Abstract

The combinatorial clock auction is a two-stage auction format, which has been used to sell spectrum licenses worldwide in the recent years. It draws on a number of elegant ideas inspired by economic theory. A revealed preference activity rule should provide incentives to bid straightforward, i.e., consistent with the bidders’ valuations on a payoff-maximizing package, in each round of the clock phase. A second-price rule should set incentives to bid truthfully in both phases. If bidders respond to these incentives and bid straightforward in the clock phase and truthful in the second sealed-bid stage, then the auction is fully efficient. Unfortunately, bidders might neither bid straightforward in the clock phase nor truthful on all packages in the second sealed-bid stage due to strategic reasons or practical limitations. We introduce metrics based on Afriat’s Efficiency Index to analyze straightforward bidding and report on empirical data from the lab and from the field in the British 4G auction in 2013 and the Canadian 700 MHz auction in 2014, where the bids were made public. The data provides evidence that bidders deviate significantly from straightforward bidding in the clock phase, which can restrict the bids they can submit in the supplementary phase. We show that such restrictions can have a significant negative impact on efficiency and revenue.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The design of auction protocols and systems has received considerable academic attention in the recent years and found application in industrial procurement, logistics, and in public tenders (Airiau and Sen 2003; Bellantuono et al. 2013). Spectrum auction design is one of the most challenging and visible applications. It is often seen as a pivotal example for the design of multi-object markets and successful auction designs are likely role-models for other markets in areas such as procurement and logistics.

Efficiency, revenue, and strategic simplicity for bidders are typical design goals that a regulator has in mind. In theory, the Vickrey–Clarke–Groves (VCG) auction is the only strategy-proof and efficient auction but for practical reasons, it has rarely been used so far (Rothkopf 2007). Several other auction formats have been designed and used for selling spectrum. The most prominent example is the Simultaneous Multi-Round Auction (SMRA) which has been used since the mid-90s to sell spectrum licenses world-wide. The more recent Combinatorial Clock Auction (CCA) is a two-phase auction format with an initial ascending clock auction and a sealed-bid supplementary bid phase afterward. It has lately been used to sell spectrum in countries such as Australia, Austria, Canada, Denmark, Ireland, the Netherlands, Slovenia, and the UK.

The CCA draws on a number of elegant ideas inspired by economic theory. A revealed preference activity rule should provide incentives for bidders to bid straightforward or consistent, i.e., to bid truthfully on one of the payoff-maximizing packages in each round of the clock phase. If bidders fail to maximize utility and bid on a package with a less than optimal payoff, we will also refer to this as inconsistent bidding behavior, i.e., bids which are not consistent with the assumption of utility maximization. A second-price rule should set incentives to bid all valuations truthfully in the second sealed-bid phase. It can be shown that if bidders respond to these incentives in both phases of the CCA, then the outcome is efficient and in the core (Ausubel et al. 2006). However, bidders might not have incentives to bid truthful in both phases, and this can lead to inefficiencies.

1.1 Reasons for Inefficiency in the CCA

The CCA is used in high-stakes auctions and much recent research tries to better understand when it is efficient in theory and in the lab. For the former, Goeree and Lien (2013) highlight possibilities for profitable manipulation and deviations from truthful bidding in core-selecting auctions in a market with several local and one global bidder. They show that the Bayesian Nash equilibrium outcome in this market can be further from the core than that of the VCG auction in a sealed-bid auction, and that in their model truthful bidding is never an equilibrium in a core-selecting auction. Sano (2012) analyzes the same market situation and shows that in ascending auctions a core-selecting payment rule can lead to an inefficient perfect Bayesian equilibrium where local bidders drop out at the start. Janssen and Karamychev (2013) and later Levin and Skrzypacz (2014) provide a complete information analysis of the CCA rules considering the activity rules of the CCA and show that there are multiple equilibria with no guarantee for efficiency. The equilibria depend on assumptions about bidders’ incentives to drive up prices of competitors, which is risk-free in the CCA as was shown in Bichler et al. (2013a) (see Sect. 2.4).

Lab experiments yielded low revenue and low efficiency for the CCA in a market with a larger number of licenses (Bichler et al. 2013a). Interestingly, also the CCA conducted in the UK in 2013 achieved a revenue below the expectations, leading to an investigation by the UK National Audit Office (Arthur 2013), whereas some other CCAs such as the one in Austria in 2013 achieved high revenue. It turns out that one reason for low efficiency and revenue in the experiments was that bidders submitted only a small subset of the thousands or millions of packages they could bid on. This can have strategic but also very practical reasons. In larger combinatorial auctions such as the Canadian 700 MHz auction in 2013 with 98 licenses, national bidders could potentially bid up to \(18^{14}\) packages. It will only be possible to submit bids on a small subset of all possible packages for any bidder. All other packages are treated by the winner determination in the CCA as if bidders had no valuation for these combinations, which is unlikely.

In contrast, the SMRA uses an “OR” bidding language, where bidders can have multiple winning bids. During the winner determination, bids on different items provide an estimate for the value that a bidder has for every possible combination of bids on individual items. Also in the British auction in 2013 only a low number of package bids was submitted. Problems due to the exponential growth in the number of packages can sometimes be addressed by a compact bid language, as was discussed in Bichler et al. (2014). The recently released rules for the upcoming CCA in Canada in 2015 try to address this problem by allowing for restricted OR bids in the supplementary stage. Of course, the bid language does not solve the strategic reasons for bidders to bid on many or only a few packages in the supplementary stage. We will discuss some of these reasons in Sect. 2.4.

1.2 Contribution of this Paper

In this paper, we show that apart from missing bids in the supplementary phase, also inconsistent bidding in the clock phase can be a source of inefficiency. We show that bidders in the lab and in the field (Canada and UK) do not bid straightforward in the clock phase. There are actually several reasons for inconsistent bidding behavior. For example, bidders might have budget constraints (Shapiro et al. 2013) or values might be interdependent, which can lead to inconsistent bidding as bidders revise their valuations when they learn about other bidders’ valuations during the auction. Even if bidders have independent and private values without budget constraints, there can be incentives to reduce or inflate demand in the clock phase in order to drive up payments of competitors (Bichler et al. 2013a; Janssen and Karamychev 2013; Levin and Skrzypacz 2014).

However, the revealed preference activity rule prohibits bidders from bidding truthfully up to their valuation in the supplementary phase, if they do not bid straightforward in the clock phase, and this can lead auctioneers to select an inefficient allocation. We provide evidence from the lab and from the field showing that the resulting inefficiencies can be significant, while being much less obvious at the same time. Measuring this inefficiency due to restrictions on the supplementary bid prices is straightforward in the lab, where the values of bidders are available. But also the analysis of the field data from the British LTE auction in 2013 and from the Canadian 700 MHz auction in 2014 suggests that inconsistent bidding was an issue. We introduce metrics based on Afriat’s Efficiency Index, which allow measuring the level of inconsistency. Numerical simulations based on data from the lab and from the UK indicate that the impact of inconsistent bidding on efficiency can be substantial. In the lab we found an overall efficiency loss of around 5 %, which can be attributed to inconsistent bidding in the clock phase. In the data from the field, where we don’t know the bidders’ true valuations, we also found a surprising large number of supplementary stage bids at the bid price limit imposed by the clock phase. This can be seen as an indication that these bids were also below the true valuation, although one can assume that bidders in these these countries tried to bid up to their true valuation.

A strong activity rule, which forces bidders to be consistent across auction rounds, appears to be an intuitive solution to fix the problems discussed in this paper. However, in the conclusions we will outline issues which arise when a regulator tries to force bidders to bid straightforward.

1.3 Outline

The remainder of this paper is structured as follows: After briefly introducing the rules of the CCA in Sect. 2, we will discuss Afriat’s Efficiency Index to analyze whether bidders in the CCA are bidding straightforward in Sect. 3. We will use this metric to analyze bidders in the lab in Sect. 4 and bidders from the British and the Canadian auction in Sect. 5. Finally, we will use computer simulations to analyze the impact of these deviations on the auction’s final outcome in Sect. 6. Section 7 discusses stronger activity rules to force consistent bidding in the clock phase and potential problems arising from such rules.

