Abstract

In this paper, we address two entrepreneurship puzzles prevailing in developing countries. First, field experiments on business training programs and grants have shown that it is much more difficult to improve business outcomes for female entrepreneurs than for their male counterparts. Second, empirical studies have revealed that it is difficult to increase entrepreneurial performance in the informal sector. We argue that an extended version of the entrepreneurship model in Lucas (Bell Journal of Economics, 9, 508–523, Lucas 1978) can provide insights into these recurrent puzzles. In particular, if female entrepreneurs are time constrained, interventions that only target business ability and credit constraints may not be sufficient to raise the entrepreneurial outcomes of female entrepreneurs. In addition, if informal entrepreneurs face business constraints in terms of both their access to credit and entrepreneurial ability, interventions that target these constraints together can have a potentially greater impact than those that target either in isolation. We support our theoretical predictions using data from a field experiment with microfinance clients, conducted in Tanzania.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The empirical literature on entrepreneurship in developing economies presents two main puzzles. First, field interventions focused on business training programs and business grants aimed at stimulating entrepreneurship tend not to succeed in raising the incomes and business profits of female entrepreneurs relative to their male counterparts.Footnote 1 The idea behind business training is to increase entrepreneurial/business ability via the teaching of good business practices. In turn, the premise of business grants is to reduce entrepreneurial credit constraints. Second, many empirical studies have revealed that it is difficult to improve the business outcomes of poor entrepreneurs, especially in the informal sector.Footnote 2 Of particular importance in this respect is that the informal sector in developing countries typically creates more jobs than the formal sector (Ayyagari et al. 2014). In this sense, it is crucial to understand better exactly what promotes growth in small businesses.

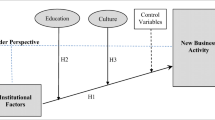

In this paper, we propose two explanations for these puzzles using a theoretical model of entrepreneurship. We then test the predictions of this theoretical model using data from a field experiment on business training and business grants in Tanzania. More specifically, the starting point of our analysis is the classical model of entrepreneurship developed by Lucas (1978). In Lucas (1978), entrepreneurship arises from the combination of capital ownership and business ability.Footnote 3 The model then predicts that individuals with greater business ability and more capital are more successful as entrepreneurs. As such, according to the theoretical model, interventions that improve entrepreneurial circumstances along these two dimensions could improve business outcomes. Accordingly, we can use the implications of the Lucas model to provide a theoretical basis for field experiments that target entrepreneurial ability and the access to capital.

We argue that besides the constraints on access to capital and business knowledge, many entrepreneurs, especially female entrepreneurs in developing countries, face another important entrepreneurial obstacle. In particular, female entrepreneurs are generally constrained as to the amount of time they can dedicate to their businesses. This is because female entrepreneurs often have domestic obligations.Footnote 4 In fact, as argued by Giné et al. (2011, page 508), “[f]emale entrepreneurship is low in many developing economies partly due to constraints on women’s time and mobility, often reinforced by social norms.”

We then extend the Lucas model to include business time-constrained entrepreneurs, i.e., entrepreneurs who dedicate less time to their businesses. In this case, the predictions of the Lucas model are that business time-constrained entrepreneurs endogenously invest less in their businesses and employ less external labor than do time-unconstrained entrepreneurs.Footnote 5 As a result, we expect that female entrepreneurs run less successful businesses than male entrepreneurs do, as they are more time constrained. Furthermore, and very importantly, interventions that target entrepreneurial ability (like business training) and capital constraints (such as a business grant), may not have their expected positive effects on female entrepreneurs. This is possibly because female entrepreneurs continue to be constrained in terms of the time that they can allocate to their business activities.

In addition, we also investigate entrepreneurship using the prism of the formal versus the informal sector. We know that running a formal business involves more costs, such as paying for business licenses and taxes. If we once again extend the Lucas model to include these cost differences between the formal and informal sectors, the model predicts that entrepreneurs in the informal sector have less business ability and less access to capital than those in the formal sector.Footnote 6 As a corollary, we expect interventions that target business ability and capital constraints to have greater impacts on informal entrepreneurs than formal entrepreneurs, because the former are more constrained along these two dimensions.Footnote 7 Moreover, we also expect that interventions that target both business ability and access to capital have a greater impact than interventions that target just one of these two dimensions.

We test the above theoretical predictions using data from a randomized field experiment with small-scale entrepreneurs in Dar es Salaam, Tanzania. The field experiment was conducted in collaboration with PRIDE, one of the leading microfinance institutions in Tanzania (for details, see Berge et al. 2015a). The objective of the field experiment was to examine the effects of business grants and training on entrepreneurial outcomes (in terms of profits).Footnote 8 One distinguishing feature of this was the implementation of three treatments: business training only, business grants only, and business training together with business grants. The control group, as usual, received neither business grants nor training.

As shown in Berge et al. (2015a), the intervention only had a positive impact on the business outcomes of male entrepreneurs who received both business grants and business training, with the intervention having no effect whatsoever on female entrepreneurs. This aligns with other entrepreneurship interventions also reporting no or modest impacts on female entrepreneurs. Very importantly, we find that while business training and business grants failed to impact the business time-constrained female entrepreneurs, they did have a positive effect on those who were not time constrained. The magnitude of this effect was similar to that for male entrepreneurs.Footnote 9

Further, with respect to formality, we find that the intervention had a larger impact on informal than on formal entrepreneurs. In other words, informal entrepreneurs mainly drive the positive impact of the business training and business grants on entrepreneurial outcomes. Furthermore, only the combined intervention of business grants together with business knowledge has a positive impact on informal entrepreneurs. The data from the field experiment thus confirms the main predictions of the extended Lucas model about business time constraints and to the division between the formal and informal sectors.

The importance of business time constraints on business outcomes has been somewhat neglected in the entrepreneurship literature.Footnote 10 However, the literature on the gender wage gap has attributed an important share to the fact that women are more time constrained than are men. First, women experience labor interruptions owing to maternity leave (Light and Ureta 1995; Wood et al. 1993). Second, women work fewer hours than men do given their domestic obligations (Bertrand et al. 2010). This argument and ours are close with regard to gender-specific entrepreneurship outcomes resulting from business training programs and grants.

In turn, the literature on formality has focused on how to boost informal firms into becoming formal ones (see de Mel et al. 2013). This draws on the belief that formality is conducive to firm growth and economic development. However, one obstacle to formality is firm size. In this sense, our results suggest a way to assist informal firms to achieve better business outcomes and therefore grow in size, which could conduce formality and enhance the chances of survival in the formal sector over the long run.

The remainder of the paper is organized as follows. Section 2 introduces the base model and its main implications. Section 3 describes the data from the field experiment together with the empirical strategy. Section 4 presents the empirical results. Section 5 discusses the main conclusions.

