Abstract

This study considers a hypothetical global pediatric vaccine market where multiple coordinating entities make optimal procurement decisions on behalf of countries with different purchasing power. Each entity aims to improve affordability for its countries while maintaining a profitable market for vaccine producers. This study analyzes the effect of several factors on affordability and profitability, including the number of non-cooperative coordinating entities making procuring decisions, the number of market segments in which countries are grouped for tiered pricing purposes, how producers recover fixed production costs, and the procuring order of the coordinating entities. The study relies on a framework where entities negotiate sequentially with vaccine producers using a three-stage optimization process that solves a MIP and two LP problems to determine the optimal procurement plans and prices per dose that maximize savings for the entities’ countries and profit for the vaccine producers. The study’s results challenge current vaccine market dynamics and contribute novel alternative strategies to orchestrate the interaction of buyers, producers, and coordinating entities for enhancing affordability in a non-cooperative market. Key results show that the order in which the coordinating entities negotiate with vaccine producers and how the latter recuperate their fixed cost investments can significantly affect profitability and affordability. Furthermore, low-income countries can meet their demands more affordably by procuring vaccines through tiered pricing via entities coordinating many market segments. In contrast, upper-middle and high-income countries increase their affordability by procuring through entities with fewer and more extensive market segments. A procurement order that prioritizes entities based on the descending income level of their countries offers higher opportunities to increase affordability and profit when producers offer volume discounts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Highlights

-

Vaccine profitability and affordability can be enhanced by orchestrating how and when markets buy vaccines, even for a non-cooperative system.

-

Vaccine affordability for low-income and low-middle-income countries can be improved if they pool-procure via multiple coordinated entities, while high- and upper-middle-income countries buy vaccines via fewer but larger pool-procuring groups.

-

Pool-procurement groups for low- and low-middle-income countries should have multiple price levels per vaccine to enhance affordability, which opposes the current single-price strategy followed by multi-lateral organizations for most pediatric vaccines.

-

The order of procurement can enhance affordability for different vaccine market segments.

2 Introduction

Pediatric vaccines are credited for saving more than 2 million lives every year [1]. They are among the most cost-effective public healthcare interventions ever employed, as treating ill patients is more expensive than preventing diseases through immunization [2]. [3] estimates that in the US alone, pediatric vaccines saved over $1.38 trillion in total societal costs between 1994 and 2013.

The global pediatric vaccine market consists of countries that procure vaccines from a limited set of producers to satisfy their immunization needs. High- and upper-middle-income countries typically buy vaccines on their own via public and private purchases. In contrast, lower-income countries rely on pool procurement and tiered pricing to take advantage of economies of scale and secure better prices [4, 5]. For example, over thirty Latin American countries procure vaccines as a group through the Pan American Health Organization (PAHO)’s Revolving Fund. Similarly, the United Nations Children’s Fund (UNICEF) procures vaccines for nearly 70 low- and lower-middle-income countries eligible to receive financial support from donors such as Gavi, the Vaccine Alliance. Gavi is a multi-lateral organization with private and public donors that works to improve affordable vaccine access in the poorest countries of the world [6]. All countries buying vaccines through either PAHO’s Revolving Fund or UNICEF pay the same price per dose for a given vaccine, although Gavi has different co-financing levels with different countries.

Pooled procurement also benefits vaccine producers. By securing more affordable vaccines for low-income countries, PAHO, UNICEF, and Gavi have established a more stable and predictable pediatric vaccine demand [7], facilitating their manufacturing and allowing producers to use tiered pricing to push vaccine inventories [8]. Furthermore, PAHO and UNICEF act as coordinators between buyers and producers. These coordinators negotiate vaccine prices at the most affordable levels for their countries while ensuring that the vaccine market remains financially attractive without jeopardizing future supply at such prices. Although PAHO and UNICEF collaborate, they purchase independently to secure supplies for their countries. Consequently, PAHO and UNICEF have each their own pricing levels. A situation in which buyers negotiate independently with limited cooperation can increase the number of possible market configurations: whether some buyers are prioritized over others and how pricing decisions differ between buyers. Those complications could be modeled and studied as hypothetical scenarios to determine their effect on buyers and producers.

Through tiered pricing, producers set different price levels for a vaccine depending on the buyers’ income levels [8]. Traditionally, vaccine producers have grouped countries into four tiers (market segments) : high-, upper-middle-, low-middle-, and low-income countries, following The World Bank country classification (see Table 1); but some producers have their own tier structures for different vaccines. Reselling low-priced vaccines to higher-income countries is usually not feasible due to market regulations, cold-chain logistics restrictions, and differences in immunization schedules. Pooled procurement and tiered pricing are not mutually exclusive, so even countries cooperating in the vaccine negotiation may not pay the same prices if they are in different market segments.

Despite the positive effect of tiered pricing and pooled procurement, pediatric vaccines are not always available and affordable for low-income countries. The World Health Organization ([10]) estimates that 19.5 million infants did not have access to essential vaccines in 2018 [10,11,12]. The attention given to other emergencies, such as the COVID-19 pandemic, could also result in the reallocation of funds away from established immunization programs, which compete for the same logistical capacity for delivering and storing vials. Unless immunization programs are fully restored, and access to affordable vaccines strengthened, COVID-19 interruptions to routine immunization programs could result in more than a million deaths among African children [13]. There are additional reasons for the lack of access to pediatric vaccines, including (1) the vaccine supply by volume is highly concentrated in a limited number of producers [2]; (2) the monetary value of the vaccine market is concentrated on sales to high-income countries; (3) logistics factors affect vaccine distribution and increase costs; (4) weak local immunization programs; (5) political turmoil disrupting immunization campaigns; and (6) low national health investments.

This study explores how uncertainties derived from pooled procurement and tiered pricing affect countries with different income levels. To that end, we consider a hypothetical globally-coordinated pediatric vaccine market where demand for multiple antigens is met via a single tenderFootnote 1. In this pediatric global vaccine market, multiple coordinating entities procure doses on behalf of countries grouped into market segments based on their income level.

In contrast to UNICEF’s and PAHO’s single-price markets, it is assumed that each coordinating entity can have multiple price levels per vaccine (i.e., it can negotiate on behalf of different market segments). The entities make vaccine procurement decisions that foster an affordable and profitable vaccine market by determining the optimal amount of vaccines to buy at each of their market segments and the range of affordable prices that ensure a desired profitability for the producers. We consider a vaccine affordable to a market segment if its price per dose is lower than its average willingness-to-pay among the countries in the market segment. Furthermore, it is assumed that the coordinating entities are trusted intermediaries that seek no financial benefit for themselves and do not cooperate with each other in making their procuring recommendations.

We consider that during a procuring cycle (e.g., a year), non-cooperative entities buy vaccines to clear their markets’ antigen demands through a sequence of negotiations with the producers. This procuring sequence is important since a successful negotiation reduces the available supply for other entities in subsequent negotiations. Furthermore, producers can offer discounts to push inventory, affecting subsequent procurement decisions. In this study, the coordinating entities’ procuring order is based on the average income of their represented countries. We explore an ascending and a descending procuring order.

In this study, the investment costs to manufacture vaccines are annualized. These costs incorporate a desired return on investment high enough to cover fixed costs for the commercialized vaccine products’ research, development, and manufacturing. Under a market with non-cooperative coordinating entities, it is assumed that producers can follow two policies to recover their annualized fixed costs: (1) offering discounts on vaccines whose supply has been partially sold to other entities, and (2) offering no discounts.

Under this framework, we investigate the effects of four relevant factors on the global affordability and profit: (1) the number of market segments in which countries are grouped, (2) the number of coordinating entities in the global vaccine market, (3) the order those coordinating entities follow to buy vaccines, and (4) whether producers push their products via discounts.

