Abstract

Why are some entrepreneurs able to start a new firm more quickly than others in the venture creation process? Drawing on pecking order and agency theory, this study investigates how start-up capital structure influences the time to either new firm founding or quitting the start-up process. The temporal aspect of the start-up process is one that is often discussed, but rarely studied. Therefore, we utilize competing risk and Cox regression event history analysis on a nationally representative sample of US entrepreneurs to investigate how start-up capital structure impacts the time in gestation to particular kinds of start-up outcomes. Our findings suggest that external equity has an appreciable impact on new firm emergence over time, and that the percentage of ownership held by the founders attenuates the benefits of external equity.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Why are some founders able to start a new firm more quickly than others? Additionally, why are some founders able to quit the start-up process more quickly than others? Finally, why do some founders persist for years, still trying to implement new firms? The time it takes entrepreneurs to create an organization is an important aspect of entrepreneurship that has rarely been examined. Although there are several perspectives and potential explanations for why some founders are quicker than others to reach some kind of outcome, our study expands on the concepts of adverse selection and moral hazard to develop arguments for the temporal impact of financial capital on start-up speed.

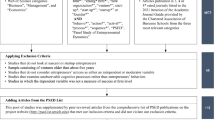

Start-up speed is the time between when the founder conceives the venture and reaches a venture creation outcome (e.g., new firm founding or quitting the start-up). Start-up speed can vary dramatically among founders, and we argue that one important factor in explaining this variation is related to the capital structure decisions of the start-up. Drawing on the pecking order perspective in concert with agency theory, we advance arguments for why certain start-up financial models enable a particular outcome resolution (e.g., an outcome of either new firm founding or quitting, versus still trying) faster than others in the nascent context (see Fig. 1).

Although there is an increasing interest in addressing financial structure in small and private firms, finance and entrepreneurship research is incomplete and remains relatively silent with regard to the temporal implications of financing options faced by the entrepreneur. Equity and debt financing (e.g., typically venture capital/business angel investment compared to bank loans) have distinct implications for founders (Schmidt 2003; Ueda 2004; Winton and Yerramilli 2008; Smith 2009). Start-up financing is an important and relevant topic because the type of financing utilized during the earliest phases of the start-up process influences the time a venture is in gestation (Liao and Welsch 2002); this is likely due to entrepreneurs trying to address information asymmetry and moral hazard problems among potential investors.

Using the panel study of entrepreneurial dynamics (PSED) I and II,Footnote 1 two nationally representative samples of individuals actively involved in the start-up process, this research investigates whether the time to start-up outcome (i.e., new firm founding, quitting, or still trying) is influenced by the start-up capital utilized by nascent entrepreneurs. We apply two kinds of event history analysis to investigate the relationship between start-up financial structure and time to start-up outcomes: competing risk regression (Fine and Gray 1999) and Cox regression (Cox 1972). A competing risk regression should be applied when an individual can experience more than one kind of event outcome. And the occurrence of one event might prohibit the occurrence of other kinds of events, and only the time to the earliest of these multiple events is observed (Lin et al. 2012), which is the case during start-up gestation. Conversely, a Cox regression models the hazard rate, or the number of new cases experiencing an event per population at risk per unit time, which is the case if we wish to examine those still trying. Event history analysis techniques such as competing Cox regression have been applied in several studies of entrepreneurship (e.g., Busenitz et al. 2005; Raffiee and Feng 2014; Tatikonda et al. 2013) However, to our knowledge, this paper is the first, if not among the very first, that investigates the temporal implications of outcome antecedents during the gestation period of start-ups in terms of two distinct competing outcomes (i.e., new firm founding or quitting) versus still trying.

Consequently, our study contributes to advanced understanding of the firm gestation process and outcomes in several important ways. First, we provide evidence of the appreciable impact of capital structure on venture creation speed and its role in the subsequent gestation outcomes. Our findings suggest that start-ups primarily financed external equity have a much higher incidence of new firm founding over time. Furthermore, as the percentage of ownership held by the founding team increases, it attenuates the impact of external equity on the incidence of new firm founding over time. We expand on extant knowledge about start-up financing and provide evidence that highlights benefits and disadvantages of particular kinds of capital in the nascent context. Second, we contribute to the burgeoning research that analyzes data on start-up outcomes by investigating founding speed as an outcome, and explore an important dimension of new venture viability in ways that complement existing outcomes studied in the entrepreneurship literature (Brush et al. 2008; Davidsson and Gordon 2012; Dimov 2010; Kim et al. 2015; Delmar and Shane 2004).Footnote 2 Third, we contribute to capital structure literature in entrepreneurship that focuses on privately held start-ups (e.g., see Berger and Udell 1998; Cassar 2004; Cole 2008; Cole and Sokolyk 2013; Robb and Robinson 2014; Frid 2009; Gartner et al. 2012; Paul et al. 2007). Fourth, we answer a call by Davidsson and Gordon (2012) that challenges pursuing more sophisticated modeling, analysis, and interpretation of start-up outcomes over time.

This article is organized as follows: We first discuss how capital structure impacts start-up outcomes. We do this by examining the underlying assumptions associated with internal funds, debt, and external equity on the timing of start-up outcomes. Using the lens of pecking order and agency theory, we then hypothesize the relationships between capital structure and the timing of such outcomes. Next, we present our results and discuss the implications of these findings. Finally, providing empirical evidence for the benefits of a reverse pecking order in the nascent context, we offer discussion and suggestions for future research to further advance our understanding of how capital structure decisions impact nascent venture outcomes.

2 Theory development and hypotheses

2.1 Capital structure in start-ups: adverse selection and moral hazard

Entrepreneurs have to cope with two forms of agency problems that of moral hazard and adverse selection (Eisenhardt 1989). Moral hazard deals with hidden action, whereas adverse selections deal with hidden information (Arrow 1984). In the start-up case, moral hazard arises when any action undertaken by the entrepreneur is unobservable and has a different value to the founder when compared to the investor. Adverse selection problems arise when the entrepreneur has more information than the investor. Focusing on the adverse selection and moral hazard arguments fundamental to pecking order and agency theory, we subsequently provide important insights to why capital structure may play an important role in driving start-up speed.

In essence, the “pecking order” corresponds to the easiest and most convenient ways to raise money and maintain control of the firm. Pecking order theory contends that companies tend to finance investments with internal funds when possible and issue debt only when these internal funds are exhausted. Once debt options are exhausted, companies will issue new common stock and raise funds via equity.Footnote 3 Consequently, pecking order aims at substantially maintaining existing ownership structure to reduce problems associated with moral hazard.

Accordingly, pecking order will create different types of agency costs by impacting performance incentives for investors and entrepreneurs. For instance, higher levels of external equity financing have been argued to exacerbate moral hazard (Bitler et al. 2005; Jensen and Meckling 1976). For an entrepreneur, higher external equity financing equates to lower retained ownership, and consistent with the agency theory assumptions, this leads to more severe agency problems. Conversely, if the start-up primarily finances itself with debt or internal funds, or places the ownership risk and rewards squarely on the start-up founders, this potentially minimizes the agency costs of moral hazard. Therefore, debt and internal funds should attenuate the agency costs associated with moral hazard because effort is positively related to the proportion of company shares retained by the entrepreneur.

