Abstract

This study provides evidence that the outcome for shareholders resulting from asset sales is determined at the time of transaction by the value for the asset sold. Assets sold above market value are followed by positive and significant abnormal returns over the following three months; these returns are magnified in firms where the balance of power in corporate governance favors shareholders. Abnormal returns following undervalued asset sales are insignificant from zero, indicating value-preservation. Value-preservation when the assets are sold below market value becomes less likely as firms approach financial constraints. The reverse is true when assets are sold above market value. This evidence is documented for apartment REITs, which have a large number of comparable transactions available for estimating expected market values.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There appears consensus in the finance literature that asset sales are generally followed by an increase of shareholder wealth. Yet the ex ante motivates of managers are given little consideration. Managers can be viewed as either opportunistic or motivated by liquidity, which should have a deterministic impact on the sale price. Valuation effects for asset sales have never been considered because expected market values are extremely challenging to estimate for the typical firm in the stock market as there is often lack of comparable transaction data due to large and heterogeneous assets being sold (e.g., specialized manufacturing equipment, oil rigs). An opportunity to consider valuation effects exists for the REIT sector where similar assets are sold on a regular basis in local markets. This study incorporates a large number of transactions for apartment properties with detailed data provided by the CoStar Group to generate a fairly precise measurement of the underlying asset value. The accuracy of the estimated asset value is based on a comprehensive set of physical, locational and market hedonics of highly comparable assets using established methods from the real estate literature.Footnote 1 The relative value for the asset sold equals the actual transaction price minus the estimated value. Discounted asset sales are those occurring below the estimated market value. Premium asset sales are above the estimated market value.

The sale of any asset provides a source of funds to the firm. The relative value for an asset is defined here as the transaction price compared to the expected market value for that asset. A distinction can be made based on these values: an asset sale at higher than expected value is opportunistic; an asset sale at lower than expected is liquidation. The ultimate transaction price determines the opportunity cost of funds generated from sale proceeds, which limits the possible use of funds that are value-enhancing. Asset sales at relatively high market values may serve as the lowest-cost source of capital available to the firm enabling managers to pursue the firm’s objectives, consistent with the financing explanation of Lang et al. (1995). Assets sold at relatively low market values have high opportunity cost but may be essential to relax financing constraints – according to the liquidity explanation of asset sales by Shleifer and Vishny (1992). Our focus is on the consequence of the managerial decision to sell an asset either above or below expected market value.

Generating funds through asset sales is value-enhancing only when managers distribute the proceeds to shareholders or invest in unfunded positive NPV projects (Bates 2005). However, these outcomes are based on the ensuing use of funds which are contingent on the decision to sell, asset selection and valuation. Prior to transaction, managers consider a purpose for the asset sale which is either opportunistic or necessity-based. Opportunistic sales are motivated by efficiency allocation, with assets being sold to the most productive firms where the investment value is high (e.g., Hite et al. 1987; Aggarwal et al. 2006). Necessity-based asset sales are the result of financial constraints imposing spontaneous demand for liquidity. Whether asset sales are motivated by liquidity or relative valuation should result in different outcomes for the shareholders. Liquidation typically occurs at a low market value (Shleifer and Vishny 1992), and funds generated for liquidity purposes are less likely to be distributed. The sale of assets at relatively high market values corresponds with a low cost of capital, expanding the set of financially feasible projects. Thus, relative asset values provide a unique identification strategy for evaluating the opportunity set available to managers on the sale date.

This study provides evidence that the outcome for shareholders is decided on the transaction date through the relative asset value. On the few days immediately surrounding the date of transaction, there is no reaction as the use of funds is unobservable to investors. Instead, a market response is delayed up to three months until at least the next quarterly accounting statement is reported. Firms with fixed assets sold above expected market values experience positive and significant abnormal returns estimated between 0.68 and 3.13% compounded over a 61-trading day window following the transaction. In contrast, asset sales occurring below expected market value are not associated with a significant price reaction over the following three months. This evidence suggests that asset sales above expected values are value-enhancing decisions, while asset sales below expected values are ineffective.

Due to the delayed reaction, it is possible that the asset sale itself is not directly causal, but instead is actually symbolic of managerial decisions at large during this period and other factors may also contribute to the abnormal returns. Another possibility is that some managers may simply have better luck in their marketing efforts to sell assets. Luck can be an observable or unobservable shock to firm performance, market outcomes, and company free cash flow among other things, and it is believed to be associated with various corporate finance decisions. Barras et al. (2010) argue that luck is a determinant factor for mutual fund performance. Managerial compensation is also impacted by luck (Bertrand and Mullainathan 2001, and Hoffmann and Pfeil 2010).

