Abstract

We analyze how an incumbent defends its competitive advantage with a focus on the under-examined methods of actively defending against the threats posed by rival innovation. We describe, delineate and analyze the set of such defenses and their likely effects. The set of such defenses differs substantially from many standard defenses, such as those aimed at defeating the threat of imitation. The further study of these pre-emptive innovation defenses is important because these defenses are different and because they can substantially affect the sustainability of firm profits and the pace of different of types of innovation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Innovation is essential to most firms, to the economy and to society (Dodgson et al. 2002; Pavitt 1990; Wolfe 1994). Unsurprisingly, innovation does not come cheap, consequently nor does it go unprotected. Innovative activity is costly due to high failure rates, due to its complexity and non-linearity, and due to the often significant, knowledge-intensive investments required to realistically pursue it (e.g., Kanter 1989; Quinn 1985). The patent system exists to help protect innovations from imitative threats in order for the innovators to recoup their investments—because without some guarantee of reward from innovating activity (i.e., a tight appropriability regime), the motivation to pursue it would vanish (Teece 1986). However, what the patent system and the innovation literature both leave un-addressed is the threat of further innovation on a current innovation’s value. We consider that gap by analyzing the defenses that deter rival innovation.

A firm innovates to create new competitive advantage by providing a more desired or more efficient process, product, service, organization, or business model (Schumpeter 1950). Through innovation, the firm effectively destroys a set of competitive advantages until then being enjoyed by an incumbent. While there exists no formal analysis of them until now, there are several ways that incumbents defend against rival innovation. For example, Nabisco defended itself against rival Kellogg’s new product launch by issuing a lawsuit to give it time to develop its own fighting brand (Wind 1997). Intel has defended its microprocessor advantages through numerous methods, including continuous innovation—specifically, the simultaneous development of RISC and CISC-based processors and of several generations of Pentium chips (D’Aveni 1995). The philosophy of hypercompetition (D’Aveni 1994) implies actions that attack a rival’s threatening capabilities, including those related to innovation. Firms that generate patent fences around a core technology to include some alternatives, and firms that concurrently research future alternative technologies aimed at addressing a similar need, are acting to reduce innovation-based threats.

Our contribution is in focusing on the approaches that sustain competitive advantage against the threat of innovation, with special interest in the more active strategies that attack a rival’s innovation before that innovation realizes its creatively destructive effect on the incumbent.Footnote 1 We consider that such defenses are distinct (i.e., they differ substantially from current strategies aimed at countering other threats such as imitation threats) and, thus, are worth formal analysis. Further, we also consider the rival’s counter-measures, as well as the eventual outcomes of the battle over innovative activity, in order to assess the fuller impact of these defenses.

We proceed in the following manner. We work through the theoretical analysis in several steps: we define key terms, introduce the multi-dimensional innovation framework, provide an approach to creating defenses against innovation, and then describe the current and a new set of defenses. The new defenses are pre-emptive in nature, and we detail their substantive characteristics, such as each one’s economic basis and main drawback. We then analyze the counter-measures to these defenses as well as what the outcome can be from the cycle of attack-defend-counter-etc. We also consider how these innovation defenses fit into the full range of options that firms choose from to protect themselves from competitive threats. We follow the theoretical analysis with a discussion that includes the managerial and research implications.

2 Theoretical analysis

The innovation literature does a good job of differentiating among various kinds of innovation—e.g., incremental, radical, disruptive, architectural, etc....—by considering the various dimensions of innovation (Abernathy and Clark 1985; Christensen 1997; Henderson and Clark 1990; McGrath and MacMillan 1995; Tushman and Anderson 1986). We also consider innovation as multi-dimensional, but in this case, as a multi-dimensional threat. Innovation, where rivals find a new basis of competitive advantage, is a significant threat because it acts to devalue incumbent products in various ways (Afuah 1996). One characteristic of the threat of innovation that makes it quite interesting to study is that innovation itself is a probable event even though the occurrence of innovation from any one source is improbable. The innovation process is fraught with failure (i.e., innovation failure rates 40% to over 90%—Leenders and Voermans 2007; Mercer 2002), but given the wide and deep investments in it, some success that is threatening to incumbents is expected, and so, must be addressed, including through defensive actions.

Below, we analyze the innovation threat in a manner similar to analyzing any other significant threat: we consider its effective dimensions, how those are addressed in defenses by an incumbent, how those defenses are countered by the innovator, and what resolution that leads to. Prior to the analysis, we define key terms for clarity.

2.1 Definitions of key terms

For our purposes, we define an innovation as a new consumable product or service generated by the use of new technological and market knowledge (Afuah 1998). There are two steps in the innovation process. We define invention as the first step in innovation; it is the creation and embodiment of the new technological or market knowledge that is potentially commercialized. We define commercialization as the second step in innovation; it is the consumable offering embodying the new knowledge that is in demand (i.e., the creation of the product, packaging, and promotion of the invention). We define the value of the innovation as the benefits created by the introduction of the innovation. There are two main types of benefits: those outside the focal firm (e.g., net increases in consumer surplus); and, those captured by the focal firm (e.g., increased profits, increased legitimacy, increased bargaining power, increased experience, etc.). Our focus is on appropriated rents to the innovating firm.

There are several types of innovation; we define the main types here. We define an innovation as radical when it destroys existing market, technological, supply chain, component production, architectural, etc. competencies of a focal incumbent firm (and by destroy, we mean it makes those existing competencies economically significantly less relevant, putting the incumbent at a disadvantage). We define an innovation as incremental when it leaves existing (incumbent) competencies mostly intact (i.e., making an incumbent very likely to be able to imitate it without significant economic cost). And we note a related concept, that of disruptive technology, as the Christensen (1997) concept that some technologies begin as inferior in product and process terms and then turn out to be superior in both, ultimately being radical innovations.

We now define the main players in the innovation competition. We define an incumbent as the firm of focus that has a market position (i.e., its set of products and services) that is threatened by rival offerings, including those based on innovation. We define the rival innovation as an innovation that competes with (or will compete with) the focal firm’s (i.e., incumbent’s) set of products and services.

We consider several defensive approaches that incumbents can take against rival innovations below; we define three of the major approaches here. We define disinformation as the use of false information to create decision-making mistakes in a rival, with the intention of making their innovation attempts less likely, more expensive, and less successful. We define disruption as the use of various means to make rival actions (in their innovation attempts) less successful, more expensive, more risky, and more time-consuming. We define capture as the use of competitive intelligence and bargaining to acquire some ownership of the rival innovation to benefit from it.

2.2 The dimensions of the innovation framework

Innovation is difficult to defend against partly because it is a concept that is multi-dimensional. We consider the three dimensions that are of interest to those trying to defend against it. These three dimensions relate to the definition of innovation; they include the basis for the newness; the new outcome of the process; and, the process of moving from the new knowledge to the application of that knowledge in a product or service offering. The basis for the newness—the new technological or market knowledge—we capture in the dimension of radicality. We define radicality as the amount of the newness of the innovation that is competency-destroying to the incumbent (i.e., the degree to which existing technological, market, supply-chain, etc... expertise and competencies are devalued by the new knowledge). The new outcome of the process—the product or service that embodies the new basis knowledge—we capture in the dimension of impact size. We define impact size as the net economic effect that the innovation has (or is projected to have) as a market-available offering in terms of profits, over time. The process—the steps from creating the new basis knowledge to commercializing it in a product—we capture in the dimension of process stage. We define the three process stages as: (1) pre-invention—what occurs prior to new (potentially commercializable) knowledge being created; (2) post-invention-pre-commercialization—what occurs given the knowledge but prior to creating the product or service; (3) post-commercialization—what occurs given the new product or service on the market. Below, we describe each dimension in more detail as well as its (general) effect on the attempt to defend against innovation (see Fig. 1).