To address the effect of those factors, we extend the mathematical framework proposed by [14], which determines vaccine procurement plans for a globally coordinated vaccine market with a single coordinating entity. We enrich this framework to handle a fragmented global vaccine market where multiple entities can make non-cooperative procurement decisions sequentially. Due to this sequential negotiation, the producers have the option of discounting their vaccine prices at subsequent negotiation rounds. The framework proposed in this study permits exploring the isolated effect of a varying level of procurement cooperation among numerous coordinating entities.

This paper is organized as follows: Section 2 reviews relevant literature on pediatric vaccine pricing and group buying studies. Section 3 describes the mathematical model and the three-stage optimization process, the experimental framework, and the performance metrics used in this study. Sections 4 and 5 describe the experimental data and the study’s results. Finally, Section 6 offers a discussion and relevant extensions.

3 Literature review

This section reviews the literature on group buying and mathematical modeling of pediatric vaccine pricing. Although there is abundant literature on general group buying and its effects on tiered pricing [15,16,17,18], we are unaware of studies considering group buying for vaccines. Vaccine pricing studies that rely on mathematical programming models have focused on the pricing of a new vaccine into a single competitive market or its logistic distribution within that market [19,20,21,22,23,24]. Proano et al. [14] proposes a mathematical programming model and a three-stage optimization-based process to explore a hypothetically coordinated vaccine market where the number of vaccines to buy and their prices maximize affordability and profit. From an economic perspective, several studies question the mechanisms through which pediatric vaccines are sold and how they affect their affordability [25,26,27,28]. Studies on vaccine pricing based on cost-benefit analysis vary broadly and without consensus, highlighting the difficulty of valuing preventive care and saving lives over multiple regions [29,30,31,32,33,34].

The literature on group buying focuses on pool procurement and its effects on affordability and profit. It considers scenarios with unlimited supplies, a single product, a producer, and an online mediator that charges membership fees to allow customers access to price discounts [15,16,17,18]. These assumptions are used in modeling frameworks that capture the relationship between order quantities, price, and the benefit of joining a group. Those assumptions may not adequately fit the characteristics of the vaccine market, which has no membership fees to access discounted prices. In the global vaccine market, countries need to meet other criteria to be part of a group, such as being in a geographical region or having specific income levels.

Hu et al. [15] assumes that a set of customers can be coordinated into group buying entities negotiating online deals with a single seller. The study deals specifically with sequencing buyers, as the negotiating order can affect whether or not there is enough demand to justify the deal. Hu et al. [15] relies on game theory to model the interaction between customers and the seller, considering a sequence of discrete interaction periods in which several customers may choose independently. Buyers in the study have the option of not satisfying their demand or choosing outside sources not represented in the model.

Under a general coordinated group-buying framework, Yang et al. [16] studies the conditions that might make it more advantageous for sellers to serve each participating buyer in a given market. The study assumes that the seller can obtain other business if the entities refuse to negotiate.

Chen and Roma [17] models group-buying through a three-step process involving producers, retailers, and buyers. Retailers can choose whether to cooperate with a group-buying entity or not. Assuming a linear demand, Chen and Roma [17] suggest that group-buying might be more advantageous to smaller, less powerful retailers than to bigger ones under a non-cooperative environment.

Anand and Aron [18] considers group-buying mechanisms for a monopoly on web-based transactions under uncertain demand. Customer product valuations are uncertain and unknown. However, such uncertainties may not hold for the vaccine market [35]. Any variations in purchased quantities are more likely to come from changes in available budgets, existing stockpile levels, reactions to outbreaks, logistical issues, and political instabilities than from birth rate changes.

Game theory models have been the core of several studies on vaccine pricing decision problems [19,20,21,22,23]. These studies have focused on the impact of new vaccines in a single market, ignoring the implications of potential buyer coordination.

Robbins et al. [21] uses a game theory model to frame the US vaccine market as an oligopoly of asymmetric producers in a Bertrand competition where each producer can supply the entire market. The paper proposes a mathematical approach to capture oligopolistic interactions for the US market that result in different pricing strategies.

Other studies address vaccine pricing through mathematical programming models [36,37,38,39], assuming a central planner for the US market without considering supply limitations. Additional studies have focused on determining how combination vaccines fit the overall schedule for the US market under a central planner [40,41,42,43]. While considering low- and lower-middle-income countries, Yang [24] proposes a general model for vaccine distribution within a country without considering pricing.

Proano et al. [14] proposes an optimization-based methodology to model pricing coordination between different market segments and producers in the global pediatric vaccine market, where a single coordinating entity acts as a decision-maker aiming to improve affordability and profit simultaneously. Countries are grouped in market segments to procure vaccines from multiple producers via a single trusted intermediary who determines affordable and profitable procuring quantities and prices. The procurement is done via a synchronized multi-antigen tender. The feasible prices satisfy tiered pricing constraints, ensure a desired profitability to the producers, and are lower than the market’s reservation prices.

Proano et al. [14] shows that it is possible to price vaccines affordably for all coordinated market segments (including high-income markets) when the supply of combination vaccines is accessible to all market segments. Additionally, Proano et al. [14] shows that the total social surplus (i.e., the total welfare resulting from aggregating savings and profit) is a consequence of the choice and volume of vaccines procured.

Considering a hypothetically coordinated vaccine market with a single entity, Mosquera [44] extends Proano et al. [14] to evaluate the effect on profits and affordability of varying the number of market segments in which countries are grouped, considering uncertainty on the vaccines’ reservation prices, and different levels for the producers’ return of investment. Mosquera [44] concludes that grouping countries into more market segments improves the affordability of low-income countries while decreasing the profits of vaccine producers. However, increasing the number of market segments in which low- and low-middle-income countries are grouped while decreasing the number of market segments for upper-middle- and high-income countries could expand affordability for low-income countries without affecting profit levels or making vaccines prohibitively expensive for the high-income countries (i.e., vaccines remain priced below each market’s reservation price). Mosquera [44] also shows that uncertainty in reservation prices and the return on investment rates do not have a significant effect on affordability.

This study differentiates from [14] and [44] by modeling market dynamics with multiple non-cooperative coordinating entities that compete to secure higher savings for their countries while maintaining a profitable market. The proposed framework allows controlling three effects absent in the [14] and [44] studies: the number of coordinating entities, the order of procurement for those coordinating entities, and the way producers adjust their investment expectations after negotiating with each entity.

Several studies have focused on Gavi, an existing coordinating entity for the vaccine market, and its impact on countries when they are no longer eligible for its financial support [7, 45, 46]. Saxenian et al. [45] evaluates the readiness of 16 countries if they stop receiving financial assistance from Gavi as they graduate, concluding that the incremental financial load on graduating countries may provoke these countries to cancel or scale down immunization programs and face issues with their vaccine supply [45], potentially decreasing their coverage levels.

Frontieres [25] discusses how the GNI-based tiered pricing does not guarantee higher affordability and might instead limit access to vaccines that become prohibitively expensive for countries that transition from low-income to lower-middle-income. This criticism is shared by [26], claiming that tiered pricing may overburden middle-income countries in an unsustainable manner while incentivizing producers to focus on the higher profits obtained from high-income markets.

