Abstract

This paper reports on a field experiment conducted to estimate the impact of the gender diversity of new venture top management teams (TMT) on research and development (R&D) intensity. Specifically, we study an entrepreneurship business game, played in groups of three, in which master’s-level business studies students play the role of top managers. We manipulated the gender composition of the teams and assigned students randomly to teams based on gender. We do not find any significant relationship between new venture TMT gender diversity and R&D intensity, regardless of the number of female managers on TMTs, the profitability of firms or the stage of development and growth of the firm. Consequently, we do not find any gender differences; there are no gender differences regarding decision making in terms of firm risk-taking. Our findings may belie the common perception that women are, in general, more risk-averse than men. The implication of our study is that we do not support (or deny) the “business case” for female managers on TMTs. Likewise, we find no evidence of any negative effect either. Our evidence implies that the representation of top female managers should be based on criteria other than innovation behavior in the early stage of a new venture growth and development process. The study extends our understanding of the effects of TMT composition and contributes to research on innovation behavior and new venture teams.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Nowadays, the business environment can be characterized by a high degree of complexity exacerbated by hyper-competition and globalization (D'Aveni and Gunther 1994). Internet and the related information and communications technologies (the ICTs) make up an important part of the economy that have deeply shaped transactions in terms of production, sales, distribution, and consumption (OECD 2012). Consequently, digital economy is present everywhere. In this context, many new ventures flourish especially in the field of ICTs, creating an environment conducive for high-tech businesses. It is therefore important to consider the success factors of these new ventures that lead to viability and sustainability.

Technology entrepreneurship is becoming a key interdisciplinary area of enquiry within entrepreneurship research (e.g., Ratinho et al. 2015) probably due to the recognition, creation, and exploitation of opportunities revolving around the ICTs. In general, most new ventures are founded and led by teams, rather by individuals (e.g., Lechler 2001). Furthermore, according to Kamm et al. (1990), new ventures are commonly started by entrepreneurial teams, especially within high-growth firms. The composition of new venture teams (NVTs) is likely to shape the new business growth (Wright and Vanaelst 2009) presumably because the team members are responsible for the key decisions that shape the strategy and the structure of the new venture (Finkelstein et al. 2009).

Consistent with Klotz et al. (2014), we define NVT as “the group of individuals that is chiefly responsible for the strategic decision making and ongoing operations of a new venture” (p. 227). Within this framework, an NVT influences strategic decision-making during all the stages of a venture’s development. As such, our definition encompasses different phases of the life-cycle and is not restricted to the early stages of development.

Although the literature has examined the composition of NVTs (e.g., Harper 2008), significant gaps exist regarding how NVTs affect firm outcome and growth. In their review of the entrepreneurship literature, Zhou and Rosini (2015) reveals some potential gaps. For instance, research on gender diversity among top management teams (TMTs) or NVTs remains limited. This sounds surprising considering the importance of gender in research. Specifically, very few authors focus on the contribution of gender diversity in TMTs to innovation (e.g., Miller and del Carmen Triana 2009). This relationship remains largely an uncharted territory.

Accordingly, our study contributes to the literature, integrating constructs from the upper echelon theory (EUT) (Hambrick and Mason 1984) into the entrepreneurship and new venture management literature. We focus primarily on young companies operating in the field of ICTs, i.e., new technology-based ventures (e.g., Autio 1997). Indeed, these companies, developing new technologies, are likely to simultaneously deal with establishing and growing issues, commercializing a technology for potentially new markets, and developing capabilities that enable them to compete in a global world. Young and new technology-based companies are likely to face challenges characterized by intense product and/or process innovations. As such, entrepreneurship and innovation are intertwined. Innovation is likely to be instantaneous, fast and inter-related. According to Eisenhardt (2013), this process is embedded on different social and inter-organizational ties. This opens novel challenges for the survival of a new venture and its growth. We argue that the post-modern environment is more complex than in the past, requiring entrepreneurs and managers to adopt a systemic view of the firm and its environment that requires adequate managerial tools. Consequently, new ventures in high-tech industries need to leverage firm’s innovation. We plead in favor of an “entrepreneurial strategic management” approach (Eisenhardt 2013). This paper also makes a theoretical contribution to the diversity and TMT literature, providing a better understanding of how gender can influence firm’s innovation.

Indeed, we argue that gender diversity in a firm’s TMT or NVT implies that the team possesses diversified social and cognitive resources, management skills and leadership styles, able to promote firm’s “capability building” (Quintana-García and Benavides-Velasco 2016), influencing its ability to innovate, launch new products, and identify new markets. Following these authors, we suggest that the value of research and development (R&D) may be viewed as indicators of firm’s “capability development” (i.e., firm’s dynamic capabilities over time) associated with firm’s learning and research processes. As such, a heterogenous or diverse TMT or NVT regarding knowledge background can lead to more original ideas and explanatory innovations (Alexiev et al. 2010).

Furthermore, we contribute to the literature by answering the call of scholars (e.g., Steffens et al. 2012) who argue that, because many demographic variables do not operate similarly within NVTs, researchers should delineate forms of heterogeneity, rather than aggregate them to form indexes of heterogeneity, or, alternatively, theoretically and empirically justify their reasoning for aggregation.

Indeed, despite increased research on the effect of team characteristics, Steffens et al. (2012) underline the little consistency of the factors considered when assessing NVT heterogeneity; a mix of demographic characteristics is often used to form an index of heterogeneity, which makes it difficult to compare findings across studies (Hmieleski and Ensley 2007).

Finally, consistent with recent literature (e.g., Apesteguia et al. 2012; Hoogendoorn et al. 2013), we used a field experiment. Two studies are similar to our work: Apesteguia et al. (2012) and Lamiraud and Vranceanu (2018). However, we differ from these studies as we specifically examine the influence of new venture TMT on R&D intensity, and the role played by gender in this relationship. We are not interested in firm performance (even if we controlled this factor), but more on the influence of gender among a team in a firm’s decision-making. The purpose of this article is therefore to examine how gender diversity among TMT/NVTs affects firm’s risk-taking, i.e., R&D intensity. To do so, we report the results of a business game, played in groups in a French business schools, in which each group play the role of an NVT.

2 Theoretical framework and hypothesis development

2.1 Heterogeneous vs. homogeneous in NVT

The literature has stated that new ventures are rarely the product of a solo entrepreneur operating in isolation (e.g., Sandberg and Hofer 1987) and that solo entrepreneurs, who are actively involved in an entrepreneurial process in terms of launching and managing new ventures, usually depend on co-founding team members and other actors (e.g., Steffens et al. 2012). In addition, other researchers (e.g., Bird 1989) argue that the ventures founded by a team tend to be overrepresented among high performers. One explanation from prior studies (e.g., (Timmons 1990) argues that, in contrast with solo entrepreneurs, team members can access complementary resources and teaming up reflects a willingness to expand entrepreneurial effort. Ancona and Caldwell (1992) emphasize the high prevalence of new venture teams which are homogeneous by age, gender, and ethnicity.

