Abstract

The entrepreneurship and dynamic capabilities literature adds to our understanding of how strategic change can drive firm performance. We draw on a recent survey of US SMEs to determine whether entrepreneurial ventures have dynamic capabilities, and, if so, whether differences in the characteristics of those ventures lead to differences in how dynamic capabilities benefit firm performance. We find that most entrepreneurial ventures report having such capabilities and that their differences in age and size lead to differences in how dynamic capabilities affect firm performance. We consider how these results redefine the overlap of the dynamic capabilities view literature with the entrepreneurship literature, because the redeployment of resources to create and adapt to opportunities that defines what are dynamic capabilities lies at the core of what is entrepreneurial activity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Two compelling bodies of literature have emerged to explain why some firms prosper during strategic change while others do not. Research in entrepreneurship (ENT; Schumpeter 1934) and in the dynamic capabilities view (DCV; Eisenhardt and Martin 2000; Teece et al. 1997; Zollo and Winter 2002) offer contrasting explanations for how firms generate rents by creating, adapting to, and exploiting change (Mahoney and Pandian 1992). ENT research describes how ventures realize short-lived rents by utilizing risky strategies and unique insights to confront dynamic environments. DCV research describes how existing firms realize quasi-rents by the use of more efficient redeployments of a firm’s unique resources to match changing environments (Mahoney and Pandian 1992; Penrose 1959; Rumelt 1984). We explore the delineation between these two overlapping theories by analyzing how venture characteristics (i.e., firm age and size) affect the relationship between capability-enhancing processes and firm performance.

There has been relatively little empirical work done to contrast these two bodies of literature (Zahra et al. 2006). Exceptions include studies by Arthurs and Busenitz (2006), who delineate between regular dynamic capabilities and ones that are more entrepreneurial, and by Branzei and Vertinsky (2006), who categorize an entrepreneurial venture’s dynamic capabilities by lifecycle stage. We take a different approach to contribute to the literature by considering contingencies rather than typologies.

To confront the contingencies, we must begin by addressing the issue of whether entrepreneurial ventures have dynamic capabilities (DCs) in the first place. Some academics rule out this possibility (e.g., Helfat and Peteraf 2003), while others assert it by definition (e.g., Newbert et al. 2008; Weerawardena et al. 2007). Assuming that entrepreneurial ventures do have such capabilities, we can then address the main issue concerning whether differences in the use of DCs by entrepreneurial ventures lead to differences in firm performance (Zahra et al. 2006). We address these core issues through the analysis of recent survey data of US entrepreneur-managers that focuses on two research questions: Do entrepreneurial ventures have dynamic capabilities? Assuming they do, how do their defining characteristics affect the ‘DC–firm performance’ relationship? Our contribution to the literature is threefold: (1) we provide one of the few studies of DCs over a wide cross-section of US small- and medium-sized enterprises (SMEs), and one that includes new information about DC costs and levels; (2) we provide the first study of the contingency effects of SME characteristics in the relationship between DCs and firm performance; and (3) we discuss how these new contingencies inform the overlap and delineation of the ENT and DCV literature.

Given that the DCV literature is still young in its conceptualizations (Winter 2003), it is important to specify our definitions of relevant terms. We define a firm’s operating capabilities (OCs) as the ways by which the firm gets its day-to-day business done, compatible with past characterizations, such as Zollo and Winter’s (2002, p. 340) explanation of OCs involving “the operational functioning of the firm (both staff and line activities)…”. We define a DC as the firm’s ability to enhance (reconfigure) its OCs, compatible with past characterizations, such as Zahra et al.’s (2006, p. 921) “…ability to change or reconfigure existing substantive capabilities…” We also distinguish between a highly-routinized DC and a less-formal DC; the former is a repeatable method that is expected to produce the intended results regarding changing the firm’s OCs.Footnote 1 This definition is consistent with past characterizations, such as Zollo and Winter’s (2002, p. 339) explanation of dynamic capabilities as “routinized activities directed to the development and adaptation of operating routines”; (p. 340) “dedicated to the modification of operating routines…”. And we define entrepreneurial ventures as SMEs; those ventures with less than 500 full-time employees and less than 20 years of age since founding (e.g., Santarelli and Sterlacchini 1990).

We chose to access data from these entrepreneurial ventures about their DCs through the survey method for two main reasons. First, it is one of the standard ways used in the DCV literature to obtain DC data, accounting for about 40 % of all DCV-related empirical work. The reason why primary data methods dominate the DCV work is because DCs are complex and new concepts to managers, concepts that are more likely to be accurately captured when respondents are given details, such as the explanations and examples that are easier to provide in a survey. Second, primary data methods are also a standard way of reaching entrepreneurial ventures, because most are privately-held (i.e., secondary data are difficult to obtain). Because we were interested in a large sample, we chose the survey over the case method, following other research in entrepreneurial ventures and DCs (e.g., Newbert et al. 2008).

We proceed in our analysis as follows. First, we drew from the DCV and ENT literature to generate our hypotheses addressing our research questions. Second, we explain our empirical approach: we describe the data generation and address the bias issues, we describe our variables, and we describe the empirical methods. Third, we describe the results of the analysis. Fourth, we discuss the results and their implications, as well as the limitations. Fifth and last, we offer concluding remarks in addition to areas for future work.

2 Hypothesis generation

2.1 The question of dynamic capabilities at entrepreneurial ventures

The first question we address is whether entrepreneurial ventures have DCs. On the one hand, there are those who say no. Teece and Pisano (1994) do so implicitly by claiming that building a DC takes years to decades—a requirement that new firms cannot meet by definition. Helfat and Peteraf (2003, p. 1004) state it explicitly: “… in a new-to-the-world organization, dynamic capabilities do not enter as a factor determining the evolutionary path. Indeed, they cannot, since a new organization has no dynamic capabilities”. On the other hand, there are also those who say yes. Arthurs and Busenitz (2006), Weerawardena et al. (2007), and Winter (2003) do so implicitly. Zahra et al. (2006, p. 941) are more explicit, for example, in their Table IV’s category heading of ‘DCs in New ventures’. Newbert et al. (2008, p. 8) are also explicit: “We define these entrepreneurship skills as a dynamic capability…”. To address these contrasting views on this question, we use a survey to determine whether the US SME managers themselves believe they do or do not have DCs.

We now argue the opposing hypotheses regarding whether entrepreneurial ventures—young or small SMEs—are likely to have DCs. We begin with the arguments against entrepreneurial ventures having DCs. These are based on the assumed lack of long-term motivation, resources, and familiarity for young and small ventures (Helfat and Peteraf 2003). Young firms do not have enough time with their new OCs to form a routine way of altering them. Young firms may gain no clear net benefit to using a highly routinized OC change method over using a more ad hoc method (Winter 2003). This is because the DC is an investment that trades off a high upfront fixed cost for low ‘OC change’ variable costs, and that high initial cost does not benefit young and small firms that need to focus on the short-term in order to address the liabilities of newness and smallness (e.g., Audretsch and Mahmood 1995; Caves 1998; Strotmann 2007). Small firms lack the slack and the range of OC targets to make a routinized change method—a method that would require dedicated resources—economically attractive (Delmar and Shane 2003). Small firms are less likely to meet the scale needed to justify DCs. Finally, small and young firms may be less likely to afford the experienced managerial talent required to build, maintain, and deploy DCs (Mahoney 2005). We thus hypothesize:

H1a

Entrepreneurial ventures do not have dynamic capabilities.

We now consider the opposing hypothesis. The case for entrepreneurial ventures having DCs begins with the counter-arguments to the points made above. Many young and small firms begin with expansion plans that are more than short term; many are motivated to consider more long-term investments—like DCs—because the managers foresee many OC changes that need to be done in order for their firms to grow. Many young and small firms plan for growth, where those plans involve having the slack resources for the creation and use of DCs to get to future higher levels of performance. In terms of the familiarity issue, the counter-argument is that, given the founding entrepreneurs would have brought in the main resources (e.g., their social networks) to the venture, they would not only be familiar with those resources but also with how to change them; i.e., the founders would have brought along their own DCs to the new venture.

