Abstract

In this study, we investigate the effects of urbanization and industrialization on income inequality within the Kuznets curve hypothesis in low-, middle- and high- income countries over the period 1990–2014. Using the method of moments quantile regression (MMQR), the study finds out mixed results about the distributional effects of both urbanization and industrialization within the three panels. In high-income countries (HIC), urbanization increases inequality from the third quantile, while industrialization reduces inequality in most low and middle quantiles and becomes insignificant in the higher quantiles. In the upper -middle income countries (UMIC), urbanization has no significant effect in low and middle quantiles but leads to a significant increase in inequality in higher quantiles. In contrast to the improvement effect of industrialization on income distribution in HIC, it rises the inequality in UMIC. The results also show that urbanization reduces inequality, while industrialization has no significant effect in all quantiles of lower -middle income countries (LMIC). We also find out evidence of the existence of an inverted Kuznets-curve relationship in both UMIC and LMIC. These different results lead to consider income level differentials between countries when examining the distributional effects of both urbanization and industrialization.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Deterioration in income distribution during the past four decades in many countries of the world aroused the interest of policymakers and prompted many economists to re-examine the causes and effects of income inequality.

The marked disparity in income distribution in favor of the rich in many countries of the world during the past four decades has led to increased interest among economists and policymakers to examine the causes and effects of income inequality. Inequality indicators confirm a considerable increase in the share of the richest 10% of the population in national income in most regions of the world. In 2016 this share reached 55% in all countries of sub-Saharan Africa, India, and Brazil, as well as 41% in China, 37% in Europe, and 61% in the Middle East (Alvaredo et al., 2018). This trend towards deteriorating income distribution and concentrating income for the benefit of the rich means that economic growth does not spread its fruits more equally to all individuals of the society in many countries of the world, which may lead to political and social unrest (Roe & Siegel, 2011).

The rising concern about income inequality is not only motivated by its increasing trends, but also as a result of its economic effects at the global economic level. In this context, many analysts attributed the causes of the global recession in 2008 to the increasing levels of income inequality in many developed economies (e.g., Petreski et al., 2018; Rajan, 2011; Stockhammer, 2013; Van Treeck & Sturn, 2012). Inequality increases the borrowing rates of the majority from banks to finance their needs without sufficient ability to repay. This increase in demand for credit to finance consumption may lead to a credit bubble (Papadopoulos, 2019) and ending with a financial crisis like the one that occurred in 2008. The relationship of financial crises to income inequality is not a new issue in empirical analysis, but many of the crises experienced by countries before the great recession in 2008 were also explained based on the increasing trends in inequality which deteriorates financial indicators, including consumer debt, and leads the economy to banking crises (Kirschenmann et al., 2016).

This study examines the relationship between inequality and two main variables: urbanization measured by the ratio of the population living in urban areas, and industrialization proxied by the industry's share in the total value added of the economy. These two variables reflect the nature of the structural change within the economy. Moreover, the effects of these two variables are analyzed within a Kuznets curve hypothesis in explaining the relationship between income inequality and economic development (Kuznets, 1955). Addressing this relationship is very important for policymakers and researchers.

Historically, we find that while the degree of income inequality has increased over the past four decades, there has been also a noticeable increase in the urbanization rate. United Nations estimated that the proportion of the population living in urban areas has increased to 55% in 2018 compared with only 30% in 1950 and is expected to be 66% by the year 2050 (United Nations, 2018). In light of this considerable increase in both income inequality and urbanization, it is necessary to analyze the distributional effect of urbanization on a global scale. This effect of urbanization on income inequality is a controversial issue, as urbanization results in transferring workers and their families from rural to urban areas where industrial centers are established, these centers often require qualified workers and pay higher wages. Although this transfer reduces the gap in wage levels for those new workers with their urban counterparts, it will, on the other side, lead to a widening gap in their income levels compared to that of workers still working in rural areas, and consequently, the final effect of urbanization on income inequality is unresolved (Sulemana et al., 2019).

The controversy on the effect of urbanization on income inequality also arises when analyzing the distributional effects of the changes in the relative share of the industrial sector in the total value-added, which also has increased during the past decades. According to the United Nations Industrial Development Organization (UNIDO), the average annual growth rate of the manufacturing value-added has increased by 3.13% over the world during the period 1991–2018 (UNIDO, 2019). This growth in the industrial sector may contribute to explain the status of income inequality worldwide. Although industrial growth means more urbanization, and urbanization supports manufacturing positively, the present study considers both urbanization and industrialization as two independent proxies of structural change. Consequently, adding these two indicators in the econometric model implies analyzing the effects of structural changes on income inequality under the Kuznets hypothesis. In other words, this way of studying the causes of income inequality provides a more rigorous analysis to test the Kuznets hypothesis by taking into account the structural considerations that occur during different stages of economic growth.

This study contributes to the ongoing literature on the impact of both urbanization and industrialization on income inequality within the Kuznets curve framework using the recent method of moments quantile regression (MMQR) with fixed effects technique developed by (Machado & Santos Silva, 2019). MMQR enables estimating the heterogenous effects of urbanization and industrialization not only on the conditional mean but also at different locations or conditional quantiles of income inequality (Ike et al., 2020). This methodology also provides greater accuracy in the results compared to ordinary least squares (OLS) methodology which only estimates the mean effect of the independent variables on the dependent variable (Allard et al., 2018; Elbatanony et al., 2021). The study also considers a sample of 67 countries classified into three panels according to the levels of income determined by the World Bank (World Bank, 2020), and therefore the study seeks to estimate the effects of different income levels on the relationship between urbanization, industrialization, and income inequality. Then, the application of the MMQR methodology allows to capture the potentially different responses of income inequality to the changes not only in mean but in the different quantiles of urbanization and industrialization.

