Abstract

In this paper, we propose a method to measure competitiveness performance at the subnational level, with an application to Peruvian regions. For this, we propose a benefit-of-the-doubt composite index that summarizes the information of several indicators that characterize competitiveness. It is based on an optimization approach, using data enveloping analysis (DEA) techniques, so that each indicator is weighted in an endogenous way, and each unit is evaluated in the most favourable light. Our proposed index is a non-radial variant of the typical DEA scores, which avoids the traditional pitfalls of DEA-based composite indices, such as unreasonable weights. Additionally, we propose a meta-frontier approach in order to compare the competitiveness performances across different periods of evaluation. Our assessments of the Peruvian regions’ competitiveness performance improve on the results of traditional DEA methods, which award high marks to regions with very heterogeneous performance (i.e., regions with very high scores in some indicators, and very poor in others). Additionally, the comparison of the performance across time shows a general decrease in the average competitiveness between 2008 and 2014 of the Peruvian regions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Usually linked with productivity, competitiveness is related to the ability of a firm, industry, cluster, region, or nation to achieve high levels of economic performance by means of supplying goods and services in a given market exposed to the competition (Porter 1990). Given its conceptual generality, competitiveness has been studied both at the microeconomic—i.e., firms (Porter 1980), and macroeconomic level—i.e., nations (Thurow 1992). In the case of regions, our focus here, competitiveness refers to the presence of conditions that enable firms in the region to compete in their chosen markets, so that the value generated by them is captured by the region (Begg 1999; Huggins 2003). Given their importance as a source of long-term economic development (Amin 1999; Malecki 2007; Werker and Athreye 2004), it is, therefore, not surprising the interest of researchers in theorizing and empirically measuring the competitiveness of regions (Huggins and Izushi 2011; Porter 1990, 2000).

In the case of Peru, Benzaquen et al. (2010) proposed an index to measure the regional competitiveness based on the methodologies used by the World Economic Forum (WEF) and the World Competitiveness Center at the IMD Business School for their own indices at the country level. These methodologies use the information of several variables to measure the performance across a specific number of dimensions, or pillars, that are considered to be the fundamental components of competitiveness. Taking these pillars as the inputs for computations, these works follow a non-optimization approach to propose a competitiveness index, where the indices are derived in an absolute sense, and the pillars are given equal importance in terms of weights. This approach raises two concerns, which have been treated in the literature of composite indicators (Cherchye et al. 2007), namely that, (1) the indices are absolute, so then the results are sensitive to the units of measurement of the pillars, and (2) some value judgements are implicit in the choice of weights (in this case, pillars may not play an equal role in the competitiveness of every region).

In order to deal with these concerns, Charles and Zegarra (2014) provided a collection of methods to construct a regional competitiveness index based on optimization models, within the framework of data envelopment analysis (DEA). These were used to rank the Peruvian regions according to their implied competitiveness levels for the year 2011. The usefulness of the DEA approach in this application lies, on the one hand, in that it is unit invariant (Lovell and Pastor 1995) and, on the other hand, in that the indices are relative, rather than absolute. Therefore, they are independent of the units of measurement of the original variables that are a part of the pillars (i.e., the currency in which an economic variable is expressed). Secondly, DEA does not assume weights for the pillars; rather, it obtains them through an optimization procedure that evaluates each region in the best possible light—the so-called ‘benefit-of-the-doubt’ approach (Cherchye et al. 2007).

In this work, we continue with the focus on competitiveness at the regional level, and extend the work of Charles and Zegarra (2014) to propose additional methods, also within the DEA framework, that deal with two further issues. The first is related to the possibility that some DEA-based methods might produce non-reasonable weights (i.e., implicit valuations) for the competitiveness pillars—in the terms of our current application. In particular, in some DEA-based methods it has been observed that if the unit under analysis (DMU) performs exceptionally well in one particular dimension, the weights for some (or even all) of the other dimensions may converge to zero. This is not surprising, given the ‘benefit-of-the-doubt’ nature of these indices that rewards the dimensions in which the DMU performs well, and punishes those in which it performs poorly. In order to deal with this phenomenon, we propose a DEA method that allows for a non-radial expansion of the pillars (a non-radial pure DEA). The second issue is related to the objective of obtaining an index that compares competitiveness performances across different moments in time. For this, we adapt some of the methods proposed by the previously referenced authors to a multi-year setup by using the concept of meta-frontier. In terms of our application, a meta-frontier involves the estimation of a single frontier for the competitiveness performance of all the regions in multiple years. By generating a single benchmark, it is then straightforward to evaluate the competitiveness performance of each region in every year.

We apply the proposed methods to the study of four years of regional competitiveness in Peru, in particular the years 2008, 2010, 2011, and 2014, to answer the question is the competitiveness of the regions rather stable across the years? The meta-frontier approach allows us to study the year-to-year evolution of the competitiveness of the Peruvian regions, by comparing the year-wise indices with those generated with reference to the meta-frontier. On the other hand, the non-radial approach provides a DEA-based method that is less susceptible to the problem of the zero weights for some of the regions’ competitiveness pillars.

