Abstract

This paper presents a model of regional innovation based on the matching of research and entrepreneurial skills. We provide a method of empirically testing the model using a dynamic knowledge matching (KM) function, which is applied to data on patent applications and new firms in Chilean municipalities for the period 2002–2008. The estimations confirm the explanatory power of the KM mechanism regarding the spatial variation of innovation in the country, a result that is largely robust to the consideration of other main hypotheses of regional innovation. This evidence warrants further consideration of the spatial dimension of innovation in the country. It also suggests that there are unexploited synergies to be had between support policies for innovation and support policies for entrepreneurship in the context of regional development initiatives.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Conventional wisdom among policy makers and many academics holds that entrepreneurship is a necessary condition for regional growth. As a consequence, the promotion of business creation has become a key component of regional development strategies across the world (Gilbert et al. 2004). The regional studies literature stresses entrepreneurship’s effects on job creation (Acs and Armington 2004), on productivity (Bosma et al. 2011), on competitiveness (Huggins 2003) and on the restructuring of regional economies (Audretsch and Keilbach 2004). But it is also true that entrepreneurship is only one among many paths for regional growth (Audretsch and Fritsch 2002), and under some circumstances, it may bring some negative short-run effects due to the crowding out of incumbent firms and labor-saving technological change (Fritsch and Mueller 2004).

Entrepreneurs perform a range of functions in the process of economic development (Carree and Thurik 2003), and endogenous growth theories have delivered new insights regarding the importance of entrepreneurship in competition-led processes of innovation. Some of these models are rooted in the Schumpeterian tradition, focusing on the entrepreneurial function of discovery and invention (Grossman and Helpman 1991; Aghion and Howitt 1992). In this present paper, however, we inquire into another role for the entrepreneur, that of liaison between basic scientific knowledge and market innovation.

We present a relationship between regional levels of entrepreneurship and innovation based on the model by Michelacci (2003) of matching between knowledge and entrepreneurial skills. This is an economy-wide general equilibrium model with endogenous growth, where innovation is the result of a random match between the stock of knowledge in the economy and the number of free entrepreneurs. These entrepreneurs (unattached to incumbent firms) are willing to incur the costs of searching and implementing scientific inventions and establish new firms in which the new knowledge is commercialized. Rational agents, in turn, choose between entrepreneurship and research activities in response to the expected return to alternative occupations. At the same time, relative expected profits determining occupational choices are a function of the rate of technological progress, a parameter directly related to the frequency of innovations. The model gives rise to an estimable knowledge matching (KM) function casting the number of innovations as a function of the stock of researchers and the level of entrepreneurship in the economy.

We test the model with a panel dataset of patent applications and new firms in Chilean municipalities, two empirical measures that closely proxy for the innovation and entrepreneurship variables that are the focus of the matching-based framework. Despite being the subject of increasing theoretical development and policy interest, empirical testing of the relationship between entrepreneurship and innovation is limited. There are mostly national or sectorial studies like Braunerhjelm et al. (2010) or Michelacci (2003), but very little verification is available at the sub-national level. It is at the local level where entrepreneurship-mediated knowledge diffusion is most likely to be expressed (Acs and Plummer 2005). One notable study at the local level is that by Acs and Plummer (2005), who confirm using a panel of counties in the State of Colorado that new ventures are more efficient than incumbent firms in turning basic knowledge into economic knowledge. Beugelsdijk (2007) found that entrepreneurial culture helps to explain the economic growth of European regions, although the connection between entrepreneurship and growth is primarily indirect via innovation.

Still, our understanding is limited regarding how the relationship between innovation and entrepreneurship is established and unfolds. Usually, regional innovation studies focus on the link between R&D inputs and innovation outputs, without explicitly addressing the relationship between innovation and entrepreneurship. The proposed KM approach in this present paper helps fill this gap by proposing a different but complementary microeconomic foundation to Romerian knowledge filter frameworks of innovation and entrepreneurship (Acs et al. 2004; Acs and Plummer 2005; Acs and Sanders 2013) and using a novel empirical approach as yet unapplied in regional innovation studies.

We further expand the model to check the robustness of the KM mechanism in the presence of other possible—and perhaps simultaneously operating—factors explaining the variation of regional innovation indicators, such as Marshall’s hypothesis of agglomeration externalities (AE) (Glaeser et al. 1992). We also use a dynamic specification that captures the cumulative nature of the innovation process and an estimation method that deals with the endogeneity of entrepreneurship, as our operational theory dictates.

The empirical analysis uses Chilean data. Chile is a fast-growing developing country, and the Global Entrepreneurship Monitor (GEM) indicates that it has high rates of entrepreneurial activity, although this is characteristic of many other countries at similar stages of development (Amorós and Poblete 2011). Levels of R&D investment (particularly by the private sector) are very low (OECD 2012), and consequently, its knowledge production and innovation performance are among the lowest for OECD economies. There are no previous studies in the country nor in Latin America analyzing the spatial patterns of innovation and entrepreneurship and their relationships at the local level.

We find that the KM mechanism has strong explanatory power with respect to the spatial variation of innovative activity in the country, a result that is largely robust in the presence of other mechanism that might condition regional knowledge spillovers. Having 2013 been declared as “the year of innovation” and 2012 “the year of entrepreneurship” by the Chilean Ministry of Economy, our results are of considerable policy relevance.

The paper is organized as follows. Section two outlines a simple KM framework to analyze the relationship between regional entrepreneurship and innovation in the country. Section three describes the data sources and the spatial patterns of innovative and entrepreneurial activity across Chilean municipalities. Section four addresses the empirical implementation, in the light of the model and the stylized facts. Section five presents and discusses the results, and the final section offers our conclusions.

2 A knowledge matching model of regional innovation

2.1 The basic KM formulation

Let k rt be the (unobservable) knowledge stock in region r at time t measured as the number of scientific inventions suitable for economic use. The number of free entrepreneurs available to create new firms or entrepreneurial slackness is s rt. Following Michelacci (2003), an innovation is realized once a free entrepreneur matches with an invention. The individual probability of matching (p rt ) is a function of the knowledge intensity in the regional economy, i.e., the stock of inventions available per entrepreneur: \(p\left( {\theta_{\text{rt}} } \right)\), with \(\theta_{\text{rt}} = k_{\text{rt}} /s_{\text{rt}}\). It is reasonable to impose the restriction that, in the relevant range, the probability of matching increases at a decreasing rate over knowledge intensity: \(0 < \xi \equiv \frac{{{\text{d}}p}}{{{\text{d}}\theta }}\frac{\theta }{p} < 1\).Footnote 1

The number of innovations in the regional economy at time \(t\left( {m_{\text{rt}} } \right)\) is therefore the product of the individual probability of matching and the entrepreneurial slackness: \(m_{\text{rt}} = p\left( {\theta_{\text{rt}} } \right)s_{\text{rt}}\). Assumptions made about the individual probability of matching \(p\left( {\theta_{\text{rt}} } \right)\) allow expressing the total count of innovations in region r in period t as a monotonically increasing, concave and homogeneous of degree one matching function of the knowledge stock and the entrepreneurial slackness:

This matching function is a parsimonious representation of the KM mechanism, reflecting that both research and entrepreneurial skills are necessary in order to innovate and that these skills are heterogeneous; thus, the matching is costly and subject to search frictions (Michelacci 2003). Furthermore, the KM function as an empirical device is broadly consistent with the knowledge filter (Acs et al. 2004; Acs and Plummer 2005) and the knowledge spillover theory of entrepreneurship (Braunerhjelm et al. 2010; Acs et al. 2013), two new strands of literature that recognize the need for pure knowledge to be transmitted from sources to productive agents (Leyden and Link 2013) and translated into economic knowledge through purposeful entrepreneurial action (Acs et al. 2004).

