Abstract

Loss firms are an economically significant and growing segment of the population of publicly traded corporations. Relatively little is known about the tax positions of loss firms because the firms are typically dropped from tax avoidance studies. We develop a new measure of corporate cash tax avoidance that is meaningful for all observations and reflects the extent to which a firm is tax-favored. We examine the extent to which inferences about corporate tax avoidance over the past twenty-seven years change when we examine the full population of firms, as opposed to a profitable and/or taxable subsample. In contrast to prior research findings, our results suggest that on average firms are tax-disfavored, by which we mean cash taxes paid exceed the product of the firm’s pre-tax book income and the statutory tax rate. In addition, many industries that appear to be tax-favored in profitable subsamples are tax-disfavored when the entire population is examined. We also find that the extent to which firms are tax-disfavored is increasing over time, and that domestic firms are more tax-disfavored than multinationals.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

We develop a new measure of corporate cash tax avoidance that is meaningful for all firm-year observations. There is widespread interest in the extent and determinants of corporate tax avoidance (Hanlon and Heitzman 2010). To date, our understanding of corporate tax avoidance is limited to firms with positive pre-tax income and/or current tax expense because most extant studies of tax avoidance omit loss firm-year observations. We use our measure to describe cash tax avoidance for the full population of firms, including loss firms. We also analyze tax avoidance for the full population, for particular industries, and over time for both multinational and domestic firms.

Corporations reporting pre-tax financial accounting losses and/or negative tax expense represent a significant portion of the population of publicly traded firms. The number of loss firms has steadily grown since 1988, reaching over half of the Compustat database during the recessions in 2001 and 2008–2009. Moreover, the subset of firms experiencing a loss during their existence makes up roughly 76% of the firms in, and over 60% of the market value of assets of, the Compustat population over the same period. This recent surge in corporate losses, and the economic importance of the firms generating them, has attracted the attention of governments concerned that growing losses could raise tax compliance risks “if companies turn to aggressive tax planning as a means of increasing and/or accelerating tax relief on their losses” (OECD 2011). As Hanlon and Heitzman (2010) point out, however, “We do not have a very good understanding of loss firms, the utilization and value of tax-loss carryforwards, and how the existence of losses affects the behavior (e.g., tax and accounting reporting and ‘real’ decisions) of any of the involved parties.”Footnote 1

A substantial body of literature documents the magnitude of and variation in corporate tax avoidance both at an aggregate level, such as the population of Compustat firms or industry sub-populations, and at the individual firm level.Footnote 2 These studies primarily measure the extent to which a firm is tax-favored using: 1) an effective tax rate measure, constructed as the ratio of financial statement tax expense to pretax book income (GAAP ETR) or cash taxes paid to pretax book income (Cash ETR), or 2) a book-tax difference (BTD) measure that captures the difference between pre-tax book income and estimated taxable income.

Because pre-tax book income can be negative, its use in the denominator of an ETR leads to ETR realizations that are difficult to interpret, as a firm with positive cash taxes paid of 20 but a pretax accounting loss of 100 would have the same Cash ETR as a firm with a cash tax refund of 20 and positive pre-tax accounting income of 100. As a result, researchers using the ETR to measure corporate tax avoidance delete loss year observations. Studies of tax avoidance often include BTDs as a separate measure, constructed as the difference between pre-tax book income and current tax expense grossed up by the statutory tax rate. Such studies delete observations with negative current tax expense and negative pre-tax income, thereby discarding a significant fraction of the overall population (36% of one-year observations and 12% of ten-year observations in our sample).

We propose an alternative measure of tax avoidance that is readily interpretable for all firm-year observations. Our measure, which we refer to as Δ, is the difference between a firm’s cash taxes paid, adjusted for tax refunds receivable, and the product of its pre-tax book income and the statutory tax rate. We then scale Δ by the market value of a firm’s assets (MVA) to make the measure comparable across firms. As in Dyreng et al. (2008), we emphasize that “tax avoidance” does not imply any unlawful or improper actions. It is simply anything that causes a firm’s cash taxes paid to be less than they would be if the U.S. federal statutory tax rate were applied to pre-tax book income.

Our measure reflects the extent to which a firm is tax-favored. A firm is tax-favored if its cash taxes paid are less than the firm’s pre-tax book income multiplied by the statutory rate. A firm is tax-disfavored if its cash taxes paid are greater than pre-tax income multiplied by the statutory rate. A firm with ∆ equal to zero is equivalent to a Cash ETR equal to the statutory tax rate. We choose the statutory tax rate as the benchmark because ETR studies routinely frame their analyses in terms of why the ETR deviates from the statutory rate, and we follow the same approach (e.g., GAO 2016; Dyreng, Hoopes, and Wilde 2016). A firm facing a 35% statutory tax rate with pretax income of 100 and cash taxes paid of 20 is thought of as tax-favored, as its ETR of 20% is less than the statutory tax rate. We consider a firm with pretax loss of 100 that receives a cash taxes refund of 20 as tax-disfavored for the same reason—its cash tax refund as a fraction of its pretax loss is low relative to the statutory tax rate.

We focus on the population of domestic corporations and construct one-, five- and ten-year measures of Δ/MVA for both our full sample and the subsample of firms with positive income and current tax expense. We replicate the conclusions from previous research regarding the extent of cash tax avoidance within a subsample of firms with positive pre-tax income and current tax expense. We then use our measure to better understand the extent to which inferences about short- and long-term corporate tax avoidance over the past twenty-seven years change when loss firms are included.

Whereas previous studies show that profitable subsamples are tax-favored, we find that the population is on average tax-disfavored. The extent to which particular industries are tax-favored also changes significantly when one looks at all of the firms in the industry instead of a profitable subsample. For example, the Petroleum and Natural Gas industry appears to be in the most tax-favored out of 30 industries within a positive pre-tax income (PTI) and positive current tax expense (CTE) subsample. When all the firms are included in the analysis, however, the industry is tax-disfavored, ranked 21st in terms of 1-year cash tax avoidance. In contrast, the Tobacco Products industry is among the most tax-disfavored industries in the positive PTI and CTE subsample, but is the second most tax-favored industry when we examine all the firms in the population.