Likewise, pecking order also aims to minimize issues of adverse selection. Pecking order theory also argues that there is unbalanced information between entrepreneurs and investors (Hancock 2009). This stems from the information asymmetry between a firm and outside investors regarding the actual value of both current operations and future prospects. The logic here is that outside financing results in entrepreneurs explaining the start-up details to outside investors, opening themselves up to investor monitoring. Therefore, outside capital will always be relatively costly compared to internal funds and equity, more so than debt (Mjøs 2008). Thus, outside investors will require compensation for their expected informational disadvantage (Akerlof 1970).

The issue of adverse selection and moral hazard is particularly acute in new ventures (Paul et al. 2007). Start-up information is opaque to investors during the earliest phases of the firm formation process (Hall et al. 2000, 2004; Schmid 2001), and assets are generally intangible and knowledge-based (Hsu 2007). This creates adverse selection risks, in that entrepreneurs have information about the nascent venture’s future prospects that investors do not have. Therefore, it is easy to see why scholars argue that this asymmetry leads organizations to prefer internal funds because they hold no adverse selection risk and minimal moral hazard risk (Ang 1991; Fourati and Affes 2013). The cost of internal funds is completely innate and controlled by the entrepreneur. However, when internal funds are no longer accessible, debt is preferable to external equity financing (Myers 1984).

Debt financing is a higher risk than internal funds; there is a requirement to repay it; however, the costs are external and thus thought to be moderate. Consequently, debt financing is associated with moderate adverse selection risk for the nascent venture (Hancock 2009). Additionally, founders can utilize debt to mitigate information asymmetry, and signal better organizational prospects for the nascent venture (Ross 1977). Moreover, debt investors typically protect themselves from moral hazard problems by ensuring that entrepreneurs have a significant enough stake in the start-up so as to align their interests with that of the debt holders. Accordingly, start-ups financed primarily with debt force entrepreneurs to perform well enough to cover debt payments or risk losing their start-up. This subsequently will motivate founders to exert the needed effort toward creating a profitable new firm. However, this is not to say there are no moral hazard problems with debt financing. The moral hazard problem that can arise with debt financing is the case of underinvestment, where founders are more concerned with paying off debt than maximizing start-up value (Stiglitz and Weiss 1981).

Finally, when internal funds and debt are not viable financing options, entrepreneurs will turn to external equity. External equity (or equity investments not contributed by the founding team, or equity from individuals or institutions external to the founding team) comes with significant adverse selection risk and information asymmetries between the investor and investee (Cassar 2004). If the start-up goes bankrupt or fails, then external equity holders are generally the last to be paid, and debt holders have precedence over preferred equity holders. Therefore, the cost of such financing is much higher because investors factor in the higher risks, and hence are looking for higher return. Accordingly, equity investors are susceptible to the agency problems of equity, because as entrepreneurs give up control of the start-up in order to move toward profitability, they may be less motivated to exert effort (Ang et al. 2000). As a result, external equity should only be sought after the ability to borrow funds is fully exhausted (Frank and Goyal 2003).

In the nascent context, research suggests that entrepreneurs use personal contributions first (initial founder equity, similar to retained profits), external debt next, followed by external equity last (Frid 2009). Personal savings are by far the largest sources of capital in nascent ventures (Parker 2004). If there were sales revenues at any point, then cash flow from sales would be used early under the start-up pecking order (Stouder 2002). The second most common source of capital for start-ups is bank loans, which tend to be highly collateralized (Åstebro and Bernhardt 2003; Parker 2004). External equity is often acquired last, or rarely among nascent ventures, because they are more difficult to secure (Frid 2009; Hechavarria 2013; Reynolds 2011).

It should be no surprise that research has consistently found a pecking order preference is present among nascent entrepreneurs. Nascent start-ups are by definition new and small. As such, it makes some financing options unavailable or difficult and time-consuming to secure (Cassar 2004). This situation ought to make the nascent entrepreneur alert and responsive to any reasonable line of funding (Stouder 2002). Therefore, founders turn to the easiest and fastest forms of capital to raise first. Correspondingly, the nascent entrepreneur can be conceptualized as a time-constrained decisional satisficer, obviously interested in minimizing the cost of start-up funds, but at the same time highly motivated to get the fledgling business off the ground (Strouder 2002). Frid (2009) provides evidence of this claim, demonstrating that nascent entrepreneurs tend to use personal funds as the main source of financing during the earliest stages of the start-up process. The probability of using external sources of funding, such as debt and external equity, only increases as time goes on (Frid 2009). Similarly, Matthews et al. (2013) find that nascent entrepreneurs, even those associated with high-growth ventures, favor internal sources due to their simplicity rather than complex sources of funding, such as external sources, at the earliest stages of the nascent process. Taken together, prior research finds the pecking order method of financing is common among start-ups. This suggests that start-ups do not necessarily have a well-thought-out capital structure, but rather that founders follow the route of least resistance that manages the adverse selection and moral hazard issues they face when financing their start-up. Although capital structure has been studied in the nascent context, it has not been fully explored in relation to gestation speed.

Research in start-up gestation has given insufficient consideration to contextual influences (e.g., Reynolds and Miller 1992), such as the nascent venture’s capital structure. Specifically, the efforts to minimize problems of adverse selection and moral hazard associated with different kinds of financing will certainly have implications for the time a start-up remains in the nascent stage. Since time is an important aspect of the start-up process (Baron 1998), it becomes imperative for researchers to better comprehend the temporal impact of contextual factors, like financing, on the time it takes to create or quit the start-up process. Consequently, we further elaborate on the relationship between capital structure and its potential link to gestation speed in the subsequent section.

2.2 Gestation speed and capital structure

Among nascent start-ups, there are two obvious possible outcomes of the start-up process: new firm creation or quitting the start-up. According to Reynolds and Curtin (2009, p.4) “a new firm is defined as a profitable business venture affecting the prices and quantities of goods traded in the market.” The “alternative transition for nascent entrepreneurs is quitting the start-up process” (Reynolds and Curtin 2009, p.4). Quitting is pretty straightforward, as it represents individual(s) who have elected to not continue working on the creation of a firm (sometimes termed disbandment or exiting) (Reynolds and Curtin 2009). A third more subtle status is an ongoing attempt, or indefinite involvement in the start-up effort (Reynolds 2007). Nascent ventures that fail to experience an outcome over an observation period remain in the still trying phase and continue in efforts to start a new business.

Practitioners, investors, researchers, and policy makers focused on nascent entrepreneurship have become increasingly interested in knowing more about the time it takes start-ups to reach an outcome after conception (e.g., Kim et al. 2015). However, prior research on start-up outcomes during gestation has often failed to mutually analyze new firm founding and quitting as distinct outcomes. Studies often examine only quitting (e.g., failure), grouping alternate statuses such as founding and still trying together (e.g., Brush et al. 2008; Coleman et al. 2013; Delmar and Shane 2003, 2004, 2006; Liao and Gartner 2006), or only success, grouping failure and still trying together (e.g., Brannon et al. 2013; Oe and Mitsuhashi 2013; Townsend et al. 2010). Therefore, a key contribution of this research is to separate the probability of gestation outcomes due to the competing risks of new firm founding and quitting.

Generally, entrepreneurship scholarship focuses on criteria such as expected revenues, profits and/or sales (Brush et al. 2008; Cassar 2010; Delmar and Shane 2006), or the survival of early-stage new firms (Delmar and Shane 2004; Parker and Belghitar 2006; Steffens et al. 2012; Tatikonda et al. 2013; Van Gelderen et al. 2011) to measure performance. We further develop on this line of research by investigating an alternate conceptualization of performance, that is, gestation speed or how fast/slow nascent entrepreneurs take to create new organizations, or quit their start-up initiative.

