Abstract

Did consumers change their payment behaviour after being exposed to a public campaign that encouraged them to use their debit cards more often? We analysed the impact of such a campaign that started in 2007, using debit card transaction data between 2005 and 2013. The overall results show positive effects of the national campaign to promote debit card usage, both in the short and in the long run. The results suggest that high campaign intensity aimed at consumers had a positive impact, as did a focus on certain large retail chains. Interventions aimed at increasing debit card acceptance by retailers were effective to some extent. Providing information to retailers about the benefits of debit card acceptance led to higher card acceptance, but no proof was found for the effectiveness of financial incentives for retailers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Consumers often have a choice of different means of payment at a point of sale (POS). Traditionally, they mainly used paper-based instruments such as cash or cheques, but since the introduction of payment cards, card usage has slowly increased at the expense of cash and cheque payments. However, in most Western countries cash is still the dominant payment instrument in terms of number of transactions (Schmiedel et al. 2013; Bagnall et al. 2016).

In the Netherlands, cash is universally accepted, and debit card acceptance among retailers is very high and continues to grow. All large retail chains and petrol stations accept debit card payments, as well as the majority of small and medium-sized shops and catering establishments (Panteia 2013). In 2013, consumers used cash 3.8 billion times for POS payments, representing a value of EUR 47 billion, and debit cards 2.7 billion times, representing a total value of EUR 85 billion (De Nederlandsche Bank (DNB)/Dutch Payments Association (DPA) 2014).Footnote 1

Payment instruments differ in several respects, such as ease of use, transaction speed, anonymity, costs and safety. Overall, an increase in debit card usage at the expense of paper-based payment instruments may be considered beneficial for society, as it enhances safety and contributes to a more cost-efficient payment system. Increased card usage benefits safety, as it lowers the risks for cash theft and robbery. In addition, it reduces the costs incurred by banks and retailers for POS payments in countries where card usage is sufficiently high to benefit from economies of scale (Brits and Winder 2005; Danmarks Nationalbank 2012; Gresvik and Haare 2009; Jonker 2013; Schmiedel et al. 2013; Segendorf and Jansson 2012). The National Forum on the Payment System (the Forum) commented in its 2006 annual report that “[t]here are plenty of opportunities to step up efficiency. Banks and retailers are working, within the Forum and in other ways, on concrete measures to encourage the wider use of debit cards. This is a way of further reducing the use of banknotes and coins, which carry relatively high social costs."Footnote 2

Market participants in the Netherlands and abroad have tried to stimulate card usage in several ways. Financial incentives such as reward programmes or surcharges on cash withdrawals steer consumers towards higher debit card usage (Bolt et al. 2010; Borzekowski et al. 2008; Carbó-Valverde and Liñares-Zegarra 2011; Verdier 2011). However, even if market participants provide the right incentives to consumers, the latter’s payment behaviour changes only gradually, as it is strongly rooted in their daily routines (Cruijsen van der et al. 2016). These daily routines are hard to break, even if consumers themselves indicate that they prefer to make debit card payments over cash ones (Jonker 2007; Cruijsen van der and Plooij 2015). An alternative is to launch a public campaign encouraging consumers and retailers to increase debit card usage by highlighting the desirability and (social) benefits of such behaviour. Such a campaign may stimulate pro-social (payment) behaviour by consumers and retailers, i.e. payment behaviour that is beneficial to society, see e.g. Helmig and Thaler (2010).

In the Netherlands, banks and retailers together launched a public campaign in 2007. Their aim was to increase safety and reduce costs by stimulating retailers to accept debit card payments and encouraging consumers to use their debit cards. The campaign consisted of several mostly nationwide interventions and some regional ones clustered in time. As far as we know, the influence of such a campaign on debit card usage in general, and retailer and consumer demand for debit card usage in particular, has never been considered in the literature. This paper aims to fill that gap and provides new insights into the effectiveness of this campaign promoting debit cards on both demand sides in the Netherlands. We studied the influence of said campaign by addressing the following questions.

-

Did the public campaign in the Netherlands influence debit card usage, and, if so,

-

was the effect temporary or sustained?

-

did it influence consumer demand and/or retailer demand?

-

-

Did the introduction of a new slogan in the Netherlands lead to a change in debit card usage and/or consumer demand?

Assessing the impact of the campaign on debit card usage entails an interesting econometric issue concerning the causality between the timing of interventions and their impact on debit card usage. Can we consider their timing as exogenous and interpret the estimated coefficients of interventions as their influence on debit card usage? Or should we be more cautious, consider the timing of the interventions as endogenous and interpret the estimated effects as correlations? In the paper we discuss this issue and provide arguments supporting the assumption that these interventions can be considered as exogenous.

We used a dataset containing the weekly number of debit card payments for the Netherlands between 2005 and 2013 provided by automated clearing house (ACH) Equens. In order to make a first attempt to disentangle the influence of the public campaign on consumer demand and retailer demand for debit card payments, we also collected information on the number of installed payment terminals at points of sale, reflecting retailer demand (provided by Equens), and the extent to which people used Google’s search engine to look for the search term ‘pinpas’ (debit card) as a proxy for consumer demand. Furthermore, we used information on the timing and nature of individual interventions aimed at consumers and retailers involved in the campaign.

First of all, we found evidence of the public campaign leading to increased debit card usage. The change in payment behaviour also seems to hold in the long run. However, a long-term effect appears to be present only if campaign intensity is high. The most effective intervention was the one focused on consumers who already use their debit cards, encouraging them to expand their usage to new situations. Secondly, we found mixed results with respect to the effectiveness of the change of campaign slogan. It raised consumers’ interest in debit cards but did not lead to higher debit card usage. Thirdly, we found that one type of intervention led to higher debit card acceptance by retailers. This intervention highlighted the benefits of debit card acceptance for retailers in terms of cost savings and increased safety and provided information about promotion materials. We did not find proof for the effectiveness of direct financial incentives for retailers.

Our findings are relevant to policymakers, marketers, payment service providers and retailers who want to influence consumers’ payment behaviour at the POS, although we cannot infer that they also hold for promoting other means of payment or for other regions.

This paper is structured as follows: Section 2 presents an overview of the relevant literature; it includes studies on payments and on marketing. Section 3 discusses the nature of the campaign and its interventions. Section 4 lists the main research questions, and Section 5 discusses the data and the research approach. Section 6 then discusses the estimation results. Finally, Section 7 provides a summary and concluding remarks.

2 Review of the literature

2.1 Literature on payments

During the past decades, the payment habits of consumers worldwide have changed considerably. Traditional means of payment have been substituted by electronic payment instruments. There is empirical evidence that the substitution of cash by card payments reduces the social costs of the payment system (Brits and Winder 2005; Danmarks Nationalbank 2012; Gresvik and Haare 2009; Jonker 2013; Schmiedel et al. 2013; Segendorf and Jansson 2012). Social costs refer to costs incurred in the payment chain by the central bank, commercial banks, cash in transit companies, ACHs, retailers and telecom providers.

A vast amount of research has been performed on the drivers behind consumers’ choices between different means of payment at a POS; see Kosse (2014) for a comprehensive and up-to-date summary. In general, consumers’ payment choices depend on demographic characteristics, transaction characteristics and situational factors. Regarding transaction characteristics, card usage increases with transaction values. This is partly due to differences in card acceptance between sectors that differ in average transaction amount, see e.g. Bagnall et al. (2016). In addition, there is evidence that people’s payment choices are made unconsciously and to a large extent depend on habits (Cruijsen van der et al. 2016; Horst van der and Matthijsen 2013), although Eschelbach and Schmidt (2013) show that German consumers do make conscious decisions about the payment instruments they use by taking into account future barriers in using cash and cards when making payments.

