Abstract

In this paper, we examine linear and nonlinear co-movements that appear in the real exchange rates of a group of 28 developed and developing countries. The matrix of Pearson correlation and Phase Synchronous coefficients have been used in order to construct a topology and hierarchy of countries by using the Minimum Spanning Tree (MST). In addition, the MST cost and global correlation coefficients have been calculated to observe the co-movements’ dynamics throughout the time sample. By comparing Pearson and Phase Synchronous information, a new methodology is emphasized; one that can uncover meaningful information pertaining to the contagion economic issue and, more generally, the debate surrounding interdependence and/or contagion in financial time series. Our results suggest some evidence of contagion in the Asian currency crises; however, this contagion is driven by previous and stable interdependence.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The increase in global integration of capital markets has produced important volatility and crisis episodes in stock and exchange rate markets since the beginning of the nineties. The European Monetary System (EMS) speculative attacks in 1992–1993, the Mexican crises in December 1994, the collapse of East Asian currencies in 1997 and 1998, the Brazilian currency devaluation in January 1999, and the Argentine currency devaluation and external debt default in January 2002 are the most relevant currency crisis episodes, but there also exist a great deal more (see for example Perez 2005; Kaminsky et al. 1998 for a complete list of currency crisis episodes). It is assumed that in some cases, crises have spread from one country to another producing what Rigobon (2001) denominates contagion or shift contagion. The assessment of contagion effects has critical implications for the management of the crisis, portfolio investment behaviour, crises’ early warning systems, and the configuration of the international financial architecture.

Perhaps the most accepted definition of contagion is that given by King and Wadhwani (1990) and Forbes and Rigobon (2002), based on correlation coefficients. Contagion is identified as an important change (increase) in cross-market linkages after a shock has affected either a single country or group of countries. Another strand in economics literature has identified contagion as an increase in the probability of a crisis after one has occurred elsewhere (for example, Eichengreen et al. 1996). Yet even to this day, the debate in economic contagion literature is whether linkages between countries grew stronger during these crises or whether they were already strong before the crises took place. This question has been labeled contagion (sometimes called shift contagion) or interdependence debate, respectively. The critical distinction between contagion and interdependence is related to a structural break in the transmission mechanism during the crises that is presented in the contagion effects. As Forbes and Rigobon (2002) have pointed out, once the cross-market correlation coefficients are corrected for the bias produced by the existence of heteroskedasticity (this phenomenon in itself being caused by an increase in volatility during the crisis), no contagion is to be found, only interdependence.

A vast body of empirical literature has been accumulated regarding this issue; however, no satisfactory procedure has been developed to answer this very question Rigobon (2003). Some works have suggested the existence of contagion by using different methodologies and data sets (for example, see Hatemi and Hacker 2005; Gravelle et al. 2006; Arestis et al. 2005; Dungey et al. 2006). Among the studies showing mixed results we can see Corsetti et al. (2005), Candelon et al. (2005), Fazio (2007). Forbes and Rigobon (2002) represent the traditional paper supporting the evidence of interdependence rather than contagion as in Bialkowski and Dobromil (2005). Finally, in Dungey et al. (2005), an extensive review of the methodologies and results surrounding this issue can be found. In this paper we have tried to contribute to the contagion-interdependence debate from a very different point of view based on recent techniques developed in the field of econophysics. A strand of this empirical literature has analyzed topological structures and hierarchical trees, especially in the stock and currency markets, in an attempt to detect linear coupling among stock return time series Mantegna (1999), Plerou et al. (1999), Beben and Orlowski (2001), Bonanno et al. (2001a, b), Brida and Risso (2007), Ortega and Matesanz (2006), Mizuno et al. (2006), Naylor et al. (2007). Few authors have used nonlinear cross-correlation tools in order to detect co-movements among stocks in a broader sense (two examples are Darbellay and Wuertz 2000 and Marschinski and Kantz 2002). This literature shows how stocks and currency cluster structures are affected by common shocks, thus dealing solely with the concept of interdependence.

Following suit with the above mentioned school, we have detected linear and nonlinear co-movements that turn up in the Real Exchange Rate (RER)Footnote 1 of a group of 28 developed and developing countries (see appendix for a complete list of countries and acronyms used). In this representative sample, we included countries from Asia, Europe, and Latin America which endured major and well-documented currency crises (see Perez 2005; Kaminsky et al. 1998) during the period from 1992 to 2002. We have used a well-known methodology based on topological trees associated with distances between financial time series in order to obtain a taxonomic country description, in line with previous works Mantegna (1999), Bonanno et al. (2001a, b), Ortega and Matesanz (2006), Mizuno et al. (2006), Naylor et al. (2007). In order to do this, Phase Synchronization (PS), in addition to the Pearson correlation, were used. By comparing Pearson and PS matrices, we present a methodology that can be useful in unveiling meaningful insights on the contagion issue.

