Abstract

This paper investigates the relationship between franchising proportion of a network and firm failure. Drawing from resource scarcity and agency theories, we show that franchising firms that overfranchise and do not structure their networks in congruence with these two theories have lower survival prospects. We test our arguments with extensive data from nearly 5000 franchising firms listed in Entrepreneur magazine. The findings suggest that franchising proportion has a U-shape relationship with network failure. Additional analysis shows that firm size and geographic scope moderate the relationship between the squared term of franchising proportion and network failure. For franchisors, our results highlight the importance of maintaining an appropriate mix of franchised and firm-owned outlets within a network.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

For many entrepreneurs, franchising is an important strategic option. When a new venture provides services that must be generated locally, franchising can be used to scale the venture into a network spanning many local markets using franchisee capital instead of the franchisor’s own capital. For some persons seeking to engage in such a local business, franchise acquisition may be preferable to starting or buying an independent business.

Although there are several explanations of why firms engage in franchising, knowledge about structuring the franchise network (i.e., determining the proportion of franchised to total units) and its consequences is very limited (Vázquez 2007). For the most part, past research (Shane 1998a) attempted to predict the proportion of franchised units in a chain, assuming that franchisors will do what is best for the firm, as reflected by overall tendencies across franchisors (El Akremi et al. 2015; Hsu and Jang 2009). Research is limited, however, as to what determines the best level of franchising within a network and whether it really matters (Castrogiovanni et al. 2006a; Shane 1998a).

Having a limited understanding of the impact of franchising on key consequences such as firm failure is especially disconcerting when considering franchising’s importance to the U.S. economy. A report prepared for the International Franchising Association (IHS Economics 2016) indicates that there were 782,573 franchising establishments in 2015 while franchising provided 8,834,000 jobs and generated a total output of US$892 billion.

Researchers have theorized about finding the right mix of franchised and firm-owned outlets in a network for more than 40 years (cf. Lafontaine and Shaw 2005; Oxenfeldt and Kelly 1968). Within this mix, it is important to know how many outlets will be franchised and also which locations within the network should be offered to entrepreneurs (i.e., franchisees) (Perryman and Combs 2012). However, the performance implications of these decisions at a network level have rarely been examined (Hsu and Jang 2009; Sorenson and Sørensen 2001). Moreover, the theoretical logic for the best mix of franchised outlets and firm-owned outlets in a network is subject to a heated debate. For example, on the one hand, proportion of franchised outlets seems to increase indefinitely for many firms (see Castrogiovanni et al. 2006a), suggesting a belief that “more is better.” On the other hand, some other studies ask the question whether an optimal franchising level (Hsu and Jang 2009) or an optimal mix of franchised and firm-owned outlets (Sorenson and Sørensen 2001) has an effect on network performance. We add to this body of research by showing that a disregard for the balance of franchised and firm-owned outlets within a franchise network can be a mistake—and sometimes that mistake can be fatal.

Firm exit or failure is a critical outcome in small business and entrepreneurship (Balcaen et al. 2010; Shane and Foo 1999). While previous research investigated the proportion of franchised outlets and the closure of individual outlets (Vázquez 2007), there is scarcity of studies that look at how network-level decisions drive the failure of the entire network. That is, a business exit is even more important when a network of entrepreneurs (franchisees) goes out of business due to the failure of a parent entrepreneur (franchisor). To address this key consequence in entrepreneurship, we specifically examine the proposition that based on agency and resource scarcity prescriptions (Oxenfeldt and Kelly 1968), franchising has a non-linear relationship with franchise network failure. We also explore whether the curvilinear effect of franchising on firm failure is moderated by resource scarcity and agency theory variables.

We thus contribute to the entrepreneurship and small business literature by providing evidence that having a high level of franchising, after considering the effects of agency and resource scarcity, increases the likelihood of network failure. We also offer some exploratory evidence that resource scarcity and agency considerations moderate the relationship between franchising proportion and firm failure (Dobbs et al. 2012).

In the next section, we review the literature on structuring the franchise network, which we used as the foundation of this study. Later, we describe the methods, and results. Finally, we discuss the findings as well as our conclusions.

2 Literature review

Perhaps the majority of franchising firms exhibit the plural form (Barthélemy 2011; Shane 1998a) in that they have a mix of firm-owned and franchised outlets. Considerable research has attempted to explain this mix. Generally, researchers have assumed that either performance-maximizing managers of firms know what they are doing or that market forces weed out inefficient firms (Combs et al. 2004; Dobbs et al. 2012). Consistent with that assumption, the performance-maximizing level of franchising is expected to vary with a firm’s circumstances, from zero for firms that do not franchise to 100% for franchisors that have no firm-owned outlets, and actual levels observed will approximate the performance-maximizing levels. In this section, theoretical perspectives on the mix of franchising outlets in a network in literature are reviewed. Then, the implications of failure to achieve a suitable mix are considered.

2.1 Antecedents of franchising levels in a network

Franchising firms structure their networks by shaping the mix of firm-owned and franchisee-owned outlets. While some franchising firms elect to franchise all of their outlets, most franchise only a proportion of them. Understanding what drives the proportion of franchised outlets has been a key research concern (Barthélemy 2011; Shane 1998a). Studies of franchising phenomena have suggested that firm executives select a proportion of franchising outlets based on firm-specific factors and that the chosen proportion remains relatively stable over time (Combs et al. 2009). Most often, the level of franchised outlets in a network is explained by resource scarcity theory (Oxenfeldt and Kelly 1968) or agency theory (Jensen and Meckling 1976).

Proposed by Oxenfeldt and Kelly (1968), resource scarcity theory suggests that it is imperative for young and small firms to grow fast in order to achieve economies of scale to increase their scope of advertising and purchasing power (Caves and Murphy 1976). However, young and small firms face a challenge when growing because they have very limited access to capital and managerial talent. Franchising can help firms overcome these and other limits to firm growth (Penrose 1959). Accordingly, young, small firms rely on franchising to reach minimum efficient scale (MES) early in their lifecycles (Carney and Gedajlovic 1991; Shane 1996). However, since franchisors get the profits of firm-owned outlets while franchisees retain the profits of franchised outlets, Oxenfeldt and Kelly (1968) suggested an “ownership redirection” proposition whereby mature franchisors that reached their MES would have sufficient internal resources to buy back franchised outlets, and as profit maximizers, they would indeed do so. Thus, resource scarcity theory suggests that the proportion of franchised outlets would be at or near 100% for young, small franchisors, and then it would decrease and eventually approach zero as resource scarcities diminish for larger, more mature franchisors. In reality, however, the proportion of outlets franchised rarely declines so dramatically; franchise networks seldom evolve into entirely firm-owned chains.