2 The Combinatorial Clock Auction

Used for the first time in 1994, the SMRA has been the de facto standard auction format for spectrum sales for almost 20 years (Milgrom 2000). A number of well-known strategic problems have led to substantial research on alternative auction formats. In particular, the exposure problem turned out to be central. Bidders are often interested in specific combinations or packages of licenses. Their value for these packages can be much higher than the sum of the individual license values in this package. As the SMRA allows only bidding on single items, a bidder risks winning only part of his package, having to pay more than what the subpackage is worth to him. Combinatorial auctions address this problem by allowing bidders to submit bids on packages rather than on single items. In 2008 the British regulator Ofcom decided on the two-stage Combinatorial Clock Auction (CCA) (Ausubel et al. 2006), a format which has been used in many countries world-wide in the last 5 years.

First, we briefly describe the overall auction process that was the same in the recent auctions. Then we discuss the activity rules, and draw on the latest version used in Canada in 2014.Footnote 1

2.1 The CCA Auction Process

In the clock phase, the auctioneer announces ask prices for all licenses at the beginning of each round. In every round bidders communicate their demand for each item at the current prices. At the end of a round, the auctioneer determines a set of over-demanded licenses for which the bidders’ demand exceeds the supply. The price for all over-demanded lots is increased by a bid increment for the next round. This clock phase continues until there are no over-demanded lots left.

The supplementary stage is designed to eliminate incentives for demand reduction and other inefficiencies in the combinatorial clock auction due to the limited number of bids that bidders can submit in the first phase. In this sealed-bid stage bidders are able to increase bids from the clock phase or submit bids on bundles they have not bid on so far. Bidders can submit as many bids as they want, but the bid price is restricted subject to the CCA activity rule (see next subsection). Finally, all bids from both phases of the auction are considered in the winner determination and the computation of payments for the winners. The winner determination is an \(NP\)-hard combinatorial optimization problem (Lehmann et al. 2006). For the computation of payments, a Vickrey-nearest bidder-optimal core-pricing rule is used (Day and Cramton 2012).

With certain assumptions on the bidders’ valuations it is possible to determine the efficient allocation and the VCG payments, even if bidders do not bid up to their true valuation in the supplementary stage. For example, if bidders have independent and decreasing marginal valuations for homogeneous items and all bidders bid straightforward then it is possible to determine Vickrey payments even bidders would not increase their bids after the clock phase. Under these assumptions bidders have strong incentives to bid truthful as the clock auction is ex post incentive compatible. However, combinatorial auctions are typically used when bidders have complementary valuations and this is when the clock auction loses its favorable properties. Without substitutes valuations an efficient outcome can not be guaranteed in a clock auction, not even with fully straightforward bidding by all participants. Actually, simple examples show that the clock phase can have very low efficiency, if all bidders bid straightforward (see Sect. 7). Actually, even if valuations were gross substitutes no ascending auction can always impute Vickrey prices (Gul and Stacchetti 1999), i.e., payments for which bidders have no incentives to shade their true valuations.Footnote 2

Apart from the observation that bidders in spectrum auctions often have complementary valuations, a number of other reasons can cause differences between the true VCG payments and the payments computed in the CCA. For example, in larger auctions with many licenses bidders might be unable to submit supplementary bids on all possible packages. However, such missing bids can have an impact on the payments of others. There are also differences to the VCG payments, if bidders bid higher or lower than their valuation for strategic reasons, and there can be multiple non-truthful equilibria in this auction (Levin and Skrzypacz 2014).

2.2 Activity Rules in the CCA

The CCA combines two auctions in the clock and in the supplementary phase. This requires additional rules setting incentives to bid truthfully in both phases. Without activity rules, bidders might not bid actively in the clock phase, but wait for the other bidders to reveal their preferences, and only bid in the supplementary phase. Originally, the clock phase of the CCA employed a simple monotonicity rule which does not allow to increase the size of the package in later rounds as prices increase. It has been shown that with substitutes preferences straightforward bidding is impossible with such an activity rule (Bichler et al. 2011, 2013a). Later versions use a hybrid activity rule using a monotonicity rule and a revealed preference rule (Ausubel et al. 2006). Revealed preference rules allow bidders to bid straightforward in the clock phase. If they do, then bidders are able to bid on all possible packages up to their true valuation in the supplementary stage (Bichler et al. 2013a). In the following we describe the latest version of the activity rules as they have been used in the Canadian 700 MHz auction in 2014. These rules have also been used in our simulations in Sect. 6.

First, an eligibility points rule is used in the clock phase to enforce activity in the primary bid rounds. The number of bidder’s eligibility points is non-increasing between rounds, such that bidders cannot bid on more licenses when the prices rise. A bidder may place a bid on any package that is within its current eligibility. Second, in any round, the bidder is also permitted to bid on a package that exceeds its current eligibility provided that the package satisfies revealed preference with respect to each prior eligibility-reducing round. Bidding on a larger package does not increase the bidder’s eligibility in subsequent rounds.

The revealed preference rule works as follows: A package in clock round \(t\) satisfies revealed preference with respect to an earlier clock round \(s\) for a given bidder if the bidder’s package \(x_t\) has become relatively less expensive than the package bid on in clock round \(s\), \(x_s\), as clock prices have progressed from the clock prices in clock round \(s\) to the clock prices in clock round \(t\). \(x_s\) and \(x_t\) are vectors where each component describes the number of licenses demanded in the respective category, i.e., region or spectrum band. The revealed preference constraint is:

where:

-

\(i\) indexes the licenses;

-

\(m\) is the number of licenses;

-

\(x_{t,i}\) is the quantity of the \(i\hbox {th}\) license bid in clock round \(t\);

-

\(x_{s,i}\) is the quantity of the \(i\hbox {th}\) license bid in clock round \(s\);

-

\(p_{t,i}\) is the clock price of the \(i\hbox {th}\) license bid in clock round \(t\); and

-

\(p_{s,i}\) is the clock price of the \(i\hbox {th}\) license bid in clock round \(s\).

A bidder’s package, \(x_t\), of clock round \(t\) is consistent with revealed preference in the clock rounds if it satisfies the revealed preference constraint with respect to all eligibility-reducing rounds prior to clock round \(t\) for the given bidder.

2.3 Activity Rules in the Supplementary Phase

Under the activity rule for the supplementary round, there is no limit on the supplementary bid amount for the final clock package. All supplementary bids on packages other than the final clock package must satisfy revealed preference with respect to the final clock round regardless of whether the supplementary bid package is smaller or larger, in terms of eligibility points, than the bidder’s eligibility in the final clock round. This is referred to as the final cap rule.

In addition, supplementary bids for packages that exceed the bidder’s eligibility in the final clock round must satisfy revealed preference with respect to the last clock round in which the bidder was eligible to bid on the package and every subsequent clock round in which the bidder reduced eligibility. This is also called the relative cap rule.

Let \(x\) denote the package on which the bidder wishes to place a supplementary bid. Let \(x_s\) denote the package on which the bidder bid in clock round \(s\) and let \(b_s\) denote the bidder’s highest monetary amount bid in the auction on package \(x_s\), whether the highest amount was placed in a clock round or the supplementary round.

A supplementary bid \(b\) on package \(x\) satisfies revealed preference with respect to a clock round \(s\), if \(b\) is less than or equal to the highest monetary amount bid on the package bid in clock round \(s\), that is, \(b_s\) plus the price difference in the respective packages, \(x\) and \(x_s\), using the clock prices of clock round \(s\). Algebraically, the revealed preference limit is the condition that:

where:

-

\(x_i\) is the quantity of the \(i\hbox {th}\) license in package \(x\);

-

\(b\) is the maximum monetary amount of the supplementary bid on package \(x\); and

-

\(b_s\) is the highest monetary amount bid on package \(x\) either in a clock round or in the supplementary round.

In addition, for supplementary bid package \(x\), let \(t(x)\) denote the last clock round in which the bidder’s eligibility was at least the number of eligibility points associated with package \(x\).

A given bidder’s collection of supplementary bids is consistent with the revealed preference limit if the supplementary bid for package \(x\), with a monetary amount \(b\) for the given bidder satisfies the following condition: for any package \(x\), the monetary amount \(b\) must satisfy the revealed preference constraint, as specified above with respect to the final clock round and with respect to every eligibility-reducing round equal to \(t(x)\) or later.

Note that, in the application of the formula above, the package \(x_s\) may itself be subject to a revealed preference constraint with respect to another package. Thus, the rule may have the effect of creating a chain of constraints on the monetary amount of a supplementary bid for a package \(x\) relative to the monetary amounts of other clock bids or supplementary bids.