However, empirical evidences on the impact of homogeneity on team performance have shown mixed findings (Ensley and Hmieleski 2005). No clear relationship between NVT heterogeneity and firm performance has emerged. Some scholars (e.g., Meakin and Snaith 1997) have argued that diversified teams are more effective due to complementary skills and creativity stimulating. Other scholars have provided opposite findings on a no significant relationship between NVT heterogeneity and performance outcomes (e.g., Chowdhury 2005).

To reconcile these conflicting results, recent studies (e.g., Steffens et al. 2012) claim the inexistence of a supporting theory able to clarify the processes by which new venture TMTs might successfully operate. Thus, building on UET and leadership research, Ensley et al. (2003) developed a theoretical model of the TMT process, shared leadership, and new venture performance, while Steffens et al. (2012) attempted, in their empirical studies, to respond to the call for further research about the relationship between the composition of new venture teams and longitudinal venture processes, including performance and persistence.

Consistent with prior works (e.g., Steffens et al. 2012), this paper focusses on the link between gender diversity among NVT and firm’s innovation, measured through R&D intensity. While gender variable is frequently included as part of the demographic proxy for heterogeneity, rare are the researches investigating the effect of gender diversity in the new venture context. Thus, we respond to the call for research in the field to consider the mechanisms through which heterogeneity influences performance outcomes.

2.2 Upper echelons theory

Upper echelons theory (Hambrick and Mason 1984) suggests that top managers have a great impact on the decisions made and ultimately on the outcomes achieved by firms. Hence, company outcomes, for example, strategic choices and performance levels, are partially predicted by manager's background characteristics, such as age, education, and experience. From this perspective, firm outcomes are viewed as reflections of the values and cognitive bases of the more powerful actors in firms. The underlying assumption of this perspective is that if strategic choices have a large behavioral component, they are likely to reflect the idiosyncrasies of the decision makers. Hambrick and Mason (1984) suggest that each decision maker brings his or her own set of cognitive bases to an administrative situation, reflected in their knowledge or assumptions about future events, and knowledge of alternatives and of the consequences attached to those alternatives. They help future (or incoming) entrepreneurs, intrapreneurs, and top managers to adopt a holistic (as well as systemic, transversal, and interconnected) viewpoint, to cross financial and market-oriented considerations with human and social perspectives.

Relying on prior research (e.g., Priem et al. 1999) in which the UET has been empirically operationalized to measure demographic differences in TMTs as an explanation of organizational performance, we adopt the UET arguments and expect new venture TMT characteristics and innovation behavior to have a significant impact on strategic decision making. Within this framework, we expect new venture top management team characteristics (gender diversity), to be reflected in how firms’ resources are allocated to innovation activities.

However, prior studies on demographic-focused TMT research have also raised serious limitations. The main criticism by Priem et al. (1999) relies upon the suggestion that such research “assumes that the demographic predictors are correlated with presumed intervening processes, which remain in the ‘black box’” (p. 936). In addition, these authors plead in favor of a higher emphasis on the processes by which TMTs influence organizational outcomes.

Consequently, following Priem et al. (1999), we consider that the intervening processes and intermediate steps in the causal chain provide a clearer picture on “how” the NVTMT impacts new venture performance. Accordingly, we focus on innovation behavior in terms of risk-taking as an intermediate step in the causal chain to performance. As such, our model is focused on NVTMT gender diversity-innovation behavior.

2.3 Innovation policy

Following Dosi (1988), innovation can be defined as the set for, and the discovery, development, improvement, adoption, and commercialization of, new processes, new products and new organizational structures and procedures. This implies uncertainty, risk taking, experimenting, and testing. Similarly, Schumpeter (1934) views innovation as the combination of resources in a novel way by entrepreneurs. Likewise, Drucker (2007) define innovation as the specific tool of entrepreneurs, the means by which they exploit change as an opportunity for a different business or service. The Schumpeterian perspective regarding entrepreneurship and innovation posits that entrepreneurs render certain industries obsolete while creating new ones. This seems to apply to digital entrepreneurship since technologies based on ICTs have generated new conditions for communication and new opportunities for business models (Porter 2001). We refer to “digital entrepreneurship” as the pursuit of opportunities based on the use of ICTs. Digital entrepreneurs used these ICTs to pursue opportunities creating disruptive changes in terms of technology (Yoo et al. 2012) or in the industry, where new high-tech ventures replace prevailing business models (Sahut et al. 2013).

While risk is commonly viewed as a key-factor of new ventures’ development and a vector of their potential rates of return, the literature also indicates that the greater level of risk involved puts substantial pressure on a new venture top management team.

Although previous scholars (e.g., Simon et al. 2000) have stated that risk does not exist in a general sense for entrepreneurs, most researchers (e.g., Bird 1989) have argued that the lack of capital (or resource scarcity) and the shortage of other necessary factors, such as time and managerial competence, are certainly a source of risk and stress to a new venture team (e.g., Dollinger 1995). More specifically, Chrisman (1999) argues that, because a new venture top management team often has few resources to work with, every resource allocation is a risk.

Among the forms of resource to be allocated, R&D investment is a key ingredient in the introduction of new products and processes and a necessary condition for productivity growth and sustainability. Indeed, R&D investment is widely accepted in the literature as a part of the innovative efforts systematically funded and organized by firms to achieve and/or entertain sustainable competitive advantages, as well as in established companies as well as in new venture firms. It is important to understand how these firms’ governance influences their R&D investment. Therefore, we assert the following:

-

Hypothesis: the gender diversity of an NVTMT has no effect on R&D intensity.

3 Method

3.1 Overview of the game

The Marketplace simulation adopted in our program is accepted as one of the most sophisticated online business simulation games, with (1) a robust simulation model that covers all the functional areas of business and their interconnectedness, and (2) the maximum possible realism, allowing students to deal with decisions and situations that are commonly encountered in a real-world business (e.g., Bonney et al. 2016). The simulation model used in Marketplace has been refined for over 25 years and played by more than 600 universities worldwide.Footnote 1

The game adopted is organized through a period of eight quarters (decision periods): the first four quarters serve as an exploration phase and the other four as an exploitation phase (Gupta et al. 2006). The game was designed to simulate real-business decision-making in high-tech new venture. The key unit of analysis is the “firm,” represented by its “TMT” which typically comprise three to four students, ramdomly teamed together, similar to the approach adopted by Bonney et al. (2016). Each firm competes against a universe of other firms made up of students enrolled in the same program.

For the purpose of this study, the design manipulates the gender composition of the TMT to allow for all possible gender combinations (thanks to the support from the business school’s administration). We used a random selection process to create teams of three to four women (i.e., all-women teams), and teams with two, one, and finally no women (i.e., all-male teams).