The remainder of the paper includes a presentation of the economic literature that contains theoretical and empirical works that analyzed the relationship between inequality, urbanization, industrialization, and economic growth in the second section. The third section is concerned with the data used and the MMQR methodology employed in the study. Empirical results of MMQR are discussed in the fourth section, while the fifth section contains the conclusion and policy implications.

2 Related Literature

Economic literature addresses the issue of income inequality in several aspects including its relationship to economic growth. The most and famous treatment of the relationship between income inequality and economic growth is performed within the Kuznets hypothesis (Kuznets, 1955), which claims that inequality increases in the initial stages of economic development, and then begins to decrease in the advanced stages after turning point of income level. Kuznets hypothesis, which also called inverted U curve hypothesis, has been tested extensively in many studies along with considering other variables in the standard model such as globalization (Azzimonti et al., 2014; Jaumotte et al., 2013; Krugman, 2008; Topuz & Dağdemir, 2020), financial development (Altunbaş & Thornton, 2019a; Shahbaz et al., 2015) corruption, political system, and democracy (Adams & Klobodu, 2019; Bašná, 2019).

The surge of the Kuznets hypothesis in imposing a certain shape of income inequality during different economic development phases has made many economists focusing their analyses on the determinants and sources of economic growth rather than on the issue of reducing income inequality, which was advocated by the neoclassical economic growth model because inequality will decrease when the economy reaches advanced stages in economic development through the trickle-down effect. According to this point of view, the early stages of development require huge investments, and these investments will not come without the existence of unequal distribution of income in favor of investors. The disparity in wage levels in the early stages of development stimulates workers towards improving their capabilities and skills to join the advanced sectors that give higher wages. Consequently, the economy will tend in the long-run to reduce the severity of income inequality after a high level of inequality in the early stages of development (Naguib, 2017).

Kuznets' prophecy of declining the degree of income inequality when the economy moves towards advanced stages of economic development has been examined by many empirical studies. As noted by (Piketty & Zucman, 2015), the continuous rise in inequality trends in most developed economies since 1970s has conducted many economists to test the validity of the Kuznets hypothesis, and hence, the analysis turned to deal with inequality related to both income and wealth, as main sources affecting and hindering economic growth through their negative effects on human capital formation as well as social and political stability (e.g., Berg et al., 2018; Breunig & Majeed, 2020).

Many econometric techniques have been employed in investigating the relationship between income inequality and economic growth. (Naguib, 2017) applied the Arellano-Bond Generalized Method of Moments (GMM) technique in a panel of 146 countries for the years 2010–2014. His results confirmed a positive relationship between wealth inequality and economic growth. Additionally, the positive effect of wealth inequality on economic growth has not been confirmed when using other formulas that include other variables in the econometric model, which means that there is no robustness in the positive relationship between these two variables when using alternative model specifications. Adding a real percentage investment share of real GDP per capita to inequality, (Herzer & Vollmer, 2012) found a negative effect of income inequality on economic growth in a panel of 46 countries including developed and developing countries over the period 1970–1995. The negative effect did not differ in either developed or developing countries, nor did the absence or existence of democracy changed the negative impact of inequality on growth.

Several studies emphasized the importance of the initial income level when examining the effect of income inequality on economic growth. According to (Shin, 2012), there is a negative impact of inequality on growth in the early stages of economic development, that is, inequality leads to lower rates of economic growth when the initial income level is low, and then the impact of inequality turns to be positive on the economic growth when income level becomes high in the advanced stages of economic development. This hypothesis means that the effects of income inequality on economic growth differ according to the initial income levels which reflects the degree of economic development (Brueckner & Lederman, 2018; Galor & Zeira, 1993). So, income inequality hinders economic growth in poor economies and stimulates it in rich ones.

Empirical literature indicates that the effects of both industrialization and urbanization on income distribution still a debatable issue. Most of the research in this filed confirms a positive effect on income inequality (Foster & Rosenzweig, 2003; Wang, 2019; Yao, 1997). (Wu & Rao, 2017) emphasized a nonlinear relationship between urbanization and income inequality. The results were conducted on a panel of 20 Chinese provinces during the period 1980–2012 using different econometric techniques (OLS, fixed, and random effects models). The results showed that there is an inverted U-shaped relationship between urbanization and income inequality.

According to (Sulemana et al., 2019) urbanization has a positive effect on income inequality. The study employed an unbalanced panel for 48 Sub-Saharan African economies spanning the period 1996–2016 using different econometric techniques including FE, RE, FGLS, and GMM. The results are compatible with the study of (Adams & Klobodu, 2019), which employed the Pooled Mean Group (PMG) and Common Correlated Effects Mean Group (CCEMG) techniques covering the period 1984–2014 on a panel of 21 Sub-Saharan African economies. The study confirmed also that inequality and urbanization are determined politically in Sub-Saharan African countries, consequently, governments should manage the urbanization process in a way that results in a more equal distribution of its benefits.

