Abstract

This study empirically assesses the uncertainty of climate change impacts on China’s agriculture economy based on IPCC RCP scenarios. The 95% confidence intervals of China’s major crop yields are projected based on an econometric estimation. Then, an agricultural partial equilibrium model is employed to reveal the uncertainty of climate change impacts on China’s agricultural economy (production, price, trade, and self-sufficiency). The results show that, on average, climate change will reduce production, raise prices, increase net imports of most crops, and lower China’s crop self-sufficiency. The uncertainty of climate change impacts on the production of different crops varies greatly. The differences in uncertainty intervals of crop production are largely determined by the sensitivity of crop yield to climate variables. The crops with the smaller estimated coefficients of crop yield to climate variables would have relatively larger uncertainty intervals of production changes. The confidence intervals for all crops widen as time passes, indicating the rising uncertainty for projecting future changes of the agricultural economy due to the continuously changing climate. Compared with RCP 2.6, the uncertainty of climate change impacts on China’s agricultural economy is much higher under RCP 8.5 for all crops. China should improve its climate preparedness, considering the range of uncertainty on climate change impacts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the past century, China has experienced a notably changing climate, which is expected to threaten its agricultural economy in the future as well. China’s annual mean temperature has risen by 1.38 °C over the past six decades (Committee of China’s National Assessment Report on Climate Change, 2015), much higher than the global average, and it is projected that the warming trend will continue in the future (Nakicenovic et al., 2000; Meehl et al., 2007; Piao et al., 2010; Liang and Yan 2016). The severity and frequency of extreme climate events, such as droughts and floods, are also expected to rise (Xie et al., 2018). Although China has ensured its food security in the past 40 years, the pressure on China’s food security in the future is expected to rise due to the ever-increasing population, continuous rise in income, and persistent resource constraints (Huang et al., 2017). Future climate change is expected to aggravate China’s food security challenges (Li et al., 2020).

Several studies have assessed the impacts of climate change on China’s crop yield, but their results have significant disparity due to climate scenarios and methodologies for the assessment. In these studies, agronomists mostly employ process-based crop models, such as the Decision Support System for Agrotechnology Transfer (DSSAT) model, to assess climate change impacts on crop yield (as reviewed in Li and Geng, 2013; Wang et al., 2014a, b). For example, Lin et al. (2005) found that the adverse impacts of climate change on wheat yield could reach 5.6–18.2% under the A2 scenario by 2020s. Tao et al. (2008) suggest that if the temperature increases by 1 ℃, rice yield would decline by 6.1–18.6%, even considering the adaptation measures. Xiong et al. (2009) predicted a relatively moderate decrease of 4.9–8.6% in rice yield by 2050s. Meanwhile, a few studies also found positive impacts of climate change on the yields of some crops if the CO2 fertilization effect is considered (Lin et al., 2005). In contrast, climate economists generally use econometric models. Using county-based data, Chen et al. (2016a) empirically estimated the non-linear and inverted U-shaped relationships between crop yields and weather variables and found that by 2100 corn and soybean yields will decline by 3–12% and 7–19%, respectively. Chen et al. (2016b) employed the same econometric framework and found that rice and wheat yields will decline by 2–6% and 3–19% by the end of the twenty-first century due to climate change. Zhang et al. (2017) also suggested that climate change is likely to decrease China’s rice, wheat, and corn yields by 36.25%, 18.26%, and 45.10%, respectively, by the end of this century.

Besides the crop yield, an increasing number of studies have assessed climate change impacts on multiple elements of the agricultural economy. Climate change would affect the consumption, trade, and prices of agricultural products through the impact and feedback mechanisms within the economy. Most of these studies coupled the results for climate change impacts on crop yield from the processed-based or econometric-based models with economic equilibrium models. For example, using the global equilibrium model of AGLINK, Zhai and Zhuang (2009) found that climate change would reduce China’s total crop production slightly (0.2–0.5%) by 2080. Xie et al. (2020) used the agricultural equilibrium model of China to find that climate change effects on crop output are significant, though with substantial differences among crops, while trade and market responses could buffer climate change impacts. Some global studies have also assessed the climate impacts on China. However, most of them either lack the solid empirical estimation of yield changes for main crops in China or did not apply any detailed nationally representative economic model that can capture the mechanisms of climate change impacts accurately (Parry et al., 2004; Zhai and Zhuang, 2009; Calzadilla et al., 2013; Nelson et al., 2014; Zhang et al., 2019).

Previous studies paid less attention to the uncertainty of climate change impacts on the agricultural economy than the average impact. Most studies simply took the uncertainty as the sensitivity analysis for the estimation results. Nevertheless, quantifying the uncertainty and its sources is a major step to improve the interpretation of impacts and resultant decisions on adaptation strategies (Ruiz-Ramos and Mínguez, 2010; Gosling et al., 2012). The ignorance of the uncertainty would lead to an inaccurate estimation of climate change impacts on the agricultural economy, which consequently causes excessive or insufficient adaptative measures against climate change (Carvajal et al., 2017). Burke et al. (2015) showed that the vast majority of quantitative estimates for climate change impacts fail to account for well-established uncertainty in future temperature and rainfall changes, leading to potentially misleading projections. Moreover, the uncertainty of climate change impacts would be much different among the crops and can change over time, making climate change assessment more complicated (Tao et al., 2018). Hence, to accurately assess climate change impacts on China’s agricultural economy, the uncertainty from different sources should be comprehensively analyzed.

A few studies have analyzed the source of the uncertainty of climate change impacts on the agricultural economy; however, none has explicitly examined the uncertainty arising from the econometric models. Olesen et al. (2007) attributed the uncertainties of climate change impacts on agriculture to the emission scenarios and climate models. Lobell and Burke (2008) focused on relative contributions of four major factors, i.e., climate model projections of future temperature or precipitation and the sensitivities of crops to temperature or precipitation changes in assessing agricultural impacts of climate change. Nelson et al. (2014) compared ten leading global economic models in assessing climate change impacts on agriculture and found that the model specification and parameter choice are significant sources of uncertainty. Rosenzweig et al. (2014) suggested that general circulation models (GCMs) and representative concentration pathways (RCPs) contribute substantially to the uncertainties of the results, and the uncertainty is higher for soybean and rice than for maize and wheat. Tao et al. (2018) quantified and compared the contribution of crop model structure, crop model parameters, and climate projections to the total variance of ensemble output. They found that the contribution of crop model structure was larger than that from downscaled climate projections and model parameters. Although an increasing number of studies assess climate change impacts on the agricultural economy based on the econometric estimations, they only utilized the estimated coefficients of climate variables. For example, Xie et al. (2020) used econometrically estimated coefficients of climate variables to project future crop yields and then simulated climate change impacts on China’s agricultural economy. They seem to ignore the uncertainty arising from the econometric models, represented by the confidence intervals of estimated coefficients, which is regarded as a source of the uncertainty of climate change impacts.

