Abstract

This paper analyses the impact of enrollment in the recently launched contributory pension scheme, Atal Pension Yojana (APY), on formal retirement savings using a unit-level sample of households from an extensive, nationally representative survey for India. We address the endogeneity in the enrollment in APY using a novel semiparametric copula regression methodology. This methodology allows us to address and control for endogeneity due to observed and unobserved confounding, nonlinear covariate effects, and non-Gaussian distributions. Our results indicate that APY positively impacts formal retirement savings. APY crowd-in other forms of formal retirement savings. Our results suggest that marginalized populations, especially the Scheduled Tribe, are more likely to enroll in APY, and digital financial technologies can bring greater financial inclusion in India. The findings have significant policy implications on how households allocate their retirement savings and help us understand the role of APY in bringing additional savings.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

In India, the number of elderly population aged 60 stood around at roughly 104 million which accounts for more than 8 percent of the total population (Census of India, 2011). Moreover, this number is growing, and this shift in demographic composition can be attributed to a significant advancement in longevity and declining fertility. However, these changes also bring their own set of challenges. Older adults are among the most vulnerable in India due to low income, rapid aging, and higher income inequality (Srivastava & Mohanty, 2012; Sengupta & Rooj, 2019). One prime reason for their vulnerability is the dearth of social security and financial preparedness, which helps mitigate the challenges later in life. A certain level of income or wealth ensures a sustainable standard of living post-retirement life. However, post-retirement income remains a challenge for them. Under such circumstances, social security benefits for the elderly may help to mitigate some of these challenges. However, the penetration of India’s old-age pension structure is low as the majority of these schemes are either discretionary or voluntary (Singh et al., 2015).

Further, India falls behind many developed and developing nations in providing ample income support, infrastructure facilities, and human resources that enable a decent quality of life for the elderly (Goli et al., 2019). Under such circumstances, prudent financial planning that ensures post-retirement cash flow is vital to safeguard the post-retirement life. However, the penetration of formal financial savings, including retirement planning, remains a challenge in India. According to NSSO (2013), only 10.9% of households had formal retirement savings, which increased to 14.5% during NSSO (2019). The low growth in one of the critical post-retirement financial instruments may hinder the prospect of ensuring quality of life for the elderly in India.

To tackle the challenges faced by longevity risks and old age income security among the poor, many countries are resorting to reforming social pension programs to support the lives of the elderly better. The Government of India also undertook such an initiative. It announced a new pension program called Atal Pension Yojana (APY) for workers in the unorganized sector to encourage saving for their retirement during the 2015-16 central budget.

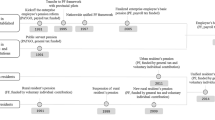

Atal Pension Yojna is a government of India-sponsored pension scheme launched in 2015 to provide retirement benefits to the vast number of unorganized sector workforce in India. APY encourages citizens to voluntarily save for retirement by contributing a fixed amount during the working years. The overall contributions and the returns from those savings can be withdrawn as pension after the age of 60. Therefore, APY enables citizens with old age income security, especially those from the unorganized sectors, without access to formal retirement savings from being an organized sector employee. Therefore, APY encourages financial savings, ensuring financial stability during the later stages of life. APY can also play a significant role in bringing greater financial inclusion in society and household welfare.

The Pension Fund Regulatory and Development Authority (PFRDA) manages APY under the National Pension System (NPS). Any Indian citizen aged between 18 and 40 with a bank account is eligible for APY. APY subscribers are guaranteed a minimum monthly pension of ₹ 1000, ₹2000, ₹3000, ₹4000, ₹5000 when they reach the age of 60 years based on their contributions at the time of joining the scheme. Subscribers can contribute at different frequencies: monthly, quarterly, or half-yearly. Subscribers can also exit from APY voluntarily, provided they fulfill certain conditions and receive the Government co-contribution, interest, and return.

The Atal Pension Yojana (APY) is a government-backed pension plan for individuals not covered by any other social security program. Once subscribed, individuals can avail of a monthly pension, and upon their demise, the accumulated corpus is returned to their nominee. The Central Government guarantees a minimum pension amount, which will be fulfilled even if the estimated returns on the corpus are lower. If the returns from the invested corpus are higher, the subscribers are also expected to receive enhanced pensionary benefits. Additionally, the Government of India (GoI) contributes 50% of the total contribution or Rs. 1000/- per annum, whichever is less, for eligible APY account holders who join the scheme between June 01, 2015, and December 31, 2015 and are not part of any other statutory social security scheme.

Low-income populations face resource constraints and often need help to save and build assets for old age. Social pension schemes can, therefore, improve household welfare through greater consumption expenditure and improved health (Huang & Zhang, 2021). A government-sponsored scheme like APY can impact the overall financial savings of the households, especially the planning for other forms of formal retirement savings. Therefore, it is vital to examine whether the introduction of APY has impacted the net savings of the households, which can have significant consequences on the future generations of older Indians and the overall health of the economy.

