (2011). Transmitters and receivers’ investments to avoid interference: Is there an optimal regime? Telecommunications Policy, 35(6), 568–578.

Caicedo, C. E. & Weiss, M. B. H. (2011). The viability of spectrum trading markets. IEEE Communications Magazine.

Ballon, P., & Delaere, S. (2009). Flexible spectrum and future business models for the mobile industry. Telematics and Informatics, 26(3), 249–258.

Basaure, A., Marianov, V., & Paredes, R. (2014). Implications of dynamic spectrum management for regulation. Telecommunications Policy, 39(7), 563–579.

Rogers, E. M. (2010). Adoption of innovations. New York: Simon and Schuster.

Damanpour, F. (1991). Organizational innovation: A meta-analysis of effects of determinants and moderators. Academy of Management Journal, 34(3), 555–590.

Electronic Communications Committee (ECC). (2009). Light licensing, license-exempt and commons, report 132.

European Commission, EU COM (2012) 478. European economic and social committee, promoting the shared use of radio spectrum resources in the internal market, Brussels.

Holland, O., De Nardis, L., Nolan, K., Medeisis, A., Anker, P., Minervini, L.F., Velez, F., Matinmikko, M., Sydor, J. (2012). Pluralistic licensing. In IEEE international symposium on dynamic spectrum access networks.

Zhao, Q., & Sadler, B. M. (2007). A survey of dynamic spectrum access. IEEE Signal Processing Magazine, 24(3), 79–89.

Matinmikko, M., Mustonen, M., Roberson, D., Paavola, J., Höyhtya, M., Yrjola, S., & Roning, J. (2014). Overview and comparison of recent spectrum sharing approaches in regulation and research: From opportunistic unlicensed access towards licensed shared access. In IEEE international symposium on dynamic spectrum access networks (DYSPAN) (pp. 92–102).

Medeisis, A., & Minervini, L. F. (2013). Stalling innovation of cognitive radio: The case for a dedicated frequency band. Telecommunications Policy, 37, 108–115.

Warma, H., Levä, T., Tripp, H., Ford, A., & Kostopoulos, A. (2011). Dynamics of communication protocol diffusion: The case of multipath TCP. NETNOMICS: Economic Research and Electronic Networking, 12(2), 133–159.

Miranda, L., & Lima, C. A. (2013). Technology substitution and innovation adoption: The cases of imaging and mobile communication markets. Technological Forecasting and Social Change, 80(6), 1179–1193.

Kim, M.-S., & Kim, H. (2007). Is there early take-off phenomenon in adoption of IP-based telecommunications services? Omega, 35(2007), 727–739.

Michalakelis, C., Varoutas, D., & Sphicopoulos, T. (2010). Innovation adoption with generation substitution effects. Technological Forecasting & Social Change, 77(2010), 541–557.

Grajek, M., & Kretschmer, T. (2012). Identifying critical mass in the global cellular telephony market. International Journal of Industrial Organization, 30(2012), 496–507.

Xiao, J., Hu, R., Qian, Y., Gong, L., & Wang, B. (2013). Expanding LTE network spectrum with cognitive radios: From concept to implementation. IEEE Wireless Communications, 20(2), 12–19.

Flores, A. B., Guerra, R. E., Knightly, E. W., Ecclesine, P., & Pandey, S. (2013). IEEE 802.11 af: A standard for TV white space spectrum sharing. IEEE Communications Magazine, 51(10), 92–100.

Lei, Z., & Shellhammer, S. J. (2009). IEEE 802.22: The first cognitive radio wireless regional area network standard. IEEE Communications Magazine, 47(1), 130–138.

Zhang, Y., Yu, R., Nekovee, M., Liu, Y., Xie, S., & Gjessing, S. (2012). Cognitive machine-to-machine communications: visions and potentials for the smart grid. IEEE Network, 26(3), 6–13.