Whether managerial decisions are consistent with shareholder objectives is known to be influenced by internal and external control mechanisms. Agency conflicts can lead to overinvestment and result in poor diversification.Footnote 2 Focusing explanations by Schoar (2002) and John and Ofek (1995) suggest that asset sales increase value by reducing the scope of investment. Reallocation of resources following asset sales provides a correction for inefficient investment (Dittmar and Shivdasani 2003). High-quality internal corporate governance can pressure managers to sell unproductive assets (Boot 1992), and insist that sale proceeds are dedicated to value-enhancing uses (Dittmar and Mahrt-Smith 2007). Managers are also influenced externally through the level of shareholder rights. In John and Sodjahin (2010), managers with numerous antitakeover provisions are more likely to sell assets as an alternative to an internal restructuring. In Jiraporn and Chintrakarn (2009), external governance leads to higher dividend payouts to alleviate agency costs. To determine whether the influence of corporate governance is distinct for asset sales above or below expected market values, we consider metrics for internal and external control as factors that might contribute to abnormal returns. To capture external control mechanisms, we use the corporate governance index introduced by Gompers et al. (2003). For internal control, we generate an index of blockholdings by institutional investors, analogous to the approach of Dittmar and Mahrt-Smith (2007). The findings of this study reveal that abnormal returns following asset sales at higher than expected market values are significantly influenced by the corporate governance index of Gompers et al. (2003) and the index of institutional blockholdings. These findings suggest that the value created from opportunistic asset sales is enhanced through a balance of power that favors shareholders. In contrast, abnormal returns following undervalued asset sales are unrelated to corporate governance and blockholdings.

Another issue is that managers may encounter financial constraints and have pressing demands for funds – this intensifies their urgency as sellers of long-term assets. The market for fixed assets lacks liquidity and anxious sellers face tradeoffs between expected time-to-sale and accepting discounts to the asset value. Firms facing financial constraints are more likely to use proceeds from asset sales to quench fixed charges, and the opportunity to invest the funds in positive NPV projects is reduced. Asset sales are more common in firms that are underperforming and have high levels of debt (Warusawitharana 2008; Lang et al. 1995). We investigate whether the benefits that accrue to firms selling overvalued or undervalued asset are related to a higher probability of facing financial constraints by creating the financial constraints index introduced by Kaplan and Zingales (1997) and estimated by Lamont et al. (2001). We find that financially constrained firms benefit from selling assets when they are overvalued. The reverse is true for undervalued asset sales which appear to destroy firm value for firms facing financial constraints.

Other studies find that firm value increases coinciding with asset sales;Footnote 3 however, the connection between relative asset values and the outcome for shareholders remains an unexplored topic in the finance and real estate literature. Existing explanations for positive stock price reactions following asset sales include efficiency allocation (Hite et al. 1987), focusing (Schoar 2002; John and Ofek 1995) and financing (Lang et al. 1995). In the real estate literature, corporate asset sales are largely considered in the setting of divestiture and sell-offs, including studies by Campbell et al. (2006), Booth et al. (1996), and Mcintosh et al. (1995). The concept of relative values for asset sales is drawn from the argument of Lang et al. (1995) that asset sales can be the lowest-cost source of funds for the firm. Both Bates (2005) and Lang et al. (1995) examine the use of funds from asset sales, finding that the stock price reaction is positive only when proceeds are distributed. This study is most related to the work of Bates (2005) and Lang et al. (1995) in recognizing that asset sales do not benefit every firm due to managerial discretion over the use of funds. The key distinction is where we focus on the comparison of transaction prices to expected market values to verify the outcome for shareholders, rather than relying on subsequent observation of the use of funds.

The contribution of this study is an identification strategy whereby relative values for asset sales have a deterministic impact on the outcome for shareholders. The extent to which these outcomes are value-enhancing or value-preserving depends on the existing internal and external control mechanisms, as well as proximity to financial constraints on the date of transaction. These findings largely support the financing hypothesis for value creation in asset sales, which is contingent upon managerial discretion over the use of funds.

The remainder of this paper is organized as follows. Section 2 describes the data used for estimating relative asset values, along with the development of indexes for corporate governance and financial constraints. Section 3 outlines the estimation of short- and intermediate-horizon abnormal returns for the overvalued and undervalued samples of asset sales. Section 4 develops an approach that examines the impact of corporate governance and financial constraints, which considers internal determinants of asset sales proposed by Warusawitharana (2008). Section 5 summarizes the conclusions of this study.