4 Methodology

This study proposes the Group Vaccine Allocation (GVA) model, a three-stage mathematical programming framework, to optimize the procurement decisions of one coordinating entity at a time. We apply GVA to an ordered set of coordinating entities to test the influence on affordability and profit of four factors: (F1) the number of market segments in which 194 countries are grouped; (F2) the number of coordinating entities facilitating procurement in the global market; (F3) the order followed by the entities in negotiating their procurement plans; and (F4) the producers adjusting minimum prices to recover their return on investment (i.e., offering discounts on leftover vaccine supply). Each experimental factor has multiple levels. For each combination of levels in an experimental instance , we create multiple replications by randomizing the vaccines’ reservation prices in each market segment. For each of these experimental instances, the GVA problem is sequentially solved for each coordinating entity following a procuring order. Before solving the GVA for the next entity in the sequence , the overall antigen demand and vaccine supply are adjusted to account for the latest entity’s purchases.

The GVA iteratively solves a sequence of three optimization problems. For each entity in the current negotiation round, the first stage determines vaccine quantities that maximize the total social surplus of all market segments served by the entity. This total social surplus aggregates the markets’ savings and producers’ profits. The second stage determines a lower bound on the prices for the procured vaccines that maintain the optimal total social surplus, and the third stage determines their upper bounds. Prices per dose between these bounds also maximize the total social surplus. The lower-bound prices correspond to the most affordable and least profitable vaccine prices per dose, while the upper-bound prices correspond to the least affordable and most profitable prices. The GVA ensures that these prices are lower than the reservation prices for each vaccine at each entity’s market segments. Without loss of generality, the GVA is solved for a one-year procurement cycle, assuming that all countries in a global market are served by coordinating entities that make procurement decisions on their behalf.

4.1 GVA: group vaccine allocation model

Through its three stages, the GVA determines a vaccine procurement plan and the feasible range of prices per dose that maximize savings for the entity’s market segments and profits for the vaccine producers (i.e., the total social surplus). The following notation and formulation describe the GVA:

Sets:

- B::

-

set of vaccines

- A::

-

set of antigens offered through immunization

- E::

-

set of coordinating entities

- M::

-

set of all market segments

- \(M_e\)::

-

set of market segments that procure through coordinating entity \(e \in E\)

- P::

-

set of vaccine producers

- \(B^1_a\)::

-

set of vaccines offering antigen \(a \in A\)

- \(Q_b\)::

-

sets of vaccines that together offer the same antigen protection as vaccine \(b \in B\), and are fabricated by the same producer.

- \(N_q\)::

-

vaccines in each subset \(q \in Q_b\).

- \(L_t\)::

-

set of all countries that qualify as \(t \in \lbrace \) low-income (LIC) , lower-middle-income (LMIC), upper-middle-income (UMIC), high-income (HIC) \(\rbrace \)

Parameters:

- \(R_{bm}\)::

-

Reservation price of vaccine \(b \in B\) in market segment \(m \in M\). The maximum price per dose that the market \(m\in M\) is willing to pay for vaccine \(b \in B\). \(R_{bm}\) corresponds to the average reservation price for countries in market m.

- \(l_m\)::

-

Average birth cohort per year in market \(m \in M\).

- \(C_b\)::

-

Annualized production, research, and development fixed costs necessary to manufacture vaccine \(b \in B\), considering a desired rate of return.

- \(d_{am}\)::

-

Number of doses of antigen \(a \in A\) needed to immunize a child in market \(m\in M\) according to the market’s immunization schedule.

- \(D_{bm}\)::

-

Maximum number of doses of vaccine \(b \in B\) allowed per child in market segment \(m \in M\) to avoid over-immunization (i.e., children receiving more doses than recommended for any of the antigens provided by vaccine \(b \in B\)).

- \(S_b\)::

-

Total supply of vaccine \(b \in B\)

- \(\hat{s}_b\)::

-

Remaining supply of vaccine \(b \in B\) at the current round of negotiations, updated after each coordinating entity negotiates.

- \(gni_m\)::

-

Average gross national income (GNI) per capita among the countries in market segment \(m \in M\)

- \(\alpha _{bm}\)::

-

Scaling factor that increases the price per dose of vaccine \(b \in B\) for market segment \(m \in M\) when purchase quantities are smaller than the available supply. It is part of an elasticity constraint incentivizing larger purchases, and equal to \(\frac{R_{bm}S_b}{C_b} - 1\).

- \(u_b\)::

-

Minimum price per dose the producer of vaccine \(b \in B\) would accept .

- \(\psi \)::

-

Monetary penalty for every unmet dose of vaccine demand.

- \(\eta \)::

-

Monetary penalty for producing vaccines that do not add social surplus. \(\eta \) prevents plans in which a vaccine is produced (\(g_b=1\)) but not bought (\(\sum _{m \in M} X_{bm} =0\)). In the numerical example, \(\eta = 1\).

Variables:

-

1.

\(X_{bm}\): Doses of vaccine \(b \in B\) to be purchased by market segment \(m \in M\)

-

2.

\(Y_{bm}\): Price per dose of vaccine \(b \in B\) in market segment \(m \in M\)

-

3.

\(g_b\): Binary variable indicating whether \(b \in B\) is being produced (i.e., \(g_b =1\)) or not (i.e., \(g_b=0)\)

-

4.

\(O_{am}\): Unmet demand of antigen \(a \in A\) in market segment \(m \in M\)

4.1.1 Stage 1: Maximizing Total Social Surplus (TSS)

For each entity \(e \in E:\)

In Stage 1, the mixed integer programming model described above determines all procurement quantities \(X_{bm}\) of vaccine b in each of the market segments \(m \in M_e\) of entity e that maximize total social surplus, penalizes not meeting antigen demands, and results in the lowest number of vaccine choices. We define the total social surplus as the sum of the total profits for producers \(\left( \sum _{b \in B}\sum _{m \in M_e}X_{bm}Y_{bm} - \sum _{b \in B}C_b \frac{\sum _{m \in M_e} X_{bm}}{S_b}\right) \) and the total savings for the market segments \(\left( \sum _{b \in B}\sum _{m \in M_e} \right. \) \( \left. (R_{bm}-Y_{bm})X_{bm}\right) \).

In the non-cooperative scenario, the producers’ revenue is generated from sequential negotiations between the producers and the coordinating entities. Therefore, the fraction of annualized fixed costs covered from vaccine sales can only be determined after all the entity negotiations have been completed. Additionally, GVA’s Stage 1 model considers that the price per dose decreases linearly as procurement quantities increase. Failure to meet demand is possible but intensely penalized.

Since we aim to increase affordability for target low-income countries, the objective function in (1) simultaneously maximizes total social surplus for an entity’s negotiation and, through penalty multipliers, minimizes gaps in meeting its vaccine demands. The total social surplus contribution from each entity considers the fraction of the annualized fixed costs resulting from the number of vaccines bought in the current iteration \(\left( i.e., \frac{\sum _{m \in M}X_{bm}}{S_b}\right) \). The closer the purchase of a vaccine is to its total supply, the higher the proportion of the fixed costs covered by the entity. The objective also minimizes the gap between the vaccine purchases and the entity’s market segments’ demands. The penalty term \(\left( \psi \sum _{a\in A, m \in M}O_{am}\right) \) in objective (1) allows for small gaps in meeting demands. Together, this penalty term and constraint (7) ensure that the procured vaccine quantities closely meet the markets’ antigen demands, avoiding infeasibility if the demand cannot be entirely satisfied. We use \(\psi = 10^6\) in our numerical experiments to ensure that our solutions fulfill as much of the demand as possible (i.e., we prioritize meeting the demand for vaccines over profits or savings). The last term in (1) minimizes the number of vaccine types used in the entity’s procurement plan. Note that any value of \(\eta > 0\) would be sufficient to induce the desired behavior. In our numerical example, we use \(\eta = 1\).