2.2.1 Radicality

The dimension of radicality pertains to the amount of destruction of the incumbent’s competencies that the innovation yields. Innovations have been typed as more radical the more they destroy a competence of the incumbent (be that a market, or a technical, or a supply chain linking, or a component production, or an architectural competence). When the innovation leaves the incumbent competences mostly intact, then the innovation is considered more incremental. The effect that radicality has on the attempt to defend against innovation is assumed to work through familiarity (i.e., the added confidence in taking action with things familiar—Fischhoff et al. 1981). The more familiar (less competency-destroying) an innovation’s new knowledge base is, the more likely the incumbent will choose to defend against it and the more likely that defense will be successful. The added success is based on the incumbent’s greater knowledge, contacts, and other resources that can be brought to bear in the more incremental settings. However, disruptive innovations, when they begin with technologies and markets that are not competency-destroying, may be defended against successfully, for example, through the capture tactic (Anthony and Christensen 2005).

2.2.2 Impact size

The dimension of impact size provides the rival’s incentive to innovate; it is the potential realizable benefits from the innovation. The size of those benefits is partially a function of the economic basis of the innovation’s value. The economic bases of the innovation’s benefits include one or more of the following: (1) an increase in consumer utility or decrease in the costs of production; (2) an increase in the appropriability of value; or, (3) an increase in the control of the market supply. The first basis is generally accomplished through product and process improvementsFootnote 2; and that is the focus in this paper. The second basis can be accomplished through efficient organization of transactions and incentives, and through increased bargaining power.Footnote 3 The third basis can be accomplished through collusion, the wielding of market power, and through increased intellectual property protection.Footnote 4 Innovations that have a greater impact, such as those that increase consumer utility or increase a firm’s market power, pose larger threats. The effect that impact size has on the attempt to defend against innovation is assumed to work through incentives—i.e., the lower the impact, the less the rival is likely to innovate, and the greater the impact, the more the rival is likely to innovate and counter any defenses by the incumbent. When the potential realizable value of the innovation is low, then the potential threat is low and no defenses may be required.Footnote 5 When the impact size is large, incumbents are more likely to defend, defend in multiple ways, and have to address the rival’s countering those defenses; essentially, the costs of not defending become too high when impact size rises (Venkataraman et al. 1997).

2.2.3 Process stage

The dimension of process stage allows analysis of when defenses should be mounted—i.e., in which stage of the innovation process. There are two main innovation steps—invention and commercialization. Of the two steps, the first—invention—is the most difficult to defend. Invention is difficult to defend because both the process and the inventors are challenging to monitor. The process is discontinuous, probabilistic, complex, and often punctuated by accidental discovery (Fleming 2002; O’Connor and Rice 2001; Quinn 1985) and, thus, difficult to track and predict. Due to its probabilistic nature, a significant proportion of the innovation is attributed to small firms (Quinn 1985). The privacy, number, and diversity of such firms make tracking and prediction of inventors difficult as well. The second step—commercialization—implies the invention and inventor are known, and the method of moving the invention to market is of interest. Shane and Venkataraman (2000) list two main methods of commercialization of the invention: through the inventing firm; and, by selling the invention to existing firms.

The effect that the process stage has on the attempt to defend against innovation is assumed to work through the quality of targeting knowledge—i.e., the less identifiable the target, the less effective the defense. Given the challenges of monitoring the invention process and the inventing firms, the incumbent is likely to have little success with the defenses at this step. However, once the invention is exposed—with both the invention and the inventor identified—the incumbent can have more success with the defenses. Specifically, using the capture defense to buy threatening inventions may be effective (Anthony and Christensen 2005). Incumbents that wish to be more pro-active at this step can do so by engaging in venture capital, consulting, and directorship at start-ups and smaller potential rivals that are more likely to generate threatening inventions. With the invention and inventor known, the incumbent can use disinformation and disruption to corrupt commercialization if it chooses not to capture the inventor. As well, several characteristics of commercialization may also affect the impact of the defenses. For example, the poorer the appropriability regime (e.g., the less legal protection) the invention has, the more likely the defenses will impact the success of its commercialization, usually through misappropriation of its benefits. The slower the commercialization (e.g., the slower the diffusion—Griliches 1957), the more likely the defenses will have the time to have a more significant effect. The riskier the commercialization (e.g., the less it can be structured like a nested option—see Luehrman 1998; McGrath 1999), the more likely the added risk generated by the defenses will have a significant impact. The greater the hurdles the commercialization process must pass to survive (e.g., qualify for additional funding), the more likely the defenses can have a significant impact.

2.3 The origins of the innovation defenses

We have outlined the main dimensions of innovation above, along with some general effects on possible defenses against innovation. Below, we use a more formal approach to understanding the issues in defending against innovation. We take the approach of asking the standard range of questions about any event to understand all the issues—i.e., we ask the what, why, when, who, where and how of the innovation threat (in that order).

2.3.1 The what

The answer to the what question is the focus of the defenses—i.e., the threatening innovation, embodied in both the new knowledge underlying the product or service and the new product or service as it gets to market.

2.3.2 The why

The answer to the why question lies in the drivers of the incentives of the incumbent to defend against rival innovation—i.e., the drivers are the size of the threat and its destructiveness (its radicality). These dimensions (covered above) effectively cover a span and a depth of cost to not defending against the innovation.

2.3.3 The when

The answer to the when question is covered in the innovation process dimension (see above); it is the choice of the stage or step in the innovation process at which a defensive action is best taken.

2.3.4 The who

The answer to the who question is the identification of the rival, and the rival’s characteristics that affect the defense actions (e.g., rival familiarity, size, similarity, etc.). We consider these characteristics below. As others have noted in competitive interactions (Venkataraman et al. 1997), it is important to assess the rival relative to the focal firm (here, the incumbent).

In general, the rivals more likely to be defended against by the incumbent are those it is familiar with (the familiarity effect—e.g., Porac et al. 1989). The ability of the incumbent to understand the rival will be based on both the incumbent’s and the rival’s intelligence—competitive, technological, market—as well as the ability to predict through foresight and roadmapping where the innovations are likely to come from (Saleh and Wang 1993). When the incumbent is relatively stronger in these areas, perhaps partially due to its incumbency, it may be able to use disinformation and disruption against the rival. Although many significant innovations come from discontinuous processes (Quinn 1985) and are therefore hard to defend against, others emerge from more predictable origins and can be more effectively deterred.

Even when the incumbent cannot specifically identify a target rival, the innovation literature can help; it provides some guidance on which firms innovate in which ways (e.g., Abernathy and Clark 1985; Afuah and Bharam 1995; Ettlie et al. 1984; Henderson and Clark 1990; Schumpeter 1950). For example, smaller firms are usually attributed the radical product improvement innovations while the larger firms are expected to be better at incremental process and product improvements. Certain innovation activity requires a level of capability and motivation that perhaps only firms of a certain size or locale or history can pursue. Successful application of defenses favors targets that are known rivals, all else being equal, as the intelligence costs are lower while the certainty of identification of areas to target is higher.