2 Data and variables

Relative asset values offer a unique identification strategy for evaluating firm performance following asset sales. Many fixed assets are physically heterogeneous and trade in segmented markets with scarce transaction data available. Previous studies examine the total value of asset sales using information obtained from 8 K forms reported to the SEC, but are unable to estimate relative asset values.Footnote 4 The approach we adopt is to consider relative values for asset sales by examining income-producing property transactions by Real Estate Investment Trusts (REITs), where comparable transaction data is available and provided by the CoStar Group. The focus is on apartment properties which are relatively less heterogeneous assets compared to other categories of income-producing property, including industrial, office or retail.Footnote 5 Apart from these differences across property types is evidence that the financing of all commercial assets has become increasingly intergrated into the broader capital markets (Sa-Aadu et al. 2000). Existing studies in the real estate literature serve as a foundation for estimating the relative asset value for apartments at the time of sale.

Income-producing apartment sales are considered using transaction-level market data with a national scope provided by the CoStar Group.Footnote 6 A comprehensive sample of apartment sales is collected over a period ranging from September 1989 through the end of the second quarter of 2008.Footnote 7 The apartment sales sample includes 29,041 properties. Asset sales by REITs are identified individually, based jointly on seller name and address.Footnote 8 In all, 354 REIT apartment sales are identified in 73 geographic markets.Footnote 9

Expected apartment values are estimated individually for each market, based on physical, legal and locational attributes, with controls for submarket activity and market conditions. In the real estate literature, the fundamentals for apartment valuation are commonly based on the work of Lambson et al. (2004), who develop a sequential search model where buyers are assumed to differ in the number of units they will purchase. Based on this theoretical assumption, the dependent variable is the natural log of price per unit, ln(Price_per_unit). Analogous to the model of Lambson et al. (2004), the operational model is written as:

The variable Age is property age in years. N_units is the number of units in the property. Avg_unit_size is the average unit size in square feet. Land_area is the lot size measured in square feet, divided by N_units. OT_Buyer is a dummy variable indicating out-of-state buyers, who tend to overpay for apartments. While the focus of Lambson et al. (2004) is actually on whether out-of-state buyers pay more for real estate, their model is now commonly used as the foundation for apartment hedonics because it is one of the earliest to use CoStar data for estimating multifamily property values.

Real estate cycles are geographically dispersed and idiosyncratic in nature, and the model in equation (1) is estimated individually for each market with YearQ indicator variables for each quarter. The time controls limit differences attributed to seasonal preferences for liquidity, as in Griffiths and Winters (1997). A generalized linear procedure is implemented using maximum likelihood estimation for the parameter vector including a dispersion parameter. The SubMkt variables are dummy variables for each submarket within a market.Footnote 10 The Sale_Condition variables are indicator variables for unique sale conditions identified by CoStar research following the transaction.Footnote 11 The standardized residuals for 224 REIT sales are collected from the estimations of equation (1).Footnote 12 These residuals represent the difference from the expected local market value at the time of sale in the relevant submarket, given the possible sale conditions and physical property characteristics. The transaction date and CRSP permno are collected to analyze the consequences for shareholders and factors that influence those outcomes. 132 of the REIT sales have positive residuals revealing that these properties were locally overvalued at the time of sale. The “premium” sample consists of 132 REIT sales with positive residuals, while the “discounted” sample consists of 92 REIT asset sales with negative residuals.

According to Bates (2005), whether asset sales are ultimately a benefit to shareholders is contingent on the funds being distributed. A related issue is that managers may favor control over funds from asset sales with potentially fewer restrictions than outside funds raised in the capital markets. REITs provide an attractive setting to examine the consequence of asset sales because of their obligation to payout at least 95% of net income as dividends.Footnote 13 Another distinction is that apartment REITs generally invest only in apartments, which reduces the likelihood that asset sales are motivated by product focusing efforts, although geographic focusing cannot be ruled out as a possible objective.

Asset sales at a premium to expected market value reflect superior managerial decisions which are consistent with obtaining lowest available cost of capital. These decisions are opportunistic and can increase shareholder wealth, depending on the use of funds. Managerial discretion over the use of excess funds is related to firm performance through corporate governance. Dittmar and Mahrt-Smith (2007) provide evidence that firms with poor corporate governance are more likely to commit excess cash holdings towards unproductive projects that are non-beneficial to shareholders. Gompers et al. (2003) construct a corporate governance index based on the count of 24 possible provisions that restrict shareholder rights, labeled the G index.Footnote 14 Higher values for the G index indicate greater managerial power and lower shareholder rights. The G index measures external governance mechanisms related to the market for corporate control and exposure to takeover. Internal governance mechanisms are the result of monitoring by large shareholders, with institutional investors commonly participating as active shareholders. To measure the quality of internal governance, the Block index is generated using data from 13(f) filings reported in CDA/Spectrum. The Block index measures the percent of shares held by institutional investors with at least 5% ownership, as in Dittmar and Mahrt-Smith (2007).

