Abstract

This study investigates the achievement gap and horizontal disparity of schools’ funding by exploring and comparing the differences of funding between extremely wealthy and poor school districts in Illinois before funding reforms took place on August 2017. We find that the students in wealthiest school districts had an average of 51% higher proficiency on standardized tests than did the students in extremely poor districts. The extremely poor school districts received about $4582 less per student than the wealthiest school districts, based on data from total funding sources in 2014. Our results indicate that federal and state funding did not have sufficient equalization impact on interdistrict property tax funding disparity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

This research examines the achievement gap between wealthy school districts and poorer school districts and investigates fiscal disparities of school funding in Illinois before funding reforms took place on August 2017. Illinois had one of the biggest funding gaps in the country for the past thirty years. The House Amendment 5, which was passed in August 2017, created the first revision of Senate Bill Public Act 100-0465(1947) in two decades. This Bill Public Act 100-0465 provides legal foundation for the distribution of general Illinois state-aid dollars to schools by establishing a multifaceted procedure for determining need and setting a goal for “adequacy” of funding in each of the Illinois state school districts. According to Geiger and Garcia (2017), efforts to end inequities in Illinois’ school funding scheme have been attempted for decades to bring fairness to a funding system that was dependent on real estate taxes and property values, and the quality of schools was often determined by ZIP code. It is hoped that the new revision of Bill Public Act 100-0465 will start fixing Illinois’ unequal school funding system.

McGee (2004), an expert on the topic of the achievement gap, mentions that the difference in school performance is astounding and alarming. He argues that the achievement gap is about a system that has failed students. Ushomirsky and Williams (2015) found that “in Illinois the highest poverty districts end up receiving 19% less in overall funding than the lowest poverty districts” (p. 1). This paper analyzes unequal school funding and explores reasons why the achievement gap may be growing between extremely wealthy and poor school districts. This research is salient because the achievement gap and schools funding gaps warrant further investigation. Furthermore, our research delves deeply into the scope of school financing and school funding disparity.

In this study were used secondary data from the Illinois Interactive Report Card (2015). This is the state’s official source for information about public schools across Illinois and it includes information about academic performance, school environment, school funding, educators, and students. The study selected from 1211 Illinois school districts 31 extremely poor districts (school districts with 90–100% of the students qualified for free lunch) and 27 wealthiest districts (school districts with 0–5% of students qualified for free lunch) and provides comparison analysis between these extremely poor districts (Quintile 1) and wealthiest districts (Quintile 5). A two-sample T-test was used to investigate the differences in students’ achievements and funding between the two types of school districts in Illinois: 58 school districts of which are at opposite ends of the spectrum in terms of socioeconomic status (SES) in 2014 (Illinois State Boards of Education 2015). The comparisons include differences in property tax funding; local, state, and federal funding per student; school expenditures; SES; student standardized test scores; and teacher characteristics and experience. The objective of the study is to provide recommendations concerning school funding systems in Illinois.

The following research questions are explored: (1) How do different types of school districts funding for extremely poor districts compare with types of funding for wealthiest districts in Illinois? (2) How do proficiency levels of students, teachers’ education and experience, and expenditures per student in extremely poor school districts compare with students in wealthiest school districts in Illinois? This article proceeds as follows. The first part provides a literature review of the achievement gap and fiscal disparities of school districts. The second section is the analysis, which investigates federal, state, local, and property tax funding; teachers’ educational level and experience; instructional and administrative support; and other types of expenditures in wealthy and poor school districts. The article concludes with a discussion of the implications of findings and suggests recommendations.

Literature Review

Achievement Gap and Family Income

The achievement gap is defined as the differences in academic outcomes between groups of students and is present in “grades, standardized test scores, course selection, dropout rates, and college-completion rates,” as well as other measures of student success (Ansell 2011). Walker (2017) suggests that “public educators concerned with equity have frequently been confronted with a singular question: How do we raise academic achievement for underperforming student populations—usually predictable by low socioeconomic status (SES) or minority status?” (p. 298).

Many researchers have analyzed how family income affects the achievement gap. According to Tavernise (2012), in the twenty-first century, family income appears to be a greater contributor to educational success than race. Socioeconomic status and the home environment have a significant effect on intellectual development of students (Dornbusch et al. 1991; Gonzales et al. 1996; Guo and Harris 2000; Parrish et al. 1995; Unnever et al. 2000; Wilson 1987, 1996). Ushomirsky and Williams (2015) suggest that a district with more resources can “offer students more support and enrichment, which are critical to the success of all children, but are especially important for those students who may not have access to these opportunities outside of school” (p. 1).

In 1972, the drop-out rate for high-income Americans was 2.3%, while for low-income students it was 14.1%. From 1972 to 2001, the overall average drop-out rate decreased from 6.1 to 5%, and at the same time low-income student drop-outs increased as high as 17% (NCES, 2005, pp. 73, 114, 138, and 151). On the other hand, McGee (2004) shows that “at 5th and 8th grades, only 36% and 44% of the low-income students, respectively, meet Illinois State reading standards, compared to 70% and 74% of their more well-to-do classmates. In mathematics, less than one in four low-income children meet state standards, and in science, the number drops to fewer than one in five” (p. 100). Two studies in 2001 and 2003 conducted by the United States Department of Education (Progress in International Reading Literacy Study [PIRLS] Program for International Student Assessment (PISA) data) showed clear and positive correlations internationally between lower numbers of students in poverty and high test scores. Up to 30% of students in the low-poverty industrialized countries (of a total of 35) scored first in the world in the PIRLS tests. The PISA data from 2001 had an SES breakdown showing that the differences between the highest and lowest SES numbers were 1.6 standard deviations. Bracey (2004) succinctly concludes that “money matters.” McGee (2004) finds that “just 6.25% of high-poverty high schools have half of their students meeting the state high school test standards, the PSAE, compared to 73.6% of the other high schools” (p. 104). The International Association for the Evaluation of Educational Achievement (IEA) civics study in 1999 in the United States of 14 year olds in eighth and ninth grades found that SES was a major predictor of democratic knowledge, attitudes, behaviors, and skills, just as it was in the 1971 IEA civics survey. SES was revealed to be a critical factor that helps to explain inputs (the hidden curriculum), throughputs (the manifest curriculum), and outputs (test and assessment results) (Farnen 2007).

Walker (2017) asserts that “some high-poverty schools and fewer high-poverty districts, often comprised of disproportionately high numbers of minority students, have successfully attained high academic standings, this trend continues to be the exception more than the rule” (p. 298). Similarly, Farnen (2007) asserts: “Poverty, like gravity, affects everything we do, especially where we go to school and the type of schooling we experience. Poverty is a system, a culture, and an institution in the USA. It predicts poor housing, violence, malnutrition, dependence on public transport, family crises, single-parent homes, divorce, child neglect, low test scores, and school drop-outs” (p. 298).

