Abstract

The evolution problem of individual wealth growth and control is investigated by applying the kinetic theory. The microscopic variation of individual wealth growth around a universal desired target is analyzed by discussing a suitable value function, which characterizes the internal trading mechanism. Inheritance, capital gifts from others, and capital gains from rising prices are treated as external mechanisms that result in the growth of individual wealth. Under the grazing collision limit, the steady-state solution of the Fokker–Planck type equation is the product of an inverse gamma distribution and a generalized inverse gamma distribution, and exhibits a fat-tailed property. To prevent the excessive growth of individual wealth, we design additive and multiplicative controls, which reduce the possibility of excessive growth of individual wealth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There have been many studies of wealth distribution for a multi-agent society by utilizing the methods of statistical physics, including the kinetic theory of active particles and rarefied gases (see [8, 10, 11, 15, 20, 31, 33]). Polk and Boghosian [37] modify the affine wealth model of wealth distribution to study the effect of non-constant redistribution. Dolfin and Lachowicz [18] use the kinetic theory of active particles to model the effects of altruism and selfishness on wealth distribution. Furioli et al. [24] investigate the influence of non-Maxwell collision kernels on the wealth distribution through the kinetic theory of rarefied gases. The kinetic theory is now widely utilized to examine various socio-economic problems, such as opinion formation [1, 19, 40], goods exchange [9, 41], financial markets [13, 32, 43], and other problems [3, 5].

The wealth distribution model is based on interaction rules with saving propensity and randomness. Cordier et al. [12] employ interaction rules to study the wealth distribution in a market. The results in [12] illustrate that the steady-state wealth distribution has power-law tails of the Pareto type. Düring and Toscani [21] utilize the interaction rules to analyze the wealth distribution model about international and domestic transactions. Bisi et al. [6] embed the taxation into the interaction rules and match an appropriate redistribution operator. The results in [6] suggest that taxation and redistribution modify the Pareto index. Pareschi and Toscani [34] consider the effect of knowledge on wealth distribution by assuming that both saving propensity and randomness depend on the individual degree of knowledge. Düring et al. [22] discuss wealth distribution by employing the interaction rule with control, and obtain that the control is able to change the Pareto index of the steady-state solution.

Although the aforementioned wealth distribution models naturally include the specific behavioral aspects of agents, one needs to consider the agent’s psychological components, such as the way they perceive risk, which may lead to irrational behavior [2, 20, 26]. The kinetic model to describe the agent’s risk perception behavior with the value function of the prospect theory [29, 30] is discussed by Maldarella and Pareschi [32]. Using the connection between human behavior and their description in terms of value function, Gualandi and Toscani [25] reproduce the formation of the service time distribution in a call center. Dimarco and Toscani [17] study the dynamics of individuals seeking high status in the social hierarchy. Similar models are employed to investigate various social phenomena, including tumor growth distribution [38], city size distribution [27], addiction behavior [16, 42].

Inspired by the works in [17, 38], we adopt a class of appropriate value functions to describe the internal trading mechanisms that cause individual wealth growth in a multi-agent society. This kind of value function satisfies the main characteristics of the value function proposed by Kahneman and Tversky [29, 30]. It describes an asymmetric effort of the individual to achieve a universal desired target. This asymmetry depends on whether the current value is above or below the universal desired target (see [16, 17, 25,26,27, 38, 42]). Meanwhile, this value function also characterizes two phenomena that exist in society. One is that the mobility of individuals with middle wealth levels is higher than those of upper and lower wealth levels. The other is that it is often difficult for individuals with lower wealth levels to exit from the very low zone, because they have little opportunity to obtain a good education and cultivate personal skills. The value function of our model differs from that of [17, 38]. The value function in [17] reflects the asymmetric effort made by agents seeking high social status. The value function in [38] embodies the asymmetric effort made by tumor cells toward reaching cell size with carrying capacity.

On the other hand, we consider inheritance, capital gifts from others, and capital gains from rising prices as external mechanisms that cause individual wealth growth. This idea comes from Tobin and Golub [39], in which inheritance, capital gifts from others, and capital gains from rising prices are regarded as factors that lead to the growth of individual wealth. Piketty [35] demonstrates that inheritance plays a key role in wealth accumulation. In our model, we assume that the transfer rate of wealth from external mechanisms is non-negative, which is a constant or a function relating to wealth variables.

One task of our work is to utilize the internal trading mechanism and the external mechanism to characterize the deterministic part of individual wealth growth. We use the non-Maxwell collision kernel to build the Boltzmann type equation. Under the grazing collision limit, the solution of the kinetic equation converges to the solution of a Fokker–Planck type equation with variable diffusion coefficients. The steady-state solution is the product of a generalized inverse gamma distribution due to the internal trading mechanism and an inverse gamma distribution generated by the external mechanism. When the parameters describing the internal trading mechanism and the external mechanism take specific values, we find that the steady-state solution becomes a specific distribution, including an inverse gamma distribution [12, 24], a generalized inverse gamma distribution, and a lognormal distribution. Meanwhile, the steady-state solutions in our job still show that the distribution of individual wealth growth presents a Pareto tail, which implies an increased risk of wealth inequality.

There are two main differences between our wealth distribution model and the previously mentioned models [6, 12, 21, 22, 24, 34]. The first is that we consider the internal trading behavior described by a value function, and conclude that different behavior parameters result in different wealth distributions, such as inverse gamma distribution, lognormal distribution, and so on. Secondly, introducing inheritance, capital gifts from others, and capital gains from rising prices as external mechanisms into the interaction rule, our results reveal that external mechanisms do not affect the tail structure of the steady-state solution.

In a society, the excessive growth of individual wealth leads to the wealth inequality, which affects the healthy development of the society [28, 36]. Thus, it is necessary for the government to take measures to prevent the excessive growth. In our model, a control variable is embedded into the elementary interaction rule of individual wealth growth. This control variable transforms the fat tail of the steady-state solution into a slim tail, thereby reducing the probability of agents having too much wealth. For the control problem of wealth inequality, the results in [22] illustrate that the control modifies the Pareto index of steady-state solution. Different from their work, the control in our model changes the variance of the Gaussian density presented in the steady-state solution.

