Abstract

The United States (US) and the People’s Republic of China (China) have the most patents in nanotechnology in their own depositories and overall in the international depositories. This paper compares nanotechnology landscapes between 2001 and 2017 as reflected in the United States Patent and Trademark Office (USPTO) and China National Intellectual Property Administration (CNIPA). It presents the evolution of nanotechnology patent development in the US and China, the differences between nanotechnology topics addressed in the USPTO and CNIPA patents, key players in nanotechnology fields in both domestic and foreign markets, and the player collaboration patterns. Bibliographic, content, and social network analyses are used. The longitudinal changes of granted patents and ranked countries, patent families, technology fields, and key players in domestic and overseas markets are outlined. Collaboration networks of assignees and the influential players have been identified based on network parameters. Results show that the US market attracts more international collaborations and has a higher level of knowledge exchange and resource sharing than the Chinese market. Companies play a vital role with regard to US nanotechnology development, resulting in more within-industry collaborations. In contrast, universities and research institutes are the dominant contributors to China’s nanotechnology development, leading to more academia-industry collaborations in China’s market.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Nanotechnology is frequently recognized as an indicator of a country’s technological competence in emerging technologies because of its current and potential role in supporting the scientific, economic, and social development. Many countries have established policy and funding incentives for supporting nanotechnology development. The United States (US) and the People’s Republic of China (China), the two largest world economies, have emphasized nanotechnology development as part of their national strategies. Over the past three decades, the two governments have developed strategic policies and provided substantial financial support to promote nanotechnology research and development (R&D) from science-centric nanoscale integration to health and sustainable development (Roco 2005, 2011; Liu and Guan 2016). The US and China differ in terms of governance of nanotechnology investment. The US has more private nanotechnology investments than China (Flynn et al. 2013; Kendrick et al. 2015), while China has a sustained rate of expanding research capacity including human and physical infrastructure.

US and after 2005 China are ranked as top countries based on the number of published papers and patenting activity in international databases such as Web of Science (WoS 2017: US, 18.0%; China, 34.9%) and World Intellectual Property Organization (WIPO 2017: US, 15.7%; China, 61.8% (Zhu et al. 2017)).

The United States Patent and Trademark Office (USPTO) continues to be a lead patent depository in the world. Since 2010, however, China has published the most nanotechnology-related patents worldwide, according to WIPO (Zhu et al. 2017). In terms of the number of nanotechnology-related WoS scientific publications, China has surpassed the US since 2011 (Committee on Triennial Review of the National Nanotechnology Initiative et al. 2016). The subject matter of these scientific papers and patents further suggests that the focus is in different areas: the US has a focus on nanomanufacturing for semiconductors, nanomedicine, and other areas (Chen et al. 2013), and China on nanoplasmonics, nanomaterial science, and other areas (Zhao et al. 2014).

Past nanotechnology development studies primarily have used scientific publications to compare nanotechnology R&D activities across countries, including the US and China (Liu et al. 2015; Dong et al. 2016; Gao et al. 2016; Bae et al. 2017). Most of these studies have focused on bibliographic analysis (Gao et al. 2016; Dong et al. 2016), and some analyzed the citation network (Liu et al. 2015). The comparison of nanotechnology application and commercialization was not reflected in these scientific publications.

“Technology landscape” includes here trends for the number of patents, key technology topics, key players, and player relationships (Dara and Sangamwar 2014; Kong et al. 2015). Although patents are only one form of intellectual property that protects technology development, patents published in one country’s patent office highlight the potential for commercialization in the respective market (Chen and Roco 2009; Kong et al. 2015; Gong and Peng 2018; Zhang et al. 2018). Other forms, such as maintaining trade secrets, are generally confidential and are not subject of this study.

Prior work has evaluated nanotechnology development using bibliographic analysis (for general trends, key players, and technology fields), content analysis (for technology topics), and social network analysis (for citation networks) (Li et al. 2007; Chen et al. 2008, 2013; Liu et al. 2009; Liu and Guan 2016). These studies predominantly use the USPTO (Chen et al. 2013) or the European Patent Office (EPO) Espacenet “worldwide” databases (Dang et al. 2010) for patent analysis. The China National Intellectual Property Administration (CNIPA) database has not been used for similar purpose until recently.