The knowledge stock is further modeled as a function of the stock of researchers in region r at time t and of the dynamics of invention. The number of researcher in the regional economy is the product of the number of agents \((C_{\text{rt}} )\) and the research effort \((f_{\text{rt}} )\)—the fraction of researchers in the regional working population. The emergence of inventions is taken as a stochastic process following a Poisson distribution with mean rate of arrival \(\lambda\), but the opportunity to turn them into innovations vanishes also as a Poisson process with a mean rate of \(\nu\).

Thus, the evolution of the knowledge stock in the regional economy proceeds according to the net rates of knowledge generation, which reflects the balance between creation of new knowledge and the obsolesce of the existing stock (Michelacci 2003): \(\mathop {k_{\text{rt}} }\limits^{ \cdot } = \lambda C_{\text{rt}} f_{\text{rt}} - \nu k_{\text{rt}}\), where \(\mathop k\limits^{ \cdot }\) is the growth rate of k. The steady-state knowledge stock is therefore:

By embedding (2) in (1), we arrive at an steady-state frequency of innovation:

The matching function (3) relates the frequency of innovations to the (observable) stock of researchers and entrepreneurs in the regional economy. It poses the number of innovations in the regional economy in each period as an increasing function of the stock of research and entrepreneurial skills, the former dependent on the size of the economy, the relative amount of human capital devoted to research activities and the mean rates of invention and obsolescence.

Implicit in the KM function (3) is a trade-off in the allocation of the regional stock of human capital between research and entrepreneurial activities. The full Michelacci’s model solves for the equilibrium allocation of talent according to a range of essential parameters, showing how under little appropriation of rents from innovation by entrepreneurs, a problem of “low returns to R&D due to lack of entrepreneurial skills” may arise. Many of such parameters are hard to observe and/or have no variation at the regional level in the Chilean context. Therefore, we limit ourselves to fit the matching function with the observed stocks of entrepreneurs and researchers and account for the endogeneity of such variables in our empirical reduced forms.

2.2 An extended KM framework

Equation (2) above is a stylized representation of the relationship between regional knowledge, entrepreneurship and innovation. It ignores, however, other important features of regional contexts conditioning localized knowledge spillovers (Glaeser et al. 1992; Feldman 1999). Indeed, there are several other explanations of the spatial variation of innovation supported by vast empirical evidence. They may well be incorporated in this basic KM setting to capture existing representations that focus more specifically on the regional aspects of innovation.

We therefore test for the robustness of the KM mechanism by including three other leading (although not mutually exclusive) explanations of regional innovation patterns. First, the knowledge production function (KPF) was proposed by Griliches (1979). It describes the process of knowledge generation as a standard neoclassical production function, where innovation is the outcome for a range of R&D inputs that characterize regional innovation systems in which agents and firms are embedded. They typically include university and private research investment, technological infrastructure and business services, among others (Fritsch and Slavtchev 2007; Acs et al. 2002; Feldman and Florida 1994). The KPF has extensive empirical verification in the regional context in the developed countries, generally supporting the importance of technological inputs as key determinants of geographical variation of innovation levels.

The second approach is Schumpeter’s creative destruction (CD) (Schumpeter 1942). According to Pe’er and Vertinsky (2008), the exit of incumbent firms releases skills and resources that could be used more innovatively and productively by other agents in the economy. Michelacci (2003) reaches a similar equilibrium result. That is why business turbulence would be an important driver of an industrial selection process leading to innovation and productivity gains (Bosma et al. 2011). Many empirical studies have tested for CD in the regional context, although usually through its effects on productivity and competitiveness (Bosma et al. 2011; Callejón and Segarra 1999). Pe’er and Vertinsky (2008) verify empirically the local nature of CD, concluding, however, that when exits rates are too high and persistent, they may discourage business entry and consequently innovation.

The third set of controls is related to agglomeration externalities (AE). While there is a general recognition that agglomeration typical of urban environments provides favorable conditions for generation and transmission of information (Glaeser et al. 1992), there is an open debate about which specific conditions favor localized knowledge spillovers (van der Panne 2004). The Marshallian tradition (following Marshall 1890) focuses on specialization externalities and points to the benefits of spatial concentration of related firms, due to specialized factor supply and industry-specific knowledge spillovers. Jacobs (1969), instead, places the emphasis on exchanges across diverse industries and agents as the most stimulating environment for innovation. At the same time, there is the related discussion about the effect of local market structures. On one hand, Porter (1990) claims that local competition in specific markets acts as a strong stimulus for agents to enhance productivity and innovation. On the other, many industrial organization models points to the negative effects of product market competition that exhausts profit opportunities and deters business entry (see Aghion and Griffith 2005). As discussed in Beaudry and Schiffauerova (2009), the vast empirical evidence on which sort of externalities prevail is inconclusive and results seem to be highly dependent on particular methodological decisions.

To nest these regional variables into our base KM function, we now relax the assumption of a fixed mean rate of arrival of invention. As in the Poisson regression setting, we let this parameter vary in time and across regions by conditioning it on a vector of location-specific regressors:

with \(z_{\text{rt}} = \left( {{\mathbf{KPF}}_{\text{rt}} ,{\mathbf{CD}}_{\text{rt}} ,{\mathbf{AE}}_{\text{rt}} } \right)\), being the additional context variables that control for regional knowledge production.

Inserting (4) into (3), we arrive at:

Equation (5) is an extended reduced-form relationship that takes into account regional heterogeneity in the process of knowledge generation while keeping the focus on the KM as the key mechanism linking knowledge and innovation. Parameters \(\delta\) capture the net effect of regional variables on the number of innovations, exerted indirectly through their conditioning effect over the mean arrival rate of invention.

3 The data

3.1 Data sources and treatment

We use patent applications per year in each Chilean municipality (called a comuna) as our measure of innovation counts. We excluded three island municipalities from the 342 comunas in the 2002 national population census.Footnote 2 There are two main reasons for the decision to conduct this investigation at the level of municipalities. First, one of our objectives is to describe the spatial variation of innovation and entrepreneurship with a high level of spatial detail and to analyze the relationship between innovation and entrepreneurship at the level of local economies. Comunas are the smallest administrative units in the Chilean political organization. Second, there is vast empirical evidence of the limited spatial reach of knowledge spillovers (Anselin et al. 1997; Jaffe et al. 1993); in regard to the particular KM mechanism considered here, we can safely argue that the KM process is largely confined to municipal boundaries. Inter-municipal mobility rates in Chile are quite low in most comunas with the exception of those of the country’s three largest urban centers. According to the data from the National Population Census of 2002, in 249 out of 342 comunas, 75 % or more of the occupied population works and lives in the same municipality.