The who question can get to the personal level as well, once target firms have been selected. When identifiable, the incumbent will use the defenses to target specific decision-makers at the rival—i.e., those individuals who are responsible for the decisions related to the discovery and exploitation of an invention (e.g., Amit and Schoemaker 1993). The defenses may attempt to manipulate their decision-making biases (e.g., anchoring—see Kahneman and Tversky 1979), their perceptions (Paine and Anderson 1977; Souitaris 2001; Weerawardena et al. 2006) and their motivations (e.g., such as their individual risk-adjusted opportunity costs—see Venkataraman 1997) through disinformation and disruption in order to hinder their effectiveness. When known, the incumbent can also attempt to influence the rival’s approach to innovation (Afuah 1998). Undermining the rival’s vision and leadership may be done through disinformation and disruption.

Another rival characteristic that an incumbent can leverage is the dependence on third parties by the rival in its innovation process. This is because the rival has no direct control over such parties, so dependence becomes a weakness when the incumbent can use those parties to impair the rival’s innovative actions.

2.3.5 The where

The answer to the where question centers on the choice of the competitive battleground of the innovation attack and defense—i.e., the product market segment, the national geographic test market, the international introduction or patent point, etc. We leave the details of such analyses to future work because it gets into some quite involved International Business, International Intellectual Property Law, and other complex issues that we cannot deal with in the length of this paper. We expect that the basic choice, however, would come down to the strength of the incumbent relative to the rival, including which party could move first. When the incumbent is in self-preservation mode, we expect strong defensive actions in its largest markets. When the incumbent is in predator mode, we expect it to take the fight to the rival where the rival is weakest in an attempt to kill any positive inertia for the rival.

2.3.6 The how

The answer to the how question is the contribution of the paper; we detail and analyze the main tactics (i.e., the how’s of defense against innovation), both old and new, below. Both old and new tactics use the same economic basis to mitigate the threat of rival innovationFootnote 6—i.e., making a targeted rival’s innovative activity more expensive, less beneficial, and more risky. The less analyzed tactics—those we refer to as new here—those that are pre-emptive in nature, address the economics by attacking the targeted rival’s change process. Since innovation is change (i.e., there is something new occurring and, hence, changing), the new tactics affect each part of the standard change process. That change process consists, in the most general terms, of: formulating the change direction, then implementing that change, and then appropriating the benefits of the implemented change. The new tactics attack formulation with disinformation, hinder the actions of implementation, and misappropriate the benefits.

2.4 The set of existing innovation defenses

We begin by exploring the current defenses. There are three main types of defense to the threat of innovation; the first two are well understood while the third is under-analyzed: innovate; react; and, actively pre-empt. In the first type, the incumbent attempts to stay ahead by continuing to innovate; this tactic actually defends against both the imitators of current advantage and the rival innovators of future advantage. In the second type, the incumbent responds to innovators through imitation; this defense is aimed at exploiting rival innovations to reduce their rewards from innovating. In the third type, the incumbent attempts to block rival efforts at innovation before they become an extreme threat; we outline these new defenses after discussing the more established defenses.

Innovate-type defenses are considered in a number of streams in the innovation literature, from economics (Lee and Wilde 1980; Loury 1979; Reinganum 1982; Tirole 1988) to operations and technology management (Abernathy and Clark 1985; Afuah 1996; Christensen 1997; Henderson and Clark 1990; McGrath and MacMillan 1995; Tushman and Anderson 1986) to organizational behavior (Chesbrough and Teece 2002; Ford and Ogilvie 1996; Lawson and Samson 2001; Ogilvie 1998). Incumbents create differentiating improvements (i.e., from incremental to radical) to a rival’s new innovation in order to compete. For example, the incumbent may be able to use second-mover advantages to exploit the rival’s pioneering costs and positioning of the new innovation (Lieberman and Montgomery 1988) to generate a better second-generation offering. Rao and Drazin (2002) consider recruitment as one means to increase innovation.

React-type defenses are considered in a few literature streams, such as in economics (Anderson and Engers 1994; Cyert and DeGroot 1970; Eaton and Engers 1990; Maskin and Tirole 1988; von Stackelberg 1934), and in some second-mover advantage management work (Gal-Or 1985; Hoppe 2000; Hoppe and Lehmann-Grube 2001; Lieberman and Montgomery 1988; Reinganum 1985). Incumbents fight an innovating rival by reacting either through imitation, or through more standard counter-attacks aimed at diminishing the value of the innovation. If the incumbent is good at reverse-engineering and production, it may be able to produce a fighting brand knock-off of the threatening innovation and even get it to some secondary markets faster. The reaction defense of imitation reduces the rival’s benefits from innovative activity and may diminish such activity overall as a result. The other reaction defenses include: price reductions to make it more difficult for the innovating rival to gain share or achieve margins; advertising blitzes to question the relative value of the innovation; and, legal maneuvering to delay the full launch of the innovation (e.g., Chen 1996; Jarratt 1998; Smith et al. 2001). Hill and Rothaermel (2003) provide a set of conditions where incumbents are more likely to adapt well to radical innovation effects.

Prior to considering the new defenses, it is worth noting that incumbents may choose one further option when confronted with competitive threats, and that is the option of no defenses. The choice not to defend is made when there are few benefits from defending, and more specifically when the costs of defending are likely to outweigh the benefits for that incumbent against a specific threat. Thus, the choice of the incumbent to use no defenses is more likely when, for example: the context is more turbulent (e.g., at the start of an industry or technological lifecycle—Agarwal et al. 2002; Utterback and Abernathy 1975); the nature of the incumbent’s current advantage is more temporary (e.g., due to imminent change in regulation or demand); the strength of the focal rival is more overwhelming; or, the incumbent is more likely to be acquired by an innovating rival.

2.5 The set of new innovation defenses

The innovation defenses we outline in this section fill a gap in the literature on actively pre-empting rival innovation. For each of these four defense options, we provide: a description; its economic basis (why it works); the time in the rival’s innovation process it is best used; conditions for its effective use (e.g., attractive innovation characteristics and rival characteristics); its main drawback; its differentiation from defenses focused on imitation threats; and, some examples of its use (see Table 1).