There are also strong theoretical reasons to believe that poor neighborhoods are likely to have lower-quality institutions, such as schools, libraries, childcare, and recreational programs. These neighborhoods are also stressful and dangerous places to live. Many parents are more concerned with keeping their children safe than with spending time communicating with their children about school assignments. These kinds of stressors may play a role in students’ low performance on standardized tests. The connection between income equality among parents and the social mobility of their children was a focus of former President Obama, as well as some Republican presidential candidates (Tavernise 2012). According to Der (2004), “the increasing exercise of school choice by racial minority families, especially in urban school districts, suggest that school districts need to strongly and sincerely support the development and maintenance of “community schools –schools not necessarily based on neighborhood residency but on a shared sense of value, vision, purpose, and goals of public schooling” (p. 314).

Achievement Gap and Ethnicity

Researchers are finding that while the achievement gap between African Americans and European American students has narrowed substantially over the past few decades, the gap between rich and poor students has grown significantly during the same period. Reardon, a Stanford University sociologist, found that the gap in standardized test scores between affluent and low-income students had grown by about 40% since the 1960s and now has doubled the testing gap between African Americans and European Americans. Reardon (2008) states that the United States has moved from a society in the 1950s and 1960s whereby race was a more important predictor of academic success than family income. He analyzed 12 sets of standardized test scores starting in 1960 and ending in 2007. He compared children from families in the 90th percentile of income—the equivalent of approximately $160,000 in 2008, when the study was conducted—and children from the 10th percentile, $17,500 in 2008. By the end of that period, the achievement gap by income had increased by 40%, while the gap between African American and European American students, regardless of income, had decreased substantially (Reardon 2008). In Illinois “at third grade, just one in three African American third-grade students meet state standards compared to 75% of White students” (McGee 2004, p. 100).

There is evidence of inequality and educational opportunity and achievement that is highly intercorrelated with race and ethnicity. Reardon et al. (2015) highlight that low-income students and students of color disproportionately attend high-poverty and low-quality schools. There is also a long tradition in the United States to associate SES as an independent variable and to associate educational products, outcomes, or processes as dependent variables. Bracey (2003, 2004) states that tests scores are correlated with socioeconomic status. Farnen (2000, 2003) notes that the typical national civics test gaps between majority and minority students’ performance level is large (10%).

The PISA study of 15 year olds in reading, math, and science found that the United States was exactly in the middle of the international group, but minorities were not. While U.S. whites scored respectively high, as 2nd, 7th, and 4th, Blacks and Hispanics were 29th, 30th, and 30th. These scores mean in a clear white majority versus the U.S. minority achievement gap (Farnen 2007, p. 289). In international comparisons many researchers also find America lagging (Daniel and Walker 2014; Darling-Hammond 2010; Hilliard 2003; Wagner 2008; Walker 2017).

School Funding in the United States

Many scholars have analyzed education funding for the most vulnerable students (Adamson and Darling-Hammond 2011; Bailey and Dynarski 2011; Beatty 2013; Dumcombe and Yinger 2004; Duncan 2014; Eom et al. 2014; Farnen and Suenker 2001; Gamoran and Long 2006; Jordan, Chapman & Wrobel, 2014; Picus et al. 2012; Ross and Nquyen-Hoang 2013). According to Ushomirsky and Williams (2015, p. 1), “Although money isn’t the only thing that matters for student success, inequities in funding are foundational to all sorts of other inequities in our school system.” In a comparison analysis of equality of Michigan and Ohio K–12 educational financing systems. Conlin (2014) found that “Ohio’s funding system has greater equality in terms of total revenue, largely due to Ohio redistributing state funds to the least wealthy districts while Michigan does not” (p.417). The author suggests that constraints on raising local revenue to fund operating expenditures in Michigan could create efficiency issues. These funding disparities convert into differences in the services provided in schools. According to the U.S. Commission on Civil Rights (2018, p.3), “with insufficient financial resources, our nation’s public schools generally struggle to provide a quality education on equal terms.”

In recent years, a growing number of researchers, education advocates, and legislators have highlighted spending inequities within school districts. Jordan, Chapman, and Wrobel (2014) assert that “one of the complexities of intergovernmental funding is determining how the higher level of government, the funder, will address disparities across the lower level of governments, the recipients” (p. 399). They analyzed the Lake View case of State of Arkansas, which led to a ruling that the state funding of schools was unconstitutional. Jordan, Chapman, and Wrobel (2014) note:

The Lake View School District argued that the state’s funding was inequitable and harmed students and taxpayers of poor districts. The ruling was as much about correcting fiscal disparities across districts as it was about correcting disparities in educational outcomes. Subsequently, state education school finance reform required the State to provide districts with equalization funding. (p. 399)

Dafflon (2004) suggests that the funding level of government does not want to provide a disincentive to the higher-capacity recipient for raising own-source revenue and does not want to penalize the lower-capacity recipient for the inability to raise adequate revenue. Kozol (1991) describes the remarkable differences between public schools in urban schools whose population is between 95 and 99% non-white and their suburban counterparts: “While central city Camden, New Jersey schools spent $3,500 that year, affluent suburban Princeton spent $7,725 per student. Schools in New York City spent $7,300 in 1990, while those in nearby suburbs like Manhasset and Great Neck spent over $15,000 per student” (p. 237). The Education Law Center (2015) finds that the highest-poverty districts receive an average of $1200 less per pupil than the lowest-poverty districts, and districts serving the largest numbers of students of color receive about $2000 less per pupil than districts who serve fewer students of color.

According to Taylor and Piche (1991), “Inequitable systems of school finance inflict disproportionate harm on minority and economically disadvantaged students” (pp. xi-xii). The Southern Poverty Law Center filed a lawsuit on behalf of black mothers in Mississippi who alleged their children’s schools lack textbooks, teachers, and basic classroom supplies (Finley 2017).

According to the New America Foundation (2017), schools are funded largely through revenue generated by local property that creates funding disparities among school districts. The level of local revenue provided for public education is correlated with property values in a particular school district; communities with less of a property tax base may have higher tax rates but still raise less funding to support the local school district (Illinois State Board of Education 2014). The Education Commission of the States (2013) noted that for decades this correlation has been a cause for concern, since disparities in wealth can create fundamental inequities in school funding between high-poverty and low-poverty districts. School finance equity can vary widely across districts, based on how states decide to distribute funds, how many school districts exist in a given state, and the size of those districts (Luebchow 2008). The National Center for Education Statistics (2012) found that during the 2008–2009 school year, 14 states, and the District of Columbia had over half of their education revenue from local sources, but in Vermont over 85% of its public education revenue came from the state. Since states typically have funding formulas to address some of the gaps in funding, these funding formulas vary across states and can contribute to educational inequities across schools (National Center for Education Statistics, 2012).

