Abstract

We investigate the extent to which investors rely on credit ratings and other factors beyond credit ratings in determining the funding cost for collateralized loan obligations (CLOs) tranches in the period 1997-2015. We find significant differences between the United States (U.S.) and European Union (E.U.) markets. In the U.S., we find a much higher and more consistent degree of reliance on credit ratings and other factors in pricing CLOs over time compared to the E.U. market. Finally, we find that investors in both markets reduce, rather than increase, funding costs when rating standards loosened. The implications for market practices are discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The credit rating industry is dominated by Moody’s, Standard & Poor’s (S&P), and Fitch. These three credit rating agencies (CRAs) have roughly 91% of the market in Europe and 95% of the market in the U.S. (ESMA 2020; SEC 2020). The market for Collateralized Loan Obligations (CLOs) is a segment of the structured finance securities marketFootnote 1 and in assigning the credit ratings of CLOs the dominance of only two CRAs, Moody’s and S&P, is pronounced. In the wake of the global financial crisis of 2008, CRAs were accused of assigning biased ratings to structured finance securities such as CLOs (e.g., Griffin et al. 2013) or, more general, to have ascribed ratings that do not appropriately reflect the risks associated with CLOs (see, e.g., Fabozzi and Vink 2012, He et al. 2016; Zhou et al. 2017; Flynn and Ghent 2018). Due to the complexity of CLO structures, investors are exposed to the risk that the assigned credit rating does not fully or precisely reflect the actual credit risk (Vink et al. 2021).

Concerned that investors may rely too heavily on potentially biased or inflated ratings, attitudes towards the role of CRAs and the dominance of the three largest CRAs in the industry has changed broadly and in some cases crystalized at the regulatory level. The Dodd-Frank ActFootnote 2 in the United States (U.S.) and regulationsFootnote 3 in the European Union (E.U.) have sought to reduce the reliance on credit ratings, especially for structured finance securities. The stated goal is for the market to move away from reliance on credit ratings. The U.S. and E.U. regulatory responses call for an empirical investigation aimed at better understanding the extent to which investors rely on credit ratings in the CLO market. This improved understanding could in turn inform policymakers seeking to improve the effectiveness of legislation.

In our paper, we investigate the degree to which in the U.S. and E.U. market investors rely on the credit ratings assigned by CRAs in the pricing the CLO at the time of issuance. Using data of CLO tranches that are orginated and sold between 1997 and 2015, we first test the extent to which investors rely on CLO credit ratings by Moody’s and/or S&P, as evidenced by the relationship between credit ratings and the quoted margin at issuance. We also examine investor reliance on other factors beyond credit ratings that are specific to the CLO market, which we refer to as “security design” factors. In this way, we gain an understanding as to the degree investors price their investments in CLOs on the basis of credit ratings or on the basis of other factors that influence their investment appetite.

We then consider if such levels of reliance changed over time, through the “steady-boom-bust-recovery” periods observed in the CLO market, and whether there are further differences to be observed in that regard between the U.S. and the E.U. markets, a consideration prompted by rating models being influenced by the business cycle (Bar-Isaac and Shapiro 2013; Dilly and Mählmann 2015). We test whether the patterns observed in the U.S. and E.U., over time, differ for large versus small, and frequent versus infrequent issuers in these markets, given suggestions in the literature that investors may vary their reliance on credit ratings, depending on the type of issuer they are dealing with (He et al. 2012). Outside of the field of structured finance ratings, studies have found that CRAs may have varied their rating standards over time (see e.g., Alp 2013). In the last part of our empirical analysis, we test whether investors take into account changes in rating standards in pricing CLOs in the U.S. and E.U. market.

Our results show that in the U.S. market, on average investors rely to a substantially greater extent on credit ratings as they determine the funding cost of CLO tranches than investors do in the E.U. market. Also, our results show that this greater extent of investor reliance on credit ratings is more consistent over time than in the E.U. market. Next, we consider if these differences between U.S. and E.U. investors can be explained by i) business cycles, ii) the impact of issuer size or iii) changes in rating standards. We find that they do. First, after the financial crisis, the reliance on credit ratings remained more or less stable in the U.S. but decreased significantly in the E.U. market. Second, funding cost required by investors in the E.U. market are different based on issuer size, while investors in the U.S. do not make such differentiation. Third, our results show that investors demand a lower funding cost for CLOs when CRAs loosen their rating standards, more so in the U.S. than in the E.U. market.

To the best of our knowledge, this paper is the first to compare investors in the U.S. and E.U. CLO market with respect to the extent to which they rely on credit ratings in pricing CLOs at issue. Our study contributes to a recent body of literature on credit ratings and credit spreads in the structured finance market (see e.g., Marques and Pinto 2020; Yang et al. 2020), and to the literature on credit rating standards (see e.g. Alp 2013; Cafarelli 2020). Our results are relevant to policymakers in the U.S. and E.U. seeking to improve the effectiveness of their (diverging) legislative frameworks on credit ratings.

The rest of the paper is organized as follows. Section 2 contains a review of the relevant literature related to credit ratings. In Section 3 we describe our CLO tranche data and then in Section 4 we present the results of our empirical tests. We provide a discussion, conclusion and set out policy implications in Section 5.

