Abstract

Firms use patents for blocking competitors’ innovation activities. Offensive blocking is a practice whereby firms patent alternatives of a focal invention preempting technological substitutes produced by competitors. Defensive blocking entails the creation of patent portfolios that block technologies in order to increase competitors’ willingness to trade patents. This paper examines the private value of both patent blocking strategies with the use of a novel measure of the offensive and defensive “blocking power” of patent portfolios. We show that both strategies increase firms’ market value. In discrete (complex) product industries, however, only offensive (defensive) patent blocking is associated with higher value.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Patents allow firms to establish a property right and thereby to protect the profits that result from commercializing their inventions. Firms, however, are not only using patents to protect against direct technology imitation but also for strategic reasons, such as blocking competitors.

Anecdotal evidence and business surveys (Duguet and Kabla 1998; Cohen et al. 2000, 2002; Blind et al. 2006) have shown that large firms adopt patent blocking strategies. Two types of patent blocking can be distinguished, following the definition by Blind et al. (2006):

- (i)

Offensive patent blocking is a practice whereby firms patent variations of own technologies in order to block others from entering the market with competitive substitutes. The aim of this strategy is to keep others away from using their own technologies by not only filing patents on first technologies but also on technological alternatives that are largely substitutive. Offensive patent blocking raises entry barriers and increases the expected profits of market incumbents (Gilbert and Newberry 1982). This strategy has also been called “patent fencing” in the literature (see, e.g., Schneider 2008).

- (ii)

Defensive patent blocking refers to the case when firms patent in order to build large patent portfolios that include complementary technologies. This strategy entails filing patents that block technology activities of others in other to get access to patent cross-licensing deals and thereby to deter patent infringement lawsuits through the use of barter trade (Blind et al. 2006).

Offensive patent blocking is a popular strategy in discrete product industries, where one product refers to one patentable element (Cohen et al. 2000). New drugs or chemicals are typically composed of a relatively small number of patentable elements. Examples of substitutive patents may be variations in formulation and dosing of drugs that may reduce side effects or allow faster achievements of the therapeutic effect.

Defensive patent blocking, in contrast, is frequently used in complex product industries where innovations are composed of numerous separately patentable elements (Levin et al. 1987; Cohen et al. 2000). Electronic products, machines, or automobiles typically comprise many—sometimes hundreds and even thousands—patentable elements and are considered as complex product industries.

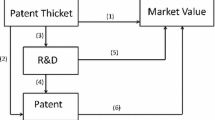

In this study, we examine the effectiveness of patent blocking strategies. We contribute to the prior literature (Cohen et al. 2000, 2002; Blind et al. 2006; Ceccagnoli 2009) in three ways: First, we explicitly distinguish between different patent blocking strategies: offensive and defensive patent blocking. Second, we examine whether the effectiveness of patent blocking strategies differs across discrete and complex product industries. Third, we propose a new set of continuous patent citation-based indicators to measure the offensive and defensive “blocking power” of patent portfolios. These indicators can be used to study patent blocking strategies quantitatively in large-scale datasets and thereby go beyond individual cases and aggregated, arguably subjective, survey-based measures.

The offensive and defensive blocking power of patent portfolios is measured with the use of information on citations that are made to the patents of the focal firm by later patent filings: forward patent citations. A patent is cited by a later patent filing if it is considered as prior artFootnote 1 to the later patent filing by a patent examiner. Hence, patent citations serve an important legal function as they limit the legal scope of protection of patents. These citations are categorized by patent examiners at the European Patent Office (EPO) which allow us to distinguish between infringing prior art—blocking citations—and non-infringing prior art. Information on blocking citations is used to measure the blocking power of patent portfolios.Footnote 2

Market-value (Tobin’s Q) estimations for a panel dataset of 151 large, R&D-intensive European, U.S., and Japanese manufacturing firms in discrete and complex product industries show that both types of patent blocking increase firms’ market value. The effectiveness of both types of patent blocking differs, however, across industries. In discrete product industries, only offensive patent blocking is associated with value, while in complex product industries only defensive patent blocking coincides with firms’ market value. Access to patent cross-licensing deals is shown to be a mechanism through which defensive patent blocking affects firms’ market value.

The remainder of the paper is organized as follows: The next section presents an overview of the literature on patent blocking. Section 3 describes our market valuation methodology. Section 4 details the data and variables and presents descriptive statistics. Section 5 shows the results. Section 6 concludes.

2 Patent Blocking Strategies

Firms rely on different strategies to profit from innovation such as secrecy, lead time advantages, the possession of complementary assets, and formal intellectual property rights: most notably patents (Teece 1986). Starting with the Yale survey (Levin et al. 1987), business surveys (e.g., Arundel et al. 1995; Duguet and Kabla 1998; Granstrand 1999; Cohen et al. 2000; Blind et al. 2006; Motohashi 2008; Giuri et al. 2007) have asked firms about their motives to patent and the effectiveness of patents to protect innovations. These studies show that, in the majority of manufacturing industries, patents are regarded as imperfect appropriation mechanisms due to: the high application costs; the high costs of defending patents in courts; the mandatory information disclosure in patent filings; and the ease of inventing around individual patents.

While patents are considered imperfect mechanisms to protect against direct imitation, they are used extensively by firms for strategic reasons (Arundel and Kabla 1998; Cohen et al. 2000; Blind et al. 2006; Giuri et al. 2007; Graham et al. 2009). Strategic reasons include: the blocking of patent activities of rival firms; enhancement of firms’ technological reputations; better access to capital markets and R&D partnerships; and using patents as a means to assess, motivate, and reward employees (Blind et al. 2006; Giuri et al. 2007; Motohashi 2008).

Blind et al. (2006) distinguished between two types of patent blocking strategies, which they label as offensive and defensive blocking. Offensive patent blocking is a practice whereby firms build “patent fences” of related technologies around a technology, which block competitors from commercializing substitutive technologies (Granstrand 1999; Arora 1997). Offensive patent blocking raises entry barriers and increases the expected profits of market incumbents (Gilbert and Newberry 1982). For example, in the 1940s Du Pont patented over 200 substitutes for its core product nylon to block competition from alternative technologies (Hounshell and Smith 1988; Cohen et al. 2000). More recently, Eli Lily erected a patent fence around its blockbuster drug Tadalafil by filing follow-up patents on new formulations and dosing regimens of its key substance (Sternitzke 2013).