Phase synchronization is a tool that allows for the uncovering of nonlinear co-movements in a very unique way. It quantifies the phase coupling among the involved variables, regardless of their amplitudes.Footnote 2 The concept of phase synchronization was introduced by Rosenblum et al. (1996) in relation to chaotic oscillators, and also by Huang et al. (1998) through the concept of the Hilbert-Huang Transform, aimed at analyzing nonlinear and non-stationary data. By using this concept we were able to avoid several problems found in the empirical literature of contagion. The first one is that it is no longer necessary to separate our sample into crisis and non-crisis periods, allowing us to avoid the typical dilemma arising from long periods of calm and short crisis samples Arestis et al. (2005). In the same way, the requirement to select the breaking points corresponding to the beginning and the end of the contagion period is avoided, and therefore we do not have to date currency crises. Thirdly, and likely the most relevant; by using the phase synchronization method it is possible to avoid the heteroskedasticity problem, caused by increasing market volatility during the crisis itself because of the way the PS method quantifies co-movements. Consequently, our main objective is the application of the phase synchronization tool to detect interdependence in a broader sense throughout the financial time series. Phase synchronization, through the use of the Hilbert-Huang Transform, has been used previously in the financial time series analysis Huang et al. (2003).

This methodology has been applied in two directions. Firstly, Pearson and Phase correlations in the complete real exchange rate time series have been calculated in order to obtain a topology and hierarchy from a structural point of view. Secondly, correlations in sliding temporal windows have been analysed in order to explore the dynamics of said interdependence and therefore in the contagion of the currency crisis. From a methodological point of view, these are the main contributions of this paper. The rest of the work is organized as follows: in Sect. 2 methodological issues and data are presented, in Sect. 3 the main results of the analysis are shown, and Sect. 4 includes our conclusions.

2 Methodology

2.1 Data sets

Returns from \(RER\) in each of the time series, named \(rRER\), have been calculated in the usual way,

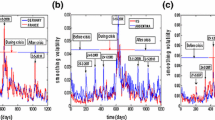

where \(rRER_i(k)\) is the monthly real exchange rate return (change) in country \(i\) at month \(k\). The period 1992 (March)–2002 (December) has been used, yielding a total of 128 data points for each country. Figure 1 shows actual time series used in all of the calculations. Countries are ordered by the entropy criteria (see reference Matesanz and Ortega 2008). Vertical dotted lines mark major international crises as stated in the literature Perez (2005), Kaminsky et al. (1998). \(RER\) is computed as the ratio of foreign price proxied by U.S. consumer price to domestic consumer price, and the result is multiplied by the nominal exchange rate of the domestic currency with the U.S. dollar. All data have been drawn from International Financial Statistics in the IMF database available on-line (http://ifs.apdi.net/imf/logon.aspx).

Returns in Real Exchange Rate (rRER) in 28 countries, from March 1992 to December 2002. Vertical dotted lines mark major international crises and the supposed countries of origin(upper \(x\)-axis). Countries categorized by entropy criterion, as explained in the text, are ordered at the right \(y\)-axis. Countries are labelled in accordance with the symbols listed in the Appendix

2.2 Linear and nonlinear synchronization measures

There exist several methods which aim to quantify co-movements or the degree of synchronization between two or more variables. The most frequently used in the literature is the cross correlation coefficient, also known as the Pearson coefficient \(\delta \). Given two stationary time series \(\varvec{x_m} = x_m(k), k=1,\ldots ,N\) and \(\varvec{x_n} = x_n(k), k=1,\ldots ,N\) the Pearson correlation coefficient between country \(m\) and country \(n\) is defined as:

where \(1\le m,n \le 28\) (number of countries) and \(1\le k \le N\) (number of analyzed months). From now on we will deal with the absolute value of \(\delta \), that is \(\rho = | \delta |\). It must be noted that \(\rho _{mn}\) is a linear measure of interdependence, that is, high values of \(\rho \) reflects high linear correlation between the variables. On the contrary, low values of \(\rho \) imply the absence of linear relation, although there could still exist a strong nonlinear correlation between them.

