Abstract

Since introduction of cointegration and error-correction modeling, the definition of the J-curve has changed to reflect short-run deterioration combined with long-run improvement of the trade balance due to currency depreciation. Standard methods such as ARDL approach of Pesaran et al. (2001) assume that adjustment of variables follow a linear path. It is now recognized that the adjustment process could be nonlinear. Application of Non-linear ARDL approach of Shin et al. (2013) provides more evidence of the J-curve supporting non-linear adjustment of variables as well as asymmetric effects of exchange rate changes on the trade balance, using bilateral trade balance models of the U.S. with each of her six largest trading partners.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The J-curve phenomenon summarizes the response of the trade balance to devaluation or currency depreciation. Magee (1973) who introduced the concept argued that due to adjustment lags such as recognition lag, production lag, delivery lag, etc. currency depreciation affects the trade balance in the future. Therefore, if the trade balance was deteriorating at the time of devaluation, it will keep deteriorating even after devaluation until the lags are realized. The trade balance then could improve, hence the J-curve pattern. Although Magee introduced the concept, Bahmani-Oskooee (1985) introduced the testing method by specifying a trade balance model and imposing a lag structure on the exchange rate as one of the determinants of the trade balance. A few negative coefficients followed by a few positive ones were shown to support the J-curve. Rose and Yellen (1989) introduced yet an alternative way of testing the J-Curve within cointegration and error-correction modeling techniques, i.e., short-run deterioration combined with long-run improvement in the trade balance due to currency depreciation.Footnote 1 Bahmani-Oskooee and Ratha (2004) and Bahmani-Oskooee and Hegerty (2010) are two comprehensive review articles on the topic.

Although Rose and Yellen (1989) introduced us an alternative concept, they criticized previous studies on the ground that failure to support the J-curve could be due to using aggregate trade flows between one country and rest of the world. They then disaggregated the U.S. trade flows by trading partners and tested the phenomenon between the U.S. and each of her six major partners using error-correction and cointegration methods. As they concluded, “No statistically reliable evidence of the J-curve was found”. In this paper we ask the following question: Could failure to support the J-curve using disaggregated trade data be due to assuming a linear adjustment process? Can we discover the J-curve if we introduce nonlinearity into error-correction and cointegration modeling methods? The nonlinear ARDL approach to error-correction modeling and cointegration not only introduces nonlinear adjustment process into testing procedure but also helps us to determine whether the short-run and long-run effects of currency depreciation on the trade balance are symmetric or asymmetric. To this end, in Section 2 we outline the model and explain the linear and nonlinear ARDL methods. In Section 3 we report empirical results of testing the J-curve between the U.S. and each of her six largest partners.Footnote 2 A summary is provided in Section 4. Finally, definition of variables and sources of the data are cited in the Appendix.

2 The Model and Methods

Following Rose and Yellen (1989) and the literature we assume the trade balance between the U.S. and trading partner i is a function of the level of economic activity or income in both countries as well as the real bilateral exchange rate. Thus, we begin with the following bilateral trade balance model:

where TBi is a measure of the trade balance between the U.S. and trading partner i and is defined as the ratio of U.S. imports from trading partner i over her exports to trading partner i. It is assumed that this measure of the trade balance depends positively on the U.S. income, YUS, and negatively on the trading partner i’s income, Yi. As the U.S. economy grows, we expect her to import more and as the trading partner i’s economy grows, we expect U.S. to export more. The real exchange rate, REXi, is defined in a manner that a decline reflects a real depreciation of the U.S. dollar. If dollar depreciation is to increase U.S. exports and reduce her imports from partner i, an estimate of d is expected to be positive for long-run improvement.

As mentioned above, Eq. (1) is a long-run model and coefficient estimates by any method only reflect long-run effects of exogenous variables. In order to judge the short-run effects of exogenous variables we must introduce short-run dynamic adjustment process into (1). We do so first following Pesaran et al.’s (2001) linear ARDL or bounds testing approach as in Eq. (2):

Equation (2) is an error-correction model in which lagged error term from (1) is replaced by its equivalent, i.e., the linear combination of lagged level variables. In this set up, the short-run effects are inferred from estimate of coefficients attached to first-differenced variables and the long-run effects are judged by the estimates of λ2 – λ4 normalized on λ1. However, for the long-run effects to be valid, we must establish cointegration. Pesaran et al. (2001) propose applying the familiar F test to establish joint significance of lagged level variables as a sign of cointegration. However, the F test in this context has new critical values that they tabulate. Since these new critical values do account for integrating properties of all variables, there is no need for pre unit-root testing and variables could be integrated of order zero, I(0) or order one, I(1) which are the properties of almost all macro variables. The J-curve effect will be supported if estimates of e’ are negative or insignificant but the estimate of normalized λ4 is positive and significant.