The positive relationship between urbanization and inequality is denied by other studies. (Wu & Rao, 2017) explored the effect of urbanization on income inequality in China employing FE and RE approaches on provincial-level data covering the period 1987–2010. They found an inverted U-shaped relationship between the two variables. Urbanization first increases inequality and after a certain threshold rate of urbanization (0.53), the effect had turned negative. It can be assumed that the effect of urbanization on inequality could be positive or negative. Urbanization implies a transfer of workers from rural to urban areas. If they join highly-paid jobs, the degree of inequality will decrease. Indeed, workers must have sufficient skills to join these highly-paid jobs, and it depends here on the level of quality of education they have received. That is, the negative impact of urbanization on inequality depends on a high level of human capital formation. As for the effect of industrialization on inequality, most studies analyze this effect through the impact of industrialization on economic growth and then the effect of growth on inequality according to the Kuznets hypothesis (Dumke, 1991; Koo, 1984; Rozelle, 1994).

It is obvious from the previous review that most of the empirical work on the drivers of income inequality employed the traditional regression estimation which may lead to inaccurate estimates of the effect of independent variables on the dependent variable (Khan et al., 2020). These traditional techniques consider only mean effects and ignore the different effects of quantiles in the independent variables on the degree of inequality in income distribution. Although there are many studies tried to find out the drivers of income inequality, such as (Bašná, 2019; Gunasinghe et al., 2019; Nie & Xing, 2019; Thornton & Tommaso, 2019), or its economic impacts (Galvin & Sunikka-Blank, 2018; Kennedy et al., 2017), studies that focused on the impact of urbanization and industrialization together as two variables representing structural change are limited and sporadic (Adams & Klobodu, 2019; Oyvat, 2016; Su et al., 2015; Sulemana et al., 2019; Zhu et al., 2018). Perhaps, it is assumed that industrialization usually leads to urbanization, and therefore it would be inappropriate to incorporate them together as two independent variables in the same model. Yet, some researchers argue that this claim does not necessarily happen as many developing economies achieved high levels of urbanization, but did not achieve high levels of industrialization (Gollin et al., 2016). This means that urbanization is not always associated with industrialization, and thus we consider that it will be appropriate to consider both industrialization and urbanization as two independent variables in order to capture their potential effects on income inequality.

3 Data and Methodology

3.1 Data

We use a balanced panel data of 67 countries over the period 1990–2014. The selection of countries is restricted by the availability of the data concerning the Gini coefficient, real GDP per capita, urbanization and the share of industrial sector in total value-added. To capture the potential heterogeneity in the effects of income level differentials across countries, we divided the whole sample into three main groups tabulated in Table 1 according to income levels based on the World Bank classification (World Bank, 2020). Table 2 illustrates the description and sources of the variables used in the study, while Table 3 reporting the statistical properties of the variables.

It is noted, according to Table 3 that all variables are not normally distributed, which is expressed by rejecting the normal distribution hypothesis according to the Jarque–Bera test. If variables are not normally distributed, the results of OLS estimation could be biased (Cheng et al., 2021) and a serious deviation could exist between the actual results and the results derived from the OLS method(Xie et al., 2021; Xu & Lin, 2018). It is also noted that Skewness is negative for some variables, and far from zero. According to these actual statistical characteristics of the data used in this study, the assumptions that make the estimators of OLS are the best linear unbiased estimators (BLUE) are not satisfied. Moreover, the application of OLS gives only a partial picture of the relationship between income inequality and the independent variables as it describes only the mean relationship between the variables (Nusair & Olson, 2019). These defaults will be avoided when employing the quantile regression techniques instead of OLS methodology.

Tables 4 shows the correlation coefficients between the variables and the variance inflation factor (VIF). All the absolute values of correlation coefficients between independent variables are less than 0.7 and the results of the VIF test confirm the absence of multicollinearity between independent variables as the average value of 1.36 is less than 5.

3.2 Model specification

This study aims to estimate the effects of industrialization on income inequality. Following many studies (e.g., Altunbaş & Thornton, 2019b; Khan et al., 2020; Liu, Jiang, & Xie, 2019; Zhu et al., 2018) we use the Gini coefficient as a proxy to represent the degree of income inequality, and the ratio of the industrial sector to the total value-added to represent industrialization status. We consider both real GDP per capita and its squared value to test the validity of the inequality Kuznets curve hypotheses. Adding real GDP per capita is so important to investigate the potential heterogeneous effects of different income levels on the relationship between industrialization and income inequality. The study also considers urbanization measured by the ratio of the population living in urban areas to the total population. Economic development usually requires a transfer of labor from rural areas to industrial centers closed to urban areas thus, the increase in the population ratio living in urban areas can be used as an indicator of structural change that has a potential effect on income distribution. This variable is widely used in empirical research to express structural change (e.g., de Bruin & Liu, 2020; Sulemana et al., 2019).

The empirical model can be expressed by Eq. (1)

where i and t denote country and time respectively, εit is the error term supposed to be independent and normally distributed. \(\alpha_{1}\)., \(\alpha_{2}\), \(\alpha_{3}\), and \(\alpha_{4}\) are the elasticities of income inequality measured by the Gini coefficient (GINI) with respect to real GDP per capita (GDP) measured in constant 2010 US dollar, Square of the real GDP per capita (GDP2), urbanization (URB), and industry share in total value-added (IND). \(\alpha_{0i}\) represents country fixed effects. All the variables in Eq. 1 and sources are reported in Table 1 and expressed in natural logarithms to avoid the potential heteroskedasticity problem. Equation 1 includes real GDP per capita and the square of real GDP per capita to explore the eventual existence of an inverted U- shape Kuznets curve which indicates that the first stages of economic growth lead to an increase in income inequality, and then the relationship is later reversed til it becomes counterproductive. Thus, if the Kuznets hypothesis holds, then the coefficients \(\alpha_{1}\) and \(\alpha_{2}\) will be > 0 and < 0, respectively. Urbanization (URB), which is measured by the proportion of the total population living in urban areas, is an indication of the structural change accompanying industrialization and economic development. Consequently, its effect on income inequality may be positive or negative. The variable (IND) represents the relative share of industry in value-added. The effects of an increase in the relative share of the industrial sector in the value-added may affect the degree of income inequality differently in middle and high-income countries. So, the expected coefficients \(\alpha_{4}\) may be > 0 or < 0.

