Abstract

This paper analyses the effects that public credit guarantees have on SME business activity and investment. We focus the study on the main regional mutual guarantee institution in the Spanish Region of Madrid, covering two distinct stages of the economic cycle and credit environments: first, the full range of the country’s financial crisis with credit constraints (2009–2011), and later, the recovery stage with credit expansion (2012–2015). Using propensity score matching based on economic activity and company size, we show that guarantees allow for the relaxation of credit constraints, driving turnover and investment during both recession and growth. We also find that mutual guarantee schemes constituted a greater stimulus for firms during contraction; thus, they can act as countercyclical policies. Moreover, although guarantees had a substantial effect on all small companies (those with fewer than 50 employees), they had the greatest impact on microenterprises (those with fewer than 10 employees). We show the activities for which guarantees constitute a greater boost, which may inform public-policy designs for specific types of business.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Access to financing is key to business development. The bearish phase of the economic cycle can induce credit tightening and thwart companies’ efforts to meet their objectives, especially for entrepreneurs and small- and medium-sized enterprises (SMEs). Such credit constraints affect these communities even more when growth slows, as this causes expectations to decline, reduces banks’ appetite for risk and lessens liquidity.Footnote 1

In this context, guarantees constitute a supplementary solution that enables companies to access bank financing even when they are unable to meet those banks’ loan conditions. Such schemes vary widely.Footnote 2 This is especially how mutual guarantee institutions (MGIs) with public participation act as a public-policy tool in support of SMEs. The organisations that benefit from guarantees can undertake initiatives under more favourable conditions, initiate new projects or strengthen their working capital (to improve their operating arrangements), depending on the purpose of the guarantee.

The core aim of this exercise is to analyse the impact that MGI actions have on regional companies by comparing growth for the organisations that benefit from credit-facilitation measures to that for comparable businesses (in terms of size and activity) in the same region. We set our focus on the guarantees’ economic additionality that is assessing whether the MGIs’ activity design fulfils its mandate on the beneficiaries’ performance. To this end, we chose two growth indicators. The first—variations in turnover—is a measure of companies’ effective performance in a given financial period. The second—variation in assets—is an indication of medium- to long-term business expectations and trends in investment policy.

Therefore, this study makes three main contributions to the literature. First, it demonstrates which types of companies (in terms of economic activity and size) respond best to guarantees in tight credit contexts, with a perspective of designing new or redesigning existing public policies. Second, it analyses the effects that guarantees have on turnover and investment in distinct stages of the economic cycle—recession and recovery—seeking to contrast the countercyclical behaviour of these policies. In this way, it contributes to the public programmes’ economic additionality line of research. A third novelty revolves around this study’s sample of companies and its analysis of Avalmadrid—the benchmark MGI in the Spanish Region of Madrid—from 2009 through 2015.Footnote 3 This study’s methods involve estimating the average treatment effect (ATE) and the average treatment effect on the treated (ATET), as well as the economic activity–company size binomial to assess the impact of financial-support measures; this constitutes a further contribution to the literature.

The rest of the article is organised as follows. Section 2 reviews the literature on the subject. Section 3 describes the study’s data and methodology. Section 4 contains the results of the analysis. Section 5 constitutes the discussion of the results, and Section 6 draws the conclusions.

2 Review of the literature

2.1 Financial constraints

Credit constraints have been extensively addressed in the literature, and the results of many studies indicate that SMEs find it more difficult to raise funds than larger companies (Winker 1999; Clementi and Hopenhayn 2006; Musso and Schiavo 2008; Bottazzi et al. 2014; Carbó-Valverde et al. 2016). Such constraints can be attributed to macroeconomic factors (Beck et al. 2006) and to the financial market (e.g. composition, lender-borrower proximity, technology, organisational structures; Beck et al. 2010) as well as to the companies’ characteristics. Direct relationships can be drawn between credit accessibility and company size, growth rate, shareholder structure, international activity and age (see e.g. Albareto and Finaldi Russo 2012; Psillaki and Daskalakis 2009; Holton et al. 2014).

The ability to raise funding is one of the keys to a company’s success. Nonetheless, there is no single parameter with which to measure such success; many possible approaches can be adopted (Neely et al. 2002; Ng and Kee 2012). Although growth is routinely cited as a variable in business success, no consensus exists regarding the most suitable measure of growth. Batsaikhan (2017) used change in turnover as a criterion; Dhawan (2001) and Koralun-Bereznicka (2016) preferred asset value; Bottazzi et al. (2008) and Ipinnaiye et al. (2017) cited profit and job creation; Rajan et al. (2001) applied added value; and Navaretti et al. (2014) and many others used headcount. Delmar (2006) proposed a suite of indicators that include all of the aforementioned as well as sales (in physical units) and market share.

Turnover, although perhaps the most widely applied criterion, has drawbacks. Delmar et al. (2003) observed that it is sensitive to inflation and exchange rate, for instance. In young companies, assets and headcount grow for a long time before they impact turnover. Sales are nonetheless a clear indicator of short-term growth or decline and they also serve as grounds for the medium- and long-term expectations that inform companies’ investment policies and, as a result, their asset values.

2.2 Growth as a variable in business success

Given the multidimensionality of business success, it is growth—rather than the establishment of a single survival target or short-term result—that is the most cited factor in business success, irrespective of the variable used to measure it. This may primarily be for strategic reasons, such as market access, economies of scale and minimum viable size. A second explanation is the proven existence of financial reasons for growth. Fazzari et al. (1988) observed that financial constraints are a significant conditioning factor in investment decisions and are inversely proportional to company size. As credit is even tighter for start-ups than for older companies, young small companies, in particular, seek to grow even though some find that interest rates are higher for faster-growing organisations (Rostamkalaei and Freel 2016). A third element is the relationship between company size and performance, which researchers have widely addressed but found no conclusive results for, as Table 1 shows.

Additionally, there is no global, internationally valid pattern that biunivocally relates size and performance. However, there is a consensus in place to ensure that the variables that determine performance depend on local factors. Bloom et al. (2009) reported that wealth and welfare are lower where decentralisation is the preferred model, contending it as a cultural component that is exported during internationalisation processes. In an analysis of nine EU countries and 13 economic activities, Koralun-Bereznicka (2016) observed that the relationship between size and performance depends on both geography and industry, albeit more heavily on the latter. As Rajan et al. (2001) showed in a study of 15 European countries, mean company size is smaller in Spain than in any of its neighbours. Given that Spain is one of the largest national markets in Europe, this finding runs counter to the accepted wisdom that market size and company size are related (Bartelsman et al. 2005).