Originally developed by Charnes et al. (1978) as a non-parametric method for identifying efficient production frontiers, the application of DEA for evaluating multi-criteria decision-making problems (MCDM) is not new (Bouyssou 1999). It is based on an extension of the original model, which contains possibly multiple inputs and multiple outputs, to scenarios with multiple outputs but no inputs (or multiple inputs and no outputs), as in Lovell and Pastor (1997, 1999). These models have been employed to analyze bank services (Lovell and Pastor 1997), facility layout design (Yang and Kuo 2003), the identification of new business areas (Seol et al. 2011), service process benchmarking (Seol et al. 2007), and service quality (Lee and Kim 2014; Charles and Kumar 2014). Besides the applications of DEA at the micro level, there have also been applications at a more aggregated level, generally to produce composite indicators, a rapidly growing area (Karagiannis and Lovell 2016). For example, Lauer et al. (2004) evaluated the health systems of a sample of countries, Lovell et al. (1995) compared the macroeconomic performance of OECD countries, Despotis (2005) created an index of human development for countries in the Asia-Pacific region, and Morais and Camanho (2011) created an index of quality of life for a sample of European cities.

The meta-frontier approach has been generally applied in productivity analysis to compare the differences in production technology for groups of firms. Furthermore, the applications are implemented in both the mathematical programming (DEA) approach, and the parametric (stochastic frontier) approach. Please refer to Chiu et al. (2012), Wang et al. (2013), Zhang and Choi (2013a, b), and Zhang et al. (2013) for applications in the energy sector, Assaf (2009) in air transport, Assaf et al. (2013) in hospitality management, Chen and Song (2008) in agriculture, and Bos and Schmiedel (2007) in banking sector integration in the Euro zone.

From this brief review of the literature we conclude that, although some of the topics are related to competitiveness, the use of DEA techniques to study competitiveness has been scant. In fact, to the best of our knowledge, besides the already referenced work of Charles and Zegarra (2014), we could not find other analogous applications to regional competitiveness. For example, Wang and Wang (2014) also studied regional competitiveness (in China), but they used the technique for order preference by similarity to ideal solution (TOPSIS). Similarly, other studies on competitiveness at the country level (Önsel et al. 2008; Zanakis and Becerra-Fernandez 2005; Kao et al. 2008) used non-optimization based methodologies.

The next sections proceed as follows. In Sect. 2, we provide a brief economic profile of the country at the national and regional level. In Sect. 3, we also briefly describe the economic rationale behind the five pillars proposed by CENTRUM (2014). In Sect. 4, we present the methodologies proposed in this work to generate the competitiveness indices. The indices proposed for each year’s data are based on pure and non-radial DEA measures and, therefore, are relative, as opposed to the absolute indices proposed in previous works. This calls for an additional method to allow the comparison of competitiveness performances across years, and for this we propose a meta-frontier approach. Section 5 discusses our findings after applying the methods proposed in the previous section to the 2008, 2010, 2011, and 2014 data for Peru. Finally, Sect. 6 concludes.

2 Economic Outlook of Peru

Considered to be one of the best performing economies in Latin America, the Peruvian economy has grown at high rates over the past years, to a large extent due to favorable international conditions such as high terms of trade, making great advances in its development (World Bank 2014). According to the same source, the latest figures show a real gross domestic product (GDP) growth for 2014 above the regional average (3.5 % for against 1.2 %, respectively), while the inflation has remained low (2.9 %).

Having experienced great economic and social structural changes over the past three decades, the economy succeeded in increasing its per capita income by more than 50 % over the past 10 years, with the services sector as the main contributor (60 %) to the country’s GDP. Furthermore, the industry has undergone a steady process of modernization, having contributed to the job creation in the country’s primary industrial areas. The economy has a projected rate of economic growth of 3.5 % for the year 2015 (FocusEconomics 2015).

The benefits of such prosperity have been translated into a significant reduction of poverty rates, with the latter being almost halved between 2005 and 2013, from 45 to 24 % of the population (World Bank 2014).

Nevertheless, despite the great advances achieved until the present, there is still much yet to be done (Charles 2015b). As such, the economy is still dependent on capital intensive, natural-resource-based exports, the public institutions lack credibility, and the general public is concerned with the very still high disparities in income. Considering this last point, it is important to mention that the Gini coefficient in 2013 was 0.44, a rather high number. Also, as shown in Table 1, some regions are much richer than others, with highland regions registering a much higher poverty rate than coastal regions. Moreover, while the Gini coefficient in rural areas fell by 1 point between 2004 and 2014, the same index fell by 5 points in urban areas during the same period of time (World Bank 2014). This is reflected in the ample differences in poverty (and extreme poverty) rates across regions, which range from around 15 % (Lima and Callao) up to 77.2 % (Huancavelica)—in terms of extreme poverty, the rates range from 0.4 % (Ica) to 46.8 % (Huancavelica). One can also observe significant heterogeneity in terms of the GDP per capita, which ranges from around 2500 PEN (Peruvian Nuevos Soles, constant from 1994) to around 14,900 PEN, that is, a sixth-fold difference within the same country.

One remarkable feature of this country is the concentration of the economic activity in the region of Lima (53 % of the national GDP—see Table 1). Lima is the region where the capital city with the same name is located. This city is the biggest city in the country, with almost 10 million inhabitants. To get some perspective, the second biggest city of the country, Arequipa (in the region with the same name), has only around 900,000 inhabitants. It is, therefore, no surprise that a big portion of the economic activity of the country is concentrated here. Another important issue is the fact that a big share of the economic activity in the regions is related to the primary sectors, which in turn are primarily oriented to external markets. One remarkable case is that of the Moquegua region, area of operation of one of the most important mining exploitations in the country. This region has the highest GDP per capita in the country; nevertheless, it still lags behind Lima in terms of poverty, and has similar or higher rates of poverty than regions with a much lower GDP per capita, such as Ica and Arequipa.

