Abstract

This study analyses the role of immigration background and education in creating new business initiatives in Luxembourg, a country where 44 % of the resident population is immigrant. We investigate the features of entrepreneurs and of the Luxembourgish System of Entrepreneurship using the Global Entrepreneurship Monitoring surveys of 2013 and 2014. We study the effect of immigration through all the stages of entrepreneurial process: interest in starting a new business, effectively starting, running a new business and managing an established business. We adopt a sequential logit to model entrepreneurial process as a sequence of stages. We find that first-generation immigrants, and in particular highly educated ones, are more interested in starting a new business than non-immigrants, but they do not differ in subsequent entrepreneurial phases. We argue that policies to attract highly educated immigrants can promote entrepreneurial initiatives in Luxembourg.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Entrepreneurship, broadly defined as “the process whereby individuals create new firms” (Reynolds et al. 2000), is regarded as an important contributor to innovation and technological progress, a driver of productivity and ultimately of economic growth (Schumpeter 1934; Audretsch 2007; Braunerhjelm et al. 2010; Wennekers and Thurik 1999). Moreover, successful entrepreneurs favour knowledge spillovers and create new jobs. The IT boom of the 1990s, and in particular the emergence of highly innovative, fast expanding and highly profitable IT firms, has largely contributed to revive the attention of policy makers and academics on entrepreneurship. Governments have become increasingly active in designing policies to foster the entrepreneurial efforts. In parallel, data collection projects have been launched to assess the largely anecdotal evidence on the link between entrepreneurship and growth and to provide support to policy actions. One of such initiatives, GEM, aims to collect internationally comparable data to deepen the understanding of entrepreneurial activities and their link with countries’ economic performances. The project rests on a conceptual framework that seeks to explain variations in countries’ growth rates studying the entrepreneurial process (Reynolds et al. 2005). To do so, GEM models entrepreneurship as a process rather than a “single phase” decision. The process comprises several phases: interest in starting a new business, intention to start, effectively starting and survival of the new firm (for a description of the various phases, see Amoros and Bosma 2014).

GEM data are collected through surveys on individuals conducted at country level. These data have been used mainly to study individual determinants of entrepreneurial involvement as well as links between entrepreneurship and economic growth (for a survey of the literature using GEM data, one can see Alvarez et al. 2014). Recent GEM waves have also focused on special topics such as the role of job satisfaction and well-being on entrepreneurial efforts, as well as the entrepreneurial attitudes of migrants (Xavier et al. 2013; Amoros and Bosma 2014). GEM also emphasises the environmental conditions, also referred to as the “framework conditions”, that may favour or hinder entrepreneurship. These range from governmental policies to public perception of entrepreneurs. Thus, GEM data are suited to analyse entrepreneurship within a systemic approach.

The idea of national systems of entrepreneurship (NSE) focuses on the role of individual determinants of entrepreneurship, while emphasising the socio-economic context in shaping entrepreneurial abilities and aspirations (Acs et al. 2014). This analysis, conducted on individual GEM data for Luxembourg, is inspired by this framework as it is motivated by the special characteristics of the country’s population and labor force, which is largely composed by non-nationals. Within this context, we focus on the individual-level behaviour and study the interaction of population characteristics with attitudes, aspirations and abilities. Thus, we investigate the role of the immigration background in shaping the Luxembourgish entrepreneurial process. In particular, we analyse the interactions of individual aspects—skills, education, previous experiences, attitudes, income, networks—with the immigrant status, from the propensity to start a business to running an established one, using a sequential logit model (Tutz 1991). This method allows us to model entrepreneurship as a sequential process, thus better reflecting the GEM framework, and to study the different barriers that immigrants might face at different stages of the entrepreneurial process.

The paper is organised as follows. Section 2 links the study to the existing empirical and theoretical literature and gives background information on Luxembourg. Section 3 describes the data used in this analysis, Sect. 4 describes the method used to obtain empirical results presented in Sect. 5, while Sect. 6 gives concluding remarks and policy implications.

2 Background

Population movements and entrepreneurship are regarded as drivers of economic growth, but so far have been mainly analysed separately. Economists have recently turned to investigate the economic contribution of immigrants (Wennekers and Thurik 1999; Hunt and Gauthier-Loiselle 2010; Peri 2012; Kerr et al. 2013), suggesting a positive impact of migrants on innovation activities and productivity. At the aggregate level, Peri (2012) finds that immigration increases total factor productivity, but negatively affects the skill-bias of the labour force. Kerr et al. (2013) analyse the impact of immigration at firm-level using matched employees–employers data and find that skilled immigration expands skilled employment and firms innovation rates. Hunt and Gauthier-Loiselle (2010) show that skilled immigrants have improved innovation performance in the USA over the period 1990–2000. These authors focus on direct involvement of immigrants in research and development activities, and measure innovation by patents per capita. Interestingly, they note that the presence of immigrants may be linked to innovation through the provision of management and entrepreneurship skills (this is referred to as the immigrants’ indirect contribution to innovation).