2 Literature Review

The academic literature on structured products has benefited greatly from a marked increase both in the theoretical and empirical studies of market reliance on credit ratings. In fact, the majority of studies performed on structured products, regardless of the product type, focus somewhat, if not primarily, on the role of the CRAs.Footnote 4 This is likely due to the widespread belief that CRAs assign favorable ratings, especially to structured finance securities. The issuer-paid business model in place for the entire CRA industry gives CRAs an incentive to cater ratings to issuers’ demand (see, e.g., Griffin et al. 2013; He et al. 2016; Zhou et al. 2017; Flynn and Ghent 2018). CRAs are accused of having contributed to the depth and length of the global financial crisis by assigning favorable ratings to structured finance securities (see, e.g., Flynn and Ghent 2018; He et al. 2016; Zhou et al. 2017), either due to poor rating standards in their analysis or because investors relied too heavily on credit ratings in evaluating assets.

In addition, CRAs are found to more likely issue less-accurate ratings during boom periods (see e.g., Bolton et al. 2012; He et al. 2012; Bar-Isaac and Shapiro 2013; Dilly and Mählmann 2015). Bar-Isaac and Shapiro (2013), for example, give a number of explanations for this business cycle effect: reputation risk, commercial motives of CRAs to maximize returns and the de-emphasis on credit monitoring by CRAs in periods of low default probability (i.e., in an economic boom).

Another factor that is found to influence rating quality is the size of the issuer. He et al. (2012) examine the role of the CRAs in the rating of private-label residential mortgage-backed securities. They find that larger issuers experience higher funding costs than smaller issuers. Their results are consistent with an earlier study on CRAs and mortgage-backed securities that suggests inaccuracy of ratings related to issuer size (He et al. 2011).

In the rating of other credit products such as corporate bonds, there is an extensive body of literature on the quality of rating standards (see e.g., Becker and Milbourn 2011; Alp 2013; Cafarelli 2020). Blume et al. (1998) show, using S&P bond ratings, that the number of credit rating downgrades is not caused by a decline in credit quality of corporate debt, but rather by CRAs applying more stringent rating standards in the U.S. market. Agreeing with Blume et al. (1998), Alp (2013) provides more evidence that over the period 1985-2002 credit rating standards varied, with divergent patterns for investment-grade and speculative-grade ratings.

These findings suggest that there are factors outside of the bond structure or collateral itself that affect credit ratings and the pricing of securities, which is consistent with Fabozzi and Vink (2012) and Marques and Pinto (2020) who found that investors look beyond the credit rating in determining the funding cost of structured finance securities. Our assessment of the literature is that rating quality can be impacted by (1) business cycles (see e.g., Bar-Isaac and Shapiro 2013; Dilly and Mählmann 2015) (2) issuer size (see e.g., He et al. 2011, 2012), and (3) changes in rating standards (see e.g., Alp 2013; Cafarelli 2020). This provides further motivation for our study, in which we seek to examine whether investors take security design factors into account when pricing CLOs at the time of issuance. We build upon these studies and investigate if investors differentiate in the pricing of CLOs between business cycles, issuer size and whether ratings are impacted by changes in rating standards. We differentiate in our analysis between CLOs issued in the U.S. and E.U. to study differences in the underlying factors which have the greatest impact on the pricing of CLOs and to test the degree to which investors rely on the ratings assigned by CRAs at time of issuance.

3 Data and Methods

We begin the process by manually collecting data obtained from Bloomberg, which provides a complete universe of 8,324 CLO tranches with a total value of $1.05 trillion, that were issued and sold in the U.S. or E.U. markets from 1996 up to 2015. For each CLO deal, the dataset provides deal and tranche names, issuer characteristics, price date, the 3-month benchmark/reference interest rate for the floating-rate tranches, credit ratings, balance and primary issuance spread. Footnote 5 All our CLO tranches are rated by either Moody’s or S&P, or both. There are an insufficient number of CLOs rated by Fitch or other smaller CRAs to enable statistical analyses. Therefore, in our dataset we use only tranches that obtained a rating from Moody’s and/or S&P, consistent with the dataset used by Griffin et al. (2013).

We apply several filters to our dataset and remove tranches with incomplete information. Because we are interested in the effect of CLOs deal complexity on the number of credit ratings, we only include in our study CLOs tranches with at least one credit rating disclosed at issue. This reduces our original sample from 8,324 to 7,910. We further discard all tranches with missing transaction or tranche size (14 tranches) and missing information on the funding cost at issue (305 tranches). This filtering resulted in a full sample of 7,591 CLO tranches, of which 5,935 tranches are issued in the U.S. market and 1,656 tranches issued in the E.U. market. Panels A to D of Table 1 reports summary statistics for the U.S. and E.U. market, respectively.

3.1 Empirical Model

We investigate the degree to which E.U. and U.S. market investors rely on the credit ratings assigned by CRAs in the pricing of CLO at the time of issuance. To examine this, we look at the impact of the credit rating of CLOs on the funding cost at issuance in these two markets using ordinary least squares (OLS) regression analysis, which is consistent with He et al. (2016). Based on our literature review in Section 2, we also examine investor reliance on other factors beyond credit ratings that are specific to the CLO market (i.e., security design factors). We are primarily interested in the following for each market: (1) the size of the credit rating coefficient controlled for time and issuer fixed effects, (2) the explanatory value of the credit rating coefficient as measured by the adjusted R2, and (3) the security design factors that investors take into account beyond the credit ratings in determining the price at issue. To achieve this, we perform several regressions that are generally based on the following model:

The data vary by year (t), deal (i) and security (j). We control for security-design characteristics, issuer-fixed effects and time-fixed effects. The specification used is an OLS regression with primary issuance spread as the dependent variable, Credit Rating as the independent variable and the other variables shown in the model above as control variables. Because the error terms have systematic heterogeneity in our estimation, we use a heteroskedasticity-consistent covariance matrix as suggested by White (1980). Due to the possibility of issuer- and time-fixed effects, which would lead our OLS results to underestimate standard errors of coefficients, we then run the analysis treating each sample as panel data. We achieve this by including the issuance-year effects and we double-cluster for all tranches sold by the same issuer and in the same year in order to build robust standard errors, as recommended by Petersen (2009).

