Abstract

This study investigates how adopting causation process during early stages of venture development can impact long-term innovation outcomes directly and indirectly through its interactions with three forms social capital. To do so, we use a sample of 1,214 new ventures in the U.S. and offer several contributions to theory and practice. First, by drawing on theories of entrepreneurial approaches, social networks, and innovation, it advances the theoretical understanding of the intersection of these areas. Second, the study uses a longitudinal approach to offer empirical evidence supporting the enduring effect of decision-making logics during early stages of new venture development on long-term innovation performance. Third, the findings of this study suggest that the dimensionality of causation is complex as presented in the heterogenous effects of the dimensions of causation on innovativeness, ranging from positive, to negative, to nonsignificant effects. Lastly, it offers insights on the complex indirect effects of causal approaches on innovativeness in new ventures, as they can both diminish and enhance the benefits of the three forms of social capital.

Plain English Summary

How founders’ adoption of entrepreneurial approaches during early stages of venture development can impact long-term innovation outcomes directly and indirectly through its interaction with social capital. Innovation is critical for the success of new ventures, and entrepreneurs rely on decision-making strategies to create new and innovative products or services. The causal decision-making process, which represents predetermined, planned, and well-defined decision-making, promotes innovativeness in various settings (Sarasvathy, Sarasvathy, Academy of Management Review 26:243–263, 2001; Sarasvathy et al., Organization Studies 29:331–350, 2008, 2010; Dew, Sarasvathy, and Venkataraman, 2004; Alvarez & Barney, 2007). However, an interesting paradox emerges as organic, dynamic, and flexible mechanisms, such as social interactions, can also foster innovativeness (Carnabuci and Diószegi, Academy of Management Journal 58:881–905, 2015). Understanding how causal processes interact with other constructs, such as social capital, to either promote or impede innovative outcomes can guide entrepreneurs as they pursue opportunities. Additionally, it is important to understand the long-term implications of the entrepreneurial processes that founders adopt during the early stages of venture development. Taken together, this study investigates how adopting causal processes during the early stages of venture development can have enduring effects on long-term innovation outcome directly and indirectly through its interaction with social capital. To test these theoretical arguments, this study uses data from the second Panel Study of Entrepreneurial Dynamics (PSED II), which surveyed 1,214 U.S. entrepreneurs between 2006 and 2011 about their ventures. This study offers several contributions. First, by drawing on theories of entrepreneurial processes, social processes, and innovation, we advance our understanding of the intersection of these areas. Second, the longitudinal approach offers empirical evidence supporting the enduring effect of decision-making logics during early stages of new venture development on long-term innovation outcomes. Third, our findings suggest that the dimensionality of causation is complex as presented in the heterogenous effects of the dimensions of causation on innovativeness ranging from positive, to negative, to nonsignificant. Lastly, we offer insights on the complex indirect effect of causal approaches on innovativeness in new ventures.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Innovation is widely regarded as essential for new venture success, and entrepreneurs often employ different entrepreneurial processes to create innovative products or services. Causal entrepreneurial processes, which represent predetermined, planned, and well-defined decision making, promote innovativeness in various settings (Sarasvathy, 2001; 2008; Dew, Sarasvathy, and Venkataraman, 2004; Alvarez & Barney, 2007). Causal processes provide structured and predictable ways of thinking which can improve decisions regarding resource allocation, strategy, and risk management. Arguably, adopting causal processes during the early stages of venture formation can positively influence innovative outcomes by promoting systematic, linear paths to devising and pursuing innovative solutions.

Our understanding of the effect of entrepreneurial processes on new venture success suffers from two weaknesses. First, studies of entrepreneurial processes tend to focus on the direct effects of these processes on innovation, often ignoring indirect effects of other antecedents on innovation (Berends et al., 2014; Futterer et al., 2018; Roach et al., 2016). For example, the social capital literature highlights the positive aspects of organic, dynamic, and flexible mechanisms, such as social interactions (which significantly contrast with the structured and linear logic of causal processes) on innovativeness (Granovetter, 1973, 1985; Tsai, 2002; Carnabuci and Diószegi, 2015). Causal processes can promote innovation by providing predetermined goals and processes, while social capital (i.e., the byproduct of interactions and relationships among individuals) can foster innovation by facilitating dynamic knowledge transfers across flexible ties (Cuevas-Rodríguez et al., 2014; Nohria & Gulati, 1996; Subramaniam & Youndt, 2005). Consequently, a perplexing milieu arises when considering the interplay between causal processes and conceptually divergent constructs, such as social capital, on innovation. An understanding of how causal processes interact with other constructs (e.g., social capital) to either promote or impede innovation can guide entrepreneurs’ pursuit of opportunities.

This study explores the interplays between social capital and causal processes, given the contrasting ways that each factor promotes innovation. Specifically, we argue that certain forms of social capital synergize with causal processes to foster innovation, while others combine to inhibit innovation. Further, our study tests whether or not the three forms of social capital interact with the multiple dimensions of causal processes and affect innovativeness in a similar manner. Third, existing entrepreneurial processes research focusing on the temporality of entrepreneurial approaches, determined by the stages of innovation, rarely investigates the longitudinal effect of these processes (Berends et al., 2014). It is important to note that causal processes lose their efficiency under uncertain conditions, such as during earlier stages of innovation development (Berends et al., 2014). However, it is unclear whether adopting causal processes during the early stages of venture development can substantially promote long-term innovation outcomes. Thus, it is important to understand the enduring effect of entrepreneurial processes adopted during the early stages of new venture development on subsequent innovation outcomes.

Taken together, this study investigates how adopting causal processes during the early stages of venture development affects long-term innovation outcomes directly and indirectly through interaction with three forms of social capital: relational, structural, and cognitive social capital (Adler & Kwon, 2002; Nahapiet & Ghoshal, 1998). We test our theoretical arguments with the second Panel Study of Entrepreneurial Dynamics (PSED II), which surveyed 1,214 entrepreneurs about their ventures in the U.S. between 2006 and 2011 (Dyer et al., 2014) .

This study offers several contributions. First, by drawing on theories of entrepreneurial processes, social capital, and innovation, it advances our insights on the complex indirect effects of causal approaches on innovativeness in new ventures, which can diminish or enhance their benefit depending on the dimensions of social capital and the dimensions of causal processes considered. Second, the study uses a longitudinal approach to offer empirical evidence supporting the enduring effect of decision-making logics during early stages of new venture development on long-term innovation performance. Third, the findings suggest that the dimensionality of causal processes is complex as observed in their heterogenous effects on innovativeness, ranging from positive, to negative, to nonsignificant, which highlights the need for researchers to consider the dimensionality of entrepreneurial processes in their research.

2 Literature review

2.1 Entrepreneurial processes and innovativeness

Innovativeness is defined as novelty in products and services, processes, marketing methods, and target market selection (Senyard et al., 2014). To create new and innovative products or services, entrepreneurs adopt different entrepreneurial processes. Sarasvathy’s (2001) seminal work conceptualizes two dichotomous entrepreneurial processes: causation and effectuation. Causation represents an entrepreneurial process that starts with predetermined goals and seeks to identify the means to achieve them. Causation is contrasted with effectuation, defined as the dynamic, interactive, and multi-dimensional approach developed through entrepreneurial expertise that starts with means, as opposed to predetermined goals (Sarasvathy, 2001; Sarasvathy et al., 2008).