In the two-sided market literature, the card payments market is considered to be a market with two groups of end-users, namely consumers and retailers. In such a market, consumer adoption and retailer acceptance of payment cards are interdependent. Although card acceptance decisions by retailers influence card usage by consumers, especially in the short run (see e.g. Jonker 2007; Arango et al. 2015), there is also evidence that consumer preferences drive card acceptance decisions by retailers (Loke 2007; Jonker 2011; Bounie et al. 2016). So the two sides of the market clearly influence each other’s card payment adoption. Furthermore, next to network externalities, pricing incentives influence consumer and retailer preferences for card payments. Market participants have tried to steer consumers towards card payments using financial incentives; see Verdier (2011) for an overview. Banks work together in a card network by setting transaction fees that will encourage card usage by consumers and card acceptance by retailers. As consumers are considered to be more sensitive to price than retailers, transaction fees for consumers are usually set at zero or are even negative, whereas those for retailers are above zero. However, retailers are allowed to charge their customers a fee for card usage. Most consumers will avoid paying this fee by using cash instead (Bolt et al. 2010). Retailers who put a surcharge on debit card payments on average receive 8.5 percentage points fewer debit card payments than similar shops that refrain from doing so. Surcharges for card usage at the POS imposed by banks have a similar impact (Borzekowski et al. 2008).Footnote 3 Positive financial incentives, such as those provided in card reward programmes, fuel consumers’ card usage (Ching and Hayashi 2010; Simon et al. 2010; Carbó-Valverde and Liñares-Zegarra 2011; Arango et al. 2015). Findings on the exact impact of reward programmes are not conclusive, however, perhaps due to cross-country differences in payment institutions or payment habits. Kosse (2013) shows that consumers also react to media reports about card fraud. Such reports depress debit card usage by a few percent. This effect lasts one day only.

In the payments literature, little attention has thus far been paid to the effect of public campaigns on payment behaviour. An exception is Aydogan (2016), who designed a real-life experiment in which she examined the impact of pro-debit card interventions in the university canteen of the Vrije Universiteit Brussel on the share of cash payments in the canteen’s revenues. The campaign focused on changing the payment behaviour of canteen customers in a controlled environment in which both cash and debit card payments were accepted. Therefore, any effect of the campaign can be ascribed to changing the canteen’s customers’ payment behaviour. The interventions did not affect students’ payment behaviour, but there was a small short-lived effect on employees’ payment behaviour.

2.2 Marketing and social marketing

As for marketing research, since the aim of the campaign in the Netherlands was to change people’s behaviour for the good of society, social marketing in particular may provide useful insights. Andreasen (1994) defines social marketing as “the adaptation of commercial marketing technologies to programs designed to influence the voluntary behavior of target audiences to improve their personal welfare and that of the society of which they are a part.” Social marketing is used in many different fields, including public health, traffic safety and environmental protection. Many social marketing campaigns, as well as marketing campaigns in general (see Vakratsas and Ambler 1999) are aimed at first changing people’s attitudes, then their intentions and finally their behaviour. In evaluations of social marketing campaigns, often attitude or intention change is measured, rather than the final behavioural change. Hence, Helmig and Thaler (2010) recommend that more studies be carried out that measure behavioural change, as well as research focused on long-term impact rather than short-term effects.

Research on social marketing has identified several factors that influence its effectiveness. Helmig and Thaler (2010) have provided an overview, identifying two general categories of relevant independent variables: general campaign characteristics and framing determinants. General characteristics of the campaign include scope and targeting, channels and interactive elements. When it comes to geographical scope, campaigns with a broader scope show better results when it comes to behavioural change. Results of targeting are mixed, messages focused on a small group being more effective in changing intentions, but campaigns focused on the general public being more successful in changing behaviour. Regarding media channels, mass media campaigns have been shown to positively affect both attitude and behavioural change, audio channels being particularly effective in changing behaviour. Interactive elements have been shown to increase the effectiveness of campaigns. The framing determinants distinguished by Helmig and Thaler are focus, direction (i.e. positive or negative), tonality (i.e. emotional, normative or rational), time horizon and content. Self-focused messages, showing the effects on the individual, are effective in campaigns targeting smoking and drinking and driving. Other-focused messages, showing the effects on others or on society as a whole, are effective in campaigns promoting environmental protection. Both positive and negative messages can be effective, depending on other variables. Emotional messages tend to be more effective than normative and rational messages. The time horizon of the effects on the behaviour that a campaign seeks to change is also important, but its effect depends on other moderating variables such as gender, age and other personal characteristics. Finally, the effectiveness of a campaign can be influenced by its content, i.e. whether multiple messages are conveyed in a single campaign, how the desired behaviour is described, etc.

Since social marketing differs from commercial marketing only in terms of goals and not methods, insights from commercial marketing can also be useful for social marketing. Sethuraman et al. (2011) for example find that advertising elasticity (defined as “the percentage increase in sales or market share for a one percent increase in advertising”) is higher during recessions, for durable goods and for products at the growth stage of their life cycle. There are also differences between regions, with advertising elasticity in Europe being higher than in the US, possibly due to under-advertising in Europe vs. optimum or over-advertising in the US. TV advertising has higher short-run elasticity than printed advertising but lower long-run elasticity. The effects of marketing campaigns tend to last only a short time, a phenomenon termed campaign decay (Tellis 2004). Social marketing campaigns, in particular tobacco control campaigns, have been shown to exhibit campaign decay as well (Durkin et al. 2012). Although research on the intensity of campaigns is limited, results indicate that the relationship between intensity and output may not be linear. At very low levels, there may be little to no effect, due to the audience not retaining the message. On the other hand, at very high levels, the audience may become saturated, meaning that additional effort may not increase the effects of the campaign. If the audience gets bored or annoyed by a campaign that is either very intense or very long, there may even be adverse effects. However, the intensity or duration at which this phenomenon occurs depends on other factors such as complexity, emotional appeal, etc. (Tellis 2004). Wansink and Ray (1996) show that advertisements focused on expanding already existing behaviour to new situations are more effective than ads aimed at substituting existing behaviour by new behaviour.

Marketing research on measuring the influence of advertising on sales also provides some insights that may be applicable to our study. According to economic theory, profit maximising firms consider advertising as one of their many input factors, which may depend on sales, price elasticity of demand, the effectiveness of advertising, and advertising by competitors. In this sense, advertising depends on sales. However, firms advertise because they believe it increases sales by shifting the consumers’ demand curve for their product, which implies that sales also depend on advertising (Verma 1980). In addition, firms may decide to advertise their product in periods when they feel advertising will be most effective for their product. So, advertising and sales may influence each other simultaneously. Consequently, the estimated effect of advertising on sales may be biased upwards if possible endogeneity between advertising and sales is not adequately addressed (Schmalensee 1972). There are several solutions to this issue, such as the use of an instrumental variable (IV) estimator for advertising. In more recent literature, (structural) vector autoregressive (S)VAR models are employed which allow for the joint modelling of consumer response, marketing interventions and other endogenous variables, such as competitor response or future company decisions. In addition, these models allow for the assessment of the net long-term impact of marketing interventions using impulse-response functions, see e.g. Pauwels (2004) for an overview.

Another econometric issue concerns the appropriate time interval to be used to obtain reliable and consistent estimates of the influence of interventions. Clarke (1976) found that the aggregation of data affects the estimated persistence of advertising: the longer the time interval used for data aggregation, the higher the estimated persistence of advertising. The longer implied persistence of advertising when using annual data is mainly due to data interval bias. Bass and Leone (1983) confirm Clarke’s finding and conclude that “it is probably best to think of the appropriate micro data interval as having a length which coincides with the average interval between purchases of the product”.