Figure 1 illustrates the geographic pattern of the heterogeneity across regions, now in terms of poverty rates. The western coastal regions (Tumbes, Piura, Lambayeque, La Libertad, Ancash, Lima, Callao, Ica, Arequipa, Moquegua, and Tacna) generally have lower poverty rates than the rest of the country. Contrastingly, the highland regions (Amazonas, Cajamarca, San Martin, Huánuco, Pasco, Junin, Huancavelica, Ayacucho, Apurimac, Cusco, and Puno), located in the middle of the country, have the highest poverty rates (particularly in the south). Finally, the eastern regions (Loreto, Ucayali, and Madre de Dios), located in the Amazonian jungle, have relatively average poverty rates when compared to the rest of the country. This pattern is repeated, in a similar style, in what concerns the GDP per capita, as can be seen in Table 1.

Despite the stellar economic performance at the macroeconomic level reflected in some of the indicators described, Peru has not improved its position in the competitiveness rankings. Actually, the position of Peru in the IMD competitiveness ranking has declined from the 35th place in 2008 to the 44th place in 2012, and furthermore, to the 50th place in 2014 (IMD 2014). Moving forward, the challenge will be to ensure the equitable distribution of the continuous growth registered, with the aim to reduce extreme poverty, tackle social conflicts, and improve the condition of the rural areas.

3 An Assessment of Competitiveness

We take the scores constructed and used to assess the competitiveness at the regional level by CENTRUM (2014). In that work, regional competitiveness is assessed from the perspective of five features, or “pillars”: economy, firms, government, infrastructure, and people, each of which we briefly describe in the following lines.

-

1.

Economy(Econ) Comprises five subfactors, namely: the size of the economy, measured by the GDP; the economic growth, expressed as a percentage of the GDP; the integration of the national economy with foreign markets, measured by the country’s exports; the degree of diversification of the economy, expressed by the range of goods and services traded; and the employment status, measured by the data on occupied labor force.

-

2.

Firms(Firms) Based on five subfactors: productivity, business environment, management skills, innovation, and employment generation. The productivity subfactor measures the average labor productivity of workers, and the number of workers of more than 14 years of age. The business environment reflects how favorable the environment is to the opening and running of successful businesses. Furthermore, the subfactor management skills includes information on the quality of managers, enhanced with data on their long-term business orientation, capacity to adapt to changes, and capacity to run their business in an international arena. The subfactor innovation reflects the existence of innovating people and firms along with the existence of innovating products, services, techniques, and processes. Lastly, employment generation is concerned with people’s access to well-paid jobs, the stability of their jobs, and the levels of their salaries, among others.

-

3.

Government(Govt) Brings together information on resources, as expressed by the numbers composing the institutional budget; regional autonomy, translated into the capacity of managing the resources; expenditure, as reported by the numbers on actual executed spending; safety, as reflected by the number of events involving crime, misconduct and offences, and terrorist attacks; and justice, as expressed by the number of judiciary cases actually solved.

-

4.

Infrastructure(Infra) Based on five subfactors: energy, reflected by the numbers on the national electric energy production and consumption; road network, a subfactor capturing a wide range of information on paved roads; transport, reflecting the situation of the land, air, and water transportation; tourism, comprising data regarding hotels and hostels; and communications, with a concern on reporting on the situation of fixed phone lines and cellphones alike.

-

5.

People(People) Includes the subfactors: school education, tertiary education, job training, education achievements, and health. The first two include information on the students’ reading comprehension and mathematical skills, and the density and number of university graduates, respectively. Job training, on the other hand, captures the situation of the technological and occupational formation, while education achievements reports the number of schooling years and literacy rate. Lastly, health reports on life expectancy coupled with malnutrition, and the situation of the health insurance programs.

For an in-depth report regarding the pillars and subfactors, as well as the corresponding variables that built up the subfactors, the interested readers are referred to Charles and Zegarra (2014). Each subfactor within each pillar is evaluated based on a measure from 0 to 100, and these scores are then averaged to form the corresponding pillar’s score. These assessments were carried out for the years 2008, 2010, 2011, and 2014—see CENTRUM (2014). Table 2 presents the pillars’ scores.

Note that the definitions of a few regions change for some of the sample years. Lima and Callao are two separate regions, but a single set of scores was calculated for them in 2008 and 2010. This treatment is not uncommon, given that Callao is a very small region, geographically located within the Lima region (Callao is an urban area next to the city of Lima, but given its strategic importance—being the port of the city, it was given a special status as a region). Nevertheless, these regions’ pillars were later calculated separately, so in 2011 we have a separate score for each one. The score of the Lima region was further disaggregated for 2014, when a set of scores was calculated for the city of Lima (Lima Metropolitana) and another set for the rest of the region (Lima Provincias). This treatment reflects the disproportionate impact of the city on the economy, not only of its region, but of the whole country, as can be readily seen in Table 2. In fact, the city of Lima (or its region, depending on the year, as we discussed) always records the higher scores in all the five pillars, except for the firms pillar in the year 2010 (when La Libertad and Loreto achieved slightly higher scores). This fact has an impact on the construction of competitiveness indices based on DEA approaches, as we discuss in the following sections.