2 The model

The Lucas (1978) model of entrepreneurship assumes that the production function of an entrepreneur with business ability θ isFootnote 11:

where K is capital, L is labor, and α (1 − α) is the share of capital (labor) in production. The price of capital is r and the wage rate is w. An entrepreneur will then choose K and L to maximize profits:

Firms are assumed price takers, and as such, prices normalize to one. From the first-order conditions, we have:

In this model, the prediction is that entrepreneurs with high entrepreneurial ability, all else being equal, employ more capital and more labor, and have higher profits.

One argument put forward concerning entrepreneurs in developing countries is that they face credit constraints (McKenzie 2015). To introduce credit constraints, consider that the wealth of an entrepreneur is A. The entrepreneur can then leverage wealth in financial markets by (a − 1), where a > 1 is a measure of credit constraint. In this case, the first-order conditions are:

where λ is the Lagrange multiplier. We then have entrepreneurs who are not credit constrained, who employ more labor, have higher profits, and do not need to have as high an entrepreneurial ability as those with credit constraints.

Thus, the Lucas model can provide a theoretical foundation for the field experiments that offer business training and grants to entrepreneurs (McKenzie 2015). The main idea is that by receiving business training, entrepreneurial ability will increase, which in turn will lead to greater entrepreneurial success. Similarly, business grants will reduce the credit constraints of entrepreneurs and they will then more likely succeed. Taking this reasoning further, a combined intervention addressing business ability and credit constraints in principle will have a better chance of a positive impact on entrepreneurial activity than those targeting just one of these dimensions.

We illustrate this reasoning in Fig. 1 (business grants) and Fig. 2 (business training). These depict the threshold level of ability that makes it profitable for an individual to become an entrepreneur or θ(K). We can see from Fig. 1 that an entrepreneur with capital level K′ needs an ability level θ′ in order to operate a profitable business. However, if the same entrepreneur receives a business grant that now allows capital level K′′, where K′′ > K′, then the entrepreneur in theory will require a lower level of entrepreneurial ability for success, such that θ′′ and where θ′ > θ′′.

Figure 2 considers the case of business training. Conceive an individual with an ability level θ′. This individual requires a capital level K′ to start a profitable business. Now, consider that the individual receives business training that lifts the level of ability to θ′′ (with θ′′ > θ′). As a result, this individual would now only require capital level K′′ (with K′′ < K′ ) to succeed as an entrepreneur.

Extant empirical evidence provides some support to Figs. 1 and 2. However, a puzzle remains in that while these interventions tend to have a positive impact on male entrepreneurs, it is not usually the same for female entrepreneurs. As discussed, one of the objectives of this paper is to provide an explanation for this puzzle. In particular, we focus on one problem faced by women in many (especially developing) countries in that female entrepreneurs are business time constrained, owing to the bulk of domestic obligations falling on them (including cooking, cleaning, childcare, care of the elderly, etc.).Footnote 12

To model these time constraints, we assume that the amount of labor that entrepreneurs can apply to their businesses is B. As for capital, entrepreneurs can leverage the amount of labor by hiring workers (b − 1), where b > 1 is a measure of time constraints. Consider then that female entrepreneurs are both time and credit constrained, whereas male entrepreneurs are only credit constrained. For female entrepreneurs the first-order conditions are now:

The implications of equation (5) are that female entrepreneurs will have less access to capital and labor than male entrepreneurs. Consequently, businesses run by female entrepreneurs will be less profitable. Further, an intervention that targets entrepreneurial ability and credit constraints may not have any effect on time-constrained female entrepreneurs.

In the same way as Figs. 1, 2, 3 and 4 illustrate the threshold levels of entrepreneurial ability that female and male entrepreneurs need in order to conduct profitable businesses, being θM(K) and θW(K), respectively. As shown, for a given level of capital, say K′, female entrepreneurs require higher ability to succeed as entrepreneurs, i.e., θ′W > θ′M (see Fig. 3). Similarly, for a given level of ability, say θ′, female entrepreneurs need more investment capital to succeed, i.e., K′W > K′M (see Fig. 4). As a result, even if an intervention elevates female entrepreneurs across these two dimensions, i.e., business ability and access to capital, the intervention may still not be successful as the female entrepreneurs continue to be business time constrained.

We now consider the formal and informal sectors: formal entrepreneurs face some costs not borne by informal entrepreneurs. Formal entrepreneurs, for instance, must purchase business licenses and pay taxes. Consider, then, that entrepreneurs in the formal sector, in addition to labor and capital costs, bear the costs of formality, T:

Further, if some entrepreneurs are more credit constrained, then the result may be that the more credit-constrained and less able entrepreneurs will invest in the informal sector. This, in turn, implies that informal entrepreneurs will have lower profits than will formal entrepreneurs.

We illustrate this in Figs. 5 and 6. These again depict the threshold level of ability that makes an entrepreneur profitable. The difference with regard to Figs. 1, 2, 3 and 4 is that we now have two sectors, formal and informal, and therefore the threshold levels of ability are now θF(K) for formal entrepreneurs and θI(K) for informal entrepreneurs. We can see that for a given level of capital, say K′, formal entrepreneurs require greater ability, i.e., θ′F > θ′I, to succeed as entrepreneurs (see Fig. 5). Similarly, for a given level of ability, say θ′, formal entrepreneurs need to invest more capital, i.e., K′F > K′I, to succeed (see Fig. 6). As a result, we expect that interventions like business training and business grants could have a greater impact on informal than formal entrepreneurs because the former are more capital and ability constrained than the latter, i.e., formal entrepreneurs are much closer to the shared production possibility frontier. Once again, interventions that target both business grants and business knowledge are more likely to have a positive impact than those that focus only on one of the dimensions.

We can now state the following model implications.

1. Female entrepreneurs tend to have lower profits than do male entrepreneurs.

2. Interventions that target entrepreneurial access to capital and ability are more likely to have a positive impact on entrepreneurs who are not time constrained. In other words, we expect the intervention to have a positive impact on male entrepreneurs (because most are not time constrained) and on female entrepreneurs who are not time constrained, but no effect on female entrepreneurs who are time constrained.

3. Formal entrepreneurs are more able and can therefore generate more profits.

4. Interventions that target entrepreneurial access to capital and ability are more likely to have a positive impact on informal entrepreneurs because informal entrepreneurs are more constrained across both dimensions. In addition, interventions that target both business knowledge and access to capital have a greater likelihood of success than interventions that target only one of the two dimensions.

2.1 Discussion of the theoretical model

The Lucas (1978) entrepreneurship model provides very clear predictions but is also very stylized. As a result, it ignores some important issues relating to entrepreneurship, and as our model is an extension, it shares some of these limitations. In particular, three issues deserve further discussion: (1) business time constraints are exogenous, (2) entrepreneurs do not choose their sector of activity, and (3) ability, capital, and the time dedicated to business solely determine entrepreneurial activity.