On the other hand, the concept of phase synchronization has been increasingly used in the last years Pikovsky et al. (1997), Huang et al. (1998, 2003), García et al. (2005), Rosenblum et al. (2001), with applications such as the cases of noisy oscillators Pikovsky et al. (1997) and non-stationary data Huang et al. (2003). The power of the method resides in the fact that it measures the phase relationship, independently on the signal amplitude. With respect to the debate between interdependence and contagion, it means that PS is quantifying co-movements as if no high volatility episodes there had existed.

In order to evaluate differences between phases in two signals, one must firstly define the instantaneous phase of the signal, by means of the analytical signal concept. For a continuous \(x_m(t)\) signal, the associated analytical or complex signal is defined as:

where \(\tilde{x}_m(t)\) is the Hilbert transform of \(x_m(t)\)

where \(p.v.\) stands for (Cauchy) Principal Value. The instantaneous phase is thus,

and the phase difference between the two signals can be calculated as

In order to implement numerically the above definition over two time series \(\varvec{x_m}\) and \(\varvec{x_n}\), the mean phase coherence \(R_{mn}\) was introduced Mormann et al. (2000):

calculated in the time window of \(N_{dat}\), where \(\Delta _{mn}(k)=\phi _m(k)-\phi _n(k)\) is the instantaneous phase difference at the discretized time \(k\). It is clear from Eq. 7 that \(R_{mn}\) follows the same relation as the \(\rho _{mn}\), that is \(0\le R_{mn} \le 1\). The literature Rosenblum et al. (2001) gives useful hints for the numerical calculation of the Hilbert Transform of a time series, i.e. Eq. 4. Phase synchronization and therefore \(R_{mn}\) quantifies the phase coupling among the involved variables, regardless of their amplitudes. Thus, it is especially useful when one or both of the variables experience strong or abrupt changes, such as crises, booms or crashes.

2.3 Distances between time series

Proximity between \(rRER\) time series is constructed by following Gower (1966), therefore we define the distance \(d(i,j)\) between the evolution of time series \(\varvec{x_m}\) and \(\varvec{x_n}\) as:

where \(\chi _{mn}\) is one of the two synchronization measures considered, namely \(\rho _{mn}\) or \(R_{mn}\). The last equality in (8) comes from the symmetric property of the correlation \(\rho _{mn}=\rho _{nm}\) and phase synchronization \(R_{mn}=R_{nm}\) matrices and normalization, \(\chi _{mm}=1 \, \forall \;m\). Lastly, note that \(0\le d(m,n) \le 1.41.\)

The Minimum Spanning Tree (MST), constructed from a set of \(M\) elements -28 countries in this study- is endowed with distances \(d(m,n)\), as defined in Eq. 8, between every pair of elements \(m\) and \(n\). The MST is a planar graph with \(M-1\) edges connecting the \(M\) elements and of minimum total length (i.e. \(\sum _{in the MST} d(m,n)\) is a minimum with respect to any other tree). The illustrative way to understand the construction of the MST is by ordering pairs by distances in ascending order and adding elements to the tree as they appear in the list. No loops exist in the MST. The MST displays only the most important links in each node.

The following is the extension of the analysis and methodology already explained in the work of Mantegna (1999) for the case of stocks, and Ortega and Matesanz (2006) for the case of the real exchange rate, by including the nonlinear information provided by the phase synchronization matrix. A comprehensive review of hierarchical trees and clustering methods can be found in Rammal et al. (1986), Mantegna and Stanley (2000).

3 Results

3.1 Static analysis

The MSTs have been directly constructed from the distances’ matrices, Eq. 8, from \(\rho _{mn}\) and \(R_{mn}\). This is a straightforward construction, as explained in Mantegna (1999), Ortega and Matesanz (2006). Correlation MST will be referred to as \(cMST\), that is, the corresponding MST obtained directly from correlation distances and phase MST (pMST), the MST obtained directly from phase synchronization.

Figures 2 and 3 show the \(cMST\) and \(pMST\) and their corresponding dendrograms. The construction of Fig. 2, is as follows. The correlation matrix calculated between every countries’ time series was obtained through Eq. 2. The conversion from correlations to distances was done by using Eq. 8. The MST was then constructed as explained in Sect. 2.3. Dendrograms, also displayed in Fig. 2, were obtained by ordering pairs of countries in a hierarchical way with their respective time series dynamics. Figure 3 was constructed in the same manner, but by using the phase synchronization matrix instead of the correlation matrix.