4 Methodology to Construct a Competitiveness Index

The objective is to rank the regions according to their competitiveness performances in various pillars, but without imposing an ad-hoc valuation (weight) for any of them. Given their multiplicity, different weights can produce different orderings in the ranking. Furthermore, imposing the same weights for every region can fail to reflect their individual preferences or constraints. For example, regions with low population but many natural resources might choose to emphasize economic growth and diversification (economy pillar) rather than employment generation (firms pillar), without losing competitiveness. These problems motivate the use of DEA-based methodologies. Also, see “Appendix 1” for a theoretical interpretation of the indices proposed.

One can see the DEA approach as consisting in obtaining region-specific weights that are chosen so that each one is evaluated in the best reasonable light. For example, a region with high scores in the pth pillar would have a heavier weight in this dimension. At the same time, the weights would also reflect the competitiveness performance of other regions that are no worse in the pth pillar and achieve better scores in other dimensions. This work applies the same logic, and extends previous contributions to (1) make the comparisons among regions to be less affected by heterogeneous performance across pillars, and (2) allow for multi-year comparisons.

4.1 Pure DEA

The following program produces the DEA index of competitiveness for region o, that has a vector of P outputs (the pillars) \(y_o = (y^1_o, \ldots ,y^{P}_o)\), and belongs to a set of R regions:

The result of this system would produce a vector \((\phi _o, \lambda _{o1},\ldots ,\lambda _{oR})\) for region o. After solving the same system for every region, \(r=1,\ldots ,R\), we use the results to build a competitiveness index \(\theta _r^{dea} = 1/\phi _r\) for each of them. We denote it as “pure” DEA to highlight that this is a model without inputs (a very similar program could be used for a model without outputs, and only inputs)—see Lovell and Pastor (1999). This is the standard methodology used in the literature on composite indices. For example, see Cherchye et al. (2007) for an introduction to its main features. It is to be noted that we present an alternative formulation of the index to what is usual in this literature, where the problem is presented as the maximization of the weighted average of the pillars, with each weight revealing the region’s implicit valuation for the pillar. The two formulations are, however, theoretically identical.

One important issue with this approach, raised in the literature of the ‘benefit-of-the-doubt’ indicators, lies at the bottom of its philosophy: because the DMUs are evaluated in the best possible light, the implied indices tend to overfocus on the dimension in which the DMU performs the best. This means that, in practice, the resulting indices tend to emphasize few dimensions (or even a single one), and completely discard the information of the others. The reason for this problem lies in the radial formulation of System (1). The maximization problem tries to find the maximum proportional increase in output, but at the same time, it constrains it to be the same in every dimension. Therefore, the problem focuses on the output dimension in which the DMU performs the best (i.e., the most likely to be constrained), and finds the combination of other DMUs (via the \(\lambda\)’s) that maximizes this distance. Furthermore, based on this reasoning, we can also see that the problem would be composed if there is an outlier DMU, that is, a DMU that performs better than the others in every dimension (like the case of the Lima region in our application). In particular, the resulting index would focus only on the dimension in which a particular DMU is the closest to the top performer DMU, and disregard completely its performance in all the other dimensions.

4.2 Non-radial Pure DEA

In order to deal with the potential shortcomings of the traditional DEA approach, discussed in the previous subsection, we propose a non-radial measure of efficiency, still within the DEA framework. This method, as the one before, does not have inputs (and then, it is “pure”), but it differs in that it allows for different expansion paths for each output (then, it is also non-radial). The method is based on the system:

Using these results, in particular, the vector \((\phi ^1_o,\ldots ,\phi ^P_o)\) for region o, we generate the corresponding competitiveness index as follows:

Our proposed index is derived from the results of a system that maximizes the sum of potential expansions along each dimension. By not constraining the expansions to be proportional, this allows to evaluate independently the distance with respect to an appropriate benchmark along every dimension. This avoids the problem of the radial version, which tends to overfocus on the best performing dimension. For example, if we have a region that has a very good performance in one pillar, very close to the top, but performs poorly on the other four, the pure DEA-based index would consider it as one of the more competitive regions of the country. On the other hand, our non-radial pure DEA-based index would take into account that the region, although is doing a good job in one pillar, is performing badly in the other four. Given that the system maximizes the sum of the potential ratios of improvement in every dimension, the total index of the region would tend to be low (\(\phi\) would be big in four dimensions, affecting negatively the index in Eq. 3). This feature of our method would improve the competitiveness performance comparisons, given that regions that have a very heterogeneous performance will not necessarily have an advantage over others that have a more homogeneous performance.

4.3 Meta-frontier in Non-radial Pure DEA

The analysis of multiple periods can bring additional information about the evolution of competitiveness performance of the regions. One way to study this is to ask whether there are differences among the competitiveness levels achieved across years, as measured by the DEA-estimated frontiers from the previous subsections. This analysis can be implemented by comparing the relative competitiveness performance of each region in a particular year to the relative performance it would achieve if compared to all the other regions in all the years—including the same region in other years. This is precisely one of the applications of the concept of the meta-frontier. See “Appendix 2” for a brief description of the meta-frontier analysis in production analysis.

In our application, this involves estimating the convex hull of the outputs of all the regions in all the years. We do this for the non-radial pure DEA measures:

where r now indicates each region-year as a DMU—therefore, it ranges now up to R times T. In the DEA literature, this is called a “meta-frontier”. The meta-frontier can be seen as reflecting the advancement of technology across the years, given that it encompasses the information of all the regions over the years.