According to McCarter (2009), Illinois ranks last in the size of the gap in per student education spending between its wealthiest and the most impoverished school districts. More than 80% of the students in the 15 poorest school districts are minorities. Illinois has created a system of school funding that provides an inadequate education to the poor simply because they are poor. Our study analyzes this gap in per student education funding along with the achievement gap and funding disparity in Illinois school districts and provides recommendations that may help reduce the funding gap in these areas.

According to the U.S. Census Bureau (2010), around 44% of total education expenditures in the United States come from state funds (the share varies by state). For school districts, the property tax is the primary own-source revenue collected. Ross and Nquyen-Hoang (2013) highlight that “for the entire course of American history, the taxation of real property has been the overwhelming source of locally generated revenue for public schools” (p. 19). Jordan et al. (2015) state that “for the vast majority of local school districts in the United States, revenue-raising capacity is determined by the taxation of the assessed value of real property” (p. 400).

Darling-Hammond (2000) states that the high level of funding disparities is a function of how public education in the United States is funded. The U.S. Commission on Civil Rights (2018, p. 37) suggests that with funding inequities at the local level and disinvestment at the state level, fundamental inequities occur based on the overall wealth of a community or district. Jordan, Chapman, and Wrobel (2014) emphasize that “one of the complexities of intergovernmental funding is determining how the higher level of government, the funder, will address disparities across the lower level of governments, the recipients” (p. 399).

The Center on Budget and Policy Priorities (CBPP 2012) notes that local school districts have a small ability to replace lost state aid on their own:

It is difficult for many school districts to raise more money from the property tax without raising rates, and rate increases are often politically very difficult. However, at least some localities are considering, and in some cases enacting, property tax increases—a sign of the challenges that schools face. (p. 4)

For example, the Granite School District and the Davis School District in Utah raised property tax rates by 4% to compensate for cuts in state funding and growing enrollments (Winters 2011). In addition, Taylor and Piche (1991) suggest that “many minorities and economically disadvantaged students are located in property-poor urban districts, which fare the worst in educational expenditures” (pp. xi-xii).

School Funding in Illinois

Illinois high schools are financed primarily by intergovernmental transfers (federal and state aid) and locally raised revenues (primarily property taxes). The vast majority of General State Aid (GSA) funds were distributed to school districts that demonstrated need. Nearly 90% of aid went to districts that lacked the local funds to meet the state’s minimum funding standards. The amount of property wealth in each school district determines the amount of taxes it can raise locally to finance its education needs. The less property wealth a district has, the more state funds it receives. The second major factor driving the flow of GSA funds is the number of low-income children located in a district. The more low-income students a district has, the more state funds it receives, regardless of the district’s ability to pay for education.

The state GSA in Illinois falls under six general categories: (1) Foundation Level Grants; (2) PTELL (Property Tax Extension Limitation Law) Adjustments; (3) Corporate Personal Property Tax Replacement Grants; (4) Poverty Grants; (5) Special Education Grants; and (6) Early Childhood Education Grants.

Illinois public school districts also receive revenue from general state aid that is distributed on a formula basis. Public Act 90–548 enacted the current formula in December 1997. In FY 2010 the formula was changed to include an alternate Property Tax Extension Limitation Law (PTELL) adjustment for school districts that passed a limiting rate increase. The General State Aid Formula is a foundation approach with three separate calculations, depending on the amount of local wealth of the school district. The first formula is referred to as the “Foundation” formula. This provision of the State Aid formula sets the foundation levels in statute and the guaranteed funding of those levels of support. The foundation level was $6119 in the 2010–2011 academic years. The majority of Illinois school districts are funded under this formula. For a district to qualify for this formula, it must have available local resources per student less than 93% of the foundation level. In Illinois, the foundation level is set by the General Assembly that inputs the foundation level into a formula to determine the general state aid, or the amount the school district will receive from the state. This formula is based on the ability of the school districts to generate revenues from their property tax base, the number of students in the district, and the poverty concentration of students (Eagan 2009). This foundation level is not based on the actual cost of providing an education to a student, but rather on the cost of having two-thirds of non-at-risk students pass Illinois’s standardized tests. In addition, the foundation level assumes a certain local property tax contribution. If local property tax base cannot support that level of funding, the state will not make up the difference in funding (Eagan 2009). This strong reliance on the local property tax base means that thousands of students do not receive a quality education because they live in a poor neighborhood with a low local property tax base (Eagan 2009). Another formula is the “Alternate” formula. To qualify for this formula, a district must have available local resources per student of at least 93% but less than 175% of the foundation level. The “Flat Grant” formula is the third formula. To qualify for this formula, a district must have available local resources per student of at least 175% of the foundation level.

From 2000 to 2012, total funding for Foundation Level grants actually dropped by 6%, while Poverty Grant funding has increased by 432%, and PTELL Adjustments have grown by 1267%. The Poverty Grants increased from $295 million to $1.6 billion since 2000 (Illinois State Board of Education 2012). In 2000, the amount of GSA funds dedicated to support low-income children was just less than $300 million, or 10% of the total GSA.

Since 1993, state, local, and federal education spending in Illinois has grown by nearly 200%, reaching $28.7 billion in fiscal year 2012 (Illinois State Board of Education 2012).

Education’s three main funding sources have all contributed to the growth in funding since 1993:

Federal funding has grown 4.1 times to $3.6 billion;

State funding has grown 2.7 times to $9.3 billion;

Local spending has grown 2.6 times to $15.8 billion.

Total per student spending was $13,748 in 2013. In 2013, a 148% increase over the past 20 years. It has grown at an average rate of nearly 5% a year—faster than the 3.5% average annual inflation rate over the same time period.

Jonathan Kozol’s 1991 Savage Inequalities describes the striking differences in funding in Illinois: “Chicago public schools spent just over $5,000 per student in 1989, nearby Niles Township High School spent $9,371 per student.” Marchitello (2017) determined that after accounting for teacher pensions, the disparity in school-level personnel expenditures between high- and low-poverty schools increases dramatically: “Even after excluding the separate Chicago pension fund, the state’s pension fund increases school funding gaps by 24%, or $211 per pupil, between high- and low poverty schools” (p. 2).

The situation did not change for thirty years in Illinois until August, 28 2017, when the House Amendment 5 created the first revision of Senate Public Act 100–0465 (1947). The new law guarantees that school districts would not lose money. The state distributes more than $5 billion a year in general state aid. The new law, however, covers only how an additional $350 million a year is doled out. The problem is that the primary goal of new law—making school funding more equitable—will proceed slowly (Geiger and Garcia 2017).

Methodology and Analysis

This research sought to clarify whether the wealthiest school districts are different from extremely poor school districts in terms of test proficiency; total, property tax, state, local, and federal funding per student; instructional, administrative, and other support expenditures per student; years of teacher experience; percentage of teachers with bachelor’s degrees; and percentage of teachers with master’s degrees. The goal of this study was to determine whether there were differences between the means of the two groups of school districts’ variables.

