Abstract

The Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) is a federally-funded food assistance program for low income participants who are at nutritional risk. Beneficiaries receive vouchers for specific foods and brands, selected for their nutritional value. While the program is designed to improve nutrition, it may also induce changes in consumption behavior that persist beyond participation in the program. In this paper, we study how participation in WIC impacts the consumption patterns and preferences during and after the program. Our analysis focuses on the cereal category, in which the subsidized brands must meet certain nutritional guidelines. As expected, during the program households increase cereal consumption volume and shift their choices towards the WIC-approved brands. More interesting is that once households exit the program, the higher category consumption rate and elevated share of WIC brands persist. To understand the behavioral mechanism underlying these consumption patterns, we estimate a choice model and find an increased preference for WIC brands after controlling for state dependence. The evidence suggests that this targeted food subsidy program is effective in creating behavior change that persists even after the incentive is withdrawn.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Changing food consumption behavior is a goal of many health policy initiatives, for example in the management of diabetes and the prevention of obesity. A variety of interventions to alter food choices, such as information provision through nutrition labels, nutrition education, and taxation of obesogenic foods, have been proposed and implemented (Gorski and Roberto 2015). This paper evaluates the efficacy of a particular type of intervention observed through the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), a government funded food subsidy program in the United States. Beneficiaries receive monthly vouchers which can be used to purchase from a selected and limited set of options. Within a category, the permitted options favor ‘healthier’ alternatives, for example, low fat milk and low sugar cereals.

In this paper, we study the impact of participation in the WIC program on consumption patterns and preferences of consumers. The key issue of interest is whether this type of intervention - where a selected set of choices are offered at zero cost over an extended time period - is effective in creating changes in behavior that persist after exiting the program, when the incentive is withdrawn (Cohen and Farley 2008). We investigate this in the context of the cereal category. First we conduct a sequence of reduced form analyses to evaluate how household consumption patterns change during the program, and whether these changes persist once they exit the program. We evaluate changes in consumption volume at the category and brand level, and changes in the nutritional composition of the selected choices. Having identified changes in behavior that are persistent, we turn to investigating the underlying behavioral mechanism. In particular, we investigate whether the observed shifts in brand choice are related to changes in household preference or a consequence of state dependence. This is of interest because the effects of state dependence are temporary and expected to dissipate over time, but changes in household preferences are more enduring in the long run. To the extent that the subsidized products are healthier, this intervention represents a potential mechanism for shifting food choices towards healthier options.

The WIC program provides subsidies for specific foods with the goal of improving nutrition and health outcomes amongst low income participants. The subsidized products are purposely selected to increase the intake of nutrients that low income groups are often deficient in, and include foods such as cereal, eggs, cheese, milk, peanut butter, vegetables and beans. While there is debate over whether the impact of WIC is overstated (Joyce et al. 2005), significant evidence indicates that the program meets its primary goal of improving health outcomes, such as birth weight and overall health (Bitler and Currie 2005; Carlson and Senauer 2003; Devaney et al. 1992). In terms of behavior, there is evidence that during program participation households shift consumption toward WIC-approved foods (Arcia et al. 1990) and increase the intake of the targeted nutrients (Oliveira and Gundersen 2000; Rose et al. 1998); however, little is known about whether these changes persist after the program, once the subsidy is withdrawn.

The structure of the program benefits may induce changes in behavior beyond improving nutrition during participation. Each month, beneficiaries receive vouchers (more recently through electronic cards) for specific types and quantities of food. The program is somewhat restrictive in the choices it makes available to participants. Each state maintains its own list of specific brands and products that the beneficiaries may purchase with the vouchers. Consider the cereal category, each month beneficiaries receive vouchers for up to 36 ounces of cereal which can be redeemed for products from the state’s list of approved cereal brands. Three distinguishing features of the program should be highlighted: the products are free, this benefit is provided monthly over an extended period of time, and the participant faces a restricted choice set. Since the product is free, it is likely that the participant will redeem the voucher, and as the benefit is provided over an extended time period, the targeted food is consumed repeatedly. Together these two factors may result in habit formation (Verplanken and Aarts 1999; Wood and Neal 2007). A household that previously consumed cereal infrequently, may develop a habit for the product, and continue to consume it at a higher rate, even after the subsidy is removed. The restricted set of products to choose from may also have an impact. In guiding participants toward selected options within the category, WIC may shift brand preferences to favor the subsidized brands. Consumers may also develop positive associations if they perceive that the brands are furthering a social cause (Hoeffler and Keller 2002; Reilly 2000; Simmons and Becker-Olsen 2006). The creation of habit and positive brand associations would operate at both the category and brand level. Even if brand preferences and habits do not change, participation in WIC could impact future consumption through its impact on the household’s state space and any tendencies toward inertia in brand choice. Thus the structure of the WIC program may induce changes in behavior that persist even beyond participation in the program.

The same program features may also work in the opposite direction. An extensive literature on the impact of price promotions generally concludes that their frequent use reduces future willingness to pay for the product (Mela et al. 1997), perceived quality (Dodson et al. 1978; Blattberg et al. 1995) and brand equity (Aaker 1991). Since the WIC product is free, similar mechanisms may operate here too. If willingness to pay falls along with perceptions of product worth, this could result in reduced category consumption after exiting from the program, possibly to even lower levels than prior to the program. Even if category consumption levels remained unaffected, the brands included in the program could lose share amongst former WIC participants. Perceptions may be further depleted amongst both WIC and non-WIC consumers simply because inclusion in WIC creates an association with ‘poverty’, ‘welfare’ and ‘lower income’ (Grier and Bryant 2005). Finally, even though participants in the program consume the product when it is free, they may dislike the fact that it was a choice from a restricted set. Reactance theory (Brehm 1966) suggests that once they exit the program, non-WIC options will appear more attractive. Within a category, this could manifest as a preference for non-WIC brands, which may be of lower nutritional value than the ones offered under the WIC program. At the extreme, consumers may even shift their preferences towards categories not sponsored by the WIC program. Rather than developing a habit for a food type or particular brand, these factors raise the possibility that consumers will reduce consumption on the WIC-subsidized categories and brands once they exit the program.

We investigate these issues in the context of the cereal category which accounts for 12.9% of WIC food costs, the third highest category in the WIC program. At $645 million, WIC’s share of the $9 billion dollar cereal category is almost 7%. The cereals included in the program must meet federal nutritional requirements. Given the value of the WIC program and the number of participants, it is little surprise that the major cereal companies seek to ensure their presence on each state’s list of WIC approved cereals and design products specifically to meet WIC nutritional guidelines (Weingarten 2013). For example, Kellogg’s Scooby Doo cereal and General Mills’ Honey Kix and Dora the Explorer cereal were created specifically with the WIC market in mind. Meeting WIC guidelines does not however imply automatic inclusion on the state’s list of approved products. For administrative reasons, a limited number of products are selected by each state for each WIC category. From the manufacturer’s perspective, inclusion in the WIC program has both short and long term benefits. The WIC program locks in market share during WIC participation. In addition to the gains in revenue, the program also ensures that the WIC approved retailers give shelf space to their products. While substantial, the short term benefits from WIC participation are not the only incentive. The program helps manufacturers reach WIC children. From the manufacturer’s perspective, ‘reaching WIC children helps establish tastes and preferences that last well into adulthood’ (Kirchhoff 1998). Whether these benefits to manufacturers are realized depends on how consumers perceive and respond to the program and the products sanctioned by it.