Growth is difficult when credit is tight, particularly for SMEs (Casey and O’Toole 2014). This is a concern among policymakers who have used different types of support programmes to enable such companies (Decramer and Vanormelingen 2016) to access otherwise unattainable resources (Cowling 2010) for reasons of either constraints or cost (Rostamkalaei and Freel 2016). Governments can and should favour credit accessibility by lowering cost, lengthening terms and easing other credit conditions (Zecchini and Ventura 2009; Gozzi and Schmukler 2015; Ughetto et al. 2017) to prevent sluggish economic environments from concurring with tighter credit, which may wreak long-term destruction (Carreira and Teixeira 2016). In this respect, mutual guarantee schemes may prevent some of the problems that limit bank lending to SMEs (Gai et al. 2016; Maffioli et al. 2017) by improving financial systems’ operations and the relations between SMEs and financial institutions (Bartoli et al. 2013). Their use should not, however, stray from the basic aim to allocate resources efficiently. To that end, the communities and initiatives to be aided must be clearly defined, an effective system for measuring costs devised and model and operation transparency ensured (Honohan 2010).

2.3 Financial additionality vs economic additionality of loan guarantee schemes

When studying the effects of financial policy programmes, an important line of research focuses on ‘additionality’ (in North America, the usual term is ‘incrementality’). This can lead to two different approaches (Levitsky 1997): (1) financial additionality, referring to the better access to credit for whose agents that, otherwise, could not access i, and (2) economic additionality, referring to the better economic performance that the companies that have received credit can have due to the public loan guarantee scheme.

The first approach is followed first by Vogel and Adams (1997), and later by Gozzi and Schmukler (2015), in a study that presents an overview of public credit guarantee schemes around the world, and Riding et al. (2007) in Canada; Cowling (2010) in the UK; Cardone-Riportella et al. (2013) in Spain; Calcagnini et al. (2014), Ughetto et al. (2017) and D'Ignazio and Menon (2012) in Italy; or Cowan et al. (2015) in Chile.

The second approach is followed by Riding and Haines Jr (2001) in Canada; Oh et al. (2009) in Korea; Bah et al. (2011) in Macedonia; Arráiz et al. (2014) in Colombia; Asdrubali and Signore (2015) in Central, Eastern and South-Eastern European Countries; Cannone and Ughetto (2014) and Gai et al. (2016) in Italy; Bertoni et al. (2018) in France; and Dvouletý et al. (2019) in Central and Eastern Europe.

In any case, it has been shown that local factors are key items in selection, implementation and the results of programmes and public policy tools. However, as it was denoted before in Spain, this kind of dataset is not very accessible, so the only studies to our knowledge that are related to this item which are based on several subsidies and public programs are: (1) Segura et al. (2004) which analysed 53 companies that received aid compared to a sample of the same size that did not receive any, and (2) Briozzo and Cardone-Riportella (2016), the study most similar to our proposal that uses a total sample of 368 companies (154 in the treatment group and 214 in the control group). Our proposal confronts the results for the census of the guaranteed companies vs the results of the census of the companies that do not participate in the program. Perhaps, the main exception is Garcia-Tabuenca and Crespo-Espert (2010), in a study of 23,328 commercial companies.

For all the aforementioned, given that the aim is to determine the effect of guarantees in offsetting financial constraints that primarily affect small companies especially in crisis situations, this article assesses their impact using the propensity score matching (PSM) technique. PSM yields two balanced samples—companies that were and those that were not guaranteed. This thereby isolates such instruments’ effects on two variables, revenue growth and asset growth, to assess the guarantees’ potential countercyclical behaviour and their implications, particularly at times of greatest difficulty for SMEs.

3 Data and methods

3.1 Description of the database

This study drew from the National Statistics Institute’s (which is known as INE, its Spanish initials) Central Company Directory (also known by its Spanish initials DIRCE), which contains information on over 212,000 Madrilenian companies with employees. We also used the Iberian Balance-Sheet Analysis System (known by its Spanish initials SABI), a database with financial information on over 2.6 million companies in Spain and Portugal. For the period available in the DIRCE, it covers 41.3% of all companies, 59% of those with more than two employees and 76% of those with more than nine (see Table 6 in the AppendixFootnote 4). It also represents a substantial percentage of the total population, although records with no information on economic activity or headcount in any of the years analysed were excluded.

In Spain, MGIs are not-for-profit financial institutions supervised by the Bank of Spain that specialises in SMEs that obtain their funding under more favourable conditions than if they were to apply directly to a lender. Each MGI is associated with a given region, normally an autonomous ‘community’, region or industry. Their activity rests on the cooperation received from their sponsoring partners, which may be public (regional or local governments or institutions) or private (banks or other local- or industry-related entities). The model is ‘anchored’ in the national counter-guarantee system through the state-run Compañía Española de Reafianzamiento, S.A. In the Spanish model, governments hold a stake in these companies, counter-guaranteeing their risks, establishing tax exemptions and subsidising either the operations or the guarantee to companies directly (Sánchez Martínez and Gascón García-Ochoa 2004). MGIs are affiliated with the Confederación Española de Sociedades de Garantía Recíproca, which coordinates, cooperates with, defends, counsels and represents its membership.

Avalmadrid is a financial institution founded with a dual objective: to furnish access to preferential financing with lower costs and longer terms and to make guarantees in favour of governments and other third parties under more lenient conditions than those offered by traditional banks. Its most prominent sponsoring partners include the Regional Government of Madrid, Bankia, Santander, CaixaBank, Popular, the Chamber of Commerce and Industry of Madrid and the Madrid Employers’ Organisation, which is a member of CEOE (the national confederation of employers). As of the end of 2016, it had 10,190 partners, an exposure of €378 million and shareholders’ equity of €66.6 million. That year, it awarded guarantees for over €86 million.

Analysing Avalmadrid and Madrid Autonomous Community is very appropriate since (1) MGIs constitute a public tool with a direct effect on credit and company performance (Honohan 2010); (2) Madrid is the second largest region of Spain by GDP (around 19%), and we will study one of the three largest MGIs in the country; and (3) the regional scope and decision making of Spanish MGIs render the national programme evaluation not possible. However, the results of this study can drive MGIs and public authorities (in Spain and abroad) to encourage these programmes.

We analysed the effect of Avalmadrid’s activity by cross-referencing SABI records (a total of 162,858 Madrilenian companies) with information about the MGI’s operations (2934 companies that were guaranteed from 2009 to 2015). The information on Avalmadrid contained a census of the secured companies. MGI partners can be divided into three categories: SMEs, individuals and entrepreneurs. The last two were excluded from this analysis for want of historical records. By focusing on corporate guarantee recipients and data from the year prior to the award, we were able to perform an automated valuation of actual operations rather than projects, the analysis of which is more subjective.