2.4 Incentives for Strategic Manipulation and the CCA’s Prisoner’s Dilemma

These activity rules have strategic implications, which have been analyzed in a number of papers. Possibilities for spiteful bidding have been shown in Bichler et al. (2011) and later in Bichler et al. (2013a), who show that standing bidders after the clock phase can determine bid prices in the supplementary round (aka. safe supplementary bids) such that their standing bid from the clock phase becomes winning with certainty. Consequently, the allocation cannot change anymore after the clock phase providing little incentives for bidding truthful in the second phase assuming independent and private values.

However, in reality bidders might often care about the prices others have to pay and consequently their payoff, i.e., bidders might be spiteful. Since the allocation cannot change anymore, the CCA provides possibilities for supplementary bids which drive up the competitors’ payments, but at no risk of losing the standing bid from the clock phase (Bichler et al. 2013a). Also, they cannot pay more for this bid than what they have bid. In recent spectrum auction implementations, the regulator decided not to reveal excess supply in the last round, in order to make spiteful bidding risky. It depends on the market specifics, if this risk is high enough to eliminate spiteful bidding.

Another issue in both the VCG auction and the CCA is that they violate the law of one price. This means, two bidders might win identical allocations at different prices. We introduce a brief example following Bichler et al. (2013a) to illustrate this point: Suppose there are two bidders and two homogeneous units of one item. Bidder 1 and bidder 2 both have preferences for only one unit and a standing bid of $5 on one unit after the clock phase. If both bidders only bid on one unit, they both pay zero. Now, according to the CCA activity rules, the allocation cannot change any more. Suppose, bidder 2 also bids $9 for two units in the CCA, although he does not have such a valuation for two units. As a consequence, bidder 2 would still pay zero, while bidder 1 would pay $4. However, outcomes where bidders get the same allocation at very different prices are typically perceived as problematic (see Sect. 5.3), no matter if they are due to spiteful bids or truthful bidding.

Violations of the law of one price and possibilities for riskless spiteful bidding introduce a situation much like in a prisoner’s dilemma: If a bidder does not want to pay more for his allocation relative to competitors, he can bid high on losing package bids to drive up payments of competitors after the clock phase. If all bidders follow this strategy, then the payments will be at their bid prices. Often there is excess supply after the clock phase, and the standing clock bids need to be increased by the price of the unsold licenses in the final clock round to win with certainty (Bichler et al. 2013a). This, of course, can also drive up their own payments to the level of this safe supplementary bid.

Janssen and Karamychev (2013) shows in a complete information analysis that bidders with an incentive to raise rivals’ costs can submit large final round bids and aggressive bids in the clock phase. Levin and Skrzypacz (2014) recently provided an elegant complete information model characterizing the ex post equilibria and resulting inefficiencies that can arise in the CCA. First, they show that the CCA can have many ex post equilibria if bidders have independent private values. If several bidders try to raise each others payments spitefully, then they show that there are again multiple equilibria featuring demand reduction in the clock phase with no guarantee of efficiency. Knapek and Wambach (2012) discuss strategic complexities partly related to an earlier version of the CCA activity rule.

3 Revealed Preference Theory and Straightforward Bidding in Auctions

As outlined earlier, straightforward bidding is a central assumption for the two-stage CCA to be efficient (Ausubel et al. 2006). Note that the revealed preference activity rules in the CCA are such that bidders can be limited in the amount they bid in the supplementary round if they do not bid straightforward in the clock phase (Bichler et al. 2011, 2013a). This can also lead to inefficiency, as we will show. Ausubel and Baranov (2014) draw on the theory of revealed preference as a rationale for the activity rules used in the latest version of the CCA in the Canadian 700 MHz auction and for future versions. They show that the current version is based on the Weak Axiom of Revealed Preference (WARP), while future versions should be based on the General Axiom of Revealed Preference (GARP) and eliminate eligibility-point-based activity rules. In what follows, we will revisit important concepts of revealed preference theory and then discuss how they relate to straightforward bidding in an auction. We will also introduce a version of Afriat’s Efficiency Index, which allows us to measure straightforward bidding in empirical bid data.

The concept of revealed preferences was originally introduced by Samuelson in order to describe rational behavior of an observed individual without knowing the underlying utility function. He described the simple observation that “if an individual selects batch one over batch two, he does not at the same time select two over one” (Samuelson 1938). The term “select over” relates to a concept which is nowadays known as “revealed preferred to” and can be defined as follows:

Definition 1

Given some vectors of prices and chosen bundles \((p_t,x_t)\) for \(t=1,\ldots ,T\), \(x_t\) is directly revealed preferred to a bundle \(x\) \((x_t R_D x)\) if \(p_t x_t\ge p_t x\). Furthermore, \(x_t\) is strictly directly revealed preferred to \(x\,(x_t P_D x)\) if \(p_t x_t > p_t x\). The relations \(R\) and \(P\) are the transitive closures of \(R_D\) and \(P_D\), respectively.

Intuitively, a selected bundle \(x_1\) is directly revealed preferred to bundle \(x_2\) if given \(x_1\) and \(x_2\), both at price \(p\), \(x_1\) is chosen. This definition implies some sort of budget (or income) for each observation. Consider a world with only two bundles \(x_1\) and \(x_2\), \(x_1\) being the more expensive one. If an individual chooses to consume \(x_1\) nevertheless, we know that she prefers it over \(x_2\) such that \(x_1 R_D x_2\). This implies that as a rational utility maximizer, she will never strictly prefer \(x_2\) when \(x_1\) is affordable at the same time. More formally, this is known as the Weak Axiom of Revealed Preference (WARP).Footnote 3 If she chooses \(x_2\), though, we do not know if that decision is due to an actual preference or a budget constraint below the price of \(x_1\). Hence, there is also no way to predict which choice will be made in another observation where she might have a higher income or face different prices as we have learned nothing about the relation \(R_D\).

In a setting with more than two bundles, WARP is not enough to determine if a consumer is a rational utility maximizer. A set of choices \(\{x_1 R_D x_2, x_2 R_D x_3, x_3 R_D x_1\}\) is not violating WARP but is possibly irrational. In order to detect this inconsistency, we need to consider the transitive closure \(R\) which also includes \(x_1 R x_3\), possibly contradicting \(x_3 R_D x_1\). Therefore, in a world with more than two bundles the consumption data of a rational utility maximizer needs to satisfy the Strong Axiom of Revealed Preference (SARP)Footnote 4 or, if indifference between distinct bundles is valid, the Generalized Axiom of Revealed Preference (GARP).Footnote 5 Varian (2006) provides an extensive discussion of WARP, SARP, and GARP.

Applying these axioms to the clock phase of the CCA is straightforward: In each clock round (observation), there is a single known price vector for which each bidder submits a single demand vector. Hence, we can easily build the revealed preference relation \(R_D\) and its transitive closure \(R\) for every bidder. For the supplementary round \(S\), we know the bid prices \(p^Sx\) even without an explicit price vector \(p^S\), as bidders bid on bundles instead of single items. As only at most one of the bidder’s bids will win, for any pair of supplementary bids \(\{x_1^S,x_2^S\}\), the bidder reveals her preference for the higher bid. This allows us to infer \(x_1^S R_D x_2^S\) if the bid on \(x_1^S\) is higher or equal to the bid \(x_2^S\), or vice versa. A bid in the clock phase \(x\) and a supplementary bid \(x^S\) will be treated as the same observation if both bids have identical demand vectors.

Example 1

Table 1 provides a simple example of CCA bidding data for an auction with 3 clock rounds and a supplementary phase. In each round of the clock phase, the considered bidder reveals her preference of the chosen bundle over all other affordable bundles. In the supplementary phase, bundles with higher bids are preferred over those with lower bids. The given data is consistent with a set of valuations such as \((85,75,55)\) for the three bundles. However, it is not consistent with the assumed actual valuations \((100,100,100)\) that would require to always choose the cheapest of the three packages. When using the actual valuations to infer revealed preferences as well,Footnote 6 the resulting relation violates GARP in this case, but it cannot be detected without knowing the true valuations.

Afriat’s Theorem says that a finite set of data is consistent with utility maximization (i.e., straightforward bidding) if and only if it satisfies GARP (Afriat 1967). However, GARP allows for changes in income or budget across different observations (see Table 2) as traditional revealed preference theory is based on the assumption of an idealized individual who “confronted with a given set of prices and with a given income [...] will always choose the same set of goods” (Samuelson 1938).

