Abstract

This paper examines the relationship between intertemporal preferences, financial literacy components, and gender. Intertemporal choices are the type of decisions whose outcomes will only be visible with the passage of time and affect a large part of everyday decisions. The contribution of this work is twofold: on the one hand, to study intertemporal preferences and the performance of the discount function with respect to gender and the three financial literacy components, i.e. financial knowledge, financial behavior, and financial attitude; on the other hand, the study proposes an application of Choquet discrete integral as an aggregation operator to study the characteristics of the classes considered. This approach provides clear and consistent results, and the Choquet integral allows a more complete description of the sample. The results are immediately applicable to customized behavioral finance. In fact, the role of gender in the promotion of optimal financial instruments is emphasized, considering behavioral factors such as risk aversion and impatience, and the importance of all financial literacy components for informed choices. In general, this research promotes the interplay between qualitative and quantitative analysis for effective customer profiling.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Intertemporal choices refer to those decisions for which an assessment of future benefits and costs, as opposed to immediate ones, is required. This implies that the decision-maker must find a trade-off between the present and the future, which is indeterminate. Therefore, the decision-making context in which intertemporal choices are developed is characterized by uncertainty. Every day, individuals face such decisions in areas fundamental to their condition, such as with respect to savings, health, and possible investment (Chabris et al. 2010).

The description of intertemporal preferences is based on comparing asset values over different periods. The concept of discounting is fundamental to comparing the future and present value of an asset. The reference mathematical model for calculating the intertemporal utility of a prospect is the discounted utility model, formalized by Samuelson (1937). In practice, given the prospect \(\left({x}_{1},{t}_{1};\dots ;{x}_{n},{t}_{n}\right)\), the intertemporal utility is obtained by multiplying the present utility of the asset \({x}_{i}\) by the value \(f ({t}_{i})\) of the discount function. The latter is rich in behavioral interpretations, as it quantifies how much future benefits are discounted by the decision maker. The key elements to describe how decision maker's preferences develop are the discount rate and the degree of impatience, defined respectively as \(\rho \left(t\right)=-\frac{{f}{\prime}\left(t\right)}{f\left(t\right)}\) and \({I}_{[{t}_{i},{t}_{j]}}=1-\frac{f ({t}_{j})}{f ({t}_{i})}\) (Cruz Rambaud and Muñoz Torrecillas 2016). Traditional theory assumes preferences represented by an exponential discount function, whereby the discount rate and the degree of impatience are constant over time (Prelec, 2004). However, decision-makers may assume attitudes that deviate from these assumptions (Green and Myerson 1996; Dasgupta and Maskin 2005; Lu and Yang 2015), manifesting preferences that are not in line with the exponential model, and preferences that do not match the exponential model have been formalized into anomalies of the discounted utility model (Loewenstein and Thaler 1989).

In this context, discount functions of a hyperbolic nature are closer to empirical evidence (Green and Myerson, 1996), and it is precisely to understand the mechanisms underlying deviations from traditional rationality that research on intertemporal choice has turned.

In fact, thanks to the development of behavioral finance (Barberis and Thaler 2003), which applies the studies of cognitive psychology to the financial decision-making process, it has been possible to understand that, during choice, the decision-maker makes systematic cognitive errors that can define less than optimal choices (Kahneman and Tversky 2013). Investigations into the relationship between intertemporal preferences and psychological components of the decision maker have proven that a decreasing degree of impatience over time underlies non-stationary preferences (Prelec, 2004), and that decreasing impatience quantifies the impact of behavioral biases on intertemporal choices (Ventre et al. 2023a, b, c). Furthermore, how individuals perceive time is also crucial for the development of preferences (Zauberman et al. 2009), and the difference between the expected preferences from the exponential model and the empirical ones defines how averse the decision maker is to uncertainty in future outcomes (Ventre and Martino 2022). These measures could be used in personalized behavioral finance to identify a relationship between decision-making styles, intertemporal preferences and personalized strategies (Martino and Ventre 2023). Beyond psychological factors, an element influencing the ability to make informed decisions is financial literacy (Huston 2010). In fact, understanding the concepts of discounting and interest is crucial for evaluating consumption, saving and investment. The same applies to the ability to plan and access financial instruments. The literature has shown many links between the quality of intertemporal decisions and the level of financial literacy, which is defined as the sum of knowledge, behavioral and attitudinal skills (Ventre et al. 2024).

