Abstract

In the U.S., households with less than one car per driver (auto-deficit households) are more than twice as common as zero-vehicle households. Yet we know very little about these households and their travel behavior. In this study, therefore, we examine whether car deficits, like carlessness, are largely a result of financial constraint or of other factors such as built environment characteristics, household structure, or household resources. We then analyze the mobility outcomes of car-deficit households compared to the severely restricted mobility of carless households and the largely uninhibited movement of fully-equipped households, households with at least one car per driver. Data from the California Household Travel Survey show that car-deficit households are different than fully-equipped households. They have different household characteristics, travel less, and are more likely to use public transit. While many auto-deficit households have incomes that presumably enable them to successfully manage with fewer cars than adults, low-income auto-deficit households are—by definition—income constrained. Our analysis suggests that low-income car-deficit households manage their travel needs by carefully negotiating the use of household vehicles. In so doing, they travel far more than carless households and use their household vehicles almost as much as low-income households with at least one car per driver. These results suggest that the mobility benefits of having at least one car per driver are more limited than we had anticipated. Results also indicate the importance of transportation and employment programs to ease the potential difficulties associated with sharing cars among household drivers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

With almost 85% of all trips in the U.S. taken by car, the preeminence of the automobile in American travel is unmatched (Federal Highway Administration 2009). U.S. residents drive roughly 13,500 miles per year, and the private vehicle is the principal mode of transportation for virtually every trip purpose (Davis et al. 2016). The central role of the automobile is not surprising since in most metropolitan areas and in almost all neighborhoods within them, automobiles offer greater access to destinations within a reasonable travel time compared to other modes (Shen 2001). Consequently, scholars find a robust and positive connection between car ownership and a range of quality-of-life outcomes such as employment, earnings, and residential location in better quality neighborhoods (Dawkins et al. 2015; Gurley and Bruce 2005; Raphael and Rice 2002).

American households exhibit extremely high levels of vehicle ownership: 93% of U.S. households own at least one car, and over 65% own two or more (Ruggles et al. 2017). While 7% of American households are without a car altogether, these households potentially represent only a small proportion of the population that struggles with inadequate vehicle access. Approximately 15% of U.S. households have fewer cars than drivers, a percentage double that of zero-vehicles households (Federal Highway Administration 2009). Some of these car-deficit households prefer to live with fewer cars than drivers, a decision celebrated by many urban planners seeking to reduce the negative environmental externalities associated with driving. For other households, having fewer vehicles than drivers may be a constraint, reflecting households’ inability to afford a car for every household adult. Low-income households (households with incomes below $35,000) are over one and a half times more likely to have an auto-deficit than higher-income households (Federal Highway Administration 2009). For these households, being car-deficient potentially limits both their mobility and access to opportunities.

Despite being twice as common as zero-vehicle households, car-deficit households have received limited attention from U.S. scholars. In particular, crucial questions about the determinants of car deficits and their implications for household travel remain unanswered. This research aims to fill this gap. In this study, we draw on data from the 2012 California Household Travel Survey (CHTS) to examine the following two questions. First, are car deficits, like carlessness, largely a result of financial constraint or of other factors, such as other household resources, household structure, or built environment characteristics? Second, how do the mobility outcomes of car-deficit households compare to the severely restricted mobility of carless households and the largely uninhibited movement of “fully-equipped” households, which we define as households with at least one car per driver?

We find that car-deficit households are different than households that are fully equipped. They have different household characteristics, travel less, and are more likely to use public transit. While many auto-deficit households have incomes that presumably enable them to successfully manage with fewer cars than adults, low-income auto-deficit households are—by definition—income constrained. We do not know for certain whether they experience a latent demand for travel. However, our analysis suggests that low-income car-deficit households manage their travel needs by carefully negotiating the use of household vehicles. In doing so, they travel far more than carless households and almost as much as low-income households with one or more vehicles per driver. They also use their household vehicles as much as higher-income auto-deficit households. These results show that the mobility benefits of being fully equipped are more limited than we had anticipated. The results also indicate the importance of transportation and employment programs to ease the potential difficulties associated with sharing cars among household drivers.

Household access to automobiles

Household income and car ownership

There is a strong positive relationship between income and vehicle ownership among U.S. households (Chu 2002; Schimek 1996). Consequently, zero-car households tend to be carless not by choice, but due to financial constraint (Brown 2017; Klein and Smart 2017; Mitra and Saphores 2017). Yet even households with limited financial resources place high premiums on car ownership; data from the 2011-2015 5-Year American Community Survey show that more than 80% of individuals in poverty live in households with at least one car (Ruggles et al. 2017). Several studies note that the Earned Income Tax Credit, which provides low-income working families with a yearly lump-sum tax rebate of up to several thousand dollars, is often directly converted into automobility, additional evidence of the importance of automobiles to low-income families (Adams et al. 2009; Goodman-Bacon and McGranahan 2008; Mendenhall et al. 2012). However, as incomes rise, the demand for automobiles is saturated, suggesting that much of the latent or unmet demand for auto ownership occurs at the bottom end of the income distribution (Blumenberg and Pierce 2012; Chu 2002; Oakil et al. 2014).

Evidence of the opposite phenomenon—the effect of falling incomes on car ownership rates—also speaks to the importance of household vehicle ownership by highlighting the asymmetry between elasticities of car ownership for those with rising incomes and those with falling incomes. Dargay (2001) finds that while the elasticity of car ownership for increasing income is quite high, car ownership elasticity is appreciably lower as incomes fall. In other words, households are eager to commit added resources to enhanced automobility, but loath to reduce their access to automobiles, even in the face of financial hardship. In contrast, in a more recent study Clark et al. (2016a, p. 595) find that “reductions in income had a stronger effect on the likelihood of vehicle losses than equal but opposite increases in income gains.” As the authors note, this finding may be due to the lingering effects of the economic recession, as the data were collected in 2010/11. Moreover, similar to the findings of other studies, their analysis shows greater volatility in second household cars compared to first cars, suggesting the desire of most households to hold on to at least one household vehicle.