First, in the model, the choice by an entrepreneur of how much time to allocate to the business is exogenous.Footnote 13 For example, with married women, this suggests that husbands and/or the family can decide how much time they dedicate to business activity. However, in reality, female entrepreneurs can choose between family and work life, and some choose (more) family while others (more) work, i.e., business time is endogenous. Both the exogenous or endogenous choice of time dedicated to the business can relate to bargaining power within the household. See, for instance, Gitter and Barham (2008), Squire (2016), Bernhardt et al. (2017), and Fiala (2017).

However, these polar cases of the exogenous versus endogenous choice of time dedicated to business activity can both influence the impact of the interventions considered here. If women have no choice, then the type of interventions we consider in this study (business grants and business training) will typically have lesser effects on female entrepreneurs. If women have a choice, i.e., they can choose whether to dedicate more time to the family or to business, we can expect that these interventions will more strongly affect the business choices of female entrepreneurs than in the exogenous case.

In both cases, however, we can expect to observe the positive effects of business grants and business training for at least some female entrepreneurs. This should be particularly the case for female entrepreneurs who work more (in the no-choice case) and for female entrepreneurs who give more weight to work, or that start to give more weight to work as a result of the intervention (in the choice case). This is exactly one of the reasons why we consider the heterogeneous effects of the working hours that entrepreneurs dedicate to their businesses. If, for instance, intervention has a positive effect on some female entrepreneurs, particularly those who are not time constrained (i.e., who dedicate more time to their business), we could argue that working hours are a restriction for female entrepreneurs, and it is then important for development agencies to focus on whether the restriction is exogenous or endogenous.

Second, the theoretical model comprises only a single sector of activity. In reality, entrepreneurs choose between different sectors, involving different entrepreneurial dynamics and potential. For instance, a “survival” entrepreneur with low entrepreneurial aspirations may choose a sector that requires less commitment, competence and effort (Morduch 1999; Berner et al. 2012). Nevertheless, even if an entrepreneur decides to operate in a sector of activity with greater potential, they can still choose to be a survival entrepreneur.

In the context of our sample, namely, micro-entrepreneurs in a developing country, we expect that many are survival entrepreneurs in the sense that they are either unable or unwilling to grow their businesses. The survival characteristics of entrepreneurs in developing countries can be even more severe for female entrepreneurs because of social norms, like family obligations, which preclude them from dedicating more time, effort, and resources to their businesses. For this reason, in the empirical analysis, we investigate heterogeneous effects across entrepreneurs and sectors. As mentioned, if we find that different female entrepreneurs react differently to the intervention, this could indicate that even in the case of survival entrepreneurs, some respond differently and positively to interventions attempting to raise their entrepreneurial activity.

Finally, only ability, capital, and the time allocated to the business determine entrepreneurial activity in the model. Other factors, such as confidence, experience, risk preferences, and competitiveness attitudes, can certainly influence entrepreneurial activity.Footnote 14 We can readily conceive that entrepreneurs who are more confident make bolder investments, more experienced entrepreneurs make better business choices, more risk-loving entrepreneurs make riskier investments, and entrepreneurs who are more competitive are less afraid of competition. In a way, business ability in the Lucas (1978) model endeavors to capture all these diverse characteristics of entrepreneurs. In the empirical analysis, we therefore also control for other entrepreneurial characteristics (besides credit constraints and the time allocated to business), including entrepreneurial aspirations, to take into consideration some of these other entrepreneurial traits.

3 Sample, data, and empirical strategy

The data we employ are from a randomized field experiment on business training and business grants conducted in Dar es Salaam, Tanzania (for details, see Berge et al. 2015a, b). The field experiment consisted of three treatments. In the first treatment, entrepreneurs received business training; in the second treatment, entrepreneurs received a business grant; and in the third treatment, entrepreneurs received both business training and a business grant. The control group received neither a business grant nor business training.

The sample consisted of 644 small-scale entrepreneurs, all members of PRIDE, one of the leading microfinance institutions in the country. Most of these entrepreneurs are involved in small-scale commerce (running a small kiosk, operating a stall in the market) or in different sorts of service activities (hairdressing, small restaurants), with a few involved in light manufacturing (tailoring, carpentry, brick making) or agriculture.

The organization of the PRIDE clients is in loan groups of five entrepreneurs, with ten loan groups making up a so-called market enterprise group.Footnote 15 All members of a market enterprise group are jointly responsible for each other’s loans in the microfinance institution in case of the default of a group member.

One important concern with many training interventions is the possibility that untreated individuals socially interact with treated individuals. For example, members of the control group can learn or observe business strategies implemented by individuals receiving business training, thereby biasing downwards any treatment effects. Conversely, if the control and treatment individuals compete for the same customers, we could imagine negative spillovers associated with business stealing effects.

Owing to the risk of treatment spillovers, we designed the experiment to minimize the risk of social interaction between the treated and untreated individuals. Foremost, we made sure that no control and treatment individuals belonged to the same loan group, as we anticipated many social interactions within loan groups given that the borrowers ex ante self-select into joint-liability groups, and ex post have an incentive to monitor each other to ensure repayment.

In particular, the business training was offered to 319 clients with weekly loan group meetings in the microfinance institution on Tuesdays (clients from the Magomeni branch) and Thursdays (clients from the Buguruni branch), whereas the remaining 325 clients not offered business training had loan group meetings on Mondays (clients from the Magomeni branch) and Wednesdays (clients from the Buguruni branch). In turn, the business grants were offered to 252 clients with a loan group meeting time at 12:00 Monday–Thursday (both branches) and 09:00 Wednesdays and Thursdays (the Buguruni branch). The remaining 392 clients, with loan group meetings at other times, did not receive the business grant.

This procedure created four groups: 126 clients received both treatments, 193 clients received business training only, and 126 clients received the business grant only. The control group consisted of 199 individuals.Footnote 16 Given that the clients in our sample work and reside across a huge urban area (Dar es Salaam), we do not believe that the risk of knowledge spillovers from trained to untrained clients is very large.

Regarding the empirical strategy, we first describe the data, then analyze correlations among the different variables, and finally test for the existence of treatment effects from the field experiment. In the description of the data, we analyze the data with regard to entrepreneurial activity: sales, profits, the number of businesses, the formality of the business, the sector of activity, the number of employees, loans, investments, business practices (such as record keeping and marketing), business knowledge, working hours, age, education, and business contacts. We pay particular attention to the gender and formality dimensions. In other words, we look at whether male and female entrepreneurs and formal and informal entrepreneurs differ with respect to their entrepreneurial choices and outcomes. We assume female and male entrepreneurs to be the main decision-makers in their businesses and that a formal entrepreneur is an entrepreneur with a business registration and/or license.

We then examine which business and entrepreneurial variables correlate with profits and other business choices, such as investments, loans, working hours, business knowledge, education, and formality. We then re-analyze these correlations, again looking at differences between male/female and formal/informal entrepreneurs.

The final exercise we perform is to examine the experimental evidence. In particular, we regress profits on the treatment variables. As discussed, there are three treatments: business grant only, business training only, and business grant plus business training. We then consider the effect of the different treatments when interacted first with the number of working hours and gender, and then with formality.