Empirical evidence on the link between immigration and entrepreneurship is scarce, possibly due to difficulties in observing immigrants’ contribution to entrepreneurial activities. Nonetheless, anecdotal evidence suggests a strong contribution of immigrants to entrepreneurship (Wadhwa 2011; Hohn et al. 2012). Basic statistics reported by Xavier et al. (2013) and OECD (2010) show that migrants are more likely to engage in entrepreneurial activities than non-migrants. Among the few studies exploring the link immigration–entrepreneurship, Constant and Zimmermann (2006) study the impact of ethnicity and immigration status on self-employment decisions using the 2000 wave of the German Socio-Economic Panel (SOEP). They show that the percentage of self-employed workers is low in Germany and more so among non-natives, despite immigrants self-employed earn a lot more than their salary workers counterparts. Overall, figures suggest that nationals and immigrants in Germany become entrepreneurs largely for the same reasons. Using GEM data collected for Spain, Irastorza and Pena (2007) find that immigrants are more likely to become entrepreneurs than natives. Batista and Umblijs (2014) analyse the relationship between risk preferences and migrant entrepreneurship using data from a survey on immigrants in the greater Dublin area; they find that willingness to take risks, experience and being part of migrants enclaves are significant predictors of entrepreneurship among immigrants.

More recently, empirical studies using regional data identified the contribution of immigration to entrepreneurship. For instance, Piergiovanni et al. (2012) provide convincing evidence that the share of immigrants in Italian regions is among the explanatory factors of their economic performance. The authors identify in the contribution to creativity the mechanism linking immigration to entrepreneurship. The idea is that a higher share of immigrants provides diversity, a wealth of experiences and know-hows, which feed creativity. When applied to economic activities, creativity becomes an engine for new solutions to old problems, for the identification of unexploited market niches, for product and process innovation ultimately increasing the chances for entrepreneurial activity. Additionally, Storper and Scott (2009) show that regions richer in human capital are more able to attract and successfully assimilating immigrants. Such regions show a higher ability to turn creativity into commercially viable knowledge, increased regional economic dynamism and employment growth.

This study expands this literature analysing the role of immigrants in creating new business initiatives in Luxembourg. Before discussing the Luxembourg case, the following gives a brief account of the theories explaining why migrants play a specific role in the entrepreneurial effort.

2.1 Immigrants and entrepreneurship

The theories seeking to explain the relationship between immigration and entrepreneurial involvement can be categorised in two broad groups: the first group relies on specific features of immigrants to explain differences in the propensity to start a business compared to non-immigrants; the second group focuses on the institutional and cultural environment of the host country.

According to the theories in the first group, immigrants have higher chances to start a new business because various kind of disadvantages (linguistic, racial, educational) steer their willingness to become entrepreneurs (Light 1979; Borjas 1986; Coate and Tennyson 1992; Clark and Drinkwater 2000; Parker 2004; Fregetto 2004). Some scholars argue that immigrants opt for self-employment to avoid low paid jobs—or those jobs perceived as preventing their upward mobility (Paulson and Townsend 2005; Rissman 2006). Other researchers emphasise the role of cultural traits. The main idea is that immigrants “inherit” the cultural traits of their countries of origin; whenever these traits determine a preference for self-employment, they result into higher chances of engaging in entrepreneurship (Masurel et al. 2004; Hofstede 2007; Chrysostome 2010). Some scholars have extended the latter model to account for the role of social networks linked to the country of origin (this is sometime referred to as the human capital theory). It is argued that such networks provide migrants with easy access to the resources—labor, capital, information and family support—needed to start a business (Sanders and Nee 1996; Peters 2002; Basu and Altinay 2002).

Linked to the human capital theory, the middleman minority and the ethnic enclave theories (Nestorowicz 2012) also belong to the first group of theories. The former, developed at the beginning of the 1970s, rests on the observation that successful migrant-led business initiatives are more commonly observed in areas with relatively large shares of immigrants. The features of migrants’ business activities—such as agents, money lenders, rent collectors, and brokers—favoured the view of immigrants as “middlemen”, i.e. intermediaries between market actors (Nestorowicz 2012). This model sees the immigrant and the host community in a symbiotic equilibrium between conflict and dependence due to economic success (Aldrich and Waldinger 1990; Terjesen and Elam 2009; Nestorowicz 2012).

The ethnic enclave theory focuses on the existence of immigrant enclaves in the host society.Footnote 1 The main idea is that immigrants have increased opportunities to start new businesses in areas where existing activities are run by individuals belonging to the same ethnic group (Altinay 2008).Footnote 2 The theory posits that enclaves benefit the entrepreneurial initiative due to the high intra-group solidarity, shared values, norms and attitudes that facilitate economic activities (Auster and Aldrich 1984; Zhou and Logan 1989). This stream of research has also investigated the conditions favouring the settling of enclaves and whether the existence of an enclave is socially desirable. Two conditions have been identified for the emergence of economic enclaves: i. access to sufficient start-up capital, usually through immigrants’ networks and connections with the country of origin; ii. a steady arrival of new labour force within the enclave (Portes and Jensen 1989; Portes and Shafer 2007). Enclaves, however, are perceived as “separated” from the resident population, a condition that may favour feelings of hostility, discrimination and ultimately conflict between the immigrant and the non-immigrant population. This theory has received considerable attention as, with some extensions and refinements, it proved to be able to explain some observed patterns (Sanders and Nee 1987; Waldinger 1993; Light et al. 1994).