The objective of our study is threefold. First, we use the All-India Debt & Investment Survey to provide an understanding of the determinants of enrollment in APY. We identify groups with a greater propensity for enrollment in this government-funded pension program. Second, we link the enrollment in APY to retirement planning behavior and examine whether the policy has the intended effect on overall retirement savings. Third, we address the causality between APY enrollment and retirement planning using a joint copula regression methodology (Marra et al., 2020; Dettoni et al., 2023; Marra et al., 2023). Our study, therefore, provides robust empirical evidence on the role of a government-sponsored retirement savings program on the formal retirement financial planning of households in India. We find that APY crowd in formal retirement financial savings, making it effective especially for rural; and marginalized households in India.

We organize the paper as follows: Section 2 discusses the literature. Section 3 provides an overview of the data set. Section 4 describes the empirical methodology. Section 5 discusses the findings, and Section 6 provides conclusions.

2 Literature review

The literature on the implications of pension on household finance is scarce and inconclusive. Theoretically, based on the life-cycle hypothesis, providing public retirement benefits can act as a negative incentive for accumulating wealth during an Individual’s working life (Attanasio & Rohwedder, 2003). Quantifying the impact of such pension policies can be challenging given that several factors, including bequest motives, liquidity constraints, size of discount factors, and rates of return, could impact the degree of substitutability between pension and other financial savings. Further, the relationship can become complex due to the distortionary effects of pension contributions on labor supply behavior (Attanasio & Rohwedder, 2003; Disney, 2006; Engels et al., 2017). The seminal work of Feldstein (1974) finds that pension wealth and other forms of financial assets are substitutes for each other. Poterba et al. (1996) also show that IRA savings characterized net new savings and were not accompanied by a large-scale reduction in other financial asset savings. Engels et al. (2017) show that the pension reform in Germany during 1992 led to the postponement of retirement and increased employment. Likewise, Attanasio and Rohwedder (2003) find that pension reforms in the U.K. have decreased discretionary private savings. Moreover, Bosworth & Burtless (2004) find that pensions and other private savings are substitutes in the U.S.

Some recent studies provide mixed evidence of the influence of pension policies on the financial behavior of households. For instance, Huang and Zhang (2021) find that introducing the New Rural Pension Scheme (NRPS) in China led to declining health insurance participation. On the other hand, Qing et al. (2022), using 2015 and 2017 rounds of China Household Finance Survey (CHFS) data, show that social pension plans can influence the financial planning of households. They find that households receiving the Urban and Rural Residents Pension Scheme (URRPS) are more likely to possess risky financial assets than non-recipients. Sometimes, pension reforms can also have unintended consequences. For instance, Atalay and Barrett (2015) find that the 1993 Australian Age Pension reform led to a rise in other social insurance plans, especially the Disability Support Pension, which can be considered an alternative retirement income source.

Moreover, there exists scant literature that emphasizes the design of the pension program on household economic activity (Disney, 2006). Disney (2006) argues that such a design can significantly affect the substitutability of private retirement savings. The author suggests that the mandatory pension program and the replacement rate level can positively affect household savings. However, the impact primarily relies on the actuarial fairness of such mandatory pension schemes. The closer the public pension system mimics a private retirement saving, the more the substitution between household savings and mandatory pension savings.

APY is a partially funded pension scheme rather than a comprehensive state pension program, allowing households greater freedom for other retirement savings decisions. The provision of retirement income by the government can impact the likelihood of households engaging in private retirement savings and their strategy for managing their wealth later in life (Disney, 2006). This behavior is also dependent on the level of pension contributions. Similarly, Rossi (2009) evaluates the effect of voluntary additional contributions to personal pension plans (PPP) in the UK. Using data from the British Household Panel Survey (BHPS), the author demonstrates a positive relationship between traditional forms of savings and contributions to PPP. It indicates that the crowding-out effect is not present and, surprisingly, that such retirement savings enhance saving in other forms. However, a previous study by Guariglia and Markose (2000) find no compensating relationship between voluntary contributions to PPPs and other forms of savings.

These studies show that public retirement income provision influences household savings behavior, including their propensity to participate in private retirement planning. These policies also play a vital role in improving old-age well-being (Muthitacharoen & Burong, 2023). We deviate from these studies by focusing on the role of a contributory public pension scheme aiming to benefit the vast unorganized sector on the formal retirement savings behavior of the household in India. APY can play a complementary role in increasing formal retirement savings. APY is primarily targeted at the unorganized sector. However, it is open to all citizens of India, and hence, it can encourage people to save more for their retirement. APY can create greater awareness for retirement savings, incentivizing people to consider other formal retirement savings options such as life and non-life insurance, private pension contributions, provident fund accounts, and annuity certificates.

Moreover, APY contributors earn tax benefits, incentivizing households to increase their retirement savings and enhancing financial security and well-being. APY can also have a “peer effect” on retirement savings decisions (Duflo & Saez, 2002), with household members enrolled in APY bringing additional savings in the formal financial channels within the same households. While APY is a valuable savings option, it can also boost other formal retirement savings. However, a major challenge for empirically examining the relationship between APY and formal retirement savings is that a household’s decisions to enroll for APY can be potentially endogenous to their financial decision-making due to the presence of unobserved confounders such as working, earnings history, and health status. Further, several key variables, such as households’ size and consumption expenditure, can be nonlinear, exhibiting the life-cycle patterns of enrollment in APY and retirement planning. We attempt to address these issues by jointly estimating the effect of enrollment in APY on formal retirement savings of the households using a semiparametric estimation method developed by Radice et al. (2016). This methodology is able to deal with unobserved confounding, nonlinear covariate effects, and non-Gaussian bivariate distribution between enrollment in APY and participation in formal retirement savings plans, relying upon minimal parametric assumptions (Sengupta & Rooj, 2019).