Next, in order to investigate whether changing credit rating standards over time have an impact on the funding costs of a CLO at issuance, we follow Alp (2013) and Liu and Wang (2019) and estimate the following models:

where Rit denotes the credit rating of security i in issuance year t. αt is the intercept for year t, β is the vector of slope coefficients, and Zit is a latent variable that relates to Rit in the ranges between different partition points μi. Rit ranges from 1 to 21 as we have 21 rating categories in our sample. The matrix Xit denotes columns with explanatory variables. The variable definitions are given in section 3.2.

In ordered logit models, coefficient values are in units of a latent variable and therefore not economically meaningful, since the year indicator coefficient at is not in the same unit as Zit. Therefore, consistent with Alp (2013) and Liu and Wang (2019), we convert at into a rating notch, that is the average distance between the partition points. The average rating notch length is calculated as (μ20 - μ1)/19. Dividing the year indicator coefficients, calculated using the ordered logit model defined in Equations (2) - (4), by the rating notch length, we create an indicator for rating standards. In order to test the impact of rating standards on credit spreads, we use this indicator in model 1, where Rating Standards denote the year indicator coefficients divided by the rating notch length in year t.

3.2 Variable Construction and Summary Statistics

3.2.1 Dependent Variable

The dependent variable of our study is the specific funding cost of CLO tranches. We measure this by the primary issuance spread, referred to simply as spread, which equates to the quoted margin for the tranche (Spread). For a given tranche, the funding cost for the issuer is the reference rate plus the quoted margin, whereby the reference rate represents the portion of the funding cost that is a marketwide benchmark and the quoted margin equates to the portion of the funding cost that is tranche-specific. This latter tranche-specific portion of the funding cost is the additional per annum compensation for the risk faced by investors by purchasing that particular tranche, which means that the quoted margin is, for our purposes, the appropriate measure of the specific funding cost of the CLO tranche. In our study, we use only floating-rate tranches issued at par that were benchmarked off the European interbank offered rate (EURIBOR) for the E.U. CLO tranches in our study and U.S. dollar London interbank offered rate (USD LIBOR) for the U.S. CLO tranches in our study.Footnote 6 For securities issued at par, the Spread at issue – the dependent variable in model (1) – equals the quoted margin between the benchmark rate agreed upon at the date of pricing and the coupon of the initial yield, measured in basis points (bps). Issuance spread is a measure of the risk premium demanded by investors when issued at par. We do not use any tranches issued at a price different from par.

3.2.2 Independent Variables

The independent variable of the model, Credit Rating, is defined as the credit rating of Moody’s and/or S&P provided for each tranche at issuance. We measure Credit Rating via a numerical scale to convert credit ratings of Moody’s (and, in parentheses, S&P) to numerical scores corresponding to the rating notches with respectively 1 for Aaa (AAA), 2 for Aa1 (AA+), 3 for Aa2 (AA), 4 for Aa3 (AA–), and so on. Table 1 reports summary statistics for the U.S. market (Panels A and C) and E.U. market (Panels B and D). First, we observe in Panels C and D that with 5,935 tranches our U.S. market dataset has a greater number of data points than our E.U. market dataset, which counts 1,656 data points. Second, we observe that in the U.S. there are more dual-rated tranches than single-rated tranches, whereas in the E.U. the opposite is the case. Specifically, in the U.S. market, for 42% (2,508 tranches) of the tranches a single rating was disclosed at issuance and for 58% (3,427 tranches) a dual rating. Slightly more of the single-rated tranches received a rating by S&P (1,492 tranches) than by Moody’s (1,016 tranches). In the E.U. market, 44% (732 tranches) of the tranches were dual-rated and 56% (924 tranches) of the tranches were single-rated, of which we observe a higher number rated by Moody’s (647 tranches) than by S&P (277 tranches).

3.2.3 Control Variables

We report the descriptive statistics and variable distributions in Panels A and B of Table 1. We include several control variables to capture security design characteristics of the underlying tranche: the number of tranches the CLO deal of which the tranche is a part; capital allocation of the tranche; tranche value; value of the CLO deal of which the tranche is a part; rating discrepancy, if any, between Moody’s and S&P, per tranche; and, finally, the year of issuance of the tranche. Invariably a CLO deal is made up of a number of tranches.

Tranche Count equals the total number of tranches in a corresponding CLO deal. In our total sample, the tranche countFootnote 7 per CLO deal ranges from 1 to 23 with a mean of 7.6 for the U.S. market sample and 6.7 for the E.U. market sample. We construct the Capital Allocation measure per tranche as the percent of protection from losses for each tranche in the capital structure. The mean capital allocation in our sample is 23% in the U.S. market and 25% in the E.U. market. This indicates the percent of cushioning in the capital structure of a CLO deal, against credit losses that a specific tranche could suffer. The cushioning is provided by other tranches in the same CLO deal that are subordinated to the tranche in question. Bloomberg does not readily report values for capital allocation and therefore we had to calculate its value for each tranche manually. This rather laborious calculation was conducted for each tranche on a deal-by-deal basis. Capital allocation aligns with credit ratings in that tranches with higher levels of subordinated capital cushioning them against credit losses usually receive a higher credit rating, so even though we label the tranches by credit rating, their credit rating also reflects the subordination structure of cash flows in the entire deal of which the tranche is a part.