The theoretical logic that underlies offensive blocking is that incumbent firms with patented technologies want to safeguard their resultant profits against the entry of new firms (diversifying firms or de novo entrants). Theoretical models (e.g. Gilbert and Newberry 1982; Schneider 2008) have shown that, under certain conditions, it is rational for firms to patent substitute inventions—which are not commercialized but shelved—to pre-empt entry into core technologies and product markets. Offensive patent blocking is expected to be an effective strategy for firms in discrete product industries, where innovations are composed of a small number of patentable elements (Arora 1997; Cohen et al. 2000).

Defensive patent blocking refers to the creation of large patent portfolios. This strategy entails filing patents that block technology activities of others in order to: get access to patent cross-licensing deals; engage in IP barter trade; and prevent or settle patent infringement lawsuits (Blind et al. 2006). Defensive patenting strengthens the firm’s own bargaining position in patent lawsuits and technology trading markets (Blind et al. 2006). Here, patent portfolios are used to gain access to important outside technologies that the firm needs in order to commercialize its own innovations (Hall and Ziedonis 2001; Shapiro 2001; Grindley and Teece 1997; Ziedonis 2004).

Defensive blocking is expected to be an effective strategy in complex product industries, where innovations are composed of numerous patents that are often owned by multiple technology entities (Cohen et al. 2000, 2002). Innovation in complex product industries is typically cumulative, and new innovations build largely upon prior innovations (Scotchmer 1991; Shapiro 2001). In these industries, it is hard to innovate without infringing on existing patent rights of other technology entities (Grindley and Teece 1997; Hall and Ziedonis 2001; Reitzig 2003, 2004; Grimpe and Hussinger 2014a); and assuring access to their patents is important.

In the mobile phone industry, firms such as Google, Apple, and Microsoft have adopted defensive patent blocking strategies (Paik and Zhu 2013). Smartphones are complex products that involve up to 250,000 patent claims,Footnote 3 and firms are racing to create patent portfolios that hold legal rights on as many as possible patentable elements. The purpose is to build a patent portfolio that provides a good bargaining position in cross-licensing deals. Patent portfolios can be amassed through internal R&D, but also through patent acquisitions. The 2011 acquisitions of Nortel’s patents on communication technologies by Apple and Microsoft, and the acquisition of Motorola Mobility by Google serve as illustrating examples (Grimpe and Hussinger 2014b).

While well-crafted patent portfolios hold the promise to improve the appropriability of inventions (Teece 1986; Granstrand 1999), they are costly to build (Van Pottelsberghe de la Potterie and Francois 2006; Cohen et al. 2000), and a thorough understanding of the technological landscape is necessary in order to craft effective blocking patent portfolios (Granstrand 1999).

Cohen et al. (2000) examined the importance of offensive and defensive patent blocking strategies in discrete and complex product industries. Using survey data from U.S. firms, they found evidence for a more frequent use of offensive blocking in discrete product industries and defensive blocking in complex product industries.

The only large-scale quantitative study that examines the impact of patent blocking strategies on firm value is conducted by Ceccagnoli (2009). Using cross-sectional data for firms that span various industries and a dichotomous indicator on firms’ involvement in offensive patent blocking (patent pre-emption),Footnote 4 Ceccagnoli (2009) shows that—under certain conditions—a positive effect of offensive patent blocking on firm value exists. His study did not examine the impact of defensive patent blocking strategies on firm value, nor did it examine differences in the effectiveness of both patent blocking strategies across discrete and complex product industries.

3 Estimating the Market Value of Patent Blocking Strategies

Following Griliches (1981) a market-value approach is applied to assess the private value of firms’ patent blocking activities. The market-value framework employs the market value as an indicator of the sum of expected future profits of the firm, which is then related to its book value and, in addition, to several measures of firms’ innovation activities. Although the market-value method is intrinsically limited in scope—because it can be used only for publicly listed firms that are traded on a well-functioning financial market—the use of this method avoids the timing problems of R&D costs and revenues, and it is capable of forward-looking evaluation (Hall 2000; Czarnitzki et al. 2006).

The market-value approach draws on the hedonic pricing model in viewing firms as bundles of assets and capabilities: from plant and equipment to intangible assets such as brand names, goodwill, and knowledge (Czarnitzki et al. 2006). It is difficult to disentangle firms’ assets and capabilities since they are priced simultaneously on the market. The market-value approach assumes that financial markets assign a valuation to the firms’ assets bundle that is equal to the present discounted value of their expected future cash flows.

Following most existing studies (see Czarnitzki et al. 2006, for an overview) we assume a market-value equation that relies on the assumption that a firm’s assets enter additively. This leads to the following equation, with A representing the physical assets and K the knowledge (or innovation) assets of firm i at time t:

Under the assumption of constant returns to scale (\( \sigma = 1 \)) Eq. (1) can be written in logarithmic form as:

The left-hand side of the equation is the log of Tobin’s Q: the ratio of the market value to the replacement cost of the physical assets. The marginal or shadow value of the ratio of knowledge capital to physical assets is represented by γ. It captures the expectations of investors as to the effect of knowledge capital relative to physical assets on the discounted future profits of the firm. Log q is the intercept of the model.

We use a number of variables to capture the knowledge assets K of a firm. First, we use the stock of a firm’s R&D expenses (RD). As R&D activities are highly uncertain, we also use the stock of patents (PAT) as a measure for successfully finished R&D activities. This follows Griliches (1981), who suggested that patented inventions may be associated with a premium above mere R&D investment. We use triadic patents—patents filed simultaneously at the European Patent Office, the Japanese Patent Office, and the US Patent and Trademark Office—to avoid introducing a home-country bias due to the fact that our sample consists of firms from different home countries that may be more inclined to file for patents at their home patent office (Dernis and Khan 2004).

Since patents vary widely in their economic value (Pakes 1985; Harhoff et al. 1999; Hall et al. 2005; Deng 2007; Gambardella et al. 2008), we use the stock of forward patent citations (CIT) as indicator of the value of patents. Prior work (e.g., Hall et al. 2005) has shown that forward patent citations carry information on the economic value of patents. Forward patent citations are calculated over a fixed time window of 5 years. The variable PAT CIT is the citation-weighted patent stock and is calculated as the sum of patent stock (PAT) and the stock of forward patent citations (CIT).Footnote 5

We also add the stock of self-citations (SELF CIT) to control for the cumulativeness of firms’ innovation activities, in line with Hall et al. (2005). Self-citations indicate that the citing and the cited patent are held by the same patent owner. Hall et al. (2005) argue that self-citations may reflect technological competition, in the sense that it may show the extent to which firms have internalized knowledge spillovers or the strength of firms’ competitive position relative to other firms in their industry.