As with the year-wise frontiers, we form the competitiveness index with the formula:

It is to be noted that it is always the case that \(\theta _o^m \le \theta _o^{nr}\), because the meta-frontier index is calculated in comparison with a bigger set of DMUs. In fact, if the inequality is strict, it would mean that the DMU is farther from the meta-frontier than its “local” frontier is. Therefore, we can use the ratio \(\theta _o^m/\theta _o^{nr}\) to get a sense of the technology gap for the corresponding observation (we then denote this as the “technology gap ratio”, or TGR, in the set of results).

Figure 2 illustrates the concept of meta-frontier. In this stylized example, each DMU produces some amount of two outputs, \(Y_1\) and \(Y_2\). Then, the curves \(F_{Y1}\) and \(F_{Y2}\) illustrate the DEA frontiers for years 1 and 2. As the figure shows, the meta-frontier is the convex hull of the full set of DMUs, for every year. This is equivalent to the envelopment of the frontier of the individual years.

According to Lovell and Pastor (1997, 1999), system (1) is unit invariant. In “Appendix 3”, it has been shown that system (4) is also unit invariant. Furthermore, Charles et al. (2016) showed that system (1) is also translation invariant under a directional distance function approach.

5 Inferences from the Analytics

In this section, we provide twofold inferences: we initially compare and contrast the results based on the pure DEA and non-radial pure DEA models; subsequently, we discuss the results under the multi-period framework based on the proposed meta-frontier approach of the non-radial pure DEA.

In Table 3, we report the competitiveness indices, which have been derived for every year of the sample through both the methodologies. It is to be noted that “pure DEA” refers to the indices obtained by running the pure DEA method with radial expansion, while “non-radial pure DEA” refers to the indices attained by running the non-radial pure DEA method proposed by the present research work. Furthermore, the regions in the table have been ordered according to their non-radial pure DEA-based competitiveness indices for the year 2008.

Based on Table 3, we can draw some noteworthy observations. Firstly, Lima remains the highest performer throughout the entire set of sample years irrespective of the methodology used. In a similar fashion, except for the second period of study (i.e., year 2010), Huancavelica holds its position as the least performing region. In other words, if a region performs exceptionally well in all the pillars or exceptionally poor in all the pillars, the region’s position in the ranking based on the indices obtained will remain the same, irrespective of the method employed, i.e., pure DEA or non-radial pure DEA. The real difference and, therefore, contribution made by the non-radial pure DEA method can be seen when a region performs well in some pillars and poor in some other pillars simultaneously.

Let us explore this in depth. One remarkable example is the case of Loreto, which according to the pure DEA-based indices is the second most competitive region in 2008 and 2010, but occupies the 14th and 16th positions, respectively, according to the non-radial DEA-based ranking. This represents a substantial change in the ranking.

The source of this phenomenon can be attributed to the fact that our non-radial pure DEA-based index values the performance in every pillar, while the traditional pure DEA-based index tends to focus almost exclusively on the pillars in which the DMU performs better. Then, for example, a region that in general performs poorly, but excels in a single pillar, would tend to obtain high overall marks under the pure DEA method. This is precisely the case of the region of Loreto, previously mentioned. This region obtains scores of 21.73, 66.57, 37.28, 10.79, and 31.34 in the economy, firms, government, infrastructure, and people pillars, respectively, which correspond to 28, 99, 58, 13, and 40 % of the top score in each dimension (year 2008). Therefore, its competitiveness index and corresponding ranking are heavily influenced by the region’s performance in the Firms pillar: it is the second best performer in this pillar in the year 2008, and so its pure DEA index also becomes the second highest (another example in the same line, although less striking, is the case of La Libertad region in the years 2010 and 2011).

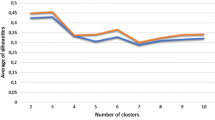

A second insight consists in observing the general behavior of the efficiency indices. Both Table 3 and Fig. 3 can help in this regard. As such, it can be observed that the efficiency indices are always higher for the pure DEA method when compared to the non-radial pure DEA method. For example, the pure DEA second best indices are 0.988, 0.979, 0.984, and 0.870 for the four years of the sample, while the non-radial pure DEA second best indices are 0.579, 0.612, 0.703, and 0.681 for the same years.

Thirdly, and in direct relation to the second insight, attention should be directed towards the variation among the efficiency indices. This variation is higher in the case of the pure DEA method when compared to the non-radial pure DEA method.

Figure 3 also helps to highlight one more pattern in the data. The plots show the indices obtained by running the pure DEA and non-radial pure DEA methods. Furthermore, the figure shows, for each region, the maximum of the ratios between the score in each pillar and the top performer’s score in the same pillar—denoted as “Max” in the graphs. It is to be noted that the Max index overlaps almost perfectly with the pure DEA-based index. In fact, the overlap is perfect for every year of the sample set except for the year 2010. The reason behind is that Lima outperforms all regions in every pillar for every year, except one—in 2010, La Libertad and Loreto registered higher scores in the Firms pillar. That is, under these circumstances, the pure DEA-based index will depend on exactly one pillar. By contrast, this does not affect our non-radial pure DEA index, whose very property is to account for the competitiveness performance in every pillar.