Constraint (2) ensures that the price negotiated for a combination vaccine is higher than the sum of the prices of the bundles of vaccines from the same producer that can offer similar antigen protection (e.g., the price of a vaccine containing antigens for diphtheria-tetanus-pertussis (DTP) and hepatitis B is higher than buying separate vaccines against hepatitis B and DTP from the same producer). For any given vaccine \(b \in B\) there is a set of vaccine bundles \(Q_b\) whose elements are sets of vaccines offering the same antigen protection as b. Each of the bundles in \(Q_b\) are vaccines made by the same producer of b. For example, consider the case of a manufacturer producing five vaccines: DTP-IPV-HiB, IPV-HiB, DTP, HiB, IPV. Then, \(Q_{\text {DTP-IPV-HiB}} = \left\{ N_1, N_2 \right\} \) where \(N_1 = \left\{ \text {IPV-HiB, DTP}\right\} \), and \(N_2=\left\{ \text {DTP, HiB, IPV}\right\} \). Constraint (2) ensures that the value of DTP-IPV-HiB is higher than the value of \(N_1\) or \(N_2\).

Constraint (3) ensures that purchases do not exceed the available vaccine supply in that round of negotiations.

If coordinating entities do not cooperate, vaccine producers cannot guarantee that the annualized R &D and production fixed costs are fully recovered until all entity negotiations are completed, and all vaccine purchases are known. Thus, under a non-cooperative scenario, procurement decisions are iteratively made for one coordinating entity at a time without complete information about the purchases made by other coordinating entities.

Constraint (4) induces economies of scale by adjusting prices per dose based on the purchased volume. If a vaccine negotiated in previous rounds still has available supply, the constraint incentivizes buying as many doses as possible in the current round. If the entire supply of a vaccine is being bought, constraint (4) guarantees the price per dose is low but sufficient to cover the annualized fixed costs (i.e., \(Y_{bm} \ge \frac{C_b}{S_b}\)). When purchasing less than the entire available supply, \(\hat{s}\), prices increase by a factor \(\alpha _{bm}\) to mitigate the risk that producers will not recover their fixed costs in following entity negotiations. The value of \(\alpha _{bm}\) is equal to (\(R_{bm} \frac{S_b}{C_b} -1\)) and ensures that –for any produced vaccine– its price per dose remains between the lowest level necessary to cover fixed cost and its reservation prices (i.e., \(\frac{C_b}{S_b} \le Y_{bm} \le R_{bm}\).) Appendix B describes how the value of \(\alpha _{bm}\) is determined.

Constraint (5) guarantees that the negotiated prices do not exceed the reservation prices for each vaccine in each market segment. Constraint (6) forces prices per dose to be above a pre-established minimum the producer of a given vaccine \(b \in B\) would be willing to accept (in our numerical example, we use \(u_b = \$0.20 ~\forall ~ b \in B\)) [7, 47]. Constraint (7) guarantees that the coordinating entities do not buy more vaccines than their demand. Constraint (8) prevents optimal vaccine purchases for a market segment from exceeding its needs.

4.1.2 Stage 2: Maximizing Total Customer Surplus (TCS)

For each entity \(e \in E\):

In Stage 2, for each entity e, a linear programming model maximizes the savings that the entity’s market segments can obtain by procuring vaccines at prices lower than their average reservation prices (i.e., the market’s reservation price), considering as inputs the vaccine quantities resulting from the solution of the Stage 1 problem (\(X^{*}\)). The Stage 2 problem establishes a lower bound on vaccine prices that maintain the optimal total social surplus from Stage 1 at profitable prices to the producers. At the same time, the market segments extract as much customer surplus as possible. Since profits can only be calculated once all coordinating entities complete their negotiations, the Stage 2 model determines vaccine prices that facilitate securing the desired return on investment from entity e’s procuring decisions.

4.1.3 Stage 3: Maximizing Total Profits, (TPF)

For entity \(e\in E:\)

In Stage 3, a similar linear programming model maximizes profits for the vaccine allocations resulting from Stage 1 for entity e. This LP formulation establishes an upper bound on the vaccine prices that maintain the optimized total social surplus from Stage 1 without exceeding the reservation prices beyond \(R_{bm}\).

It is assumed that all market segments can purchase any vaccine. Table 2 summarizes the constraints enforced at each stage of the GVA for an entity and a problem instance.

While in a fully cooperative market, it is possible to estimate the global profit. In a non-cooperative framework with a sequential procurement process, it is not trivial to determine how much of the fixed costs are covered by negotiating with each coordinating entity. For this reason, the objective function (13) is similar to (4) but considers that the annualized fixed costs are proportional to the fraction of the supply sold to the entity. Since the total profits cannot be estimated until all entities have completed their procurement, we also report on the actual revenue. Finally, after each entity negotiation round, any remaining supply is available for subsequent coordinating entities.

The feasible region ((2)-(11)) for the Stage 1 problem of a coordinated fully cooperative framework is less restrictive than the feasible region of a non-cooperative framework because the latter is solved iteratively for each coordinating entity. Hence, the total social surplus of a cooperative framework is an upper bound for the total social surplus of a non-cooperative framework.

The results of Stages 2 and 3 depend on the procurement plans determined in Stage 1. Hence, their feasible regions are not necessarily the same for the cooperative and non-cooperative frameworks (e.g., vaccine purchases for the fully cooperative framework may not be the same as determined by coordinating entities optimizing savings for their own subset of market segments). Therefore, the non-cooperative negotiation can extract a greater total customer surplus or total profit than a fully cooperative market. Nevertheless, the total social surplus of a non-cooperative negotiation remains lower than that of a fully cooperative framework.

After the GVA has been applied to all entities, the overall profit corresponds to the revenue obtained from sales to all entities minus the annualized fixed costs for all procured vaccines. Producing a vaccine is not financially sustainable if it has negative profit even at the highest acceptable price levels in the optimal procurement plan. Similarly, a vaccine is guaranteed to do financially well if the profit is positive, even at the lowest prices.

4.2 Experimental framework

We design experimental scenarios by controlling four key factors: (F1) the number of market segments in which 194 countries are grouped; (F2) the number of coordinating entities facilitating procurement in the global market; (F3) the order followed by the entities in negotiating their procurement plans; and (F4) the producers’ decision of adjusting or not their minimum prices to recover their return on investment. Table 3 summarizes the experimental scenarios tested to answer the research questions.

For factor (F1), 194 countries are grouped into 2, 4, 8, or 12 different market segments based on the similarity of their average GNI per capita, \(gni_m\). The market segments are then ranked based on their average income per capita and assigned to coordinating entities so that the entities make procurement decisions for an equal number of market segments. For example, in a scenario with 2 coordinating entities and 12 market segments, the first coordinating entity would be responsible for the 6 market segments with the highest \(gni_m\), and the second coordinating entity would be assigned the 6 market segments with the lowest \(gni_m\).

Factor (F2) allows the number of non-cooperative coordinating entities to vary in six levels (1, 2, 3, 4, 6, 12). Under an equal distribution of market segments per entity, if the number of market segments is 12, the number of markets per entity decreases (12, 6, 4, 3, 2, and 1) as the number of entities increases (1, 2, 3, 4, 6, and 12). The maximum number of entities used per experimental scenario equals the number of market segments. The case when a single coordinating entity serves all market segments is considered a benchmark scenario. Hence, there is a benchmark scenario for each number of markets segments in which countries are clustered.

For factor (F3), the coordinating entities’ procurement order can be ascending or descending based on the average wealth of their market segments (i.e., \(gni_m\)). In practice, high-income markets are the first to purchase and secure vaccine access, which is captured by a descending procuring order. The descending procuring order may be favored by producers, given their need to secure profit rapidly. In contrast, the ascending order incentivizes large volume purchases to be secured first.