This study purposes to estimate climate change impacts on China’s agriculture economy towards 2050 under IPCC RCP scenarios, with a particular focus on the uncertainty of climate change impacts arising from the econometric-based assessments. RCP 8.5 and RCP 2.6 scenarios are regarded as the worst and best climate change scenarios, respectively.Footnote 1 Specifically, we calculate the projected changes and 95% confidence interval of the yield of major crops in China based on an econometric estimation. Then, a widely used agricultural partial equilibrium model (China Agricultural Policy Simulation Model, CAPSiM) is employed to estimate the uncertainty of climate change impacts on China’s agricultural economy through changes in production, price, trade, and self-sufficiency. Our study is comparable to the existing studies on the uncertainty of climate change impacts on the agricultural economy and considers the uncertainty from the estimated coefficients of econometric models, which is poorly understood in previous studies. This paper contributes to the literature in the following aspects: (1) the uncertainty of climate change impacts on China’s agricultural economy arising from the econometric-based assessment is quantitively assessed; (2) the heterogeneity of the uncertainty of climate change impacts among different types of crops is revealed. Understanding the uncertainty of climate change impacts on the agricultural economy is also vital to making mitigation and adaptation strategies more resilient.

The rest of the paper is organized as follows. Section 2 introduces the projection of future crop yield. The simulation model is described in Section3. Section 4 reports the simulation results for the uncertainty of climate change impacts on China’s agricultural production. Section 5 discusses the results and limitations of this study. Section 6 concludes this study with several policy implications.

2 The uncertainty intervals of future crop yield changes

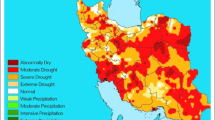

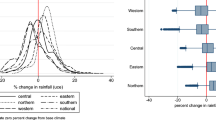

This paper investigates the effects of climate change on China’s agricultural economy under the worst (RCP 8.5) and best (RCP 2.6) climate change scenarios. The data on changing trends of temperature and precipitation are obtained from Liang and Yan (2016) and are based on the RCP scenarios of the Intergovernmental Panel on Climate Change Fifth Assessment Report (AR5 report) (IPCC 2014). In Liang and Yan (2016), several global circulation models, provided by CMIP5, are applied to project monthly temperature and precipitation during 2010–2100 in each province of China with the base year of 1980–2010. We focus on nine crops: rice, wheat, maize, soybean, cotton, rapeseed, peanut, sugarcane, and sugar beet.Footnote 2 The annual average and standard deviation of temperature and precipitation in each crop’s growing season are calculated. The projections show that compared to 2010, each crop’s annual average temperature and precipitation will increase significantly during 2020–2050. Meanwhile, annual precipitation deviation will enlarge significantly for each crop (Appendix Fig. 2).

The changes in crop yield due to climate change are calculated based on the econometric results estimated by Wang (2016), briefly introduced in Appendix A. They used China’s provincial panel data for 1980–2010 to estimate the impacts of climate variables on different crop yields, including annual temperature, precipitation, and their deviation changes in the growing season of major producing provinces, controlling for agriculture input and technology progress.Footnote 3 They found a non-linear correlation between climate variables and crop yield that could be used to extrapolate the changes of China’s crop yields under RCP scenarios for 2010–2050. Moreover, Wang (2016) also reported the standard errors of climate variables and the 95% confidence intervals of the estimated coefficients. The econometric results of Wang (2016) for the impacts of climate variables on crop yield in China are shown in the Appendix (Appendix Table 5 and 6).

The uncertainty of climate change impacts on each crop’s yield is measured in terms of the 95% confidence interval of each crop’s yield change. Based on the estimated coefficients of climate change variables and their standard errors, we can apply the Delta method (Wooldridge, 1999; Papke and Woodridge, 2005; Powell, 2007) to estimate the 95% confidence interval of each crop’s yield change due to climate change. Holding the agriculture production input unchanged, we apply the Delta method to the non-linear equation that links each crop’s yield with climate change variables, which is the simplified equation from the econometric model of Wang (2016), as follows:

wherein Y represents the annual yield of each crop. T is the annual temperature, and P is precipitation during each crop’s growing season. The square forms of annual temperature and precipitation are introduced in Eq. (1) to account for the non-linear effects of climate variables. SDT and SDP are the annual standard deviation of temperature and precipitation during each crop’s growing season, respectively. \(\widehat{\beta }\) s are the estimated coefficients of climate variables by Wang (2016). Differentiating Eq. (1) would give us a non-linear equation linking the percentage changes of each crop’s yield and climate change variables. Combining the 95% confidence interval of estimated coefficients of climate change variables with the projected change in climate variables, the 95% confidence interval of the percentage changes in each crop’s yield caused by climate change is projected under RCP 2.6 and RCP 8.5 (Table 1, figures in parentheses). It is worth noting that as the changes in climate variables are projected at the national level, Eq. (1) derives the impact of future climate change on national crop yield.

The direct impacts of climate change on crop yields are quite heterogeneous among crops in China (Table 1). Wheat, rice, and sugar crops are projected to experience yield reductions under both RCP 2.6 and 8.5 scenarios, and among them, wheat would have the highest yield loss. Influenced by climate change, the wheat yield would decline significantly in 2050 by 5.79% under RCP2.6 and 9.39% under RCP 8.5. After wheat, rice yield would drop moderately, by 1.51% under RCP 2.6 and 2.62% under RCP 8.5 in 2050. Climate change impacts on sugar crop yield are projected to be smaller, except in 2030 under RCP 8.5. The yields of other crops, including cotton, soybean, and maize, may increase under climate change. Cotton will have the most significant increase in yield among these crops due to climate change, followed by soybean and maize. Under RCP 8.5, the cotton yield is projected to increase by 1.29% in 2030 and 4.05% in 2050. Compared with cotton, the positive impacts on soybean and maize are relatively small such that their yields would increase by less than 0.5% in 2050 under RCP 8.5, except that maize yield would fall in 2030 under RCP 8.5 (− 0.09%). The changing climate would have mixed impacts on oilseed yield—declining slightly under RCP 2.6 and increasing by ~ 0.2% under RCP 8.5 in 2050.