Castrogiovanni et al. (2006a), for example, found that the proportion of franchised outlets does tend to peak and then diminish for relatively young firms—consistent with resource scarcity theory. Presumably, firms that reached MES would tend to either buy back franchised outlets or open firm-owned outlets because it is more profitable to do so. However, Castrogiovanni et al. also observed that proportion of franchised outlets eventually started to increase again. They attributed this to agency influences (see below) taking precedence over resource considerations once resource scarcities cease to be problematic.

Agency theory is employed to explain how franchising firms manage the trade-off between two types of agency costs (Combs et al. 2004): vertical and horizontal costs. Shirking, one of the most common vertical agency problems, occurs when agents withhold effort in situations where their behaviors are not directly observed (Alchian and Demsetz 1972; Perryman and Combs 2012). In contrast, free riding, the most common horizontal agency problem, occurs when agents engage in money saving activities (e.g., using diluted chemicals to clean floors) to enhance outlet profits, underinvest in local advertising, or fail to supervise employees (Bradach 1997; Brickley and Dark 1987; Caves and Murphy 1976).

Franchising eases shirking concerns since entrepreneurs (i.e., franchisees) may lose potential profits along with equity investments in their outlets if they do not work hard to make their outlets successful. Employee managers of firm-owned outlets have no equity investment in their outlets, and they receive their salaries even when their outlets perform poorly (Jensen and Meckling 1976). Thus, without the profit motive, employee managers may tend to put forth less than maximal effort (Combs et al. 2004). Even when employee managers receive sales- or profit-based bonuses, they still tend to have less incentive than franchisees because the bonus only reflects part of their total compensation. A firm may be able to reduce potential shirking among employee managers by using various monitoring mechanisms. However, such mechanisms can be costly because agents, that need to be monitored regularly, may be located far away from firm headquarters, such as in foreign or remote locations.

Whereas franchising eases potential shirking and thus reduces vertical agency costs, it may enhance free riding and thus increase horizontal agency costs. Franchisees tend to absorb the full cost of maintaining network standards within their individual outlets, but they may not reap the full benefit of their individual efforts. Consequently, they may be able to maximize their profits by free riding off of others in the network. Suppose, for example, that you become a loyal Burger King patron after having positive experiences at a Burger King outlet near your home. Then 1 day you come across a Burger King at an airport food court, during a flight layover on a business trip. Because you are a loyal Burger King patron, you choose that airport Burger King over your other alternatives. As a result, the airport Burger King gets your business even if its food tastes terrible and its service is the worst in the whole Burger King network.

Perryman and Combs (2012) thus explained that franchising firms seek a balance between the costs of monitoring to contain shirking and the costs of free riding (Lafontaine 1992; Rubin 1978). In its basic form, agency theory posits that franchising firms strive to balance their particular (shirking) benefits of franchising and (free riding) costs. The particular balance can vary across franchising firms depending on their specific circumstances. For some, that point may be less than 30% franchised outlets, and for others, it may be 80% or more. Furthermore, the balance for a given firm may continue to shift as contextual characteristics change over time on the basis of prescriptions of agency and resource scarcity explanations. In support of this view, Castrogiovanni et al. (2006a) found a cubic pattern suggesting that franchising proportion shifts as a firm’s reasons for franchising change over the course of its lifecycle. In sum, the point at which vertical versus horizontal agency costs are in balance shifts as firms mature and grow.

While there were other theoretical explanations of how much a firm should franchise such as institutional theory (Barthélemy 2011; Combs et al. 2009), agency and resource scarcity explanations still maintain their prominence (Castrogiovanni et al. 2006b; Combs and Ketchen 1999). For example, in a study by Barthélemy (2011) most measures capturing resource scarcity and agency considerations retained their significance. Therefore, one of the main assumptions of the present study is that franchising networks should attend to resource scarcity and agency considerations to ensure network success.

2.2 Franchising proportion and network success

The decision of how much to franchise may have long-term consequences on network success. Some studies assume that franchising overall is good for firms and thus higher franchising is associated with higher performance (Madanoglu et al. 2013). Another research stream suggests that there is an optimal franchising proportion for each firm, and thus performance should increase as franchising approaches that optimum and then decrease as franchising surpasses that point (Bordonaba Juste et al. 2009; El Akremi et al. 2015; Hsu and Jang 2009; Sorenson and Sørensen 2001). Table 1 summarizes key studies in this area.

Using the “plural form” logic Bradach (1997) explained that franchisee managers of outlets in a network are desirable when learning and adaptation are needed, and employee managers are desirable when control and standardization are needed (cf. Kaufmann and Eroglu 1999). However, firms face steep adjustment costs when they try to change their mix (Combs et al. 2009) especially in the short-term because franchising contracts usually have a term of 10 to 20 years. Thus, the proportion of franchised outlets in a network should balance the long-term needs for adaptation and standardization. This view was shared by Sorenson and Sørensen (2001) who used organizational learning theory to argue that by franchising their outlets networks engage in exploration, while exploitation is achieved by firm-owned outlets. As it can be seen in Table 1, these authors contended that the environmental heterogeneity will play a key role in network’s decision about what proportion of outlets should be franchised. That is, in highly heterogonous environments, firms would resort to franchising to explore these markets.

In a study of franchise chains in France, Perrigot et al. (2009) attempted to answer the question posed by Shane (1998a) about how much firms should franchise given their network characteristics. These authors found that plural form franchise chains have higher efficiency than fully franchised chains (100% franchising) and firms that do not franchise at all (0% franchising). The most efficient level of franchising proportion in their study was 59%. In a similar vein, Hsu and Jang (2009) asked the question whether an optimal franchising level exists. These authors observed that among US restaurant firms, franchising is positively related to financial performance at low levels of franchising proportion. However, at higher levels of franchising proportion, firm financial performance tends to decrease. Thus, Hsu and Jang (2009) concluded that the relationship between franchising proportion and firm financial performance (ROA, ROE, and Tobin’s Q) is curvilinear and that franchising firms performed the best when their franchising proportion was between 37 and 46%. In another study of more than 400 networks in France and the Top 200 franchisors in the USA, El Akremi et al. (2015) observed an inverted U-shape relationship between franchising proportion and worldwide sales.

Using a different analytical approach, Vázquez (2007) found that, based on agency theory prescriptions, the more a franchise firm deviates from its predicted proportion of franchised outlets, the lower the sales growth per outlet and the higher the percentage of discontinued outlets. He also contended that firm-level consequences such as firm performance should not be attributed to the proportion of franchised outlets per se but rather to the absolute deviation of that proportion from the level predicted by agency theory considerations.