In this specific Marketplace game, the team aims at starting a new company that will be entering the international microcomputer business. It will be able to introduce a new line of microcomputers into 20 international markets. As the executive team, team members will provide the seed capital (investment money) needed to start their business. They can use this money to build a factory, open sales offices, and design brands. They will invest 1,000,000 € in each of the first four quarters. An additional 5,000,000 € will become available in quarter 5 from venture capitalists, making a total of 9,000,000 €. In sum, the executive team has 2 years (eight quarters or decision periods) to get the company off the ground. Within this time frame, their firm should become self-sufficient and earn substantial profits from the operations completed.

Over the eight quarters (decision periods) of the game, each new venture’s management team assumes responsibility for various facets of the early growth and development of new venture process. Each team plays the role of a new venture’s top manager, playing in a market composed of five to eight other new simulated ventures. In turn, teams must make decisions about which market segment(s) to pursue, product specifications, pricing strategies, geographic locations for sales offices, advertising, sales forecasting, production capacity, R&D investments, and financing decisions. Hence, the initial conditions are identical for all participating teams. After decisions are made, the game advances to the next quarter, and teams are provided with data on how their decisions impacted their new venture performance and are also given other market information (e.g., customer preferences, customer segment analysis, and competitive information). Within this simulation framework and all the information on hand, the teams must make decisions in terms of opportunity identification and exploitation, with the aim of creating value. The rules of the game are clearly stated in the detailed instructions provided, although a proper understanding of the instructions requires a great deal of time and effort.

A “balanced scorecard” is used to measure firm performance as a consequence of team decisions, and this is compared with competitors’ results, which also illustrates the consequences of decisions taken by competitors. Firm performance is based on financial results, marketing effectiveness, market performance, investments in the firm’s future, creation of wealth, financial risk, asset management, and manufacturing productivity. Hence, performance is a result of how well a team has allocated resources to either exploit an unfilled gap in the PC market or grow sales in current segments relative to the competition (i.e., the other teams playing the game). As such, performance is not only determined by current profits alone but also by broader management decisions that may be exploited in the future, such as investment in R&D. The winning teams in the final round are awarded with a money prize. Perhaps more importantly, the winning teams have the opportunity to celebrate their expertise in the early growth acceleration process and to present their entrepreneurship journey during the mini conference organized at the end of the education program, with 350 attending (including key actors in the entrepreneurship ecosystem) on average each year. This event enables the players to meet high-profile professionals, and some of the students are offered employment opportunities.

3.2 Research design

The adopted approach, which includes observation, survey, documents and secondary data from the simulation, allowed us to collect a rich and unique database at both the individual and team levels. Teams are considered as new ventures evolving over time, and at this level, longitudinal data was collected regarding the team decision-making process, strategic choices, and innovation behavior outcomes. In order to test empirically the impact of the gender diversity of top management teams and their innovation behavior in terms of risk-taking, we used data from the game completed in 2016. Hence, a dataset from a cohort of 61 teams attending the same business school was compiled from multiple sources (team demographic profiles and simulator results, such as balance sheets and income statements). In addition to team-level data, this database comprises individual-level data of 183 students who played the role of the top management teams in the 61 new ventures launched and developed during the simulation. For robustness, measures were chosen at different points of the exploratory and exploitation phases of the business cycle (e.g., March 1991). To allow for greater variance in firm dynamics, the teams were sampled from three different campuses across France and Germany and eight simulated markets (“planets”). Operationalization of the mean variables and other control variables was based on datasets drawn from detailed simulator reports.

3.3 Variables

3.3.1 Dependent variable

R&D intensity is measured as the ratio of RD-to-sales (e.g., Baysinger et al. 1991).

3.3.2 Independent variable

We operationalized female representation in top management using two measures. First, we calculate the proportion of female top managers as the number of female top managers divided by the total number of top managers (Lyngsie and Foss 2017).

Second, we use Blau (1977) index of heterogeneity:

where k stands for the number of categories (here, k = 2: men and women) and pi is the proportion of group members in a category (i.e., the fraction of female/male among the TMT).

The index is standardized as follows: H = 0 signifies that all TMT members are male; H = 0.50 means that the TMT encompasses an equal number of females and males; and H = 1 indicates that all TMT members are female.

3.3.3 Control variables

The control variables include size, profitability, leverage, sales growth, and the ratio of current assets to total assets. We include both the firm’s sales and the firm’s growth (Ghosh 2016). In the Schumpeterian growth model, large firms are more likely to enjoy economies of scale (Dinopoulos and Thompson 1999). We control for leverage, as Hall (1989) suggests that high debt levels may impede R&D investments. Furthermore, a firm’s high profitability may induce an increase in its resources and, in turn, R&D intensity. Finally, we control for a firm’s liquidity (Ghosh 2016).

Since the strategic context in which a firm operates varies across the game’s universe, various dimensions of the environment are considered. For this study, the industry is considered to encompass all teams competing across the game. Munificence, the measure of resource abundance in the industry, is operationalized using a standardized measure of industry sales growth over a two-year period. Dynamism, the measure of an industry’s volatility or instability, is operationalized using a standardized measure of the volatility of industry sales growth over the same period. Complexity, the measure of heterogeneity or resource concentration in the industry (Aldrich 1979), is measured through the Herfindahl-Hirschman Index (HHI), which ranges from 0 to 1, where lower values indicate greater market competition. This index is calculated by squaring the concentration ratio for the four largest companies and summing those squares to a cumulative total.

3.4 Model and estimation method

3.4.1 Empirical model

Our regression model is as follows:

where R&Di,t is the R&D intensity of firm i in year t, α and βk are unknown estimated coefficients, and X is a vector of the explanatory variables used in Eq. (1). Finally, the expressions ηt and εi,t refer to time effects (which are time-variant and common to all companies) and the classical error term (which is assumed to be independently and identically distributed), respectively.

3.4.2 Estimation method

Equation (1) was estimated using ordinary least squares (OLS) regression (Chen et al. 2016). It is worth noting that we do not use firm fixed effects to estimate Eq. (1) because our main explanatory variable (female representation on TMTs) varies little over time for a given firm.Footnote 2

All t-statistics are computed using heteroskedasticity-corrected standard errors. Furthermore, to take account of correlations within the same firm over time, we cluster all standard errors at the firm level (Wooldridge 2010).

3.5 Descriptive statistics and correlation analysis

Table 1 presents the descriptive statistics of all the variables. Women make up approximately 48% of the TMTs. The average Blau score in our sample is 0.47. Among the TMTs, 21% were exclusively composed of women, 26% consisted solely of men, and 26% of the teams had exactly two women on their TMTs.

One interesting feature from Table 1 is that the companies in our sample experienced fairly strong growth, as suggested by sales (15.20), firm growth (+ 112%), and firm size (15.27). As such, firms from our experimental field tend to be extraordinarily high-growth and entrepreneurial (Markman and Gartner 2002).

Table 2 provides the correlation matrix of the study variables. A correlation of 0.70 or higher in absolute value may be an indication of multicollinearity. In Table 2, the highest correlation of 0.91 appears between our independent variables. However, since these two variables are used alternately in Eq. (1), this high correlation is not an issue. No other correlation coefficient has an absolute value higher than 0.7.