The uncertainty represented by the 95% confidence interval of crop yield change would make it much harder to draw any unequivocal conclusions about climate change impacts on crop yield. The 95% confidence interval indicates that crop yield changes due to climate change would locate in the range suggested by the confidence interval with the probability of 95%. It is noteworthy that the uncertainty discussed here is accompanied by all econometric-based assessments for climate change impacts. Wheat yield changes have the largest confidence interval among the crops, suggesting the most significant uncertainty in assessing climate change impacts. Wheat yield is projected to decline by 5.79% under RCP 2.6 and 10.63% under RCP 8.5 in 2050. However, as for the uncertainty, the projected ranges of wheat yield change in 2050 are − 11.51 to 0.31% under RCP 2.6 and − 20.61 to 0.61% under RCP 8.5. Hence, the 95% confidence interval of wheat yield change spans over negative as well as positive values. Compared with wheat, rice yield change has a much smaller confidence interval, covering only negative values. Though on average, maize yield is projected to increase slightly both under RCP 2.6 and RCP 8.5 in 2050, the 95% confidence intervals of maize yield change include negative values. On the other hand, cotton yield change would only span over positive values for the 95% confidence interval.

We also see that crop yield changes have larger 95% confidence intervals in 2050 than those in 2030 and are mainly driven by wider fluctuations in climate change variables. For example, under RCP 8.5, while wheat yield would change in the range of 7.39 percent points (− 7.30 to 0.09%) with the probability of 95% in 2030, the range of wheat yield change is 21.22 percent points (− 20.61 to 0.61%) in 2050. The larger confidence intervals of crop yield changes in 2050 indicate that as we move farther into the future, the uncertainty of climate change impacts on crop yield will grow further, accompanied by the continuously changing climate.

3 The methodology

3.1 Simulation model

To track the uncertainty of climate change impacts on the agricultural economy, we use an agricultural partial equilibrium model of China, CAPSiM (China’s Agricultural Policy Simulation Model). CAPSiM was developed by China Center for Agricultural Policy, Peking University, in the mid-1990s as a framework for analyzing policies affecting agricultural production, consumption, prices, and trade in China (Huang and Li, 2003). Since then, the CAPSiM model has been periodically updated and expanded. Later versions of CAPSiM are designed to analyze more intricate policy changes, such as trade liberalization, biofuels, biotech, and climate change (Huang et al. 2002; Lin et al. 2012; Huang et al., 2017). The component crops/commodities are highly disaggregated in the model, accounting for more than 90% of China’s agricultural output. The model involves 21 crops, livestock, and fishery sectors: including three main cereal crops (rice, wheat, maize), sweet potato, potato, soybean, other grain, other edible oil crops, cotton, vegetables, fruit, other crops, as well as six categories of livestock products and three categories of fishery goods. The accompanying database of CAPSiM has been updated to the year 2015 using the official statistics from the NBSC (2020).

The CAPSiM model incorporates three major modules for each of 21 agricultural commodities: supply, demand, and market clearing modules. Production equations of each commodity, decomposed by area and yield for crop and production or output for the animal sector and other products, allow own- and cross-price market responses for producers, as well as the effects of shifts in technology and irrigation, and yield changes resulting from exogenous shocks of climate and other factors. Demand equations bifurcated into urban and rural consumers allow consumers to respond to own- and cross-price, as well as the effects of shifts in income, population level, urbanization, market development, and other shocks. Market clearing is solved by finding the commodity prices that simultaneously balance the demand and supply of each commodity. As for international trade, a small-country assumption is used, following most partial equilibrium models. A detailed description of the working of the CAPSiM model is given in Huang and Li (2003).

A distinguishing feature of CAPSiM is that, unlike other agricultural economic models, most of the elasticities in the CAPSiM are based on the econometric estimations made under several empirical studies by CCAP (Ma et al. 2004; Jin et al. 2010; Wang et al. 2014a, b). As the model contains specific equations for the sown area and yield of different crops, it is easy to introduce climate change shocks to simulate their impacts on China’s agricultural economy under different RCP scenarios. The CAPSiM model has also been extensively used for the projection of China’s agriculture in the future (e.g., Huang et al. 2017), which is very critical to construct a reasonable future baseline scenario for this study.

3.2 Baseline scenarios

To assess climate change impacts on China’s agricultural economy towards 2050, we first establish a baseline scenario using the CAPSiM model by recursively updating the database. To do this, a series of assumptions are made concerning China’s economic growth, population growth, urbanization, urban and rural households’ income growth, and agricultural technology advancement, following Huang et al. (2017) for assumptions and Huang and Li (2003) and Yang et al. (2012) for the procedure. The data on these assumptions are introduced in Huang and Xie (2019). The annually averaged growth rate of China’s GDP is assumed to be 5.5%, 4.5%, 4.0%, and 3.5% during the period of 2020–2025, 2025–2030, 2030–2035, and 2035–2050, respectively. The population is projected to grow from 1.42 billion in 2020 to 1.45 billion in 2030, then fall to 1.35 billion by 2050. The urbanization rate is assumed to increase to 70% in 2030, 73% in 2035, and 80% in 2050. The government will continuously increase the input for agricultural technology development in the following decades and maintain the annually averaged rate of technological progress at a level of 0.5–1.0% for different agricultural products.

In the baseline projection, China’s agricultural production will continuously increase by 2050, with a simultaneous and significant rise in the imbalance between agricultural production and demand (Appendix Tables 7 and 8). By 2050, the domestic production of rice and wheat—the major food crops—will mostly meet China’s demand, reaching a high self-sufficiency rate of over 95%. Demand for feed grains (soybean, maize) will grow more quickly than their domestic production, leading to declining self-sufficiency ratesFootnote 4 in these crops. If China does not implement a tariff-rate quota (TRQ) in the future, China’s maize import is projected to surpass 60 million tons by 2050 (compared to 4.79 million tons in 2019), leading to a self-sufficiency rate of 81%. Similarly, soybean import is projected to exceed 100 million tons in 2050 (compared to 85.51 million tons in 2019), resulting in less than 10% self-sufficiency. Demand for sugar crops and edible oil crops will be significantly higher than their respective domestic production, leading to decreasing self-sufficiency levels for both groups of crops. In contrast, the pace of domestic production of vegetables and fruits is projected to increase with domestic demand, ensuring almost complete self-sufficiency. By 2050, China’s self-sufficiency rates will range over 70–80% for most livestock products, except beef and dairy. China will maintain an almost total supply–demand balance with minimal imports for aquatic products.