Data

The Illinois School Data Report Card was used to select the school districts included in the study. Two criteria were used: the poor school districts (Quintile 1) had to have more than 90% of the students qualifying for federal lunch programs (2.4% of all school districts), and the wealthy school districts (Quintile 5) had to have less than 5% of their students qualifying for federal lunch programs (2.35% of all school districts). Solomon (2003) argues, “70% of Edison students are in the free or reduced lunch plan, which is ‘a proxy roughly corresponding to some degree of poverty” (pp. 1318–1319). The Illinois School Data Report Card provides data on student characteristics, teacher characteristics, and funding data. This website is publicly available. For the purpose of this study, the school districts that were selected were not identified but simply referred to as wealthy (Quantile 5) and poor school districts (Quantile 1).

In this study the two-sample t-test was used. This test was selected because it most effectively afforded an opportunity to analyze the two groups of school districts (Quintile 1 and 5). The two-sample t-test was used to determine whether the two groups (poor and wealthy schools) were equal.

Based on the theory and research reviewed above, the present study made the following predictions: the extremely wealthy school districts (Quintile 5) and extremely poor school districts (Quintile 1) in Illinois would have the following significantly different characteristics: (1) proficiency scores; (2) demographic situation; (3) total funding per student; (4) property tax funding per student; (5) local funding per student; (6) state funding per student; (7) federal funding per student; (8) instructional expenditures per student; (9) administrative expenditures per student; (10) support expenditures per student; (11) other expenditures per student; (12) average teacher’s salary; (13) teacher’s years of experience; and (14) teacher’s level of education.

Analysis

Fifty-eight school districts were selected for inclusion in the study. These were divided into two levels: those with less than 5% poverty (as determined by qualification for free and reduced lunch) (27 school districts) and those with more than 90% poverty (31 school districts). The purpose of the selection of the school districts was to compare educational outcomes, school district funding, school expenditures, and teacher characteristics.

Table 1 presents descriptive statistics for 58 school districts. Table 1 provides descriptive statistics.

Findings

Achievement Gaps

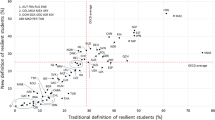

Achievement gaps are clearly evident between students in school districts serving students who qualify for free and or reduced lunch programs (the highest poverty districts - Quintile 1) compared with those serving the fewest students in poverty (the lowest poverty districts - Quintile 5) (see Fig. 1). Analysis of student performance shows that students’ percentage of proficiency levels was less than 50% in Quintile 1 (poor school districts). The median in Quintile 1 was 35 (Mean: 33). In Quintile 5 (wealthy school districts) the proficiency test levels were 71% and higher (Median: 86, Mean: 86) (see Fig. 1).

Proficiency of students in Quintile 1 and 5 in Illinois in 2014. Source: Calculated by authors from data by Illinois Interactive School Data Report Card (2015)

School Funding Disparities

Several types of school funding exist in Illinois: federal, state, local, and property tax funding. However, as Kadner (2015) states: “In recent years, the state’s contribution has dipped below 30%, forcing local school districts to raise their property tax levy or cut programs” (p. xx). The Illinois school districts are characterized by extreme funding disparity.

Table 2 presents total funding per student from local, state, and federal sources. The table shows the degree of total funding disparity between wealthy and poor school districts in Illinois.

The findings show that the mean is $15,511.61 (median $17,625) of total funding per student while the range is $18,161.89, which is a high disparity between wealthy and poor school districts. The wealthy school districts have total funds per student on average of $4582 more than do poor school districts (Fig. 2).

These gaps add up. For a middle school with 500 students, for example, a $1200 funding gap per student means a shortage of $2.29 million per year. For a 1000-student high school, it means $4.58 million in missing resources. Arguably, schools in poor areas receive Title 1 funding, which is not available to school districts in more affluent areas (Illinois Interactive Report Card 2015). Originally, the idea of Title 1 was enacted in 1965 under the Elementary and Secondary Education Act (ESEA). This policy committed to closing the achievement gap between low-income students and other students. The policy was rewritten in 1994 to improve fundamental goals of helping at-risk students. The basic principles of Title 1 state that schools with large concentrations of low-income students will receive supplemental funds to assist in meeting student educational goals. The Title I program is designed to provide extra resources to high-poverty schools to help them meet the greater challenges of educating at-risk students (U.S. Department of Education 2011a). According to the Illinois State Board of Education (2015), “Schools with targeted assistance programs use Title I funds to implement comprehensive strategies for improving the educational program of the whole school in schools with 40% or more poverty to increase the achievement of all students, particularly at-risk students.” Title I funds may be used only to provide services to eligible students identified as having the greatest need for special assistance, who are failing, or most at risk of failing, to meet the Illinois Learning Standards. Types of students that might be served by Title 1 funds include migrant students, students with limited English proficiency, homeless students, students with disabilities, neglected students, delinquent students, at-risk students, or any student in need. Students can be classified as at-risk for numerous reasons, including showing low academic performance, being held back a grade for one or more years, or being homeless. Title 1 funds can be used for curriculum improvement, instructional activities, counseling, parental involvement, increases in staff and program improvement (Hall and Ushomirsky 2010; Miller 2010; Luebchow 2009; Roza 2008). The funding should assist schools in meeting the educational goals of low-income students. According to the U.S. Department of Education, Title 1 funds typically support supplemental instruction in reading and math.

Table 3 presents federal funding per student in poor and wealthy school districts Illinois.

The law requires that districts ensure that Title I schools receive “comparability of services” from state and local funds, so that federal funds can serve their intended purpose of supplementing equitable state and local funding (U.S. Department of Education 2011a). The Report of U.S. Department of Education (2011b) “Comparability of State and Local Expenditures Among Schools Within Districts: A Report From the Study of School-Level Expenditures” shows that schools serving low-income students are being shortchanged because school districts across the country are inequitably distributing their state and local funding.