Manusco, A., Probasco, L., & Patil, B. (2013). Protocol to access white space (PAWS) database: Use cases and requirements. Internet-draft.

Ghosh, S., Naik, G., Kumar, A., & Karandikar, A. (2015, February). OpenPAWS: An open source PAWS and UHF TV white space database implementation for India. In IEEE twenty first national conference on communications (NCC) (pp. 1–6).

Paavola, J., & Kivinen, A. (2014). Device authentication architecture for TV white space systems. In IEEE 9th international conference on cognitive radio oriented wireless networks and communications (CROWNCOM) (pp. 460-465).

Mueck, M. (2014). Standardisation for reconfigurable radio systems: where we are. ETSI workshop on reconfigurable radio systems. Presentation accessed in July 2015. Retrieved December 3 from www.etsi.org

Palola, M., Matinmikko, M., Prokkola, J., Mustonen, M., Heikkila, M., Kippola, T., \(\ldots \), Heiska, K. (2014). Live field trial of Licensed Shared Access (LSA) concept using LTE network in 2.3 GHz band. In IEEE international symposium on dynamic spectrum access networks (DYSPAN) (pp. 38–47).

4G Americas. LTE carrier aggregation: Technology development and deployment worldwide. Retrieved October 2014. Accesses in July 2015 from www.4gamericas.org.

Yuan, G., Zhang, X., Wang, W., & Yang, Y. (2010). Carrier aggregation for LTE-advanced mobile communication systems. IEEE Communications Magazine, 48(2), 88–93.

Alkhansa, R., Artail, H., & Gutierrez-Estevez, D. M. (2014). LTE-WiFi carrier aggregation for future 5G systems: A feasibility study and research challenges. Procedia Computer Science, 34, 133–140.

Lin, X., Andrews, J., Ghosh, A., & Ratasuk, R. (2014). An overview of 3GPP device-to-device proximity services. IEEE Communications Magazine, 52(4), 40–48.

Webb, W. (2012). Weightless: The technology to finally realise the m2m vision. International Journal of Interdisciplinary Telecommunications and Networking (IJITN), 4(2), 30–37.

Sridhar, V., Casey, T., & Hämmäinen, H. (2013). Flexible spectrum management for mobile broadband services: How does it vary across advanced and emerging markets? Telecommunications Policy Special Issue on Cognitive Radio, 37, 178–191.

Shy, Oz. (2004). Economics of network industries. Cambridge: Cambridge University Press.

Jang, S.-L., Dai, S.-C., & Sung, S. (2005). The pattern and externality effect of diffusion of mobile telecommunications: The case of the OECD and Taiwan. Information Economics and Policy, 17(2005), 133–148.

Mahajan, V., Muller, E., & Bass, F. (1993). New-product adoption models. In Handbook in operations research and management science, Chapter 8, Marketing (Vol. 5). Amsterdam: North Holland.

Gurbaxani, V. (1990). Adoption in computing networks: The case of BITNET. Communications of the ACM, 33, 65–75.

Economides, N., & Himmelberg, C. P. (1995). Critical mass and network size with application to the US fax market. NYU Stern School of Business EC-95-11.

Mak, V., & Zwick, R. (2010). Investment decisions and coordination problems in a market with network externalities: An experimental study. Journal of Economic Behavior & Organization, 76(2010), 759–773.

Norton, J. A., & Bass, F. M. (1987). A diffusion theory model of adoption and substitution for successive generations of high-technology products. Management Science, 33(9), 1069–1086.

Modis, T. (2003). A scientific approach to managing competition. The Industrial Physicist, 9(1), 24–27.

Pistorius, C. & Utterback, J. (1996). A Lotka-Volterra model for multi-mode technological interaction: Modeling competition, symbiosis and predator prey modes. Sloan school of management, MIT, WP # 3929.

Kucharavy, D., & De Guio, R. (2011). Application of S-shaped curves. Procedia Engineering, 9, 559–572.