4 Results

In this section, we report the empirical results. Table 1 details the descriptive statistics by gender (on the left-hand side) and formality (on the right-hand side). In terms of gender (Table 1), we observe the following statistically significant differences between female and male entrepreneurs. First, male entrepreneurs when compared to female entrepreneurs have higher sales, larger profits, and operate more businesses that are formal. Second, female entrepreneurs operate more service businesses (such as hairdressing or restaurants), but fewer manufacturing businesses (such as carpentry). Finally, while female entrepreneurs typically have more formal education, they also have less business knowledge and fewer business contacts.Footnote 17 Importantly, female entrepreneurs work on average 8 h per week less than male entrepreneurs.Footnote 18 The descriptive statistics in relation to gender are then mostly in accordance with the implications of the theoretical model.

In terms of formality (Table 1), we identify the following statistically significant differences between formal and informal entrepreneurs. First, we formal entrepreneurs hold larger loans and investments. Second, formal entrepreneurs work longer hours and employ more workers in their businesses. Third, formal entrepreneurs generate greater profits and have higher sales. The descriptive statistics in terms of formality are therefore also in accordance with the theoretical model.

Table 2 presents the descriptive statistics for working hours for females, in particular for females who work more and less than 60 h a week. The idea is to compare female entrepreneurs who are relatively time constrained (< 60 h) with female entrepreneurs who are not time constrained (> 60 h).

As shown, female entrepreneurs who work more than 60 h a week have greater profits and operate more businesses. They are also more likely to be in the formal sector, the service sector, younger, and more educated. Apart from these differences, females who work than more than 60 h a week do not differ in any other dimension from those working less than 60 h a week. In particular, they do not differ in terms of the access to capital (they have approximately the same values of loans and investments), number of employees, marketing strategies, and business knowledge.

Table 3 details the correlations between profits and the set of business indicators and characteristics. We show these correlations for the whole sample (column (1)), according to gender (columns (2) and (3)), and according to formal status (columns (4) and (5)).

For the whole sample (column (1)), we can see that profits are positively and statistically significantly correlated with investments, loans, the level of service, commerce as the sector of activity, working hours, the number of employees, the formal sector, and male entrepreneurs. For female entrepreneurs only (column (2)), a similar pattern holds as for the whole sample, with the exception that formality is no longer statistically significant. In turn, when we analyze male entrepreneurs only (column (3)), the same pattern holds as for the whole sample, with the exception that investments are now no longer statistically significant, service is now negative but statistically insignificant, business knowledge is now statistically significant with a positive impact on profits, and working hours are now not statistically significant. This last result is worth highlighting, as it demonstrates that male entrepreneurs, unlike female entrepreneurs, are not business time constrained.Footnote 19

In terms of formality, we obtain the following. For formal entrepreneurs (column (4)), the following variables have a positive and statistically significant impact on profits: loans, service and commerce sectors, the number of employees, and the level of education. In turn, there is a negative and statistically significant correlation between profits and female entrepreneurs. For informal entrepreneurs (column (5)), the same pattern arises as for formal entrepreneurs, with the exception that investments now have a positive and statistically significant effect, the service sector is no longer statistically significant, and working hours and business knowledge now have a positive and statistically significant impact on profits.

Table 4 presents correlates of business practices other than those related to profits, particularly investments, loans, working hours, business knowledge, education, and formality.Footnote 20 We can see that investment positively and statistically significantly correlates with running a formal business, being active in the service sector, having more employees, and being a male entrepreneur. In turn, loans positively and statistically significantly correlate with running a formal business and working fewer hours (demonstrating the substitutability between capital and labor). Working hours are positively and statistically significantly correlated with formal activity, lower loans (again demonstrating the substitutability between capital and labor), being active in the service sector, having more years of education, and being a male entrepreneur (note that working hours are very strongly negatively correlated with being a female entrepreneur). In turn, business knowledge negatively and statistically significantly correlates with being active in the commerce sector, the level of education, and being a female entrepreneur. Education negatively and statistically significantly correlates with the formal sector, being active in the service sector, and business knowledge, but positively and statistically significantly correlates with working hours. Finally, formality positively and statistically significantly correlates with loans, investments, working hours, and negatively and statistically significantly correlates with the service sector and the level of education.

We now present the experimental evidence using the theoretical model as guidance. In particular, we focus on the following implications of the theoretical model. First, we expect interventions that improve entrepreneurial access to capital and ability not to have an impact on business time-constrained female entrepreneurs. However, for female entrepreneurs who are not business time constrained, such interventions can have a positive impact. Second, we expect these types of interventions exert a stronger impact on the informal than the formal sector.

We begin by looking at the effects of business training and business grants by gender and working hours. Table 5 provides the treatment effects for the full sample (column (1)). In turn, columns (2) to (7) detail the treatment effects according to the number of working hours entrepreneurs dedicate to their businesses.

We can see that for the full sample, the intervention had a positive and statistically significant impact for male entrepreneurs who received both the business grant and the business training. For female entrepreneurs, in the full sample there is no impact in any of the treatments, including those receiving both treatments. Similar results emerge if we only consider those entrepreneurs working between 30 and 70 h a week, columns (2) to (5).Footnote 21 However, for female entrepreneurs who work more than 70 h a week, columns (6) and (7), the combined impact of business training and business grant is positive, and more importantly, similar to that for male entrepreneurs. Furthermore, for entrepreneurs working more than 80 h a week, the result is now that there are no statistically significant effects for male entrepreneurs but there are positive, large, and statistically significant effects for female entrepreneurs. Furthermore, the dual treatment coefficient for female entrepreneurs working more than 80 h a week is significantly different from that for female entrepreneurs also working less than 80 h a week (p value = 0.0210). This shows that for female entrepreneurs who are not business time constrained, business training and business grants can have a large positive impact, similar to that for male entrepreneurs.

Nonetheless, the question arises whether female entrepreneurs who are and who are not business time constrained are essentially different. One possibility may be that the more motivated female entrepreneurs “self-select” into not being business time constrained. In this situation, the female entrepreneurs who are not business time constrained could be labeled as growing female entrepreneurs with high entrepreneurial aspirations. In contrast, we could label the business time-constrained female entrepreneurs as survival female entrepreneurs.Footnote 22 Alternatively, it could be argued that the female entrepreneurs who are not business time constrained are only so because they do not face these restrictions. Then again, we could wonder why the same is not the case for male entrepreneurs. In this sense, it seems that the effects we reveal not only relate to self-selection, but also to social norms about the gender roles prevalent in many developing countries.

Using Table 2, we found that time-constrained female entrepreneurs do not differ much from female entrepreneurs who are not time constrained. While the non-time-constrained entrepreneurs tend to be younger and more educated and to do better in business, they tend to have the same number of employees, business loans, and investments. As younger people are less likely to be married and to have children, this could indicate that family obligations are a limitation for female entrepreneurs as they reduce the amount of time they can dedicate to their business. This appears to demonstrate that time-unconstrained female entrepreneurs do not self-select as such, but rather that this is because of external limitations like family obligations. Furthermore, external capital and employment does not appear to compensate for the limitations of time constraints.