We further classified the companies by size and economic activity according to the National Classification of Economic Activities (known by its Spanish initials CNAE), as shown in Table 7. Over 85% of the MGI guarantees were granted to regional micro and small companies. In the period analysed, each of those 2934 members was guaranteed at least once (and up to 259 times). For all of the companies in the database, the publicly available SABI data included the year founded, economic activity and yearly accounts published, as well as the details on the guarantee operations concluded in the period from 2009 to 2015 (e.g. amount requested, amount awarded, interest rate, term and existence of other collateral associated with each operation).

3.2 Methods

Our main aim is to identify causal effects of guarantees on SMEs’ growth. We study this through the main mutual guarantee institution in the Spanish Region of Madrid.

The most prominent tools to study MGIs’ effects, according to Zecchini and Ventura (2006), include linear (Beck et al. 2010) and nonlinear (Columba et al. 2010) regression methods, as well as impact evaluation techniques (Briozzo and Cardone-Riportella 2016), to attempt to identify the causes underlying the impact. Given the nature of our dataset and our main aims, we think ATE or ATET models are well-suited to correctly estimate those effects. We developed a suite of explanatory models using various dependent variables built on the grounds of increase in turnover (Δturnoverit) and assets (Δassetsit) and both expressed in per cent, where t is year and i is the company analysed.

We fitted continuous choice models to the data on support measures versus increase in turnover and assets by economic activity and company size. We used dummy variables to classify certain types of economic activity as one of the 21 CNAE groups listed in Tables 7 and 8 in the Appendix. An initial estimate of the explanatory capacity of the variables, performed with factor analysis and including variable rotation analysis, yielded no significant findings, as none of the factors explained over 5.5% of the total variance. That ruled out any reduction in the number of variables to be used in the model.

The causal relationship between guarantees and the dependent variable (i.e. turnover or investment) was instrumental. For that type of analysis, Cerulli (2015) distinguished among several techniques, such as regression-adjustment, matching, difference-in-differences, instrumental-variables and regression-discontinuity-design.

Matching methods, introduced by Rosenbaum and Rubin (1983), create new samples by matching observations with values that are similar to the propensity score estimated. These generate a balanced sample, reducing the possible differences between the cases benefitting and not benefitting (i.e. treated and not treated, respectively) from the measure at issue. Matching methods aim to isolate the external and internal factors that are unrelated to the treatment, which could consequently affect the behaviour of the companies studied. Research by Dehejia and Wahba (2002) and Caliendo and Kopeinig (2008) was instrumental to the practical implementation of the method, whereas Smith and Todd (2001) adopted an approach that differed from that of Dehejia (2005). Researchers have used matching to analyse the effects of public policy (Bryson et al. 2002; O’Keefe 2004; Autio and Rannikko 2016; Marino et al. 2016). Lechner (2002), Segura et al. (2004) and Oh et al. (2009) put forward proposals for situations similar to those addressed here.

Our analysis follows a triple strategy:

-

1)

We found the mean difference for each studied variable for the guaranteed and non-guaranteed groups, assuming normal distributions with different variances.

-

2)

Through a suite of regression, we analysed the relationship between the existence of a guarantee awarded to a company and observed turnover and asset growth, with the objective to assess whether companies benefitting from support performed better than those that did not. We adjusted our equations at both the extensive margin (being guaranteed assume a value of 1 in pit = guaranteeit, adjusted on zit − 1 = sizeit − 1 and xi = activity code) and the intensive margin (Δ(%)turnoverit, Δassetsit). uitwas the error term. Time was referenced to two financial years in each case—year t and year of the award—based on information available for the previous year t-1. We attempted to use dummy-based intervals for size to allow for nonlinear effects, around which the debate in the literature is ongoing. The resulting model is as follows:

$$ {y}_{it}=\delta {p}_{it}+{\gamma}^{\prime }{z}_{it-1}+{\beta}^{\prime }{x}_i+9{u}_{it}. $$(1)We excluded outliers from this sample. The cut-off for rise or decline in turnover or assets was consequently set at ± 100%, as in Bentzen et al. (2012). Depending on which variable we chose to determine the results, we used the same variable (either turnover or assets) to eliminate outliers in each analysis.

-

3)

The third part of the study developed a counterfactual analysis through PSM in an attempt to determine to what extent public support (access to funding) affected recipient companies, studying whether turnover/asset growth was higher among the guaranteed companies than among the non-guaranteed companies and how much greater it was.

The effect of a guarantee from Avalmadrid to a company is the difference between the growth in the chosen dependent value (turnover or assets) in the year of the award and the value of that variable for that same company and year if it had not been guaranteed.

The control group comprised companies that, in the year of the award, were classified into the same category for economic activity and size under the assumption that the characteristics of the treated and control groups were the same. Neither the treated group nor the control group was deemed to be the object of an intervention other than these guarantees because there is only one MGI in this scope—the one assessed—in the region analysed. Other types of finance for which untreated companies might have applied would be open to all companies, whether or not they were Avalmadrid’s partners. Under such conditions, the difference in results (i.e. rise in the target variable of turnover or assets) would be the sole outcome for the award of guarantees. We excluded outliers that deviated from the criterion defined earlier, and we define them as being outside the intervals: (− 1 < Δturnoverit < 1) and (− 1 < Δassetsit < 1), which are both expressed in per cent.

We used sample matching to analyse the impact of guarantees on Madrilenian companies. To match an element in the treated group to one in the control group, the initial assumption was that, given the observable characteristics, which in this case were size and economic activity (2-digit CNAE code) expressed as categorical variables, the presence or absence of the treatment was unrelated to the potential value of the dependent variable. We estimated the propensity score with the probit model using Abadie and Imbens’s (2016) proposed methodology. The breadth of the database afforded very similar results between the experimental and non-experimental data (Heckman et al. 1998), preventing any bias that might be introduced by the nature of the treatment which was applied non-randomly to companies that, voluntarily requesting funding, passed the MGI’s risk analysis test.

Converting the multidimensionality of the covariable vector to a unidimensional problem by defining a set of numbers containing all the information was instrumental to the analysis. The covariables we used referred to the economic activity and size in the previous year (Tables 6 and 7). Size was described by creating five groups.Footnote 5

Assuming, then, that X designates a pretreatment matrix of observable variables, for each company i, the expected result would be unrelated to the treatment (guarantee), under the conditional mean independence assumption, which we believe is going to be satisfied given the design previously explained:

ATE would be

ATET would be

Seeking to ascertain the effect of Avalmadrid’s activity on Madrid Autonomous Community’s businesses, we compared the variation in corporate turnover and investment to the value in the absence of guarantees across the entire period studied (2009–2015), irrespective of the term of the operation (average duration was 5 years, with a median of 3 years and a mode of 6 months). In the analysis, we noted that once MGI companies were granted a guarantee, they often continued to resort to the instrument in keeping with their means.