For factor (F4), producers follow either an ‘adjusted’ or ‘invariant’ pricing policy. As stated earlier, producers estimate a minimum price per vaccine dose considering the annualized fixed R &D production costs to be recovered. With an ‘adjusted’ policy, if part of a vaccine’s supply has been sold to some coordinating entities, producers adjust their vaccine prices for subsequent negotiations to try meeting their annualized fixed costs goals. This is achieved by updating these goals after each entity negotiation, as shown in Algorithm 1, consequently changing the bounds of Constraint (4). In the ‘invariant’ policy, at the beginning of the procuring cycle, producers estimate the minimum price needed to recover the entire annualized fixed costs and keep it fixed during the procurement sequence. In practice, adjusting the bounds of Constraint (4) allows coordinating entities to pay a lower price per dose for a vaccine that has already been purchased by another entity and still has leftover supply. This strategy is equivalent to a "discount price" to incentivize buyers to purchase leftover supply instead of setting up production for a new vaccine.

The four-factor level combinations result in 60 experimental scenarios. For each scenario, we randomize each vaccine’s reservation prices (at each market) from 90% to 110% of their baseline reservation prices. Vaccines with no available historical data had their reservation prices estimated as a function of each market segment’s income and historical prices for other vaccines offering similar antigens, as described in [44]. We generate 1,000 random instances for each experimental scenario. For each random instance, we iteratively solve the GVA three-stage optimization process for each procuring entity as illustrated in Algorithm 1.

4.3 Output metrics

For all experimental scenarios, we monitor the following metrics:

-

the aggregated profits for the producers,

-

the aggregated savings for all market segments, and

-

savings and revenue generated by LIC, LMIC, UMIC, and HIC (based on the World Bank classification) as they are grouped in different market segments.

A market’s savings in procuring a vaccine (i.e., customer surplus) is reported by the difference between the market’s reservation price and the mid-price between the lower and upper price bounds determined in Stages 2 and 3 of the GVA process. The mid-price may be interpreted as the price negotiated when both savings and profits have equal bargaining power. Using the mid-prices allows our analysis to focus on the research questions proposed for this study. Given that the price countries are willing to pay is randomized for each experimental scenario, the dollar value of the global vaccine market is also random. Hence, we normalize our metrics over the market dollar value of each experimental instance. Table 4 summarizes the set of metrics used in this study. Appendix A offers additional details on the experimental results, including the number of producers who do not cover annualized fixed costs for their vaccines, the number of times market segments do not satisfy all of their antigen demands, savings, and revenue per country.

5 Experimental data

This study considers a vaccine market consisting of 14 producers offering 52 vaccines to satisfy demands for 6 different antigens (1. Hib: Haemophilus Influenza type B, 2. HepB: Hepatitis B, 3. DTP: Diphtheria Tetanus and Pertussis, 4. V: Varicella, 5. MMR: Measles, Mumps and Rubella, and 6. IPV: Polio) (see Table 5); 194 countries are grouped by their GNI per capita into market segments for tier-pricing purposes. Rather than having only the usual 4-tier market segmentation (i.e., high-income, upper-middle-income, lower-middle-income, and low-income countries based on the World Bank classification [9]), we rank countries in descending order by their GNI per capita and group them in either 2, 4, 8, or 12 market segments (see Table 6). Consequently, each vaccine has a different average reservation price in each market segment. In this study, all variations of diphtheria-tetanus-pertussis vaccines and all polio vaccines are assumed to offer the same type of antigens and are represented by DTP and IPV, respectively.

6 Results

6.1 Experimental benchmarks

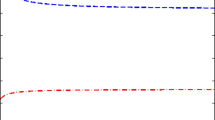

For each of the 60 experimental scenarios, we compare key metrics to a benchmark where all market segments receive procurement recommendations from a single coordinating entity. As a result, there is a different benchmark for each number of market segments in which the global vaccine market is divided (i.e., 2, 4, 8, or 12). Each benchmark mimics a fully coordinated system for a given number of market segments in which there is no need to follow any procurement order nor adjust the recovery of the annualized fixed costs, and all tenders are synchronized. Note that the only factor with multiple levels for this benchmark is the number of market segments, explored already in [44] that shows that a higher number of market segments increases Total Social Surplus. Figure 1 shows changes in Total Social Surplus for different levels of the three factors introduced in this study.

Aggregated \(\frac{TSS}{MV}\) for a global vaccine market when the number of market segments changes. Results compare ascending and descending negotiation policies, considering invariant or adjusted discounts, when the number of coordinating entities (CE) is 2 or 4. Total social surplus increases when there are more market segments in the negotiation process

Aggregated \(\frac{TSS}{MV}\) for a global vaccine market with 12 market segments, for a varying number of coordinating entities, different procurement priority orders, and different fixed cost recovery policies. The horizontal line corresponds to the baseline scenario with a single coordinating entity. For all scenarios, \(\frac{TSS}{MV}\) increases as the number of entities decreases. Other factors have a smaller impact, but descending order with invariant pricing policy dominates

For clarity and brevity, and without loss of generality, this section contrasts the results collected for experimental scenarios with countries grouped in 12 market segments, given that Fig. 1 shows that a higher number of market segments leads to higher Total Social Surplus). Results for scenarios with 2, 4, and 8 market segments are available in Appendix A and ratify the trends described in this section. The output metrics are computed considering the mid-point prices between the lowest and highest feasible prices per vaccine dose for each market segment.

6.2 Global-level effects: Aggregated results across market segments

Figure 2 illustrates the Total Social Surplus as a fraction of the dollar value of the global market (\(\frac{TSS}{MV}\)) for each experimental instance. Figures 3 and 4 illustrate the Total Customer Surplus (\(\frac{TCS}{MV}\)) and Total Profit (\(\frac{TPF}{MV}\)) considering the mid-point prices of the feasible price range resulting from the three-stage optimization process. Figures 5 to 12 illustrate the customer surplus and revenue for specific market segments grouped into the World Bank classification as low-, lower-middle-, upper-middle- and high-income countries.

Figure 2 shows that total social surplus (\(\frac{TSS}{MV}\)) increases as the number of coordinating entities decreases, or – since the number of market segments is equally distributed by the number of entities in each experiment – as the number of market segments handled by each entity increases. These results illustrate that the \(\frac{TSS}{MV}\), and hence the global market’s aggregated affordability and profit expand when the market is more cooperative (i.e., fewer coordinating entities) and when entities leverage on tiered pricing opportunities by coordinating a large number of market segments. As discussed in Section 3, this is an expected result given the less restrictive nature of a fully cooperative coordinated negotiation. Scenarios with an invariant pricing policy had higher TSS than those with an adjusted policy.

Aggregated \(\frac{TPF}{MV}\) in the global vaccine market with 12 market segments, for a varying number of coordinating entities, different procurement priorities, and choice of fixed cost recovery policy. The horizontal line corresponds to the baseline scenario with a single coordinating entity. \(\frac{TPF}{MV}\) decreases as the number of entities increase in a similar shape as the \(\frac{TSS}{MV}\)

Aggregated \(\frac{TCS}{MV}\) in a global vaccine market with 12 market segments, varying number of coordinating entities, different procurement priorities, and choice of fixed cost recovery policy. The horizontal line represents the value for the baseline scenario with a single coordinating entity. Unlike Figs. 2 and 3, \(\frac{TCS}{MV}\) increases as the number of entities increase, and performs better under an adjusted pricing policy

Figure 3 shows that the overall profitability (\(\frac{TPF}{MV}\)) increases as the number of coordinating entities decreases (or equivalently, as the number of markets per entity increases) in a similar trend to the \(\frac{TSS}{MV}\). Furthermore, scenarios following a ‘descending’ procuring policy perform better than those following an ‘ascending’ policy in all cases with less than 6 coordinating entities. This Figure also shows that the vaccine producers are not able to leverage discounts with the ’adjusted’ pricing policy to increase overall profits. On the contrary, the discounted prices result in lower profits in all scenarios. The remaining Figures follow the same trend of lower profits or revenue when using the ‘adjusted’ pricing policy.