Although time is central to our understanding of entrepreneurship, temporal issues are some of the most challenging to comprehend. Venture gestation is a “time-based pacing process in which entrepreneurs explore various possible paths and activities” (Liao et al. 2005, pg 2). As a result, Busenitz et al. (2003) rightly acknowledge, we still do not really understand why some entrepreneurs are able to start a new firm more quickly than others during the venture creation process. It is clear that for some, it can take decades, as extant evidence suggests that nearly one-third of these nascent entrepreneurs seems to be involved for very long periods of time. Yet others appear to be able to create a new firm within a year (Reynolds 2007; Reynolds and Curtin 2009).

So why are some founders able to initiate new ventures faster than others, while others seem to be engaged in the start-up process for years without ever reaching a resolution? We believe that in trying to cope with issues of adverse selection and moral hazard that underpin different kinds of capital, founders affect their gestation start-up speed. Therefore, we anticipate that particular kinds of capital resources utilized during the start-up process would affect the subsequent time horizons to different start-up outcomes. Consequently, our subsequent discussion centers on how certain kinds of capital accelerate or mitigate time to new firm founding, quitting.

Among sources of capital, external equity is the most information-sensitive and has large adverse selection costs. As a start-up increases its use of external equity, it is giving up control of the business and increases agency costs of equity. The agency cost of equity results from the difference in potential interests between the external equity holders and start-up founders. Founders may be coaxed to make suboptimal business decisions that may not necessarily maximize the value of the start-up for investors. Any initiatives taken to monitor and prevent such suboptimal decisions will have a cost associated with it. Accordingly, agency costs will include both the cost due to the suboptimal business decisions and the cost incurred by investors to oversee the entrepreneurs in order to prevent them from making these suboptimal business decisions. Stien (1988) argues that this may lead to managerial myopia, which can stifle the successful exploitation of the opportunity. Thus, financing by outside equity could have the negative effect of reducing insiders’ incentives to exert effort.

According to Myers and Majluf (1984), it is assumed that the return distribution is fixed and known only by the start-up founders in advance. This informational asymmetry leads entrepreneurs to raise external equity if she/he has unfavorable private information about future prospects of the start-up. Therefore, requests for external equity by start-ups likely signal that the start-up is overvalued (Myers 2001). Thus, external equity investors conclude that the entrepreneurs have decided to offer external equity because it is valued higher than the nascent ventures intrinsic market worth. Under these circumstances, pecking order theory assumes where external equity and debt are substitute financing means, one would expect firms that use larger proportions of external equity to subsequently perform worse controlling for observable characteristics of the start-up (Myers and Majluf 1984). Manigart et al. (2002) find evidence to support this argument in the start-up context. According to their research, start-up and early-stage companies backed by external equity have a lower probability of survival than comparable companies not backed by external equity.

Furthermore, the cost of securing external equity can be considerable for nascent entrepreneurs in terms of time. External equity investments for start-ups and early-stage ventures are highly selective, with only about one percent of US firms securing external equity (Mulcahy 2013). Busenitz et al. (2005) suggest that by the time, an exchange of money occurs, and the external equity investors may know so much about a start-up that the information gap between founders and external equity investors becomes relatively small. This is because external equity investors engage in considerable due diligence to reduce agency and verifiability problems (Bergemann and Hege 1998; Gompers 1995), since about only one-third of all nascent start-ups reaches new firm status (Reynolds and Curtin 2009). Scholars suggest it takes, on average, at least a year to secure external equity among start-ups (Gompers and Lerner 2001). As a result, the process to secure external equity is frequently cumbersome for nascent entrepreneurs and often involves extended periods of time. It should be no surprise that external equity investments constitute a very small percentage of nascent start-ups, often estimated as less than three percent (Brännback et al. 2013). Consequently, it may be more beneficial for entrepreneurs to pursue external equity after the firm is established and seeking to grow, and not during the nascent stage as it seeks to establish itself as a start-up. Moreover, it could be also argued that ownership also plays a role in start-up speed. The agency theory assumption is that ownership incentives will influence the founder to maximize his/her utility and accordingly maximize the performance of the start-up. If external equity investors generally require an average yearly return of about 55 % for early-stage investments (Sapienza et al. 1996), it could accelerate the time to quitting when founders own considerably less shares of the start-up than external stakeholders. If founders own less stake in the start-up than external equity investors, they may be less motivated maximize wealth (see Fig. 1). Taken together, start-ups primarily financed with external equity spread the risk and reward between the entrepreneurs and investors, as such we hypothesize that:

H1a

Start-ups that use external equity as their primary source of start-up funding will quit venturing quicker than those that do not.

H1b

Start-ups that use external equity as their primary source of start-up funding will quit venturing quicker than those that do not, particularly as the percentage of ownership decreases among founders.

Unlike external equity, debt financing has moderate information asymmetry and adverse selection costs. The agency cost of debt results from the different interests between founders and debt holders. Anticipating such misalignment and information asymmetry, debt holders often take preventive measures to prohibit founders from suboptimal decisions. For instance, banks often mandate that start-ups and early-stage firms deposit and maintain their cash in its bank as a condition to receiving venture debt (Levin et al. 2004). Moreover, the debt holders may also impose higher interest rates to protect themselves from potential losses, or restrictive lending contracts. Therefore, scholars argue that debt financing is the optimal form of capital because both parties know the distribution function generating the firm’s cash flows (Fluck 2010). Therefore, the proportion of debt utilized by an entrepreneur signals both his/her personal guarantees regarding the start-up.

Furthermore, scholars argue that informational asymmetry leads the entrepreneur to take up debt if she/he has favorable private information regarding the firm’s prospects (Myers and Majluf 1984). Moreover, research has found a positive relationship between firm performance and debt (Constand et al. 1991; Poutziouris et al. 1999). The vast majority of US start-ups use venture debt (Robb and Robinson 2014). Furthermore, Cole and Sokolyk (2013) find that new firms that use debt in their initial capital structure perform better than their counterparts, providing further evidence of the relationship between debt and performance. Likewise, Cosh et al. (2009) found evidence that profitable early-stage firms pursue debt finance prior to equity finance. This is because increasing debt signals to investors that the organization’s founders feel confident in the firms ability to pay interest in the future, because they are confident about the firms future earnings prospects. Increasing leverage increases the value of the firm because it signals to investors the stability and dependability of future cash flows (Ross 1977).

In terms of start-up speed, nascent ventures seeking debt financing may facilitate timely emergence due to the fact that debt is easier to come by in terms of funding, as there are more lenders in the world than equity investors (Kuratko 2013). In order for start-ups to secure debt financing, the quality of financial records and reports needed is high, which reduces asymmetric information. Accordingly, many debt lenders have added special services and programs for entrepreneurs by streamlining their loan paperwork and approval process to get loans to entrepreneurs in a timely manner (Ibrahim 2010). Furthermore, scholars argue that debt lenders are better informed than external equity investors because they have unbiased expectations on the future of a start-up’s potential to repay loans. This is because debt lenders can draw on their cumulative portfolio of loans to make more accurate predictions based on historical experience (de Meza and Southey 1996).