The case for entrepreneurial ventures having DCs is also supported by several theoretical assertions. Arthurs and Busenitz (2006, p. 200) state: “…as an entrepreneurial venture advances, the need for dynamic capabilities becomes apparent...”. Branzei and Vertinsky (2006) link entrepreneurial ventures to DCs via innovation. The main logic behind the arguments for entrepreneurial ventures having DCs is that what an entrepreneur does is what a DC is. In theory, entrepreneurs redeploy accessible resources to create and/or exploit new opportunities to make profits, and that redeployment is, by definition, a dynamic capability (Zollo and Winter 2002). Thus, in ENT theory, what it is to be entrepreneurial aligns closely with what it is to have a DC—the ability to change OCs in pursuit of competitive advantage. Entrepreneurial ventures need to have DCs in order to survive and prosper. A firm with the ability, motivation, and awareness (e.g., the familiarity, managerial talent, slack resources, long-term vision, and desire to grow in a changing competitive context) to invest and use such OC change methods is more likely to discover, exploit, and defend profitable opportunities. The opposing hypothesis follows:

H1b

Entrepreneurial ventures have dynamic capabilities.

The expected results from testing this set of opposing hypotheses is that the level of DCs at entrepreneurial ventures is likely to lie between the two extremes—of none and all—proposed. For example, there are several reasons why it is unlikely that all small or young SMEs will self-report DCs in any given survey. Not all SMEs are successful in the real world because mistakes are made; some SMEs will fail because they lacked DCs. Some SMEs will have chosen not to have DCs because these firms would have been created to exist temporarily (i.e., without a need to change)—e.g., as ‘transitional employment’. Other SMEs will have chosen not to have DCs because they had targeted stable niche markets (e.g., buggy-whip manufacturing) where changing OCs is not likely to be required.

2.2 SME differences of size and age that affect the effects of DCs on firm performance

We now argue that entrepreneurial ventures will have a different DC-use experience and that those differences are likely to be embodied in performance differences. To make the argument for those contingencies, we must first argue that a significant relationship between DCs and firm performance exists. We can then argue how certain firm characteristics (i.e., age and size) of entrepreneurial ventures would affect that relationship between DCs and firm performance.

The theoretical DCV literature that argues for a positive relationship between DCs and performance for any firm, including entrepreneurial ventures, is deep (e.g., Cavusgil et al. 2007; Eisenhardt and Martin 2000; Teece 2007; Teece and Pisano 1994; Teece et al. 1997; Zahra et al. 2006). The empirical support in the DCV for the positive relationship between DCs and performance is similarly deep and mostly consistent. Researchers find that DCs increase firm performance by helping firms change operations more efficiently and effectively—e.g., to provide the firm with advantageous new strategies, new markets, new skills, new organizational forms, and new internationalization. Papers that link financial performance explicitly to DCs report a significant positive relationship and include works by Adner and Helfat (2003), Lampel and Shamsie (2003), Narasimhan et al. (2006), Wu (2007), and Yalcinkaya et al. (2007). Clearly, the idea that DCs should improve firm performance enjoys both theoretical and empirical support.

Clearly, the literature provides evidence supporting a positive relationship between DCs and firm performance ceteris paribus, and we now consider some relevant contingencies of that relationship. We assume that a DC is like many other ‘strategic tools’ that have the potential to increase firm performance. And like any such tool, its benefits are dependent on how the tool is used. That use is a function of several factors, such as the characteristics of who uses it. For example, a tool’s effect on a project’s outcome is contingent on the skill of the tool’s user—a just-in-time manufacturing system can provide efficiency benefits (e.g., in lower inventory costs) when managed well, but can be very costly (e.g., in losses when lines are shut down due to materials shortages) when not managed well.

We expect that entrepreneurial ventures will be unique in several dimensions, and that some of those ‘user’ characteristics are likely to affect the benefits of applying the strategic tool—here, the DC. Two characteristics normally attributed to an entrepreneurial venture are newness and smallness. Footnote 2 By new we mean the SME is only a few years out from being founded as an independent entity. By small we mean the SME has few employees and resources. Smallness is often due to capital access restrictions that arise from imperfections in the capital markets caused by informational hazards, or from a lack of collateral in knowledge-based businesses, etc. (e.g., Amit et al. 1990). Smallness can also be a choice of initial form, as a way to mitigate the risks from the many uncertainties that new ventures face (e.g., in technology, demand, competition, liquidity, and so on; e.g., Venkataraman 1997). And smallness may also be the appropriate choice to match the scale of small opportunities.

We now consider how newness and smallness are likely to affect the relationship between DCs and firm performance at SMEs. We begin by analyzing the effect of youth on the way DCs can benefit the firm. A younger firm is not weighed down by the inertia existing at older firms, inertia that would impede the learning required to effectively use DCs (Zahra et al. 2002). With OC changes as yet infrequent at the younger firm, DCs will increase learning more and have a greater impact on future firm performance (Zollo and Winter 2002). Most importantly, the motivation of employees is greater at younger SMEs. Those employees care more about the firm being successful at adapting to change for several reasons: many of the employees are likely to hold equity in the firm and so have bigger personal monetary stakes in the success of the SME. The employees are also likely to have bigger personal non-monetary stakes in the success of the firm; for example, that is the case for the employees who are hoping to gain greater marketable management experience in that firm as it grows. Employees are likely to feel a bigger sense of responsibility at the younger firm because they are more likely to have had input into early significant decisions and into actions that they cannot shirk from—given there is no place to hide at most young firms (Carayannopoulos 2009). Besides the greater motivation, employees at young firms are more likely to have greater ‘room’ to adapt because fewer frictions and politics would have built up there compared to at more established ventures. Given that early actions have magnified effects at new ventures (i.e., to meet hurdles to attain further funding), the motivation to enhance OCs efficiently, effectively, and quickly is very high. Combining the greater motivation and opportunity to use DCs at younger SMEs with the positive effects of DCs on firm performance, we propose our second hypothesis:

H2

Younger SMEs will benefit more in firm performance from having dynamic capabilities.

While the energy of youth in SMEs is beneficial to the ‘DC–firm performance’ relationship, we expect that the ‘smallness’ characterizing most entrepreneurial ventures will be costly to that relationship. Smaller SMEs will not obtain the advantages from DCs that larger SMEs do for several reasons. First, we expect there to be scale and scope economies for any learned capability, including a DC (e.g., Bowman and Ambrosini 2003; Zollo and Winter 2002). Such economies come from: (1) the spreading of the fixed-costs-related-to-learning-a-DC over a larger set of resources and products to which it is applied; (2) the greater chance for innovation that comes from applying the DC to a larger and more diverse range of OCs; (3) the greater chance for innovation that comes from applying the DC to a larger base of absorbed knowledge; (4) the opportunities for greater specialization economies at larger firms where DC-specialists can drive down a learning curve further than the more jack-of-all-trades employees at smaller SMEs (Macher and Mowery 2009); and (5) the reduction in the restrictions on DC applications when resource bases are larger. Thus, because smaller SMEs will not benefit as much by the scale economies in applying DCs relative to larger firms, smaller SMEs will experience relatively lower performance outcomes.

The scale and scope arguments regarding DC use to support the idea that smallness is relatively detrimental to firm performance are made with the assumption that the SME is interested in growing. For firms uninterested in growth—e.g., for those focused on a very specific niche—the argument turns to the question of the appropriateness of having a DC in the first place. For a firm without any intention of extending its performance—where growth is one option to do so—there is less need for a routinized method of changing OCs, as these are less likely to need to be changed. In that case, the extra cost of having a DC will also cause lower performance in such a small, niche-focused SME that chose to invest in a DC.

So, either through scale effects of through inappropriate choice, smallness is likely to hurt the ‘DC–firm performance’ relationship. Our third hypothesis follows:

H3

Smaller SMEs will benefit less in firm performance from having dynamic capabilities.

