Abstract

We show that corporate governance mechanisms play an important role in controlling managers’ opportunistic behavior. Low executive equity compensation and a high intensity of outside monitoring help to discourage undesirable self-interested disclosure decisions by management before share repurchases. Corporate governance mechanisms also have a significant impact on long-run abnormal stock prices and operating performance. Firms that manipulate pre-repurchase disclosures experience positive long-term abnormal stock returns. However, we do not find that these firms experience positive long-run operating performance. Corporate governance mechanisms significantly attenuate the tendency toward negative pre-repurchase disclosures and their effects on stock prices and operating performance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The separation of ownership and control in modern corporations raises the possibility of conflicts of interest between managers and shareholders (Jensen and Meckling 1976). Two types of governance mechanisms discourage undesirable behaviors by corporate executives. First, executive compensation contracts can help to align the interests of managers and shareholders (Mehran 1995; Berger et al. 1997; Cho 1998). Second, outside monitoring can curb self-serving management decisions (Fama and Jensen 1983; Walsh and Seward 1990; Teng and Hachiya 2013).

Since the 1980s, firms have been increasingly distributing free cash flows through share repurchases (Grullon and Michaely 2002). According to the free cash flow hypothesis outlined by Jensen (1986), repurchases make managers less likely to misuse excess cash. Although repurchases are perceived to help reduce the free cash flow problem (Grullon and Michaely 2004), several studies show that managers’ equity stakes in the firm provide managers with the incentives to deflate the repurchase price to transfer wealth effectively from the shareholders who sell their stock to the remaining shareholders who do not sell, including managers themselves (Barclay and Smith 1988; Brockman et al. 2008; Gong et al. 2008).

In this vein of research, Gong et al. (2008), Brockman et al. (2008), and Cooper et al. (2018) find supportive evidence that managers actively deflate earnings numbers and tend to announce bad news before repurchasing shares. High equity stakes of CEOs increase managerial incentives to depress the repurchase price, which reduces the effectiveness of equity compensation as a governance mechanism. Gong et al. (2008) also show that the post-repurchase superior performance is due, at least in part, to pre-repurchase downward earnings management. Recently, Caton et al. (2016) documented that well-governed repurchasing firms tend to produce better long-term stock and operating performance than do less well-governed firms.Footnote 1 These studies, however, do not specifically examine the role of the equity compensation and outside monitoring on managers’ self-serving behaviors before repurchasing shares and on firms’ subsequent performance after repurchases.Footnote 2 In contrast to prior literature, this paper focuses on the differences between firms, in terms of managerial manipulation behavior before repurchases and related long-term stock and operating performances after repurchases, under various governance mechanisms.

According to Brockman et al. (2008), management has considerable discretion over the release of information at the time of stock repurchases.Footnote 3 Managers with higher equity compensation tend to have greater incentives to buy back shares at a lower price because they also enjoy the wealth transfer effects. The higher equity incentives may give CEOs and CFOs further incentives to benefit personally by depressing the repurchase prices. Managers can benefit from personal share purchases at a lower price subsequent to pre-repurchase information manipulation if the stock price returns to pervious levels 3–5 years after repurchase. As a result, the governance mechanism particularly matters to the self-interested disclosure policy because it involves management’s personal trading behavior. We conjecture that the opportunistic behavior of managers in deliberately disclosing negative news is related to the governance mechanisms of equity compensation and outside monitoring. Specifically, managers are more (less) likely to manipulate voluntary disclosures before share repurchases, especially when the equity compensation is relatively high (low) and the outside monitoring intensity is relatively low (high). As a result, we posit that firms with high (low) executive equity compensation and low (high) outside monitoring intensity are more (less) likely to manipulate pre-repurchase disclosures.Footnote 4

This paper investigates the effect of executive equity incentives and outside monitoring on the pre-repurchase management opportunism of voluntary disclosures and the associated post-repurchase performances. We use the equity compensation schemes of both CEOs and CFOs to gauge firms’ incentives to engage in opportunistic pre-repurchase voluntary disclosures. The intensity of outside monitoring is proxied by institutional ownership concentration (i.e., the five largest institutional investors’ ownership), percentage of independent directors and number of analysts following. Prior literature shows that higher institutional ownership concentration, percentage of independent directors, and number of analysts following lead to better monitoring of managers (Agrawal and Mandelker 1990; Wright et al. 2002; Yu 2008). We examine how pre-repurchase management forecasts, proxied by managers’ voluntary disclosures (Brockman et al. 2008), and post-repurchase stock prices and firm performance are affected by the governance mechanisms of executive equity compensation and outside monitoring.

Given that the use of stock- and option-based compensation increased dramatically during the 1990s, managers have high wealth exposure to the stock prices of their companies, which may motivate them to engage in self-interested short-termist behavior. Brockman et al. (2008) find that CEO equity stakes encourage pre-repurchase manipulation of bad news to deflate the repurchase price. Fuller and Jensen (2002, 2010) argue that the increasing proportion of stock options in an executive compensation package causes both CEOs and CFOs to focus on enhancing short-term stock prices as a personal priority. Previous research shows links between CEO equity incentives and earnings accruals management (Bergstresser and Philippon 2006) and the likelihood of beating analyst forecasts (Cheng and Warfield 2005). Jiang et al. (2010) find that the role of CFO equity incentives is greater than that of the CEO in earnings management. Chava and Purnanandam (2010) report that both CEOs and CFOs choose their firms’ financial policies based on the risk-taking incentives generated from their personal holdings of stocks and options in the company. As a result, prior studies suggest that equity-based compensation may induce both CEOs and CFOs to act in a manner that is primarily consistent with their own interests.

However, because outside monitors are less influenced by managers, they perform the function of decision control and thus mitigate managerial opportunism. Previous research has explored the roles of institutional investors, independent directors, and security analysts in corporate governance.Footnote 5 The literature shows that outside monitors have opportunities, resources, and the ability to monitor, discipline, and influence managers. Outside monitors also help to reduce information asymmetry between managers and shareholders by inducing firms to disclose information in an appropriate and timely manner. Therefore, institutional investors, independent directors, and security analysts can force managers to focus more on corporate performance and less on opportunistic or self-serving behavior, thereby minimizing the agency costs.

Lie (2005) finds that firms experience significant operating performance improvement after repurchases. He infers that managers use repurchases to communicate favorable private information about their future operating performance. We posit that only firms that do not tend to manipulate pre-repurchase disclosures (non-manipulating firms) experience improved post-repurchase operating performance, as the managers of these firms are less likely to engage in opportunistic or self-interested behavior and their repurchases announcements will contain better information about firms’ future prospects. In contrast, managers of firms that manipulate pre-repurchase disclosures (manipulating firms) are more likely to release bad news deliberately before share repurchases, and their repurchase announcements are less likely to contain truthful information about firms’ future prospects; thus, their post-repurchase operating performance is not likely to improve.

Klein (2002), Ajinkya et al. (2005), Karamanou and Vafeas (2005), and Kanagaretnam et al. (2007) find that firms with better corporate governance have lower information asymmetry and greater transparency. In a more transparent environment, stock prices should be more informative about future events (Piotroski and Barren 2004; Barberis et al. 2005; Chan and Hameed 2006; Dasgupta et al. 2010). As a result, when events occur, there should be less “surprise”; that is, less new information is impounded into the stock price. Therefore, we expect the post-repurchase operating performance improvement of non-manipulating firms will not generate long-term stock price outperformance. However, investors are likely misled by the pre-repurchase information for manipulating firms and thus may be positively surprised when realized post-repurchase operating performance exceeds prior expectations and the stock prices outperform in the long run. This conjecture is consistent with Louis (2004), Gong et al. (2008), Chen et al. (2009), and Cooper et al. (2018) who argue that as long as investors have difficulties in interpreting firm information, pre-event management information manipulation will be associated with post-event abnormal stock returns.