Residential location and automobile ownership

Prior to 2010, there were more than 200 studies on the relationship between the built environment and travel (Ewing and Cervero 2010). A subset of these studies examines the role of the built environment in vehicle ownership decisions (which is related to other household travel outcomes). Households without automobiles tend to live in dense, transit-rich neighborhoods oftentimes located in central cities where they can use non-auto modes to access needed destinations (Bhat and Guo 2007; Glaeser et al. 2008). Even controlling for this residential self-selection process, some studies find relationships between the characteristics of the built environment—such as transit availability and street block density—and rates of automobile ownership; however, these effects are typically smaller than the effects of demographic and economic factors such as income (Bhat and Guo 2007; Clark et al. 2016a; Van Acker and Witlox 2010).

Other determinants of automobile ownership

In addition to income and residential location, studies show that changes in automobile ownership are strongly related to changes in life events such as employment (e.g. new job, retirement) and household structure (the addition or loss of household members) (Clark et al. 2016a, b; Oakil et al. 2014; Oakil et al. 2016b; Yamamoto 2008). However, changes such as the birth of a first child, divorce, and employment may be uniquely relevant to women and, as the research suggests, positively related to women’s decision to obtain unlimited access to a vehicle (Oakil 2016).

Auto access and mobility

Most households in the U.S. are willing to commit financial resources toward car ownership, even if these resources are severely limited, because households with unfettered access to automobiles also tend to have increased levels of mobility (Blumenberg and Pierce 2012; Dieleman et al. 2002; Giuliano and Dargay 2006; Pucher and Renne 2003). By and large, studies find that higher rates of car ownership translate into more personal miles of travel (PMT) (Giuliano and Dargay 2006).

While more PMT is not positive a priori, the sprawling, decentralized development patterns of most metropolitan areas in the U.S. mean that key destinations are often spatially distant from one another and require considerable travel to access. Although public transit theoretically could fulfill an individual’s transportation needs, the private automobile almost universally allows people to travel further, faster, and more efficiently than other modes (Kawabata and Shen 2007). Automobiles provide greater access than transit to both work and non-work destinations (Kawabata and Shen 2007; Syed et al. 2013; U.S. Department of Agriculture 2009). Cars also are more convenient for certain trip types. For example, they can make it easier to trip chain, tours in which travelers perform several activities at multiple locations en route to a primary destination (McGuckin et al. 2005). Trip chaining is a highly efficient way to accomplish daily tasks; however, its complexity means that a car is a virtual necessity (Hensher and Reyes 2000; Ye et al. 2007). Moreover, analysis of time use data suggest that some activity types are simply better suited to automobile travel such as escorting children, shopping, and carrying heavy goods (Mattioli et al. 2016).

The access and convenience afforded by the automobile helps to explain the growing number of studies that show a relationship between car ownership and several quality of life outcomes such as employment, earnings, and living in better neighborhoods (Blumenberg and Pierce 2017; Dawkins et al. 2015; Gurley and Bruce 2005; Raphael and Rice 2002). Those without car access thus often face a significant disadvantage in terms of travel efficiency, and either must spend considerable time on slow or unpredictable transit options, or completely forego trips they deem less essential.

Car-deficit households

Despite the importance of the above findings, there are some notable gaps in the literature surrounding car ownership and car use. Much of the existing literature on automobile ownership focuses on the determinants of car ownership and explanations for changes—increases and decreases—in household vehicle fleets (Clark et al. 2016a, b; Oakil et al. 2016a). Very few studies focus specifically on auto-deficit households, either their determinants or their travel characteristics. One of the most salient issues is the role of intra-household competition for and sharing of automobiles—in other words, the impact of car deficits on travel behavior and consequent activity patterns. In households with more drivers than vehicles, internal competition for automobile use may mitigate the salutary effects of vehicle ownership, as household members are forced to allocate limited car access amongst individuals with diverse travel schedules and needs. Conversely, households may adopt strategies to effectively share household vehicles, suggesting potential models for either reducing or mitigating increases in household vehicle fleets.

As we note above, intra-household competition for vehicle use is by no means rare. Among the few existing studies, the vast majority focus on European contexts and examine the role of gender in intra-household car allocation decisions, perhaps because one-car, male–female households are likely the most common type of car-deficit household (Anggraini et al. 2008; Maat and Timmermans 2009; Scheiner and Holz-Rau 2012a, b). However, virtually no attention has been paid to the factors associated with car deficits. Further, little is known about the travel outcomes of car-deficit households. Only Delbosc and Currie (2012), in their study of Melbourne, Australia, focus specifically on the mobility and travel behavior of households with automobile shortages. They find substantial gaps not only in travel outcomes, but also in the psychological wellbeing of those living in “involuntary” car-deficit households (i.e., households that could not afford to own additional vehicles). Because Delbosc and Currie’s (2012) analysis—like virtually all car-deficit studies—was performed outside of the U.S., the way in which car deficits affect travel behavior in a U.S. context remains unexplored.

Conceptual framework

Figure 1 presents our conceptual model. Conceptually, the decision-making process governing car ownership decisions is fundamentally different for car-deficit households than for carless or fully-equipped households. In particular, three key characteristics interact to make car ownership decisions in car-deficit households uniquely complex: household income, residential location, and intra-household car allocation (e.g. carpooling). We briefly discuss each of these factors in turn.