Our claim in this paper is that failure to find support for the J-curve effect could be due to assuming that the effects of exchange rate changes are symmetric. Once depreciations are separated from appreciations and their effects on the trade balance are tested separately, it is possible that depreciations could have significant effect whereas appreciations may not, i.e., effects of exchange rate changes could be asymmetric. To this end, following the literature we decompose the movement of the LnREX variable into its negative (dollar depreciation) and positive (dollar appreciation) partial sum as: LnREX = LnREX 0 + LnREX + t + LnREX − t where LnREX + t and LnREX − t are the partial sum process of positive and negative changes in LnREX. More precisely:

We then follow Shin et al. (2013) and replace LnREX in Eq. (2) by POS and NEG variables as in (4):

The new variables in Eq. (4) now allow us to test whether exchange rate changes have asymmetric or symmetric effects on the U.S. trade balance with trading partner i. Error-correction model (4) is said to be a nonlinear ARDL model and nonlinearity is introduced through partial sum or cumulative sum concept included in generating the new variables POS and NEG. Shin et al. (2013) justify applying Pesaran et al.’s (2001) bounds testing approach to Eq. (4).Footnote 3 Error-correction models (2) and (4) are estimated in the next section.Footnote 4

3 The Results

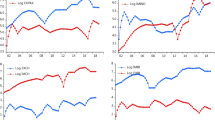

In this section we estimate both error-correction models (2) and (4) using bilateral data between the U.S. and each of her six major trading partners. The list that was also considered by Rose and Yellen (1989) includes: Canada, France, Germany, Italy, Japan, and the U.K. While definitions of variables and data sources are provided in the Appendix, it should be mentioned that quarterly data over the period 1971I-2013III are used to carry the estimation procedure. Following the literature (e.g., Bahmani-Oskooee and Tanku 2008) we impose a maximum of eight lags on each first-differenced variable and use Akaike’s Information Criterion (AIC) to select the optimum lags. Results from each optimum model are reported in Tables 1, 2, 3, 4, 5 and 6. Note that there are two parts in each table. Part I reports estimates and diagnostics of Eq. (2) and Part II does the same for Eq. (4). Furthermore, there are three panels in each part. While Panel A displays short-run coefficient estimates, Panel B does the same for long-run estimates. Finally Panel C reports diagnostic statistics.

Let us concentrate on the U.S.-Canada models and Table 1 first. From Part I and Panel A, it is clear that the real exchange rate has no significant short-run effects. However, from Panel B we gather that at least at the 10 % level of significance, it carries a positive and significant coefficient in the long run, supporting the J-curve hypothesis. From the long-run results we also gather that the level of income in both the U.S. and Canada carry significant coefficients, again at the 10 % significance level. Are these long-run estimates valid? To answer this question, we must establish joint significance of lagged level variables in Eq. (2) as a sign of cointegration. Given its upper bound critical value of 3.52, from Panel C we gather that the F test is not significant, failing to support cointegration.Footnote 5 In such cases, following the literature (e.g., Bahmani-Oskooee and Tanku 2008) we use normalized long-run coefficient estimates and Eq. (1) and calculate the error term. Denoting this new series by ECM, we replace the linear combination of lagged level variables in (2) by ECM t-1 , and estimate the new model after imposing the same optimum lag orders from Panel A. A significantly negative coefficient obtained for ECM t-1 will support convergence toward long-run equilibrium or cointegration. As can be seen from Panel C, this is exactly the case.

A few other diagnostic statistics are also reported in Panel C. The Lagrange Multiplier (LM) statistic is reported to make sure residuals are autocorrelation free. It is distributed as χ 2 with four degrees of freedom. Given its critical value of 9.48, the LM statistic is somewhat significant, implying existence of serial correlation. We also report Ramsey’s RESET statistic to check misspecification. It is also distributed as χ 2 but with only one degree of freedom. Given its critical value of 3.84 at the 5 % level of significance, the optimum model is correctly specified since the RESET statistic is insignificant. Finally, to test for stability of all coefficient estimates, following others (e.g., Pesaran et al. 2001; Bahmani-Oskooee and Tanku 2008) we apply CUSUM and CUSUMSQ tests to the residuals of the optimum model. Stable coefficients by either test are indicated by “S” and unstable ones by “US”. Clearly, all coefficient estimates are stable.