The second group of theories explains migrants involvement in entrepreneurship focusing on the interaction between migrants’ individual features and the institutions and characteristics of the hosting societies and markets. Waldinger et al. (1990) proposed the so-called interactive model according to which immigrants’ entrepreneurial involvement is the outcome of the interaction between immigrants’ own resources and societies’ opportunity structures. The latter are historically shaped circumstances, such as market conditions that do not require mass production or distribution, characterised by decreasing return to scale in which ethnic goods are in demand. These conditions allow the mobilisation of immigrants’ characteristics—named as ethnic strategies—towards the entrepreneurial initiative (Pütz 2003; Volery 2007). More recently, Kloosterman and Rath (2001) refined the interactive model to account for country-specific institutional frameworks. These authors developed the “mixed embeddedness” model suggesting that while immigrants belong to ethnic networks, they are also embedded (entrenched) in specific market conditions, socio-economic and politico-institutional environments. The interactive and the mixed embeddedness models have received considerable attention in the literature and have been extended to account for gender differences, the role of family business, of suburban ethnic clusters, of cultural characteristics, and for the evolution of institutions and market conditions (Light and Rosenstein 1995; Bonacich 1993; Rath 2002; Pütz 2003; Portes and Rumbaut 2006; Li 1998; Kloosterman 2010). Finally, these studies have contributed to identify a set of control variables—such as managerial and other individual abilities, family background, occupational status, financial constraints and economic activity—for studying determinants of self-employment (Aliaga-Isla and Rialp 2013).

2.2 The focus on Luxembourg

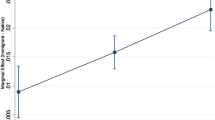

Luxembourg’s demographic structure makes it an interesting case for the study of national systems of innovation and entrepreneurship. Since 1990, the resident population has increased by more than one-third from immigration.Footnote 3 At the same time, increased demand and supply of labour have driven the expansion of domestic employment.Footnote 4 In this context, Jean et al. (2007) and Barone (2009) document that the country has been successful in implementing policies for promoting skilled immigration (Fig. 1).

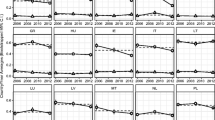

In Luxembourg, the share of immigrants in the resident population is higher than in any other European country (see Fig. 2). As of the first of January 2013, about 45 % of the Luxembourgish resident population is constituted of immigrants coming from more than 100 different countries (STATEC 2012). Thus, Luxembourg offers a unique combination in terms of high share of immigrants and of high diversity among ethnic groups. In addition, the country anticipates some tendencies that are expected to affect other European countries in the coming years (see Fig. 3). Population projections by EUROSTAT show that by 2061 a majority of EU countries are expected to significantly increase the share of non-nationals on their resident population (Lanzieri 2011).Footnote 5 According to such predictions, the challenges that Luxembourg faces in 2013–2014 will become relevant also to other countries. Hence, lessons on the relationship between immigration and determinants of entrepreneurial activity drawn from Luxembourg are also of more general relevance.

These facts suggest that the Luxembourg case may contribute to a better understanding of the role of migration on innovation activities and entrepreneurship. According to Fig. 1, Luxembourg is the seventh country with the highest share of people involved in TEA after USA, Canada, Singapore, Israel, Netherlands and Ireland. (This is shown in Fig. 1, which depicts population’s involvement in early-stage entrepreneurial activities.) Moreover, existing evidence suggests that immigrants play a special part in entrepreneurship: Ries (2006) reports that foreigners account for the 75 % of entrepreneurs in Luxembourg.

Share of foreign background persons in the EU Member States in 2011 and projected in 2061. Source: Lanzieri (2011)

In the light of the evidence from previous studies and of the features of the Luxembourgish socio-demographic composition, we test the following hypothesis:

-

1.

immigrants have higher chances than nationals to be willing to engage in entrepreneurial process;

-

2.

condition upon the willingness to engage in entrepreneurial process, the chances that an immigrant will start a new company are not significantly different from those for nationals;

-

3.

higher-educated immigrants have higher chances to start a new business in Luxembourg.

3 Data

We use data from the Adult Population Surveys of Global Entrepreneurship Monitor (GEM) survey. GEM is a rich, internationally harmonised source of individual-level information about people’s motives and aspirations towards entrepreneurship. This survey is currently administered in more than 100 countries worldwide, covering more than 75 % of the world population.

In 2013 and 2014, the National Statistical Office of Luxembourg (STATEC), and in 2013 the University of Luxembourg and the Centre de Recherche Publique “Henri Tudor”, administered the first two waves of the GEM survey in Luxembourg. In both waves, a nationally representative sample of about 2000 people replied to a questionnaire about entrepreneurial activity, aspirations and attitudes. The aim of the survey was to collect information about the attitudes and behaviours leading to the creation of entrepreneurial activities, along with a set of socio-demographic and socio-economic variables.

Data have been collected on a single sample of the population with an age comprised between 18 and 64 years. Approximately half of the sample has being interviewed using fixed-line telephone, and the remaining half filled-in an online survey. In the latter case, individuals have been randomly selected from a data base with over 14,000 e-mail addresses. These methods do not cast particular doubts about the selection of the sample as virtually every household in Luxembourg has a landline and more than 92 % of the population has internet access.

We pool the waves of 2013 and 2014 to retrieve individual-level information about immigration status, entrepreneurship activities, entrepreneurial attitudes, gender, age, education of the respondents and sector of economic activity of the new business. Pooling the waves increases the sample size and allows more precise estimations.

3.1 Dependent variables

Our empirical strategy follows the GEM model. This model describes the entrepreneurship process as composed by the following sequence of stages:

-

1.