3 Methods

3.1 Data

We use an electronic survey to generate the data for analysis of our research question. Primary data sourcing is the standard approach when assessing a complex factor, like a change-capability, and when accessing privately-held firms, like most SMEs. Instead of using a case or interview technique we chose the survey; this is because we were more interested in a high sample count rather than a very detailed picture of a process. Although many publicly-accessible larger enterproses and SMEs may issue statements about their adaptability and their DCs, this information is generally not comparable across firms and it is not broken down by specific issues; hence, the use of a survey was deemed appropriate (Christmann 2000).

We developed the survey in two stages. In the first stage, we designed the initial draft based on a review of the literature in DCV and entrepreneurship. We presented this version to 15 local SME owner-managers for pretest and review in order to check the validity of the items. We also used secondary data to check for common method bias in the performance questions, and found no evidence of that bias. In the second stage, we used feedback from these entrepreneur-managers to design the final survey instrument that was then entered into Zoomerang.com’s system to be deployed electronically to a target audience by MarketTools—the market research company parent of the on-line survey firm, Zoomerang.

The survey was deployed in late 2008, targeting SMEs in the USA. It was conducted on-line by MarketTools, an independent firm. When using data from third-parties (e.g., databases from Thompson Financial, etc.), and from surveys in general, it is important to consider several issues to assure quality and validity; we do so now.

The first issue is the quality of the sampling method. MarketTools uses a quality-assured sampling method where they validate that the respondents are who they say they are, that no respondents take the survey twice, and that respondents are engaged. Their samples have been tested in independent studies where they have been shown to provide accurate representations of the US population based on checks against census data.

The second issue is the use of the on-line method. The electronic survey technique (EST) is newer and entails additional concerns versus a mailed survey; see Simsek and Veiga (2000). EST was an appropriate choice for this current paper for several reasons. MarketTools’ sample respondents consist of members that regularly complete on-line surveys. They are scattered and mobile and harder to reach through regular mail. EST is less prone to non-sampling errors such as data collection and data processing. And none of the common problems in EST applications applied to our application: bias in sampling frames due to users versus non-users of the Internet (and e-mail) was not a concern due to the MarketTools’ database of members; lack of universal coverage was not an issue given the validated representative population of MarketTools; and compatibility problems and technical problems simply did not exist with the Internet-based survey method.

The third issue is representativeness of the responses received. Table 1 provides several descriptive outcomes from the survey that netted 307 completed responses. The distribution along age, size, and geographic categories (and across other items not formally reported) provided for us confidence in the representativeness of the sample. For example, firms 10 years old and newer comprised half of the sample; firms employing 10 or fewer workers comprised half of the sample; and firms were geographically spread in a manner consistent with the population (e.g., with the largest concentration in the northeast). Firms did mostly service and production in the industry supply chain. And the sample represented firms from across the major economic sectors in North America (Newbert 2005).Footnote 3

The fourth issue concerns the responses, in terms of the response rate and non-response bias. The response rate was over 24 %, which is within the range common in the SME literature and when surveys heavily involve new and small businesses (Alreck and Settle 1985; Dennis 2003; Newby et al. 2003). To evaluate non-response bias, we tested for statistically significant differences between completed surveys recorded early and those recorded late (Armstrong and Overton 1977; Lambert and Harrington 1990), and we did not find a bias.Footnote 4

The fifth issue arises from surveying SMEs—where it is very common for a single responder to provide information on both the explanatory and dependent variables. In other words, there are concerns over single-respondent bias and common method bias. We employ the suggested remedies and assessments for each bias, as explained below (Krishnan et al. 2006; Podsakoff et al. 2003).

Common method bias may pose problems for survey research that relies on self-reported data, especially when the data are provided by a single respondent—i.e., the same person at the same time. The usual concern is that these biases will artificially inflate observed relationships between focal variables. We used both procedural and statistical approaches to minimize the effects.Footnote 5 The procedures and the statistical results suggested that common method bias and single-respondent bias were not serious problems in this study.

3.2 Variables

The “Appendix” provides the detailed descriptions of the survey-based variables involved in the formal statistical analyses. Dependent, explanatory, and control variables are based on survey items that were sourced for the most part from previous surveys concerning entrepreneurship, dynamic capabilities, and firm performance (e.g., Covin and Slevin 1989; Lumpkin and Dess 2001; Menguc and Auh 2006; Miller and Friesen 1982; Newbert 2005; Newbert et al. 2008; Sher and Lee 2004; Wu 2006; Yalcinkaya et al. 2007; Zahra et al. 2002). We relied on past research to select a range of items that were considered to affect our dependent variables.

The dependent variables is firm_performance, which is a four-item construct regarding questions of “relative to rivals, how would you compare the firm’s current performance in terms of financial and competitive measures” (e.g., the items are RoA, sales growth, market share, and increase in competitive position; it is a construct based partially on Zahra et al. 2002) The construct’s Chronbach alpha levelFootnote 6 is α = 0.870. The assessment of performance through a multi-dimensional measure has precedence (e.g., in the marketing literature; Capron and Hulland 1999); it is often used in survey-based research (e.g., Vorhies and Morgan 2005) and has been legitimized in past research (Venkatraman and Ramanujam 1986).

Our first research question depends on our measure of the DC. To delineate firms with DCs, we asked the following questions: Would you agree that your firm has a routine method for changing your main Operating Capability, and does it have a repeatable method that it uses that produces intended results regarding the changing of your firm’s main Operating Capability?Footnote 7 If they answered no to that, then they were asked “Would you agree that your firm uses a less-routinized way to change its Operating Capabilities in a significant way nonetheless?” If the response was no to both of these questions, then we coded the firm as not having a DC. There were 220 of the 307 responses that indicated some form of DC (i.e., either a routinized_DC or an other_DC); we focused on this subset of 220 firms to test the hypotheses that involved changes in the relationship between DCs and firm performance. This is because changes in that relationship apply only to firms with the DCs to have the relationship.

To explain the firm_performance score, we focused on both the industry-level variables and the firm characteristics, including DC-related factors. There are two main explanatory variable sets in this study: firm age/size, and firm DC quality. The category-type variable young (old) indicates a firm age level of 5 years and less since founding for young (10 years and more for old). The category variables small (large) indicates the firm’s size in terms of the number of full-time-equivalent employees of 10 employees and less for small (100 employees and more for large).

Drawing on the DCV literature, we assumed that the firm’s DC quality would affect, positively, firm performance (what we refer to as the ‘DC–firm performance’ relationship). We measure the effectiveness of OC enhancement in the variable DC_quality; it is based on the multi-item construct regarding the question of how well has your firm’s ability to change its Operating Capabilities in the past produced specific enhancements in day-to-day business processes (there are 13 items in the construct, where α = 0.945). We also include the integer variable OC_change_frequency to quantify the use of firm DCs.

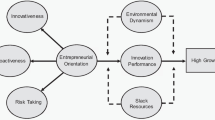

As controls, we considered other firm characteristics that have been shown to affect SME performance in previous studies (e.g., Rauch et al. 2009; Simsek et al. 2007; Thornhill and Amit 2003). The variable resources is based on the multi-item construct that rates the abundance of firm resources (there are 9 items in this construct, where α = 0.846). There are three variables measuring different aspects of management attitude. The variable locus_of_control rates how much the firm’s management believes performance is in their control versus being based on luck (based on Lumpkin and Dess 2001). The variable entrepreneurial_orientation is a multi-item construct rating of the firm’s competitiveness, aggressiveness, risk-lovingness, boldness, etc. (and is based on Covin and Slevin 1989; Lumpkin and Dess 2001; Miller and Friesen 1982); there are 11 items in the construct (where α = 0.923). The variable outcome_focus is a multi-item construct that rates the firm’s focus on getting the job done by adaptation and innovation (and is based on Newbert et al. 2008); there are 4 items in the construct (where α = 0.808).