Our empirical analysis is based on consumer purchase histories from the Nielsen HomeScan panel data (2006-2010), which also includes information about current and past participation in WIC. This allows us to evaluate the household level impact of WIC participation on overall category consumption. For a subset of states, we collected historical administrative data on the specific brands that were part of the state’s WIC program in each year. With this information, we can evaluate the impact on the brands that were part of the subsidy. The Nielsen data also provides detailed demographic information, which allows us to identify differences in response based on characteristics such as household size and income.

Our research contributes to the understanding of the WIC program and, more generally, how a structured food subsidy program impacts behavior. Most studies with a few exceptions (e.g., Herman et al. (2008)) investigate consumption patterns during participation in the WIC program, but the long term impact on behavior is not yet completely understood. Our study explores consumption during and after the participants exit from the program. Our purpose is to understand whether participation creates changes in behavior that are persistent even after the subsidy has been removed. This should be of interest to policy-makers who seek to identify effective behavior change mechanisms through the use of temporary interventions. Second, in addition to measuring the impact of WIC program participation on category-level consumption, we investigate the impact on brand-level consumption patterns and preferences. This provides insights for brand and WIC managers into the extent of category expansion due to the program, and the longer term benefits for brands that are included. Finally, most research to date on the impact of WIC relies on surveys or food diaries over a short time period, whereas our analysis is based on a large consumer purchase panel data observed over multiple years.

The next section provides an overview of the WIC program, and describes the main sources of data. Section 3 presents the reduced form analyses of changes in consumption volume at the category and brand level, and changes in nutritional content. In Section 4, we investigate potential behavioral mechanisms that might drive the observed changes at the brand level. Section 5 concludes the paper with a discussion of our findings and their implications for managers and policy makers.

2 Data

2.1 Overview of the WIC Program

The WIC program was established in 1972 with the goal of improving nutrition and health outcomes amongst low income participants - specifically pregnant and breast-feeding women, infants, and children up to age 5 who are found to be at nutritional risk. In 2016, WIC served 7.7 million women and children each month, providing each beneficiary on average $43 in monthly food subsidies, at an annual food cost of $3.9 billion dollars.Footnote 1 WIC reportedly serves 53 percent of all infants born in the United States, primarily through the provision of infant formula.Footnote 2 In most states, WIC participants receive monthly vouchers to purchase specific foods that are designed to supplement their diets with specific nutrients. WIC foods include a variety of categories such as infant cereal, iron-fortified adult cereal, vitamin C rich fruit or vegetable juice, eggs, milk, cheese, peanut butter, and canned fish.

The two eligibility criteria are a family income below 185% of the U.S. Poverty Income Guidelines, and an assessment of nutritional risk by a medical professional. In addition, beneficiaries of Medicaid, Food Stamps, or AFDC are automatically eligible.Footnote 3 In practice, income eligibility is the main criterion used to award the benefit as this is typically correlated with nutrition quality, and more easily assessed than nutritional risk. A recent study of whether eligible participants received WIC benefits found the coverage rate to be approximately 60% (Martinez-Schiferl 2012a), with the highest coverage in Vermont at 76% and the lowest in Montana at 45%. The primary cause of undercoverage is lack of awareness about eligibility.

The WIC program is administered by the Food and Nutrition Service (FNS) under the US Department of Agriculture. The FNS provides funds to WIC state agencies to pay for program and administrative costs. While nutritional guidelines and permitted food categories are determined at the federal level, the state decides which specific food items to approve for the WIC program based on the federal guidelines. It is each state agency’s responsibility to identify foods that are acceptable for use in its WIC program in accordance with federal WIC regulations. When making decisions about which types, brands, and physical forms of WIC-eligible foods to authorize, state agencies consider factors such as price, product availability in a state, container size, WIC participant acceptance and program management costs.

The cereal category in the WIC program

The focus of our study is the cereal category.Footnote 4 Cereal accounts for 12.9% of WIC food costs, the third highest category in the program. At $645 million, WIC’s share of the $9 billion dollar cereal category is almost 7%. The category is highly competitive, heavily branded and advertised, and consumer brand preferences are often well defined. The penetration rate of this category is also very high. Cereals must meet federal nutritional requirements: the amount of sugar per serving may not exceed 6g, there is a required minimum amount of iron, and at least half of the cereals on the state’s list must have whole grains as the primary ingredient. The cereal benefit is offered to every class of participant; in particular, infants can receive this benefit up to age five.

2.2 Data description

For the empirical analysis, we constructed a unique data set that integrates multiple data sources. The primary source is the Nielsen HomeScan data from 2006 to 2010,Footnote 5 which provides detailed consumer purchase histories and demographic information, including participation in the WIC program. We supplement this data with two additional sources. We constructed a database of the products included in the WIC program from several states for the time period between 2006 and 2010. We also collected nutrition information data for the cereal category.

2.2.1 AC nielsen data

HomeScan data and the cereal category

The AC Nielsen HomeScan data contains the purchase histories of approximately 100,000 households spanning 50 US states over the time period from 2006 to 2010.Footnote 6 The households in the panel report the details of each grocery purchase from all retail outlets over the course of one to five years. For each store visit the database records the date of purchase, identification of the retail outlet, the total amount spent on the shopping trip, and detailed information on every product in the shopping basket such as the product description (brand name, size, etc.), number of units purchased, price paid, and indicators for any promotion or coupon usage.

Table 1 summarizes the market shares and average price paid for leading manufacturers in the cold breakfast cereal category. The two dominant players are General Mills(31%) and Kellogg(29%), while Post and Private Labels each account for 13% market share. GM and Kellogg offer products at a similar price point, around $0.18 and $0.17 per ounce respectively. In the data, the average annual household consumption of cereal was 377 ounces, approximately 21 boxes of cereal (in the 18 ounce size). Table 2 shows the result of regressing household cereal consumption volume on household demographics. On average, a large household (more than three members) consumes 184 oz. more than a smaller household. College education and white race is also associated with higher consumption volume, but income does not appear to correlate with consumption volume.

WIC indicators and demographic information

Each household in the panel provides an annual report of personal demographic information related to age, income, education, household size, marital status, and employment. From 2006 onwards, supplemental studies also asked panelists questions related to participation in the WIC program. The first question, which is also the main focus of our analysis, asks whether anyone in the household received WIC benefits at any time during the year. The second question, also used in our analysis, asks whether anyone in the household has received WIC benefits in the past.