We contribute to the existing literature in several ways. For example, first, notwithstanding that some Indian studies have explored the dynamics of government-sponsored pension programs such as APY (Narayana, 2018, 2019) and Rajasekhar et al. (2017), no study so far has examined the effect of APY on formal retirement savings. Hence, this is the first paper to analyze this relationship between APY and retirement savings using a nationally representative sample of households in India.

Second, studies analyzing the effect of APY on formal retirement savings need to address the problem of endogeneity or selection bias that may be inherent in this type of model and generate biased and inconsistent estimates. Hence, we use a flexible semi-parametric estimation method to jointly analyze the effect of APY on formal retirement savings by addressing the problem of unobserved confounding and non-Gaussian dependencies with a rich set of controls in our models. The joint analysis allows us to model the two retirement savings choices as the outcome of two jointly made decisions (Rossi, 2009; Pfarr & Schneider, 2013).

Moreover, some key variables, like age, household size, and consumption expenditure, may show a nonlinear pattern in both APY and formal retirement savings models. Most importantly, the nonlinear effects of age may reveal the life-cycle patterns of APY enrollment and demand for formal retirement savings using penalized thin-plate splines. We analyze the effects of these nonlinear covariates to ascertain the threshold values for some of these critical variables in our models. This will also help us identify the groups that need greater focus. Our results suggest that APY significantly increases the likelihood of having formal retirement savings. This finding suggests that APY contributions characterize new savings rather than simply being a substitute for other formal financial savings related to retirement planning. Our paper, therefore, provides new insights into the evolution of the financial system in India.

3 Data and variables

We aim to empirically analyze the role of APY on other forms of retirement savings in India. We use the data from the NSSO 77th round Debt and Investment survey conducted from January to December 2019. The database provides detailed information on the assets and liabilities of the households, including unit-level observations on financial assets such as shareholdings, private pensions, provident funds, insurance purchases, and other financial services. The survey also captures information related to household members contributing to the government insurance and pension subscriptions such as Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), and Atal Pension Yojana (APY). The survey captures information across all the Indian states and union territories and provides a representative sample of the Indian population. Given that all the information related to financial assets and participation is available at the household level, we merged information on the household demographic variables with their asset holdings. The final sample consists of 110,244 observations after removing missing values on some key variables.

The primary variable of analysis is formal retirement savings. NSSO captures savings information at the household level. Therefore, we define FRETSAV = 1 if a household has formal retirement savings in private pensions, provident fund accounts, life insurance, and annuity certificates. It takes the value of 0 if they have no such accounts.

The independent variable of our analysis is whether any household had enrolled in APY. Therefore, we define APY = 1 if households have enrolled in APY and 0 otherwise. Following the literature (Bucher-Koenen & Lusardi, 2011), we further include a set of demographic control variables such as the place of residence, religion, social group and household size, educational background, and occupational categories of the households in our analysis. We also capture the household’s income using household monthly consumption expenditure (HHEXP) as a proxy.

Further, the life-cycle theory suggests that the need for retirement savings increases over the working life. However, people may also start actively planning for private pension schemes until their late 30 s or 40 s or even later (Foster & Smetherham, 2013). Given that our database only considers household retirement savings instead of individual savings, we consider the median age of the household as a control variable in our analysis. All the variable definitions are described in Table 1.

We report the descriptive statistics in Table 2. Financial well-being at retirement age is a big concern for most Indians. We find that only 0.5 percent of the households in our sample are enrolled in APY. Almost 15 percent of households had any form of formal retirement savings. Figure 1 also shows that households enrolled in APY enjoy greater consumption savings.

Similarly, Fig. 1 shows that households with APY enjoy greater consumption expenditure. Similarly, Fig. 2 shows that formal retirement savings enjoy greater consumption expenditure. So, on the one hand, the data indicate low penetration of formal financial planning for households in India (even much lower for APY). On the other hand, the data also shows that APY and formal financial planning help improve household welfare. Pension benefits and retirement financial assets can be helpful to meet unforeseen expenses as well as the overall well-being of the households. Therefore, we explore whether enrollment in APY can bring more households under the ambit of financial inclusion through formal retirement savings planning.

4 Empirical model

This paper aims to analyze the effect of enrollment in APY on formal retirement savings of households, which is a binary variable. Enrollment in APY as a determinant of formal retirement savings can be endogenous, where endogeneity may arise due to unobserved factors (such as motivation, risk preferences, financial literacy, and community support) affecting both APY and FRETSAVE. Further, participation in APY is voluntary for all eligible residents. Therefore, enrolling in APY may be biased by self-selection or non-random sample selection. Therefore, a single equation estimation method to examine the impact of APY on FRETSAVE may yield inconsistent estimates. In such a scenario, it is important to account for endogeneity to get unbiased estimates of APY. A standard approach to deal with such endogeneity is to use an instrument variable approach (e.g., 2SLS). However, when the endogenous variable is non-continuous, the two-stage approach may no longer yield consistent estimates (Blundell & Powell, 2004; Wooldridge, 2010; Marra et al., 2020)Footnote 1.