To strengthen further the evidence in this respect, we examine the effects of the interventions on the number of hours worked per week. We could well believe that if an entrepreneur is not time constrained, then the intervention could affect how many hours an entrepreneur dedicates to their business (training could, for example, motivate the entrepreneur to work harder). Table 6 provides the results. As shown, there is some evidence that males work more because of the interventions, in particular with the dual treatment of training and grants. For female entrepreneurs, while the coefficients are positive, there is no significant evidence that any of the treatments affect the number of hours they dedicate to their businesses. Although there could be other underlying reasons for this finding, it at least aligns with the assumption that female entrepreneurs tend to be more time constrained than male entrepreneurs because of, for example, family obligations.

Table 7 details the impact of the intervention depending on business formality. We observe that for the full sample, only the combined treatment (business training and business grant) had a positive and statistically significant impact on profits. However, if we divide the sample between formal and informal entrepreneurs, we can see that the intervention only had a positive and statistically significant effect for informal entrepreneurs. This shows that the intervention was more valuable for informal entrepreneurs, i.e., entrepreneurs who are more capital and ability constrained, than for formal entrepreneurs. However, the result is not as strong as for business time-constrained female entrepreneurs, as the coefficient for the dual treatment for informal entrepreneurs is not statistically different from that for formal entrepreneurs (p value = 0.1342).

As for business time-constrained entrepreneurs, we may well ask if formal entrepreneurs are more motivated than are their informal counterparts. We argue that what is at play here is that informal entrepreneurs face constraints that are very difficult to overcome, and which are not normally as strong or as common as among formal entrepreneurs. However, we find that the intervention had larger impacts on informal entrepreneurs than on formal entrepreneurs. This seems to present evidence that informal entrepreneurs, similar to what is usually argued for formal entrepreneurs, are also willing to invest and to take risks in order to enhance their businesses.

As shown in Table 1, contrary to what happens with time-constrained female entrepreneurs, formal entrepreneurs differ in many dimensions from informal ones. Formal entrepreneurs tend to have more education, work longer hours, and have larger loans and investments. As a result, they also have better business outcomes. We are then rather less confident in saying that formal entrepreneurs do not endogenously self-select into the formal sector.

A final question arises as to how relevant our results stemming from a sample of microfinance clients are for the general population of entrepreneurs in Tanzania. This raises the issue of self-selection into microfinance. The available empirical evidence suggests that microfinance institutions tend to exclude the poorest (see, for instance, Tedeschi 2008; Beaman et al. 2015). In other words, microfinance entrepreneurs are poor, but they are typically not among the most destitute. This likely relates to the fact that joint-liability microfinance groups have an incentive to exclude those with a higher probability of default, and it is reasonable to assume that the probability to default is higher among the poor.

Furthermore, we have no reason to believe that micro-entrepreneurs from PRIDE are very different from other urban entrepreneurs in other microfinance institutions in Tanzania. The entrepreneurs in our sample in fact look very similar in terms of observables (such as age, loan, income, gender, and education) to members of other Tanzanian microfinance institutions, as reported in Kessy et al. (2015) and Randhawa and Gallardo (2003).Footnote 23

5 Concluding remarks

A common criticism of field experiments is that they often do not have a solid theoretical background. In this paper, we explicitly consider this critique in an effort to explain two puzzles that have arisen from several field experiments on business grants and business training and empirical studies on firm growth. First, field interventions with business grants and training tend only to have a positive impact on male entrepreneurs, with no discernible impact on female entrepreneurs. Second, empirical studies show that it is very challenging to improve the business outcomes of informal entrepreneurs.

We started with an entrepreneurship model based on Lucas (1978), where entrepreneurship is comprised of two dimensions: capital investment and business ability. To the Lucas model, we added a third dimension: the entrepreneur’s own labor investments. In addition, we divided the economy into the formal and informal sector, where the formal sector has higher fixed costs for running a business, because—for instance—of business licensing.

The extended Lucas model predicts that when entrepreneurs are constrained along these three dimensions (capital, ability, and labor investments) and only two of these dimensions are lifted, say ability (via business training) and capital (through business grants), business time-constrained entrepreneurs may still not be able to grow their businesses. We argue that in many developing countries, female entrepreneurs are often constrained with respect to the time they can dedicate to their businesses because of their domestic obligations. The model also predicts that interventions that attempt to boost entrepreneurial business ability and access to capital can have a greater impact on informal entrepreneurs, as they are more constrained along these dimensions than are formal entrepreneurs.

Finally, we presented evidence from a randomized field experiment on business grants and business training in a microfinance institution in Tanzania that confirms the main predictions of the theoretical model. In particular, we showed that business training and business grants did have a positive impact on female entrepreneurs who were not business time constrained, but no impact on business time-constrained female entrepreneurs. Similarly, we found that the intervention had larger effects on informal than on formal entrepreneurs. Accordingly, informal entrepreneurs drove the positive impact of the intervention.

In this sense, our results have relevant policy implications. First, improving access to capital and business knowledge for female entrepreneurs in developing countries might not be sufficient in enabling them to become successful entrepreneurs. Second, development interventions that aim at promoting female entrepreneurship should also target social norms, such as the burden of domestic obligations that fall on women, as these necessarily restrict their capacity and potential as entrepreneurs.Footnote 24 Third, interventions in business ability and capital access should focus more on informal entrepreneurs, given that they face greater constraints along these dimensions than do formal entrepreneurs. The potential impact of these interventions can therefore be larger for informal than formal entrepreneurs.

Our results also show that an important avenue for future research is the question of self-selection into entrepreneurship. Optimally, we would like the best entrepreneurs to self-select into entrepreneurship in order to promote successful entrepreneurship and ultimately economic growth. However, in developing countries this is not always the case, as many entrepreneurs are mere survivalists. It could be, for example, that less able entrepreneurs self-select themselves to be business time constrained or into the informal sector. Responding to these questions could yield an important contribution to the research on entrepreneurship in developing countries.

Notes

See, for instance, Field et al. (2010), Karlan and Valdivia (2011), Banerjee and Duflo (2011), Giné and Mansuri (2011), Klinger and Schündeln (2011), Bruhn and Zia (2012), de Mel et al. (2013, 2014), Drexler et al. (2014), Karlan et al. (2015), Berge et al. (2015a), Bulte et al. (2015), Higuchi et al. (2015), Higuchi and Sonobe (2015), and Angelucci et al. (2015). In addition, several studies reveal that female entrepreneurs tend to have worse entrepreneurial outcomes than males (see Fairlie and Robb 2009; Lee and Marvel 2014). For a review of female entrepreneurship in developing countries, see Minniti and Naudé (2010).