Inactive;

-

2.

Potential (expecting to start a new business within the next three years);

-

3.

Nascent entrepreneur (involved in setting up a business);

-

4.

New entrepreneur (owner-manager of firm younger than 42 months that pays wages during last three months);

-

5.

Established entrepreneur (owner-manager of firm older than 42 months that pays wages during last three months).

Individuals who wish to establish a firm cross the various stages. Crossing stages depend on subjective and institutional factors that allow an individual to become a potential entrepreneur, to decide to start a firm, to set it up and to lead an established company. The various phases are observed via respondents’ self-declarations of involvement in entrepreneurial activity. In other words, respondents are asked to situate their company in a specific phase of the entrepreneurial process. Based on these answers, we built a set of four dummy variables, one for each phase of the process. These variables take value 1 if the respondent is in a specific or higher phase, and zero otherwise. This is illustrated in Fig. 4.

3.2 Variables of interest

The main independent variable is the migratory background of the respondents. We distinguish the respondents in nationals (individuals born in Luxembourg with both Luxembourgian parents), first-generation immigrants (individuals born abroad) and second-generation immigrants (individuals born in Luxembourg with at least one foreign parent).

The distinction in first- and second-generation immigrant is relevant because the attitudes, behaviours and motives of immigrant entrepreneurs may differ significantly between first- and second-generation immigrants. For example, it is plausible that the second generation of immigrants reports more similar features to the nationals than to the first generation. This might be due to the fact that the second generation is born and grows up in Luxembourg, and therefore it gets educated and socialised as nationals (Callens et al. 2014). However, there are also reasons to believe that the second generation is not different from the first one. This argument is based on the recent work by Algan and Cahuc (2010) showing that trust in others is an individual trait partly inherited by parents, thus depending on trust prevalent in the country of origin. Since trust in others is an important factor shaping people’s attitudes and intentions to invest in an economic activity, it is plausible to expect that eventual differences between first-generation immigrants and nationals are also mirrored in the second generation. Descriptive statistics in Table 1 show that first-generation migrants are more active in entrepreneurial activities than nationals and second-generation migrants over all stages of the entrepreneurial process.

3.3 Control variables

The entrepreneurial attitude is measured by three dummy variables. Each variable takes value 1 if the respondent:

-

1.

knows someone who started a business;

-

2.

perceives himself as skilled and experienced enough to start a new business;

-

3.

fears to fail in starting a new business.

The attitude towards starting a new business is particularly relevant only in first phases of entrepreneurship process (up to effectively starting a new business) and is not implemented when investigating later phases. It is worth noticing that the fear of failure allows to control for individual risk aversion. This is particularly important to address the self-selection concern due to the fact that more risk-prone individuals can also be more likely to become immigrants and to start new businesses.

To account for individual socio-economic conditions, we control for age, gender, education, occupation and income of the respondent. Age is measured as a continuous variable ranging from 18 to 64 years. Gender is a dummy variable set to 1 if the respondent is male and 0 otherwise. Education is observed by a set of dummy variables, respectively, set to 1 if the respondent declares to have one of the following levels of education classified in line with the International Standard Classification of Education. Retained education categories are (a) lower secondary; (b) upper secondary and craftsman; (c) tertiary (e.g. bachelor and higher). Employment status, implemented only in the first two phases of entrepreneurial process, is measured with a categorical variable that takes the following values: (a) full-time, (b) part-time, (c) self-employed, (d) seeking employment and (e) others (e.g. students retired etc.). The availability of private financial resources to fund the business is observed through respondent’s self-declaration of belonging to one of the following income classes: 0–40,000; 40,001–60,000; 60,001–80,000; 80,001–100,000; more than 100,000. In later phases of entrepreneurial process, individual’s income can be seen as a measure of the profitability of the business.

The sectors of economic activities are observed according to the International Standard Industrial Classification (ISIC). Sectors are aggregated on the basis of knowledge intensity as defined by (EUROSTAT 2008). Retained categories are: knowledge-intensive services, low-knowledge-intensive services and others (e.g. agriculture, manufacturing). Finally, to account for time effect, we include year fixed effects. All variables are interacted with the immigration variable to capture the possible different influence on the probability to become an entrepreneur for people with different migratory backgrounds. Descriptive statistics and correlation matrix are reported in Tables 4 and 5 in the Appendix.

4 Methodology

This section presents the empirical strategy used in this analysis. As noted in previous sections, the GEM framework models entrepreneurship as a process comprising several stages. These include the intention to start a new business, the involvement in new ventures, and the survival of new firms. Thus, each entrepreneur passes through intermediate steps before setting up an established business; at each stage, the entrepreneur can stop or proceed to the next phase. Figure 4 gives a graphical representation of the entrepreneurship model. To account for the GEM setting, we adopt a variant of the sequential model of Tutz (1991) proposed by Buis (2010).

The idea is that only some people are potentially interested to start a new business, and among them only a fraction will effectively start a new business. This framework allows us to establish whether the probability to successfully proceed over subsequent stages differs over immigration status (nationals; first generation; second generation). The probabilities p that an individual proceeds through the various stages are as follows:

where i denotes the individual, and Imm. the immigration background. One can see that this model is composed by five phases, resulting in four transitions from inactive to established entrepreneurs. Entrepreneurs can move to a new phase only if they have achieved the previous stage (see Fig. 4). The transition-specific intercept is \(\alpha _{k}\), with \(k = 1, 2,\ldots , 4; \lambda _{k}\), the coefficient of the immigration status, is the coefficient of interest; X is a vector of control variables.