Both correlation and phase synchronization matrices are plotted in Figs. 4 and 5. Once correlations between countries’ \(rRER\) are obtained through Eq. 2, conversion to distances is performed by using Eq. 8. This is what is plotted in Fig. 4. Analogously, once PS between countries’ \(rRER\) are obtained through Eq. 7, conversion to distances is performed by using Eq. 8. This is what is plotted in Fig. 5.

The \(y\)-axis in Fig. 1 and both the \(x\)- and \(y\)-axes in Figs. 4 and 5 correspond to countries ordered by the entropy criterion. In short, each country is identified with the Shannon entropy of its \(rRER\) time series. As we have recently shown Matesanz and Ortega (2008), countries which are more prone to crisis tend to have lower entropy values. Hence, countries are categorized in ascending order by their \(rRER\) entropy value in the analyzed period, from Argentina (lower) to Australia (higher).

In the \(cMST\) in Fig. 2, approximatelyFootnote 3 the same results are obtained as those in Ortega and Matesanz (2006) where three groups of countries were clearly seen. The group of EU countries appears in first place with the smallest distances between them; next follow the Asian countries; and in third place are the Latin American countries which show greater distance between their countries than the first two groups. Between 1992 and 1995, the European Union endured currency crises in several countries in what were referred to as the European Storms. Italy, Spain, the United Kingdom and Denmark supposedly underwent currency crises at this time. Intense connections in the EU group are due to the common exchange rate policy of the European Monetary System until 1998, and the transition to a common currency, the Euro, in January1999. Interestingly enough, Denmark (DEN) is the most linked country into the group, even though it has not joined the Euro. This suggests that it might not be necessary for countries to give up their currencies in order to obtain stability with commercial and regional partners. In 1997, and in the first few months of 1998, Asian currencies were devaluated intensely and contagion effects were supposed to appear from Thailand to other countries such as Malaysia, etc. As one may well know, countries in this group are tightly connected, with Thailand playing a central role in this local network. Finally, Latin America seems to be a more disconnected region, showing that it is not a homogeneous group, unless we could see how Brazil plays a central position in the exchange rate dynamics of the region. Other countries, such as Mexico, India, and Turkey, are isolated in strange positions that fall outside this overarching trend. The corresponding dendrogram in Fig. 2 clearly shows the same three regional groups.

In Fig. 4 the Pearson correlation distance matrix among all countries is shown. Black squares represent perfect linear correlation and consequently \(d(m,n)= 0\). White squares imply the absence of linear correlation and \(d(m,n)=1.41\). We can observe how the EU countries have demonstrated closeness dynamics and as such, there are only short distances between them, especially among the Northern countries where again, Denmark is the most connected, whereas the ”Southern” countries of Spain and Portugal show very short distances. Similarly, Asian countries show an intense linear coupling among them, with Thailand and Malaysia having the shortest distances in the group. Of interest in this group is the Singapore situation, which not only has intense relations with Asian countries, but also a close proximity to the EU group and with developed countries in general. Of course, the role of Singapore as a world financial centre underpins this fact, as well as its location in the \(cMST\), just in the middle of the European and Asian countries. Finally, the Latin American group does not show regional co-movement, with only Brazil having some coupling with Chile, Colombia and Peru.

The methodology used however, suffers from the same problems that arise in the empirical economic literature. Namely, we do not know whether the regional taxonomy shown in Fig. 4 is due mainly to the crises effects or if it represents an accurate picture of the underlying long-term dynamics of exchange rate.

This distinction is important for the following causal reason. If the taxonomic picture represents an actual interdependence among countries, then currency crises have spread as a result, and, in the direction of the strongest links. On the contrary, it is possible that those crises, due mostly to strong and sudden changes, are really what is behind the taxonomy displayed. This last fact is certainly possible when linear statistics, such as the correlation coefficient, are used to quantify the interaction among countries.

In Fig. 3 we have plotted the \(pMST\) to answer the previous question. Although this topology is slightly different from the linear \(cMST\) shown in Fig. 2, important similarities between them can be noted. From a global perspective, we obtained the same three regional groups: EU, Asian, and Latin American countries. For instance, European countries are also tightly connected and again, Denmark is in the middle of the group. Similarly, the Mediterranean countries (SPA, ITA and POR) form the same subgroup as in the \(cMST\). In the same fashion, we can observe the central position of Thailand in the Asian group and Singapore with intense and more diversified links, repeating our previous findings. However, Latin American countries now appear to be more connected than in the \(cMST\), with Brazil and Argentina showing short distances between them. Again we find some countries isolated and with positions which make no economic sense. For instance, Ecuador is linked directly to Greece, which has no economic explanation. India and Mexico follow quite isolated. Ireland and Australia continue together, linked to the Asian group.