Revenue obtained from sales to low-income countries (LIC) across all experimental scenarios for 12 market segments. The horizontal line corresponds to the baseline scenario with a single coordinating entity. Revenue tends to increase as the number of coordinating entities increases, and an ascending procuring order is used. Under a descending procuring order, the revenue is insensitive to the number of coordinating entities

Revenue from sales to upper-middle-income countries (UMIC) across all experimental scenarios for 12 market segments. The horizontal line corresponds to the baseline scenario with a single coordinating entity. A descending priority procuring order offers higher revenue from sales to UMIC than an ascending order

Revenue from sales to high-income countries (HIC) across all experimental scenarios for 12 market segments. The horizontal line corresponds to the baseline scenario with a single coordinating entity. Revenue increases with fewer coordinating entities. The descending order dominates the ascending order, while the fixed cost recovering policy seems to have little to no effect

Figure 4 shows that the overall market affordability (i.e., aggregated total customer surplus across all entities) increases when there are more entities or, equivalently, when the number of market segments per entity decreases. Additionally, there is little difference in total customer surplus resulting from adopting an ‘ascending’ or ‘descending’ procuring order (around 1% for the scenario with 2 coordinating entities.) The magnitude of the Total Customer Surplus is lower than the Total Profits in Figure 3 (maximum \(\frac{TCS}{MV}\) of around 18% compared to the maximum \(\frac{TPF}{MV}\) of around 60%. Therefore, the Total Social Surplus in Fig. 2 (i.e., the sum of both metrics) follows the profit trends and decreases when there are more entities.

\(\frac{TCS}{MV}\) for low-income countries (LIC) across all experimental scenarios for 12 market segments. The horizontal line corresponds to the baseline scenario with a single coordinating entity. \(\frac{TCS}{MV}\) for LIC is very sensitive to procuring order. Descending priority provides overall higher TCS, especially with a higher number of coordinating entities

\(\frac{TCS}{MV}\) for lower-middle-income countries (LMIC) across all experimental scenarios for 12 market segments. The horizontal line corresponds to the baseline scenario with a single coordinating entity. \(\frac{TCS}{MV}\) for LMIC improves with a higher number of coordinating entities. The descending procuring order dominates the ascending procuring order. The choice of fixed cost recovering policy has an insignificant effect on the response

6.3 Market-level effects at the LIC, LMIC, UMIC, and HIC

Figures 5 and 6 show that producers can extract more revenue from sales to LIC and LMIC under an ascending policy and a higher number of coordinating entities. The revenue levels are not significantly affected by any other factor when the procurement order is descending. The relatively constant revenue seen in the descending negotiation order suggests that the available vaccines are bought at near reservation price levels, regardless of the number of coordinating entities.

\(\frac{TCS}{MV}\) for upper-middle-income countries (UMIC) across all experimental scenarios for 12 market segments. The horizontal line corresponds to the value for the baseline scenario with a single coordinating entity. The ascending negotiating order dominates the descending order. Scenarios with an ’adjusted’ pricing policy dominate invariant policy for the same number of entities

\(\frac{TCS}{MV}\) for high-income countries (HIC) across all experimental scenarios for 12 market segments. The horizontal line represents the value for the baseline scenario with a single coordinating entity. Affordability decreases as the number of coordinating entities increases. Ascending priority dominates results, while there is little impact when using an adjusted pricing policy

The revenue for UMIC and HIC (Figs. 7 and 8) follows the total profit trends (Fig. 3), where revenue increases as the number of entities decreases. Sales to markets with higher reservation prices contribute the most to profit gains, even if their sales volumes are lower than other markets (Figs. 5 and 6). The revenue from all income groups decreases when vaccine producers offer discounts on leftover products through the ‘adjusted’ pricing policy, which explains the decrease in profits seen in Fig. 3. Therefore, regardless of the increase in savings experienced by LIC in Fig. 9, vaccine producers are unlikely to adopt an ’adjusted’ pricing policy.

LIC can ensure a modest customer surplus, between 1 and 5% of the MV. Figure 9 shows that customer surplus for LIC decreases with a fewer number of entities under a ‘descending’ procuring order. The same decreasing TCS pattern can be observed for LMIC regardless of procurement order (Fig. 10). However, for LIC and LMIC, the descending procuring policy offers more TCS. Figures 11 and 12 show that for UMIC and HIC customer surplus increases as the number of entities decreases, in particular under the ascending procuring policy.

6.4 Country-level effects

A low Total Customer Surplus at the market level is not necessarily bad news. The GVA framework ensures that vaccine prices per dose are lower than the average reservation prices of the countries in each market. Consequently, in any market segment, it is possible that even when the market secures a positive customer surplus, its recommended vaccine prices are unaffordable to some of its countries. Low customer surplus at a market level can also result when a market’s recommended prices are closer to its countries’ reservation prices. This is especially true when the countries in the market segment have similar reservation prices; or when countries are grouped in an increasing number of market segments.

Figures 13 and 14 show the affordability gaps (i.e., the difference between a country’s reservation price and its market recommended price) for LICs, for ascending and descending procurement orders under adjusted prices (Fig. 9 illustrates the market customer surplus for these scenarios.) Figures 13 and 14 show that although the TCS/MV decreases for a single coordinating entity, the affordability gaps are less dispersed and less negative when segmentation per entity increases (i.e., cooperation increases). In these figures, the interquartile ranges in the boxplots are narrower, although the whisker lengths and outliers increase. Thus, increasing cooperation makes countries pay closer to their reservation prices and reduces the number of countries paying more than their reservation prices.

A practical implication of these results is that given enough supply, organizations procuring on behalf of lower-income countries can redirect customer surplus to target countries by procuring after higher-income market segments. Additionally, these organizations should group their participating countries in as many market segments as possible and start procurement negotiations sequentially, in descending order, starting with market segments that have higher \(gni_m\). This implies that as long as producers offer discounts for high-volume purchases and demand is elastic in price, organizations such as UNICEF can benefit from scheduling their tenders after markets with higher income levels, and organize the participating countries internally into multiple market segments rather than considering them part of a single-price market for LICs and LMICs.

7 Conclusions

Our results suggest that under a non-cooperative vaccine market, there are opportunities to concentrate savings on LIC and LMIC and generate profit from sales to UMIC and HIC while maintaining affordable prices for all countries, regardless of their income level. This study suggests that affordability at the market level for low-income and low-middle-income countries can be improved by having more coordinating entities for LIC countries or effectively having a coordinating entity for LIC countries organized in a high number of market segments that procure sequentially. However, producers would see lower profit levels when negotiating with multiple coordinating entities, primarily due to a revenue decrease from high- and upper-middle-income countries despite gains from sales to LIC.

Additionally, comparing the fixed costs recovering policies, adjusting the annualized fixed-cost expenses based on the volume of vaccines that remain to sell is less effective than an ‘invariant’ policy. Furthermore, ordering the entities by descending GNI helps prevent losses for producers by extracting higher revenue from higher-income countries.