Debt lenders understand that start-ups are likely to fail. Therefore, the goal of debt lenders was to recover its principal and specified interest (De Bettignies and Brander 2007). Hence, debt lenders are more concerned with when a start-up fails rather than whether it fails (Ibrahim 2010). As a result, debt lenders provide early-stage debt because they believe that only later, once loans have been repaid, is a start-up likely to fail (Ibrahim 2010). Research by Reynolds (2011) provides evidence to support this argument, with less than six percent of all nascent start-ups quitting the start-up process after receiving formal debt investments. Therefore, debt financing may facilitate accelerating the time to initial new firm founding among start-ups. This suggests that debt might provide start-ups with financial slack needed to successfully exploit opportunities, void of managerial myopia. Since debt financing places the risk squarely on the start-up, it may facilitate timely exploitation of opportunities among start-ups, in order to satisfy the repayment requirements of associated with debt. Accordingly, we hypothesize:

H2a

Start-ups that use debt as their primary source of start-up funding will create a new firm faster than those that do not.

H2a

Start-ups that use debt as their primary source of start-up funding will create a new firm faster than those that do not, particularly as the percentage of ownership increases among founders.

Van Auken and Carter (1989) suggest that founders prefer to use internal sources of capital rather than external equity or debt finance when their ventures are profitable. In general, this holds because this form of financing can eliminate the problem of agency costs altogether. For this reason, start-ups that use internal funds primarily to finance their start-up will most likely remain still trying in their efforts because there is no outsider oversight or stakeholder pressure to provide return on investment. This also holds true because there are no repayment pressures placed on the nascent venture by debt holders or external equity stakeholders. Furthermore, internal funds have no adverse selection risk because the cost is internal and completely controlled by the start-up.

Empirical evidence also suggests that internal financing does not completely proxy for formal financing, such as debt and external equity, because it fails to scale up a start-up (Estrin et al. 2009). Consequently, it is unlikely that internal finance can lead to particular outcomes, such as new firm founding or quitting. Since adverse selection and agency costs are low, we can see an escalation of a commitment problem arise (Staw 1981). Therefore, founders may continue to invest internal funds from personal savings and rents generated by the fledging firm, and persist trying in their start-up efforts, without reaching an outcome resolution. Therefore, we hypothesize that:

H3a

Start-ups that use internal funds as their primary source of initial funding are less likely to experience an outcome and remain in the still-trying phase.

H3b

Start-ups that use internal funds as their primary source of initial funding are less likely to experience an outcome and remain in the still-trying phase, particularly as the percentage of ownership increases among founders.

Firms utilize different forms of capital at different stages of their lifecycle (Timmons and Spinelli 2007). Pecking order and agency theory have been used to explain why entrepreneurs choose the type and source of capital at various stages. However, no assessment, to our knowledge, explicitly examines how adverse selection and moral hazard (fundamental aspects of pecking order and agency theory) can inform start-up speed in terms of the various competing start-up outcomes during gestation. Financing choices during the start-up phase are very important decisions for founders so that they can maximize returns to their various stakeholders. Investigating how internal financing, debt, and external equity can affect the speed of new firm founding and quitting, explicitly linking time in gestation to start-up financing choices.

3 Methods

Our objective was to investigate the impact of various covariates and factors on the time to the occurrence of an event, namely exiting the start-up process via new firm founding or quitting. Therefore, this research uses event history analysis and employs both a competing risk regression and Cox proportional hazards regression to test our hypotheses.

We utilize competing risk regression to investigate our first and second hypotheses. Among nascent entrepreneurs who are in the start-up process, beyond the process of still trying, there are two primary outcome events in contention: either reaching new firm status or quitting. Therefore, competing risk regression analysis is the most appropriate event history analysis technique to apply in this case. Competing risk analysis involves more than one type of event, and the competing risk approach allows for a more specific analysis of duration since it takes into consideration time until occurrence of the combined end point and endpoint kind. Competing risk analysis allows researchers to calculate real-world probabilities, so we can analyze a nascent entrepreneur who is not only at risk of reaching new firm status, but other causes of exit from the start-up process, such as quitting. This method also provides a way of assessing probabilities of events to give entrepreneurs a clearer indication of the risks that they face with each decision that they make. Every nascent entrepreneur is at risk of any of these competing causes of an event until it experiences one, or is censored. As a result, in order to investigate the incidence of new firm founding and quitting, this technique is the most appropriate for our context

In order to investigate our third hypothesis, we utilize a Cox proportional hazards model, or Cox regression. This method is utilized in order to investigate the impact of multiple variables upon the time, or duration, of a specified event period. This technique models the survival times (or more specifically, the so-called hazard function) on the explanatory variables. Therefore, a Cox model allows us to estimate the hazard (or risk) of disengaging from the start-up process via new firm founding or quitting, given their prognostic variables. We subsequently plot the survival function, or the probability that whether a start-up survives to time t, given the start-up will experience an outcome in the next instant.

3.1 Sample

In order to investigate the relationships postulated in this study, data from the PSED I, PSED II, and the harmonized PSED transitions outcome file are utilized. The PSED is a longitudinal study of nascent entrepreneurs (Curtin and Reynolds 2013, 2011, 2004).Footnote 4 The PSED I and PSED II offer a nationally representative sample of nascent entrepreneurs for the USA to offer systematic, reliable, and generalizable data on the business formation process. It is one of the only publically available datasets that provide data on the time it takes founders to implement a new firm or quit the start-up process (Gartner and Shaver 2012). It includes data on the characteristics of the adult population attempting to start new businesses (Reynolds 2009). The PSED harmonized transition outcome file provides standardized measures of the timing and nature of important start-up activities, transitions, and outcomes (Reynolds and Curtin 2011).

The PSED I involved screening of 62 thousand adults that was completed from 1998 through 2000, to locate 830 nascent entrepreneurs that completed a 60-min phone interview and a subsequent 12-page mail questionnaire; three follow-ups were completed over the next 40 months. The PSED II screened 32,000 individuals to locate a cohort of 1214 respondents who were identified while they were in the process of starting new businesses in 2005. The respondents identified as nascent entrepreneurs then completed a single 60-min phone interview in each of six waves of data collected, initial and five follow-up interviews, 12 months apart. The PSED harmonized transition outcome dataset provides a consolidated and standardized time line for all cases reporting the timing of activities which identifies the conception, birth date, or death date for each case. The value of these harmonized measures for transitions and outcomes for PSED I and PSED II cases is that it facilitates accurate temporal time lines for each nascent start-up, which ultimately will facilitate replication among scholars using PSED databases.Footnote 5

To be considered a nascent entrepreneur during the screening process, the respondent had to answer that “(a) considered themselves in the firm creation process; (b) had been engaged in some behavior to implement a new firm—such as having sought a bank loan, prepared a business plan, looked for a business location, or taken other similar actions; (c) expected to own part of the new venture; and (d) the new venture had not yet become an operating business” (c, pg. 172). The individuals screened yielded 830 in PSED I and 1214 in PSED II.

Since most studies of firm organizing activities have been retrospective explorations of the start-up behaviors of individuals who are already in business, there is an inherent selection bias that may confound findings. Through examining individuals currently involved in the process of organizing a new firm, our work using the PSED I and II addresses this selection bias limitation.

For this study, the unit of analysis is the start-up itself. Combing respondents in both PSED I and PSED II result in 2024 cases for analysis. Cases are tracked over a 4-year period in PSED I and over a 6-year period in PSED II. Attrition obviously impacts the number of cases with outcomes available for analysis. In PSED I, there were three follow-up interviews over 46 months. In PSED II, there were five follow-up interviews over 60 months. There is about 30 % attrition rate, and ultimately, the data yield 1704 cases with outcomes by the end of the interview period for both cohorts. From these 1704 cases, our sample is adjusted to only include data for cases which we can compute time to new firm or quitting outcome from conception date (this procedure will be further discussed in the next section). Subsequently, our sample is further limited to 1409 cases from both PSED I and PSED II cohorts that have a time line data for their gestation period, in months (conception to outcome date), and complete data on control and independent variables to test our hypotheses.