We built a yearly panel of total patent applications in each comuna for the years 2002–2008 from a database of the National Institute of Industrial Property of Chile (INAPI).Footnote 3 Excluding foreign patents and Chilean patents with foreign inventors only, there are 1,857 applications. We located patent applications according to the working address of the inventor, thus better identifying the true location of the invention (Andersson et al. 2009). Verification was done by performing an exhaustive case-by-case web search to avoid problems such as locating the patent in the address of the headquarters of multi-plant companies (typical, for instance, in the case of large mining companies). In the infrequent cases of applications with multiple inventors located in different comunas, and similar to Agrawal and Cockburn (2003), the same application was allocated more than once to each inventor’s comuna, in order to acknowledge the multiple origins of that invention. This yielded a total of 1,968 “localized innovations” for the period.Footnote 4

Despite their widespread use in empirical analysis (Andersson et al. 2009; Michelacci 2003; Agrawal and Cockburn 2003; Paci and Usai 1999), patents are imperfect indicators of innovation outputs. Griliches (1990), for example, argues that patents should be thought of as intermediate outputs, motivating the use of alternative metrics closer to commercial outcomes such as innovations introduced in the market. Indicators of commercially relevant innovations would be a more direct measure of what Griliches considers the most relevant output: the net accretion of economically valuable knowledge. In this regard, Acs et al. (2002) have shown that patents are still a useful measure for the empirical analysis at disaggregated scales, because patents and realized innovations are comparably correlated with R&D inputs.Footnote 5

A second and more difficult argument against using patents as measures of innovation outputs is that not all economically valuable inventions are patented or even patentable. This introduces a potential bias and would be of particular importance in sectors where the expected returns to innovation and the effectiveness of intellectual property protection mechanisms are lower (Moser 2005). This is an intrinsic limitation of the patent metric, and the reader should interpret the empirical results that follow for the Chilean case in the light of the possibility that patent counts could underestimate local innovation levels particularly in rural areas, which in Chile are far less dependent on knowledge-based industries.

In terms of the KM variables, we use as our indicator of local entrepreneurial activity the number of new formal (tax-paying) businesses in each comuna (hereon new firms). This is also an imperfect variable of entrepreneurial activity, but, as discussed in Glaeser and Kerr (2009) and Parker (2009), as is the case of any other metric of entrepreneurship, the variable is intended to reflect some important aspects of what is essentially a multi-dimensional phenomenon. In particular, the number of new firms captures the dynamic nature of entrepreneurship and also captures the fact that economically relevant entrepreneurial action ultimately takes place in firms (Glaeser and Kerr 2009). The count of new firms is a widely used metric of entrepreneurship (van Praag and Veerslot 2007; Parker 2009). It is also in the spirit of the entrepreneurial slackness variable in the Michelacci (2003) model, where the slackness represents the number of free entrepreneurs available to create new businesses, empirically implemented by the author as the count of self-employed.Footnote 6 A year panel from 2002 to 2008 was built from the Internal Revenue Service (SII) business initiations database.Footnote 7

The research effort variable was built as the proportion of highly skilled workers in research-related sectors (“researchers”) in the working population. We used the 2000, 2003, 2006 and 2009 rounds of the National Survey of Socioeconomic Characterization (CASEN), which registers in detail the occupation of workers, according to the International Standard Classification of Occupations (ISCO). After some sensitivity tests, we defined researchers as professionals of physical, chemical and mathematical sciences (category 21) and professionals of biological sciences, medicine and health (category 22). For intermediate years, the research effort variable was obtained by linear interpolation of values obtained from the survey.Footnote 8 As in Michelacci (2003), the scale of the economy for each year in the period 2002–2008 was proxied by total adult (above 17 years old) population in the comuna, generated by the National Institute of Statistics (INE) and downloaded from the National System of Municipal Indicators (SINIM).Footnote 9

The first KPF variable included is the annual public scientific research expenditures in each comuna for 2002–2008 (KPF1). It was proxied by the total amount spent by the two largest scientific research programs of the National Commission of Scientific and Technological Research of Chile (CONICYT) in each comuna. The first is FONDECYT (National Fund for Scientific and Technological Research), a program of around 158 US$ million annual budget, aimed at promoting the basic scientific and technological research in the country.Footnote 10 , Footnote 11 The second is FONDEF (Fund for the Promotion of Scientific and Technological Research), a US$ 33 million per year program, aimed at stimulating applied research and technological development useful for the productive sector.Footnote 12 By 2006, both programs accounted for nearly half of the total budget of CONICYT (2009). Databases of granted projects each year were provided by CONICYT including the amount allocated to each initiative, the researchers and their academic units. Again, we located expenditures according to the place of work of researchers and were expressed in U.F.’s, the inflation-indexed unit in Chile.Footnote 13 In comunas without public scientific research expenditures, this variable was set as 0.1 when expressed in logs.

We also included spatially lagged public research expenditures (KPF2) in order to test for the presence of knowledge spillovers of scientific research, generally observed but showing limited spatial reach (Anselin et al. 1997; Jaffe et al. 1993). We built spatial weight matrices containing the inverse of the Euclidean distance between centroids of each pair of comunas. Two alternatives bandwidths were used to define neighboring municipalities: 200 and 300 km. Finally, we included the number of large- and medium-size firms in each comuna (KPF3) as a proxy for total private R&D investment. This may be a very crude proxy for the municipal private R&D investments, but it can be justified with the results by Benavente (2005), who, based on a micro-level analysis of Chilean manufacturing firms, concludes that firm size is a very good predictor of its R&D investment. The number of large- and medium-size firms en each comuna was taken from the firm databases of SII and is available for the period 2005–2008.Footnote 14

Following previous studies (Bosma et al. 2011; Callejón and Segarra 1999), we measured creative destruction (CD1) through the turnover (or turbulence) rate, calculated as the sum of entries and exits divided by the number of firms each year.Footnote 15 The number of entries was obtained from the SII business initiations database, and the exits were taken from a SII dataset of tax payers finishing activities each year.Footnote 16 The number of firms in each comuna comes from the same SII firms dataset used to obtain the number of medium- and large-size firms.

As in van der Panne (2004), we test for three sources of AE. The first (AE1) are Marshallian externalities, measured through a sectorial specialization index (E), a location quotient that measures how specialized the local economy is in a particular sector compared to the national economy as a whole (Glaeser et al. 1992). Here, it was built for each year as the share of firms in sector l in comuna r relative to the share of the same sector in the whole country:

with n being the number of firms, \(l = 1, \ldots ,18\) economic sectors and \(r = 1, \ldots ,339\) comunas. In each municipality, we took the highest index among all sectors. The accumulated empirical evidence (from outside of Chile) provides no conclusive results with respect to the role of specialization (see Beaudry and Schiffauerova 2009), and so we have no strong a priori expectation of the general effect of this variable on local innovations. Nevertheless, the descriptive analysis of spatial patterns in the specific context of Chile (in the following section) is suggestive of potential specialization effects in some regional economies reliant on certain extractive industries.

The second are Jacobs externalities (AE2), following van der Panne (2004) and Paci and Usai (1999) as a productive diversity index (D). It was built here as the reciprocal of the sectorial Gini index of the number of firms:

with L the number of residing sectors and n the number of firms in each sector, sorted ascendingly. The index measures how much the local economy departs from a perfectly even distribution across economic sectors (D = 1), or, from another perspective, how much it departs from total concentration in one single sector (D = 0). Again, determining the sign of the relationship with innovation levels is an empirical matter. The literature, however, does suggest that diversification effects are usually found with highly disaggregated industrial classifications (Beaudry and Schiffauerova 2009), which is not the case here.

Van der Panne (2004) notes that measured this way, regional specialization and diversification may coexist, since the latter index is only region-specific, while the former is region- and sector-specific.

The third are Porter externalities (AE3), measured as a competition coefficient (C), built as the ratio of firms per worker in each sector in each municipality relative to the ratio across all sectors and regions in the country. A larger value of the index reflects higher industry-specific local labor competition or otherwise lower average firm size and thus lower average market power (van der Panne 2004):

with w being the number of workers. Again, we took the highest index among all sectors in each comuna. Conventional wisdom suggests that the estimated marginal effect of this competition index should be positive in the regressions, as local competition between firms for workers’ human capital should encourage innovative performance (Jacobs 1969). Alternatively, it may reflect contestable local markets with low average market power, which should also benefit innovation (van der Panne 2004).