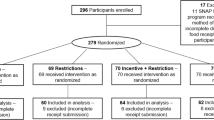

Between 2006 and 2010, a total of 1820 households reported participation in the WIC program. The geographic distribution of the WIC households across states is mapped in Fig. 1. Each household in the Nielsen sample has an associated projection weight based on their demographics. In Table 3, we apply the projection weights to the full sample and the WIC sample for each year. This allows us to evaluate the extent to which the estimation sample is representative of the target population. In column (a) the application of the projection weights to the full sample shows that the data represents the approximately 300 million US population. In column (b) the application of the projection weights to the WIC sample shows that an average of 4 million WIC participants are represented in the data annually. Column (c) shows the number of WIC participants each year. On average, the Nielsen panel captures the behavior of 40% of the WIC participants. The under representation of WIC may be due to two factors. First, the reporting of WIC status is voluntary and likely under-reported. Second, the lowest income WIC participants are unlikely to participate in the sample (discussed in more detail next).

The characteristics of the panelists are captured with a rich set of demographic and personal variables. In Fig. 2, we show the distributions of select demographics and, where possible, compare the characteristics of the Nielsen WIC sample with the US WIC population. In terms of household size, the Nielsen WIC average of 4 matches with the US WIC average. For household income, three-quarters of the sample falls below $50,000. The average household income is very different between the two populations, with the Nielsen WIC household income in the mid-30s and the US WIC average in the mid-teens. This difference is likely due to the economic conditions of the US WIC population. Two-thirds of the US WIC population falls below the US federal poverty level, which in 2010 was an annual income of $22,050 for a family of four.Footnote 7 Half of this group falls in deep poverty (Martinez-Schiferl 2012), below 50% of the federal poverty level. A significant proportion of the US WIC households are homeless, or lack permanent housing. This group of extreme poor households are unlikely to be present in a database that requires regular reporting. The Nielsen sample more closely matches the US WIC population in terms of race, with majority white participants.

The WIC indicator provides valuable information in terms of identifying participating households. Despite the availability of this indicator, there is a critical data limitation. We do not know when during the course of the year benefits start and how long they continue. The indicator only tells us that at some point in the year, the household received WIC benefits. Although this is an imperfect measure of WIC participation, it is still valuable for identifying WIC households and studying changes in behavior during and after participation in WIC.

For WIC participants, the WIC status indicator is used to assign the households into stages: ‘Pre-WIC’, ‘During WIC’, and ‘Post-WIC’. We classify the years during which households reported WIC participation as ‘During’. For consecutive years of participation, we do not differentiate the impact of the first versus second year of participation. While it would be valuable to evaluate the impact of the length of participation on post-participation outcomes, the number of observations is too limited for inference. Up to two years immediately preceding participation in WIC are classified as the ‘Pre’ period, and up to two years immediately following WIC participation are classified as ‘Post’. This allows us to trace changes in consumption before, during and after WIC participation. The number of observations for the pre and post-WIC periods are different because the observation periods vary across households; for example, some households may be in the data for the year before WIC participation, but not after. In some cases, households had a lapse in reporting, when this occurred in a year adjacent to WIC participation, we dropped the observation from the analysis.

The survey also asks if the household has ever received WIC benefits in the past. A total of 13,267 households identified as former WIC recipients. Although we do not know the time elapsed since they received these benefits, this variable allows us to explore the longer run implications of WIC participation.

Nielsen monitor-plus (advertising) data

Information on local television advertising from 210 Designated Market Areas (DMA) is also available from Nielsen Monitor-Plus. Occurrences, expenditure and impressions are recorded for different product categories. We match the brand descriptions from the advertising data with the UPC description from the HomeScan data to generate a measure of monthly local advertising expenditure for each brand at the DMA level. We use the advertising data to test if a manufacturer responds to its WIC participation status strategically by changing its advertising expenditures in the local market.

2.2.2 State-level WIC approved products list

An essential piece of information is the specific products included in each state’s list of WIC-approved foods. For most states, the current list of approved foods can be found online. The difficulty is that we are using historical data from several years ago, and most states do not maintain this information online. To collect the historical data, we contacted WIC agencies in each state and requested this information. The information was typically sent to us via mail in the form of a brochure, as shown in Fig. 3. This information was coded into a database and matched with the UPC file. All the products on the food lists were identified and matched at the UPC level, except for the private label products. Given the time consuming nature of this endeavour, we targeted states with a high number of WIC participants observed in the Nielsen panel. Information was collected from California, Florida, Michigan, Minnesota, Ohio, Pennsylvania and Texas. There are 712 WIC households observed in these states

Across seven states, 51 different brand-flavor combinations were included in the WIC program. Figure 4 shows that there is significant variation in the number of brands across states and years. For example, California had nine brands Footnote 8 across all years, but Florida had 16 brands in the first two years, then added 10 to increase to 26 brands for the next two years, and 24 brands in the final year. Figure 5 shows whether a brand is included in WIC in each year and state. California maintains the same nine brands across the observation period, while other states introduce and withdraw brands regularly. Some brands, such as General Mill’s Cheerios and Kellogg’s Corn Flakes are included in all states and years.

2.2.3 Nutrition information

The nutrition information for our analysis is obtained from Harris et al. (2009). Their study collects comprehensive information for both adult and children’s cereal, covering 115 brands and 277 cereals, excluding data for private label and generic brands. Their data provides sugar content, fiber content and sodium based on the nutrition facts label. In our analysis, we focus on the sugar and fiber content as they are key criteria for selection to the WIC list.

2.3 Advertising and pricing of WIC brands

When a brand is selected into the WIC program, it creates incentives for manufacturers and retailers to strategically manage the brand. Retailers could have an incentive to raise price, knowing that WIC customers are using vouchers and are therefore insensitive to price, although this would of course discourage purchase among non-WIC customers (Davis 2011). Manufacturers could also have an incentive to increase advertising in the state in an effort to attract a larger share of WIC purchase volume. This is important to address because we are interested in how WIC participation impacts consumers’ purchase pattern, unconfounded by firms’ strategic behavior such as a change in advertising or price promotion. Significant changes in firms’ price and advertising decisions may also have spillover effects on consumers who are not in the WIC program. We exploit cross-sectional and time series variation in whether a brand is selected for WIC to identify any changes in price or advertising strategy. To determine whether firms engage in this strategic behavior, we regress measures of price and advertising on an indicator for whether the brand is included in the WIC program.

For the pricing analysis, we use price information from each individual transaction. Table 4(a) shows the results of a regression of ln(Price) on indicators for whether the brand or the brand family is in the WIC program for the time and state, and fixed effects for chain, market, year and UPC. We find no evidence that prices are higher when a brand is included in the WIC program. Prices of WIC family brands are however 0.8% higher with WIC participation.

Measures of advertising at the brand level are more complex because a significant portion of advertising is at the brand family level. We calculate monthly media expenditures for each brand family in each DMA. We restrict this analysis to large brands with aggregate monthly sales above $5000 reported in the HomeScan data in each state. The total sales from these large brands account for above 91% of total sales in the cold cereal category. To reduce sampling errors from aggregation, we also only include the data from largest DMA in each state - the total sales from the largest DMA are about one third of the state sales recorded by Nielsen. Table 4(b) shows the results of a regression of ln(Advertising) on an whether the brand family is in the WIC program for the time and state, market fixed effects, brand fixed effects, and monthly national TV ad expenditures for the family brand. We do not find significant changes in local advertising expenditures for the WIC products.