The model above is estimated by fitting logistic regressions for each transition, using the sub-sample constituted by individuals who have achieved that stage (Tutz 1991). As factors affecting the transition probabilities may vary over the sequence, we do not restrict the set of control variables to be the same at each phase.Footnote 6 To capture possible differences between immigrants and non-immigrants for various levels of the control variables, we also include interaction effects of the immigration variable Imm. with all control variables.

5 Results

We find that the willingness to engage in entrepreneurial activities is higher for first-generation migrants than for Luxembourgish nationals. At subsequent stages of the entrepreneurial process, however, the behaviour of migrants and non-migrants does not differ significantly. Table 2 reports marginal effects of the migration background on the probabilities of engaging in entrepreneurial activities. One can see that the probability that a first-generation migrant becomes a potential entrepreneur is 7 percentage points higher than for a non-migrant (first column). Among potential entrepreneurs, however, the probability to start a new business does not differ significantly over migration backgrounds. Similar results are found for the subsequent steps of the entrepreneurial process, i.e. running and successfully establishing a new firm.

A possible explanation for this result is that individuals that are more willing to take risks are more likely to migrate. In other words, it is plausible to expect that our results are due to self-selection of “risk-lover” people among migrants. To account for this source of endogeneity, we control for the respondents’ fear of failure. Indeed, the fear of failure may be regarded as a measure of the risk aversion of the respondents Batista and Umblijs (2014).

The average marginal effects on the transition probabilities for all variables in the model are reported in the Appendix.Footnote 7

5.1 The role of education

This section focuses on the effects of variables describing the educational level of individuals on entrepreneurial activities. This is relevant to Luxembourg because of the important share of highly educated immigrants living in the country. This analysis may help to better understand how human capital affects the relation between immigration background and entrepreneurship. The idea is that innovative businesses, often concentrated in high-tech and high-knowledge industries, usually require specific skills and highly trained people. The availability of such skills may be crucial in determining both the probability to become entrepreneurs and the survival of new ventures.

To investigate this aspect, we re-estimate the likelihood of transitioning across entrepreneurship phases taking into account different educational levels. Results are shown in Table 3. Highly educated first-generation immigrants are more likely to become potential entrepreneurs. In particular, first-generation immigrants with tertiary education are more likely to be potential entrepreneurs than non-immigrants with tertiary education (about 14 percentage points), while we do not find any statistical difference across educational levels and migration status in successive steps.

Second-generation immigrants with lower secondary education are less likely to become nascent entrepreneurs compared to non-immigrants with comparable educational level. However, second-generation immigrants with upper secondary and craftsman education are more likely to involve in start-ups.

Summarising, highly educated immigrants are more likely to be potential entrepreneurs than less educated ones. This result holds after controlling for the fear of failure and for having the skills and experience to run a company. After individuals become entrepreneurs, the differences among immigrants and non-immigrants, as well as among individuals with different educational level, disappear. This result may be interpreted as the outcome of the interplay of two different conditions: on one side, the role of higher education which acts as an engine of entrepreneurial involvement; on the other, the role of the national system of entrepreneurship. The latter supports the establishment of new companies and provides equal opportunities for those who start a company, independently from their educational or migration background.

6 Conclusions

Entrepreneurship, an important driver of economic growth, is attracting increasing interest from academic and policy makers alike. This study explores the role of migrants in promoting new business initiatives in host countries. We analyse the effects of the immigration background on different phases of the entrepreneurial process, from being interested in starting a company to running an established one. We consider different types of immigration background and distinguish between first- and second-generation immigrants. The analysis is performed on pooled data from the Global Entrepreneurship Monitoring surveys of 2013 and 2014 for Luxembourg.

Controlling for a set of individual characteristics (fear of failure, skills, age, sex, education, occupation, income) and firm features (sector of activity), the econometric results evidence the high propensity of first-generation migrants for starting a new business. This effect is stronger for highly educated individuals. At subsequent stages of the entrepreneurial process, the immigration effect disappears. In other words, migrants do not have higher chances to succeed in starting a business and running a start-up or an established business than nationals. This result is consistent with previous studies (Constant and Zimmermann 2006; Desiderio and Salt 2010).

Our findings suggest that there is a large potential of entrepreneurship among first-generation immigrants, especially among highly educated people. This is relevant to policy as it suggests a link between immigrant entrepreneurs, skills, and, possibly, start-up in knowledge-intensive sectors. Since innovation contributes to the long-term economic growth of a country, policies aiming to attract highly educated migrants, as well as migrants willing to create new businesses, are desirable. Policies for entrepreneurship and for immigration are often considered separately. Yet, our study shows that smart policies for immigration strengthen the National System of Entrepreneurship and thus promote growth and development. This confirms the need for a comprehensive approach to entrepreneurship, which is consistent with the theoretical underpinnings of the National System of Entrepreneurship.