3.3 Transmitting yield change to CAPSiM model

We model crop yield changes in response to climate change as shocks to total factor productivity (TFP) of crop sectors through the CAPSiM model. Roson and Mensbrugghe (2012) modeled the variations in agricultural yield as changes in multifactor productivity for agricultural activities so that output volumes vary when using the same mix of production factors (they used the ENVISAGE—a general equilibrium economic model). The shocks were additive shifters in a yield or supply equation for the partial equilibrium models. Robinson et al. (2014) discussed the implications of incorporating yield shocks into general/partial equilibrium models as TFP shifters. In the CAPSiM model, crop yield change is a linear function of crop prices and input prices (including fertilizer, land, and labor) and three shift variables representing irrigation, policy, and changing climate. For this study, the impacts of climate change on crop yield shown in Section 2.1 are transmitted into the crop production module in the CAPSiM model as crop yield shifters. To study the uncertainty of climate change impacts on China’s agricultural economy, we simulate the projection intervals of changes in crop production, price, trade, and self-sufficiency. For this, we simulate the mean and 95% confidence intervals of each crop’s yield change in the CAPSiM as crop yield shifters.

4 The simulation results

The following section describes the simulated results for climate change impacts on China’s agricultural economy (production, price, trade, and self-sufficiency) based on the CAPSiM model for 2020–2050. Then, we examine the uncertainty of climate change impacts on China’s agricultural economy sourced from the econometric model. To save space, the results for rice, wheat, maize, soybean, oilseeds, sugar, and cotton are reported here. To this end, the percentage changes indicated in the text refer to the difference in simulation results with and without climate change.

4.1 The uncertainty of climate change impacts on crop production

On average, climate change impacts on China’s crop production in the future are significant. With the CAPSiM model, we find that (1) rice, wheat, and sugar will have production losses due to climate change both under the RCP 2.6 and RCP 8.5 (Fig. 1a, b, f), and wheat is projected to have the worst production losses towards 2050 (1.85% under RCP 2.6 and 4.16% under RCP 8.5). The production losses of these crops are much lower than their yield losses. (2) Some crops with positive yield changes will end up having lower production. For example, by 2050, maize will have a slight yield improvement under RCP 8.5 (0.13%, Table 1). However, its production is projected to decrease slightly under RCP 8.5 (− 0.59%, Fig. 1c). Rice and wheat yields are more severely affected by climate change relative to maize, which would lead to higher prices for rice and wheat and stimulate farmers to reduce the planting areas of maize. Like maize, soybean has a slightly positive yield impact due to climate change; however, affected by the substitution effect between crops, soybean output would decline by 0.31% under RCP 2.6 and 1.44% under RCP 8.5 by 2050. (3) Climate change will have mixed effects on the output of oilseeds. Although oilseed crop yield is projected to decrease slightly (0.05%) towards 2050 under RCP 2.6, oilseed output would increase slightly (0.04%) due to rising prices relative to other crops. However, under RCP 8.5, oilseeds’ output would decline slightly by 0.15% towards 2050 regardless of their rising yield (0.18%), resulting from the decreasing prices relative to other crops. Besides, cotton production would benefit from climate change by 2050, both under RCP 2.6 (0.76%) and RCP 8.5 (2.89%). Because cotton yield increases are more significant by 2050 (1.79% for RCP 2.6 and 4.05% for RCP 8.5), cotton production will increase by 2050, although partly offset by the substitution effect arising from competing crops.

Source: authors’ simulations based on CAPSiM. a Rice. b Wheat. c Maize. d Soybean. e Oilseeds. f Sugar. g Cotton

The uncertainty of climate change impacts on China’s crop production (%). The red and blue lines represent the mean values of crop production changes under RCP 8.5 and 2.6, respectively; the red and blue shaded areas represent the uncertainty of crop production changes under RCP 8.5 and 2.6, respectively.

The uncertainty of changes in crop production that stems from the econometric results makes it trickier to draw clear-cut conclusions about climate change impacts. The shaded areas of Fig. 1 that show the projected confidence intervals of the changes in crop production due to climate change over the period 2020–2050 represent the uncertainty of crop production changes.

We obtain several important findings. First, there is significant disparity among different crops on the uncertainty of climate change impacts on the production. Wheat has the largest uncertainty for the production changes among the crops. For example, the uncertainty intervals of wheat production changes are from − 3.16 to 0.16% under RCP 2.6 and from − 7.15 to 0.23% in 2050 under RCP 8.5. Cotton and soybean also have large uncertainty intervals for the production changes, as they also have relatively large yield changes. The uncertainty interval of cotton production changes in 2050 under RCP 8.5 will be between 0.13 and 6.23%. The production of soybean would change over the range from − 3.71 to 1.53%.

Hence, without considering the information from the uncertainty intervals, the estimation provides an inaccurate assessment of climate change impacts on crop production. Comparably, rice, maize, oilseeds, and sugar have relatively smaller uncertainty intervals of production changes. For example, under RCP 8.5, rice production is projected to decline over the range from − 1.08 to − 0.60%. The uncertainty interval of the changes in maize production is from − 1.38 to 0.31%. Considering the average of the production changes, the uncertainty intervals for production changes of these crops are relatively narrower.

Interestingly, we also find that the differences in uncertainty intervals of changes in crop production are primarily determined by the sensitivity of crop yield to climate variables, as we use the estimation by Wang (2016) to project the future yield of crops. The crops with the larger estimated coefficients of crop yield to climate variables have relatively larger uncertainty intervals of production changes. In Table 5, wheat has a relatively large coefficient in absolute value for temperature and standard deviation of temperature, which lead to the large confidential interval of projected changes in wheat yield, considering the continuous rising mean and standard deviation of temperature. Meanwhile, cotton has the largest coefficient of temperature in absolute value, but it also has the negative coefficient of squared temperature, offsetting the effect of the positive coefficient of temperature (Table 6). As a result, the cotton also has a large confidential interval for the projected changes in yield, which leads to great uncertainty for predicting production changes. In contrast, the crops with the smaller coefficients to climate variables have relatively narrow uncertainty intervals of production changes.