Another stream of research looked at the moderators of the relationship between franchising proportion and network success or used franchising proportion as a moderator. Barthélemy (2008) investigated the moderating effects of franchising proportion and business practices tacitness on the relationship between brand name capital and chain performance. He reported that firms with high brand-name capital perform better when they have low franchising proportion. Firms with high tacit business practices experience a drop in performance if they had a high franchising proportion. In a related study, Perdreau et al. (2015) found that the effect of franchising proportion on firm performance is greater for networks with high intangible human capital relative to networks with low intangible capital.

Dobbs et al. (2012) used the interaction term of firm age as a moderator between proportion of franchised outlets and firm failure in the automobile industry. Their study showed that a higher franchising proportion leads to a higher probability of firm failure among young firms, but helps improve the survival prospects of older firms.

2.3 Hypotheses

2.3.1 Resource scarcities, agency costs, and firm failure

Based on the discussions in the preceding section, there is a tendency to expect that firms facing resource scarcity issues and/or incurring high agency costs are more likely to face negative consequences such as low franchise network performance. A key tenet here is that managers of franchise networks are rational, and thus they will attend to issues related to resource scarcities and agency costs when designing their networks. More specifically, the scarcity of resources or agency costs should have a detrimental effect on organizational outcomes such as profitability and survival. For instance, firms that fall short of reaching MES within a given timeframe may face efficiency issues that may impact firm profitability and thus lead to firm failure. As networks grow larger, they also benefit from business scope that may consist of expanded products and services, which leads to a higher probability of firm survival (Bercovitz and Mitchell 2007). Previous studies in franchising support this view by showing that larger franchising networks are less likely to fail (Kosová and Lafontaine 2010; Shane 1996; Shane and Foo 1999). As franchising firms grow older they also gain more experience which helps them secure managerial talent and attract external capital, which in turn should increase the probability of survival of franchising networks. Extant literature provides some evidence of this claim by demonstrating that older franchising firms are less likely to fail (Shane 1996).

In franchising networks, franchisors try to maintain a balance between monitoring costs and costs of free riding in a network (Perryman and Combs 2012). Franchisee free riding is more likely to occur when the cost of monitoring is high. Franchising networks can control monitoring costs by opening outlets that are geographically concentrated. Or if the chain needs to expand in remote areas or unfamiliar markets, the franchisor may prefer to grow by franchising its outlets. Thus, the ease of monitoring of nearby outlets and franchising more remote outlets to franchisees that are motivated by residual profits should help minimize the costs of shirking (Carney and Gedajlovic 1991; Shane 1996). Nevertheless, networks that have a higher geographic dispersion are more likely to fail (Shane 1996).

Moral hazard is another type of agency cost that occurs when prospective agents seeking to run outlets in the network have little to lose by overstating their qualifications. If they are currently unemployed, for example, they may feel that temporary employment as an employee manager of an outlet is better than no employment, and in the worst case they would have a job and get paid for a while until their incompetence was discovered. Franchising eases this problem by increasing the risk faced because the fees, startup costs, and other initial expenses incurred by franchisee managers reduce the incentives for overstating qualifications (Caves and Murphy 1976). Franchisors facing high potential moral hazard may thus charge a high entry fee into the network (i.e., a franchise fee) to attract more capable franchisees (Carney and Gedajlovic 1991). Another way to reduce the probability of moral hazard is to require high initial investment by the franchisee. Thus, the franchisor ensures that only franchisees that are motivated and have a long-term outlook in this line of business will enter the system/network.

The discussions pertaining to resource scarcities and agency costs lead to the following hypotheses:

-

Hypothesis 1: the lower the resource scarcities, the lower the probability for a franchising network to experience firm failure.

-

Hypothesies 2: the higher the agency costs, the higher the probability for a franchising network to experience firm failure.

2.3.2 Optimal franchising

There is mounting evidence that franchising proportion has a non-linear relationship with network success. Taken together, recent studies concur that the relationship between franchising proportion and firm financial performance is curvilinear (El Akremi et al. 2015). More specifically, firms with low levels of franchising proportion are usually associated with high firm performance, whereas at high levels of franchising proportion firms experience lower firm performance (El Akremi et al. 2015; Hsu and Jang 2009). One of the key reasons for the observed relationship is the fact that as firms franchise more outlets, the costs of free riding on franchisor’s brand name by franchisees will be higher than benefits realized from reduced monitoring costs to curb shirking. In addition, having a high franchising proportion may lead to difficulties in maintaining control over the whole network of outlets (Bürkle and Posselt 2008).

The relationship between the quadratic term of franchising proportion and firm failure has received very limited attention. Bordonaba Juste et al. (2009) tested the curvilinear effect of dual distribution, measured as percentage of company owned outlets, on firm failure. These authors calculated a turning point which reveals that firms are more likely to fail if they franchise more than 69% of their outlets.

As H1 and H2 suggest, firms will franchise to the extent that it offsets resource scarcities and agency costs. As franchising proportion increases to the point warranted by those resource and agency concerns, the likelihood of failure will diminish. If there is indeed an optimal level of franchising for each firm, however, then we would expect firm failure to increase when the franchising proportion increases beyond the optimum. Stated formally:

-

Hypothesis 3: franchising proportion has a U-shaped relationship with firm failure. There are more failures when franchising proportion is low or high than when it is moderate.

3 Methods

3.1 Data source and characteristics

Data were obtained from Entrepreneur magazine’s annual franchisor listings, which have been used as a major data source in previous studies (Castrogiovanni et al. 2006a; Combs et al. 2009; Shane 1996) and seem to represent the franchisor population adequately (Lafontaine 1992; Shane 1998a; Shane and Foo 1999). Entrepreneur began listing franchising networks in 1980. The staff of Entrepreneur compares the information provided by franchising networks with networks’ Uniform Franchise Offering Circulars (UFOCs) or if listed in Canada with disclosure documents in Alberta, Canada (Combs et al. 2009). The initial sample consisted of 20,277 firm-year observations for 5018 franchising networks. Missing data for some variables and the use of lagged values brought our final sample to 17,769 observations for 4778 franchisors in more than 20 industries (Kosová and Lafontaine 2010).

3.2 Measures

3.2.1 Dependent variable

The outcome variable in this study is franchise network exits, which is used as a measure for network failure. Exits have been commonly used as an indicator for franchising network mortality (hereafter firm failure) in numerous studies (Dobbs et al. 2012; Kosová and Lafontaine 2010; Shane and Foo 1999). Franchise networks that appeared in the listings for the current year (e.g., 1996) but were not included in next year’s (e.g., 1997) listings were classified as “exits” (Dobbs et al. 2012). In some rare cases (e.g., 1 to 2% of all firms per year), some networks would re-appear in listings in future years (i.e., 1998 and beyond). We reclassified these firms as surviving firms (Shane 2001).