3.2 Variables

3.2.1 Dependent variables

The dependent variable in an event model is composed of two parts: an event indicator and a measure of time from baseline to the event or censoring. For this analysis, the time to event, or duration of gestation period, is our time measure. Time is measured in months until an event outcome from the initial activity the start-up initiated (time). The first initial activity is subsequently referred to as the conception date of the start-up (Reynolds and Curtin 2011). The second part of the dependent variable for this study is the kind of start-up outcome. Under the PSED framework, a new firm outcome is a start-up that has reported initial profits, which is operationally defined as positive month cash flow for six of the past 12 months (two economic quarters) in PSED II, and three of the past 12 months (one economic quarter) in PSED I (Reynolds 2007). Conversely, a quit outcome is defined as an entrepreneur who reports the start-up is no longer being worked on by anyone. Finally, cases that have not reached a resolution after the observation period is complete constitute those who are still trying and will be right-censored cases in our event history analysis.

We will investigate three models of time to a specific gestation outcome: (1) new firm founding, (2) quitting, and (3) either new firm or quit event outcome. First, we model the time to quitting, with the competing risk of new firm founding to test our first hypothesis. Second, we model time to new firm founding, with the competing risk of quitting to test our second hypothesis. Finally, we model the time to new firm founding and/or quitting outcomes (e.g., both new firms and quits together) to understand the still-trying phase, or those who fail to exit the start-up process by the end of the study period to test our third hypothesis.

All time data were computed based on the harmonized transitions file on the PSED Web site for both PSED I and II datasets.Footnote 6 Gestation period is the time, in months, from the first initial start-up activity from the two activities reported within a 12-month period and the reported date of their outcome status, as provided by the respondent. We used variables Su_quit, Su_newf, Su_active, and Su_begin as the basis for computing outcome date. Su-begin provides conception date, and we utilized Su_quit, Su_newf, and Su_active, as well as compute time, in gestation for each case from the PSED I and PSED II Harmonized Transitions Data File (Reynolds and Curtin 2011).

3.2.2 Independent variables

The independent variable for internal funds computed from all personal investments among the start-up team has accumulated before and after the start-up is legally registered (Q268, Q270, R771, S771, T771, R771A, S771A, T771A/A-BQ12x_1 A-BQ12x_2 A-BQ12x_3A- BQ12x_4 A-BQ12x_5 BQ12x_6). A total amount is computed for each wave based on the sum of financing reported by the start-up as personally coming from the start-up founders. Owner operators and start-up team members investing their own personal funds into the start-up fall into this category. The rationale for this classification is that in the context of nascent start-up, regardless of either being equity or debt, if the financing comes from the start-up team members that are owner operators, this constitutes internal firm financing.

The independent variable for debt is computed from all reported loans and debt the start-up has accumulated before and after it is legally registered (Q272, Q274, Q276, Q277A, Q279, Q281, Q282A, Q286, R-T770a; A-EQ 13_1 A-EQ 13_2 A-EQ 13_3 A-EQ 13_4 A-EQ 13_5 B-EQ 13_6/A-ER21). A sum is calculated for each wave based on the total amount of financing reported by the start-up as debt. To be classified as a loan, the loan must be made by an outside party from the start-up team (e.g., credit card, loans from friends and family, and supplier credit). Finally, independent variable for equity is computed from all reported equity investments, and the start-up has accumulated before and after the start-up is legally registered (Q284, Q288A, R-T770; AR4-ER4). A sum is computed for each wave based on the total amount of financing reported by the start-up. For the context of this study, owner operator equity is considered internal investments, whereas outside owner operator equity investments are classified as external equity. For instance, an individual investing money in the start-up for ownership share who is not actively involved on the start-up team as a member would be considered an external equity financer.

To capture whether the majority of funding came from a particular source, we calculated the percentage of funding from each funding source. Subsequently, we calculated a second set of binary measures to identify whether primary or majority of the start-up’s financing came from either internal, debt, or equity funds.

Ownership is measured based on the responses of the lead entrepreneur on what proportion of ownership each team member expects to own (Q207_1-5/AG6_1-5). We sum these items together to create an ownership measure that captures the total amount of shares controlled by the start-up team.

3.2.3 Control variables

The start-up Team Size (Q116/AG2) is controlled for because previous research has shown that the quitting start-up efforts decrease with organization size (Carroll and Hannan 2000). We also calculated the sweat equity investments of teams, in terms of total among all founding team members (Q211, R-T677/A-FH14). We also control for the founder’s Growth Aspiration (Q302/AT1). Overall, the tendency of firm founders to be over-optimistic might lead them to underestimate competition and overestimate their growth aspirations (Delmar and Shane 2004). In addition, we control for the type of business planning in which the start-up engaged. Delmar and Shane (2004) suggest that planning significantly influences the time to new firm founding. Therefore, Business Planning (Q111; R-T568/A-ED1) is calculated as an ordinal variable (no plan is zero, unwritten plan is one, informal plan is two, and formally written plan is three). We also include separate measures that capture whether or not financial projections (Q137/A-FD26) had been completed in addition to the degree of planning. These two measures capture attempts among founders to reduce asymmetric information. We control for average team industry experience in years (Q199/AH11), average prior start-up attempts of the team (Q200/AH12), and average level of education of the start-up team (Q343/AH6), because human capital can affect the time it takes to create a venture (Cooper et al. 1997). The Innovativeness of the start-up (Q299, Q300, Q301/AS4, AS5, AS6) is measured as an ordinal measure following Aldrich and Ruef (2006), where zero indicates the start-up is a reproducer venture and 3 indicates the start-up is an innovator venture. Prior research has found that the nature of the opportunity is linked to start-up speed (Tornikoski and Renko 2014). This study also controls for the industry classification codes from the PSED I and PSED II protocol (SUSECTOR/AA1), which will be grouped into four categories: (1) extractive, (2) transforming, (3) business services, and (4) consumer oriented to control for Industry (Reynolds et al. 2005). In general, the hazard of quitting varies across industries (Delmar and Shane 2004). We control for the number of Total Men (Q217A, R-T683/A-FH1) on the start-up team because male nascent entrepreneurs have a rate twice that of women according to Reynolds et al. (2004), and “women entrepreneurs tend to underperform relative to their male counterparts” (Klapper and Parker 2011, p. 243). We control for the number of Total Caucasians (Q203, Q219_1-5, R-T685_1-5; AH4a_1-5) on the start-up team because Reynolds (2007) found considerable evidence that individuals with Caucasian ethnic backgrounds are associated with start-ups with larger requirements and larger personal financial commitments. We also control for the Household Net Worth (Q391, R-T814/A-FZ36x) of the lead respondent. Overall, it has been shown that wealth impacts the probability of quitting the start-up process (Frid et al. 2015b). Likewise, we control for the Total Funds, regardless of source, secured by the start-up team (Reynolds 2011). We include a series of five variables to control for the number of members of the start-up teams between 18 and 24, 25–34, 35–44, 45–54, and 55–99 to take into account Age (Q218, R-T684/A-FH2); this is due to the fact that prior research has found that older entrepreneurs were more likely to survive or obtain higher income (Brockhaus et al. 1986; Denison and Alexander 1988).

