Abstract

We examine property sell-offs by real estate investment trusts (REITs) and find that investors respond favorably to sales of properties located close to a sell-off firm’s headquarters. The negative relationship between the distance from headquarters and cumulative abnormal returns (CARs) that we document exists only in non-gateway markets, though; there is no such relationship in gateway markets. This finding suggests that the positive effects of selling assets in small markets with high perceived risk and limited growth opportunities dominates the negative effects of the efficiency loss brought about by holding assets far away from home. This is the first study to simultaneously examine the proximity of a firm’s underlying assets to its headquarters and the location of individual assets in the context of asset sales. Our results are robust to several measures of proximity (using geographic distance, in miles, between a firm’s headquarters and its underlying assets or a nearby dummy for below-median distance), to alternative market classifications, to the inclusion of various fixed effects and controls for geographic concentrations (the Herfindahl index of how close to one another the properties are located) and property performance, and to bargaining power and business cycles.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The impact of geographic location on a real estate investment trust’s (REIT’s) performance has been studied extensively.Footnote 1

Many argue that firms can optimize their investments by holding assets located close to home. The riskiness associated with the location of individual assets has, however, been overlooked in previous studies that focus on geographic concentration. One possible explanation for this omission is that it is difficult to tease out the effects of the geographic proximity of individual assets to a firm’s headquarters from that of property-portfolio concentration because the location-specific risk associated with individual geographic exposures is diversifiable and is not priced in a portfolio context.

In this paper, we tackle these issues by examining investor reactions to asset sell-offs by REITs. This is the first study that simultaneously examines proximity to headquarters (the proximity effect) and the riskiness associated with the location of individual assets (the location risk effect) in the context of asset sales. The efficiency gains a firm realizes by holding assets located close to home implies that investors should react negatively to nearby sell-offs. On the other hand, in general, assets located in larger metropolitan markets face lower risk and perform better than assets located in smaller and lower-tier markets, suggesting that investors should react positively if assets being sold are located in small markets (e.g. Riddiough et al. 2005; Ling et al. 2019b).

Consider two sell-off cases in which investors face a trade-off between the proximity effect and the location risk effect. In the first case, the firm disposes of distant assets located in a large market with low perceived risk. In the second case, the firm disposes of nearby assets located in a small and lower-tier market with high perceived risk. Will the positive (negative) reaction to the sell-off in the low- (high-)risk market offset, or even dominate, the negative (positive) reaction to the sell-off close to (far away from) home? In short, will the location risk dominate the proximity effect? If so, the location risk effect would seem to be more important than the proximity effect in the return-generating process.

Our study differs from previous studies in two major respects. First, we examine the proximity effect and the location risk effect simultaneously. Many studies have examined the effects of proximity to headquarters (or to other properties), but the evidence remains inconclusive. For example, Ambrose et al. (2000) and Gyourko and Nelling (1996) find that geographic concentration does not benefit firm performance. Hartzell et al. (2014), Campbell et al. (2003), and Cronqvist et al. (2001) find a positive relationship between concentration and firm value. A small but growing body of literature suggests that differences in risk and return across metropolitan statistical areas (MSAs) explain REIT returns (e.g. Ling et al. 2018b, 2019a; Zhu and Lizieri 2019). Using a hand-collected sample of property sell-offs, we add to this strand of the literature by documenting the offsetting effects of proximity and location risk on firm value.

The second factor that differentiates our study from the others is that most prior studies focus on asset allocation at the property-portfolio level. These studies focus on an average effect because the idiosyncratic risk from individual geographic exposures is diversifiable in a portfolio context. In contrast, by studying investors’ reactions to sell-offs of individual assets, we are able to examine the marginal effects of individual locations while controlling for portfolio-level geographical concentration, property-type concentration, and property performance. In other words, we focus on the marginal effects of asset allocation while controlling for its average effects.

Equity REITs provide an ideal setting in which to analyze investor reactions to asset sell-offs. By focusing on REITs we are able to collect a large panel of property-level data with detailed information on location, property type, size, and value. Uncertainty in the real estate sector involves primarily property type and location. This relative simplicity makes REITs a plausible sample in which to evaluate the effects of proximity to headquarters, which differs from evaluating the effects of concentration. While this may be expected, our sample shows that REITs exhibit a wide dispersion of properties that are not close by conventional measurements. For example, an average REIT held properties in nineteen states in 2018. In addition, REITs operate under restrictions that potentially help mitigate the likelihood of alternative explanations of asset sell-offs, such as changes in corporate strategies (Kaplan and Weisbach 1992), financing needs (Lang et al. 1995), and corporate governance (John and Sodjahin 2010; John et al. 2011).Footnote 2

To capture differences in risk-and-return profiles associated with location, we classify asset locations into gateway and non-gateway MSAs following Pai and Geltner (2007), Geltner et al. (2014), and Ling et al. (2018b, 2019a). Hartzell et al. (1987) find that variations in risk exposures within commercial property markets are driven by differences in an MSA’s economic base. Riddiough et al. (2005) suggest that assets located in larger MSAs face lower risk than those located in smaller and lower-tier MSAs.Footnote 3 As property performance is derived largely from local fundamentals, properties generally perform better in markets with high growth opportunities, low cap rates, and low risk premiums. For example, Feng et al. (2019a) find a positive correlation between gateway MSAs and firm-level performance measures, including funds from operations (FFO) divided by assets and Tobin’s Q. Ling et al. (2018b) also find that gateway markets outperform non-gateway markets for all property types. In addition, gateway markets are more liquid and transparent because of size and depth, which could drive down risk premiums (see, for example, McAllister and Nanda 2015; Devaney et al. 2019).

As pointed out in Hartzell et al. (2014), property type is another major determinant of asset productivity and value. In addition, noncore property types (e.g. self-storage, strip centers, diversified, etc.) are also considered less transparent because they represent small sectors (e.g. Chen et al. 2012; Ling et al. 2018b; Feng et al. 2019b). We therefore classify asset types into core and non-core assets and perform additional analyses that parallel those involving location.

We construct a panel sample of 1,943 firm-level (313,987 property-year) observations with detailed information on property type and location, taking sales, purchases, and mergers and acquisitions into consideration. Based on all the sell-offs identified by the S&P Global Real Estate (formerly SNL) Database, we find that a REIT firm is more likely to sell off properties when its underlying property portfolio is dispersed far away from its headquarters. Based on property-year observations, distant properties are more likely to be sold within a firm. These results are consistent with the portfolio-level story that the average effects of proximity on firm performance are positive.

Next, in our event study using a hand-collected sample of property sell-offs, we find that market reactions (measured by cumulative abnormal returns, or CARs) are negatively associated with distance from headquarters. This result seems contradictory to those reported in previous studies that concentration enhances firm value at the property-portfolio level. Further investigation suggests however that this negative relationship between CAR and proximity to headquarters is driven entirely by sell-offs in non-gateway markets, indicating that investors reward dispositions close to home where there is high risk and growth opportunities are relatively limited. These results suggest that, when we consider the marginal effects based on sell-offs, the quality of asset location (a proxy for riskiness and investment opportunities) is relatively more important than proximity to headquarters.