Table 2 provides some preliminary findings. R&D intensity is not significantly correlated (at the 5% level) to our measures of gender diversity in TMTs (the variable of primary interest). This provides a preliminary indication regarding the relationship between R&D intensity and gender diversity in TMTs. Furthermore, R&D intensity is positively and significantly (at the 1% level) correlated with firm sales. Finally, our measure for gender diversity among TMTs is highly correlated (at the 1% level) with the Blau index of heterogeneity, suggesting that they are largely convergent.

4 Results

In this section, to test our hypothesis, we consider only results that reach conventional significance levels of 1% and 5%.

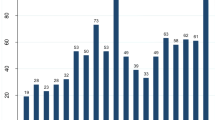

4.1 Univariate analysis

In Table 3, we present the differences in means (t- and W-tests) for firms with high and low proportions of women in their TMTs. We define “low” gender diversity as those firms where the TMT contains no women or where women are in the minority. Conversely, “high” gender diversity indicates those firms where the TMT is composed exclusively of women or where women are in the majority.

Several observations can be made from Table 3. First, there is no significant difference (at the 10% level) between firms with high and low TMT gender diversity with respect to R&D intensity (t = 0.37). It seems, therefore, that there are no gender differences regarding firm risk-taking (Sila et al. 2016). Second, with regard to both a company’s growth and its profitability, we do not find any significant differences between firms with high and low TMT gender diversity. These preliminary univariate results provide some indication of the relationship between gender diversity in TMTs and R&D intensity.

4.2 Multivariate analysis

Table 4 presents the results of Eq. (1). Models 1 and 2 reveal that the coefficients associated with gender diversity in TMTs are certainly negative, but they are not significantly different from zero (at the 10% level). This suggests that there is no evidence of a significant link between gender diversity among TMTs and R&D intensity in our experimental field.

Our findings belie some of the myths regarding women’s aversion to risk. Indeed, if women are more risk-averse than men, this would probably affect organizations’ strategic decision making, much of which is conducted in teams. As presented in Table 3, we did not see any significant difference between high and low gender diversity among TMTs. Table 4 reinforces this finding by showing that there is no significant relationship between gender diversity in TMTs and R&D intensity. Results from our field experiment suggest that, because women may not be fundamentally risk-averse, investment decisions made by TMTs are not influenced by the gender of its members. Our results are consistent with Johnson and Powell (1994), who argue that female and male managers exhibit the same investment behavior and make decisions that are not gendered. Our findings are also in line with Atkinson et al. (2003), who find that female and male mutual fund managers are similar with respect to fund performance and risk behavior. Finally, our results are consistent with Sila et al. (2016), who show that there is no evidence that women on corporate boards (WOCB) significantly affect firm risk-taking. However, our results are at odds with Apesteguia et al. (2012) and Hoogendoorn et al. (2013), who each conducted experimental field studies. The first study, based on a business game, finds that teams exclusively made up of women invest significantly less than mixed or men-only teams. Hoogendoorn et al. (2013), based on companies created and managed by students at the University of Amsterdam, find that mixed teams significantly perform better than male-dominated teams in terms of profit and sales.

Regarding the control variables, Table 4 shows that both firm sales and size have a positive and significant effect (at the 1% level) on R&D intensity. These results are not surprising, as larger firms are more likely to invest in R&D. This is consistent with Coad and Rao (2010), who find that the R&D intensity of US firms is significantly correlated to sales growth. The sign of a firm’s profitability (return on assets or ROA) is negative and statistically significant (at the 1% level). This runs contrary to Ghosh (2016), who finds the opposite relationship. We must recall that Tables 2 and 3 show that firms in our field experiment exhibit a negative ROA. Our result, therefore, reflects this specificity. Furthermore, firm leverage is negatively and significantly correlated to R&D intensity in Model 1 (not verified in Model 2). This suggests that creditors are reluctant to finance a firm’s innovation, as suggested by Atanassov (2013). Finally, we notice that firm liquidity has a negative and significant influence (at the 1% level) on R&D intensity. This suggests that firms in our field experiment are liquidity constrained, thus impeding their ability to redirect some liquidity towards their R&D activities (Bougheas et al. 2003).

4.3 Robustness checks

In this section, we present the robustness check to confirm our main results. First, we split the sample according to firm economic performance. Specifically, any firm with a ROA above the median for its “planet” is considered profitable and labeled a “high ROA” firm. Indeed, it has been established in the literature that the relationship between a firm’s R&D intensity is fundamentally contingent upon the level of profitability of the firm (e.g., Ito and Pucik 1993). Accordingly, we examine if the relationship between gender diversity in NVTs and R&D intensity is influenced by the firm’s level of profitability.

Second, the literature has pointed out that R&D intensity is correlated to firm growth. For instance, Falk (2012) finds that initial R&D intensity is significantly correlated with the first years of a firm. However, over time, this relationship becomes blurred. Both contingency (Lawrence and Lorsch 1967) or institutional theorists (DiMaggio and Powell 1983) argue that, as organizations change, their structure will also changes to match environmental contextual demands. As such, R&D intensity may fluctuate in line with life cycle of the firm, as well as the evolution of the market and the competition. Consequently, the stage of development of the venture may influence firm risk-taking. Given that our field experiment begins at the birth of a firm and moves into its stage of development, the link between gender diversity in NVTs and R&D intensity may be influenced by the stage of development of the firm. We have, therefore, addressed this possibility. Period “1” is from period 3 to 5, while period “2” is from period 6 to the end of the game (i.e., period 8).

Table 5 presents an excerpt of the results. The results are again qualitatively unchanged. Overall, in none of the models presented in Table 5, we do not find any significant relationship between gender diversity in NVTs and R&D intensity at the 10% level, consistent with the previous results. This suggests that gender diversity in NVTs does not influence R&D intensity, regardless of the profitability level of the firm or its stage of development.

5 Discussion

5.1 Non-significant results, sectoral effect, and “mimetic attitudes”

According to neo-institutional theory (DiMaggio and Powell 1983), organizations act (i.e., create, distribute, compete, cooperate, etc.) in a context of uncertainty, in which actors possess a limited and situated rationality, benefit from a partial access to information and knowledge, and of a deficient capacity to handle data, facts, and figures.

Consequently, organizations challenge complexity and navigate ambiguity. Accordingly, following a collective, but imperfect rationality, organizations tend to imitate successful firms’ strategies to reduce risk, limit costs (induced by information-and-knowledge searches and processing, solution design, ideation of change patterns, etc.), simplify decision-making processes, and, fundamentally, aim to become (and be perceived as) more legitimate in their field.