3.2.2 Independent variables

To assess the linear effect of resource scarcities and agency costs on exits we used several variables which represent resource scarcity and agency theory considerations. The first resource scarcity variable was franchising network age, measured as the difference between the observation year and the year a firm began franchising (Combs et al. 2009). Previous literature shows that older franchise networks have a higher probability of survival (Kosová and Lafontaine 2010).

The second resource scarcity variable was firm size measured as total number of outlets (Castrogiovanni et al. 2006a; Shane and Foo 1999). The selection of these two variables to test H1 was based on Oxenfeldt and Kelly’s (1968) proposition that young, small franchisors face greater resource scarcities than older, larger ones.

The first agency variable was the ease of monitoring which was measured as geographic dispersion. Ease of monitoring occurs when franchise networks are geographically concentrated. Consequently, firms with higher geographic dispersion (i.e., low geographic concentration) should have a higher probability of firm failure (Shane 1998b). Geographic scope was measured as the sum of the number of U.S. regions (out of seven), plus one for Canada, plus one if a franchising firm has an international presence (Combs et al. 2009).

The second agency cost variable—franchisee fee—is a one-time payment that a franchisee makes to the franchisor as compensation for initial training and orientation expenses (Lafontaine 1992). Previous research contends that higher franchisees fees may generate quasi-rents for the franchisor and also increase franchisor holdup (Lafontaine 1992; Shane and Foo 1999) which in turn would increase agency costs. Therefore, franchise fees should be positively related to firm failure.

The final variable capturing agency costs was the average franchisee startup cost (Castrogiovanni et al. 2006b; Combs et al. 2009). Lafontaine (1992) asserted that large and more expensive outlets tend to have greater scale economies in monitoring costs for the franchising firm. In addition, a high startup cost leads to a higher investment value for the franchisee (Sen 1993). As a consequence, startup cost should be negatively related to exits. The following two equations are employed to test the first two hypotheses in this study:

It should be noted that the independent variables (franchising network age and firm size) in Eq. 1 serve as controls along with other control variables in Eq. 2. The same situation applies to Eq. 1 where the three independent variables in Eq. 2 are used as controls.

The focal independent variable in this study is the proportion of franchised outlets to total outlets (hereafter franchising proportion). The previous literature contends that franchising proportion has a curvilinear effect on firm-level performance consequences (Bordonaba Juste et al. 2009; El Akremi et al. 2015; Hsu and Jang 2009). Therefore, we use the quadratic term of the franchising proportion by mean centering it to facilitate its interpretability (Dawson 2013) and reduce any potential multicollinearity (Aiken et al. 1991).

3.2.3 Control variables

We used several control variables which have been shown to influence firm failure or survival. Kosová and Lafontaine (2010) reported that firms with more business experience (i.e., taking a longer time to begin franchising) were more likely to remain in business. Business experience is calculated as the difference between the year a firm began franchising and the year it was founded. The royalty rate charged by franchisors was used as a covariate that influences firm survival or failure (Bordonaba-Juste et al. 2011; Lafontaine and Shaw 1998). Royalty rate is the percentage of sales that franchisees should remit to a franchisor on an ongoing basis (Kosová and Lafontaine 2010). Shane and Foo (1999) observed that franchising firms who possessed media certification were less likely to fail. Media certification is a binary variable where franchising networks that are ranked in the Franchise 500 list of Entrepreneur Magazine are coded as 1 and 0 otherwise (Shane and Foo 1999). It is likely that the industry in which a firm operates may have an effect on firm failure. Therefore, we controlled for industry effects by creating 25 industry categories as in Kosová and Lafontaine (2010).

3.3 Modeling procedures and data analysis

Previous research contends that studies that look at the effect of organizational form and performance may be subject to endogeneity because firm executives choose franchising proportion due to some unobserved factors and those factors may also influence firm survival (Kosová et al. 2012). The issue is further exacerbated by the claims of Vázquez (2007) who argues that franchising proportion is not directly related to performance but rather differences in performance should be attributed to unobserved factors that influence franchising proportion. To address challenges posed by endogeneity, we employed a two-step modeling procedure to measure the effect of franchising proportion on firm failure. We used a procedure called a two-stage residual inclusion (2SRI) model (Terza et al. 2008) which resembles the well-accepted two-stage least squares (2SLS) approach. However, when the second-stage analysis is non-linear, 2SLS produces inconsistent results which makes it necessary to employ 2SRI (Terza et al. 2008).

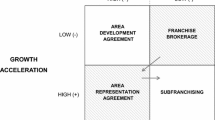

The first stage of 2SRI is identical to 2SLS modeling where the endogenous variable (franchising proportion) is predicted by a set of predictor variables and an instrumental variable through an OLS regression. The instrumental variable should be related to the endogenous variable (i.e., franchising proportion) but should not be directly related to firm failure (See Fig. 1). That is, the endogenous variable can influence firm failure only through franchising proportion.

To address the endogeneity between resource scarcity and agency costs, and firm failure, we sought an instrumental variable which can predict franchising proportion but should not be related to firm failure. One such variable has to do with franchise termination laws which require a “good cause” if franchisors desire to end their relationship with a franchisee prior to the expiration date of the franchising contracts (Brickley et al. 1991). In their studies, Shane and Foo (Shane and Foo 1999) and Brickley et al. (1991) identified 14 US states (Arkansas, California, Connecticut, Delaware, Hawaii, Illinois, Indiana, Michigan, Minnesota, Nebraska, New Jersey, Virginia, Washington, and Wisconsin) that had franchise termination laws. Franchisors which are headquartered in states with termination laws tend to franchise less because these laws increase the costs of quality within the network (Brickley et al. 1991). We measured termination laws as a binary variable where US states that have termination laws were coded as 1 and 0 otherwise. We posit that the existence of termination laws will be negatively related to franchising proportion.

We used the two resource scarcity and the three agency variables from H1 as determinants of franchising proportion on the basis of several studies (Alon 2001; Castrogiovanni et al. 2006b; Shane 1998a). In addition, we included industry dummies because the type of the industry may have an influence of how much each firm franchises. Formally, in Eq. 3a we predicted the linear term of franchising proportion. In Eq. 3b, we set out to estimate the quadratic term of franchising proportion. Our approach is similar to Hashai (2015) who ran two separate analyses for the linear term and the quadratic term of his endogenous variable.