4 Results

4.1 Preliminary evidence of the effects

Guarantees furnished by an MGI revitalised the company’s business; furthermore, the less favourable the economic environment, the more effective the aid was. Below, we discuss the findings gleaned from the data in Tables 9 (turnover) and 10 (assets).

Performance among companies that benefitted from guarantees was, on average, 4.71% higher than among those that did not. The stimulus was greater in the first period (2009–2011), when credit was tighter, than in the second (2012–2015). The effect of the guarantees on turnover was greater in the year they were awarded (7.04%) than across the entire period. Year by year, the mean upward variation in turnover was 2.73 to 6.20% greater in guaranteed than in non-guaranteed companies. We also observed differences of 3.72 to 6.88% between companies that received a guarantee at some time in the period (treatment = 1) and those that received none (treatment = 0). The difference in turnover was 5.79% to 8.8% greater in the year when the security was awarded (yearguarantee = 1) than in any other year (yearguarantee = 0), irrespective of the term of the guarantee (Table 11).

Guaranteed companies increased their assets an average of 3.44% more than non-guaranteed organisations during the life of the security, and investment was the most intense during the year of the award. Guarantees were used as an investment-favouring tool, especially during the recession, when the difference in asset growth was significantly wider (guaranteed companies’ assets grew 5.36% more than those of their non-guaranteed counterparts) than during economic recovery (when the former saw 2% higher growth in assets than the latter). Year by year, the mean upward variation in assets was 1.15 to 15.52% greater in guaranteed companies. A narrower spread (2 to 7.53%) was observed for companies that received a guarantee at some time during the period compared to those that received none. Guarantees were used to fund investment at the time of the award: companies secured in a given year (yearguarantee = 1) raised their assets 10.86% more than those with no guarantee that year (yearguarantee = 0). The difference ranged from 8.35 to 14.15% year by year.

Analysing treated companies only, the stimulus in turnover in the year of the award was greater in the recovery period (3.76% on average) than during the crisis (0.06%). As seen in Table 11, the investment stimulus in these companies was significantly higher in the year the guarantee was awarded than in others in both the recovery period (with asset growth 9.85% higher than in other years) and during the crisis (7.2% higher than in all other years).

Analysing only companies with guarantees in effect, the stimulus in turnover in the year of the award was greater in the recovery period (4.34% greater on average) than during the crisis (1.29%). In these companies, the investment stimulus was significant in the year of the award in both the recovery period (with asset growth 11.12% higher than in other years) and during the crisis (10.56% higher than in all other years).

4.2 Regression results

We evaluate the impact of guarantees in greater detail below. The proposed continuous choice models used economic activity and size measured in terms of headcount as independent variables, irrespective of the existence of a guarantee. The results are given in Tables 12 and 13. We did note selection bias; growth-oriented companies tended to seek more outside funding and were more prone to investment.

MGI activity was a significant factor in sales growth; the companies that benefitted from guarantees grew their turnover 5% more than those that did not. Given that an increase in sales is a key factor for long-term performance, this economic policy measure clearly benefitted the Madrilenian business community. Further to the notion set out above that growth is an indicator of business success, as guarantees contributed to such success measured in terms of SME turnover, they can be said to constitute an effective economic policy instrument. In the present form of the guarantees (amount and rules for award), they made a significant difference for companies with under 50 employees and an even greater difference for companies with fewer than 10 (among which turnover growth in guaranteed companies was 6.12% higher than in non-guaranteed organisations). The effect on medium-sized companies was not statistically significant in the 2012–2015 period or for large companies across the entire period, although the size of the latter group was negligible, as noted earlier. Additionally, as noted above, guarantees are a countercyclical economic policy tool. They have a heavier impact during recessions and, naturally, when credit is tight.

In the proposed model, economic activity was significantly related to turnover growth. The effect was significant and beneficial in manufacturing, construction, wholesaling, motor-vehicle repair, hospitality and health and social services.

The award of the guarantees was associated with asset growth, and although less intensely than in the case of turnover, the relationship was significant. Companies receiving such support saw their assets grow 3.2% more than those without it. The investment stimulus induced by guarantees was greater during contraction (5.05%) than during recovery (1.93%).

The guarantees’ impact also proved to be significant on assets. The guarantee to total assets ratioFootnote 6 observed (5.5%) implied that injecting liquidity at 5.5% of a company’s assets generated a 3.2% rise in its asset value. According to MGI information, that can be explained by the fact that approximately 60% of the operations were undertaken to strengthen companies’ working capital, although no microdata liable to statistical verification were available. Guarantees favour financial daily operations of the firms, but, to date, the features of the institution’s guarantee are not specifically used to stimulate investment or innovation. This was particularly obvious during the recovery period when credit constraints had largely been eased. Consequently, if investment, whether in general or geared towards innovation, is a priority, policymakers should design guarantees that explicitly support such actions and advance company initiatives towards that direction.

Current guarantee design and award procedures render these instruments scantly apt to significantly drive medium-sized company investments, although they do favour investments in smaller organisations, especially those with no employees. Nonetheless, guarantees affect turnover more than investment.

In regard to economic activity, we observed beneficial and statistically significant effects on assets in manufacturing, construction, wholesaling and retailing, motor-vehicle repair and information and communication.

In summary, guarantees impacted microcompanies most, followed by small enterprises. Companies of all sizes favoured access to credit more during economic contraction and financial constraints. Some industries were more responsive to the stimulus, making them particularly apt targets for specific public policies.

4.3 Propensity score matching: impact of guarantees

We analyse ATE and ATET below by period using PSM based on company size and economic activity (two-digit CNAE code).

4.3.1 Company turnover

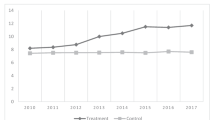

The ATE on Madrilenian company turnover, estimated yearly, yielded values 4.7% higher for guaranteed than non-guaranteed companies across the entire period, although the impact was greater during the period characterised by recession and financial constraint (5.8% higher) than during expansion (3.8%). The ATE findings showed 99% significance in every year except for 2013 and 2014, when the value had 90% significance (Table 2).

ATET was 3.57% for the entire period and higher when credit was tight (4.46%) than when financing was more readily accessible (2.89%). Here, we also found a 99% significance except in 2013, when it was 90% (Table 2).

The aforementioned findings were corroborated by the robustness tests conducted (epigraph 4.3.3.) including both nearest neighbour matching and a nonlinear model in which the variation in sales was treated as a binary variable.

4.3.2 Company assets

The ATE estimates showed that asset growth was 3.3% higher in guaranteed than in non-guaranteed companies at 99% significance in all years except 2012 and 2014 (when it was 90%) and 2013, for which the result was not significant (Table 3). However, a self-selection bias may affect these findings: companies more prone to investments were more likely to apply for a guarantee (or any other manner of external finance). This behaviour was similar to that observed for turnover: the spread was wider during contraction (with a mean of 5.2%) than during expansion (1.92%).