Consistent with our expectation, we find that manipulating firms that have higher equity incentives for CEOs and CFOs and a lower intensity of outside monitoring (i.e., lower institutional ownership concentration, lower independent board percentage, and smaller number of analysts following) release significantly more bad news, both in terms of frequency and magnitude, within 30 days before the start of a share repurchase program. We also find evidence of downward-biased management earnings forecasts before repurchases. Moreover, these firms release significantly more good news within 30 days after the completion of repurchases than during the 30 days before repurchases, suggesting that they withhold good news prior to repurchasing shares. In contrast, we find no evidence of management opportunism for non-manipulating firms.

In terms of management’s personal incentives, we find that the likelihood of buying shares subsequent to pre-repurchase management forecasts is significantly larger for CEOs and CFOs with high equity compensation than for those with low equity. Our results suggest that managers with high equity compensation attempt to gain personal benefits from buying shares at a lower price, which is consistent with the argument in Kim et al. (2013). The evidence shows that managerial actions to manipulate pre-repurchase disclosures simultaneously benefit managers personally.

Looking at post-repurchase stock price performances, we find significantly positive long-term abnormal stock returns for manipulating firms, indicating that the effects of the deliberately released bad news by such firms reverse in the long run. Because managers of non-manipulating firms are less likely to manipulate pre-repurchase news releases, the stock prices tend to react to the information contained in the repurchase announcement immediately, and the firms experience no long run stock outperformance. These findings support the argument that managers with high equity compensation personally benefit from pre-repurchase bad news manipulation because, as we show, they are more likely to purchase shares at a lower price subsequent to pre-repurchase management forecasts, and the stock price returns to previous levels 3–5 years after repurchase.

Furthermore, the operating performance of manipulating firms that engage in opportunistic pre-repurchase news releases does not change significantly, which indicates that the pre-repurchase news releases and repurchase announcements have limited information content. Only non-manipulating firms experience a significant subsequent improvement in operating performance, indicating that the repurchase announcements by managers who do not engage in opportunistic or self-serving behavior contain information about favorable future prospects.

Our paper emphasizes the differences in management’s pre-repurchase manipulating behavior and the associated post-repurchase stock and operating performance among firms under various governance mechanisms. We contribute to the literature in the following ways.Footnote 6 First, we show that corporate governance mechanisms play an important role in deterring managers’ opportunistic behavior. Prior research demonstrates that CEOs’ equity compensation induces them to deflate repurchase prices (Brockman et al. 2008; Gong et al. 2008). We show that non-manipulating firms—that is, those with low equity incentives and strong outside monitoring—are less likely to mislead investors.Footnote 7 Second, we show a significant impact of corporate governance on post-repurchase stock prices and operating performance. The absence of long-run positive stock price performance for firms that do not manipulate voluntary disclosures before repurchasing shares shows that the stock prices of non-manipulating firms can instantly and accurately reflect the future improvement in firms’ operating performances. The subsequent superior operating performance of non-manipulating firms is consistent with prior findings that share repurchase announcements contain information about firms’ future prospects.

Third, our findings for manipulating firms, which have high executive equity compensation and weak outside monitoring intensity, are consistent with the literature on voluntary disclosure showing that management has incentives to accelerate the disclosure of bad news and delay announcements of good news. The managers first manage investors’ expectations downward and eventually compensate with good news in the longer run to help mitigate litigation concerns (Skinner 1994; Kasznik and Lev 1995), increase CEOs’ stock option compensation (Aboody and Kasznik 2000), and maximize insider trading profits (Cheng and Lo 2006). In this study, we also find that CEOs and CFOs with high equity incentives attempt to benefit from personal trading during the process of voluntarily releasing bad news rather than good news, which is consistent with Cheng and Lo (2006). The findings illustrate that the governance mechanism particularly matters to the self-interested disclosure policy because it involves management’s personal trading behavior.

The remainder of the paper proceeds as follows. Section 2 develops the hypotheses. Section 3 describes the sample and outlines the research design. Section 4 presents the empirical results of the effect of the governance mechanisms of executive compensation and outside monitoring on pre-repurchase voluntary disclosure behavior. Section 5 analyzes how the governance mechanisms of executive compensation and outside monitoring affect the post-repurchase stock price and operating performance. Finally, Sect. 6 concludes the paper.

2 Literature review and hypothesis development

2.1 Executive compensation

Since the 1990s, firms have dramatically increased the use of equity-based executive compensation as a governance mechanism to discourage certain types of wasteful empire-building behavior by executives. This usage is consistent with the agency theory, which suggests that stock and option holdings tying managers’ wealth to a firm’s stock price can help to align executives’ self-interest with the interests of shareholders (Mehran 1995; Berger et al. 1997; Cho 1998). However, linking managers’ wealth to a firm’s stock price constitutes compensation risk for executives due to uncertainty regarding future firm performance. Accordingly, equity-based incentives can unintentionally motivate undesirable behaviors so that executive interest misalignment occurs (Zhang et al. 2008).

Previous empirical research on managerial compensation largely focuses on CEOs. Cheng and Warfield (2005), Bergstresser and Philippon (2006), Burns and Kedia (2006), and Efendi et al. (2007), among others, find a positive relation between CEO equity incentives and earnings management. Furthermore, recent research provides evidence that the equity incentives of CFOs influence corporate decisions requiring financial expertise (Chava and Purnanandam 2010; Jiang et al. 2010; Kim et al. 2011). Therefore, corporate decisions are likely affected by the equity compensation of both CEOs and CFOs, resulting in the possibility of managerial opportunism in corporate decisions.

Managers have considerable discretion over the flow of information around share repurchases. Gong et al. (2008) and Brockman et al. (2008) find a positive and significant relation between the private incentives and managerial opportunism of CEOs by manipulating financial information prior to repurchases in order to depress stock prices. Executives can manage discretionary disclosures in terms of whether to make a forecast, and they can also manage the timing, form, and specificity of disclosures. Because CEOs and CFOs are both important decision-makers in earnings forecasts, they have higher equity incentives that likely cause management to engage in opportunistic behavior related to voluntary forecast disclosures before upcoming repurchases. As discussed in Sect. 1, the manipulation of voluntary forecast disclosures can make the stock market less likely to correctly incorporate information into firms’ stock prices at the time of the announcement. Consequently, these firms can experience long-run positive abnormal stock price performance when the effects of the bad news deliberately released by managers are reversed in the long run. Further, the repurchase announcements of manipulating firms are less likely to contain truthful information about firms’ future prospects for operation performance.

Therefore, we expect that firms with higher (lower) equity incentives for CEOs and CFOs, referred to as manipulating (non-manipulating) firms, voluntarily disclose more (fewer) negative forecasts, are more (less) likely have long-run stock outperformance and less (more) likely to experience operating performance improvement.

2.2 Outside monitoring

2.2.1 Institutional ownership concentration

Institutional investors have the incentive and ability to monitor executives because they are often major shareholders with the scrutiny skills of professional investors. Through a variety of actions, such as direct negotiations, public announcements, and shareholder proposals, institutional investors can leverage their large ownership share to influence managers (Wahal 1996; David et al. 2001). Empirical research also provides evidence of institutional investor activism as a source of outside monitoring (Smith 1996; Wright et al. 2002; Hartzell and Starks 2003; Ajinkya et al. 2005). Therefore, we expect that institutional investors play an important role in controlling managerial opportunistic behavior.