The model may also become complicated when continuous variables, such as household age composition, educational attainment, and household consumption expenditure, are anticipated to have a nonlinear relationship with the decision to enroll in APY and FRETSAVE. These variables may have a life cycle or a productivity effect, resulting in nonlinear impacts. Therefore, if such a nonlinear relationship is not properly taken into consideration, it may fail to capture the complex relationship between these variables, which may result in yielding a biased estimate of APY on FRETSAVE (Radice et al., 2016). Moreover, the traditional assumption of bivariate normality in selection models can be too limiting for such empirical analysis (Radice et al., 2016).

Therefore, Marra and Radice (2017) extended the copula regression spline model of Radice et al. (2016). The model can simultaneously deal with non-random sample selection, nonlinear covariate effects, as well as the non-normal bivariate distribution between the treatment and outcome equations. The conventional setup having two equations represented by a binary selection equation and a binary outcome equation helps tackle the sample selection issue. The assumption of the joint distribution of the error terms addresses the endogeneity aspect of the analysis. The nonlinearity in the covariates is addressed by applying splines, and finally, the non-normal distribution is treated using copula functions (Marra & Radice, 2013).

The empirical model, as described by Radice et al. (2016), consists of two random variables;

\({y}_{1i}\) is the treatment variable, and \({y}_{2i}\) represents the outcome variable for \(i=\mathrm{1,2}\ldots n\). Now consider the probability of event \(\left({y}_{1i}=1,{y}_{2i}=1\right)\), which is defined using a copula representation P(y1i = 1, y2i = 1) = C(P(y1i = 1)P(y2i = 1); θ), where C is a two-place copula function, and θ is an association parameter that measures the dependence between \(P\left({y}_{1i}=1\right)\) and \(P\left(\,{y}_{2i}=1\right)\). Using Copula allows for the joint distribution to be expressed in terms of marginal distributions and a copula function C. Such an approach can accommodate the marginal distributions from different families, such as Clayton, Frank, Gaussian, Gumbel, and Joe, and rotated versions of Clayton, Gumbel, and Joe. The rotation by 90° and 270 allows the capture of negative dependencies.Footnote 2

We represent the relationship between APY and FRETSAVE using the following equations. The treatment equation is

And, the outcome equation is

where \({s}_{{ji}}\) are the unknown smooth functions. The smooth components are estimated using penalized thin plate regression splines having basis dimensions equal to 20, and the penalties are based on second-order derivatives (Radice et al., 2016). Although the model is theoretically identified, we need an extra covariate in the model that is correlated with the endogenous APY variables but may not be directly related to private retirement savings (Maddala, 1983; Filippou et al., 2023). In other words, in the case of a recursive model such as ours having an endogenous regressor and the set of covariates that are common across both the treatment and outcome equations, the model requires at least one instrument for the treatment equation (Han & Vytlacil, 2017). Therefore, we use information on Pradhan Mantri Suraksha Bima Yojana (PMSBY) to satisfy the exclusion restriction in the treatment equation. PMSBY is a binary variable that captures the enrollment in another GoI-sponsored insurance program. PMSBY was launched simultaneously with APY as an accidental insurance scheme. It offers coverage against the death or disability due to an accident for the policyholder. The policy has a small annual premium of INR 20, renewable yearly. Given that it was launched during the same time as APY and it is an accidental insurance scheme having a small premium, we use this as an extra covariate in the model, which correlates with APY but may not be directly related to private retirement savings once other covariate are taken in to account (Marra et al., 2020). It is imperative to note here that the results remain unchanged even if we ignore the exclusion restrictions. The primary coefficient of interest is φ. The crowd in effect of APY would indicate a statically significant and positive value of φ.

5 Empirical findings

5.1 Selection of the Copula

Table 3 provides the values of Akaike or (Schwarz) Bayesian information criterion (AIC or BIC), Kendall’s τ, and θ, from different copula specifications. The objective is to finalize the model with the appropriate Copula suitable for the data. We consider Gaussian, Frank, Student-t, Clayton, Gumbel, and Joe and their rotated versions (i.e., 90 and 270) of the Clayton, Gumbel, and Joe copula (Marra & Radice, 2013) for our analysis. We begin the process by considering Gaussian, Frank, and Student-t Copula as they do not require a sign restriction on θ. The null of θ being equal to zero suggests no correlation between equations 1 and 2 (i.e., our treatment variable is exogenous). However, we find that estimated values of θ are negative and significant for Gaussian and Frank, and it is positive and significant for Student-t, indicating no conclusive evidence of any correlation between the marginals for our sample data structure. Therefore, we further consider Clayton, Gumbel, and Joe and the 90-degree and 270 degrees and rotated Clayton (Clayton90, Clayton270), Gumbel (Gumbel90, Gumbel270), and Joe (Joe90, Joe270), respectively. The Gaussian copula represents the standard bivariate normal probit model. The final choice of the model is based on the model with the lowest AIC or BIC. We rely on AIC, and the lowest AIC model is the 270-degree rotated Joe(J270). However, models with similar AICs, such as C90 and G90 and G270, also provide similar resultsFootnote 3. This finding, therefore, indicates some association between the error terms of the enrollment in APY and participation in the other formal retirement savings due to unobserved confounders leading to endogeneity.