ATET was 3.1% at 99% significance for all years except 2012, when it was 95%, and 2013 and 2014 (not significant). At 5%, the effect was substantial during the tight-credit period (Table 3).

4.3.3 Robustness check of the results

In our study, we conducted a triple analysis. The first one consisted of an ATE and ATET analysis using the latent binary variable (upwrdtrnvr) matched to an observed binary indicator (0 or 1, without loss of generality), where:

For investment, the robustness tests were conducted using the observed binary indicator upwrdassetsit (0 or 1, without forfeiting generality), where:

The findings (Table 4) showed that guarantees could reverse turnover contraction to growth. ATE was 99% significant for the population as a whole except in 2012, when it was at 90%, and 2014, when it was not significant. ATET, on the other hand, was 99% significant in all years. The tests conducted on asset growth also confirmed the utility of guarantees in stimulating investment. The results exhibited 95% significance for the tight-credit period, proving them to be an instrument able to convert divestment into positive investment, as shown by both the ATE and ATET findings.

We designed the second robustness check to circumvent the imbalance between the treatment and control samples (given that the latter was much larger than the former). The procedure used a larger number of matches (10) for each case, (again, we selected the probit model to estimate the propensity score).

As the third and last robustness check, we deployed the nearest neighbour match, which was measured as the Mahalanobis distance, which factors in the correlation between random variables. Formally, the Mahalanobis distance for yit = Δturnoverit is:

where \( {y}_{it}^0 \) is the increase in turnover recorded in year t by company i, without a guarantee in effect in that year; \( {y}_{it}^1 \) is the increase in turnover recorded in year t by company i, with a guarantee in effect in that year; and Σ is the covariance matrix.

The same analysis was applied to the variable Δ(%)assetsit.

The PSM with 10 matches and the nearest-neighbour-matching test (Table 5) yielded similar results.

The inference to be drawn from the above discussion is that guarantees were a determinant in countering the credit constraints confronting these companies. These findings are consistent with Zecchini and Ventura’s (2009) analysis that guarantees impact both turnover and investments in companies in all lines of business and of all sizes, although the effect is inversely proportional to the latter.

5 Discussion of the results

The main objective of the present study is to identify the impact that public guarantees have on company growth in the region. The results show that mutual guarantee schemes allow for credit constraint relaxation and company performance improvement, particularly in times of contraction-induced financial stress. These results are consistent with Bartoli et al. (2013), Asdrubali and Signore (2015) and Briozzo and Cardone-Riportella (2016). During the recession, guarantees act as countercyclical policies that have beneficial effects on both SMEs’ turnover and the materialisation of investment intentions.

However, the effect is greater in the year of the concession and is diluted with time, regardless of the duration of the guarantees. Although this could have been interesting, we cannot prove the permanence of the effects once the guarantees were finalised. Our findings are similar to those of Dvouletý et al. (2019), who do not find statistically significant improvement in guaranteed companies compared to the non-guaranteed companies; Asdrubali and Signore (2015) who do find that beneficiaries outperform control group companies in the fifth year after the signature date; and Bertoni et al. (2018) who find economically significant positive effects which persist up to 10 years after receipt of the loan. Therefore, there is no coincidence in the results. Having a broader dataset would inform us and provide an opportunity to identify the optimal design for public credit guarantees.

Our analysis shows that guarantees are a stimulus, regardless of the statistical technique we used. However, on the one hand, the regression shows that guarantees improve turnover more strongly than investment. In our opinion, this is because those companies that receive guarantees are able, first, to undertake daily activity that otherwise would not be possible and second, to start investments that will set the companies in the right position to undertake future activity. Subsequently, on the other hand, the PSM (the most common method for economic additionality studies, as in Oh et al. 2009; Bah et al. 2011; Arráiz et al. 2014; Asdrubali and Signore 2015; Briozzo and Cardone-Riportella 2016; and Bertoni et al. 2018) shows a stimulus in turnover and investment, but neither of them is consistently greater than the other throughout the studied period. The fact that the effect is greater during the recession than during the recovery is very remarkable. We decided to use both regression and PSM to provide additional robustness to our tests. The results, on average, are statistically indistinguishable.

We have also proved that guarantees most effectively stimulate micro and small firms (those companies for which credit is more difficult to access), as in Bertoni et al. (2018). Our sample allowed us to test this hypothesis, unlike Asdrubali and Signore (2015) or Gai et al. (2016). This effect is even larger than those companies with no employees. Although medium firms also benefit significantly, they do so less than small companies. The effect on larger companies is negligible. Our opinion is that the effect on medium and large enterprises is driven by two factors: such organisations do not seek this type of finance because they have access to other market instruments, and the funding lines designed by MGIs are poorly suited to their needs.

Due to the lack of detail on the object of the guarantees (e.g. working capital, investment, job creation, new projects already on stream), the extent to which the specific objectives of the analysed financial operations in question were met was not possible to study. The actual effect of guarantees on investment is greater than observed here, given that this paper includes operations addressed to both strengthen working capital (according to MGI data, 60% of the operations were used for this aim) and finance growth, and our dataset did not distinguish this issue. This task is out of the scope of our study and we reserve it for future research whenever we are able to access those variables.

6 Conclusions

This study sought to ascertain whether public financial tools effectively spur SME activity, in terms of both turnover and investment. We analysed this by considering economic activity and size in different phases of the economic cycle and credit accessibility. We tested its effects by using several alternatives.

We showed that mutual guarantee schemes allow for the relaxing of credit constraints, particularly in times of contraction-induced financial stress. In such times, guarantees act as countercyclical policies that have beneficial effects on both SMEs’ turnover and the materialisation of investment intentions. Guarantees most effectively stimulate those companies for which credit is more difficult to access—that is micro and small firms. This effect is even greater than for companies with no employees. Although medium firms also benefit significantly, they do so less than small companies. The effect on larger companies is negligible. Our opinion is that the effect on medium and large enterprises is driven by two factors: such organisations do not seek this type of finance because they have access to other market instruments, and the funding lines designed by MGIs are poorly suited to their needs.

This study provides the following contributions to the literature, mainly related to the ‘economic additionality’ effects of guarantees, during and after the recession: (i) guarantees have a significant effect in turnover and investment; (ii) companies use these instruments to meet their growth objectives and slake their investment appetite, even though the instrument studied is not specifically designed to support investment or innovation and guarantees are often requested to strengthen working capital; (iii) the results may inform differential public policy design for specific areas of business; and (iv) guarantees act as countercyclical policies on both SMEs’ turnover and investment.