In order to appreciate the impact of the Lima region, we recalculate the competitiveness indices by means of excluding this region from our analysis. The results are depicted in Fig. 4. By excluding the Lima region, the pure DEA-based index differs now more significantly from the Max index for almost all the regions. This means that the pure DEA-based index now takes into account more than just the information of the best performing pillar. However, this still happens in a few cases, mainly in the case of the Loreto region, for the first 3 years of the sample set, where we can observe a quite close overlap between the pure DEA-based and the Max indices. The reason behind is that this region has very uneven performances across the pillars, as discussed before. This is shown in the graph that presents the mean squared difference with respect to the mean pillar score for each region (denoted as “SD” in the plots, measured in the secondary vertical axis). In situations of very uneven performances, the pure DEA-based and the Max indices overlap, which means that the former only assesses the single best performing pillar of the region. In terms of the “benefit-of-the-doubt” literature, DEA would be assigning a zero weight to four of the five pillars in this case.

By evaluating the results in a more qualitative manner, we can see that, in general, the coastal regions tend to be the top performers (Arequipa, Ica, Tacna, Moquegua, Lambayeque, La Libertad, and Piura), while the regions in the Andean center-south tend to be the worst performers (Apurimac, Huancavelica, Ayacucho, Huánuco), jointly with the Amazonas (a western Amazonian jungle region in the north) and Cajamarca (a northern Andean region).

Similar to the analysis provided by Charles and Zegarra (2014), our results seem to be intimately related to the behavior of the poverty rates of the regions (shown in Table 1). The results are less related to the ranking of the GDP per capita, where, for example, we have high performers like Moquegua, Ancash, Pasco, and Madre de Dios, which do not get high competitiveness indices. This seems to originate in their poor performance in the Infrastructure and Economy pillars. Given the big degree of specialization of these regions (the economies of the first three regions being heavily focused on primary extractive activities—such as mining, exclusively oriented to external markets), we can expect a low performance in the diversification factor that is part of the Economy pillar. Also, given that these industries tend to be capital-intensive, rather than labor-intensive, the employment factor should not necessarily be driven up with the same intensity as the GDP per capita in these regions.

Additionally, it is to be noted that although not all mining regions rank low in competitiveness, interestingly enough, the regions with the largest mining production in the country, i.e., Apurimac and Cajamarca, belong to the group of the 10 least performing regions, throughout the entire period of study. This finding is consistent with what is known in the literature as the “resource curse”, a paradox according to which precisely the regions with an abundance of natural resources tend to have less economic growth. Undoubtedly, mining in Peru has enabled only a small portion of the potential welfare that the country and its society could benefit from (Charles 2015a, b, 2016).

A direct comparison of the yearly indices is not informative, given that they are normalized within each year. In order to attempt such a comparison, we estimate the meta-frontier under the non-radial pure DEA method. Table 4 shows again the non-radial pure DEA-based indices for each year, as well as those based on a single meta-frontier. The table also shows the TGR ratios, that is, the ratio \(\theta _m=\theta _{nr}\) for every DMU. By studying the TGRs for the non-radial pure DEA method, we can easily observe that adding the observations for the other years does not alter the 2008 efficiency indices of the regions (hence, all TGRs equal 1). On the other hand, the average TGRs are 0.98, 0.912, and 0.896 for 2010, 2011, and 2014, respectively. Therefore, these results help us to conclude that there was a monotonic decrease in the competitiveness levels throughout the years.

6 Conclusions

DEA techniques can be useful to quantify the competitiveness performance of regions in the multiple dimensions that policy-makers identify as key to competitiveness. If one sees competitiveness as an unobservable variable that regions seek to maximize, then DEA provides a method to rank the regions’ success in this task without imposing strong assumptions on the unobservable function that transforms pillars into levels of competitiveness. The method proposed only assumes that regions are comparable at some level (which is actually always required to have a meaningful ranking), and that their behavior has some level of optimality—the indices see each region in the best possible light. Although the use of DEA techniques to elaborate rankings on multiple dimensions is not new, in this paper we extend the applicability of the method to comparisons across multiple years, which allows us to study, additionally, the evolution of the general level of competitiveness at the country level. In our application to the case of Peru for the years 2008, 2010, 2011, and 2014, we find a continuous decrease in productivity.

In spite of the lack of competitiveness data for consecutive years, our results are reflected in related works. For example, the findings reported by the IMD (2014) at the global level, show that Peru has started to lag behind in terms of competitiveness, relative to other countries, since 2008. Therefore, the country’s rankings during the years of our sampling were 35 (2008), 41 (2010), 43 (2011), and 50 (2014).

A future direction of the current study would be to incorporate the stochastic noise of the competitiveness data (an attempt that has not been pursued so far in the relevant literature) and then model the regional competitiveness index by means of determining the efficiencies of the regions with certain level of probability. The proposed DEA approach could also be applied to derive the competitiveness levels of other competing Latin American countries. Furthermore, value judgments could be incorporated into the model, which should be of practical interest.

Finally, it should be noted that the proposed model does not only serve to compute the index of regional competitiveness, but it can also be used to construct other index systems, such as, the Social Progress Index, Doing Business Index, Happiness Index, Innovation Index, and so on.

References

Amin, A. (1999). An institutionalist perspective on regional economic development. International Journal of Urban and Regional Research, 23(2), 365–378.

Assaf, A. (2009). Accounting for size in efficiency comparisons of airports. Journal of Air Transport Management, 15(5), 256–258.

Assaf, A., Pestana, C., & Josiassen, A. (2013). Hotel efficiency: A bootstrapped metafrontier approach. International Journal of Hospitality Management, 29(3), 468–475.

Begg, I. (1999). Cities and competitiveness. Urban Studies, 35(5–6), 795–809.

Benzaquen, J., Del Carpio, L., Zegarra, L., & Valdivia, C. (2010). Un índice regional de competitividad para un país. Revista Cepal, 102, 69–86.