Casey, T., & Töyli, J. (2012). Mobile voice adoption and service competition: A system dynamic analysis of regulatory policy. Telecommunications Policy, 36, 162–174.

Funk, J. L. (2011). Standards, critical mass, and the formation of complex industries: A case study of the mobile Internet. Journal of Engineering and Technology Management, 28(4), 232–248.

Shin, D. H., & Bartolacci, M. (2007). A study of MVNO adoption and market structure in the EU, US, Hong Kong, and Singapore. Telematics and Informatics, 24(2), 86–100.

Stigler, G. J. (1983). The organization of industry. Economics books. Chicago: University of Chicago Press.

Park, Eun-A. (2009). Explicating barriers to entry in the telecommunications industry. Info, 11(1), 34–51. doi:10.1108/14636690910932984.

Demsetz, H. (1982). Barriers to entry. The American Economic Review, 47-57

Suomi, H., Basaure, A., & Hämmäinen, H. (2013). Effects of capacity sharing on mobile access competition. In Proceeding capacity sharing workshop (CSWS’13)

Coase, R. H. (1937). The nature of the firm. Economica, 4(16), 386–405.

Klein, B., Crawford, R. & Alchian, A. (1978) Vertical integration, appropriable rents, and the competitive contracting process. Journal of Law and Economics, 297–321

Klemperer, P. (1995). Competition when consumers have switching costs: An overview with applications to industrial organization, macroeconomics, and international trade. Review of Economic Studies, 62, 515–539.

Beard, T., Ford, G., Spiwak, L., & Stern, M. (2010). A policy framework for spectrum allocation in mobile communications. Federal Communications Law Journal, 62, 630.

Lundborg, M., Reichl, W., & Ruhle, E.-O. (2012). Spectrum allocation and its relevance for competition. Telecommunications Policy, 36(2012), 664–675.

Hazlett, T. W. (2008). Property rights and wireless license values. 51 journal of law & economics 563–98

Freyens, B. P. (2010). Shared or exclusive radio waves? A dilemma gone astray. Telematics and Informatics, 27(3), 293–304.

European Communications Office. (2012). ECO report 03: The licensing of mobile bands in CEPT.

Prasad, R., & Sridhar, V. (2008). Optimal number of mobile service providers in India: Trade-off between efficiency and competition. International Journal of Business Data Communications and Networking, 4(3), 69–81.

Mayo, J., & Wallsten, S. (2010). Enabling efficient wireless communications: The role of secondary spectrum markets. Information Economics and Policy, 22(2010), 61–72.

Telecommunications Regulatory Authority of India (TRAI). (2014a). Recommendations on working guidelines for spectrum trading. Retrieved from http://traui.gov.in. Accessed on 15th July 2014.

Telecommunications Regulatory Authority of India (TRAI). (2014b). Recommendations on guidelines on spectrum sharing. Retrieved from http://traui.gov.in. Accessed on 25th July 2014.

Sridhar, V., & Prasad, R. (2011). Towards a new policy framework for spectrum management in India. Telecommunications Policy, 35, 172–184. doi:10.1016/j.telpol.2010.12.004.

Fransman, M. (2010). The new ICT ecosystem: Implications for Europe. Cambridge: Cambridge University Press.

Arthur, W. B. (2009). The nature of technology: What it is and how it evolves. New York: The Free Press.

Forrester, J. W. (1958). Industrial dynamics: A major breakthrough for decision makers. Harvard Business Review, 36(4), 37–66.

Tookey, A., Whalley, J., & Howick, S. (2006). Broadband adoption in remote and rural Scotland. Telecommunications Policy, 30, 481–495.

Davies, J., Howell, B. E., & Mabin, V. (2008). Telecom Regulation, regulatory behaviour and its impact—a system view. Communications & Strategies, 70, 145.

Lin, M.-S., & Wu, F.-S. (2013). Identifying the determinants of broadband adoption by adoption stage in OECD countries. Telecommunications Policy, 37, 241–251.