Consequently, firms involved in the same field are encouraged to adopt similar structures, strategies, functioning and languages, and to share comparable sense-making and sense-giving patterns (e.g., Gioia and Chittipeddi 1991) and analogous systems of values, norms, rules, and organizational beliefs. Beyond efficiency or performance issues, homogenization of organizational systems, rules, processes, and, fundamentally, cultures (values, myths, beliefs, etc.) seems to strengthen firms’ legitimacy.

Institutional isomorphic change (DiMaggio and Powell 1983) describes the isomorphic movement pushing same-field organizations to reduce their structural differences and strategic and normative divergences, at the confluence of coercive and/or normative/professional pressures and mimetic attitudes. Accordingly, we argue that in the computing information and communications technology and high-tech sector, mimetic attitudes are particularly frequent. Specifically, actors replicate and/or adaptatively copy leader/dominant firms’ strategies, regarded a lever to achieve rational and efficient solutions, reducing (hypothetically) risks and costs.

The R&D investment strategy is largely shared among (and legitimated by) computing sector companies, as the most effective way to survive in a highly uncertain and competitive sector, in which any ambiguity in a firm’s aims is greatly exacerbated by uncertainty surrounding technological changes and challenges.

Thus, the non-significance of the impact of NVT gender diversity on R&D intensity can be explained by the “computing sector effect” (which points to a highly intense investment strategy as the only rational and proven solution to new technological venture growth) and “mimetic isomorphism.”

Pleading in favor of contextualization (considering the sector’s objective characteristics as well as the surrounding universe of beliefs), the present paper calls for take into account sectorial/market specificities, as well as economic climate (the entrepreneurship business game has been played in France during a period of economic instability that has, partially, preserved the hi-tech/computing sector, which has been plunged into an investment spiral and caught in a technological race). Nevertheless, this preliminary explanation must be enriched looking at the sociological composition of TMTs, their cultural homogeneity, and, thus, their academic path dependency.

5.2 “Gender impact insignificance,” “scholar and social endogamy,” and “normative/professional isomorphism”

The non-significance of feminization of TMTs in the R&D investment can be analyzed by considering the sociological endogamy of the TMTs themselves. They are, effectively, composed of young, highly educated students, with a shared academic background and similar pre-professional, apprenticeship, and/or traineeship experiences, operating in an isochronic and (approximatively) iso-spatial context.

All the (male and female) students in the game have been educated and trained in the same business schools, under the guidance of a faculty spreading and supporting, consciously or unconsciously, rightly (or not), a pro-investment strategy that is masculine-connoted. Within a certain frame of view, academics as well as professionals are invited to teach or provide testimony in a business school or take part in conducting training experiences that contribute, nolens volens, to disseminating, reinforcing and, retrospectively, legitimating the professional norms and standards shared among the TM in the technological fields. By supporting tested models and already-experienced layouts, they participate in normative isomorphic dynamics, seeking to establish or maintain systems of rules, methods, conditions, and techniques, sketching cognitive patterns to support professional (or qualified) action. As an instrument, a tool, a proof of trade professionalization and a lever of organizational field structuring, normative isomorphism, viewed as an institutional isomorphic change process, is developed through the standardization of educational itineraries (curricula and contents) and the reinforcement of professional networks.

In addition, the social endogamy among student-entrepreneur TMTs is reinforced and sustained by an intensive socialization, strengthening their confidence and mutual trust (particularly in developing multiplex relationships) as well as increasing social discipline among the student groups. Thus, alignment to the masculine model of executives and top managers reduce the potential for the alternative or creative contribution of gender diversity to TMT strategy- drawing and -driving (Apesteguia et al. 2012; Hoogendoorn et al. 2013). As DiMaggio and Powell (1983) underline, the firm’s members aspiring to management functions tend to anticipate and rapidly assimilate the organizational rules, as well as the values and systems of beliefs shared in the company. They manage to align their thinking, their actions to the cognitive, and normative framework of the venture. Thus, the students who take part in our game reinforce institutional isomorphism, breaking down (or rapidly forgetting) their disrupting and innovative potential. That could explain the non-significance of the impact of TMT feminization on R&D intensity in our sample, which can be regarded as a “social laboratory.”

According to DiMaggio and Powell (1983), the more firm’s executives and top managers possess a similar academic background, the more that company will tend to be similar to other firms in the same sector, particularly those showing a dominant position.

The endogamy of our TMTs is strengthened by the sociological homogeneity in French Grandes Écoles system. Despite equal opportunities and diversity policies, French business schools, as “power schools,” display a homogeneous and selective sociology, with a high concentration of students from the social, economic, and cultural elite. Following a Bordieuan perspective (Bourdieu 1979), the business schools’ lack of diversity reveals a deficiency of the French high school system, which seems egalitarian and meritocratic in theory but is socially and systemically discriminating in practice. Thus, gender factor presses lesser than social one: the homogeneous framework of thinking and acting of male and female players induces a similar attitude towards risk-taking and R&D investment.

In conclusion, the homogeneity in students’ behavior can be explained by looking at their common scholarly (academic, cultural, and even ideological) embeddedness, their similar and endogamous socialization and their inexperience in business and management. All these factors contribute to the cultural path dependency to the supposed efficiency of masculine business strategies.

5.3 Women’s aversion to risk and business strategy

Table 4 shows that, in our experimental business game, there are no significant gender differences regarding firm risk-taking in the TMTs sample.

Even if empirical evidence tends to point out to women’s lower propensity to risk-taking (Byrnes et al. 1999), consequently, the findings in the literature are neither convergent nor repetitive. Where Sila et al. (2016), working on a sample of US firms, find no evidence concerning the influence of WOCB on corporate risk-taking, Chen et al. (2016) show, from a sample of Chinese firms, that WOCB exert a positive and significant impact on firm investment opportunities.

Observing the impact of CEO gender on corporate financial and investment decisions, Huang and Kisgen (2013) find that male executives show relative overconfidence in significant corporate decision making compared with their female counterparts. They underline that male executives undertake (in comparison with female executives) more acquisitions and issue debt, and acquisitions made by firms led by men have “announcement returns approximately 2% lower than those made by female executive firms, and debt issues also have lower announcement returns for firms with male executives” (p. 822). In addition, they argue that female executives seem more prudent in earnings estimations and tend to exercise stock options early. These observations are consistent with Faccio et al. (2016), who find that firms run by female CEOs have lower leverage, less volatile earnings, and a higher chance of survival than similar firms run by male CEO and that “transitions from male to female CEOs (or vice versa) are associated with economically and statistically significant reductions (increases) in corporate risk-taking” (p. 822).

Nevertheless, contrasting results regarding the impact of CEO/executive’s gender on decision making and corporate risk-taking can be explained by considering the heterogeneity of research topics (Faccio et al. 2016; Sila et al. 2016), the business context (economic and financial market’s level of development, business sector, national/regional culture, macro-economic conjuncture), sample’s size, or the econometric specification used (controlling for endogeneity).