See, for instance, Morduch (1999), Khandker (2005), Hermes and Lensink (2007), Cull et al. (2009), Rijkers and Costa (2012), and Cintina and Love (2017). The usual definition of the formal sector is firms that are officially registered, organized, and regulated in a country. In practice, this means that firms that are legally registered with authorities keep records and pay taxes. The opposite is the case for informal firms.

On the importance of credit constraints on entrepreneurship, see, for instance, Cotler and Woodruff (2008), Brown et al. (2005), de Mel et al. (2011), Bruhn and Love (2011), and Kairiza et al. (2017). For the significance of business knowledge on entrepreneurship, see, for example, Jäckle and Li (2006).

Emran et al. (2006) explain why women are more common in the informal sector (and particularly in microfinance) using non-existent or “missing” labor markets for women. This argues that as women suffer discrimination in the formal labor market, they have no other choice than to work or become entrepreneurs in the informal sector.

Note that our results differ from those in Fafchamps et al. (2014), where business grants only had an impact on female entrepreneurs already earning higher profits at the commencement of the intervention.

Bandiera et al. (2011) focus differently on time constraints by considering the way CEOs allocate time at work. They show that the division of time between different activities (spending time with insiders versus outsiders of the firm) is central for CEO productivity and firm performance.

Obviously, other explanations are possible, and we discuss some below.

Note that in the Lucas (1978) model, credit constraints are also exogenous.

The average attendance rate per session was 70%, while 83% of the clients qualified for a diploma (after participating in 10 or more sessions).

On the importance of business contacts for entrepreneurship, see McAdam et al. (2018).

Note that working hours are a good proxy for domestic work for women. Women in our sample report that they do most of the domestic work in their households. This is possibly the reason why female entrepreneurs work closer to their homes than male entrepreneurs.

As discussed, we could well believe that the bargaining power inside the household also influences female entrepreneurial activity, business time constraints, and profits. However, our measures of bargaining power (who makes decisions in the household and controls the savings of the family) are uncorrelated with female profits and working hours.

In the appendix, we provide the correlates of working hours by gender (see Appendix Table 8). As shown there, working hours for the full sample positively and statistically significantly correlate with formality, the service sector, and the level of education, but negatively and statistically with loans (indicating the substitutability between capital and labor) and female entrepreneurs. Dividing by gender, a similar pattern arises with the exception that the loan variable is no longer statistically significant.

The exception is for female entrepreneurs who received the business grant and work more than 30 or 40 h a week. However, the magnitude of the coefficients is larger in this interval, before it again declines and increases again, and even though the coefficients in all regressions are economically significant, the standard errors are quite large. In this sense, it is difficult to rule out the possibility that the coefficients are identical as well as positive. Note also that the theoretical model does not exclude the possibility of a positive impact on entrepreneurial activities of the grant-only treatment.

For entrepreneurial aspirations, we posed five questions during the baseline survey to capture to what extent the clients had entrepreneurial “potential.” If anything, the results based on an index of these questions suggest that female entrepreneurs are borderline significantly more “entrepreneurial” than males. Conversely, when the enumerators were asked to subjectively judge the entrepreneurial potential of the subjects in our study, males scored better, although not significantly (p value = 0.132).

Using data on 100 self-employed/small-scale entrepreneurs from another experiment we have conducted in Dar es Salaam, including both microfinance members (not necessarily members of PRIDE) and non-microfinance members, we find only modest evidence that microfinance members are different from non-microfinance members. In particular, looking at income stability, mathematical ability, willingness to compete, risk aversion, trust, and patience, we identify no significant differences between microfinance members and non-members. Though, we note that microfinance members are more likely to report that they have a stable income than non-microfinance members (although the difference is not significant). If we look at happiness, microfinance members report they are significantly happier with their lives than non-microfinance members.

McMullen (2011) argues that institutional and cultural interventions should complement a market-based approach to entrepreneurs in developing countries. This seems to be in accordance with our findings.

References

Agarwal, B. (1994). A field of one’s own: Gender and land rights in South Asia. Cambridge: Cambridge University Press.

Agénor, P.-R. (2005). The macroeconomics of poverty reduction. The Manchester School, 73, 369–434. https://doi.org/10.1111/j.1467-9957.2005.00453.x.

Alby, P., Auriol, E., Nguimkeu, P. (2013). Social barriers to entrepreneurship in Africa: The forced mutual help hypothesis, Mimeo.

Alesina, A., Giuliano, P., & Nunn, N. (2013). On the origins of gender roles: Women and the plough. Quarterly Journal of Economics, 128, 469–530. https://doi.org/10.1093/qje/qjt005.

Angelucci, M., Karlan, D., & Zinman, J. (2015). Microcredit impacts: Evidence from a randomized microcredit program placement experiment by Compartamos banco. American Economic Journal: Applied Economics, 7, 151–182. https://doi.org/10.1257/app.20130537.

Atolia, M., & Prasad, K. (2011). Relative wealth concerns and entrepreneurship. Economica, 78, 294–316. https://doi.org/10.1111/j.l468-0335.2009.00812.x.

Ayyagari, M., Demirguc-Kunt, A., & Maksimovic, V. (2014). Who creates jobs in developing countries? Small Business Economics, 43, 75–99. https://doi.org/10.1007/s11187-014-9549-5.

Bandiera, O, Guiso, L., Prat, A., Sadun, R. (2011). What do CEOs do? CEPR Discussion Paper No. 8235.

Banerjee, A., Duflo, E. (2011). Poor economics: A radical rethinking of the way to fight global poverty. Public Affairs.

Beaman, L., Karlan, D., Thuysbaert, B., Udry, C. (2015). Self-selection into credit markets: Evidence from agriculture in Mali. NBER Working Paper No. 20387.

Berge, L. I. O., Bjorvatn, K., & Tungodden, B. (2015a). Human and financial capital for microenterprise development: Evidence from a field and lab experiment. Management Science, 61(4), 707–722. https://doi.org/10.1287/mnsc.2014.1933.

Berge, L. I. O., Bjorvatn, K., Garcia Pires, A., & Tungodden, B. (2015b). Competitive in the lab, successful in the Field? Journal of Economic Behavior & Organization, 118, 303–317. https://doi.org/10.1016/j.jebo.2014.11.014.

Berner, E., Gomez, G., & Knorringa, P. (2012). ‘Helping a large number of people become a little less poor’: The logic of survival entrepreneurs. European Journal of Development Research, 24, 382–396. https://doi.org/10.1057/ejdr.2011.61.

Bernhardt, A., Field, E., Pande, R., Rigol, N. (2017). Household matters: Revisiting the returns to capital among female micro-entrepreneurs. NBER Working Paper No. 23358.

Bertrand, M., Goldin, C., & Katz, L. (2010). Dynamics of the gender gap for young professionals in the financial and corporate sectors. American Economic Journal: Applied Economics, 2, 228–255. https://doi.org/10.1257/app.2.3.228.