Industry conditions have also been proven important in explaining firm performance variance (e.g., Lichtenthaler 2009; Pavlou and El Sawy 2011; Simsek et al. 2007). Thus, we included the variable industry_hostility in the analysis; it is a multi-item construct that rates the firm’s main industry in terms of its riskiness, stress, and domination (there are three items in the construct, where α = 0.759). We also included the variable industry_turbulence in the analysis; it is a multi-item construct that rates the firm’s main industry in terms of its dynamism (in marketing, technology, and production) and its predictability (in rival and customer actions) (there are five items in the construct, where α = 0.817). These variables control for the effects of competitive environments where changes are either necessary for survival (e.g., in the DCV) or advantageous for entry (e.g., in entrepreneurial activity). In addition, we included dummy variables for industries and for geographic regions (but we do not formally report these individually in the results).Footnote 8

In a follow-up survey, to inform our main findings, we also obtained specific information about the characteristics of the DCs used. For the firms that indicated they had a routinized DC, we also gathered information on: the effect of their DCs on product differentiation; the rarity of their DCs; the inimitability and non-substitutability of their DCs; and the initial costs and the maintenance costs of their DCs.

We provide the main descriptive statistics in Table 2 (where the top depicts the full sample and the lower depicts the firms-with-DCs subsample). Note that the simple positive correlation result linking both DC_quality and routinized_DC’s to firm performance is consistent with most previous empirical work in the DCV (e.g., Adner and Helfat 2003; Ettlie and Pavlou 2006; Lampel and Shamsie 2003; Narasimhan et al. 2006; Wu 2007; Yiu and Lau 2008). Regarding the focal moderators—youth and smallness—we note the following significant correlations. Youth is significantly correlated negatively with both ‘locus of control’ and firm resources. It is not surprising to find infant firms being resource-poor. And, apparently, managers at newer firms are also more likely to feel at the mercy of the environment rather than feel ‘in control’, consistent with their early positions on the learning curve. Smallness is significantly correlated negatively with entrepreneurial orientation, resources, and operational change frequency, and positively with having ‘less-routinized’ DCs. Again, it is not surprising for small firms to be resource-poor. It is not surprising for smaller firms to be less aggressive and risk-taking. It is not surprising for small firms to change operations less as they have a narrower range of tasks that would be exposed to the threats and opportunities of change. The result that smaller firms have ‘less formal’ DCs may provide one explanation for why smallness may be less beneficial to performance—e.g., because small firms choose lower-quality DCs.

3.3 Empirical methodology

To address the first research question, we assess the relevant statistics from the survey data to determine what proportion—both absolutely and relatively—of entrepreneurial ventures have DCs. We first use a proportions test (i.e., two-tailed z-statistic) to assess whether our SMEs never report DCs (H1a) or always report them (H1b). From that test of ‘absolute’ proportion, we move to a test of ‘relative’ proportions. We use means t tests (i.e., two-tailed, and assuming unequal sample variances) to compare the small-or-young subsample against the large-or-old subsample to determine whether entrepreneurial ventures report significantly less DCs as so-called regular firms (i.e., those firms normally studied in the DCV).

To address the second research question (covering both H2 and H3), we use hierarchical ordinary least squares regression (OLS) analysis on firm performance (Aiken and West 1991). This is the standard methodology for survey-based studies (e.g., studies limited in data collection) that add new interaction terms and have similar sample sizes and similar numbers of variables (e.g., Arend 2012; Fairlie and Robb 2009; Gardner 2012; Grant 2012; Simsek et al. 2007). This allows us to isolate the effects of the two focal contingencies of age and size on the ‘DC–firm performance’ relationship. To do that, we look at the significance and direction of the interaction between the firm characteristic (i.e., of age or size) and DC quality in its correlation with firm performance. Specifically, the interaction implies that the relationship between one predictor (DC_quality) and the outcome (firm_performance) varies as a function of another predictor (here, the firm age or size terms). We hypothesize that age and size moderate the ‘DC–firm performance’ relationship for SMEs. In the reduced form equation below, we denote the outcome as ‘y’, the focal predictor as ‘x’, and the moderator as ‘z’. The specification of the empirical model is then:

where the βs represent regression weights and ε the error.

Because we could not use the category terms—young and small—to calculate the interaction terms, we used the bases for those categories—i.e., the continuous variables of firm age and firm size—to calculate the interactions. Further, we centered all relevant variables at the means (Aiken and West 1991; Belsley et al. 1980) prior to the calculation in order to address multicollinearity issues. Collinearity diagnostic tests indicated no serious problems in the regression models (all VIFs were below a 2.5 level).

We assessed the hierarchical OLS analysis for robustness. First, we reran the analysis on the full sample of firms; in that analysis, we included dummy variables to control for DC type. Second, we checked for endogeneity related to choosing to have a DC by running a Heckman-style self-selection model. The first-stage probit analysis was run to explain the choice of a DC.Footnote 9 The second-stage selection-corrected OLS was run to explain firm performance in a treatment model, including both the DC choice term and the lambda (inverse Mill’s ratio variable) calculated in the first-stage probit analysis.

4 Results

On the one hand, the first two-tailed z-statistic proportions test revealed that the proportion of entrepreneurial ventures (i.e., small or young SMEs) was significantly greater than the zero percent level, supporting the opposite of H1a. On the other hand, a second test revealed that the proportion of entrepreneurial ventures was significantly less than the 100 % level, supporting the opposite of H1b. The proportion reported by young or small SMEs in our sample was approximately 74 %. In other words, the proportion favored H1b more than H1a, Footnote 10 but neither extreme case was verified.

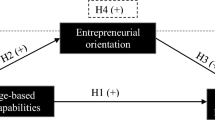

After testing the first hypotheses based on ‘absolute’ proportions, we turned to testing the ‘relative’ proportion of entrepreneurial ventures reporting DCs. We did so by comparing the relative levels of DC-related measures of young-and-small SMEs to those of old-and-large firms. We summarize those results in Fig. 1. There were no significant differences in means (at the p < 0.10 level for two-tailed t tests) for the young or small or young-and-small SMEs versus the average SME (or versus old or large or old-and-large SMEs) across the measures of the proportion of firms with routinized DCs and with any DC. Further, there were no significant differences in the firm performance and DC quality levels, or even in the differences in the proportion of firms with second-level routinized DCs. In other words, the testing that was based on relative proportions did not support H1a, as there was no difference in the proportion of entrepreneurial ventures having DCs compared to the proportion of ‘regular’ firms having DCs.

To summarize, neither extreme hypothesis (H1a or H1b) was supported. Supplemental testing indicated that the levels of self-reported DC attainment—across several measures—were similar between young or small (and young-and-small) SMEs and old or large (and old-and-large) SMEs. Additionally, the young and/or small SME DC levels were consistent with levels reported in previous studies of ‘traditional’ firms (i.e., studies not focused on SMEs) (e.g., Ettlie and Pavlou 2006; Lichtenthaler 2009; Protogerou et al. 2012).

We summarize the main testing of H2 and H3 in the hierarchical OLS regression analysis in Table 3; we provide the robustness checks in Table 4.

The two data columns in Table 3 depict the hierarchical OLS analysis on the subsample of 220 firms reporting having DCs. The full model—the one including the two interaction terms—is a significant improvement over the base model (F test at the p < 0.01 level). The first three data columns in Table 4 provide the first robustness check, depicting a similar hierarchical OLS analysis on the full sample of 307 firms. The full model (i.e., the third data column in Table 4) is a significant improvement over both the base model and the model with the dummy variables controlling for DC type (F test at the p < 0.01 level). The last three data columns in Table 4 provide the second robustness check, depicting the Heckman-style two-stage self-selection corrected analysis on the full sample of 307 firms. The fourth data column in Table 4 is the first-stage probit analysis that predicts the choice of a routinized_DC; it is significant.Footnote 11 The full model (i.e., the last data column Table 4) is a significant improvement over the base selection-corrected OLS model (F test at the p < 0.01 level). (Note that neither the coefficients on the ‘DC choice’ term, or the lambda term, were significant in the corrected OLS equations; in other words, there was no evidence of an endogeneity effect.) The main result to note, however, consistent across all full models, is that each interaction variable was significant in the predicted direction.Footnote 12

The interaction with age was significantly negatively correlated with firm performance (age × DC_quality: β = −0.205; p < 0.05), supporting H2. Younger SMEs (i.e., those with a lower age) enjoyed higher performance from having a more effective DC than older SMEs (i.e., as the interaction term would provide positive effects on firm performance for firms below the mean age, due to the mean-centering in the calculation). In other words, younger SMEs benefited relatively more from the ‘DC–firm performance’ relationship (where that relationship was expressed in the ‘DC_quality—firm_performance’ positive significant correlation). The interaction with size was significantly positively correlated with firm performance (size × DC_quality: β = 0.080; p < 0.05), supporting H3. Smaller SMEs (i.e., those with a lower size) experienced lower performance from having a more effective DC than larger SMEs (i.e., as the interaction term would provide negative effects on firm performance for firms below the mean size, due to the mean-centering in the calculation). In other words, smaller SMEs benefited relatively less from the ‘DC–firm performance’ relationship.