2.5.1 The confuse defense

The first defense option for actively pre-empting the threat of rival innovation is termed the confuse defense. The confuse defense consists of broadcasting disinformation to increase the rival’s difficulty in discovering the innovation, evaluating it, and exploiting it efficiently. An incumbent attempts to downplay or deny disadvantages it may have relative to the rival to make the rival’s innovation opportunities seem fewer. An incumbent also attempts to overstate or understate the potential value and costs related to the innovation opportunity in order to make the rival’s calculus and resource planning inaccurate. Disinformation can also be based on exploiting how decisions are made. Adjustment of anchors and other reference frames (e.g., Kahneman and Tversky 1979) of the rival may exploit a bias in decision-making behavior toward seeing the opportunity less favorably. The defense works because it increases the rival’s costs of information gathering, filtering, and calculating; it may also reduce the attraction of innovation opportunities to the rival. The confuse defense is best used early in the rival’s innovative activity, when the asymmetry of information favors the incumbent. Conditions that improve the effectiveness of this defense include: having a high degree of knowledge of the potential innovation threats (which is more likely with more incremental invention) and of the rivals; defending against rivals that are less likely to stay informed and objective in gathering information; and, defending against medium impact sized innovation where the benefit-to-cost ratio of defense is attractive and the rivals may not have high incentives for countermeasures. The one major drawback from the confuse defense is that a relatively high level of knowledge of the opportunity and of the rival innovator is required to create effective, believable disinformation. Although the incumbent may be privy to a knowledge advantage at some level due to its current position, the competitive and technological intelligence required to target and confuse rivals may be difficult to acquire (Ghoshal and Westney 1991; Prescott and Smith 1987). The innovation-targeted disinformation is different than disinformation aimed at deterring imitation. The disinformation is not aimed at creating causal ambiguity about the incumbent’s processes or at making an incumbent’s market look less attractive. Instead, an incumbent attempts to downplay or deny the changes and dynamics that generate opportunities. Examples of the use of the confuse defense include: spurious product pre-announcements (e.g., vaporware—predatory product pre-announcements—made by Ashton-Tate and Lotus in spreadsheets or Microsoft for Windows 98), and feinting investment in decoy business areas (e.g., Ralston’s Pro Plan line launch into specialty pet stores to decoy Iams and Hill’s away from the supermarket outlet for pet food—see McGrath et al. 1998).

2.5.2 The collude defense

The second defense option for actively pre-empting the threat of rival innovation is termed the collude defense. The collude defense consists of legally cooperating with other incumbent parties to block the exploitation of threatening inventions. The cooperating incumbent parties may be suppliers, distributors or other stakeholders with a common interest in keeping their current industry positions. The collude defense works by targeting the rival’s ability to appropriate returns from innovation; it effectively shifts bargaining power to the parties that the innovator rival must confront in order to exploit its innovation. The collude defense is more effective for use prior to the rival’s commercialization of its invention. Conditions that improve the effectiveness of this defense include: the incumbent having a low degree of drawing the attention and penalties from anti-trust regulators; stronger and more cohesive co-conspirator firms in the supply chain (which is more likely when the incumbent is familiar with them, which is more likely for more incremental innovation); a greater number of such firms that can be negatively affected by the rival’s innovation (which is more likely with a larger impact size of the innovation); and, targeting of rivals that are less likely to influence regulators and less likely to find sympathetic business partners early. The major drawback is the significant amount of risk involved due to the anti-competitive nature of this defense, although few resource commitments are made. Bringing in vertical parties to the collusive activity differentiates the innovation defense from the imitation defenses (i.e., in imitation, vertical partners normally only benefit from increased numbers of rivals at the incumbent’s level due to the bargaining power shift). Examples of the use of the collude defense include: using vertical foreclosure (e.g., Monsanto’s merger with D&PL in genetically modified cottonseed to possibly reduce innovation in biotech), and locking distributors into long-term relationships (e.g., Intel’s preferred customer plan that reduced attractive customers for new entrants).

2.5.3 The capture defense

The third defense option for actively pre-empting the threat of rival innovation is termed the capture defense. The capture defense consists of investing in, allying with, or otherwise monitoring the rival innovators in order to create an option to acquire that is exercised before the successful invention is fully exploited. This defense works when the incumbent has a greater payoff from controlling the innovation than the rival. That may arise when some asymmetry can be exploited to benefit both parties. The capture defense is best used near the rival’s commercialization of its innovation, when any asymmetries in valuation are more certain. Conditions that improve the success of this defense include: effectiveness in monitoring rival innovation and in bargaining down the acquisition price of the rival; medium radicality of the innovation (i.e., higher radicality is harder to monitor and bargain down but the benefits from learning the new knowledge behind the innovation are higher) and lower impact size of the innovation (i.e., given capture cost rise with size); and, targeting of rivals that are worse at bargaining, worse at investigating potential acquirers, and worse at firewalling off technologies. While the initial investment and monitoring expenses can be relatively low, acquisition expenses can be relatively high, making the capture defense significantly costly—its main drawback. This innovation defense is differentiated from the imitation defenses because most incumbents would not wish to buy redundant (imitative) resources unless they held market power and, in that case, may be hindered from doing so by anti-trust regulators. An example of the use of the capture defense is provided by larger technology firms like IBM, which during the 1990s engaged in hundreds of alliances with different partners, some of which it acquired (n.b., more recent examples include Google’s acquisitions of rivals like Doubleclick, and at least 11 new, small web outfits, like microblogging service Jaiku, in 2007).

2.5.4 The corrupt defense

The fourth defense option for actively pre-empting the threat of rival innovation is termed the corrupt defense. The corrupt defense consists of disrupting key points in the rival’s innovative process in order to make success at each key point more costly, time-consuming, and frustrating than it would otherwise be. This defense works because it increases the costs of the rival’s innovative processes at the most critical times; and, because it may disrupt the rival’s ability to signal to investors (i.e., the disruption may cause a rival to miss a milestone that triggers the next round of venture capital). This defense is best used prior to a major rival innovation milestone. Conditions that improve the effectiveness of this defense include: greater competitive intelligence in identifying a rival’s milestones and its investors and partners (which is more likely with more incremental, familiar, innovation); innovations that are of medium impact size (where the incentives for attacking are higher but the rival’s incentives for countermeasures are not as high); targeting the rivals that are poorer at keeping their innovation processes secret, at monitoring unusual incumbent behavior, and at keeping their partners, customers and employees loyal. The major drawback of this defense is the depth of competitive intelligence required to identify the rival’s milestones, key employees, and partners. This innovation defense is differentiated from imitation defenses because it attacks the innovation process points rather than the imitation process points (e.g., for imitation, the points of reverse-engineering the incumbent product, scaling up to mitigate learning curve advantages, coat-tail marketing efforts, etc. would be the targets). Examples of the use of the corrupt defense include: the conventional attacks (e.g., through price wars, lawsuits, advertising, fighting brands, etc.) of milestone events in the rival’s process, such as its first test market trial; and, the hiring away of key rival employees at key process points (e.g., Microsoft hiring away key web employees from IBM, like Ferguson and Ozzie, while both companies try to compete in web services against Google and Yahoo; or, ITV hiring away Michael Grade from BBC while the BBC faces a crisis with the British Government).

All four types of these pre-emption defenses against rival innovation exploit and manipulate the cost and benefit differences between the incumbent firm and the rival innovator. Most often, the defenses raise the costs of bringing an innovation to market for the rival, but also at a cost to the incumbent firm.

2.6 Counter-measures to the defenses and the resulting endgame

The effectiveness of the defenses and the ultimate outcome of the incumbent’s and rivals’ actions depend on the counter-measures that the rivals use. That set of moves and counter-moves parallels a repeated competitive game. As a result, the expected outcomes of the play of the game consist of the following three possibilities: the incumbent dominates with a successful defense against the innovation threat; the rival dominates with a successful innovation; or, the incumbent and rival battle to an intermediate result where the innovation emerges eventually, with a delay caused by the defenses. Below, we first consider the likely counter-measures of the innovating rival, and then we consider in more detail the outcomes.