Sarasvathy (2001) views causation and effectuation as opposite processes, compared and contrasted along seven categories. First, Sarasvathy argued that in causal processes, effect is a given, while in effectuation processes, only some of the required means and tools are given. Second, with regards to the decision-making criteria, causal processes help entrepreneurs choose between means to achieve a given effect, while effectuation assists entrepreneurs in choosing between possible effects that can be achieved through given means and tools. Third, in terms of competencies, causation is useful in exploiting knowledge, while effectuation is instrumental in exploiting contingencies. Fourth, regarding context of relevance, Sarasvathy considers causation as more ubiquitous in nature in terms of market rivalry and competition, while effectuation is more ubiquitous in human actions. Fifth, in addressing the nature of unknowns, causation focuses on predicting aspects of uncertainties, whereas effectuation generally focuses on controlling aspects that are commonly considered unpredictable. Sixth, the underlying logic of causal processes are described as a belief that future events can be controlled to the extent that entrepreneurs can predict them, while effectuation is based on the logic that entrepreneurs do not need to predict the future, as long as they can control the future to a certain extent. Lastly, the outcome of causation is considered as achieving market share in existing markets through devising competitive strategies, while creating new markets through forming alliances and other types of cooperative strategies is typically with effectuation.

Contrasting Sarasvathy’s conceptualization of effectuation and causation as dichotomies, recent literature views the two approaches as complementary (Alsos et al., 2020; Kerr & Coviello, 2019; Smolka et al., 2018). For instance, Kerr and Coviello (2019) adopt a network driving approach to conceptualize effectuation and suggest a simultaneous and interactional use of effectuation and causation. They argue that effectuation is contingent on the characteristics of pre-existing and emerging networks and the processes that create them. Smolka et al. (2018)’s survey data from 1,453 entrepreneurs finds that ventures benefit from using effectuation and causation logics in tandem.

The link between entrepreneurial processes and innovation are explored in various contexts, including small and medium-sized enterprises (SMEs) (Roach et al., 2016), corporate venturing (Futterer et al., 2018), emerging economies (Lingelbach et al., 2015), corporate entrepreneurship (da Costa & Brettel, 2011), high technology firms (Mthanti & Urban, 2014), and project management (Nguyen et al., 2018). The results are complex and mixed (Berends et al., 2014; Futterer et al., 2018; Roach et al., 2016). For instance, Berends et al. (2014) find that both approaches are used during the product innovation process. However, they find that the efficiency of causation and effectuation vary based on the stage of innovation process, suggesting a temporal effect. Their analysis of 352 events in five small firms reveals that effectuation is used in earlier stages of innovation development, while causation is used in later stages. Further, effectuation results in a product innovation process that is driven by the availability of resources and tends to progress toward tangible outcomes. In contrast, causation is driven by setting objectives and investing in resources to achieve them.

Other research suggests that the combination of entrepreneurial approaches is influenced by resource constraints and industry context (Lingelbach et al., 2015). For instance, Futterer et al. (2018) find that while both effectuation and causation approaches are effective in business model innovation, efficacy is contingent on the context and setting, with effectuation more beneficial in high industry growth settings, and causation more effective in low growth settings. Similar disparities are also observed at the project level where greater levels of effectuation are associated with more innovative R&D projects (Brettel et al., 2012; Nguyen et al., 2018). Brettel et al. (2012) also report that in projects with low levels of innovativeness, causation is more beneficial.

Research reveals varied results across different dimensions of entrepreneurial approaches. For instance, Alzamora-Ruiz et al. (2021) report that effectual logic promotes innovation through only one dimension, namely Leveraging the Unexpected. Additionally, their findings suggest that causation can positively influence innovation through only two of the four dimensions (i.e., Goals and Overcoming the Unexpected). Roach et al. (2016) study the mediating effect of the dimensions of effectuation on the link between innovation orientation and product/service innovation in a sample of SMEs. They find that while Pre-commitment, Experimentation, and Use of Existing Means positively mediate this relationship, the mediating effect of the Affordable Loss dimension is not significant. Lingelbach et al. (2015) report inconsistent emphasis on the role of the dimensions of effectuation on the innovation process in emerging economies as the effect of Flexibility on the innovation process is underemphasized, and the role of Pre-commitment is overemphasized.

2.2 Social capital and innovativeness

Complex exchanges which are often central to innovativeness, such as knowledge transfer, are commonly mobilized by relationships and social interactions among individuals (Granovetter, 1973, 1985; Tsai, 2002). These social relationships manifest in the dimension of social capital (Brehm & Rahn, 1997). Social capital is a multidimensional construct composed of three dimensions, namely structural, relational, and cognitive capital (Nahapiet & Ghoshal, 1998). The structural dimension of social capital is characterized by the properties of the social system and of the relationships within the network, and reflects the connections between people and units. The relational dimension concerns the nature of the relationships members share as a result of historical interactions. The cognitive dimension of social capital involves the resources which contribute to shared representations, interpretations, and systems of meaning of knowledge and information among parties.

Research exploring the relationships between different forms of social capital and innovativeness yields mixed results (e.g., Cuevas-Rodríguez et al., 2014; Nohria & Gulati, 1996; Subramaniam & Youndt, 2005). Studies that find a positive effect of social capital on innovation commonly attribute this to the freedom to transfer knowledge and learning through social interactions (Hansen, 2002; Uzzi & Lancaster, 2003). For instance, Vinarski-Peretz et al. (2011) identify a positive relationship between subjective relational experience and employee engagement in innovative behavior, and Tsai and Ghoshal (1998) find significant relationships between both the structural and relational dimensions of social capital and product innovativeness.

However, studies consistently report significant relationships between the dimensions of social capital and innovativeness. For instance, Nahapiet and Ghoshal (1998) find a U-shaped relationship between structural density and access to new and divergent knowledge, meaning, after a certain threshold, the structural dimension of social capital carries a negative effect on innovativeness. Subramaniam and Youndt (2005) report that while organizational capital positively influenced radical innovative capability, the effect of human capital on radical innovative capability is negative. Other scholars uncover complex relationships between different forms of social capital and innovativeness. For instance, Cuevas-Rodríguez et al. (2014) find that external social capital diminishes the positive effect of internal social capital on the radical product innovation.

The inconsistent findings associated with the link between social capital and innovativeness indicate that these relationships are complex and might be influenced by various factors or contingencies, acting as moderators or mediators. For instance, Carnabuci and Diószegi (2015) find that the relationship between the structural density (defined as the actual number of connections out of all possible connections) of intra-organizational social networks and innovation performance is moderated by employees’ cognitive style (Kilduff & Brass, 2010). Chang et al. (2013) report that work engagement mediates the positive relationship between relational contracts and innovative behavior and the negative relationship between transactional contracts and innovative behavior.

Scholars also examine the impact of social capital on mechanisms central to innovation, such as knowledge transfer. The link between social capital and knowledge transfer is investigated as a central process in addressing uncertainties and lack of information. For instance, Uzzi (1996) argues that social capital is conducive to reducing transactional uncertainty associated with tacit and intangible exchanges. Lin and Lee (2005) explore the cognitive factors that influence knowledge sharing in online communities. The authors find that cognitive factors, such as cognitive trust and cognitive social capital, play a significant role in facilitating knowledge sharing among members of online communities where individuals may not have face-to-face interactions. Furthermore, Alavi and Leidner (2001) highlight the cognitive benefits of knowledge sharing which enhance individual and organizational learning by promoting the acquisition and application of new knowledge. They suggest that knowledge sharing can be particularly beneficial in complex and dynamic environments, where individuals and organizations must constantly adapt to changing circumstances.

The effect of social structures and networks on innovation is explored in times of crisis. For instance, Weick’s (1993) study of the Mann Gulch disaster suggests that under conditions of uncertainty, role structures commonly fail and the underlying social systems take control. Weick shows that performance under high levels of uncertainty is contingent on relying on social mechanisms that promote creativity, such as social support and interactions, real-time knowledge and learning, and the adoption of emergent roles. Similarly, Majchrazak, Jarvenpaa, and Hollingshead (2007) attribute the relative success of emergency response groups to applying mental models that facilitate knowledge coordination during social interactions. Shared understanding of individuals’ distinct knowledge, expertise, and cognitive abilities, as well as the collective whole, is particularly vital to fostering innovation and building effective knowledge networks (Lewis, 2004; DeChurch & Mesmer-Magnus, 2010; Phelps et al., 2012).