3 The impact of WIC participation on household consumption

In this section, we first address empirical concerns related to measuring the impact of the WIC program on behavior and the limitations imposed by the available data. Next we measure the impact of WIC participation on household consumption volume, at the levels of category and brand, and on the total nutritional content of the products consumed.

3.1 Empirical issues: Control group and self-selection

Ideally, an evaluation of the impact of the WIC program would compare outcomes between test and control groups to which eligible households were randomly assigned. Our data however is observational, and we observe only the outcomes of a group of people who chose to enroll in the WIC program and disclosed this information in the panel survey. In this section, we discuss the creation of a control group and factors affecting enrollment amongst eligible households.

One approach to measuring the impact would be to simply compare the outcomes between pre, during, and post program participation among the WIC participants. There are however some concerns with this approach. Participation in WIC coincides with simultaneous changes in the household, due to the birth of the baby, and changes in household behavior are expected regardless of external intervention or program participation. Any changes observed over time may be due to changes in household composition and situation as well as participation in WIC.

To address these concerns, we selected a set of households to serve as a control group. This allows comparison of the consumption changes in WIC households to changes in household’s that are comparable in key demographics and experience similar changes in household structure. To construct the control group, we use a stratified sampling approach. We selected households into the control group based on the following six stratification variables: initial cereal consumption volume, new birth (birth/no birth recorded during the observation period), race (White and Other), education (high school or less, some college, college and higher), income quintile, household size (1, 2, 3, 4, 5+). With the stratified sampling approach, the goal is to construct a control group to match the WIC group in terms of initial cereal consumption, characteristics that are used to determine eligibility (income), and demographic characteristics likely to impact consumption (household size, education, etc.). Control group households with a recorded birth are assigned to ‘pre’, ‘during’ and ‘post’ WIC stages based on the timing of the birth. The ‘during’ stage is the year in which a child is first reported. The ‘pre’ and ‘post’ periods are the years before and after the first year in which an additional child is reported. For control group households with no recorded births, assignment to pre, during and post is sequential. We note that the control group is selected based on observed characteristics, but there are likely to be unobserved differences between the test and control group. Nevertheless, the control group allows us to account for changes in consumption that may be driven by changes in household structure over time.

Since eligible individuals must apply for benefits, self-selection is a potential source of bias. To enroll in the program, participants must visit a WIC clinic. For some this is the regular clinic used for their prenatal care, but for others the primary care doctor will recommend WIC and an appointment with a WIC clinic must be scheduled to complete the paperwork and enrollment process. When deciding to enroll in the program, households must weigh the benefits versus the costs of participation, such as the frequency of trips required to the WIC office and access to transportation (Bitler et al. 2003; Rasmussen et al. 2016; Smith 2016). The primary concern here is that households who are more interested in the WIC program and its benefits are more likely to enroll, and the consequence is that the estimated impact of the program will be overstated. Indeed, WIC participation among eligible households is estimated to be only 60%, with significant variation in participation across states - ranging from a low of 46% to a high of 76% (Martinez-Schiferl 2012b; Smith 2016). A critical factor accounting for the variation across states are the differences in outreach and communication efforts by local WIC agencies, resulting in differences in information and awareness. This is a key source of exogenous variation as it impacts enrollment but is highly unlikely to be correlated with the response to the program. While bias due to self-selection based on the household’s expected benefits remains a concern, the differences in outreach efforts provide an exogenous source of variation which allows us to compare WIC participants to non-participants.

3.2 Impact of WIC on household consumption volume: Category and brand

3.2.1 Impact on category consumption volume

We first focus on the impact of participation in the WIC program on total volume consumption in the cereal category. For this, we use data from WIC and control group households across all states.Footnote 9 Our measure is the household’s annual volume of cereal purchased in ounces.Footnote 10 To demonstrate the patterns in the data, Fig. 6a plots the average annual household-level cereal consumption volume pre, during and post participation in the WIC program. During the pre-WIC period, consumption volume is comparable between the WIC and control groups. Cereal consumption increases during the WIC period, as expected, and falls once households exit the program, but does not return to its pre-WIC level. Figure 6b shows the consumption volume for lower income (bottom two quintiles)Footnote 11 versus higher income (top three quintiles). For lower income households, consumption increases during WIC participation, but returns to pre-WIC consumption levels once households exit WIC. In contrast, for higher income households, consumption increases during the WIC period and continues to remain high post-WIC. Figure 6c shows consumption volume by household size. Smaller households do not appear to change consumption level during WIC, which suggests that WIC simply subsidizes their current consumption and does not expand it; but for larger households, consumption volume increases during WIC and does not return to pre-WIC levels after households exit the program.

For accurate estimates of the WIC effect on consumption volume, we estimate a hierarchical linear regression model with controls for household characteristics. The modeling approach accounts for heterogeneity across households and yields within-household estimates of the impact of program participation; this accounts for unobserved heterogeneity in trends across households.

For a household i,let Y i t denote the annual consumption volume (oz.) of cereal. We model the household’s consumption volume of cereal as a function of the time period, where During indicates periods of WIC participation and Post indicates post participation periods and ε i t ˜ N(0,σ i2).:

For household i, the intercept term α i captures initial consumption level, the coefficients β i and γ i measure any shifts in consumption levels across time periods During and Post. Let 𝜃 i be the vector of household specific parameters, 𝜃 i = (α i , β i , γ i ). We assume that the parameters in 𝜃 i have a common multivariate normal distribution with mean vector ΔZ i and variance-covariance matrix Σ:

where Z i is a vector of household characteristics including an indicator for WIC participants, income, household size, interactions between WIC and income and household size, college degree, white, and birth. The parameter vector Δ accounts for individual differences in 𝜃 i that can be related to the observed demographics Z i . Of particular interest are the coefficients on the indicators for WIC participants as they capture whether consumption trends differ for WIC households, the magnitude of the increase in consumption due to the WIC program during participation, and whether the impact persists after participation in the program once the food subsidy is withdrawn.

We use a hierarchical Bayesian approach for inference. The mean and standard deviation for the posterior draws for the population level parameters in Δ are reported in Table 5(a). In the first column, the intercept captures the overall mean for the control group. The coefficients for During (8.41) and Post (12.24) capture time trends in consumption for the control group and indicate a positive trend. The next set of columns report the coefficients for the WIC group and the interactions with household size and income. Income and household size are mean-centered to facilitate the interpretation of the coefficients. The WIC coefficient for the Intercept term (0.78) indicates that the consumption levels of the WIC and control groups are similar during the pre-WIC period. Similarly, the interactions of WIC with income and household size indicate no differences based on these characteristics. The WIC coefficient for During (25.03) indicates the increase in cereal consumption for WIC households of average income and household size, approximately two additional 12 oz. boxes of cereal consumed per year during the program. The increase is greater for larger households, where each additional household member adds 9 oz. of cereal to the annual total. The WIC coefficient for Post is important as it captures any differences in consumption level for WIC households after they exit from the WIC program. At average income and household size, WIC households are consuming an additional 16 ounces of cereal per year, after controlling for trends in the control group. The effect is stronger for higher income households, where households consume an additional 9 oz. of cereal for each additional $10,000 in household income. Lower income households may be income constrained or face transportation costs that limit their opportunities to purchase cereal. The remaining columns show the impact of household characteristics; for example, the coefficients for white indicate that white households consume 100 oz. more of cereal and have a general upward trend in their consumption. Overall, the results are important because they show that households expand their cereal consumption volume after exposure to the WIC program.