The auction literature typically assumes that bidders have quasi-linear utility functions such that they maximize their payoff given the prices. Quasi-linear utility functions imply that there are no binding budget constraints or “infinite income.” Ausubel and Baranov (2014) argue that a GARP-based activity rule would require GARP and quasi-linearity. Also, the efficiency results for the CCA in Ausubel and Milgrom (2002) and Ausubel et al. (2006) only hold if bidders are quasi-linear and they bid straightforward. Unfortunately, Table 2 shows that the traditional definition of GARP allows for changes in income and therefore allows substantial deviations from straightforward bidding if we assume quasi-linear utility functions.

Example 2

The example in Table 2 is no violation of GARP. It can be explained by an increase in income from \(t=1\) to \(t=2\).

Therefore, we aim for a stronger definition of revealed preference with non-binding budgets, as they are assumed in theory. With this assumption, the different bids in an auction also reveal how much one bundle is preferred to another one:

Definition 2

Given some vectors of prices and chosen bundles \((p_t,x_t)\) for \(t=1,\ldots ,T\) and a constant income, we say \(x_t\) is revealed preferred to a bundle \(x\) by amount \(c\) (written \(x_t R_c x\)) if \(p_t x_t \ge p_t x + c\).

Intuitively, \(x_t R_c x\) can be interpreted as “\(x_t\) is chosen over \(x\) if it costs no more than the price of \(x\) plus \(c\)”. We will refer to this definition of revealed preference as GARP with quasi-linear utility (GARPQU). Note that \(c\) will be negative in all cases where \(x\) is more expensive than \(x_t\), which would be ignored in the traditional definition of revealed preferences (see Definition 1). The result of applying this definition to a set of bid data will be a family of relations \(R_c\) instead of a single revealed preference relation \(R\). \(R_c\) has several properties:

-

\(x_1 R_c x_2\) implies \(x_1 R x_2\) if \(c\ge 0\) (definition)

-

\(x_1 R_c x_2\) implies \(x_1 P x_2\) if \(c>0\) (definition)

-

\(x R_c x\) for all \(c\le 0\) (reflexivity)

-

\(x_1 R_{c_1} x_2\) and \(x_2 R_{c_2} x_3\) imply \(x_1 R_{c_1+c_2} x_3\) (transitivity)

-

\(x_1 R_{c_1} x_2\) implies \(x_1 R_{c_2} x_2\) if \(c_1>c_2\) (derived from transitivity and reflexivity of \(R_{c_1-c_2}\))

These properties are sufficient to derive a contradiction \(x R_c x\) with \(c>0\) (“\(u(x)>u(x)\)”) for any non-straightforward bidding behavior that can be detected without knowing the actual utility function \(u\). For example, it is easy to see that the choices in Table 2 do not describe straightforward bidding because they are not consistent under the above properties of \(R_c\): \((x_1 R_{-40} x_2 \wedge x_2 R_{50} x_1\Rightarrow x_1 R_{10} x_1)\).

The clock stage and the supplementary stage lead to different questions to the bidders. In the clock stage a straightforward bidder is asked to indicate which bundle has the highest payoff given some vector of prices. In contrast, a bidder should submit his true valuations for all packages. Therefore, a bidder who submits bids on the packages of the last round at the clock prices in the last round does not necessarily satisfy GARPQU.

Example 3

Let’s assume there are two lots A and B. At a price of ($100, $50) for both lots, a bidder demands a quantity vector of (0, 3). In the next round prices increase to ($100, $100), and the bidder demands (1, 2). Let \(v(\cdot )\) be the value of a package. In the first round, the bidder revealed that \(v(0,3) + \$50 \ge v(1,2)\). In the second round, he reveals that \(v(1,2) \ge v(0,3)\). The auction stops and the bidder submits exactly the same prices for the packages as supplementary bids: \(\left<(0,3), \$150 \right>\) and \(\left<(1,2),\$300\right>\). The differences in supplementary bids are interpreted as differences in the valuations, such that \(v(1,2)-150 \ge v(0,3)\). Together with the revealed preferences from the clock phase, this leads to a violation of GARPQU \(v(0,3)+ \$50 \ge v(1,2) \ge v(0,3) + \$150\). If the bidder revealed his valuations truthfully in the supplementary stage, he would not submit the very same bid as in the clock phase. With a bid of \(\langle (0,3), \$270 \rangle \) GARPQU will not be violated.

Note that the result of such an analysis of a series of bids is always binary: either a set of data satisfies GARPQU or it does not. In revealed preference theory, measures such as Afriat’s Efficiency Index (AI) were developed to describe how well a set of consumer choices conforms to utility maximization. The AI is a goodness of fit metric that spans the range \([0;1]\) with 1 indicating perfect compliance with a tested axiom (Afriat 1973). It requires a variable \(e\) in all revealed preference inequations (see Definitions 1, 2):

-

\(x_t R_D x\): \(p_t x_t \ge p_t x\) becomes \(e\cdot (p_t x_t) \ge p_t x\)

-

\(x_t P_D x\): \(p_t x_t > p_t x\) becomes \(e\cdot (p_t x_t) > p_t x\)

-

\(x_t R_c x\): \(p_t x_t \ge p_t x + c\) becomes \(e\cdot (p_t x_t) \ge p_t x + c\)

Applying the axioms with \(e<1\) leads to a relaxed version that is easier to satisfy. For instance, assume \(e=0.9\): If bundle \(x_t\) was chosen for a price of $100 the pair \((x_t,x)\) will only be included in \(R_D\) if \(p_t x\le \) $90. The AI is equal to the maximum value of \(e\) which satisfies the tested axiom. We will use a graph-based algorithm based on Smeulders et al. (2012) for computing the AI. There are related metrics such as the Varian Index (VI) which follows the same principle as the AI but uses a vector instead of a single constant value \(e\) (Varian 1990). Unfortunately, the computation of VI is NP-hard (Smeulders et al. 2012).

4 Evidence from the Lab

In a lab experiment we cannot only observe the bids, but also know the induced valuations of bidders. In what follows, we will analyze straightforward bidding in the lab and draw on the data from experiments conducted by Bichler et al. (2013a). We will focus on 16 auctions with 4 bidders in a multi-band value model with 24 blocks in 4 different bands. This means, bidders could submit up to 2400 package bids. This experimental setup is comparable to multi-band auctions with national licenses as they were conducted in Austria, Ireland, the UK, and Switzerland, although the number of bands differed from country to country.

4.1 Missing Bids

The auctions in the lab suffered from the missing bids problem with only 8.3 supplementary bids per bidder on average. Bichler et al. (2013a) argue that this has contributed to the low efficiency of only 89.3 % observed in the CCA, which was substantially lower than that of the auctions with SMRA, which achieved an average efficiency of 98.5 %. In comparison with the standing clock bids, the allocation changed after the supplementary phase in 14 auctions by 34.9 % of all licenses on average. Significant changes in the allocation could also be observed in the British auction after the supplementary stage.

4.2 Inconsistent Bidding

Figure 1 shows the AI based on GARPQU for all 64 bidders participating in a CCA in the lab experiments. The left-hand box plot describes bids from the clock phase only, the middle box plot the bids submitted in both phases, and the right box plot the clock bids and all true valuations for all packages of a bidder. A median AI of 1.000 for clock bids shows that there is no evidence for significant deviations from straightforward bidding in the bids during the clock rounds. When including data from the supplementary round, however, the median AI drops to 0.938, indicating inconsistencies between the two phases. The AI with truthful supplementary bids for all possible bundles, which is described in the third boxplot (All valuations) drops to 0.816 and suggests that bidders did indeed not bid straightforward with respect to their true valuations in the clock phase.

Deviations from straightforward bidding such as those indicated by boxplot 3 can limit the possible bid amount in the supplementary phase substantially. For the lab data we can see how high bidders have bid in the supplementary phase relative to their bid price limit.

The left scatter plot in Fig. 2 shows that bidders often bid close to the bid price limit (Pearson correlation coefficient of 0.9448). The right scatter plot illustrates the private valuations with respect to the bid price limit imposed by the activity rule and their behavior in the clock phase. For 57.2 % of all submitted supplementary bids, the bid price limit was lower than their valuation for the corresponding bundle and hence it did not allow bidders to bid their valuation truthfully in the supplementary phase.