For most households, the relationship between income and vehicle ownership is straightforward. Carless households, the majority of whom are low-income, are typically willing to tolerate the financial strain and stress of car ownership in exchange for the dramatic mobility benefits an automobile affords. As a result, these households often quickly spend additional capital to purchase a vehicle (Blumenberg and Pierce 2012). In contrast, fully-equipped households tend to eschew the substantial costs associated with an additional car, presumably because having access to more than one car per person provides little added household mobility. For car-deficit households, however, the calculus for purchasing an additional car is more nuanced. We predict that the mobility advantages of an extra car, while potentially significant, are far more modest than those gained from the transition out of carlessness since households likely experience decreasing marginal benefits from each additional household vehicle. Therefore, car-deficit households considering adding a household vehicle must weigh the benefits of a moderate bump in mobility against the considerable costs associated with an extra vehicle—a calculation that, likely, is more complex than the one faced by carless or fully-equipped households.

The impact of residential location on vehicle ownership decisions is also uniquely complex in car-deficit households. If opportunities are highly accessible by non-automotive modes, zero-car households have little incentive to obtain a vehicle. In contrast, if a community offers little in the way of transit, walking, or biking access to destinations, these households either move to transit-rich neighborhoods (Glaeser et al. 2008), transition out of carlessness whenever possible (Clark et al. 2016a), or remain immobile or reliant on others for their travel (Mattioli 2014). The connection between neighborhood and car ownership is similarly straightforward for fully-equipped households. The centrality of the automobile in the U.S. ensures that most neighborhoods are designed to handle a high level of vehicle ownership. This means that, in general, fully-equipped households have little reason to adjust their level of car access. Neighborhood characteristics, however, can exert a distinct influence on the vehicle ownership decisions of car-deficit households. Good transit, dense development, and mixed land uses might encourage households to shed a car (Bhat and Guo 2007). Conversely, ample auto infrastructure might spur additional car ownership, but only if development is sprawling and dispersed enough to require a vehicle for every household driver.

Intra-household vehicle-allocation decisions—decisions about use of the household vehicle fleet—are complicated in car-deficit households. Drivers in carless and fully-equipped households typically do not compete for the use of household vehicles either because there is no car in the household or because household drivers have access to a vehicle whenever they need to use one. For car-deficit households, however, tension surrounding the use of the household vehicle is presumably far more common, and the ability of households to effectively negotiate the allocation of automobile use within the household will dictate their demand for further automobility. Household members may have complementary rather than competing travel needs, allowing them to efficiently share a single automobile among multiple drivers; they may travel together in a single vehicle (carpooling); and/or one or more drivers may be able to reach their destinations using modes other than the automobile. If these strategies are successful, car-deficit households might face few mobility constraints, and will likely maintain a modest level of car ownership. Conversely, if car-deficit households are unable to effectively allocate their scarce vehicle resources, their mobility may be constrained, and they may feel pressure to purchase an additional car.

Data and research design

To test our conceptual framework and to understand the determinants and travel behavior of car-deficit households, we draw on household-level data from the 2012 California Household Travel Survey (CHTS), a 1-day travel survey stratified to represent all households in the 58 California counties.Footnote 1 The sample provides detailed demographic, socioeconomic, and travel data for over 42,000 households. Among these households, 80% have at least one car per driver (“fully-equipped households”), 14% have less than a one-to-one ratio between household cars and drivers (“car-deficit households”), and 6% live in households without a household vehicle (zero-vehicle households).

We divide our analysis in two parts. We first analyze vehicle ownership status. Using data on household licensure and vehicle ownership, we separate households into three different groups: zero vehicle, car deficit (less than one driver per household car), and fully equipped (one or more cars per driver). Household drivers are adults 20 years or older who hold a driver’s license. We then use a multinomial logistic model to assess the relative role of household demographic characteristics, household economic characteristics, and residential location in predicting vehicle ownership status. The model form is the following:

The independent variables are drawn from the studies reviewed above where x1 represents a vector of household socioeconomic characteristics (e.g. age, race, household member with a disability, number of children, and number of workers), x2 represents economic status and includes ten discrete income categories, x3 is neighborhood type, and x4 is metropolitan area.

To examine the association between residential location and the three vehicle ownership status groups, we draw on a unique neighborhood typology developed by Voulgaris et al. (2016). The authors applied factor and cluster analysis to a range of tract-level built environment characteristics, including the presence of public transit, to identify seven distinct neighborhood types. Described in Table 1, the neighborhood typology consists of three urban, three suburban, and one rural neighborhood type. Including this neighborhood typology in our analysis provides us with a holistic snapshot of residential location characteristics assembled from numerous built environment and transit system features. The neighborhood types have more robust associations with travel behavior than density alone (Ralph et al. 2017). We also control for the three largest metropolitan areas in the state—Los Angeles, San Francisco, and San Diego.

We then construct a set of statistical models to better understand the relationship between vehicle ownership status (as defined above) and four different outcome measures aggregated by household: (a) personal miles traveled (PMT) (b) vehicle miles traveled (VMT) (c) number of trips and (d) one or more transit trips. The first two—PMT and VMT—measure the extent of travel; the number of trips serves as a proxy for activity participation. Finally, the likelihood of using transit on the survey day explores the relationship between vehicle ownership status and the likelihood of using alternative modes of transportation.

The models take different forms. The first two (PMT and VMT) are ordinary least squares regressions. The distribution of these variables is highly skewed and, therefore, requires that we use the natural logarithm of each. The third model is a negative binomial regression appropriate for estimating count data, such as the number of trips; and the final model is a logistic regression to predict the likelihood of taking at least one transit trip on the survey day. In addition to vehicle ownership status, these models control for a set of household and built environment characteristics associated with travel outcomes, including household size, income, and residential location.