The threatening rival innovator can respond effectively to the possibility of the pre-emptive defenses in several ways. We start at the general level and move to the more specific. At the general level, the rival can potentially defeat incumbent defenses when it can elude the incumbent’s awareness, motivation to act, and capability to act (Venkataraman et al. 1997). The rival can try to stay under the incumbent’s radar in the first part (e.g., be privately held, closely knit, and initially outside the industry or geographical interests of the incumbent). The rival can appear small in the second part (e.g., appear to commit to a small scale or defined niche) to reduce the perceived impact on the incumbent. And, the rival can be complex and fast in the third part (e.g., use multiple simultaneous attacks and be a flat, well-connected, well-funded organization) to challenge the incumbent’s capabilities and any delays in using them.

More specifically, the rival can mitigate the four pre-emptive defenses against innovation threats in the following ways. Against the confuse defense, the rival can stay informed and objective (e.g., use an experienced, heterogeneous board; recruit a well-rounded, informed management team; use outside consultants; etc.). Against the collude defense, the rival can identify and court sympathetic partners early, especially ones that could profit more if the innovation is successful; and, it could inform regulators to be wary of the incumbent’s actions. Against the capture defense, the rival could obtain good competitive information (and then due diligence) on potential acquirers and investors. Against the corrupt defense, the rival could be secretive of its milestones and monitor any unusual incumbent behavior coming at its milestones; it could also enforce firewalls of important knowledge and lock-in or get non-compete conditions on key employees.

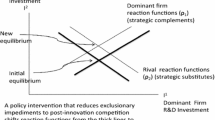

The most likely outcome of the pre-emptive innovation defenses and possible responses to consider is some intermediate equilibrium—an interior solution where each party makes costly investments and the innovation is commercialized at some point. This equilibrium is likely because the defenses and responses are each costly, partially offsetting, and of uncertain effectiveness. A simultaneous optimization of the incumbent’s investments in defenses and the rival’s investments in innovation and responses would be difficult, given the uncertainty involved, so the idea of initial dominance by either party is less likely. These other two results are boundary solutions: the incumbent does not defend, resulting in temporary profits for the incumbent until it is displaced; or, the rival does not innovate, resulting in long-sustained profits for the incumbent.

Incumbents are likely to account for the costs of the defenses and the possible outcomes of defending against rival innovation. As such, we can expect the incumbent to pursue the defenses when it is more likely to win, and we expect that likelihood to increase as the costs of the defenses decrease ceteris paribus. When an incumbent has synergies between its own innovation activities and the creation of defenses to rival innovation then the costs of the defenses are likely to be relatively lower. The possibility of such synergies presents itself in many forms. For example, knowledge of potential inventions and rivals—i.e., knowledge that is used to apply the defenses—may come from the incumbent’s own previous innovation activities (e.g., Cohen and Levinthal 1990). As well, the incumbent may be able to create information to innovate while banking disinformation to use in defenses or, the incumbent may be able to hire to create innovation by targeting employees of future rivals. Additionally, the incumbent may be able to build partnerships to involve in commercializing an invention and later to involve in defending against future rival innovations, or the incumbent may be able to establish a method to value innovations to itself and for the efficient capture of potential rivals.

2.7 Considering other threats besides innovation, and their defenses

These four preceding defense options—defenses that actively pre-empt rival innovation—are a subset of all tactics that a firm can use to defend against the full set of competitive threats. An incumbent faces three main competitive threats: the threat of imitation; the threat of innovation; and, the threat of context change. We have described the threat of innovation above; we describe the other two threats and their standard defenses below.

2.7.1 Delineating the three threats

The three threats differ in their main mechanism (i.e., the cores of these threats can be delineated), but there is some overlap in their effects. As such, there is some potential overlap in the defense tactics that can be employed. It may be best to consider the three threats in a Venn diagram where there is overlap among all three (see Fig. 2). The delineation is as follows: the main mechanism of innovation is replacement; the main mechanism of imitation is substitution; the main mechanism of context change is supply–chain relationship alteration. Innovation is threatening because it replaces incumbent offerings with new (i.e., better) offerings, based on new product and market knowledge. Imitation is threatening because it substitutes incumbent offerings with similar (i.e., fulfills the same consumer need in the same way) offerings, based on existing knowledge (or new knowledge that does not currently translate into better products, nor will in the foreseeable future). Context change is threatening because it affects the value, control of supply, and appropriability of the incumbent’s offerings without affecting the actual incumbent offering (Arend 2004; D’Aveni 1995). Take devaluation as an example of how the three different threats work. Innovation devalues the incumbent product with a new, better rival product. Imitation devalues the incumbent product with an increased supply of new but similar rival products (possibly with a lowered market share for the incumbent as well—e.g., Porter 1980). Context change devalues the incumbent product with a new perception that an existing rival product is better than the incumbent offering (e.g., through an effective marketing campaign that attacks the incumbent product). As noted, there can also be some overlap. For example, innovations can also create context change (e.g., when the new product introduces new supply chain players). Imitation can also create context change (e.g., when suppliers increase their bargaining power because there is more demand from the imitating producers).

The main threats to the incumbent. Notes: (1) Imitation can lead to context changes (e.g., increased supplier power). (2) Innovation can lead to context changes (e.g., changes in perceived value). (3) Imitation, in special circumstances, can lead to innovation (e.g., through the disruptive technology cycle)

2.7.2 The imitation threat and its defenses

The threat of imitation is best understood and defended against threat. It is the basis of the intellectual property rights system—a system that offers protection from imitators as a reward to the successful innovator to allow it a period of return on its investments. A substantial amount of the strategy literature is devoted to defending against imitation, either through internal barriers (i.e., the resource-based view’s approach—see Barney 1986, 1991; Dierickx and Cool 1989; Peteraf 1993), or through external barriers at the industry or strategic group level (i.e., the industrial organization approach—see Porter 1980).

The externally focused imitation defenses alter forces in the industry supply chain to increase the costs of procurement and distribution for the rivals attempting to imitate the incumbent. Most of these defenses are of the lock and block variety (Patterson 1993). For example, locking up customers by building switching costs, locking up distributors and key suppliers with exclusive long-term contracts, and locking up geographic markets that are characterized by economic deterrence (i.e., markets that can only be profitably serviced by one supplier) by entering them first. For some industries, there is an extended supply chain; one that involves complementors (Brandenburger and Nalebuff 1996). In those cases, incumbents can attempt to lock up firms that produce complementary products in order to deter imitation by rivals. Firms may also block out imitators through the legal system (e.g., with patent enforcement), and the regulatory system (e.g., filing for protection from foreign competition, like Harley Davidson did). Many of the benefits of first-mover advantage are based on the effectiveness of these defenses (Lieberman and Montgomery 1988) used in a pre-emptive fashion.

The internally focused imitation defenses increase the rival’s costs of reverse-engineering and of manufacturing the incumbent product. The resource-based view (RBV) has delineated several mechanisms that make a firm’s resources and capabilities economically unattractive to imitate, such as: causal ambiguity; time compression diseconomies; and, path dependency. A firm may also have an inimitable product because of the rarity of an underlying production resource that may have come from endowment or luck or partnering with the right firm. Scale and scope economies may also provide an incumbent with a cost advantage against any potentially imitating rival that may deter their action. Locking up complementary assets (Teece 1986) or creating a cost advantage in them may also make products economically infeasible to imitate. As well, incumbents may raise barriers through high investments in brand, capacity, and technology in order to deter or otherwise credibly threaten potential imitators (e.g., with high fixed costs or over-supply). Defenses leverage these mechanisms effectively (e.g., by building causal ambiguity into a product to foil reverse-engineering; by using initial low pricing to drive down a learning curve to gain a cost advantage; by heavily investing in pull-through advertising to differentiate a product in the customer’s perceptions; etc.), doing so mostly pre-emptively. Thoenig and Verdier (2003) consider how firms innovate with a bias toward skilled-labor-intensity in order to reduce spillovers in order to defend against imitation.