3.3 MMQR

The standard regression approach is interested in estimating the average relationship between the response variable and one or more independent variables. This technique may fail in estimating the appropriate coefficients and may, therefore, fail to address the real relationships between variables as it provides only a partial view of the relationship. For example, if we want to model the marginal effect of saying a 1% shift in one or more explanatory variables on the 30th quantile or the 90th quantile or some other percentile of the response variable, the conventional regression techniques like OLS cannot do this because they consider only the mean effect which leads to losing important information for policy implications. To avoid this limitation, we can benefit from the advantages of the panel quantile regression technique in estimating the impact of industrialization, urbanization, and economic growth, on income inequality. Quantile regression was suggested by (Koenker & Bassett, 1978) as an extension of the conditional mean's traditional least square methodology to estimate the response variable's conditional median or other quantiles. This approach provides a more comprehensive understanding of the effects of explanatory variables on different points or locations of the dependent variable, and it is more accurate if the random error term is not normally distributed along with the existence of outliers (Zhu et al., 2018). This method allows us to investigate the drivers of income inequality across the conditional distribution. Given \(x_{i}\), the conditional quantile (percentile) of \(y_{i}\) is formulated as

where \(Q_{{y_{it} }} \left( {\left. \tau \right|x_{it} } \right)\) refers to the τth quantile of the response variable (income inequality), \(x_{it}^{\tau }\) is a vector of independent variables (economic growth, urbanization, and industrialization) for each country \(i\) at time \(t\) for quantile \(\tau\), where \(\beta_{\tau }\) represents the coefficients of the independent variables for quantile \(\tau\) (Koenker, 2004; Xu & Lin, 2018; Zhu et al., 2018). Using quantile regression allows regression’s line slopes to differ across quantiles, which is more powerful compared with the OLS technique. So, the conditional quantile regression with fixed effects can be represented as

where \(\alpha_{i}\). refers to the unobservable individual effect and x stands for the matrix of independent variables and k is the quantile index. As mentioned by (Koenker, 2004), the estimation of different quantiles is obtained simultaneously by solving the minimization problem as follows:

where \(w_{k}\) is the weight of the \(k\)-th quantile, T is the index for the number of observations per countries, \(N\) is the number of countries and \(\rho_{{\tau_{k} }}\) is a piecewise linear quantile loss function. To calculate the panel quantile with a fixed effect, (Koenke 2004) recommended that these individual effects can be regularized towards a standard value by including the individual effect \(\alpha_{i}\) as one of the regression parameters, the parameters can be estimated as follows:

where \(\lambda\) is the tuning parameter that decreases the effects to zero to improve the precision and robustness of the coefficient β to be measured.

Though the simple panel quantile regression is preferred in the case of outliers, it is unable to consider the unobserved heterogeneity within panels. This limitation is captured in (Machado & Silva, 2019) by introducing quantile regression via moments to consider the potential heterogeneous effects of independent variables not only in altering means as in (Canay, 2011) but also permits to affect the distribution as a whole (An et al., 2020; Aziz et al., 2020). The MMQR introduces a flexible estimation to determine the potential effects of both urbanization and industrialization and other control variables on the whole conditional distribution of income inequality, it is relevant in the case of endogeneity and heterogeneity. The MMQR allows for individual effects to affect the entire distribution generated by including fixed effects, and rather than the traditional panel quantile regression which only considers that the covariate affects the conditional distribution of the interest variable through location shifters, the MMQR allows for location and scale functions (Alhassan et al., 2020). Following (Machado & Silva, 2019) the location-scale model can be expressed as follows:

where \(X_{it}\) is a vector of explanatory variables includes \(LNGDP\), \(LNGDP^{2}\), \(LNURB\), and \(LNIND\) for country \(i\) at time \(t\). \(a_{i}\) is the individual effect and \(a_{i} + \delta_{i} q\left( \tau \right)\) denotes the scaler parameter for the country \(i\) at quantile \(\tau\). \(Z\) refers to a \(k\)-vector of components of \(X\). It is noted from Eq. (6) that the individual effects are time-invariant and don’t represent the intercept shifts, rather they represent heterogeneous effects that differ across different locations or points of the distribution of income inequality. Instead of Eq. (5), the MMQR tries to solve the following optimization problem:

In Eq. (7), \(\rho_{\tau } \left( A \right)\) represents the standard loss function of quantile \(\tau\) and equals (\(\tau AI\left\{ {A > 0} \right\} + \left( {\tau - 1} \right)AI\left\{ {A \le 0} \right\}\).

4 Results and discussion

4.1 HIC

The results of Table 5 contrast with the Kuznets hypothesis, as all coefficients are significantly negative and positive for both GDP and GDP2 respectively for all quantiles indicating a U-shaped relationship. That is, increase in per capita GDP leads to more equality in income distribution during the early stages of economic development, and then deteriorates income distribution in the advanced stages. These results agree with other studies (Sulemana et al., 2019).