It is important to note that household vehicle ownership can be transitory (Klein and Smart 2017). Households buy and sell vehicles depending on a host of conditions such as fluctuations in household composition and income, the aging of household members into driving age, the receipt of large lump-sum payments, and changes in residential location and vehicle reliability (Clark et al. 2016a; Oakil et al. 2014). Consequently, the “auto-deficit” category may be a function of the use of cross-sectional data—data at one point in time—rather than a reflection of a discrete household type and, therefore, difficult to predict. Moreover, the data do not include information about household preferences related to the automobile and travel by other modes, making it difficult to identify the extent to which there is a latent demand for automobile travel. Research suggests that attitudes influence automobile ownership decisions, travel behavior, as well as decisions to move to dense urban neighborhoods to more easily travel by modes other than the automobile (Goetzke and Weinberger 2012; Schwanen and Mokhtarian 2005).

Results: determinants of vehicle ownership status

We first examine whether car-deficit households are distinctive relative to the two other household types—zero car and fully equipped. Table 2 includes descriptive statistics on household structure, socioeconomics, demographics, and residential location for each of the three household types and the significance of these characteristics relative to fully-equipped households.

The table shows several clear differences in the composition of the three household types, with the largest differences between zero-car households and the two other household types. Compared to car-owning households, carless households are smaller, much poorer, and far more likely to be headed by a black or Hispanic individual and include a household member with a disability. They also are less likely to include an adult who works outside of the home—34% compared to over 72% in fully-equipped households. Finally, zero-car households also live in very different types of neighborhoods than households that are fully equipped. Two-thirds of carless households live in urban-type neighborhoods; by contrast, fully-equipped households are heavily suburban.

A comparison of car-deficit households and fully-equipped households reveals few dramatic differences. Car-deficit households are larger, more likely to be poor, less likely to be wealthy (have household incomes over $100 k), and tend to live in neighborhoods with slightly more urban characteristics than fully-equipped households. By and large, however, car-deficit households are far more similar to fully-equipped households than to zero-car households; for virtually every variable listed above, the gap between carless and car-deficit households is substantially larger than the gap between car-deficit households and those that are fully equipped.

Table 3 presents the results of the car ownership model. Coefficients represent the log odds of a household either being carless or having a car-deficit, relative to the likelihood of being fully equipped. We measure all independent variables at the household level. In general, the control variables perform as expected. Race is a strong predictor of car ownership, and households with nonwhite heads are far more likely to be carless or have a car deficit versus being fully equipped. Household structure also plays an important role in vehicle ownership, and both the number of children and age of the household head are negatively related to the likelihood of a household having zero cars or a car deficit (although the negative relationship with age weakens as individuals grow older). In contrast, the presence of household members with a disability is associated with a substantial increase in the likelihood that the household will be carless or have a car deficit.

The number of workers in a household functions differently with respect to carlessness and car deficits. Additional workers are negatively related to the likelihood of being carless versus being fully equipped, with an additional worker associated with a 52% (1 − e−0.736) decrease in the odds of carlessness. Conversely, an extra employed household member is correlated with a 41% (e0.343) higher likelihood of having a car deficit.

The fact that an additional household worker is negatively associated with the odds of being carless but positively related to the likelihood of having a car deficit (relative to being fully equipped) potentially stems from a confluence of factors. The first is the importance of automobiles in accessing employment and non-work destinations (Kawabata and Shen 2007; Syed et al. 2013; U.S. Department of Agriculture 2009). The second is the role of intra-household vehicle sharing; households with more workers may be able to maximize the use of vehicles through sharing the vehicle (using the household vehicle at different times or days) or carpooling. In such a context, the increased mobility afforded by a one-to-one vehicle-to-driver ratio does not justify the added expense additional vehicles incur, and, as the model predicts, households may be more likely to limit auto ownership than to pursue fully-equipped status.

Household income is negatively related to being carless versus being fully equipped. In other words, as incomes rise, households are far more likely to be fully equipped than carless. This finding highlights the fact that zero-car households, with their severely limited mobility, seem to clearly favor increasing their vehicle ownership levels, even among the very poor. As with zero-car households, the relationship between income and having a car deficit (relative to being fully equipped) is also negative. However, this association holds only for households with incomes above $50,000. Households at the lower end of the income distribution—those earning between $10,000 and $50,000—are actually more likely to maintain a car deficit than to be fully equipped. For this income group, the finding almost certainly stems from the inherent tension outlined in the conceptual framework—a tension in which low-income households must balance the mobility gains of vehicle ownership against the costs associated with the purchase and upkeep of an automobile. For low-income households with a car deficit, the mobility gains of being a fully-equipped household may not justify the heightened purchase and maintenance costs of an additional vehicle.

Finally, like other studies find, residential location is related to vehicle ownership status. Compared to households living in Rural neighborhoods, residence in any of the other neighborhood types is associated with a higher probability of either carlessness or a car deficit, with the largest effect for residents in Old Urban neighborhoods. Residence in the San Francisco metropolitan area, even controlling for neighborhood type, is also associated with a higher probability of being either carless or having a car deficit. These findings suggest that, at least to some degree, living in dense urban areas can compensate for limited automobility. For car-deficit households, these neighborhoods may offer high-quality transit service that meets the households’ travel needs. To be sure, there is undoubtedly endogeneity at play in these results. People who, for whatever reason, own few automobiles often settle in urban neighborhoods where they can more easily travel by modes other than the automobile (Glaeser et al. 2008). Moreover, the high likelihood of being carless or having a car deficit in Old Urban neighborhoods is not necessarily due solely to the positive travel-related characteristics of the neighborhood. Instead, low levels of car ownership likely stem, at least in part, from the expense, congestion, and inconvenience of owning a vehicle in dense urban environments.

Results: vehicle ownership status and travel outcomes

In the second part of our analysis, we examine travel outcomes by vehicle ownership status. Table 4 provides descriptive statistics for our three household types. Similar to Table 2, Table 4 shows dramatic differences in travel behavior between zero-car households and households with at least one automobile. While differences between car-deficit and fully-equipped households remain, they are substantially smaller than the travel outcome gap between carless and car-owning households. For example, zero-car households make far fewer total trips, more trips by non-auto modes, and travel fewer miles compared to either car-deficit or fully-equipped households. Car-deficit households travel more than the other two household types as measured by number of trips, VMT, PMT, and travel minutes due to their larger size. However, as the data on individuals show, members of car deficit households are more likely to use modes other than the car—transit and walk/bike.