The PS distance matrix presented in Fig. 5 supports results from the \(pMST\), as took place with the \(cMST\) and the correlation distance matrix. However, there exist some novelties in the PS distance matrix: for instance, Argentina has co-movements with Brazil which were not identified in linear correlation; also Thailand and Mexico seem to be quite connected to developed countries, as occurred with Singapore. The corresponding dendrogram in Fig. 5 clarifies and supports the \(pMST\) topology. From our point of view, what is important from Figs. 3 and 5 is that by avoiding the intense volatility of the crisis events (which is reflected in the PS matrix), regional connections and co-movements continue at the centre of \(RER\) dynamics. Naturally, there remain unexplained linkages from an economic point of view such as the connections between Ecuador with Greece, for example.

By comparing the information obtained from the \(cMST,\,pMST\), and the corresponding distance matrices, we can conclude that important similarities among the exchange rate topology and co-movement reflect economic liaisons among regional groups of countries (or more isolated countries). Figures 2 to 5 illustrate that connections and coupling among currencies are quite stable and existed previous to currency crises events. From this point of view, currency crises in the nineties spread due to interdependence in the international arena.

For the sake of completeness, one last point should be addressed before going further into the dynamical analysis. Note that in Fig. 2 and also in Fig. 3, both the dendrogram and MST have been displayed. The rationale behind this is that even though the MST is a very illustrative construction in that main links between countries are readily displayed, it turns out that sometimes this can be misleading. Even though the MST displays the most intense links between countries, this does not imply that each link between every pair of countries should be intense. Take for instance in Fig. 3 the case of DEN-FIN and DEN-TUR. As it is displayed, it is apparent that \(rRER\) co-movements between Denmark and Finland are similar to those between Denmark and Turkey. However, a look at the dendrogram reveals that this is not the case. Denmark and Finland are much closer to each other than are Denmark and Turkey. This is a minor drawback to the MSTs’ construction. Therefore, in order to correctly interpret the MST it is always recommended to plot both the MST and the dendrogram jointly. Moreover, one should always be prudent when interpreting the distance level at which coupling between countries does happen. In Fig. 3 for instance, there are three pairs of countries, namely POR-SPA, THA-SIN and COL-PER that seem to be tightly coupled. However, they are located at very different positions in the distance axis. While POR-SPA are located quite deeply in the dendrogram, COL-PER are located somewhat higher, at a distance level of approximately 1.2 (note that the maximum allowed value of distance is 1.41). One certainly cannot compare these couplings in the same fashion. As an extreme counterfactual example, take for instance the dendrogram constructed by using the returns of central bank international reserves from the same countries in the same temporal period, shown in Fig. 6. There exists a strong coupling between POR-SPA in comparison with the rest of the countries. However, the coupling is at a distance of 1.26, which is rather high overall. In fact, this distance is nearly as high as the most pronounced distances in the dendrogram of exchange rates (Fig. 2). The other couplings between countries occur at even larger distances, as shown in Fig. 6. Therefore, both the distance range and the distance level at which couplings occur should always be taken with a measure of precaution in order to correctly analyze the dendrograms and MSTs. By doing so, one may avoid pitfalls such as the misinterpretation of linkages between ARG-IND in the dendrogram in Fig. 3 as ”true” co-movements between their respective exchange rates, which could have arisen solely as a casual circumstance (e.g. identical exchange rate policies).

3.2 Dynamical analysis

In order to further explore the temporal behaviour of interdependence relations between the analyzed countries, the following are the calculations that have been done. Distance correlation and PS matrices have been calculated in overlapping windows of 16 months, going forward in time. This temporal window has been moved throughout the whole period, in increments of one month, starting in March 1992. In each window, the matrices’ coefficients have been summed up and normalized to the maximum value in the whole period. Therefore, each data point plotted in Figs. 7 and 8 represents the sum of distances among all countries in the past 16 months, so September 1993 is the first point of analysis, reflecting coupling from March 1992 to August 1993. In addition, the corresponding MSTs have been calculated for each 16-month window. The results of Pearson and Phase Synchronous data are displayed in Figs. 7 and 8, respectively. In each one, we have plotted the sum of the distances \(d(m,n)\) between pairs of countries (bold line) and the MST cost (dotted line). MST cost is the sum of the distances in the MST, namely, the sum of all the branches in the tree. The lower the value of the MST cost, the tighter the connections among the countries. Similarly, the sum of all the matrices’ coefficients gives us an idea of the interdependence between all countries, what we have designated global correlation. Again, a lower value in the sum of distances infers a tighter coupling among the countries.