However, these divergent and even contradictory findings in the literature participate in the deconstruction of a highly stereotyped, and essentialized, myth of women’s “natural” aversion to risk and calls for contextualized analysis and interpretations. From that standpoint, our empirical findings tend to balance and nuance the hypothesis of women’s natural risk aversion. Accordingly, it is critical to underline that, as suggested by Adams and Funk (2012), female directors may adopt specific behaviors and, thanks to contrapuntist dialog, can originally contribute to strategy shaping and decision making), not in the name of a supposed “natural difference” among men and women, but because of their dissimilar social itineraries, described in terms of demographic traits and human and social capitals (e.g., Hillman et al. 2002).

As underlined, the entrepreneurship business game TMTs are sociologically, generationally, and academically homogeneous. Where the differentiation between female and male executives has to be appreciated with regard to social and human capital and demographics (Johnson et al. 2013), the endogamy of TMTs reduces effective sources of diversification. This induces no significant discrepancies in male vs female organizational behavior or decision-making and R&D investment strategies.

Nevertheless, our findings show that top management teams with majority female leaders tend to implement more prudent strategies, marked by lower R&D intensity. However, these less risky strategies seem, counterintuitively, to be successful in terms of sales (significant result) and growth (non-significant result), even if the computing and hi-tech sector is characterized by high capitalistic intensity, a technological race and high competitive intensity (Porter 2008). These results are consistent with Perryman et al. (2016), who show that companies with a greater level of gender diversity in their top management teams have lower firm risk and deliver better performance. Nevertheless, their argument (the moderating effect of gender diversity on executive compensation, by which female executives are paid less than their male counterparts even at the TMT level, and even if increased gender diversity tends to reduce the salary gender gap) could not be used in the present case.

6 Conclusion

6.1 Scientific achievements and managerial implications

Grounded in an entrepreneurship business game, the article offers an empirical, valuable contribution to an academically and managerially crucial issue: the impact of top management’s gender diversity of on R&D intensity in new computing ventures. Accordingly, we follow a stream of the literature (Apesteguia et al. 2012; Lamiraud and Vranceanu 2018) that examines gender diversity impact through business games (simulation).

Consistent with the ambiguities found in the literature, our paper does not find any significant correlation between new venture TMT gender diversity and R&D intensity, regardless of the number of female managers on the TMT, the profitability of the firm or the stage of development and growth of the firm.

Nevertheless, our findings show that top management teams composed of women tend to develop and implement more prudent and careful strategies, privileging greater liquidity over higher ROA. However, these less risky strategies seem to be successful in terms of sales and growth, even if the computing sector is engulfed in harsh capitalistic, technological, and inter-firm competition. Consequently, our findings tend to balance, contextualize, and nuance the presupposition of women’s natural risk aversion, and break down the essentialization of the stereotyped framework of beliefs surrounding the relationship between the feminization of CEOs and TMTs and firms’ lower risk-taking, less aggressive strategies and lower economic profitability.

In our business game, players share a similar sociological, generational, academic, and pre-professional embeddedness and show a similar pre-professional experience; there are no gender differences regarding firm risk-taking. These can be understood by articulating a contextual approach (“computing sector effect”), a sociological interpretation (“scholarly and social endogamy”) and a more complex gender-based explanation (“women’s aversion to risk hypothesis”), and looking at neo-institutional theory (“mimetic attitudes” and “normative/professional isomorphism”).

Considering the composition of the TMTs in our business game, the results can be seen as valuable and useful in driving technological/digital start-ups, created and led by young graduates from French business schools, professionally inexperienced but socially, academically, and economically well placed. Although the aim of this paper is not to investigate directly the impact of our education program, the key finding can be used to illustrate and bring insight with regard to the role of education as one of the most powerful tools that policy makers may leverage to bridge the digital gender divide. Getting people to take risks and work in a more agile way are identified as the biggest challenge impacting a company’s ability to compete in a digital environment. This is one of findings from the seventh annual survey of more than 4300 business executives, managers, and analysts from organizations around the world conducted by MIT Sloan Management Review, in collaboration with Deloitte in their study investigating the challenges and opportunities associated with the use of social and digital business.

Therefore, our paper may contribute to increasing awareness regarding the digital gender deal and addressing stereotypes and strengthening women’s participation in high-technology sectors. This is important in terms of implication for practice and society regarding how to empower women in the digital era as well as women’s digital and soft skills achievement. Help to equip and train girls with the soft skills needed to participate and thrive in the digital transformation, and educate the whole society so as to curb socio-cultural norms that discriminate women are mandatory to fostering women’s inclusion in the labor market.

Our findings encourage the feminization of TMTs in the name of equality and meritocracy but are unable to support (or deny) the “business case” for female managers on TMTs. Our evidence suggests that the representation of top female managers should be based on criteria other than innovation behavior in the early stage of the new venture growth and development process. The study extends our understanding of the effects of TMT composition and contributes to research on innovation behavior and new venture teams. It underlines the strong assimilative effect of generation, social milieu, endogenous socialization, socio-educational itinerary as well as of shared cultural patterns, and behavioral models (including those acquired in training programs) that limit teams’ cognitive diversity despite gender diversity.

6.2 Limitations

First, our results can be challenged arguing that students are not valuable surrogates for managers in that kind of experiments. We argue that students may be a good proxy as Fuchs and Sarstedt (2010) found that two-thirds of experiments published over the period 2005 and 2007 use students as a proxy. Existing studies (Apesteguia et al. 2012; Lamiraud and Vranceanu 2018) also use the same protocol. We are, therefore, confident in our results. The only point that may show up is that we may use managers to do the same simulation. In this context, we may see if students and managers react in the same way.

Second, the sociological and generational homogeneity of players constitutes a methodological limit. In addition, the age, the generational, and social homogeneity of the business game TMTs can be viewed as an approximation, because entrepreneurship projects are frequently built with associates of different ages and professional experiences. This simplification of social “casuistic” (based on the homogenization of players’ theoretical and experiential background and action framework) must be underlined because of the potential neglect of intersectionality, particularly the interconnected crossed impact of age, entrepreneurial experience and gender, or of demography and social and human capitals.

Notes

For more details, see http://www.marketplace-simulation.com/.

In situations where the explanatory variable changes little over time, firm fixed-effects regression may fail to detect any relationship in the dataset even if it exists.

References

Adams, R., & Funk, P. (2012). Beyond the glass ceiling: Does gender matter? Management Science, 58(2), 219–235. https://doi.org/10.1287/mnsc.1110.1452.

Aldrich, H. (1979). Organizations and environments. Englewood Cliffs: Prentice-Hall.

Alexiev, A., Jansen, J., Van den Bosch, F., & Volberda, H. (2010). Top management team advice seeking and exploratory innovation: The moderating role of TMT heterogeneity. Journal of Management Studies, 47(7), 1343–1364. https://doi.org/10.1111/j.1467-6486.2010.00919.x.

Ancona, D., & Caldwell, D. (1992). Demography and design: Predictors of new product team performance. Organization Science, 3(3), 321–341. https://doi.org/10.1287/orsc.3.3.321.