This paper proposes further investigating the relationship between intertemporal choices and financial literacy, through an original approach involving Choquet's discrete integral (Choquet 1954) to aggregate the data. The reason for choosing to use this operator is that it can better represent the interdependencies between variables, offering greater flexibility (Beliakov et al. 2007). In fact, this operator is especially used to handle uncertainty and to express group preferences (Zapletal et al. 2023; Pomeret-Coquot et al. 2023). From an operational point of view, the reason why it is so versatile lies in its definition based on fuzzy sets. In the present work, therefore, it will be shown how Choquet's integrals, obtained with the measures of decreasing impatience (Prelec, 2004) in different intertemporal perspectives and with the measure of uncertainty aversion of the discount function (Ventre and Martino 2022), are significantly different when considering the classes of financial literacy and gender. By constructing the discount functions and histograms through the aggregated values with Choquet, it will be possible to visualize these differences graphically. Furthermore, to emphasize the effect of aggregation on the data set concerning the context under consideration, the graphs obtained with Choquet and those obtained with the statistical median will be compared.

Thus, the contribution of this work to the literature is twofold. In fact, while on the one hand, the relationship between the financial literacy components and intertemporal preferences will be enriched, on the other hand, an alternative to the simple interpolation of the median used in Ventre et al.(2023a, b, c) will be presented. The discussion will emphasize the ability of the Choquet integral to capture the synergies of the data and offer a more realistic and expressive representation of the category in which the values are aggregated.

2 Methods and materials

2.1 Measures for intertemporal preferences

An intertemporal prospect is the n-tuple \(({x}_{1}, {t}_{1};\dots ; \,{x}_{n}, {t}_{n})\) where \({x}_{i}\in {\mathbb{R}}\) are the alternatives available at the time \({t}_{i} \in {\mathbb{R}}^{+}\). If the decision-maker accepts the prospect, the outcome \({x}_{i}\) will be received at instant \({t}_{i}\). The Discounted Utility Model states that \(U\left({x}_{1}, {t}_{1};\dots ; {x}_{n}, {t}_{n}\right)= \sum_{i=1}^{n}U({x}_{i})f({t}_{i})\) where \(U({x}_{i})\) is the cardinal utility of \({x}_{i}\) and \(f:{\mathbb{R}}^{+}\to {\mathbb{R}}^{+}\) is the discount function such that \(f\left(0\right)=1, f\left(t\right)\) monotonous decreasing and \(\underset{t\to +\infty }{\text{lim}}f\left(t\right)=0\). The discount function defines a preference relation of total order and vice versa (Cruz Rambaud and Muñoz Torrecillas 2016), where the relation is such that, considering \({(x}_{1},{t}_{1};\dots ;{x}_{n},{t}_{n})\) and \({(y}_{1},{s}_{1};\dots ;{y}_{n},{s}_{n})\) two different prospects then:

-

\({(x}_{1},{t}_{1};\dots ;{x}_{n},{t}_{n}){>}_{f}{(y}_{1},{s}_{1};\dots ;{y}_{m},{s}_{m})\) ⟺ \(\sum_{i=0}^{n}U({x}_{i)}f\left({t}_{i}\right)>\sum_{i=0}^{m}{U(y}_{i})f\left({s}_{i}\right)\)⟺ the decision-making prefers to select the prospect \({(x}_{1},{t}_{1};\dots ;{x}_{n},{t}_{n})\);

-

\({(x}_{1},{t}_{1};\dots ;{x}_{n},{t}_{n}){\sim }_{f}{(y}_{1},{s}_{1};\dots ;{y}_{m},{s}_{m})\) ⟺ \(\sum_{i=0}^{n}U({x}_{i)}f\left({t}_{i}\right)=\sum_{i=0}^{m}{U(y}_{i})f\left({s}_{i}\right)\) ⟺ the decision-making is indifferent with respect to the two prospects.

The way the discount function decreases over time is captured by the discount rate \(\rho \left(t\right)=-\frac{{f}{\prime}\left(t\right)}{f\left(t\right)}\) (Read 2008), while impatience, defined in \({[t}_{i,}{t}_{j}]\) by the ratio \(1-\frac{f\left({t}_{j}\right)}{f\left({t}_{i}\right)}\), represents how much the decision maker is willing to lose in order to receive a unit of money immediately.