In Figs. 7 and 8 we observe several results from this dynamical point of view. Firstly, both figures show an initial part (approximately until data point 50, the first few months of 1996) where global correlation is very close to the MST cost and sometimes below it. After that, the MST cost is almost always below the global correlation. This first result demonstrates that since the middle of the nineties the first connections between countries (which are observed in the corresponding MST, called the MST cost) became more intense than the global correlation. Therefore, since the mid-nineties the linear and nonlinear topology we obtained becomes more relevant than in previous periods, suggesting that financial agents paid more close attention to these initial and more tightly woven links.

Secondly, we can see how Pearson global correlation and corresponding MST cost clearly increased (distances decrease in Fig. 7) from 1995 up until approximately the beginning of the new century. This long period seems to be a noticeably more connected one in currency markets. We observe recurrent peaks in the intensity of the correlation, although they are not clearly related to the currency crisis dates.

In the PS distances plotted in Fig. 8, we do not observe such decrease in the distance coefficients in the global correlation. In this case, our results indicate that co-movement in this wide, nonlinear sense has been quite flat. On the contrary, the PS MST cost reaches its minimum around the time of the Asian currency crises. This implies that at this point PS distances in the MST are the shortest of the period. Because we do not know which countries are responsible for those short distances, we have constructed Fig. 9. In this figure the number of connections for every country is displayed. In every temporal window of 16 months, PS matrices and its corresponding MST are constructed. The number of links every country has inside the MST is then counted. By assigning a gray tone to the number of connections, we can observe how connections in each country vary as a function of time. In this figure the minimum connections of any given country are 1 (lightest gray), and the maximum connections reported here are 6 (darkest gray) in Thailand and Norway. From this figure, it can be observed that the links are quite diffuse and that only those in Thailand and Singapore were intense around the time of the Asian crises, suggesting some evidence in favour of the existence of contagion effects during this period. The originating country seems to be Thailand, with its maximum number of linkages throughout the period (6) at this time.

Number of connections (for every country) in each temporal MST obtained from the PS matrix. For every temporal window (16 months), the MST is constructed and the number of linkages for each country is calculated and plotted. Gray tone in each square represents the number of connections of each country in the MST. Darker squares mean more linkages of a country in the MST

4 Conclusions

In this paper we have examined linear and nonlinear co-movements that appeared in the real exchange rates in a group of 28 developed and developing countries that have suffered currency and financial crises. The Pearson correlation matrix and the Phase Synchronous coefficients have been used to construct topological and hierarchical pictures of our country sample. With this methodology, structural (long term) and dynamical (short term) linkages among currency markets have been analyzed. The use of the phase synchronization matrix has proven to be valuable for better understanding the cross-correlations and linkages in financial markets and especially, in the inconclusive contagion-interdependence debate. Regarding the currency markets, our main conclusions consist of the following:

-

(1)

The structural information obtained from the Pearson and phase synchronous MSTs and the corresponding dendrograms presented in Figs. 2 and 5 suggest that exchange rate hierarchical taxonomy reproduces the stable economic liaisons among regional groups of countries. The European Union, the Asian group and the Latin American countries appear as three different exchange rate areas, even though there are some countries having diffused connections such as Chile or those with even more isolated currency dynamics as is the case in India or Ecuador. The overall results indicate that structural linkages connect global currency markets, which highlight the regional interdependence among them. As such, this also implies that the currency crises in the nineties spread mainly because of interdependence in the international arena, a supposition in line with works such as Candelon et al. (2005), Bialkowski and Dobromil (2005).

-

(2)

From the dynamical analysis point of view, Figs. 7 and 8 show two additional results. First is that the MST cost has been below the global correlation since approximately 1996. This situation suggests that currency markets have been more connected with their first links than with other countries. Given that both the \(cMST\) as well as the \(pMST\) have shown a regional construction, these results suggest that market agents understood that currency turbulences were more regional than global. Structural linkages presented in MST Figs. 4 and 5 support this conclusion.