Incomplete patent citation data in the CNIPA prevents a rigorous citation analysis-based comparison of patent applicant relationships between the US and China. However, an alternate relationship may be used, that of collaboration. Applicants collaborate in sharing resources, complement each other’s advantages, improve work efficiency, and accelerate innovation (Tang and Shapira 2011; Zheng et al. 2014). Patent co-assignees represent this collaborative relationship.

In this study, we use the USPTO and CNIPA patent data during 2001–2017 to answer the following questions:

-

What are the growth trends of granted patents in the USPTO and CNIPA?

-

What are the key nanotechnology fields in the US and Chinese patents?

-

What are the evolving trends of the key nanotech topics in both countries?

-

Who are the key players (patent assignees) in their domestic and overseas markets?

-

What are the different characteristics between the patent assignee collaboration networks in the USPTO and CNIPA?

Methods

Our research design consists of two parts: data collection and technology landscape analysis (Fig. 1).

Each US patent publication includes, besides the assignees and description, an abstract, claims, and references as well as the assignee’s affiliation. The Chinese patent publications have a similar structure as the US patents. We have collected the USPTO and CNIPA nanotechnology patent data (2001–2017) from the Orbit IntelligenceFootnote 1 “Fullpat” database with “title-abstract” keyword search (Chen et al. 2008; Vincent et al. 2017). The “Fullpat” database was established in 2000 and includes patents from 110 patent-issuing authorities or depositories, updated weekly.

In order to focus on fundamental, substantial, and innovative invention and exclude other patent types such as industrial designs, we only used “utility patents” in the USPTO and “patents for invention” in the CNIPA.

We have adopted the combined nanotechnology keywords used by the National Science Foundation (NSF) from Zhu et al. (2017). Patents that contained incidental noise such as “nanosecond,” “nanoliter,” “nanoampere,” “nano2,” or “nano3” were excluded from our collection. Keywords and search results are detailed in Table 12 (Appendix).

In total, from 2001 to 2017, the USPTO and CNIPA granted 42,496 and 73,634 nanotechnology patents, respectively, accounting for 60.2% and 36.5% of the filed patent applications. The nanotechnology keywords search results show that nanotechnology is more frequently related to “atomic force microscope,” “scanning tunneling microscope,” “plasmonic,” and “optoelectronic” in the USPTO. In contrast, “metamaterial” and “graphene” stand out in the CNIPA (Appendix Table 12).

In this study, we perform three types of analysis: bibliographic, content, and social network. Bibliographic analysis provides an overview of four general areas: development trend, demographics, market interest, and key players (i.e., most active company, institution, or agency in patenting nanotechnology-related technology).

-

First, we quantify the growth of nanotechnology-related patents issued in 2001–2017 to depict the differences of nanotechnology patent grant trend in the US and Chinese markets.

-

Second, we examine the key origins (country/region) of the patents in the US and Chinese markets. We also analyze these patents’ patent family information to understand how many of the patents are recognized worldwide.

-

Third, we categorize patents into 35 nanotechnology fieldsFootnote 2 and compare the field development between the US and Chinese markets.

-

Fourth, we identify (1) key players in the USPTO and CNIPA to show player characteristics in both markets, and (2) key US players in the CNIPA and key Chinese players in the USPTO to understand market and investment intention of American and Chinese applicants in mutual markets (i.e., overseas market participation).

Content analysis is used to extract textual information and understand latent topics from patent documents with the extraction technique latent Dirichlet allocation (LDA) (Blei et al. 2003; Wang et al. 2014; Govindarajan et al. 2018). LDA takes patent titles, abstracts, or claims as textual input. It models the probabilities of keywords used in potential latent topics. In the content analysis, it is assumed that (1) different topics will have distinguishable word distributions, (2) a patent description is modeled as an observed joint probability sampled from a particular word distribution, and (3) one does not know the topics of patent descriptions a priori. Therefore, we have to use all the patent descriptions to infer the word distributions of each topic, which are yet unknown. Thus, the topics are “hidden” or “latent” compared to the “observed and known” patent descriptions. The final outputs are the keywords that characterize each latent topic. Based on the keyword distribution in the document, each patent can be automatically assigned to multiple topics. We are then able to capture key technical development trends/evolutionary trends in nanotechnology R&D. We select three to five representative keywords for every topic (Suominen et al. 2016) and track the evolution of the identified nanotechnology topics across 2001–2017.