The main difference between exponential and hyperbolic models is that in hyperbolic models the discount rate and the degree of impatience decrease over time, generating preferences that do not meet normative predictions (Prelec, 2004). The term anomalies refers to those preferences that.

cannot be rationalized from a modelling point of view (Loewenstein and Prelec 1992; Loewenstein and Thaler 1989). Among the anomalies of the discounted utility model, this paper turns to the investigation of the following:

-

Delay effect (Loewenstein and Thaler 1989) for which, considering \(s<t\), and \(0<x < y\) then \(\left(x, s\right)\sim \left(y, t\right)\Rightarrow \left(x, s+h\right)< \left(y, t+h\right)\);

-

Interval effect (Read 2004) for which, \({|d}_{2}-{d}_{1}\left|+{|d}_{3}-{d}_{2}\right|\ne |{d}_{3}-{d}_{1}|\)

-

Magnitude effect (Benzion et al., 1989; Noor 2011) for which, considering \(s<t\), \(x < y\), \(x < X < Y\) then \(\frac{U\left(y\right)}{U\left(x\right)} = \frac{U\left(Y\right)}{U\left(X\right)}\left(x,s\right)\sim \left(y, t\right)\Rightarrow \left(X,s\right)\prec \left(Y, t\right)\)

-

Sign effect (Loewenstein and Thaler 1989; Cruz Rambaud and Sánchez Pérez 2018) for which, considering \(s<t\), \(0<x < y\) then \(\left(x,s\right)\sim \left(y, t\right)\Rightarrow (-x,s) \succ (-y, t)\)

The description of the anomalies in terms of a decrease in the degree of impatience (Ventre et al. 2023a, b, c b) made it possible to quantify, using the hyperbolic factor (Rohde 2010), the relationship between the behavioral biases of individuals and their decision-making process, a concept fundamental to personalized behavioral finance. Indeed, psychology has investigated how distinct behaviors influence decision-making styles, and previous studies have explored this issue with respect to the context of intertemporal choices (Ventre et al. 2023c).

Another key factor in the development of intertemporal preferences is how individuals perceive time. Indeed, although the objective nature of chronological time is recognized, subjective time reflects the individual's perception of the passage of time (Zauberman et al. 2009). The perception of time can vary from individual to individual (Zimbardo and Boyd 2008) and is influenced by the experimental context due to the characteristics of the stimuli and how they interact with the emotional sphere. This perception strongly influences the assessment of intertemporal perspectives, as it modulates emotional factors and uncertainty about the future. The description of the mathematical properties of discount functions by means of a temporal transformation made it possible to define a measure quantifying uncertainty aversion. This measure is consistent with the idea that uncertainty aversion can vary over time: the degree of uncertainty aversion increases over time if the decision maker is able to perceive the indeterminacy of the future. It follows that, from a certain point onwards, the aversion decreases until it disappears (Ventre and Martino 2022). Aversion to future uncertainty can influence financial, behavioral, and life decisions, and is a measure that highlights the crucial role of emotions and perceptions in shaping future choices.

2.2 Financial literacy and gender gap in financial choices

Financial literacy includes the knowledge and skills needed to make informed and conscious decisions. In general, financial literacy can be understood as the sum of financial knowledge (FK), financial behavior (FB), and financial attitudes (FA) (D’Alessio et al., 2020). Specifically, financial knowledge refers to the understanding of basic financial concepts, including savings, interest, and debt. On the other hand, financial behaviour refers to how people relate to financial choices, and, more specifically, how they translate their financial knowledge into action. Finally, the financial attitude is the set of beliefs and ideas associated with personal finances, long- and short-term planning, and the distribution of consumption. In the light of what has just been said, the three components are, therefore essential to the definition of financial education. For example, a decision-maker capable of understanding financial instruments but unable to control impulses might still make sub-optimal choices.

Recent studies have verified how the way individual levels of FK, FB, and FA interact has a decisive impact on the evaluation of intertemporal prospects (Ventre et al. 2024). Regarding intertemporal choices, the degree of FL positively influences the evaluation of alternatives distributed over time. In fact, some studies have verified an association between a higher degree of patience and a higher level of financial education. Moreover, as the quality of the decision-making process also extends to other areas, in addition to the purely financial ones, increased financial literacy enables more effective decisions in different contexts. However, precisely because decisions and decision-making style also depend on factors beyond knowledge, it is essential to promote all financial literacy components. In this regard, the gender discourse has generated much interest in understanding how gender differences are reflected in financial decisions. For example, Chen and Volpe (2002) proved that women are generally uninterested in financial knowledge and that social stereotypes may influence their lower inclination toward financial studies (Hawash et al. 2020). These differences negatively affect the status of women, as they are more exposed to financial problems. However, it is not necessary to understand these differences with a negative connotation; rather, it is necessary to recognize them and investigate possible causes to promote social and individual growth. From a practical point of view, investigating these differences is not possible if one does not also consider intra-gender differences, thus including factors of a subjective nature. The inclusion of subjective factors and behavioural factors, in addition to knowledge, highlights that each gender has strengths and weaknesses that can be acted on, underlining the need for diversity awareness. For example, with respect to the perception of risk, the relationship between the financial literacy components and the gender difference is apparent. In fact, while individuals with a higher degree of financial knowledge are able to make more accurate assessments, individuals with a good level of financial behavior are able to act more thoughtfully with respect to risky situations.