3 Debit card-related public campaigns

3.1 Nationwide public campaigns

3.1.1 First campaigns in the 1990s

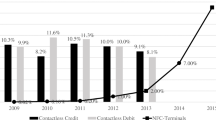

Banks introduced debit cards in the Netherlands in 1987. At first, consumers could only use their debit cards to withdraw cash from automated teller machines (ATMs), but from 1990 onwards debit cards could also be used to pay for purchases at a small number of points of sale. Figure 1 shows the annual growth in the number of POS debit card payments. During the first years, a campaign was held to encourage consumers to use debit cards for medium and high value transactions. During these years annual growth was very high; sometimes debit card usage would even double.

3.1.2 Nationwide campaign to increase debit card usage

After 2003, the annual growth rates of debit card usage dropped well below 10%. However, Brits and Winder (2005) showed that both banks and retailers could save costs by promoting card usage at the expense of cash. Their study revealed that debit card payments had been the most cost-effective payment instrument for most transaction amounts in 2002. Only for purchases below EUR 11.63 were cash payments more cost-effective.Footnote 4 In 2002, the average transaction amount of a debit card payment was EUR 44.13. Consequently, cost savings for society could be achieved if consumers used their debit cards also for medium and low value amounts. In November 2005, banks and retailers agreed on several measures to promote the use of debit cards, thus reducing costs and increasing the security of the payment system. One of these measures was the lowering of the retailers’ transaction fee for debit card transactions by 1 eurocent from December 2005 onwards. Another measure was the creation of the Foundation for the Promotion of Efficiency in Payments (FPEP). Among its key activities are promotional activities targeting retailers, including the introduction of a EUR 100 subsidy for the purchase of a debit card terminal in order to increase debit card acceptance, especially among small and medium-sized retailers (available between April 2007 and October 2012). There were also awareness-raising interventions such as radio commercials and information brochures. The materials provided to retailers included practical information about card acceptance as well as more specific promotional articles focusing on the benefits of accepting card payments, such as cost savings for retailers, improved security and convenience, as well as tips on how retailers can promote debit card usage by their customers.

Additionally, Currence, which at the time owned the Dutch debit card scheme PIN, developed a consumer campaign in cooperation with the FPEP. The consumer campaign did not focus on substituting card payments by cash payments, but rather used a behaviour expansion strategy, encouraging consumers who were already using their debit cards for medium and high-value payments to also use it for low value payments. This strategy was mainly used between 2007 and mid-2012, using the slogan Klein bedrag? Pinnen mag! (KBPM), which roughly translates as “Paying a small amount? Feel free to use your debit card!”. In 2012–13 the FPEP decided to change the message, believing that this slogan had lost its appeal. In 2012, it switched to U pint toch ook?- (UPTO), which translates as “Why not use your debit card?” and in May 2013 it launched its third slogan: Pinnen? Ja, graag! (PJG), which translates as “Debit card? Yes, please!”. These new slogans promoted debit card payments in general, rather than focusing on low value payments alone.

The national campaign included mass media (television and radio commercials, billboards, online advertising), social media (only the PJG slogan), promotional materials at the POS and interventions referred to as “Pin & win”, in which consumers who used their debit card could win a prize. In 2010 a “debit card week” was organised; in the following years the campaign was intensified during the national “security week”. The KBPM campaign focused on supermarkets and large retail chains first, and was later expanded into other sectors, such as drugstores, DIY stores and the catering industry (FPEP 2009, 2010, 2011, 2012, 2013).

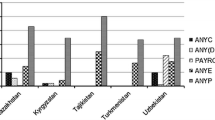

3.2 Consumers’ attitudes towards debit card payments

Given that the earliest debit card campaign in the 1990s focused on medium and high-value payments, many consumers were under the impression that debit card payments were less cost efficient than cash payments. This notion was enhanced by surcharges applied by retailers for low-value debit card payments. Toth et al. (2010) show that during the first phase of the campaign there was a shift from a general preference for cash towards one for using cash only for low amounts, and from preferring cash for low amounts towards preferring debit cards for all transaction sizes. However, in 2010, 35% of consumers were still under the impression that retailers were not fond of low-value debit card payments, and 26% believed that small retailers disliked debit card payments in general.

The campaign also appears to have been successful in increasing debit card acceptance by smaller retailers: between 2006 and 2011, debit card acceptance increased from 82% to 92%.Footnote 5 Surcharging for low-value debit card transactions also became less common.Footnote 6 Results from the DNB household surveyFootnote 7 show a small but significant improvement in consumers’ attitudes towards debit card acceptance from 2010 to 2011, coinciding with a slight decline in their attitudes towards acceptance of cash. Nevertheless, it should be noted that actual acceptance of cash is still almost 100% in every sector, whereas acceptance of debit cards is considerably below 100% in some sectors, such as street trading and catering (Wils et al. 2012).

Survey results also show small but significant changes in the perceived costs and safety of cash and card payments. When it comes to costs, the pre-campaign difference in favour of cash has almost completely disappeared.Footnote 8 As for the perceived safety of the debit card: after dropping in 2010 – possibly due to media reports about skimming fraud – safety perception picked up in the later years of the campaign. As perceived safety of cash remained more or less unchanged during the same period, this means that the already existing difference in favour of debit card payments widened (Fig. 2).

4 Research questions

The ultimate goal of public campaigns is to influence people’s behaviour. Our first research question therefore was:

Did the public campaign in the Netherlands influence debit card usage? and, if so,

-

was this effect temporary or sustained?

-

did it influence consumer demand and/or retailer demand?

During the first years of the campaign, consumers were encouraged to expand the use of their debit cards in POS locations where debit card usage for medium and high-value payments was already quite common. This new use seems to be relatively congruent with the existing consumer usage schemes and was therefore likely to be evaluated favourably by consumers. Consequently, we expect that interventions undertaken in the course of the public campaign positively influenced debit card usage by consumers.Footnote 9 In the later years of the KBPM slogan, interventions were undertaken in order to encourage consumers to use their debit cards more often in situations where its use had thus far remained rather uncommon, such as in the catering industry and on street markets. As a result, consumers may have experienced a stronger discrepancy between the existing payment behaviour and the proposed behaviour than during the first years of the campaign. This may have hampered the transfer of these later interventions to real payment situations. Consequently, we believe that the influence of the campaign diminished over time. During the first years of the campaign the effects may have been temporary as it takes repetition of debit card usage (Triandis 1980; Wood and Quinn 2005) before the intention to use a debit card is translated into actual daily payment behaviour. However, in the long run, when people got used to paying by debit card, the campaigns may have led to increased use of debit cards.

As for the activities aimed at retailers, these had more varied messages and characters throughout the various campaign periods. They aimed both to incentivise those who did not yet accept card payments to start doing so by lowering the financial barriers to card acceptance and to provide information to and encourage those who already accepted cards to promote card usage among their customers. It is therefore difficult to disentangle the effects of these different strategies. To the extent that the campaign was successful in convincing merchants to start accepting card payments, we expect a long-term effect on debit card acceptance and usage, since this is a long-term decision by the retailer that increases the possibility for those consumers wishing to pay by card for actually doing so. The effect of the interventions on debit card promotion by retailers and – indirectly – on debit card usage by consumers is likely to have been similar to that of the interventions aimed directly at consumers, although the effectiveness of promotional materials displayed at points of sale may have been higher because consumers could immediately put their intention to pay by debit card into practice.