The second stage of our model uses the franchising proportion, franchising proportion squared, and the residuals (ε1 and ε2) from the first-stage equation along with resource scarcity, agency variables, and other controls. To establish the U-shape effect of franchising proportion on firm failure, we first ran the following model:

Then, we added the quadratic term of franchising proportion and the residual from Eq. 3b to test the following model:

where firm failure is a dummy variable equal to 1 if a firm exits business, and 0 otherwise, network size denotes number of outlets in a network, franchising network age is number of years franchising, geographic scope is number of U.S. Regions, a presence in Canada and in an additional foreign country, franchise fee is the initial fee paid by the franchisee to join a chain, startup cost is the total investment required to open an outlet, royalty rate is the percentage of sales that franchisees pay to the franchisor on an ongoing basis, industry is a dummy for industry categories, ε1 is the residual from Eq. 3a, franchising proportion is the proportion of franchised outlets to total outlets, ε2 is the residual from Eq. 3b, and franchising proportion squared is the quadratic term of franchising proportion.

We conducted an exploratory analysis by employing resource scarcity and agency theory variables as moderators of the relationship between the squared term of franchising proportion and firm failure. For this purpose, we run five additional models such as franchising proportion squared*network size, franchising proportion squared*franchise network age etc.

Similarly to Dobbs et al. (2012), data in our study spans for approximately 20 years. Because of changes in proportions of hazards over time, we used Cox regression as our model of choice (Dobbs et al. 2012; Kosová and Lafontaine 2010; Shane and Foo 1999). It is plausible that some chains may experience negative duration dependence (i.e., a liability of aging). Consequently, we adopt a proportional model with Weibull distribution because it produces more robust estimates (Dobbs et al. 2012; Kosová and Lafontaine 2010). For more details about Cox regressions with Weibull distribution please see Dobbs et al. (2012). The analysis was conducted by using the streg routine in STATA (version 14) software. We also used a logit model to conduct a likelihood ratio (LR) test. The LR test allowed us to assess whether franchising proportion and its squared term improve model fit, over and above, resource scarcity, agency costs and other controls.

4 Results

4.1 Main findings

Table 2 presents descriptive statistics showing that firms in our sample had an average size of approximately 244 outlets and about 10 years of franchising experience. The average proportion of franchised outlets for our sample was 0.775. Table 2 also shows correlations among independent and control variables. A closer look at the explanatory variables indicates that they were not highly correlated, which eases concerns about possible multicollinearity. Additionally, we checked variance inflation factor (VIF) values, which ranged between 1.057 and 2.095, and were well below the suggested threshold value of 10 (Pedhazur 1997). Thus, we conclude that multicollinearity was not a concern.

To test hypothesis 1, we first ran a model (Model 1) with all control variables (see Table 3). Results showed that business experience, royalty rate and media certification were negatively related to firm failure. In Model 2, we added variables that measure resource scarcities (network size and franchise network size). Findings reveal that both variables are negatively related to firm failure which lends support for hypothesis 1. The Likelihood Ratio (LR) test indicated that Model 2 provides a better fit relative to Model 1 (77.68, p < 0.001) which denotes that resource scarcity model improves model fit. To test the linear effect of agency costs on firm failure, we included the three agency cost variables to form Model 3. Results in Table 3 indicated that only geographic scope is significantly related to firm failure. However, due to the negative sign of geographic scope (b = −0.015, p < 0.05) on firm failure, hypothesis 2 is not supported. Consequently, it is confirmed that agency cost variables are not significantly related to firm failure which implies that hypothesis 2 is not supported overall. We ran Model 4 to check whether jointly resource scarcity and agency variables predict firm failure better than either Model 2 (resource scarcities) or Model 3 (agency costs) or both models. The results of LR test reveal that the joint model (Model 4) has a better fit relative to both Model 2 and Model 3 (25.68, p < 0.001 and 62.10, p < 0.001, respectively). In the joint model, both network size and franchise network age retained their significant and negative relationship with firm failure which provided further support for hypothesis 1, after controlling for agency costs.

Prior to investigating the influence of franchising proportion and firm failure, we first predicted franchised proportion (Eq. 3a) and franchised proportion squared (Eq. 3b). The results show that the employed variables explained approximately 13% of the variance in franchising proportion (See Table 4). More importantly, the instrumental variable—termination laws—was negatively related to franchising proportion (b = −0.013, p < 0.01). In the next analysis, it is also observed that termination laws are significantly related to franchising proportion squared (b = 0.007, p < 0.01). The obtained residuals from both equations (residual 1 and residual 2) were used in the second-stage analysis where firm failure was the outcome variable of interest.

To test hypothesis 3, which posits a U-shape relationship between franchising proportion and firm failure, we first used the linear term of franchising proportion as our focal independent variable (Model 5 in Table 5). Results in Table 5 demonstrated that the linear term of franchising proportion is negatively related to firm failure (b = −1.650, p < 0.001). Among control variables, network size, business experience, royalty rate, and media certification had a negative relationship with the probability of firm failure. The residual (residual 1) from the first stage Eq. (3a) to predict franchising proportion was significant and positive which suggests that unobserved firm characteristics are positively related to firm failure. The second step of hypothesis 3 was established through Model 6 which investigates the relationship between the squared term of franchising proportion and firm failure (see Table 5). Findings reveal that the squared term of franchising proportion is positively related to firm failure (b = 17.470, p < 0.001). Thus, taken together Models 5 and 6 provide support for hypothesis 3. That is, at lower levels of franchising proportion, firms are less likely to fail (Model 5). However, at higher levels of franchising proportion, firms are more susceptible to network failure (Model 6). The significant control variables in Model 5 retained both their significance and directional signs in Model 6. In addition, as opposed to Model 5, in Model 6 geographic scope had a negative relationship with failure, while franchise fee was positively related to failure. Both residuals (1 and 2) had a significant negative relationship with firm failure. We ran a LR test to ensure that the inclusion of the squared term of franchising proportion improves model fit. We observed a significant difference between Models 5 and 6 (19.69, p < 0.001) which denotes that the squared term of franchising proportion and the residual from Eq. 3a contribute to the explanation of firm failure above and beyond franchising proportion and other variables in Model 5.

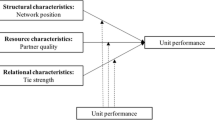

Our exploratory moderating analysis reveals that among five resource scarcity and agency variables size and geographic scope are significant moderators of the relationship between franchising proportion squared and firm failure (See Table 6, Models 7a and 7c, respectively). As shown in Fig. 2, larger networks with high franchising proportion are more likely than smaller networks to fail when they have a high franchising proportion. Networks with low geographic scope and high franchising proportion are more likely to fail than networks with high geographic scope and high franchising (see Fig. 3).

4.2 Robustness checks and sensitivity analysis

To accommodate more recent arguments that the proportion of franchised outlets is influenced by institutional theory (Barthélemy 2011; Combs et al. 2009), we calculated an industry (adjusted) franchising variable which is franchising proportion for a firm i in year t less the average franchising proportion for industry I in year t. We found that industry franchising proportion was not significant predictor of franchising proportion which increased our confidence in the first-stage analysis of the 2SRI approach.