Firm-level sell-off decisions are endogenous and subject to selection bias, as firms are self-selected as sellers. One commonly used approach to mitigating this concern is constructing a matched sample of non-sell-off firms by using propensity-score matching (PSM) to control for firm characteristics. Selection bias may also, however, occur at the property level. Property-level selection bias arises within a firm mainly as a result of location and property type, as many studies have documented that location and property-type concentrations affect liquidity and firm performance (Cronqvist et al. 2001; Capozza and Seguin 1999; Hartzell et al. 2014; Danielsen and Harrison 2007). Conditional on the probability of a sell-off at the firm level, a REIT firm tends to dispose of distant properties, and a REIT that specializes in offices is less likely to dispose of its office properties than other types of REITs. In other words, assets being sold might be fundamentally different from those being held.

We address this selection problem with a two-stage sequential decision-making process. In the first stage, we estimate the likelihood of asset sell-offs at the firm level. In the second stage, we estimate the likelihood of property-level sell-offs, conditional on firm-level sell-off decisions. A matched sample is generated based on joint probabilities, which is the product of the estimated firm-level sell-off probability and the property-level conditional probability. This research design should help us mitigate double selection bias at both the firm and property levels.

Based on a matched sample while controlling for both firm-level and property-level selection biases, we still find that investors respond more negatively to distant sales. Most importantly, this negative relationship is driven by sell-offs in non-gateway cities. Our results are robust to alternative discrete-choice models (logit and probit), matched samples (i.e. based on firm level only and on both the firm and property levels), weights (by the number of sell-offs and by the number of underlying properties), and model specifications. Lastly, we conduct a battery of tests of bargaining power, alternative classifications of markets, and business cycles, and conclude that our findings are robust.

Overall, this study contributes to the previously mentioned literature on the relevance of geography. To the best of our knowledge, this study is the first in the REIT literature to simultaneously examine proximity to headquarters and asset location per se. Asset location is one of the most important determinants of the value of REITs. Controlling for well-documented geographical and property-type concentration as well as property performance, our results highlight the importance of variations in risk across geographic classifications. Our sample of asset sell-offs by REITs with detailed information on more than 300,000 property-year observations spanning a 16-year sample period makes it possible for us to investigate the double endogeneity and selection bias problems at both the firm level and the property level using a sequential choice model. Our findings lead us to propose a new perspective and suggest that it is important to consider variations in risk and return associated with the location of individual assets.

The remainder of the paper is organized as follows. In Section 2 we describe our sample construction and variable measurement. In Section 3 we discuss our results. Section 4 concludes.

Data and Sample Construction

REIT Underlying Properties

We construct a comprehensive panel dataset of historical property holdings at the firm and property levels based on the S&P Global Real Estate Properties Database and Factiva news searches for property dispositions. Specifically, we start with the most current properties held and track backward through historical property acquisitions and dispositions. To account for delisting and IPOs, we follow Feng et al. (2011) and compile a comprehensive list of U.S. public equity REITs identified by the National Association of Real Estate Investment Trusts (NAREIT).Footnote 4

Our final sample includes 1,943 firm-year observations and 313,987 property-year observations for the period running from 2003 through 2018. We make use of this panel dataset in three steps. First, we identify sell-offs at the firm level to examine whether geographically dispersed firms are more likely to sell off properties. Second, we investigate sell-offs at the property level to examine whether properties located farther from headquarters are more likely to be sold than closer properties. Lastly, based on the predicted likelihood of sell-offs from the first two stages, we estimate propensity scores to construct a treatment sample of firms with sell-off events and a control sample consisting of firms without sell-offs but for which sell-offs are similarly likely.

Sell-off Events and Cumulative Abnormal Returns (CARs)

We hand-collect major sell-off events with reported transaction amounts greater than $20 million, following Campbell et al. (2006).Footnote 5 Specifically, we search in Factiva to collect news announcements on property sales by REITs. Based on Intelligent Indexing®, Factiva links Dow Jones News Search (DJNS) articles to companies that are the subjects of the articles. Because of Intelligent Indexing, Factiva is considered effective for identifying articles that are relevant to specific companies. By conducting rigorous searches of (1) the Wall Street Journal, (2) the Dow Jones Newswire, and (3) Business Wire, we gather 2,914 articles on property sell-offs by REITs for the period running from January 1, 2003 through December 31, 2018.

For each sell-off event, we define an event date as the first trading day on which a sell-off announcement appears in any of the three abovementioned publications if the announcement is made prior to 3:59 p.m. If the announcement is made after 3:59 p.m., we use the next trading day as the event date. Events are deleted if there were any other major corporate announcements during the event window. The sample selection process gives us 309 property sell-offs. We hand-collect detailed information on sale purpose and the use of sale proceeds. After deleting observations that lack property-level information, our final example includes 293 sell-off events.

We compute CARs using the CRSP value-weighted market index, excess returns of small caps over big caps (SMB), excess returns of value over growth (HML), and a momentum factor as systemic-risk factor loadings. We follow Wiley (2013) and use an estimation period that includes one year of stock returns and ends 50 trading days before event windows. Event windows include (1) the trading day before an asset sale (-1, 0), (2) the trading day when the asset sale occurs (0, 0), (3) the trading day after the asset sale (0, +1), (4) the trading day before the asset sale until the trading day after (-1, +1), (5) five trading days before the asset sale until the trading day before the asset sale (-5, -1) and (6) five trading days before the asset sale until five trading days after the asset sale (-5, +5).

Data on deal sizes are verified manually by matching Factiva search results with EDGAR SEC filings. We obtain stock-price data from CRSP and financial data from the CRSP/Compustat Merged Database.

Distance and Geographic Concentration

We follow Coval and Moskowitz (1999 and 2001) and calculate firm–property distance as the arc length (in miles) between the location of a property sold (or held) and the headquarters location of the seller (owner).Footnote 6 We then calculate the mean and median of firm–property distances for each firm-year observation because REITs hold multiple properties. Similarly, we calculate the mean and median for each transaction because, in most of cases, multiple properties were sold in each sell-off transaction.

where dij represents the firm–property distance, and nt equals the number of properties sold or held by firm i at time t (i.e. the year or event date).

In property-level regressions, we define a Nearby dummy that equals one if a property is located in the same MSA as the firm’s headquarters and zero otherwise. We also re-run all the tests after defining the Nearby dummy using within 100 miles or the same state as the standard. The results are qualitatively similar and can be provided on request.

We calculate property-level geographic concentration as a Herfindahl Index:

where Pi, m, t equals the proportion of the total adjusted cost of REIT i’s properties located in MSA m as of the beginning of year t. The adjusted cost of a property is defined by S&P Global as the maximum of (1) the reported book value, (2) the initial cost of the property, or (3) the historical cost of the property, including capital expenditures and tax depreciation.Footnote 7 Property-type concentration is calculated in a similar way by substituting the proportion of properties located in a given MSA with the proportion of properties invested in a given property type.