Graham et al. (2002) showed that men adopt a less conservative strategy in retirement planning than women, while in the context of financial risk, single women show a lower risk appetite than single men (Sunden et al., 1998; Finucane et al. 2013). In this regard, if one views ‘risk as a feeling’ (Loewenstein et al. 2001), it is natural to imagine that, since women tend to perceive emotions more intensely than men, there is a more considered attention to risk, while a lack of planning could be associated with a lack of competence. With respect to the emotional profile, gender differences relate not only to the intensity of emotions but also to the type of emotions experienced in the same situation (Grossman and Wood 1993) and as different emotions lead to divergent attitudes (Lerner et al. 2003) thus explaining the different ways of approaching risk. Another significant element of gender inequality is the overconfidence bias: although both sexes may exhibit this tendency, men tend to be more self-confident than women (Lundeberg 1994). Therefore, men's greater propensity to show overconfidence makes them more confident of their capabilities, fueling a riskier attitude, especially in competitive contexts (Niederle and Vesterlund 2007).

This discussion underlines why the present work contextualizes the description of discounting functions with respect to all financial literacy components and gender to prove that gender differences do not stem from differences in decision-making ability, but rather from different motivations driving the behavior of the two genders.

2.3 Choquet discrete integral

The Choquet discrete integral (Choquet 1954) is an aggregation operator that is used to synthesize a set of input data into single output data. Formally, an aggregation function is a function of \(n>1\) arguments with \(n\in {\mathbb{N}}\), such that \(f:{[\text{0,1}]}^{n}\to [\text{0,1}]\) for which \(f\left(\text{0,0},\dots ,0\right)=0\), \(f\left(\text{1,1},\dots ,1\right)=1\) and \(\forall x,y\in {[\text{0,1}]}^{n}\), \({\varvec{x}}\le {\varvec{y}}\) implies \(f({\varvec{x}})\le f({\varvec{y}})\). The Choquet discrete integral, characterized by its great flexibility and applicable to many fields of research, is based on the concept of discrete fuzzy mesaure: given \(N=\{1,\dots ,n\}\), a discrete fuzzy measure is a function \(v:{2}^{N}\to [\text{0,1}]\) which is monotonic (\(v\left(A\right)\le v\left(B\right)) if A\subset B,\) \(v\left(\varnothing \right)=0\) and \(v(N)=1\). Considering \(v\) a fuzzy measure, the discrete Choquet integral with respect to \(v\) is given as (Beliakov et al. 2007):

where the input vector \({\varvec{x}}\) is sorted by non-decreasing permutation \({{\varvec{x}}}_{\uparrow }=({x}_{\left(1\right)},\dots , {x}_{\left(n\right)})\) and \({H}_{i}=\{\left(i\right),\dots ,\left(n\right)\}\) is the subset of indices on the \(n-i+1\) largest components of \(x\) (Beliakov et al. 2007).

In the present paper, the Choquet integral is used to aggregate the values of the hyperbolic factors, uncertainty aversion, and discount function for each category considered. This operator, in fact, allows non-linear relationships between variables to be included in the output data, enabling a more accurate representation of the data than other techniques. Dealing more effectively with uncertainty in the data and the interrelationships among the variables can capture the interdependencies among the variables, and thus provide a more complete and more precise picture. The results produced, because they more fully reflect the relationships between the data, result in a more sophisticated and accurate approach to data aggregation, which can lead to more characterizing input of individual categories and better results in analysis. For the calculation of the Choquet integral, the following fuzzy measure was set (Beliakov et al. 2007):

Specifically, the present fuzzy function allows to define a measure that does not depend on the order of the input data, but on their relative order and the cardinality of the set.

3 Experimental phase

3.1 Experimental design

The questionnaire constructed for the experimental phase consists of three parts, each aimed at calculating a specific measure used for the analysis. The questionnaire was implemented in an online application to allow greater dissemination and sample variation. In fact, once the coding was finished, the link was spread online, and the answers were collected in a database and then converted to an Excel file. The questionnaires are completely anonymous, and the only information requested from the user is age and gender. The first questionnaire was designed to calculate the degree of financial literacy (D’Alessio et al., 2020), i.e. the three components FK, FB, and FA, with a total of 24 questions: 9 for financial knowledge, 12 for financial behavior, and the remainder for financial attitudes. The response mode of the first questionnaire is varied, with some questions being open-ended, others multiple-choice, and others where only one answer is possible. Questions are given a score of 1 if the answer is correct (in some questions more than one answer can be correct), and a score of 0.97 is deducted if the respondent selects ‘I do not know the answer’ and 0.99 if the answer ‘I prefer not to answer’ is selected.