5.2 Parametric results

The chosen model with the lowest AIC is the 270-rotated Joe (J270). The estimated value of the association parameter (θ) is negative and statistically significant, confirming the endogeneity in enrollment in APY. We present the estimated coefficients from both equations from the J270 model.

First, we explore the factors associated with enrollment in APY from Equation 1 (Table 4). Our empirical estimation shows that the estimated coefficients of HINDU and MUSLIM are not statistically significant, indicating that religion has no significant role in the enrollment in APY. With respect to social groups, compared to other groups, the estimated coefficient of ST is positive and statistically significant. This is an interesting finding. The finding indicates that the enrollment in APY for the marginalized social group is higher. In India, the marginalized groups work primarily in the low-paid, unorganized sectors (National Commission for Enterprises in the Unorganised Sector, & Academic Foundation, New Delhi, India, 2008). Therefore, the higher enrollment of APY among the ST population augers well for policymakers. The findings related to the household occupation group also provide some interesting insights. Enrollment is higher among WAGEEMP (although statistically insignificant) but lower for the CASULEMP compared to other occupational groups. This could be because CASULEMP households may not have regular employment and may not have the option to make any contribution. This finding aligns with Guariglia and Markose (2000), who argue that higher permanent income leads to greater voluntary contributions. Therefore, we find that the likelihood of APY enrollment increases with being in marginalized social groups. However, it decreases for those who do not have a stable form of income. Further, we find that greater usage of digital forms of financial transactions among households also raises the probability of enrollment in APY, indicating the positive role of digitization in delivering and accessing financial products in India. Besides, the estimated coefficient of PMSBY is also positive and statistically significant. Therefore, it is a valid instrument for APY.

Next, we examine the findings from the outcome equation (Equation 2). The results indicate that the estimated coefficient of endogenous APY from the outcome equation is positive and statistically significant. It implies that adopting APY leads to a rise in the enrollment in formal retirement savings. The finding is consistent with the notion that APY leads to a crowd in greater participation in the financial planning for retirement. Therefore, our results align with Rossi (2009), who shows a positive association between public pensions and private savings for retirement.

We also find that while HINDU households have a greater likelihood of participating in the FRETSAVE, the probability decreases for MUSLIM households. This could be because of lower educational attainment among Muslim households in India (Sengupta & Rooj, 2018). However, compared to other groups, we observe that ST households are likely to participate in FRETSAVE. Again, this is an interesting finding, but very encouraging that marginalized sections of India are showing greater financial inclusivity. Self-employed groups of households are less likely to FRETSAVE than other occupation groups. The reason could be that Self-employed groups in India face greater uncertainty in income flows, which, rather than enhancing financial savings, reduces FRETSAVE (Rossi, 2009). The increasing effect of land size (LANDA) on FRETSAVE supports the hypothesis that wealth is an important indicator of retirement savings. Households with more female than male members are also likely to participate in the FRETSAVE. This could be because greater FMRATIO leads to larger dependency and, therefore, a greater need for financial planning, especially for the older age. Interestingly, FRETSAVE is higher for households residing in rural areas than urban areas. The positive impact HHDIGIT on FRETSAVE, further indicates the important role of digital technologies in promoting financial inclusion in India.

5.3 Non-parametric results

Figures 3 and 4 depict the smooth function estimates and their Bayesian confidence intervals for the J270 model specification. We observe a consistent rise in the likelihood of enrollment in APY with higher levels of education (Fig. 3). This finding implies that education plays a significant role in creating awareness about APY, and educated households have a higher probability of enrolling in APY. Further, we observe that the enrollment in APY first mostly remains stable with LCONEXP and reaches an inflection point, and after that, it increases with LCONEXP. Without an income indicator, LCONEXP captures the monetary value of household consumption expenditure on all the goods and services typically consumed by a household. It, therefore, represents the wealth effect on APY. Therefore, the findings indicate the absence of any wealth effect on APY at smaller consumption expenditure levels. However, at higher levels of consumption expenditure, the effect is positive. APY is a voluntarily contributing pension program; greater income leads to a greater ability to make contributions. The enrollment in the APY rate increases when the median age of the household is between 18 and 40; after that, the adoption rate remains relatively stable until a little over 60, and finally, it decreases after that. This finding indicates that households in their prime working age are more likely to enroll in APY to reap its benefits later in life. By construction, APY enrollment is not permissible for individuals older than 60. The returns from the contributions become smaller at an older age, and hence higher age composition of the household lowers the incentive to participate in APY (Qing et al., 2022). HHSIZE is relatively flat, showing an increasing slope initially, but becomes negatively associated with APY after the household size reaches 14. Additional members in the household can cause a greater financial burden on the family, leaving smaller resources for making contributions at regular intervals.