Ajinkya et al. (2005) suggest that corporate disclosures are closely watched by institutions. By attending conference calls, institutions consistently explore a company for more specific, unbiased, and accurate information about its prospects. Although, as outsiders, institutions may not directly oversee managerial activities, their demand for information from the firm can elicit greater transparency and reduce manipulation. Institutional owners with large shareholdings have greater incentives to monitor managers (Demsetz 1983; Shleifer and Vishny 1986). Agrawal and Mandelker (1990) find that a higher concentration of institutional ownership relates to better monitoring of managers. We use the percentage of a firm’s common stock held by the five largest institutional owners to measure institutional ownership concentration (Ajinkya et al. 2005). Firms with a higher concentration of institutional ownership are less likely to engage in opportunistic managerial disclosure behavior prior to repurchases, and, thus, the stock market correctly incorporates these firms’ information into its stock prices. As a result, the repurchase announcements contain better information about firms’ future prospects for operating performance.

Therefore, we expect that firms with higher (lower) institutional ownership concentration, referred to as non-manipulating (manipulating) firms, voluntarily disclose less (more) negative forecasts and are less (more) likely to have long-run stock outperformance and more (less) likely to experience operating performance improvement.

2.2.2 Percentage of independent directors

Monitoring management performance and protecting shareholder interests are the fiduciary duties of corporate boards. Fama (1980) and Fama and Jensen (1983) argue that outside directors bear a reputation cost in the outside directorship market if their firms’ performances are poor, which serves as an important incentive for them to monitor executives more carefully compared to other directors. Unlike insider and affiliated directors, whose careers or personal interests are tied to the firm’s management, outside directors monitor the actions of a firm management from an independent position. They are therefore less beholden to executives of the firm and can be more objective in their evaluations of executives’ performance. Prior literature finds that firms with boards dominated by outsiders are more likely to remove poorly performing CEOs (Weisbach 1988) and to nominate outside CEOs (Borokhovich et al. 1996). A number of studies indicate that the addition of outsiders to the board leads to an increase in shareholder wealth and to improved financial performance (Rosenstein and Wyatt 1990; Byrd and Hickman 1992; Brickley et al. 1994).

Previous work suggests that the monitoring role of independent outside directors extends to the financial reporting process.Footnote 8 Managers acting in the best interests of the firm issue more frequent, specific, and accurate forecasts to enhance transparency (Skinner 1994; Kasznik and Lev 1995; Williams 1996). However, various reasons, such as insider trading opportunities and the reputation or litigation risks of erroneous forecasts, can lead managers to act self-interestedly by disclosing suboptimal information. Independent outside directors can help encourage greater transparency, thereby mitigating managerial opportunism and increasing the quality of voluntary management forecasts. A higher percentage of independent directors thus reduces opportunistic managerial disclosure behavior prior to repurchases. Consequently, the stock market can correctly incorporate information into its stock prices, and the repurchase announcements contain better information about firms’ future prospects for operating performance.

Therefore, we expect that firms with a higher (lower) percentage of independent directors, referred to as non-manipulating (manipulating) firms, voluntarily disclose less (more) negative forecasts and are less (more) likely to have long-run stock outperformance and more (less) likely to experience operating performance improvement.

2.2.3 Number of analysts following

Shareholders often have less knowledge about the firm than executives do. Information asymmetry between shareholders and managers therefore exacerbates agency problems (Comment and Jarrell 1991). Jensen and Meckling (1976) argue that analysts act as monitors of managerial performance and thus reduce agency costs. Financial analysts engage in the production of private information as they collect, analyze, and disseminate knowledge to interested parties, thereby mitigating information asymmetry and controlling for executives’ potential misbehaviors (Chung and Jo 1996; Healy and Palepu 2001). Dyck et al. (2010) provide evidence that analysts play an active role in corporate fraud detection. Yu (2008) also finds that firms followed by more analysts have a lower level of earnings management.

Analysts possess several particular characteristics that make them effective monitors of management’s voluntary financial disclosures. Analysts are usually well trained in finance and accounting and have substantial background knowledge in the industries they follow. In addition, analysts track firms on a regular basis, often interact directly with management, and can query aspects of a firm’s financial reporting numbers through conference calls. As a result, they constantly monitor managers’ financial information releases. Because analysts actively participate in the information distribution process, the strength of analyst coverage can influence management’s financial reporting decisions (Yu 2008). A greater analyst following increases the effectiveness of monitoring and consequently decreases opportunistic managerial disclosure behavior prior to repurchases. As a result, the stock market can correctly incorporate information into its stock prices, and the repurchase announcements contain better information about firms’ future prospects for operating performance.

Therefore, we expect that firms with a higher (lower) analyst followings, referred to as non-manipulating (manipulating) firms, lead the voluntary disclosure of less (more) negative forecasts, are less (more) likely to have long-run stock outperformances and more (less) likely to experience operating performance improvement.

3 Sample selection and method

3.1 Sample

We use the Security Data Corporation (SDC) Mergers and Acquisitions database to retrieve repurchase announcements.Footnote 9 Conditional on a repurchase announcement on SDC, we follow Gong et al. (2008) to identify a carry-through repurchase announcement as an announcement followed by actual share repurchases during the fiscal quarter of the announcement and/or the subsequent quarter.Footnote 10 We estimate actual repurchases in a given quarter based on the Compustat quarterly data item “Purchase of Common and Preferred Stock.” To reduce the noise, we include a carry-through repurchase announcement in our sample only when the dollar value reported in this item exceeds 1% of the firm’s market value.

We obtain management forecasts from the First Call database, which starts in January 1994. This study covers management forecasts from January 1994 to December 2007. Consistent with Cheng and Lo (2006) and Brockman et al. (2008), we use all management forecasts, including earnings and non-earnings forecasts and quarterly and annual forecasts. We treat multiple forecasts by the same firm on the same day (e.g., an earnings forecast for next quarter and for next year) as a single forecast event.

Returns information comes from the Center for Research in Security Prices (CRSP). We use abnormal announcement returns around the management forecasts, which are calculated as the stock returns of the three-day window [− 1, 1] around management forecasts minus the CRSP value-weighted index returns for the same period, to define bad news forecasts and good news forecasts. If the abnormal return is negative (non-negative), we classify the forecast as bad (good) news. Following Brockman et al. (2008), we compare management forecasts issued within a 30-day window prior to the beginning of repurchasing shares relative to all other management forecasts issued by our sample firms over the 1994–2007 sample period.Footnote 11

Panel A of Table 1 reports the sample size for the full sample. We identify 943 management forecasts issued within 30 days prior to the beginning date of 868 share repurchase programs by 764 unique firms. For this set of 764 unique firms, we identify 17,064 management forecasts issued during the 1994–2007 period that do not fall within 30 days prior to share repurchases. Therefore, we have a total of 18,007 management forecasts out of which 8741 (9266) are classified as bad (good) news.

3.2 Research design

3.2.1 Properties of management forecasts

To investigate the association of executive compensation and outside monitoring with pre-repurchase voluntary disclosures, we focus on the frequency and magnitude of bad news announcements. BN is a dummy variable that equals 1 if a management forecast is classified as bad news, and zero otherwise. AR is the abnormal return over the three-day window [− 1, 1] around management forecasts. Event is a dummy variable that equals 1 if the management forecast falls within the event window (30 days prior to the beginning date of the share repurchase) and zero otherwise.

3.2.2 Governance measures

To examine the effects of executive compensation, we collect information on CEO and CFO equity compensation from the Compustat Executive Compensation database. We follow Brockman et al. (2008) to measure stockholdings of the CEO and CFO as the proxy of executive equity compensation. CEOComp (CFOComp) is the sum of the value of CEO (CFO) stock option grants (valued by the Black–Scholes option pricing model), the value of CEO (CFO) restricted stock grants, and the value of stock held by the CEO (CFO), all scaled by the firm’s market value.