We further control for tranche size, measured as the natural logarithm of the face value of a tranche at issuance (Log Tranche Size). The mean tranche size of tranches issued in the U.S. market is $98 million. For the E.U. market, we observe a higher mean tranche size of $250 million. This difference is substantial, and only in part due to there being, as mentioned above, on average more tranches in the U.S. market than in the E.U. market: deals in the E.U. were on average 39.2% larger than in the U.S. market. Log Transaction Value equals the natural logarithm of the transaction value (i.e., the face value, at issuance, of the total CLO of which the tranche is a part) measured in million U.S. dollars. The mean Transaction Value of the U.S. market sample is $557 million and for the E.U. market sample $1,140 million. We also control for Rating Discrepancy, a dummy variable equal to 1 if at issuance a security rated by Moody’s received a different rating from S&P and 0 if not. Finally, we control for time by adding the control variable Year of Issuance, which equals the year of tranche issuance and ranges from 1997 to 2015. In our regression, we control for issuer fixed effects (Issuer Dummy), an encoded dummy variable for each unique issuer for use as a parameter in our issuer fixed-effects (I.F.E.) regressions.

4 Results

In Tables 2, 3 and 4, we test the degree to which investors rely on the credit rating assigned by CRAs at the time of issuance and identify the security design factors, beyond credit ratings, with a significant impact on the funding cost. In Table 2 we report the estimates of the OLS test of Equation (1), where we regress the Spread at issuance on the Credit Rating for the U.S. and E.U. market separately for CLO tranches issued from 1997 to 2015. In Table 3, we repeat the analysis of Table 2, but here we create four time intervals to test whether credit ratings have a different impact on funding cost for different time periods. In Table 4, we break down the sample based on the market share of issuers to test whether credit ratings are priced differently by investors across issuers with varying market shares. In Table 5, we estimate the level of rating standards for each year in our sample. Finally, in Table 6 we test the impact of rating standards over time on the funding cost at issue.

4.1 Credit Rating and the Impact on the Funding cost for U.S. and E.U. Markets

We are interested in the size of the credit rating coefficient in Equation (1) and the security design factors beyond credit ratings that impact funding cost of CLO tranches. Panel A of Table 2 do not include control variables; in Panel B we add control variables related to the structure of the transaction, issuer and time fixed effects. We compare the U.S. market in columns (1) to (3) with the E.U. market in columns (4) to (6) in Panels A and B. We observe striking differences between these two markets. First, we see in the U.S. market a coefficient of 29.98 (t-stat=154.3), which is substantially larger than 18.95 (t-stat=29.3) for the E.U. market. So, on average a substantially larger portion of the spread can be attributed to credit ratings in the U.S. market than in the E.U. market.

Furthermore, for the U.S. market in comparison to the E.U. market, more of the security design factors are statistically significant. For the U.S. market, investors rely heavily on security design: Capital Allocation, Transaction Value, and Tranche Count all report at least a 5% degree of significance. Since Capital Allocation is already a key input in the CRA models in constructing a credit rating, our findings suggest that investors in the U.S. compared to the E.U. market look beyond the credit rating and price additionally for the impact of capital allocation. But they also price additionally for Transaction Value and Tranche Count, factors which typically are not a key input in CRA models. The findings are robust for controls on CLO vintage, time and issuer fixed effects.

4.2 Time Period Differences

In this section we discuss the regression results shown in Table 3 on subsamples separated by time periods. We report the results for each of the following four intervals: (1) 1997-2003, (2) 2004-2007, (3) 2008-2011, and (4) 2012-2015 in Table 3. We again compare the U.S. (Panel A) with the E.U. (Panel B) and observe a number of differences across time periods. We have chosen these particular time intervals to reflect the impact of the credit rating on the funding cost under prevailing market circumstances in the global CLO market over time.

The period 1997-2003 can be considered a period of stable growth in CLO issuance, followed in the years 2004-2007 by rapid growth. The years 2008-2011 are the years during which the financial crisis severely disrupted the market, resulting in a dramatic slowdown in new issuance. The final period is one of market recovery, coinciding with the period of key legislation implemented in both the U.S. and E.U. after the crisis.

Let us examine Table 3. We first look at the time period 1997-2003 in columns (1) and (2) of Panel A and B. In column (2) of both panels we find a statistically significant credit rating coefficient of 30.12 (t-stat=18.01) in the U.S. market and 29.35 (t-stat=14.98) in the E.U. market. This means that in the time period 1997-2003, in both markets, credit ratings were a significant factor in determining the funding costs. In our model without control variables, we see in column (1) that the R2 reveals roughly the same explanatory power to credit rating in both markets, with a R2 of 0.616 in the U.S. market and 0.614 in the E.U. market. Hence, the proportion of variation in funding cost is explained for roughly 61% by the credit rating for both markets in the period 1997 to 2003. In column (2) of Panels A and B we further find that beyond credit rating, Capital Allocation and Tranche Size were significant factors in determining the funding cost in both markets in that time period. For Capital Allocation we find a coefficient of 45.14 (t-stat=2.79) in the U.S. market and 50.91 (t-stat=2.40) in the E.U. market, and for Tranche Size we find a coefficient of 7.28 (t-stat=2.45) for the U.S. market, significant at the 5% level, and 8.56 (t-stat=3.17) in the E.U. market but only significant at the 1% level. Rating Discrepancy is another significant factor, albeit only in the E.U. market.