Our analysis suggests that the majority of observations deleted in prior tax avoidance research are tax-disfavored firms. Focusing on a subsample of firms with positive PTI and CTE yields the conclusion that an overwhelming majority of firms (almost 75%) are tax-favored; however, our analysis of the full population suggests that there are about the same number of tax-favored and tax-disfavored firms. Thus, previous studies of tax avoidance have focused on understanding the extent and variation in tax avoidance of a subsample of primarily tax-favored firms.

We also replicate Dyreng et al. (2017), who examine aggregate trends in corporate tax avoidance, using both a profitable subsample and the full sample of firms. Dyreng et al. (2017) find that most firms are tax-favored and that tax avoidance has increased over the past 25 years. They also find that this pattern is similar for both domestic and multinational firms, but domestic firms are more tax-favored than multinationals. Using our measure, we find the same pattern for positive PTI/CTE firms, but find that the full sample of firms is tax-disfavored in all of the past twenty-seven years. When splitting the sample into domestic and multinational subsamples, we find that domestic firms are more tax-disfavored than multinational firms and that the average domestic firm becomes more tax-disfavored over time. The tax status of the average multinational firm is consistent over time.

Throughout our study, we validate our measure by comparing it to the Cash ETR in the subsample of firms with positive PTI and CTE. Inferences using Δ/MVA are identical to those using Cash ETR in the positive PTI and CTE subsample used in previous studies. This suggests that our measure captures cash tax avoidance in much the same way as the Cash ETR. We also perform several tests to ensure that the use of MVA as a scalar for ∆ does not induce its own bias in the measure of corporate tax avoidance. We conclude that MVA is conceptually and empirically superior to alternative scalars because it exhibits a stronger correlation with ∆ and results in a measure of corporate tax avoidance whose variation is predominantly driven by variation in the numerator as opposed to the scalar. We also show that book value of assets BVA is a reasonable scalar and yields identical inferences.

Our measure contributes to tax research in two important ways. First, we introduce a measure of tax avoidance that is meaningful for all observations. The use of cash taxes paid instead of current tax expense is arguably subject to less measurement error with respect to capturing tax avoidance activities. We improve upon the measure of cash tax avoidance by adjusting it for tax refunds receivable. Finally, we show that, contrary to the conventional wisdom, the average domestic corporation and many industries thought to be aggressive tax avoiders are actually tax-disfavored due to the tax system’s asymmetric treatment of profits and losses.

Our measure should be of use to future research examining corporate cash tax avoidance for which it is important to include tax-disfavored firms. For example, there is considerable interest from researchers and policy makers on the extent to which the population of firms’ Cash ETRs differ from statutory rates (Dyreng et al. 2017; GAO 2016). These studies contribute to the current policy debate on corporate tax reform by providing an analysis of the extent to which the overall population of firms avoids taxes over time. There are also other existing research questions for which our measure is useful. Asset pricing studies, which are highly sensitive to data truncation bias (Teoh and Zhang 2011), use book-tax difference measures and often drop firms with negative pre-tax income (e.g., Chi, Pincus, and Teoh 2013). Further, a growing body of literature studies firm-level implicit taxes. An implicit tax is the decrease in the expected pre-tax rate of return on a tax-favored investment because of higher demand for the asset (Jennings et al. 2012). Although implicit taxes are based on supply and demand at the population level, these studies restrict their sample to profitable firms with positive tax expense. Finally, loss firms are particularly relevant to questions involving the effect of a firm’s tax position (i.e., favorable or unfavorable) on firm decisions (e.g., mergers and acquisitions, financing choices, etc.), credit risk, or market value. We also look forward to future research that further studies the part of the population that is tax-disfavored.

Although our measure overcomes a significant limitation of previous measures of tax avoidance, we note its shortcomings so that researchers may carefully consider its use. The information necessary to compute MVA is not available for all firms. Although we do not have reason to think that missing Compustat data generates a systematic bias in the measure of tax avoidance that would be correlated with potential independent variables of interest, we replace missing MVA with BVA in all of our analyses to mitigate this potential bias.

2 Measuring tax avoidance

2.1 Background

There is a substantial body of literature examining short- and long-run corporate tax avoidance, consisting of two primary research streams. The first broadly examines the extent to which firms avoid taxes at the overall population or industry level. The early ETR studies in this stream include Gupta and Newberry (1997) and Shevlin and Porter (1992), which examine the effect of the Tax Reform Act of 1986 (TRA86) on corporate ETRs. These studies interpreted differences in firm ETRs as a measure of the extent to which the law favored particular industries. The second stream focuses on the determinants of tax avoidance at the individual firm level. Two studies from the time period we examine include Mills, Erickson, and Maydew (1998), who use a firm’s ETR as a measure of tax planning effectiveness in their study of the returns to investments in tax planning, and Rego (2003), who uses the ETR to examine the relation between a firm’s size, extent of multinational activities, and tax planning effectiveness. In addition, Brown and Drake (2014) examine network ties among firms with low Cash ETRs.

The majority of studies measure tax avoidance with an ETR, which is defined as some measure of taxes paid or accrued divided by pre-tax book income. Our primary contribution is to research questions within the two streams of literature above for which both positive and negative pre-tax firms are relevant, but loss firms are dropped because the ETR measure is not meaningful to them. We do not argue that every tax avoidance study should include loss observations. If a study focuses on aggressive tax avoidance (e.g., Kubick et al. 2015 or Brown and Drake 2014), dropping loss observations is appropriate because loss firms have little incentive to pursue aggressive tax avoidance strategies.

The types of studies for which our measure is most relevant are those that examine variation in average effective tax rates across the population of firms or in average effective tax rates across industries. Recently, there has been renewed interest in understanding the tax positions of the corporate sector as a whole from both academic and regulatory perspectives. As described above, Dyreng et al. (2008) examine the extent to which firm ETRs measured over long periods differ from their statutory tax rates. Dyreng et al. (2017) examine aggregate trends in corporate ETRs over twenty-five years in order to contribute to the policy debate on corporate tax reform. Finally, the GAO recently performed a study of average ETRs at the request of Sen. Bernie Sanders, concluding that average corporate ETRs are significantly below the statutory tax rate (GAO 2016). News media outlets quickly made sensational headlines out of the GAO study’s conclusions.Footnote 3 However, several tax professionals have noted that the GAO’s analyses are based on calculations using only corporations with positive book income in a given year, which can lead to very misleading conclusions (Lyon 2013; Driessen 2014).