Our measures of outside monitoring are institutional ownership concentration, independent director percentage, and number of analysts following. We extract this information from Thomson Reuters, the Investor Responsibility Research Center, and the Institutional Brokers Estimate System, respectively. InstCon is the percentage of a company’s common stock held by the five largest institutional owners of the firm (Agrawal and Mandelker 1990; Ajinkya et al. 2005). IndDir equals the percentage of independent directors. NumAst is the number of analysts following the firm.

3.2.3 Control variables

Based on prior research, we select several additional governance variables, firm characteristics, and other independent variables to control for other possible determinants of the properties of management forecasts (Ajinkya et al. 2005; Karamanou and Vafeas 2005; Cheng and Lo 2006; Fich and Shivdasani 2006; Brockman et al. 2008; Cornett et al. 2008; Yu 2008).

Inst is the percentage of the company’s aggregate common stock held by institutions. BoardSize is the total number of corporate directors. Duality is a dummy variable that equals 1 if the company’s CEO is also the chairman of the board, and zero otherwise. BusyBoard is a dummy variable that equals 1 if the company’s board is defined as busy, which occurs when 50% or more of the board’s independent outside directors hold three or more directorships, and zero otherwise. AstDisp is the standard deviation (dispersion) of analysts’ forecasts. AstExp measures analysts’ experience, defined as the number of years that an analyst has been working as an analyst. LogMV is the natural logarithm of market value as of the fiscal year preceding the date of the management forecast. MTB is the market-to-book ratio as of the fiscal year preceding the date of the management forecast. Litigate is a dummy variable that equals 1 for all firms in the biotechnology (2833–2836 and 8731–8734), computers (3570–3577 and 7370–7374), electronics (3600–3674), and retail (5200–5961) industries, and zero otherwise.Footnote 12ROE is the return on equity as of the fiscal year preceding the date of the management forecast. Loss is a dummy variable that equals 1 if the firm reported losses in the current period, and zero otherwise. EarnVol is the standard deviation of quarterly earnings over 12 quarters ending in the year before management forecast, divided by median asset value over the 12 quarters. PriorCAR is the cumulative abnormal returns computed as the excess firm returns over the CRSP value-weighted index during the three months ending 2 days before the issuance of a management forecast. FD is a dummy variable that equals 1 if a management forecast falls in the post–Reg FD period (after October 23, 2000), and zero otherwise.Footnote 13

3.2.4 Regression specifications

To examine how executive compensation and outside monitoring influence managers’ voluntary disclosure behavior prior to repurchasing shares, we estimate the following equations based on two models in Brockman et al. (2008) using BN and AR as the dependent variables:

where Event is a binary variable used to identify whether a management forecast falls within the repurchase event window; GOV is governance measure of executive compensation and outside monitoring that includes all governance variables; and Controls represents the control variables. We calculate the variables related to executive compensation, institutional investors, board of directors, and analysts based on the latest data available before the management forecast date.

We use logistic regressions clustered by year and industry (based on the two-digit SIC code) to estimate Eq. (1), and ordinary least squares (OLS) regressions clustered by year and industry to estimate Eq. (2).

3.2.5 Descriptive statistics

Panel B of Table 1 reports the descriptive statistics of the variables. Approximately 5.24% of management forecasts are issued within the 30 days prior to the beginning of share repurchases.Footnote 14 The average abnormal return around all management forecasts is − 0.58%. These abnormal returns vary from − 3.62% for the lower quartile to 3.73% for the upper quartile. The average abnormal return for bad news forecasts is − 6.35%, and the average abnormal return for good news forecasts is 4.85%. Our results in general are consistent with those of Brockman et al. (2008).Footnote 15 The average stockholdings, relative to the firm’s market value, are 1.53% and 0.13% for CEOs and CFOs, respectively. The ownership by the five largest institutional owners in each firm represents on average 24.47% of total. The average percentage of independent directors on a board is 68.54%, and a firm is covered by 7.77 analysts on average.

Table 1, Panel B also presents summary statistics for selected control variables. On average, institutional ownership is approximately 70.91%, a board of directors seats 9.76 members, and a firm is covered by analysts with 6.75 years of experience. The sample firms have a mean market value of around $12.54 billion and a mean market-to-book ratio of 5.37. The mean return on equity is 21.69%, and the mean cumulative abnormal return during the three months preceding the issuance of management forecasts is 1.41%.

3.3 Brockman et al. (2008) comparison

We replicate the tests in Brockman et al. (2008) to ensure that our sample characteristics are similar. Panels A and B of Table 2 report the univariate and regression analyses for the full sample, respectively. Panel A shows that the frequency of bad news is higher for management forecasts issued 30 days prior to share repurchases than it is for management forecasts issued outside the event window (57.37% vs. 48.05%, a difference of 9.32%), significant at the 1% level. The mean (median) abnormal returns around the issuance of management forecasts within and outside the event window are − 2.97% (− 1.28%) and − 0.45% (0.18%), respectively. The mean (median) difference of 2.52% (1.46%) is statistically significant at the 1% level.Footnote 16 To assess the differences in means and medians, we use t tests and Wilcoxon rank sum tests, respectively.

Panel B of Table 2 reports the analyses for logistic regressions of BN and OLS regressions of AR clustered by year and industry. We compute the t values for the OLS regressions with heteroskedasticity-consistent standard errors (White 1980). Models 1 and 2 show the results without and with control variables, respectively. To replicate the tests in Brockman et al. (2008), control variables in Model 2 do not include governance variables. As a result, control variables in Model 2 only include LogMV, MTB, Litigate, ROE, Loss, EarnVol, PriorCAR, and FD. The coefficients on Event for BN as the dependent variable in both Models 1 and 2 are positive and statistically significant at the 5% level, and the coefficients on Event for AR as the dependent variable in both Models 1 and 2 are negative and statistically significant at the 1% level. These results suggest that firms significantly increase the frequency and magnitude of bad news announcements during the pre-repurchase event period. These results are similar to those in Brockman et al. (2008).

4 Effects of executive equity compensation and outside monitoring on pre-repurchase voluntary disclosure behavior

4.1 Univariate analysis

To examine the effects of executive compensation and outside monitoring, we split management forecasts issued within and outside the management share repurchase event window into three subsamples according to the five governance measures, CEOComp, CFOComp, InstCon, IndDir, and NumAst. We classify management forecasts that fall within the first tercile (second/third) of these governance measures as low (middle/high) corporate governance. Table 3 compares the frequency of bad news announcements and the three-day abnormal return within and outside the management share repurchase event window to these three corporate governance subsamples.

Panel A of Table 3 shows the effects of executive compensation. The low CEO and CFO equity compensation subsample shows no significant difference in the frequency of bad news and the mean (median) abnormal return between management forecasts within and outside the repurchase event window. By contrast, the differences in the frequency of bad news and the mean (median) abnormal return for the high CEO and CFO equity compensation subsample are statistically significant at the 1% level. Specifically, the frequency of bad news for the high-CEO-equity-compensation subsample is 66.47% and 45.75% for management forecasts within and outside the repurchase event window, respectively. The statistical test shows that the difference of 20.72% is significant at the 1% level. The mean (median) abnormal return of − 5.78% (− 3.14%) around management forecasts announced within the repurchase event window is significantly lower than that of − 0.02% (0.51%) outside the repurchase event window, significant at the 1% level.