There are several other results to note from Tables 3 and 4. First, there are the significances and signs of the focal category variables of youth and smallness to consider. In the ‘full’ models (i.e., the regression models with all the controls and interactions), the young and the small variable coefficients are significant (at the p < 0.05 level) and in the expected negative direction—indicating liabilities of newness and smallness (e.g., Audretsch and Mahmood 1995; Caves 1998; Strotmann 2007). Second, there are several controls that are significant to consider. As expected, correlated with higher firm performance was the firm’s level of resources and its entrepreneurial orientation; these results are consistent with previous studies on scale- and innovativeness-related benefits. Also positively correlated was adaptability—as measured by how often the firm changed its operations; this result is also consistent with previous studies on the benefits of flexibility and fit. Negatively correlated with firm performance was industry hostility; this is consistent with studies on contextual competitive pressures (e.g., in industrial organization). Third, the regression significance levels indicate that the base models were reasonably well specified (e.g., compared with past analyses of firm performance using survey-based research). It is always possible to increase the explanation of variance by including additional variables, but the usual issues involving the survey methodology constrained the data available. That said, the base model did include the usual standard controls for the analysis of SME performance: firm age and size, industry and location, entrepreneurial characteristics and orientation, firm resources and dynamism, and industry characteristics.

We supplement our main analysis with descriptive results from a follow-up survey on the characteristics of DCs in firms reporting routinized DCs, as shown in Table 5. We note several significant differences relevant to DC characteristics for the more entrepreneurial firms (i.e., the young and small SMEs). The young firms report significantly more rare, less-imitable, and less-substitutable DCs than the older firms, with the tradeoff coming in higher maintenance costs for those DCs.Footnote 13 The smaller firms report less-costly DCs than their larger counterparts, with a tradeoff in lower differentiation value of those DCs on their products. In other words, younger SMEs focused on DCs that were in low supply in the medium-to long-term to create advantageous changes that could be enjoyed non-temporarily. Smaller firms drew on DCs that were relatively undifferentiating but also relatively inexpensive; that choice appears to have put them at a disadvantage. This appears confirmed in Table 2 where young-or-small SMEs chose relatively high levels of lower-quality DCs (i.e., the other_DC’s).

5 Discussion

5.1 Discussion of results

The analysis of our recent survey of US SMEs established the self-reported existence of DCs at entrepreneurial ventures (at levels above 0 % and below 100 %) at levels consistent with ‘traditionally-studied’ firms (based on testing H1a and H1b). The debate over the question of whether young and small SMEs have DCs appears to have been answered by the fact that most entrepreneurial ventures have DCs from the beginning, where these DCs were imported by the founders (along with their skills, network, financing, etc.…). Whether those DCs are as sophisticated and effective at young and small SMEs is another matter. The survey depicts no significant differences in proportions of DC-holding firms across age- and size-divided subsamples, whereas the follow-up survey highlights a few differences in DC characteristics across those subsamples.

The second part of our analysis begins to address the effectiveness differences (based on testing H2 and H3). SME size and age affect the benefits that DCs provide to firm performance. Youth helps, while smallness hurts. The former outcome we surmise is the result of differences in employee motivation and in the rarity of the DCs built at younger firms. The latter outcome we surmise is the result of differences in scale economies, in product-differentiating DCs, and in the DC-quality chosen at the smaller firms. Future work could test these more specific explanations; it could also test the effects of other firm characteristics on the impacts of DCs on firm performance, such as some of the more fine-grained issues that size and age proxy for, such as absorptive capacity, legitimacy, and diversification. Although our analysis was robust to the checks we ran, we encourage future work that considers alternative methods, factors and controls, and in non-US settings, to further verify these results.

The results indicated several ways to improve firm performance based on the significant correlations of the full models. Managers should build higher-quality DCs and leverage them by changing their operations more; managers should gather more resources, and be more entrepreneurially-oriented (i.e., more proactive, aggressive, risk-taking and innovative); and managers should try to avoid hostile industries. That said, it is expected that entrepreneurs will not completely escape from the liabilities of newness and smallness nonetheless.

5.2 Implications

There are three main areas where our results have implications: (1) regarding past empirical work; (2) regarding the overlap of the theoretical literatures; and (3) regarding practice. Our analysis has consequences for past empirical work on SME DCs related to model specification. Our results indicate that relationships of DCs with firm performance can be contingent on firm characteristics, like size and age. This raises the issue of the validity of past work that did not control for such effects. This also implies a relatively high dimensionality to consider when testing DCV theory in that there appears to be a need to control for interaction effects with firm characteristics. However, we unfortunately believe that such relatively high sensitivity to multiple dimensions tends to make the criticism about the post hoc nature of the empirical support of the DCV even stronger. This is because the identification of DCs after-the-fact would be based on simple correlations rather than ex ante-identified contingencies, making the ex post evidence of DC effects on performance even less valid, as they would likely have been based on mis-specified models.

Our results also have implications for the overlap of ENT and DCV domains because our results provide a unique insight into the nexus of ENT and DCV concepts due to the significant contingency effects found—contingency effects that combine ENT and DCV factors. On the one hand, the results indicate an overlap of ENT and DCV given that a significant proportion of entrepreneurial ventures have DCs. On the other hand, the results also indicate a delineation of the DCV from ENT. This is because firm characteristics that are not usually associated with entrepreneurship—like old age and large size—have different effects on the relationship between DCs and firm performance, and that result can be used to define a non-ENT-related DCV domain. This latter result is important, as our underlying assumption is that the DCV has yet to provide a strong case it is not subsumed by ENT theory.

Our assumption that the ENT domain subsumes the DCV was based on several arguments.Footnote 14 While there are arguments for the significant overlap of the ENT and DCV domains, there are also arguments for significant differences between them, for example, based on how SMEs are likely to differ in their use of, and benefits from, DCsFootnote 15—which was the focus of this paper. We hope that studies such as this one can continue to define both the overlap and the distinction between the ENT and DCV domains.Footnote 16

While we recommend future work that helps to separate out what is uniquely DCV (i.e., what is not ENT-related), we cannot ignore the connection between the two bodies of literature. Thus, we also recommend that the DCV draw more deeply on the sizable, more-established ENT literature for added insights (into contingencies, applications, typologies, etc.…). It is likely that a clearer definition and a better delineation of the DCV from the resource-based view (RBV; Barney 1991; Penrose 1959; Wernerfelt 1984) could be found there.

Besides the academic implications, there are also practical implications arising from our results for entrepreneurs, for managers and for pro-SME policymakers. Our results indicate that new venture managers may wish to build and use DCs early, given the positive interaction of youth with DC use. Drawing on the supplemental results, we suggest that younger firms should build DCs with greater rarity, inimitability, and non-substitutability when possible, in order to define and defend their niches. However, entrepreneurs may need to be wary of DC use when the firm is small, given the negative interaction of smallness with DC use. That said, simple means tests of the performance of small-firms-with-DCs compared to those without DCs revealed significant advantages for the small-firms-with-DCs (p < 0.001 for two-tailed means t test of performance differences). In other words, small firms gain an advantage from having DCs over peers without DCs, but those advantages are lower than if the firm itself was larger. Drawing on the supplemental results, we also suggest that small SME managers not spare on building product-differentiating DCs. Entrepreneurs need to understand the tradeoffs involved when building a DC, regarding its costs and economies; when entrepreneurs invest in a DC, especially a ‘higher-quality’ one, they need to use it and leverage it to enjoy its full benefits.