Secondly, we observe how co-movements became more connected, revealing an increase in the correlation coefficients around the Asian crises but not in the other currency crises, suggesting some contagion and some interdependence in currency crises, in line with Corsetti et al. (2005), Gravelle et al. (2006) among others. This situation is due to an increase in regional correlation (PS MST cost in Fig. 8) and clearly related to the Asian countries (see Fig. 9), satisfying the definition of contagion first expounded in King and Wadhwani (1990); Forbes and Rigobon (2002). The novelty of the paper is that by using the phase synchronous matrix we are able to avoid heteroskedasticity problems arising from the high volatility market regimes surrounding currency crises episodes. However, Asian contagion responds to structural and stable linkages as can be seen in our global topologies in Fig. 2, and especially Fig. 3. In this sense, our major conclusion is that contagion effects are found only during the Asian crises, but they are driven by previous and stable interdependence and in accordance with Fazio (2007), these contagion effects are more regional than global in nature.

Notes

We have used the real exchange rate, instead of the nominal exchange rate, to avoid the influence of hyperinflation episodes in some countries during the considered period. Moreover, returns of real exchange rates have been used in order to stabilize time series, making them suitable for further analysis.

In Sect. 2.2 the phase synchronization concept is explained in depth.

Different number of data points have been used in both cases; 155 months in Ortega and Matesanz (2006) and 128 months in the present work.

References

Arestis, P., Caporale, G.M., Cipollini, A., Spagnolo, N.: Testing for financial contagion between developed and emerging markets during the 1997 East Asian crisis. Int. J. Finance Econ. 10(4), 359–367 (2005)

Beben, M., Orlowski, A.: Correlations in financial time series: established versus emerging Markets. Eur. Phys. J. B 20, 527–530 (2001)

Bialkowski, J., Dobromil, S.: Financial contagion, spillovers and causality in the Markov switching framework. Quant. Finance 5(1), 123–131 (2005)

Bonanno, G., Lillo, F., Mantegna, R.N.: Levels of complexity in financial markets. Phys. A 299, 16–27 (2001a)

Bonanno, G., Lillo, F., Mantegna, R.N.: High frequency cross-correlation in a set of stocks. Quant. Finance 1, 96–104 (2001b)

Brida, J.G., Risso, W.A.: Dynamics and structure of the main Italian companies. Int. J. Modern Phys. C 18(11), 1783–1794 (2007)

Candelon, B., Hecq, A., Verschoor, W.F.C.: Measuring common cyclical features during financial turmoil: evidence of interdependence not contagion. J. Int. Money Finance 24, 1317–1334 (2005)

Corsetti, G., Pericoli, M., Sbracia, M.: Some contagion, some interdependence: more pitfalls in tests of financial contagion. J. Int. Money Finance 24, 1177–1199 (2005)

Darbellay, G.A., Wuertz, D.: The entropy as a tool for analysing statistical dependences in financial time series. Phys A 287, 429–439 (2000)

Dungey, M., Fry, R., Martin, V., Gonzlez-Hermosillo, B.: Empirical modeling of contagion: a review of methodologies. Quant Finance 5(1), 9–24 (2005)

Dungey, M., Fry, R., Martin, V.L.: Correlation, contagion, and Asian evidence Asian. Econ Papers 5(2), 32–72 (2006)

Eichengreen, B., Rose, A.K., Wyplosz, C.: Contagious currency crises: first tests. Scand. J. Econ. 98, 463–484 (1996)

Fazio, G.: Extreme interdependence and extreme contagion between emerging markets. J. Int. Money Finance 26, 1261–1291 (2007)

Forbes, K.J., Rigobon, R.: No contagion, only interdependence: measuring stock market co-movements. J. Finance 57(5), 2223–2261 (2002)

García, Domínguez L., Wennberg, R.A., Gaetz, W., Cheyne, D., Snead, O.C., Perez Velazquez, J.L.: Enhanced synchrony in epileptiform activity? Local versus distant phase synchronization in generalized seizures. J. Neurosci. 25(35), 8077–8084 (2005)

Gower, J.C.: Some distance properties of latent root and vector methods used in multivariate analysis. Biometrik 53, 325–338 (1966)

Gravelle, T., Kichian, M., Morley, J.: Detecting shift-contagion in currency and bond markets. J. Int. Econ. 68, 409–423 (2006)

Hatemi, J.A., Hacker, R.S.: An alternative method to test for contagion with an application to the Asian financial crisis. Appl. Financial Econ. Lett. 1, 343–347 (2005)

Huang, N.E., Shen, Z., Long, S.R., Wu, M.C., Shih, E.H., Zheng, Q., Tung, C.C., Liu, H.H.: The empirical mode decomposition and the Hilbert Spectrum for nonlinear and non-stationary time series analysis. Proc. R. Soc. Lond. A454, 903–909 (1998)