Table 3, Panel B, presents the effects of outside monitoring. The differences in the frequency of bad news and the mean (median) abnormal returns of management forecasts within and outside the repurchase event window for the low institutional ownership concentration, low percentage of independent directors, and small number of analysts following subsamples are statistically significant at the 1% level. For example, for the subsample of low institutional ownership concentration, bad news accounts for 56.05% of the 314 management forecasts within the repurchase event window, but only 42.67% of the 5672 management forecasts outside the repurchase event window are bad news. The difference of 13.39% is statistically significant at the 1% level. Moreover, management forecasts announced within the repurchase event window experience a mean (median) abnormal return of − 3.91% (− 1.38%), whereas those announced outside the repurchase event window experience a mean (median) abnormal return of 0.4% (0.69%), with the difference in both means and medians significant at the 1% level. In contrast, the differences in the frequency of bad news and the mean (median) abnormal return between management forecasts within and outside the repurchase event window for the subsamples with strong outside monitoring (i.e., high institutional ownership concentration, high percentage of independent directors, and large number of analysts following) are not significantly different at conventional levels.

Therefore, Table 3 shows that high equity compensation for both CEOs and CFOs induces managers to release significantly more bad news during the 30 days prior to the start of a share repurchase, which generates significant negative returns. Conversely, high institutional ownership concentration, high percentage of independent directors, and large analyst following can restrain managerial pre-repurchase opportunistic behavior.

4.2 Multivariate analysis

Table 4 uses regression analyses to examine the effects of executive compensation and outside monitoring on firms’ voluntary disclosure strategy prior to share repurchases. Panels A and B report results with BN and AR as dependent variables, respectively. Even after considering governance measures and more control variables, we find that the coefficients on Event are significantly positive (negative) at least at the 10% (5%) level in Panel A (Panel B). These findings are consistent with those in Table 2, demonstrating again that managers tend to issue more bad news to depress stock prices prior to buying back shares.

To investigate the effects of executive compensation and outside monitoring, we focus on the interaction terms between governance measures and Event. Models 1, 3, and 4 of Table 4, Panel A, show that regardless of the inclusion of control variables and outside monitoring variables, the coefficients on the interaction term between managerial equity compensation and Event are significantly positive. These results indicate that managers issue more bad news during the repurchase event window when managerial equity compensation is high. This bad news generates significantly negative abnormal returns, as shown by the negative coefficients on the interaction terms between managerial equity compensation and Event in Models 1, 3, and 4 in Panel B. In contrast, Models 2, 3, and 4 of Panel A show that, regardless of the inclusion of control variables and managerial compensation variables, the coefficients on the interaction term between outside monitoring and Event are significantly negative. These results indicate that managers tend to refrain from issuing bad news during the repurchase event window when the outside monitoring intensity is high. This scenario generates significantly positive abnormal returns, as shown by the positive coefficients on the interaction terms between outside monitoring and Event in Models 2, 3, and 4 in Panel B.

Table 4 shows that manipulation of bad news announcements prior to share buybacks is positively associated with executive equity compensation and negatively associated with the intensity of outside monitoring. Higher CEO and CFO equity compensation induce executives to increase the probability and magnitude of bad news for management forecasts within the event window, which decreases the repurchase price. However, higher institutional ownership concentration, higher percentage of independent directors, and a larger analyst following deter managers from manipulating information flows prior to repurchases. These findings support our hypothesis.Footnote 17

4.3 Bias of voluntary disclosures

Brockman et al. (2008) show that managers guide investor expectations of firm value downward to achieve a lower share repurchase price by disclosing negatively biased earnings forecasts before share repurchases. We expect the earnings forecast bias ahead of a repurchase to be negatively related to the executive equity compensation but positively related to the outside monitoring intensity. We follow the model specification in Ajinkya et al. (2005) and Brockman et al. (2008) to estimate the following equation using OLS regressions clustered by year and industry:

where Bias is measured as (management forecast of earnings per share [EPS]—actual EPS)*100/price at the beginning of the forecast month.

Table 5 reports the results. The coefficients on Event for all models are negative and statistically significant at the 10% level or better, which confirms that managers tend to issue downward-biased earnings forecasts prior to repurchases, which allows them to accumulate company shares at relatively low prices.

To investigate how executive equity compensation and outside monitoring influence the issuance of downward-biased earnings forecasts, we focus on the interaction terms between our governance measures and Event. In the models with or without control variables in Table 5, the coefficients on the interaction term between CEOComp/CFOComp and Event are negative and statistically significant at the 5% level or better, whereas the coefficients on the interaction term between InstCon/IndDir/NumAst and Event are positive and statistically significant at the 5% level or better.

The results in Table 5 demonstrate that higher executive equity compensation (outside monitoring) encourages (discourages) the manipulation of the information content of voluntary disclosures prior to repurchases. Higher CEO and CFO equity compensation induce managers to lower EPS forecasts opportunistically before share buybacks. However, higher institutional ownership concentration, percentage of independent directors, and analyst following limit the biases in the information content of managerial forecasts before repurchases. These findings further support our hypotheses.Footnote 18,Footnote 19

4.4 Endogeneity test

Although corporate governance serves to deter pre-repurchase managers’ opportunistic behavior, the tendency toward management misbehavior may motivate firms to enhance their governance mechanisms, which can generate an endogeneity problem. To provide further support for our previous findings, we clarify the causality between corporate governance mechanisms and managerial opportunism using a two-stage regression approach.

In the first stage, we use the full sample to estimate the probability of a management forecast falling within the repurchase event window based on a set of exogenous or predetermined instrumental variables identified in prior research (Brockman and Chung 2001; Brockman et al. 2008) along with the control variables used in Eq. (1). We employ logistic regressions clustered by year and industry to estimate the following equation:

where Instru includes the instrumental variables Rf, measured as the annual return from a risk-free asset (three-month Treasury bill) during the year of the share repurchase; CFOprt, measured as cash flow from operations scaled by total assets preceding the fiscal year of the share repurchase; MktVol, measured by the standard deviation of the value-weighted monthly market return during the year of the share repurchase; and NumRep, which is the number of share repurchases made during the year preceding the share repurchase.Footnote 20

To identify the causality between governance mechanisms and managers’ self-serving behavior, in the second stage we use logistic regressions clustered by year and industry to estimate BN, and we use OLS regressions clustered by year and industry to estimate AR for the three subsamples classified by the executive compensation and outside monitoring measures:

where Event is replaced by the expected probability of a management forecast falling within the event window estimated from the full sample in the first-stage regression.

If firms respond to managers’ manipulation of disclosure of bad news prior to buying back shares to decrease the repurchase price by improving corporate governance mechanisms, the coefficients on Event in the second stage in all subsamples of executive equity compensation and outside monitoring should be statistically significant. However, if executive equity compensation and outside monitoring affect managerial opportunism, the coefficients on Event in the second stage should only be significant for the high executive compensation and low outside monitoring intensity subsamples.

Table 6 reports the two-stage regression results. Column 1 shows coefficient estimates for the first-stage regression. To save space, the remaining columns only provide results in the second-stage regression for the top and bottom terciles classified by executive compensation and outside monitoring measures. Panel A shows that the concordance percentage in the first-stage regression is fairly high—approximately 68%—which suggests that the instrumental variables perform reasonably well at predicting share repurchases.