Results

Firm-level and Property-level Asset Sales

We start our analysis by examining (1) whether REITs holding distant properties are more likely to sell off assets and (2) whether distant asset properties are more likely to be disposed of. We run the following regressions:

Our outcome variable in Equation (3) equals one if REIT firm i disposes of any properties in year t and zero otherwise. Our test variables are distance proxies, as defined in Section 2. To control for portfolio-level concentration, we include Geographic Concentration and Property-Type Concentration, following Hartzell et al. (2014) and Ling et al. (2019b). Feng et al. (2019b) highlight operating efficiency as an important channel through which geographic diversification may affect firm value. We hence include both Property-level Operating Efficiency (NOI divided by total assets) and Firm-level Operating Efficiency (FFO divided by total assets) in the regressions.Footnote 8 We follow the related finance and real estate literature (e.g. Campbell et al. 2006; Lang et al. 1995; Warusawitharana 2008) and compute our baseline control variables, including Size, Debt Ratio, Tobin’s Q, Cash, Sales Growth, Coverage, and Momentum. Firm fixed effects and year fixed effects are included in the regressions. All variables are defined in Appendix 1.

Our outcome variable in Equation (4) equals one if property j was disposed of by REIT firm i in year t and zero otherwise. We further include Nearby as an additional distance proxy. Nearby is a dummy variable that takes the value of one if property j is located in the same MSA as the seller’s headquarters and zero otherwise. Diverse is a dummy variable that equals one if the property type of property j differs from firm i’s major property type and zero otherwise. We include firm fixed effects (or property-type fixed effects) and year fixed effects.

Equations (3) and (4) serve as a premise in our later investigation of the impact of asset location on shareholder wealth maximization. As our full sample includes more than 300,000 property-year observations, we are not able to identify the purpose of each disposition because of the massive amount of data involved. Here we define property disposition by comparing changes in property holdings regardless of purpose. This weakness is addressed in our event-study analysis that we describe in Section 3.2, in which we are able to identify a clean dataset of property sell-offs by searching and reading through news articles.

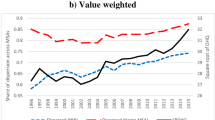

Table 1, Panel A, shows summary statistics. Our sample includes 1,943 firm-year and 313,987 property-year observations. For an average REIT firm, the average holding distance of its underlying properties is about 809 miles. As seen in Figure 1, we find that, on average, REITs are becoming more geographically dispersed over time, as characterized by rising holding and sell-off distance. In 2003, the average holding distance was less than 691 miles; this measure increased to 916 miles in 2018. Put differently, although REITs prefer to hold nearby properties, they will become more dispersed as they seek growth, especially during an expansionary time for the industry (Feng et al. 2019b).

Trends in sell-off and holding distances (defined by S&P Global) of REITs. This figure shows time-series trends in REIT sell-off and holding distances for the period running from 2003 through 2018. Sell-off (holding) distance is defined as the average distance (in miles) between a REIT’s headquarters and the properties sold (owned) by that REIT

Property holdings are highly concentrated in terms of property type, with a median concentration measure (defined in Section 2) of 0.87. Compared with property-type concentration, REIT firms exhibit much lower geographical concentration. The median Geographic Concentration is only 0.38. These measures are consistent with those reported in Hartzell et al. (2014). Property-level statistics suggest that about 21% of assets are located in gateway markets, while 43% of assets are core property types.

Our firm-level results shown in Panel B suggest that, even after controlling for geographical concentration and property-type concentration, the proximity of holding properties to headquarters still matters in REIT sell-off decisions. REITs are more likely to sell off properties if the average holding distance is greater. Based on results in Model (2), a one-standard-deviation increase in distance from headquarters is associated with a 28% increase in sell-off probability, holding other variables at their means. The sell-off probability is higher among REITs with lower geographic concentration, suggesting that ex-ante geographically concentrated REITs are likely to be in an equilibrium state, where dispositions of nearby assets are unlikely to take place. Consistent with Hartzell et al. (2014), the role of property-type concentration is insignificant. Consistent with Feng et al. (2019b), the coefficients of operating efficiency are positive, indicating that greater operating efficiencies are associated with geographic diversification. However, these coefficients are not statistically significant. Other controls have the expected signs: larger firms that have higher debt ratios, lower Tobin’s Q, and lower sales growth are more likely to dispose of properties. Our results are robust to a linear probability model and alternative discrete choice models (logit and probit).

Panel C provides evidence at the property level: the greater the distance from headquarters, the more likely a property is to be sold.Footnote 9 This finding is robust to alternative measures of distance proxies, as coefficient estimates of Firm-Property-Distance and Nearby are statistically significant across models. Property-type fixed effects allow us to address concerns that our results are driven by property-type-specific unobserved heterogeneity. Importantly, the coefficients of Gateway are negative and statistically significant in all model specifications, suggesting that properties in prime locations with low perceived risk and better performance are less likely to be sold. In addition, older properties and properties that differ from a firm’s core property type are more likely to be sold. Multifamily and industrial properties are more likely to be disposed of than other types.

These property-level results are in line with prior literature. For example, REITs tend to specialize in operating single types of property or in more narrowly focused geographic areas (Capozza and Seguin 1999; Campbell et al. 2003; Hartzell et al. 2014; Ro and Ziobrowski 2012). An underlying property is more likely to be sold if it is of a different type from that of the majority of a REIT’s underlying properties or is located in an area that is farther from headquarters than the majority of its properties.

Market Reactions to Equity REIT Property Sell-offs

The main objective of this study is to examine the role of asset location and shareholder wealth maximization through REIT property sell-offs using an event-study methodology. The results reported in Panel A of Table 2 summarize the annual frequency, total value, and average deal size of property sell-offs from 2003 through 2018. Our final sample includes 309 transactions with a total value of approximately $63 billion. The average deal size is $205 million. The number of sell-offs and the average deal size plummeted around the Global Financial Crisis (GFC) in 2008 and 2009.Footnote 10

We next divide our sample by property type and stated use of the proceeds of sales and report results in Panel B, Table 2. The largest group by property type comprises office and industrial properties (46.9%). Approximately 33% of the sell-off firms do not announce the use of sale proceeds. Among sell-offs with stated purposes, the largest group uses proceeds to fund acquisitions (22.4%), mixed-use projects (12.7%), and reduce debt (11.7%). Only 2.6% (3.6%) of sell-offs use proceeds to distribute dividends (to repurchase shares).Footnote 11

Panel A, Table 3 shows summary statistics on CARs based on six event windows, (-1,+1), (-1,0), (0,0), (0,+1), (-5,+5) and (-5,0), which represent the one-day before, day of, one-day ahead, three-day, eleven-day, and six-day windows, respectively. All CARs are positive and significant at the 5% level. The mean in our three-day window (-1, 1) is 0.50%, which is close to the 0.8% reported in Campbell et al. (2006).