Bos, J., & Schmiedel, H. (2007). Is there a single frontier in a single european banking market? Journal of Banking & Finance, 31(7), 2081–2102. (Developments in European Banking).

Bouyssou, D. (1999). Using DEA as a tool for MCDM: Some remarks. Journal of the Operational Research Society, 50, 194–978.

CENTRUM. (2014). Índice de competitividad regional del Perú 2014. PUCP: CENTRUM Católica Graduate Business School.

Charles, V. (2015a). Mining cluster development in Peru: From triple helix to the four clover. Strategia, 38, 38–46.

Charles, V. (2015b). Mining cluster development in Peru: Learning from the international best practice. Journal of Applied Environmental and Biological Sciences, 5(1), 1–13.

Charles, V. (2016). Mining and mitigating social conflicts in Peru. OR/MS Today, INFORMS, 43(2), 34–38.

Charles, V., Fare, R., & Grosskopf, S. (2016). A translation invariant pure DEA model. European Journal of Operational Research, 249, 390–392.

Charles, V., & Kumar, M. (2014). Satisficing data envelopment analysis: An application to SERVQUAL efficiency. Measurement, 51, 71–80.

Charles, V., & Zegarra, L. F. (2014). Measuring regional competitiveness through data envelopment analysis: A peruvian case. Expert Systems with Applications, 41, 5371–5381.

Charnes, A., Cooper, W., & Rhodes, E. (1978). Measuring the efficiency of decision-making units. European Journal of Operational Research, 2, 429–444.

Chen, Z., & Song, S. (2008). Efficiency and technology gap in China’s agriculture: A regional meta-frontier analysis. China Economic Review, 19(2), 287–296.

Cherchye, L., Moesen, W., Rogge, N., & Van Puyenbroeck, T. (2007). An introduction to the ‘benefit of the doubt’ composite indicators. Social Indicators Research, 82, 111–145.

Chiu, C.-R., Liou, J.-L., Wu, P.-I., & Fang, C.-L. (2012). Decomposition of the environmental inefficiency of the meta-frontier with undesirable output. Energy Economics, 34(5), 1392–1399.

Despotis, D. K. (2005). Measuring human development via data envelopment analysis: The case of asia and the pacific. Omega, 33, 385–390.

FocusEconomics. (2015). Peru economic outlook, Technical report. FocusEconomics.

Huggins, R. (2003). Creating a UK competitiveness index: Regional and local benchmarking. Regional Studies, 37(1), 89–96.

Huggins, R., & Izushi, H. (2011). Competition, competitive advantage, and clusters: The ideas of Michael Porter. Oxford, UK: Oxford University Press.

IMD. (2014). IMD World Competitiveness Yearbook 2014. Lausanne: IMD.

Kao, C., Wu, W.-Y., Hsieh, W.-J., Wang, T.-Y., Lin, C., & Chen, L.-H. (2008). Measuring the national competitiveness of southeast asian countries. European Journal of Operational Research, 187, 613–628.

Karagiannis, G., & Lovell, C. (2016). Productivity measurement in radial DEA models with a single constant input. European Journal of Operational Research, 251, 323–328.

Lauer, J. A., Lovell, K., Murray, C., & Evans, D. (2004). World health system performance revisited: The impact of varying the relative importance of health system goals. BMC Health Services Research, 4(1), 19.

Lee, H., & Kim, C. (2014). Benchmarking of service quality with data envelopment analysis. Expert Systems with Applications, 41, 3761–3768.

Lovell, C. K., & Pastor, J. T. (1995). Units invariant and translation invariant DEA models. Operations Research Letters, 18, 147–151.

Lovell, C. K., & Pastor, J. T. (1997). Target setting: An application to a bank branch network. European Journal of Operational Research, 98(2), 290–299.

Lovell, C. K., & Pastor, J. T. (1999). Radial DEA models without inputs or without outputs. European Journal of Operational Research, 118(1), 46–51.

Lovell, C. K., Pastor, J. T., & Turner, J. A. (1995). Measuring macroeconomic performance in the OECD: A comparison of European and non-European countries. European Journal of Operational Research, 87, 507–518.

Malecki, E. J. (2007). Cities and regions competing in the global economy: Knowledge and local development policies. Environment and Planning, C: Government and Policy, 25(5), 638–654.

Morais, P., & Camanho, A. S. (2011). Evaluation of performance of European cities with the aim to promote quality of life improvements. Omega, 39, 398–409.

Önsel, S., Ülengin, F., Ulusoy, G., Aktaş, E., Kabak, O., & Topcu, Y. I. (2008). A new perspective on the competitiveness of nations. Socio-Economic Planning Sciences, 42(4), 221–246.

Porter, M. (1990). The competitive advantage of nations. New York, NY: The Free Press.

Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competitors. New York, NY: Free Press.

Porter, M. E. (2000). Location, clusters, and company strategy. In G. L. Clark, M. P. Feldman, & M. S. Gertler (Eds.), The Oxford handbook of economic geography (pp. 253–274). Oxford: Oxford University Pres.

Rao, D. P., O’Donnell, C. J., & Battese, G. E. (2003). Metafrontier functions for the study of inter-regional productivity differences, CEPA Working Papers Series WP012003. School of Economics, University of Queensland, Australia.

Seol, H., Choi, J., Park, G., & Park, Y. (2007). A framework for benchmarking service process using data envelopment analysis and decision tree. Expert Systems with Applications, 32(2), 432–440.