The trend in Fig. 9 suggests that to increase customer surplus while guaranteeing a desired profit level for the producers, the vaccine market should organize low- and lower-middle-income countries into more non-cooperating entities, and high- and upper-middle-income countries in fewer coordinating entities. In practical terms, this also implies that entities with LIC and LMIC countries group them in a higher number of market segments procuring sequentially in descending GNI per capita. Currently, in the global vaccine market, low-income countries pool-procure through a few coordinating entities (e.g., UNICEF and PAHO) under a single-market segment. In contrast, higher-income countries negotiate independently and have different price levels. Gavi’s and PAHO’s efforts to innovate market dynamics have incentivized pooled procurement for LIC and LMIC through large single-price markets, which are equivalent to procuring through a few large, coordinating entities with a single-price policy per vaccine dose. Our study suggests that if the market is not entirely cooperative, having a higher number of price levels per coordinating entity offers more saving opportunities, especially when low-income countries buy vaccines after higher-income countries (UMIC and HIC). Ordering the negotiation by decreasing GNI may lead to lower coverage if there is a limited supply of vaccines. Under such conditions, following an ascending negotiating order can still generate customer surplus for low-income countries while securing additional access to vaccines. Maintaining a high level of market segmentation could induce most countries to pay close to – but still below – their reservation price.

This study shares insights from an academic experiment that assumes that all procuring entities aim to buy vaccines affordably and ensure that producers obtain the desired return on their sales. Under this hypothetically altruistic buying, there are opportunities to enhance affordability by controlling when countries buy vaccines and how the pool procurement structure is organized. The current procurement already has incentives to follow the optimal procuring order, but reductions in supply availability might make it beneficial to have incentives for procuring following an ascending order.

Our modeling effort aims to understand if there are better ways of procuring and deploying vaccines than the status quo in a non-cooperative market with price discounts by volume. We rely on an optimization-based approach to generate insights for synchronizing a global vaccine market. We do not expect all existing coordinating entities to embrace a mathematically-based procurement. However, we believe that our recommendations can provoke a reconsideration of whether entities such as Gavi and PAHO should continue having single-price levels. This study suggests extending pooled procurement to UMICs and HICs can offer a revenue cushion to mitigate global profit losses when the global pediatric vaccine market is synchronized to offer more affordability to LICs.

Data Availibility Statement

All results and figures included in the manuscript, and additional experimental results are available at the public GitHub repository https://github.com/ba8641/ME_General.git

Notes

An antigen is a substance that provokes an immune response to a particular disease. (e.g., polio vaccines offer antigens that induce a response to Polio viruses. Combination vaccines such as DTP offer antigens against Diphtheria, Tetanus, and Pertussis in a single dose)

References

GAVI (2020) Value of vaccination. http://www.gavi.org/about/value/. [Online; accessed 18-Oct-2017]

WHO (2017) Immunization coverage. http://www.who.int/mediacentre/factsheets/fs378/en/. [Online; accessed 18-Oct-2017]

Whitney CG, Zhou F, Singleton J, Schuchat A (2014) Benefits from immunization during the vaccines for children program era-United States. 1994–2013. MMWR. Morbidity and mortality weekly report 63(16):352–355

The World Bank and Gavi (2010a) Brief 12: The vaccine market-Pooled procurement. https://www.who.int/immunization/programmes_systems/financing/analyses/Brief_12_Pooled_Procurement.pdf. [Online; accessed 19-Mar-2021]

Pagliusi S, Che Y, Dong S (2019) The art of partnerships for vaccines. Vaccine 37(40):5909–5919

Gavi (2018) About Gavi, the Vaccine Alliance.https://www.gavi.org/about/. [Online; accessed 26-Jun-2018]

Le P, Nghiem VT, Swint JM (2016) Post-GAVI sustainability of the Haemophilus influenzae type b vaccine program: The potential role of economic evaluation. Human Vaccines & Immunotherapeutics 12(9):2403–2405

The World Bank and Gavi (2010b) Brief 14: The vaccine market-Tiered vaccine pricing. https://www.who.int/immunization/programmes_systems/financing/analyses/Brief_14_Tiered_Pricing.pdf. [Online; accessed 19-Mar-2021]

The World Bank (2021) How are the income group thresholds determined?. https://datahelpdesk.worldbank.org/knowledgebase/articles/378833-how-are-the-income-group-thresholds-determined. [Online; accessed 18-Mar-2021]

WHO (2019) Immunization coverage. https://www.who.int/en/news-room/fact-sheets/detail/immunization-coverage. [Online; accessed 27-May-2020]

WHO (2017) Vaccine market: Global vaccine supply. http://www.who.int/immunization/programmes_systems/procurement/market/global_supply/en/. [Online; accessed 18-Oct-2017]

Sanofi (2019) Vaccination coverage. https://www.sanofi.com/en/your-health/vaccines/vaccination-coverage.[Online; accessed 27-May-2020]

Abbas K, Procter SR, Kv Zandvoort, Clark A, Funk S, Mengistu T, Hogan D, Dansereau E, Jit M, Flasche S et al (2020) Routine childhood immunisation during the COVID-19 pandemic in Africa: A benefit-risk analysis of health benefits versus excess risk of SARS-CoV-2 infection. Lancet Glob Health 8(10):e1264–e1272

Proano RA, Jacobson SH, Zhang W (2012) Making combination vaccines more accessible to low-income countries: The antigen bundle pricing problem. Omega 40(1):53–64

Hu M, Shi M, Wu J (2013) Simultaneous vs. sequential group-buying mechanisms. Management Science 59(12):2805–2822

Yang YC, Cheng HK, Ding C, Li S (2017) To join or not to join group purchasing organization: A vendor’s decision. Eur J Oper Res 258(2):581–589

Chen RR, Roma P (2011) Group buying of competing retailers. Prod Oper Manag 20(2):181–197

Anand KS, Aron R (2003) Group buying on the web: A comparison of price-discovery mechanisms. Manage Sci 49(11):1546–1562

Behzad B, Jacobson SH, Jokela JA, Sewell EC (2014) The relationship between pediatric combination vaccines and market effects. Am J Public Health 104(6):998–1004

Behzad B, Jacobson SH (2016) Asymmetric Bertrand-Edgeworth-Chamberlin competition with linear demand: A pediatric vaccine pricing model. Serv Sci 8(1):71–84

Robbins MJ, Jacobson SH, Shanbhag UV, Behzad B (2013) The weighted set covering game: a vaccine pricing model for pediatric immunization. INFORMS J Comput 26(1):183–198

Martonosi SE, Behzad B, Cummings K (2021) Pricing the covid-19 vaccine: A mathematical approach. Omega 103:102451

Cummings K, Behzad B, Martonosi S (2021) Centers for disease control and prevention as a strategic agent in the pediatric vaccine market: an analytical approach. Manufacturing & Service Operations Management 23(6):1398–1412

Yang Y, Bidkhori H, Rajgopal J (2021) Optimizing vaccine distribution networks in low and middle-income countries. Omega 99:102197

Medecins Sans Frontieres (2015) The Right Shot: bringing down barriers to affordable and adapted vaccines. Medecins Sans Frontieres

Moon S, Jambert E, Childs M, Tv Schoen-Angerer (2011) A win-win solution?: A critical analysis of tiered pricing to improve access to medicines in developing countries. Glob Health 7(1):39

Pfizer (2018) Global vaccine differential pricing approach. https://www.pfizer.com/files/health/vaccines/PFE_Global_Vaccines_Tiered_Pricing_Approach_03MAR2018.pdf. [Online; accessed 01-Aug-2019]

GlaxoSmithKline (2014) GSK public policy positions: Tiered pricing and vaccines. https://www.gsk.com/media/3370/tiered-pricing-and-vaccines-apr14.pdf. [Online; accessed 01-Aug-2019]