Second, the shaded areas get wider as time passes for all crops, which indicates the rising uncertainty for projecting future crop production changes due to the continuously changing climate. Both the continuously rising temperature and the increasingly severe fluctuation of climate variables would aggravate the uncertainty of climate change impacts on crop production over time. For example, under RCP 8.5, the uncertainty interval of wheat production change by 2030 is from − 3.84 to 0.18%, expanding to − 8.71 to 0.37% by 2050. Similarly, the uncertainty interval of rice production change by 2030 is from − 0.45 to − 0.18% and expands to the range of − 1.08 to − 0.60%. More interestingly, while the average change of soybean production is projected to fall slightly towards 2050, the uncertainty of soybean production changes will expand continuously, as the confidential interval of soybean yield changes would expand.

Furthermore, the uncertainty of changes in crop production due to climate change is much higher under RCP 8.5 than RCP 2.6 (illustrated by a wider shaded area of the latter for all crops in Fig. 1). For example, the confidence intervals of changes in wheat production in 2050 range over 4.06 percent points (− 3.82 to 0.24%) under RCP 2.6 and 9.08 percent points (− 8.71 to 0.37%) under RCP 8.5. Although, on average, climate change would have negative impacts on the production of some crops, their confidence intervals may also cover positive values. For example, average wheat production would decline significantly by 4.16% under RCP 8.5 in 2050 (Fig. 1b). However, its confidence interval representing projection uncertainty spreads from − 8.71 to 0.37%. The uncertainty interval suggests that we cannot exclude the possibility of climate change to impact wheat production positively. Therefore, we need to be more cautious in precisely assessing climate change impacts on crop production by not only concentrating on the mean effects but also the projection uncertainty from the econometric-based assessment.

4.2 The uncertainty of climate change impacts on crop prices

On average, the prices of adversely affected crops by climate change would rise by 2030 and 2050, both under RCP 2.6 and RCP 8.5. As mentioned above, rice, wheat, and sugar production will decrease due to climate change, and their prices will also rise, resulting from yield loss caused by climate change. Wheat, which experiences the most severe yield loss, will have the most substantial price increase towards 2050 of 6.83% under RCP 2.6 and 17.53% under RCP 8.5 (Table 2). Rice price will increase moderately towards 2050 by around 2.66% under RCP 2.6 and 5.29% under RCP 8.5. Compared with wheat and rice, the increase in sugar prices will be much smaller. Meanwhile, cotton, which is positively affected by climate change, will have a decrease in its price both under RCP 2.6 (0.27%) and RCP 8.5 (1.37%) towards 2050. However, some crops with positive yield changes due to climate change will also have a price increase. Influenced by climate change, maize, soybean, and oilseeds will have yield increase under RCP 8.5 in 2050, and in the meantime, their prices will also increase slightly. For example, maize prices will increase by 0.31% under RCP 2.6 and 0.39% under RCP8.5 in 2050, respectively (Table 2).

Like crop production, the simulated impacts of climate change on crop prices will also have considerable uncertainty based on the econometric results. Among them, wheat will have the largest confidence interval of price changes, accompanied by the largest uncertainty of production changes. The wheat price in 2050 will change over the range of − 0.44 to 13.29% under RCP 2.6 and − 1.00 to 38.25% under RCP 8.5. The uncertainty interval shows that wheat prices may increase by more than 30% or even decrease slightly under RCP 8.5 in 2050. Although cotton has relatively large uncertainty intervals of production changes, the uncertainty intervals of its price changes are relatively small. The change of cotton price in 2050 ranges from − 2.73 to 0.05% under RCP 8.5, compared with the uncertainty interval of the production change from 0.13 to 6.23%.

Moreover, although the uncertainty intervals of other crops are much smaller than those of wheat, some crops, such as maize, soybean, and oilseeds, with an average increase in prices, have confidence intervals covering negative values. For example, the maize price will increase on average by 0.39% under RCP 8.5 in 2050. However, the confidence interval of changes in maize price ranges from − 0.19 to 0.96%. Therefore, more prudence should be shown while assessing climate change impacts on crop prices and devising adaptation strategies.

4.3 The uncertainty of climate change impacts on crop trade

On average, China’s net imports of the crops adversely affected by climate change will increase significantly, especially rice and wheat. Because of the largest yield loss, wheat is projected to have the most significant increase in net imports both under RCP 2.6 and RCP 8.5. The net imports of wheat in 2050 will increase by 20.33% under RCP 2.6 and 56.81% under RCP 8.5 (Table 3). Similarly, rice net imports in 2050 will increase by 22.16% under RCP 2.6 and 43.93% under RCP 8.5. The net import of sugar would also increase under both RCP 2.6 and RCP 8.5. Moreover, cotton will see a decline in net imports both under RCP 2.6 and RCP 8.5, which is consistent with positive yield changes and falling domestic prices for cotton. The net imports of other crops, including maize, soybean, and oilseeds, will increase under RCP 2.6 and decrease under RCP 8.5 in 2050. For example, soybean net import will decrease by 0.47% under RCP 2.6 in 2050 and increase moderately by 1.69% under RCP 8.5. The changing trends of soybean net imports are consistent with domestic soybean prices in that soybean prices will decrease by 0.02% under RCP 2.6 and increase by 0.13% under RCP 8.5 (Table 2). Interestingly, maize net imports will decrease by 0.47% with rising prices (0.31%) under RCP 2.6 in 2050.

The simulated impacts of climate change on crop net imports will also have considerable uncertainty stemming from the econometric results. Wheat, for example, will have the widest confidence interval of net import, where the net import in 2050 will change over the range of − 1.33 to 42.42% under RCP 2.6 and − 3.06 to 134.10% under RCP 8.5 (Table 3). The large uncertainty interval shows that wheat net imports may more than double due to climate change or may even decrease slightly under RCP 8.5 in 2050. Following wheat, rice will also have wide uncertainty intervals of net import changes. Moreover, although the uncertainty intervals of other crops are much smaller than those of wheat and rice, some crops, such as maize, soybean, and oilseeds, with average expansion net import, have confidence intervals covering negative values. For example, the net import of maize will increase on average by 1.69% under RCP 8.5 in 2050. However, the confidence interval of maize net import changes is from − 0.84 to 4.20%. These results further show that we should be more cautious while drawing conclusions about the climate change impacts on net imports of crops.