Columns (3) and (4) of Panels A and B show results for the period 2004-2007. We now find a significantly higher credit rating coefficient for the U.S. market than for the E.U. market, both when looking at credit rating alone in column (3) and for our model containing all control variables in column (4). With credit rating coefficients of 33.63 (t-stat=54.24) in the U.S. and 22.93 (t-stat=21.85) in the E.U. market, compared to the preceding period the coefficient in the U.S. increased and in the E.U. decreased. This means that credit ratings in the U.S. market reported an increase in their impact on the funding cost, whereas in the E.U. we see the opposite. Furthermore, looking at column (3), the R2 of 0.766 in the U.S. market in 2004-2007 is significantly higher compared to the R2 in the previous period, whereas the R2 in the E.U. of 0.635 remained similar to the previous period. It therefore appears that in this time period U.S. investors were building up their reliance on credit ratings and, on top of that, the credit rating itself determined a larger portion of the funding cost at issue than in the E.U. market. If we look at the security design factors, we find similar results for the E.U. market compared to the time subset 1997-2003. The only difference is that for the U.S. market we find that Tranche Count turns significant at the 5% level with a coefficient of –1.7 (t-stat=–1.96) in column (4) of Panel A.

We now turn to the period 2008-2011 in columns (5) and (6) of Panels A and B. We find that for the U.S. market the credit rating coefficient with 28.44 (t-stat=13.16) in Panel A column (6) decreased slightly compared to the previous periods. However the decrease in the credit rating coefficient in the E.U market was much more drastic, with a coefficient of 8.10 (t-stat=5.26) in Panel B column (6), a drop of about 65% during the collapse of the structured finance markets in the period 2008–2011 compared to the previous period 2004-2007, columns (4) and (6) of Panel B. This suggests that in contrast to the E.U, credit ratings in the U.S. market, even during the financial crisis, remained a large and consistent determinant of funding cost.

Looking at credit rating alone in column (5) of Panels A and B, the R2 reveals a significant higher explanatory power of the credit rating for the U.S. market (R2 of 0.55) compared to the E.U. market (R2 of 0.13). Hence, consistent with the subset 2004-2007, investors in the U.S. market relied to a greater extent on credit ratings alone compared to E.U. market investors. In fact, the R2 of 0.13 in the E.U. market is considerably lower than the R2 in the previous two year subsets with R2s of 0.614 in column (1) and 0.635 in column (3).

Next we study the security design factors and look at some differences between the two markets for the period 2008-2011. We see that Log Tranche Size becomes insignificant in the E.U. while it becomes highly significant with a coefficient of –29.77 (t-stat=5.43) in the U.S market. Thus, for the 2008-2011 period, larger CLO tranches experienced lower funding cost in the U.S., but we do not observe the same in the E.U. market. Furthermore, although in the U.S. market we generally see a consistently positive and highly significant coefficient for Capital Allocation across time, in the 2008-2011 period it has no significant impact on the funding cost. This is different in the E.U. market, where we see for the first time a highly significant coefficient for Capital Allocation of 64.95 (t-stat=3.15) with a negative sign. So, in this period, which was characterized by substantial market disruption, our results suggest that in the two markets investors had a different opinion on how capital allocation is to be taken into account in the pricing of CLOs, in addition to how CRAs had already taken it into account in their credit ratings.

Lastly, we move to the period 2012-2015 and find some substantial differences between Panels A and Panel B, columns (7) and (8). First, in line with the previous year subset 2004-2007 and 2008-2011, we once again find a higher credit rating coefficient in the U.S. market compared to the E.U. market, with a credit rating coefficient of 30.84 (t-stat=143.9) for the U.S. market and 25.12 (t-stat=11.74) for the E.U. market (column (8) of both panels). Having examined all year subsets, we can now see that the size of the credit rating coefficient in the U.S. market is more stable over time than in the E.U. market. For example, looking at the E.U. market across time we find credit rating coefficients ranging from 6.76 (t-stat=6.18) in column (5) to 29.35 (t-stat=14.98) in column (2) of Panel B, while for the U.S. we are looking at a much smaller range from 24.49 (t-stat=19.17) in column (1) to 33.63 (t-stat=54.24) in column (4).

Second, when looking at credit rating alone in column (7) of Panels A and B, we observe a significantly and dramatically higher R2 of 0.902 in the U.S. market compared to a R2 of 0.292 in the E.U. market. This difference is less pronounced when we turn to our full model in column (8), although the R2 in the U.S. market sample remains higher with 0.945 compared to 0.818 in the E.U. market sample, in the final period 2012-2015. Hence, our results not only suggest that on average a higher portion of funding cost at issue is determined by the credit ratings in the U.S. market compared to the E.U. market, but also that in the U.S. market investors were observed to be increasing their reliance on credit ratings in this period, consistent with the previous two time periods 2004-2007 and 2008-2011.

Third, in our results we find security design factors that significantly determine the funding cost at issue in the U.S. market compared to the E.U. market. In fact, Tranche Count, Capital Allocation, Log Transaction Value and Rating Discrepancy all are statistically significant at the 1% level in the U.S. market sample. For the E.U., beyond credit rating, only Rating Discrepancy turns out significant, and only at a 5% significance level in the 2012-2015 period.

To summarize, first, looking at the size of the R2, investors in the U.S. market compared to the E.U. tend to rely substantially more on the credit rating in the assessment of the funding cost at issuance. These results are most pronounced in the period leading up to the crisis and in the recovery period after the crisis. Second, our results show a substantially and consistently higher credit rating coefficient for the U.S. compared to the E.U. market. This means that for the U.S. on average a substantially higher portion of the funding cost is determined by credit ratings. The same applies to the security design factors and their impact on the funding cost. Third, the size of the credit rating coefficient in the U.S. market is more stable over time than in the E.U. market. In the E.U. market, investors dramatically reduced the degree to which they relied on credit ratings in pricing CLOs during the aftermath of the structured finance markets collapse in the period 2008-2011. This is far less the case for the U.S. market.