An additional source of information in the data is whether households have ever received WIC benefits in the past, although the time elapsed since receiving WIC benefits is not known. We use this data to determine whether there are any long run differences between former WIC participants and non-participants on category consumption levels, after controlling for household demographics. The data contains 13,287 households who received WIC benefits in the past, not including households who reported receiving WIC benefits at any time during the data collection period. Table 6 shows the results of a regression of cereal volume on indicators for WIC participation in the past, controlling for household size, income, race and college education. This analysis uses all households reporting in the database. We find that previous WIC participants consume more cereal compared to non-WIC households. This effect varies with household size, smaller households consume an average of 26 ounces more cereal annually (approximately 2boxes) whereas larger households consume 42 ounces (approximately 3.5 boxes) more per year. These effects are both statistically and economically significant. This analysis provides additional evidence that households increase their cereal consumption after exposure to the WIC program.

3.2.2 Impact on WIC brand consumption volume

We turn next to the impact of WIC participation on consumption volume of the WIC brands subsidized by the program. While an increase in WIC brand consumption during the program is expected, our primary interest is in what happens once the households exit the program. We first show the patterns in the raw data and then estimate a hierarchical model using the volume of WIC brand consumption as the focal variable. Figure 7a shows the consumption volume of WIC brands. For the control group, there is a downward trend in volume over time. For the WIC group, the volume of WIC brands increases during WIC as expected. In the post-WIC period, consumption volume falls but remains higher than the pre-WIC levels. In terms of income, Fig. 7b shows that both high and low income households increase consumption of WIC brands during WIC, but only high income households continue to purchase at a higher rate in the post-WIC period; for lower income households, purchase of WIC brands falls once they are not subsidized. Figure 7c shows that smaller households increase consumption of WIC brands during WIC, and continue to consume at a higher level even after they exit the program. Given that smaller households do not increase total consumption, this suggests that smaller households substitute to WIC brands and this effect persists even when these brands are not subsidized. For larger households, WIC brand consumption increases during WIC but falls back again in the post-WIC period. So while larger households increase total consumption volume in the post-WIC period, WIC brands do not benefit from this expansion.

Table 5(b) shows the model estimation results where the dependent variable is the consumption volume of WIC brands. The estimates indicate a positive but negligible trend in the control group. Our primary interest is in the WIC coefficients reported in the second column. The WIC coefficient for During indicates that for the household of average income and size, WIC brand volume increases by 27 oz. during the program (approximately two 12 oz. boxes of cereal). The change does not vary with income level, but each additional family member increases the impact by 9 oz.

The coefficients for Post reveal the impact once the households exit the program. For households of average income and household size, the increase in the post-WIC period is 18.13 oz. (approximately one and a half boxes). The results are of economic significance as it shows that WIC brands benefit from inclusion in the program, and that this benefit persists even after the subsidy is withdrawn.

3.3 Impact of WIC on nutrition content

The end goal of the WIC program is to improve nutrition and health outcomes. Our analysis thus far focuses on the intermediate effects in terms of aggregate purchase behavior. We now explore the impact on the nutrition content of the purchased products in terms of the volume of sugar, which the program seeks to reduce, and fiber, which the program seeks to increase. A key limitation is that we were unable to identify the nutrition content of all brands, in particular private label brands. Despite this, the analysis yields evidence of a beneficial impact of the WIC program. The sugar and fiber content are measured as the percent of the total volume consumed by weight. Table 7(a) shows the average volume percent of sugar and fiber content of WIC participants before the program. Table 7(b) shows the results of regressions of the sugar and fiber content for each purchase on fixed effects for each household and for During and Post periods. The household fixed effects control for each households level of sugar and fiber. The coefficients for During and Post measure the changes of interest. When evaluated relative to the overall average level of sugar consumption, we find a decrease in sugar of 5.9% during WIC, but after WIC the magnitude of this decrease falls to 2.2%. For fiber consumption, we find an increase of 4.4% during WIC, and 3.4% post WIC. The analysis yields evidence of a positive impact on nutrition during the program and, while smaller in magnitude, the change persists after WIC.

3.4 Summary of results

Overall, we find evidence of a positive impact of WIC on consumption and nutrition which persists even after the households exit the program. In terms of household size, consumption volume increases for larger households during and post WIC participation. In terms of income, both lower and higher income households increase consumption volume during WIC, but post-WIC only higher income households continue to purchase at a higher level, while consumption returns to pre-WIC levels for lower income households. For brands included in the WIC program, consumption increases while participants are in the program, and on average participants continue to consume WIC brands at a higher level even after they exit the program; the post-WIC effect is stronger for higher income households.

To check robustness of our findings, we also considered alternative estimation approaches. We first use a regression discontinuity approach which exploits the fact that the eligibility to participate in WIC is primarily determined by household income. For the analysis we use households within a defined interval around the threshold, where WIC participants above the threshold are treated as the test group, and non-participants below the threshold are treated as the control group. The results (Table 8) are directionally consistent with our main results but not statistically significant, partially due to the smaller sample size used in estimation. We also use a propensity score weighting method. We first estimate a logit model of WIC participation with household characteristics, and use the predicted probabilities as weights in the analysis. The results (Table 9) are consistent with our main analysis, but only the impacts on WIC brand consumption are statistically significant.

4 Behavioral mechanism testing

A key result from the analysis of brand purchase patterns is that the shift in household-level consumption toward WIC brands persists even after the households exit the program. In this section, we explore potential behavioral mechanisms through which participation in the WIC program impacts future brand choice. We find a measurable positive shift in preference for WIC brands even after accounting for state dependence. We then investigate whether the observed shift in preferences is consistent with learning, at the category or brand level. Our focus here is not to build a specific model of learning, rather we want to explore whether the observed change in preferences is consistent with learning.

4.1 Shift in brand preferences and state dependence

While participating in the WIC program, a shift in household purchases toward the subsidized WIC brands is expected. The results in the previous section show that once consumers exit the program, WIC brand consumption falls but remains significantly higher than pre-program levels. A potential explanation is that this is a consequence of state dependence and tendencies toward brand inertia (Keane 1997; Seetharaman et al. 1999; Dubé et al. 2010). The program promotes the selection of WIC brands and merely manipulates the household’s purchase state, so that the elevated brand shares are a temporary and short term consequence of brand inertia. An alternative explanation is that the exposure to WIC brands during the program shifts household brand preferences towards them, an effect that is expected to be more enduring and have long term implications for brand share. Previous research has documented persistence in brand choice over the long term based on early life exposure (Bronnenberg et al. 2012). This is also the perspective from manufacturers who expect that ‘reaching WIC children helps establish tastes and preferences that last well into adulthood’ (Kirchhoff 1998). Whether the higher shares are due to a change in preferences or an indirect effect through state dependence and choice dynamics is an empirical question and an important aspect of evaluating the impact of the program.