2.7.3 The context change threat and its defenses

The threat of context change garners much less attention than the threat of imitation. Firms have two main defenses to these threats—i.e., either pre-emptively block them or, ex post, adapt to them better than the initiating rivals. Incumbents can block, but need substantial power to influence the industry context by definition, so they must either be individually powerful or be able to form a friendly coalition. Regulatory context changes may be pre-empted with effective lobbying and capture. Appropriability context changes may be pre-empted with long-term contracts and investments in bargaining power against parties in the supply chain. Demand context changes may be pre-empted with heavy investment in marketing and alternative use possibilities for the focal product. As for the defenses that are aimed at adapting to context changes, firms can either be better at predicting the change (i.e., to have longer to adapt and have first-mover advantage), or they can be more flexible to better fit the new context (Zajac et al. 2000). Investing in trend-spotting is an example defense of the former kind, while flat organizational structuring is an example defense of the latter kind.

3 Discussion and conclusion

We have described, delineated and analyzed the threats facing an incumbent, focusing on threats from rival innovation, and further on a specific set of under-examined defenses available to the incumbent—i.e., the defenses that pre-empt the threat of rival innovation. We now turn to the managerial and research implications of our preceding analysis.

3.1 Managerial implications

It is not possible to provide a clear-cut set of specific application directions for managers, even given the knowledge of the array of threats and possible defenses. Table 1 provides some conditions for the application of pre-emptive innovation defenses, but we cannot prescribe actions for managers in any specific competitive situations; there are simply too many contingencies to consider. Contingencies include: the full set of specific threats faced by the incumbent; the resource constraints of the incumbent; the characteristics of the rival and the focal threat; the timing, geography, and markets of the potential battlegrounds; the spillovers and synergies of actions; etc.... We recommend a full competitive analysis, the details of which cannot be provided in one journal article. In lieu of clear-cut application prescriptions, we consider using the preceding analysis to predict where defenses are most likely to occur. There are two conditions when defenses are less likely: when defenses are not worthwhile—the cost does not support addressing an insignificant threat; and, when defenses are too costly even though the threat is substantial. We focus on the more interesting, latter condition. From Table 1 and the supporting analysis about conditions attractive for using defenses, we state the first proposition.

P1:

Incumbent defensive actions against rival innovation threats are less likely when the rival and the innovation are less familiar (e.g., a pre-invention stage innovation; a less incremental innovation), when the innovation will be protected by a tight appropriability regime, when there is a competitive market for acquisitions in the industry, when the value of the innovation is easily estimated, and when the innovation will be difficult to invent around (e.g., the technology curve is flattening).

The first managerial implication summarizes conditions when defenses are likely of high cost and thus less likely to be implemented. The second implication considers conditions when those costs are reduced—i.e., when synergies from related defensive actions exist. Incumbents must choose among their defenses given a range of threats. Defenses are costly, both in monetary terms and in terms of forgone opportunities. While costly, these pre-emptive defenses against innovation have the effect of delaying, possibly indefinitely, the success of rival innovations that threaten the profitability of an incumbent’s current products. We expect that incumbents would apply the marginalist principle in selecting defenses and investment in defenses—using defenses up to a cost where the next marginal dollar of investment just equals the next marginal dollar of expected return. This means the incumbent must be aware of all threats and all defenses, including their costs, expected benefits and risks, when choosing among the defenses. The incumbent must also be aware of any synergies that can be created with the defenses selected—e.g., it may be possible to use a defense that partially blocks both innovation and imitation threats from a specific target, perhaps by using the capture tactic (see discussion in Sect. 2.6). There may also be cost synergies in applying the defenses across related product markets that hold rival innovators (n.b., however, it may also be the case that firms may wish to stay clear of innovations that need to be defended across multiple economic sectors because of the costs of doing so). As well, firms that can generate defenses while they innovate (e.g., finding good supply chain partners to help commercialize their innovation now and using those partners in a collude defense in the future) should have a cost advantage in defending against rival innovation. The second proposition follows.

P2:

Incumbent defensive actions against rival innovation threats are more likely when the incumbent leverages related synergies (e.g., cost savings from creating and applying the same defenses across different rivals and across different threats, and cost savings from using the same efforts to innovate in creating defenses for that innovation).

The first two implications arise from considering the costs of defensive actions. The third implication translates that to a profit impact on the incumbent (drawing on Sect. 2.6). The defenses affect the incumbent in a complex way, even though a beneficial outcome is the net expected effect of any choice of defense. By using the pre-emptive innovation defenses, we expect that the incumbent’s profits will be lower in margin, higher in sustainability, and less volatile. In effect, the defenses are costly (at each period applied), but increase the periods of incumbency while reducing the shocks of attacks. The defenses delay (at best, indefinitely) the negative effects of the rival innovation by making a rival’s innovation more costly, less beneficial and more risky. Additionally, the defenses should reduce shocks in two ways: first, by actively defending, the incumbent is less likely to be caught off guard, without contingency plans; second, the range of defenses addresses a wide range of the possible innovation attacks, and so, should provide more control of negative earnings effects from those sources if used wisely. We also note that the use of defenses is actually doubly costly to the incumbent—first the incumbent must defeat the defenses of the previous incumbent in order to successfully innovate, and then the incumbent must defend against future rival innovation. The third and final proposition follows.

P3:

Incumbents that use defensive actions against rival innovation threats are more likely to have lower margins that are sustained longer with less volatility than incumbents that do not use such defenses.

3.2 Research implications

While managers may wish to know how to apply the defenses and what the effects will be, researchers are also focused on where to test the implications of the defenses, how to test them, and what other work can follow on the work started here.

3.2.1 Where to test

The innovation defenses are more likely necessary when the primary mode of attack is through innovation. There are contexts in which only the threat of innovation is the focus because the threat of imitation is ruled out. When the context is characterized by economic deterrence—the condition where an imitator could not profitably enter an industry because of the presence of an incumbent—then innovation is the rational means of entry. When the context is characterized by a tight appropriability regime—a high degree of control over the complementary assets required for imitating an incumbent’s products—innovation is the rational means of entry. When the context is technologically turbulent (e.g., e-commerce, web-based telephony, etc.) or characterized by continuous innovation (e.g., computing, communications, entertainment), then innovation not imitation is the primary means of competition. Thus, we recommend that research into the use of the pre-emptive innovation defenses should focus initially on such contexts.

3.2.2 How to test

In order to explore the issues we have raised in defending against the threat of rival innovation, empirical and experimental analyses are recommended. The real-world type of empirical research may require primary—e.g., survey—data where decision-makers are questioned as to whether and how they use certain defenses and what the outcome was (e.g., Tang 2006). Another avenue is to consider specific competitive dyads over time to track how an incumbent defends against the innovation threat of a certain rival, using press releases and other secondary information sources (e.g., Smith et al. 2001). A third avenue is case-study style research at specific incumbent firms in innovation-threatening contexts, perhaps contrasting a displaced incumbent with an incumbent that successfully defended its position (e.g., Eisenhardt 1989). Experimental research may also provide insight when a setting can be created where one team plays the incumbent and another the innovating rival, with choices of defense and counter-measures as primary choices of interest.