As for the effect of both urbanization and industrialization on the disparity in income distribution, the effect of urbanization is significant in all quantiles except the 10th and 20th quantiles. As shown in Table 5, more urbanization increases the severity of income inequality in high-income economies. This result is consistent with other studies such as (Chen et al., 2016; Oyvat, 2016; Sulemana et al., 2019). This means that the increasing level of urbanization has positive but limited effects on income distribution in high-income economies.

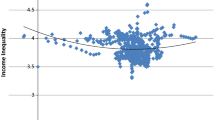

On the contrary, the impact of industrialization was negative and significant in all quantiles. But it is noticeable according to Table 5 and Fig. 1 that the industrialization effect is more pronounced in the lower quantiles, where it reached −0.254 in the 10th and then begins to gradually decline to reach −0.0178 in the 90th quantile. This can be explained by the fact that most high-income economies, the majority of them are major industrialized economies, have reached considerable levels of urbanization so that the majority of their population lives in urban areas, and the industrial sector largely contributes to value-added, and thus the movements from rural to urban, or from the countryside to the industrial centers in the cities have been largely done in the past, structural changes has been taken place in most of these economies, compared to developing economies that need to achieve more structural changes that will have a significant impact on the degree of income inequality.

4.2 UMIC

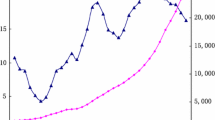

At the level of UMIC economies, the Kuznets hypothesis of the relationship between economic growth and income inequality is already confirmed in all quantiles according to the results shown in Table 6 and Fig. 2.

This means that inequality increases in the early stages and then improves in the advanced stages of economic development in the UMIC. It is noted that the effect of urbanization is positive and significant only in higher quantiles (70th, 80th, and 90th). This means that urbanization deteriorates income distribution in the highest quantiles of the Gini coefficient. Industrialization increases the degree of inequality in income distribution in all quantities, which means that economic development policies in UMIC are biased against the poor and in favor of the rich.

4.3 LMIC

The Kuznets hypothesis is strongly supported in all quantiles where the signs of the GDP and GDP2 coefficients are positive and negative in all the quantities, which indicates that growth leads to a deterioration of income distribution in the early stages and then reduces the degree of inequality in the advanced stages of economic development in the LMIC.

The effect of urbanization on inequality is negative and significant in all quantiles. On the contrary, the results that are shown in Table 7 and Fig. 3 indicate that there is no significant effect of industrialization on income inequality since the value-added of the manufacturing sector in the GDP does not represent a significant weight in the LMIC, unlike the case in both HIC and UMIC.

Table 8 summarizes the differences in the impact of growth, industrialization, and urbanization on inequality in HIC, UMIC, and LMIC. The effect of income growth on inequality in HIC contradicts the Kuznets inequality curve hypothesis. It is consistent with the current widely-shared view that the relationship between growth and inequality takes the U-shaped curve rather than the inverted U-shaped relationship in many developed countries like the United States and other developed countries (Blanco & Ram, 2019; Piketty & Saez, 2003). This regular U-shaped is consistent with the markedly increasing inequality in most high-income countries in recent years, and it could be attributed to the apparent structural change from industry towards the services sector in most of the advanced and high-income economies during the last few decades.

Upper and lower middle-income countries are still in the stage of traditional structural change from agriculture to industrialization, and the associated increase in urbanization rates. This case supported the Kuznets' inverted U-curve (Aiyar & Ebeke, 2020; Fosu, 2017). The relatively high economic growth in most developing countries during the last three decades in comparison with growth rates in developed and high-income countries leads to reducing poverty, and thus income inequality, in many middle-income countries like China, Egypt, and Malaysia.

5 Conclusion and Policy Implications

This paper aims to estimate the effects of economic growth, urbanization, and industrialization on income inequality in three different groups of countries classified according to income levels based on the World Bank. Instead of relying on the standard OLS method, the current study adopted the method of moments quantile regression to estimate the effect of economic growth, urbanization, and industrialization on different quantiles of the income inequality measured by the Gini coefficient. Results showed heterogeneous distributional effects of these variables across different panels and within different quantiles (see Table 8. The inverted U-curve hypothesis doesn't exist in HIC whereas, it is so confirmed in both the UMIC and LMIC. Urbanization increases inequality only in the middle and upper quantiles of HIC, while it has a positive effect only in UMIC. Conversely, urbanization reduces inequality in LMIC across all quantiles. The distributional effects of industrialization are also heterogeneous. Industrialization reduces income inequality in HIC, while it increases inequality in all quantiles for UMIC and does not have any significant impact on the Gini coefficient for LMIC.

Results support the importance of considering income level differentials between countries when examining the effects of economic growth, urbanization, and industrialization on income inequality. The differences in income levels among the three panels lead to a difference in the impact of economic growth on inequality. While the Kuznets hypothesis is realized in both UMIC and LMIC, it is not proven in HIC, but rather the opposite. Consequently, it is recommended for economic policymakers in HIC to realize that non-interference in influencing the pattern of income distribution in their countries in the hope that economic growth will carry out this task in the long term is not correct. So, it is sutiable to generate redistribution policies to guarantee more equal income distribution and avoid the negative effects of income inequality on economic growth in the long run. As for both UMIC and LMIC, it is expected that the enduring of economic growth will lead to an improvement in inequality in the long run because it is consistent with the Kuznets hypothesis.

The differences in income levels are also reflected in the different effects of urbanization on inequality. Urbanization reduces inequality in LMIC, while it leads to a deterioration in income distribution in both HIC and UMIC, especially in the high quantiles which indicates that urbanization policies in these economies should take into account their negative effects on the pattern of income distribution. This result provides policymakers to consider urbanization as a structural process to reduce income inequality for HIC and UMIC.