The question now is if J-curve is supported by estimating Eq. (2) which follows linear ARDL specification, what do we learn from estimates of nonlinear ARDL model outlined by Eq. (4)? From the long-run coefficient estimates in part II of Table 1, we gather that at least at the 10 % significance level the NEG variable carries significant coefficient whereas, the POS variable does not. This implies that the long-run effects of exchange rate changes are asymmetric. More precisely, while real depreciation of the U.S. dollar has long-run favorable effects on the U.S.-Canada trade balance, real appreciation of the U.S. dollar has no long-run effects. Other statistics carry the same level of standing as those in linear ARDL model except that serial correlation among the residuals has now disappeared since LM statistic is insignificant. Cointegration is supported by ECMt-1 approach, there is lack of serial correlation, the nonlinear ARDL model is correctly specified and all estimated coefficients are stable.

Results in the case of the U.S.-France (Table 2) and the U.S.-Germany (Table 3) are similar to those of the U.S.-Canada in that the J-curve is supported by the linear ARDL model. However, when we consider the results from nonlinear ARDL model, in the case of France, exchange rate changes have symmetric effects whereas in the case of Germany the effects are asymmetric. This is because both POS and NEG variables carry significantly positive coefficients in the long run that are very close in size in the results for France but not for Germany. Note that in all four models reported in Tables 2 and 3 cointegration is supported by both the F test and ECMt-1, residuals are all autocorrelation free, models do not suffer from misspecification, and all estimated short-run and long-run coefficients are stable.

In the remaining three cases, i.e., the US-Italy, the US-Japan, and the US-UK models whose results are reported in Tables 4, 5 and 6, the real bilateral exchange rate does not carry significant coefficient in the long run. If we were to rely upon these results from linear ARDL models we would have concluded that dollar depreciation has no long-run significant effects on the U.S. trade balance with each of these trading partners. However, when we shift to estimates of nonlinear ARDL models, the NEG variable carries significantly positive coefficient in all three cases except Japan, implying that real depreciation of the dollar against euro and pound will improve the U.S. trade balance with Italy and the UK.Footnote 6 In sum, when we consider the results from linear ARDL model, there is evidence of the J-curve in three cases (Canada, France, and Germany). However, when the results from nonlinear ARDL model are considered, there is evidence of the J-curve in all countries but Japan.Footnote 7 Thus, nonlinear ARDL model provide more evidence of the J-curve than the linear ARDL model. Furthermore, the non-linear approach reveals that in most cases exchange rate changes have asymmetric effects on the trade balance.

4 Summary and Conclusion

A country that is experiencing deterioration in its trade balance may adhere to currency devaluation or depreciation. However, due to adjustment lags the effects of devaluation is not instantaneous. Indeed, the trade balance will continue to deteriorate and improve only after some times, hence the J-curve phenomenon. Early studies tested the phenomenon by using aggregate trade flows of one country with the rest of the world and standard VAR models. Rose and Yellen (1989) criticized those studies on the ground that they suffer from aggregation bias and they did not test for integrating or cointegrating properties of the variables in the trade balance model. To demonstrate their points they used bilateral trade flows data between the U.S. and her six major trading partners as well as Engle and Granger (1987) cointegraion and error-correction modeling. By using these methods they also provided a new definition of the J-curve, i.e., short-run deterioration combined with long-run improvement. However, they found no evidence of the J-curve in any model.

In this paper we revisit the bilateral trade balance models used by Rose and Yellen (1989) one more time but try to improve on the method. Due to evidence of Purchasing Power Parity (PPP) in some cases, the real bilateral exchange rate could be a stationary variable whereas, the other variables in the trade balance model could be non-stationary. In such circumstance, the appropriate method will be the bounds testing or ARDL approach of Pesaran et al. (2001) which does not require pre-unit root testing and variables could be combination of stationary and non-stationary. This relatively new method that has been used by some previous studies assumes that the adjustment of variables follow a linear path. Could this assumption cause J-curve to fail? If the answer is in the affirmative, we try an additional step and use Nonlinear ARDL approach of Shin et al. (2013) and provide evidence of the J-curve phenomenon. More precisely, when linear ARDL approach to error-correction and cointegration was used, there was evidence of the J-curve effect in three out of six models. However, when non-linear ARDL approach was used, the J-curve effect was supported in five out of six models. Thus, introducing non-linear adjustment process helps us to discover more evidence of the J-curve. Furthermore, the non-linear approach also shows us that in most cases the effects of exchange rate changes are asymmetric.