Although its use is quite prevalent, the ETR as a measure of tax avoidance faces criticism in the academic literature as well. Wilkie (1992), Wilkie and Limberg (1993), Dunbar and Sansing (2002), and Musumeci and Sansing (2014) show various drawbacks to the use of the ETR as a measure of corporate tax preferences. In addition, Omer et al. (1991) discuss the various ways of measuring GAAP effective tax rates and conclude that the definition of income used as the denominator of the various GAAP ETR measures has a notable effect on them.Footnote 4

More recently, Dyreng et al. (2008) provide a detailed discussion of the computation of ETRs and make two important innovations in the measurement of corporate tax avoidance. First, they argue that cash taxes paid rather than book tax expense should be in the numerator to include temporary book-tax differences and effects of stock option exercise, as well as to exclude changes in the firm’s valuation allowance. Second, they argue that an annual measure could simply reflect transitory conditions, and hence measure both the numerator and denominator of the Cash ETR over a ten-year period to provide descriptive evidence of long-run corporate tax avoidance and the characteristics of firms that engage in it.

Dyreng et al. (2008) improve upon existing measures of broad tax avoidance by using cash taxes paid in the numerator. Our study further extends this literature by drawing attention to the sample selection procedure inherent in the use of ETRs. Whether the measure is a single- or multi-year ETR measure or an ETR “differential” as examined in Armstrong et al. (2015), negative pre-tax income or tax expense results in measures of tax avoidance that lack a convenient economic interpretation. As a result, most studies of corporate tax avoidance drop loss observations and/or observations with negative current tax expense. Further, the remaining ETRs are reset to fall between 0 and 1. As a result, the literature excludes the effect of loss firms on the extent of corporate tax avoidance.Footnote 5

Statistical inferences about corporate tax avoidance may be biased because the sample selection process underlying them is not random. In other words, the literature’s focus on the subsample of profitable firms is driven not by the research questions but by the measure employed to answer them. This non-random deletion of sample firms or firm-years based on realizations of the dependent variable generates what Teoh and Zhang (2011) refer to as a “data truncation bias.”

2.2 Our measure of tax avoidance

In developing a measure of cash tax avoidance that has a convenient economic interpretation for both positive and negative realizations of pre-tax income, we first begin with the definition of a firm’s Cash ETR, which is equal to its cash taxes paid (CTP) divided by PTI for a given measurement period. A firm that has no tax preferences and is subject only to the U.S. corporate income tax with a rate of τ has a tax liability and cash taxes paid equal to τ*PTI. In this baseline case, this firm’s Cash ETR is equal to τ.

Because we want to include loss years in our analysis, we augment CTP by any receivable that the firm recognizes in connection with a current year loss that can be carried back for a refund of cash taxes paid. In the case of a loss carryback, a firm does not receive an immediate refund of cash taxes paid, but instead files a refund claim on Form 1139 or Form 1120X. Once the claim is filed, the firm records a tax refund receivable on its financial statements until the refund claim is paid.Footnote 6 Therefore, we adjust cash taxes paid by the change (δ) in a firm’s tax refund receivable (TXR).

Now suppose instead that, due to some combination of tax avoidance activities, the firm’s adjusted cash taxes paid (CTPADJ) is different than τ*PTI.

Thus, CTPADJ is equal to an expected amount of tax payments based on the firm’s pre-tax income (τ*PTI) plus the effects of all transactions that cause a firm’s cash taxes paid to differ from this amount (Δ).

Δ is our measure of cash tax avoidance and reflects the extent to which a firm is tax-favored or tax-disfavored, where Δ > 0 indicates the firm is tax-disfavored and Δ < 0 indicates the firm is tax-favored. Like other tax avoidance measures, ours encompasses reductions in cash taxes paid arising from both certain and uncertain tax positions, including the tax effects of such items as temporary and permanent book-tax differences, tax credits, stock option exercises, state income taxes, and foreign tax rate differentials. Firms are tax-disfavored due to unfavorable book-tax differences such as expenses accrued for financial reporting purposes but deducted for tax purposes on a cash basis. Book-tax differences also arise if a firm has a net operating loss that can only be carried forward to offset future income.

Using eq. (2), one can express the difference between the Cash ETR adjusted for tax refund claims (Cash ETR_adj) and the statutory tax rate (τ) as:

which is our measure of cash tax avoidance (Δ) scaled by pre-tax book income. With eq. (3), we follow the approach of previous academic and policy-oriented studies by defining tax avoidance as the extent to which Cash ETR differs from the statutory corporate income tax rate (e.g., GAO 2016).

We set τ equal to 34% for fiscal years ended 1998 through 1992 and to 35% for fiscal years ended 1993 through 2014 in our analyses. These rates are chosen because they are the statutory tax rates for all but very small U.S. corporate taxpayers during our sample period. If there were no book-tax differences (either permanent or temporary), no deferral of U.S. tax on foreign earnings (i.e., immediate repatriation of foreign earnings), no general business tax credits, no alternative minimum tax, no state income tax, and immediate refunds for taxable losses, then ∆ would be zero for all firms. If ∆ is less than zero, the firm is tax-favored; if ∆ is greater than zero, the firm is tax-disfavored.Footnote 7 For example, consider a U.S. multinational with no book-tax differences but with a foreign subsidiary subject to a tax rate lower than 35%. The U.S. multinational is tax-favored according to our measure, assuming that the foreign subsidiary’s earnings are not currently being repatriated.

Empirical estimates of Cash ETR often discard observations with negative values of PTI. The characterization in eq. (3) allows us the convenience of simply changing the tax avoidance scalar without changing the conceptual or practical definition of tax avoidance relied upon in the extant literature. Changing the scalar in eq. (3) results in a measure of tax avoidance that is defined for both profit and loss observations. The ideal scalar should be positive for all observations and facilitate comparison of ∆ across firms.

We consider two alternative scalars to PTI: market value of assets (MVA) and book value of assets (BVA). MVA is defined as

where BVA is equal to a firm’s book value of assets, MVE is the firm’s market value of equity, and BVE is the firm’s book value of equity. Both MVA and BVA are measures of firm size, but MVA includes the value of internally developed intangible assets, such as intellectual property arising from research and development (R&D) and a firm’s brand arising from advertising, whereas BVA does not.