4.4 The uncertainty of climate change impacts on crop self-sufficiency

Our results show that, on average, climate change will lower China’s crop self-sufficiency. Compared to the baseline scenario, crops experiencing adverse yield shocks will decrease self-sufficiency rates (Table 4). Among the crops, wheat has the most significant reduction in self-sufficiency rate in 2050 (by 0.48 percentage points under RCP 2.6 and 1.37 percentage points under RCP 8.5), which is consistent with our results that wheat output will drop by the highest margin and its net import increase the most. Under the RCP 2.6 scenario, the self-sufficiency rates of rice, wheat, and sugar will decrease in 2050 due to climate change. Other crops will have rising self-sufficiency rates under RCP 2.6, including maize, soybean, cotton, and oilseed crops. On the other hand, under the RCP 8.5 scenario, all crops will have lower self-sufficiency rates by 2050 than 2020, except for cotton, which benefits the most from climate change. The overall self-sufficiency rate in major cerealsFootnote 5 would decrease by 0.21 percentage points under RCP 2.6 and 0.65 percentage points under RCP 8.5.

The simulated impacts of climate change on crop self-sufficiency will also have considerable uncertainty based on the econometric results. Once again, wheat will have the broadest confidence interval of self-sufficiency rate, where wheat self-sufficiency rate in 2050 will change over the range of − 1.02 percentage points to 0.03 percentage points under RCP 2.6 and − 3.31 percentage points to 0.08 percentage points under RCP 8.5 (Table 4). The uncertainty range shows that the wheat self-sufficiency rate may decline by more than three percentage points due to climate change or may even increase slightly under RCP 8.5 in 2050. Following wheat, maize also has wide uncertainty intervals for the changes in the self-sufficiency rate. Moreover, although the uncertainty intervals of other crops are much smaller than those of wheat and maize, the uncertainty intervals still make it harder to reach an unequivocal conclusion about climate change impacts on crop self-sufficiency rates. Therefore, more cautiousness should be paid to precisely assess climate change impacts on crop self-sufficiency.

5 Discussion

The uncertainty analysis for climate change impacts could also primarily illustrate the strengths and weaknesses of the econometric models against the process-based models. The econometric models and process-based models are widely used in previous studies to estimate climate change impact on agricultural production (Li and Geng, 2013; Wang et al., 2014a, b). As the econometric estimations utilized the statistical data on agricultural production, the estimations could capture the changes in agricultural production that happened in the field caused by climate change. The econometric models could also consider regional economic conditions that influence agricultural production by controlling regional fixed effects or economic variables, such as non-farm wages, land rents, and governmental policies. Another advantage of econometric models is that they mostly utilize the statistical data at the provincial and county level, which are relatively easy to obtain. However, as shown in this study, the econometric models would suffer the uncertainty for assessing climate change impacts from the estimated coefficients of climate variables. In comparison, the processed-based models can depict the growth process of different crops in fine detail and simulate the impacts of climate variables (such as climate and precipitation) on crops at different growing stages, which theocratically produce more certain results. They could also simulate the effects of mitigation and adaptation strategies for buffering climate change impacts on the agricultural economy, which is more challenging to perform with econometric models. Another advantage of process-based models is that they can explicitly examine the impact of CO2 fertilization effect on crop production, which may benefit the crop production and even offset the adverse impact of changing climate (Weigel and Manderscheid, 2012; Karimi et al., 2018).

This study relies on the econometric results from Wang (2016), which estimated the impacts of climate change on China’s crop yield using provincial panel data. Several studies have also estimated the climate variable impacts on China’s crop yield with econometric models (Chen et al., 2018). Compared with Wang (2016), they only analyzed the climate change impacts on the yield of staple food crops, including wheat, rice, maize, and soybean, demonstrating a clear advantage of using Wang (2016). The other advantage of using Wang (2016) is that they selected the yearly averaged temperature and precipitation and the standard deviation of temperature and precipitation as climate variables, while other studies mostly used the non-linear climate variables, such as growing degree days (GDD), that are created from the daily value of temperature and precipitation. As the projections of climate variables at the yearly level are relatively easier to obtain, the equations estimated by Wang (2016) can more easily project the future changes in crop yield. Considering two factors, we adopted the equations estimated by Wang (2016) to project future crop yields.

This study has three major limitations. First, we only consider climate change impacts on China’s agricultural economy through changing crop yield. However, climate change would also influence agricultural production through other channels, such as the reduction of labor productivity (Chen and Gong, 2021), sea-level rise (Cui et al., 2018), the diseases and insect pests (Savary et al., 2019), and the extreme weather events (Xie et al., 2018). These diversified channels may exacerbate the uncertainty of climate change impacts on the agricultural economy, which should be explored in future studies. Second, the choice of climate variables would change the econometric results for climate change impacts on crop yield, consequently influencing the simulation impacts on the agriculture economy. Hence, the choice of climate variable is a source of uncertainty for the assessment and should be included in future works. Third, we do not consider the impacts of climate change in other countries on China’s agricultural economy through the trade of agricultural products. As we could not obtain the impacts of climate change on crop yield for other countries estimated by the econometric model, we simulate climate change impacts on China’s agricultural economy with a single-country partial equilibrium model, holding global food prices unchanged.

6 Conclusion

Like many countries around the globe, climate change is a serious challenge to the future agricultural economy in China, which relies on agriculture to feed its ~ 1.4 billion people. However, previous studies have not explicitly accounted for the uncertainty of climate change impacts on China’s agricultural economy arising from the econometric results. To narrow this research gap, we assess climate change impacts on China’s agriculture and elaborate the impact mechanisms based on an integrated assessment approach, coupling the econometric results and the agricultural partial equilibrium model of China, with a particular focus on the uncertainty of climate change impacts, from 2020 to 2050 under IPCC RCP 2.6 and RCP 8.5 scenarios.

Our results show that climate change would significantly affect agricultural production but with large variations among crops. (1) On average, climate change will damage production, raise prices, increase net imports of most crops, and lower China’s crop self-sufficiency. (2) There is great disparity among different crops on the uncertainty of climate change impacts on the production. Wheat has the largest uncertainty for climate change impacts. (3) The differences in uncertainty intervals of crop production changes are determined by the sensitivity of crop yield to climate variables. The crops with the smaller estimated coefficients of crop yield for climate variables have relatively large uncertainty intervals of production changes. (4) The confidence intervals for all crops get wider as time passes, indicating the rising uncertainty for projecting future changes of crop production, price, and trade due to the continuously changing climate. (5) Compared with RCP 2.6, the uncertainty of climate change impacts on China’s agricultural economy is much higher under RCP 8.5. Therefore, the uncertainty of climate change impacts that stem from the econometric-based assessment makes it harder to reach unequivocal conclusions about climate change impacts on China’s agricultural economy.