Industrialization represents a major problem for income distribution structure in UMIC. Referring to our results, industrialization increases the inequality in these countries, compared to its improvement effect for HIC and insignificant effects for LMIC. This means that industrialization in UMIC is occurring at the expense of equity in income distribution which may reduce economic growth for these countries in the long run. Therefore, it is necessary to follow income redistribution policies in favor of more equal distribution. As long as industrialization is necessary to achieve growth in UMIC countries, it is imperative that the negative impact it has on the structure of income distribution be minimized by refocusing on labor-intensive production technologies. Also, it is recommended to increase public spending on education and training and other human development indicators in UMIC so that improving labor skills and reducing disparities in wage rates within the industrial sector. These income redistribution policies help UMIC like Argentina, Brazil, and China, to avoid the middle-income trap (Glawe & Wagner, 2016). Reducing income inequality in these countries allows boosting domestic demand and so overcoming the problems resulting from decreasing of their competitiveness in the global markets. According to the middle-income trap hypotheses, countries that benefit from exports depending on their low wages will be stuck in the class of middle-income countries and will not have the possibilities to access the classes of higher-income countries if they lose their competitiveness as a result of eventual wages increase, and do not compensate the decrease of external demand for their exports. To overcome this, domestic demand could exert a strong alternative that supports economic growth. In this context, restructuring the income distribution in favor of more equity could lead to an increase in the domestic demand in these countries, and real per capita income will increase without the trap. We believe that it will be more rigorous to analyze the determinants of income inequality using econometric modeling considering structural change occurring in different faces of economic development.

References

Adams, S., & Klobodu, E. K. M. (2019). Urbanization, economic structure, political regime, and income inequality. Social Indicators Research, 142(3), 971–995. https://doi.org/10.1007/s11205-018-1959-3

Aiyar, S., & Ebeke, C. (2020). Inequality of opportunity, inequality of income and economic growth. World Development, 136, 105115. https://doi.org/10.1016/j.worlddev.2020.105115

Alhassan, A., Usman, O., Ike, G. N., & Sarkodie, S. A. (2020). Impact assessment of trade on environmental performance: accounting for the role of government integrity and economic development in 79 countries. Heliyon, 6(9), e05046. https://doi.org/10.1016/j.heliyon.2020.e05046

Allard, A., Takman, J., Uddin, G. S., & Ahmed, A. (2018). The N-shaped environmental Kuznets curve: An empirical evaluation using a panel quantile regression approach. Environmental Science and Pollution Research, 25(6), 5848–5861.

Altunbaş, Y., & Thornton, J. (2019a). Finance and income inequality revisited. Finance Research Letters. https://doi.org/10.1016/j.frl.2019.101355

Altunbaş, Y., & Thornton, J. (2019b). The impact of financial development on income inequality: A quantile regression approach. Economics Letters, 175, 51–56. https://doi.org/10.1016/J.ECONLET.2018.12.030

Alvaredo, F., Chancel, L., Piketty, T., Saez, E., & Zucman, G. (2018). World inequality report 2018. Belknap Press.

An, H., Razzaq, A., Haseeb, M., & Mihardjo, L. W. W. (2020). The role of technology innovation and people’s connectivity in testing environmental Kuznets curve and pollution heaven hypotheses across the belt and road host countries: New evidence from method of moments quantile regression. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-020-10775-3

Aziz, N., Mihardjo, L. W., Sharif, A., & Jermsittiparsert, K. (2020). The role of tourism and renewable energy in testing the environmental Kuznets curve in the BRICS countries: Fresh evidence from methods of moments quantile regression. Environmental Science and Pollution Research, 27(31), 39427–39441. https://doi.org/10.1007/s11356-020-10011-y

Azzimonti, M., De Francisco, E., & Quadrini, V. (2014). Financial globalization, inequality, and the rising public debt. American Economic Review, 104(8), 2267–2302.

Bašná, K. (2019). Income inequality and level of corruption in post-communist European countries between 1995 and 2014. Communist and Post-Communist Studies, 52(2), 93–104. https://doi.org/10.1016/j.postcomstud.2019.05.002

Berg, A., Ostry, J. D., Tsangarides, C. G., & Yakhshilikov, Y. (2018). Redistribution, inequality, and growth: New evidence. Journal of Economic Growth, 23(3), 259–305. https://doi.org/10.1007/s10887-017-9150-2

Blanco, G., & Ram, R. (2019). Level of development and income inequality in the United States: Kuznets hypothesis revisited once again. Economic Modelling, 80, 400–406. https://doi.org/10.1016/j.econmod.2018.11.024

Breunig, R., & Majeed, O. (2020). Inequality, poverty and economic growth. International Economics, 161, 83–99. https://doi.org/10.1016/j.inteco.2019.11.005

Brueckner, M., & Lederman, D. (2018). Inequality and economic growth: The role of initial income. Journal of Economic Growth, 23(3), 341–366. https://doi.org/10.1007/s10887-018-9156-4

Canay, I. A. (2011). A simple approach to quantile regression for panel data. The Econometrics Journal, 14(3), 368–386.

Chen, G., Glasmeier, A. K., Zhang, M., & Shao, Y. (2016). Urbanization and income inequality in post-reform China: A causal analysis based on time series data. PLoS ONE, 11(7), e0158826–e0158826.