Following Schleifer and Vishny (1992), undervalued asset sales in the set are more likely to be motivated by liquidity needs. To examine this issue, the REIT transaction dates are merged with accounting data from Compustat. The financial constraints index is from Kaplan and Zingales (1997), with the logit estimates reported in Lamont et al. (2001). The components of the KZ index include the ratio of cash flow to total assets, Tobin’s q, the debt ratio, the ratio of dividends to total assets, and the ratio of cash to total assets.

Table 1 reports the summary statistics for the sample, comparing differences in firm characteristics between the two samples. Several previous studies examining asset sales are related to mergers and divestiture.Footnote 15 However, none of the asset sales in this sample of REITs are related to mergers or bankruptcy. As of September 2009 (one year after the most recent asset sale in the sample), not a single firm in the sample had filed for bankruptcy. In one case, CBRE Realty Finance was permanently delisted from the NYSE in November 2008 after failing to sustain a minimum value due to toxic mortgage assets. CBRE Realty Finance accounts for only one asset sale in March 2008.

3 Asset sales and stock returns

Abnormal stock return methods are used to evaluate the identification strategy generated from relative values for asset sales. Previous studies examining price reactions to asset sales document significant abnormal returns around the announcement date.Footnote 16 However, a necessary condition for event studies around the announcement date is that the asset sale is publicly announced by the firm. The data used in this study is unique in that the observations are based on transaction data in contrast to public announcements. Large-scale apartment transactions are sporadically covered by local newspapers, although seldom is there an official press release from the selling firm. Out of 224 asset sales in the full sample, only 24 sales were announced publicly by the selling REIT.Footnote 17 Instead, information related to the asset sale is generally deferred to the next quarterly accounting statement. Such passive disclosure practice suggests that it may be relevant to consider up to 60 trading days following the transaction, in addition to the few days immediately surrounding the transaction date.

Price reactions during two short-horizon windows include a window that spans from one day before the transaction to one day after (−1,+1) and a window ranging from five days before the transaction to five days after (−5,+5). The method is to estimate a market model using a 250 day estimation period that ends 50 trading days before the transaction date. The primary benchmark used for this analysis is a value-weighted index of apartment REIT stock returns, which excludes the subject firm in each iteration. The list of US Apartment REITs is from Bloomberg and the stock returns used to create the index are collected from CRSP. A secondary approach is to use the equally-weighted CRSP index as the market factor.Footnote 18 Abnormal returns are calculated as the difference between the actual and projected returns on a given day within the window. Cumulative abnormal returns (CAR) measure aggregate abnormal returns during the window. Mean and median cumulative abnormal returns are reported in Table 2. As expected, short-horizon price reactions are not significant for either window in the three samples.Footnote 19 This lack of evidence coheres with the record that news of these transactions is essentially local business and more than 89% are unannounced by the selling firm.

In cases where the press release includes transaction price and sale proceeds, it is unclear whether this news should be interpreted as positive or negative news without considering relative asset values. Measures of operating performance may improve, but it could take up to three months before the next quarterly accounting statement is released. For this reason, intermediate-horizon reaction is examined over the 61-trading day window coinciding with the transaction date (0,+60). Intermediate-horizon abnormal returns are vulnerable to misspecification (e.g., Fama 1998). To address this concern, three methods are adopted to examine the price reaction over the 61-day window. The first approach is to consider the mean cumulative abnormal return, similar to estimations in the short-horizon analysis. The second procedure calculates buy-and-hold price reactions as the mean compound abnormal return over the 61-day window. The third method makes use of the three-factor model introduced by Fama and French (1993), with the addition of Cahart’s (1997) momentum factor.

Table 3 provides the results from the estimates of price reactions over the (0,+60) window. For the full sample and discounted sample, there is no evidence of a significant price reaction around the transaction date of the asset sale. Abnormal returns are small or negative for the discounted sample. Conversely, asset sales in the premium sample are followed by positive and significant intermediate-horizon abnormal returns based on all three methods. These findings support the identification strategy for asset sales based on relative asset values. Largely unannounced asset sales experience no significant price reaction during the immediate window surrounding the transaction date. Instead, the price reaction is delayed up to three months, but only for the assets sold above expected market value. Buy-and-hold compound returns for the overvalued sample outperform the market by as much as 9% on an annualized basis. This evidence suggests that sales of overvalued assets are opportunistic and provide a signal for the quality of managerial decisions. The benefits from opportunistic decisions are realized by shareholders over a period that includes the release of the next quarterly accounting report.