Data on the number of firms and workers per comuna and sector for each of the years 2005–2008 were taken from the SII firms database. Sectorial aggregation is based on an internal SII classification system of 18 sectors, closely resembling the 1-digit ISIC.Footnote 17

3.2 Descriptive statistics

Table 1 reports the descriptive statistics for the sample of comunas considered in this study, illustrating the large spatial variation in terms of both the determinants and the outcomes of local innovative activity. First note that measured as patent applications, innovation appears to be a rare phenomenon in Chile. Its large variation relative to the mean is the result of a highly left-skewed municipal distribution, with innovative activity concentrated in just a handful of comunas. Only little more than one-third of Chilean municipalities show at least one application during 2002–2008. Second, scientific research expenditures considered here are even more concentrated: Just 37 out of 339 municipalities have recipient institutions. Thus, the lack of scientific research could well be a reason for so many places without patent applications. Third, there is a group (18) of very small comunas that do not have medium or large local firms and therefore are very unlikely to have any meaningful private R&D spending. Fourth, mean turbulence rates and their standard deviation across comunas are very close to those reported by Bosma et al. (2011) for NUTS-3 regions in the Netherlands in the 1990s and 2000s. Fifth, there is a large variation in the specialization and competition indexes, with implausibly large maximums that heavily distorts the municipal distribution. This is due to a little group of small rural municipalities that according to the SII data would be specialized in quite peculiar sectors, such as extra-territorial organizations or public administration and defense. This is not representative of their true sectorial composition, which is based on small-scale agriculture. We therefore excluded from the estimation sample comunas with a population below 3,000 (the bottom 7 % of the municipal distribution) for those specifications including AE variables. Given the way rurality is defined in Chile, these are fully rural municipalities.

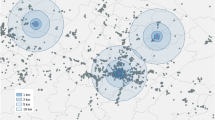

3.3 Spatial patterns of innovative and entrepreneurial activity in Chile

Figure 1 depicts the total number of patent applications in 2002–2008 per 1,000 adults in Chilean comunas. Regarding the spatial differences in innovation, it reveals a similar picture compared to advanced economies such as Germany (Fritsch and Slavtchev 2007), Italy (Paci and Usai 1999) or the USA (Acs et al. 2002). High levels of innovative activity can be found mostly in the capital city of Santiago and in other regional capitals (all over 300,000 inhabitants). On the other hand, several medium-sized industrial comunas (all below 100,000 inhabitants) at the fringe of large cities show relatively large levels of innovative activity (between 10 and 50 applications).

But beyond the apparent influence of scale, several innovative comunas in the national capital city and in other regional capitals in central Chile also have university facilities that are active promoters of local innovation. This is not the case of other universities located in more peripheral regional capitals, even those of significant scale by Chilean standards (around 150,000 inhabitants or more). On the other hand, there are some rural municipalities below 25,000 inhabitants where public research institutions are stimulating innovative research in agriculture.

Finally, when looking at natural resource-dependent economies, there seems to be a role for the sectorial orientation. For example, comunas with large copper mining operations are the origin of many innovations as suggested by the relatively large number of applications in otherwise unlikely places (such as Machalí with 29,000 inhabitants and 14 applications). In contrast, even though the forestry industry is one of the five main exporting sectors, comunas with the largest wood and pulp processing plants show only one application during the entire period.

Municipal entrepreneurial activity rates measured as the total number of new firms per 1,000 adults (above 17 years old) during 2002–2008 are shown in Fig. 2. What emerges is an apparently dual regime. Some of the most entrepreneurial comunas are, as anticipated, service-oriented municipalities in the largest cities, but other entrepreneurial comunas are poor, rural and sparsely populated communities. The least entrepreneurial places tend to be poor, where small-scale agriculture coexists with forestry plantations. Summarizing, the map reflects a geography of entrepreneurship possibly shaped by a balance between “push” and “pull” forces (Parker 1996), and where idiosyncratic factors also seem to be important (Amorós et al. 2013).

Overall, the maps are at best suggestive but definitively inconclusive about a strong spatial association between entrepreneurial and local innovative activity.

4 Empirical specification and estimation method

We propose an empirical specification that is consistent with the non-negative integer nature of the dependent variable in the theoretical model (regional innovation counts per year), but that also captures some of the stylized facts observed in Fig. 1.

Following Michelacci (2003), we use a constant-elasticity representation of the matching function: \(m\left( {k_{\text{rt}} ,s_{\text{rt}} } \right) = Ak_{\text{rt}}^{\alpha } s_{\text{rt}}^{\gamma }\). This is a simple functional form satisfying the assumed properties of the matching function. Once replaced in (5), our empirical equation takes the form:

which is a standard linear exponential (or log-link) specification commonly used for count data models, and in particular, in empirical studies of regional innovation (Andersson et al. 2009; Van der Panne 2004; Agrawal and Cockburn 2003). It is consistent with the low frequency of innovation in Chilean comunas described in Fig. 1, as the Poisson distribution can be understood as the result of multiple Bernoulli trials with a low probability of occurrence (see Cameron and Trivedi 1997).

Parameters \(\alpha\), \(\gamma\) and \(\omega\) comprise elasticities of innovative activity to RHS variables to be estimated. Given the model assumptions, one interesting empirical question is whether \(\alpha { + }\gamma { = 1}\), i.e., the hypothesis of constant returns to scale (CRS) in matching. CRS in matching would be implied by an assumption that the probability of a match is also a constant-elasticity function: \(p\left( \theta \right) = A\theta^{\alpha } = A\left( \frac{k}{s} \right)^{\alpha }\). Verification of CRS implies empirical support to the assumption that the matching probabilities are diminishing with knowledge intensity. Michelacci (2003) verifies CRS in the matching between researchers and entrepreneurs in the USA.

Taking advantage of the panel nature of our dataset, we adopt a specification that accounts for the intrinsically dynamic nature of innovation: a path-dependent cumulative process subject to obsolescence (Zucker et al. 2007). So following Blundell et al. (2002), we fit an order 1 linear feedback version of model (6) with multiplicative fixed effects:

with m rt being the number of innovations in region r at time t, X and β are vectors of regressors and estimation parameters, respectively, and δ is a distributed lag coefficient to be estimated, usually interpreted as a depreciation parameter of the stock of knowledge capital (Blundell et al. 1999). It should yield \(0 < \delta < 1\) in order to have such economic meaning and to reflect a stable non-negative series. \(v_{\text{r}} \equiv \exp \left( {\eta_{\text{r}} } \right)\) is a permanent scaling factor for the individual mean, and \(\eta_{\text{r}}\) is a fixed effect capturing unobserved heterogeneity due to permanent differences in innovativeness among comunas, likely correlated with the regressors. Such source of heterogeneity introduces a mechanism that accounts for the over-dispersion of patent applications reported in Table 1.

Blundell et al. (1995) discuss how this specification rests on less stringent assumptions than over-parameterized Poisson models, such as the negative binomial. The error term \(\varepsilon_{\text{rt}}\) is assumed to be serially uncorrelated and uncorrelated with the fixed effect, and it partially accounts for the noisy nature of our variable of regional innovation. As explained in Blundell et al. (2002), the vector β reflect long-run (steady-state) elasticities ignoring any feedback from past innovative activity to contemporaneous levels of the RHS variables. The product (1 − δ)β, in turn, measures short-run elasticities.