Of course, our study is not exempt from limitations, most of them involving selection bias. First, companies more geared to growth tended to seek external funding and consequently apply for guarantees. Second, some investment-oriented companies may have requested and been denied guarantees (for which there is no information in the database). Given the small number of organisations involved (Avalmadrid reported that approximately 10% of the operations were rejected), the effect on the suite of non-guaranteed companies can be deemed negligible. In contrast, the availability of information on economic activities that most intensely receive funding can be used to design public policies.

In light of the beneficial effect of guarantees on turnover and investment, at least three lines of research can be pursued in the future. One would be to ascertain the impact of guarantees on job creation (to verify Bah et al.’s 2011 and Maffioli et al.’s 2017 results) or on the performance results of guaranteed companies. Second, an analysis could be conducted on the impact of larger publicly guaranteed loans on the regional economy as a whole. Lastly, the effect of guarantees on company productivity should be identified, as proposed by Briozzo and Cardone-Riportella (2016), in terms of both labour and company results. In the medium term, when data with an extended duration become available for companies, future studies might be conducted on the effects of long-term guarantees. As noted earlier, to date, it has not been possible to determine the durability of the effects after guarantees expire. This is due to the paucity of data on companies that have been awarded guarantees in the past but no longer benefit from such support, given the duration of such instruments and the period for which these data are at hand. The recent creation of funding lines to specifically stimulate technological innovation start-ups and SME technological innovation by the MGI under study will provide an opportunity to analyse their effects on turnover, investment, productivity and job creation—issues that lie beyond the scope of this study.

Notes

Consequently, entrepreneurs and SMEs are optimal candidates for alternative or supplementary solutions (Casey and O’Toole 2014) such as trade credits, guarantees, factoring, leasing or renting, seed capital, venture capital, lease-backs, crowdfunding, direct lending and private (including so-called fintech) placements.

Beck et al. (2010) described 76 partial loan-security schemes from 46 countries. In Europe, these schemes tended to conform to two models: public guarantee programmes and mutual guarantee institutions (MGIs); these styles coexisted in some countries. MGIs are most developed in Germany, France, Spain and Italy (Columba et al. 2010), where they play an increasingly important role. Europe-wide, these schemes are regulated by EU Regulation 575/2013 and EU Directive 36/2013; their purpose is to secure loans for partners in the form of guarantees (though not guarantee insurance) to finance those partners’ business operations. These semi-public schemes enable governments to focus support on target groups by designing financing programmes that are geared to companies or initiatives of interest.

In Spain, this type of data availability is infrequent, as evidenced by the scarcity of studies related to this country, despite having a large number of entities (18) of (predominantly) regional scope with public-involved support, encouragement and decision making.

The appendix is titled as Electronic Supplementary Material.

Even though the MGI’s corporate purpose is to favour SME and entrepreneur access to credit and it consequently has no large-corporation partners, we distinguished a group for large corporations because headcount is only one of the three criteria used per EC recommendations. We found references in the client/partner database that were awarded a guarantee in the period analysed; their inclusion allowed for a comparison to the region’s entire business population.

The authors’ calculation excluded outliers (i.e., guarantees that were over 50% of the prior year’s total assets).

References

Abadie, A., & Imbens, G. W. (2016). Matching on the estimated propensity score. Econometrica, 84(2), 781–807. https://doi.org/10.3982/ECTA11293.

Albareto, G., & Finaldi Russo, P. (2012). Financial fragility and growth prospects: credit rationing during the crisis. Bank of Italy Occasional Paper No. 127. https://doi.org/10.2139/ssrn.2159210.

Arráiz, I., Meléndez, M., & Stucchi, R. (2014). Partial credit guarantees and firm performance: evidence from Colombia. Small Business Economics, 43(3), 711–724. https://doi.org/10.1007/s11187.014.9558.4.

Asdrubali, P., & Signore, S. (2015). The Economic Impact of EU Guarantees on Credit to SMEs–Evidence from CESEE Countries (no. 2015/29). EIF Working Paper. https://doi.org/10.1787/eco_surveys.jpn.2015.graph.51-en.

Autio, E., & Rannikko, H. (2016). Retaining winners: van policy boost high-growth entrepreneurship? Research Policy, 45(1), 42–55. https://doi.org/10.1016/j.respol.2015.06.002.

Bah, E. H., Brada, J. C., & Yigit, T. (2011). With a little help from our friends: The effect of USAID assistance on SME growth in a transition economy. Journal of Comparative Economics, 39(2), 205–220. https://doi.org/10.1016/j.jce.2011.03.001.

Bartelsman, E., Scarpetta, S., & Schivardi, F. (2005). Comparative analysis of firm demographics and survival: evidence from micro-level sources in OECD countries. Industrial and Corporate Change, 14(3), 365–391. https://doi.org/10.1093/icc/dth057.

Bartoli, F., Ferri, G., Murro, P., & Rotondi, Z. (2013). Bank–firm relations and the role of mutual guarantee institutions at the peak of the crisis. Journal of Financial Stability, 9(1), 90–104. https://doi.org/10.1016/j.jfs.2012.03.003.

Batsaikhan, M. (2017). Trust, trustworthiness, and business success: lab and field findings from entrepreneurs. Economic Inquiry, 55(1), 368–382. https://doi.org/10.1111/ecin.12359.

Beck, T., Demirgüç-Kunt, A., Laeven, L., & Maksimovic, V. (2006). The determinants of financing obstacles. Journal of International Money and Finance, 25(6), 932–952. https://doi.org/10.1016/j.jimonfin.2006.07.005.

Beck, T., Klapper, L. F., & Mendoza, J. C. (2010). The typology of partial credit guarantee funds around the world. Journal of Financial Stability, 6(1), 10–25. https://doi.org/10.1016/j.jfs.2008.12.003.

Bentzen, J., Madsen, E. S., & Smith, V. (2012). Do firms’ growth rates depend on firm size? Small Business Economics, 39(4), 937–947. https://doi.org/10.1007/s11187.011.9341.8.

Bertoni, F., Colombo, M. G., & Quas, A. (2018). The effects of EU-funded guarantee instruments of the performance of small and medium enterprises: Evidence from France (no. 2018/52). EIF Working Paper. https://doi.org/10.1016/j.eap.2018.09.011

Bloom, N., Sadun, R., & Van Reenen, J. (2009). The organization of firms across countries (no. w15129). National Bureau of Economic Research. https://www.nber.org/papers/w15129.pdf. Accessed 1 Apr 2019

Bottazzi, G., Secchi, A., & Tamagni, F. (2008). Productivity, profitability and financial performance. Industrial and Corporate Change, 17(4), 711–751. https://doi.org/10.1093/icc/dtn027.