3.2.3 Future work

There are many areas for related future work. For example, research into how firms choose among defenses and targets when confronted by multiple types of threats is an area for future work. As well, research into the social welfare aspects of such defenses remains an area of future work (n.b., it is not simply evident that innovation defenses are welfare-decreasing, given the defenses actually create more incentive to innovate for those likely successful at circumventing current defenses). We would also like to see follow on work on the international issues (e.g., does government intervention, geographic clustering, culture, bankruptcy regulation, etc. effect innovation defensive activity?).

Regardless of the specific how, where, and what of follow-on research, the challenge of defending competitive advantage against threats is a valuable subject for academics to consider in order to help managers think ahead and make better decisions in facing the challenges that they have some control over (Cañas et al. 2003). Without such research, firms may continue to sow the seeds of their own destruction either directly by their own actions or indirectly by their lack of actions to respond to rivals, including rival innovators.

Notes

We advocate only legal ways of preventing threatening rival innovations. Such approaches must be adjusted, in practice, to the legal and ethical standards of the organization and context involved. Regardless, it is important to acknowledge the spectrum of possible defenses, many of which have been used, whether legal or not. As with any competitive situation and especially one with significant societal impact, such issues—legal and ethical—arise, but are left for future work in those literatures most relevant to those specific issues.

There are opportunities that increase the consumable utility, and there are opportunities that decrease the costs of production. The first category may arise due to changes in what can and could generate utility, and in the level of utility generated by existing goods. Opportunities in the latter category may arise due to changes in production technologies—technical, organizational, and inter-organizational—as well as changes in related regulations.

For bargaining outside the rival venture, opportunities may arise due to changes in the supply and demand of external complementary assets (Teece 1986), in the underlying added value of external complementary assets, and in the relative value of their substitutes. For bargaining inside the rival venture, opportunities may arise due to changes in labor laws, compensation methods, monitoring costs, individual productivity technology, labor supply and demand, and labor substitution.

Increasing the control of the market supply can be done either directly or indirectly. Opportunities for direct influence include applying new knowledge to strengthen market power and to facilitate collusion. Such knowledge may be in the form of regulatory changes affecting anti-competitive behavior and cooperative behavior, in the form of new ways to signal, monitor, and punish competitors, and in the form of new ways to raise entry barriers and lower exit barriers.

We can break out the potential profits from the potential realizable profits in order to proceed in stages instead. If the potential value is high, however, then it may be worthwhile to estimate how much of the potential value the rival is likely to appropriate and how well it will be able to defend its advantage from imitation by other rivals. If appropriation and defendable advantage are low then the threat is low; if not, then the incumbent firm will require defenses.

We note that defense strategies will more likely be those the incumbent can measure and legally pursue. Future work may consider the morality and social good of using any specific defensive tactic.

References

Abernathy, W., & Clark, K. B. (1985). Mapping the winds of creative destruction. Research Policy, 14, 3–22.

Afuah, A. N. (1996). Maintaining a competitive advantage in the face of a radical technological change: The role of strategic leadership and dominant logic. Working Paper, University of Michigan Business School.

Afuah, A. N. (1998). Innovation management: Strategies, implementation, and profits. New York: Oxford University Press.

Afuah, A. N., & Bharam, N. (1995). The hypercube of innovation. Research Policy, 24, 51–76.

Agarwal, R., Sarkar, M., & Echambadi, R. (2002). The conditioning effect of time on firm survival: An industry life cycle approach. Academy of Management Journal, 45(5), 971–994.

Amit, R. H., & Schoemaker, P. J. H. (1993). Strategic assets and organizational rent. Strategic Management Journal, 1(4), 33–46.

Anderson, S. P., & Engers, M. (1994). Strategic investment and timing of entry. International Economic Review, 35(4), 833–853.

Anthony, S. A., & Christensen, C. M. (2005). How you can benefit by predicting change. Financial Executive, 21(2), 36–41.

Arend, R. J. (2004). The definition of strategic liabilities, and their impact on firm performance. Journal of Management Studies, 41(6), 1003–1027.

Barney, J. B. (1986). Strategic factor markets: Expectations, luck and business strategy. Management Science, 32, 1231–1241.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17, 99–120.

Brandenburger, A. M., & Nalebuff, B. J. (1996). Co-opetition. New York: Currency-Doubleday.

Cañas, J., Quesada, J, Antolí, A., & Fajardo, I. (2003). Cognitive flexibility and adaptability to environmental changes in dynamic complex problem-solving tasks. Ergonomics, 46(5), 482–501.

Chen, M.-J. (1996). Competitor analysis and interfirm rivalry: Toward a theoretical integration. Academy of Management Review, 21(1), 100–134.

Chesbrough, H. W., & Teece, D. J. (2002). Organizing for innovation: When is virtual virtuous? Harvard Business Review, 80(8), 127–135.

Christensen, C. M. (1997). The innovator’s dilemma: When new technologies cause great firms to fail. Boston, MA: Harvard Business School Press.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35, 128–152.

Cyert, R., & DeGroot, M. (1970). Multiperiod decision models with alternating choice as a solution to the Duopoly problem. Quarterly Journal of Economics, 84, 410–429.

D’Aveni, R. A. (1994). Hypercompetition. New York, NY: Free Press.

D’Aveni, R. A. (1995). Coping with hypercompetition: Utilizing the new 7S’s framework. Academy of Management Executive, 9(3), 45–57.

Dierickx, I., & Cool, K. (1989). Asset stock accumulation and sustainability of competitive advantage. Management Science, 35, 1504–1511.

Dodgson, M., Gann, D. M., & Salter, A. J. (2002). The intensification of innovation. International Journal of Innovation Management, 6(1), 53–83.

Eaton, J., & Engers, M. (1990). Intertemporal price competition. Econometrica, 58, 637–659.

Eisenhardt, K. M. (1989). Making fast strategic decisions in high velocity environments. Academy of Management Journal, 32(3), 543–576.

Ettlie, J. E., Bridges, W. P., & O’Keefe, R. D. (1984). Organization strategy and structural differences for radical versus incremental innovation. Management Science, 30, 682–695.

Fischhoff, B., Lichteinstein, S., Slovic, P., Derby, S. C., & Keeney, R. L. (1981). Acceptable risk. Cambridge: Cambridge University Press.

Fleming, L. (2002). Finding the organizational sources of technological breakthroughs: The story of Hewlett-Packard’s thermal ink-jet. Industrial & Corporate Change, 11(5), 1059–1084.

Ford, C. M., & Ogilvie, D. T. (1996). The role of creative action in organizational learning and change. Journal of Organizational Change Management, 9(1), 54–62.

Gal-Or, E. (1985). First mover and second mover advantages. International Economic Review, 26(3), 649–653.

Ghoshal, S., & Westney, D. E. (1991). Organizing competitor analysis systems. Strategic Management Journal, 12, 17–31.

Griliches, Z. (1957). Hybrid corn: An exploration in the economics of technological change. Econometrica, 25, 501–522.

Henderson, R., & Clark, K. B. (1990). Architectural innovation: The reconfiguration of existing product technologies and the failure of established firms. Administrative Science Quarterly, 35, 9–30.