We suggest that policymakers help SMEs build DCs, especially at smaller firms. That help could be provided in the form of training, instruction manuals, benchmarking, and other activities and resources that could encourage planning and improvements in operational change processes. Policymakers could also promote the DC-type skills by requiring them (e.g., to be explained in business plans) for funding (e.g., for SBA loans).

Finally, we suggest follow-up longitudinal studies that track the longer-term effects of ex ante-identified DCs in order to help establish our preliminary results and interpretations. Such studies at SMEs may even lead to support for a recommendation that managers of established firms access new DCs from SMEs. Incumbent firms could use strategically targeted corporate venture capital investments in, and alliances with, entrepreneurial ventures to gain benchmarking and acquisition opportunities at attractive DC-using SMEs.

5.3 Limitations

Our analysis has its limitations, as does every empirical paper. There are limitations involving the data: e.g., the quality of the source; the representativeness of the sample; the effects of survivor bias and other hidden biases in the sample and responses; and the effects of the timing of data collection on generalizability and on longitudinal representation.Footnote 17 There are limitations in the variables chosen: e.g., the importance of performance measures to the respondents; multicollinearity of independent variables; and misinterpretation of variable definitions.Footnote 18 There are limitations arising from the number of variables included: other possible variables also associated with firm performance could be possible to include in order to address omitted variable bias concerns.Footnote 19 There are limitations in the methods chosen—e.g., in meeting the assumptions underlying the empirical models, including error distributions. However, we found no evidence that the survey data were biased or otherwise non-representative or inaccurate; our testing, our source, and our sample’s raw results were consistent with high-quality information. Also, we found no evidence of any inappropriateness of the dependent variables used, nor any significant multicollinearity among independent variables (as assessed through VIF analysis), nor any evidence of consistent misinterpretation of survey items (e.g., given the consistency across similar items—not formally reported in this paper), nor any significant endogeneity issues.

Regardless, we realize that limitations of the data bound the generalizability of the results. Specifically, for the outcome that entrepreneurial ventures have DCs (at significant absolute and relative levels), we see the following issues affecting ‘generalizability’: the basis of the analysis being the proxies of young-small versus old-large firms; the possibility that the data did not go young and small ‘enough’; the possibility that that outcome differs substantially across industries; and the possibility that 2008 US SME data were ‘unique’ on this issue. For the outcome that youth helps and smallness hurts the ‘DC–firm performance’ relationship at SMEs, we see the following issues affecting generalizability: the possibility that the age or size distributions of firms was unusual; the possibility that the specific age or size categories were unusual; the possibility that the firm performance measure did not represent the dimensions that SMEs focus on; and the possibility that omitted variables affected the contingencies. For the outcome that ENT and DCV domains have specific overlapping and distinctive areas, we see the following issues affecting our deductions: the possibility that the survey definitions involving ENT activity and DCs were misrepresentative (e.g., under-defined, biased, etc.); and the limited number of questions asked in the surveys only providing a partially-complete ‘drill down’ on what specifically is overlapping and what specifically is distinctive between the two domains. Regardless, we do believe that for this kind of paper such limitations are not unusual and, thus, we believe that the outcomes in our paper are not ‘less supported’ relative to other previous studies in ENT and in the DCV.

6 Conclusions

Our analysis of recent survey data of US SMEs explored the questions of whether entrepreneurial ventures have DCs, and if the defining characteristics of those entrepreneurial ventures affect how such capabilities benefit firm performance. Addressing these questions led to a closer link between the DCV and ENT domains, and complemented previous literature on that overlap (e.g., Zahra et al. 2006). We found that a significant proportion of entrepreneurial ventures (over 70 %) self-report at least one level of DC (and some report even a second, higher level as well—25 %), which were proportions statistically similar to those of older and larger firms. We also found significant contingencies related to the effects of DC impacts on firm performance; contingencies based on characteristics of entrepreneurial ventures. Specifically, younger SMEs with DCs realized relatively greater performance benefits, while smaller SMEs with DCs realized relatively lower benefits.

Through this study, we contributed to the ENT and DCV literature by providing evidence for the existence and nature of their linkage, and by providing the first evidence of a clear delineation of DCV-theory-that-is-not-also-ENT-theory. We found value in analyzing one of the few DC-focused studies of SMEs, and one of the fewer cross-sectional studies, by using it to answer some interesting research questions and be a basis for re-examining the overlap between the domains of ENT and DCV research. Specifically, we contributed to the literature by answering the debated question of whether or not entrepreneurial ventures have dynamic capabilities, and by providing empirical evidence of new contingency effects in the DCV. Our results imply that it may be prudent to revisit some of the past empirical evidence of DC-correlated SME performance to correct for contingency effects. Regardless, our results continue the stream of research-based support for firms, even young and small SMEs, to build and use DCs as a way to enhance OCs and increase firm performance in turbulent environments.

Future work should include longitudinal studies of DCs at SMEs, where DCs are identified early to more cleanly assess their longer-term net benefits. Such intensive study of DCs may also be worthwhile across a wide set of firms, in order to continue an effective categorization of the types of DCs and DC characteristics and origins. Such work may help SME managers compete better in turbulent industries and make successful transitions to address future changes. Such work may also benefit incumbents to better assess SMEs to purchase, ally with, and invest in. Regardless, such work in the firm-level capabilities will increase the understanding of how firms can better address the challenges of competitive changes, and that may help guide the next generation of small business managers, those who are bound to face the kinds of changes that have not been seen before.

Notes

The terms ‘OC’ and ‘DC’ refer to two different capabilities. To be clear: all firms have OCs in order to operate; not all firms have DCs, and fewer have highly-routinized DCs. All DCs change OCs.

The firm characteristics of newness and smallness are also attractive as empirical measures. They are relatively objective measures, simple to understand, and available. Each has been shown to affect firm performance in the entrepreneurship literature (i.e., these items are often used as controls; Steffens et al. 2009). These factors also provide a solid basis for building upon in future work because they proxy for more sophisticated factors such as: scale economies, market power, bargaining power, resource slack, specialization, experience, and so on.

Note in Table 1 that several descriptive results were sensible (e.g., the main reason given for not having a routinized DC was logical), and that the sample provided a good proportion of firms reporting DCs.

The final responses were the proxy for non-respondents and the early responses were the proxy for respondents. The t tests for differences between the two groups yielded no statistically significance in the survey items used in the analysis. We determined that there were no statistically significant differences between early and late respondents at the two-tailed p < 0.05 levels for any of the dependent or independent variables.

The procedural methods we used included:

-

Protecting respondent anonymity in order to decrease the respondents’ tendency to make socially desirable responses. We accomplished this through the on-line method chosen, where anonymity was guaranteed through the third-party intermediary.

-

Reducing survey item ambiguity. We accomplished this through careful attention to wording in our questions, assessed through our pretesting stage.

-

Separating scale items in order to reduce the likelihood of respondents guessing the relationship between variables and then consciously matching their responses to those relationships. We accomplished this by placing predictor and criterion variables far apart; i.e., we placed dependent and independent variables to diminish the effects of consistency artifacts (Podsakoff et al. 2003; Salancik and Pfeffer 1977).

-

Targeting the top managers as respondents. Single-respondent bias is less of a problem when focal organizations are small (Gerhart et al. 2000). By surveying the top managers, we obtained the greatest information on the enterprise from that single response.

The statistical methods we used included:

-

Triangulation through field interviews. Our first stage in the survey writing, with pretesting in the field, established the reliability and validity of the variables.