To understand the collaborative relationships among patent applicants, we first construct co-assignee networks for both patent offices and analyze collaboration patterns with social network analysis (SNA). The collaboration networks have two components: nodes and edges. Nodes represent patent assignees filing patent applications in the USPTO or CNIPA. Node size denotes the awarded patent count for the assignee. Edges denote the co-assignee relationship between nodes. An edge exists only when the two assignees are awarded the same patent. Edge weight is co-assigned patent count between the two assignees. Each edge is further categorized with assignee origins (country or region) and assignee types (academia or industry). The collaboration is domestic when the two assignees are from the same origin (country or region), otherwise international. Based on the assignee types, the collaboration can be “within-academia,” “academia-industry,” or “within-industry.” The thicker an edge, the more nanotechnology patents the two patent assignees share. We derive general characteristics of collaboration networks in light of connected node number, average node degree, network diameter, etc.

To identify the most influential player (i.e., patent assignee) from both markets, we extract the largest connected networks in the USPTO and CNIPA. These networks are further analyzed with SNA metrics such as node degree, betweenness centrality, and PageRank (Brin and Page 1998; Barabási 2016). Node degree indicates the level at which a player collaborates with other players. Betweenness centrality reveals whether a player has a bridging role among collaborations. PageRank rates the importance of players in the collaboration network. GephiFootnote 3 is used to construct, analyze, and visualize collaboration networks.

Research results

Below, we present the research results for the market development status (growth trends, country distribution, patent families, technology fields, and topic evolution) and market players (key players in domestic and overseas markets, players’ collaboration networks).

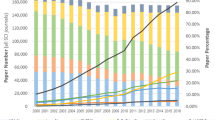

The growth of nanotechnology patents

Granted nanotechnology-related patents in the USPTO and CNIPA show different growth patterns in three stages during the interval 2001–2017 (Fig. 2). During 2001–2007, more patents were granted in the USPTO than in the CNIPA. The National Nanotechnology Initiative provided grand challenge goals and increased funding (Roco 2011). Granted patents per year in both USPTO and CNIPA did not exceed 1600. During 2008–2010, annual granted patent counts in the CNIPA slightly surpassed those in the USPTO. In the next interval 2011–2017, the annual granted patent count grew faster in the CNIPA than the USPTO, with a growth rate of 21.3% versus 9.4%.

Compared with the steady growth in the US, granted patents have shown a sharp increase in China after 2014. This sharp increase can be attributed to the policy-driven investments in nanotechnology-related fields. For example, the 12th Five Year Plan for the National Development of Strategic Emerging Industries strategically emphasized developing seven emerging industries (e.g., new materials, new energy, and biology), for which nanotechnology is a basic (inspiring) and enabling technology (The State Council of China 2012).

Country/region distributions

It is most common for applicants to file a patent in their home country. The patent will be protected from competition by the Paris Convention right of priorityFootnote 4 (also known as foreign priority rights) in other countries.

Patents with the US and China designated as the priority country are dominant in the USPTO and CNIPA, respectively, accounting for 70.5% and 88.5% in each corresponding office (Fig. 3). This shows that Chinese applicants have a greater home advantage in the CNIPA than American applicants in the USPTO. South Korea, Japan, and Germany are three important source countries of nanotechnology patent applications in both markets. South Korea, Japan, Germany, Taiwan, France, and the UK maintained the relative percentages at 7.4%, 7.1%, 4.1%, 2.3%, 2%, and 1.1% in the USPTO, while their percentages are smaller at 1.3%, 2%, 1.1%, 0.2%, 0.4%, and 0.3% in the CNIPA. These higher percentages in the USPTO compared to the CNIPA indicate that assignees from these countries or regions paid more attention to the US nanotechnology market.

Patent families

We collected the patent family information from the Orbit Intelligence’s “Fampat” database. A patent family is a collection of patents granted in various patent offices to protect a single invention worldwide. We summarize nanotechnology-related patents’ family sizes in the USPTO and CNIPA in Table 1.