Non-parametric estimation results from the treatment equation (APY). This figure shows the nonlinear effect of maxHIGHESTEDU, LCONEX, MDAGE & HHSIZE. Smooth function estimates and associated 95% point-wise confidence intervals in the treatment equation are obtained using the J270copula regression spline model. The rug plot at the bottom of each graph shows the covariate values. Source: Authors’ calculations

Non-parametric estimation results from the outcome equation (FRETSAVE). This figure shows the nonlinear effect of maxHIGHESTEDU, LCONEX, MDAGE & HHSIZE. Smooth function estimates and associated 95% point-wise confidence intervals in the treatment equation are obtained using the J270copula regression spline model. The rug plot at the bottom of each graph shows the covariate values. Source: Authors’ calculations

With respect to FRETSAVE, we find some interesting observations related to the continuous variables in Equation 2. Education has a positive influence on FRETSAVE. However, we observe that for the maxHIGHESTEDU between 8 to 12, the FRETSAVE declines and increases after that. However, the overall finding supports that the propensity to save increases with the level of education (Rossi, 2009). Higher education also indicates greater earning potential and enhanced financial planning abilities (van Groezen et al., 2009). Moreover, greater education leads to lower entry costs arising from information asymmetry in the financial markets. Higher education also indicates that the households would be better informed about the income tax exemptions that households can benefit from by enrolling in APY and other formal retirement savings plans such as private pensions, provident fund accounts, life insurances and annuity certificates.

Further, we observe that FRETSAVE steadily increases with LCONEXP, which is used as a proxy for the income of the households. These findings are consistent with Cappelletti et al. (2013) and Foster and Smetherham (2013), who show that higher income leads to a greater ability to subscribe to alternative retirement savings. First, we do not observe any nonlinear behavior for the age variable. The likelihood of enrollment in the FRETSAVE steadily increases with the median age of the household. Given that we are working with household-level data, it is difficult to ascertain the precise nature of the relationship between age and FRETSAVE participation from our analysis. Participation in FRETSAVE decreases with household size. Increasing the household size leads to a greater burden on financial resources for the households, leaving fewer resources for financial savings.

5.4 Robustness analysis

InFootnote 4 this section, we perform robustness checks for our baseline analysis. It is believed that Self-employed individuals have lower replacement rates. They are also assumed to bear greater responsibilities than employed people (Torricelli et al., 2016; Vivel-Búa et al., 2019) and, therefore, have a greater likelihood of enrolling in supplementary pension schemes. However, the baseline model shows that the estimated coefficient of SELFEMP is negative but not statistically significant. In our data, we do not have individual occupation choices; the occupational levels are given at the household levels. Therefore, following Metzger (2018), we re-estimate our baseline model excluding households with the primary occupation group being self-employed and examine whether the primary results hold when we exclude the SELFEMP households from our estimation sample. The findings from the sub-sample analysis are provided in Table 5. The results indicate that the impact of APY on FRETSAEV is positive and statistically significant. Therefore, our results are robust to excluding the SELFEMP group of households from our analysis and the crowd-in effect of APY on formal retirement savings holds. However, this sub-sample analysis also reveals some additional insights. For instance, we find that for this specification, the likelihood of APY increases for households residing in rural areas. This result is similar to Qing et al. (2022). The results also suggest that the likelihood of FRETSAVE increases for all the marginalized groups (ST, SC, & OBC).

Moreover, Navaneetham and Dharmalingam (2012) argue that the possibility of living longer and having a longer retirement period is a significant incentive for saving. The data shows that the average median age of the Indian household is around 31.5, varying across the states. Therefore, we examine the results across states with higher-aged households than those with comparatively lesser-aged households. We examine the impact of APY on FRETSAVE based on a subsample analysis where the first sample is the states with an average MDAGE below 31.5, and the second sample is the states with an average MDAGE greater than 31.5. Table 6 presents the estimated coefficients of APY on FRETSAVE. We find that for both the sub-samples, the impact of APY is positive, and they are also statistically significant, indicating that irrespective of the demographic composition of the states, the crowd-in effect of APY on FRETSAVE remains intact.

6 Conclusion

Despite being a young country, India is expected to experience a significant increase in its aging population. The changes in the demographic composition can bring several challenges, especially for the elderly. Social safety nets that provide for old age benefits can mitigate such challenges. Introducing a new contributory pension scheme in the form of APY is one such pathway that can help better financial management for the elderly and households. However, what role does it bring to the other aspects of financial planning still needs to be answered.

The introduction of APY is a vital policy initiative to provide greater access to formal retirement savings for workers in the unorganized sector. The scheme has several benefits, including providing a guaranteed pension after 60 and encouraging savings and financial planning among subscribers. This paper examines the effects of APY enrollment on additional savings through formal retirement planning. We use nationally representative household data in India and jointly estimate the effect of the enrollment in APY and on formal retirement savings of households using a novel semiparametric estimation method using copula regression. The most appealing finding from our study is that the contributory pension program generates additional savings. We also find a nonlinear effect of some key variables on enrollment in APY and formal financial retirement savings.