Panel A of Table 6 shows the probability of bad news releases preceding share repurchases. The coefficients on Event are positively significant at the 5% level for the high executive equity compensation and low outside monitoring intensity subsamples. These results are consistent with our main findings. Panel B shows abnormal returns preceding share repurchases. The coefficients on Event are negatively significant at the 5% level for the high executive equity compensation and low outside monitoring intensity subsamples. Again, these results are consistent with our previous findings. Thus, after controlling for the endogeneity problem, we provide a better causality test of how executive equity compensation and outside monitoring intensity impact the opportunistic managerial news announcements and the associated abnormal returns preceding share repurchases.Footnote 21

4.5 Withholding good news

If managers have an incentive to repurchase company shares at below full-information prices, intuitively, they may not only manipulate bad news disclosures before repurchasing shares but also delay disclosure of good news until the completion of share buybacks (Kothari et al. 2009). We therefore conduct a robustness check to examine whether managers withhold good news up to the completion of repurchases. We compare the frequencies of good news and three-day abnormal returns between management forecasts disclosed within 30 days after repurchasing (post-repurchase) and those disclosed within 30 days prior to the beginning of repurchases (pre-repurchase) based on the same repurchase programs for the subsamples classified by the executive equity compensation and outside monitoring measures.Footnote 22 Table 7 presents the results.

Panel A of Table 7 identifies the effects of executive equity compensation. The subsamples of low CEO and CFO equity compensation have no significant differences in the frequencies of good news and in the mean (median) abnormal returns between management forecasts issued post- and pre-repurchases. In contrast, the differences in the frequencies of good news and in the mean (median) abnormal returns are positively significant at the 1% level for the subsamples of high executive equity compensation. Specifically, the frequencies of good news for the high CEO equity compensation subsample are 55.29% and 33.53% for management forecasts issued post- and pre-repurchase, respectively. The statistical test shows that the difference of 21.76% is significant. In addition, the mean (median) abnormal return of 1.21% (1.21%) for post-repurchase management forecasts is significantly higher than that of − 5.78% (− 3.14%) for pre-repurchase management forecasts.

Table 7, Panel B, reports the effects of outside monitoring on the withholding of good news. The differences in the frequency of good news and the mean (median) abnormal returns of management forecasts issued post- and pre-repurchase for the low outside monitoring intensity subsamples are positively significant at the 5% level or better. Specifically, the frequencies of good news releases for the low institutional ownership concentration subsample are 60.74% and 43.95% for post- and pre-repurchase management forecasts, respectively. The difference of 16.79% is significant at the 1% level. Moreover, the mean (median) abnormal returns of management forecasts announced post-repurchase (1.07% [0.97%]) are higher than those announced pre-repurchase (− 3.91% [− 1.38%]), significant at the 1% level. In contrast, the differences in the frequencies of good news and the mean (median) abnormal returns between post- and pre-repurchase management forecasts for the subsamples of high outside monitoring intensity are insignificant.

The results in Table 7 show that managers of firms with higher equity compensation and lower outside monitoring intensity tend to withhold good news until the completion of repurchases. Therefore, our previous findings are robust even when we use the good news disclosure strategy as the proxy of managerial opportunistic behavior.Footnote 23 Overall, consistent with our expectations, managers are more likely to manipulate information flows prior to share repurchases when executive compensation is relatively high and the outside monitoring intensity is relatively low.

4.6 Management’s personal goals

Managers with higher equity compensation tend to have greater incentives to buy back shares at a lower price because they also enjoy the wealth transfer effects. In our sample, the average stockholdings, relative to the firm’s market value, are 1.53% and 0.13% for CEOs and CFOs. For the samples of high executive equity compensation, the average stockholdings of CEOs and CFOs are 4.83% and 0.24%, respectively. The higher equity incentives may give CEOs and CFOs further incentives to benefit personally by depressing repurchase prices. We thus examine the probability of managerial purchases of shares within 1 month, 3 months, and 6 months following pre-repurchase management forecasts for CEOs (CFOs) with either high or low equity compensation. We also show the gains for CEOs and CFOs, who have high equity compensation and personally buy shares within 1 month, 3 months, and 6 months following pre-repurchase management forecasts. We obtain open market purchases of shares by CEOs and CFOs from the Thomson Reuters insider-filing database. The results are shown in Table 8.

According to Panel A of Table 8, the likelihood of buying shares subsequent to pre-repurchase management forecasts is significantly larger for CEOs and CFOs with high equity compensation than for those with low equity compensation at the 10% level or better. For example, the probability of management purchasing personal shares within 6 months after pre-repurchase management forecasts is 10.00% and 3.55% for the samples with high and low CEO equity compensation, respectively. The difference of 6.45% is statistically significant at the 5% level.

Panel B of Table 8 shows that the amounts of gains are economically significant if managers with high equity compensation personally purchase shares after pre-repurchase management forecasts. In Table 3, we show that the mean 3-day abnormal returns around management forecasts announced 30 days prior to share repurchases for the high CEO and CFO equity compensation subsamples are − 5.78% and − 7.44%, respectively. According to Table 9, the stock prices eventually return to previous levels. If managers personally purchase shares subsequent to pre-repurchase management forecasts, the 3-day abnormal returns can be applied to proxy their potential profits. We thus multiply the mean abnormal returns of − 5.78% and − 7.44% by the value of the dollar position of CEOs’ and CFOs’ personal share purchases to gauge managerial personal profits. For example, the average gains for CEOs and CFOs buying shares within 6 months subsequent to pre-repurchase management forecasts are $53,835 and $52,221, respectively.

Our results suggest that managers with high equity compensation attempt to gain personal benefits by buying shares at a lower price. We believe that the gains are economically significant in motivating managers to manipulate pre-repurchase disclosures. As a result, the evidence indicates that managerial actions to manipulate pre-repurchase disclosures simultaneously serve those managers’ personal interests.

5 Effects of executive equity compensation and outside monitoring on post-repurchase long-run performance

5.1 Post-repurchase long-run stock performance

As discussed in Sect. 1, when managers deliberately manipulate bad news releases, the market is less likely to correctly incorporate repurchase announcement information into its stock prices. As a result, the stock prices of manipulating firms tend to experience positive long-run performance as it becomes clear that managers purposefully released negative information preceding the share repurchase period.

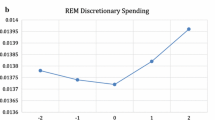

We follow the methods applied in Ikenberry et al. (1995) and Massa et al. (2007) to plot figures of long-run stock returns for repurchasing firms in the top and bottom terciles classified by the executive compensation and outside monitoring measures. Panels A and B of Fig. 1 report the average cumulative abnormal returns (CARs) and buy-and-hold abnormal returns (BHARs), respectively, for repurchasing firms for the 60 months following the repurchase announcement. Abnormal returns are calculated using four different methods: market-adjusted returns using the CRSP value-weighted index (CRSP VW), market-adjusted returns using the CRSP equal-weighted index (CRSP EW), size-adjusted returns using equal-weighted portfolio returns from the same size decile (SIZE ONLY), and size- and market-to-book-adjusted returns using equal-weighted portfolio returns from the same size decile and market-to-book quintile (SIZE & MTB).

Post-repurchase abnormal returns. This figure shows the governance effects on post-repurchase abnormal returns. Management forecasts fall within the first tercile (second/third) of the governance measures classified as the low (middle/high) corporate governance subsample. Panels A and B report results for the average cumulative abnormal returns and buy-and-hold abnormal returns for repurchasing firms in the low and high corporate governance subsamples for the 60 months following the repurchase announcement. Abnormal returns are calculated using four different methods: market-adjusted returns using the CRSP value-weighted index (CRSP VW), market-adjusted returns using the CRSP equal-weighted index (CRSP EW), size-adjusted returns using equal-weighted portfolio returns from the same size decile (SIZE ONLY), and size- and market-to-book-adjusted returns using equal-weighted portfolio returns from the same size decile and market-to-book quintile (SIZE & MTB). Abnormal returns are depicted on the y-axis, while the number of months relative to the repurchase announcement month are shown on the x-axis

Panels A and B of Fig. 1 show that only the subsamples of high executive equity compensation and low outside monitoring intensity experience positive long-run CARs and BHARs, respectively. Across the different methods used to calculate long-run performances at different time horizons, the patterns of CARs and BHARs are generally flat or somewhat downward sloped for the subsamples of low CEO and CFO equity compensation, whereas the long-run performances of high executive compensation subsamples clearly move upward. For the subsamples of low outside monitoring intensity, the results show that repurchasing firms outperform in the long run for both CARs and BHARs. For the subsamples of high outside monitoring intensity, the abnormal return patterns are generally flat for CARs and somewhat downward sloped for BHARs. These results are consistent with our expectations that only manipulating firms outperform in the long run post-repurchase as the information in their repurchase announcements becomes clearer.