According to Kenyon and Reschovsky (2014, p. 373), “The property tax is the mainstay of local K–12 education revenue. Public schools derive over 80% of their local own-source revenue from the property tax.” The primary source of local funding for Illinois schools is the local property tax. Schools in poor school districts receive state funding, but the revenue they receive from local property taxes is low (Tavernise 2012). Illinois real property values and related taxes are established on a calendar-year basis. Property assessments for the 2014 calendar year provide the basis for property tax revenues distributed in calendar year 2015. The Illinois State Board of Education uses a worksheet that school district administrators complete to establish their level of local wealth. Local wealth is tied to Equalized Assessed Valuations (EAV) per student. EAVs represent the taxable base for schools as certified by the Illinois Department of Revenue. The higher EAV is per student, a the wealthier the school district. State-directed equalization factors (multiplier adjustments) are designed to assure equal valuation treatment across the 102 counties in Illinois. Since assessment levels can vary from county to county, especially from Cook County, Illinois property tax calculation requires that assessed values be converted to EAV as part of the property tax calculation process. Therefore, EAV is the revised assessed value of a home after the state multiplier has been applied to adjust for under-assessment (Illinois State Board of Education 2014). A school district’s wealth is generally linked to the total value of taxable property within district boundaries, which is the district’s tax base. A school district’s tax base is determined by adding together the value of all taxable property, whether it is vacant land, residential, or business based (Illinois Board of Education website). Because the value of property differs contingent on its location and type, some school districts will have much more property wealth than others will. School districts in the northern suburbs of Chicago that have a regional shopping mall and multiple high-rise corporate office buildings will have an overall significantly higher tax base than school districts located in the south suburbs of Chicago that do not have these. Because of wide discrepancies in Illinois school district tax bases, a vast amount of inequity exists between the poor and wealthy school districts. Much of the disparity is driven by differential endowments of property taxes. Table 4 presents property tax funding per student.

Table 4 shows the degree of this property tax funding disparity between poor and wealthy school districts. The patterns in the table are striking. The wealthy school districts have an average of $11,314 property tax per student more than poor school districts. Maximum property tax funding per students is $24,822 while the minimum property tax funding per students is $1122. The difference is $23,700; in other words, the maximum property tax funding per student is 22 times more than the minimum property tax funding per student. The range of the poor school districts is $14,339, while the range of the wealthy school districts is $18,595. Remarkably, the property tax funding of schools creates disparity that is even greater than the disparity seen across the total funding of the school districts (Fig. 3).

Property tax funding per student in Quintile 1 and 5 in Illinois in 2014. Source: Calculated by authors from data by Illinois Interactive School Data Report Card (2015)

A second major source of local revenue for schools is Corporate Personal Property Replacement Tax (CPPRT) revenues. In 1979, Illinois law eliminated the taxation of the personal property of businesses and replaced it with an alternative tax on Illinois businesses. The CPPRT imposes a state-collected tax on the net income of business and on invested capital of public utilities. The proceeds of this tax are distributed to local taxing bodies in the proportion to the relative share of personal property taxes received by these local taxing bodies prior to 1979. Public schools receive approximately 52% of the replacement revenues generated by the CPPRT (Illinois State Board of Education website).

Table 5 presents local funding per student.

The State Aid Formula also has a mechanism to provide additional funding for the impact of poverty in the district (Illinois State Board of Education website). Table 6 presents state funding per student.

In recent four years, the state’s contribution has decreased below 30%, forcing local school districts to raise their property tax levy or cut programs. Figure 4 are showing the average funding sources of Illinois public school districts.

According to Wilson (2014), 66% of the funding for school districts was derived from local sources in Illinois in 2014. The average state and local shares of education cost in the United States were the following: 44% state share and 44% local share, with the remaining cost paid with other grants or federal dollars. Difficult financial times in Illinois have resulted in the state steadily reducing its portion of funding to the public school systems. The operation of the Illinois schools’ revenue system, combined with the considerable range in economic capacity of the local governments, gives some schools enormous revenue advantages in comparison with others. Any efforts to provide students approximately comparable fiscal endowment for the provision of educational services would require extremely aggressive federal and state transfer programs.

Boyd et al. (2005) conducted a study in New York City and found that low-achieving students often are taught by the least-qualified teachers. According to Angrist and Guryan (2004), “A controversial aspect of increasing teacher education is the fact that few teachers specialize in an academic subject: rather, their major field is typically education itself” (p. 241). Interactions between teacher qualifications and student achievement are important. Teachers, especially highly qualified teachers, are more likely to transfer or quit when teaching lower-achieving students, even after accounting for student and teacher race. According to Beatty (2013), “Research has established that the students most likely to lag behind academically are those who attend schools with less-qualified teachers and poorer resources” (p. 69).

Many scholars find that low-income students and students of color disproportionately are more frequently taught by unqualified, inexperienced, and out-of-field teachers (Adamson and Darling-Hammond 2011; Goldhaber et al. 2014; Partee 2014). In addition, the average teacher apparently prefers to avoid schools with low-performing students, although many teachers are unaffected while others are strongly affected. Teachers who lived farther from their school prior to starting their job are more likely to quit or transfer. The phenomenon has substantive implications, since urban districts are net importers of teachers from surrounding suburbs.

This study did not find a big difference in teacher experiences between wealthy school districts and poor school districts.

Table 7 presents teachers experience at total, in poor and wealthy school districts in Illinois in 2014.

In contrast to the effect of teacher experience, the differences in teacher qualifications are large when we analyze how many teachers in poor and wealthy school districts have a master’s degree (Table 8).

Two-Sample T-Test

We conducted a two-sample T-test to compare the means of the same variables between two groups: wealthy and poor school districts. The test assumed that variances for the two populations are the same. Degrees of freedom were 56. The interpretation for the p-value was the same as in other types of t-tests. Table 9 provides the results of two-sample T-test variables in wealthy (Quintile 5) and poor school districts (Quintile 1).

We found differences between the means with 99% confidence as follows: (1) the proficiency of students; (2) ethnicity; (3) total funding per student; (4) property tax funding per student; (5) state funding per student; (6) local funding per student; (7) federal funding per student; (8) instructional expenses per student; (9) administrative expenses per student; (10) average teacher’s salary; (11) percentage of teachers with bachelor’s degree; and (12) percentage of teachers with master’s degree. We did not find significant differences between the means with 99% confidence regarding expenditures per student, other expenditures per student, and teacher experience. The students in wealthy school districts had an average of 51% higher proficiency than did the students in poor school districts. The wealthy school districts had 55% fewer African-American students than did poor school districts.

Findings from the literature review and analysis of the data collected from the Illinois Interactive School Data Report Card revealed that wealthy and poor school districts had a high disparity in property tax funding per student in 2014. Examination of the allocation deriving from property tax funding per student showed that the funding was higher in wealthy school districts. The wealthy school districts received in average of $15,451 from property tax per student, $11,314 more than did the poor school districts in 2014 in Illinois. The wealthy school districts also received in average of $899.7 local funds per student, $466 more than poor school districts.

We also investigated the disparity between federal and state funding per student and found that the average state funding and federal funding per student were lower in wealthy school districts. Poor school districts received an average of $5575 from state funding per student more than wealthy school districts in 2014. Poor school districts received an average $1930 from federal funds per student, more than $1605 than wealthy school districts in 2014. However, we also found that wealthy school districts received an average of $18,090 total funding per student compared with poor school districts receiving an average of $13,507; this difference represents a fiscal disparity of $4582 in total funding per student in 2014.