Bottazzi, G., Secchi, A., & Tamagni, F. (2014). Financial constraints and firm dynamics. Small Business Economics, 42(1), 99–116.

Briozzo, A., & Cardone-Riportella, C. (2016). Spanish SMEs’ subsidized and guaranteed credit during economic crisis: a regional perspective. Regional Studies, 50(3), 496–512. https://doi.org/10.1080/00343404.2014.926318.

Bryson, A., Dorsett, R., & Purdon, S. (2002). The use of propensity score matching in the evaluation of active labour market policies. http://eprints.lse.ac.uk/4993/1/The_use_of_propensity_score_matching_in_the_evaluation_of_active_labour_market_policies.pdf. Accessed 1 Apr 2019

Calcagnini, G., Farabullini, F., & Giombini, G. (2014). The impact of guarantees on bank loan interest rates. Applied Financial Economics, 24(6), 397–412. https://doi.org/10.1080/09603107.2014.881967.

Caliendo, M., & Kopeinig, S. (2008). Some practical guidance for the implementation of propensity score matching. Journal of Economic Surveys, 22(1), 31–72. https://doi.org/10.1111/j.1467.6419.2007.00527.x.

Cannone, G., & Ughetto, E. (2014). Funding innovation at regional level: an analysis of a public policy intervention in the Piedmont region. Regional Studies, 48(2), 270–283. https://doi.org/10.1080/00343404.2011.653338.

Carbó-Valverde, S., Rodríguez-Fernández, F., & Udell, G. F. (2016). Trade credit, the financial crisis, and SME access to finance. Journal of Money, Credit and Banking, 48(1), 113–143. https://doi.org/10.1111/jmcb.12292.

Cardone-Riportella, C., Trujillo-Ponce, A., & Briozzo, A. (2013). Analyzing the role of mutual guarantee societies on bank capital requirements for small and medium-sized enterprises. Journal of Economic Policy Reform, 16(2), 142–159. https://doi.org/10.1080/17487870.2013.801317.

Carreira, C., & Teixeira, P. (2016). Entry and exit in severe recessions: lessons from the 2008–2013 Portuguese economic crisis. Small Business Economics, 46(4), 591–617. https://doi.org/10.1007/s11187.016.9703.3.

Casey, E., & O’Toole, C. M. (2014). Bank lending constraints, trade credit and alternative financing during the financial crisis: evidence from European SMEs. Journal of Corporate Finance, 27, 173–193. https://doi.org/10.1016/j.jcorpfin.2014.05.001.

Cerulli, G. (2015). Econometric evaluation of socio-economic programs. Advanced Studies in Theoretical and Applied Econometrics Series, 49. https://doi.org/10.1007/978.3.662.46405.2.

Clementi, G. L., & Hopenhayn, H. A. (2006). A theory of financing constraints and firm dynamics. The Quarterly Journal of Economics, 121(1), 229–265. https://doi.org/10.1093/qje/121.1.229.

Columba, F., Gambacorta, L., & Mistrulli, P. E. (2010). Mutual guarantee institutions and small business finance. Journal of Financial Stability, 6(1), 45–54. https://doi.org/10.1016/j.jfs.2009.12.002.

Cowan, K., Drexler, A., & Yañez, Á. (2015). The effect of credit guarantees on credit availability and delinquency rates. Journal of Banking & Finance, 59, 98–110. https://doi.org/10.1016/j.jbankfin.2015.04.024.

Cowling, M. (2010). The role of loan guarantee schemes in alleviating credit rationing in the UK. Journal of Financial Stability, 6(1), 36–44. https://doi.org/10.1016/j.jfs.2009.05.007.

Decramer, S., & Vanormelingen, S. (2016). The effectiveness of investment subsidies: evidence from a regression discontinuity design. Small Business Economics, 47(4), 1007–1032. https://doi.org/10.1007/s11187.016.9749.2.

Dehejia, R. (2005). Practical propensity score matching: a reply to Smith and Todd. Journal of Econometrics, 125(1–2), 355–364. https://doi.org/10.1016/j.jeconom.2004.04.012.

Dehejia, R. H., & Wahba, S. (2002). Propensity score-matching methods for nonexperimental causal studies. Review of Economics and Statistics, 84(1), 151–161. https://doi.org/10.1162/003465302317331982.

Delmar, F. (2006). Measuring growth: methodological considerations and empirical results. Entrepreneurship and the Growth of Firms, 1(1), 62–84. https://doi.org/10.4337/9781781009949.00011.

Delmar, F., Davidsson, P., & Gartner, W. (2003). Arriving at the high growth firm. Journal of Business Venturing, 18(2), 189–216. https://doi.org/10.1016/s0883.9026(02)00080.0.

Dhawan, R. (2001). Firm size and productivity differential: theory and evidence from a panel of US firms. Journal of Economic Behavior & Organization, 44(3), 269–293. https://doi.org/10.1016/s0167.2681(00)00139.6.

D'Ignazio, A., & Menon, C. (2012). The causal effect of credit guarantees for SMEs: evidence from Italy. The Scandinavian Journal of Economics. https://doi.org/10.1111/sjoe.12332.

Dvouletý, O., Čadil, J., & Mirošník, K. (2019). Do firms supported by credit guarantee schemes report better financial results 2 years after the end of intervention. The BE Journal of Economic Analysis & Policy, 19(1). https://doi.org/10.1515/bejeap.2018.0057.

Fazzari, S. M., Hubbard, R. G., Petersen, B. C., Blinder, A. S., & Poterba, J. M. (1988). Financing constraints and corporate investment. Brookings Papers on Economic Activity, 1988(1), 141–206. https://doi.org/10.2307/2534426.

Gai, L., Ielasi, F., & Rossolini, M. (2016). SMEs, public credit guarantees and mutual guarantee institutions. Journal of Small Business and Enterprise Development, 23(4), 1208–1228. https://doi.org/10.1108/jsbed.03.2016.0046.

Garcia-Tabuenca, A., & Crespo-Espert, J. L. (2010). Credit guarantees and SME efficiency. Small Business Economics, 35(1), 113–128. https://doi.org/10.1007/s11187.008.9148.4.

Gozzi, J. C., & Schmukler, S. (2015). Public credit guarantees and access to finance 27. European Economy, 101(2). https://doi.org/10.1596/978.0.8213.7080.3_ch7.

Hanousek, J., Kočenda, E., & Shamshur, A. (2015). Corporate efficiency in Europe. Journal of Corporate Finance, 32, 24–40. https://doi.org/10.1016/j.jcorpfin.2015.03.003.

Heckman, J. J., Ichimura, H., & Todd, P. (1998). Matching as an econometric evaluation estimator. The review of economic studies, 65(2), 261-294.

Holton, S., Lawless, M., & McCann, F. (2014). Firm credit in the euro area: a tale of three crises. Applied Economics, 46(2), 190–211. https://doi.org/10.1080/00036846.2013.824547.