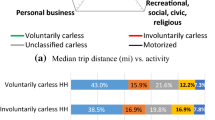

The above table does not address the role of choice in vehicle ownership decisions, particularly for car-deficit households. In short, we seek to understand why households have car-deficits. It is possible that some households prefer to have fewer vehicles than drivers, perhaps to save money or space or perhaps to reduce the household’s carbon footprint. It also is possible that car-deficit households forgo high levels of vehicle ownership because they find it unnecessary; in other words, they are able to accomplish their desired travel without having one car per driver. Conversely, car-deficit households may own relatively few automobiles not by choice, but due to financial necessity. For example, they may have a latent desire for more automobility but are unable to afford the costs of owning an additional car, and thus must make due with less than one vehicle per household driver.

Unfortunately, while the CHTS includes data on households’ reasons for carlessness (Brown 2017; Mitra and Saphores 2017), it does not contain information on the reasons why households have car deficits. Therefore, to assess travel behavior differences between “preference” and “constraint” car-deficit households, we use household income as a proxy. Given the costs associated with car ownership (American Automobile Association 2017), we assume that low-income households (those making less than $35,000 per year) face non-choice car deficits. Similarly, since high-income households (those making over $100,000 per year) can, in most cases, afford to equip each household driver with a vehicle, we assume that these households likely have a car deficit by choice. More than a quarter of auto-deficit households have incomes less than $35,000.

Table 5 shows the characteristics of car-deficit households by three income groups. As the bottom of Table 5 shows, there are significant differences in travel outcomes between households that presumably have car deficits by choice and those that face car deficits due to financial constraints. In terms of the most meaningful travel outcomes—total trips, VMT, and PMT—low-income households travel far less than high-income households. Higher-income car-deficit households make 33% more car trips, travel 42% more miles by car, and 49% more miles overall than poor car-deficit households. Furthermore, those living in high-income car-deficit households, despite making a relatively high number of car trips, also make more walking and bicycle trips, and more transit trips than individuals in low-income households. Thus while Tables 1 and 2 suggest relatively small differences in terms of household characteristics and travel outcomes between car-deficit and fully-equipped households, there is demonstrable diversity in travel behavior within car-deficit households themselves.

Next, in Table 6, we examine the relationship between vehicle ownership status and the four household travel outcomes—PMT (Model 1), VMT (Model 2), number of trips (Model 3), and the likelihood of transit use (Model 4). The household variables in the models largely conform to expectations. We find a strong positive relationship between the number of household members and the four travel measures. However, controlling for other factors, households with young children tend to travel less than other households (PMT and VMT), make fewer trips, and are less likely to use public transit. Age is positively associated with all of our travel outcomes; the squared term indicates that travel declines with advanced age, a finding consistent with other data (Santos et al. 2011). As expected, compared to middle-income households, low-income households travel less and higher-income households travel more. Higher-income households, however, are more likely to use transit than middle-income households. Finally, the models show less travel and more transit use in all of the neighborhood types compared to rural areas, with the largest effect in the most urban neighborhood types.

With respect to race and ethnicity, non-white households are more likely to use transit than white households with the effect largest for black households, a finding consistent with the broader literature (Giuliano 2003; Pucher and Renne 2003). Non-white households also take fewer trips than white households. However, controlling for income, black households have higher PMT (but not VMT), perhaps reflecting the need to make long-distance trips on public transit. Kneebone and Holmes (2015) find that in the largest metropolitan areas between 2000 and 2012, the number of nearby jobs declined for everyone; however, the decline was greatest for poor and non-white residents, groups most likely to use public transit.

We are primarily interested in how vehicle ownership status relates to travel. The models show that even controlling for other characteristics, including income and residential location, members of car-deficit households travel less than fully-equipped households; they are also more likely to use public transit. As the descriptive statistics also show, the effects are much larger for zero-car households but remain statistically significant for car-deficit households.

In Fig. 2, we again examine the role of choice and constraint in travel outcomes. The graph shows the relationship between income, vehicle ownership status, and one of our outcome measures—PMT—using predicted values from the model.Footnote 2 As expected, there is a positive relationship between income and PMT for each vehicle ownership status group. The graph also shows differences in PMT by income and vehicle ownership status. Across all three income groups, auto-deficit households travel less than fully-equipped households, with zero-car households traveling the least. However, households gain far more mobility transitioning from having zero-cars to having a vehicle (regardless of the number of drivers) compared to moving from auto deficit to fully equipped. On average, low-income fully-equipped households travel just four more miles a day than low-income auto-deficit households, compared to 15 miles more than low-income carless households.

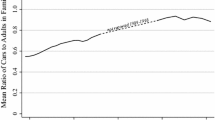

Despite traveling fewer miles than higher-income households, low-income auto-deficit households use their vehicles about as much as auto-deficit households in the other two income groups. In a supplementary analysis, we focus on the vehicles themselves rather than the travel behavior of individuals in households. We calculate the mean miles per household automobile by income group (without controlling for other factors). As Fig. 3 shows, miles-per-vehicle is higher in auto-deficit households than in fully-equipped households for all income groups. In other words, when household members must share an automobile, the automobile gets more use, suggesting that low-income households carefully manage their household fleet to accomplish their necessary travel.

Conclusion

What do we now know about auto-deficit households in the U.S.? Although much of the scholarly attention has centered on zero-vehicle households, there are more than twice as many auto-deficit households as zero-vehicle households. The biggest differences in the characteristics of households by vehicle ownership status occur when households move from carlessness to auto ownership. Yet significant differences remain between auto-deficit and fully-equipped households across many dimensions. Auto-deficit households tend to be larger, suggesting the need to coordinate household travel either in the form of carpooling or negotiating complementary use of the household vehicle. They are also more likely to live in dense urban areas where some household members might be able to take advantage of high levels of transit service.