The wealthiest school districts had $425 administrative expenses per student and $161 other expenses per student less than extremely poor school districts but $182 supportive expenses per student more than did poor school districts in 2014. Average teacher salaries were $21,960 higher in the wealthy school districts than in poor school districts. Also, higher levels of education were found in the wealthy school districts than in poor school districts. In wealthy school districts, 68.9% of teachers completed their master’s degree, while in poor school districts 48.9% have teachers who completed their master’s degrees. The wealthy school districts had 22% fewer teachers with a bachelor’s degree than did poor school districts.

The poorest and least advantaged school districts did benefit from federal and state equalization, meaning that the inequality of those school districts was reduced, but a clear disparity remains between the wealthiest districts (Quintile 5) and the poorest districts (Quintile 1) in 2014.

Conclusions and Recommendations

This study found funding differences between extremely wealthy and poor school districts in Illinois in 2014. This research establishes that differences in per student funding and the tie to local property taxes are among other contributing factors to the problem of social justice and the achievement gap in Illinois. As the disparity among school districts’ funding increases, so does the demand for central fiscal transfers from federal and state governments. School districts in affluent areas have higher property taxes and hence can provide greater funding for their public schools than can poorer school districts. In contrast, the poorest and least advantaged school districts benefit from federal and state equalization, meaning that the inequality for those school districts is reduced but that a disparity remains between the wealthiest districts and the poorest districts.

As a result, this study found that support services to students that result from property tax revenues are dramatically different across Illinois school districts. Poorer school districts face significantly lower levels of services, teachers’ salary and education, or any combination of the three. Without substantial transfers from the national government, these districts’ financial situation would be even more distressed in comparison with wealthier school districts. These findings support the need for Title I funds from the federal government.

According to Kenyon and Reschovsky (2014), school funding systems vary tremendously across states, as does state support for public education across states. If the Illinois Education Board seeks a more balanced opportunity for all its students, without regard to where they might live in the Illinois, its funding of the schools would need to change. To this end, Illinois should use best practices from other states. According to Ushomirsky and Williams (2015), “in Connecticut, the legislature directs more than three times as much state funding per student to the highest poverty districts as it does to the lowest poverty districts. As a result, even though they receive fewer local dollars, the highest poverty districts still receive 5% more in overall (state and local) funding than their lowest poverty counterparts because the state fills in the gap” (p. 6). Illinois could use the example of Connecticut to improve the equalization system of school districts funding.

This study concludes that increased local fiscal disparity demands aggressive redistributive policies from federal and state governments and that funding decisions about school systems in Illinois need re-examination. On April 1, 2014, Senator Andy Manar introduced Amendment 1 to Senate Bill 16, or the Illinois School Funding Reform Act of 2014. It proposed to set up a formula to distribute education funding based on a local district’s “ability to pay,” which considers a district’s available local resources through property tax revenues. The formula considers the poverty level of districts by factoring in low-income student populations and adds greater weight to other special funding needs districts face, such as students with disabilities or gifted learners. Currently, about 44% of the $4.3 billion in general state aid for education is distributed to districts based on their ability to pay.

This research shows the need to reform Illinois education funding and state education aid systems in order to produce a steadier flow of state aid during economic downturns and to increase the educational opportunities of all students. A school reform that would improve the achievement of low-income students would be one that assures them access to high-quality teaching within the context of a rich and challenging curriculum supported by personalized schools and classes. Accomplishing such a goal will require equalization of financial resources, changes in curriculum and testing policies, and improvements in the supply of highly qualified teachers to all students.

Ushomirsky and Williams (2015) assert that “in Illinois the legislature does not distribute state funds progressively enough to counteract disparities in local dollars” (p. 1). The transfer system would need to be clearly defined as redistributive and not subject to political overrides or negotiations. Illinois made decisions to improve the system of allocation the funds to school districts in August 2017. Illinois should choose to distribute dollars based on school district need, taking into account each school district’s fiscal capacity and the characteristics of the students it serves. This study supports the recommendation that funding levels be forcefully equalized in order to close the achievement gap between Illinois school districts. The unequal local taxes bases lead to unequal resources, which in turn lead to unequal levels of service resulting in divergent outcomes. These decisions can have a profound effect on the educational opportunities school districts provide. Future studies should analyze the impact of new funding reforms on fiscal disparity and achievement gap between extremely wealthy and poor school districts in Illinois. More studies in different school districts from different states should be done in order to have a better understanding of disparities in school-level expenditures, the impact of district budgeting practices, and Title I comparability reform.

Limitation of Study

This study compared the average funding, expenditures, proficiency of students, and teachers’ characteristics of groups of school districts (the quartiles with the highest poverty and lowest poverty), rather than the funding, expenditures, proficiency of students, and teachers’ characteristics of individual school districts. Within each group, some districts may be receiving substantially more or less funding than these averages. This study did not attempt to determine whether the total amount of funding given to districts is adequate. While this question is crucial, especially given the recent declines in school funding across the country, it was beyond the scope of this analysis.

In addition, future studies should analyze what causes proficiency differences between wealthy and poor school districts, including the following independent variables: parental involvement, parents setting expectations for their children, and parents’ education levels. Additionally the management of school funds could be factors that help play a role in contributing to the variations that we see when examining test score differences between the wealthy schools and poor school districts.

References

Adamson, F., & Darling-Hammond, L. (2011). Addressing the inequitable distribution of teachers: What it will take to get qualified, effective teachers in all communities. Research brief, Stanford Center for Opportunity Policy in Education, December 2011, Retrieved from https://edpolicy.stanford.edu/sites/default/files/publications/addressing-inequitabledistribution-teachers-what-it-will-take-get-qualified-effective-teachers-all-_1.pdf.

Angrist, J. D., & Guryan, J. (2004). Teacher testing, teacher education, and teacher characteristics. American Economic Review, 94(2), 241–246.

Ansell, S. Achievement gap. (2011). Education week. Retrieved from http://www.edweek.org/ew/issues/achievement-gap/

Bailey, M. J., & Dynarski, S. (2011). Gains & gaps: Changing inequality in U.S. college entry and completion. PSC research report no. 11-746. Retrieved from http://www.nber.org/papers/w17633.

Beatty, A. S. (2013). Schools alone cannot close achievement gap. Issues in Science & Technology, 29(3), 69–75.

Boyd, D., Lankford, H., Loeb, S., & Wyckoff, J. (2005). Explaining the short careers of high-achieving teachers in school with low-performing students. American Economic Review, 95(2), 166–171. Retrieved from http://www.aeaweb.org/articles.php?. https://doi.org/10.1257/000282805774669628.

Bracey, G. (2003). The condition of public education. Phi Delta Kappan, 85(2), 148–164.

Bracey, G. (2004). Setting the record straight. Portsmouth: Heinemann.