In the context of new ventures, research suggests social capital facilitates innovation (Stevenson & Radin, 2009; Slotte-Kock & Coviello, 2010). For instance, Yli‐Renko, Autio & Sapienza(2001) report a link between social capital and knowledge acquisition in high-technology ventures. Others find a positive effect of social capital among founders on growth and expansion of new ventures (Prashantham & Dhanaraj, 2010). Some scholars focus on the attributes and forms of social capital that are most conducive to growth and performance of new ventures. For instance, Han and McKelvey (2008) suggest that forming a moderate number of weak network ties is most conducive to achieving superior performance in technology-based new ventures.

3 Hypotheses development

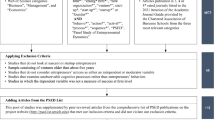

The streams of literature reviewed in the preceding section provide the foundation for the model proposed in this study. The model, as presented in Fig. 1, reflects the direct influence of causal processes on innovativeness, as well as its indirect impact via the moderating effect of social capital. This model demonstrates the interplay between causal processes and social capital in the context of new ventures. To untangle the complexities of this interplay, we explore the moderating effect of social capital across cognitive, structural, and relational dimensions.

3.1 Causal entrepreneurial processes and innovativeness

Effectuation can be beneficial and is more frequently utilized than causal processes in highly innovative projects (Kaartemo et al., 2018; Brettel et al., 2012; Nguyen et al., 2018). The efficiency and utility of causal processes decreases under uncertain conditions, such as earlier stages of innovation development (Berends et al., 2014). However, adopting causal processes during the early stages of new venture development may promote long-term innovation outcomes, considering that the majority of start-up efforts take approximately five years to reach a resolution point (Reynolds & Curtin, 2007). There are several benefits of adopting a causal decision-making approach at early venture stages. First, causal processes are systematic and linear, enabling entrepreneurs to devise a long-term plan to pursue specific innovative solutions and goals. Second, causal approaches provide structured and predictable frameworks for decision-making, which can help founders improve their decisions concerning resource allocation, strategy, and risk management. Such a structure can enable new ventures to successfully develop more innovative outcomes.

As a highly structured approach, causal processes require innovative efforts to follow a linear pattern, where each stage must be completed before moving to the next stage. For instance, innovation requirements must be finalized before design begins, and the design must be complete before implementation begins, and so on. The resulting innovation process is very rigid, leaving little room for flexibility, deviations, or changes. This approach can provide clear milestones which much be achieved at each stage, which helps long-term planning efforts. However, this linear, sequential approach generally requires a long lag time between design, development, and subsequent commercialization. In short, the decision-making approach adopted by new ventures during the early stages of development can significantly impact a venture’s long-term innovative outcomes. Therefore, we expect that adopting a causal decision-making approach during the early stages of venture formation is positively associated with long-term innovativeness:

-

H1: Adoption of causal processes during the early stages of venture formation is positively associated with long-term innovativeness outcomes.

3.2 Interplay between social capital and causation

3.2.1 Cognitive capital

The cognitive dimension of social capital refers to the resources stemming from shared knowledge and information among individuals (Nahapiet and Ghoshal, 1998) . This dimension is particularly important for developing shared mental schemas that compile complementary knowledge and expertise of individuals connected in social contexts. Cognitive capital fosters the development of a shared understanding of the aggregate intellectual capabilities and knowledge of innovation teams (Lewis, 2004). Hollingshead (1998) find that a shared understanding of individuals’ specialization improves innovation outcomes by more effectively organizing and retrieving information. Moreover, shared understandings provide access to a wider range of knowledge. New ventures with high levels of cognitive capital will rely on cognitive maps and schemas to retrieve dispersed knowledge, and can thus leverage more diverse expertise and skillsets to generate innovative solutions. Identifying and utilizing each team member’s unique skills and expertise to create new opportunities and solve problems will lead to more innovative outcomes.

This conducive effect of cognitive capital on innovativeness may be attenuated when new ventures adopt a strong causal approach that predefines the knowledge and expertise needed for a given task. The foundational aspect of the causal entrepreneurial process pertains to “choosing between available means to achieve the given effect” (Sarasvathy, 2001: 251). Thus, the causal process limits the potential benefits of diverse cognitive capital within new ventures by overlooking valuable sources of knowledge or ideas outside of predetermined selection criteria. For instance, when teams define the knowledge and expertise resources required for all project stages at an early phase, these teams are more likely to fail to consider or integrate valuable sources of knowledge or ideas that arise during the development process outside of the predetermined selection criteria. This limited approach to cognitive capital utilization may constrain innovation teams’ potential to leverage diverse expertise and skillsets to generate innovative solutions, thus impeding the development of innovative outcomes. In short, because the causal process predefines knowledge and expertise needed for a given task, causation may inhibit the full potential of a new venture’s cognitive capital to develop innovations at later venture stages:

-

H2: Adoption of causal decision-making during the early stages of venture formation negatively moderates the effect of cognitive capital on long-term innovativeness outcome.

3.2.2 Structural capital

The structural dimension of social capital concerns the properties of the social ties and connectedness among individuals (Nahapiet and Ghoshal, 1998). In the context of new ventures, structural capital is established at early stages by the formal and informal introductions among founders and key members involved in venture development and growth. Overtime, structural capital becomes crucial to flexible and dynamic flows of information, which enables new ventures to access, integrate, and coordinate diverse resources, knowledge, and expertise in a fluid and agile manner. Structural capital enables organic coordination of individual contributions and productive workflows and collaborative behavior (Austin, 2003). New ventures with more developed social connections can leverage the benefits of ad-hoc access to information and insights, leading to expedited and enriched innovation.

In new ventures that adopt the causal entrepreneurial process, knowledge, and information flow and integration will follow pathways that were deliberately designed in the venture’s early stages (Berends et al., 2014; Hirst et al., 2011; Ibarra, 1992). These preplanned designs and structures tend to be static, inflexible, and rigid. Such rigid designs inhibit the ability of social structures to evolve organically overtime, thus limiting the long-run benefits of structural capital on innovativeness. Causal processes adopted at the venture’s founding stage can predetermine the flow of information based on the organizational chart and reporting orders established during venture formation. Relying on these pre-planned rigid designs can limit the potential for ad-hoc access to information and insights through social structures that emerge and develop over time. In short, the static design of information flows resulting from causal processes can impede the benefits of the flexible nature of structural capital during subsequent innovation processes.

-

H3: Adoption of causal decision-making during the early stages of venture formation negatively moderates the effect of structural capital on long-term innovativeness outcome.

3.2.3 Relational capital

The relational dimension of social capital concerns the kinds of personal relationships individuals have with each other, and the nature of the resources which form from them, such as trust, respect, and friendships (Nahapiet & Ghoshal, 1998). In the early stages of new venture development, relational capital is largely based on preexisting relationships among founders and key members. However, overtime, this form of capital is shaped by the ongoing interactions among individuals engaged in the new venture.

Relational capital developed among members in new ventures facilitates the distribution of tasks based on shared understanding, familiarity, and trust in group members' expertise (Jung et al., 2017). The credibility of individuals’ knowledge and contributions are established as they freely interact and explore the range and accuracy of each other's knowledge and capabilities (Lewis, 2004). Vinarski-Peretz et al. (2011) find a positive relationship between subjective relational experience, in terms of positive regard, mutuality, vitality, and engagement in innovative behaviors. Tsai and Ghoshal (1998) attribute the positive effect of relational capital on product innovativeness to facilitating the distribution of tasks and activities central to the innovation process. In short, relational capital can help build trust and shared values among individuals, which are important factors in promoting open communication and idea-sharing. Ultimately, the cultivation of relational capital can lead to the development of a supportive and dynamic environment that fosters innovation behaviors.