This distinction makes MVA an a priori more attractive scalar for several reasons. First, R&D and advertising activities are currently expensed, often resulting in the loss observations that are deleted. Second, R&D activities are often associated with tax avoidance activities but do not affect BVA.Footnote 8 Consistent with this notion, prior research on the valuation of losses emphasizes the importance of considering internally developed intangibles for loss firms, and suggests that book values do not adequately capture the underlying economics of the firm (Joos and Plesko 2005; Klein and Marquardt 2006; Darrough and Ye 2007). In other words, scaling by MVA should result in a more meaningful comparison of ∆ across profit and loss observations because ∆ and MVA are influenced by similar factors. We prefer MVA to MVE because high leverage does not reduce the economic magnitude of a business, but does reduce its MVE.Footnote 9 That being said, MVA is affected by factors that do not affect BVA, such as the market’s assessment of growth opportunities, time varying risk premiums, and pricing bubbles.

In Table 1, we empirically evaluate MVA, BVA, and PTI as potential scalars. The ideal scalar will exhibit a strong association with ∆. Panel A presents the correlation of ∆ with MVA, BVA, and PTI for the full sample of firms and separately for observations with ∆ less than zero and ∆ greater than zero. PTI exhibits the smallest correlation with ∆ for the full sample of firms. The Pearson correlation between PTI and ∆ is negligible and the Spearman correlation is negative when ∆ is greater than zero. The low correlation between PTI and ∆ motivates our search for a better scalar.

Both BVA and MVA exhibit a significant positive correlation with ∆ for both subsamples of positive and negative ∆. We conclude that both MVA and BVA are reasonable scalars for ∆. Consistent with our expectation, MVA exhibits a larger correlation with ∆ overall and when ∆ is positive. In untabulated analyses, we also find that MVA is a less volatile measure of firm size, resulting in a measure of tax avoidance whose variation is driven by the level of cash tax avoidance (the numerator) as opposed to its scalar.Footnote 10 Though our evidence supports MVA as the preferred scalar for ∆, MVA is not available for all firms in Compustat or for private firms. In the analyses to follow, we replace MVA with BVA when it is missing because our evidence also suggests BVA is a suitable scalar. As a robustness check in Section 5, we repeat our analyses using BVA as a scalar and find that our inferences are unchanged.

2.3 Expected effect on tax avoidance studies

We expect that deleting loss observations and/or observations with negative CTE in both population- and firm-level studies overstates the extent of corporate tax avoidance. We illustrate the expected effect of deleting such observations in Table 2. In both panels, we present a firm with pre-tax loss in Year 1 and pre-tax income in Year 2. The firm’s cash taxes paid and NOL carryforward are presented for each year, assuming the firm has no reductions in taxable income relative to book income other than the generation and use of NOLs. In Year 1, the firm generates a loss of $40 and would thus be deleted from the sample. The only observation included for this firm in a study of its cash tax avoidance is Year 2. In Year 2, the firm appears to be avoiding cash taxes (i.e., a negative value of Δ) but is simply using its NOL carryforward to reduce cash taxes paid.

The asymmetric treatment of income and loss years implies that the practice of deleting loss observations systematically overstates the extent of tax avoidance in the population and ignores any information about corporate tax status for loss firm-years. It is true that the longer the measurement window, the less likely it is that the measure of tax avoidance is affected by carryforwards from a year before the measurement window starts (for example, the effect of the asymmetric treatment of profit and loss years is completely mitigated in our stylized example by using a long-run measure of tax avoidance). However, we show in the remaining sections that even when researchers employ long-term tax avoidance measures, the bias arising from dropping loss generation years but retaining loss carryover use years is not completely extinguished.

Panel B of Table 2 presents the full picture of the firm’s tax avoidance. Over the two-year interval, the firm is neither tax-favored nor tax-disfavored; the firm generates $60 of net pre-tax book income and pays $21 in cash taxes. Using ∆/MVA, we are able to measure the extent to which the firm is tax-disfavored in the first year, when the loss is generated, and tax-favored in the second year, when the loss is used. In this example, ∆/MVA would provide an unbiased, albeit noisy, measure of tax preferences for a single year. A multi-year study that included both Year 1 and Year 2 would correctly show that the firm did not engage in tax avoidance.

Although the majority of recent tax avoidance studies use Cash or GAAP ETRs, some of these studies also use some variant of book-tax differences as an alternative measure of corporate tax avoidance.Footnote 11 For example, Higgins et al. (2015) use permanent book-tax differences as an alternative measure in examining the influence of a firm’s business strategy on its tax aggressiveness. Chen et al. (2010) use book-tax differences (among other measures) to test whether family firms are more tax aggressive than non-family firms. Wilson (2009) and Lisowsky (2010) examine the relation between book-tax differences and the use of tax shelters.

Book-tax differences are typically calculated as the difference between financial statement income and taxable income scaled by the book value of assets, where taxable income is estimated by grossing up current tax expense. ∆/MVA is similar to the traditional book-tax difference measure. The differences are that we measure ∆ using adjusted cash taxes paid instead of current tax expense and that we scale by the market value of assets instead of the book value of assets. As discussed in Hanlon (2003) and Dyreng et al. (2008), current tax expense does not necessarily capture a firm’s tax burden, due to the effects of exercised employee stock options and tax contingency reserves. Book-tax difference studies are also not free of sample selection issues, as researchers often discard observations with negative current tax expense and/or pre-tax losses.Footnote 12

To understand the influence of using cash taxes paid as opposed to current tax expense in capturing book-tax differences, we assess the correlation between ∆ and book-tax differences (BTD) in our full sample of firms. We measure BTDs as estimated taxable income minus pre-tax income. Following Wilson (2009) and Lisowsky (2010), we estimate taxable income by grossing up a firm’s current tax expense (CTE) by the statutory tax rate as followsFootnote 13:

We find that ∆ and BTD are highly correlated, with a Pearson (Spearman) correlation of 0.7463 (0.5593) for the one-year measures, 0.6025 (0.6330) for the five-year measures, and 0.6343 (0.6546) for the ten-year measures, all with p-values of less than 0.0001. The correlations are similar in both magnitude and statistical significance when both ∆ and book-tax differences are scaled by the book value of total assets. As eqs. (5) and (6) make clear, these correlations reflect the correlations between current tax expense and adjusted cash taxes paid.

3 Tax avoidance in the full population of firms

In this section, we investigate the extent to which including loss firms in the analysis of tax avoidance yields systematically different insights about corporate tax avoidance at the population and industry levels. Existing measures of tax avoidance lack an economic interpretation for firms with negative pre-tax income and negative current tax expense, whereas our measure is applicable to all Compustat firms with non-missing values of cash taxes paid, pre-tax book income, and book or market value of assets.