We ran additional analyses to rule out alternative explanations of the effect of other variables on firm failure. First, we included a dummy variable for established firms (i.e., firms that have been franchising 7 years or more) (Lafontaine and Shaw 2005). The established vs. young franchising firms were coded as 1 and 0, respectively. Results showed that established franchise networks had the same probability of failure as their younger counterparts (p = 0.478). The squared term of franchising proportion remained positively and significantly related to network failure, which is consistent with hypothesis 3.

Next, we controlled for left censoring by adding a censoring dummy by coding firms that were founded before 1980 as 1 and 0 otherwise (Dobbs et al. 2012; Silverman et al. 1997). While firms founded before 1980 were less likely to fail (−0.210, p < 0.001), our focal variable—franchising proportion squared—remained significant and positive (b = 11.498, p < 0.05) which increased our confidence in the robustness of our model. It is possible that industry dummies may not be capturing the varying rates of firm failure in different industries under changing economic conditions. This is because supply and demand in some industries are more likely to be influenced by the economic environment. Following Dobbs et al. (2012), we added annual GDP growth and annual change in inflation to Model 6. Here again, franchising proportion squared remained positive and significant which is consistent with the predictions of hypothesis 3. We estimated an alternative model which captures the effect of the economic environment. We used a dummy variable which took the value of 1 for recessionary periods on the basis of the National Bureau of Economic Research (NBER) and 0 otherwise. Results have shown that recessionary periods did not have a significant relationship with firm failure; however, the U-shape relationship of franchising proportion remained the same. We also created an interaction variable for franchising proportion squared and economic recessions. Findings revealed that this interaction was not significant while franchising proportion squared was significant and positive.

Last, we evaluated whether the influence of firm growth has an influence on firm failure. We computed a network growth variable which is the annual growth in the number of outlets. Results indicated that network growth was not significantly related to firm failure (b = 0.003, p > 0.05). As in previous cases, franchising proportion squared was positive and significant (b = 19.41, p < 0.01).

5 Discussion

One of the key contributions of our study to the entrepreneurship literature pertaining to franchising is that we show that the appropriate network mix of franchised and firm-owned outlets has important implications for firm failure, after considering the endogeneity of franchising proportion. Using more than 20 years of data, we find that high levels of franchising proportion increases the likelihood of firm failure for franchising networks. We obtained these results by considering the unobserved factors that may have an effect both on franchising proportion and firm failure by using 2SRI approach. Thus, we add to the research on franchising proportion and network success (El Akremi et al. 2015; Hsu and Jang 2009).

We also tested the linear effect of resource scarcity and agency cost variables on firm failure to ascertain whether managers attend to these theoretical considerations. Findings revealed that only network size and franchise network age had the hypothesized relationships with firm failure which is consistent with previous studies (Kosová and Lafontaine 2010). Combining the main effect of the squared term of franchising proportion with the moderating effect of agency and resource scarcity variables, we have shown that network size and geographic scope are significant moderators. More specifically, larger networks with high franchising are more likely to experience firm failure probably because scale efficiencies begin to provide diminishing benefits to a franchisor. Among agency variables, geographic dispersion attenuates the influence of high franchising proportion on firm failure which may be due to increased environmental heterogeneity which may lead to some diversification benefits for a firm (Sorenson and Sørensen 2001).

While overall the proportion of franchised outlets has increased in the past 30 years (e.g., see Combs et al. 2009), in large part because within-network franchising has increased (e.g. Castrogiovanni et al. 2006a), we show that this overall increase may not be beneficial for all franchising firms. Rather, individual franchising firms should look at their firm-specific characteristics to determine the target mix of outlets in a franchise network. Otherwise, overfranchising could be a costly mistake that can force the franchisor firm out of business, which in turn would hurt the survival prospects of the franchisee entrepreneurs in the same network as well.

Through this study we obtained strong evidence that franchising proportion has a U-shaped relationship with network failure. This finding is robust to unobserved factors that influence both franchising proportion and firm survival. Consequently, we conclude that the relationship between franchising proportion and firm failure is curvilinear. More specifically, lower levels of franchising proportion are negatively related to firm failure. Yet, at high levels of franchising, firms tend to be more likely to fail. Unlike Vázquez (2007) who focuses on discontinuation of outlets within a network, our findings capture influences at a network level that ultimately have an effect on franchisee entrepreneurs within that network.

5.1 Implications for practice

For franchisors, the obvious implication is that a high franchising proportion of a network increases the likelihood of firm failure. Thus, franchisors should carefully manage their resource and agency considerations when deciding whether to franchise specific outlets or own them outright. To the extent that such considerations are firm specific, different franchisors will have different targets of proportion of franchised outlets. However, in general, having very high levels of franchising is detrimental to network success.

Our moderating analyses results provide additional insights. The significance of size as a moderator lends some support to the ownership redirection hypothesis of Oxenfeldt and Kelly (1968). We observed that large networks with high franchising proportion are more likely to fail than small networks. The ownership redirection hypothesis suggests that large networks should cut back on their franchising proportion to keep more profits for themselves—and the findings of this study suggest that this will reduce their risk of failure. Regarding geographic scope as a moderator, our significant findings suggest that the horizontal agency costs may outweigh the vertical agency benefits of franchising when firms with low geographic scope reach high franchising proportions. Thus, low-scope firms should contain their use of franchising.

More generally, since optimal franchising depends on a firm’s unique circumstances, each firm may need to discover its optimal point through trial-and-error (cf. Bradach 1997; Lafontaine 1992). Franchisors may closely monitor changes in performance, or perhaps an indicator of potential failure like the Z-score (Altman 1968), as their franchising proportion increases, so that they might cut back on franchising when further increases become detrimental.

Potential entrepreneurs often are attracted to franchising because industry advocates claim that survival rates are higher for franchised outlets than for comparable independent businesses (Bates 1998). Though research is mixed as to whether franchised outlets are indeed more likely to survive, potential franchisees should rely more on firm-specific considerations than their understanding of general tendencies (Castrogiovanni and Justis 2007). Consequently, potential franchisees should assess the level of franchising within a network along with other network characteristics such as geographic dispersion, franchisee fee, and media certification to make a prudent decision prior to joining a given franchising network.