Center on Budget and Policy Priorities (2012). New school year brings more cuts in state funding for schools. Retrieved from https://www.cbpp.org/sites/default/files/atoms/files/9-4-12sfp.pdf

Conlin, M. (2014). Michigan and Ohio K–12 educational financing systems: Equality and efficiency. Education Finance and Policy, 9(4), 417–445.

Dafflon, B. (2004). Federal-cantonal equalization in Switzerland: An overview of the reform in progress. Public Finance & Management, 4(4), 521–558.

Daniel, P. T. K., & Walker, T. (2014). Fulfilling the promise of Brown: Examining laws and policies for remediation. The Journal of Negro Education, 83(3), 256–273.

Darling-Hammond, L. (2000). Teacher quality and student achievement: A review of state policy evidence. Educational Policy Analysis Archives, 8(1). Retrieved from http://epaa.asu.edu/epaa/v8nl.

Darling-Hammond, L. (2010). The flat world and education: How America’s commitment to equity will determine our future. New York: Teachers College Press.

Der, H. (2004). Resegregation and achievement gap: Challenges to San Francisco school desegregation. Berkeley Women's Law Journal, 19(2), 308–316.

Dornbusch, S. M., Ritter, P. L., & Steinberg, L. (1991). Community influences on the relation of family statuses to adolescent school performance: Differences between African Americans and non-Hispanic whites [special issue: Development and education across adolescence]. American Journal of Education, 99(4), 543–567.

Dumcombe, W., & Yinger, J. (2004). How much more does a disadvantaged student cost? Syracuse: Center for Policy Research at Syracuse University Retrieved from http://surface.syr.edu/cgi/viewcontent.cgi?article=1102&context=cpr.

Duncan, L. P. (2014). Fixing school funding. Illinoistimes.com. Retrieved July 17, 2015 from http://illinoistimes.com/article-13787-fixing-school-funding.html.

Eagan, M. (2009). Mind the gap: Reforming the Illinois education funding formula. Chicago: The Loyola University Chicago Childlaw and Education Institute Forum Retrieved from http://www.luc.edu/law/academics/special/center/child/childed_forum/2009_child_forum.html.

Education Commission of the States (2013). The progress of education reform: Who pays the tab for K-12 education? Retrieved from http://www.ecs.org/clearinghouse/01/08/47/10847.pdf.

Education Law Center (2015). Cheating our future: How decades of disinvestment by states jeopardizes equal educational opportunity. Retrieved from http://ctschoolfinance.org/assets/uploads/files/Cheating-Our-Future-How-Decades-of-Disinvestment-byStates-Jeopardizes-Equal-Educational-Opportunity.pdf.

Eom, T., Dumcombe, W., Nguyen-Hoang, P., & Yinger, J. (2014). The unintended consequences of property tax relief: New York’s STAR program. Education Finance and Policy, 9(4), 446–480.

Farnen, R. (2000). Political socialization, culture, and education in 21st century USA and Canada: State of the art in North America. Paper delivered to the 18th international political science association world congress, research committee no. 21, Quebec City, Canada, august 1-5.

Farnen, R. (2003). Service learning, volunteerism, and democratic civic education in North America: Is it worth the effort? Paper presented to panel one on Youth’s political socialization at the Phillips University European consortium for political research conference in Marburg, Germany, September 18–21.

Farnen, R. (2007). Class matters: Inequality, SES, education and childhood in the USA and Canada today. Policy Futures in Education, 5(3), 278–302.

Farnen, R., & Suenker, H. (2001). The politics, sociology, and economics of education. In New York: St. Martin’s and London: Macmillan.

Finley, T. (2017, May 24). Black parents sue Mississippi over inequitable schools. Huffington Post, May, 24, 2017 Retrieved from http://www.huffingtonpost.com/entry/black-parents-lawsuit-mississippi-inequitableschools_us_59258e34e4b0650cc020afcf

Gamoran, A., & Long, D. A. (2006). Equality of educational opportunity, A 40-year retrospective. Wisconsin Center for Education Research: University of Wisconsin-Madison.

Geiger, J. & Garcia, C. (2017). Win on schools bill comes at a price. Chicago Tribune. 31 August 2017. Retrieved from http://www.chicagotribune.com/news/local/politics/ct-bruce-rauner-school-funding-met-0901-20170831-story.html

Goldhaber, D., Lavery, L., & Theobald, R. (2014). Uneven playing field? Assessing the inequity of teacher characteristics and measured performance across students, CEDR working paper 2014-4, University of Washington, 2014. Retrieved from: http://www.cedr.us/papers/ working/CEDR%20WP%202014-4.Pdf;

Gonzales, N. A., Cauce, A. M., Friedman, R. J., & Mason, C. A. (1996). Family, peer, and neighborhood influences on academic achievement among African-American adolescents: One-year prospective effects. American Journal of Community Psychology, 24(3), 365–387.

Guo, G., & Harris, K. M. (2000). The mechanisms mediating the effects of poverty on Children’s intellectual development. Demography, 37(43), 1–47.

Hall, D., & Ushomirsky, N. (2010). Close the hidden funding gaps in our schools. Washington: Education Trust.

Hilliard, A. G. (2003). No mystery: Closing the achievement gap. In T. Perry, C. Steele, & A. Hilliard (Eds.), Young, gifted and black: Promoting high achievement among African-American students (pp. 131–165). Boston: Beacon Press.

Illinois Interactive Report Card (2014). Retrieved from http://iirc.niu.edu/Default.aspx

Illinois Interactive Report Card. (2015). Retrieved from http://iirc.niu.edu/Default.aspx

Illinois State Board of Education. (2012) Fiscal year 2012 proposed budget. Retrieved March 29, 2012 from http://www.isbe.state.il.us/budget/FY12_budget_book.pdf.

Illinois State Board of Education. (2014) Title I, Part A: Targeted assistance school programs & schoolwide programs. Retrieved from http://www.isbe.net/grants/html/title1.htm

Illinois State Boards of Education. (2015). Data analysis and accountability. Retrieved from http://www.isbe.net/research/htmls/fall_housing.htm

Jordan, M., Chapman, D., & Wrobel, S. (2014). Rich districts, poor districts: the property tax equity impact of Arkansas school finance. Public Finance and Management, 14(4), 399–415

Jordan, M., Chapman, D., & Wrobel, S. (2015). Rich districts, poor districts: The property tax equity impact of Arkansas school finance equalization. Public Finance and Management, 14(4), 399–415.

Kadner, P. (2015, March). Illinois Schools have biggest funding gap in nation. Chicago Tribune. Retrieved from: http://www.chicagotribune.com/suburbs/daily-southtown/opinion/ct-sta-kadner-sudies-st-0327-20150326-column.html#page=1.

Kenyon, D., & Reschovsky, A. (2014). Introduction to special issue on the property tax and the financing of K–12 education. Education Finance and Policy., 9(4), 373–382.