Apesteguia, J., Azmat, G., & Iriberri, N. (2012). The impact of gender composition on team performance and decision making: Evidence from the field. Management Science, 58(1), 78–93. https://doi.org/10.1287/mnsc.1110.1348.

Atanassov, J. (2013). Do hostile takeovers stifle innovation? Evidence from antitakeover legislation and corporate patenting. The Journal of Finance, 68(3), 1097–1131. https://doi.org/10.1111/jofi.12019.

Atkinson, S., Baird, S., & Frye, M. (2003). Do female mutual fund managers manage differently? Journal of Financial Research, 26(1), 1–18. https://doi.org/10.1111/1475-6803.00041.

Autio, E. (1997). New, technology-based firms in innovation networks symplectic and generative impacts. Research Policy, 26(3), 263–281. https://doi.org/10.1016/S0048-7333(96)00906-7.

Baysinger, B., Kosnik, R., & Turk, T. (1991). Effects of board and ownership structure on corporate R&D strategy. Academy of Management Journal, 34(1), 205–214. https://doi.org/10.5465/256308.

Bird, B. (1989). Entrepreneurial Behavior. Glenview, IL: Scott Foresman and Company.

Blau, P. (1977). Inequality and heterogeneity: A primitive theory of social structure. New York: Collier Macmillan.

Bonney, L., Davis-Sramek, B., & Cadotte, E. (2016). “Thinking” about business markets: A cognitive assessment of market awareness. Journal of Business Research, 69(8), 2641–2648. https://doi.org/10.1016/j.jbusres.2015.10.153.

Bougheas, S., Goerg, H., & Strobl, E. (2003). Is R&D financially restrained? Theory and evidence from Irish manufacturing. Review of Industrial Organization, 22(2), 159–174. https://doi.org/10.1023/A:1022905102446.

Bourdieu, P. (1979). The inheritors: French students and their relations to culture. Chicago: University of Chicago Press.

Byrnes, J., Miller, D., & Schafer, W. (1999). Gender differences in risk taking: A meta-analysis. Psychological Bulletin, 3, 367–383. https://doi.org/10.2307/3152047.

Chen, S., Ni, X., & Tong, J. (2016). Gender diversity in the boardroom and risk management: A case of R&D investment. Journal of Business Ethics, 136(3), 599–621.

Chowdhury, S. (2005). Demographic diversity for building an effective entrepreneurial team: Is it important? Journal of Business Venturing, 20(6), 727–746. https://doi.org/10.1016/j.jbusvent.2004.07.001.

Chrisman, J. (1999). The influence of outsider-generated knowledge resources on venture creation. Journal of Small Business Management, 37(4), 42.

Coad, A., & Rao, R. (2010). Firm growth and R&D expenditure. Economics of Innovation and New Technology, 19(2), 127–145. https://doi.org/10.1080/10438590802472531.

D'Aveni, R., & Gunther, R. (1994). Hypercompetition: Managing the dynamics of strategic maneuvering. New York: The Free press.

DiMaggio, P., & Powell, W. (1983). The iron cage revisited: Collective rationality and institutional isomorphism in organizational fields. American Sociological Review, 48(2), 147–160. https://doi.org/10.1016/S0742-3322(00)17011-1.

Dinopoulos, E., & Thompson, P. (1999). Scale effects in Schumpeterian models of economic growth. Journal of Evolutionary Economics, 9(2), 157–185. https://doi.org/10.1007/s001910050079.

Dollinger, M. (1995). Entrepreneurship: Strategies and resources. Boston: Irwin.

Dosi, G. (1988). Sources, procedures, and microeconomic effects of innovation. Journal of Economic Literature, 26(3), 1120–1171. https://www.jstor.org/stable/2726526

Drucker, P. (2007). Innovation and entrepreneurship: Practice and principles (2nd ed.). Oxford: Butterworth-Heinemann.

Eisenhardt, K. (2013). Top management teams and the performance of entrepreneurial firms. Small Business Economics, 40(4), 805–816. https://doi.org/10.1007/s11187-013-9473-0.

Ensley, M., & Hmieleski, K. (2005). A comparative study of new venture top management team composition, dynamics and performance between university-based and independent start-ups. Research Policy, 34(7), 1091–1105. https://doi.org/10.1016/j.respol.2005.05.008.

Ensley, M., Pearson, A., & Pearce, C. (2003). Top management team process, shared leadership, and new venture performance: A theoretical model and research agenda. Human Resource Management Review, 13(2), 329–346. https://doi.org/10.1016/S1053-4822(03)00020-2.

Faccio, M., Marchica, M.-T., & Mura, R. (2016). CEO gender, corporate risk-taking, and the efficiency of capital allocation. Journal of Corporate Finance, 39(August), 193–209. https://doi.org/10.1016/j.jcorpfin.2016.02.008.

Falk, M. (2012). Quantile estimates of the impact of R&D intensity on firm performance. Small Business Economics, 39(1), 19–37. https://doi.org/10.1007/s11187-010-9290-7.

Finkelstein, S., Hambrick, D., & Cannella, A. (2009). Strategic leadership: Theory and research on executives, top management teams, and boards. New York, NY: Oxford University Press.

Fuchs, S., & Sarstedt, M. (2010). Is there a tacit acceptance of student samples in marketing and management research? International Journal of Data Analysis Techniques and Strategies, 2(1), 62–72. https://doi.org/10.1504/IJDATS.2010.030011.

Ghosh, S. (2016). Banker on board and innovative activity. Journal of Business Research, 69(10), 4205–4214. https://doi.org/10.1016/j.jbusres.2016.03.004.

Gioia, D., & Chittipeddi, K. (1991). Sensemaking and sensegiving in strategic change initiation. Strategic Management Journal, 12(6), 433–448. https://doi.org/10.1002/smj.4250120604.

Gupta, A., Smith, K., & Shalley, C. (2006). The interplay between exploration and exploitation. Academy of Management Journal, 49(4), 693–706. https://doi.org/10.5465/amj.2006.22083026.

Hall, B. (1989). The impact of corporate restructuring on industrial research and development. NBER working paper no. 3216.

Hambrick, D., & Mason, P. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9(2), 193–206. https://doi.org/10.5465/amr.1984.4277628.

Harper, D. (2008). Towards a theory of entrepreneurial teams. Journal of Business Venturing, 23(6), 613–626. https://doi.org/10.1016/j.jbusvent.2008.01.002.

Hillman, A., Cannella, A., & Harris, I. (2002). Women and racial minorities in the boardroom: How do directors differ? Journal of Management, 28(6), 747–763. https://doi.org/10.1177/014920630202800603.

Hmieleski, K., & Ensley, M. (2007). A contextual examination of new venture performance: Entrepreneur leadership behavior, top management team heterogeneity, and environmental dynamism. Journal of Organizational Behavior, 28(7), 865–889. https://doi.org/10.1002/job.479.