Our second research question Did the introduction of a new campaign slogan in the Netherlands lead to a change in debit card usage and/or consumer demand? is about the impact of using a new slogan. We examined whether the introduction of the new UPTO and PJG slogans led to changes in payment behaviour and consumer demand for debit cards. The new slogans and the new content of the interventions may have increased people’s interest in debit cards and may have stimulated pro-social payment behaviour of new groups of consumers who were prepared to contribute to the safety of shopkeepers by using debit cards instead of cash. Compared to the KBPM slogan, the wording of the PJG slogan expresses more clearly that retailers really appreciate their customers’ debit card usage, irrespective of the amount involved in the transaction. Some consumers may have taken the KBPM slogan to mean that retailers only permitted them to use their debit cards for small amounts, although these retailers in reality may not necessarily prefer debit cards to cash. The impact of the wording of the UPTO slogan on consumers is less clear; it may be perceived as inviting, but it may also be perceived as slightly intimidating, as if to suggest that consumers are behind the times if they prefer cash over debit cards. All in all, we expect that the effect of the new slogans was higher than the impact of the KBPM slogan during its last years.

5 Data description and methodology

We used two different approaches to assess the influence of interventions on debit card usage. By doing so we make the best possible use of the available data. In the first approach we use weekly data on debit card usage and the timing of interventions in order to gain an understanding of the influence of mainly non-financial interventions in the short run on debit card usage by consumers. In the second approach we use monthly data on debit card usage, consumer demand for debit cards and retailer demand for debit cards, as well as information on the timing of various types of financial and non-financial interventions. The latter approach allows us to analyse the influence of consumer and retailer demand on debit card usage and to assess specifically the influence of interventions aimed at retailers on debit card acceptance. As some time will pass between a retailer’s decision to accept debit card payments and the actual installation of a debit card terminal in their establishment, a monthly model may be more suitable than a weekly model. We consider the estimated influence of interventions on consumer demand as an additional robustness check on the estimated effects in the weekly model.

5.1 Data

We used several datasets for this study, including debit card transaction data provided by the Dutch ACH Equens. This includes the weekly number of debit card payments made in the Netherlands with debit cards issued by Dutch banks in the Netherlands between 2005 and 2013. Equens also provided the monthly number of installed debit card terminals, which we used to capture retailers’ demand for debit card payments.Footnote 10 We also collected monthly information for consumer demand/interest for debit card usage, using the search term ‘pinpas’ (debit card) for the period 2005–2013 for the area of the Netherlands in Google Trend.Footnote 11 The debit card is the device that consumers in the Netherlands use for making debit card payments at the point of sale. We therefore think it is a suitable proxy for consumer’s interest in debit card usage.

In addition, we used information supplied by the DPA on the weeks in which the interventions took place, the nature of these interventions, the relevant retail chains or branches and the target groups, i.e. consumers and/or retailers. In total, there were 57 nationwide interventions. They were clustered in periods of several months, followed by intervention-free periods also lasting several months. In total, we distinguished 13 nationwide intervention cycles (see Fig. 3). The number of interventions differs between clusters. We defined the intensity of a cluster as the ratio between the number of interventions and the number of weeks. Cluster 8 has a relatively low intensity of 0.16, whereas cluster 7 has the highest intensity level of 0.55 (see Table 1). For an overview of all individual interventions, see Appendix 1.

Furthermore, we included information from Statistics Netherlands on the consumer spending levels in retail trade. By doing this, we ensured that changes in consumer spending did not interfere with the effects of interventions. Following Kosse (2013), we collected information from the Royal Netherlands Meteorological Institute on weather conditions in the Netherlands. We used this information to adjust for the influence of extreme weather conditions on consumers’ shopping behaviour and their usage of debit cards.

5.2 Variables

5.2.1 Dependent variable

For the public campaign we focused on the effect of the interventions on the weekly number of debit card transactions in the Netherlands, expressed by DC t , with t denoting the number of weeks that passed, starting from the first week in January 2005.Footnote 12 , Footnote 13

We used DC m as the dependent variable for explaining the influence of retailer and consumer demand/interest on debit card usage, with m denoting the number of months since 1 January 2005. As a proxy for consumer demand/interest in debit card usage, we used the monthly relative intensity for the search term ‘pinpas’ (debit card) expressed by GT_pinpas m as the dependent variable. Lastly, we used the monthly number of installed debit card terminals at points of sale Terminals m as the dependent variable reflecting retailer demand for debit card payments.

5.2.2 Intervention variables

For the campaign, we distinguished several types of interventions (j), i.e. general interventions aimed at consumers, general interventions aimed at retailers, KBPM interventions focused on specific branches, KBPM interventions focused on large retail chains, UPTO interventions and PJG interventions. We also distinguished several clusters (k).

We made a distinction between two types of impact: an impulse effect and a step effect.Footnote 14 An impulse effect is a short-term effect of an intervention during the intervention period, which may be either positive or negative. After the intervention period, the number of debit card payments will return to its baseline level. We denoted the impulse dummy of a nationwide intervention j in week t (month m) by Impulse jt (Impulse jm ) . It equals 1 if intervention j took place in week t (month m) and is equal to zero otherwise. A step effect is a fixed long-term effect of a series of interventions in a specific cluster, which permanently shifts the baseline development of the weekly number of debit card payments upwards or downwards. We denoted the step dummy of the nationwide intervention cluster k in week t by Step kt . This dummy equals 1 from the start of cluster k and zero otherwise.Footnote 15

Table 2 presents an example of the value of the intervention indicators. The period lasts 10 weeks and includes two cycles with one intervention. The first intervention j = 1 in cycle 1 is in weeks 3 and 4, and the second intervention j = 2 of cycle 2 is in week 8. Figure 4a, b present graphical illustrations of these possible effects.

5.2.3 Control variables

We included several control variables. First of all, we included the variable ‘retail sales’ in order to control for the development of consumer spending at the POS. This measure reflects the real value of consumer spending in retail trade, is available on a monthly basis and is normalised at its value for March 2010 (March 2010 = 100). We also included weather indicators as control variables. These indicators are dummies equalling 1 in weeks with particularly cold, hot, stormy, or rainy weather, i.e. weather conditions in which people may prefer to stay at home and put off outdoor shopping. Last but not least, we included variables reflecting seasonal and calendar effects. Previous research has shown strong effects of these variables on consumers’ usage of POS payment instruments (Esteves and Rodrigues 2010; Kosse 2013). We therefore took into account possible calendar and holiday effects in the weekly model such as month of the year, week of the month – as people usually receive their main income in one of the last two weeks of the month – school holidaysFootnote 16, public holidays or other special days.Footnote 17 In the monthly model we included dummies indicating the different months of the year.

5.3 Econometric models

This section introduces the weekly model and the monthly model. In these models we assume that the public campaign and its individual interventions are exogenous. In section 5.3.3 we provide arguments supporting the plausibility of this assumption.

5.3.1 Weekly model

Figure 5 presents the trend of the weekly number of debit card payments in the Netherlands. The number of debit card payments shows a definite positive trend with steady growth. This may reflect increasing card acceptance, declining debit card surcharging and autonomous growth in debit card usage by consumers.

We performed several statistical tests to examine whether the weekly number of debit card payments and consumption were trend stationary. We used the augmented Dickey Fuller (ADF) test and the Philips-Perron (PP) Test. Both tests reject the null hypothesis of a unit root in the weekly number of the debit card payments, when allowing for a time trend. This means that the number of debit card payments is generated by a trend stationary process, which can be estimated using OLS regression.

We estimated the following univariate autoregressive time-series model in order to assess the influence of the public campaign on the weekly number of debit card payments in the Netherlands.

with X t including other control variables and ε t denoting the error term reflecting white noise.

5.3.2 Monthly model disentangling consumer demand and retailer demand

Figure 6 presents the trend of the monthly number of debit card payments in the Netherlands, the monthly number of installed debit card terminals and the monthly trend in Google Trend’s search intensity for ‘pinpas’ in the period 2005–2013. All three variables show an upward trend over time. The increase in the number of debit card transactions is steeper than for the number of debit card terminals. The Google search term ‘pinpas’ shows a spike in November 2005; probably the media attention when the payment covenant was closed prompted people to look for information about debit cards.