The second questionnaire, on the other hand, aims to derive for everyone the values of the discount function to be interpolated (Ventre and Martino, 2023); starting from a figure of 100, one is asked to construct indifference pairs of intertemporal perspectives, as shown in Table 1.

To simulate a feeling of haste and agitation, a timer with a 20-s countdown was introduced and visible at the bottom of the questionnaire, at the end of which a warning urged the user to respond ‘immediately’, without further thought. The variables associated with the user also included a count of the number of times the time expired, so submissions with more than 10 deadlines were considered invalid, information that was shared with the participants. The values obtained for the various time instants are interpolated and compared using exponential interpolation. For each individual, the calculation of the degree of uncertainty aversion is provided by the maximum absolute value of the point difference of the discount functions and the respective values interpolated with the exponential function.

The third part of the questionnaire aims to calculate the degree of decrease in impatience through the hyperbolic factor (Rohde 2010). Here again, users were able to construct indifference pairs for which, by varying the time instants and varying the figures considered, it was possible to derive hyperbolic factors measuring how the individual's behavior varies with respect to the anomalies mentioned in Sect. 2.1, shown in Table 2.

3.2 Results

Data collection lasted for about two months, during which the link to the experiment was disseminated through social media. The number of respondents for which the experiment could be considered valid is 195, whose characteristics are shown in Table 3.

For each candidate, FK, FB, and FA scores were calculated and then the sample was divided into the three categories, into which individuals fell if they performed best in FK, FB, and FA, respectively. The results by gender are represented in Fig. 1.

Looking at Fig. 1, it emerges that while men perform almost equally well in both FK and FA, women perform especially well in FA, highlighting an important gap in levels of financial knowledge. The 21.43% of women performing more in FK confirms the hypothesis that this gender difference should also be addressed by including consideration of the intra-gender difference. However, compared to the level of FB, the overall picture shows that this is the least predominant component, indicating that active and meaningful financial behavior belongs to only 12.31% of the distribution. These observations emphasize the need for action on all aspects of financial literacy in order to build knowledge that can be transformed into action.

To highlight the role and impact that Choquet's integral has on the evaluation of the data, the sample will be analyzed both through the median and through the aggregation.

Table 4. Median value for the classes considered With the median values, it emerges that the FB class has the generally highest values of both the degree of uncertainty aversion and the hyperbolic factors. From this simple observation, it follows that precisely the median may fail to capture the interactions of the data distribution. In fact, an individual who performs better in the behavioral aspect of financial literacy is also supposed to be more prone to a moderate evaluation of alternatives. For example, among the questions used for FB, the individual is asked to indicate on a scale of 1 to 5 how well the statement “I set long-term financial goals and strive to achieve them” is represented. Or, in the same vein, “I pay my monthly rent, debt repayments, mortgage, utility bills and other recurring expenses on time”. While the latter could justify the high value of impulsivity in the sign effect, the former is incongruent with the high value of the delay effect and the interval effect.

Using an algorithm in Python, the Choquet integral values were calculated for each category, shown in Table 5.

In this case, the values obtained are more heterogeneous, and the aggregation makes it possible to discuss the propensity for the various anomalies in the discounted utility model. In general, the Choquet integral integrates useful information to capture more nuances of the classes considered. This is reflected in the way in which the values are distributed: whereas previously the values of the FB class differed significantly from the other classes on the evaluation of anomalies, with the Choquet integral there is an attenuation of the differences; on the contrary, whereas with the median the genders showed small differences, and for some values the medians are even almost equal, with the Choquet integral the differences in the description are amplified.

Figures 2, 3, 4 compare the hyperbolic factors and the measure of aversion to uncertainty obtained for each category with both the Choquet integral and the median.

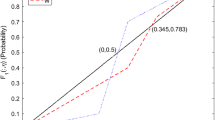

To directly visualize the discount function of the five classes under consideration, the median and the values obtained by Choquet's aggregation were interpolated. In practice, for each class, the values of \(f(0)\) were aggregated, then \(f(2)\) and so on.

Again, the discount function obtained with the Choquet integral is more appropriate for describing the preferences of the classes. Figure 4 represents the discount functions for the genders. It emerges that the discount applied by women is higher, consistent with what one could imagine with respect to the degree of uncertainty aversion (Fig. 5).

Finally, Fig. 6 shows the discount functions for the individuals who performed in FK, FB, and FA, respectively.

The graphical representation shows that all classes exhibit a high discount rate, i.e. a rapid reduction in perceived value over time. Participants tend to strongly prefer immediate rewards over future rewards, and in particular, the FA and FB classes show an even more pronounced reduction in perceived value. It is interesting to observe that uncertainty aversion does not follow the expected decrease: in Tables 5 and 4, the value of uncertainty aversion for the FB class is higher than that for the FA class, although in the graphical representation (both with median interpolation and Choquet integration), the curve of the FB class is above that of the FA class. This is an interesting result as it would indicate that the two measures, the degree of decreasing impatience and uncertainty aversion, although related remain two distinct measures.