The organizational structure of this paper is as follows. In Sect. 2, we construct a linear kinetic model of individual wealth growth, in which the microscopic variation of the wealth growth depends on an internal trading mechanism determined by a value function, an external mechanism and stochastic fluctuations. In Sect. 3, under the grazing collision limit, the Fokker–Planck equation corresponding to the kinetic model of individual wealth growth is derived and a steady-state solution with a fat tail is obtained. In Sect. 4, we introduce the control variable into the interaction of individual wealth growth and build control models. The steady-state solution of the model is computed under similar scaling technology. The conclusion is stated in Sect. 5.

2 Kinetic Description

According to the classical method of kinetic theory [33], we assume that the population of agents is homogeneous in terms of personal wealth and indistinguishable, which indicates that an agent’s state at any time \(t\ge 0\) is completely characterized by the wealth \(w\ge 0\). Hence, the state of the system is wholly represented by the unknown density function f(w, t), where the wealth \(w\in R_{+}\) and the time \(t\ge 0\). In general, the density function f(w, t) is normalized to one, i.e.,

The variation of the density function f(w, t) over time is attributed to the fact that the agents in the system continuously update the amount of their wealth through microscopic interactions. To be consistent with the classical kinetic theory of rarefied gases, we regard a single update of the wealth quantity w as an elementary interaction.

2.1 A Linear Kinetic Model

In [12, 24], microscopic variations of wealth depend on the trading behavior of agents in the market. Following the ideas in [12, 24], we consider the behavior of agents participating in market transactions as an internal trading mechanism that causes the growth of individual wealth. On the other hand, as mentioned in the introduction, inheritance, capital gifts from others, and capital gains from rising prices are one of the factors that cause individual wealth growth. Then, we view inheritance, capital gifts from others, and capital gains from rising prices as external mechanisms.

The purpose of accumulating wealth for agents is to ensure their basic survival needs, and the value of wealth to achieve this goal is denoted by \(\overline{w}>0\). After achieving the goal, agents work toward a greater amount of wealth \(\overline{w}_{L}>\overline{w}\), where \(\overline{w}_{L}\) is considered as the level of a satisfactory wealth. Similar to the classification of agents’ wealth levels in [18], the value \(\overline{w}\) and \(\overline{w}_{L}\) divide agents’ wealth into three levels: the low wealth region \((0, \overline{w})\), the middle wealth region \((\overline{w}, \overline{w}_{L})\), and the high wealth region \((\overline{w}_{L},+\infty )\). It is notable that both \(\overline{w}\) and \(\overline{w}_{L}\) are in the form of mean values since there are differences in each agent’s perception.

The elementary interaction is employed to model the change in the agent’s wealth based on the aforementioned analysis, and it portrays the natural tendency of the agent’s wealth to reach the value \(\overline{w}_{L}\). Therefore, for any given wealth value w, we model the elementary variation of w to \(w_{*}\) in the form

In (1), the variable \(z\in R_{+}\) denotes the agent’s wealth from the external mechanism, such as inheritance, capital gifts from others, and capital gains from rising prices. We assume that the distribution of z is known and is represented by \(\varepsilon (z)\). (1) illustrates that the microscopic variation of agent wealth comes from three different mechanisms, each of which is expressed in the form of a product of two terms and parameterized by a small positive parameter \(\epsilon \ll 1\). The term \(\Psi ^{\epsilon }_{\delta }(\cdot )w\) characterizes the small deterministic change in wealth caused by the agent’s internal trading mechanisms, where \(\Psi ^{\epsilon }_{\delta }(\cdot )\) is a function of the quotient \(w/\overline{w}_{L}\) and its value is positive or negative. \(I^{\epsilon }_{E}(\cdot )z\) represents a small deterministic change in wealth caused by an external mechanism, where \(I^{\epsilon }_{E}(\cdot )\) is a function of wealth w and denotes the transfer rate of wealth from external mechanisms. The term \(\eta _{\epsilon }w\) denotes the change of wealth due to uncertainty factors. \(\eta _{\epsilon }\) is a random variable with mean zero and finite variance, i.e., \(\langle \eta _{\epsilon }\rangle =0\), \(\langle \eta ^{2}_{\epsilon }\rangle =\epsilon \sigma \), \(\sigma >0\). It is remarkable that, since \(\Psi ^{\epsilon }_{\delta }(\cdot )\) is a nonlinear function of the quotient \(w/\overline{w}_{L}\) (see the discussion in the Sect. 2.2), the elementary interaction (1) is no longer a linear interaction.

From the classical kinetic theory [33], we know that the elementary interaction (1) causes the density f(w, t) to change with time, and the variation is described by a linear Boltzmann type operator. We adopt its weak form, namely, for any smooth function \(\varphi (w)\), the evolution of f(w, t) obeys the equation

where \(\langle \cdot \rangle \) denotes mathematical expectation with respect to the random variable \(\eta _{\epsilon }\). The function K(w) is a collision kernel, which measures the frequency of elementary interaction. We assume that the first two moments of \(\varepsilon (z)\) are bounded. In particular, we set

The non-Maxwell collision kernel (variable collision kernel) is proposed in [24] to indicate that agents in trading should have a certain amount of wealth, otherwise it leads to a net loss of market funds. This idea is applied to study various socio-economic phenomena [4, 17, 42]. Following the idea in [17], we assume that the mathematical form of the collision kernel is

where \(\kappa >0\) and \(0<\alpha \le 1\) are constant. This collision kernel assigns a high frequency to the elementary interaction if agents have a high level of wealth, and a low frequency to the elementary interaction when agents are subject to a low level of wealth. In addition, it means that agents with more wealth have more resources to achieve the wealth value \(\overline{w}_{L}\), but agents with less wealth struggle to reach \(\overline{w}\), and it would be extremely difficult to go beyond \(\overline{w}\) to \(\overline{w}_{L}\).

2.2 Value Function

In this section, we discuss the specific form of the value function \(\Psi ^{\epsilon }_{\delta }(\cdot )\), which is based on the prospect theory of Kahneman and Tversky [29], to model the internal trading behavior of agents in market transactions.