On average, auto-deficit households have lower incomes than fully-equipped households. Household income is negatively associated with the likelihood of being an auto-deficit household. However, this relationship is far weaker than the relationship between income and zero-vehicle household status. In other words, echoing the broader literature, zero-vehicle households quickly devote additional income to purchasing a car. Auto-deficit households do the same but at a lower rate. Additionally, among lower-income households, income is not associated with a decline in the likelihood of being an auto-deficit household relative to being fully equipped. Combined, these results underscore the importance of auto ownership—having at least one vehicle in the household—but also confirm that at the bottom end of the income distribution the mobility benefits of an additional car may not outweigh the ownership costs.

Auto-deficit households also have different travel patterns than fully-equipped households; they travel fewer miles, take fewer trips, and are more likely to use public transit. However, higher-income auto-deficit households travel a lot, more than twice as much as low-income auto-deficit households, which may reflect greater choice in residential location. In theory, higher-income households can move to neighborhoods that accommodate their transportation needs and preferences. Low-income auto-deficit households travel almost as much as low-income fully-equipped households, an unexpected finding. Data on miles per household vehicle suggest that these households achieve this level of mobility by negotiating complementary use of the household car.

The findings suggest the importance of car ownership—having at least one household vehicle—to mobility, particularly for low-income U.S. households. These findings may be less evident in high-density metropolitan areas in the U.S. and internationally, where the costs of driving are high (e.g. parking, congestion) and the accessibility gap between driving and other modes of travel narrows. The analysis would be strengthened by longitudinal data allowing us to better isolate changes in household vehicle fleets and the effects of these changes on mobility and access to opportunities. Structural equation modelling (SEM) also may provide additional insights, allowing car ownership levels to serve as an outcome and, in so doing, mediate the determinants of travel behavior. Studies that adopt this approach often focus on developing better estimates of the effect of the built environment on travel behavior. This is the focus of Van Acker and Witlox (2010) who using travel survey data from Ghent also find that automobility among higher-income households is due to high levels of automobile ownership rather than the direct effects of income on travel. Their findings underscore the significance of our vehicle ownership status models and the potential benefits of SEM in addressing some of the endogeneity issues to which we refer.

For car-deficit households, sharing vehicles among household drivers can be challenging. It requires that household members plan to either carpool or arrange their schedules so that they do not need to use the household vehicle at the same time. These arrangements may negatively affect household residential location, employment outcomes, and the ability of households to partake in other activities, topics for future research. Also, the extensive use of vehicles in auto-deficit households likely results in more frequent vehicle maintenance and replacement, costs that are difficult to evaluate without longitudinal data. Finally, unless they live in transit-rich neighborhoods, single-vehicle households can be stranded when the household car malfunctions.

The findings from this study suggest the importance of policies to help increase automobile access among households who do not have cars and who live in neighborhoods or have jobs that make it difficult to reach opportunities without driving. However, the additional benefits of being a fully-equipped household are more limited than we had anticipated. These results indicate support for policies to offset the potential challenges of sharing household vehicles, particularly for low-income households. Policies might include subsidies to support pay-per-mile access to non-household automobiles such as formal car sharing programs (e.g. Zipcar) and ride-hailing services (e.g. Uber, Lyft). For example, in their analysis of carsharing users in North America, Martin and Shaheen (2011) find significant downsizing in vehicles per household as well as evidence that carsharing enabled some households to avoid purchasing new vehicles. The adoption of policies to incentivize flexible work schedules or opportunities to work remotely also might enable households to more easily share limited car resources. Our findings, coupled with support for these types of programs, may have the collateral benefit of motivating some households to reduce or limit their household vehicle fleets without compromising their mobility and access to opportunities.

Notes

The final survey weights were developed at the county level. However, the demographic controls and trip correction factors were balanced at the statewide level only. All analysis utilizes survey weights.

In predictions, we hold all continuous variables constant at the mean. For categorical variables, we predict travel outcomes using the largest category, with neighborhood type as “New Development,” and race as non-Hispanic white.

References

Adams, W., Einav, L., Levin, J.: Liquidity constraints and imperfect information in subprime lending. Am. Econ. Rev. 99(1), 49–84 (2009). https://doi.org/10.1257/aer.99.1.49

American Automobile Association: Your Driving Costs. How much are you really paying to drive? Heathrow, FL: AAA Association Communication (2017). http://exchange.aaa.com/wp-content/uploads/2017/08/17-0013_Your-Driving-Costs-Brochure-2017-FNL-CX-1.pdf. Accessed 2017

Anggraini, R., Arentze, T.A., Timmermans, H.J.P.: Car allocation between household heads in car deficient households: a decision model. Eur. J. Transp. Infrastruct. Res. 8(4), 301–319 (2008)

Bhat, C.R., Guo, J.Y.: A comprehensive analysis of built environment characteristics on household residential choice and auto ownership levels. Transp. Res. Part B Methodol. 41(5), 506–526 (2007). https://doi.org/10.1016/j.trb.2005.12.005

Blumenberg, E., Brown, A., Ralph, K., Taylor, B.D., Voulgaris, C.T.: Typecasting neighborhoods and travelers: Analyzing the geography of travel behavior among teens and young adults in the U.S. Los Angeles, CA: UCLA Institute of Transportation Studies (2015). https://www.its.ucla.edu/publication/typecasting-neighborhoods-and-travelers-analyzing-the-geography-of-travel-behavior-among-teens-and-young-adults-in-the-u-s/. Accessed 2017

Blumenberg, E., Pierce, G.: Automobile ownership and travel by the poor. Transp. Res. Rec. J. Transp. Res. Board 2320, 28–36 (2012). https://doi.org/10.3141/2320-04