4.3 The Impact of Issuer Size

In this section, we test whether the credit rating and the other identified factors have different effects on the funding cost depending on the size of the issuer. Our consideration behind this is the notion that investors may price CLOs differently for issuers that are either large and/or tap the market frequently, in line with He et al. (2012) and in line with Cordell et al. (2021), who focus on manager size, which is broadly the same as issuer size in the CLO market where managers typically run their only one CLO issuance program. We examine issuer size in two ways: by market share value and by frequency of issuance.

In columns (1) to (4) of Table 4, we split our sample into Large and Small. Tranches fit into “Large” if they are issued and sold by an issuer who is among the top 10% of issuers based on global CLO market share by issuance amount for the period of 1997-2015 in columns (1) and (2), and Small refers to all others in columns (3) and (4). In columns (5) to (8), we show regression results based on the number of tranches issued by the issuer. For these simple comparisons, “Frequent” issuers refers to those tranches of an issuer that is among the top 10% measured by number of tranches contributed to the total number of CLO tranches issued globally (1997-2015) in columns (5) and (6), and “Infrequent” refers to all other CLOs in columns (7) and (8).

We start by comparing the credit rating coefficients for the U.S. with the E.U. in columns (1) to (8) of Panels A and B. We find roughly similar magnitudes of credit coefficients for the four subsets in the U.S. market. For example, we observe a credit rating coefficient of 32.03 (t-stat=83.85) for large issuers in column (2) and a coefficient of 31.72 (=97.91) for small issuers in column (4). Also when looking at frequent versus infrequent issuers we find roughly similar coefficients of 31.47 (t-stat=90.37) in column (6) and 32.22 (t-stat=90.99) in column (8). In the E.U. market, however, our results suggest that investors do differentiate between issuers based on size. For example, we find credit rating coefficients for the large issuers in the E.U. of 14.54 (t-stat=12.40) in column (2) and 25.67 (t-stat=26.82) for small issuers in column (4). Comparing frequent with infrequent issuers, in column (6), we observe a substantially lower credit rating coefficient of 16.54 (t-stat=14.47) for frequent issuers, compared to 22.91 (t-stat=19.24) in column (8) for infrequent issuers. These findings suggest that on average investors in the U.S. market do not differentiate the funding cost based on both of our measures of issuer size, but investors in the E.U. do, also based on both of our measures of issuer size. In the E.U. investors allocate on average a lower funding cost on the basis of credit ratings for tranches that are issued by larger and more frequent issuers compared to those issued by small and infrequent issuers.

Next, turning to the explanatory values in Table 4, we find results consistent with Table 2 to 3, that is, the R2 is on average higher and more consistent over different subsamples in the U.S. market compared to the E.U. market. For the U.S. market, we observe R2s ranging from 0.65 to 0.69 in Panel A, whereas for the E.U. market, in Panel B, we find a higher variation, but at a lower level with R2s ranging from 0.33 to 0.53. This indicates that in the U.S. market, regardless of our measurements for issuer size, investors again tend to rely more, and more consistently, on the credit rating in determining the funding cost at issuance for CLOs, than in the E.U. market where we see a less consistent and smaller reliance on credit ratings in pricing CLOs.

When we compare the number of significant factors beyond the credit rating coefficient in both markets in Panels A and B, we see a similar pattern: in the E.U. market credit ratings have a higher impact on funding cost for smaller and infrequent issuers, and a lower impact for larger and frequent issuers, whereas in the U.S. market we do not see a substantial difference in impact on the magnitude of the coefficients on the basis of issuers being large or frequent.

4.4 Rating Standards

In this section, we test whether investors identify changes in credit rating standards in the pricing for CLOs issued in the E.U. and U.S. market in time. First, we present the results of our ordered logit model given in Equations (1) to (3) that allow us to estimate the level of the credit rating standard for each year in our sample in Table 5.Footnote 8 Second, we examine the impact of rating standards on funding costs for our full sample and triple A sample in Table 6.Footnote 9

Table 5 shows the results of the ordered logit model for the U.S. market in columns (1) to (3) and for the E.U. market in columns (4) to (6). Columns (1) and (4) show that the tranche-related characteristics are highly significant for both the E.U. and U.S. market and the signs are consistent between the two markets. For example, in both markets a tranche with a higher capital allocation level will on average have a better rating. The second and fifth column in Table 5, shows what the improvement is in the credit rating measured in the number of notches given a one-standard-deviation increase in capital allocation. For example, a one-standard-deviation increase in capital allocation level on average decreases the credit rating by 2.5 notch in the US market and 1.2 notch in the EU market.Footnote 10

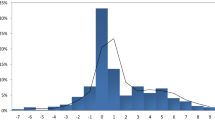

Next, the results in columns (3) and (6) allow us to estimate the rating standards over time consistent with Alp (2013). We convert the year indicators to units of rating notches by dividing the year coefficient estimates by the rating notch length. Figure 1(a) provides the plot of Panel A column (3) for the the US market and Figure 1(b) displays the plot for Panel B column (3) the E.U. market. We see an interesting different trend in both markets. Figure 1(a) shows that rating standards loosened in the U.S. market until the start of the global financial crisis and became significantly tighter after 2008. While in the EU market, Figure 1(b), rating standards tended to be more stable over time with the exception of 2010.