To obtain the results reported in Panel B, row (1), we separate our asset sales into two groups. We assigned an asset to the above-median (below-median) group if its distance from headquarters is greater (smaller) than the median of our sample of asset sales. We find that CARs in the below-median group are double those in the above-median group. By further dividing our asset sales into distance quartiles in Appendix 2, we find a monotonically decreasing pattern across distance quartiles. In addition, CARs are statistically significant only in the first two quartiles.

At first glance, this negative relationship between distance and CARs seems contradictory to prior research that finds that concentration enhances firm value because of increased (firm-level) operating efficiency. It is, however, worth noting that investor reactions to asset sales capture a marginal effect of proximity on firm value. In contrast, most previous studies using property portfolios examine average effects. In other words, by using property portfolios to examine the relationship between concentration and firm value, researchers assume that the idiosyncratic risk from individual geographic exposures is diversifiable. Thus, there may be offsetting effects based on cross-sectional heterogeneity because assets are heterogeneous and contribute differently to a firm’s productivity. For example, a positive CAR does not reflect the effects of distance alone, it also reflects the likelihood of the property’s bad performance or the risks associated with the asset location. Although we do not observe the performance (e.g. net operating income) of every single property, we do observe two major determinants of the property’s risk-and-return profile: location and property type (Hartzell et al. 2014; Ling et al. 2019b).Footnote 12

For asset location, we focus on gateway and non-gateway MSAs. Conventional wisdom suggests that assets located in larger metropolitan markets are subject to lower risk than assets located in smaller and lower-tier markets (Riddiough et al. 2005; Ling et al. 2019b). In addition, Feng et al. (2019b) find a positive correlation between gateway MSAs and performance measures, including FFO divided by assets and Tobin’s Q. For property type, relative to small sectors (e.g. data centers, diversified), core property types are associated with higher transparency and lower risk (Chen et al. 2012; Feng et al. 2019b).

As such, we next split the sample along these two dimensions and compare the differences. For asset location, we follow Pai and Geltner (2007), Geltner et al. (2014) and Ling, Naranjo, and Schieck (Ling et al. 2018a; Ling et al. 2019a) and separate our sample into two groups, Gateway and Non-gateway, depending on the location of (the majority of) sell-off properties. Gateway cities include Boston, Chicago, Los Angeles, New York, San Francisco and Washington, D.C. For property type, we classify our sample into Core (apartments, industrial, office, retail) and Non-Core property types (e.g. Chen et al. 2012; Ling et al. 2018b; Feng et al. 2019b).

The results reported in Panel B, rows (2) and (3) suggest that CARs are significantly higher for Non-gateway and Non-Core. By double-sorting CAR (1) by Nearby and by Gateway and (2) by Nearby and by Core in Panel C, the results further reveal that the negative relationship between distance and CARs is driven by dispositions in Non-gateway cities because the CAR difference is statistically significant in the non-gateway group but not in the gateway group. We do not find reliable evidence that property types drive the results as there is no statistically significant difference in either core or non-core groups. This is likely because the majority of sell-offs consist of core property types (see Table 2 Panel B) and because the performance differences between core and non-core property types are mixed.Footnote 13

Market Reactions to Asset Sales, Proximity to Headquarters, and Asset Location

Our preliminary investigation suggests that the negative relationship between distance and CARs is driven by dispositions in non-gateway cities, suggesting that investors value the quality of a location relatively more highly than its proximity to headquarters. To further investigate this issue, we conduct multivariate analysis while controlling for concentrations, operating efficiency, and other firm-level characteristics. We restrict our analysis to the event window (3 days) to avoid potential overlap with other events, e.g. mergers and acquisitions. All concentration and fundamental variables are constructed on a quarterly basis and lagged by one quarter. Panel B of Appendix 1 lists the variable definitions. Appendix 3 presents summary statistics.

The model of the impact of distance on market reactions with firm fundamentals is:

where Distance Proxies include average and median firm-property distance as described in Equation (1). As continuous distance measures might be driven by outliers, we use a preferred binary measure of distance, Nearby, which equals one if median distance in Equation (1) is shorter than the sample median of the 293 sell-offs and zero otherwise. It is noted that our results remain unchanged when we define the nearby dummy based on the full sample instead of the sell-off sample.

Models (1)–(3) in Panel A, Table 4 are estimated using the full sample of 293 sell-off events. We find that investors react negatively to distant sales: all three distance proxies are statistically significant. The effect is also economically significant. The standard deviation of average (median) distance is 0.531 (0.576), as seen in Appendix 3. The coefficient estimate on average (median) distance is -1.371 (-1.016) in Model (1) (Model (2)), suggesting that a one-standard-deviation increase in average (median) distance is associated with a decrease in CARs of 1.371*0.531= 0.73 (1.016*0.576= 0.59) percentage points, or 73 (59) basis points. Geographic concentration, property-type concentration, and property-level operating efficiency are insignificant in all the model specifications, suggesting that the effects of distance and location on shareholders’ wealth are not likely to be confounded by concentration or property performance. Coefficient estimates of other control variables are suppressed for brevity.

In Models (4)–(9), we separate the sell-off sample by gateway and non-gateway markets. We find that the distance coefficients are significant only in the non-gateway subsample, consistent with the univariate results in Table 3. Thus, the factor that drives the negative relationship between distance and CARs is the asset location per se after controlling for concentration measures, operating efficiency, and other firm fundamentals. For example, the positive (negative) reaction to the sell-off in the low (high) risk market offsets the negative (positive) reaction to the sell-off close to (far away from) home. The concentration measures have expected negative signs, suggesting that both appear to be value-enhancing. Interestingly, like distance, geographic concentration is significant only in the non-gateway subsample, confirming that proximity is of second-order importance relative to asset location per se.

To obtain the results reported in Panel B, we use our full sample and include Nearby, Gateway, and interaction between the two. We also include Core and interaction between Core and Nearby for the purpose of comparison.

where Firm Fundamentals include our baseline controls for firm fundamentals (FF) in Models (1–3). Additional Controls include source of fund (SF) in Models (4–6), use of fund (UF) in Models (7–9) and deal-level determinants (DD) in Models (10–12) following the literature (e.g. Lang et al. 1995; Campbell et al. 2006; Wiley et al. 2012; Wiley 2013). Appendix 1 Panel B summarizes the variable definitions.

Regarding SF, we control for funding generated from the proceeds of an asset sale and/or from capital markets. UF indicates how funding raised by a property sale is spent. For example, such funding can be used to retire debt, be distributed as preferred and/or common dividends, and/or be invested in new projects. SF and UF are likely to affect ex-post sell-off stock performance. For instance, firms paying out proceeds are typically poor performers and highly levered; managers are self-interested and might pursue their own objectives. Therefore, including these two sets of controls helps to control the effects of our variable of interest, distance, and location measures, from financing and investment activities.