There are 42,759 and 76,203 patent families with at least one patent issued in the USPTO and CNIPA, respectively. Patent families with two or more and seven or more patents in the CNIPA have the proportions of 18.3% and 8.41% as compared to the sum. In the USPTO, only 16.56% of the granted patents have one patent family. The results show that the remaining 83.44% of USPTO nanotechnology patent applicants applied for the same inventions in two or more countries. These applicants likely attached great importance to international markets. In contrast, most patent applicants in China (81.7%) filed patents only within the CNIPA, focusing on the domestic market and resulting in less recognition worldwide.

Technology fields

Technology classifications, such as IPC and United States Patent Classification, have been widely used to categorize patents into various technological fields according to technological content or function. These classifications are mostly inconsistent across countries when conducting international comparisons (Schmoch 2008). We adopt a systematic technology classification developed by WIPO for international comparison in this study. This classification categorizes all technologies into 35 fields based on the IPC codes (e.g., semiconductors, chemical engineering, biotechnology). The numbers of granted patents in each technology field within both patent offices are detailed in Tables 13 and 14 (Appendix). Figure 4 illustrates the top ten technology fields in the USPTO and CNIPA. Two markets have significant disparities in focused technology fields. In the USPTO, the technology fields with the most granted patents are semiconductors and electrical machinery, which are product oriented. In contrast, the most granted technology fields in the CNIPA are materials, metallurgy, and chemistry/chemical engineering. These fields are heavily manufacturing oriented.

Topic evolution

To reveal the detailed nanotechnology R&D focus evolution, we further extract latent topics from the patent title and abstract. 13 topics and associated keywords were identified by LDA for each patent office and validated by a domain expert. Figure 5 shows the topic evolution and associated keywords in the USPTO and CNIPA.

It is apparent from these analyses that the emphasis of nanotechnology R&D has changed over time. Between 2001 and 2008, the “optoelectronic, optical, circuit, body, assembly” topicFootnote 5 was prevalent in the USPTO. The interval 2009–2017 saw the rise of 10 topics. The fastest-growing topics (related fields) in the USPTO are “electrode, plurality, nanowire” (nanoelectronics), “therapeutic, drug, delivery, tissue, cell” (nanomedicine), “polymer, nanocomposite, fiber, coating” (nano materials), and “pattern, transistor, nanowire, regions” (nanoelectronics). These fast-growing fields indicate that the US market not only continues to lead in nanoelectronics manufacturing but has also branched into new topic areas such as nanomedicine.

Between 2001 and 2009, the “nanoparticles, polymer, metal” topic was prevalent in the CNIPA. The interval 2010–2017 saw the rise of all 13 topics, indicating a fast-expanding market trend. The fastest-growing topics and related fields in the CNIPA are “resin, rubber, paint, coating, resistance,” “zinc, silver, copper, production,” and “graphene, membrane, liquid, separation.” We observe that the Chinese market shifted the focus from conventional metallurgy to cutting-edge materials science. Each of these fastest-growing topics is nanomaterial-related.

During 2001–2017, the US market generally focused on nanoelectronics and nanomedicine, while China focused on nanomaterials. These differences concur with those in technology field analysis that two markets’ R&D focuses differ significantly.

Key players in domestic markets

Beyond the general market trends, this study also focuses on key contributors to each market. Tables 2 and 3 summarize the 20 assignees who own the most nanotechnology-related patents in the USPTO and CNIPA. Although both lists consist of large companies, universities, and research institutes, the proportions of assignee types and the absolute quantities owned by each assignee type differ significantly in the two markets. Chinese universities and institutes are the dominant contributors (19 out of 20) to China’s nanotechnology innovation (Table 3). The applicants from academia also possess the most nanotechnology patents in the Chinese market. In the US market, the composition of the top 20 assignees is more balanced (11 companies and 9 research institutes) (Table 2). However, companies own the majority of the patents in the absolute quantity.

Understanding the origins of the top assignees in both markets can reveal the market diversity. The top 20 assignees in the CNIPA are all from mainland China and Taiwan. In contrast, seven out of the top 20 USPTO assignees are foreign applicants. These globally active applicants include Samsung Electronics Co., Ltd. (South Korea), Hon Hai Precision Industry Co., Ltd. (Taiwan), Tsinghua University (mainland China), Osram Opto Semiconductors GmbH (Germany), French Alternative Energies and Atomic Energy Commission (France), Toshiba Corporation (Japan), and Industrial Technology Research Institute (Taiwan). Since the US has fewer market entry and trade barriers than China, more foreign companies are willing and able to enter the US market, resulting in a fully competitive and more internationalized nanotechnology market in the US (Morrison 2018).