Figure 2 deserves further explanation. As described in Sect. 2, if bidders had independent and decreasing marginal valuations, then they would not need to bid up to their true valuation in the second phase and even if bidders did not bid at all after the clock phase, the auctioneer could compute the correct Vickrey payments. The valuations of bidders in the lab were complements and there was often excess supply after the clock phase. Given the uncertainty that bidders faced in the lab, their most likely strategy was to bid truthful on their supplementary packages if possible. Bidders in the lab knew in which order they had to submit supplementary bids such that they could maximize the bids for supplementary packages. However, there were significant differences between the final payments of bidders in the clock stage and the payments one would get if bidders submitted all their valuations truthfully in a sealed-bid auction. In Sect. 6 we analyze the impact that inconsistent bidding has on the efficiency of these auctions.

4.3 Clock Prices

It would be helpful for bidders, if there was some connection between the final clock prices and the core payments, because this could give bidders a useful hint on how high they need to bid in the second phase. However, the final prices from the clock phase can differ substantially from the payments. We compared the core payments of all winning bids with the corresponding linear bundle prices in the final clock round and found that the average payment was only 59.1 % of the last clock price. The standard deviation of this ratio in the lab was 22.6 %. For the British LTE auction in 2013 this average payment was at 56.5 % of the final clock prices. Also in simulations with straightforward bidders who bid truthful in the supplementary round the clock prices do not necessarily provide an indication for payments or winning supplementary bids.

5 Evidence from the Field

The British regulator Ofcom was the first to publish the bid data on a CCA in 2008 and 2013 (Ofcom 2013a). We will primarily focus on the 2013 multi-band spectrum auction as it is closest to auctions in other countries and similar to the environment analyzed in the lab (Bichler et al. 2013a). Then we will discuss the Canadian 700 MHz auction in 2014, where bid data was revealed as well, before we summarize public information about CCA applications in some other countries. Although, all these auctions used a CCA there are important differences in the caps used, in the licenses and the band plan, and in details of the auction rules, which requires caution in the comparison of the results. Of course, we cannot know the true valuations of bidders in these auctions, however, we highlight some patterns which are similar to what we found in the lab data. In particular, bidders only bid on a small subset of all possible packages and there was a very high number of supplementary package bids at the bid price limit and not below, which can be seen as an indication of bidders over-constraining themselves in the supplementary phase due to inconsistent clock bids.

5.1 The British LTE Auction in 2013

In the British auction in 2013, 28 licenses in the 800 MHz and 2.6 GHz bands were sold, and the bid data was released to the public. There were 4 A1 blocks of paired spectrum in 800 MHz and another A2 block with a coverage obligation. In addition, there were 14 blocks of paired spectrum in the 2.6 GHz band, and another 9 blocks of unpaired spectrum in the 2.6 GHz band. The unpaired spectrum was considered less valuable than paired spectrum bands. There were seven bidders, Vodafone, Telefonica, Everything Everywhere, Hutchinson, Niche, HKT, and MLL. A spectrum cap was put on the 800 MHz band for Vodafone and Telefonica, who are considered large bidders. The detailed rules can be found at (Ofcom 2013b).

The bid data reveals the main interests of these seven bidders. Vodafone and Telefonica bid on 800 MHz and both 2.6 GHz bands. They consistently bid on two \(2\times 5\) MHz blocks in 800 MHz spectrum throughout the clock phase and both won two blocks. Everything Everywhere and Hutchinson also bid on the valuable 800 MHz spectrum, but ceased to bid on 800 MHz in the clock phase. Niche, MLL, and HKT can be considered smaller players. MLL and HKT only bid on the unpaired spectrum in 2.6 GHz and they did not win anything. Niche bid on both 2.6 GHz bands and also won blocks in both bands. More details on the auction can be found in “Appendix”, where we describe the valuations of bidders for our numerical experiments.

5.1.1 Missing Bids

Let us now provide some statistics to shed light on the missing bids problem in the British auction, which might be one of the reasons for the low revenue encountered (Arthur 2013; Smith 2013), before we discuss straightforward bidding. With all the caps considered, larger bidders such as Vodafone and Telefonica could bid on 750 packages in this auction. However, after 52 clock rounds in which the seven bidders selected 7.7 distinct bundles on average, they submitted only 39.6 supplementary bids per bidder on average (277 bids in total). Bidders always submitted higher bids on the packages submitted in the clock phase, but bid on average on 31.9 new bundles only in the supplementary phase. Telefonica submitted no more than 11 supplementary bids, while Vodafone submitted 94 of 750 supplementary bids mostly covering combinations of licenses with 20 MHz in low frequency bands. Everything Everywhere submitted 84 supplementary bids, and Hutchinson only 17 bids.

Note that the winner determination treats a missing bid as if the valuation of a bidder for this package was zero in a CCA. It is questionable if bidders had no value for all the other packages or a value below the reservation prices. In this case, the missing bids problem appears to have been an issue.

The total revenue from the bidder-optimal core prices of £2.23 bn is equivalent to the Vickrey payments in this auction, which is also due to the low number of supplementary bids which led to a lower number of core constraints when computing the bidder-optimal core payments (Day and Cramton 2012). Consequently, the discounts were very high. The sum of the bids in the revenue maximizing allocation amounts to £5.25 bn.

It is interesting to note that with only the bids from the clock phase and without the supplementary phase the auction had a revenue of £1.92 bn, which is only 13.9 % less than the final result including the bids of the supplementary phase. The supplementary phase did change the allocation considerably, however, which might have come as a surprise to some bidders. 19.3 % of all winning licenses from the clock phase (weighted by their eligibility points) were re-allocated after the supplementary round.

5.1.2 Inconsistent Bidding

Next, we analyze straightforward bidding in the British auction using Afriat’s index as we have discussed it in Sect. 3. Table 3 shows the AI per bidder for the clock phase only and for all bids including the supplementary phase. Although the median AI is high (0.995) for bids in the clock phase only, it decreases to 0.811 when we also consider supplementary bids. Note that this value is lower than what we have found in the lab auctions even though it is an upper bound for the “true AI”. If the true valuations of each bidder are taken into account the AI can be considerably lower as we have seen in Sect. 4 and in the example in Table 1.

The reason for low auctioneer revenue after the supplementary phase might, however, also have been due to limits on the bid prices imposed by the activity rule. Figure 3 compares the supplementary bid prices and the corresponding bid price limit imposed by the activity rule and shows that the bids of many bidders are very close to this limit. The bid data is highly correlated with the bid price limit imposed by the activity rule (Pearson correlation coefficient of 0.9824) and yields a median ratio of the bid price to the bid price limit of 92.3 % (mean: 80.5 %). Interestingly, this ratio was particularly high for the big bidders Vodafone and Telefonica with a median of 98.1 and 96.5 % respectively. For supplementary bids of the remaining five bidders, the median ratio was only 83.0 %, which might be due to the fact that these were financially weaker bidders. In this auction spiteful bidding (bidders submitting high losing package bids to drive up payments of competitors) did not seem to be an issue such that the more likely explanation is that bidders could not bid up to their valuations.

5.2 The Canadian 700 MHz Auction in 2014

The Canadian 700 MHz auction in 2014 comprised 5 paired spectrum licenses (A, B, C, C1, and C2), and two unpaired licenses (D, E) in 14 service areas. B and C as well as C1 and C2 were treated as generic licenses. Although the licenses are all in the 700 MHz band, they are technically not similar enough to sell all of them as generic licenses of one type.

The total revenue of $5.27 bn from the bidder-optimal core prices was 32.4 % less than $7.14 bn, the sum of provisionally winning bids after the final clock round. The sum of the bids in the revenue maximizing allocation was $9.13 bn. Again, the clock prices provided little guidance for what might constitute a winning bid in the supplementary phase.

The auction was dominated by three national carriers Bell, Rogers, and Telus. Rogers was the strongest bidder and contributed 62.45 % to the overall revenue, while Telus paid 21.69 % and Bell 10.73 %. Rogers did not bid on C1/C2 and aimed for licenses in A, and B/C throughout the auction, while Bell and Telus also bid on C1/C2 in certain service areas. The smaller bidders mainly bid on remaining C1/C2 blocks. Bell and Telus had to coordinate and find an allocation such that they both got sufficient coverage in the lower 700 MHz band (A, B and C blocks), which explains much of the bid data. There was a disparity in how much bidders had to pay for different packages, which can be explained by different valuations that bidders placed on packages and the payment rule. Still, due to the high competition and revenue the auction is considered successful.