-

Conducting Harman’s (1967) one-factor test on the data to ascertain whether one factor accounts for most of the variance when all variables are entered together. Our results gave eight factors with eigenvalues over 1.0, where the largest factor explained only 29 % of variance.

-

Assessing the significance of interaction terms in the analysis to determine whether a pattern of significant interaction terms exists. The results of the contingency model (see below) suggest that such outcomes are unlikely to have resulted from single-respondent bias (Aiken and West 1991; Kotabe et al. 2003). It would be unlikely that respondents would consciously theorize these complex relationships among variables when responding to a survey.

-

The Chronbach alpha is a coefficient of reliability or internal consistency of a construct, increasing with the inter-correlations among construct items. It is widely accepted as an indicator of the degree to which a set of items measures a single latent construct, where those items measure different substantive areas within that construct. The normal cutoff level for acceptability of reliability is an alpha of 0.70. The constructs are continuous variables created by combining—usually by taking the mean of—several separate Likert-scale survey question responses related to a specific measure.

An example was given to illustrate this type of DC: “If your firm was in a technology industry and its main operating capability was its product R&D, does it have a standard operating procedure that can change the way R&D is done, in a coordinated, timely, comprehensive and competent manner?” Firms that answered yes were categorized as having a routinzed_DC.

The full survey upon which this current paper is based contained several other questions, many of which are complementary, but not focal to this study. For example, other questions related to the DC-building process, DC characteristics, DC use, and so on. We do not report these results or variables formally here because they are not focal to the points made in this paper.

The probit analysis was run using the following instruments: firm age and firm size—to control for experience and need related to building a DC (Pavlou and El Sawy 2011; Protogerou et al. 2012); industry and geography/location dummy variables—to control for contextual pressures and effects on DC attainment (Capron and Mitchell 2009; Lichtenthaler 2009); entrepreneurial orientation—to control for decision-making syle (e.g., risk-taking) on choosing a DC to enhance adaptability (Lichtenthaler 2009; Rothaermal and Hess 2007); firm resources—to control for how comfortably a firm could afford to build and maintain a DC (McKelvie and Davidsson 2009; Pavlou and El Sawy 2011); industry hostility and industry turbulence—to control for how the competitive pressures, the dynamism and unpredictability of the context could motivate the firm to build a DC (Lichtenthaler 2009; Menguc and Auh 2006); and frequency of changes to operations—to control for the need to have a DC as a specialized method of changing operating capabilities (Karim 2009; Tzabbar 2009).

A third proportions test revealed that significantly over 50 % of entrepreneurial ventures reported having DCs.

The probit provided a significant improvement in the ‘hit rate’; from 51 to 62 %.

We also checked for the robustness of the results to industry dynamism (not formally reported); we ran the analysis with an interaction term between DC activity and industry turbulence—the key results remained, and this term was not significant.

DC value, rarity, inimitability and non-substitutability were rated on a 5-point Likert scale (from Not at all to Very much). DC costs were rated on a 5-point Likert scale (from Less than 20 % of Gross Benefits to More than 80 % of Gross Benefits).

The process of gaining a competitive advantage—of redeploying resources (in new combinations; Schumpeter 1934) ahead of rivals to exploit an opportunity—is exactly the same process for each of the DCV and ENT ‘views’. The conceptual support of the rents for both views is based on first mover advantages (Lieberman and Montgomery 1988) and on the exploitation of spot arbitrage opportunities (i.e., buying and creating factors under their true future value). The sustainability mechanisms vary, but those of both views include: second-mover disadvantages; market frictions; property rights; and time compression diseconomies (Dierickx and Cool 1989). The usual distinction is that the DCV rents are sustainable in the longer-term than ENT rents. We make two arguments against that distinction: (1) it is a post hoc distinction at best at the empirical level; and (2) such longer-term sustainability is usually described as a series of ‘temporary’ advantages, the type of advantages at the core of ENT theory.

Entrepreneurial ventures will likely differ from larger, older firms in their use of DCs in several ways, including: the timeframe involved (shorter for the SME); the size and scope of the intended impact (smaller for the SME); the OC target type (e.g., technological versus market-oriented); the frequency of use (lower for the SME); the strategic stance (less reactionary for the SME); and the timing (earlier in the industry lifecycle for the SME; e.g., Branzei and Vertinsky 2006). Also, entrepreneurial ventures will likely differ from larger, older firms in the intended and realized outcomes from their use of DCs in several ways, including: the pace of the results (faster for the SME); the sustainability of the results (less for the SME); the variance of the results (higher for the SME; e.g., Ahuja and Lampert 2001); and the rival reaction to the initial results (less reaction from larger rivals for the SME).

Our unique contribution to this stream was to delineate the part of the DCV that does not apply to ENT; i.e., the effects of DCs used at large and old firms that are distinct because of the interactions of age and size on firm performance that SMEs do not experience.

The data collection was a one-time survey, although it requested the respondents account for past variable values. This was not true panel data, where unobserved heterogeneity could be controlled; this is a limitation of the paper, and we recommend follow-on work be longitudinal. Despite this limitation, we believe that the results provide a contribution to the literature.

For example, in the DCV, the issue of measurement is problematic. The DC concept is not consistently defined in theory or practice (Williamson 1999; Winter 2003), so it is not surprising that the study of the relationship between DCs and performance involves different methods and controls (Arend and Bromiley 2009). Thus, we advise caution in applying our results (or any DCV study’s results) in a ‘general’ fashion.

There is no limit on the possible variables that could have been included to explain performance, and so omitted variable bias is always a concern in a study like this—i.e., a study on SME performance using survey data. We followed the precedent of related studies by including the main controls—i.e., on firm characteristics, contextual conditions, and entrepreneurial orientations. We were limited on the number of variables we could include by the sample size, by concerns regarding multicollinearity, and by the constraints related to using a survey (e.g., limits due to participant attention). Our regression significances and VIFs were reasonable, however, indicating that we achieved a similar balance in analysis to related studies (e.g., Grant 2012; Simsek et al. 2007). That said, future studies could include controls for other factors, such as those related to the entrepreneur (e.g., social capital), the top management team (e.g., network characteristics), founding conditions, intellectual property, alliance activity, new product development, R&D and advertising intensities, international presence, and other factors that have been specifically studied in strategic entrepreneurship in the past in order to help explain the remaining variance in firm performance.

References

Adner, R., & Helfat, C. E. (2003). Corporate effects and dynamic managerial capabilities. Strategic Management Journal, 24(10), 1011–1025.

Ahuja, G., & Lampert, C. M. (2001). Entrepreneurship in the large corporation: A longitundinal study of how established firms create breakthrough inventions. Strategic Management Journal, 22(6), 521–544.

Aiken, L. S., & West, S. G. (1991). Multiple regression: Testing and interpreting interactions. Newbury Park, CA: Sage.

Alreck, P., & Settle, R. (1985). The survey research handbook. New York: Irwin.

Amit, R., Glosten, L., & Muller, E. (1990). Entrepreneurial ability, venture investments, and risk sharing. Management Science, 36(10), 1232–1245.

Arend, R. J. (2012). Ethics-focused dynamic capabilities: A small business perspective. Small Business Economics. doi:10.1007/s11187-012-9415-2.

Arend, R. J., & Bromiley, P. (2009). Assessing the dynamic capabilities view: Spare change, everyone? Strategic Organization, 7(1), 75–90.

Armstrong, J. S., & Overton, T. (1977). Estimating nonresponse bias in mail surveys. Journal of Marketing Research, 35(8), 396–402.

Arthurs, J., & Busenitz, L. (2006). Dynamic capabilities and venture performance: The effects of venture capitalists. Journal of Business Venturing, 21(2), 195–215.

Audretsch, D. B., & Mahmood, T. (1995). New firms survival: New results using a hazard function. The Review of Economics and Statistics, 77(1), 97–103.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17, 99–120.

Belsley, D. A., Kuh, E., & Welsch, R. E. (1980). Regression diagnostics. New York: Wiley.