The causal entrepreneurial process, on the other hand, often involves clarifying divisions of labor and establishing processes and procedures, which can help set clear expectations and roles for team members. As a result, causal processes can foster greater trust and cooperation among team members and reduce conflicts that can hinder innovation in the long run. Additionally, causal processes can establish a more systematic approach to innovation by providing clear, mutually agreeable guidelines and processes for idea generation, evaluation, and implementation. This can reinforce positive team norms and dynamics in addition to ensuring that all team members are working towards a common goal.

Division of labor and defining the roles and responsibilities of team members typically occur during the planning phase, which involves gathering requirements and defining the scope of the innovation process. Once roles are assigned, deliverables are divided into smaller, more manageable components, assigned to a specific team members. By defining roles and responsibilities and breaking the work into smaller tasks at early stages, causal processes can ensure that conflict is minimized and team members are working towards a common goal. Establishing common goals improve social cohesion and, by extension, the impact of shared values of relational capital on innovation process. In short, defining roles and goals within innovation teams through causal processes can enhance the benefits derived from shared values of relational capital during the innovation process.

-

H4: Adoption of causal decision-making during the early stages of venture formation positively moderates the effect of relational capital on long-term innovativeness outcome.

4 Methods

4.1 Research setting and sample

To test the proposed hypotheses, this study utilizes data from the second Panel Study of Entrepreneurial Dynamics (PSED II) which consists of responses from 1,214 entrepreneurs about their new ventures in the U.S. from 2006 to 2011. New ventures were selected as a context that represents high tendency for innovativeness. All participants were identified before they launched their ventures, and thus, all ventures in the sample were at the same stage of development. The PSED protocol features extensive field testing and several screening procedures to ensure data reliability and validity, which includes conducting a detailed interview shortly after the initial screening (Reynolds, 2000; Reynolds et al., 2016). The nascent entrepreneurs were tracked annually through gestation, launch, and further growth or death of their venture. The dataset includes information about the ventures (self-reported by one of founders) and three categories of actors in new ventures: founders, non-founder key members, and helpers. PSED has been utilized to represent: (a) founders of startups or (b) startups, located by sampling founders (Reynolds, 2000). This study is founded based on the later interpretation to analyze new ventures as reported and located by sampling founders.

We selected new ventures as the context of our study for three reasons. First, due to the advantage of newness, new ventures are a more suitable context for investigating innovation than established firms (Eisenhardt & Martin, 2000; Hitt et al., 2001). Second, due to their resource constraints relative to established firms, new ventures can more clearly reveal the implications of causal processes in terms of specifying and prioritizing resources. Third, new ventures and founding teams’ flat structures lead to more pronounced social cohesion and connections indicative of social capital (Hansen, 2002).

4.2 Analysis

This study examines the effect of causal entrepreneurial processes during the early stages of a venture’s development on its long-term innovativeness. Hierarchical linear regression analysis separates the effects associated with control variables, independent variables, and interaction terms. Full and partial models examine the direct and interaction effects of social capital and causation on innovativeness. To treat missing values in the dataset, we used the linear trend at point method.

In addition to analyzing interaction terms in regression models, we further investigate the moderation effect with Process Macro, a versatile computational tool for observed variable mediation, moderation, and conditional process modeling. Developed by Andrew F. Hayes, Process Macro provides several indices to assess the strength and significance of moderation effects, such as the interaction effect coefficient, simple slopes, and Johnson-Neyman technique. This technique calculates the range of the moderator variable where the effect of the independent variable on the dependent variable is significant, and provides a graph to visualize these results.

To examine the effect of causal processes during the early stages of venture development on long-term innovativeness, we utilized a five-year lag. This approach was chosen because most start-ups require five years to reach a resolution point, eventually growing into new firms or failing (Reynold, 2007). Thus, we examined the independent and control variables in year one (2006), and the dependent variables in year five (2011), which also helped establish causality and mitigate the threat of common source bias (Spector, 2006). The temporal sequence between variables strengthens our ability to establish causality, and examines the effect of causal processes on long-term innovativeness while controlling for other factors that could influence the results.

4.3 Measures

4.3.1 Dependent variable

To comprehensively capture the nuances of innovation, this study employs the concept of Innovativeness, which encompasses novelty in products and services, processes, marketing strategies, and target market selection (Senyard et al., 2014). We identified four items in PSED II that best correspond to various facets of innovativeness (Table 7 in the Appendix). Conducting an exploratory factor analysis (EFA) followed by a confirmatory analysis (CFA) on these items resulted in a single dimension, as presented in Table 1. The dependent variable, Innovativeness, is uni-dimensional. We used the factor score, obtained through the coefficient analysis, as the dependent variable in the regression models.

We conducted several tests to ensure the robustness of this measure. The KMO measure was well above 0.70 (i.e., 0.727 to 0.754), which is commonly considered typical (Stewart, 1981), confirming the appropriateness of the matrix for factoring. Bartlett’s test statistic is significant (p < 0.000), suggesting that the correlation matrix is not orthogonal, thus further confirming appropriateness for factoring. Lastly, Cronbach’s alpha (0.774) is well above the cutoff point of 0.5 for scales with less than ten items, which suggests reasonable internal consistency. To further validate the results of EFA, we replicated the analyses on sample data of four previous years from 2007 to 2010 (see Table 1) which resulted in the same number of dimensions (uni-dimensional) with similar item loadings, suggesting the robustness of the obtained factor score.

The CFA results, conducted using SPSS AMOS, also indicated an acceptable model fit (see Table 1). CMIN/DF (normed/relative Chi-Square) is well below 5.00, indicating a reasonable model fit (Marsh & Hocevar, 1985). The p-value of CMIN/DF is 0.046, which is slightly below the cut-off point of 0.05 suggested for an acceptable fit (Jöreskog & Sörbom, 1996). However, in large samples, such as in this study, the p-value tends to be relatively small. To further ensure an acceptable model fit, we used several other measures. Comparative fit index (CFI) is greater than 0.95, indicating an excellent fit (West, Taylor & Wu, 2012). Other incremental fit measures (i.e., IFI and TLI) are well above the minimum advised cut-off of 0.90. Additionally, the Root Mean Square Error of Approximation (RMSEA) is below 0.05, suggesting excellent fit (MacCallum, Browne & Sugawara, 1996). Lastly, PCLOSE is well above 0.5, further confirming model fit. Figure 2 provides a Path diagram of CFA on items representing innovativeness. Overall, EFA and CFA metrics support the validity and reliability of the factors. Taken together, the results of robustness checks in EFA, CFA, and replication analysis confirm the validity of the factor score used as the dependent variable Innovativeness in regression analysis.

4.3.2 Independent variables

This section discusses operationalizations of the Causation construct and three dimensions of social capital: Relational, Cognitive, and Structural.

Causation

Causation is not consistently operationalized across the literature. For instance, in contrast to Sarasvathy’s original conceptualization, Chandler et al. (2011) argue for uni-dimensionality of causation. Chandler et al. (2011) develop a formative measure of effectuation composed of three independent subdimensions: (a) experimentation, (b) affordable loss, and (c) flexibility, and one subdimension of pre-commitment which overlaps with causation. Their measure is criticized for weak representation of the original theoretical constructs conceptualized by Sarasvathy (2001) and low correlations among the effectuation components. Brettel et al. (2012) use forced-choice items to measure the four contrasting dimensions of causation (i.e., goal-driven, expected returns, competitive market analysis and overcoming the unexpected) and effectuation (i.e., means-driven, affordable loss, partnerships, and acknowledging the unexpected).

Overall, studies on effectuation and causation tend to adopt various methodological approaches. As McKelvie et al. (2020) observes in their sample of studies that use multi-item measures, five followed Brettel et al. (2012), 11 used the Chandler et al. (2011) measures, and six developed new measures. Exacerbating this inconsistency, some newly developed measures follow Sarasvathy’s original conceptualization, while others develop context-driven proxies that are conceptually-distanced from the effectuation/causation literature (e.g., Jisr & Maamari, 2017). More recent studies tend to fall somewhere in the middle of this spectrum by adjusting the existing measures to the context of their research (Blauth, Mauer & Brettel, 2014; Appelhoff et al., 2016).