5.2 Limitations and future directions

It is possible that other variables grounded in agency theory influence the level of franchised firms. While we used the 2SRI approach to address the effect of such factors on both franchising and firm failure, future studies should attempt to capture other important agency variables that affect the mix of franchised and firm-owned outlets. For example, multi-outlet franchising (MOF) is used by some firms to capture the best locations quickly. On one hand, engaging in MOF helps increase proportion of franchised outlets. On the other hand, outlet managers are employees of a franchised outlet. That is, when the MOF owner of outlets functions as a mini-franchising firm, it is not clear how this phenomena influence the likelihood of network failure. Future studies should consider MOF in order to further establish the relationship between franchising and firm success. In addition, there are several other factors that can influence the appropriate mix of outlets in a network such as brand name, percentage of repeat customers, tacitness of business knowledge transfer, availability of local managerial expertise etc. Since we did not include these factors in our predicted franchising models, our results should be interpreted with some caution. Finally, future studies can include concepts such as contractual incompleteness to better understand how franchising influences network success (Hendrikse et al. 2015; Hendrikse and Jiang 2011).

In this study, we aimed to demonstrate how franchising proportion influences network success. However, we could not consider specific locations or outlet density of franchised outlets within a network for firms operating in the same industry with identical levels of franchising (i.e., 75%). Therefore, future research needs to delve into the optimal mix of franchised and firm-owned outlets by including other considerations such as international scope and breadth, geographic depth per US state and the distance of franchised outlets from firm-owned outlets within a market. All these measures may play a role in achieving this best mix.

6 Conclusions

This study complemented findings of prior studies that investigated the correlates of network success by focusing on firm failure (Bordonaba-Juste et al. 2011; Dobbs et al. 2012; Kosová and Lafontaine 2010; Shane 1996). In so doing, we provide clarity and confidence in the conclusions reached in that stream of research because these relationships were tested by addressing the endogeneity between franchising proportion and firm failure on a sample of approximately 5000 franchising networks.

Adding to almost five decades of research on franchising, we demonstrate that on the basis of agency and resource scarcity considerations, overfranchising is detrimental for firm survival. Future researchers should employ other perspectives such as the resource-based view and property rights theory to further explore the delicate relationship between franchising proportion and firm survival.

References

Aiken, L. S., West, S. G., & Reno, R. R. (1991). Multiple regression: Testing and interpreting interactions. Newbury Park: SAGE.

Alchian, A. A., & Demsetz, H. (1972). Production, information costs, and economic organization. The American Economic Review, 62(5), 777–795.

Alon, I. (2001). The use of franchising by U.S.-based retailers. Journal of Small Business Management, 39(2), 111–122. doi:10.1111/1540-627X.00011.

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589–609. doi:10.1111/j.1540-6261.1968.tb00843.x.

Balcaen, S., Manigart, S., & Ooghe, H. (2010). From distress to exit: determinants of the time to exit. Journal of Evolutionary Economics, 21(3), 407–446. doi:10.1007/s00191-010-0192-2.

Barthélemy, J. (2008). Opportunism, knowledge, and the performance of franchise chains. Strategic Management Journal, 29(13), 1451–1463. doi:10.1002/smj.719.

Barthélemy, J. (2011). Agency and institutional influences on franchising decisions. Journal of Business Venturing, 26(1), 93–103. doi:10.1016/j.jbusvent.2009.05.002.

Bates, T. (1998). Survival patterns among newcomers to franchising. Journal of Business Venturing, 13(2), 113–130. doi:10.1016/S0883-9026(97)00066-9.

Bercovitz, J., & Mitchell, W. (2007). When is more better? The impact of business scale and scope on long-term business survival, while controlling for profitability. Strategic Management Journal, 28(1), 61–79.

Bordonaba Juste, V., Lucia-Palacios, L., & Polo-Redondo, Y. (2009). Franchise firm entry time influence on long-term survival. International Journal of Retail & Distribution Management, 37(2), 106–125. doi:10.1108/09590550910934263.

Bordonaba-Juste, V., Lucia-Palacios, L., & Polo-Redondo, Y. (2011). An analysis of franchisor failure risk: evidence from Spain. Journal of Business & Industrial Marketing, 26(6), 407–420. doi:10.1108/08858621111156403.

Bradach, J. L. (1997). Using the plural form in the management of restaurant chains. Administrative Science Quarterly, 42(2), 276–303. doi:10.2307/2393921.

Brickley, J. A., & Dark, F. H. (1987). The choice of organizational form: the case of franchising. Journal of Financial Economics, 18(2), 401–420. doi:10.1016/0304-405X(87)90046-8.

Brickley, J. A., Dark, F. H., & Weisbach, M. S. (1991). The economic effects of franchise termination laws. The Journal of Law and Economics, 34(1), 101–132. doi:10.1086/467220.

Bürkle, T., & Posselt, T. (2008). Franchising as a plural system: a risk-based explanation. Journal of Retailing, 84(1), 39–47. doi:10.1016/j.jretai.2008.01.004.

Carney, M., & Gedajlovic, E. (1991). Vertical integration in franchise systems: agency theory and resource explanations. Strategic Management Journal, 12(8), 607–629. doi:10.1002/smj.4250120804.

Castrogiovanni, G. J., & Justis, R. T. (2007). Franchise failure: a reassessment of the Bates (1995) results. Service Business, 1(3), 247–256. doi:10.1007/s11628-007-0023-1.

Castrogiovanni, G. J., Combs, J. G., & Justis, R. T. (2006a). Shifting imperatives: an integrative view of resource scarcity and agency reasons for franchising. Entrepreneurship Theory and Practice, 30(1), 23–40. doi:10.1111/j.1540-6520.2006.00108.x.

Castrogiovanni, G. J., Combs, J. G., & Justis, R. T. (2006b). Resource scarcity and agency theory predictions concerning the continued use of franchising in multi-outlet networks. Journal of Small Business Management, 44(1), 27–44. doi:10.1111/j.1540-627X.2006.00152.x.

Caves, R. E., & Murphy, W. F. (1976). Franchising: firms, markets, and intangible assets. Southern Economic Journal, 42(4), 572–586.

Combs, J. G., & Ketchen, D. J. (1999). Can capital scarcity help agency theory explain franchising? Revisiting the capital scarcity hypothesis. Academy of Management Journal, 42(2), 196–207. doi:10.2307/257092.

Combs, J. G., Michael, S. C., & Castrogiovanni, G. J. (2004). Franchising: a review and avenues to greater theoretical diversity. Journal of Management, 30(6), 907–931. doi:10.1016/j.jm.2004.06.006.

Combs, J. G., Michael, S. C., & Castrogiovanni, G. J. (2009). Institutional influences on the choice of organizational form: the case of franchising. Journal of Management. doi:10.1177/0149206309336883.

Dawson, J. F. (2013). Moderation in management research: what, why, when, and how. Journal of Business and Psychology, 29(1), 1–19. doi:10.1007/s10869-013-9308-7.

Dobbs, M. E., Boggs, D. J., Grünhagen, M., Palacios, L. L., & Flight, R. L. (2012). Time will tell: interaction effects of franchising percentages and age on franchisor mortality rates. International Entrepreneurship and Management Journal, 10(3), 607–621. doi:10.1007/s11365-012-0245-0.