Blumenberg, E., Pierce, G.: Car access and long-term poverty exposure: evidence from the Moving to Opportunity (MTO) experiment. J. Transp. Geogr. 65, 92–100 (2017). https://doi.org/10.1016/j.jtrangeo.2017.10.009

Brown, A.E.: Car-less or car-free? Socioeconomic and mobility differences among zero-car households. Transp. Policy 60(Supplement C), 152–159 (2017). https://doi.org/10.1016/j.tranpol.2017.09.016

California Department of Transportation: California Household Travel Survey [dataset]. Author, Sacramento, CA (2012)

Chu, Y.-L.: Automobile ownership analysis using ordered probit models. Transp. Res. Rec. J. Transp. Res. Board 1805, 60–67 (2002). https://doi.org/10.3141/1805-08

Clark, B., Chatterjee, K., Melia, S.: Changes in level of household car ownership: the role of life events and spatial context. Transportation 43(4), 565–599 (2016a)

Clark, B., Lyons, G., Chatterjee, K.: Understanding the process that gives rise to household car ownership level changes. J. Transp. Geogr. 55, 110–120 (2016b). https://doi.org/10.1016/j.jtrangeo.2016.07.009

Dargay, J.M.: The effect of income on car ownership: evidence of asymmetry. Transp. Res. Part A Policy Pract. 35(9), 807–821 (2001). https://doi.org/10.1016/S0965-8564(00)00018-5

Davis, S.C., Williams, S.E., Boundy, R.G.: Transportation Energy Data Book, Edition 35 (No. ORNL-6992). Oak Ridge National Laboratory, Oak Ridge, TN (2016)

Dawkins, C., Jeon, J.S., Pendall, R.: Vehicle access and exposure to neighborhood poverty: evidence from the Moving to Opportunity Program. J. Reg. Sci. 55(5), 687–707 (2015). https://doi.org/10.1111/jors.12198

Delbosc, A., Currie, G.: Choice and disadvantage in low-car ownership households. Transp. Policy 23, 8–14 (2012). https://doi.org/10.1016/j.tranpol.2012.06.006

Dieleman, F.M., Dijst, M., Burghouwt, G.: Urban form and travel behaviour: micro-level household attributes and residential context. Urban Stud. 39(3), 507–527 (2002). https://doi.org/10.1080/00420980220112801

Ewing, R., Cervero, R.: Travel and the built environment. J. Am. Plan. Assoc. 76(3), 265–294 (2010)

Federal Highway Administration: 2009 National Household Travel Survey (NHTS) [dataset]. U.S. Department of Transportation, Washington, DC (2009)

Giuliano, G.: Travel, location and race/ethnicity. Transp. Res. Part A Policy Pract. 37(4), 351–372 (2003). https://doi.org/10.1016/S0965-8564(02)00020-4

Giuliano, G., Dargay, J.: Car ownership, travel and land use: a comparison of the US and Great Britain. Transp. Res. Part A Policy Pract. 40(2), 106–124 (2006). https://doi.org/10.1016/j.tra.2005.03.002

Glaeser, E.L., Kahn, M.E., Rappaport, J.: Why do the poor live in cities? The role of public transportation. J. Urban Econ. 63(1), 1–24 (2008)

Goetzke, F., Weinberger, R.: Separating contextual from endogenous effects in automobile ownership models. Environ. Plan. A Econ. Space 44(5), 1032–1046 (2012). https://doi.org/10.1068/a4490

Goodman-Bacon, A., McGranahan, L.: How do EITC recipients spend their refunds? Econ. Perspect. 32(2), 17–32 (2008)

Gurley, T., Bruce, D.: The effects of car access on employment outcomes for welfare recipients. J. Urban Econ. 58(2), 250–272 (2005). https://doi.org/10.1016/j.jue.2005.05.002

Hensher, D.A., Reyes, A.J.: Trip chaining as a barrier to the propensity to use public transport. Transportation 27(4), 341–361 (2000). https://doi.org/10.1023/A:1005246916731

Kawabata, M., Shen, Q.: Commuting inequality between cars and public transit: the case of the San Francisco Bay Area, 1990–2000. Urban Stud. 44(9), 1759–1780 (2007). https://doi.org/10.1080/00420980701426616

Klein, N.J., Smart, M.J.: Car today, gone tomorrow: the ephemeral car in low-income, immigrant and minority families. Transportation 44(3), 495–510 (2017). https://doi.org/10.1007/s11116-015-9664-4

Kneebone, E., Holmes, N.: The growing distance between people and jobs in metropolitan America. Washington, D.C.: Brookings Institution (2015). https://www.brookings.edu/wp-content/uploads/2016/07/Srvy_JobsProximity.pdf. Accessed 2017

Maat, K., Timmermans, H.J.P.: Influence of the residential and work environment on car use in dual-earner households. Transp. Res. Part A Policy Pract. 43(7), 654–664 (2009). https://doi.org/10.1016/j.tra.2009.06.003

Martin, E., Shaheen, S.: The impact of carsharing on household vehicle ownership. Access Mag. 38, 22–27 (2011)

Mattioli, G.: Where sustainable transport and social exclusion meet: households without cars and car dependence in Great Britain. J. Environ. Plan. Policy Manag. 16(3), 379–400 (2014). https://doi.org/10.1080/1523908X.2013.858592

Mattioli, G., Anable, J., Vrotsou, K.: Car dependent practices: findings from a sequence pattern mining study of UK time use data. Transp. Res. Part A Policy Pract. 89, 56–72 (2016). https://doi.org/10.1016/j.tra.2016.04.010

McGuckin, N., Zmud, J., Nakamoto, Y.: Trip chaining trends in the U.S.—understanding travel behavior for policy making (Vol. Paper # 05-1716). Presented at the Transportation Research Board, Washington DC (2005)