In addition, we must control for left truncation in our sample. Left truncation occurs because cases have been exposed to the risk of experiencing the event of interest before they enter into the observation period (Yang and Aldrich 2012). The pre-observation period is the lag between conception, or the origin time for the venture, and first initial interview, or the beginning time of the observation. The length of the pre-observation period among start-ups depends on each start-ups own gestation time. According to Yang and Aldrich (2012, pg. 482), “the longer the time that a startup is exposed to the risk of termination at the sample selection time, the greater the possibility that they over-represent the resilient cases.” By contrast, the most fragile cases were quickly selected out of the sample, and thus, we would never observe them during sampling (Yang and Aldrich 2012). To account for left truncation of cases, we calculate the time in process before the respondents were screened into the PSED interview. We compute the Conception Lag (in months) from the harmonized PSED outcome file, as the difference between the date for the first wave (W1_Date) PSED interview and the conception date (Cpt_my). Finally, to minimize the effects of heterogeneity on our results, we use robust estimators to obtain consistent standard errors, as suggested by Davidsson (2006).

4 Results

On average, nascent entrepreneurs take about 46 months to reach some type of outcome event (see Table 1).Footnote 7 The average time lag from conception to the first interview is about 22 months among respondents. The average team size for the nascent start-ups is 1.7 people. The average amount of hours per member per month is about 9,853 per team. Additionally, most start-ups have about one male on the team. In other words, only about 27 % of firms have no men at all involved in the start-up. Most start-ups have about one person of Caucasian ethnicity on the team. Or in other words, only about 27 % of start-ups have no one of Caucasian ethnic background involved. In regard to age, start-up averages are reported in Table 1; the majority of start-ups have team members between 35–44 and 45–54 years of age. The average household net worth in our sample is about $422. About 80 % want a business that is easy to manage, and only 20 % of entrepreneurs want to maximize growth. About 40 % of entrepreneurs indicate they do not have a business plan, 11 % have an unwritten plan, 26 % have an informal written plan, and 23 % have a formal written business plan. Additionally, about 42 % have completed financial projections. Founding teams have about 9 years industry experience and have engaged in one other start-up. Most founding teams have a college degree. Emphasis on high technology is about 0.79, indicating low high technology emphasis falls among the majority of nascent start-ups (on a scale of 0 = none to 3 = high). In terms of innovativeness, only 5 % of all start-ups report high technology or innovativeness start-ups (business high technology = 3). About 3 % of start-ups are in the extractive sectors, 17 % are in the transforming sectors, 26 % are in the business services sector, and 36 % in the consumer oriented sectors (see Table 1). In terms of ownership, the founding team on average own about 90 % of their start-up.

We calculated the total amount of funds secured by the start-ups purely for descriptive purposes. We summarize all the items for all sources of financing,Footnote 8 as discussed in the prior section; however, we do not distinguish the source of the funding. The average amount of total funds invested in the start-up is estimated to be $310,039. However, Reynolds (2011) identified that the extreme amounts of investment in nascent start-ups are generally associated with a very small proportion of all legally registered nascent start-ups. Therefore, we also calculated the 5 % trimmed mean.Footnote 9 In doing so, we are able to control for extreme outliers. Based on the trimmed mean, the average amount of total funds utilized by nascent entrepreneurs is about $31,888.

The average amount of funds invested among start-ups from internal funds is about $68,382 compared to $183,787 from debt, and $57,870 from external equity. Again, we also calculated the 5 % trimmed means to control for extreme outliers. The average amount of funds invested among start-ups from internal funds is about $68,382 compared to $183,787 from debt, and $57,870 from external equity. Based on the trimmed mean, the average amount of total funds utilized by nascent entrepreneurs is about $9,064 from internal funds compared to $12,768 from debt, and $1,234 from external equity. The average nascent start-up contributes about 35 % of internal funds, 24 % debt funds, and 5 % external equity funds toward their start-up initiatives.

Overall, 28 % of all start-ups are financed with the majority of financing coming from internal funds, about 20 % of all start-ups are financed with the majority of financing coming from debt funds, and only about 4 % of all start-ups are financed with the majority of financing coming from external equity funds. Finally, about 31 % of cases quit the start-up process, 22 % are still trying, and 19 % reach new firm status. Additionally, Table 1 presents descriptive and bivariate statistics for the sample. Examining the relationships between the types of funding explanatory variables reveals interesting relationships.

Figure 2 presents the status plot for the probability of continuing in the still-trying phase, along with the probability of quitting, or new firm founding among all nascent entrepreneurs with outcome data. The first thing we calculate is the Kaplan–Meier (KM) estimator of overall survival. The KM survival function estimates the survival probability beyond time t in right-censored data (Kaplan and Meier 1958). The median length of gestation to an outcome is about 34.98 months. Next, we estimated the cumulative incidence function (CIF) for the event of interest and each named competing cause using the STCOMPET command written by Coviello and Boggess (2004) for STATA. The CIF, also referred to as the cause-specific failure probability (Gaynor et al. 1993), illustrates the cumulative probability that a failure of type k occurs on or before time t (Bryant and Dignam 2004). The CIF helps to determine patterns of failure and to assess the extent to which each component contributes to overall event. Applying the STCOMPET command, we generated the CIF for the incidence of new firm founding, given the competing risk of quitting, and the incidence of quitting given the competing risk of new firm founding. Following a procedure by Singer and Willet (2003), we stack all these estimates together to create the status plot. The dark gray area is the survival function, the probability of remaining in still in process, or still trying. The two lighter grays are the two incidence functions that show us that exits by quitting and new firm birth are not equally likely, and therefore merit further investigation.

Moreover, according to the data, the last outcome among the cases has occurred at about 585.77 months from conception, and the first at about 0.92 months from conception. The median time to new firm founding is 23.98 and to quitting about 29.01. Subsequently, we explore the impact of the independent variables on start-up speed in the next section.

4.1 Competing risk regression analysis

A competing risk regression hazard model (Fine and Gray 1999) is utilized to test the proposed hypotheses one and two. To complete the competing risk regression models for this analysis, the STCRREG command in STATA 12 is utilized. Using the STCRREG command, this study analyzed data from 1,409 nascent entrepreneurs in PSED I screened between 1998 and 1999, and PSED II 2005–2006.Footnote 10 First, a competing risk regression model was fit with a new firm as the event of interest, and quitting was the competing risk event. The analysis focused on the effect of the majority of funds from internal funds, the majority of funds from debt, the majority of funds from external, and ownership, while controlling for conception lag, team size, sweat equity in total hours, total men, total Caucasians, total owners age 18–24, total owners age 25–34, total owners 35–44, total owners total 45–54, total owners 55–99, household net worth, total funds, growth preference, innovativeness, business planning, financial projections, industry experience, start-up experience, education, and industry. For this analysis, among nascent start-up cases, 402 cases reached new firm status, 547 were competing quits and 460 are censored (e.g., still trying).