The findings from our analysis provide several policy implications. First, it allows us to understand the population group more likely to enroll in APY. The increased adoption rate among the marginalized ST community provides evidence of the influential role of contributing pension plans in APY in improving financial inclusion in India. Second, we find that Self-employed people are less likely to go for formal retirement savings than other occupation groups. Therefore, policymakers can think about how retirement planning can be encouraged for these groups of the population suffering from greater income uncertainty. The positive impact of digital financial technologies on APT and FRETSAVE also indicates that the digitalization of the economy can bring in additional savings to help India’s vulnerable populations. Finally, our findings indicate that savings in APY do not substitute savings in formal retirement savings, confirming that there is no displacement effect of APY on formal retirement savings planning. The empirical evidence from the joint analysis suggests that APY enhances formal retirement planning, creating additional resources for households. The complementary role of APY in enhancing formal retirement savings is helpful for Indians. With the evolving financial inclusion and financial technologies, the system will further strengthen the financial planning of households, which will consequently help improve household welfare.

There are some potential limitations of this study. This study primarily uses household data rather than individual-level data. Therefore, our paper provides evidence of the collective household savings decisions, missing the outcome based on individual behavioral decisions related to retirement and financial planning. Further, it is challenging to uncover the impact of APY on specific groups of workers as NSSO data does not differentiate between the organized and unorganized sectors. Therefore, comprehensive individual-level administrative data with variables capturing the financial decisions of the individuals, including enrollment in APY and financial literacy, would provide greater insights into such decision-making processes.

Notes

Please refer to Basu et al. (2017) for a detailed discussion.

See Radice et al. (2016) for a detailed description.

The results are available upon request.

We do not provide the non-parametric estimation results from the robustness exercise as results from these analyses are not qualitatively different from our baseline findings. They are available upon request.

References

Atalay, K., & Barrett, G. F. (2015). The impact of age pension eligibility age on retirement and program dependence: Evidence from an Australian experiment. Review of Economics and Statistics, 97(1), 71–87.

Attanasio, O. P., & Rohwedder, S. (2003). Pension wealth and household saving: Evidence from pension reforms in the United Kingdom. American Economic Review, 93(5), 1499–1521. https://doi.org/10.1257/000282803322655419.

Basu, A., Coe, N., & Chapman, C. G. (2017). Comparing 2SLS VS 2SRI for binary outcomes and binary exposures (No. w23840). National Bureau of Economic Research

Bosworth, B., & Burtless, G. (2004). Pension reform and saving. National Tax Journal, 57(3), 703–727.

Bucher-Koenen, T., & Lusardi, A. (2011). Financial literacy and retirement planning in Germany. Journal of Pension Economics & Finance, 10(4), 565–584.

Blundell, R. W., & Powell, J. L. (2004). Endogeneity in semiparametric binary response models. The Review of Economic Studies, 71(3), 655–679.

Cappelletti, G., Guazzarotti, G., & Tommasino, P. (2013). What determines annuity demand at retirement? The Geneva Papers on Risk and Insurance – Issues and Practice, 38(1), 777–802.

Census of India (2011). Office of the Registrar General & census commissioner, New Delhi 2013.

Dettoni, R., Bahamondes, C., Yevenes, C., Cespedes, C., & Espinosa, J. (2023). The effect of obesity on chronic diseases in USA: a flexible copula approach. Scientific Reports, 13(1), 1831.

Disney, R. (2006). Household saving rates and the design of public pension programmes: Cross–country evidence. National Institute Economic Review, 198(1), 61–74. https://doi.org/10.1177/0027950106074040.

Duflo, E., & Saez, E. (2002). Participation and investment decisions in a retirement plan: the influence of colleagues’ choices. Journal of Public Economics, 85(1), 121–148. https://doi.org/10.1016/s0047-2727(01)00098-6.

Engels, B., Geyer, J., & Haan, P. (2017). Pension incentives and early retirement. Labour Economics, 47, 216–231.

Feldstein, M. S. (1974). Social security, induced retirement, and aggregate capital accumulation. Journal of Political Economy, 82, 905–926.

Filippou, P., Marra, G., Radice, R., & Zimmer, D. (2023). Estimating the Impact of Medical Care Usage on Work Absenteeism by a Trivariate Probit Model with Two Binary Endogenous Explanatory Variables. AStA Advances in Statistical Analysis, 107(4), 713–731.

Foster, L., & Smetherham, J. (2013). Gender and pensions: An analysis of factors affecting women’s private pension scheme membership in the United Kingdom. Journal of Aging & Social Policy, 25(3), 197–217. https://doi.org/10.1080/08959420.2013.791783.

Goli, S., Reddy, A. B., James, K. S., & Srinivasan, V. (2019). Economic independence and social security among India’s elderly. Economic and Political Weekly, 54(39), 32–41.

Guariglia, A., & Markose, S. (2000). Voluntary contributions to personal pension plans: Evidence from the British household panel survey. Fiscal Studies, 21(4), 469–488.

Han, S., & Vytlacil, E. J. (2017). Identification in a generalization of bivariate probit models with dummy endogenous regressors. Journal of Econometrics, 199(1), 63–73.

Huang, W., & Zhang, C. (2021). The power of social pensions: Evidence from China’s new rural pension scheme. American Economic Journal: Applied Economics, 13(2), 179–205.

Maddala, G. S. (1983). Limited-dependent and qualitative variables in econometrics (No. 3). Cambridge University Press.

Marra, G., & Radice, R. (2013). A penalized likelihood estimation approach to semiparametric sample selection binary response modeling. Electronic Journal of Statistics, 7, 1432–1455.