To gauge whether dropping observations with a non-meaningful interpretation results in a material reduction in a study’s sample size, Fig. 1 depicts the proportion of firms in the Compustat population that experience a loss and/or negative tax expense throughout our sample period. Figure 1 shows that the incidence of losses and/or negative tax expense is increasing, with over half of the population of publicly traded corporations affected during the recessions of 2001 and 2008–2009. About 36% of the firm-year observations would be deleted due to negative values of pre-tax income or current tax expense if tax avoidance were measured on an annual basis.

Deleting firm-years with negative PTI or negative CTE also limits the ability to study time series variation in an individual firm’s tax avoidance. Approximately 76% of firms (14,139 of 18,532) in the Compustat population from 1988 through 2014 would have had at least one of their firm-year observations discarded because either PTI or CTE is negative. Figure 2 shows that those 14,139 firms represent more than 60% of total MVA for Compustat firms, and that this fraction has increased over time. Together, these figures suggest that deleting firms with losses or negative current tax expense excludes an economically significant proportion of the population.

3.1 Sample

We begin our examination of the effect of deleting loss firms and firms with negative CTE by constructing a sample of U.S. corporations from 1988 to 2014.Footnote 14 To generate a sample of one-year tax avoidance measures, we delete firms missing the Compustat data needed to generate tax avoidance measures, yielding a one-year sample of 124,514 firm-year observations with non-missing Δ/MVA1, which we refer to as the “full sample.” To generate a sample of five-year tax avoidance measures, we start with the full sample of 124,514 one-year observations, deleting observations that do not have five years of consecutive non-missing components of the tax avoidance measures. We use a five-year rolling window to compute each measure. The first five-year measure we construct covers 1988–1992; the last five-year measure we construct covers 2010–2014. Our full sample of non-missing Δ/MVA5 consists of 63,867 firm-year observations. Similarly, we construct a full sample of Δ/MVA10 observations over a 10-year rolling window with non-missing values of tax avoidance measures over ten years. Our full sample of non-missing Δ/MVA10 consists of 33,371 observations.

Our full samples of non-missing Δ/MVA observations contain both profit and loss observations and observations with both positive and negative current tax expense. It is clear from Table 3 that a significant number of corporations experience losses or negative current tax expense over one-, five-, and ten-year periods throughout 1988–2014. In a typical study examining a one-year measure of corporate tax avoidance, researchers would drop approximately 36% of observations; researchers using a five-year measure would drop 22.5% of observations; and researchers using a ten-year measure would drop 17% of observations.

Because we cannot compare our measure directly to ETR for firms with negative PTI and CTE, we also generate a “positive PTI and CTE subsample” in which both Δ/MVA1 and Cash ETR1 are defined in order to validate our measure. Throughout our analysis, we compare Δ/MVA to the Cash ETR in the positive PTI and CTE subsample to see whether the two measures have similar properties when applied to profitable firms.

3.2 Population analysis

We report the descriptive statistics for the one-, five-, and ten-year tax avoidance measures separately for the full sample of firm-years, the positive PTI and CTE subsample, and a subsample of firms with negative PTI (Compustat PI) and negative current tax expense in Table 4.Footnote 15 Overall, the distribution of cash tax avoidance, or Δ, is similar whether scaled by MVA or BVA and whether measured over 1, 5 or 10 years. In the discussion of the descriptive statistics that follows, we focus on the one-year measures in Panel A; the patterns are qualitatively similar in Panels B and C. There are several items of note. First, Δ/MVA1 has a mean of −0.51% within the PTI > 0 subsample. By way of comparison, Dyreng et al. (2008) found an average one-year Cash ETR of 27%. A firm with an average Cash ETR of 27% and pre-tax ROA of 6.72% (the mean ROA in our Positive PTI and CTE subsample) would have a cash tax avoidance measure of Δ/MVA = 6.72% x (27% – 35%) = −0.54%, so our results are consistent with what one would expect based on Cash ETRs.

In the full sample, however, the mean of Δ/MVA1 is positive and larger in magnitude at 1.47%, indicating that on average firms are tax-disfavored. The difference between Δ/MVA1 in the full population and the subsample with positive income and positive tax expense occurs because firms with pre-tax book losses also often have negative taxable income. Firms with negative taxable income are typically tax-disfavored due to the tax system’s asymmetric treatment of profits and losses. Therefore, omitting firms with losses or negative current tax expense understates the extent to which firms are tax-disfavored. In the tables that follow, we only tabulate one- and ten-year measures for brevity. Our conclusions with five-year measures (untabulated) most closely correspond to those generated with the one-year measure.

3.3 Industry analysis

To examine the effects of deleting a substantial portion of the population on conclusions regarding corporate tax avoidance at the industry level, we compare rankings of cash tax avoidance by industry for both the full sample and the positive PTI and CTE subsample. Consistent with Dyreng et al. (2008), we rank Δ/MVA for the Fama-French 30 industries in Table 5. We also plot the one-year (ten-year) rankings for Δ/MVA across the full sample and the positive PTI and CTE subsamples in Figs. 3a, b and 4a, b, respectively.

It is clear from Table 5 that the industry rankings of cash tax avoidance significantly change when we include loss firms. For the one-year measures, the utility industry is in the most favorable tax position in the full sample of firms, but appears to be in one of the least favorable tax positions in the positive PTI and CTE subsample. Conversely, the petroleum and natural gas industry appears to avoid the most taxes in the positive PTI and CTE subsample, but is in one of the most unfavorable tax positions in the full subsample of firms. Consistent with these anecdotes from Table 5, the correlation between the industry rankings of Δ/MVA1 in the full sample versus the positive PTI and CTE subsample is negative 39%. The distinction between industry rankings of Δ/MVA10 across the full sample and the positive PTI and CTE subsample is present but less dramatic due to the exclusion of fewer firms. Figures 3a, b suggest that the relation between Δ/MVA for the full sample and for the positive PTI and CTE subsample is negligible. This suggests that the bias introduced by excluding observations with negative pre-tax book income or current tax expense is considerable when assessing tax avoidance at the industry level.