We used unit root tests (augmented Dickey Fuller and Philips Perron) in order to check for stationarity of the time series. It turned out that the hypotheses that DC m and Terminals m have a unit root cannot be rejected at the 5% level of significance. However their first differences are stationary, according to both tests. With respect to GT_pinpas the two tests show mixed results; according to the ADF test this series is stationary after first differencing, but according to the Philips Perron test the undifferenced data is trend stationary. To ensure its stationarity, we decided to take its first difference d.

We estimated the following autoregressive univariate polynomial lag models to assess the influence of consumer demand and retailer demand on the monthly number of debit card payments in the Netherlands (Eq. 2a), the influence of interventions aimed at consumers on monthly consumer demand (Eq. 2b) and the influence of interventions aimed at retailers on retailer demand (Eq. 2c).Footnote 18 An advantage of this type of models is the flexibility it provides in specifying the shape of the lag distribution. However, the polynomial model truncates the distribution at a specific point. We decided to use a lag length of 3.Footnote 19

with C_Impulse jm (R_ I mpulse lm ) reflecting the impulse function for consumer (retailer) intervention of type j (l) in month m. The estimated coefficients ψ and κ reflect the influence of the interventions on the growth rate in consumer and retailer demand, respectively, for debit cards. X am , X bm and X cm contain control variables and υ m , ω m and η m denoting the error terms reflecting white noise for Eqs. (2a-c).Footnote 20

5.3.3 Econometric issues regarding causality and correlation

Estimating the influence of the campaign on debit card usage entails an interesting econometric question concerning the interpretation of the estimated coefficients of interventions and clusters of interventions: do they reflect causal effects on debit card usage, consumer demand and retailer demand for debit card payments or do they merely reflect correlations? Simultaneity bias and omitted variable bias may distort the estimation of the true effects of interventions and clusters of interventions.

Simultaneity bias

Marketing research points at the possibility of simultaneity bias when measuring the influence of interventions on debit card usage using least squares estimation (see section 2.2). If interventions and debit card usage are simultaneously determined the estimated effect of interventions on debit card usage may be biased upwards if the issue is not adequately addressed (Schmalensee 1972). For illustrative purposes, consider the following stylized simple 2-equation structural model relating debit card usage DC t and a specific intervention i Impulse i, with t = 1 …T: Footnote 21

Assume that ε t and ϑ t are independently and identically normally distributed error terms at time t, which could be contemporaneously correlated and that α 1 > 0 and β 1 > 0. If a realisation of the error term ε t in the debit card equation is positive than, other things being equal, debit card usage DCt will rise. An increase of DC t would also imply an increase in Impulse it , given that β 1 > 0 and cov(ε t , ϑ t ) is not sufficiently negative to compensate for one another. This implies that in the debit card Eq. (3a) the explanatory variable Impulse it and the error term ε t are positively correlated, i.e. Impulseit is endogenous. In that case least squares estimation of Eq. (3a) leads to an upwardly biased and inconsistent estimate of α 1, which suggests a stronger impact of the intervention than is actually the case. A necessary condition to ensure consistent estimation of the causal effect of intervention α 1 using least squares estimation is that the timing of intervention i is exogenous, i.e. does not depend on debit card usage, which requires that β 1 = 0 and consequently E[Impulseitεt] = 0. If the model also includes lagged values of the interventions in Eq. 3a, reflecting that it may take some time before an intervention becomes effective, consistent estimation of the parameters α 1s > 0 requires that the timing of current and past interventions are exogenous with respect to debit card usage DC t , i.e. E[Impulseisεt] = 0 for all t and s with s < =t.

At first sight it seems natural to think that the public campaign to stimulate debit card usage in the Netherlands should be treated as endogenous in order to avoid simultaneity bias. In general, interventions of campaigns are often instituted when they are most likely to be successful, i.e. are effective in changing consumers’ behaviour. However, for changing payment behaviour it is not clear-cut why the timing of the interventions over the year might matter in the first place, as consumers make POS payments every week and every month of the year. For each of these payments they have to choose between paying in cash or by debit card (provided that the merchant accepts both means of payment), and why would they be more responsive to the interventions in some periods than in others? One possible reason could be that in some periods people are more liquidity constrained than in other periods. In such periods, they may be more prone to use cash to reduce the risk of overspending, leading to fewer debit card transactions and a lower response to interventions.Footnote 22 However, there is no evidence suggesting that the financial position of Dutch households played a role in the timing of the interventions, see also Appendix 3 for more empirical evidence.

Omitted variable bias

Misleading results regarding the existence or the magnitude of the impact of an intervention on debit card usage may also be due to omitted variable bias. This bias occurs when one or more important variables are not included in the set of regressors, but are correlated with the dependent variable DC t and with the incidence of intervention i. The regression model then compensates for the omitted variable by ascribing (part of) the impact of the omitted variables on debit card usage to the effect of intervention i. The estimated effect may then become smaller or larger than actually is the case, and may also suggest causality while in fact the intervention itself is not effective at all.

In our analyses we included several additional control variables next to the dummy variables reflecting the incidence of specific intervention (impulse) and cluster dummies (step) in order to avoid omitted variable bias. For this reason, we did not only include calendar and seasonal variables as controls, but also variables reflecting extreme weather conditions and the overall level of retail sales which may have coincided with intervention weeks and affected the number of POS payments made in these weeks. We therefore feel it is reasonable to assume that the estimation results do not suffer from omitted variable bias. Therefore, any significant effects found for interventions or clusters of interventions in the regression analyses seem to point at causal effects and not to correlations.

6 Estimation results

6.1 Results public campaign using the weekly model

Table 3 shows the estimation results for the weekly model.Footnote 23 The second column provides the estimates of the calendar model, the third column also includes holiday effects and the other control variables, the fourth column provides the impulse effects of interventions on debit card usage (short-term model), and the fifth column presents the impulse effects of individual types of interventions as well as the step effects of clusters of interventions (total model).

There were two types of interventions with a significant short-term impact on debit card usage, i.e. the payment brochure focused on informing retailers about the benefits of debit card payments over cash payments and the KBPM campaign encouraging consumers to use their debit card for small amounts at large retail chains (KBPM_GWB). In order to assess whether the impact of these interventions changed over time, we estimated their impact for each year separately. These estimations show that in 2007, during weeks with KBPM_GWB interventions the number of debit card transactions was 3.8% higher on average than in weeks without such interventions. In 2008 this type of interventions resulted in 1.7% more debit card transactions during the intervention. The negative result for the year 2010 suggests that while the interventions had a positive effect on the number of debit card transactions at the early stages of the campaign, near the end of its lifecycle this type of intervention had lost its impact on consumer behaviour. An alternative explanation may be that the cluster 7 picked up the impact of the KBPM_GWB interventions in 2010. Regarding the payment brochure, we see a significant effect of 3.2% for the year 2008 in the short run model.

The long-term step effects of a series of interventions in a specific period are presented by the different Cluster variables. In general, the estimated effects of interventions, the organic trend, and the control variables are fairly robust to inclusion of the long-term cluster variables. The interventions that are significant in the short-term model are also significant in the total model, although the magnitude of the estimated effects have become larger. The step effects for clusters 3 (start: September 2007) and 7 (start: October 2010) are positive and significant. Cluster 3 led to 2.4% more debit card payments and cluster 7 to 5.8% more debit card payments. These clusters include KBPM_GWB interventions in the retail chains of the Blokker and Ahold holding companies. The former consists of a retail chain with the highest number of stores selling household appliances in the Netherlands, where consumers typically effect many small transactions; the latter is the holding company of Albert Heijn, the largest supermarket chain in the Netherlands. In paragraph 5.1 we established that the 7th cluster had the highest level of intensity. This result suggests that a long-term effect of a series of interventions during a specific period will be more robust if many different interventions are made within a relatively short amount of time. While this holds true for cluster 7, cluster 3 displays an average intensity level and is nonetheless significant. One explanation may be the participation of the Albert Heijn supermarket chain in this cluster. We also see a positive effect of 1.7% for cluster 9 (start: September 2011). However, contrary to the influence of clusters 3 and 7, the impact of this cluster is not sustained, as it is neutralised by a negative impact of a similar size for cluster 10 (start: April 2012).