Before selecting an appropriate value function \(\Psi ^{\epsilon }_{\delta }(\cdot )\), we review the linear trading rule utilized in [24]. The wealth \(x_{*}\) after the interaction is the result of three different factors, i.e.,

where the constant \(\lambda \in (0,1)\) is the transaction rate parameter (also called saving propensity parameter), \(\eta \) is a random variable with mean zero and finite variance, the positive constant \(\xi \ll 1\) is used to characterize the intensity of the interaction. The first term on the right-hand side of (4) denotes the remained wealth after the agents trade a fraction \(\xi \lambda x\) of their wealth in the market. The second term is the wealth obtained from the market after participating in the transaction, where \(\overline{x}>0\) characterizes the average wealth. The third item considers the presence of market risk.

As computed in [17], the linear trading rule (4) can be rewritten in the form

where, for \(s=\frac{x}{\overline{x}}>0\),

It is seen that \(\Psi ^{\xi }(s)\) is a concave increasing function on \(R_{+}\) and ranges from \(-\infty \) to \(\xi \lambda \). It is equal to zero at the point \(s=1\), which is called the reference point. After a simple calculation, it is verified that the function satisfies the following two properties:

-

(i)

For \(0<\Delta s\le 1\), \(-\Psi ^{\xi }(1-\Delta s)>\Psi ^{\xi }(1+\Delta s)\) holds.

-

(ii)

If \(\xi \rightarrow 0\), then

$$\begin{aligned} \lim \limits _{\xi \rightarrow 0}\frac{\Psi ^{\xi }(s)}{\xi }=\lambda (1-\frac{1}{s}). \end{aligned}$$(7)

Property (i) is reminiscent of the prospect theory of Kahneman and Twersky [29], in which an important feature of the value function is the asymmetry. Concerning the reference point, the value function below the reference point is steeper than the value function above it. The function \(\Psi ^{\xi }(s)\) satisfies the property of the value function. Here, we call \(\Psi ^{\xi }(s)\) a value function [17, 25, 26, 42].

In (6), if \(x<\overline{x}\), then \(\Psi ^{\xi }(s)<0\); if \(x>\overline{x}\), then \(\Psi ^{\xi }(s)>0\). Thus, in absence of random fluctuations, elementary interaction (5) makes the wealth x tend to \(\overline{x}\). This is consistent with the interaction (4).

Under the condition that the random fluctuations in (5) does not exist, the feature that the value function \(\Psi ^{\xi }(s)\) has no lower bound leads to a sharp rise in the agent’s wealth to infinity after a single interaction, which is clearly inconsistent with the real situation. To overcome this deficit, we introduce a new function in the elementary interaction (1), it is given by

where the constant \(\gamma \in (0,1)\) is the transaction rate parameter, the positive constant \(\epsilon \ll 1\) denotes the intensity of the interaction. It is observed that the function \(\Psi ^{\epsilon }_{0}(s)\) is bounded, i.e.,

The function \(\Psi ^{\epsilon }_{0}(s)\) has properties similar to those of \(\Psi ^{\xi }(s)\). For any given constant \(\gamma \) and \(\epsilon \), \(\Psi ^{\epsilon }_{0}(s)\) is a concave increasing function on \(R_{+}\), and equal to zero at the reference point \(s=1\) (i.e., \(w=\overline{w}_{L}\)). If \(0<\Delta s \le 1\), we have

Inequality (9) implies that the function \(\Psi ^{\epsilon }_{0}(s)\) has an asymmetry about the reference point \(s=1\). From a mathematical view, it is easier to reach the value \(s=1\) from below than from above. For this reason, the different form of the value function \(\Psi ^{\epsilon }_{0}(s)\) has been adopted in the study of human behavior [26] as well as in the study of call center service times [25].

A straightforward calculation gives a property of the function \(\Psi ^{\epsilon }_{0}(s)\), namely,

The value function \(\Psi ^{\epsilon }_{0}(s)\) is a special case of a class of functions \(\Psi ^{\epsilon }_{\delta }(s)\), which is defined by

where the constant \(\gamma \in (0,1)\) is the transaction rate parameter, the constant \(0<\delta \le 1\) characterizes the behavior of the agent, and the positive constant \(\epsilon \ll 1\) represents the intensity of the interaction. When \(\delta \rightarrow 0\), the function \(\Psi ^{\epsilon }_{\delta }(s)\) becomes \(\Psi ^{\epsilon }_{0}(s)\).

In agreement with the previous analysis, for any given parameters \(\epsilon , \gamma \) and \(\delta \), the function \(\Psi ^{\epsilon }_{\delta }(s)\) is increasing with s and is equal to zero at the reference point \(s=1\) (i.e., \(w=\overline{w}_{L}\)). Furthermore, we have

In (12), the lower bound of the function \(\Psi ^{\epsilon }_{\delta }(s)\) is consistent with \(\Psi ^{\epsilon }_{0}(s)\), but the upper bound is related to \(\epsilon \) and \(\delta \) in addition to \(\gamma \). A simple verification yields \(b(\gamma ,\epsilon ,\delta )<1\), meaning that it is more difficult to go back to the value \(s=1\) from above compared to the value function \(\Psi ^{\epsilon }_{0}(s)\). According to the upper bound in (12) and ensuring that the wealth after the interaction in (1) is positive, we require that the random variable \(\eta _{\epsilon }\) satisfies the condition \(\eta _{\epsilon }\ge -1+b(\gamma ,\epsilon ,\delta )\).

In the absence of random fluctuations and external mechanisms in the elementary interaction (1), when \(w<\overline{w}_{L}\), \(\Psi ^{\epsilon }_{\delta }(s)<0\) implies an increase in individual wealth after the interaction. When \(w>\overline{w}_{L}\), \(\Psi ^{\epsilon }_{\delta }(s)>0\) leads to a decrease in post-interaction individual wealth. To the former, this is the natural tendency for agents to achieve a satisfactory wealth value \(\overline{w}_{L}\). For the latter, if agents’ wealth exceeds the value of satisfactory wealth \(\overline{w}_{L}\), they realize that their continued substantial accumulation of wealth leads to a decline in the total wealth of society [18], bringing disadvantages to social development and affecting their future wealth. Therefore, for the majority of agents, we assume that they do not expect such problems to occur. When \(w>\overline{w}_{L}\), they would help the poor or invest in some public utility, which might reduce their wealth.