Boeke, J. (1953). Economics and economic policy of dual societies. New York: Institute of Pacific Relations.

Brown, J., Earle, J., & Lup, D. (2005). What makes small firms grow? Finance, human capital, technical assistance, and the business environment in Romania. Economic Development and Cultural Change, 54, 33–70. https://doi.org/10.1086/431264.

Bruhn, M., & Love, I. (2011). Gender differences in the impact of banking services: Evidence from Mexico. Small Business Economics, 37, 493–512. https://doi.org/10.1007/s11187-014-9549-5.

Bruhn, M., & Zia, B. (2012). Stimulating managerial capital in emerging markets: The impact of business and financial literacy for young entrepreneurs. Mimeo: World Bank.

Bulte, E., Lensink, R., van Velzen, R., & Vu, N. (2015). Do gender and business trainings affect business outcomes? Mimeo: Experimental evidence from Vietnam.

Cabral, L., & Mata, J. (2003). On the evolution of the firm size distribution: Facts and theory. American Economic Review, 93, 1075–1090. https://doi.org/10.1257/000282803769206205.

Calá, C., Arauzo-Carod, J.-P., Manjón-Antolín, M. (2015), The determinants of entrepreneurship in developing countries, working papers 2072/246964. Universitat Rovira i Virgili, Department of Economics.

Cintina, I., & Love, I. (2017). Re-evaluating microfinance: Evidence from propensity score matching. The World Bank Economic Review. https://doi.org/10.1596/1813-9450-8028.

Cotler, P., & Woodruff, C. (2008). The impact of short-term credit on microenterprises: Evidence from the Fincomun-bimbo program in Mexico. Economic Development and Cultural Change, 56, 829–849. https://doi.org/10.1086/588169.

Cull, R., Demirgüç-Kunt, A., & Morduch, J. (2009). Microfinance meets the market. Journal of Economic Perspectives, 23, 167–192. https://doi.org/10.1257/jep.23.1.167.

Dasgupta, P. (1993). An inquiry into well-being and destitution. Oxford: Clarendon Press.

de Mel, S., McKenzie, D., & Woodruff, C. (2011). Getting credit to high return microentrepreneurs: The results of an information intervention. The World Bank Economic Review, 25, 456–485. https://doi.org/10.1093/wber/lhr023.

de Mel, S., McKenzie, D., & Woodruff, C. (2013). The demand for, and consequences of, formalization among informal firms in Sri Lanka. American Economic Journal: Applied Economics, 5, 122–150. https://doi.org/10.1257/app.5.2.122.

de Mel, S., McKenzie, D., & Woodruff, C. (2014). Business training and female Enterprise start-up, growth, and dynamics: Experimental evidence from Sri Lanka. Journal of Development Economics, 106, 199–210. https://doi.org/10.1016/j.jdeveco.2013.09.005.

De Mel, S., McKenzie, D., Woodruff, C. (2016). Labor drops: Experimental evidence on the return to additional labor in microenterprises. NBER Working Paper No. 23005.

de Quidt, J., Fetzer, T., & Ghatak, M. (2016). Group lending without joint liability. Journal of Development Economics, 121, 217–236. https://doi.org/10.1016/j.jdeveco.2014.11.006.

Dey-Abbas, J. (1997). Gender asymmetries in intrahousehold resource allocation in sub-Saharan Africa: Some policy implications for land and labor productivity. In L. Haddad, J. Hoddinott, & H. Alderman (Eds.), Intrahousehold resource allocation in developing countries: Models, methods, and policy. Baltimore: John Hopkins University Press.

Drexler, A., Fischer, G., & Schoar, A. (2014). Keeping it simple: Financial literacy and rules of thumb. American Economic Journal: Applied Economics, 6, 1–31. https://doi.org/10.1257/app.6.2.1.

Emran, M., Morshed, A., Stiglitz, J. (2006). Microfinance and missing markets. Mimeo.

Evans, D., & Jovanovic, B. (1989). An estimated model of entrepreneurial choice under liquidity constraints. Journal of Political Economy, 97, 808–827. https://doi.org/10.1086/261629.

Fafchamps, M., McKenzie, D., Quinn, S., & Woodruff, C. (2014). Female microenterprises and the fly-paper effect: Evidence from a randomized experiment in Ghana. Journal of Development Economics, 106, 211–226. https://doi.org/10.1016/j.jdeveco.2013.09.010.

Fairlie, R., & Robb, A. (2009). Gender differences in business performance: Evidence from the characteristics of business owners survey. Small Business Economics, 33, 375–395.

Fergusson, L. (2013). The political economy of rural property rights and the persistence of the dual economy. Journal of Development Economics, 103, 167–181. https://doi.org/10.1007/s11187-009-9207-5.

Fiala, N. (2017). Business is tough, but family is worse: Household bargaining and investment in microenterprises in Uganda. Mimeo: University of Connecticut.

Field, A. (1984). Microeconomics, norms, and rationality. Economic Development and Cultural Change, 32, 683–711. https://doi.org/10.1086/451421.

Field, E., Jayachandran, S., & Pande, R. (2010). Do traditional institutions constrain female entrepreneurship? A field experiment on business training in India. American Economic Review Papers and Proceedings, 100, 125–129. https://doi.org/10.1257/aer.100.2.125.

Fischer, G., & Ghatak, M. (2011). Spanning the chasm: Uniting theory and empirics in microfinance research. In B. Armendáriz & M. Labie (Eds.), The handbook of microfinance. Singapore: World Scientific.

Giné, X., & Mansuri, G. (2011). Money or ideas?, A field experiment on constraints to entrepreneurship in rural Pakistan. Mimeo.

Giné, X., Harigaya, T., Karlan, D., & Nguyen, B. (2006). Evaluating microfinance program innovation with randomized control trials: An example from group versus individual lending. ERD Technical Note Series, 16, 1–20.

Giné, X., Mansuri, G., & Picón, M. (2011). Does a picture paint a thousand words? Evidence from a microcredit marketing experiment. The World Bank Economic Review, 25, 508–542. https://doi.org/10.1093/wber/lhr026.

Gitter, S., & Barham, B. (2008). Women’s power, conditional cash transfers, and schooling in Nicaragua. The World Bank Economic Review, 22, 271–290. https://doi.org/10.1093/wber/lhn006.

Hermes, N., & Lensink, R. (2007). The empirics of microfinance: What do we know? The Economic Journal, 117, F1–F10. https://doi.org/10.1111/j.1468-0297.2007.02013.x.

Higuchi, Y., Sonobe, T. (2015). Short and longer run impacts of management training: The case of kaizen in Tanzania. Mimeo.

Higuchi, Y., Nam, V., Sonobe, T. (2015). Sustained impacts of kaizen training. Mimeo.

Hurst, E., & Lusardi, A. (2004). Liquidity constraints, household wealth, and entrepreneurship. Journal of Political Economy, 112, 319–347. https://doi.org/10.1086/381478.