Mendenhall, R., Edin, K., Crowley, S., Sykes, J., Tach, L., Kriz, K., Kling, J.R.: The role of earned income tax credit in the budgets of low-income households. Soc. Serv. Rev. 86(3), 367–400 (2012). https://doi.org/10.1086/667972

Mitra, S.K., Saphores, J.-D.M.: Carless in California: green choice or misery? J. Transp. Geogr. 65, 1–12 (2017)

Oakil, A.T.M.: Securing or sacrificing access to a car: gender difference in the effects of life events. Travel Behav. Soc. 3, 1–7 (2016). https://doi.org/10.1016/j.tbs.2015.03.004

Oakil, A.T.M., Ettema, D., Arentze, T., Timmermans, H.: Changing household car ownership level and life cycle events: an action in anticipation or an action on occurrence. Transportation 41(4), 889–904 (2014). https://doi.org/10.1007/s11116-013-9507-0

Oakil, A.T.M., Manting, D., Nijland, H.: Determinants of car ownership among young households in the Netherlands: the role of urbanisation and demographic and economic characteristics. J. Transp. Geogr. 51, 229–235 (2016a). https://doi.org/10.1016/j.jtrangeo.2016.01.010

Oakil, A.T.M., Manting, D., Nijland, H.: Dynamics in car ownership: the role of entry into parenthood. Eur. J. Transp. Infrastruct. Res. 16(4), 661–673 (2016b)

Pucher, J., Renne, J.L.: Socioeconomics of urban travel: evidence from the 2001 NHTS. Transp. Q. 57(3), 49–77 (2003)

Ralph, K., Voulgaris, C.T., Brown, A.: Travel and the built environment. Transp. Res. Rec. J. Transp. Res. Board 2653, 1–9 (2017). https://doi.org/10.3141/2653-01

Raphael, S., Rice, L.: Car ownership, employment, and earnings. J. Urban Econ. 52(1), 109–130 (2002). https://doi.org/10.1016/S0094-1190(02)00017-7

Ruggles, S., Genadek, K., Goeken, R., Grover, J., Sobek, M.: Integrated Public Use Microdata Series: Version 7.0 [dataset]. University of Minnesota, Minneapolis (2017). https://doi.org/10.18128/D010.V7.0

Santos, A., McGuckin, N., Nakamoto, Y., Gray, D., Liss, S.: Summary of Travel Trends: 2009 National Household Travel Survey (No. FHWA-PL-ll-022). Federal Transit Administration, Department of Transportation, Washington, DC (2011)

Scheiner, J., Holz-Rau, C.: Gender structures in car availability in car deficient households. Res. Transp. Econ. 34(1), 16–26 (2012a). https://doi.org/10.1016/j.retrec.2011.12.006

Scheiner, J., Holz-Rau, C.: Gendered travel mode choice: a focus on car deficient households. J. Transp. Geogr. 24(Supplement C), 250–261 (2012b). https://doi.org/10.1016/j.jtrangeo.2012.02.011

Schimek, P.: Household motor vehicle ownership and use: how much does residential density matter? Transp. Res. Rec. J. Transp. Res. Board 1552, 120–125 (1996). https://doi.org/10.3141/1552-17

Schwanen, T., Mokhtarian, P.L.: What affects commute mode choice: neighborhood physical structure or preferences toward neighborhoods? J. Transp. Geogr. 13(1), 83–99 (2005). https://doi.org/10.1016/j.jtrangeo.2004.11.001

Shen, Q.: A spatial analysis of job openings and access in a U.S. metropolitan area. J. Am. Plan. Assoc. 67(1), 53–68 (2001). https://doi.org/10.1080/01944360108976355

Syed, S.T., Gerber, B.S., Sharp, L.K.: Traveling towards disease: transportation barriers to health care access. J. Community Health 38(5), 976–993 (2013). https://doi.org/10.1007/s10900-013-9681-1

U.S. Department of Agriculture: Access to Affordable and Nutritious Food: Measuring and Understanding Food Deserts and their Consequences. U.S. Department of Agriculture, Washington, DC (2009)

U.S. Environmental Protection Agency: Smart Location Database. Author, Washington, DC (2014)

Van Acker, V., Witlox, F.: Car ownership as a mediating variable in car travel behaviour research using a structural equation modelling approach to identify its dual relationship. J. Transp. Geogr. 18(1), 65–74 (2010). https://doi.org/10.1016/j.jtrangeo.2009.05.006

Voulgaris, C.T., Taylor, B.D., Blumenberg, E., Brown, A., Ralph, K.: Synergistic neighborhood relationships with travel behavior: An analysis of travel in 30,000 US neighborhoods. J. Transp. Land Use (2016). https://doi.org/10.5198/jtlu.2016.840

Yamamoto, T.: The impact of life-course events on vehicle ownership dynamics. The cases of France and Japan. IATSS Res. 32(2), 34–43 (2008). https://doi.org/10.1016/S0386-1112(14)60207-7

Ye, X., Pendyala, R.M., Gottardi, G.: An exploration of the relationship between mode choice and complexity of trip chaining patterns. Transp. Res. Part B Methodol. 41(1), 96–113 (2007). https://doi.org/10.1016/j.trb.2006.03.004

Acknowledgements

Funding was provided by the University of California Center on Economic Competitiveness in Transportation (UCCONNECT).

Author information

Authors and Affiliations

Contributions

E. Blumenberg: developed funding proposal including research question and analytical approach, supervised all research, editing. A. Brown: helped guide research, manuscript writing, editing. A. Schouten: data analysis, manuscript writing, editing.

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Rights and permissions

About this article

Cite this article

Blumenberg, E., Brown, A. & Schouten, A. Car-deficit households: determinants and implications for household travel in the U.S.. Transportation 47, 1103–1125 (2020). https://doi.org/10.1007/s11116-018-9956-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11116-018-9956-6