With respect to the other explanatory variables, we found a positive trend indicating organic growth of 8.3% in the number of debit card payments per year (estimation total model). This reflects changing payment habits independently of the campaign. There is a positive correlation between the value of retail sales and debit card usage; a 1% increase in the value of retail sales correlates with 0.37–0.54% more debit card payments. Regarding extreme weather conditions, it turns out that storm and extreme cold have a downward effect on debit card usage.

Robustness check

As a robustness check, we re-estimated the short run regression model using monthly data on debit card usage in first differences (see Table 5 in Appendix 2). Monthly data on debit card usage contain a unit root and are stationary after first differencing (section 5.3.2). The dependent variable reflects the difference in debit card usage between two consecutive months. In such a setting, we expect that the estimated effects of interventions in month m on debit card usage growth to be smaller in magnitude than in the weekly model, as the influence of interventions on consumers’ payment behaviour are often short-lived.

The estimation results confirm that interventions aimed at using the debit card for small amounts in large retail chains in 2007 and 2008 led to higher debit card usage by consumers, whereas other interventions aimed at consumers failed to do so. In that respect, the results are in line with the main findings in the weekly total model. We also find a few differences between the weekly and the monthly model. First, we no longer find a negative effect for interventions aimed at using the debit card for small amounts in large retail chains in 2010. This result seems more plausible than the result in the weekly model, as it seems unlikely that an intervention to promote debit card usage leads to less debit card payments. Maybe the impact of the intervention was not immediate but took some time to kick in. The significance of the interventions in cluster 7 (second half of 2010) in Table 3 is in line with the latter interpretation. Furthermore, the publication of the payment brochure for retailers in 2009 had a negative significant impact on debit card usage instead of an insignificant impact. It is unlikely that the publication and mailing of the payment brochure to retailers had a negative impact on card usage in 2009. We therefore think that the negative impact of the publication/mailing of the payment brochure in 2009 is merely a coincidence. This is supported by the finding mentioned in section 6.2 that publication of the payment brochure in 2009 actually had an upward effect on debit card acceptance.

Overall, we feel that the results of this robustness check confirms most of the findings of the weekly model. Regarding our first research question, we observed that the initial short-run increase in debit card usage evolved into a longer lasting effect for the later years in the sample with the interventions focused on encouraging consumers to use the debit card for small amounts in large retail chains and the publication of the payment brochure aimed at merchants being two of the drivers. Considering our second research question, we found no evidence that the introduction of new campaign slogans contributed to increased debit card usage.

6.2 Monthly model: disentangling the influence of interventions on consumers and retailers

As the debit cards market is a two-sided market, interventions with a positive influence on debit card usage may be the result of increased debit card usage by consumers (irrespective of card acceptance), increased debit card acceptance by merchants or both. In this section we make a first attempt to disentangle the effect of interventions on both sides of the market. It turns out that the public campaign led to a higher demand for debit cards among both consumers and retailers.

6.2.1 Debit card usage

First, we examine the influence of changes in consumers’ and retailers’ interest in debit cards on debit card usage. The results are shown in columns 2–3 of Table 4.

We find that both the number of installed debit card terminals reflecting retailer demand and consumer interest in debit cards influence the number of debit card payments positively. Increased card acceptance gradually leads to higher debit card usage. The effect becomes statistically significant at the 5% level after three months. It turns out that a 1% increase in debit card acceptance results in 0.18% more debit card payments in two months’ time and 0.37% more debit card transactions after three months’ time. A possible reason for the time lag may be that it takes time for consumers to learn that they can use their debit card at a point of sale at which they used to pay in cash.

A 1% increase in consumers’ interest in the debit card leads to 0.08% more debit card payments after one month. The effect is significant at the 10% level. As expected, the influence of consumers’ interest on card usage takes place faster than increased card acceptance. However, its impact on debit card usage is much smaller than of card acceptance.Footnote 24 A possible reason may be that increased card acceptance influences the payment behaviour of many consumers that frequent a card-accepting point of sale, whereas increased interest by consumers will only affect the payment behaviour of individual consumers who looked for information on debit cards, but not of others. Furthermore, although increased interest in debit cards may persuade some people to use their debit card more frequently, this may not hold for all interested people.

6.2.2 Consumer demand

For the explanation of consumer interest in debit card usage based on the Google Trend search term ‘pinpas’ (debit card) between 2005 and 2013, we used interventions aimed at consumers as explanatory variables (see columns 4–5 of Table 4). We also added a dummy ‘EMV 2012’, as banks spent a lot of effort informing consumers about the changeover to EMV in 2012 that requires a different way to present a debit card to a payment terminal (‘dipping’ instead of swiping). This changeover may have increased consumers’ interest in the debit card, apart from the pro-debit card interventions. In addition, we controlled for the value of retail sales in order to ensure that jumps in sales leading to more debit card payments were not attributed to interventions taking place in the same period. Finally, we controlled for the number of installed payment terminals, which allows us to assess the influence of card acceptance decisions by retailers on consumers’ demand for debit card payments.

We find an upward effect of the interventions aimed at stimulating debit card usage by consumers for low amounts in large retail chains on the number of Google searches for ‘pinpas’.Footnote 25 This finding supports the view that the search term ‘pinpas’ is an adequate proxy for consumer demand. The impact is significant at the 5% level for the year 2007.Footnote 26 One month after an intervention the number of Google searches for ‘pinpas’ increased by 16.8%. The second largest effect of this type of intervention is found in 2010. The 1 month lagged effect amounts to 9%. However, this effect is not statistically significant at the 10% level. The effects of KBPM_GWB for 2007 and 2010 support the results found for cluster 3 and 7 in the weekly model.

We also find that some of the other interventions resulted in increased consumer attention for debit cards. The UPTO intervention in the year 2012 has a one month lagged upward effect of 8% on increased search intensity and the PJG interventions in 2013 leads to 8.9% more search intensity in the month of the intervention, followed by less search intensity one month later. These findings indicate that the change in slogan in 2012 and 2013 raised consumers’ interest in the debit card, although they did not lead to increased debit card usage (see Table 3). Furthermore, an increase in the number of debit card terminals reflecting higher debit card acceptance leads to a higher search intensity. The effect is quite large, though not significant at the 10% level. Regarding the other variables, there is no indication that the value of retail sales influences interest among consumers for debit card payments, nor did the changeover to EMV which made debit card payments safer.

6.2.3 Retailer demand

For the explanation of the number of installed terminals we used interventions aimed at merchants as explanatory variables, such as the general interventions aimed at merchants and the publication of promotion and information materials for merchants. Inspired by the findings of Arango et al. (2015) with respect to financial rewards for consumers, we also added two dummy variables ‘covenant’ and ‘subsidy’ for periods in which merchants could benefit from financial incentives to accept debit card payments. The dummy ‘covenant’ equals 1 from December 2005 and the dummy ‘subsidy’ is equal to 1 between April 2007 and October 2012.