As a calibration exercise, we also include the industry rankings of Cash ETR for the positive PTI and CTE subsample to ensure that Δ/MVA reflects cash tax avoidance in much the same manner as does the Cash ETR. We plot the one-year (ten-year) Δ/MVA and Cash ETR rankings for the positive PTI and CTE subsample in Figs. 3b, 4b. It is clear from Table 5 and Figs. 3b, 4b that the industry rankings of Δ/MVA roughly correspond to the industry rankings of Cash ETR within the positive PTI and CTE subsample. In fact, the correlation between the industry rankings for Δ/MVA and Cash ETR is approximately 90%, and the five industries in the most favorable tax positions (i.e., those avoiding the most cash taxes paid) are consistent across both one-year measures of cash tax avoidance.

4 Trends in average tax avoidance

Our primary contribution is to the study of tax avoidance for the entire population of publicly held firms. Firms with pre-tax losses are relevant when assessing tax avoidance for the population as a whole, but are typically dropped because the ETR measure is difficult to interpret when the denominator is negative. Our analyses thus far suggest that tax avoidance studies focusing on subsamples of profitable firms overstate the extent of corporate tax avoidance in the overall population. This result is important from a tax policy perspective because it stands in stark contrast to the conclusion that tax avoidance is a pervasive phenomenon. Because the majority of tax policy–oriented analyses focus only on profitable firms (e.g., GAO 2016; Dyreng et al. 2017), it is important to directly examine how their conclusions do or do not change when examining the full population of firms to which tax policy is relevant.

Dyreng et al. (2017) examine aggregate trends in corporate tax avoidance over twenty-five years in order to contribute to the policy debate on corporate tax reform. They test two hypotheses: 1) that ETRs of U.S. corporations are decreasing over time, and 2) that the ETRs of multinational firms decrease more over time than the ETRs of domestic firms. Because Dyreng et al. (2017) measure tax avoidance as the Cash ETR, their sample is limited to firms with pre-tax income greater than zero. Their analyses suggest that, for profitable firms, corporate ETRs are declining over time. Further, multinational firms have higher Cash ETRs than domestic firms, and the pattern of decline over time is similar for both multinational and domestic corporations. This finding is particularly surprising because of an a priori assumption that multinational corporations increasingly take advantage of income shifting and reorganization tactics to avoid a greater proportion of tax expense over time.

In this section, we re-examine the Dyreng et al. (2017) hypotheses using the full population of firms. We expect that their emphasis on profitable firms overstates the extent of corporate tax avoidance over the past twenty-five years because they discard loss-generation years but retain subsequent years in which the loss carryforwards are used to reduce taxable income relative to book income. We also expect that ∆/MVA1 will increase over time in the full sample of firms due to the increasing frequency of loss observations in Compustat over time, as indicated by Fig. 1. The impact of the inclusion of loss observations on comparisons of tax avoidance trends in domestic versus multinational firms is an empirical question that depends on the number and significance of losses in each subsample.

We first replicate tests of Dyreng et al. (2017)‘s two primary hypotheses using CETR1 and ∆/MVA1 in the positive PTI/CTE subsample of firms to ensure that their main CETR1 results hold in our sample period (which spans 1988–2014, while theirs spans 1988–2012) and with our new measure of tax avoidance. We then test, in the full sample of firms, whether ∆/MVA1 decreases over time (and therefore whether tax avoidance increases over time) and whether the trend we identify differs for multinational versus domestic firms.

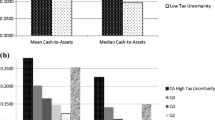

We plot the mean annual CETR1 and ∆/MVA1 over our sample period for the positive PTI and CTE subsample of firms in Figs. 5a, b, and regress CETR1 and ∆/MVA1 on a linear time trend in Table 6. Consistent with Dyreng et al. (2017), we show a clear decline in CETR1 and ∆/MVA over time in Fig. 5, suggesting that the choice of scalar does not change the basic impressions that emerge when analyzing the subset of positive PTI and CTE firm-years. This result is further supported by a significant negative association between the linear time trend variable (TIME) and both CETR1 and ∆/MVA1 in the positive PTI and CTE subsample. Firms in this subsample are tax-favored on average and are becoming more tax-favored over time.

Figure 5c, which shows average ∆/MVA1 over time for the full population of firms, paints a very different picture of tax avoidance. Consistent with our expectations, the full sample of firms is tax-disfavored over the sample period, and the extent to which it is tax-disfavored is increasing over time. The timing of peaks and troughs in average tax avoidance over time for the positive PTI and CTE subsample, when compared to those in the full sample, is consistent with the asymmetric treatment of profit and loss observations. ∆/MVA1 for the full sample peaks in 2001 due to losses associated with the recession. Such peaks are non-existent when looking at either CETR1 or ∆/MVA1 in the positive PTI and CTE subsample because loss observations are discarded. However, a sharp valley appears for both measures in the profitable subsample in 2003 and 2004 as the loss carryforwards arising from losses generated in the recession are used to offset taxable income when firms became profitable.

Our tests of Dyreng et al. (2017)‘s second hypothesis are presented in Fig. 6 and Table 6. For the positive PTI and CTE subsample, domestic firms have lower CETR1 and ∆/MVA1 than multinationals overall, suggesting that domestic firms are more tax-favored. Each measure of tax avoidance is decreasing over time at a similar rate across the two groups. Again, conclusions change when we examine the full sample of firms. We find that domestic firms are more tax-disfavored than multinationals for every year in our sample period. Domestic firms become more tax-disfavored over time, while tax avoidance within multinational firms appears to remain relatively constant, which is opposite the conclusion gleaned from the positive PTI and CTE subsample.

This exercise underscores the importance of including loss observations in population and industry-level analyses, particularly those intended to inform and influence tax policy. Results of studies focusing solely on profitable firms are not generalizable to the population as a whole. If a study’s conclusions are used to inform decisions that impact the overall population of corporate taxpayers, they should be based on analyses of the full sample.

5 Robustness tests

In this section, we assess the extent to which our conclusions are robust to scaling our measure of tax avoidance by book value of assets (∆/BVA) as opposed to MVA. Book value of assets is equal to the firm’s ending total assets (Compustat AT) for a given year.Footnote 16 In untabulated analyses, we find that both the one-year and ten-year measures of ∆/BVA and ∆/MVA are very highly correlated in the full sample of firms, with Pearson correlations of 44% for the one-year measures and 73% for the ten-year measures, and Spearman correlations of 98% for each. From a practical perspective, it is important to note that scaling Δ by BVA generates extreme observations due to small realizations of total assets.Footnote 17 After deleting observations with BVA less than $10 million, the Pearson correlation between ∆/MVA1(10) and ∆/BVA1(10) jumps to 71 (72) percent.