Huang, N.E., Wu, M.-L., Qu, W., Long, S.R., Shen, S.S.P.: Applications of Hilbert-Huang transform to non-stationary financial time series analysis. Appl. Stoch. Model Bus. Ind. 19, 245–268 (2003)

Kaminsky, G., Lizondo, S., Reinhart, C.M.: Leading indicators of currency crises. IMF Staff Papers 45, 1–56 (1998)

King, M., Wadhwani, S.: Transmission of volatility between stock markets. Rev. Financial Stud. 3(1), 5–33 (1990)

Mantegna, R.N.: Hierarchical structure in financial markets. Eur. Phys. J. B 11, 193–197 (1999)

Mantegna, R.N., Stanley, H.E.: An introduction to econophysics: correlations and complexity in finance. University Press, Cambridge (2000)

Marschinski, R., Kantz, H.: Analysing the information flow between financial time series. An improved estimator for transfer entropy. Eur. Phys. J. B 30, 275–281 (2002)

Matesanz, D., Ortega, G.J.: A (econophysics) note on volatility in exchange rate time series. Entropy as a ranking criterion. Int. J. Modern Phys. C 19, 1095–1103 (2008)

Mizuno, T., Takayasu, H., Takayasu, M.: Correlation networks among currencies. Phys A 364, 336–342 (2006)

Mormann, F., Lehnertz, K.D.P., Elger, C.E.: Mean phase coherence as a measure for phase synchronization and its application to the EEG of epilepsy patients. Phys. D 144, 358–369 (2000)

Naylor, M.J., Rose, L.C., Moyle, B.J.: Topology of foreign exchange markets using hierarchical structure methods. Phys. A 382, 199–208 (2007)

Ortega, G.J., Matesanz, D.: Cross-country hierarchical structure and currency crises. Int. J. Modern Phys. C 17(3), 333–341 (2006)

Perez, J.: Empirical identification of currency crises: differences and similarities between indicators. Appl. Financial Econ. Lett. 1(1), 41–46 (2005)

Pikovsky, A.S., Rosenblum, M.G., Osipov, G.V., Kurths, J.: Phase synchronization of chaotic oscillators by external driving. Phys. D 79, 219–238 (1997)

Plerou, V., et al.: Universal and nonuniversal properties of cross correlations in financial time series. Phys. Rev. Lett. 83, 1471–1474 (1999)

Rammal, R., Toulouse, G., Virasoro, M.A.: Ultrametricity for physicists. Rev. Modern Phys. 58(3), 765–788 (1986)

Rigobon, R.: Contagion: how to measure it. In: Edwards, S., Frankel, J. (eds.) Preventing Currency Crises in Emerging Markets. University of Chicago Press, Chicago (2001)

Rigobon, R.: On the measurement of international propagation of shocks: is the transmission stable? J. Int. Econ. 61, 261–283 (2003)

Rosenblum, M.G., Pikovsky, A.S., Kurths, J.: Phase synchronization of chaotic oscillators. Phys. Rev. Lett. 76, 1804–1807 (1996)

Rosenblum, M.G., Pikovsky, A., Schfer, C., Tass, P.A., Kurths, J.: Phase synchronization: from theory to data analysis. In: Moss, F., Gielen, S. (eds.) Handbook of Biological Physics. Elsevier Science, Amsterdam (2001)

Acknowledgments

DM thanks financial support from the Spanish Ministry of Education through the José Castillejo Program (JC2010-0273). GO thanks financial support from CONICET PIP (PIP 11420100100261) and Universidad Nacional de Quilmes PUNQ 1000/11.GO is member of CONICET Argentina. The authors are very grateful to Teressa Canosa for exhaustive language revision.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

The 28 countries included in this work are as follows (order by increasing entropy):

Argentine (ARG), Malaysia (MAL), Thailand (THA), Mexico (MEX), Korea (KOR), Indonesia (INDO), Brazil (BRA), Venezuela (VEN), Peru (PER), India (INDI), Ecuador (ECU), Turkey (TUR), Colombia (COL), Singapore (SIN), Philippines (PHI), United Kingdom (U_K), Sweden (SWE), Italy (ITA), Ireland (IRE), Finland (FIN), Chile (CHI), Greece (GRE), Portugal (POR), Switzerland (SWI), Denmark (DEN), Spain (SPA), Norway (NOR), Australia (AUS).

Rights and permissions

About this article

Cite this article

Matesanz, D., Ortega, G.J. Network analysis of exchange data: interdependence drives crisis contagion. Qual Quant 48, 1835–1851 (2014). https://doi.org/10.1007/s11135-013-9855-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-013-9855-z