Moreover, the function \(\Psi ^{\epsilon }_{\delta }(s)\) has a certain asymmetry about the reference point \(s=1\), i.e., for \(0<\Delta s \le 1\), the inequality

holds. This is also confirmed by Fig. 1. Consequently, if two agents starting from below and above are at the same distance from the satisfactory wealth value \(\overline{w}_{L}\), the agent starting below reaches \(\overline{w}_{L}\) faster than the agent starting above. The reason behind this phenomenon is that when the agent’s wealth is less than \(\overline{w}_{L}\), the agent has a strong motivation and willingness to achieve \(\overline{w}_{L}\). When the agent’s wealth is greater than \(\overline{w}_{L}\), the agent becomes antagonistic to returning to \(\overline{w}_{L}\) in order to maintain his/her living and investment habits.

From Fig. 1, it is observed that the value function \(\Psi ^{\epsilon }_{\delta }(s)\) has an inflection point \(s=\overline{s}\) in (0, 1) and the inflection point \(\overline{s}\) moves to the right as \(\delta \) increases for given \(\epsilon \) and \(\gamma \). As mentioned in the previous section, the value \(w=\overline{w}_{L}\), i.e., the satisfactory level of wealth corresponds to the reference point \(s=1\). Then the value \(w=\overline{w}\), which is the level of wealth needed to ensure basic survival, corresponds to the inflection point \(\overline{s}=\overline{w}/\overline{w}_{L}<1\). The inflection point \(\overline{s}\) and the reference point \(s=1\) split the graph of the value function into three regions \((0, \overline{s}), (\overline{s}, 1)\) and \((1, +\infty )\), such that the value function is convex in \((0, \overline{s})\) and concave in \((\overline{s}, 1)\cup (1, +\infty )\). The graph in the interval \((\overline{s}, 1)\) is steeper than those in the other two intervals, suggesting that agents whose wealth lies in the middle region are more likely to reach their satisfactory wealth value \(\overline{w}_{L}\) through the interaction (1).

By calculation, we obtain

When \(\delta =1\), (13) becomes equation (7). A similar form of the function \(\Psi ^{\epsilon }_{\delta }(s)\) has been used to investigate social climbing [17] and control of tumor growth distribution problems [38].

2.3 Variable Collision Kernel

In this section, to ensure that certain features of the value function and collective phenomena are preserved for the parameters \(\epsilon \rightarrow 0\), we focus on determining a reasonable constants \(\kappa \) and \(\alpha \) in (3).

For a given value function \(\Psi ^{\epsilon }_{\delta }(s)\), the growth rate of the internal trading mechanism is given by

where \(h=\epsilon \frac{s^{-\delta }-1}{\delta }\). Equation (14) implies that the growth rate of the internal trading mechanism is zero when \(\epsilon \rightarrow 0\). To ensure that the collective growth does not vanish as \(\epsilon \rightarrow 0\), we assume

On the other hand, when we choose \(\kappa =1/\epsilon \) to adjust the collective memory growth of the value function, we need to face the collective variation of wealth

Consider a reasonable \(\alpha \) under the condition \(s\le 1\). In (11), \(\epsilon =0\) yields \(\Psi ^{0}_{\delta }(s)=0\). According to the Lagrangian theorem, we get

Then

Let \(y(h)=(1-\gamma )e^{h/2}+\gamma e^{-h/2}\), which has a minimal value point

and the minimal value is given by

Hence, the choice \(\alpha =\delta \) enables the collective variation of wealth to be uniformly bounded with respect to \(\epsilon \), i.e.,

It is worthwhile to mention that if we choose \(\alpha <\delta \), the variation in the collective growth of wealth is extremely high as s gets closer to zero. Therefore, we exclude this case. However, as s gets closer to zero, the choice \(\alpha >\delta \) leads to an extremely small variation of the collective growth, which makes it impossible for the collective growth to start at lower wealth values. The choice \(\alpha =\delta \) is appropriate. Therefore, the variable collision kernel becomes

Based on the previous discussion, the weak form of the Boltzmann type equation (2) becomes

In the following discussion, to understand the role of internal trading mechanisms for individual wealth growth, we assume that the function \(I^{\epsilon }_{E}(w)\) is constant, i.e., \(I^{\epsilon }_{E}(w)=\epsilon I_{E}\), where \(I_{E}\) is a non-negative constant.

In (17), \(\varphi (w)=1\) illustrates that the solution of kinetic equation is mass conservation. This means that if \(f(w,0)=f_{0}(w)\) is a density function describing the distribution of individual wealth growth, then the solution of (17) is a density function characterizing the distribution of individual wealth growth at each subsequent moment.

When \(\varphi (w)=w\), (17) characterizes the evolution of the mean of individual wealth, i.e.

Substituting (1) into (18) produces

Utilizing (15) and the Jensen’s inequality, we obtain

The right-hand side of inequality (19) is non-negative if and only if the positive quantity \(m(t)\le \overline{m}\), where \(\overline{m}\) is the bounded quantity such that

Therefore, if \(m(0)<\overline{m}\), the right-hand side of (19) is positive, m(t) increases with time but does not cross the value \(\overline{m}\). If \(m(0)>\overline{m}\), m(t) decreases with time. In any case,

These calculations reveal that the steady-state solution of the kinetic equation has bounded moments.

3 Fokker–Planck Equation and Steady-State Solutions

The linear kinetic equation (17) expresses that the evolution of the density f(w, t) is attributed to the microscopic interactions (1) as well as to the variable collision kernel (16), and it is valid for the parameters \(\delta , \gamma \) and \(\epsilon \). In fact, in the microscopic interaction (1), the parameter \(\epsilon \ll 1\) describes a situation in which a single interaction determines a very small change of the value w, while the dependence of the colliding kernel (16) on the value \(\epsilon \) balances the smallness of a single interaction by increasing its frequency. This situation is known as the grazing collision limit in the kinetic theory of rarefied gases [44, 45].