Deal-level characteristics include hand-collected information on purpose of sale and usage of sale proceeds. Geographic Focus is an indicator variable that equals one if the stated goal of a particular asset sale is to adopt a geographically focused asset allocation strategy and zero otherwise. This variable further controls for the confounding factors that might correlate with the distance proxies, i.e. our test variables. While the concentration measures reflect the levels of the corresponding Herfindahl Indices, the Geographic Focus dummy proxies for change in concentration, but in a timely manner—once a sell-off is announced to the public, the value is known. This caveat is especially useful when a firm disposes of properties multiple times within a year. Moreover, Geographic Focus might be correlated with the distance proxies, and neglecting it might lead to a spurious relationship between distance proxies and post-sell-off stock performance. Also, as shown in Campbell et al. (2006), other information from news announcements, such as transaction amount (deal size), reduction of long-term debt (URLTD), and usage of a 1031 exchange clause (EXCH), significantly predicts post-sell-off stock returns. These variables are important as they reflect investors’ expectations for asset sell-offs and thus can affect post-sell-off stock performance. In all model specifications, we include property-level operating efficiency to control for property performance.

In Panel B, the reported coefficient estimates of Nearby are positive while the coefficient estimates of Nearby × Gateway are consistently negative in all model specifications. This finding suggests that investors react positively (negatively) to a nearby (distant) sale. This effect is however muted by sell-offs in gateway cities because we fail to reject the null hypothesis that the coefficients on Nearby and the interaction term are jointly zero (see the row “F-stat: β2 + β4 = 0)”. In other words, the negative relationship between CAR and distance to headquarters exists only in non-gateway cities, consistent with our previous findings reported in Table 3 and 4. These findings suggest that investors reward dispositions close to home only when home markets are non-gateway cities where the perceived risk is relatively high and growth opportunities are relatively limited. Again, this is not inconsistent with the previously mentioned finding that property concentration (or home concentration) is value-enhancing at the portfolio level (an average effect) because our sell-off analysis captures a marginal effect on the trade-off between proximity to home and the quality of asset location. In other words, properties in gateway markets are more likely to have better performance than those in non-gateway markets. This finding highlights the importance of the perceived ex-ante risk and fundamentals associated with location as the location risk effect dominates the proximity effect.

Matched Sample Based on a Two-stage Sequential Model of Asset Sell-off Decisions

Our regression results suggest that investors react more positively to sell-offs of nearby assets. Selection bias may occur at the firm level, however, even after controlling for a large set of factors that might affect the abnormal returns of asset sell-offs, because we observe the CAR–distance relationship only among firms that self-select to become sellers. For example, firms that are relatively financially constrained and those holding more geographically dispersed properties are more likely to become sellers, as shown in Table 1 Panel B. A possible solution is to construct a matched sample of firms with characteristics that are similar to those of sell-off firms. However, one complication arises because, given that a sell-off is likely to be carried out at the firm level, selection bias may occur at the property level because assets being sold might differ fundamentally from those being held, as shown in Table 1 Panel C. As a result, selection bias is likely to occur at the property level; firm-level matching is not sufficient to mitigate this problem.

To check for selection bias, in Table 5 we show the results of comparing (1) a treatment sample of 292 firm-year (2,063 property-year) observations in sell-off events identified by Factiva news searches with (2) a comparison sample of all firm-years in the COMPUSTAT database, excluding sell-off firms that are identified in the S&P Global full sample (9,131 firm-year and 1,631,859 property-year observations).Footnote 14 In the last two columns we report t-test statistics of the mean differences between sell-off firms and non-sell-off firms as well as their statistical significance.

The “firm-level” comparison suggests a stark and significant difference between these two groups: sell-off firms are larger, have better operating performance prior to a sell-off, and hold more debt and less cash. These findings are consistent with those reported in Campbell et al. (2006) and Warusawitharana (2008). The “property-level” comparison suggests that sell-off firms adopt a “pecking order” and tend to dispose of distant properties (Landier et al. 2009; Petersen and Rajan 2002; and Liberti and Petersen 2019). If an underlying property is different from the majority of a REIT’s properties, it is more likely to be disposed of. In addition, sell-off firms tend to hold properties in gateway cities and of core property types. Breaking down the underlying properties by type, there is a large discrepancy in property composition between treatment firms and control firms: firms are more likely to dispose of office, multifamily, and industrial properties. Together, the comparisons between the sell-off and non-sell-off subgroups suggest that it is important to control for heterogeneities at both the firm level and the property level.

We construct our matching sample based on a two-stage sequential decision-making process, in which the first stage involves estimating the likelihood that an asset sell-off occurs at the firm level and the second stage involves estimating, conditional on the firm-level sell-off, the likelihood that a property will be sold within the firm. The first stage involves estimating Equation (3) using the sample used to generate results reported in Panel B of Table 2. The second stage involves estimating Equation (4) except that the outcome variable becomes P(ppty sold = 1| seller = 1)i, j, t instead of P(ppty sold = 1)i, j, t. The joint probability is the product of estimating the firm-level sell-off probability and the property-level conditional probability.

where P(ppty sold = 1, seller = 1)i, j, t is the joint probability that property j is disposed of by firm i in transaction at time t, P(seller = 1)i, t is the probability of a sell-off by firm i in transaction t, and P(ppty sold = 1| seller = 1)i, j, t is the conditional probability that property j held by firm i is disposed of, given that P(seller = 1)i, t = 1.

We calculate the propensity score for a given firm-transaction by aggregating the predicted joint probabilities at the property level as an average predicted probability, as shown below.

To construct our control sample, we calculate the absolute differences between the average predicted probabilities (propensity scores) of firms in our sell-off sample (the treatment group) and those in the comparison sample. We then rank the absolute differences and keep firms in the comparison group using the nearest neighborhood with 1:1 replacement (Rosenbaum and Rubin 1983). The match is performed for each firm-transaction observation.

Table 6 presents results based on the propensity-score matched sample (the sell-off sample and the control group) using four PSM methods, including logit, probit, and logit and probit with weights equal to the inverse of the number of properties held by firm i in year t. We examine the covariate balance between the treatment and control samples to ensure that the observable dimensions of the matched pairs are similar, except for their sell-off propensities. Untabulated results show that the differences in means (based on t-tests) are insignificant for all the control variables except size. The absence of significant differences between the variables suggests that the covariates are balanced across the treatment and control groups and that differences between the matched pairs based on these observed variables are not likely to confound our estimates of the treatment effects.

In Table 6, Panel A (Panel B), we show the propensity-score matched sample results of regressing three-day CARs on Distance (Nearby). Distance is the arithmetic average firm-property distances of all the properties disposed of by sellers (or held by the matched firms prior to the asset sell-off). Nearby equals one if more than half of the properties sold are located in the same MSA as the seller’s headquarters and zero otherwise. The coefficient estimates of Distance (Nearby) are negative (positive) and statistically significant, consistent with previous finding that firms selling more distant properties performed worse. When we add additional controls for sources of funds (SF in Models (5-8)) and uses of funds (UF in Models (9-12)), our results are still robust. The insignificant coefficients on Sell-off suggests that we are able to match the probability of sell-offs for the treated and control groups.Footnote 15

In Table 7, we show matched-sample results by gateway and non-gateway subsamples. Again, the negative relationship between distance and CARs exists only among property sell-offs in non-gateway cities. There is no such relationship involving sell-offs in gateway cities.