5.2.1 Missing Bids

Overall, the high competition among the three national telecoms Bell, Rogers, and Telus and the clever spectrum caps for them explains much of the result. All eight bidders were restricted to at most 2 paired frequency blocks in each service area. Large national wireless service providers such as Rogers, Bell, and Telus were further limited in that they could only bid on one paired license in each service area among licenses B, C, C1 and C2. This cap on large wireless service providers did not, however, include block A. Still, the national bidders could bid on \(2\times 3\times 3=18\) packages per region including the empty package, which leads to \(18^{14}\approx 3.75\times 10^{17}\) packages in all regions. Rogers submitted 12 supplementary bids, Bell 543 and Telus 547 bids, which suggests that there was a missing bids problem as it is questionable if all other packages had no valuation for the bidders. Note that only one license remained unsold after the auction. Rogers bid consistently on the A licenses and one license in B/C, such that the coordination problem was largely solved by Bell and Telus, who split the regional service areas on B/C and C1/C2.

5.2.2 Inconsistent Bidding

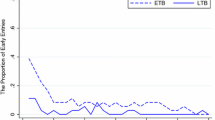

It is interesting to understand straightforward bidding in the Canadian 700 MHz auction as well. Although the regulator disclosed all the bid data, the clock prices were not made public. We used a linear program which helped us reconstruct clock prices from the bid data. There are some assumptions in this linear program and we cannot compute the price trajectories and the resulting AI with certainty, such that the numbers in Table 4 are only estimates. However, the order of magnitude in the AI was similar for different price trajectories that we could derive. The numbers suggest that bidders deviated substantially from straightforward bidding. One explanation is that bidders such as Bell and Telus actively tried to coordinate and agree on non-overlapping packages of licenses. It is also interesting to note that some small local bidders bid on competitive service areas in A and B/C outside the service area in which they operate. One conjecture is that this was done in an attempt to park eligibility rights and keep clock prices low in their own service area. As the regulator did not disclose the excess supply after the clock phase and due to the uncertainty in this large scenario, it is not unreasonable to believe that bidders tried to bid up to their true valuation in the supplementary stage. Actually, in Canada the supplementary bid on the final clock package was substantially higher than the final clock round bid for many bidders. Figure 4 shows that, again, a very large proportion of the other supplementary bids are exactly at their bid price limit indicating that they might have been truncated due to restrictions imposed by the activity rule. The low AIs for the different bidders provide further evidence.

5.3 Observations from Other Countries

Apart from Canada and the UK, bids were not made public in other countries. As mentioned earlier, the UK also released data for two earlier CCAs in 2008, the L-band auction with 17 licenses, and the 10–40 GHz auction with 27 licenses. In the L-band auction bidders submitted between 0 and 15 bids in the supplementary phase also indicating missing bids from at least some of the bidders. In this auction with much less valuable spectrum than in 2013, one bidder won all 17 lots with a bid of £20 m. The bidder only had to pay £8.334 m, which was the revenue of the best coalition of bidders without the winner (Cramton 2008). In the 10–40 GHz auction all but one bidder made their highest supplementary bid either on the final clock package, or on a subset thereof (Jewitt and Li 2008).

The Swiss auction in 2012 was remarkable, because one bidder payed almost 482 million Swiss Francs, while another one payed around 360 million Swiss Francs for almost the same allocation. This can happen in a Vickrey auction as well as in a CCA when one bidder contributes more to the overall revenue with his bids than another bidder (see Sect. 2.4).

The Austrian Auction in 2013 on the 800, 900, and 1800 MHz bands is another interesting case. Bidders could potentially submit up to 12,810 package bids. The regulator reported that the three bidders actually submitted 4000 supplementary bids in total. The regulator also disclosed that most of these bids were submitted on very large packages (RTR 2013). This large number of supplementary bids can be seen as one reason for the high prices paid in Austria. The attempt to drive up prices of other bidders and avoid having to pay more for an allocation than ones competitors, as it happened in Switzerland, can serve as one explanation for this bidding behavior. However, it leads to the Prisoner’s dilemma discussed in Sect. 2.4.

6 Estimating the Impact of Missing Bids and Inconsistent Bidding

We performed computer simulations of the CCA for the lab value model as well as for the British 4G auction. For the latter, we estimated valuations for the seven bidders from the bid data with base valuations, intra-band and inter-band synergies. The estimated valuations are described in “Appendix”. We did not perform this analysis for the large Canadian auction with 98 licenses, because this would require many more assumptions due to the regional structure and the many licenses involved. Data from 16 auctions in the lab and 10 sets of synthetic valuations for the British scenario were used. All significance tests reported in this section are using a Wilcoxon signed-rank sum test.

Efficiency and revenue of an auction are typically used as primary metrics. Throughout the rest of this paper, we will use the terms allocative efficiency:

and auctioneer’s revenue share:

The revenue share shows how the resulting total surplus is distributed between the auctioneer and the bidders. Optimal surplus describes the resulting revenue of the winner-determination problem if all valuations of all bidders were available, while actual surplus considers the true valuations for those packages of bidders selected by the auction. In contrast, auctioneer’s revenue describes the cumulative payments of the bids selected by the auction, not their underlying valuations.

In the following subsections we analyze the impact of missing bids and inconsistent bidding in the clock phase. The main results are summarized in Table 5. A baseline for this analysis are the simulations with truthful bidders, i.e., bidders who bid straightforward in each clock round and submit truthful supplementary bids on all bundles. As expected, all simulations where bidders submitted all package bids truthfully were 100 % efficient in contrast to the efficiency of 89.3 % we measured in the lab.

6.1 Impact of Missing Bids in the Supplementary Phase

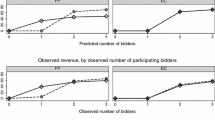

We first evaluate the impact of the missing bids problem. In this set of simulations, the simulated bidders bid straightforward in the clock phase (see Fig. 5 and the first two column-pairs in Table 5), such that they could bid up to their valuation in the supplementary phase. As human bidders only submit a small subset of possible supplementary bids, there are just a few core constraints leading to lower prices and hence lower auctioneer revenue. In order to better understand the impact of this effect, we restricted our bidders in the number \(N\) of additional packages they can bid on in the second phase.

More precisely, bidders always started the supplementary phase with truthful bids on all clock bundles in reverse order of submission which allows them to maximize the amount they can bid on other packages without violating the activity rule. Then they submitted additional truthful bids on bundles chosen after a heuristic which we observed in the British auction. First, bidders do not demand more units of a certain band than they did in the clock phase, and second, the bidders Telefonica and Vodafone do not submit any bids without two A blocks. Out of this pre-selection, bidders selected up to \(N\) of their \(2N\) strongest bids. We define the strength of a bid as the valuation divided by the bundle size in terms of the corresponding eligibility points. We have also tested different bundle selection heuristics, but the differences in efficiency were minor. The artificial bidders were bidding truthful as far as they could, such that only limitations in the number of bids submitted matter.

For the simulations with the lab value model, there is a significant difference in revenue between no supplementary bids at all (first line in Table 5) and the submission of one new bid. This is due to the fact that in the treatment without additional supplementary bids, we just evaluated the bids submitted in the clock phase. In the treatment with one additional bid, clock bids were updated to their true valuation. The number of bids affects auctioneer revenues in both value models. Even for 50 additional bids, the revenue share is still significantly lower than with supplementary bids on all bundles \((p\,\hbox {value} =.0000)\), which is due to missing bids.

With 50 additional bids, the efficiency was beyond 99 % in both value models. While we found an average efficiency of 89.3 % for the CCA in the lab with 8.3 supplementary bids on average, simulated auctions with no bids in the second phase at all yielded an efficiency of 95.3 %, which is significantly higher than in the lab (\(p\,\hbox {value}=.0052\)). A substantial part of this difference can be attributed to inconsistent bidding in the clock phase which we will discuss next.

6.2 The Impact of Inconsistent Bidding in the Clock Phase

As we have discussed in Sect. 4, bidders in the lab and in the field did not bid straightforward in the clock phase and were therefore limited by the activity rule in the supplementary phase. Now, we want to understand how much efficiency loss can be attributed to these limitations in the simulations. In the British value model we only have the bid data of a single instance, which is why we only report on the lab value model.

For all 16 instances we replicated the bids of human bidders in the clock phase. In the supplementary phase the agents tried to bid their true valuations on additional bundles like in the previous subsection. If this was impossible due to the revealed preference activity rule, they chose the highest possible bid price instead.