The linear feedback specification has many practical advantages in the context of dynamic log-link specifications, because the inclusion of lagged values of the dependent variable in the exponential term may lead to explosive dynamics and to problems due to transformation of zero values (Blundell et al. 2002). It worth noting, however, that it in this context, it does not allow for an explicit feedback of past innovation on contemporaneous rates of firm creation, a relationship that has been established empirically by many studies (e.g., Fritsch and Amoucke 2013; Fritsch and Mueller 2007).

A main estimation issue emerging from the Michelacci (2003) framework is the endogeneity of entrepreneurship and research efforts to the levels of innovation. Technological change conditions occupational choices by differentially affecting the expected profitability of both entrepreneurship and research activities, through the reduction in the effective discount rate of agents, i.e., a capitalization effect. More intuitively, many authors in the urban and regional science literature have stressed the importance of environments rich in knowledge and innovation for entrepreneurship as they provide market opportunities and enhance the local business environment (Acs et al. 2013; Jacobs 1969). Such endogeneity renders standard fixed-effect estimators based on maximum likelihood procedures such as the panel Poisson or negative binomial models inconsistent (Blundell et al. 1995, 1999), so we rely on GMM estimation.

Wooldridge (1991) and Windmeijer (2000) (WW) propose the following moment conditions for count data models in the presence of endogenous regressors:

\(E\left( {d_{\text{rt}} |g_{\text{r}}^{t - 2} x_{\text{r}}^{t - 2} } \right) = 0\), with d rt being the quasi-difference transformation: \(d_{\text{rt}} = \frac{{g_{\text{rt}} - \delta g_{{{\text{rt}} - 1}} }}{{\mu_{\text{rt}} }} - \frac{{g_{{{\text{rt}} - 1}} - \delta g_{{{\text{rt}} - 2}} }}{{\mu_{{{\text{rt}} - 1}} }}.\)

In addition to the endogenous variables in the Michelacci model (entrepreneurship and research efforts), the variables related to public and private R&D expenditures, turbulence rates and local industrial structure are also potentially influenced by shocks in local innovation. The effects of these shocks are likely expressed with some delay, so we treat such variables as weakly exogenous (predetermined). In the case of the spatial lag of public research expenditures, endogeneity is unlikely, because the variable depends on the research activity of surrounding municipalities. Therefore, we treated it as an exogenous variable.

The validity of the assumptions regarding the exogeneity of the regional controls was statistically assessed and verified by means of the Difference-in-Hansen test of subsets of instruments (Arellano and Bond 1991). Accordingly, the instrumentation strategy made use of second-order (and higher) lags of the endogenous variables (the KM variables) and of the dependent variable, the use of first-order (and higher) lags of the predetermined variables (KPF1, KPF3, CD1, AE1, AE2 and AE3) and the use of the model’s exogenous variables (KPF2 and time dummies instrumenting themselves).

As the model specifications included a larger number of variables, we adopted a conservative criterion of using fewer lags (depending on the specification), to avoid problems of an excessively increased instrument count (see Roodman 2009). The Hansen J test of over-identifying restrictions (Hansen 1982) was used to assess the joint validity of the whole instrument set. Finally, the Arellano–Bond serial correlation test (Arellano and Bond 1991; Windmeijer 2002) was used to check for a lack of second-order serial correlation in the quasi-differenced model residuals, which is an implicit test for the main identifying assumption of the absence of serially correlated errors.

5 Estimation results

Table 2 summarizes the results of the GMM panel estimation at the level of comunas for ten variants of the model as presented in Eq. (6).Footnote 18 Results in columns (1) and (2) are for the base knowledge matching (KM) specification, and the other columns report coefficients for models that progressively add subsets of variables related to the other hypothesis considered here. In the odd columns, we report specifications that include year dummies, to account for transitory shocks common to all comunas.Footnote 19 Only long-run elasticities are reported.

Looking across specifications (and other regressions unreported here due to space limitations), for most variables, regression parameters are largely stable, with a few changes in signs. The most salient result is the strong positive elasticity of innovation with respect to new firms and with respect to variables related to knowledge generation (stock of researchers and/or KPF variables depending on the specification). In the case of the stock or researchers, in five out of ten specifications, this variable is positive and significant, at least at the 10 % level. Only in specifications that include all regional controls (9 and 10), does the parameter associated with the stock of researchers become negative, although statistically insignificant. More generally, only in these two specifications, the variables that more directly capture knowledge generation (f and KPF) have high p values. We have two possible explanations for this result. One is the possibility of confounding the effects among many factors that condition local knowledge spillovers. The other possibility, more likely, is related to small-sample and weak-instrumentation biases and imprecision in the presence of “persistent” regressors (Blundell et al. 2002), such as those related to industrial structure (slowly changing over time). Finally, the test of CRS in matching is rejected at the 5 % level in only two models (those excluding controls other than KM variables) and only for long-run elasticities. We interpret this result as an indication of the importance of accounting for contextual factors in regional KM models.

Another notable result is the rapid depreciation of knowledge capital, reflected by the low point estimates of the autoregressive coefficient (not higher than 0.28, implying annual depreciation rates not lower than 72 %). We interpret this result as evidence of little technological lock-in effects in Chilean regional economies. Instead, municipal innovation behaves much more as a random walk in time, with discontinuous innovation processes in key local industries.Footnote 20

We have no evidence of major specification errors that might affect estimations. For all model variants, specification tests support identifying assumptions and validate the instrument set. The Chi-2 tests of overidentifying restrictions fail to reject the exogeneity of the instrument set in all specifications. On the other hand, z-tests of second-order serial correlation are unable to reject the null hypothesis of no serial correlation of the errors, as assumed by the WW estimator.

Looking the results in more detail, estimates for the basic model (in the first and second columns) are consistent with the proposed KM mechanism. Both the stock of researchers and the number of new firms show positive and statistically significant coefficients. Our point estimates are in general higher than those reported by Michelacci (2003) for a time series analysis of the US economy. Given the presumably lower levels of knowledge intensity in Chile, this evidence is consistent with matching probabilities increasing at a diminishing rate. When year dummies are not included (column 1), the estimated long-run elasticity of innovation to new firms is larger (albeit not statistically) than one, which in the model would imply a negative elasticity of the probability of matching to the knowledge intensity.Footnote 21 The linear feedback coefficient is in the expected range (0–1), but the point estimates are quite low compared to those reported by Blundell et al. (2002) for USA firms. Consequently, the short-run elasticity with respect to the number of new firms is lower, actually lower than one: 1.195*(1 − 0.281) = 0.859 (with a [0.515 − 1.202] confidence interval).

In columns (3) and (4), we report estimations including KPF1 and KPF2 variables, using the 200-km spatially lagged KPF2. The addition of KPF variables does not affect previous results in qualitative terms. Steady-state elasticities of innovative activity to new firms and to the stock of researchers remain high and significant, with point estimates very similar to those in columns (1) and (2). Scientific research expenditures emerge as a highly significant variable, confirming what indicated by previous studies in developed countries (Feldman and Florida 1994; Acs et al. 2002). Estimated parameters are close to those reported by Fritsch and Slavtchev (2007) for the elasticity of patent to university funding in German districts. The positive and highly statistically significant parameters of the spatially weighted variable suggest spatial spillovers of scientific research far beyond municipal borders (at least within a radius of 200 km). These are far-reaching spillovers compared to those reported by Anselin et al. (1997) for the USA, but in the range of those found by Bottazzi and Peri (2003) for European regions. Sign and statistical significance of these spillovers are insensitive to the spatial weight matrix used.Footnote 22

The inclusion of the number of large- and medium-size firms (KPF3, columns 5 and 6) preserves the expected sign for the KM and KPF variables. The coefficient for the KPF3 variable is positive and significant at the 10 %, which gives some support to the conjecture that the stock of larger firms should somewhat signal the local stock of private R&D inputs. The result would be in accordance with the ample evidence pointing at a positive effect of private R&D expenditures on local innovation (Acs et al. 2002; Feldman and Florida 1994). The inclusion of this variable renders the stock of researchers and the spatially lagged public research expenditures either marginally, or simply not, significant depending on the specification. We believe this has more to do with statistical efficiency losses due to the sharp reduction in the sample size.