We find a significant effect of the publication of the payment brochure aimed at retailers but not of general interventions.Footnote 27 , Footnote 28 , Footnote 29 There was a time lag of a few months between the mailing of the payment brochure to retailers and its influence on debit card acceptance (column 6 and 7). It turns out that it had only a significant impact in 2009 but not in 2007 and 2008 (columns 8 and 9). Overall, the results confirm the results found in the weekly model for interventions aimed at retailers. Note that we do not find evidence that financial incentives lead to higher debit card acceptance. This result suggests that providing information to retailers that highlights the advantages of debit card payments over cash in terms of private costs and safety has a larger impact on retailers’ decisions with respect to acceptance of cards (or any other new means of payment) than financial incentives alone. Maybe retailers were not aware of the precise private costs of debit card and cash payments, making changes in retailer fees less effective in changing retailers’ behaviour.Footnote 30 In order to raise card acceptance among retailers it may be a good idea to provide information to them highlighting the benefits of card acceptance for retailers in terms of private costs and safety.

7 Summary and concluding remarks

The results of our research show that the public campaign on debit card usage in the Netherlands has contributed to the substitution of cash by debit card payments. Interventions aimed at consumers and retailers both contributed to increased debit card usage.

The most effective interventions aimed at consumers used the behaviour expansion strategy, encouraging consumers to use their debit cards not only for higher value purchases, but also for low value purchases (Klein bedrag? Pinnen mag!). We did not find evidence of declining effectiveness of the KBPM slogan during the duration of the campaign, although the effect of intervention periods wears off after some time. The later slogans no longer focused on behaviour expansion, but rather on following the behaviour of others (“Why not use your debit card?” U pint toch ook?- UPTO) or adapting to the preferences of retailers (“Debit card? Yes, Please” Pinnen? Ja, graag! - PJG). Although the interventions UPTO in the year 2012 and PJG in 2013 raised consumers’ interest in the debit card, they did not lead to increased debit card usage. It may be the case that those consumers who were open to changing their payment behaviour, and whose main reason not to pay by debit card was the perception that certain retailers preferred cash, were already reached in the early stages of the campaign. For those who were not convinced to change their behaviour by the campaign in the early years, later interventions were perhaps unlikely to have made a difference. Looking at campaign characteristics, there is some indication that increasing intensity had a positive impact, as did a focus on certain large retail chains.

The public campaign also included interventions aimed at retailers. One of them led to higher debit card acceptance. This was the intervention in which retailers were informed by means of a payment brochure about the benefits of debit card usage over cash with respect to costs and safety and about the availability of promotion materials. Other interventions were not effective, neither were purely financial incentives, such as a reduction in the transaction fees or a subsidy on the purchase of a payment terminal. Maybe retailers are not aware of the precise private costs and pricing of payment products. In order to raise card acceptance it may be a good idea to provide information to retailers highlighting the advantages of card acceptance for retailers in terms of private costs and safety.

The results of this study are based on the experiences with one particular campaign in the Netherlands. We cannot infer that such a campaign would have similar effects in other countries or for other payment instruments as well. It may therefore be productive to look at such campaigns in other regions or for other means of payment in order to assess whether the results found in this study also apply to other situations.

Notes

In the Netherlands almost all adults have a current account and a debit card that they can use for cash withdrawals and for making POS payments, both of which are free of any transaction fees. Reward programmes for debit or credit card payments are uncommon. Apart from cash and debit cards, people can also use credit cards or prepaid cards; these payments represent only a few percent of all POS payments.

The Forum was instigated in 2002 at the request of the Minister of Finance to contribute to a socially efficient organisation of the Dutch retail payment system. It was established in 2003. The Forum represents both providers and users of payment systems, including retailers’ and banks’ umbrella organisations, the Consumentenbond consumer interest association and elderly and disabled people’s organisations.

Jonker (2013) showed that the threshold level had dropped to EUR 3.06 between 2002 and 2009. So, from 2009 onwards debit card usage was the most cost–effective option for almost any transaction amount.

This number does not include street trading and catering, which have relatively low acceptance rates.

It is, however, difficult to say by how much. Bolt et al. (2010) show that in 2006, 22% of the retailers applied a surcharge, most of them owners of small shops in which consumers make relatively few payments. According to HBD (2011), the percentage of retailers that applied a surcharge was 5% in 2009, dropping to 3% in 2010 and 2% in 2011. In 2009, HBD also asked retailers whether they had applied a surcharge on card payments in the past. Of those that did not do so in 2009, 8% said they had done so 1–2 years earlier, and another 10% said they had done so more than 2 years earlier. This implies that around 12–13% of the retailers applied a surcharge in 2007 (HBD 2009). The methodologies of the studies were different, however. HBD surveyed retail establishments (including individual shops belonging to a larger chain), while Bolt et al. (2010) surveyed independent retailers only. Also, in contrast to the other two sources, HBD did not include catering establishments.

The DNB household survey is held on a recurring basis among about 2000 Dutch households that are members of the CentERpanel, which is managed by the CentERdata research institute. The panel members are fairly representative of the Dutch-speaking population.

It should be noted, however, that perceived costs do not seem to be an important driver of payment behaviour in the Netherlands, with user-friendliness, safety and speed being more relevant (Cruijsen van der and Plooij 2015). Moreover, although the decline in surcharging may have had an effect on consumer payment behaviour, this effect is likely to have been a gradual one, any effect of which on debit card usage would be reflected in the positive trend in the number of debit card payments rather than in the effects of interventions that took place in specific weeks.

Ideally, we would have used an experimental approach to examine the impact of the campaign on consumers’ debit card usage, with one group living in the Netherlands and receiving the treatment (public campaign exposure) and another group living outside the Netherlands and not receiving the treatment (control group). Unfortunately, we could not do this, as we do not have weekly debit card data for countries that could have acted as a control group, i.e. countries which are comparable to the Netherlands with respect to debit card usage and debit card acceptance, such as Belgium or the UK.

Annual figures on the number of debit card payments provided by Equens may differ from statistics provided by the DPA, due to differences in reporting transaction data. However, the trends in card usage are similar.

Google Trend is a public web facility of Google Inc., based on Google Search, which provides a normalised data-series reflecting the relative search intensity for a specified search term relative to the highest intensity in a specific period. The user can specify the region and time period.

An even better variable for assessing the impact of the public campaign on debit card usage would have been the share of debit card payments in all POS payments made by Dutch consumers. Unfortunately, such information is not available as cash payments are not registered by banks or processed by ACHs, unlike card payments.

In order to examine the impact of a campaign it would be best to evaluate its impact on all four stages of the consumers’ decision process, i.e. attention, interest, desire and action (Strong 1925). However, we only have suitable weekly data on the last stage. There is no data about the campaigns’ impact on the other three stages.

Next to impulse and step effects, the interventions may influence the slope in the time trend for the number of debit card transactions; i.e. they may influence the natural development in debit card usage. It is conceivable that interventions lead to a higher growth rate in debit card usage. We conducted several statistical tests to assess whether the slope in the time trend was influenced by the public campaign or its interventions. The tests did not reject the hypothesis that the slope in the time trend had remained stable since the start of the campaign. In addition, the hypothesis that clusters of interventions had affected the slope in the time trend in the long run could also not be rejected. Only cluster 7 had a significant impact on the slope in the time trend but its impact was neutralised by the significant negative effect of cluster 8 on the slope. The hypothesis that the sum of these two effects equals zero could not be rejected at the 5% level.

We did not use monthly step functions as the inclusion of both impulse and step functions in the monthly models resulted in serious multicollinearity. In the monthly model we used lagged effects of the impulses to capture long term effects.

Christmas holidays, Spring holidays, May holidays, Summer holidays, Autumn holidays.

New Year’s Day, Valentine’s day (14 February), Koninginnedag (30 April), Sinterklaas (5 December), Christmas Day and Boxing Day, New Year’s Eve, Easter, Whitsun, Ascension Day, Mother’s Day, Father’s Day.