Table 2 presents the empirical results from the analysis of the main effects of capital structure. Results indicate that start-ups that are primarily financed with external equity (SHR = 1.471, p = 0.054) significantly influence the cumulative incidence of new firm founding over time. Examining the sub-hazard ratios reported in Table 2, we can further explore the nature of this relationship. If the estimated sub-hazard ratio is greater than 1 for any variable of interest, we can conclude that higher levels of that variable of interest are associated with higher incidence of new firm founding (controlling for other variables in the model and taking into account that quitting can also occur). Consequently, we can conclude that if the start-up’s capital structure is dominated by external equity, there is a 47 % increase in the incidence of new firm founding over time. Figure 3a shows the average cumulative incidence function for the estimated model of new firm founding for start-ups financed with funds coming primarily from external equity, and firms with the majority funds not coming from external equity, given the competing risk of quitting. Figure 3a shows that about 100 months out from conception (or about 8 years), the model finds the cumulative incidence of new firm founding is about 43 % for firms primarily financed with external equity. Conversely, for firms not financed primarily with external equity, the cumulative incidence of new firm finding is about 26 %.

a Competing risk regression: cumulative incidence function of new firm found given the competing risk of quitting: external equity (model estimated at mean of covariates). b Competing risk regression interaction effects: sub-hazard ratios of new firm found given the competing risk of quitting: external equity by ownership (model estimated at mean of covariates)

Furthermore, we did find significant interaction effect between ownership and external equity, in our subsequent interaction effects model for the competing risk regression on new firm founding. The interaction term for the percentage of ownership and the start-up being primarily financed with external equity (SHR=0.971, p = 0.054) decreases the incidence of new firm founding over time. Accordingly, we can conclude that if the start-up’s capital structure is dominated by external equity, and ownership increases, there is a 3 % increase in the incidence of new firm founding over time. Figure 3b illustrates the nature of the interaction further by plotting the sub-hazard ratio of the predictive margins. The model finds if a start-up team has 10 % ownership, they are about 7.4 times more likely to create a new firm than those who retain 90 % ownership of the start-up. Therefore, as founding team ownership increases, it decreases the time to new firm founding among firms primarily financed with external equity.

Secondly, the competing risk regression was modeled with the hazard of quitting and the competing risk of new firm founding among start-ups. Again, the analysis was focused primarily on the effect of the majority of funds from internal funds, the majority of funds from debt, the majority of funds from external, and ownership while controlling for controlling for conception lag, team size, sweat equity in total hours, total men, total Caucasians, total owners age 18–24, total owners age 25–34, total owners 35–44, total owners total 45–54, total owners 55–99, household net worth, total funds, growth preference, innovativeness, business planning, financial projections, industry experience, start-up experience, education, and industry. For this analysis, 547 cases reached quit, 402 were competing new firms, and 460 are censored (e.g., still trying).

For this model, we estimate the main effects of capital structure and find start-ups financed primarily with debt (SHR = 0.641 p = 0.0007) and primarily financed with external equity (SHR = 0.462, p = 0.035) significantly decrease the incidence of quitting over time. Further examining the variables associated with financing, we see start-ups primarily financed with debt decreases the incidence of quitting by about 35 % over time, and start-ups primarily financed with external equity decreases the incidence of quitting by about 54 % over time.

After fitting the competing risk regression model, STCURVE was used to plot the estimated cumulative incidence of quitting the start-up process in the presence of the competing risk of new firm founding for start-ups majority financed by debt and external equity, and those that are not. Figure 4a shows the average cumulative incidence function for the estimated model of quitting, given the competing risk of new firm founding. Figure 3 shows that about 100 months out from conception, the model finds the cumulative incidence of quitting is about 21 % for start-ups that are primarily financed with equity. On the other hand, the incidence for quitting for start-ups not primarily financed with external equity is about 43 %. Furthermore, Fig. 4 also shows that about 100 months out from conception, the cumulative incidence of quitting is about 31 % for start-ups that are primarily financed with debt. On the other hand, the incidence for quitting for start-ups not primarily financed with external equity is about 45 %.

Next, we modeled the interaction effects for the competing risk regression of quitting for ownership and debt; however, we did not find a significant interaction effect.

4.2 Cox proportional hazard model

In order to analyze the relationship between start-up continuance and the amount of financing coming from internal funds, debt, and equity, a Cox proportional hazards model was applied. All cases that experienced some form of event (either new firm founding or quitting) were categorized as one and those who did not reach an event (still trying at their start-up) were categorized as zero. Using Cox regression, we estimated the time to some kind of event with the effect of being financed with the majority of funds from internal funds, the majority of funds from debt, the majority of funds from external, and ownership while controlling for conception lag, team size, sweat equity in total hours, total men, total Caucasians, total owners age 18–24, total owners age 25–34, total owners 35–44, total owners total 45–54, total owners 55–99, household net worth, total funds, growth preference, innovativeness, business planning, financial projections, industry experience, start-up experience, education, and industry. In this analysis, 949 cases experienced an outcome, and 460 cases were censored (e.g., still trying). Table 3 provides the results from this analysis. Findings do not indicate that the hazard of an outcome decreases with increased use of internal funds as the primary source of financing.

4.3 Robustness checks

In order to assess the sensitivity of the main results, we developed alternative specifications and analyses by performing a series of additional tests. Our goal was to address the issue of endogeneity, a common problem in entrepreneurship research (Caliendo 2013). In terms of reverse causality, longitudinal analysis is an approach that can eliminate much of the endogeneity problems associated with examining transitions into start-up outcomes. Longitudinal analyses have the advantage of using past values reported by respondents to explain future outcome transitions, and we can therefore be more confident that past values are a cause rather than a consequence of new firm founding or quitting. Secondly, the possibility of endogeneity being caused by omitted variables is ruled out by including a number of control variables that are likely to affect time to outcome status. Finally, a formal test for the presence of omitted variables is performed by running three full models as separate OLS regressions with: (1) time to new firm status, (2) time to quitting status, and (3) time to either new firm or quitting status as dependent variables, and employing the post-estimation commands “estat ovtest” and “linktest” in STATA (Cameron and Trivedi 2010: 92): In all cases, we fail to reject the null hypothesis “H0: the model has no omitted variables” as the |Prob > F| is always nonsignificant with the minimum value approaching 0.059.Footnote 11

5 Summary

In sum, we find some interesting evidence of the affect of capital structure on start-up speed. In H1, we hypothesize that the use of external equity as the primary source of start-up financing would accelerate the time to quitting the start-up, and the relationship becomes most pronounced among start-ups as the percentage of ownership decreases. Our findings provide compelling evidence that being financed primarily with external equity does not accelerate time to quitting. In fact, it decreases the cumulative incidence of quitting over time. In fact, we found significant evidence contrary to H1. There is significant evidence that being financed primarily with external equity actually increases the incidence of new firm founding over time, given the competing risk of quitting; it also demonstrates that the appreciable impact of external equity decreases as the ownership shares of the founding team increase. In H2, we hypothesize that the use of debt as the primary source of start-up financing would accelerate the time to new firm founding, and the relationship becomes most pronounced among start-ups as the percentage of ownership increases. Again, we find evidence to the contrary. Our study identified evidence that start-ups primarily financed with debt actually decrease the incidence of quitting over time, and in fact no impact on the incidence to new firm founding over time. Thus, we did not find evidence to support H2. Moreover, in H3, we hypothesize that the use of internal funds as the primary source of start-up financing would increase the hazard of staying in the gestation process, or start-ups would be more likely to remain “still trying” to implement their firms, and the relationship becomes most pronounced among start-ups as the percentage of ownership increases. Again, we find no evidence to support this hypothesis.

6 Discussion

Analysis of the PSED datasets reveals a considerable amount of variability among respondents, specifically regarding the amount of time spent in the process of creating a new organization (Davidsson and Gordon 2012; Frid 2011). Nascent entrepreneurs do not form new ventures at the same rate, not even within the same industry. Our study also provides evidence that start-up capital structure is a tangible factor influencing the gestation window, or time in the start-up process, of nascent start-ups.