Our results have important policy implications for national adaptation plans. First, the adaptation policies should prioritize the crops based on the severity of production losses. Notably, the investments in adaptation measures should be channeled to more adversely affected crops and those that play a more vital role in national food security. Second, more consideration should be paid to precisely assess climate change impacts on the agricultural economy in the future, as the uncertainty would expand remarkably accompanied by changing climate. Furthermore, more sources of the uncertainty should be explored further, including the uncertainty from the choice of climate variables in econometric models. Third, the adaptation policies should be given more resilience and flexibility to cope with the uncertainty of climate change impacts on China’s agricultural economy. The strengthening of adaptation policies should depend on the severity of agricultural damages, fully considering the uncertainty intervals of climate change effects. On the contrary, if the adaptation policies are too rigid, we might end up having over-adaptation or insufficient adaptation to climate change. Moreover, the resilience of agricultural production could be strengthened by such crop diversification, drought-resistant varieties, climate-risk insurance, and climate-smart agriculture.

Notes

RCP 8.5 and RCP 2.6 and are named after a possible range of radiative forcing values in the year 2100 relative to pre-industrial values (+ 8.5 and + 2.6 W/m2, respectively). We can easily see that RCP 8.5 and RCP 2.6 represent high and low carbon emission pathway in the future respectively, and correspondingly high and low temperature increase in future (Vermeulen, 2014).

To concord with crop sectors in China’s agricultural equilibrium model (CAPSiM), oilseed yield is the average of rapeseed and peanut yields, and sugar yield by sugarcane and sugar beet yields, both weighted by the harvest areas in 2015.

If the readers are interested in the data source, detail estimation method, and results, you can contact our corresponding author to email the report.

The self-sufficiency rate is defined as the ratio of domestic food production to food supply (production plus net import).

Major cereals include rice, wheat, and maize.

References

Burke M, Dykema J, Lobell DB, Miguel E, Satyanath S (2015) Incorporating climate uncertainty into estimates of climate change impacts. Rev Econ Stat 97(2):461–471

Calzadilla A, Rehdanz K, Betts R, Falloon P, Wiltshire A, Tol RSJ (2013) Climate change impacts on global agriculture. Clim Change 120(1):357–374

Carvajal PE, Anandarajah G, Mulugetta Y, Dessens O (2017) Assessing uncertainty of climate change impacts on long-term hydropower generation using the CMIP5 ensemble—the case of Ecuador. Clim Change 144(4):611–624

Chen S, Chen X, Jintao Xu (2016) Impacts of climate change on agriculture: evidence from China. J Environ Econ Manag 76(76):105–124

Chen S, Jintao Xu, Zhang H (2016) The impact of climate change on China’s grain production: an empirical analysis based on county panel data. China Rural Economy 5:2–15 ([In Chinese])

Chen S, Gong B (2021) Response and adaptation of agriculture to climate change: evidence from China. Journal of Development Economics 148:102557

Committee of China’s National Assessment Report on Climate Change (2015) The Third National Assessment Report on Climate Change. Science Press, Beijing

Cui Q, Xie W, Liu Y (2018) Effects of sea-level rise on economic development and regional disparity in China. J Clean Prod 176:1245–1253

Erda L, Wei X, Hui J, Yinlong X, Liyong X (2005) Climate change impacts on crop yield and quality with co2 fertilization in China. Philosophical Transactions of the Royal Society B Biological Sciences 360(1463):2149–2154

Gosling SN, McGregor GR, Lowe JA (2012) The benefits of quantifying climate model uncertainty in climate change impacts assessment: an example with heat-related mortality change estimates. Clim Change 112(2):217–231

Huang Ji-Kun W, Wei W, Cui Q, Xie W (2017) The prospects for China’s food security and imports: will china starve the world via imports? J Integrative Agri 016(012):2933–2944

HuangLi JH (2003) China’s agricultural policy simulation and projection model-CAPSiM. J Nanjing Agri Univ (social Sciences Edition) 3(2):30–41 ([In Chinese])

Huang J et al (2002) Impacts of agricultural biotechnology on China’s economy and world trade. China’s Science Foundation 6:324–329

Huang Jikun, and Xie Wei 2019 Policy Research on supply and demand of agricultural products and food security in China. Science Press, [In Chinese]

Jin S, Ma H, Huang J, Hu R, Rozelle S (2010) Productivity, efficiency and technical change: measuring the performance of China’s transforming agriculture. J Prod Anal 33(3):191–207

Fei Li et al (2020) Maize wheat and rice production potential changes in China under the background of climate change. Agricultural Systems 182:102853

Karimi V, Karami E, Keshavarz M (2018) Climate change and agriculture: impacts and adaptive responses in Iran. J Integr Agric 17(1):1–15

Liang Y, Yan X (2016) Prediction and uncertainty of climate change in China during 21st century under RCPs. J Trop Meteorol 32(2):184–192

Lin E et al (2005) Climate change impacts on crop yield and quality with CO2 fertilization in China. Philosophical Trans Royal Soc B 360(1463):2149–2154

Lin H, Glauben T, Yang J, He LY (2012) Impacts of the US farm bill 2008 on China’s agricultural production and rural poverty. Agri Econ (AGRICECON) 58(4):157–164

Liu H, Li X, Fischer G, Sun L (2004) Study on the impacts of climate change on China’s agriculture. Clim Change 65(1):125–148

Lobell DB, Burke MB (2008) Why are agricultural impacts of climate change so uncertain? The importance of temperature relative to precipitation. Environmental Research Letters 3(3):034007

Ma, H., Rae, A., Huang, J., Rozelle, S. (2004). Chinese animal product consumption in the 1990s. Australian Journal of Agricultural and Resource Economics, 48(4).

Meehl GA, Covey C, Taylor KE, Delworth T, Stouffer RJ, Latif M et al (2007) The WCRP CMIP3 multimodel dataset: a new era in climate change research. Bull Am Meteor Soc 88(9):1383–1394

Nakicenovic, N., et al 2000 Special report on emissions scenarios: a special report of Working Group III of the Intergovernmental Panel on Climate Change

NBSC (National Bureau of Statistics China). 2020. The data is available at http://data.stats.gov.cn/.

Nelson GC et al (2014) Climate change effects on agriculture: economic responses to biophysical shocks. Proceed National Acad Sci USA 111(9):3274–3279

Olesen JE et al (2007) Uncertainties in projected impacts of climate change on European agriculture and terrestrial ecosystems based on scenarios from regional climate models. Clim Change 81(1):123–143

Papke LE, Wooldridge JM (2005) A computational trick for delta-method standard errors. Econ Lett 86(3):0–417

Parry ML, Rosenzweig C, Iglesias A, Livermore M, Fischer G (2004) Effects of climate change on global food production under SRES emissions and socio-economic scenarios. Global Environ Change-Human and Policy Dimensions 14(1):53–67

Piao S, Ciais P, Huang Y, Shen Z, Peng S, Li J, Zhou L, Liu H, Ma Y, Ding Y (2010) The impacts of climate change on water resources and agriculture in China. Nature 467(7311):43–51

Powell, L. A. 2007. Approximating variance of demographic parameters using the delta method: a reference for avian biologists. The Condor, 109(4).