To address this question, we estimate a household level model of product choice conditional on purchase from the cereal category. For a household i, the utility from a product j on trip t is expressed as

where P j t is the price of product j at time t and β i represents household i’s price sensitivity; α i j captures household i’s preference for the brand of product j. I(j = WICBrand) is an indicator for products that are part of the WIC program, and λ i measures any differences in preference for WIC products relative to the preference for its brand.Footnote 12 For example, of the various products available from the brand Cheerios,such as Frosted Cheerios and Multigrain Cheerios) only Cheerios and Multigrain Cheerios are part of WIC. I{s i t = j} is an indicator for whether household i purchased product j on the previous purchase occasion and ω i is the state dependence parameter. I(j = WICBrand) ∗ I(i t = P o s t) is an interaction between indicators for WIC brand and the post program time period; the parameter δ i accounts for any change in preference for the WIC products after the program. Our interest here is the state dependence parameter ω and the measure of shift in preferences δ: δ = 0 and ω > 0 would indicate that there is no change in preference and that the elevated share of WIC products post-program are a temporary impact of inertia. The model is estimated on purchases observed prior to and post the WIC program, but not during the program, since our interest is identifying the differences in preferences between pre and post WIC.Footnote 13

Assuming the error term ε i j t follows an iid Type I extreme-value distribution, the probability that a household will choose product j at time t is:

Let 𝜃 i be the vector of household-specific parameters including β i , α i1...α i J , λ i , ω i , δ i . To understand the relationship between household parameters and demographic variables, we employ a hierarchical structure with a second level that allows the parameters to be related to the observed demographics and a random component. Assuming that the random component follows a normal distribution, then 𝜃 i is drawn from a multivariate normal distribution with a mean vector ΔZ i and variance matrix Σ :

where Z i is a vector containing the characteristics of household i including household size, income, race, education, and birth. The population parameter matrix Δ accounts for differences in 𝜃 i due to observed household demographics, and the matrix Σ accounts for variance that cannot be accounted for by the observed demographics and correlation across parameters.

For estimation, we use the top 60 products in terms of volume share and included all the WIC brands, resulting in a total of 77 products which accounted for 80% of the cereal volume consumed within the sample. We used the remaining brands as an outside good. With the large choice set of 77 alternatives and an average of 28 choice occasions per household, the estimation data is large. For estimation, we use a random subset of the full choice set which yields consistent parameter estimates (McFadden 1978) even for mixed logit with random household-specific coefficients (Brownstone, Bunch and Train 2000, Keane and Wasi 2012). On each choice occasion, the choice set includes the chosen product, the previously chosen product, and 12 randomly selected choice alternatives from the remaining options. We use a hierarchical Bayesian estimation approach, relying on MCMC procedures with non-informative priors.

Results

The population level parameter estimates of Δ and the diagonal elements of Σ are presented in Table 10. As income and household size are mean centered, the first column of the table measures the parameter mean for the average income and size, non-white household with no college or birth, and the following columns measure the parameter shifts with the demographics. The price coefficient is negative, as expected, with lower price sensitivity for college educated and white households and higher price sensitivity for households with a recent birth. Interestingly, the coefficient for WIC brands is also positive (0.399), indicating that even after controlling for the brand family there is a positive preference for the set of brands included in the WIC program, and this preference is stronger for households with a recent birth.

The main parameters of interest are the state dependence parameter and the coefficient of WICBrand*Post. The coefficient on the state dependence parameter is positive (0.163) indicating that some of the observed shift in shares toward WIC brands is related to state dependence, and so is temporary in nature. The coefficient of WICBrand*Post captures whether preference for WICBrands are different in the post-WIC period relative to the pre-WIC period. The coefficient on WIC Brand*Post is also positive (0.106), and indicates an increase in preference for WIC brands following participation in the program. This effect is detected even after accounting for state dependence. Also of interest are the coefficients on the demographic terms. We highlight the coefficient on white, which is particularly interesting as it is relatively large in magnitude (0.26). After the program, the preferences of white households shift toward the WIC brands to a far greater extent that non-white households. If a goal of the WIC program is to encourage change toward healthier food options, this result indicates a disparity based on race.

The household level parameters are also of interest. Figure 8 shows the distribution of the household level estimates of state dependence parameter and the coefficient of WICBrand*Post. The mean of the state dependence parameter is positive (0.17), and while much of the support is also positive there is a segment of households with negative state dependence. The mean of the coefficient on WICBrand*Post is also positive (0.11), and there is a large segment of households with a negative change in their preference for WIC brands. This suggests that there is a segment of households for whom brand equity of WIC brands depletes due to participation in the program.

To measure the impacts of state dependence and change in brand preference on market shares we use the household level parameters to run a sequence of simulations. For the baseline we compute the market share of WIC brands if there is neither state dependence nor a change in WIC brand preferences (i.e. both parameters are restricted to 0). The baseline is compared to the outcome if there is state dependence and the outcome if there is both state dependence and a change in WIC brand preferences. The simulation results are reported in Table 11. The baseline WIC brand market share is 34%. Accounting for state dependence raises the market share to 34.5%. Accounting for a change in WIC brand preferences results in a 4 percentage point increase in WIC brand market share from 34.5% to 38.6%, which represents an approximately 12% increase in market share. The simulations show that the much of the increase in market share toward WIC brands can be attributed to preference change following participation in the program.

Overall, our results indicate that the observed shift in market share toward WIC brands that persists even after the subsidy is withdrawn is driven by the effects of state dependence and to a larger extent a change in preference for WIC brands. While the effects of state dependence are short term and expected to diminish, the change in preferences represents a longer term shift that is expected to persist. This also relates to our finding in section 3 that households who identify as having previously participated in WIC consume higher levels of cereal.

Relating the shift in brand preferences to learning: category and brand level

Having identified a shift in brand preferences, we next explore whether these shifts can be related to learning at the category or brand level. Here we do not seek to estimate a formal learning model, rather we want to see if the observed patterns are consistent with learning of some form.

We first consider category level learning. It may be the case that households who are infrequent or low volume consumers of cereal form stronger preferences for the WIC brands when they are exposed to them during the program. If this is the case, then we would expect that the correlation between household consumption volume in the pre-period and the WICBrand*Post parameter to be negative, since households with higher levels of initial consumption are expected to change preferences less. We find instead that the measured correlation (0.06) is slightly positive and not statistically significant. The correlation is plotted in Fig. 8. The change in preference appears to be unrelated to the initial consumption volume, so learning at the category level as an explanation for the shift in preferences is not supported.

We next turn to brand level learning as a factor in explaining the shift in preferences. In our case, we believe that brand learning could arise from households whose exposure to the WIC brands was low prior to the program. This could come from households who were low users of the category as well as households who were category users but not WIC brand users. With brand learning, we would expect the correlation between household consumption volume of WIC brands in the pre-period to be negatively correlated with the WICBrand*Post parameter. The correlation between these two measures, plotted in Fig. 8, is -.18. Although the magnitude is small, the measure is statistically significant, and it indicates that households with lower initial WIC brand consumption tend to display a greater shift in preferences toward the WIC brands.