For given \(\epsilon \ll 1\), the difference \(w_{*}-w\) is small. The smooth function \(\varphi (w)\) follows the Taylor expansion

where \(\widetilde{w}=\theta w_{*}+(1-\theta )w\), \(0\le \theta \le 1\). According to (1), we obtain

where the remainder term \(R_{\epsilon }(w)\) is given by

Substituting (20) into (17) yields

When \(\epsilon \rightarrow 0\), the second term on the right-hand side of (21) is vanishing at the order \(\epsilon ^{3/2}\). Hence, (21) converges to the weak form of the Fokker–Planck equation

Integrating by parts and providing that the boundary term vanishes, we derive the Fokker–Planck equation

A brief analysis which illustrates the vanishing of the boundary term is found in [23].

Equation (23) describes the evolution of the density f(w, t) for the agent with wealth \(w\in R_{+}\). We obtain from (23) that \(f_{\infty }(w)=f(w,+\infty )\) satisfies the first-order differential equation

Substituting (13) into (24) and solving the resultant equation, we have

where \(C_{1}\) satisfies \(\int _{R_{+}}f_{\infty }(w)dw=1\). In fact, the density (25) is a product of two distribution functions. One is an inverse gamma distribution due to an external mechanism

The other is a generalized inverse gamma distribution [14] due to an internal trading mechanism

where \(\theta _{1}=\left( \frac{2\gamma }{\sigma \delta ^{2}}\right) ^{1/\delta }\overline{w}_{L}\), \(\alpha _{1}=1-\frac{1}{\delta }+\frac{2\gamma }{\sigma \delta ^{2}}\). That is,

where \(\widetilde{C}_{1}\) satisfies \(\int _{R_{+}}f_{\infty }(w)dw=1\). Note that, if the agent does not accumulate wealth, namely the parameters \(\gamma =\delta =0\) and \(\Psi ^{\epsilon }_{\delta }(s)=0\), the steady-state solution (25) is an inverse gamma distribution (26). In the absence of an external mechanism, i.e., \(I_{E}=0\), the steady-state solution (25) is a generalized inverse gamma distribution

where \(\theta _{2}=\left( \frac{2\gamma }{\sigma \delta ^{2}}\right) ^{1/\delta }\overline{w}_{L}\), \(\alpha _{2}=1+\frac{1}{\delta }+\frac{2\gamma }{\sigma \delta ^{2}}\).

In addition, when \(w\rightarrow \infty \), we acquire \(f_{\infty }(w)\sim w^{-(2+\delta +\frac{2\gamma }{\sigma \delta })}\). Thus, the steady-state solution (25) has the Pareto tail [7], i.e., a fat tail. The Pareto index is \(1+\delta +\frac{2\gamma }{\sigma \delta }\). It is related to the transaction rate parameter \(\gamma \), the behavior parameter \(\delta \), and the variance \(\sigma \) of the random fluctuations, independent of the level of satisfactory wealth \(\overline{w}_{L}\) and the external mechanism parameter \(I_{E}\).

In (24), when \(\delta =1\), we derive the inverse gamma distribution of unit mass

where \(\mu =1+\frac{2\gamma }{\sigma }\), \(\rho =\frac{2(I_{E}M_{E}+\gamma \overline{w}_{L})}{\sigma }\). This result is consistent with the steady-state distribution structure of wealth in [12, 24].

When \(\delta \rightarrow 0\), the value function is (8) and \(K(w)=1/\epsilon \). After calculation, the steady-state solution is given by

where \(C_{2}\) satisfies \(\int _{R_{+}}f_{\infty }(w)dw=1\). Here, in the absence of an external mechanism, the steady-state solution of unit mass is a lognormal distribution with a slim tail, i.e.

where \(d=\frac{\sigma }{\gamma }\).

Next, we consider that \(I^{\epsilon }_{E}(w)\) depends on wealth w. Assuming that the transfer rate increases with w, a natural choice is

where the positive parameter \(\epsilon \ll 1\), the constant \(\nu >0\) denotes the maximum transfer rate from external mechanisms. This choice implies that the growth rate of wealth due to external mechanisms gradually stabilizes at a constant \(\epsilon \nu \) when \(w\rightarrow \infty \). Thus, (28) indicates that as the wealth w increases, agents are more likely to receive inheritance or capital gifts from others, but the received wealth is finite.

In this case, the steady-state solution of the Fokker–Planck equation (23) is the solution to the first-order differential equation

Letting \(g_{\infty }(w)=w^{2+\delta }f^{\infty }_{\nu }(w)\) and solving (29), we obtain the steady-state solution

where \(C_{3}\) satisfies \(\int _{R_{+}}f^{\infty }_{\nu }(w)dw=1\). In (30), the Pareto index is still \(1+\delta +\frac{2\gamma }{\sigma \delta }\). This result is consistent with that of (25). Thus, the transfer rate (28) does not change the tail structure of the steady-state solution.

The effects of different values of the parameters \(\gamma , \delta , \sigma \), and \(I_{E}\) on the wealth distribution (25) are given in Fig. 2. For the parameters \(\gamma \) and \(\delta \), which characterize the internal trading mechanism, it is observed that the wealth distribution curve keeps shifting to the left as \(\gamma \) or \(\delta \) increases. However, the dispersion of the wealth distribution is different, increasing \(\gamma \) makes the wealth distribution more concentrated and increasing \(\delta \) makes the wealth distribution more dispersed. As the parameter \(I_{E}\), which reflects the external mechanism, increases, the wealth distribution curve shifts to the right and the distribution becomes more dispersed. The impact of uncertainty on the wealth distribution is measured by the parameter \(\sigma \). When \(\sigma \) increases, the wealth distribution curve shifts left and the distribution becomes increasingly dispersed.