Kozol, J. (1991). Savage inequalities. New York: Crown.

Luebchow, L. (2008). School finance equity: National trends, New America Foundation, January 29, 2008, Retrieved from http://preview.staging.newamerica.org/education-policy/school-finance-equity-national-trends/.

Luebchow, L. (2009). Equitable resources in low income schools: Teacher equity and the federal title I comparability requirement. Washington: New America Foundation.

Marchitello, M. (2017). Illinois’ teacher pension plans deepen school funding inequities. In Research paper at the policy and thought leadership team at bellwether education partners Retrieved from https://bellwethereducation.org/sites/default/files/Bellwether_TP_IL_PlanInequity_Final-082317.pdf.

McCarter, K. N. (2009). Challenging public education funding in Illinois: A new approach. Minority Trail Lawyer, 7(4), 1–10.

McGee, G. (2004). Closing the achievement gap: Lessons from Illinois' golden spike high-poverty high-performing schools. Journal of Education for Students Placed at Risk (JESPAR), 9(2), 97–125.

Miller, R. (2010). Comparable, schmomparable: Evidence of inequity in the allocation of funds for teacher salary within California’s public school districts. Washington: Center for American Progress.

National Centre for Education Statistics (NCES) (2012). The conditins of education. Washington: U.S. Department of Education. https://nces.ed.gov/pubs2012/2012045.pdf

National Center for Education Statistics (2012). The condition of education. Retrieved from https://nces.ed.gov/pubs2012/2012045.pdf

National Centre for Education Statistics (NCES). (2005). Revenues and expenditures by public school districts: School year 2001–02. Washington: U.S. Department of Education.

New America Foundation (2017). Local funding. https://www.newamerica.org/education-policy/policy-explainers/early-ed-prek-12/school-funding/

Parrish, T. B., Matsumoto, C. S., & Fowler, W. J. (1995). Disparities in public school district spending 1989–90: A multivariate, student-weighted analysis, adjusted for differences in geographic cost of living and student need. Washington: National Center for Education Statistics, U.S. Department of Education.

Partee, G. (2014, April). Attaining equitable distribution of effective teachers in public schools. Center for American Progress. Retrieved from https://cdn.americanprogress.org/wp-content/uploads/2014/04/TeacherDistro.pdf

Picus, L., Odden, A., Glenn, W., Griffith, M., & Wolkoff, M. (2012). An evaluation of Vermont’s education finance system. Working draft. Retrieved from http://www.leg.state.vt.us/jfo/Education%20RFP%20Page/Picus%20and%20Assoc%20VT%20Finance%20Study%20with%20Case%20Studies%201-2-12a.pdf

Reardon, S. F. (2008). The widening academic achievement gap between the rich and the poor: New evidence and possible explanations. In G. J. Duncan & R. J. Murnane (Eds.), Whither opportunity? Rising inequality, schools, and children’s life chances (pp. 91–116). Russell Sage Foundation.

Reardon, S., Robinson, J., & Weathers, E. (2015). Patterns and trends in racial/ethnic and socioeconomic academic achievement gaps. In H. A. Ladd & E. B. Fiske (Eds.), Handbook of research in education finance and policy (2nd ed.). Lawrence Erlbaum.

Ross, J., & Nquyen-Hoang, P. (2013). School district income taxes: New revenue or a property tax substitute? Public Finance and Budgeting, 33(2), 19–40.

Roza, M. (2008). What if we closed the title I comparability loophole? In J. Podesta & C. Brown (Eds.), Ensuring equal opportunity in public education: How local school district funding practices hurt disadvantaged students and what federal policy can do about it (pp. 59–71). Washington: Center for American Progress.

Solomon, L. (2003). Edison schools and the privatization of K-12 public education: A legal and policy analysis. Fordham Urban Law Journal, 30(1), 1276–1284.

Tavernise, S. (2012). Education gap grows between rich and poor, studies say. Retrieved from http://www.nytimes.com/2012/02/10/education/education-gap-grows

Taylor, W. L., & Piche, D. M. (1991). A report on shortchanging children: The impact of fiscal inequity on the education of students at risk. Prepared for the committee on education and labor, U.S. house of representatives. Washington: U.S. Government Printing Office.

The United States Commission on Civil Rights (2018). Public education funding inequity in an era of increasing concentration of poverty and resegregation. Report. Washington, DC. Retrieved from www.usccr.gov

U.S. Census Bureau (2010). Annual survey of school system finances. Retrieved from https://www.census.gov/programs-surveys/school-finances.html

U.S. Department of Education (2011a). More than 40% of low-income schools don't get a fair share of state and local funds, Department of Education Research Finds. Retrieved from http://www.ed.gov/news/press-releases/more-40-low-income-schools-dont-get-fair-share-state-and-local-funds-department-education-research-finds

U.S. Department of Education (2011b). Comparability of state and local expenditures among schools within districts: A report from the study of school-level expenditures Retrieved from http://www2.ed.gov/rschstat/eval/title-i/school-level-expenditures/school-level-expenditures.pdf

Unnever, J. D., Kerckhoff, A. C., & Robinson, T. J. (2000). District variations in educational resources and student outcomes. Economics of Education Review, 19(3), 245–259.

Ushomirsky, N., & Williams, D. (2015). Funding gaps 2015: t\Too many states still spend less on educating students who need the most. In Education Trust’s report Retrieved from http://edtrust.org/wpontent/uploads/2014/09/FundingGaps2015_TheEducationTrust1.pdf

Wagner, T. (2008). The global achievement gap. New York: Basic Books.

Walker, A. (2017). Recasting the vision for achieving equity: A hstorical analysis of testing and impediments to process-based accountability. Education and Urban Society, 49(3), 297–313.

Wilson, W. J. (1987). The hidden agenda. In W. J. Wilson (Ed.), The truly disadvantaged: The inner city, the underclass, and public policy (pp. 140–164). Chicago: University of Chicago Press.

Wilson, W. J. (1996). When work disappears: The world of the new urban poor. New York: Alfred A. Knopf.

Wilson, C. (2014). Education calculations: How much local, state, and federal school funding Illinois districts receive. December 2014. Rebootillinois.com. Retrieved July 17, 2015 from http://www.rebootillinois.com/2014/12/08/editors-picks/caitlinwilson/education-calculations-much-local-state-federal-school-funding-illinois-districts-receive/29968/

Winters, R. (2011, August 2). Granite School District OK’s $5 Million Tax Boost, The Salt Lake Tribune.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bruce, M.D., Ermasova, N. & Mattox, L. The Fiscal Disparity and Achievement Gap between Extremely Wealthy and Poor School Districts in Illinois. Public Organiz Rev 19, 541–565 (2019). https://doi.org/10.1007/s11115-018-0417-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11115-018-0417-7