Given the magnitude of abnormal returns which accrue over the intermediate-horizon window in comparison to the size of the average asset sale, it is not practical to conclude that the asset sale itself causes this entire return. Instead, it is more likely that the relative value for the asset sale is simply evidence of prudence and market timing by managers during a period which precedes superior stock performance. Other factors which should influence managerial decisions during this period are discussed in the next section, including the determinants of assets sales, corporate governance, and financial constraints.

4 Influential factors in intermediate-horizon price reactions

The identification strategy supported by evidence in the previous section is that relative values for asset sales correspond with intermediate-horizon outcomes for shareholders. The necessary set of information for estimating whether asset sales are above or below expected market values is available in a sample of comparable transaction data, and not in the public announcement. The intermediate-horizon (61-day) abnormal returns associated with asset sales above expected market value are pronounced and substantiate opportunistic selection by managers. Analysis outlined in this section examines whether intermediate-horizon abnormal returns associated with asset sales are related to corporate governance or financial constraints. Corporate governance encompasses frictions in the market for corporate control; the concern is for managerial discretion over use of sale proceeds. According to Dittmar and Mahrt-Smith (2007), managers in firms with strong shareholder rights are expected to exercise diligence with unsaturated cash by investing in positive NPV projects and distributing unnecessary funds. However, asset sales may be related to financial constraints, in which case managerial prudence may result in sale proceeds that are absorbed primarily by debt.

The effects of corporate governance and financial constraints are considered after the transaction occurs, although preceding motives should have a deterministic impact. Warusawitharana (2008) provides a theoretical foundation for the asset sales decision based on endogenous selection related to the underlying fundamentals. As an empirical strategy, Warusawitharana (2008) proposes the following variables as determinants of asset sales: return on assets, size, momentum, market-to-book, leverage, cash, sales growth, and PP&E growth.Footnote 20 The set of determinants is based on the prediction that changes in profitability and investment opportunities trigger the asset sale decision. Our approach is to adopt the set of variables used by Warusawitharana (2008) to consider whether anterior motives, proxied through the fundamental characteristics of the firm, have a significant impact on the intermediate-horizon abnormal returns following an asset sale. In a subsequent study, Ray and Warusawitharana (2009) find that abnormal returns following the purchase of major assets are positively related to the relative transaction size, which equals the transaction amount scaled by the market value of equity. To consider this, we add a relative size variable to the list of asset sale determinants.

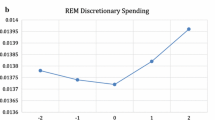

Table 4 presents the results from the estimation of intermediate-horizon abnormal returns and the determinants of asset sales for the premium and discounted samples. In the discounted sample, the asset sale has no impact and any variation in abnormal returns is unexplained by the determinants of asset sales. For the premium sample, ROA and PPE growth have a positive and significant impact on the intermediate-horizon abnormal returns, while Sales growth and the Market-to-Book ratio have negative and significant impacts. In Warusawitharana (2008), return on assets predicts which firms will are likely to sell assets, with asset sales following a loss in productivity. The results in Table 4 reveal that highly profitable firms, those with high ROA, benefit the most following overvalued asset sales. Firms that recently experienced an accumulation of property, measured by PPE growth, also tend to benefit more from the divestiture of overvalued assets. The market-to-book ratio is a proxy for investment opportunity, with low values indicating better opportunities. Abnormal returns are significantly higher for firms selling overvalued assets when there are better investment opportunities available. The outcome is also related to revenue, as firms who encounter stalled revenue growth experience significantly higher abnormal returns following the sale of an overvalued asset.

Table 5 reports the results of estimates for the impact of the corporate governance on the intermediate-horizon abnormal returns following the asset sale. The model is estimated separately for the premium and discounted samples, as well as for abnormal returns calculated using the buy-and-hold method (BHAR60) and the cumulative abnormal return method (CAR60). The standard errors are generated from the heteroskedasticity-consistent estimator of the covariance matrix introduced by White (1980). Statistical significance for each coefficient is evaluated based on these standard errors. The G index is the corporate governance index proposed by Gompers et al. (2003), where low values for the G index indicate stronger shareholder rights. Kose and Sodjahin (2010) find that high values for the G index increase the likelihood that managers will decide to sell assets in lieu of an internal restructuring. The first two columns in Table 5 consider the impact of the G index on the premium sample, and the coefficient for G index is negative and significant. Low values for the G index result in significantly higher abnormal returns following the sale of assets above expected market values. These sales are opportunistic and associated with significant abnormal returns over the three-month window following the transaction. Those abnormal returns are amplified for firms with strong shareholder rights, as measured by the G index. No similar results obtain for the discounted sample.