Credit rating standards over time sorted by market. This figure shows the credit rating standards over time, for the U.S. and E.U. market separately. The credit rating standards over time are derived from the year indicators in the ordered logit regression of the underlying credit factors on the credit ratings (Table 5). The sample is sorted by year and market of issuance. Figure 1(a) presents the results for the CLOs issued in the U.S. market only; Panel B for CLOs issued in the E.U. market only

In Table 6, we present the regression results of the rating standards and show the impact on the funding cost at issue. If investors perceive the variation in rating standards, then strictly rated CLOs should have lower credit spreads compared to loosely rated CLOs with the same actual rating. We again compare the U.S. market in columns (1) and (2) with the E.U. market in columns (3) and (4) and observe fascinating results and differences. In contrast with our expectation, in columns (1) and (3), we find rating standards highly significant with a negative sign at the 1% level for both markets. This means that investors demand a lower (higher) funding cost in case the CLO is issued in times of lower (higher) credit rating standards. Looking at the magnitude of the impact in column (1), we see in the US market a coefficient of -40.08 (t-stat= -63.96), which is substantially larger than -11.65 (t-stat= -3.34) for the EU market, column (3). We find similar results for the triple A sample in columns (2) and (4), Table 6. This suggests that on average investors in the U.S. and E.U. market demand lower premiums in situations of loosening credit rating standards, and in the U.S. drastically more so than in the E.U. market.Footnote 11

5 Conclusions and Policy Implications

Investors in the U.S. and in the E.U. rely considerably on credit ratings in pricing CLOs. However, the divergence between the two markets is striking. First, the reliance on credit ratings is stronger in the U.S. than in the E.U. market. Second, investors also take other security design characteristics beyond credit ratings into consideration, such as tranche count (i.e., number of tranches in a structure) and CLO deal size, when determining funding cost for CLO tranches, more so in the U.S. than in the E.U. market. Third, our results show that after the global financial crisis the reliance on credit ratings remained more or less stable in the U.S. but dropped markedly in the E.U. market. So, the level of reliance is much more consistent over time in the U.S. than in the E.U. market. Fourth, contrary to the findings for the U.S. CLO market, in the E.U. investors do appear to look to issuer size when they price CLO tranches: they increase their reliance on credit ratings and other factors in the case of smaller or infrequent issuers.

These observed differences between the U.S. and E.U. markets could point to the potential existence of a more general divergence in approach between the investor communities in the U.S. and the E.U. markets for CLO tranches. Such a deviation in approach could have its rational basis in the simple fact that the CLO market in the U.S. is much larger than the E.U. (in our sample this is also shown by 5,935 tranches in the U.S. and 1,656 in the E.U.). That means that in the U.S., investors considering the purchase of a specific individual CLO tranche could compare and contrast that tranche with a larger – and therefore possibly more varied – universe of CLO tranches than investors could in the E.U. market. In the E.U., with less tranches available from which to select, investors may have good cause to focus their investments on large and frequent issuers with whom they are more likely to have to deal with than on tranches issued by smaller and infrequent issuers.

Finally, the impact of tightening and loosening of credit rating standards adversely impacts funding costs in both markets, in the U.S. drastically more so than in the E.U. market, meaning that investors seem to price CLOs tighter when credit standards loosen. The existence of such an inverse relation could point to investors and CRAs at the same time succumbing to market exuberance, thereby exarcerbating the business cycle in the CLO market through better (worse) ratings and lower (higher) funding costs. Investors would therefore be well-served by becoming more aware of signals of increasing and decreasing market exuberance, so that they could adapt their risk pricing policies accordingly on a timely basis. CRAs, data-providers and financial market associations obviously have enabling roles to play in this regard.

For further academic research we suggest focusing on improving the academic understanding of the pricing dynamics related to CLOs. Given that the Financial Stability Board (2020) predicts that due to changing prudential regulations banks may be set to shift more lending activities from their balance sheet to CLOs, the E.U. CLO market may well grow even further in magnitude and importance, increasing the need for a better understanding of investor CLO pricing behavior.

Notes

Dodd-Frank Act 2010, Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Section 941 Subsection 15G.

Regulation (EU) No 462/2013 of the European Parliament and of the Council of 21 May 2013 amending Regulation (EC) No 1060/2009 on CRAs.

There are studies that focus on other factors besides credit rating that determine the pricing of structured products. For example, Deku et al. (2019), using a sample of 4,201 European originated MBS tranches show that the quality of the trustee has an impact on the pricing of structured finance securities during the most recent global financial crisis.

If fixed-rate tranches were to be included in our study, then it would be necessary to determine the appropriate benchmark yield curve for each tranche in the sample in order to obtain primary issuance spreads that could be consistently compared across the sample. By restricting the tranches in our sample to 3-month floating-rate tranches where the reference rate is the same interest rate benchmark, we avoid this problem. Furthermore, in constructing the final sample, we had to eliminate some tranches due to errant data or metrics that represented vastly atypical observations. For our analysis, we want to have a consistent benchmark for assessing the funding cost.

EURIBOR reflects the interest rate at which highly credit rated banks can borrow, in euros, from other banks on an unsecured basis. USD LIBOR reflects the interest rate at which highly credit rated banks can borrow, in U.S. dollars, from other banks on an unsecured basis. EURIBOR and USD LIBOR are determined and communicated on a daily basis for a variety of maturities.

We excluded one outlier with 29 tranches in one deal.

Our sample only includes EU tranches that are issued from 1999 – 2015. To make an accurate comparison on changes in rating standards over time, we exclude all US tranches that are issued before 1999 in this regression.