Honohan, P. (2010). Partial credit guarantees: principles and practice. Journal of Financial Stability, 6(1), 1–9. https://doi.org/10.1016/j.jfs.2009.05.008.

Ipinnaiye, O., Dineen, D., & Lenihan, H. (2017). Drivers of SME performance: a holistic and multivariate approach. Small Business Economics, 48(4), 883–911. https://doi.org/10.1007/s11187.016.9819.5.

Koralun-Bereznicka, J. (2016). Corporate size-performance relation across countries and industries: findings from the European Union. International Journal of Economic Sciences, 5(1), 50–70. https://doi.org/10.20472/es.2016.5.1.004

Lechner, M. (2002). Program heterogeneity and propensity score matching: an application to the evaluation of active labor market policies. Review of Economics and Statistics, 84(2), 205–220. https://doi.org/10.1162/003465302317411488

Levitsky, J. (1997). Credit guarantee schemes for SMEs–an international review. Small Enterprise Development, 8(2), 4–17. https://doi.org/10.3362/0957.1329.1997.013.

Maffioli, A., Negri, J. A., Rodriguez, C. M., & Vazquez-Bare, G. (2017). Public credit programmes and firm performance in Brazil. Development Policy Review. https://doi.org/10.1111/dpr.12250.

Marino, M., Lhuillery, S., Parrotta, P., & Sala, D. (2016). Additionality or crowding-out? An overall evaluation of public R&D subsidy on private R&D expenditure. Research Policy, 45(9), 1715–1730. https://doi.org/10.1016/j.respol.2016.04.009.

Musso, P., & Schiavo, S. (2008). The impact of financial constraints on firm survival and growth. Journal of Evolutionary Economics, 18(2), 135–149. https://doi.org/10.1007/s00191.007.0087.z.

Navaretti, G. B., Castellani, D., & Pieri, F. (2014). Age and firm growth: evidence from three European countries. Small Business Economics, 43(4), 823–837. https://doi.org/10.1007/s11187.014.9564.6.

Neely, A. D., Adams, C., & Kennerley, M. (2002). The performance prism: the scorecard for measuring and managing business success. London: Prentice Hall Financial Times. https://doi.org/10.1108/13683040010377818.

Ng, H. S., & Kee, D. M. H. (2012). The issues and development of critical success factors for the SME success in a developing country. International Business Management, 6(6), 680–691. https://doi.org/10.3923/ibm.2012.680.691.

O’Keefe, S. (2004). Job creation in California’s enterprise zones: a comparison using a propensity score matching model. Journal of Urban Economics, 55(1), 131–150. https://doi.org/10.1016/j.jue.2003.08.002.

Oh, I., Lee, J. D., Heshmati, A., & Choi, G. G. (2009). Evaluation of credit guarantee policy using propensity score matching. Small Business Economics, 33(3), 335–351. https://doi.org/10.1007/s11187.008.9102.5.

Pagano, P., & Schivardi, F. (2003). Firm size distribution and growth. The Scandinavian Journal of Economics, 105(2), 255–274. https://doi.org/10.1111/1467.9442.t01.1.00008.

Peric, M., & Vitezic, V. (2016). Impact of global economic crisis on firm growth. Small Business Economics, 46(1), 1–12. https://doi.org/10.1007/s11187.015.9671.z.

Prabal, K. d., & Nagaraj, P. (2014). Productivity and firm size in India. Small Business Economics, 42(4), 891–907. https://doi.org/10.1007/s11187.013.9504.x.

Psillaki, M., & Daskalakis, N. (2009). Are the determinants of capital structure country or firm specific? Small Business Economics, 33(3), 319–333. https://doi.org/10.1007/s11187-008-9103-4.

Rajan, R. G., Zingales, L., & Kumar, K. B. (2001). What determines firm size? CRSP Working Paper No. 496; and USC Finance & Business Econ. Working Paper No. 01-1. https://doi.org/10.3386/w7208.

Riding, A. L., & Haines, G., Jr. (2001). Loan guarantees: costs of default and benefits to small firms. Journal of Business Venturing, 16(6), 595–612. https://doi.org/10.1016/S0883-9026(00)00050-1

Riding, A., Madill, J., & Haines, G. (2007). Incrementality of SME loan guarantees. Small Business Economics, 29(1–2), 47–61. https://doi.org/10.1007/s11187.005.4411.4.

Rosenbaum, P. R., & Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika, 70(1), 41–55. https://doi.org/10.2307/2335942.

Rostamkalaei, A., & Freel, M. (2016). The cost of growth: small firms and the pricing of bank loans. Small Business Economics, 46(2), 255–272. https://doi.org/10.1007/s11187.015.9681.x.

Sánchez Martínez, L. C. & Gascón García-Ochoa, F. (2004). Veinticinco Años del Sistema de Garantías Español. Revista Asturiana de Economía, N 31/2004. https://doi.org/10.5944/rdp.58.59.2003.8902

Segura, A. C. F., de Lema, D. G. P., & Guijarro, A. M. (2004). Efectos económicos y financieros de las subvenciones a la inversión en la PYME. Un estudio empírico. Spanish Journal of Finance and Accounting, 33(123), 899–933. https://doi.org/10.1080/02102412.2004.10779534.

Smith, J. A., & Todd, P. E. (2001). Reconciling conflicting evidence on the performance of propensity-score matching methods. American Economic Review, 91(2), 112–118. https://doi.org/10.1257/aer.91.2.112.

Ughetto, E., Scellato, G., & Cowling, M. (2017). Cost of capital and public loan guarantees to small firms. Small Business Economics, 1–19. https://doi.org/10.1007/s11187.017.9845.y.

Vogel, R. C., & Adams, D. W. (1997). The benefits and costs of loan guarantee programs. The Financier, 4(1), 22–29.

Winker, P. (1999). Causes and effects of financing constraints at the firm level. Small Business Economics, 12(2), 169–181. https://doi.org/10.1023/a:1008035826914.

Zecchini, S., & Ventura, M. (2006). Public credit guarantees and SME finance. ISAE Working Paper 73. https://doi.org/10.2139/ssrn.947106

Zecchini, S., & Ventura, M. (2009). The impact of public guarantees on credit to SMEs. Small Business Economics, 32(2), 191–206. https://doi.org/10.1007/s11187.007.9077.7.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

APPENDIX

APPENDIX

Rights and permissions

About this article

Cite this article

Martín-García, R., Morán Santor, J. Public guarantees: a countercyclical instrument for SME growth. Evidence from the Spanish Region of Madrid. Small Bus Econ 56, 427–449 (2021). https://doi.org/10.1007/s11187-019-00214-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-019-00214-0