We also compare the industry rankings of tax avoidance for ∆/MVA versus ∆/BVA for the full sample of firms in untabulated analyses. All industry rankings and the sign of the average scaled ∆ are generally consistent when scaling by ∆ by either MVA or BVA for both the one- and ten-year measures. The correlation between the industry rankings of ∆/MVA1(10) and ∆/BVA1(10) are 78 (87) percent. Overall, scaling ∆ by BVA does not significantly affect our conclusions regarding the superiority of MVA over PTI as a scaling variable for our cash tax avoidance measure.

6 Conclusions

We propose a new measure of corporate cash tax avoidance, Δ/MVA, which addresses the exclusion of loss firms and firms with negative current tax expense from the study of corporate tax avoidance. Because MVA is always positive, our measure has a sensible economic interpretation for all observations with non-missing data. We use this measure to determine whether and how previous conclusions about tax avoidance change when loss observations are included in the analysis of aggregate corporate tax avoidance.

We find that omitting negative PTI and CTE firm-year observations changes the overall picture of corporate tax avoidance by suggesting that, on average, firms are tax-disfavored. Further, industries that appear to be tax-favored in positive PTI and CTE subsamples are actually tax-disfavored when loss firms are included. Finally, we find that trends in tax avoidance for the full population of firms and for the full population of domestic and multinational firms look drastically different than trends among profitable-only firms.

The primary contribution of our measure is that, unlike most measures of corporate tax avoidance, it is defined for the full population of publicly traded firms. This means that it can be used to further our understanding of the tax positions of loss firms, an area of the literature that is relatively understudied. We look forward to future research that provides more robust theoretical and empirical study of loss firms.

Notes

Erickson et al. (2013) examine tax-motivated loss shifting and find that firms increase losses in order to generate cash refunds arising from carryback of those losses.

See, for example, the Huffington Post story titled “This Study Shows How Low Corporate America’s Taxes Really Are” (http://www.huffingtonpost.com/entry/gao-study-profitable-corporations-no-federal-taxes_us_570e6c62e4b0ffa5937dbadb), the US News article titled “GAO: Many Companies Paid No Federal Income Tax” (http://www.usnews.com/news/articles/2016-04-14/bernie-sanders-outraged-by-gao-study-that-finds-many-companies-paid-no-income-tax), or the Yahoo article titled “Many U.S. corporations pay little in federal income taxes: report”(https://www.yahoo.com/news/many-u-corporations-pay-little-federal-income-taxes-130429817--business.html).

Callihan (1994) provides a comprehensive review of this branch of the ETR literature.

Our review of studies that use an ETR or book-tax difference measure and that were published in The Accounting Review, Journal of Accounting Research, Journal of Accounting and Economics, Contemporary Accounting Research, and Review of Accounting Studies between 2013 and 2016 revealed that 20 of 23 studies dropped firms with negative PTI or CTE, and 14 of 23 studies reset ETRs to fall between [0,1].

According to the instructions to Form 1120X, the processing time for carryback claims is typically 3–4 months. A firm that extends its corporate income tax return will ultimately file it on September 15 of a given year. A four-month processing time yields a refund receipt in January of the following year.

The use of a 34%/35% benchmark is based on the top U.S. statutory income tax rate and does not include an expected tax burden for state taxes or implicit taxes. Given a specific research need, it would be perfectly reasonable to set a benchmark that incorporates such factors (e.g., 35% plus a blended state income tax rate of X% for domestic firms).

Some of the largest IRS settlements in history have involved intercompany transactions related to internally developed intangibles and trademarks. For example, Glaxo Smith Kline Holdings Inc. agreed to pay the IRS $3.4 billion in 2006, AstraZeneca settled with the IRS for $1.1 billion in 2011, and Western Union settled for $2 billion in 2011.

We prefer to scale by firm size instead of sales because we do not consider a low margin/high sales volume firm to be larger than a high margin/low sales volume firm and because sales are undefined for financial institutions. Operating cash flow (OCF) is a potential alternative scalar but, like PTI, it is negative in a significant proportion (26%) of firm-year observations within our sample. Further, MVA is a less volatile measure of economic magnitude than are sales, operating cash flow, and even BVA. In untabulated analyses we find that the standard deviation of Δ/BVA (Δ/OCF) is approximately 4 (25) times that of Δ/MVA.

Further, our comparison of ∆/MVA and CETR within the profitable subsample in all of our analyses yields similar results, suggesting that MVA does not induce bias in the measurement of tax avoidance. We also performed our analyses scaling by sales and found that, because sales can exhibit very small values, its use in the denominator results in a significant number of extreme observations.

There are also several other measures of tax avoidance, including uncertain tax balances, discretionary permanent book-tax differences, and tax shelter participation. Like ETRs and BTDs, our measure captures the whole of the tax avoidance spectrum, whereas these other measures capture the more aggressive end.

Within our sample of one-year tax avoidance measures, approximately 13% of observations have negative values of current tax expense.

We measure current tax expense as the sum of current federal tax expense (TXFED) and current foreign tax expense (TXFO). When current federal or foreign tax expense is missing, we set current tax expense equal to total tax expense (TXT) less deferred tax expense (TXDI), state tax expense (TXS) and other tax expense (TXO). TXDI, TXS, and TXO are all set to zero when missing.

Following Dyreng et al. (2008), we consider firms to be U.S. corporations if Compustat data item FINC is equal to zero. We eliminated non-corporate firms by deleting firms with a SIC code of 6798 (REITs), firms with names ending in “-LP” containing “TRUST,” and firms with six-digit CUSIPs ending in “Y” or “Z.” In addition, we delete observations where Compustat data item STKO is equal to 1 (subsidiary of a publicly traded company) or 2 (subsidiary of a non-publicly traded company), and when STKO is equal to zero (publicly traded company) but share price is missing.

As in Lisowsky (2010) and McGuire et al. (2012), we define total current tax expense as current federal tax expense plus current foreign tax expense (Compustat TXFED + TXFO). Where either of those values are missing, current tax expense is equal to total tax expense less the sum of deferred tax expense, state tax expense, and other tax expense (Compustat TXT – [TXDI + TXS + TXO]).