This study follows the most recommended approach to operationalize the construct of Causation as a multidimensional construct with distinct characteristics. We drew on Sarasvathy’s (2001) seminal work which characterized causation using seven facets of entrepreneurial processes: (1) Underlying Logic: Prediction; (2) Decision-making Selection Criteria: Expected Return; (3) Outcomes: Market Share; (4) Context of Relevance: Ubiquitous in Nature; (5) Competencies Employed: Exploiting Knowledge; (6) Nature of Unknowns: Committing to Risk; and (7) Givens: Effect (see Appendix Table 5). Table 2 reveals EFA and CFA of the seven items from the first wave of the panel data, resulting in three robust dimensions of causation which we interpreted relative to the most common measures currently used in this literature.

The first dimension comprises three items: (a) Logic of prediction, (b) Expected return, and (c) Market share (strategies). Although Brettel et al. (2012) use two separate dimensions of competitive analysis and expected return, in our study, the high correction between comparable items (i.e., Expected return and Market share) can be justified by the fact that new ventures conduct both in their business plans. Considering this fact and taking into account the third item representing logic of prediction, we interpret the first dimension as Planning.

The second dimension comprises two items: (a) Ubiquitous nature, and (b) Exploiting knowledge. These items suggest avoiding uncertainties by relying on existing knowledge and established markets. This dimension would be equivalent to one of the dimensions in Brettel et al. (2012): Overcoming the unexpected. However, because our data was taken at the very early phase of venture formation, these two items in our measure are representative of avoiding unexpected situations rather than overcoming them. Taken together, we interpret the second dimension as Avoiding the Unexpected.

The third dimension constitutes two items: (a) Committing to risk, and (b) Given effect, which suggest an aptitude to prioritizing goals and pursuing them despite associated risk. Brettel et al. (2012) posits a conceptually similar dimension described as goal-driven. Others adapt this dimension under similar terminologies such as goal-orientation (Appelhoff et al., 2016). In our study, this dimension reflects venture’s commitment to specific effect at early stages of formation. Thus, we interpret the third dimension as Goal Commitment.

We used the factor scores, obtained through the coefficient analysis, as dependent variables in the regression models. To ensure the reliability and validity of these scores, we conducted a number of tests, including EFA and CFA metric evaluation and subsample testing. The KMO measure of 0.573 is considered acceptable (Stewart, 981), confirming the appropriateness of the matrix for the factoring process. Further, the Bartlett’s test statistic is significant (p < 0.000), suggesting that the correlation matrix is not orthogonal, and thus appropriate for factoring. Cronbach’s alpha (0.676) is above the cutoff point of 0.5 for scales with less than ten items, thus suggesting reasonable internal consistency. We further validated the dimensions reached in the EFA. Because the items used in this EFA were only available in the first year of panel data, we replicated the analyses on a random subsample (fifty percent) of data (see Table 7). This validation confirmed the robustness of the obtained scores to be used as dimensions of causation in the regressions. Dimensions presented in EFA results were extracted based on their eigenvalues. We use Varimax rotation to facilitate interpretability of dimensions.

The CFA results indicated acceptable model fit, as demonstrated in Table 2. CMIN/DF (normed/relative Chi-Square) is well below 3.00, indicating good model fit (Marsh & Hocevar, 1985). The p-value of CMIN/DF is well above the minimum cut-off point of 0.05 (Jöreskog & Sörbom1996). CFI is greater than 0.95, indicating an excellent fit (West, Taylor & Wu 2012). Other incremental fit measures (i.e., IFI and TLI) are well above the minimum advised cut-off of 0.90. RMSEA is below 0.05, suggesting excellent fit (MacCallum, Browne & Sugawara, 1996). Lastly, PCLOSE is well above 0.5, further confirming model fit. Figure 3 presents the path diagram of CFA on Causation.

Path diagram of CFA on seven items based on Sarasvathy (2001) framework

Dimensions of Social Capital

As the contextual complement to human capital (Coleman, 1988), social capital is commonly operationalized based on study context, which in our case is new venture teams and innovativeness. Social capital as a form of intangible assets is difficult to measure objectively, and thus is commonly measured using proxy metrics and perceptual measures (Kannan & Aulbur, 2004). Consistent with common practice, we used proxies that best reflect the purpose and context of this study (Fukuyama, 2001). We selected our measures from the PSED II by reviewing existing research that examines the role of social capital in driving the entrepreneurial process (Bosma et al., 2004; Brüderl & Preisendorfer, 1998; Davidsson & Honig, 2003; Stam, Arzlanian & Elfring, 2014; Hormiga, Batista‐Canino, & Sánchez‐Medina, 2011; Alomani et al., 2022). As such, relational, cognitive, and structural capital were operationalized by measuring mechanisms that drive social interactions, collaboration, and knowledge sharing.

Cognitive Capital

Cognitive capital is concerned with intangible shared assets such as tacit and explicit knowledge, skills, and capabilities that individuals and organizations possess. Cognitive capital is a byproduct of information dissemination activities and events. As Alomani et al. (2022) note “there is no established agreement among scholars of what constitutes cognitive capital.” As a result, they choose items from PSED-I that best serve the context of their study. Similarly, measuring cognitive capital in our study can prove challenging because it is difficult to determine what knowledge and information is shared among individuals in new venture teams. Thus, we examine mechanisms and processes that facilitate knowledge sharing, as well as integrating knowledge and information from various sources. PSED II asks about whether members in the new venture team engage in such mechanisms, including dispersion of information among members, and training and advising others in the venture. In short, we operationalize the cognitive dimension of social capital as a summative measure representing total number of members involved in dispersion of information among members, training, and advising.

Structural Capital

Structural capital is a byproduct of connectedness among individuals, which supports the effective functioning of networks. In the context of new ventures, structural capital is established at early stages by means of the formal and informal introductions among founders and key members involved in venture development and growth. Measuring structural capital can be challenging in new venture teams, but one approach is to examine mechanisms responsible for connecting disparate groups or individuals (Haas & Hansen, 2007). The primary mechanism that facilitates connections and exchanges between actors in a social network is referred to as brokering (Burt, 2000; Brass, 1984; Obstfeld, 2005). Brokering can provide valuable insights into the dynamics of structural capital within an organization or network. It can be a useful tool for understanding how communication and collaboration are facilitated within an organization, and for identifying opportunities for improvement. By measuring the extent to which brokering occurs, we can gain insights into the level of structural capital and the effectiveness of existing structures and processes. PSED II asks about whether members in the new venture teams engage in such mechanisms by making introductions and creating connections. We operationalize the cognitive dimension of social capital as a summative measure representing the total number of members actively creating social connections by making introductions linking individuals involved in developing new ventures.

Relational Capital

Relational capital is an intangible asset which is a byproduct of interactions among individuals, resulting in connections and relationships that exist amongst different social groups or individuals. These relationships facilitate flows of information, resources, and ideas amongst groups and individuals and enables accessing new knowledge or resources (Lin, 1999). In early stages of new venture development, relational capital is largely attributed to preexisting relationships among founders and key members. Overtime, this form of capital is shaped by the interactions among individuals engaged in the new venture. Measuring the quality and strength of social ties offers insights into the level of relational capital that exists within a particular network, and by extension, connections and exchanges between individuals and groups that help access valuable resources and opportunities. This can be useful for understanding the dynamics of social networks within a particular community or team. In early stages of new venture development, relational capital mainly reflects preexisting relationships among founders and key members.