Bowman, C., & Ambrosini, V. (2003). How the resource-based and the dynamic capability views of the firm inform corporate-level strategy. British Journal of Management, 14(4), 289–303.

Branzei, O., & Vertinsky, I. (2006). Strategic pathways to product innovation capabilities in SMEs. Journal of Business Venturing, 21, 75–105.

Capron, L., & Hulland, J. (1999). Redepolyment of brands, sales forces, and general marketing management expertise following horizontal acquisitions. A resource-based view. Journal of Marketing, 63, 41–54.

Capron, L., & Mitchell, W. (2009). Selection capability: How capability gaps and internal social frictions affect internal and external strategic renewal. Organization Science, 20(2), 294–312.

Carayannopoulos, S. (2009). How technology-based new firms leverage newness and smallness to commercialize disruptive technologies. Entrepreneurship: Theory & Practice, 33(2), 419–438.

Caves, R. E. (1998). Industrial organization and new findings on the turnover and mobility of firms. Journal of Economic Literature, 36, 1947–1982.

Cavusgil, E., Seggie, S. H., & Talay, M. B. (2007). Dynamic capabilities view: Foundations and research agenda. Journal of Market Theory & Practice, 15(2), 159–166.

Christmann, P. (2000). Effects of “Best Practices” of environmental management on cost advantage: The role of complementary assets. Academy of Management Journal, 43(4), 663–680.

Covin, J. G., & Slevin, D. P. (1989). Strategic Management of small firms in hostile and benign environments. Strategic Management Journal, 10, 75–87.

Delmar, F., & Shane, S. (2003). Does business planning facilitate the development of new ventures? Strategic Management Journal, 24(12), 1165–1186.

Dennis, W., Jr. (2003). Raising response rates in mail surveys of small business owners: Results of an experiment. Journal of Small Business Management, 41(3), 278–295.

Dierickx, I., & Cool, K. (1989). Asset stock accumulation and sustainability of competitive advantage. Management Science, 35, 1504–1511.

Eisenhardt, K. M., & Martin, J. A. (2000). Dynamic capabilities: What are they? Strategic Management Journal, 21(10–11), 1105–1121.

Ettlie, J. E., & Pavlou, P. A. (2006). Technology-based new product development partnerships. Decision Sciences, 37(2), 117–147.

Fairlie, R. W., & Robb, A. M. (2009). Gender differences in business performance: Evidence from the characteristics of business owners survey. Small Business Economics, 33(4), 375–395.

Gardner, H. K. (2012). Performance pressure as a double-edged sword: Enhancing team motivation but undermining the use of team knowledge. Administrative Science Quarterly, 57(1), 1–46.

Gerhart, B., Wright, P. M., & McMahan, G. C. (2000). Measurement Error in research on the human resources and firm performance relationship: Further evidence and analysis. Personnel Psychology, 53(4), 855–872.

Grant, A. M. (2012). Leading with meaning: beneficiary contact, prosocial impact, and the performance effects of transformational leadership. Academy of Management Journal, 55(2), 458–476.

Harman, H. H. (1967). Modern factor analysis. Chicago: University of Chicago Press.

Helfat, C. E., & Peteraf, M. A. (2003). The dynamic resource-based view: Capability lifecycles’. Strategic Management Journal, 24(10), 997–1010.

Karim, S. (2009). Business unit reorganization and innovation in new product markets. Management Science, 55(7), 1237–1254.

Kotabe, M., Martin, X., & Domoto, H. (2003). Gaining from vertical partnerships: Knowledge transfer, relationship duration, and supplier performance improvement in the US and Japanese automotive industries. Strategic Management Journal, 24, 293–316.

Krishnan, R., Martin, X., & Noorderhaven, N. G. (2006). When does trust matter to alliance performance? Academy of Management Journal, 49(5), 894–917.

Lambert, D., & Harrington, T. (1990). Measuring nonresponse bias in mail surveys. Journal of Business Logistics, 11(2), 5–25.

Lampel, J., & Shamsie, J. (2003). Capabilities in motion: New organizational forms and the reshaping of the Hollywood movie industry. Journal of Management Studies, 40(8), 2189–2210.

Lieberman, M., & Montgomery, D. B. (1988). First-mover advantages. Strategic Management Journal, 9, 41–58.

Lichtenthaler, U. (2009). Absorptive capacity, environmental turbulence, and the complementarity of organizational learning processes. Academy of Management Journal, 52(4), 822–846.

Lumpkin, G. T., & Dess, G. G. (2001). Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment and industry life cycle. Journal of Business Venturing, 16, 429–451.

Macher, J. T., & Mowery, D. C. (2009). Measuring dynamic capabilities: Practices and performance in semiconductor manufacturing. British Journal of Management, 20(S1), S41–S62.

Mahoney, J. T. (2005). Economic foundations of strategy. Thousand Oaks, CA: Sage.

Mahoney, J. T., & Pandian, J. R. (1992). The resource-based view within the conversation of strategic management. Strategic Management Journal, 13, 363–380.

McKelvie, A., & Davidsson, P. (2009). From resource base to dynamic capabilities: An investigation of new firms. British Journal of Management, 20, S63–S80.

Menguc, B., & Auh, S. (2006). Creating a firm-level dynamic capability through capitalizing on market orientation and innovativeness. Journal of the Academy of Marketing Science, 34(1), 63–73.

Miller, D., & Friesen, P. H. (1982). Innovation in conservative and entrepreneurial firms: Two models of strategic momentum. Strategic Management Journal, 3, 1–25.

Narasimhan, O., Rajiv, S., & Dutta, S. (2006). Absorptive capacity in high-technology markets: The competitive advantage of the haves. Marketing Science, 25(5), 510–524.

Newbert, S. L. (2005). New firm formation: A dynamic capability perspective. Journal of Small Business Management, 43(1), 55–77.

Newbert, S. L., Gopalakrishnan, S., & Kirchoff, B. A. (2008). Looking beyond resources: Exploring the importance of entrepreneurship to firm-level competitive advantage in technologically intensive industries. Technovation, 28, 6–19.

Newby, R., Watson, J., & Woodliff, D. (2003). SME survey methodology: Response rates, data quality, and cost effectiveness. Entrepreneurship Theory and Practice, 28(2), 163–172.

Pavlou, P. A., & El Sawy, O. A. (2011). Understanding the elusive black box of dynamic capabilities. Decision Sciences, 42(1), 239–273.

Penrose, E. T. (1959). The theory of the growth of the firm. New York, NY: Wiley.

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88, 879–903.

Protogerou, A., Caloghirou, Y., & Lioukas, S. (2012). Dynamic capabilities and their indirect impact on firm performance. Industrial & Corporate Change, 21(3), 615–647.

Rauch, A., Wiklund, J., Lumpkin, G. T., & Frese, M. (2009). Entrepreneurial orientation and business performance: An assessment of past research and suggestions for the future. Entrepreneurship: Theory & Practice, 33(3), 761–787.

Rothaermel, F. T., & Hess, A. M. (2007). Building dynamic capabilities: Innovation driven by individual-, firm-, and network-level effects. Organization Science, 18(6), 898–921.

Rumelt, R. P. (1984). Toward a strategic theory of the firm. In R. Lamb (Ed.), Competitive strategic management (pp. 556–570). Engelwood Cliffs, NJ: Prentice-Hall.

Salancik, G. R., & Pfeffer, J. (1977). An examination of need-satisfaction models of job attitudes. Administrative Science Quarterly, 22, 427–456.

Santarelli, E., & Sterlacchini, A. (1990). Innovation, formal vs. informal R&D, and firm size: Some evidence from Italian manufacturing firms. Small Business Economics, 2(3), 223–228.

Schumpeter, J. (1934). Capitalism, socialism, and democracy. New York: Harper & Row.

Sher, P. J., & Lee, V. C. (2004). Information technology as a facilitator for enhancing dynamic capabilities through knowledge management. Information & Management, 41(8), 933–945.

Simsek, Z., & Veiga, J. (2000). The electronic survey technique: An integration and assessment. Organizational Research Methods, 3(1), 93–115.