4 Discussion

This paper discusses an original approach to two important aspects of the study of intertemporal choice. First, a direct comparison is made between the intertemporal discount, the anomalies of the discounted utility model, gender and the FK, FB and FA classes, the sum of which more generally defines the degree of Financial Literacy. However, in this paper, individual components are considered to emphasize that all three variables have a different impact on the assessment of intertemporal choices. The classes of the distribution were obtained in terms of performance on the questionnaire, i.e. who scored (as a proportion of the total score) the best on the three components. In this way, it was possible to verify an important difference in the distribution between FK and FA with respect to gender: women have higher scores in FA, whereas men in FK. This result suggests that to increase the sample's levels of financial literacy, it is essential to carry out an assessment in which we examine which aspect needs to be improved. In fact, Sect. 2.2 draws attention to the possible causes behind males' greater susceptibility to financial knowledge and women's greater caution. With respect to FB grade, on the other hand, it is not particularly distributed between the two genders, precisely because it reflects the individual's behavioral predisposition but is the component on which there is a lower frequency of better performance. Contextualizing the result to the sample, the above indicates that the impact of interventions aimed at financial behavior education should not be neglected. The second original aspect dealt with in this paper addresses the way in which data are studied. Considering the high variability of the data and the context they represent; the description of the sample was conducted both through the median value and using Choquet's discrete integral. Both evaluations are significant for the sample, as could be verified with a chi-square analysis in Tables 4 and 5. To verify whether the Choquet integral values and those of the median define a significant representation of the classes with respect to the variables considered, the chi-square analysis was conducted in Tables 6, 7, 8, 9, 10, 11.

Compared to the previous tables, it should be noted that the row containing the weights of the classes in the distribution has been added, which is necessary to put the values into context with respect to the sample under investigation. In the case of both the median and Choquet, the tables analyzing the relationship between FK, FB, and FA with respect to intertemporal preferences are significant. On the other hand, the comparison with gender is not significant when decontextualized from the financial literacy classes. This observation could be further confirmation of the idea that the investigation of inter and intra-gender difference must necessarily turn to a multilevel analysis. With respect to the results obtained, it was possible to observe significant differences between the classes under investigation and intertemporal preferences with Choquet aggregation. First, with respect to uncertainty aversion, it emerges that women have a higher degree, consistent with the fact that among the financial literacy classes, the FK class (in which the majority of men are distributed) is the one with the lowest degree of uncertainty aversion. With respect to the anomalies of the discounted utility model, it is interesting to observe that the FK class excels with respect to the lag effect and the interval effect, indicating that in these contexts, despite knowing the basics of finance, one might underestimate the difficulty of choice, acting impulsively. On the other hand, with respect to the magnitude effect, a contrasting result emerges with the pattern of the discount functions of FB and FA as the lower value of the hyperbolic factor relates to the FA class, while the higher value relates to FB. Once again, the idea that all aspects of financial literacy need to be cultivated to reduce the impact that decreasing impatience has on intertemporal preferences is confirmed. Another result, which is highly consistent with the financial literacy classes, is the sign effect. In fact, those whose financial behavior is higher in proportion to the other components have a very attentive attitude to payments, so they suffer more than earnings of the same magnitude. On the contrary, the FK class, by virtue of its knowledge, does not vary its attitude with respect to the sign of the outcome, but the expectation is experienced and perceived almost in the same way. Finally, with respect to gender, the evaluation of hyperbolic factors indicates that men are more impulsive in their intertemporal preferences despite being less uncertainty-averse than women.

5 Conclusions

The present work investigated the relationship between intertemporal preferences, financial literacy components, and gender. The importance of the topic lies in the fact that intertemporal choices are, by definition, decisions whose outcomes emerge over time and thus affect most of the choices individuals make daily. Understanding the characteristics of the discount function and the pattern of preferences is crucial for investigating financial decision-making.

The contribution of the present study is twofold. In fact, while on the one hand the characteristics of FL classes and gender in the context of intertemporal choices were discussed, on the other hand a new strategy for investigating the discount function and sample values was proposed through the discrete Choquet integral. This approach yielded quantitatively clear and qualitatively class-consistent results.

The immediate applicability of the study results addresses the field of personalized behavioral finance. Indeed, the introduction of instruments to protect investors, such as the European Regulation Markets in Financial Instrument Directive II (MiFID II), which aims to regulate European financial markets and support product transparency and investor protection, emphasizes the need to consider the client profile and the client-advisor asymmetry.