Graph of the steady-state wealth distribution (25) corresponding to different values of the parameters \(\gamma , \delta , I_{E}\) and \(\sigma \). For \(\overline{w}_{L}=1\) and \(M_{E}=1\), (a): \(\delta =\sigma =0.2\), \(I_{E}=1\); (b): \(\gamma =\sigma =0.2\), \(I_{E}=1\); (c): \(\gamma =\delta =\sigma =0.2\); (d): \(\gamma =\delta =0.2\), \(I_{E}=1\)

4 Control Problem

In the previous section, we discuss a kinetic model of individual wealth growth. The key to the construction of this model is the choice of the value function (11) for the interaction (1). The value function (11) characterizes the growth of individual wealth in terms of the parameters \(\gamma \) and \(\delta \), which ultimately leads to a steady-state solution with a Pareto tail. As we all know, the emergence of the Pareto tail indicates that most of the wealth in society is concentrated in the hands of a few people, which inevitably causes wealth inequality and brings crisis to the healthy development of society [28, 36]. In this case, it is necessary for the government to take measures to prevent the excessive growth of individual wealth and reduce the inequality of wealth distribution.

To study the influence of government measures (such as taxation and redistribution) on individual wealth growth, we embed a control variable \(\zeta \) (representing the external action of a government) into the elementary interaction (1) to provide an instantaneous correction for individual wealth growth. We consider incorporating control \(\zeta \) into the elementary interaction (1) in two ways. One is in the additive form [38], the elementary interaction is given by

where the small parameter \(\epsilon \ll 1\) is used to adjust the size of the controlled variable. The other is in the multiplicative form [38], the elementary interaction reads

which means a direct action on the internal trading mechanism.

The optimal control \(\zeta ^{*}\) is determined by the minimum value of the cost functional

subject to the constraints (31) or (32). In (33), \(\Theta \) denotes the space of all admissible controls. To obtain a steady-state analytical solution, we consider a quadratic cost functional in the form

where \(w_{e}>0\) is the wealth that the action implementer expects the individual to possess, \(\chi _{\epsilon }>0\) is a selective penalization coefficient, implying that the action implementer wants to adopt different measures to different wealth levels. The notation \(\langle \cdot \rangle \) indicates that the control obtained is independent of the random fluctuations. Equation (34) implies that the cost increases quadratically with the distance from the expected amount of wealth. This choice models the fact that more effort is required to control a greater amount of wealth.

4.1 Additive Control

In this section, we consider the effect of additive control on the steady-state solution. According to the discussion in Sect. 3, the choice of \(I^{\epsilon }_{E}(\cdot )\) as a constant or a function of wealth w does not affect the tail structure of the steady-state solution. Therefore, to simplify the calculation, we choose \(I^{\epsilon }_{E}(w)=\epsilon I_{E}\).

Using the constraint (31) and the cost functional (34), we formulate the Lagrangian function

where \(\iota \in R\) is a Lagrange multiplier. The first-order conditions read

In (35), eliminating the Lagrange multiplier, we obtain the optimal value

Substituting the optimal value \(\zeta ^{*}\) into Eq. (31) produces the optimal constrained interaction

If \(w<\overline{w}_{L}\), the function \(\Psi ^{\epsilon }_{\delta }\left( \frac{w}{\overline{w}_{L}}\right) \) is negative, ensuring the second term on the right-hand side of (36) is positive. In this case, the post-interaction value \(w_{*}\) is non-negative if \(\eta _{\epsilon }\) satisfies the condition

When \(w>\overline{w}_{L}\), since function \(\Psi ^{\epsilon }_{\delta }(\frac{w}{\overline{w}_{L}})\) is positive, a sufficient condition for \(w_{*}\) to be non-negative is

For \(w\in R_{+}\), we have

Equation (37) ensures that the post-interaction value \(w_{*}\) is non-negative.

In what follows, we consider the grazing collision limit as before. Assume that all relevant interaction parameters in the optimal constrained interaction (36) are scaled with respect to \(\epsilon \), where the penalization coefficient \(\chi _{\epsilon }\rightarrow \epsilon \chi \), \(\chi >0\). Then

Using a similar derivation as in Sect. 3, in the grazing collision limit \(\epsilon \rightarrow 0\), we obtain that the kinetic model with additive control converges to the Fokker–Planck equation with a modified drift term

where \(f_{a}(w,t)\) denotes the distribution of individual wealth growth after introducing the additive control. From (38), we acquire the steady-state solution

where \(C_{4}\) satisfies \(\int _{R_{+}}f_{a,\infty }(w)dw=1\).

Compared to (25), the steady-state solution (39) contains the form of the Gaussian density

with mean value \(w_{e}\) and variance \(\frac{\sigma \chi }{2}\). Note that the range of the variable w in (40) is the whole real line R. To be consistent with the range of the variable w in our model, it needs to be multiplied by an characteristic function of \(w\ge 0\), denoted by \(\mathcal {A}(w\ge 0)\). Thus, (39) is rewritten as the product of three densities, i.e.

where \(\widetilde{C}_{4}\) satisfies \(\int _{R_{+}}f_{a,\infty }(w)dw=1\). In (41), the presence of Gaussian density implies that by choosing the penalization coefficient \(\chi \) sufficiently small, the action implementer can move the agent’s wealth close to the desired wealth value \(w_{e}\) and achieve the purpose of control.

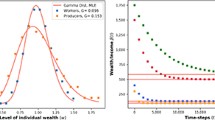

The steady-state wealth distribution (39) with different penalization coefficients is given in Fig. 3a. It is seen that as the penalization coefficient \(\chi \) decreases continuously, the agent’s wealth gets closer to the desired wealth \(w_{e}\). Figure 3b gives a graph of the individual wealth growth (25) versus the wealth distribution with additive controls (39). The results of the comparison imply that the additive control transforms the fat tails into slim tails and that the control becomes effective as \(\chi \) decreases.