Specifications in columns 7 and 8 include the CD variable. The turbulence rate induces no meaningful change compared to previous estimates, but turning the KPF1 variable only marginally significant. In contrast to expected Schumpeterian mechanisms, the estimated CD1 parameters are negative, but in this case largely insignificant.

Keeping in mind the likely weak instruments problem of our last two estimates, specifications (9) and (10) confirm the positive correlation between entrepreneurship and local innovation, but not so for the stock of researchers. On the other hand, results provide some weak support for AE. In terms of the diversification-versus-specialization debate, estimates tend to favor Jacobs over Marshall externalities. We found a marginally significant negative (positive) coefficient for the specialization (diversification) index when year dummies are excluded (column 9). As reported for the Netherlands by van der Panne (2004), we obtained a negative parameter for the competition index, which would support claims of some industrial organization models pointing at the negative effects of excessive market competition on business entry and therefore on innovation. This variable is, however, not significant. Our results are consistent with some patterns in the meta-analysis by Beaudry and Schiffauerova (2009); that is, regional (in contrast to firm-level) studies tend to support Jacobs externalities as the results do here. The results, however, conflict with other meta-analysis findings, such as evidence of Marshallian externalities in studies using broad industrial classifications.

Overall, our results give consistent support to the knowledge matching mechanism as an (certainly partial) explanation to the spatial variation of innovative activity in Chile.

6 Summary and conclusions

Our analysis has developed a theoretical relationship between regional entrepreneurship and innovation from the perspective of the KM hypothesis. We are able to verify this relationship and the underlying role of entrepreneurship (as measured by new firms) in linking knowledge with market needs in Chilean local economies. This is the first study available in the Chilean and Latin American contexts that analyzes the geographic patterns of, and the relationship between, innovation and entrepreneurship at this level of spatial disaggregation.

We have confirmed that the explanatory power of the KM mechanism is largely robust with respect to the inclusion of other regional factors conditioning knowledge spillovers. By doing so, we have also verified the importance of local innovation systems, in particular the positive effect of scientific and technological infrastructure (and perhaps of economic diversification). On the contrary, we have found no evidence of local CD, specialization externalities and competition effects. It is important, however, to bear in mind that the results presented here are subject to several methodological caveats: those related to our imperfect measures of regional innovation and entrepreneurship, the short time span for which many series are available, and the absence of potentially important feedback mechanisms in our empirical specifications.

The KM model presented here offers a novel approach for understanding the relationship between regional entrepreneurship and innovation. Nevertheless, further consideration of the heterogeneity of localities and economic agents (including researchers), as well as of spatial interactions, seems warranted in a regional context. These are all aspects likely influencing the probabilities of matching between inventions and entrepreneurs. Embedding such features into the modeling framework is a straightforward avenue for future research.

From a policy perspective, the large sub-national variations in innovative activity, and the importance of contextual variables in explaining such variations, should draw more attention to the spatial dimension in the design of Chilean innovation policies. The fact that innovative activity is largely concentrated in a few large cities is worrisome from a regional development point of view. But at the same time, the evidence that regional innovation is responsive to policy variables opens the ground for spatially sensitive innovation support programs. In this vein, two important implications arise from our results. First, investments aimed at enhancing local conditions for knowledge creation and diffusion have the potential for harnessing innovation in lagging areas of the country. Second, since one important condition is entrepreneurial activity, there are unexploited opportunities for stronger synergies between entrepreneurship and innovation support initiatives in the context of regional development policies in Chile.

Notes

Michelacci (2003) imposes this restriction which assures the existence of equilibrium research efforts. Intuitively, without some “saturation” of the knowledge stock, research effort has constant or increasing returns to scale in the probability of matching with an entrepreneur, and so such efforts would tend to increase. Eventually, the gains from additional effort would have to decrease as the probability of a match approaches one.

Isla de Pascua (Easter Island), Juan Fernández and Antartica.

Data are available at http://ion.inapi.cl:8080/Patente/ConsultaAvanzadaPatentes.aspx.

The database included invention patents (67.3 % of all applications), utility models (14.6 %), industrial designs (17.8 %) and industrial drawings (0.1 %).

An additional complaint with respect to using patent counts is that they are noisy even as measures of intermediate outputs, greatly differing in their relevance and quality. This problem has stimulated the use of quality-weighting schemes to account for such heterogeneity, making use of data on patent citations (e.g., Aghion et al. 2005). We do not have enough information to establish the quality of each innovation, but we argue that patent applications published by the INAPI entail a non-trivial innovative effort. All applications in the INAPI dataset passed a first technical assessment conducted by INAPI’s experts and thus qualified for the external examination process. This first filter ensures that the applications meet minimum standards of: (1) novelty, (2) industrial applicability and iii) inventive level. Applications include at least a descriptive report (summary and a review of the state of the art), a description and justification of the innovation to be protected and the technical sketches. The detailed content in the application and the costs involved in its preparation (technical advisory, preparation, publication) ensure that the applicant and the government body share what Griliches (1990, p. 1669) succinctly refers to as a “non-negligible expectation to its ultimate utility and marketability.”

As pointed by one of the reviewers, many theoretical models of endogenous growth equate new firms to innovations themselves, so this variable could well be in the left-hand side of our estimation equation. Given the low-levels of R&D investment and the poor performance of the Chilean economy with respect to the production of knowledge and innovation (OECD 2012), it is more realistic to assume that only a small share of new firms in Chile are actually created to implement some new innovation. Therefore, the number of new firms would be a closer indicator of regional entrepreneurship (as usually has been accepted in the regional science literature) rather than of regional innovation levels.

http://www.sii.cl/estadisticas/inicio_actividades.htm (version with date of extraction: 13/06/2011).

We thank an anonymous referee for suggesting the CASEN data source and the interpolation approach used to build the research effort variable.

The database included information of the following specific instruments of the program: Regular Contest, International Cooperation, Research Initiation and Postdoctoral Studies.

1 U.F. is around $US 45.

http://www.sii.cl/estadisticas/empresas.htm (version with date of extraction: 17/08/2011).

We thank an anonymous referee for suggesting this variable.

http://www.sii.cl/estadisticas/inicio_actividades.htm (version with date of extraction: 25/05/2011).

http://www.sii.cl/estadisticas/empresas.htm (version with date of extraction: 17/08/2011).

During the exploratory analysis, we fitted other count data models, such as pooled and panel Poisson and negative binomial. Also, pooled zero-inflated Poisson (ZIP) and negative binomial (ZINB) models that are frequently used with patent data (Agrawal and Cockburn 2003; Andersson et al. 2009). Using these approaches, parameter estimates were consistent with expectations for specifications that included variables available for the period 2002–2008 (1–4), but were very unstable across the various model specifications and estimation methods when the other variables were included. Other estimations included “true” fixed-effects ZINB models (Allison and Waterman 2002), for which convergence of the log-likelihood function was not achieved.