Robustness Tests

Search Costs and Bargaining Power

One might argue that managers possess better information on and bargaining power over nearby assets, and that these sell-offs are more profitable; thereby, sales of these assets generate more favorable market reactions. In addition, distant buyers face higher search costs than, and have an information disadvantage compared with, nearby investors. Therefore, the abnormal returns could simply come from extra gains realized by the sellers resulting from search costs and bargaining power. To investigate this potential threat, we follow Harding et al. (2003) and Ling et al. (2018a) and run the following regression model:

where DB (DS) is a dummy variable for distant buyers (sellers), defined as the buyer-property (seller-property) distance greater than the sample median.Footnote 16

The test variable is DB − DS which takes values of -1, 0 or +1. A value of 0 means the buyer and seller do not differ in proximity to the sell-off property. A value of -1 (+1) means that the buyer (seller) has greater bargaining power and a lower search cost. If the positive reaction to nearby sell-offs can be explained by the search costs incurred by distant buyers or the bargaining power of local sellers, or both, we expect to find a positive coefficient of DB − DS. Following Harding et al. (2003), it is important to add DB + DS as a control because omitted variables that explain the selling price might be correlated with buyer–seller attributes.

Although our estimation model differs from models used in prior studies that model the transaction price as a function of hedonic characteristics and enter bargaining power as an additive term, we argue that our estimation model in Equation (9) is effective in testing the alternative explanation of bargaining power. Specifically, the estimation in Harding et al. (2003) is:

where P is the transaction price, sC measures the expected sale price—the bundle of characteristics C multiplied by a vector of corresponding shadow prices, s—and Dseller (Dbuyer) measures the effects of the seller’s (buyer’s) bargaining over P. In our study, Dseller (Dbuyer) is measured by DS (DB). As abnormal profits can be estimated by the difference between the transaction price, P, and the expected sale price, measured by sC, it is easy to see that Equation (10) can be re-written by subtracting sC from both side of the estimation equation, i.e.

where Abnormal Profit = P − sC. The alternative explanation builds on a positive correlation between CAR and the profitability of a sale reflecting search costs and bargaining power, implying the existence of a positive relationship between CAR and bargaining power.

We hand-collect the locations of buyers and sellers from the news search.Footnote 17 Results reported in Appendix 4 suggest that distance-induced search costs and bargaining power do not drive our results: the sign of the coefficient estimate of DB − DS is the opposite of that predicted by the alternative explanation and is statistically insignificant.Footnote 18

Alternative Classification of Market Tiers

We next run robustness tests using alternative market classifications. We divide all the MSAs into two groups based on the classification provided by S&P Global Market Intelligence, CoStar, and the NAREIT. “Large” markets include Atlanta, Boston, Chicago, Los Angeles, New York, San Francisco, Washington DC, Austin, Dallas, Denver, Houston, Nashville, Phoenix, San Jose, Seattle, and Tampa (i.e. their primary and secondary markets); “Small” markets include the rest of the MSAs (i.e. their tertiary markets and others).Footnote 19 Compared with our previous classification of gateway and non-gateway markets, this alternative classification includes additional markets with robust employment and demand. Therefore, we should observe a similar pattern, as shown in Panel B of Table 4, our baseline results. In addition, as these additional markets are relatively smaller than the gateway markets, we should observe a larger coefficient of the interaction term. Results reported in Appendix 5 are consistent with our expectations: the results we derive from both univariate and multivariate analyses are highly similar, and the interaction coefficients reported in Panel B become larger in magnitude.

Subsample Tests based on Business Cycles

The business cycle might exert differential effects on small and large MSAs and potentially drive the previously documented comparative results for gateway and non-gateway markets. When facing economic downturns, REITs located in smaller (non-gateway) MSAs are subject to higher external capital costs, and thus are more likely to dispose of quality assets to raise funds. If assets being sold by financially insolvent REITs in non-gateway markets differ from those sold in the non-crisis period, our previous findings might be spurious, and one should observe an increase in the abnormal returns on Post-Recession sell-offs in non-gateway MSAs. To test the robustness test of this finding, we use the fall of Lehman Brothers (May 28, 2009) as the cut-off point. Sell-offs occurring prior to May 28, 2009 are defined as Pre-Recession sell-offs; the remaining sell-offs are defined as Post-Recession sell-offs. We find little evidence that our previous findings are affected by business cycles.

Conclusion

While the relationship between asset location and firm value has been studied extensively, there are intriguing aspects that we have not yet understood. On the one hand, firms possess an informational advantage when they invest in nearby assets. On the other hand, the risks and fundamentals associated with the locations of the assets could affect asset performance and firm value.

In this paper, we examine a hand-collected sample of REIT asset sell-offs as an ideal setting in which one can simultaneously examine proximity to headquarters (the proximity effect) and the riskiness associated with the location of individual assets (the location risk effect). We can identify the locations of individual properties owned or transacted by REITs using the S&P Global Real Estate Database, allowing us to examine the marginal effects of location on firm value (as compared with the average effects calculated in prior studies). In addition, this setting mitigates the impact of confounding effects, such as portfolio-level concentration and property performance. As sell-off decisions are made endogenously at the firm level and the property level, we apply a two-stage sequential decision method to mitigate selection bias based on a large and unique panel dataset of more than 300,000 property-year observations spanning a 16-year sample period.

Our findings suggest that there is a negative relationship between the distance from the seller’s headquarters to the sale properties and post-sell-off stock market reactions. Most importantly, this finding appears only among sell-offs in non-gateway markets, suggesting that the location risk effect dominates the proximity effect as the positive (negative) reaction to a sell-off in a low (high) risk market is larger than the negative (positive) reaction to a sell-off close to (far away from) the seller. This result is not sensitive to the alternative specifications of sell-off distance or alternative sets of controls and is consistent based on the matched sample using the two-stage sequential decision method. Our results are robust to alternative explanations documented in the literature, including the imbalance between information advantage and bargaining power between buyers and sellers and the heterogeneity of asset quality sold in Pre- and Post-recession periods.

Overall our paper contributes to current research on the geography of finance by suggesting that the risks and fundamentals associated with the locations of the assets are important determinants in shareholder value.

Notes

REITs operate within a single asset class (because 75% of a REIT’s assets and income must come from real estate–related assets), follow regulated dividend payout policies (because they are required to pay out 90% of taxable income as dividends), feature high levels of institutional ownership (see Chan et al. 2003), and have similar antitakeover provisions (because of the 5/50 rule and excess share provision).

Riddiough et al. (2005) propose that adjusting the location differences might be important for reconciling the differences between private and public real estate returns. This is because the NCREIF index is biased toward larger assets located in first-tier markets while REITs hold a large percentage of their assets in lower-tier markets. Ling, Naranjo, and Scheick (2018) suggest that the lower risk profile of larger MSAs reflects the constraints that developers face in adding new supply. In other words, land supply elasticities (Saiz 2010) could be positively correlated with ex-ante required rates of returns. Gateway markets have relatively inelastic supplies and experience lower ex-ante risk premiums than non-gateway markets.