The third column-pair of Table 5 and Fig. 6 summarizes the results. Even for supplementary bids on all possible bundles, the efficiency was only 95.0 % on average. This is not significantly different \((p\,\hbox {value} >.95)\) to the mean efficiency of 95.3 % that we measured with straightforward bidders but without any supplementary bids. These findings provide evidence that non-straightforward bidding in the first phase reduces efficiency of the final outcome. The auctioneer revenue share was significantly lower as well. For some simulations the average differences in revenue share were more than 10 %, which was only due to inconsistent bidding in the clock phase.

7 Can Strong Activity Rules Serve as a Remedy?

Our analysis of bids in a CCA in the lab and in the recent British and Canadian spectrum auctions indicates that bidders do not bid straightforward in the clock phase of the CCA. This inconsistent bidding with respect to their true valuations can lead to inefficiencies, because the deviations from straightforward bidding in the clock phase restricts bidders from bidding up to their true valuations in the supplementary phase. The difference in efficiency and revenue in simulations with bidders bidding on their bid price limit induced by the activity rule and bidders bidding truthful is substantial, even if we assume the same number of supplementary bids being submitted by the bidders. If bidders do not bid up to their true valuations in the supplementary stage, this can have an impact on payments and the allocation of bidders as simulations show. Both, the missing bids problem and restrictions due to inconsistent bidding can lead to payments in the CCA, which are quite different from the VCG or core payments if bidders submitted their valuations truthfully.

Efficiency, simplicity, transparency, and robustness against manipulation are often considered design goals for spectrum auctions. No auction format is perfect and there are always trade-offs that an auctioneer needs to make. For example, a Vickrey auction exhibits dominant strategies, but the payments of bidders are not anonymous and it can happen that two bidders with similar allocations pay vastly different prices, which can cause envy. In a similar way, non-core outcomes can be considered unfair, however, core-selecting auctions cannot have dominant strategies for general valuations. For regulators it is important to understand the properties of different auction formats and make an informed choice. Giving up anonymous prices and the transparency of a simple ascending auction format should only be done if the resulting auction achieves higher efficiency and has stronger incentives for bidders to bid truthful.

The CCA has developed over the recent years and a number of suggestions have been picked up to improve the design. For example, new versions of the CCA will allow for a restricted set of OR bids to address the missing bids issue in large auctions. There have also been suggestions to address problems such as dead ends arising from the current activity rule (Ausubel and Baranov 2014) via stronger activity rules in the clock phase, which enforce straightforward bidding. While the current activity rules can be derived from the Weak Axiom of Revealed Preference (WARP), future activity rules should be based on the General Axiom of Revealed Preference (GARP), which checks for consistency throughout the entire bidding history of a bidder. Such strong activity rules would also avoid problems due to inconsistent bids in the clock phase. However, there are a number issues that need to be considered.

-

First, straightforward bidding with a larger number of licenses is challenging for human bidders and probably requires automated bidding agents or decision support for larger auctions with dozens or hundreds of licenses, let alone that there are reasons for bidders not to bid straightforward, such as budget constraints mentioned in the introduction or interdependencies in the valuations of bidders. One might be able to address budget constraints during the auction such that automated agents could be a remedy. However, they would effectively turn the clock phase into a sealed-bid auction, which is then followed by another supplementary sealed-bid stage in the current CCA design. The advantages of such a two-stage design compared to ascending auctions deserve some discussion.

-

Second, Bichler et al. (2013b) show that the efficiency of a clock auction with certain types of bidder valuations and straightforward bidding can be close to zero.Footnote 7 Not only that the standing bids after the final clock round do not provide an indication for the efficient allocation, also the clock prices do not provide helpful information about the final payments, as can be seen in data from the field and the lab. At least, it is not obvious how bidders should use these price signals from the clock phase.

Both points raise the question, which added value the clock phase provides. One argument in favor of an ascending or dynamic multi-object auction is that bidders do not need to provide all their valuations on exponentially many packages in one step. Levin and Skrzypacz (2014) write that ”economists think of dynamic auctions as having an advantage in this regard because bidders can discover gradually how their demands fit together.” Although the single-stage combinatorial clock auction was shown to be highly efficient in lab experiments apparently helping bidders to find efficiency-relevant bundles, bidders in the lab did not bid straightforward (Scheffel et al. 2012). Overall, using GARP with a traditional clock auction exhibits some challenges.

Many regulators have adopted an ascending auction over sealed-bid alternatives for efficiency reasons. Evan Kwerel, senior economist at the FCC, explained the decision of the US Federal Communications Commission (FCC) to adopt an ascending auction format for selling spectrum licenses by saying: “In the end, the FCC chose an ascending bid mechanism, largely because we believed that providing bidders with more information would likely increase efficiency and, as shown by Paul Milgrom and Robert J. Weber, mitigate the winner’s curse” (Milgrom 2004). The argument draws on the linkage principle, which implies that ascending auctions generally lead to higher expected prices than sealed-bid auctions with interdependent bidder valuations (Milgrom and Weber 1982). In contrast to bidders with independent values, bidders with interdependent values might not always bid consistent as their valuations can change and GARP can be too strong to allow for these changes.

Transparency is also an important argument for ascending auctions as a bidding team needs to set expectations throughout the auction and inform stakeholders. Bidders in SMRA see the final allocation and prices develop throughout the auction, which typically takes several weeks. However, this type of transparency is much reduced in the CCA. How much bidders finally have to pay depends on the bids submitted in the supplementary stage and is a result of a quadratic optimization problem which is almost impossible to predict given the many possible packages bidders can bid on and the missing bids problem. If they are unable to submit a safe supplementary bid, then the allocation can change substantially after the clock phase, as it has happened in the British LTE auction. This makes the outcome of the CCA hard to predict during the auction.

One advantage that an ascending auction still has over a sealed-bid auction is the fact that winners do not need to reveal their valuation for the winning package to the regulator. Regulators need to decide whether this feature outweighs the added complexity stemming from a two-stage CCA. Ascending combinatorial auctions can certainly be of help for bidders in coordinating with other bidders and finding a feasible allocation among the many possible ones. However, if an activity rule enforces straightforward bidding, the possibilities for such coordination will be much reduced.

Designing efficient multi-item auctions is difficult when a regulator needs to consider conflicting design goals such as incentive-compatibility, simplicity, efficiency, and the law-of-one-price. The bid language, the payment rule, and the decision to use a sealed-bid or an ascending format are design choices, which all have significant impact on efficiency and revenue of an auction. A simple bid language can have a substantial positive impact on the efficiency of an auction as was shown in lab experiments (Bichler et al. 2014), and it is not unreasonable to assume similar effects in the field. The pros and cons of different activity rules considering realistic assumptions about bidder preferences in a spectrum auction are still a fruitful area for future research.

Notes

The auction rules of the Canadian 700 MHz auction in 2014 can be found at http://www.ic.gc.ca/eic/site/smt-gst.nsf/eng/sf10583.html. The auction rules of the British auction in 2013 can be found at http://stakeholders.ofcom.org.uk/spectrum/spectrum-awards/awards-archive/completed-awards/800mhz-2.6ghz/.

Ausubel (2006) showed that there is an ascending auction with multiple price trajectories and item-level prices, which is efficient and yields the VCG allocation and payments. The auction runs one ascending auction with all bidders, and one with each bidder excluded in turn. However, this auction format is quite different from the clock auctions used in the field so far.

If \(x_t R_D x_s\) then it must not be the case that \(x_s P_D x_t\) for WARP to be satisfied.

If \(x_t R x_s\) then it must not be the case that \(x_s R x_t\) for SARP to be satisfied.

If \(x_t R x_s\) then it must not be the case that \(x_s P x_t\) for GARP to be satisfied.

\(x_i R_D x_j\) for any pair \((i,j)\) as all valuations are equal.

Let’s introduce a simple example to better illustrate how straightforward bidding can lead to inefficiency in the clock auction: Consider a market with two items \(\{A,B\}\) and three bidders. Bidder 1 has a value of $10 for \(A\), bidder 2 has a value of $4 for \(B\) and $10 for \(\{A,B\}\), and bidder 3 only has a value of $10 for the package \(\{A,B\}\). If all bidders bid straightforward starting with prices of zero and unit increments, then bidder 2 will never reveal his valuation for A, leading to 71% efficiency. Bidders 2 and 3 would actually drop out at a price of $5 for both items in the clock stage, which is when bidder 1 still bids on item \(A\). It is easy to extend the example and achieve very low revenue.