Following a recommendation by one of the reviewers, we also fitted the models including regional year dummies to control for unobserved transitory shocks common to all comunas within an administrative region. These additional dummies induced no substantive changes in the results. These estimates are available upon request.

As suggested by one of the reviewers, we also estimated the models at a different spatial scale. We worked at the level of labor market areas built by Berdegué et al. (2011) following the methodology by Killian and Tolbert (1993). Labor market areas (or functional regions) reflect areas of high intraregional economic and social interaction (Karlsson and Olson 2006), usually delimited by workers’ commuting flows. In Chile, they encompass 3.3 comunas in average. Results (available upon request) for specifications 1–4 with 430 observations indicate that the results for the KM and KPF1 variables remain qualitatively unchanged. The autoregressive parameter, however, becomes negative in some of the specifications. In addition, results for specifications 5–10, based on less than 250 observations, yielded unstable and mostly counterintuitive coefficients. All these results can be attributed to small-sample biases of the WW estimator, reported by Blundell et al. (2002).

Since \(\beta^{s} = \frac{{{\text{d}}\ln (m)}}{{{\text{d}}\ln (s)}} = 1 - \frac{{{\text{d}}\ln (p)}}{{{\text{d}}\ln (k/s)}}\).

In unreported results, we estimated models (3) to (10) using a spatial weight matrix with a bandwidth of 300 km. Available upon request.

References

Acs, Z. J., Anselin, L., & Varga, A. (2002). Patents and innovation counts as measures of regional production of new knowledge. Research Policy, 31, 1069–1085. doi:10.1016/S0048-7333(01)00184-6.

Acs, Z., & Armington, C. (2004). Employment growth and entrepreneurial activity in cities. Regional Studies, 38(8), 911–927. doi:10.1080/0034340042000280938.

Acs, Z. J., Audrestsch, D. B., & Lehmann, E. (2013). The knowledge spillover theory of entrepreneurship. Small Business Economics, 41(4), 757–774. doi:10.1007/s11187-013-9505-9.

Acs, Z., Audretsch, D., Braunerhjelm, P., & Carlsson, B. (2004). The missing link: The knowledge filter entrepreneurship and endogenous growth. Center for Economic Policy Research, London, UK, December No. 4783

Acs, Z. J., & Plummer, L. A. (2005). Penetrating the “knowledge filter” in regional economies. Annals of Regional Science, 39, 439–456. doi:10.1007/s00168-005-0245-x.

Acs, Z. J., & Sanders, M. (2013). Knowledge spillover entrepreneurship in an endogenous growth model. Small Business Economics, 41(4), 775–795. doi:10.1007/s11187-013-9506-8.

Aghion, P., Bloom, N., Blundell, R., Griffith, R., & Howitt, P. (2005). Competition and innovation: An inverted-U relationship. Quarterly Journal of Economics, 120(2), 701–728. doi:10.1093/qje/120.2.701.

Aghion, P., & Griffith, R. (2005). Competition and growth: Reconciling theory and evidence. Cambridge, MA: MIT Press.

Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60(2), 323–351. doi:10.2307/2951599.

Agrawal, A., & Cockburn, I. (2003). The anchor tenant hypothesis: Exploring the role of large, local, R&D-intensive firms in regional innovation systems. International Journal of Industrial Organization, 21(9), 1227–1253. doi:10.1016/S0167-7187(03)00081-X.

Allison, P. D., & Waterman, R. P. (2002). Fixed-effects negative binomial regression models. Sociological Methodology, 32, 245–265. doi:10.1111/1467-9531.00117.

Amorós, J. E., Felzensztein, C., & Gimmon, E. (2013). Entrepreneurial opportunities in peripheral versus core regions in Chile. Small Business Economics, 40, 119–139. doi:10.1007/s11187-011-9349-0.

Amorós, J. E., & Poblete, C. (2011). Global Entrepreneurship Monitor (GEM): Reporte nacional de Chile 2011. Santiago de Chile: Universidad del Desarrollo.

Andersson, R., Quigley, J. M., & Wilhelmsson, M. (2009). Urbanization, productivity, and innovation: Evidence from investment in higher education. Journal of Urban Economics, 66(1), 2–15. doi:10.1016/j.jue.2009.02.004.

Anselin, L., Varga, A., & Acs, Z. (1997). Local geographic spillovers between university research and high technology innovations. Journal of Urban Economics, 42, 422–448. doi:10.1006/juec.1997.2032.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58, 277–297. doi:10.2307/2297968.

Audretsch, D. B., & Fritsch, M. (2002). Growth regimes over time and space. Regional Studies, 36, 113–124. doi:10.1080/00343400220121909.

Audretsch, D., & Keilbach, M. (2004). Entrepreneurship capital and economic performance. Regional Studies, 38, 949–959. doi:10.1080/0034340042000280956.

Beaudry, C., & Schiffauerova, A. (2009). Who’s right, Marshall or Jacobs? The localization versus urbanization debate. Research Policy, 38, 318–337. doi:10.1016/j.respol.2008.11.010.

Benavente, J. M. (2005). Investigación y desarrollo, innovación y productividad: Un análisis econométrico a nivel de la firma. Estudios de Economía, 32(1), 39–67.

Berdegué, J., Jara, B., Fuentealba, R., Tohá, J., Modrego, F., Schejtman, A., & Bro, N. (2011). Territorios Funcionales en Chile. Documento de Trabajo No 102. Programa Dinámicas Territoriales Rurales. Rimisp. Santiago, Chile.

Beugelsdijk, S. (2007). Entrepreneurial culture, regional innovativeness and economic growth. Journal of Evolutionary Economics, 17, 187–210. doi:10.1007/s00191-006-0048-y.

Blundell, R., Griffith, R., & Van Reenen, J. (1995). Dynamic count data models of technological innovation. The Economic Journal, 105(429), 333–344. doi:10.2307/2235494.

Blundell, R., Griffith, R., & Van Reenen, J. (1999). Market share, market value and innovation in a panel of British manufacturing firms. The Review of Economic Studies, 66(3), 529–554. doi:10.1111/1467-937X.00097.

Blundell, R., Griffith, R., & Windmeijer, F. (2002). Individual effects and dynamics in count data models. Journal of Econometrics, 108, 113–131. doi:10.1016/S0304-4076(01)00108-7.

Bosma, N., Stam, E., & Schutjens, V. (2011). Creative destruction and regional productivity growth: Evidence from the Dutch manufacturing and services industries. Small Business Economics, 36, 401–418. doi:10.1007/s11187-009-9257-8.

Bottazzi, L., & Peri, G. (2003). Innovation and spillovers in regions: Evidence from European patent data. European Economic Review, 47, 687–710. doi:10.1016/S0014-2921(02)00307-0.

Braunerhjelm, P., Acs, Z., Audretsch, D., & Carlsson, B. (2010). The missing link: Knowledge diffusion and entrepreneurship in endogenous growth. Small Business Economics, 34(2), 105–125. doi:10.1007/s11187-009-9235-1.

Callejón, M., & Segarra, A. (1999). Business dynamics and efficiency in industries and regions: The case of Spain. Small Business Economics, 13, 253–271. doi:10.1023/A:1008015317323.

Cameron, A., & Trivedi, P. (1997). Regression analysis of count data. Cambridge: Cambridge University Press.