Further, we add a set of variables that measure the blocking power of patent portfolios (Grimpe and Hussinger 2008, 2014b; Guellec et al. 2012; Della Malva and Hussinger 2012): A first variable (BLOCK CIT) measures the overall blocking power of patent portfolios and is the stock of blocking forward patent citations. Information on patent citations is retrieved from patent search reports at the European Patent Office (EPO). A patent search report is a report that is composed by a patent examiner, which mentions the documents that are taken into consideration when deciding whether an invention is novel and represents an inventive step over the state of the art so that it is patentable.Footnote 6 The search for prior art that is undertaken by the patent examiner follows The Guidelines for Examination in the European Patent Office.Footnote 7

In the EPO examination system, each citation in a search report is classified. For instance, citations may refer to other (patent) documents that do not prejudice the novelty or the inventive step of a new patent filing. Such references are marked as “state of the art” by the patent examiner. In other cases, however, existing prior art may describe essential parts of the new patent filing or question the inventive step of the patent, and therefore block the patentability.Footnote 8 These references are marked as “blocking” citations by the patent examiner (Harhoff et al. 2005; Criscuolo and Verspagen 2008).Footnote 9 Prior research has shown that patents with a search report that cite a substantial amount of prior art that is flagged as blocking have a lower probability to be granted (Guellec et al. 2012; Della Malva and Hussinger 2012) and are perceived as weaker patents (Harhoff and Reitzig 2004; Czarnitzki et al. 2009).

The specification of our regression model is an augmented market value equation. In order to avoid multi-collinearity with the RD/A variable, we divide the citation weighted patent stock by R&D. Thus, the estimated coefficient of the citation-weighted patent stock can be interpreted as premium (or discount) on top of the market value of R&D. In addition, we add the share of self-citations in total forward citations. Regarding our main variable of interest, the share of blocking citations, the estimated coefficient \( \gamma_{4} \) is expected to be positive, showing a value-premium for patent stocks with a large blocking power. The specification of the regression model is

where the vector x denotes several control variables that are described below in the data section. In contrast to the most common specification that is used in the literature where the model’s intercept q is a constant common to all firms, we allow this factor to vary across firms by implementing fixed effects regressions. \( \varepsilon \) denotes the statistical error term.

In a more detailed variant of the baseline model, we distinguish between the offensive and defensive blocking power of patent stocks by decomposing the overall blocking stock variable in two variables: Offensive blocking power—which results from the patenting of competitive substitutes—is measured by the stock of blocking self-citations (BLOCK SELF CIT). Blocking self-citations occur when patents are cited as infringing (blocking) prior art on later patent filings of the same firm. We normalize the measure of offensive patent blocking by dividing the stock of blocking self-citations by the total stock of self-citations (SELF CIT). This allows for the identification of an additional effect of offensive patent blocking beyond a general effect of the cumulativeness of firms’ innovation activities.

The defensive blocking power of a firm’s patent portfolio—which results from the creation of patent portfolios that serve to block others in other to strengthen the own bargaining position in technology markets—is measured by the stock of blocking non-self-citations. Blocking non-self-citations occur when patents are cited as infringing (blocking) prior art on later patent filings of other firms. We normalize the measure of defensive patent blocking by dividing the stock of blocking non-self-citations (BLOCK NON-SELF CIT) by the total stock of non-self-citations (NON-SELF CIT). This results in the following specification:

In a last specification, we distinguish between the offensive and defensive blocking power of firms in discrete and complex product industries. We expect that offensive blocking is of higher value in discrete product industries, whereas defensive blocking is expected to be more important in complex product industries.

Besides examining the impact of the blocking power of patent portfolios on the market value of firms, this paper has several other new features as compared to existing studies of the market value of innovation activities: First, while most market value studies focus on U.S. or U.K. firms, in combination with national patent data (Czarnitzki et al. 2006), we use a global sample of firms: the top R&D spending U.S., European, and Japanese firms in three R&D intensive industries.

Second, we benchmark the value of triadic patents: patents that are jointly filed at the U.S., European, and Japanese patent offices. Triadic patents reflect inventions for which the owner expects high profits as she is willing to incur the relatively high patent filing and maintenance costs at all three patent offices (Guellec and van Pottelsberghe de la Potterie 2008).

Third, we use panel-data methods to control for unobserved firm-specific effects, which is not common in the market-value literature.Footnote 10 Fourth, our data feature a characteristic that has not been considered in early market-value studies: Our patent data are consolidated annually, and thus account for annual changes in corporate group structures that are due to firm acquisitions, divestments, and green-field investments.

4 Data and Variables

4.1 Sample and Data

Our sample consists of 151 publicly traded European,Footnote 11 U.S., and Japanese manufacturing firms that are active in three main industries: chemicals and pharmaceuticals (including biotechnology); electronics and IT hardware; and engineering and general machinery. Chemicals and pharmaceutical industries are discrete product industries, while the other industries are complex product industries (Cohen et al. 2000). We have chosen these industries because the propensity to patent inventions is relatively large (Arundel and Kabla 1998).

The sample firms are the largest R&D spenders in their sector and country of origin according to the “2004 EU Industrial R&D Investment Scoreboard”. The scoreboard lists the top 500 corporate investors in R&D whose headquarters are located in the EU, and the top 500 firms whose headquarters are located outside the EU (mainly the U.S. and Japan). The sample firms are roughly equally distributed over the different industries and home regions.

We collected financial, R&D and patent data at the consolidated group level for building a firm-level panel database that covers the period 1995–2000. Market value, total assets, and R&D expenditures (all expressed in million US$) are obtained from the Datastream and Worldscope financial databases. Patent data are gathered from the OECD/EPO patent citation database (Webb et al. 2005) that contains information on all patents that are filed at the EPO and at the World Intellectual Property Organization (WIPO), under the Patent Cooperation Treaty (PCT), from the introduction of EPO in 1978 until September 2006.

The OECD/EPO patent citation database also provides for all patent filings a list of patent filings in other national or regional patent offices that pertain to the same invention (patent equivalents).Footnote 12 This information is used to calculate firm-level stocks of triadic patents: patents that are jointly filed at the U.S., European, and Japanese patent offices. Further, patent equivalents as well as the consolidated firm structures were taken into consideration for the construction of the patent citation measures.