The FTSE NAREIT US Real Estate index contains all Equity REITs except those designated as Timber REITs or Infrastructure REITs. Updated annually, the list starts in 1993, which is deemed a symbolic year at the beginning of the modern REIT era (Feng et al. 2011), and runs until the present.

Although we are able to identify 1,943 firm-year observations of sell-offs based on S&P Global, in our event studies we rely on hand-collected sell-off events following Campbell et al. (2006) instead of using S&P Global for several reasons. First, while we are able to track changes in property portfolios, we do not know if a reduction in a portfolio is a real sell-off event because the purposes of these changes are not stated. For example, some portfolio reductions happen in cases of property exchanges, mergers, or acquisitions. Second, S&P Global includes asset sale dates but not announcement dates. Using the transaction (completion) dates from S&P Global for an event study is problematic because some transactions were announced several months before they were completed. For example, Highwoods sold 39 office properties in a transaction in 2005. The S&P Global transaction date for this transaction is July 22, while the announcement date is June 6. Third, the S&P Global database does not identify major sell-off events that are economically meaningful enough to influence trading. Small transactions convey little economic significance to firms. Lastly, as stated in Campbell et al. (2006), when examining CARs, it is important to control for deal-level information, which requires hand-coding from news searches.

Specifically, the arc length, dij, for each underlying property j sold (or held) by firm i is defined as: \( {d}_{ij}=\operatorname{arccos}\left({\mathit{\deg}}_{latlon}\right)\times \frac{2\pi r}{360}, \) where deglatlon = cos(lati) × cos(loni) × cos(latj) × cos(lonj) + cos(lati) × sin(loni) × cos(latj) × sin(lonj) + sin(lati) × sin(latj). Lat and lon are property and headquarters latitudes and longitudes provided by S&P Global Real Estate Database, and r is the radius of the earth (≈3,959 miles).

The use of adjusted cost or book value in place of unobservable true market values may understate the (value-weighted) percentage of a REIT’s portfolio invested in MSAs that have recently experienced relatively high rates of price appreciation. Conversely, its use may overstate the percentage of a REIT’s portfolio in MSAs that have experienced relatively low rates of price appreciation.

Capozza and Seguin (1999) suggest that Property-level Operating Efficiency can be expressed as the sum of FFO, general administration costs, and interest expenses, all divided by total assets.

It is noted that the tendency among firms to hold nearby properties and dispose of distant properties does not imply that the average distance from the underlying properties to headquarters declines over time. As our paper focuses on dispositions, we do not examine acquisitions. It is possible that the average distance (in miles) between a firm’s underlying assets and its headquarters remains stable (or even increases) through mergers, acquisitions, and property exchanges.

In unreported results, there were 68 unique sellers (defined by their CRSP PERMNOs), of which 32 appeared only once while 17 appeared more than three times.

In our sample, the breakdown by property type is qualitatively similar to that deployed in Campbell et al. (2006), who examine equity REIT property sell-offs between 1992 and 2002. The breakdown by the use of sale proceeds is different, though, from that reported in Campbell et al. (2006), as the largest group in our more recent sample use sales proceeds to acquire funds.

In addition, we control for property age because, on average, older properties are more costly to run.

In fact, most non-core property types outperform core types in terms of returns and NOI growth. See the following Seeking Alpha link: https://seekingalpha.com/article/4276161-core-vs-non-core-reits-much-ado-nothing.

Here, the treatment sample is constructed based on sell-off events identified in Factiva news searches and differs from the sell-off sample based on the S&P Global full sample discussed in Section 3.1.

The reported results are based on a matched sample of treated firms that actually sold off properties and control firms with similar sell-off propensities. The control group (firms without sell-offs) should be similar to the treated group (i.e. firms with sell-offs) to estimate what would have happened to the treated group if it had not received the treatment (i.e. sell-offs). In other words, finding that CARs are significantly positive across all the models suggests that we failed to match the sell-off firms with the control firms for which sell-offs did not take place. Also, we do not include the gateway variable because it is used as one of the covariates in matching.

If the sell-off consists of multiple buyers/properties, we use the median distance to define DB and DS.

This exercise is performed based on a sell-off sample for the 2003 through 2013 period, which consists of 154 sell-off events. We retrieve buyer information from CoStar or the news articles. The sample size is further reduced to 56 because of missing buyer information. We are not able to include hedonic characteristics because in most of the cases, the characteristics of individual properties and their transaction prices were not disclosed.

In a related exercise, we test whether anchoring to the buyer’s home market price level explains the results. Following Ling, Naranjo, and Petrova (2018) and Liu et al. (2015), and using an approach similar to the approach we used to construct DB and DS, we construct a dummy variable indicating whether the buyer (seller) is from an expensive market, defined as the median price in the buyer’s (seller’s) home market that is above the sample median. By taking the difference between the two dummies and controlling for the sum, we find that the coefficients are never statistically significant. Results are not tabulated and but are available upon request.

We are not able to apply three tiers because of insufficiently many sell-off events in the secondary markets.

References

Ambrose, B. W., Ehrlich, S. R., Hughes, W. T., & Wachter, S. M. (2000). REIT Economies of Scale: Fact or Fiction? Journal of Real Estate Finance and Economics, 20(2), 213–224.

Campbell, R. D., Petrova, M., & Sirmans, C. F. (2003). Wealth Effects of Diversification and Financial Deal Structuring: Evidence from REIT Property Portfolio Acquisitions. Real Estate Economics, 31(3), 347–366.

Campbell, R. D., Petrova, M., & Sirmans, C. F. (2006). Value creation in REIT property sell-offs. Real Estate Economics, 34(2), 329–342.

Capozza, D. R., & Seguin, P. J. (1999). Focus, Transparency and Value: The REIT Evidence. Real Estate Economics, 27(4), 587–619.

Chan, S. H., Erickson, J., & Wang, K. (2003). Real Estate Investment Trusts, Structure, Performance, and Investment Opportunities. Oxford University Press.

Chen, H., Downs, D. H., & Patterson, G. A. (2012). The information content of REIT short interest: Investment focus and heterogeneous beliefs. Real Estate Economics, 40(2), 249–283.

Coval, J. D., & Moskowitz, T. J. (1999). Home Bias at Home: Local Equity Preference in Domestic Portfolios. Journal of Finance, 54(6), 2045–2073.

Cronqvist, H., Högfeldt, P., & Nilsson, M. (2001). Why Agency Costs Explain Diversification Discounts. Real Estate Economics, 29(1), 85–126.

Danielsen, B. R. B., & Harrison, D. M. D. (2007). The Impact of Property Type Diversification on REIT Liquidity. Journal of Real Estate Portfolio Management, 13(4), 329–343.

Devaney, S., Scofield, D., & Zhang, F. (2019). Only the Best? Exploring Cross-Border Investor Preferences in US Gateway Cities. Journal of Real Estate Finance and Economics, 59, 490–513.