Table 6 considers the impact of blockholdings by institutional investors. Block measures the percent of shares held by institutional investors with at least 5% ownership. Higher values for Block are associated with higher quality of internal governance through the collective influence of institutional shareholders on the board of directors. The coefficient for Block is positive and significant in both estimates for the premium sample in Table 6, and has no impact on the discounted sample. Controlling for conditions that prevailed when managers decided to sell assets above market value, the outcome for shareholders is improved when there is high participation by institutional investors. Absent effectiveness of internal governance, managers favor control and are inclined to squander excess cash or pursue suboptimal investment. Thus, internal governance is beneficial when assets are sold above market value.

The relevance of financial constraints is considered in Table 7, with controls included for the determinants of asset sales. Financial constraints are measured by the KZ index, introduced by Kaplan and Zingales (1997) with logit estimates reported by Lamont et al. (2001). For the premium sample, the KZ index has a positive and significant impact on abnormal returns. In the discounted sample, the KZ index has a negative and significant impact on abnormal returns. The KZ index is increasing in the likelihood that a firm will face financial constraints. High values of the KZ index correspond to firms with high leverage, low dividends, and low cash flow. Financially constrained firms face increasing costs of external finance, and some sell assets to raise cash for liquidity needs. Limited access to capital markets reduces managerial flexibility and investment opportunities. The evidence reported in Table 7 suggests that financially constrained firms benefit from selling assets, but only when those assets are sold above market value. Assets sold below market value destroy value for firms facing financial constraints.

5 Conclusion

The findings of this study document empirically that relative values for asset sales identify unique outcomes for shareholders. Asset sales occurring above expected market values are followed by positive and significant abnormal returns, estimated between 0.68 and 3.13% compounded over the following three months. In contrast, there is no evidence that asset sales occurring below estimated market value result in either positive or negative abnormal returns. Thus, relative values for asset sales provide an identification strategy which reveals the opportunity set of managers at the time of transaction, based on the opportunity cost for the source of funds.

Overvalued asset sales correspond with a period of value-enhancement. From the list of determinants for asset sales, abnormal returns for the premium sample during the intermediate-horizon are positively influenced by firm profitability (ROA) and previous PPE growth and negatively influenced by revenue growth and the market-to-book ratio. Abnormal returns following asset sales that occur above market value are positively influenced by a lack of anti-takeover provisions, measured by low values for the corporate governance introduced by Gompers et al. (2003), and by an index of institutional investor blockholdings. This suggests that value created from opportunistic asset sales is enhanced through a balance of power that favors shareholders. Undervalued asset sales are value-preserving (neither value-increasing, nor value-decreasing). Value preservation following discounted asset sales is less likely to occur when the firm is financially constrained. The reverse is true when the assets are sold above market value.

These findings complement two sides of the literature dedicated to asset sales. One side provides existing explanations for asset sales which rely on the ex ante motives of managers, including efficiency allocation, focusing and financing. The other side considers that the ex post use of funds generated from asset sales determine the outcome for shareholders. The contribution of this study is to emphasize that there is relevant information revealed at the time of transaction, including the actual transaction price relative to the expected market value. While firms have no obligation to provide a press release for every asset sale, this information is shown to be symbolic of managerial prudence and reveals a connection between the ex ante motives and the ex post use of funds.

Notes

Overinvestment occurs when managers invest in manager-specific assets (Shleifer and Vishny 1989) or attempt to maximize firm size, when compensation is a function of size (Baker, Jensen and Murphy 1988). As an example, product-diversifying acquisitions are found to be risk increasing for financial services institutions (Gleason, Mathur and Wiggins 2006). Inefficient diversification could be the consequence of attempts to reduce their own risk when managers are heavily invested in the firm’s equity (May 1995).

Demand for apartments within each market consists of a large pool of potential users who desire small and similar quantities of space with short-term leases. For industrial, office and retail properties, there are fewer tenants with unique requirements and varied leasing terms. Thus, for income-producing properties, apartment values are estimated on a per unit basis with a higher degree of accuracy.

CoStar provides listing and marketing services for commercial real estate. The data available from CoStar is based on transactions that resulted from these listing services. There are other opportunities for sellers to list and market apartment properties including the local Multiple Listing Service (MLS). The decision to list with CoStar is influenced by sellers who desire to attract a national audience for their property.