We consider the post-repurchase stock performances in more detail by implementing three tests employed in Massa et al. (2007). First, we measure the long-run stock performance of repurchasing firms in event time using Ibbotson (1975) returns across time and securities (RATS) method. Second, we adopt Ikenberry et al. (2000) calendar time portfolio regression (CTPR) approach. Finally, we use a matching firm method to compare stock performance in the post-announcement period of repurchasing and non-repurchasing control firms.

5.1.1 Returns using the RATS approach

We apply the Ibbotson (1975) RATS method combined with the Fama and French three-factor model to examine the long-run stock performance of repurchasing firms. The RATS technique requires that we regress post-announcement monthly excess returns over the risk-free rate from repurchasing firms on the concurrent Fama–French three factors to produce a time-series of cross-sectional intercept estimates. We then sum the intercepts over 12, 24, 36, 48, and 60 months following the repurchase announcement as CARs for the subsamples in each tercile classified by the executive equity compensation and outside monitoring intensity measures.

Panel A of Table 9 provides the results of the RATS regressions for repurchasing firms. Manipulating firms significantly outperform non-manipulating firms over 12, 24, 36, 48, and 60 months. For example, 60 months after the announcement, firms with high CEO equity compensation and low institutional ownership concentration experience a statistically significant CAR of 19.50% and 35.61%, respectively, significant at the 5% level or better. Firms with low CEO equity compensation and high institutional ownership concentration only experience statistically insignificant CARs of 6.88% and 5.95%, respectively. These additional tests are consistent with our main results.

5.1.2 CTPR approach

For the CTPR approach, we construct portfolios in each calendar month during our sample period by using our executive equity compensation and outside monitoring measures. We go long on repurchasing firms in the top (bottom) tercile and go short on firms in the bottom (top) tercile, as classified by the executive equity compensation (outside monitoring) measures. We rebalance the portfolios every month to include in the portfolio stocks that announce a repurchase program in the previous month and to drop stocks that reach the end of their holding period of 60 months. We consider both equally and value-weighted portfolios. We then regress the time-series portfolio returns using the Fama–French three-factor model and Carhart (1997) four-factor model, which includes a momentum factor. We use the intercept of the time-series regression to gauge the abnormal returns.

Panel B of Table 9 reports the results for the CTPR tests. The abnormal returns for both the equally or value-weighted portfolios are positively significant at the 5% level or better for all executive equity compensation and outside monitoring measures. For example, for the equally weighed portfolios, firms with high CEO equity compensation outperform their low-CEO-equity-compensation counterparts by 0.52% (0.56%) per month using the three- (four-) factor model. The differences in value-weighted returns for high and low CEO compensation portfolios are 0.82% (0.74%) per month for the three- (four-) factor model. The results for portfolios classified by outside monitoring measures also consistently show that firms with low outside monitoring intensity outperform those with high outside monitoring intensity.

Consistent with our hypotheses, manipulating firms experience significantly higher post-announcement long-run abnormal returns than do their non-manipulating counterparts, as, over time, the market identifies managers’ purposeful manipulation of negative information releases preceding the share repurchase period.

5.1.3 Matching firms approach

For the matching firm methodology, we create a sample of non-repurchasing control firms for each repurchasing firm and analyze the differences in their post-announcement stock performances. In particular, for each repurchasing firm, we identify a control firm within the same two-digit SIC industry as the repurchasing firm in the year of announcement. We select a non-repurchasing firm as the control firm if the firm is closest to the repurchasing firm in terms of the sum of the absolute percentage differences in size and book-to-market ratio. We then calculate the average CARs and BHARs for portfolios that are long in the repurchasing firms and short in their respective controls over 12, 24, 36, 48, and 60 months after repurchasing announcements for subsamples classified in terciles by the executive equity compensation and outside monitoring measures.

Panel C of Table 9 report the results. Portfolio returns computed using long positions in repurchasing firms and short positions in their respective controls are positively significant at the 5% level or better for firms with high executive equity compensation and low outside monitoring intensity. For example, repurchasing firms with high CEO equity compensation and low institutional ownership concentration outperform their controls by 26.26% and 30.06% (34.20% and 50.94%), respectively, over 60 months when using CARs (BHARs). In contrast, non-manipulating repurchasing firms do not outperform their controls. Thus, the overall results obtained from the control firm approach are consistent with our main results.

The findings in Table 9 support that managers with high equity compensation personally benefit from pre-repurchase bad news manipulation because, as we show, they are more likely to purchase shares at a lower price subsequent to pre-repurchase management forecasts, and the stock price returns to previous levels in 3–5 years after repurchases.

5.1.4 Isolating the confounding effect on post-repurchase stock performances

It is possible that the superior post-repurchase stock performances in the sample with high CEO (CFO) equity compensation result from the positive role of equity incentives instead of from pre-repurchase management strategic disclosures. In order to isolate the confounding effect, we divide our sample of high CEO (CFO) equity compensation into non-announcing and announcing-bad-news subsamples and explore their post-repurchase long-run stock performances. For the positive role of equity incentives, firms with high executive equity compensation are expected to experience post-repurchase positive abnormal stock returns regardless of whether they manipulate news before repurchases or not. If the post-announcement outperformance of stocks is mainly due to manipulation of news, then only those announcing bad news prior to repurchases will have post-repurchase stock outperformances because the temporary negative effects on the short-run returns are expected to be reversed in the long run. The results are reported in Table 10.

According to Table 10, all three measurements of long-run stock performances, including the RATS method in Panel A, the CTPR approach in Panel B, and the matching firm methodology in Panel C, show that for the sample of high CEO (CFO) equity compensation, only firms announcing bad news before repurchases experience post-repurchase superior stock performances, while those not announcing bad news do not experience long-run stock outperformances. Taking the RATS method in Panel A as an example, 60 months after the repurchase announcement, firms announcing bad news have a CAR of 24.98%, which is statistically significant at the 5% level, while those not announcing bad news experience a statistically insignificant CAR of 2.01%. The evidence illustrates that rather than the positive role of equity incentives, it is deliberately announced bad news that depresses prices before repurchases, and this leads to positive long-term abnormal stock returns.

5.2 Post-repurchase long-run operating performance

Next we explore the long-run operating performances of repurchasing firms conditioned on executive compensation and outside monitoring. We follow Lie (2005) and Gong et al. (2008) to examine the performance-adjusted operating performance, which is measured as the operating performance of a sample firm less that of its matched control firm over 20 quarters after the repurchase announcement quarter. Operating performance is calculated as operating income scaled by the average of cash-adjusted assets (i.e., book value of assets less cash and short-term investments) at the beginning and end of the fiscal quarter. To create a matched control firm for each sample firm, we generate a set of control firms composed of firms in the same industry that have similar pre-event performance characteristics and market-to-book ratios.