Cheng, C., Ren, X., Dong, K., Dong, X., & Wang, Z. (2021). How does technological innovation mitigate CO2 emissions in OECD countries? Heterogeneous analysis using panel quantile regression. Journal of Environmental Management, 280, 111818. https://doi.org/10.1016/j.jenvman.2020.111818

de Bruin, A., & Liu, N. (2020). The urbanization-household gender inequality nexus: Evidence from time allocation in China. China Economic Review, 60, 101301. https://doi.org/10.1016/j.chieco.2019.05.001

Dumke, R. (1991). Income inequality and industrialization in Germany, 1850–1913: the Kuznets hypothesis re-examined. Income Distribution in Historical Perspective, 117–148.

Elbatanony, M., Attiaoui, I., Ali, I. M. A., Nasser, N., & Tarchoun, M. (2021). The environmental impact of remittance inflows in developing countries: Evidence from method of moments quantile regression. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-021-13733-9

Foster, A. D., & Rosenzweig, M. R. (2003). Agricultural development, industrialization and rural inequality. Unpublished.

Fosu, A. K. (2017). Growth, inequality, and poverty reduction in developing countries: Recent global evidence. Research in Economics, 71(2), 306–336. https://doi.org/10.1016/j.rie.2016.05.005

Galor, O., & Zeira, J. (1993). Income distribution and macroeconomics. The Review of Economic Studies, 60(1), 35–52.

Galvin, R., & Sunikka-Blank, M. (2018). Economic inequality and household energy consumption in high-income countries: A challenge for social science based energy research. Ecological Economics, 153, 78–88. https://doi.org/10.1016/j.ecolecon.2018.07.003

Glawe, L., & Wagner, H. (2016). The middle-income trap: Definitions, theories and countries concerned—a literature survey. Comparative Economic Studies, 58(4), 507–538. https://doi.org/10.1057/s41294-016-0014-0

Gollin, D., Jedwab, R., & Vollrath, D. (2016). Urbanization with and without industrialization. Journal of Economic Growth, 21(1), 35–70. https://doi.org/10.1007/s10887-015-9121-4

Gunasinghe, C., Selvanathan, E. A., Naranpanawa, A., & Forster, J. (2019). The impact of fiscal shocks on real GDP and income inequality: What do Australian data say? Journal of Policy Modeling. https://doi.org/10.1016/j.jpolmod.2019.06.007

Herzer, D., & Vollmer, S. (2012). Inequality and growth: Evidence from panel cointegration. The Journal of Economic Inequality, 10(4), 489–503. https://doi.org/10.1007/s10888-011-9171-6

Ike, G. N., Usman, O., & Sarkodie, S. A. (2020). Testing the role of oil production in the environmental Kuznets curve of oil producing countries: New insights from method of moments quantile regression. Science of the Total Environment, 711, 135208. https://doi.org/10.1016/j.scitotenv.2019.135208

Jaumotte, F., Lall, S., & Papageorgiou, C. (2013). Rising Income Inequality: Technology, or Trade and Financial Globalization? 61(2). https://doi.org/10.1057/imfer.2013.7

Kennedy, T., Smyth, R., Valadkhani, A., & Chen, G. (2017). Does income inequality hinder economic growth? New evidence using Australian taxation statistics. Economic Modelling, 65, 119–128. https://doi.org/10.1016/j.econmod.2017.05.012

Khan, H., Khan, I., & Binh, T. T. (2020). The heterogeneity of renewable energy consumption, carbon emission and financial development in the globe: A panel quantile regression approach. Energy Reports, 6, 859–867. https://doi.org/10.1016/j.egyr.2020.04.002

Kirschenmann, K., Malinen, T., & Nyberg, H. (2016). The risk of financial crises: Is there a role for income inequality? Journal of International Money and Finance, 68, 161–180. https://doi.org/10.1016/j.jimonfin.2016.07.010

Koenker, R. (2004). Quantile regression for longitudinal data. Journal of Multivariate Analysis, 91(1), 74–89. https://doi.org/10.1016/j.jmva.2004.05.006

Koenker, R., & Bassett, G. (1978). Regression quantiles. Econometrica, 46(1), 33–50. https://doi.org/10.2307/1913643

Koo, H. (1984). The political economy of income distribution in South Korea: The impact of the state’s industrialization policies. World Development, 12(10), 1029–1037.

Krugman, P. R. (2008). Trade and wages, reconsidered. Brookings Papers on Economic Activity, 2008(1), 103–154.

Kuznets, S. (1955). Economic growth and income inequality. The American Economic Review, 45(1), 1–28.

Liu, C., Jiang, Y., & Xie, R. (2019). Does income inequality facilitate carbon emission reduction in the US? Journal of Cleaner Production, 217, 380–387. https://doi.org/10.1016/j.jclepro.2019.01.242

Machado, J. A. F., & Santos Silva, J. M. C. (2019). Quantiles via moments. Journal of Econometrics, 213(1), 145–173. https://doi.org/10.1016/j.jeconom.2019.04.009

Naguib, C. (2017). The relationship between Inequality and growth: Evidence from new data. Swiss Journal of Economics and Statistics, 153(3), 183–225. https://doi.org/10.1007/BF03399507

Nie, H., & Xing, C. (2019). Education expansion, assortative marriage, and income inequality in China. China Economic Review, 55, 37–51. https://doi.org/10.1016/J.CHIECO.2019.03.007

Nusair, S. A., & Olson, D. (2019). The effects of oil price shocks on Asian exchange rates: Evidence from quantile regression analysis. Energy Economics, 78, 44–63. https://doi.org/10.1016/j.eneco.2018.11.009

Oyvat, C. (2016). Agrarian Structures, Urbanization, and Inequality. World Development, 83, 207–230. https://doi.org/10.1016/j.worlddev.2016.01.019

Petreski, M., Jovanovic, B., Petreski, B., & Kocovska, T. (2018). Income Inequality and the Great Recession: A Comparative Study.