Carree, M. A., & Thurik, A. R. (2003). The impact of entrepreneurship on economic growth. In Z. J. Acs & D. B. Audretsch (Eds.), Handbook of entrepreneurship research (pp. 437–471). Boston, MA: Kluwer Academic. doi:10.1007/0-387-24519-7_17.

CONICYT. (2009). CONICYT, Memoria Institucional 2006–2009. Santiago de Chile.

Feldman, M. P. (1999). The new economics of innovation, spillovers and agglomeration: A review of empirical studies. Economics of Innovation and New Technology, 8(1–2), 5–25. doi:10.1080/10438599900000002.

Feldman, M. P., & Florida, R. (1994). The geographic sources of innovation: Technological infrastructure and product innovation in the United States. Annals of the Association of American Geographers, 84(2), 210–229. doi:10.1111/j.1467-8306.1994.tb01735.x.

Fritsch, M., & Amoucke, R. (2013). Regional public research, higher education, and innovative start-ups: An empirical investigation. Small Business Economics, 41(4), 865–885. doi:10.1007/s11187-013-9510-z.

Fritsch, M., & Mueller, P. (2004). Effects of new business formation on regional development over time. Regional Studies, 38, 961–975. doi:10.1080/0034340042000280965.

Fritsch, M., & Mueller, P. (2007). The persistence of regional new business formation activity over time—Assessing the potential of policy promotion programs. Journal of Evolutionary Economics, 17, 299–315. doi:10.1007/s00191-007-0056-6.

Fritsch, M., & Slavtchev, V. (2007). Universities and innovation in space. Industry and Innovation, 14(2), 201–218. doi:10.1080/13662710701253466.

Gilbert, B. A., Audretsch, D. B., & McDougall, P. P. (2004). The emergence of entrepreneurship policy. Small Business Economics, 22(3–4), 313–323. doi:10.1023/B:SBEJ.0000022235.10739.a8.

Glaeser, E., Kallal, H., Scheinkman, J., & Shleifer, A. (1992). Growth in cities. Journal of Political Economy, 100, 1126–1152.

Glaeser, E., & Kerr, W. (2009). Local industrial conditions and entrepreneurship: How much of the spatial distribution can we explain? Journal of Economics and Management Strategy, 18(3), 623–663. doi:10.1111/j.1530-9134.2009.00225.x.

Griliches, Z. (1979). Issues in assessing the contribution of research and development to productivity growth. Bell Journal of Economics, 10(1), 92–116. doi:10.2307/3003321.

Griliches, Z. (1990). Patent statistics as economic indicators: A survey. Journal of Economic Literature, 28(4), 1661–1707.

Grossman, G. M., & Helpman, E. (1991). Quality ladders in the theory of growth. Review of Economic Studies, 58, 43–61. doi:10.2307/2298044.

Hansen, L. P. (1982). Large sample properties of generalized method of moments estimators. Econometrica, 50, 1029–1054. doi:10.2307/1912775.

Huggins, R. (2003). Creating a UK competitiveness index: Regional and local benchmarking. Regional Studies, 37(1), 89–96. doi:10.1080/0034340022000033420.

Jacobs, J. (1969). The economies of cities. New York: Random House.

Jaffe, A., Trajtenberg, M., & Henderson, R. (1993). Geographic localization of knowledge spillovers as evidenced by patent citations. Quarterly Journal of Economics, 108, 577–598. doi:10.2307/2118401.

Karlsson, C., & Olsson, M. (2006). The identification of functional regions: Theory, methods, and applications. The Annals of Regional Science, 40, 1–18. doi:10.1007/s00168-005-0019-5.

Killian, M. S., & Tolbert, C. M. (1993). Mapping social and economic space: The delineation of local labour markets in the United States. In F. A. Desaran & J. Singelmann (Eds.), Inequalities in labour market areas (pp. 69–79). Boulder: Westview.

Leyden, D. P., & Link, A. N. (2013). Knowledge spillovers, collective entrepreneurship, & economic growth: The role of universities. Small Business Economics, 41(4), 797–817. doi:10.1007/s11187-013-9507-7.

Marshall, A. (1890). Principles of economics. London: MacMillan.

Michelacci, C. (2003). Low returns to R&D due to lack of entrepreneurial skills. The Economic Journal, 113(484), 207–225. doi:10.1111/1468-0297.00095.

Moser, P. (2005). How do patent laws influence innovation? Evidence from nineteenth-century world fairs. The American Economic Review, 95(4), 1214–1236. doi:10.1257/0002828054825501.

OECD. (2012). OECD science, technology and industry outlook 2012. Paris, France.

Paci, R., & Usai, S. (1999). Externalities, knowledge spillovers and the spatial distribution of innovation. GeoJournal, 49, 381–390. doi:10.1023/A:1007192313098.

Parker, S. C. (1996). A time series model of self-employment under uncertainty. Economica, 63(251), 459–475. doi:10.2307/2555017.

Parker, S. C. (2009). The economics of entrepreneurship. Cambridge: Cambridge University Press.

Pe’er, A., & Vertinsky, I. (2008). Firm exits as a determinant of new entry: Is there evidence of local creative destruction. Journal of Business Venturing, 23, 280–306. doi:10.1016/j.jbusvent.2007.02.002.

Porter, M. E. (1990). The competitive advantage of nations. New York: The Free Press.

Roodman, D. (2009). How to do xtabond2: An introduction to “difference” and “system” GMM in Stata. The Stata Journal, 9(1), 86–136.

Schumpeter, J. A. (1942). From capitalism, socialism and democracy. New York: Harper.

van der Panne, G. (2004). Agglomeration externalities: Marshall versus Jacobs. Journal of Evolutionary Economics, 14(5), 593–604. doi:10.1007/s00191-004-0232-x.

van Praag, C. M., & Versloot, P. H. (2007). What is the value of entrepreneurship? A review of recent research. Small Business Economics, 29(4), 351–382. doi:10.1007/s11187-007-9074-x.

Windmeijer, F. (2000). Moment conditions for fixed effects count data models with endogenous regressors. Economics Letters, 68, 21–24. doi:10.1016/S0165-1765(00)00228-7.

Windmeijer, F. (2002). ExpEnd, a gauss programme for non-linear GMM estimation of exponential models with endogenous regressors for cross section and panel data. Working Paper, Institute for Fiscal Studies.

Wooldridge, J. M. (1991). Multiplicative panel data models without the strict exogeneity assumption. Working Paper 574, MIT, Department of Economics.

Zucker, L. G., Darby, M. R., Furner, J., Liu, R. C., & Ma, H. (2007). Minerva unbound: Knowledge stocks, knowledge flows and new knowledge production. Research Policy, 36, 850–863. doi:10.1016/j.respol.2007.02.007.

Acknowledgments

We are grateful to Fernanda Castañeda for her research assistance and to Carlos Peña at the National Institute of Intellectual Property (INAPI) for providing us a detailed background of the patent application system in Chile. We appreciate useful comments and suggestions from Henri de Groot, Marcelo Lufin, two anonymous referees, SBEJ managing editor Erik Stam and participants at the 53rd Congress of the European Regional Science Association and at the 3rd Congress of the Regional Science Association of the Americas. Modrego wishes to thank the financial support of Project FONDECYT 1130356 of the National Commission of Scientific and Technological Research of Chile and of the Territorial Cohesion for Development Program funded by the International Development Research Centre of Canada (IDRC).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Modrego, F., McCann, P., Foster, W.E. et al. Regional entrepreneurship and innovation in Chile: a knowledge matching approach. Small Bus Econ 44, 685–703 (2015). https://doi.org/10.1007/s11187-014-9612-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-014-9612-2