We select all firms with the same two-digit SIC code, operating performance within ± 20% or within ± 0.01 of the performance of the sample firm in the announcement quarter (quarter 0), operating performance for the four quarters ending with the quarter 0 within ± 20% or within ± 0.01 of the corresponding performance for the sample firm, and pre-announcement market-to-book value of assets within ± 20% or within ± 0.1 of that of the sample firm. If no firms meet the criteria, we relax the industry criterion to a one-digit SIC code. If still no firms meet the criteria, we ignore the SIC code, performance, and market-to-book criteria. From all these potential matches, we choose the firm that has the lowest sum of absolute differences in operating performance, defined as:

Following Lie (2005) and Gong et al. (2008), if the sample firm lacks the necessary data to compute operating performances for any of the four quarters ending with the quarter 0, we neglect the second term.

Table 11 reports the results for operating performances for sample firms classified in terciles by executive equity compensation and outside monitoring measures. Changes in performance-adjusted operating performance from quarter 0 to future quarters improve significantly for non-manipulating firms (i.e., those with low executive equity compensation and high outside monitoring intensity). For example, the mean (median) change in operating performance from quarters 0 to 4 of the low CEO equity compensation subsample is 0.0084 (0.0045), significant at the 5 percent level. The mean (median) change in operating performance from quarters 0 to 4 for the high institutional ownership concentration subsample is 0.0091 (0.0027), significant at the 5 percent level. All of these improvements appear to persist for at least five years. However, all changes in operating performance are statistically insignificant at conventional levels for manipulating firms. Only the repurchase announcements of non-manipulating firms contain truthful information about firms’ future prospects of operating performance.Footnote 24

The findings in Tables 9, 10 and 11 support our hypotheses. Manipulating firms are more likely to deliberately release bad news, which generates long-run abnormal stock price performances because the effects of this news are reversed in the long run. In addition, these firms’ share repurchase announcements do not seem to contain material information about firms’ future operating prospects.

6 Conclusion

We investigate how executive equity compensation and outside monitoring affect firms’ pre-repurchase disclosure decisions and post-repurchase stock and operating performances. We use CEO and CFO equity compensation to proxy for the motivation of executives to manipulate bad news releases, and we use institutional ownership concentration, percentage of independent directors, and analyst following to proxy for outside monitoring intensity. Using a sample of management forecasts for the period 1994–2007, we find that high levels of executive equity compensation and low intensity of outside monitoring induce managers to deliberately release bad news and withhold good news before share repurchases. In contrast, low levels of executive equity incentives and high intensity of outside monitoring effectively constrain pre-repurchase managerial opportunistic behavior. Managers with high equity compensation also attempt to benefit from their personal purchases of shares in the process of voluntarily preempting bad news rather than good news prior to repurchases.

Our post-repurchase performance results show that manipulating firms experience positive long-term abnormal stock returns because the negative effects of the deliberately released bad news on the short-run stock returns are reversed in the long run. However, we find that manipulating firms do not experience positive long-run operating performance after repurchase announcements, which contradicts results commonly found in the literature, possibly because manipulating firms’ repurchase announcements contain limited information about firms’ future prospects due to the agency problems created by high levels of executive equity compensation and low intensity of outside monitoring. In contrast, non-manipulating firms have less severe agency problems and thus do not experience abnormal long-run stock returns because their repurchase announcements, which contain truthful information about better long-run operating outperformances, are correctly incorporated into the short-run announcement period stock returns. These findings show that managers with high equity compensation benefit from the purchase of personal shares at a lower price subsequent to pre-repurchase management forecasts because the stock price returns to pervious levels in 3–5 years after repurchases.

Our study contributes to the extant literature by providing evidence that corporate governance mechanisms play an important role in controlling managers’ opportunistic behavior. Low executive equity compensation and high intensity of outside monitoring help to discourage managers from undesirable self-interested disclosure decisions before share repurchases. In addition, we show that corporate governance mechanisms have important implications for the information content of share repurchase announcements and for long-run abnormal stock prices and operating performance. Finally, managers with high equity compensation tend to accelerate the disclosure of bad news and delay announcements of good news prior to repurchases, which is consistent with the literature on voluntary disclosure. We further find that managers with high equity compensation attempt to benefit from their personal stock purchases in the information-manipulation process. Due to the accompanying personal trading behavior of management, the chosen governance mechanism is particularly relevant for this self-serving disclosure policy.

Notes

Instead of focusing on the governance effects of managerial equity compensation and outside monitoring, Caton et al. (2016) employ an index of the number of antitakeover laws enacted by the state in which the firm is incorporated to proxy for the strength of a firm’s corporate governance.

Although Brockman et al. (2008) also analyze the effects of CEO compensation on the pre-repurchase disclosure policy, they do not explore the effect of CEO compensation on post-repurchase stock and operating performance.

In the United States, disclosure requirements for share repurchases are relatively lenient. Corporations can buy back shares without making repurchase announcements, and those announcing repurchases are under no obligation to carry out their proposed programs. According to the survey of Kim et al. (2005), among the 10 major stock markets around the world, the United States has relatively loose regulations for share repurchases in terms of disclosure and execution.

Managers with low equity compensation do not have strong incentives to depress repurchase prices because there is less wealth transfer from the shareholders who sell their stock to the remaining shareholders who do not sell, including managers themselves, which in turn results in less incentive for management stock purchases subsequent to pre-repurchase information manipulation. In addition, since strategic disclosures prior to repurchases involve management’s personal incentives, outside monitoring is expected to partially control for this incentive. High intensity of outside monitoring can thus mitigate managerial opportunism. Although transactions to deflate the repurchase price also benefit the remaining stockholders, the accompanying management trading behavior for personal benefit makes corporate governance matter to this strategic disclosure. Hence, low executive equity compensation and high outside monitoring intensity make managers less likely to engage in pre-repurchase strategic disclosures.

Wright et al. (2002) propose that security analysts, independent outside board members, and activist institutional investors may limit selfish managerial behavior and thus protect the interests of shareholders. Beasley (1996), Smith (1996), Core et al. (1999), Klein (2002), Hartzell and Starks (2003), Ajinkya et al. (2005), and Karamanou and Vafeas (2005) find evidence that corporate monitoring by institutional investors and outside directors can constrain managers’ behavior. Chung and Jo (1996), Healy and Palepu (2001), and Yu (2008) suggest that analysts play an important role in corporate governance.

Our research differs from Brockman et al. (2008) in the following ways. We additionally study the effects of CFO equity compensation on repurchase events, which is not tested by Brockman et al. (2008). In addition, we relate the pre-repurchase disclosure policy to the post-repurchase long-run stock and operating performance, which again are not examined by Brockman et al. (2008).

Our findings indicate that the motivation of management to depress buyback prices is mainly to pursue personal benefits, rather than to maximize the wealth of the majority of shareholders. As most of the shareholders are likely uninformed and unaware of such deceptive behavior, they might easily fall prey to subsequent false discourses. Thus, from the corporate governance perspective, it is improper for managers to engage in pre-repurchase strategic disclosures, as such behavior indicates a lack of integrity when managing a firm. Firms operated by managers without integrity could lead to severe conflicts of interest between managers and shareholders or to agency problems, such as the free cash flow problems. If the corporate governance mechanism cannot lead managers to behave honestly in the event of repurchases, in the long run, it is possible that managers with excess cash flow will tend toward over-investment or engage in empire building, instead of investing in positive net present value projects to maximize shareholder value. Such adverse effects of lack of integrity would eventually be detrimental to firms’ long-term performance. Accordingly, good governance should restrain managerial pre-repurchase opportunistic disclosure behavior and encourage the managers to maintain integrity in managing the firm.