Therefore, our study operationalized the relational dimension based on the strength of ties among individuals involved in development of new ventures. Measuring strength of ties depends on the context of the study. For instance, Hormiga et al. (2011) operationalize relational capital as the number of hours per week dedicated to establishing and maintaining network of relations. PSED II categorizes individuals involved in developing a new venture into three groups: owners, non-owner key members, and helpers. The questionnaire also asks about relationships amongst members in eight categories: spouses, partners sharing a household, relatives living in the same household, relatives living in different households, friends or acquaintances from work, friends or acquaintances you have not worked with, strangers before joining the new business teams, and partners living in different households. We coded these categories based on the degree of familiarity in relationships among all three categories of members involved in developing new ventures (i.e., owners, key members, and helpers). In our study degree of familiarity refers to the history, past experience, and level of commitment of the ties among these members. We calculated this degree as the summative measure based on the nature of relationships among members. For instance, the category of spouses involved in developing new ventures indicated the highest level of relational capital, while the category of strangers who met by virtue of the new venture formation represented the lowest level of relational capital. The scores obtained through this method for each relationship were added to create a summative measure of relational capital for ventures.

4.3.3 Control variables

Our study controlled for the effect of variables that can impact innovativeness in new ventures, including firm-level, customer network-level, industry-level, and environmental level. We controlled for factors associated with human capital, such as education and experience, as existing studies show the potential impact of human capital on innovation outcome (Kianto et al., 2017). Further, we controlled for new venture engagement with potential customers as a source of generating social capital outside the boundaries of the venture. Customer engagement, as the cornerstone of lean startups and processes, has a conducive effect on innovation (Ho et al., 2020). We also controlled for industry effects using NAICS codes. Lastly, we controlled for the impact of creating a supportive environment for innovation, which can foster creativity and subsequently improve innovation outcomes (Abbey & Dickson, 1983). In short, our decision to include certain variables in the regression models was informed by existing literature and statistical tests such as maximum likelihood test. For instance, we excluded variables that caused high levels of multicollinearity.

At the firm level, we controlled for Size, Education, Industry experience, Entrepreneurship experience, and Innovation motivation. We operationalized the Size as the total number of individuals involved in the new venture, including founders, non-founder key members, helpers, part-time, and full-time employees. Education is the total years of education of key members (i.e., individuals who make a distinctive contribution to the founding of the venture, through involvement in planning, development, financial resources, materials, training, or business services). Industry experience is total years of experience of founders in the industry related to the new venture. Entrepreneurship experience is the total number of businesses owned by founders in the past. Innovation motivation is a dummy variable representing whether the decision to start the business was motivated by the desire to be creative. Innovation climate is a categorical variable that represents the degree to which social norms encourage creativity and innovation in the environment, based on a 5-point scale. We also controlled for new venture engagement with potential customers with Customer involvement, a categorical variable representing whether discussions with potential customers have been initiated or will be initiated in the future. To control for Industry effects, we created seventeen categories based on NAICS codes.

5 Results

Table 3 presents the descriptive statistics and bi-variant correlations for the relevant variables. On average, each new venture has 4.19 employees, and key members have approximately 19 years of education and 14 years of industry experience. Table 3 demonstrates a negative and significant (p < 0.01) correlation between the Avoiding the Unexpected dimension of causation and Innovativeness. The Planning dimension of causation, correlates positively (p < 0.01), but not as significantly, with Innovativeness. The Goal Commitment dimension of causation shows a negative insignificant relationship with Innovativeness. Table 4 presents full and partial model results of hierarchical regression analyses that examine: (a) the direct effect of dimensions of causation on Innovativeness and, (b) the interaction effects of dimensions of causation and social capital on Innovativeness. The moderation effects were further tested using Process Macro computational tool. We conducted statistical analyses to confirm various assumptions of regression. For instance, we rejected the threat of multicollinearity since the Variance Inflation Factors (VIF) in all models were below 4.00 and tolerance scores were above 0.25.

In supporting the effect of adopting causal approach in early stages of venture formation on long-term Innovativeness for hypothesis 1, as demonstrated in Model 2 in Table 4, the result for Planning is positive and significant (p < 0.01). The results for the Avoiding the Unexpected, in contrast, suggest a negative and significant (p < 0.01) effect, contradicting hypothesis 1. The results for Goal Commitment is not significant, failing to support hypothesis 1. These findings remain consistent in Model 3, which indicate the robustness of analysis. Overall, we find: (a) a significant positive effect associated with Planning; (b) a significant negative effect of Avoiding the Unexpected, and (c) no effect with Goal Commitment, thus, partially supporting hypothesis 1.

Our moderation effect tests of the three dimensions of causation on the relationship between Innovativeness and dimensions of social capital identify two significant results: (a) the interaction between Cognitive capital and Goal Commitment is negative and significant (p < 0.05), supporting hypothesis 2, and (b) the interaction between Relational capital and Avoiding the Unexpected is positive and significant (p < 0.01), supporting hypothesis 4. The interaction terms between Structural capital and the dimensions of causation are not significant, failing to support hypothesis 3. We further tested the moderation effect using the Process Macro computational tool, further verifying the moderation effect of Avoiding the Uncertainty on the relationship between Relational capital and Innovativeness. However, the Process model results do not support for the moderation effect of Goal Commitment on the relationship between Cognitive capital and Innovativeness, suggesting the weakness of effect observed in the regression model.

In short, the overall results offer partial support for the positive effect of Planning on Innovativeness, as proposed in hypothesis 1. Interestingly, we also found the significant negative effect of the Avoiding the Unexpected on Innovativeness, which suggests the long-term effect of causation on innovation can be more complex than previously thought. The results suggest weak support for the negative moderation effect of Goal Commitment on the link between Cognitive capital and Innovativeness, proposed in hypothesis 2. The results also suggest support for the positive moderation effect of Avoiding the Unexpected on the link between Relational capital and Innovativeness, as proposed in hypothesis 4. Our study found partial support for hypotheses 1 and 4, weak partial support for hypothesis 2, and no support for hypothesis 3.

6 Discussion

Our results suggest that the direct and moderating effect of causation on new venture innovativeness is complex in terms of dimensions, context, and measures. As discussed earlier, existing research suggests varying degrees of the influence of causation and effectuation on innovativeness. For instance, causation utility decreases in uncertain conditions, such as earlier stages of innovation development (Berends et al., 2014). Interestingly, while the literature overlooks the potential for both positive and negative effects of adopting causal approach at early-stages of venture formation on long-term innovativeness outcomes, our findings suggest that dimensions of causations have mixed effects on Innovativeness, ranging from positive (Planning), to negative (Avoiding the Unexpected) to no effect (Goal Commitment).

Supporting the adverse effect of causation on Innovativeness, we find a strong negative effect associated with the Avoiding the Unexpected dimension, which can be explained by the logic that relying on existing opportunities and competencies, as opposed to creating new ones, can reduce the subsequent degree of novelty in products and services. This reasoning and finding confirms theoretical arguments that suggest over-reliance on exploiting knowledge and resources rather than contingencies commonly attributed to causation (Sarasvathy, 2001), can inhibit the creation of novel opportunities, and by extension, innovation.

The significant positive relationship between Planning and Innovativeness may suggest the benefit of analytical approaches, such as market analysis, which strengthen the outcomes associated with capturing value and profiting from innovation (Pisano, 2006; Teece, 2007). This justification is consistent with existing research that suggests a temporal effect of entrepreneurial approaches, where the positive influence of causation strengthens at later stages of innovation. Interestingly, we did not find a significant effect associated with the Goal Commitment dimension, which could suggest that a disposition towards focusing on predictable aspects of the future in the causal approach is inconsequential for innovation. Collectively, these findings suggest the need for a better understanding of the nuances of innovation outcomes associated with various facets of causation, which is especially important as the literature in this area tends to assume a homogenous effect across dimensions of entrepreneurial process (Sarasvathy et al., 2008).