Jäckle, A., & Li, C. (2006). Firm dynamics and institutional participation: A case study on informality of micro Enterprises in Peru. Economic Development and Cultural Change, 54, 557–578. https://doi.org/10.1086/500027.

Johnson, S. (2004). Gender norms in financial markets: Evidence from Kenya. World Development, 32, 1355–1374. https://doi.org/10.1016/j.worlddev.2004.03.003.

Jovanovic, B. (1982). Selection and the evolution of industry. Econometrica, 50, 649–670. https://doi.org/10.2307/1912606.

Kairiza, T., Kiprono, P., & Magadzire, V. (2017). Gender differences in financial inclusion amongst entrepreneurs in Zimbabwe. Small Business Economics, 48, 259–272. https://doi.org/10.1007/s11187-016-9773-2.

Karlan, D., & Valdivia, M. (2011). Teaching entrepreneurship: Impact of business training on microfinance clients and institutions. Review of Economics and Statistics, 93, 510–527. https://doi.org/10.1162/REST_a_00074.

Karlan, D., Knight, R., & Udry, C. (2015). Consulting and capital experiments with micro and small tailoring enterprises in Ghana. Journal of Economic Behavior and Organization, 118, 281–302. https://doi.org/10.1016/j.jebo.2015.04.005.

Kessy, J., Mtamakaya, C., Jeremia, D., Uriyo, J., Stray-Pedersen, B., Grete, B., & Msuya, S. (2015). Microfinance and clientele description—Tanzania. Indian Journal of Scientific Research, 4, 308–313. https://doi.org/10.15373/22501991/September2015/106.

Khandker, S. (2005). Microfinance and poverty: Evidence using panel data from Bangladesh. The World Bank Economic Review, 19, 263–286. https://doi.org/10.1093/wber/lhi008.

Klinger, B., & Schündeln, M. (2011). Can entrepreneurial activity be taught? Quasi-experimental evidence from Central America. World Development, 39, 1592–1610. https://doi.org/10.1016/j.worlddev.2011.04.021.

Lee, I., & Marvel, M. (2014). Revisiting the entrepreneur gender-performance relationship: A firm perspective. Small Business Economics, 42, 769–786. https://doi.org/10.1007/s11187-013-9497-5.

Lele, U. (1986). Women and structural transformation. Economic Development and Cultural Change, 34, 195–221. https://doi.org/10.1086/452611.

Lewis, A. (1954). Economic development with unlimited supplies of labour. The Manchester School, 22, 139–191. https://doi.org/10.1111/j.1467-9957.1954.tb00021.x.

Light, A., & Ureta, M. (1995). Early-career work experience and gender wage differentials. Journal of Labor Economics, 13, 121–154. https://doi.org/10.1086/298370.

Lucas, R. (1978). On the size distribution of firms. Bell Journal of Economics, 9, 508–523. https://doi.org/10.2307/3003596.

Mammen, K., & Paxson, C. (2000). Women’s work and economic development. Journal of Economic Perspectives, 14, 141–164. https://doi.org/10.1257/jep.14.4.141.

Mandelman, F., & Montes-Rojas, G. (2009). Is self-employment and micro-entrepreneurship a desired outcome? World Development, 37, 1914–1925. https://doi.org/10.1016/j.worlddev.2009.05.005.

McAdam, M., Harrison, R., & Leitch, C. (2018). Stories from the field: Women’s networking as gender capital in entrepreneurial ecosystems. Small Business Economics, forthcoming. https://doi.org/10.1007/s11187-018-9995-6.

McKenzie, D. (2015). Identifying and spurring high-growth entrepreneurship: Experimental evidence from a business plan competition. World Bank Policy Research Working Paper No. 7391.

McMullen, J. (2011). Delineating the domain of development entrepreneurship: A market-based approach to facilitating inclusive economic growth. Entrepreneurship Theory and Practice, 35, 185–193. https://doi.org/10.1111/j.1540-6520.2010.00428.x.

Mesnard, A., & Ravallion, M. (2006). The wealth effect on new business startups in a developing economy. Economica, 73, 367–392. https://doi.org/10.1111/j.1468-0335.2006.00515.x.

Minniti, M., & Naudé, W. (2010). What do we know about the patterns and determinants of female entrepreneurship across countries? The European Journal of Development Research, 22, 277–293. https://doi.org/10.1057/ejdr.2010.17.

Morduch, J. (1999). The microfinance promise. Journal of Economic Literature, 37, 1569–1614. https://doi.org/10.1257/jel.37.4.1569.

Munshi, K., & Myaux, J. (2006). Social norms and the fertility transition. Journal of Development Economics, 80, 1–38. https://doi.org/10.1016/j.jdeveco.2005.01.002.

Pitt, M., & Khandker, S. (1998). The impact of group-based credit programs on poor households in Bangladesh: Does the gender of participants matter? Journal of Political Economy, 106, 95–996. https://doi.org/10.1086/250037.

Potash, B. (1986). Widows in African societies: Choices and constraints. Stanford: Stanford University Press.

Randhawa, B., & Gallardo, J. (2003). Microfinance regulation in Tanzania: Implications for development and performance of the industry. World Bank, Africa Region Working Paper Series No. 51.

Rijkers, B., & Costa, R. (2012). Gender and rural non-farm entrepreneurship. World Development, 40, 2411–2426. https://doi.org/10.1596/1813-9450-6066.

Saito, K. (1994). Raising the productivity of women farmers in sub-Saharan Africa. World Bank Discussion Papers: Africa Technical Department Series No. 230.

Squire, M. (2016). Kinship taxation as a constraint to microenterprise growth: Experimental evidence from Kenya. PEDL Research Papers.

Tedeschi, G. (2008). Overcoming selection bias in microcredit impact assessments: A case study in Peru. The Journal of Development Studies, 44, 504–518. https://doi.org/10.1080/00220380801980822.

Udry, C. (1996). Gender, agricultural production, and the theory of the household. Journal of Political Economy, 104, 1010–1046. https://doi.org/10.1086/262050.

Van Tassel, E. (2004). Household bargaining and microfinance. Journal of Development Economics, 74, 449–468. https://doi.org/10.1016/j.jdeveco.2003.07.003.

Vollrath, D. (2009). How important are dual economy effects for aggregate productivity? Journal of Development Economics, 88(2), 325–334. https://doi.org/10.1016/j.jdeveco.2008.03.004.

Wood, R., Corcoran, M., & Courant, P. (1993). Pay differences among the highly paid: The male-female earnings gap in lawyers’ salaries. Journal of Labor Economics, 11, 417–441. https://doi.org/10.1086/298302.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The study was organized by The Choice Lab and financed by grant 204691 from The Research Council of Norway.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Oppedal Berge, L.I., Garcia Pires, A.J. Gender, formality, and entrepreneurial success. Small Bus Econ 55, 881–900 (2020). https://doi.org/10.1007/s11187-019-00163-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-019-00163-8