Notes

Rose and Yellen (1989, p. 67).

These are the same partners that were considered by Rose and Yellen (1989).

Note that expected sign of normalized coefficient estimates of POS and NEG variables in model (4) are the same as that of REX in model (2). Therefore, if exchange rate changes are to have symmetric favorable effects on the trade balance, we expect the POS and NEG variables in (4) to carry significantly normalized positive coefficients that are the same in size.

This critical value is at the usual 5 % significance level and when there are three exogenous variables. It comes from Pesaran et al. (2001, Table CI-Case III, p. 300).

Note that in these two cases (i.e., the US-Italy and the US-UK) effects of exchange rate changes are asymmetric since the POS and NEG variables carry coefficients that are different in size and significance..

In all models cointegration is supported at least by F test or by ECMt-1. The RESET statistic is insignificant in all 12 models and the LM statistic is significant in four out of 12 models. To reduce the LM statistic to an insignificant level, we added additional lags of the dependent variable. There were no significant changes in the results. These results are available upon request.

Note that instruction to download the data from the Federal Reserve Bank of St. Louis hints that “All OECD data should be cited as follows: OECD (2010), ”Main Economic Indicators - complete database“, Main Economic Indicators (database), http://dx.doi.org/10.1787/data-00052-en (Accessed on date)”

References

Apergis N, Miller S (2006) Consumption asymmetry and the stock market: empirical evidence. Econ Lett 93:337–342

Bahmani-Oskooee M (1985) Devaluation and the J-Curve: some evidence from LDCs. Rev Econ Stat 67:500–504

Bahmani-Oskooee M, Ratha A (2004) The J-Curve: a literature review. Appl Econ 36(13):1377–1398

Bahmani-Oskooee M, Tanku A (2008) The black market exchange rate vs. the official rate in testing PPP: which rate fosters the adjustment process. Econ Lett 99:40–43

Bahmani-Oskooee M, Hegerty SW (2010) The J- and S-Curves: a survey of the recent literature. J Econ Stud 37:580–596

Bahmani-Oskooee M, Fariditavana H (2014) Do exchange rate changes have symmetric effect on the s-curve? Econ Bull 34(1):164–173

Engle RF, Granger CWJ (1987) Cointegration and error correction: representation, estimation, and testing. Econometrica 55(2):251–276

Magee, S. P. (1973) Currency contracts, pass-through, and devaluation. Brookings Papers on Economic Activity, No. 1, pp. 303–325

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Rose AK, Yellen JL (1989) Is there a J-curve? J Monet Econ 24:53–68

Shin Y, Yu B, Greenwood-Nimmo M (2013) Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework Festschrift, forthcoming, Springer

Verheyen F (2013) Interest rate pass-through in the emu: new evidence using nonlinear ARDL framework. Econ Bull 33:729–739

Author information

Authors and Affiliations

Corresponding author

Additional information

Valuable comments of two anonymous referees are greatly appreciated. Remaining errors, however, are ours.

Appendix

Appendix

1.1 Data Definition and Sources

Quarterly data over the period 1971I-2013III are used to carry out the empirical analysis. They come from the following sources:

-

a.

Direction of Trade Statistics by the IMF.

-

b.

Federal Reserve Bank of St. Louis.Footnote 8

1.2 Variables

TBi = U.S. trade balance with partner i is defined as the U.S. imports from partner i over her exports to partner i. The data come from source a.

YUS = Measure of United States income. It is proxied by index of real GDP. The data come from source b.

Yi = Trading partner i’s income. This is also proxied by the index of real GDP in country ii and the data come from source b.

REXi = The real bilateral exchange rate of the U.S. dollar against the currency of partner i. It is defined as REXi = (PUS.NEXi/ Pi) where NEXi is the nominal exchange rate defined as number of units of partner i’s currency per U.S. dollar, PUS is the price level in the U.S. (measured by CPI) and Pi is the price level in country i (also measured by CPI). Thus, a decline in REX reflects a real depreciation of the U.S. dollar. All nominal exchange rates and price levels data come from source b.

Rights and permissions

About this article

Cite this article

Bahmani-Oskooee, M., Fariditavana, H. Nonlinear ARDL Approach and the J-Curve Phenomenon. Open Econ Rev 27, 51–70 (2016). https://doi.org/10.1007/s11079-015-9369-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-015-9369-5