To construct patent indicators at the consolidated level, we collected patents by the sample firms as well as their majority-owned subsidiaries. For this purpose, we used yearly lists of firms’ subsidiaries included in corporate annual reports, yearly 10-K reports filed with the Securities and Exchange Commission (SEC) in the U.S., and (for Japanese firms) information on foreign subsidiaries that is published by Toyo Keizai in the yearly “Directories of Japanese Overseas Investments”. This consolidation exercise has been conducted for each year in our panel to account for changes in the group structure of firms due to M&As, green-field investments, and spin-offs.

The patent stock of an acquired firm is considered part of the patent stock of an acquiring firm from the acquisition year onwards. The annual consolidation exercise constitutes a methodological improvement over early market-value studies where scholars consolidated data only in a single point in time. Only recent market value studies are based on consolidated data (e.g., Belderbos et al. 2014). Due to missing data on some variables (mostly R&D expenses), our final sample is an unbalanced panel of 873 observations for 151 firms.

4.2 Variables

Table 1 provides an overview of the variables, their abbreviations, and their definitions.

4.2.1 Main Variables

Our dependent variable is a modified Tobin’s Q: calculated as the ratio of the market value of the firm to the book value (as proxy for the replacement costs) of its physical assets. Market value is defined as the sum of market capitalization (share price times the number of outstanding shares at the end of the year), preferred stock, minority interests, and total debt. The book value is the sum of net property, plant and equipment, current assets, long-term receivables, investments in unconsolidated subsidiaries, and other investments.

R&D stocks are calculated for each firm and year as a perpetual inventory of past and present annual R&D expenditures of the firm with a depreciation rate (δ) of 15%, as is common practice in the literature (Griliches and Mairesse 1984; Hall et al. 2005). We use the following formula for the R&D stock (RD) of a firm i in year t:

The initial value of the R&D stock is calculated at the first year of available R&D data for each firm as:

A firm-specific annual growth rate (gi) is used. The average of gi equals 8.7% in our sample. This is comparable to the growth rate of 8% that has been used in prior market value studies (Hall and Oriani 2006; Hall et al. 2007). Annual R&D expenditures and total assets are deflated using GDP deflators.

The citation weighted patent stock (PAT CIT) is constructed using a similar formula as for R&D stocks and the same depreciation rate (δ) of 15%Footnote 13:

Citationsit measures the forward citations to patents of year t over a fixed five-year time window. PAT CIT is based on the complete listing of firms’ triadic patents.Footnote 14 The citation stock (CIT) and the self-citation stock (SELF CIT) are constructed using the same formula as the R&D and patent stocks.

In order to define our blocking patent measures we rely on information on blocking patent citations. The variable BLOCK CIT is the stock of forward blocking citationsFootnote 15 that firms’ patents receive in a fixed 5-year window and is considered an indicator of the blocking power of firms’ patents. We normalize BLOCK CIT by the stock of forward citations (CIT) to avoid a potentially high correlation. Since we regress current (in year t) Tobin’s Q against the current stock of patents and their future patent citations, some of the patent citations will materialize only after year t. Here we assume that financial markets anticipate the (blocking) nature of the technology that is embedded in the patents. This is common practice in market value studies.

We further distinguish between firms’ patents being cited as blocking prior art in their own future patent filings (blocking self-citations) or in those of third parties (blocking non-self-citations). A frequent occurrence of blocking self-citations shows that firms patent a number of related inventions and suggests that they adopt offensive patent blocking strategies and build patent fences. We use the stock of blocking self-citations (BLOCK SELF CIT) as the measure of offensive patent blocking and normalize this variable by the stock of self-citations (SELF CIT).

The drug Tadalafil—which is widely known by the brand-name Cialis—is an example of a technology that has been protected with a patent fence (Sternitzke 2013). Tadalafil is a blockbuster drug of the U.S. pharmaceutical firm Eli Lilly for the treatment of male erectile disorders. Eli Lilly has erected a patent fence to block competition offensively for Tadalafil (Sternitzke 2013).Footnote 16 Eli Lilly’s first patent (EP0740668) describes the basic chemical compound and utility in various therapeutic areas. The other patents that form the fence (EP0839040, EP1173181, EP1200091, EP1200092) protect variations in formulations and dosing that allow for, amongst others, a minimization of adverse side effects and a better and faster achievement of the therapeutic effect. The EPO search reports of these patents contain four citations to each other (i.e. self-citations). All the self-citations are classified as blocking citations.

Firms’ patents that are cited as blocking prior art in patent filings of third parties (blocking non-self-citations) are used to construct our indicator of the defensive blocking power of a firm’s patent portfolio. Patents that receive blocking non-self-citations hinder the granting of patents of other firms and are valuable from a defensive patent blocking perspective as they allow firms to get access to outside technologies via technology markets. We use the stock of blocking non-self citations (BLOCK NON-SELF CIT) as indicator of defensive patent blocking, and normalize the variable by dividing it by the stock of non-self citations (NON-SELF CIT).

4.2.2 Control Variables

In addition to the main variables, we add several control variables. First, we control for the density of the patent thicket (THICKET) of the technology fields in which a firm is active. A technology field is characterized as a patent thicket if there is dense web of overlapping patent rights, which is the consequence of high product complexity and many individual patent rights (Von Graevenitz et al. 2011).

Our firm-level measure of the density of the patent thicket is based on the technology field level measure that is developed by Von Graevenitz et al. (2011). This measure counts how frequently there are constellations (triples) in a technology field whereby three firms each own patents that block patents of the two others, as measured by blocking citations. The intuition behind the measure is that blocking relationships in triple constellations are difficult to solve and indicative of patent thickets.

The Von Graevenitz et al. (2011) measure is a technology-field-level measure: in our case for 30 Fraunhofer-INPI-OST technology classes for EPO patents (Schmoch 2008).Footnote 17 We transform the patent thicket measure into a firm-level measure by weighting the technology-field-level patent thicket measures with the shares of firms’ patent activities across technology fields (see Grimpe and Hussinger 2014b):

where j refers to the technology field; i to the firm; t to the year; THICKET to the patent thicket index (count of triples following Von Graevenitz et al. 2011); and \( w_{it\;j} = \frac{{PAT_{it\;j} }}{{PAT_{it} }} \), with PAT representing patent stock variables at the firm-year and firm-technology field-year level.Footnote 18 Our patent thicket measure captures the extent to which each individual firm faces patent thickets—overlapping patent rights—in the technology fields over which it is spanning its technology activities.

Second, we include an indicator (SALES DIV) for the firms’ sales concentration to control for the degree of product diversification and the product diversification discount that is frequently found in the literature (Martin and Sayrak 2003). Sales concentration is measured as the Herfindahl index of firms’ sales over four-digit ISIC industries in which a firm has reported sales. Industry level sales data is collected from Worldscope, Datastream, and firm annual reports.