IHS Economics (2016). Franchise Business Economic Outlook for 2016.

El Akremi, A., Perrigot, R., & Piot-Lepetit, I. (2015). Examining the drivers for franchised chains performance through the lens of the dynamic capabilities approach. Journal of Small Business Management, 53(1), 145–165. doi:10.1111/jsbm.12059.

Hashai, N. (2015). Within-industry diversification and firm performance—an S-shaped hypothesis. Strategic Management Journal, 36(9), 1378–1400. doi:10.1002/smj.2290.

Hendrikse, G., & Jiang, T. (2011). An incomplete contracting model of dual distribution in franchising. Journal of Retailing, 87(3), 332–344. doi:10.1016/j.jretai.2011.01.003.

Hendrikse, G., Hippmann, P., & Windsperger, J. (2015). Trust, transaction costs and contractual incompleteness in franchising. Small Business Economics, 44(4), 867–888. doi:10.1007/s11187-014-9626-9.

Hsu, L.-T. (. J.)., & Jang, S. (. S.). (2009). Effects of restaurant franchising: does an optimal franchise proportion exist? International Journal of Hospitality Management, 28(2), 204–211. doi:10.1016/j.ijhm.2008.07.002.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. doi:10.1016/0304-405X(76)90026-X.

Kaufmann, P. J., & Eroglu, S. (1999). Standardization and adaptation in business format franchising. Journal of Business Venturing, 14(1), 69–85. doi:10.1016/S0883-9026(97)00097-9.

Koh, Y., Lee, S., & Boo, S. (2009). Does franchising help restaurant firm value? International Journal of Hospitality Management, 28(2), 289–296. doi:10.1016/j.ijhm.2008.10.001.

Kosová, R., & Lafontaine, F. (2010). Survival and growth in retail and service industries: evidence from franchised chains. The Journal of Industrial Economics, 58(3), 542–578. doi:10.1111/j.1467-6451.2010.00431.x.

Kosová, R., Lafontaine, F., & Perrigot, R. (2012). Organizational form and performance: evidence from the hotel industry. Review of Economics and Statistics, 95(4), 1303–1323. doi:10.1162/REST_a_00330.

Lafontaine, F. (1992). Agency theory and franchising: some empirical results. The Rand Journal of Economics, 23(2), 263–283.

Lafontaine, F., & Shaw, K. L. (1998). Franchising growth and franchisor entry and exit in the U.S. market: myth and reality. Journal of Business Venturing, 13(2), 95–112. doi:10.1016/S0883-9026(97)00065-7.

Lafontaine, F., & Shaw, K. L. (2005). Targeting managerial control: evidence from franchising. The Rand Journal of Economics, 36(1), 131–150.

Madanoglu, M., Lee, K., & Castrogiovanni, G. J. (2013). Does franchising pay? Evidence from the restaurant industry. The Service Industries Journal, 33(11), 1003–1025. doi:10.1080/02642069.2011.628384.

Oxenfeldt, A., & Kelly, A. (1968). Will successful franchise systems ultimately become wholly-owned chains? Journal of Retailing, 4, 69–83.

Pedhazur, E. J. (1997). Multiple Regression in Behavioral Research (3rd ed.). Orlando, FL: Harcourt Brace.

Penrose, E. (1959). The theory of the growth of the firm. New York: John Wiley and Sons.

Perdreau, F., Le Nadant, A.-L., & Cliquet, G. (2015). Human capital intangibles and performance of franchise networks: a complementary view between agency and critical resource perspectives. Managerial and Decision Economics, 36(2), 121–138. doi:10.1002/mde.2656.

Perrigot, R., Cliquet, G., & Piot-Lepetit, I. (2009). Plural form chain and efficiency: insights from the French hotel chains and the DEA methodology. European Management Journal, 27(4), 268–280. doi:10.1016/j.emj.2008.11.001.

Perryman, A. A., & Combs, J. G. (2012). Who should own it? An agency-based explanation for multi-outlet ownership and co-location in plural form franchising. Strategic Management Journal, 33(4), 368–386. doi:10.1002/smj.1947.

Rubin, P. H. (1978). The theory of the firm and the structure of the franchise contract. The Journal of Law & Economics, 21(1), 223–233.

Sen, K. C. (1993). The use of initial fees and royalties in business-format franchising. Managerial and Decision Economics, 14(2), 175–190. doi:10.1002/mde.4090140209.

Shane, S. (1996). Hybrid organizational arrangements and their implications for firm growth and survival: a study of new franchisors. Academy of Management Journal, 39(1), 216–234. doi:10.2307/256637.

Shane, S. (1998a). Explaining the distribution of franchised and company-owned outlets in franchise systems. Journal of Management, 24(6), 717–739. doi:10.1177/014920639802400603.

Shane, S. (1998b). Making new franchise systems work. Strategic Management Journal, 19(7), 697–707. doi:10.1002/(SICI)1097-0266(199807)19:7<697::AID-SMJ972>3.0.CO;2-O.

Shane, S. (2001). Organizational incentives and organizational mortality. Organization Science, 12(2), 136–160. doi:10.1287/orsc.12.2.136.10108.

Shane, S., & Foo, M.-D. (1999). New firm survival: institutional explanations for new franchisor mortality. Management Science, 45(2), 142–159. doi:10.1287/mnsc.45.2.142.

Silverman, B. S., Nickerson, J. A., & Freeman, J. (1997). Profitability, transactional alignment, and organizational mortality in the US trucking industry. Strategic Management Journal, 18(S1), 31–52. doi:10.1002/(SICI)1097-0266(199707)18:1+<31::AID-SMJ920>3.0.CO;2-S.

Srinivasan, R. (2006). Dual distribution and intangible firm value: Franchising in restaurant chains. Journal of Marketing, 70(3), 120–135. doi:10.1509/jmkg.70.3.120.

Sorenson, O., & Sørensen, J. B. (2001). Finding the right mix: franchising, organizational learning, and chain performance. Strategic Management Journal, 22(6–7), 713–724. doi:10.1002/smj.185.

Terza, J. V., Basu, A., & Rathouz, P. J. (2008). Two-stage residual inclusion estimation: addressing endogeneity in health econometric modeling. Journal of Health Economics, 27(3), 531–543. doi:10.1016/j.jhealeco.2007.09.009.

Vázquez, L. (2007). Proportion of franchised outlets and franchise system performance. The Service Industries Journal, 27(7), 907–921. doi:10.1080/02642060701570685.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Madanoglu, M., Castrogiovanni, G.J. Franchising proportion and network failure. Small Bus Econ 50, 697–715 (2018). https://doi.org/10.1007/s11187-017-9890-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-017-9890-6