Present results are of general relevance because population and migration trends in Luxembourg anticipate the trends of other developed countries. Yet, this study is essentially exploratory. The analysis leaves out some relevant issues which will be addressed in future research. For example, the link between typologies of new businesses and migrants characteristics, as well as the contribution of migrants to highly innovative and high growth firms, requires further investigation. This is relevant for countries’ competitiveness. Additionally, as findings in this study are based on evidence from a single country, future research should perform a cross-country comparison of the role of immigration for entrepreneurship. In particular, it is interesting to test whether the link between immigration and entrepreneurship follows similar patterns across developed countries. GEM data are suitable to this purpose as the consortium provides internationally comparable data on entrepreneurship worldwide. As it is often the case in survey studies, our findings hinge on partial correlations which are not necessarily causal relationships. This issue will be the object of future research.

Notes

Ethnic enclaves can be defined as self-contained minority communities nested in metropolitan areas (Wilson and Martin 1982).

In a well-known study, Wilson and Portes (1980) found that Cuban immigrants working for Cuban employers in Miami experienced significant returns to their human capital.

Luxembourg en chiffres, STATEC, 2014 can be found on: http://www.statistiques.public.lu/en/publications/series/lux-figures/index.html.

On labour force statistics in Luxembourg, one can see data and publications on STATEC’s website, in particular http://www.statistiques.public.lu/en/population-employment/index.html. One can also see the various issues of the Rapport travail et cohésion sociale, published regularly by STATEC.

In six other European countries—namely, Cyprus, Austria, Germany, Great Britain, Ireland and Belgium—people with an immigration background will account for more than 30 % of the resident population.

For example, questionnaire provides information about the sector of economic activity only after the starting of the new venture. Therefore, only the last two phases include these controls.

Model estimates are available upon request from the authors.

References

Acs, Z., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: Measurement issues and policy implications. Research Policy, 43(3), 476–494. doi:10.2139/ssrn.2008160.

Aldrich, H. E., & Waldinger, R. (1990). Ethnicity and entrepreneurship. Annual Review of Sociology, 16(1), 111–135. doi:10.1146/annurev.so.16.080190.000551.

Algan, Y., & Cahuc, P. (2010). Inherited trust and growth. The American Economic Review, 100(5), 2060–2092. doi:10.1257/aer.100.5.2060.

Aliaga-Isla, R., & Rialp, A. (2013). Systematic review of immigrant entrepreneurship literature: Previous findings and ways forward. Entrepreneurship & Regional Development, 25(9–10), 819–844. doi:10.1080/08985626.2013.845694.

Altinay, L. (2008). The relationship between an entrepreneur’s culture and the entrepreneurial behaviour of the firm. Journal of Small Business and Enterprise Development, 15(1), 111–129. doi:10.1108/14626000810850874.

Alvarez, C., Urbano, D., & Amoras, J. (2014). GEM research: Achievements and challenges. Small Business Economics, 42(3), 445–465. doi:10.1007/s11187-013-9517-5.

Amoros, J., & Bosma, N. (2014). Global Entrepreneurship Monitor global report 2013.

Audretsch, D. B. (2007). Entrepreneurship capital and economic growth. Oxford Review of Economic Policy, 23, 63–78. doi:10.4337/9781783476923.00011.

Auster, E., & Aldrich, H. (1984). Small business vulnerability, ethnic enclaves and ethnic enterprise. In R. J. Robin Ward (Ed.), Ethnic communities in business: Strategies for economic survival (Chap. 3, pp. 39–54). Cambridge, NY: Cambridge University Press.

Barone, C. (2009). Occupational promotion of migrant workers. http://www.eurofound.europa.eu/ewco/studies/tn0807038s/tn0807038s.htm.

Basu, A., & Altinay, E. (2002). The interaction between culture and entrepreneurship in London’s immigrant businesses. International Small Business Journal, 20(4), 371–393. doi:10.1177/0266242602204001.

Batista, C., & Umblijs, J. (2014). Migration, risk attitudes, and entrepreneurship. IZA Journal of Migration. doi:10.1186/s40176-014-0017-4.

Bonacich, E. (1993). The other side of ethnic entrepreneurship: A dialogue with Waldinger, Aldrich, Ward and associates. International Migration Review, 27(3), 685–692. doi:10.2307/2547120.

Borjas, G. (1986). The self-employment experience of immigrants. The Journal of Human Resources, 21(4), 485–506. doi:10.2307/145764.

Braunerhjelm, P., Acs, Z., Audretsch, D., & Carlsson, B. (2010). The missing link: Knowledge diffusion and entrepreneurship in endogenous growth. Small Business Economics, 34(2), 105–125. doi:10.1007/s11187-009-9235-1.

Buis, M. (2010). Chapter 6, not all transitions are equal: The relationship between inequality of educational opportunities and inequality of educational outcomes. In M. L. Buis (Ed.), Inequality of educational outcome and inequality of educational opportunity in the Netherlands during the 20th century. Ph.D. thesis. http://www.maartenbuis.nl/dissertation/chap_6.

Callens, M. S., Valentova, M., & Meuleman, B. (2014). Do attitudes towards the integration of immigrants change over time? A comparative study of natives, second-generation immigrants and foreign-born residents in Luxembourg. Journal of International Migration and Integration, 15(1), 135–157. doi:10.1007/s12134-013-0272-x.

Chrysostome, E. (2010). The success factors of necessity immigrant entrepreneurs: In search of a model. Thunderbird International Business Review, 52(2), 137–152. doi:10.1002/tie.20320.