Third, we control for the diversification of a firm’s technology activities (TECH DIV). A firm might have a very concentrated technology portfolio that contributes to only a few technology fields or a broad technology portfolio that spans many fields. Therefore, we calculate the Herfindahl index for the distribution of a firm’s patents across the 30 Fraunhofer-INPI-OST technology fields (Leten et al. 2007). This variable accounts for potential systematic differences in technology diversification among firms in complex and discrete product industries.

We also control for year and industry effects as well as for their interactions. In addition, a set of country dummy variables is included.

4.3 Descriptive Statistics

Table 2 shows descriptive statistics for our full sample and for discrete and complex product industries separately. The sample firms are large and R&D-intensive: total assets, R&D stocks, and citation-weighted patent stocks are equal respectively to US$9.8 billion, US$2.9 billion, and 448 citation-weighted triadic patents, on average. The Tobin’s Q values have a mean value of 2.23, which is well above unity. About 42% of the patent citations that are received by the sample firms’ patents can be labelled as blocking.

About 26% of all citations are self-citations. The share of blocking self-citations in all self-citations equals 26%, while the share of blocking non-self-citations in all non-self-citations equals 42%. The descriptive statistics for discrete versus complex product industries separately show that firms in discrete product industries have higher ratios of both blocking self-citations and non-self-citations.

Table 3 shows the correlation coefficients.

5 Market Value Estimations

Table 4 reports the results for the estimation of market value equations by nonlinear least squares. Our model includes firm-specific effects that are modeled as the average value of the dependent variable in the pre-sample period, which is included in the regression models as an additional regressor (Blundell et al. 1995).

The baseline specification includes only the R&D and citation-weighted patent stock variables, as well as the controls. We then sequentially add the blocking patent variables. Country, industry, year and industry-year interaction dummy variables are included in all specifications. The citation-weighted patent stock (PAT CIT/RD) and the patent thicket variable (THICKET) are positively and significantly related to Tobin’s Q. Somewhat surprisingly, the variable R&D/assets (RD/A) is insignificant. This may be explained by the fact that R&D changes slowly over time and is therefore highly correlated with the firm-specific fixed effect (Hall et al. 2005). This explanation receives support by the fact that the R&D variable becomes significant if we drop the pre-sample mean (the firm fixed effects) from the specification.

In our augmented model II, we add our first variable of special interest: the blocking citation ratio (BLOCK CIT/CIT). The overall share of self-citations (SELF CIT/CIT) is added as a further control variable. The coefficient for the blocking citation ratio shows a positive sign and is statistically significant. This result indicates that the market value of firms is higher when firms’ patents receive a higher number of forward citations that are “blocking” in nature: when the overall blocking power of firms’ patent portfolios is strong. This finding is in line with prior results by Grimpe and Hussinger (2008, 2014b) that show that patents with blocking citations increase the price of target firms in mergers and acquisitions.

Model III distinguishes between blocking self-citations (BLOCK SELF CIT/SELF CIT)—which is our measure for offensive patent blocking—and blocking non-self-citations (BLOCK NON-SELF CIT/NON-SELF CIT): our measure for defensive patent blocking. The estimation results show that both offensive and defensive patent blocking add positively and significantly to the market value of firms.

Model IV distinguishes between offensive (BLOCK SELF CIT/SELF CIT) and defensive blocking (BLOCK NON-SELF CIT/NON-SELF CIT) in discrete and complex product industries. An interesting difference appears. In line with our theoretical expectations, offensive blocking (BLOCK SELF CIT/SELF CIT) is relevant in discrete product industries, while defensive blocking (BLOCK NON-SELF CIT/NON-SELF CIT) adds to firms’ market value only in complex product industries. This suggests that patent fencing is a valuable strategy in discrete product industries, while building a patent portfolio that has the power to block competitors is valuable in complex product industries that are characterized by more cumulative innovation activities and distributed technology ownership.

To get an indication of the economic magnitude of the estimated effects, we calculated semi-elasticities of Tobin’s Q with regard to each of the main variables as the derivative of the non-linear market value equation with regards to the variable of interest (see, e.g., Hall et al. 2007). Table 5 reports average values of the semi-elasticities and standard errors across all sample observations.

The largest effect for a unit change of a regressor in Table 5 is found for the blocking citations variable (BLOCK CIT/CIT). A unit change—a change in BLOCK CIT/CIT from 0 to 1—increases Tobin’s Q by 117%. A more realistic change in BLOCK CIT/CIT of one standard deviation (= a value of 0.11) yields a higher Tobin’s Q value of about 12.87%. With an average market value of US$17 billion, this corresponds to an increase of US$2.19 billion of the market value (keeping the book value constant).

Table 5 (Model III) further shows that if we distinguish between offensive (BLOCK SELF CIT/SELF CIT) and defensive blocking (BLOCK NON-SELF CIT/NON-SELF CIT) the latter has a stronger effect on firms’ market value. The semi-elasticities indicate that a change in the offensive blocking variable—the ratio of blocking self-citations—by one standard deviation (= a value of 0.19) increases Tobin’s Q by about 5.13%, while a change in defensive blocking by one standard deviation (= a value of 0.11) increases Tobin’s Q by 10.01%. With an average market value of US$17 billion, this corresponds to increases of US$0.87 billion and US$1.72 billion of the market value (keeping the book value constant).

With the final specification (Model IV), where we allow for different effects of both types of blocking in discrete and complex product industries, the result becomes clearer. Offensive patent blocking is only relevant in discrete product industries. Here, a change in the blocking self-citations ratio by one standard deviation (= a value of 0.20) increases Tobin’s Q by about 9.80%, corresponding to US$1.86 billion with an average market value of US$19 billion in complex product industries, keeping the book value constant. There is no evidence for a positive effect of defensive patent blocking in discrete product industries.

In complex product industries, on the contrary, we find that defensive patent blocking increases Tobin’s Q by 24.20% if the defensive blocking variable increases by one standard deviation (= a value of 0.22). This corresponds to an increase of US$3.47 billion with an average market value of US$16 billion in complex product industries, keeping the book value constant. There is no effect of offensive blocking on the market value of firms in complex product industries.Footnote 19

5.1 Supplementary Analysis

We conducted an additional analysis to examine whether defensive blocking contributes to a higher market value by encouraging firms to reach cross-licensing agreements. Information on cross-licensing is collected from the Lexis Nexis news archive database. Key data sources for LexisNexis include major disseminators of news releases such as Business Wire, PR Newswire Association, Information Bank Abstracts (by The New York Times), Information Access Company (Thomson Corp.) etc., as well as more specialized information brokers such as Reuters Health Medical News, Intellectual Property Today, Espicom Business Intelligence, among many others. It is fair to assume that Lexis Nexis offers a comprehensive coverage of publicly known codified information about corporate business activities.