Key players in overseas markets

The CNIPA granted 3534 US nanotechnology-related patents during 2001–2017. Table 4 shows the top 10 US assignees of these patents, all of which are companies except the University of California. Six companies were also the top 20 contributors in the USPTO: 3M Company, IBM, Intel Corporation, Xerox Corporation, and Hewlett-Packard Company. These key US players are large multinational corporations who have global visions and value overseas markets as well as their home market.

USPTO awarded 1632 patents from China over 2001–2017. Six out of the top 10 assignees are companies, which is significantly different from the top 20 assignees in the CNIPA (Tables 3 and 5). This difference indicates that Chinese companies have a better global vision in protecting intellectual property than universities and research institutes.

Companies are key players in overseas markets among all the US and Chinese assignees aligning with their global business strategies. American assignees pay more attention to patent applications overseas than Chinese assignees, revealing a higher level of global engagement.

However, two Chinese assignees, Tsinghua University and Hon Hai Precision Industry, stand out with more than 800 USPTO granted patents, due to a long-term collaboration in nanotechnology R&D (Chan et al. 2013; Chan 2017). Below, we further explore such collaboration relationships in both markets.

Collaboration networks

Following the procedures described in the methods section, we constructed collaboration networks for both markets. The parameters of the full collaboration networks in the USPTO and CNIPA are summarized in Table 6. The “collaboration ratio” between assignees is higher in the USPTO (46%) data than in those from the CNIPA (22%); also, the “average degree” (1.166) in the USPTO is greater than that (0.435) in the CNIPA. Both the ratio and degree reflect that more assignees in the US market jointly file the patent applications, indicating a higher level of collaboration (e.g., knowledge exchange and resource sharing) than the Chinese market. Figure 6 illustrates the largest assignee collaboration networks in the USPTO and CNIPA.

The largest collaboration networks a in the USPTO and b in the CNIPA respectively. This figure color-codes academia (magenta and blue), academia-industry (red and cyan), and industry (yellow and green) collaborations in light of assignee characteristics. The diagrams also distinguish domestic collaborations (i.e., both assignees have the same origin) and international ones (i.e., between different origins) with warm (i.e., magenta, red, and yellow) and cool (i.e., blue, cyan, and green) colors

Table 7 summarizes the parameters of these two networks. According to the number of nodes and average degree, the USPTO has more active collaborations than the CNIPA. A smaller network diameter and a larger average degree denote a denser collaboration network in the USPTO than CNIPA (Table 7, Fig. 6a). This dense network indicates assignees in the USPTO extensively collaborate among each other, forming more cliques (i.e., fully connected groups of nodes). In contrast, the collaborations in the CNIPA have a hierarchical, tree-like structure (Fig. 6b). Small institutes or companies dedicatedly collaborate with a specific major organization, forming closed-clusters that are less collaborative within the market.

We also examined the collaboration types and assignee origins to compare and contrast these two collaboration networks. Tables 8 and 9 show the proportions of different collaboration types in the USPTO and CNIPA.

USPTO and CNIPA share several similar characteristics. In both markets, around 13% of collaborations are within-academia. Domestic collaboration is the most prevalent type (74.77% and 90.07%), and international collaborations are primarily industry-centric (i.e., within-industry or academia-industry) (23.03% and 8.75%). However, the two markets demonstrate significant differences in collaboration as well. In the USPTO, 25.23% of collaborations are international, significantly higher than that of the CNIPA (9.93%). The dominant collaboration types are within-industry (58.77%) in the USPTO and academia-industry (40.64%) in the CNIPA. Such structural differences confirm that companies in the USPTO and academic institutes in the CNIPA control the majority of nanotechnology patents. CNIPA’s academia-industry and within-academia collaboration rates (40.64% and 13.13%) indicate that major assignees in the network are academic institutes while small players are primarily companies who control few patents. Our analyses highlight a unique academia-industry collaboration between Tsinghua University and Hon Hai Precision Industry (also known as Hong Fujin Precision Industry in the CNIPA). Hon Hai Precision Industry donated 300 million Chinese Yuan (~ 44.9 million USD) to build the Tsinghua-Foxconn Nanotechnology Research Center in Tsinghua University in 2001. The result of such a close collaboration is the more than 800 co-assigned patents we identified in Table 5.