The support for the negative moderating effect of the Goal Commitment dimension on Cognitive capital may confirm that a focus on the effect or goal as opposed to means associated with causation can reduce new ventures’ reliance on cognitive capital in order to innovate. This is due to the fact that in the causal approach, the collection and integration of knowledge follows a predetermined approach based on objectives instead of relying on the development of cognitive maps and schemas to retrieve dispersed knowledge. It is important to note that we operationalized Cognitive capital using activities for dispersion of information, training, and advising other members. This measure suggests a reliance on existing knowledge, as opposed to efforts to create new knowledge, which may lower the degree of novelty in new venture products and services. Subsequently, future research may not only dissect the effects associated with various dimensions of social capital, but also consider the effects on both types of radical and incremental innovation to capture the nuances associated with the level of novelty.

Further, the support for the positive moderation effect of the Avoiding the Unexpected dimension on Relational capital, although weak, suggests that defining roles and processes at early stages in order to exploit knowledge can improve the conducive effect of trust and cohesion on innovation outcome in the long run. The temporality of this effect is noteworthy, as conflicts often arise over time. However, early safeguards such as clarifying roles and norms can help minimize them. In other words, the potential positive moderating effect of the Avoiding the Unexpected dimension of causation on the link between Relational capital and Innovativeness may suggest that relying on exploiting knowledge to discover opportunities and markets can improve the reliance on relational experiences and trust among venture members in order to innovate. Unlike the moderating effect on Cognitive capital, entrepreneurs who adopt the causal approach may benefit from the flexibility of social structures (Structural capital) that guide collaboration and flow of the innovation process in an ad hoc manner (Berends et al., 2014).

Lastly, the insignificant results in this study reveal gaps in our understanding of the entrepreneurial approaches, their dimensionality, and interaction with other constructs. Future researchers can explore the relationships that, contrary to the theoretical assumptions, were not supported by the data, and then design future studies to address these gaps. For instance, the impact of causation on innovativeness may vary over the life cycle of new ventures. This suggests that having a predetermined product idea and acquiring the means to create the product (i.e., Goal Commitment) may affect early stage innovativeness, but become inconsequential in later venture stages, which was the outcome of interest in our study. Conversely, in later stages, overall innovativeness can benefit from deliberation and analytical learning related to activities such as market analysis (i.e., Avoiding the Unexpected), because these stages are commonly focused on capturing value and profiting from innovation (Teece, 2007; Pisano, 2006). This temporal effect suggests the importance of understanding the effect of entrepreneurial processes in different stages of venture development. From a broader perspective, future studies should investigate complexities associated with varying dimensions and periods in order to better explain the effect of causation on innovation.

7 Conclusion

Innovation is critical to the success of new ventures, and entrepreneurs rely on their decision-making to create new products or services. The use of the causal logic, which involves predetermined decision-making processes, promotes innovation at later stages of development— although research suggests that its utility suffers at early stages (Berends et al., 2014). However, social interactions and flexible mechanisms also foster innovation, and this paradox highlights the complex nature of factors that contribute to innovation (Carnabuci and Diószegi, 2015). Existing research largely focuses on the direct effect of causation on innovation, disregarding the indirect effect of other antecedents on innovation. Additionally, the longitudinal effect of causal logic on innovation outcome in new ventures is yet to be fully understood. To address these gaps, we investigated how adopting causation at early stages of venture development can impact long-term innovation outcome directly and indirectly through its interaction with social capital.

This study provides valuable insights into the relationship between entrepreneurial processes, social capital, and innovativeness. We fill existing literature gaps by examining the moderating effect of causation on the relationship between social capital and innovativeness, and by investigating this relationship longitudinally. We offer insights on both the enduring conducive and adverse effect of causal approaches (Sarasvathy, 2001) on innovativeness in new ventures (Pildes, 1996). Our findings suggest that the dimensionality of causation is complex as presented in the heterogenous effects of dimensions of causation on innovation, ranging from positive, to negative, to nonsignificant effects. Second, we offer insights on the complex indirect effect of causal approaches on innovativeness in new ventures. Moreover, this study provides empirical evidence supporting the temporal effect of decision making by showing how adopting causal approach in early venture stages affects long-term innovation outcome. Finally, our findings offer practical implications for new venture founders and investors regarding strategies for fostering innovation through understanding the interplay of causation and social capital.

Despite these contributions, we acknowledge some limitations. This study utilized archival data, self-reported by founders of new ventures. There are methodological and conceptual issues stemming from the ambiguity surrounding whether the PSED data represents founders of startups or startups, located by sampling founders (Reynolds, 2000). In this study, these challenges were most pronounced in operationalizing two measures of causation and social capital. Self-reported survey responses to evaluate entrepreneurs’ logic in adopting entrepreneurial approaches may be subject to response bias. On the other hand, self-reporting information about dimensions of social capital, such as relational, is prone to confirmation bias, as an entrepreneur’s responses may be influenced by personal beliefs and values.

The selected dataset was collected at a time of major global crisis, which as an externality may impact the innovation outcomes beyond the factors included in this study. Subsequently, this limitation may affect the generalizability of the findings to other timelines. Consequently, future studies should use cross-sectional analyses of more recent datasets to improve generalizability. Additionally, the dataset constitutes a sample of U.S. new ventures, which could limit the generalizability to other countries. Future studies should explore the impact of causation on innovation in new ventures using samples from various countries and cultures.

With regards to directions for future research, as briefly discussed earlier, the direct and moderation effects associated with various dimensions of causation should be further investigated to better understand why the results obtained in this study differed across the causation dimensions. Further, there may be temporal effects of the impact of the causation approach on innovativeness, suggesting the importance of better understanding the venture-level outcome associated with entrepreneurial processes in different stages of new venture development. Future studies should explore the impact of causation on innovativeness over new venture life cycles.

Furthermore, future studies should dissect the effects associated with social capital and causations on different forms of innovation, such as radical and incremental innovations. Researchers can then further investigate complexities associated with varying effects across dimensions and overtime to better explain the effect of entrepreneurial process on innovation. Lastly, our study focuses on the direct and indirect effects of adopting causation by venture founders on innovation outcomes, while controlling for the effect of variables that can impact innovativeness in new ventures in multitudes of levels including firm-level, customer network-level, industry-level, and environmental level. Future studies should explore and control for other potential factors such as technological and market conditions, and the regulatory environment.

References

Abbey, A., & Dickson, J. W. (1983). R&D work climate and innovation in semiconductors. Academy of Management Journal, 26(2), 362–368. https://doi.org/10.2307/255984

Adler, P. S., & Kwon, S. W. (2002). Social capital: Prospects for a new concept. Academy of Management Review, 27(1), 17–40. https://doi.org/10.5465/amr.2002.5922314

Alavi, M., & Leidner, D. E. (2001). Knowledge management and knowledge management systems: Conceptual foundations and research issues. MIS Quarterly, 25(1), 107–136. https://doi.org/10.2307/3250961

Alomani, A., Baptista, R., & Athreye, S. S. (2022). The interplay between human, social and cognitive resources of nascent entrepreneurs. Small Business Economics, 59(1), 1–26. https://doi.org/10.1007/s11187-022-00539-8

Alsos, G. A., Clausen, T. H., Mauer, R., Read, S., & Sarasvathy, S. D. (2020). Effectual exchange: From entrepreneurship to the disciplines and beyond. Small Business Economics, 54(3), 1–15. https://doi.org/10.1007/s11187-018-0030-5

Alvarez, S. A., & Barney, J. B. (2007). Discovery and creation: Alternative theories of entrepreneurial action. Strategic Entrepreneurship Journal, 1(1–2), 11–26. https://doi.org/10.1002/sej.4

Alzamora-Ruiz, J., Fuentes-Fuentes, M. D. M., & Martinez-Fiestas, M. (2021). Effectuation or causation to promote innovation in technology-based SMEs? The effects of strategic decision-making logics. Technology Analysis & Strategic Management, 33(7), 797–812. https://doi.org/10.1080/09537325.2020.1740985