4.2 Multiplicative Control

Similar to additive control, for the constraint (32) and the cost functional (34), the Lagrangian function is

where \(\iota \in R\) is a Lagrange multiplier. In this case, the first-order conditions are

Solving (42) yields the optimal control

Inserting \(\zeta ^{*}\) into (32) leads to the optimal constrained interaction

According to (11), if \(w<\overline{w}_{L}\), then \(\Psi ^{\epsilon }_{\delta }\left( \frac{w}{\overline{w}_{L}}\right) ^{2}\le \left( \frac{\gamma }{1-\gamma }\right) ^{2}\); if \(w>\overline{w}_{L}\), then \(\Psi ^{\epsilon }_{\delta }(\frac{w}{\overline{w}_{L}})^{2}\le H^{2}=(\frac{\gamma }{1-\gamma })^{2}e^{\frac{2\epsilon }{\delta }}\). After a simple calculation, the condition

guarantees that the post-interaction wealth is non-negative.

The optimal constrained interaction of multiplicative control (43) is different from that of additive control (36). In the absence of random fluctuations and external mechanisms in (43), the post-interaction wealth increases toward the desired value \(w_{e}\) when \(w<w_{e}\), and the post-interaction wealth decreases toward the desired value \(w_{e}\) when \(w>w_{e}\). While in (36), the change in wealth after interaction needs to compare the value \(\overline{w}_{L}\) and \(w_{e}\). Indeed, supposing \(\overline{w}_{L}<w_{e}\), the post-interaction wealth increases toward \(\overline{w}_{L}\) when \(w<\overline{w}_{L}\). For \(\overline{w}_{L}<w<w_{e}\), the constrained interaction (36) is a balance between a growth term and a decrease term. When \(w>w_{e}\), the change of wealth after the interaction is consistent with the multiplicative control.

As in Sect. 4.1, we apply the grazing collision limit by choosing \(\chi _{\epsilon }\rightarrow \epsilon \chi \), where \(\chi >0\), to obtain

Thus, in the limit \(\epsilon \rightarrow 0\), we get that the density \(f_{m}(w,t)\) satisfies the Fokker–Planck equation

where \(f_{m}(w,t)\) denotes the distribution of individual wealth growth after introducing the multiplicative control. Solving (44) produces

where \(C_{5}\) satisfies \(\int _{R_{+}}f_{m,\infty }(w)dw=1\), and for \(\delta \ne \frac{1}{2}\), \(\delta \ne 1\),

In particular, for \(\delta =\frac{1}{2}\), the steady-state solution is

where \(C_{6}\) satisfies \(\int _{R_{+}}f^{\infty }_{m,\delta =1/2}(w)dw=1\), and

When \(\delta =1\), the steady-state solution is given by

where \(C_{7}\) satisfies \(\int _{R_{+}}f^{\infty }_{m,\delta =1}(w)dw=1\).

In Fig. 4a, we give a graph of the steady-state wealth distribution (45) with different penalization coefficients. The figure illustrates that the agent’s wealth gradually tends to the required wealth \(w_{e}\) as the penalization coefficient \(\chi \) keeps decreasing. The graphs of the individual wealth growth (25) versus the wealth distribution with multiplicative control (45) is depicted in Fig. 4b, which presents that the multiplicative control also transforms the fat tails into slim tails and that the control becomes effective as \(\chi \) decreases.

In summary, both additive and multiplicative controls are used to manage the excessive growth of individual wealth. As can be seen in Figs. 3 and 4, the additive control approaches the required target quickly, while the multiplicative control approaches the required target gently.

5 Conclusion

In this article, we study the evolution problem of individual wealth growth and control by using kinetic theory. A value function characterizing the internal trading mechanisms is introduced into the elementary interaction. Inheritance, capital gifts from others, and capital gains from rising prices are treated as external mechanisms. Combining the non-Maxwell collision kernel, we construct the Boltzmann type equations for the growth of individual wealth. Under the grazing collision limit, the steady-state solution of the Fokker–Planck type equations is the product of an inverse gamma distribution and a generalized inverse gamma distribution. When the behavior parameter is equal to one, the steady-state solution is an inverse gamma distribution. If the behavior parameter tends to zero, a lognormal distribution resulting from the internal trading mechanism appears in the steady-state solution.

In response to the fat tail that characterizes the growth of individual wealth, we introduce control variables into the elementary interaction in two ways. One is additive control, which instantaneously corrects for changes of wealth in terms of an external action. The other is multiplicative control, which instantaneously corrects for changes of wealth by acting on internal trading mechanisms. The results illustrate that both control methods can transform fat tails into slim tails and achieve the goal to prevent the excessive growth of individual wealth.

Data Availability

Data sharing is not applicable to this article as no datasets were generated or analysed during the current study.

References

Albi, G., Pareschi, L., Zanella, M.: Opinion dynamics over complex networks: kinetic modelling and numerical methods. Kinet. Relat. Model 10(1), 1–32 (2017)

Ajmone Marsan, G., Bellomo, N., Gibelli, L.: Stochastic evolutionary differential games toward a systems theory of behavioral social dynamics. Math. Models Methods Appl. Sci. 26, 1051–1093 (2016)

Aristov, V.V.: Biological systems as nonequilibrium structures described by kinetic methods. Results Phys. 13, 102232 (2019)

Ballante, E., Bardelli, C., Zanella, M., Figini, S., Toscani, G.: Economic segregation under the action of trading uncertainties. Symmetry 12, 1390 (2020)

Bellomo, N., Burini, D., Dosi, G., Gibelli, L., Knopof, D., Outada, N., Terna, P., Virgillito, M.E.: What is life? A perspective of the mathematical kinetic theory of active particles. Math. Models Methods Appl. Sci. 31(9), 1821–1866 (2021)

Bisi, M., Spiga, G., Toscani, G.: Kinetic models of conservative economies with wealth redistribution. Commun. Math. Sci. 7, 901–916 (2009)

Bisi, M.: Some kinetic models for a market economy. Boll. Unione Mat. Ital. 10, 143–158 (2017)

Boghosian, B.M., Devitt-Lee, A., Johnson, M., Marcq, J.A., Wang, H.: Oligarchy as a phase transition: the effect of wealth-attained advantage in a Fokker–Planck description of asset exchange. Physica A 476, 15–37 (2017)

Brugna, C., Toscani, G.: Kinetic models for goods exchange in a multi-agent market. Physica A 499, 362–375 (2018)

Chakraborti, A., Chakrabarti, B.K.: Statistical mechanics of money: effects of saving propensity. Eur. Phys. J. B 17, 167–170 (2000)

Chatterjee, A., Chakrabarti, B.K., Manna, S.S.: Pareto law in a kinetic model of market with random saving propensity. Physica A 335, 155–163 (2004)

Cordier, S., Pareschi, L., Toscani, G.: On a kinetic model for a simple market economy. J. Stat. Phys. 120, 253–277 (2005)

Cordier, S., Pareschi, L., Piatecki, C.: Mesoscopic modelling of financial markets. J. Stat. Phys. 134(1), 161–184 (2009)

Crooks, G.E.: The Amoroso distribution. Statistics (2010). https://arxiv.org/pdf/1005.3274v1.pdf.