September 1989 is the first apartment property transaction reported in the CoStar data.

The list of REIT company names is based on CRSP data availability, collected from the sample of firms with SIC code 6798. At the end of July 2008 the list includes 329 firms.

The list of 73 markets includes Albuquerque, Atlanta, Augusta, Austin, Baltimore, Baton Rouge, Birmingham, Boston, Charleston (SC), Charlotte, Chattanooga, Chicago, Cincinnati/Dayton, Cleveland, Colorado Springs, Columbia, Columbus, Dallas/Ft Worth, Denver, Detroit, East Bay/Oakland, Fayetteville, Fort Wayne, Greensboro/Winston-Salem, Greenville/Spartanburg, Hampton Roads, Houston, Huntington/Ashland, Huntsville, Indianapolis, Inland Empire (CA), Jackson, Jacksonville (FL), Las Vegas, Lexington/Fayette, Little Rock, Long Island (NY), Los Angeles, Louisville, Marin/Sonoma, Memphis, Milwaukee/Madison, Minneapolis/St Paul, Nashville, New York City, Northern New Jersey, Ocala, Oklahoma City, Orange (CA), Orlando, Philadelphia, Phoenix, Portland (OR), Portland (ME), Providence, Raleigh/Durham, Richmond (VA), Sacramento, San Antonio, San Diego, San Francisco, Santa Barbara, Savannah, Seattle/Puget Sound, South Bay/San Jose, South Florida, Tallahassee, Tampa/St Petersburg, Toledo, Tucson, Washington DC, Westchester/South Connecticut, Wichita.

For example, the New York City model includes 4 submarkets defined by CoStar: Uptown, Midtown, Midtown South and Downtown.

There are 107 unique pairs of sale conditions in the sample. Examples include 1031 exchange, soil contamination, and deferred maintenance.

Standardized residuals are unavailable for 130 of the 354 REIT apartment sales due to data limitations. Examples include transactions where property age, or lot size are unreported.

The mean percentage change in quarterly dividends following an asset sale is insignificant from zero for the premium and discounted samples.

The data is derived from publications of the Investor Responsibility Research Center, and the index is available on Professor Metrick’s website.

Examples of studies examining asset sales related to mergers include Maksimovic and Phillips (2001), Jovanovic and Rousseau (2002). Studies considering asset sales during divestitures include Alexander, Benson and Kampmeyer (1984), Boot (1992), Schlingemann, Stulz and Walkling (2002), Dittmar and Shivdasani (2003), Çolak and Whited (2007).

The 24 announcements occur at the earliest one day before the transaction and up to three trading days after at the latest.

Other indexes considered include the CRSP value-weighted index, the S&P 500 and the Nasdaq Composite. The CRSP equally-weighted index produces the lowest aggregate mean squared error over the 224 estimations.

Differences between mean and median cumulative abnormal returns for the premium and discounted samples are not significant.

Warusawitharana (2008) also proposes a wave dummy variable which corresponds to a heightened period of asset purchases and sales over a two-year window. The wave dummy is found to be a significant determinant for asset purchases, but not for asset sales.

References

Aggarwal R, Akhigbe A, McNulty JE (2006) Are differences in acquiring bank profit efficiency priced in financial markets? J Financ Serv Res 30:265–286

Alexander GJ, Benson PG, Kampmeyer JM (1984) Investigating the valuation effects of announcements of voluntary corporate selloffs. J Finance 39:503–517

Baker GP, Jensen MC, Murphy KJ (1988) Compensation and incentives: practice vs. theory. J Finance 43:593–616

Barras L, Scaillet O, Wermers R (2010) False discoveries in mutual fund performance: measuring luck in estimated alphas. J Finance 65:179–216

Bates TW (2005) Asset sales, investment opportunities, and the use of proceeds. J Finance 60:105–135

Benjamin JD, Chinloy P, Hardin WG, Wu Z (2008) Clientele effects and condo conversions. Real Estate Econ 36:611–634

Bertrand M, Mullainathan S (2001) Are CEOs rewarded for luck? The ones without principals are. Q J Econ 116:901–932

Boot A (1992) Why hang on to losers? Divestitures and takeovers. J Finance 47:1401–1423

Booth GG, Glasscock JL, Sarkar SK (1996) A reexamination of corporate sell-offs of real estate assets. J Real Estate Finance Econ 12:195–202

Cahart MM (1997) On persistence in mutual fund performance. J Finance 52:57–82

Campbell RD, Petrova M, Sirmans CF (2006) Value creation in REIT property sell-offs. Real Estate Econ 34:329–342