We identified news articles on cross-licensing deals by our sample firms by searching for the term “cross-license” in LexisNexis articles for our 151 sample firms. This resulted in a set of 1055 news articles for the period 1995–2000.Footnote 20 To test whether defensive blocking helps firms to reach cross-licensing agreements, we have estimated the effect of BLOCK NON-SELF CIT/NON-SELF CIT on the number of newly announced cross-licensing deals by the 64 companies that had at least one such cross-licensing agreement during 1995–2000. The results of fixed-effects poisson models and fixed-effect quasi-maximum likelihood poisson models, which are robust against overdisperion, are presented in Table 6.

The control variables show that firms that are large (log(A)) and R&D-intensive (RD/A) and that operate in technology markets with overlapping IP rights (THICKET) engage more in cross-licensing. While there is no effect of offensive blocking (BLOCK SELF CIT/SELF CIT) on cross-licensing, defensive blocking (BLOCK NON-SELF CIT/NON-SELF CIT) has a positive effect on the number of cross-licensing deals. This result—taken together with the positive and significant correlation (0.2) between cross-licensing and firms’ market value—shows that access to cross-licensing deals is one mechanism through which defensive patent blocking affects firms’ market value. These results continue to hold when the likelihood to engage in cross-licensing (fixed-effect logit model) is considered rather than the number of cross-licensing deals. They are also robust when a random effects tobit model is used. These additional results are available from the authors upon request.

6 Conclusions

This paper contributes to the literature on patent strategies by investigating whether two specific patent strategies correlate with a higher market value of firms: First, offensive patent blocking is a strategy whereby firms patent technological alternatives to a focal technology so as to prevent competitors from entering a market with substitute technologies. Second, defensive patent blocking involves creating patent portfolios that block technologies of competitors so as to increase the competitors’ willingness to trade important patents (e.g., via cross-licensing agreements).

We hypothesize that offensive patent blocking is an effective strategy in discrete product industries, while defensive patent blocking is effective in complex product industries (Arora 1997; Cohen et al. 2000). The reasoning is that in discrete product industries where products primarily use one or a few patents it is useful to build a patent fence around core technologies as a shield against competition. In complex product industries, where products consist of many patents, a strong patent portfolio that has the power to block other technology owners is a useful instrument to get access to cross-licensing deals and to avoid costly patent lawsuits.

Our research questions are empirically examined by developing a new set of measures for the blocking potential of patent portfolios and introducing them into the firm-level market-value (Tobin’s Q) equation of Hall et al. (2005). Market value estimations show that in discrete product industries, offensive patent blocking brings value to firms, while in complex product industries defensive patent blocking increases market value. Further analyses demonstrate that firms that engage in defensive blocking are involved in more cross-licensing agreements with other technology owners. Altogether, these results confirm that firms can maximize the returns of their innovation activities by intelligently managing intellectual property rights and crafting appropriate patent portfolios that take into account the peculiarities of their industries.

Our findings also contribute to prior studies on patent citation heterogeneity. Prior studies have shown that citations should be aggregated with care. Alcacer and Gittelman (2006), for instance, have shown that at the USPTO patent references that are made by the patent applicant differ significantly from examiner-given citations. Our study indicates that blocking forward patent citations at the EPO are correlated more strongly with firms’ market value than are the average forward citations that a patent receives.

Our study is not free of limitations: the most important limitation is that we cannot establish that firms follow a defensive or offensive patent blocking strategy on purpose. We rather observe the outcome of patent management in the form of firms’ patent portfolios and their characteristics. Second, our measures for patent blocking are proxy variables. We only “witness” the blocking potential of a patent when other patents are filed and blocking citations are generated. Last, our sample consists of large R&D spending firms. Our results have to be interpreted accordingly, and one should be cautious when generalizing the results for samples of small and medium-sized firms.

Notes

The prior art consists of all information (including patents) that is publicly available prior to the date that a patent is filed and that is relevant for a patent examiner to assess the novelty and inventiveness (and hence the patentability) of the patent filing. Infringing prior art documents contain claims that prejudice the novelty or inventiveness of claims of the patent filing.

Note that the blocking power of patents is never perfect in the sense that no patent on related technologies (and hence no one that cites the earlier patent) is granted in the near future. This is because patent applications change during the application process, so that applicants can narrow the scope of the invention for which they seek protection in case blocking prior art is found. This explains why patent applications that infringe on prior patents can still be granted, but in a modified version.

Claims are the building blocks of inventions that seek patent protection. Covering individual parts of the invention they define the scope and the boundaries of the patent.

Ceccagnoli (2009) relies on data from the Carnegie Mellon survey—which was also used by Cohen et al. (2000)—to construct an indicator of offensive patent blocking. The offensive patent blocking variable takes a value of one if a firm indicated in the survey that the blocking of rivals and not licensing nor cross-licensing were reasons to file for their most recent product or process patent. .

In constructing the citation-weighted patent stock, we used an ‘additive’ or ‘linear’ approach whereby each citation is considered to be worth as much as each patent. This choice is based on the work of Trajtenberg (1990), who found that a linear weighting of patents by the number of forward patent citations provides a good approximation of the underlying economic value of patents.

These documents may have been suggested by the applicant at the time of the patent filing, or the examiner might have found additional pieces of prior art and added these to the patent dossier under scrutiny. Other than at the USPTO the applicant of a patent at EPO does not have to report relevant prior art in the patent filing. In consequence, about 90 percent of all patent citations in EPO patents are added by the patent examiner (Criscuolo and Verspagen 2008).

Note that a patent can still be granted if it receives blocking citations to prior art, although this is less likely. This can, for instance, be the case for patent filings with many claims. Blocking citations pertain to individual claims, and the remaining claims can be strong enough to support the granting of a modified (although reduced in scope) patent. In our data, we see blocking references to prior art in the initial patent filing.

Blocking citations include the citation categories “X” and “Y” of the European search reports.

The European firms are located in Belgium, Switzerland, Denmark, Finland, France, Germany, the Netherlands, Sweden, and the United Kingdom.

An invention can be applied for at multiple national patent offices, in which case each patent office assigns a different patent number to the same invention.