Since EE is the largest mobile service provider in the UK (Ofcom 2011), it might be surprising to describe them as secondary bidders. However, the classification was solely made based on the bids in this particular auction.

References

Afriat SN (1967) The construction of utility functions from expenditure data. Int Econ Rev 8(1):67–77

Afriat SN (1973) On a system of inequalities in demand analysis: an extension of the classical method. Int Econ Rev 14(2):460–472

Airiau S, Sen S (2003) Strategic bidding for multiple units in simultaneous and sequential auctions. Group Decis Negot 12(5):397–413. doi:10.1023/B:GRUP.0000003741.29640.ac

Arthur C (2013) 4G auction to be investigated by audit office after poor return. http://www.theguardian.com/technology/2013/apr/14/4g-auction-national-audit-office

Ausubel L, Baranov O (2014) Market design and the evolution of the combinatorial clock auction. Am Econ Rev Pap Proc 104(5):446–451

Ausubel LM (2006) An efficient dynamic auction for heterogeneous commodities. Am Econ Rev 96(3):602–629

Ausubel LM, Milgrom PR (2002) Ascending auctions with package bidding. Front. Theor. Econ. 1(1):1–42. http://www.ausubel.com/auction-papers/ascending-proxy-auctions.pdf

Ausubel LM, Cramton P, Milgrom P (2006) The clock–proxy auction: a practical combinatorial auction design. In: Cramton P, Shoham Y, Steinberg R (eds) Combinatorial auctions, chap 5. MIT Press, Cambridge, pp 115–138. The ISBN-10 is 0262514133

Bellantuono N, Ettorre D, Kersten G, Pontrandolfo P (2013) Multi-attribute auction and negotiation for e-procurement of logistics. Group Decis Negot 1–21. doi:10.1007/s10726-013-9353-7

Bichler M, Shabalin P, Wolf J (2011) Efficiency, auctioneer revenue, and bidding behavior in the combinatorial clock auction. In: Second conference on auctions. Market mechanisms and their applications (AMMA), New York, NY, USA

Bichler M, Shabalin P, Wolf J (2013a) Do core-selecting combinatorial clock auctions always lead to high efficiency? An experimental analysis of spectrum auction designs. Exp Econ 16:511–545

Bichler M, Shabalin P, Ziegler G (2013b) Efficiency with linear prices? A theoretical and experimental analysis of the combinatorial clock auction. In: INFORMS information systems research, pp 394–417

Bichler M, Goeree J, Mayer S, Shabalin P (2014) Spectrum auction design: simple auctions for complex sales. Telecommun Policy 38(7):613–622

Bundesnetzagentur (2010) Frequency Award 2010. http://www.bundesnetzagentur.de/cln_1931/EN/Areas/Telecommunications/Companies/FrequencyManagement/ElectronicCommunicationsServices/FrequencyAward2010_Basepage.html

Cramton P (2008) A review of the L-band auction. Technical report August. http://works.bepress.com/cramton/11/

Danish Business Authority (2012) Information memorandum—800 MHz auction. http://erhvervsstyrelsen.dk/file/251159/information-memorandum-800mhz-auction.pdf

Day RW, Cramton P (2012) Quadratic core-selecting payment rules for combinatorial auctions. Oper Res 60(3):588–603

Goeree JK, Lien Y (2013) On the impossibility of core-selecting auctions. Theor Econ (forthcoming). http://econtheory.org/

Gul F, Stacchetti E (1999) Walrasian equilibrium with gross substitutes. J Econ Theory 87(1):95–124

Janssen M, Karamychev V (2013) Gaming in combinatorial clock auctions. Technical report, Tinbergen Institute

Jewitt I, Li Z (2008) Report on the 2008 UK 10–40 GHz spectrum auction. Technical report. http://stakeholders.ofcom.org.uk/binaries/spectrum/spectrum-awards/completed-awards/jewitt.pdf

Knapek S, Wambach A (2012) Strategic complexities in the combinatorial clock auction. CESifo Working Paper Series 3983, CESifo Group Munich. http://ideas.repec.org/p/ces/ceswps/_3983.html

Lehmann D, Müller R, Sandholm T (2006) The winner determination problem. In: Cramton P, Shoham Y, Steinberg R (eds) Combinatorial auctions. MIT Press, chap 12. http://www.cs.cmu.edu/~sandholm/winner-determination-final.pdf

Levin J, Skrzypacz A (2014) Are dynamic vickrey auctions practical? Properties of the combinatorial clock auction. Stanford University working paper September

Milgrom P (2000) Putting auction theory to work: the simultaneous ascending auction. doi:10.1086/262118

Milgrom P (2004) Putting auction theory to work. Cambridge University Press, Cambridge

Milgrom PR, Weber RJ (1982) A theory of auctions and competitive bidding. Econometrica 50(5):1089–1122

Ofcom (2011) Everything Everywhere becomes the UKs largest network in terms of revenue. http://stakeholders.ofcom.org.uk/market-data-research/market-data/communications-market-reports/cmr11/telecoms-networks/5.48

Ofcom (2012) The wireless telegraphy (licence award) regulations 2012. http://www.legislation.gov.uk/uksi/2012/2817/contents/made

Ofcom (2013a) 800 MHz & 2.6 GHz auction data. http://stakeholders.ofcom.org.uk/spectrum/spectrum-awards/awards-archive/completed-awards/800mhz-2.6ghz/auction-data/

Ofcom (2013b) 800 MHz & 2.6 GHz combined award. http://stakeholders.ofcom.org.uk/spectrum/spectrum-awards/awards-archive/completed-awards/800mhz-2.6ghz/

Rothkopf MH (2007) Thirteen reasons why the vickrey-clarke-groves process is not practical. Oper Res 55(2):191–197

RTR (2013) Multiband Auction 800/900/1800 MHz. Rundfunk und Telekom Regulierungs-GmbH. https://www.rtr.at/en/tk/multibandauktion

Samuelson PA (1938) A note on the pure theory of consumer’s behaviour. Economica 5(17):61–71. http://www.jstor.org/stable/10.2307/2548836

Sano R (2012) Non-bidding equilibrium in an ascending core-selecting auction. Games Econ Behav 74:637–650

Scheffel T, Ziegler A, Bichler M (2012) On the impact of package selection in combinatorial auctions: an experimental study in the context of spectrum auction design. Exp Econ 15:667–692

Shapiro R, Holtz-Eakin D, Bazelon C (2013) The economic implications of restricting spectrum purchases in the incentive auctions. Georgetown University Washington working paper

Smeulders B, Spieksma FCR, Cherchye L, De Rock B (2012) Goodness of fit measures for revealed preference tests: complexity results and algorithms. aghedupl V(212):1–16. http://home.agh.edu.pl/~faliszew/COMSOC-2012/proceedings/paper_11.pdf

Smith C (2013) Did Ofcom’s 4G auction rules cost the UK an extra 3 billion? http://www.techradar.com/news/phone-and-communications/did-ofcom-s-4g-auction-rules-cost-the-uk-an-extra-3-billion-1138302

Varian HR (1990) Goodness-of-fit in optimizing models. J Econom 46:125–140. http://www.sciencedirect.com/science/article/pii/030440769090051T

Varian HR (2006) Revealed preference. In: Szenberg M, Ramrattan L, Gottesman AA (eds) Samuelsonian economics and the twenty-first century, January 2005, chap 6. Oxford University Press, Oxford, pp 99–115

Author information

Authors and Affiliations

Corresponding author

Appendix: Details on the Value Model and the Simulations based on the British 4G Auction

Appendix: Details on the Value Model and the Simulations based on the British 4G Auction

The value model used in our simulations in Sect. 6 is based on the British 4G auction in 2013 in which the 800 MHz as well as the 2.6 GHz band were sold (Ofcom 2013b). We will provide a brief description of the British auction and how we derived the value model for each bidder in our simulations, mirroring the main characteristics of this market. The valuations can be made available upon request.

1.1 Licenses Up for Sale

Table 6 illustrates the lots used in the auction. We simplified this band plan to allow for an easier analysis. The 800 MHz spectrum was split into two generic lots A(i) and A(ii) where A(ii) has twice as much bandwidth and eligibility points. Furthermore, the winner of A(ii) is obliged to use his spectrum to build a nationwide network. For simplicity, we neglected these legal details in our experiments and combined A(i) and A(ii) into one generic lot A with 6 licenses and the specifications of A(i).