Appelhoff, D., Mauer, R., Collewaert, V., & Brettel, M. (2016). The conflict potential of the entrepreneur’s decision-making style in the entrepreneur-investor relationship. International Entrepreneurship and Management Journal, 12, 601–623. https://doi.org/10.1007/s11365-015-0357-4

Austin, J. R. (2003). Transactive memory in organizational groups: The effects of content, consensus, specialization, and accuracy on group performance. Journal of Applied Psychology. 88(5): 866–878. https://psycnet.apa.org/doi/https://doi.org/10.1037/0021-9010.88.5.866

Berends, H., Jelinek, M., Reymen, I., & Stultiëns, R. (2014). Product innovation processes in small firms: Combining entrepreneurial effectuation and managerial causation. Journal of Product Innovation Management, 31(3), 616–635. https://doi.org/10.1111/jpim.12117

Blauth, M., Mauer, R., & Brettel, M. (2014). Fostering creativity in new product development through entrepreneurial decision making. Creativity and Innovation Management, 23(4), 495–509. https://doi.org/10.1111/caim.12094

Bosma, N., Van Praag, M., Thurik, R., & De Wit, G. (2004). The value of human and social capital investments for the business performance of startups. Small Business Economics, 23, 227–236. https://doi.org/10.1023/B:SBEJ.0000032032.21192.72

Brass, D. J. (1984). Being in the right place: A structural analysis of individual influence in an organization. Administrative Science Quarterly, 518–539. https://doi.org/10.2307/2392937

Brehm, J., & Rahn, W. (1997). Individual-level evidence for the causes and consequences of social capital. American Journal of Political Science, 41(3), 999–1023. https://doi.org/10.2307/2111684

Brettel, M., Mauer, R., Engelen, A., & Küpper, D. (2012). Corporate effectuation: Entrepreneurial action and its impact on R&D project performance. Journal of Business Venturing, 27(2), 167–184. https://doi.org/10.1016/j.jbusvent.2011.01.001

Brüderl, J., & Preisendörfer, P. (1998). Network support and the success of newly founded business. Small Business Economics, 10, 213–225. https://doi.org/10.1023/A:1007997102930

Burt, R. S. (2000). The network structure of social capital. Research in Organizational Behavior, 22, 345–423. https://doi.org/10.1016/S0191-3085(00)22009-1

Carnabuci, G., & Diószegi, B. (2015). Social networks, cognitive style, and innovative performance: A contingency perspective. Academy of Management Journal, 58(3), 881–905. https://doi.org/10.5465/amj.2013.1042

Chandler, G. N., DeTienne, D. R., McKelvie, A., & Mumford, T. V. (2011). Causation and effectuation processes: A validation study. Journal of Business Venturing, 26(3), 375–390. https://doi.org/10.1016/j.jbusvent.2009.10.006

Chang, H. T., Hsu, H. M., Liou, J. W., & Tsai, C. T. (2013). Psychological contracts and innovative behavior: A moderated path analysis of work engagement and job resources. Journal of Applied Social Psychology, 43(10), 2120–2135. https://doi.org/10.1111/jasp.12165

Coleman, J.S. (1988). Social capital in the creation of human capital. American Journal of Sociology, 94 (S): 95-120. http://www.jstor.org/stable/2780243. Accessed 03-06-2024

Cuevas-Rodríguez, G., Cabello-Medina, C., & Carmona-Lavado, A. (2014). Internal and external social capital for radical product innovation: Do they always work well together? British Journal of Management, 25(2), 266–284. https://doi.org/10.1111/1467-8551.12002

da Costa, A. F., & Brettel, M. (2011). Employee effectuation-what makes corporate employees act like entrepreneurs? Frontiers of Entrepreneurship Research, 31(17), 2. http://digitalknowledge.babson.edu/fer/vol31/iss17/2. Accessed 02-06-2024

Davidsson, P., & Honig, B. (2003). The role of social and human capital among nascent entrepreneurs. Journal of Business Venturing, 18(3), 301–331. https://doi.org/10.1016/S0883-9026(02)00097-6

DeChurch, L. A., & Mesmer-Magnus, J. R. (2010). The cognitive underpinnings of effective teamwork: a meta-analysis. Journal of Applied Psychology, 95(1), 32. https://doi.org/10.1037/a0017328

Dew, N., Sarasvathy, S. D., & Venkataraman, S. (2004). The economic implications of exaptation. Journal of Evolutionary Economics, 14, 69–84. https://doi.org/10.1007/s00191-003-0180-x

Dyer, J., Furr, N., & Lefrandt, C. (2014). The industries plagued by the most uncertainty. Harvard Business Review, 11, 563–584. https://hbr.org/2014/09/the-industries-plagued-by-the-most-uncertainty. Accessed 03-06-2024

Eisenhardt, K. M., & Martin, J. A. (2000). Dynamic capabilities: what are they?. Strategic Management Journal, 21(10–11), 1105–1121. https://doi.org/10.1002/1097-0266(200010/11)21:10/11%3C1105::AID-SMJ133%3E3.0.CO;2-E

Fukuyama, F. (2001). Social capital, civil society and development. Third World Quarterly, 22(1), 7–20. https://doi.org/10.1080/713701144

Futterer, F., Schmidt, J., & Heidenreich, S. (2018). Effectuation or causation as the key to corporate venture success? Investigating effects of entrepreneurial behaviors on business model innovation and venture performance. Long Range Planning, 51(1), 64–81. https://doi.org/10.1016/j.lrp.2017.06.008

Granovetter, M. S. (1973). The strength of weak ties. American Journal of Sociology, 78(6), 1360–1380. https://doi.org/10.1086/225469

Granovetter, M. (1985). Economic action and social structure: The problem of embeddedness. American Journal of Sociology, 91(3), 481–510. https://www.jstor.org/stable/2780199. Accessed 03-06- 2024

Haas, M. R., & Hansen, M. T. (2007). Different knowledge, different benefits: Toward a productivity perspective on knowledge sharing in organizations. Strategic Management Journal, 28(11), 1133–1153. https://doi.org/10.1002/smj.631

Han, M., & McKelvey, B. (2008). Toward a social capital theory of technology‐based new ventures as complex adaptive systems. International Journal of Accounting & Information Management, 16(1), 36–61. https://doi.org/10.1108/18347640810887753

Hansen, M. T. (2002). Knowledge networks: Explaining effective knowledge sharing in multiunit companies. Organization Science, 13(3), 232–248. https://doi.org/10.1287/orsc.13.3.232.2771

Hitt, M. A., Ireland, R. D., Camp, S. M., & Sexton, D. L. (2001). Strategic entrepreneurship: Entrepreneurial strategies for wealth creation. Strategic Management Journal, 22(6–7), 479–491. https://doi.org/10.1002/smj.196

Hirst, G., Van Knippenberg, D., Chen, C. H., & Sacramento, C. A. (2011). How does bureaucracy impact individual creativity? A cross-level investigation of team contextual influences on goal orientation–creativity relationships. Academy of Management Journal, 54(3), 624–641. https://doi.org/10.5465/amj.2011.61968124

Ho, M. H. W., Chung, H. F., Kingshott, R., & Chiu, C. C. (2020). Customer engagement, consumption and firm performance in a multi-actor service eco-system: The moderating role of resource integration. Journal of Business Research, 121, 557–566. https://doi.org/10.1016/j.jbusres.2020.02.008

Hollingshead, A. B. (1998). Distributed knowledge and transactive processes in groups. In Neale, M.A., Mannix, E.A., & Gruenfeld, D.H. (Eds.) Research on managing groups and teams,15(6), 633–644. Greenwich, CT: JAI Press. https://www.jstor.org/stable/30034766. Accessed 03-06-2024

Hormiga, E., Batista‐Canino, R. M., & Sánchez‐Medina, A. (2011). The impact of relational capital on the success of new business start‐ups. Journal of Small Business Management, 49(4), 617–638. https://doi.org/10.1111/j.1540-627X.2011.00339.x