We analyzed each player’s role in these networks with three SNA metrics: degree, betweenness centrality, and PageRank. Tables 10 and 11 summarize the top ten players in the USPTO and CNIPA, ranked by their degrees (i.e., the number of collaborations). The French National Center for Scientific Research, University of California, and Samsung Electronics collaborate with the most assignees in the USPTO. They demonstrate their hub roles in three distinct regions: Europe, North America, and Asia, respectively (Fig. 6a). All top three collaborative assignees in the CNIPA are from China: Chinese Academy of Sciences, State Grid Corporation of China, and Tsinghua University. Though from the same country, they represent the major collaborators of each assignee type: research institute, industry, and university.

A node (i.e., assignee) with high betweenness centrality has a large influence on knowledge transfer in the collaboration network (Liu et al. 2015). Universities and research institutes (e.g., the University of California and Chinese Academy of Sciences) are more likely to bridge collaborations among players with different interests due to fewer R&D constraints than companies (Tables 10 and 11). On the other hand, companies with high betweenness centrality (e.g., Samsung, IBM, State Grid Corporation of China) are giants in the market who control a wide range of critical and fundamental patents.

PageRank measures a player’s influence in the market. The top three players in the US market, the French National Center for Scientific Research, University of California, and Samsung Electronics, share similar influence (PageRank = 0.013, Table 10). In contrast, the Chinese Academy of Sciences stands out in the Chinese market with a PageRank of 0.03 (Table 11). These results indicate that the US nanotechnology market is more competitive with multiple influential contributors from different countries. In contrast, the Chinese market is more centralized.

Comments and concluding remarks

The nanotechnology landscapes (patents, their topics, key players, and collaborative patterns) of the US and China have been compared by conducting bibliographic analysis, content analysis, and social network analysis on granted patents from the USPTO and CNIPA databases.

Both the US and China have a strategic focus on nanotechnology development, leading to rapid nanotechnology-related patent growth between 2001 and 2017. Two major characteristics have been identified. First, domestic collaborations prevail in both countries, sharing resources and knowledge to speed up the R&D progress. Second, companies are driven by business incentives and are more engaged than academic organizations in global patenting and technology commercialization.

Differences between the two countries are in topics, level of collaboration, and role of academia. With first-mover advantages in high-tech manufacturing and healthcare, the US market favors semiconductor, electrical machinery, and nanomedicine-related technologies. It also demonstrates mature characteristics that players from both academia and industry protect and commercialize their nanotechnology R&D outcomes. These players of different types leverage their advantages in knowledge exchange and resource sharing, resulting in more extensive and balanced collaborations. This environment attracts international players (e.g., multinational corporations) to actively engage in the market development and collaborations. Therefore, the “within-industry” collaboration is significant in the US nanotechnology market.

In contrast, the Chinese nanotechnology internal market is more focused on several areas. Owing to its position as the “World’s Factory,” China focuses its development on metallurgy, chemical engineering, and nanomaterials. During 2001–2017, China has a higher patent growth rate (21.3%) and granted more nanotechnology-related patents (73,634) than the US (42,496; growth rate of 9.4%). However, most of these patents are still controlled by major universities and research institutes, resulting in hierarchical “academia-industry” collaboration relationships in the market with academic players having major roles. Consequently, lacking companies’ business incentives for global intellectual property protection and commercialization, 81.7% of the patent applications are only within the CNIPA.

Considering the characteristics of the US and Chinese markets, it is essential for the players in nanotechnology field to learn the overall balance in patent publications to understand the overall context of innovation in the field, leverage their strengths and competitive opportunities with those trends and respective contributors, and identify appropriate strategies for collaboration and competition on that basis.

Notes

Defined by WIPO International Patent Classification (IPC) and technology concordance (Schmoch 2008).