Bärnighausen T, Bloom DE, Canning D, Friedman A, Levine OS, O’Brien J, Privor-Dumm L, Walker D (2011) Rethinking the benefits and costs of childhood vaccination: The example of the Haemophilus influenzae type b vaccine. Vaccine 29(13):2371–2380

Melliez H, Levybruhl D, Boelle PY, Dervaux B, Baron S, Yazdanpanah Y (2008) Cost and cost-effectiveness of childhood vaccination against rotavirus in France. Vaccine 26(5):706–715

Coudeville L, Paree F, Lebrun T, Jc Sailly (1999) The value of varicella vaccination in healthy children: Cost-benefit analysis of the situation in France. Vaccine 17(2):142–151

McGuire TG (2003) Setting prices for new vaccines (in advance). Int J Health Care Finance Econ 3(3):207–224

Lee BY, McGlone SM (2010) Pricing of new vaccines. Hum Vaccin 6(8):619–626

Stephens DS, Ahmed R, Orenstein WA (2014) Vaccines at what price? Vaccine 9(32):1029–1030

The World Bank (2018) Birth rate, crude (per 1,000 people). https://data.worldbank.org/indicator/SP.DYN.CBRT.IN. [Online; accessed 05-Aug-2018]

Jacobson SH, Sewell EC, Deuson R, Weniger BG (1999) An integer programming model for vaccine procurement and delivery for childhood immunization: A pilot study. Health Care Manag Sci 2(1):1–9

Weniger BG, Chen RT, Jacobson SH, Sewell EC, Deuson R, Livengood JR, Orenstein WA (1998) Addressing the challenges to immunization practice with an economic algorithm for vaccine selection. Vaccine 16(19):1885–1897

Sewel EC, Jacobson SH, Weniger BG (2001) Reverse engineering a formulary selection algorithm to determine the economic value of pentavalent and hexavalent combination vaccines. Pediatr Infect Dis J 20(11):S45–S56

Hall SN, Jacobson SH, Sewell EC (2008) An analysis of pediatric vaccine formulary selection problems. Oper Res 56(6):1348–1365

Behzad B, Jacobson SH, Sewell EC (2012) Pricing strategies for combination pediatric vaccines based on the lowest overall cost formulary. Expert Rev Vaccines 11(10):1189–1197

Robbins MJ, Jacobson SH, Sewell EC (2010) Pricing strategies for combination pediatric vaccines and their impact on revenue: Pediarix® or pentacel®? Health Care Manag Sci 13(1):54–64

Jacobson SH, Sewell EC, Karnani T (2005) Engineering the economic value of two pediatric combination vaccines. Health Care Manag Sci 8(1):29–40

Jacobson SH, Sewell EC (2002) Using Monte Carlo simulation to determine combination vaccine price distributions for childhood diseases. Health Care Manag Sci 5(2):135–145

Mosquera G (2016) Vaccine access and affordability in a coordinated market under stochastic reservation prices. https://scholarworks.rit.edu/theses/8957. [Online; accessed 18-Mar-2021]

Saxenian H, Hecht R, Kaddar M, Schmitt S, Ryckman T, Cornejo S (2014) Overcoming challenges to sustainable immunization financing: early experiences from GAVI graduating countries. Health Policy Plan 30(2):197–205

Shaginyan V, Marievsky V, Gural A, Sergeyeva T, Maksimenok E, Demchishina I (2010) Role of vaccination in reduction of Hepatitis B incidence in Ukraine. EpiNorth Journal 11(2)

Gavi (2016) Co-financing policy. https://www.gavi.org/about/programme-policies/co-financing/. [Online; accessed 25-Mar-2019]

WHO (2019) Vaccination coverage. https://www.who.int/immunization/programmes_systems/procurement/v3p. [Online; accessed 27-May-2020]

Acknowledgements

This work was supported, in whole or in part, by the Bill & Melinda Gates Foundation [Grant number OPP1152241]. The conclusions and opinions expressed in this work are those of the author(s) alone and shall not be attributed to the Foundation. Under the grant conditions of the Foundation, a Creative Commons Attribution 4.0 License has already been assigned to the Author Accepted Manuscript version that might arise from this submission. Please note works submitted as a preprint have not undergone a peer review process. The authors also express their gratitude to Galo Mosquera, who provided initial data for this study, and to the anonymous reviewers for their invaluable feedback and comments.

Funding

This work was supported by The Bill & Melinda Gates Foundation, Seattle, WA, [grant number OPP1152241]. The authors certify that the sponsor did not influence the study’s design, interpretation, and conclusions and allowed the research team to work independently

Author information

Authors and Affiliations

Contributions

All the authors have approved the contents of this paper and have substantially contributed to the underlying research and manuscript preparation. All authors attest they meet the ICMJE criteria for authorship. Each of the authors confirms that the manuscript has not been previously published and is not under consideration by any other journal

Corresponding author

Ethics declarations

Conflicts of interest

The authors have no relevant financial or non-financial interests to disclose.

Ethics statement

Ethics approval (IRB) was not needed for this study

Contribution statement

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by Bruno Alves-Maciel, and Ruben A. Proano. The first draft of the manuscript was written by Bruno Alves-Maciel and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Suggested referees

The authors have suggested the names of potential referees based on their expertise and research affinity with this study. The authors maintain no working relationship with any of the referees and have not interacted with them in ways that can influence a fair evaluation of thisstudy.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Appendix A: Additional figures and results

All figures generated for this study and additional results for different market-entity configurations are available at the GitHub repository at https://github.com/ba8641/ME_General.git.

1.2 Appendix B: Price elasticity: determining\(\alpha _{bm}\)

Section 3.1.1 described that constraint (4) aims to incentivize entities to purchase as much as possible of the vaccine supply that remains to be sold after previous entities have completed their negotiations. The incentive increases the vaccine price if the buyers do not buy all the available supply, helping recover fixed costs and allowing prices to be as low as possible if the order is equivalent to the available supply.

Consider constraint (4): \(Y_{bm} \ge \left[ \frac{(\hat{s} g_b - X_{bm}) \alpha _{bm}}{S_b} +g_b \right] \frac{C_b}{S_b} ~~~~~~~ \forall ~~ b \in B, ~m \in M_e:\hat{s}_b > 0 \)

1.2.1 Determining a value for \(\alpha _{bm}\)

The minimum price per dose to recover the fixed cost investment \(C_b\) with a supply \(S_b\) is such that \(Y_{bm}\ge \frac{C_b}{S_b}\). If not all the supply of a vaccine b has been bought by previous entity negotiations, constraint (4) increases the price per dose by a factor \(\left( \left( \frac{\hat{s}_b}{S_b}\alpha _{bm}\right) +1\right) \), unless all the remaining supply is allocated (i.e., \(X_{bm} = \hat{s}_b\).) Allocating the remaining supply ensures that the price per dose could still be the minimum needed.

However, due to constraint (5), the incremental price per dose cannot be higher than the reservation price \(R_{bm}\). Consider the case where the unsold vaccine supply is close to the original maximum supply \(\hat{s}_b \approx S_b\). To prevent a small order quantity, \(X_{bm} \approx 0\), it is necessary to increase the price per dose so that its gap with its lower bound is as high as possible, making it attractive to buy larger volumes. In this case, the highest penalty brings the price to its reservation price. Hence,

Solving for \(\alpha _{bm}\) then result on \(\alpha _{bm} = R_{bm}\frac{S_b}{C_{b}}-1\), which is used as a parameter to constraint (4).

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Alves-Maciel, B., Proano, R.A. Enhancing affordability and profit in a non-cooperative, coordinated, hypothetical pediatric vaccine market via sequential optimization. Health Care Manag Sci (2024). https://doi.org/10.1007/s10729-024-09680-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10729-024-09680-9