Seol, H., Lee, S., & Kim, C. (2011). Identifying new business areas using patent information: A DEA and text mining approach. Expert Systems with Applications, 38(4), 2933–2941.

Thurow, L. (1992). Head to head: The coming economic battle among Japan, Europe, and America. New York, NY: Warner Books.

Wang, Q., Zhao, Z., Zhou, P., & Zhou, D. (2013). Energy efficiency and production technology heterogeneity in china: A meta-frontier DEA approach. Economic Modelling, 35, 283–289.

Wang, Z.-X., & Wang, Y.-Y. (2014). Evaluation of the provincial competitiveness of the chinese high-tech industry using an improved topsis method. Expert Systems with Applications, 41, 2824–2831.

Werker, C., & Athreye, S. (2004). Marshall’s disciples: Knowledge and innovation driving regional economic development and growth. Journal of Evolutionary Economics, 14(5), 505–523.

World Bank. (2014). Peru overview.

Yang, T., & Kuo, C. (2003). A hierarchical AHP/DEA methodology for the facilities layout design problem. European Journal of Operational Research, 147(1), 128–136.

Zanakis, S. H., & Becerra-Fernandez, I. (2005). Competitiveness of nations: A knowledge discovery examination. European Journal of Operational Research, 166, 185–211.

Zhang, N., & Choi, Y. (2013a). Environmental energy efficiency of China’s regional economies: A non-oriented slacks-based measure analysis. The Social Science Journal, 50(2), 225–234.

Zhang, N., & Choi, Y. (2013b). Total-factor carbon emission performance of fossil fuel power plants in China: A metafrontier non-radial Malmquist index analysis. Energy Economics, 40, 549–559.

Zhang, N., Zhou, P., & Choi, Y. (2013). Energy efficiency, \(\text{ CO }_2\) emission performance and technology gaps in fossil fuel electricity generation in Korea: A meta-frontier non-radial directional distance function analysis. Energy Policy, 56, 653–662.

Acknowledgments

The authors would like to express their gratitude to Dr. Fernando A. D’Alessio Ipinza, Director General of CENTRUM Católica Graduate Business School, whose continuous support and encouragement made this research possible. Moreover, the authors are grateful to the Editor-in-Chief and three anonymous referees for their valuable comments and suggestions on the previous drafts of this article. The authors also would like to thank Premio PODER Magazine for awarding the title of the best research award for the 2013 Think Tank of the Year in the category of Peru’s Most Innovative Study.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

1.1 A Simple Framework

Each region \(j \in J\) produces a vector \(\mathbf {y}_j \in \mathbb {R}^M\) of outputs. Each output \(\{y^i_j\}_{i=1,\ldots ,M}\) in this vector is produced with a specific allocation of \(\mathbf {x}^i_j \in \mathbb {R}^N\) inputs, through the function:

for each element \(i = 1,2, \ldots ,M\) of vector \(\mathbf {y}_j\) (this assumes no joint production). The region has an endowment of inputs \(\bar{\mathbf {x}}_j \in \mathbb {R}^N\). Then, the production possibility frontier (PPF) for firm j is defined by:

so that the PPF is defined conditional on the endowment of each region. Given that we can expect heterogeneity in the regions’ endowments, we have that each would be facing its own PPF. Now consider the convex-hull of the union of these sets:

The estimators proposed in the text measure the distance of each region’s \(\mathbf {y}_j\) to this frontier. As follows from this discussion, we can see the distances as a mixture of differences in resources (\(\bar{\mathbf {x}}_j\)) and, potentially, inefficiencies.

Appendix 2

1.1 Meta-frontier in DEA

In this appendix, we present the theory of meta-frontier analysis for the usual input–output analysis. The exposition is based on Rao et al. (2003). Consider \(k=1,\ldots , K\) groups of DMUs (for example, each year in the application in this paper). Define the technology available for an arbitrary group k as:

where \(x \in \mathbb {R}^{p}_+\) is a vector of inputs, and \(y \in \mathbb {R}^{q}_+\) is a vector of outputs. Based on this, we can define the output required sets for each level of output \(x \in \Psi ^k\):

and the corresponding Farrell efficiency measure at DMU 0 as:

Now, let us define the meta-frontier technology:

that is:

We can also define the Farrell efficiency measure at DMU 0 for this new technology, \(\lambda (x_0,y_0)\), in an analogous way as for the single group frontiers. Naturally, it will always be the case that \(\lambda (x_0,y_0) \ge \lambda ^k(x_0,y_0)\), given that the meta-frontier is the convex envelopment of the group frontiers. Then, we can define the so-called technology gap ratio (TGR):

which will be equal to 1 only if the group frontier coincides with the meta-frontier at evaluation point (x, y). If the group frontier of point (x, y) is farther away from the meta-frontier, this ration will tend to be higher, indicating a larger gap with respect to the meta-frontier.

Appendix 3

To verify that (4) is unit invariant, let us consider the pth constraint

Change the unit by a, then

Since a cancels, we have our original pth constraint (9).

Rights and permissions

About this article

Cite this article

Charles, V., Díaz, G. A Non-radial DEA Index for Peruvian Regional Competitiveness. Soc Indic Res 134, 747–770 (2017). https://doi.org/10.1007/s11205-016-1444-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-016-1444-9

Keywords

- Regional competitiveness

- Competitiveness index

- Competitiveness performance

- Economic growth

- Data envelopment analysis

- Meta-frontier