To further explore the notion of brand learning, we compute the proportion of cereal consumption that was WIC brand in the pre-WIC period (ratio of WIC brand to total cereal volume). We consider this to be a proxy for exposure to WIC brands relative to cereal category exposure prior to WIC enrollment. With brand learning we would expect that households with lower ratio of WIC to total consumption would experience larger shifts in brand preference. We do in fact find that the correlation between this ratio and the WICBrandPost parameter is negative (-0.21) and significant. We also compute the ratio of WIC brand consumption during WIC to pre-WIC enrollment. This measures the relative change in WIC consumption induced by participation in the program. With brand learning, we expect that households who experienced a larger relative change in WIC brand consumption would be more likely to shift their brand preferences toward the WIC brands. In fact, we find that the correlation is positive (0.09) and significant. While the magnitudes of these correlations is not large, the overall evidence suggests that there is a role for brand learning in explaining the shift in preferences.

5 Conclusion

Our paper is a systematic study of the impact of the WIC program on consumption behavior. The question of interest is whether participation in the program changes people’s behavior, in particular does the behavior that is incentivized under the program persist once the incentive is removed. At a more fundamental level, we evaluate whether providing a product for free is effective in creating a preference for that product, so that people continue to consume the product even when it is no longer free. Our general result is that this intervention is effective in changing behavior, and that the change in behavior persists even after the incentive is removed. Not surprisingly, during the program participants increase cereal consumption and shift their choices toward WIC-approved products. More important is that once the participants exit the program, the higher consumption rate persists, both at the category level and for the products subsidized by the program. It is worth noting that the expansion in volume is highly beneficial to the cereal industry overall, as it represents a subsidized long term expansion of demand.

We investigate the behavioral mechanism underlying the change in brand choice behavior. A possibility is that the observed changes are a consequence of state dependence and inertia, and participation in the program merely manipulates the household’s state. This means the observed effects are temporary and will dissipate over time. Alternatively, the observed shifts could be related to changes in underlying preferences, which is of interest as changes in households preferences are more enduring. Our analysis finds evidence of a shift in brand preferences as well as a tendency toward inertia, however, the impact of the change in brand preferences is stronger. To the extent that the subsidized products are healthier, this type of intervention represents a potential mechanism for shifting food choices towards healthier options.

The change in behavior would only be beneficial if participants also continued to consume ‘healthier’ cereals, as prescribed by the WIC program. Our results show an improvement in nutrition, as the sugar content decreases and fiber content increases both during and after participation in the program. The results suggest that the newer additions to the WIC program, fruits, vegetables and whole grains, will be effective in improving nutrition and eating habits. Generally, ‘in-kind’ transfers are considered inefficient as they distort consumption, but in this case the ‘distortion’ is beneficial in promoting healthier choices. It is also expected that the consumption distortions last only as long as the ‘in-kind’ transfers, but here the distorted behavior continues even when the subsidy is withdrawn.

These findings are also relevant beyond the WIC program. The WIC program is relatively small compared to the larger food subsidy program, the Supplemental Nutrition Assistance Program (SNAP) or ‘food stamps’ which reaches a larger number of US households. These households tend to be lower income, the group that also bears a disproportionate burden of the obesity epidemic. The Healthy Incentives Pilot recently studied the use of incentives to promote healthier choices, but the idea of introducing restrictions on how participants can spend their SNAP dollars is hotly debated. Our results suggest that restricting the type of foods that can be purchased would result in long term behavior change and nutrition improvement.

There are several issues we are not able to address, because of data availability and sample size issues, which suggest directions for further investigation. Ideally, we would like to comment on the design of the intervention. A characteristic of the WIC program is that the products are fully subsidized and made available for free. Previous research has explored whether giving a product away for free lowers perceived value and discourages consumption; in addition, if participants were to incur an out-of-pocket cost, consumption could increase through a sunk cost effect (Thaler 1980; Ashraf et al. 2010). Although we have shown that the program is effective in changing behavior, the question is whether the program would be more impactful if the cost of the products to the participants was non-zero. The number and type of brands, national versus private label, offered is also likely to impact program effectiveness. It is difficult for us to address this because of sample size limitations. We also do not address how length of time in the program impacts participation, whether additional time in the program results in greater change in behavior. These are highly important issues to address, not only for understanding how the WIC program can be improved, but also for general learning about the design of nutrition interventions. For example, if the marginal impact of additional time in the program is known, it can help policy makers design programs to optimize the eligibility period for program participation. The WIC program could also have unobserved spillover effects if WIC households share their subsidy with neighbors or their social networks. Understanding the extent of such practices and whether they are beneficial would also allow policy makers to adjust the program to account for such effects. Future evaluations of the program could also expand the analysis to cover all the categories offered by the program, to understand its broader effects and account for cross-category effects. Recent changes have expanded the categories covered by the WIC program and it would be fruitful to evaluate whether the expanded categories facilitate a healthier behavior more effectively. We believe these issues can be addressed with further detailed data collection efforts and broader analysis.

Notes

”WIC At A Glance”. http://www.fns.usda.gov/fns

The higher income eligibility cutoffs for pregnant women on Medicaid means that women with incomes above the 185% of the poverty level are also included.

At the time of data collection, WIC categories were Beans, Cereal, Cheese, Eggs, Fruit Juices, Milk, Peanut Butter, Canned Seafood. More recently fruit, vegetables and whole grains have been added.

Information on access to the data is available at http://research.chicagobooth.edu

The database actually starts from 2004. Our key household characteristics is participation in the WIC program. Nielsen started recording this information from 2006 onwards.

In the rest of the paper, we refer to brand-flavor combinations as brand, which includes multiple UPCs.

Since we are evaluating total category consumption, we only need to know whether a household was in WIC or not, thus we can use information from all states. When we analyze how WIC status impacts consumption at the brand level, we restrict our analysis to the seven states for which the specific brands included in WIC are known.

We observe a consumer’s purchases but not consumption from HomeScan data. It is possible that a consumer could share his or her subsidized food with others, but such information is not recorded in our data.

Note that previous years income is collected from the HomeScan panel. Our analysis accounts for this as we matched the demographic data to the previous years consumption.

For example, the parent brand Cheerios offer a range of products such as Frosted Cheerios and Multigrain Cheerios. Both Frosted Cheerios and Multigrain Cheerios would have the brand ’Cheerios’, and the Multigrain Cheerios product would also have the WICBrand indicator equal to 1.

This allows us to avoid an issue related to price, during the WIC progam the product price for participants is essentially 0.

References

Aaker, D.A. (1991). Managing brand equity. New York: The Free Press.

Arcia, G.J., Crouch, L.A., & Kulka, R.A. (1990). Impact of the WIC program on food expenditures. American Journal of Agricultural Economics, 72(1), 218–226.

Ashraf, N., Berry, J., & Shapiro, J.M. (2010). Can higher prices stimulate product use? Evidence from a field experiment in Zambia. American Economic Review, 100(5), 2383–2413.

Bitler, M., Currie, J., & Scholz, J.K. (2003). WIC eligibility and participation. The Journal of Human Resources, 38(Supplement), 1139–1179.

Bitler, M.P., & Currie, J. (2005). Does WIC work? The effects of WIC on pregnancy and birth outcomes. Journal of Policy Analysis and Management, 24(1), 73–91.