Results remain unchanged when BVA is set equal to beginning total assets.

Even after winsorizing Δ/BVA1 at 1 and 99%, there are still 1761 instances where Δ is greater than 100% of a firm’s total assets. Visual inspection of the data revealed that the majority of these observations were due to total assets being less than 1. We also considered the use of total sales as a scalar for Δ, but found that its use generated a significant fraction of extreme observations due to a small denominator issue.

References

Armstrong, C., Blouin, J., Jagolinzer, A., & Larcker, D. (2015). Corporate governance, incentives, and tax avoidance. Journal of Accounting and Economics, 60(1), 1–17.

Brown, J., & Drake, K. (2014). Network ties among low-tax firms. The Accounting Review, 89(2), 483–510.

Callihan, D. (1994). Corporate effective tax rates: A synthesis of the literature. Journal of Accounting Literature, 13, 1–43.

Chen, S., Chen, X., Cheng, Q., & Shevlin, T. (2010). Are family firms more tax aggressive than non-family firms? Journal of Financial Economics, 95, 41–61.

Chi, S., Pincus, M., & Teoh, S. H. (2013). Mispricing of book-tax differences and the trading behavior of short sellers and insiders. The Accounting Review, 89, 511–543.

Darrough, M., & Ye, J. (2007). Valuation of loss firms in a knowledge-based economy. Review of Accounting Studies, 12, 61–93.

Driessen, P. (2014). Corporate tax fate may hinge on modeling omission. Tax Notes December, 1(2014), 1043–1048.

Dunbar, A., & Sansing, R. (2002). Measuring corporate tax preferences. Journal of the American Taxation Association, 24(Fall), 1–17.

Dyreng, S., Hanlon, M., & Maydew, E. (2008). Long-run corporate tax avoidance. The Accounting Review, 83(1), 61–82.

Dyreng, S., Hanlon, M., & Maydew, E. (2010). The effects of executives on corporate tax avoidance. The Accounting Review, 85(4), 1163–1189.

Dyreng, S., Hanlon, M., Maydew, E., & Thornock, J. (2017). Changes in corporate effective tax rates over the past twenty-five years. Journal of Financial Economics, 124(3), 441–463.

Erickson, M., Heitzman, S., & Zhang, X. F. (2013). Tax-motivated loss shifting. The Accounting Review, 88(5), 1657–1682.

GAO-16-363. (2016). Corporate income tax: Most large profitable U.S. corporations paid tax but effective tax rates differed significantly from the statutory rate. Rerpot to the Ranking Member, Committee on the Budget, U.S. Senate.

Gupta, S., & Newberry, K. (1997). Determinants of the variability in corporate effective tax rates: Evidence from longitudinal data. Journal of Accounting and Public Policy, 16(Spring), 1–34.

Hanlon, M. (2003). What can we infer about a Firm’s taxable income from its financial statements? National Tax Journal, 56(4), 831–863.

Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of Accounting and Economics, 50(2–3), 127–178.

Higgins, D., Omer, T., & Phillips, J. (2015). The influence of a Firm’s business strategy on its tax aggressiveness. Contemporary Accounting Research, 32(2), 674–702.

Jennings, R., Weaver, C., & Mayew, W. (2012). The extent of implicit taxes at the corporate level and the effect of TRA86. Contemporary Accounting Research, 29(4), 1021–1059.

Joos, P., & Plesko, G. (2005). Valuing loss firms. The Accounting Review, 80(3), 847–870.

Klein, A., & Marquardt, C. (2006). Fundamentals of accounting losses. The Accounting Review, 81(1), 179–206.

Kubick, T., Lynch, D., Mayberry, M., & Omer, T. (2015). Product market power and tax avoidance: Market leaders, mimicking strategies, and stock returns. The Accounting Review, 90(2), 675–702.

Lisowsky, P. (2010). Seeking shelter: Empirically modeling tax shelters using financial statement information. The Accounting Review, 85(5), 1693–1720.

Lyon, A. 2013. Another look at corporate effective tax rates, 2004–2010. Tax Notes October 21, 2013: 313–318.

McGuire, S., Omer, T., & Wang, D. (2012). Tax avoidance: Does tax-specific industry expertise make a difference? The Accounting Review, 87(3), 975–1001.

Musumeci, J., & Sansing, R. (2014). Corporate tax preferences: Identification and accounting measurement. Journal of the American Taxation Association, 36(Spring), 89–103.

OECD. 2011. Corporate loss utilization through aggressive tax planning, OECD Publishing. doi: https://doi.org/10.1787/9789264119222-en.

Omer, T., Molloy, K., & Ziebart, D. (1991). Measurement of effective corporate tax rates using financial statement information. Journal of the American Taxation Association, 13(Spring), 57–72.

Rego, S. (2003). Tax-avoidance activities of U.S. multinational corporations. Contemporary Accounting Research, 20(Winter), 805–833.

Shevlin, T., & Porter, S. (1992). “The corporate tax comeback in 1987”: Some further evidence. Journal of the American Taxation Association, 14(Spring), 58–79.

Teoh, S. H., & Zhang, Y. (2011). Data truncation bias, loss firms, and accounting anomalies. The Accounting Review, 86(4), 1445–1475.

Wilkie, P. (1992). Empirical evidence of implicit taxes in the corporate sector. Journal of the American Taxation Association, 14(Spring), 97–116.

Wilkie, P., & Limberg, S. (1993). Measuring explicit tax (dis)advantage for corporate taxpayers: An alternative to average effective tax rates. Journal of the American Taxation Association, 15(Spring), 46–71.

Wilson, R. (2009). An examination of corporate tax shelter participants. The Accounting Review, 84(3), 969–999.

Acknowledgements

We thank Paul Fischer (editor), Kathleen Andries, T. J. Atwood, Michael Donohoe, Scott Dyreng, Jonathan Lewellen, Tom Omer, George Plesko, Leslie Robinson, Steve Utke, University of Texas Tax Readings Group, our anonymous reviewers, and participants at the University of Illinois, University of Illinois at Chicago, Tilburg University, University of Memphis, and Virginia Tech accounting workshops, the American Accounting Association Annual Meeting, and the American Taxation Association Midyear Meeting for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Henry, E., Sansing, R. Corporate tax avoidance: data truncation and loss firms. Rev Account Stud 23, 1042–1070 (2018). https://doi.org/10.1007/s11142-018-9448-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-018-9448-0