Hill, C. W. L., & Rothaermel, F. T. (2003). The performance of incumbent firms in the face of radical technological innovation. Academy of Management Review, 28, 257–274.

Hoppe, H. C. (2000). Second-mover advantages in the strategic adoption of new technology under uncertainty. International Journal of Industrial Organization, 18(2), 315–338.

Hoppe, H. C., & Lehmann-Grube, U. (2001). Second-mover advantages in dynamic quality competition. Journal of Economics & Management Strategy, 10(3), 419–433.

Jarratt, D. G. (1998). A strategic classification of business alliances: A qualitative perspective built from a study of small and medium-sized enterprises. Qualitative Market Research, 1(1), 39–49.

Kahneman, D., & Tversky, A. (1979). Prospect theory, an analysis of decision under risk. Econometrica, 47, 263–291.

Kanter, R. M. (1989). Swimming in newstreams: Mastering innovation dilemmas. California Management Review, 31(4), 45–69.

Lawson, B., & Samson, D. (2001). Developing innovation capability in organisations: A dynamic capabilities approach. International Journal of Innovation Management, 5(3), 377–400.

Lee, T., & Wilde, L. (1980). Market structure and innovation: A reformulation. Quarterly Journal of Economics, 94, 429–436.

Leenders, M. A. A. M., & Voermans, C. A. M. (2007). Beating the odds in the innovation arena: The role of market and technology signals classification and noise. Industrial Marketing Management, 36(4), 420–429.

Lieberman, M., & Montgomery, D. B. (1988). First-mover advantages. Strategic Management Journal, 9, 41–58.

Loury, G. C. (1979). Market structure and innovation. Quarterly Journal of Economics, 93, 395–410.

Luehrman, T. A. (1998). Investment opportunities as real options: Getting started on the numbers. Harvard Business Review, 76(4), 51–67.

Maskin, E., & Tirole, J. (1988). A theory of dynamic Oligopoly, II: Price competition, kinked demand curves, and Edgeworth cycles. Econometrica, 56, 571–599.

McGrath, R. G. (1999). Falling forward: Real options reasoning and entrepreneurial failure. Academy of Management Review, 24(1), 13–30.

McGrath, R. G., Chen, M.-J., & MacMillan, I. C. (1998). Multimarket maneuvering in uncertain spheres of influence: Resource diversion strategies. Academy of Management Review, 23(4), 724–740.

McGrath, R. G., & MacMillan, I. C. (1995). Discovery-driven planning. Harvard Business Review, 73(4), 4–12.

Mercer Inc. (2002). Just the facts. Journal of Business Strategy, 23(4), 3.

O’Connor, G. C., & Rice, M. P. (2001). Opportunity recognition and breakthrough innovation in large established firms. California Management Review, 43(2), 95–116.

Ogilvie, D. T. (1998). Creative action as a dynamic strategy. Journal of Business Research, 41(1), 49–56.

Paine, F. T., & Anderson, C. R. (1977). Contingencies affecting strategy formulation and effectiveness: An empirical study. Journal of Management Studies, 14(2), 147–158.

Patterson, W. C. (1993). First-mover advantage: The opportunity curve. Journal of Management Studies, 30(5), 759–777.

Pavitt, K. (1990). What we know about the strategic management of technology. California Management Review, 32(3), 17–26.

Peteraf, M. A. (1993). The cornerstones of competitive advantage: A resource-based view. Strategic Management Journal, 14(3), 179–191.

Porac, J. F., Thomas, H., & Baden-Fuller, C. (1989). Competitive groups as cognitive communities: The case of Scottish knitwear manufacturers. Journal of Management Studies, 26(4), 397–416.

Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competitors. New York, NY: Free Press.

Prescott, J. E., & Smith, D. C. (1987). A project-based approach to competitor analysis. Strategic Management Journal, 8(5), 411–423.

Quinn, J. B. (1985). Managing innovation: Controlled chaos. Harvard Business Review, 63(3), 73–84.

Rao, H., & Drazin, R. (2002). Overcoming resource constraints on product innovation by recruiting talent from rivals: A study of the mutual fund industry, 1986–1994. Academy of Management Journal, 45, 491–507.

Reinganum, J. (1982). Dynamic game of R&D: Patent protection and competitive behavior. Econometrica, 50(3), 671–688.

Reinganum, J. (1985). A two-stage model of research and development with endogenous second-mover advantages. International Journal of Industrial Organization, 3(3), 275–292.

Saleh, S. D., & Wang, C. K. (1993). The management of innovation: Strategy, structure, and organizational climate. IEEE Transactions on Engineering Management, 40(1), 14–21.

Schumpeter, J. A. (1950). Capitalism, socialism and democracy (3rd ed.). New York, NY: Harper.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25(1), 217–226.

Smith, K. G., Ferrier, W. J., & Grimm, C. M. (2001). King of the hill: Dethroning the industry leader. Academy of Management Executive, 15(2), 59–70.

Souitaris, V. (2001). Strategic influences of technological innovation in Greece. British Journal of Management, 12, 131–147.

Tang, J. (2006). Competition and innovation behaviour. Research Policy, 35(1), 68–82.

Teece, D. J. (1986). Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Research Policy, 15(6), 285–305.

Thoenig, M., & Verdier, T. (2003). A theory of defensive skill-based innovation and globalization. American Economic Review, 93, 709–728.

Tirole, J. (1988). The theory of industrial organization. Cambridge: The MIT Press.

Tushman, M. L., & Anderson, P. (1986). Technological discontinuities and organizational environments. Administrative Science Quarterly, 31, 439–465.

Utterback, J., & Abernathy, W. (1975). A dynamic model of process and product innovation. OMEGA, 3, 639–656.

Venkataraman, S. (1997). The distinctive domain of entrepreneurship research: An editor’s perspective. In J. Katz & R. Brockhaus (Eds.), Advances in entrepreneurship, firm emergence, and growth (Vol. 3, pp. 119–138). Greenwich, CT: JAI Press.

Venkataraman, S., Chen, M.-J., & MacMillan, I. C. (1997). Anticipating reactions: Factors that shape competitor responses. In G. S. Day, D. J. Reibstein, & R. E. Gunther (Eds.), Wharton on dynamic competitive strategy. New York, NY: John Wiley & Sons Inc.

von Stackelberg, H. (1934). Marktform und Gleichgewicht. Vienna and Berlin: Springer.

Weerawardena, J., O’Cass, A., & Julian, C. (2006). Does industry matter? Examining the role of industry structure and organizational learning in innovation and brand performance. Journal of Business Research, 59(1), 37–45.

Wind, J. (1997). Preemptive strategies. In G. S. Day, D. J. Reibstein, & R. E. Gunther (Eds.), Wharton on dynamic competitive strategy. New York, NY: John Wiley & Sons.

Wolfe, R. A. (1994). Organizational innovation: Review, critique and suggested research directions. Journal of Management Studies, 31(3), 405–431.

Zajac, E. J., Kraatz, M. S., & Bresser, R. K. F. (2000). Modeling the dynamics of strategic fit: A normative approach to strategic change. Strategic Management Journal, 21, 429–453.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Arend, R.J. Defending against rival innovation. Small Bus Econ 33, 189–206 (2009). https://doi.org/10.1007/s11187-008-9097-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-008-9097-y