Clark, K., & Drinkwater, S. (2000). Pushed out or pulled in? Self-employment among ethnic minorities in England and Wales. Labour Economics, 7(5), 603–628. doi:10.1016/s0927-5371(00)00015-4.

Coate, S., & Tennyson, S. (1992). Labor market discrimination, imperfect information and self employment. Oxford Economic Papers, 44(2), 272–288. doi:10.2307/2663369.

Constant, A., & Zimmermann, K. (2006). The making of entrepreneurs in Germany: Are native men and immigrant alike? Small Business Economics, 42(3), 279–300. doi:10.1007/s11187-005-3004-6.

Desiderio, M., & Salt, J. (2010). Main findings of the conference on entrepreneurship and employment creation of immigrants in OECD countries. Paris: OECD.

EUROSTAT. (2008). Eurostat indicators of high-tech industry and knowledge-intensive services, Annex 3.

Fregetto, E. (2004). Immigrant and ethnic entrepreneurship: A U.S. perspective. In H. Welsch (Ed.), Entrepreneurship: The way ahead (pp. 253–268). New York: Routledge. doi:10.4324/9780203356821.ch18.

Hofstede, G. (2007). Asian management in the 21st century. Asia Pacific Journal of Management, 24(4), 411–420. doi:10.1007/s10490-007-9049-0.

Hohn, M., Atkins, L., & Waslin, M. (2012). Immigrant entrepreneurs. Creating jobs and strengthening the economy. Labor, Immigration and Employee Benefits Division of the US Chamber of Commerce; Immigration Policy Center of the American Immigration Council.

Hunt, J., & Gauthier-Loiselle, M. (2010). How much does immigration boost innovation? American Economic Journal: Macroeconomics, 2(2), 31–56. doi:10.1257/mac.2.2.31.

Irastorza, N., & Pena, I. (2007). Entrepreneurial activity of immigrants versus natives in Spain: Are immigrants more enterprising than natives? Frontiers of Entrepreneurship Research, 27(9), 2.

Jean, S., Causa, O., Jimenez, M., & Wanner, I. (2007). Migration in OECD countries: Labour market impact and integration issues, OECD working paper No. 562.

Kerr, S. P., Kerr, W. R., & Lincoln, W. F. (2013). Skilled immigration and the employment structures of U.S. firms. NBER Working Papers 19658, National Bureau of Economic Research, Inc. doi:10.3386/w19658. http://ideas.repec.org/p/nbr/nberwo/19658.html.

Kloosterman, R. (2010). Matching opportunities with resources. A framework for analysing migrant entrepreneurship from a mixed embeddedness perspective. Entrepreneurship and Regional Development, 22(1), 25–45. doi:10.1080/08985620903220488.

Kloosterman, R., & Rath, J. (2001). Immigrant entrepreneurs in advanced economies: Mixed embeddedness further explored. Journal of Ethnic and Migration Studies, 27(2), 189–201. doi:10.1080/13691830020041561.

Lanzieri, G. (2011). Fewer, older and multicultural? Projections of the EU populations by foreign/national background. EUROSTAT Methodologies and Working Papers (12). doi:10.2785/17529. http://ec.europa.eu/eurostat/documents/3888793/5850217/KS-RA-11-019-EN.PDF/0345b180-b869-4cb0-907b-d755b699a369.

Li, W. (1998). Anatomy of a new ethnic settlement: The Chinese ethnoburb in Los Angeles. Urban Studies, 35(3), 479–501. doi:10.1080/0042098984871.

Light, I. (1979). Disadvantaged minorities in self-employment. International Journal of Comparative Sociology, 20(1–2), 31–45. doi:10.1177/002071527902000103.

Light, I., Sabagh, G., Bozorgmehr, M., & Der-Marirosian, C. (1994). Beyond the ethnic enclave economy. Social Problems, 41(1), 65–80. doi:10.2307/3096842.

Light, I. H., & Rosenstein, C. N. (1995). Race, ethnicity, and entrepreneurship in urban America. New York: Transaction Publishers.

Masurel, E., Nijkamp, P., & Vindigni, G. (2004). Breeding places for ethnic entrepreneurs: A comparative marketing approach. Entrepreneurship & Regional Development, 16(1), 77–86. doi:10.1080/0898562042000205045.

Nestorowicz, J. (2012). Immigrant self-employment: Definitions, concepts and methods. Central and Eastern European Migration Review, 1(1), 37–55.

OECD. (2010). Entrepreneurship and migrants, report by the OECD working party on SMEs and entrepreneurship.

Parker, S. C. (2004). The economics of self-employment and entrepreneurship. Cambridge: Cambridge University Press.

Paulson, A., & Townsend, R. (2005). Financial constraints and entrepreneurship: Evidence from the Thai financial crisis. Economic Perspectives, Federal Reserve Bank of Chicago, 29(3), 34–48.

Peri, G. (2012). The effect of immigration on productivity: Evidence from United States. Review of Economics and Statistics, 94(1), 348–358. doi:10.1162/REST_a_00137.

Peters, N. (2002). Mixed embeddedness: Does it really explain immigrant enterprise in Western Australia? International Journal of Entrepreneurial Behaviour & Research, 8(1/2), 32–53. doi:10.1108/13552550210423705.

Piergiovanni, R., Carree, M. A., & Santarelli, E. (2012). Creative industries, new business formation, and regional economic growth. Small Business Economics, 39(3), 539–560. doi:10.1007/s11187-011-9329-4.