Initially, we estimated a simple VAR model containing the endogenous variables d(log(DCm)), d(log(Terminalsm)), d(log(GT_pinpasm)) and d(log(Retail_salesm)) as endogenous variables. According to Granger Causality / Block Wald test the hypothesis that d(log(DCm)) is exogenous cannot be accepted (p = 0.000), but the hypotheses that d(log(Terminalsm)) d(log(retail_salesm)) and d(log(GT_pinpastm) are exogenous are accepted at the 5% level of significance. These results indicate that only one of the four variables can be considered as endogenously determined by the other three. We therefore decided to continue using single time series models, as it provides more flexibility in the specification of the model per dependent variable than (S)VAR-analysis.(VAR) estimation results are presented in Table 7 in Appendix 4.

We used a lag length of three, following the results on the optimal lag length from the VAR analysis described in Appendix 4.

We did not include step functions in the monthly model as the long-term dynamics are captured by means of the lag structure of the model.

The illustration draws heavily on Berndt (1991, pp. 375–376).

Hernandez et al. (2017) show that consumers tend to use the means of payment that they think helps them best control their spending. Arango et al. (2015) stress the importance of cash with respect to limit overspending; they find that “those concerned about overspending tend to shun credit cards and rely more on cash, but not on debit cards”.

Diagnostic checks revealed that the residuals contained some heteroscedasticity and autocorrelation. Including AR and MA terms partly solved the problem, but not completely. The hypothesis of no autocorrelation was not rejected according to the Breusch-Godfrey Serial Correlation LM Test (F statistic, p = 0.11), but the correlogram up to 36 lags showed some small though significant autocorrelation in lags 3 and higher. Furthermore, the Breusch-Pagan-Godfrey rejected the hypothesis of no heteroscedasticity (F-statistic, p = 0.01). We therefore decided to use the robust Heteroskedastic and Autocorreled Consistent (HAC) standard errors by Newey-West, which provide a consistent estimation of the covariance matrix in case of heteroscedasticity or autocorrelation of unknown form.

In order to check whether consumer search affects card usage after 2 or more months, we ran a Wald redundancy test on d(log(GT_pinpasm)) for lags 2 and 3. The test indicated that they were not jointly significant (p = 0.57), therefore we did not include them in the set of explanatory variables.

Diagnostic checks revealed that the residuals were autocorrelated. Including AR(1), AR(2) and AR(3) terms and controlling for two outliers (November 2005 and February 2006) solved a large part of this problem. The hypothesis of no autocorrelation was not rejected according to the Breusch- Godfrey Serial Correlation LM Test (F statistic, p = 0.15), and the Breusch-Pagan-Godfrey did not reject the hypothesis of no heteroscedasticity (F-statistic p = 0.32). However, the correllogram up to 36 lags showed some remaining serial correlation between lags 3–5. Therefore we decided to use the robust standard errors by Newey-West which provide a consistent estimation of the covariance matrix in case of heteroscedasticity or autocorrelation of unknown form. The estimation results hardly altered.

In 2008 the immediate (−7.3%) and one month lagged (+8.3%) for KPM_GWB interventions are both significant, but have opposite effects and almost cancel each other out. As it seems unlikely to us that the immediate effect of an intervention is negative followed by a positive effect we decided to test whether the two effects cancel each other out. According to a Wald test the hypothesis that the sum of the immediate and one month lagged effect equals zero cannot be rejected (p = 0.78). Therefore we decided to remove the immediate and one month lagged effect for KBPM_GWB in 2008 from the set of explanatory variables.

We did some diagnostic checks on the residuals and it turned out that they were autocorrelated. Including AR(1) and AR(2) terms in the set of explanatory variables solved the problem.

We ran a Wald redundancy test in order to test the joint significance of the calendar effects (11 month dummies). The p-value (0.93) of the F-statistic indicated they were not. Therefore we removed them from the set of explanatory variables.

We examined whether interventions aimed at consumers led to higher debit card acceptance, using both immediate and lagged variables. These interventions did not have a significant impact on the number of installed debit card terminals.

Jonker (2011) finds that in 2007 many merchants were unaware of the costs associated with cash and card acceptance. 29% of retailers did not know their costs of cash and 38% did not know their costs of card payments.

References

Arango C, Huynh K and Sabetti L (2015) Consumer payment choice: merchant card acceptance versus pricing incentives. J Bank Financ 55:130–141

Aydogan, S (2016), Insights on Consumer Payment Behavior: What Factors Determine and Allow to Influence the Use of Payment Instruments?, PhD thesis, Vrije Universiteit Brussel

Bagnall J, Bounie D, Hyunh K, Kosse A, Schmidt T, Schuh S and Stix H (2016) Consumer cash usage: A Cross-Country Comparison with Payment Diary Survey Data, Forthcoming in Int J Central Banking 12(4), 1–61

Bass FM and Leone RP (1983) Temporal aggregation, the data interval bias, and empirical estimation of bimonthly relations from annual data. Manag Sci 29(1):1–11

Berndt ER (1991) The practice of econometrics. Classic and contemporary. Addison-Wesley Publishing Company, Reading

Bolt W and Chakravorti B (2012) Digitisation of retail payments, in Feitz M, Waldfogel J (eds) The Oxford handbook of the digital economy, Oxford University Press, 108–137

Bolt W, Jonker N and Van Renselaar C (2010) Incentives at the counter: an empirical analysis of surcharging card payments and payment behavior in the Netherlands. J Bank Financ 34:1738–1744

Borzekowski R, Kiser E and Ahmed S (2008) Consumers use of debit cards: patterns, preferences, and price response. J Money Credit Bank 40:149–172

Bounie D, Van Hove L and François A (2016) Consumer payment preferences, network externalities, and merchant card acceptance: an empirical investigation, Review of Industrial Organization, forthcoming

Brits H, Winder C (2005), Payments are no free lunch, DNB occasional studies 3(2), De Nederlandsche Bank, Amsterdam

Carbó-Valverde S and Liñares-Zegarra JM (2011) How effective our rewards programs in promoting payment card usage? Empirical Evidence. J Bank Financ 35:3275–3291

Ching AT and Hayashi F (2010) Payment card rewards programs and consumers payment choice. J Bank Financ 34:1773–1787

Clarke DG (1976) Econometric measurement of the duration of advertising effects on sales. J Mark Res 13(4):345–357

Cruijsen van der C. and Plooij, M. (2015), Changing payment patterns at point-of-sale: their drivers, DNB working paper 471, De Nederlandsche Bank

Cruijsen van der C., Hernandez, L. and Jonker, N. (2016), In love with the debit card, but still married to cash, Applied Economics, forthcoming

Danmarks Nationalbank (2012) Costs of payment in Denmark. Denmarks Nationalbank, Copenhagen

DNB/ DPA (2014) Factsheet Betalen aan de kassa 2013. De Nederlandsche Bank nv/ Dutch Payment Association, Amsterdam

Durkin S, Brennan E and Wakefield M (2012) Mass media campaigns to promote smoking cessation among adults: an integrative review. Tob Control 21:127–138

Eschelbach M and Schmidt T (2013) Precautionary motives in short-term cash management: evidence from German POS interventions. Deutsche Bundesbank discussion paper 38/2013

Esteves P and Rodrigues P (2010) Calendar effects in daily ATMs withdrawals, working paper 2010–12, Banco de Portugal

Foundation for the Promotion of Efficiency in Payments (2009) Annual Report 2009

Foundation for the Promotion of Efficiency in Payments (2010) Annual Report 2010

Foundation for the Promotion of Efficiency in Payments (2011) Annual Report 2011

Foundation for the Promotion of Efficiency in Payments (2012) Annual Report 2012

Foundation for the Promotion of Efficiency in Payments (2013) Terugblik op het Vierjarenplan 2009-2012

Gresvik O and Haare H (2009), Costs in the Norwegian payment system, staff memo no. 4, Norges Bank