Blattberg, R.C., Briesch, R., & Fox, E.J. (1995). How promotions work. Marketing Science, 14(3), G122–G132.

Brehm, J.W. (1966). A theory of psychological reactance. New York.

Bronnenberg, B.J., Dubé, J.P., & Gentzkow, M. (2012). The evolution of brand preferences: evidence from consumer migration. American Economic Review, 102(6), 2472–2508.

Brownstone, D., Bunch, D., & Train, K. (2000). Joint mixed logit models of stated and revealed preferences for alternative-fuel vehicles. Transportation Research Part B, 34, 315–338.

Carlson, A., & Senauer, B. (2003). The impact of the special supplemental nutrition program for women, infants, and children on child health. American Journal of Agricultural Economics, 85(2), 479–491.

Cohen, D., & Farley, T.A. (2008). Eating as an automatic behavior. Preventing Chronic Disease, 5(1), A23.

Davis, D.E. (2011). Bidding for WIC infant formula contracts: Do non-WIC customers subsidize WIC customers? American Journal of Agricultural Economics, 94(1), 80–96.

Devaney, B., Bilheimer, L., & Schore, J. (1992). Medicaid costs and birth outcomes: the effects of prenatal wic participation and the use of prenatal care. Journal of Policy Analysis and Management, 11(4), 573–92.

Dodson, J.A., Tybout, A.M., & Sternthal, B. (1978). Impact of deals and deal retraction on brand switching. Journal of Marketing Research, 15, 72–81.

Dubé, J.P., Hitsch, G.J., & Rossi, P.E. (2010). State dependence and alternative explanations for consumer inertia. The RAND Journal of Economics, 41 (3), 417–445.

Gorski, M.T., & Roberto, C.A. (2015). Public health policies to encourage healthy eating habits: recent perspectives. Journal of Healthcare Leadership, 2015(7), 81–90.

Grier, S., & Bryant, C.A. (2005). Social marketing in public health. Annual Review of Public Health, 26(1), 319–339.

Harris, J.L., Schwartz, M.B., Brownell, K.D., Sarda, V., Weinberg, M.E., Speers, S., Thompson, J., Ustjanauskas, A., Cheyne, A., Bukofzer, E., Dorfman, L., & Byrnes-Enoch, H. (2009). Cereal FACTS: Evaluating the nutrition quality and marketing of children’s cereals. Ruud Center, Yale University.

Herman, D.R., Harrison, G.G., Afifi, A.A., & Jenks, E. (2008). Effect of a targeted subsidy on intake of fruits and vegetables among low-income women in the special supplemental nutrition program for women, infants, and children. American Journal of Public Health, 98(1), 98–105.

Hoeffler, S., & Keller, K.L. (2002). Building brand equity through corporate societal marketing. Journal of Public Policy & Marketing, 21(1), 78–89.

Joyce, T., Gibson, D., & Colman, S. (2005). The changing association between prenatal participation in WIC and birth outcomes in New York City. Journal of Policy Analysis and Management, 24(4), 661–685.

Keane, M.P. (1997). Modeling heterogeneity and state dependence in consumer choice behavior. Journal of Business & Economic Statistics, 15(3), 310–327.

Keane, M.P., & Wasi, N. (2012). Estimation of discrete choice models with many alternatives using random subsets of the full choice set: With an application to demand for frozen pizza. Oxford: Univerisity of Oxford Working Paper. No. 2012-W13.

Kirchhoff, S. (1998). Nutrition Program’s Tempest In A Cereal Bowl Congressional Quarterly, May 18. http://www.cnn.com/ALLPOLITICS/1998/05/18/cq/cereal.html.

Martinez-Schiferl, M. (2012a). WIC participants and their growing need for coverage. Income and Benefits Policy Center, Urban Institute. Retrieved from. http://www.urban.org/UploadedPDF/412549-WIC-Participants-and-Their-Growing-Need-for-Coverage.pdf.

Martinez-Schiferl, M. (2012b). WIC Coverage in your state. UrbanWire, Food and Nutrition, Urban Institute. Retrieved from. http://www.urban.org/urban-wire/wic-coverage-your-state.

McFadden, D. (1978). Modeling the choice of residential location. In Karlqvist, A., Lundqvist, F., Snickars, F., & Weibull, J. (Eds.) Spatial interaction theory and planning models (pp. 75–96). North-Holland: Amsterdam.

Mela, C.F., Gupta, S., & Lehmann, D.R. (1997). The long term impact of promotion and advertising on consumer brand choice. Journal of Marketing Research, 34, 248–61.

Oliveira, V.J., & Gundersen, C. (2000). WIC and the nutrient intake of children. Economic Research Service: US Department of Agriculture.

Rasmussen, K.M., Latulippe, M.E., & Yaktine, A.L. (Eds.) (2016). Review of WIC food packages: proposed framework for revisions: interim report. Committee to review WIC food packages; food and nutrition board. institute of medicine; national academies of sciences, engineering, and medicine; Washington (DC). Washington: National Academies Press (US). Jul 6 2016.

Reilly, J. (2000). Charitable work sells at a number of firms. Marketing News, 34(19), 46.

Rose, D., Habicht, J.P., & Devaney, B. (1998). Household participation in the food stamp and WIC programs increases the nutrient intakes of preschool children. The Journal of N utrition, 128(3), 548–555.

Seetharaman, P.B., Ainslie, A., & Chintagunta, P.K. (1999). Investigating household state dependence effects across categories. Journal of Marketing Research, 36, 488–500.

Simmons, C.J., & Becker-Olsen, K.L. (2006). Achieving marketing objectives through social sponsorships. Journal of Marketing, 70(4), 154–169.

Smith, K. (2016). Fewer than half of WIC-eligible families receive WIC benefits. Carsey Research National Issue Brief #102, Carsey School of Public Policy, University of New Hampshire, Summer 2016. http://scholars.unh.edu/cgi/viewcontent.cgi?article=1277&context=carsey.

Thaler, R. (1980). Toward a positive theory of consumer choice. Journal of Economic Behavior & Organization, 1(1), 39–60.

Verplanken, B., & Aarts, H. (1999). Habit, attitude, and planned behaviour: is habit an empty construct or an interesting case of goal-directed automaticity? European Review of Social Psychology, 10(1), 101–134.

Weingarten, H. (2013). Kellogg’s Scooby Doo Cereal – low sugar option for kids. Fooducate 27 February 2013. http://blog.fooducate.com/2013/02/27/kelloggs-scooby-doo-cereal-low-sugar-option-for-kids/.

Wood, W., & Neal, D.T. (2007). A new look at habits and the habit-goal interface. Psychological Review, 114(4), 843.

Acknowledgments

We acknowledge the Kilts Center for Marketing at the University of Chicago Booth School of Business and Frank Piotrowski of AC Nielsen for providing access to the Nielsen Homescan and RMS data.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Khan, R., Zhu, T. & Dhar, S. The effect of the WIC program on consumption patterns in the cereal category. Quant Mark Econ 16, 79–109 (2018). https://doi.org/10.1007/s11129-017-9191-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-017-9191-z