Therefore, this paper has addressed these two aspects. Indeed, with respect to gender, this characteristic is indispensable for the promotion of the best instruments and solutions, with respect also to several behavioral factors such as risk aversion and impatience. Furthermore, this study highlighted how gender differences can be seen as a phenomenon to be understood and addressed by exploiting strengths and weaknesses, taking advantage of them rather than diminishing them.

With respect to the degree of financial literacy, on the other hand, its components play an important role: individuals with a good degree of financial knowledge can understand and analyze risks and opportunities, reducing the risk of deceptive practices, even without the support of advisors; individuals with a good degree of financial behavior tend to control their instincts and make less impulsive choices, oriented towards savings and management behavior; individuals with a good degree of financial attitude have a conscious and prudent attitude. Indeed, the analysis of the results shows that all aspects of financial literacy need to be addressed. In general, the interplay between qualitative and quantitative analysis can produce useful results for customer profiling models that include the description of risk through subjective probability, the relationship between risk context and uncertainty, and the biological and cultural factors that influence financial decision-making (Martino and Ventre 2023).

References

Barberis, N., Thaler, R.: A survey of behavioral finance. Handbook Econ. Financ. 1, 1053–1128 (2003)

Beliakov, G., Pradera, A., Calvo, T.: Aggregation functions: a guide for practitioners, vol. 221. Springer, Heidelberg (2007)

Chabris, C.F., Laibson, D.I., Schuldt, J.P.: Intertemporal choice. In: Behavioural and experimental economics, pp. 168–177. Palgrave Macmillan UK, London (2010)

Chen, H., Volpe, R.P.: Gender differences in personal financial literacy among college students. Financ. Serv. Rev. 11(3), 289–307 (2002)

Choquet, G. (1954). Theory of capacities. In Annales de l'institut Fourier (Vol. 5, pp. 131–295).

Cruz Rambaud, S., Muñoz Torrecillas, M.J.: Measuring impatience in intertemporal choice. PLoS ONE 11(2), e0149256 (2016)

Cruz Rambaud, S., Sánchez Pérez, A.M.: The magnitude and “peanuts” effects: Searching implications. Front. Appl. Math. Stat. 4, 36 (2018)

D'Alessio, G., De Bonis, R., Neri, A., & Rampazzi, C. (2020). L’alfabetizzazione finanziaria degli italiani: i risultati dell’indagine della Banca d’Italia del 2020 [Italian People’s Financial Literacy: The Results of the Bank of Italy’s 2020 Survey]. Bank of Italy Occasional Paper, (588)

Dasgupta, P., Maskin, E.: Uncertainty and hyperbolic discounting. Am. Econ. Rev. 95(4), 1290–1299 (2005)

Finucane, M. L., Slovic, P., Mertz, C. K., Flynn, J., & Satterfield, T. (2013). Gender, race and perceived risk: The ‘White-Male'Effect. In The Feeling of Risk (pp. 125–139). Routledge.

Graham, J.F., Stendardi, E.J., Jr., Myers, J.K., Graham, M.J.: Gender differences in investment strategies: an information processing perspective. Int. J. Bank Market. 20(1), 17–26 (2002)

Green, L., Myerson, J.: Exponential versus hyperbolic discounting of delayed outcomes: risk and waiting time. Am. Zool. 36(4), 496–505 (1996)

Grossman, M., Wood, W.: Sex differences in intensity of emotional experience: a social role interpretation. J. Pers. Soc. Psychol. 65(5), 1010 (1993)

Hawash, R., Stephen, S. A., & McCormick, M. (2020). Is finance for me? Gender differences in choice of finance as a college major. Journal of Higher Education Theory and Practice, 20(8).

Huston, S.J.: Measuring financial literacy. J. Consum. Aff. 44(2), 296–316 (2010)

Kahneman, D., & Tversky, A. (2013). Prospect theory: An analysis of decision under risk. In Handbook of the fundamentals of financial decision making: Part I (pp. 99–127).

Lerner, J.S., Gonzalez, R.M., Small, D.A., Fischhoff, B.: Effects of fear and anger on perceived risks of terrorism: a national field experiment. Psychol. Sci. 14(2), 144–150 (2003)

Loewenstein, G., Prelec, D.: Anomalies in intertemporal choice: evidence and an interpretation. Q. J. Econ. 107(2), 573–597 (1992)

Loewenstein, G., Thaler, R.H.: Anomalies: intertemporal choice. J. Econ. Perspect. 3(4), 181–193 (1989)

Loewenstein, G.F., Weber, E.U., Hsee, C.K., Welch, N.: Risk as feelings. Psychol. Bull. 127(2), 267 (2001)

Lu, Y., & Yang, C. (2015). Measuring impatience: experiments of intertemporal choices. Education Management and Management Science, 311–314.