Çolak G, Whited TM (2007) Spin-offs, divestitures and conglomerate investment. Rev Financ Stud 20:557–595

Corrado CJ (1989) A nonparametric test for abnormal security-price performance in event studies. J Financ Econ 23:385–396

Dittmar A, Mahrt-Smith J (2007) Corporate governance and the value of cash holdings. J Financ Econ 83:599–634

Dittmar A, Shivdasani A (2003) Divestitures and divisional investment policies. J Finance 58:2711–2743

Fama E (1998) Market efficiency, long-term returns, and behavioral finance. J Financ Econ 49:283–306

Fama E, French KR (1993) Common risk factors in the returns of stocks and bonds. J Financ Econ 33:3–55

Frew J, Jud GD (2003) Estimating the value of apartment buildings. J Real Estate Res 25:77–86

Gleason KC, Mathur I, Wiggins RA (2006) The evidence on product-market diversifying acquisitions and joint ventures by U.S. banks. J Financ Serv Res 29:237–254

Gompers P, Ishii J, Metrick A (2003) Corporate governance and equity prices. Q J Econ 118:107–155

Griffiths MD, Winters D (1997) On a preferred habitat for liquidity at the turn-of-the-year: evidence from the term-repo market. J Financ Serv Res 12:21–38

Hite GL, Owers JE, Rogers RC (1987) The market for interfirm asset sales: partial sell-offs and total liquidations. J Financ Econ 18:229–253

Hoffmann F, Pfeil S (2010) Reward for luck in a dynamic agency model. Rev Financ Stud 23:3329–3345

Jiraporn P, Chintrakarn P (2009) Staggered boards, managerial entrenchment, and dividend policy. J Financ Serv Res 36:1–19

John K, Ofek E (1995) Asset sales and increase in focus. J Financ Econ 37:105–126

John K, Sodjahin WR (2010) Corporate asset purchases, sales and governance. Working paper, New York University

Jovanovic B, Rousseau PL (2002) The Q-theory of mergers. Am Econ Rev 92:198–204

Kaplan SN, Zingales L (1997) Do investment-cash flow sensitivities provide useful measures of financing constraints? Q J Econ 112:169–215

Lambson VE, McQueen GR, Slade BA (2004) Do out-of-state buyers pay more for real estate? An examination of anchoring-induced bias and search costs. Real Estate Econ 32:85–126

Lamont O, Polk C, Saá-Requejo J (2001) Financial constraints and stock returns. Rev Financ Stud 14:529–554

Lang L, Poulson A, Stulz R (1995) Asset sales, firm performance, and the agency costs of managerial discretion. J Financ Econ 37:3–37

Maksimovic V, Phillips G (2001) The market for corporate assets: who engages in mergers and asset sales and are there efficiency gains? J Finance 56:2019–2065

May DO (1995) Do managerial motives influence firm risk reduction strategies? J Finance 50:1291–1308

Mcintosh W, Ott SH, Liang Y (1995) The wealth effects of real estate transactions: the case REITs. J Real Estate Finance Econ 10:299–307

Patell JM (1976) Corporate forecasts of earnings per share and stock price behavior: empirical tests. J Acc Res 14:246–276

Ray S, Warusawitharana M (2009) An efficiency perspective on the gains from mergers and asset purchases. The B.E. Journal of Economic Analysis & Policy, 9 (Contributions), Article 43

Sa-Aadu J, Shilling JD, Wang GK (2000) A test of integration and cointegration of commercial mortgage rates. J Financ Serv Res 18:45–61

Schlingemann FP, Stulz RM, Walkling RA (2002) Divestitures and the liquidity of the market for corporate assets. J Financ Econ 64:117–144

Shleifer A, Vishny RW (1989) Management entrenchment: the case of manager-specific investments. J Financ Econ 25:123–139

Shleifer A, Vishny RW (1992) Liquidation values and debt capacity: a market equilibrium approach. J Finance 47:1343–1366

Schoar A (2002) Effects of corporate diversification on productivity. J Finance 57:2379–2403

Warusawitharana M (2008) Corporate asset purchases and sales: theory and evidence. J Financ Econ 87:471–497

White H (1980) A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 48:817–838

Wiley JA (2009) Physical attributes and transaction premiums in properties earmarked for conversion. J Real Estate Pract Educ 12:137–155

Wiley JA, Wyman D (2011) Key factors affecting valuation for senior apartments. J R Estate Res, forthcoming

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wiley, J.A., Cline, B.N., Fu, X. et al. Valuation Effects for Asset Sales. J Financ Serv Res 41, 103–120 (2012). https://doi.org/10.1007/s10693-011-0112-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-011-0112-0