Available on https://gephi.org/users/download/

The Paris Convention for the Protection of Industrial Property. Available on https://www.wipo.int/treaties/en/ip/paris/

References

Bae S-H, Kim J, Shin K-M, Yoon JS, Kang SK, Kim JH, Lee J, Kim MK, Han CH (2017) Comparative analysis of co-authorship and keyword network for nanotechnology: carbon nanomaterials field. J Korean Soc Manuf Technol Eng 26:172–184. https://doi.org/10.7735/ksmte.2017.26.2.172

Barabási A-L (2016) Network science, 1st edn. Cambridge University Press

Blei DM, Edu BB, Ng AY et al (2003) Latent Dirichlet allocation. J Mach Learn Res 3:993–1022. https://doi.org/10.1162/jmlr.2003.3.4-5.993

Brin S, Page L (1998) The anatomy of a large-scale hypertextual web search engine. Comput Networks ISDN Syst 30:107–117. https://doi.org/10.1016/S0169-7552(98)00110-X

Chan J (2017) Robots, not humans: official policy in China. In: New Int. https://newint.org/features/2017/11/01/industrial-robots-china. Accessed 11 Mar 2019

Chan J, Pun N, Selden M (2013) The politics of global production: Apple, Foxconn and China’s new working class. N Technol Work Employ 28:100–115. https://doi.org/10.1111/ntwe.12008

Chen H, Roco MC (2009) Mapping nanotechnology innovations and knowledge. Springer US, Boston

Chen H, Roco MC, Li X, Lin Y (2008) Trends in nanotechnology patents. Nat Nanotechnol 3:123–125. https://doi.org/10.1038/nnano.2008.51

Chen H, Roco MC, Son J, Jiang S, Larson CA, Gao Q (2013) Global nanotechnology development from 1991 to 2012: patents, scientific publications, and effect of NSF funding. J Nanopart Res 15:1951. https://doi.org/10.1007/s11051-013-1951-4

Committee on Triennial Review of the National Nanotechnology Initiative, National Materials and Manufacturing Board, Division of Engineering and Physical Sciences (2016) Triennial review of the national nanotechnology initiative. National Academies Press, Washington, D.C.

Dang Y, Zhang Y, Fan L, Chen H, Roco MC (2010) Trends in worldwide nanotechnology patent applications: 1991 to 2008. J Nanopart Res 12:687–706. https://doi.org/10.1007/s11051-009-9831-7

Dara A, Sangamwar AT (2014) Clearing the fog of anticancer patents from 1993–2013: through an in-depth technology landscape & target analysis from pioneer research institutes and universities worldwide. PLoS One 9:e103847. https://doi.org/10.1371/journal.pone.0103847

Dong H, Gao Y, Sinko PJ, Wu Z, Xu J, Jia L (2016) The nanotechnology race between China and the United States. Nano Today 11:7–12. https://doi.org/10.1016/j.nantod.2016.02.001

Flynn H, Hwang D, Holman M (2013) Nanotechnology update: corporations up their spending as revenues for nano-enabled products increase. LuxResearch Inc., Boston

Gao Y, Jin B, Shen W, Sinko PJ, Xie X, Zhang H, Jia L (2016) China and the United States—global partners, competitors and collaborators in nanotechnology development. Nanomedicine 12:13–19. https://doi.org/10.1016/j.nano.2015.09.007

Gong H, Peng S (2018) Effects of patent policy on innovation outputs and commercialization: evidence from universities in China. Scientometrics 117(2):687–703. https://doi.org/10.1007/s11192-018-2893-5

Govindarajan UH, Trappey AJC, Trappey CV (2018) Immersive technology for human-centric cyberphysical systems in complex manufacturing processes: a comprehensive overview of the global patent profile using collective intelligence. Complexity 2018:1–17. https://doi.org/10.1155/2018/4283634

Kendrick I, Bos A, Chen S (2015) Nanotechnology update: U.S. leads in government spending amidst increased spending across Asia. LuxResearch Inc., Boston

Kong X, Hu Y, Cai Z, Yang F, Zhang Q (2015) Dendritic-cell-based technology landscape: insights from patents and citation networks. Hum Vaccin Immunother 11:682–688. https://doi.org/10.1080/21645515.2015.1008857

Li X, Lin Y, Chen H, Roco MC (2007) Worldwide nanotechnology development: a comparative study of USPTO, EPO, and JPO patents (1976–2004). J Nanopart Res 9:977–1002. https://doi.org/10.1007/s11051-007-9273-z

Liu N, Guan J (2016) Policy and innovation: nanoenergy technology in the USA and China. Energy Policy 91:220–232. https://doi.org/10.1016/j.enpol.2016.01.020