Portes, A., & Jensen, L. (1989). The enclave and the entrants: Patterns of ethnic enterprise in Miami before and after Mariel. American Sociological Review. doi:10.2307/2095716.

Portes, A., & Rumbaut, R. G. (2006). Immigrant America: A portrait. Oakland: University of California Press.

Portes, A., & Shafer, S. (2007). Revisiting the enclave hypothesis: Miami twenty-five years later. Research in the Sociology of Organizations, 25, 157–190. doi:10.1016/S0733-558X(06)25005-5.

Pütz, R. (2003). Culture and entrepreneurship—Remarks on transculturality as practice. Tijdschrift voor Economische en Sociale Geografie, 94(5), 554–563. doi:10.1046/j.1467-9663.2003.00282.x.

Rath, J. (2002). Needle games: A discussion of mixed embeddedness. In J. Rath (Ed.), Unravelling the Rag Trade: Immigrant entrepreneurship in seven world cities (pp. 1–28). Berg: University of New York Press.

Reynolds, P., Bosma, N., Autio, E., Hunt, S., DeBono, N., Servais, I., et al. (2005). Global Entrepreneurship Monitor: Data collection design and implementation 1998–2003. Small Business Economics, 24(3), 205–231. doi:10.1007/s11187-005-1980-1.

Reynolds, P. D., Michael, H., Bygrave, W. D., Camp, S. M., & Autio, E. (2000). Global Entrepreneurship Monitor: 2000 executive report. Kansas City, MO: Kauffman Center for Entrepreneurial Leadership.

Ries, J. (2006). Une typologie des entrepreneurs Luxembourgeois, STATEC Cahier Economique No 103.

Rissman, E. R. (2006). The self-employment duration of younger men over the business cycle. Economic Perspectives—Federal Reserve Bank of Chicago, 30(3), 14–27.

Sanders, J. M., & Nee, V. (1987). Limits of ethnic solidarity in the enclave economy. American Sociological Review, 52(6), 745–773. doi:10.2307/2095833.

Sanders, J. M., & Nee, V. (1996). Immigrant self-employment: The family as social capital and the value of human capital. American Sociological Review, 61(2), 231–249. doi:10.2307/2096333.

Schumpeter, J. (1934). The theory of economic development: An inquiry into profits, capital, credit, interest, and the business cycle. Cambridge: Harvard University Press.

STATEC. (2012). La population par nationalité (1). Recensement de la population 2011. Premiers résultats n. 04. http://www.statistiques.public.lu/catalogue-publications/RP2011-premiers-resultats/2012/04-12.

Storper, M., & Scott, A. J. (2009). Rethinking human capital, creativity and urban growth. Journal of Economic Geography, 9(2), 147–167. doi:10.1093/jeg/lbn052.

Terjesen, S., & Elam, A. (2009). Transnational entrepreneurs’ venture internationalization strategies: A practice theory approach. Entrepreneurship Theory and Practice, 33(5), 1093–1120. doi:10.1111/j.1540-6520.2009.00336.x.

Tutz, G. (1991). Sequential models in categorical regression. Computational Statistics & Data Analysis, 11(3), 275–295.

Volery, T. (2007). Ethnic entrepreneurship: A theoretical framework. Handbook of Research on Ethnic Minority Entrepreneurship. doi:10.4337/9781847209962.00009.

Wadhwa, V. (2011). America’s new immigrant entrepreneurs. Tech. rep., UC Berkeley, School of Information.

Waldinger, R. (1993). The ethnic enclave debate revisited. International Journal of Urban and Regional Research, 17(3), 444–452. doi:10.1111/j.1468-2427.1993.tb00232.x.

Waldinger, R., Ward, R., Aldrich, H. E., & Stanfield, J. H. (Eds.). (1990). Ethnic entrepreneurs: Immigrant business in industrial societies. London: Sage.

Wennekers, S., & Thurik, R. (1999). Linking entrepreneurship and economic growth. Small Business Economics, 13(1), 27–56. doi:10.1023/A:1008063200484.

Wilson, K. L., & Martin, W. A. (1982). Ethnic enclaves: A comparison of the Cuban and Black economies in Miami. American Journal of Sociology, 88(1), 135–160. doi:10.2307/2779407.

Wilson, K. L., & Portes, A. (1980). Immigrant enclaves: An analysis of the labor market experiences of Cubans in Miami. American Journal of Sociology, 86(2), 295–319. doi:10.2307/2778666.

Xavier, S., Kelley, D., Kew, J., Herrington, M., & Vorderwulbecke A (2013). Global Entrepreneurship Monitor global report 2012, GEM consortium.

Zhou, M., & Logan, J. R. (1989). Returns on human capital in ethic enclaves: New York City’s Chinatown. American Sociological Review, 54(5), 809–820. doi:10.2307/2117755.

Acknowledgments

The authors wish to thank the participants to the “Conference of National Systems of Entrepreneurship” held in Mannheim on 20–21 November 2014 and two anonymous reviewers for their comments and suggestions on earlier versions of this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

The opinions and views expressed in this paper are those of the authors and do not reflect in any way those of STATEC.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Peroni, C., Riillo, C.A.F. & Sarracino, F. Entrepreneurship and immigration: evidence from GEM Luxembourg. Small Bus Econ 46, 639–656 (2016). https://doi.org/10.1007/s11187-016-9708-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-016-9708-y