Lundeberg, M.A., Fox, P.W., Punćcohaŕ, J.: Highly confident but wrong: gender differences and similarities in confidence judgments. J. Educ. Psychol. 86(1), 114 (1994)

Martino, R., Ventre, V.: An analytic network process to support financial decision-making in the context of behavioural finance. Mathematics 11(18), 3994 (2023)

Niederle, M., Vesterlund, L.: Do women shy away from competition? Do men compete too much? Q. J. Econ. 122(3), 1067–1101 (2007)

Noor, J.: Intertemporal choice and the magnitude effect. Games Econom. Behav. 72, 255–270 (2011)

Pomeret-Coquot, P., Fargier, H., & Martin-Dorel, É. (2023). Bel-Games: a formal theory of games of incomplete information based on belief functions in the Coq proof assistant.

Prelec, D.: Decreasing impatience: a criterion for Non‐stationary time preference and “hyperbolic” discounting. Scand. J. Econ. 106(3), 511-532 (2004)

Read, D.: Intertemporal choice. In: Koehler, D.J., Harvey, N. (eds.) Blackwell handbook of judgment and decision making, pp. 424–443. Wiley, NY (2004)

Read, D.: Blackwell handbook of judgment and decision making; John Wiley & Sons: Hoboken. NJ, USA (2008)

Rohde, K.I.: The hyperbolic factor: a measure of time inconsistency. J. Risk Uncertain. 41, 125–140 (2010)

Samuelson, P.A.: A note on measurement of utility. Rev. Econ. Stud. 4(2), 155–161 (1937)

Sunden, A.E., Surette, B.J.: Gender differences in the allocation of assets in retirement savings plans. Am. Econ. Rev. 88(2), 207–211 (1998)

Ventre, V., Martino, R.: Quantification of aversion to uncertainty in intertemporal choice through subjective perception of time. Mathematics 10(22), 4315 (2022)

Ventre, V., Martino, R., Maturo, F.: Subjective perception of time and decision inconsistency in interval effect. Qual. Quant. 57(5), 4855–4880 (2023a)

Ventre, V., Cruz Rambaud, S., Martino, R., Maturo, F.: An analysis of intertemporal inconsistency through the hyperbolic factor. Qual. Quant. 57(1), 819–846 (2023b)

Ventre, V., Cruz Rambaud, S. Martino, R., Maturo, F.: A behavioral approach to inconsistencies in intertemporal choices with the Analytic Hierarchy Process methodology. Annal. Financ. 19(2), 233–264 (2023c)

Ventre, V., Martino, R., Muñoz Torrecillas, M. J.: Relationship between an inconsistent degree of financial literacy and inconsistent decision-making in intertemporal choices. Heliyon 10(5), e27253 (2024)

Zapletal, F., Hudec, M., Švaňa, M., Němec, R.: Three-level model for opinion aggregation under hesitance. Soft. Comput. 27(10), 6653–6669 (2023)

Zauberman, G., Kim, B.K., Malkoc, S.A., Bettman, J.R.: Discounting time and time discounting: subjective time perception and intertemporal preferences. J. Mark. Res. 46(4), 543–556 (2009)

Zimbardo, P., & Boyd, J. (2008). The time paradox: The new psychology of time that will change your life. Simon and Schuster.

Acknowledgements

The authors are very grateful for the comments and suggestions provided by two anonymous referees. MJMT acknowledges the financial support from University of Almería Research and Transfer Plan, funded by Junta de Andalucía-FEDER 2021-2027. Program: 54.A. (Research Project: P_LANZ_2023/004).

Funding

Universidad de Almería,P_LANZ_2023/004,Muñoz Torrecillas María José

Author information

Authors and Affiliations

Contributions

R.M.: Conceptualization, Data collection, Methodology, Writing- Reviewing and Editing. M.J.M.T.: Conceptualization, Writing- Reviewing and Editing, Funding acquisition. V.V.: Conceptualization, Data curation, Methodology, Writing- Reviewing and Editing.

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose. Co-author of this article confirm being co-Guest Editor for the special issue. They confirm no conflict of interest related to this submission, and were excluded from the peer review process to ensure that the evaluation of the article is completely objective.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Martino, R., Torrecillas, M.J.M. & Ventre, V. Discrete Choquet integral aggregation applied to intertemporal choices: financial literacy components and gender in anomalies and uncertainty aversion. Qual Quant (2024). https://doi.org/10.1007/s11135-024-01957-z

Accepted:

Published:

DOI: https://doi.org/10.1007/s11135-024-01957-z