We use the triple A sample to test if the effects are consistent if we use a fixed rating category, in line with Alp (2013). There are an insufficient number of observations for the other fixed rating categories to enable statistical analyses.

The rating notch length in our sample is (3.75 – (-8.20))/19=0.63. The coefficient of rating discrepancy in Panel A of Table 5 is 0.57 with a standard deviation of 0.50 (see Table 1, Panel A). Hence, a one-standard-deviation increase in rating discrepancy increases the credit rating by 0.57*0.50/0.63= 0.453 notches.

In unreported tests we have also included the security design factors in our model and obtained similar results.

References

Alp A (2013) Structural shifts in credit rating standards. The Journal of Finance 68(6):2435–2470

Bar-Isaac H, Shapiro J (2013) Ratings quality over the business cycle. Journal of Financial Economics 108:62–78

Becker B, Milbourn T (2011) How did increased competition affect credit ratings? Journal of Financial Economics 101:493–514

Bloomberg. (2019). Europe CLOs gear up for the second quarter after beating tough odds. Retrieved from https://www.bloomberg.com/news/articles/2019-04-01/europe-clos-gear-up-for-second-quarter-after-beating-tough-odds

Blume ME, Lim F, Mackinlay AC (1998) The declining credit quality of U.S. corporate debt: Myth or reality? Journal of Finance 53:1389–1413

Bolton P, Freixas X, Shapiro J (2012) The credit ratings game. Journal of Finance 67:85–111

Cafarelli A (2020) Creditworthiness risk over years: The evolution of credit rating standards. The Journal of Corporate Accounting & Finance 31(4):48–59

Cordell, L., Roberts, M. R. & Schwert, M. (2021). CLO performance. Working paper. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3652124

Deku SY, Kara A, Marques-Ibanez D (2019) Trustee reputation in securitization: When does it matter? Financial Markets. Institutions & Instruments 28(2):61–84

Dilly M, Mählmann T (2015) Is there a "Boom Bias" in agency ratings? Review of Finance 20:979–1011

Dodd-Frank Act. (2010). Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Section 941 Subsection 15G.

European Securities and Markets Authorities (ESMA).(2020). Report on CRA market share calculation. Retrieved from https://www.esma.europa.eu/press-news/esma-news/esma-reports-annual-market-share-credit-rating-agencies-0

Fabozzi FJ, Vink D (2012) Looking beyond credit ratings: Factors investors consider in pricing European asset-backed securities. European Financial Management 18(4):515–542

Financial Stability Board (2020). Global monitoring report on non-bank financial intermediation 2019. Retrieved from https://www.fsb.org/wp-content/uploads/P190120.pdf

Flynn S, Ghent S (2018) Competition and credit ratings after the fall. Management Science 64(4):1477–1973

Griffin JM, Nickerson J, Tang DY (2013) Rating shopping or catering? An examination of the response to competitive pressure for CDO credit ratings. Review of Financial Studies 26(9):2270–2310

He J, Qian J, Strahan PE (2011) Credit ratings and the evolution of the mortgage-backed securities market. American Economc Review 101:131–145

He J, Qian J, Strahan PE (2012) Are all ratings created equal? The impact of issuer size on the pricing of mortgage-backed securities. Journal of Finance 67:2097–2137

He J, Qian J, Strahan PE (2016). Does the market understand rating shopping? Predicting MBS losses with initial yields. Review of Financial Studies, 29(2), 457-485.

Luo D, Tang DY, Wang SQ (2016). A little knowledge is a dangerous thing: model specification, data history, and CDO (mis) pricing. Unpublished working paper. Shanghai University of Finance and Economics.

Marques MO, Pinto JM (2020) A comparative analysis ex ante credit spreads: Structured finance versus straight debt finance. Journal of Corporate Finance, forthcoming.

Petersen MA (2009) Estimating standard errors in finance panel data sets: Comparing approaches. Review of Financial Studies 22(1):435–480

Regulation (EU) (2013) No 462/2013 of the European Parliament and of the Council of 21 May 2013 amending Regulation (EC) No 1060/2009 on CRAs.

Regulation (EU) (2017) No 2017/2402 of the European Parliament and of the Council of 12 December 2017 laying down a general framework for securitisation and creating a specific framework for simple, transparent and standardised securitisation.

Securities and Exchange Commission (SEC) (2020) Annual Report on Nationally Recognized Statistical Rating Organizations. Retrieved from https://www.sec.gov/files/2020-annual-report-on-nrsros.pdf

S&P Global Market Intelligence (2018) US CLO issuance hits record volume, topping $125B. Retrieved from https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/leveraged-loan-news/us-clo-issuance-hits-record-volume-topping-125b

Vink D, Nawas M, van Breemen V (2021) Security design and credit rating risk in the CLO market. Journal of International Financial Markets, Institutions and Money, forthcoming.

White H (1980) A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Journal of the Econometric Society 48(4):817–838

Zhou X, Xu G, Wang Y (2017) The issuer-pays business model and competitive rating market: Rating network structure. Journal of Real Estate Finance and Economics 55(2):216–241

Yang L, Wang R, Chen Z, Luo X (2020). What determines the issue price of lease asset-backed securities in China? International Review of Financial Analysis, forthcoming.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interests/Competing interests

We have no potential conflicts to disclosure.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Fabozzi, F., van Breemen, V.M., Vink, D. et al. How much do Investors Rely on Credit Ratings: Empirical evidence from the U.S. and E.U. CLO primary market. J Financ Serv Res 63, 221–247 (2023). https://doi.org/10.1007/s10693-021-00372-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-021-00372-x