Devitt-Lee, A., Wang, H., Li, J., Boghosian, B.: A nonstandard description of wealth concentration in large-scale economies. SIAM J. Appl. Math. 78(2), 996–1008 (2018)

Dimarco, G., Toscani, G.: Kinetic modeling of alcohol consumption. J. Stat. Phys. 177, 1022–1042 (2019)

Dimarco, G., Toscani, G.: Social climbing and Amoroso distribution. Math. Models Methods Appl. Sci. 30(11), 2229–2262 (2020)

Dolfin, M., Lachowicz, M.: Modeling altruism and selfishness in welfare dynamics: the role of nonlinear interactions. Math. Models Methods Appl. Sci. 24(12), 2361–2381 (2014)

Dolfin, M., Lachowicz, M.: Modeling opinion dynamics: how the network enhances consensus. Netw. Heterog. Media 4, 877–896 (2015)

Dolfin, M., Leonida, L., Outada, N.: Modeling human behavior in economics and social science. Phys. Life Rev. 22–23, 1–21 (2017)

Düring, B., Toscani, G.: International and domestic trading and wealth distribution. Commun. Math. Sci. 6, 1043–1058 (2008)

Düring, B., Pareschi, L., Toscani, G.: Kinetic models for optimal control of wealth inequalities. Eur. Phys. J. B 91(10), 265 (2018)

Furioli, G., Pulvirenti, A., Terraneo, E., Toscani, G.: Fokker–Planck equations in the modelling of socio-economic phenomena. Math. Models Methods Appl. Sci. 27, 115–158 (2017)

Furioli, G., Pulvirenti, A., Terraneo, E., Toscani, G.: Non-Maxwellian kinetic equations modeling the dynamics of wealth distribution. Math. Models Methods Appl. Sci. 30, 685–725 (2020)

Gualandi, S., Toscani, G.: Call center service times are lognormal. A Fokker–Planck description. Math. Models Methods Appl. Sci. 28, 1513–1527 (2018)

Gualandi, S., Toscani, G.: Human behavior and lognormal distribution. A kinetic description. Math. Models Methods Appl. Sci. 29, 717–753 (2019)

Gualandi, S., Toscani, G.: The size distribution of cities: a kinetic explanation. Physica A 524, 221–234 (2019)

Islam, M.R., McGillivray, M.: Wealth inequality, governance and economic growth. Econ. Model. 88, 1–13 (2020)

Kahneman, D., Tversky, A.: Prospect theory: an analysis of decision under risk. Econometrica 47(2), 263–292 (1979)

Kahneman, D., Tversky, A.: Choices, Values, and Frames. Cambridge University Press, Cambridge (2000)

Li, J., Boghosian, B.M., Li, C.: The affine wealth model: an agent-based model of asset exchange that allows for negative-wealth agents and its empirical validation. Physica A 516, 423–442 (2019)

Maldarella, D., Pareschi, L.: Kinetic models for socio-economic dynamics of speculative markets. Physica A 391, 715–730 (2012)

Pareschi, L., Toscani, G.: Interacting Multiagent Systems. Kinetic Equations & Monte Carlo Methods. Oxford University Press, Oxford (2013)

Pareschi, L., Toscani, G.: Wealth distribution and collective knowledge. A Boltzmann approach. Philos. Trans. R. Soc. A 372, 1–15 (2014)

Piketty, T.: On the long-run evolution of inheritance: France 1820–2050. Q. J. Econ. 126(3), 1071–1131 (2011)

Piketty, T.: About capital in the twenty-first century. Am. Econ. Rev. 105(5), 1–15 (2015)

Polk, S.L., Boghosian, B.M.: The nonuniversality of wealth distribution tails near wealth condensation criticality. SIAM J. Appl. Math. 81(4), 1717–1741 (2021)

Preziosi, L., Toscani, G., Zanella, M.: Control of tumor growth distributions through kinetic methods. J. Theor. Biol. 514(6), 110579 (2021)

Tobin, J., Golub, S.: Money, Credit and Capital. McGraw-Hill/Irwin, Boston (1998)

Toscani, G.: Kinetic models of opinion formation. Commun. Math. Sci. 4, 481–496 (2006)

Toscani, G., Brugna, C., Demichelis, S.: Kinetic models for the trading of goods. J. Stat. Phys. 151, 549–566 (2013)

Toscani, G.: Statistical description of human addiction phenomena. Trails Kinet. Theory 25, 209–226 (2019)

Trimborn, T., Pareschi, L., Frank, M.: Portfolio optimization and model predictive control: a kinetic approach. Discret. Cont. Dyn. B 24(11), 6209–6238 (2019)

Villani, C.: On a new class of weak solutions to the spatially homogeneous Boltzmann and Landau equations. Arch. Ration. Mech. Anal. 143, 273–307 (1998)

Villani, C.: A review of mathematical topics in collisional kinetic theory. In: Friedlander, S., Serre, D. (eds.) Handbook of Mathematical Fluid Dynamics. Elsevier Press, New York (2002)

Acknowledgements

This research is supported by the National Natural Science Foundation of China (No. 11471263). The authors are very grateful to the reviewers for their helpful and valuable comments, which have led to a meaningful improvement of the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Communicated by Pierpaolo Vivo.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhou, X., Lai, S. A Kinetic Description of Individual Wealth Growth and Control. J Stat Phys 188, 30 (2022). https://doi.org/10.1007/s10955-022-02961-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10955-022-02961-z