Papadopoulos, G (2019). Income inequality, consumption, credit and credit risk in a data-driven agent-based model. Journal of Economic Dynamics and Control. 104 39 73. https://doi.org/10.1016/J.JEDC.2019.05.002

Piketty, T., & Saez, E. (2003). Income inequality in the United States, 1913–1998. The Quarterly Journal of Economics, 118(1), 1–41.

Piketty, T., & Zucman, G. (2015). Chapter 15 - Wealth and Inheritance in the Long Run. In A. B. Atkinson & F. B. T.-H. of I. D. Bourguignon (Eds.), Handbook of Income Distribution (Vol. 2, pp. 1303–1368). Elsevier. https://doi.org/10.1016/B978-0-444-59429-7.00016-9

Rajan, R. G. (2011). Fault lines: How hidden fractures still threaten the world economy. princeton University press.

Roe, M. J., & Siegel, J. I. (2011). Political instability: Effects on financial development, roots in the severity of economic inequality. Journal of Comparative Economics, 39(3), 279–309. https://doi.org/10.1016/J.JCE.2011.02.001

Rozelle, S. (1994). Rural industrialization and increasing inequality: Emerging patterns in China′ s reforming economy. Journal of Comparative Economics, 19(3), 362–391.

Shahbaz, M., Loganathan, N., Tiwari, A. K., & Sherafatian-Jahromi, R. (2015). Financial development and income inequality: Is there any financial kuznets curve in Iran? Social Indicators Research, 124(2), 357–382. https://doi.org/10.1007/s11205-014-0801-9

Shin, I. (2012). Income inequality and economic growth. Economic Modelling, 29(5), 2049–2057. https://doi.org/10.1016/j.econmod.2012.02.011

Stockhammer, E. (2013). Rising inequality as a cause of the present crisis. Cambridge Journal of Economics, 39(3), 935–958. https://doi.org/10.1093/cje/bet052

Su, C.-W., Liu, T.-Y., Chang, H.-L., & Jiang, X.-Z. (2015). Is urbanization narrowing the urban-rural income gap? A cross-regional study of China. Habitat International, 48, 79–86. https://doi.org/10.1016/j.habitatint.2015.03.002

Sulemana, I., Nketiah-Amponsah, E., Codjoe, E. A., & Andoh, J. A. N. (2019). Urbanization and income inequality in Sub-Saharan Africa. Sustainable Cities and Society, 48, 101544. https://doi.org/10.1016/j.scs.2019.101544

Thornton, J., & Tommaso, C. D. (2019). The long-run relationship between finance and income inequality: Evidence from panel data. Finance Research Letters. https://doi.org/10.1016/j.frl.2019.04.036

Topuz, S. G., & Dağdemir, Ö. (2020). Analysis of the relationship between trade openness, structural change, and income inequality under Kuznets curve hypothesis: The case of Turkey. The Journal of International Trade & Economic Development. https://doi.org/10.1080/09638199.2019.1711146

UNIDO (2019). Industrial development report 2020. Industrializing in the digital age. United Nations Industrial Development Organization, Vienna.

United Nations (2018). World Urbanization Prospects. In Demographic Research (Vol. 12). https://doi.org/10.4054/demres.2005.12.9

Van Treeck, T., & Sturn, S. (2012). Income inequality as a cause of the Great Recession?: A survey of current debates. ILO.

Wang, Y. (2019). A model of industrialization and rural income distribution. China Agricultural Economic Review.

World Bank (2020). World Bank Country and Lending Groups. World Bank. Retrieved February 01, 2020 from https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-andlending-groups.

Wu, D., & Rao, P. (2017). Urbanization and income inequality in China: An empirical investigation at provincial level. Social Indicators Research, 131(1), 189–214. https://doi.org/10.1007/s11205-016-1229-1

Xie, Z., Wu, R., & Wang, S. (2021). How technological progress affects the carbon emission efficiency? Evidence from national panel quantile regression. Journal of Cleaner Production, 307, 127133. https://doi.org/10.1016/j.jclepro.2021.127133

Xu, B., & Lin, B. (2018). Investigating the differences in CO2 emissions in the transport sector across Chinese provinces: Evidence from a quantile regression model. Journal of Cleaner Production, 175, 109–122. https://doi.org/10.1016/j.jclepro.2017.12.022

Yao, S. (1997). Industrialization and spatial income inequality in rural China, 1986–92 1. Economics of Transition, 5(1), 97–112.

Zhu, H., Xia, H., Guo, Y., & Peng, C. (2018). The heterogeneous effects of urbanization and income inequality on CO2 emissions in BRICS economies: Evidence from panel quantile regression. Environmental Science and Pollution Research, 25(17), 17176–17193. https://doi.org/10.1007/s11356-018-1900-y

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ali, I.M.A., Attiaoui, I., Khalfaoui, R. et al. The Effect of Urbanization and Industrialization on Income Inequality: An Analysis Based on the Method of Moments Quantile Regression. Soc Indic Res 161, 29–50 (2022). https://doi.org/10.1007/s11205-021-02812-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-021-02812-6

Keywords

- Income inequality

- Method of moments quantile regression

- Industrialization

- Urbanization

- Inequality kuznets curve