Liu X, Zhang P, Li X, Chen H, Dang Y, Larson C, Roco MC, Wang X (2009) Trends for nanotechnology development in China, Russia, and India. J Nanopart Res 11:1845–1866. https://doi.org/10.1007/s11051-009-9698-7

Liu X, Jiang S, Chen H, Larson CA, Roco MC (2015) Modeling knowledge diffusion in scientific innovation networks: an institutional comparison between China and US with illustration for nanotechnology. Scientometrics 105:1953–1984. https://doi.org/10.1007/s11192-015-1761-9

Morrison WM (2018) China-U.S. trade issues. Available on https://fas.org/sgp/crs/row/RL33536.pdf. Accessed 16 Mar 2019

Roco MC (2005) International perspective on government nanotechnology funding in 2005. J Nanopart Res 7:707–712. https://doi.org/10.1007/s11051-005-3141-5

Roco MC (2011) The long view of nanotechnology development: the National Nanotechnology Initiative at 10 years. J Nanopart Res 13:427–445. https://doi.org/10.1007/s11051-010-0192-z

Schmoch U (2008) Concept of a technology classification for country comparisons. Final report to the World Intellectual Property Organisation (WIPO), WIPO

Suominen A, Li Y, Youtie J, Shapira P (2016) A bibliometric analysis of the development of next generation active nanotechnologies. J Nanopart Res 18:270. https://doi.org/10.1007/s11051-016-3578-8

Tang L, Shapira P (2011) China–US scientific collaboration in nanotechnology: patterns and dynamics. Scientometrics 88:1–16. https://doi.org/10.1007/s11192-011-0376-z

The State Council of China (2012) 12th Five Year Plan for the National Development of Strategic Emerging Industries. The State Council of China, Beijing

Vincent CL, Singh V, Chakraborty K, Gopalakrishnan A (2017) Patent data mining in fisheries sector: an analysis using Questel-Orbit and Espacenet. World Patent Inf 51:22–30. https://doi.org/10.1016/j.wpi.2017.11.004

Wang B, Liu S, Ding K, Liu Z, Xu J (2014) Identifying technological topics and institution-topic distribution probability for patent competitive intelligence analysis: a case study in LTE technology. Scientometrics 101:685–704. https://doi.org/10.1007/s11192-014-1342-3

Zhang G-P, Duan H-B, Wang S-Y et al (2018) Comparative technological advantages between China and developed areas in respect of energy production: quantitative and qualitative measurements based on patents. Energy 162:1223–1233. https://doi.org/10.1016/j.energy.2018.08.081

Zhao Y-L, Song Y-L, Song W-G, Liang W, Jiang XY, Tang ZY, Xu HX, Wei ZX, Liu YQ, Liu MH, Jiang L, Bao XH, Wan LJ, Bai CL (2014) Progress of nanoscience in China. Front Phys 9:257–288. https://doi.org/10.1007/s11467-013-0324-x

Zheng J, Zhao Z, Zhang X, Chen DZ, Huang MH (2014) International collaboration development in nanotechnology: a perspective of patent network analysis. Scientometrics 98:683–702. https://doi.org/10.1007/s11192-013-1081-x

Zhu H, Jiang S, Chen H, Roco MC (2017) International perspective on nanotechnology papers, patents, and NSF awards (2000–2016). J Nanopart Res 19:370. https://doi.org/10.1007/s11051-017-4056-7

Acknowledgments

This research was supported by the National Science Foundation under Grant No. NSF EFMA-1832926, the National Social Science Fund of China under Grant No. 15BGL037, and the National Natural Science Foundation of China under Grant No. 71673135. The fourth co-author was supported by the Directorate for Engineering in NSF. The authors thank Questel.com for making patent database available for research and Qingmin Ji at Herbert Gleiter Institute of Nanoscience at Nanjing University of Science and Technology for her help in validating nanotechnology topics and keywords. The opinions expressed here are those of the authors and do not necessarily reflect the position of the respective supporting agencies.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Wu, L., Zhu, H., Chen, H. et al. Comparing nanotechnology landscapes in the US and China: a patent analysis perspective. J Nanopart Res 21, 180 (2019). https://doi.org/10.1007/s11051-019-4608-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11051-019-4608-0