Since we have complete annual listings of patent filings of the sample firms since 1978 (the foundation year of EPO), the initial value for PAT is set to zero.

We use only patent applications that have been granted at the EPO while using their application date as the relevant date for the match. Although patent applications enter the pool of prior art and may hence constitute conflicting prior art for future patent applications, they do not grant the right to exclude third parties from using the invention—which is the intention of blocking patent strategies. We rely on the EPO grant decision because: (1) the grant rate at the USPTO is relatively high, which leads to a large number of low-quality granted patents (Carley et al. 2013); and (2) patent applications at the JPO cover fewer claims than do patents at the EPO and at the USPTO (Van Pottelsberghe de la Potterie 2011).

Forward citations (blocking and non-blocking) are derived from the OECD/EPO Patent Citation Database and include citations to patent applications at the EPO and the WIPO. By constructing citation counts on patent applications, we get a more complete picture of the blocking potential of patents. Patent equivalents at national patent offices are taken into account in the calculation of citations in order not to underestimate the number of forward patent citations (see Harhoff et al. 2005; Webb et al. 2005).

The fence consists of five patent families that are listed in the U.S. Food and Drug Administration (FDA) “Orange Book”. The FDA Orange Book identifies drug products, and their patents, that are approved with regards to the safety and effectiveness standards of the FDA.

We thank Franz Schwiebacher for providing this measure.

E.g. if a firm patented only in technology class 1 in the past, the weights are (1, 0, 0, 0, …, 0). If a firm patented equally much in technology classes 1 and 2, the weights are (0.5, 0.5, 0, 0, …, 0).

The reader might wonder whether the coefficients for the control variables differ as well for complex and discrete product industries. We ran a regression that estimates different coefficients for firms in discrete and complex industries. A test on the null hypothesis of jointly equal coefficients for product and complex product industries is not rejected at the 5% level.

Intel has the highest numbers of deals (193 times), followed by Motorola (114), Hewlett Packard (94), Alcatel (78), Texas Instruments (63), Fuji Electric (38), Toshiba (33) and National Semiconductor (31). All these firms operate in complex product industries, where cross-licensing is a frequent strategy. A significant number of firms (87 of 151 firms), which are active in both discrete and complex product industries, have no cross-licensing agreements in the sample period 1995–2000.

References

Alcacer, J., & Gittelman, M. (2006). Patent citations as a measure of knowledge flows: The influence of examiner citations. Review of Economics and Statistics,88(4), 774–779.

Arora, A. (1997). Patents licensing and market structure in the chemical industry. Research Policy,26, 391–403.

Arundel, A., & Kabla, I. (1998). What percentage of innovations are patented? Empirical estimates from European firms. Research Policy,27, 127–141.

Arundel, A., van de Paal, G., & Soete, L. (1995). Innovation strategies of Europe’s largest industrial firms. Maastricht: MERIT.

Belderbos, R., Cassiman, B., Faems, D., Leten, B., & Van Looy, B. (2014). Co-ownership of intellectual property: Exploring the value-appropriation and value-creation implications of co-patenting with different partners. Research Policy,43, 841–852.

Blind, K., Edler, J., Frietsch, R., & Schmoch, U. (2006). Motives to patent: Empirical evidence from Germany. Research Policy,35, 655–672.

Bloom, N., & Van Reenen, J. (2002). Patents, real options and firm performance. Economic Journal,112(3), 97–116.

Blundell, R., Griffith, R., & van Reenen, J. (1995). Dynamic count data models of technological innovation. Economic Journal,105, 333–345.

Blundell, R., Griffith, R., & Van Reenen, J. (1999). Market share, market value and innovation in a panel of British manufacturing firms. Review of Economic Studies,66, 529–554.

Carley, M., Hegde, D. & Marco, A. (2013). What is the probability of receiving a US patent? USPTO economic working paper No. 2013-2.

Ceccagnoli, M. (2009). Appropriability, preemption and firm performance. Strategic Management Journal,30(1), 81–98.

Cohen, W., Goto, A., Nagata, N., Nelson, R., & Walsh, J. (2002). R&D spillovers, patents and the incentives to innovate in Japan and the United States. Research Policy,31, 1349–1367.

Cohen, W., Nelson, R. & Walsh, J. (2000). Protecting their intellectual assets: Appropriability conditions and why U.S manufacturing firms patent (or not). NBER working paper 7552.

Criscuolo, P., & Verspagen, B. (2008). Does it matter where patent citations come from? Inventor vs. examiner citations in European patents. Research Policy,37, 1892–1908.

Czarnitzki, D., Hall, B. H., & Oriani, R. (2006). The market valuation of knowledge assets in US and European firms. In D. Bosworth & E. Webster (Eds.), The management of intellectual property (pp. 111–131). Cheltenham: Cheltenham Glos.

Czarnitzki, D., Hussinger, K., & Schneider, C. (2009). Why challenge the ivory tower? New evidence on the basicness of academic patents. Kyklos,62, 488–499.

Della Malva, A., & Hussinger, K. (2012). Corporate science in the patent system: An analysis of the semiconductor technology. Journal of Economic Behavior & Organization,84, 118–135.

Deng, Y. (2007). Private value of European patents. European Economic Review,51, 1785–1812.

Dernis, H. & Khan, M. (2004). Triadic patent families methodology. OECD Science, Technology and Industry working papers 2004/2, OECD Publishing.

Duguet, E., & Kabla, I. (1998). Appropriation strategy and the motivations to use the patent system: An Eeconometric analysis at the firm level in French manufacturing. Annals of Economics and Statistics,49(50), 289–327.

Gambardella, A., Harhoff, D., & Verspagen, B. (2008). The value of European patents. European Management Review,5, 69–84.

Gilbert, R., & Newberry, D. (1982). Preemptive patenting and the persistency of monopoly. American Economic Review,72(3), 514–526.

Giuri, P., Mariani, M., Brusoni, S., Crespi, G., Francoz, G., Gambardella, A., et al. (2007). Inventors and invention processes in Europe: Results from the PatVal-EU survey. Research Policy,36, 107–1127.

Graham, S. J. H., Merges, R. P., Samuelson, P., & Sichelman, T. (2009). High technology entrepreneurs and the patent system: Results of the 2008 Berkeley patent survey. Berkeley Technology Law Journal,24(4), 1255–1328.

Granstrand, O. (1999). The economics and management of intellectual property. Cheltemham UK: Edward Elgar.

Griliches, Z. (1981). Market value, R&D and patents. Economics Letters,7, 183–187.