Feng, Z., Hardin III, W. G., & Wu, Z. (2019a). Employee productivity and REIT performance. Real Estate Economics.

Feng, Z., Price, S. M., & Sirmans, C. F. (2011). An Overview of Equity Real Estate Investment Trusts (REITs): 1993-2009. Journal of Real Estate Literature, 19(2), 307–343.

Feng, Z., Pattanapanchai, M., Price, S. M., & Sirmans, C. F. (2019b). Geographic diversification in real estate investment trusts. Real Estate Economics.

Geltner, D., Miller, N., Clayton, J., & Eichholtz, P. M. A. (2014). Commercial Real Estate Analysis and Investments (3rd ed.). Mason: OnCourse Learning.

Gyourko, J., & Nelling, E. (1996). Systematic Risk and Diversification in the Equity REIT Market. Real Estate Economics, 24(4), 493–515.

Harding, J. P., Rosenthal, S. S., & Sirmans, C. F. (2003). Estimating Bargaining Power in the Market for Existing Homes. Review of Economics and Statistics, 85(1), 178–188.

Hartzell, D. J., Shulman, D. G., & Wurtzebach, C. H. (1987). Refining the Analysis of Regional Diversification for Income-Producing Real Estate. Journal of Real Estate Research, 2, 85–95.

Hartzell, J. C., Sun, L., & Titman, S. (2014). Institutional investors as monitors of corporate diversification decisions: Evidence from real estate investment trusts. Journal of Corporate Finance, 25, 61–72.

John, K., Knyazeva, A., & Knyazeva, D. (2011). Does geography matter? Firm location and corporate payout policy. Journal of Financial Economics, 101(3), 533–551.

John, K., & Sodjahin, W. R. (2010). Corporate Asset Purchases. Working Paper: Sales and Governance.

Kaplan, S. N., & Weisbach, M. S. (1992). The Success of Acquisitions: Evidence from Divestitures. Journal of Finance, 47(1), 107–138.

Landier, A., Nair, V. B., & Wulf, J. (2009). Trade-offs in staying close: Corporate decision making and geographic dispersion. Review of Financial Studies, 22(3), 1119–1148.

Lang, L., Poulsen, A., & Stulz, R. (1995). Asset sales, firm performance, and the agency costs of managerial discretion. Journal of Financial Economics, 37(1), 3–37.

Liberti, J. M., & Petersen, M. A. (2019). Information: Hard and Soft. The Review of Corporate Finance Studies, 8(1), 1–41.

Ling, D. C., Naranjo, A., & Petrova, M. T. (2018a). Search Costs, Behavioral Biases, and Information Intermediary Effects. Journal of Real Estate Finance and Economics, 57(1), 114–151.

Ling, D. C., Naranjo, A., & Scheick, B. (2018b). Asset Location, Timing Ability, and the Cross-Section of Commercial Real Estate Returns. Real Estate Economics, 46(2), 1–51.

Ling, D. C., Naranjo, A., & Scheick, B. (2019a). There’s No Place Like Home: Local Asset Concentration, Information Asymmetries and Commercial Real Estate Returns. Working Paper.

Ling, D. C., Wang, C., & Zhou, T. (2019b). The Geography of Real Property Information and Investment: Firm Location, Asset Location and Institutional Ownership. Real Estate Economics.

Liu, Y., Gallimore, P., & Wiley, J. A. (2015). Nonlocal Office Investors: Anchored by their Markets and Impaired by their Distance. Journal of Real Estate Finance and Economics, 50(1), 129–149.

McAllister, P., & Nanda, A. (2015). Does Foreign Investment Affect U.S. Office Real Estate Prices? Journal of Portfolio Management, 41(6), 38–47.

Milcheva, S., Yildirim, Y., & Zhu, B. (2020). Distance to Headquarter and Real Estate Equity Performance. Journal of Real Estate Finance and Economics forthcoming.

Pai, A., & Geltner, D. (2007). Stocks Are from Mars, Real Estate Is from Venus. The Cross-Section of Long-Run Investment Performance. Journal of Portfolio Management, 33(5), 134–144.

Riddiough, T. J., Moriarty, M., & Yeatman, P. J. (2005). Privately Versus Publicly Held Asset Investment Performance. Real Estate Economics, 33(1), 121–146.

Petersen, M. A., & Rajan, R. G. (2002). Does distance still matter? The information revolution in small business lending. The Journal of Finance, 57(6), 2533–2570.

Ro, S., & Ziobrowski, A. J. (2012). Wealth effects of REIT property-type focus changes: evidence from property transactions and joint ventures. Journal of Property Research, 29(3), 177–199.

Rosenbaum, P. R., & Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika, 70(1), 41–55.

Saiz, A. (2010). The Geographic Determinants of Housing Supply. Quarterly Journal of Economics, 125(3), 1253–1296.

Warusawitharana, M. (2008). Corporate asset purchases and sales: Theory and evidence. Journal of Financial Economics, 87(2), 471–497.

Wiley, J. A. (2013). REIT Asset Sales: Opportunistic Versus Liquidation. Real Estate Economics, 41(3), 632–662.

Wiley, J. A., Cline, B. N., Fu, X., & Tang, T. (2012). Valuation Effects for Asset Sales. Journal of Financial Services Research, 41(3), 103–120.

Zhu, B., & Lizieri, T. (2019). Location Risk and REIT Returns. Working Paper.

Zhu, B., & Milcheva, S. (2018). The Pricing of Spatial Linkages in Companies’ Underlying Assets. Journal of Real Estate Finance and Economics. https://doi.org/10.1007/s11146-018-9666-z.

Acknowledgment

We gratefully acknowledge helpful comments from or discussions with James B. Kau (our editor), Brad Case, George D. Cashman, John Clapp, Jeffrey P. Cohen, Gang-Zhi Fan, Gerald D. Gay, John L. Glascock, Joseph Golec, Shantaram Hegde, David C. Ling, Glenn Mueller, Timothy Riddiough, Harley E. “Chip” Ryan, Jr., Jaideep Shenoy, Stacy Sirmans, Lingling Wang, Jon Wiley, Vincent Yao, two anonymous referees, and seminar participants at the Financial Management Association (FMA), the Midwest Finance Association (MFA), the NUS-University of Cambridge–University of Florida Real Estate Finance and Investment Symposium, the University of Connecticut, Georgia State University, the American Real Estate Society (ARES), the Global Chinese Real Estate Congress (GCREC), the American Real Estate and Urban Economics Association (AREUEA) National Conference, and the AREUEA-ASSA Conference. All errors remain our own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Appendix 2

Appendix 3

Appendix 4

Appendix 5

Rights and permissions

About this article

Cite this article

Wang, C., Zhou, T. Trade-offs between Asset Location and Proximity to Home: Evidence from REIT Property Sell-offs. J Real Estate Finan Econ 63, 82–121 (2021). https://doi.org/10.1007/s11146-020-09770-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-020-09770-9