Ruiz-Ramos M, Mínguez MI (2010) Evaluating uncertainty in climate change impacts on crop productivity in the Iberian Peninsula. Climate Res 44(1):69–82

Robinson S et al (2014) Comparing supply-side specifications in models of global agriculture and the food system. Agri Econ 45(1):21–35

Rosenzweig C et al (2014) Assessing agricultural risks of climate change in the 21st century in a global gridded crop model intercomparison. Proceed National Acad Sci US A 111(9):3268–3273

Roson R, van der Mensbrugghe D (2012) Climate change and economic growth: impacts and interactions. Int J Sustain Econ 4(3):270–285

Rui-Li LI, Geng S (2013) Impacts of climate change on agriculture and adaptive strategies in china. J Integr Agric 000(008):1402–1408

Savary S, Willocquet L, Pethybridge SJ, Esker P, McRoberts N, Nelson A (2019) The global burden of pathogens and pests on major food crops. Nat Ecol Evol 3(3):430–439

Tao F, Yokozawa M, Liu J, Zhang Z (2008) Climate-crop yield relationships at provincial scales in China and the impacts of recent climate trends. Climate Res 38(1):83–94

Vermeulen, Sonja J (2014) Climate change, food security and small-scale producers: analysis of findings of the Fifth Assessment Report (AR5) of the Intergovernmental Panel on Climate Change (IPCC)

Wooldridge, Jeffrey M 1999 Introductory econometrics: a modern approach

Wang, J. X. 2016. Climate change impacts on crop yield: evidence from econometric estimation. China Center for Agricultural Policy, 1–44 (973 project report).

Wang J, Mendelsohn R, Dinar A, Huang J, Rozelle S, Zhang L (2009) The impact of climate change on China’s agriculture. Agric Econ 40(3):323–337

Wang, X., Yamauchi, F., Otsuka, K., & Huang, J. (2014a). Wage growth, landholding, and mechanization in Chinese agriculture. Policy Research Working Paper Series.

Wang JX, Huang J, Yang J (2014) Overview of impacts of climate change and adaptation in China’s agriculture. J Integr Agric 000(001):1–17

Weigel H-J, Manderscheid R (2012) Crop growth responses to free air CO2 enrichment and nitrogen fertilization: rotating barley, ryegrass, sugar beet and wheat. Eur J Agron 43:97–107

Xie W et al (2018) Decreases in global beer supply due to extreme drought and heat. Nature Plants 4(11):964–973

Xie W, Huang J, Wang J, Cui Q, Robertson R, Chen K (2020) Climate change impacts on China’s agriculture: the responses from market and trade. China Economic Review 62:101256

Xiong W, Conway D, Lin E, Holman I (2009) Potential impacts of climate change and climate variability on China’s rice yield and production. Climate Res 40(1):23–35

Xiong W, Lin E, Hui Ju, Yinlong Xu (2007) Climate change and critical thresholds in China’s food security. Clim Change 81(2):205–221

Jun Y, Huang J, Rozelle S et al (2012) Where is the balance? Implications of adopting Special products and sensitive products in Doha negotiations for world and China’s agriculture. China Econ Rev 23:651–664

Zhai, Fan, and Juzhong Zhuang. 2009. Agricultural impact of climate change: a general equilibrium analysis with special reference to Southeast Asia. Asian Development Bank Institute.

Zhang X et al (2019) Impacts of climate change on self-sufficiency of rice in China: A CGE-model-based evidence with alternative regional feedback mechanisms. J Clean Prod 230:150–161

Zhang P, Zhang J, Chen M (2017) Economic impacts of climate change on agriculture: the importance of additional climatic variables other than temperature and precipitation. J Environ Econ Manag 83:8–31

Tao, F., Rötter, R. P., Palosuo, T., Díaz‐Ambrona, C. G. H., Mínguez, M. I., Semenov, M. A., … Hoffmann, H. (2018). Contribution of crop model structure, parameters and climate projections to uncertainty in climate change impact assessments. Global Change Biology, 24(3), 1291–1307

Funding

The authors received their respective financial supports from the National Natural Sciences Foundation of China (71922002; 71873009; 71903014; 71934003; 41861124006).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

A. The econometric results for climate change impacts on China’s crop yield.

Wang (2016) estimated the impacts of climate variables on China’s cop yield with provincial panel data. Nine crops are covered, including rice, wheat, maize, soybean, cotton, rapeseed, peanut, sugarcane, and sugar beet. The econometric equation for each crop is specified as follows:

where i and t donate the province and year respectively. The dependent variable, Log(yit), represents the logarithmic function of the crop yield for province i in year t. Tempit and Precit are the average values of temperature and precipitation during the growth period of each crop, respectively. The Std_temit and Std_preit are the standard deviations of temperature and precipitation during the growth period of each crop for province i in year t. The producing input (inputkit) of each crop includes fertilizer, labor, and other inputs, all in the logarithmic function. In addition, the time trend variable T and provincial fixed effects Rt are also controlled. The fixed-effect regression is employed to estimate Equation A1.

The historical data on daily temperature and precipitation of each province from 1980 to 2010 are derived from China Meteorological Data Network (http://data.cma.cn). Then, the average values of temperature and precipitation during the growth period of each crop, as well as the standard deviation of temperature and precipitation, are calculated. The provincial data on crop yield and production input from 1980 to 2010 are collected from China Rural Statistical Yearbook (1981 − 2011).

B. The supply and demand projection of China’s agricultural products in 2050.

C. The projection of future climate variables under RCP 2.6 and RCP 8.5

Source: Liang and Yan (2016)

The percentage changes in average and standard deviation of temperature and precipitation for different crops during their growing season by 2050 (base year: 2010).

Rights and permissions

About this article

Cite this article

Cui, Q., Ali, T., Xie, W. et al. The uncertainty of climate change impacts on China’s agricultural economy based on an integrated assessment approach. Mitig Adapt Strateg Glob Change 27, 25 (2022). https://doi.org/10.1007/s11027-022-09999-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11027-022-09999-0