Griliches, Z., & Mairesse, J. (1984). Productivity and R&D at the firm level. In Z. Griliches (Ed.), R&D, Patents and Productivity: 339–74. Chicago: University of Chicago Press.

Grimpe, C., & Hussinger, K. (2008). Pre-empting technology competition through firm acquisitions. Economics Letters,100, 189–191.

Grimpe, C., & Hussinger, K. (2014a). Resource complementarity and value capture in firm acquisitions: The role of intellectual property rights. Strategic Management Journal,35(12), 1762–1780.

Grimpe, C., & Hussinger, K. (2014b). Pre-empted patents, infringed patents, and firms’ participation in markets for technology. Research Policy,43, 543–554.

Grindley, P., & Teece, D. (1997). Managing intellectual capital: Licensing and cross-licensing in semiconductors and electronics. California Management Review,39(2), 8–41.

Guellec, D., Martinez, C., & Zuniga, M. P. (2012). Pre-emptive patenting: Securing market exclusion and freedom to operate. Economics of Innovation and New Technology,21(1), 1–29.

Guellec, D., & van Pottelsberghe de la Potterie, B. (2008). The economics of the European patent system. Oxford: Oxford University Press.

Hall, B. H. (2000). Innovation and market value. In R. Barrell, G. Mason, & M. O’Mahoney (Eds.), Productivity, innovation and economic performance. Cambridge: Cambridge University Press.

Hall, B. H., Jaffe, A. B., & Trajtenberg, M. (2005). Market value and patent citations. Rand Journal of Economics,36, 16–38.

Hall, B. H., & Oriani, R. (2006). Does the market value R&D investment by European firms? Evidence from a panel of manufacturing firms in France, Germany, and Italy. International Journal of Industrial Organization,5, 971–993.

Hall, B.H., Thoma, G. & Torrisi, S. (2007). The market value of patents and R&D: Evidence from European firms. NBER working paper 13426, Cambridge, MA.

Hall, B. H., & Ziedonis, R. H. (2001). The determinants of patenting in the U.S. semiconductor industry, 1980–1994. RAND Journal of Economics,32, 101–128.

Harhoff, D., Hoisl, K. & Webb, C. (2005). European patent citations: How to count and how to interpret them. Mimeo, Munich.

Harhoff, D., Narin, F., Scherer, F. M., & Vopel, K. (1999). Citation frequency and the value of patented innovation. Review of Economics and Statistics,81(3), 511–515.

Harhoff, D., & Reitzig, M. (2004). Determinants of opposition against EPO patent grants—The case of biotechnology and pharmaceuticals. International Journal of Industrial Organization,22, 443–480.

Hounshell, D. A., & Smith, J. K. (1988). Science and corporate strategy. Cambridge: Cambridge University Press.

Leten, B., Belderbos, R., & Van Looy, B. (2007). Technological diversification, coherence and performance of firms. Journal of Product Innovation Management,24, 567–579.

Levin, R., Klevorick, A., Nelson, R., & Winter, S. (1987). Appropriating the returns from industrial research and development. Brookings Papers on Economic Activity,3, 783–831.

Martin, J. D., & Sayrak, A. (2003). Corporate diversification and shareholder value: A survey of recent literature. Journal of Corporate Finance,9, 37–57.

Motohashi, K. (2008). Licensing or not licensing? An empirical analysis of the strategic use of patents by Japanese firms. Research Policy, 37(9), 1548–1555.

Paik, Y. & Zhu, F. (2013). The impact of patent wars on firm strategy: Evidence from the global smartphone market. HBS working paper 14-015. Harvard Business School.

Pakes, A. (1985). On patents, R&D, and the stock market rate of return. Journal of Political Economy,93(21), 390–408.

Reitzig, M. (2003). What determines patent value? Insights from the semiconductor industry. Research Policy,32, 13–26.

Reitzig, M. (2004). The private values of ‘thickets’ and ‘fences’: Towards an updated picture of the use of patents across industries. Economics of Innovation and New Technology,13(5), 457–476.

Schmoch, U. (2008). Concept of a technology classification for country comparison. Final Report to the World Intellectual Property Rights Orgainzation (WIPO), Fraunhofer Institute for Systems and Innovation Research, Karlsruhe, Germany.

Schneider, C. (2008). Fences and competition in patent races. International Journal of Industrial Organization,26, 1348–1364.

Scotchmer, S. (1991). Standing of the shoulders of giants: Cumulative research and the patent law. The Journal of Economic Perspectives,5(1), 29–42.

Shapiro, C. (2001). Navigating the patent thicket: Cross licenses, patent pools, and standard-setting. Innovation Policy and the Economy,1, 1–31.

Sternitzke, C. (2013). An exploratory analysis of patent fencing in pharmaceuticals: The case of PDE5 inhibitors. Research Policy,42, 542–551.

Teece, D. (1986). Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Research Policy,15, 285–305.

Toivanen, O., Stoneman, P., & Bosworth, D. (2002). Innovation and market value of UK firms, 1989–1995. Oxford Bulletin of Economics and Statistics,64, 39–61.

Trajtenberg, M. (1990). A penny for your quotes: Patent citations and the value of innovations. RAND Journal of Economics,21(1), 172–187.

Van Pottelsberghe de la Potterie, B. (2011). The quality factor in patent systems. Industrial and Corporate Change,20(6), 1755–1793.

Van Pottelsberghe de la Potterie, B. & Francois, D. (2006). The cost factor in the patent systems. CEB working paper No. 06/002, Solvay Business School, Brussels.

Von Graevenitz, G., Wagner, S., & Harhoff, D. (2011). How to measure patent thickets—A novel approach. Economics Letters,111, 6–9.

Webb C., Dernis, H., Harhoff, D. & Hoisl, K. (2005). Analyzing European and international patent citations: A set of EPO database building blocks. STI working paper 2005/9, OECD.

Ziedonis, R. H. (2004). Don’t fence me in: Fragmented markets for technology and the patent acquisition strategies of firms. Management Science,50(6), 804–820.

Acknowledgements

We thank Rene Belderbos, Paul Jensen, Leo Sleuwaegen, and Lawrence White, as well as two anonymous reviewers for helpful comments. This paper was presented at the Pacific RIM Conference in Melbourne, the EARIE Conference in Istanbul, and the Patent Statistics Conferences in Vienna and Leuven. We thank the participants for helpful comments and discussions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Czarnitzki, D., Hussinger, K. & Leten, B. How Valuable are Patent Blocking Strategies?. Rev Ind Organ 56, 409–434 (2020). https://doi.org/10.1007/s11151-019-09710-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-019-09710-9