Hoogendoorn, S., Oosterbeek, H., & Van Praag, M. (2013). The impact of gender diversity on the performance of business teams: Evidence from a field experiment. Management Science, 59(7), 1514–1528. https://doi.org/10.1287/mnsc.1120.1674.

Huang, J., & Kisgen, D. (2013). Gender and corporate finance: Are male executives overconfident relative to female executives? Journal of Financial Economics, 108(3), 822–839. https://doi.org/10.1016/j.jfineco.2012.12.005.

Ito, K., & Pucik, V. (1993). R&D spending, domestic competition, and export performance of Japanese manufacturing firms. Strategic Management Journal, 14(1), 61–75. https://doi.org/10.1002/smj.4250140107.

Johnson, J., & Powell, P. (1994). Decision making, risk and gender: Are managers different? British Journal of Management, 5(2), 123–138. https://doi.org/10.1111/j.1467-8551.1994.tb00073.x.

Johnson, S., Schnatterly, K., & Hill, A. (2013). Board composition beyond independence: Social capital, human capital, and demographics. Journal of Management, 39(1), 232–262. https://doi.org/10.1177/0149206312463938.

Kamm, J., Shuman, J., Seeger, J., & Nurick, A. (1990). Entrepreneurial teams in new venture creation: A research agenda. Entrepreneurship Theory and Practice, 14(4), 7–17. https://doi.org/10.1177/104225879001400403.

Klotz, A., Hmieleski, K., Bradley, B., & Busenitz, L. (2014). New venture teams: A review of the literature and roadmap for future research. Journal of Management, 40(1), 226–255. https://doi.org/10.1177/0149206313493325.

Lamiraud, K., & Vranceanu, R. (2018). Group gender composition and economic decision-making: Evidence from the Kallystée business game. Journal of Economic Behavior & Organization, 145(January), 294–305. https://doi.org/10.1016/j.jebo.2017.09.020.

Lawrence, P., & Lorsch, J. (1967). Organization and environment: Managing differentiation and integration. Boston: Harvard University.

Lechler, T. (2001). Social interaction: A determinant of entrepreneurial team venture success. Small Business Economics, 16(4), 263–278. https://doi.org/10.1023/A:1011167519304.

Lyngsie, J., & Foss, N. (2017). The more, the merrier? Women in top-management teams and entrepreneurship in established firms. Strategic Management Journal, 38(3), 487–505. https://doi.org/10.1002/smj.2510.

March, J. (1991). Exploration and exploitation in organizational learning. Organization Science, 2(1), 71–87. https://doi.org/10.1287/orsc.2.1.71.

Markman, G., & Gartner, W. (2002). Is extraordinary growth profitable? A study of Inc. 500 high-growth companies. Entrepreneurship: Theory & Practice, 27(1), 65–75. https://doi.org/10.1111/1540-8520.t01-2-00004.

Meakin, V., & Snaith, B. (1997). Putting together a goal-scoring team. In S. Birley & D. F. Muzyka (Eds.), Mastering Enterprise. London: Pitman.

Miller, T., & del Carmen Triana, M. (2009). Demographic diversity in the boardroom: Mediators of the board diversity–firm performance relationship. Journal of Management Studies, 46(5), 755–786. https://doi.org/10.1111/j.1467-6486.2009.00839.x.

OECD. (2012). OECD internet economy outlook 2012. Paris: OECD.

Perryman, A., Fernando, G., & Tripathy, A. (2016). Do gender differences persist? An examination of gender diversity on firm performance, risk, and executive compensation. Journal of Business Research, 69(2), 579–586. https://doi.org/10.1016/j.jbusres.2015.05.013.

Porter, M. (2001). Strategy and the internet. Harvard Business Review, 79(3), 62–78.

Porter, M. (2008). The five competitive forces that shape strategy. Harvard Business Review, 86(1), 78–93.

Priem, R., Lyon, D., & Dess, G. (1999). Inherent limitations of demographic proxies in top management team heterogeneity research. Journal of Management, 25(6), 935–953. https://doi.org/10.1177/014920639902500607.

Quintana-García, C., & Benavides-Velasco, C. (2016). Gender diversity in top management teams and innovation apabilities: The initial public offerings of biotechnology firms. Long Range Planning, 49(August), 507–518. https://doi.org/10.1016/j.lrp.2015.08.005.

Ratinho, T., Harms, R., & Walsh, S. (2015). Structuring the technology entrepreneurship publication landscape: Making sense out of chaos. Technological Forecasting and Social Change, 100(November), 168–175. https://doi.org/10.1016/j.techfore.2015.05.004.

Sahut, J. M., Hikkeorva, L., & Moez, K. (2013). Business model and performance of firms. International Business Research, 6(2), 64–76. https://doi.org/10.5539/ibr.v6n2p64.

Sandberg, W., & Hofer, C. (1987). Improving new venture performance: The role of strategy, industry structure, and the entrepreneur. Journal of Business Venturing, 2(1), 5–28. https://doi.org/10.1016/0883-9026(87)90016-4.

Schumpeter, J. (1934). The theory of economic development: An inquiry into profits, capital, credit, interest, and the business cycle. Cambridge, MA: Harvard University Press.

Sila, V., Gonzalez, A., & Hagendorff, J. (2016). Women on board: Does boardroom gender diversity affect firm risk? Journal of Corporate Finance, 36, 26–53. https://doi.org/10.1016/j.jcorpfin.2015.10.003.

Simon, M., Houghton, S., & Aquino, K. (2000). Cognitive biases, risk perception, and venture formation: How individuals decide to start companies. Journal of Business Venturing, 15(2), 113–134. https://doi.org/10.1016/S0883-9026(98)00003-2.

Steffens, P., Terjesen, S., & Davidsson, P. (2012). Birds of a feather get lost together: New venture team composition and performance. Small Business Economics, 39(3), 727–743. https://doi.org/10.1007/s11187-011-9358-z.

Timmons, J. (1990). New venture creation: Entrepreneurship in the 1990s. Homewood, IL: Irwin.

Wooldridge, J. (2010). Econometric analysis of cross section and panel data. Cambridge: MIT Press.

Wright, M., & Vanaelst, I. (2009). Entrepreneurial teams and new business creation. Cheltenham: Edward Elgar.

Yoo, Y., Boland, R., Lyytinen, K., & Majchrzak, A. (2012). Organizing for innovation in the digitized world. Organization Science, 23(5), 1398–1408. https://doi.org/10.1287/orsc.1120.0771.

Zhou, W., & Rosini, E. (2015). Entrepreneurial team diversity and performance: Toward an integrated model. Entrepreneurship Research Journal, 5(1), 31–60. https://doi.org/10.1515/erj-2014-0005.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Biga-Diambeidou, M., Bruna, M.G., Dang, R. et al. Does gender diversity among new venture team matter for R&D intensity in technology-based new ventures? Evidence from a field experiment. Small Bus Econ 56, 1205–1220 (2021). https://doi.org/10.1007/s11187-019-00263-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-019-00263-5