Marra, G., & Radice, R. (2017). Bivariate copula additive models for location, scale, and shape. Computational Statistics & Data Analysis, 112, 99–113.

Marra, G., Radice, R., & Zimmer, D. (2020). Estimating the binary endogenous effect of insurance on doctor visits by copula-based regression additive models. Journal of the Royal Statistical Society: Series C (Applied Statistics), https://doi.org/10.1111/rssc.12419

Marra, G., Fasiolo, M., Radice, R., & Winkelmann, R. (2023). A flexible copula regression model with Bernoulli and Tweedie margins for estimating the effect of spending on mental health. Health Economics, 32(6), 1305–1322.

Metzger, C. (2018). Intra-household allocation of non-mandatory retirement savings. The Journal of the Economics of Ageing, 12, 77–87.

Muthitacharoen, A., & Burong, T. (2023). Retirement Saving Over the Life Cycle: Evidence from a Developing Country. Journal of Aging & Social Policy, 1–18.

National Commission for Enterprises in the Unorganised Sector, & Academic Foundation (New Delhi, India). (2008). Report on conditions of work and promotion of livelihoods in the unorganised sector. Academic Foundation.

Narayana, M. R. (2018). Organizing old age pensions for India’s unorganized workers: A case study of a sector-driven approach. The Journal of the Economics of Ageing. https://doi.org/10.1016/j.jeoa.2018.04.001

Narayana, M. R. (2019). Organizing old age pensions for India’s unorganized workers: a case study of a sector-driven approach. The Journal of the Economics of Ageing, 13, 56–69.

Navaneetham, K., & Dharmalingam, A. (2012). A review of age structural transition and demographic dividend in South Asia: Opportunities and challenges. Journal of Population Ageing, 5(4), 281–298. https://doi.org/10.1007/s12062-012-9071-y.

NSSO. (2013). All India debt and investment survey (70th round). New Delhi: MOSPI, Government of India.

NSSO. (2019). All India debt and investment survey (77th round). New Delhi: MOSPI, Government of India.

Pfarr, C., & Schneider, U. (2013). Choosing between subsidized or unsubsidized private pension schemes: Evidence from German panel data. Journal of Pension Economics & Finance, 12(1), 62–91.

Poterba, J. M., Venti, S. F., & Wise, D. A. (1996). How retirement saving programs increase saving. Journal of Economic Perspectives, 10(4), 91–112. https://doi.org/10.1257/jep.10.4.91.

Qing X., W. Ma, Wang, F., Yang Q., Liu J (2022). Social pensions and risky financial asset holding in China, Applied Economics, Taylor & Francis Journals, 54(29), 3412–3425.

Radice, R., Marra, G., & Wojtyś, M. (2016). Copula regression spline models for binary outcomes. Statistics and Computing, 26, 981–995.

Rajasekhar, D., Kesavan, S., & Manjula, R. (2017). Are our contributory pension schemes failing the Poor? Economic and Political Weekly, 52(27), 77−85.

Rossi, M. (2009). Examining the interaction between saving and contributions to personal pension plans: Evidence from the BHPS. Oxford Bulletin of Economics and Statistics, 71(2), 253–271. https://doi.org/10.1111/j.1468-0084.2008.00525.x.

Sengupta, R., & Rooj, D. (2018). Factors affecting gender disparity in muslim education in India. Journal of Development Policy and Practice, 3(1), 87–113.

Sengupta, R., & Rooj, D. (2019). The effect of health insurance on hospitalization: Identification of adverse selection, moral hazard and the vulnerable population in the Indian healthcare market. World Development, 122, 110–129.

Singh, C., Bharati, K., & Sanyal, A. (2015). Ageing in India: Need for universal pension scheme. Economic and Political Weekly, 50(18), 40-46.

Srivastava, A., & Mohanty, S. K. (2012). Poverty among elderly in India. Social Indicators Research, 109, 493–514.

Torricelli, C., Urzì, M. C., & Santantonio, M. (2016). Does homeownership partly explain low participation in supplementary pension schemes? Economic Notes, 45(2), 179–203. https://doi.org/10.1111/ecno.12054.

van Groezen, B., Kiiver, H., & Unger, B. (2009). Explaining Europeans’ preferences for pension provision. European Journal of Political Economy, 25(2), 237–246. https://doi.org/10.1016/j.ejpoleco.2008.10.003.

Vivel-Búa, M., Rey-Ares, L., Lado-Sestayo, R., & Fernández-López, S. (2019). Financial planning for retirement: the role of income. International Journal of Bank Marketing, 37(6), 1419–1440.

Wooldridge, J. M., (2010). Econometric Analysis of Cross Section and Panel Data (MIT Press).

Author contributions

Contributions: D.R. was involved in conceptualizing and designing the paper. D.R. also wrote the first draft of the paper. R.S. organized the data contributed in methodology and completing the draft. Both the authors contributed to the final draft preparation.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Rooj, D., Sengupta, R. Contributory pension scheme and formal retirement savings: is there a trade-off? -evidence from India’s Atal Pension Yojna using copula regression methodology. Rev Econ Household (2024). https://doi.org/10.1007/s11150-024-09705-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11150-024-09705-w