We argue that start-ups that use external equity as their major source of start-up funding will accelerate quitting among nascent entrepreneurs, and that ownership moderates this relationship. Findings from this analysis found no evidence to support this hypothesis. We also argue that start-ups that use debt as their major source of start-up funding will reach new firm status quicker than nascent entrepreneurs who do not, and that ownership moderates this relationship. Findings from this analysis found evidence to support this position. Finally, we argue that start-ups that use internal funds as their source of start-up funding will persist in their efforts and will not experience an event outcome, and that ownership moderates this relationship. Our analysis did not find significant evidence to confirm that being primarily financed of internal funds did in fact decrease the hazard of experiencing an event outcome. However, we did find significant evidence that being primarily financed with external equity is associated with the increased incidence of new firm founding. We also found evidence that as the percentage of ownership increases among the team, it decreases the incidence of new firm founding. Overall, our findings provide evidence to challenge the efficacy of moral hazard and adverse selection in the context of nascent start-ups and time to particular outcomes.

The most striking feature of the assessments generated by this research is the differential impact of external equity and debt on gestation speed. As previously noted, start-ups primarily financed by external equity have a much greater impact on the speed to new firm founding. Start-ups primarily financed with debt had considerable impact on decreasing the incidence of quitting, as did external equity funds. An explanation for these findings could be associated with the different procedures taken to secure different forms of financing. It may be the impact of preparing a prospectus; this is usually executed in a formal written form to those providing debt, which can decrease the incidence of quitting and, in turn, increase the incidence of new firm founding. Some scholars argue that preparing a prospectus takes time, and founders should focus energies on other start-up activities, since research on planning has yielded inconclusive evidence on the efficacy of planning (Gartner and Liao 2005; Robinson and Pearce 1984, Sexton and Van Auken 1985). However, our findings highlight that both business planning and preparing financial projections significantly increase the incidence of new firm founding over time. Therefore, the effort and formality of business planning does not appear to lead to longer gestation periods among start-ups. A proposal for external financing requires a statement on the short- to medium-term prospects for the business, which requires a more careful assessment of the business idea and its prospects for success. Thus, preparing a prospectus for potential investors likely mitigates the information asymmetry between parties, and likely attenuates the high potential cost of the capital for both parties. Furthermore, as the percentage of ownership decreases, the positive impact of external equity increases. This is contrary to arguments advanced in agency theory regarding moral hazard. This provides compelling evidence for the efficacy of smart capital (Müller and Zimmermann 2009; Sørensen 2007). According to the smart capital framework, there is a two-way flow of information, such that information flows from the start-up to the investor, and consultation and the support flow from the investor to the start-up.

On the other hand, most debt is actually asset-based; therefore, the only issue for the debt provider is an estimate of the value of the asset used as collateral for the loan, which could take less time to prepare than an external equity prospectus. As a result, this may fail to clarify the potential of the firm for the founding team and, in particular, lead to decreased incidence of quitting. Therefore, as founders try to mitigate the issue of adverse selection associated with particular kinds of financing, it may actually help facilitate successful creation of new firms.

7 Implications

Implications from this research can inform scholars and practitioners alike of the importance of external equity in accelerating the speed of founding, and also the costs and benefits of retained founding team ownership. Specifically, scholars should be concerned with exploring what, in particular, it is about external equity in the nascent stage that helps accelerate new firm founding. It may be the case that the impact of preparing a formal prospectus, usually in a formal written form to those providing external equity, is one factor that influences the incidence of new firm founding among start-ups who utilize greater amounts of external equity.

For practitioners, these research findings highlight that having a closely held venture with external equity has its dangers. External equity may have specific advantages in the speed of reaching profitability, but it could also create agency costs when founders closely hold the start-up. Having a venture where the founders are the majority owners could be the reason why external equity also seems to considerably influence why some ventures get “stuck” in the start-up process. About 5 % of nascent entrepreneurs have been thinking about starting a new business for over 5 years (Brixy et al. 2012). These nascent entrepreneurs can be involved in the creation of a venture for an extended period of time, and they seem to be satisfied with participation without resolutions (Reynolds and Curtin 2009). There is likely a link to ventures that remain closely held, and the still-trying phase and future research would do well to address this particular issue.

Furthermore, findings on the patterns of financing can inform practitioners to pinpoint the appropriate time in the life course of their start-up to secure external funding (debt or external equity). It may be that debt is most appropriate during the intermediate stages of gestation, and external equity is ideal during later stages. Thus, founders can prepare appropriately when trying to lobby for external funding sources based on their time in process, particularly if the opportunity being pursued is time-sensitive. Again, further inquiry into this domain can further help clarify this link to the timing of a particular kind of financing and speed to outcomes.

In regard to policy makers, the findings from this research suggest that although external equity is the least likely pursued by entrepreneurs, it is the most beneficial in regard to speed to new firm founding. Therefore, policy makers may want to focus on fostering and creating external equity networks, and connecting such members to potential founders and nascent entrepreneurs. For instance, angel investors often cluster near universities that promote entrepreneurship programs because of the high level of new business activity they can potentially generate. Therefore, if policy makers can incentivize business angels to coordinate members into more formal networks, it could potentially help raise awareness and access to external equity to nascent entrepreneurs. By creating and advocating such networks, it could facilitate access to external equity investments in nascent start-ups. Currently, according to the Angel Capital Association (2014), in North America alone there are 165 angel groups, which represent 7000 accredited angel investors located in 44 US states and six Canadian provinces. Yet, there are 4599 Title IV degree-granting institutions, either colleges or universities in the USA. Moreover, another critical policy implication is what role should public funds, such as government business development grants, play in new firm creation? Public funds might serve to supplement private equity financing, requiring that new ventures first receive support from external private equity before being eligible for public funds.

8 Contributions

Our study contributes to both the entrepreneurship and finance research efforts in several important ways. First, we contribute to the growing literature that analyzes data from the PSED by presenting new evidence on the benefits of equity and debt during the nascent venture gestation process on start-up outcomes. Pecking order theory predicts that firms with higher leverage should subsequently perform better. Our research confirms that equity is positively associated with the incidence of new firm founding, and debt and equity decrease the incidence of quitting. Therefore, our research challenges the benefits argued by pecking order, in terms of the rank ordering of financing, and highlights that external sources of capital, such as debt and equity, could add more value to investee firms than internal capital from savings.

Second, we document that the initial capital structures nascent ventures choose for financing their start-up is significantly linked to the timing of start-up outcomes. Therefore, we extend prior research on pecking order in the entrepreneurship context by linking capital structure to new firm founding and quitting of start-up efforts. Prior studies have mainly focused on establishing the preference or variations in pecking order among nascent ventures and new firms (Cassar 2004; Frid 2009; Robb and Robinson 2014; Stouder 2002). Although some have investigated survival among early-stage new firms (Cole and Sokolyk 2013), to our knowledge, our study is the first to link start-up capital to new firm founding and quitting the start-up effort in terms of start-up speed.

Finally, current studies in entrepreneurship and organization theory often treat either failure or success as binary outcomes when analyzing new venture performance, thus implicitly assuming symmetric effects between the two (Ghosh and Mallory 2011). Consequently, results on success inform us about failure and the still-trying phase together. Analyzing success and failure together, therefore, provides a useful empirical tool by exposing the still-trying phase and enabling the examination of how a variety of factors influence these three outcomes, as well as a key contribution of this research.

9 Limitations