Abstract

We investigate how the Nontradable Share Reform (NTS Reform) affects cross-sectional relations between liquidity and stock return autocorrelations using a new illiquidity measure that measures more precisely the liquidity of the Chinese stock market. We find that winner and loser portfolios exhibit different return autocorrelations before and after the NTS Reform. All return autocorrelations are stronger for high-illiquidity portfolios after controlling for turnover ratio. We use market capitalization to determine the extent of speculative trading and assume that return reversal (continuation) accompanied by high illiquidity occurs in large (small) stocks. Our empirical results are remarkably consistent with our hypothesis after the NTS Reform.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper explores cross-sectional relations between liquidity and return autocorrelations using Chinese stock market data over the period from 2001 to 2012. To this end, we develop a new illiquidity index that measures the liquidity of the Chinese stock market more precisely than indexes used in previous studies. We also examine whether information asymmetry among traders can explain the cross-sectional relations.

Return predictability has become a popular topic in financial markets. Many researchers have shown that the return reversal effect and momentum effect exist in stock markets worldwide (e.g., DeBondt and Thaler 1985; Lehmann 1990; Jegadeesh 1990; Jegadeesh and Titman 1993; Shen and Wu 1999; Kang et al. 2002; Wu 2011). However, none of these studies examines why these phenomena occur or proposes a reasonable explanation. Theoretically, Campbell et al. (1993) (henceforth CGW) show that price movements caused by noninformational trading, when absorbed by liquidity suppliers, will reverse in the short term. Under information asymmetry, as an extension of Wang (1994), Llorente et al. (2002) (henceforth LMSW) demonstrate that returns generated by speculative trading tend to continue, while returns generated by trading to rebalance portfolios tend to reverse, and both accompanied by high trading volumes.Footnote 1 Empirically, Cooper (1999) finds that price continuation is accompanied by high trading volumes, whereas Avramov et al. (2006) document that large reversals occur in high-turnover and illiquid stocks, which is consistent with the CGW model.Footnote 2 On the other hand, Conrad et al. (1994) find that high-volume stocks exhibit price reversals, while low-volume stocks exhibit price continuations. Lee and Swaminathan (2000) show that high-trading-volume winners (low-volume losers) are more likely to reverse in the near future because they tend to be substantially overvalued (undervalued), and vice verse. Others like Gagnon et al. (2006) examine the volume–return relationship worldwide and show that stocks from countries with a high-quality information environment have a higher tendency to exhibit return reversal than countries with a poor information environment. Avramov et al. (2013) use the absence or presence of overconfident investors in markets to represent the level of market liquidity and find that overconfident investors cause return continuation following high illiquidity.Footnote 3

Prior to the Nontradable Share Reform (NTS Reform) in China, roughly two-thirds of all shares were nontradable and were held by state governments or legal entities and large institutions, while only one-third of all shares were tradable, the majority of which were held by domestic individuals and some qualified institutions.Footnote 4 However, by 2007, following the NTS Reform, almost 97 % of shares were tradable (Statistics Annual Shanghai Stock Exchange). Meanwhile, the proportion of tradable shares owned by individual shareholders declined, whereas the proportion owned by institutional shareholders increased. Thus, we predict that following the NTS Reform, the increase in the number of tradable shares and the change in the nature of market participants could have influenced the relation between liquidity and return autocorrelations. Motivated by the existing state of the Chinese stock market, we develop a new illiquidity measure and another trading activity measure, the turnover ratio, to investigate the cross-sectional relationship between liquidity and stock return autocorrelations.

The main findings of previous studies on the Chinese stock market are that both the level of liquidity and the liquidity risk influence stock returns (Zhang et al. 2009; Narayan and Zheng 2010; Li and Feng 2013). A few studies that examine the relation between trading volumes and stock returns use a model with symmetric information. However, there are some shortcomings in these previous studies. First, none of these studies takes account of the NTS Reform in examining the relation between liquidity and stock returns.Footnote 5 Second, regarding the liquidity measure, many studies prefer the turnover ratio as a liquidity measure for examining the relationship between liquidity and stock returns (Su and Mai 2004; Wu and Song 2007). Individual investors in the Chinese stock market are in hot pursuit of short-term profits, which results in a higher turnover ratio, meaning that the turnover ratio is not an appropriate measure of liquidity in the Chinese stock market. Third, although studies such as Groenewold (2004) and Wang et al. (2009) analyze return autocorrelations and liquidity, they offer only limited insights because they use symmetric versions of the CGW model. Such models are inappropriate because information in the Chinese stock market is extremely asymmetric among investors.

This paper offers three distinct contributions. First, it is the first study to investigate the relation between liquidity and stock returns taking account of the NTS Reform. The change in the nature of market participants as a result of the NTS Reform influences the optimal liquidity measure and affects the liquidity–return relationship. Second, in contrast with previous studies using the turnover ratio, we propose a new illiquidity measure that measures more precisely the liquidity of the Chinese stock market. Third, using the LMSW model to estimate the relation between illiquidity–return autocorrelation and information asymmetry, we conjecture that trading motivated by a desire to rebalance portfolios causes return reversal accompanied by high illiquidity, while speculative trading causes return continuation accompanied by high illiquidity.

This paper presents the following results. First, we develop a new illiquidity measure, illiq_zero, which is a combination of the illiquidity measure of Amihud (2002) and the percentage of zero-return days. This new measure captures price reactions to trading volumes as well as transaction costs. The higher the new measure, the lower the stock liquidity. The new measure is different from the turnover ratio, which implies that this measure contains new information on the illiquidity of the Chinese market.

Second, before the NTS Reform, winner portfolios exhibit return reversals, and loser portfolios exhibit return continuations, while after the NTS Reform, winner portfolios exhibit return continuations, and loser portfolios exhibit return reversals. Additionally, return autocorrelations for winner portfolios and loser portfolios after the NTS Reform are similar to the results for the entire sample period. These results imply that the NTS Reform generated positive stock returns, consistent with the results of Beltratti and Bortolotti (2006), Beltratti et al. (2011).

Third, all of these return autocorrelations for winner portfolios and loser portfolios are stronger for high-illiquidity portfolios after controlling for turnover. Here stocks are sorted into four groups by turnover and illiq_zero independently within loser (winner) portfolios, which generate 16 turnover-illiq_zero loser (winner) portfolios. Before the NTS Reform, larger return continuations (reversals) for the 16 turnover-illiq_zero loser (winner) portfolios are concentrated in higher illiq_zero portfolios. Similarly, after the NTS Reform, for both loser and winner portfolios, the differential returns between highest illiq_zero portfolios and lowest illiq_zero portfolios are all significantly positive for each turnover portfolio.

Finally, following the LMSW model, we use market capitalization to determine the extent of speculative trading and find that return reversal accompanied by high illiquidity occurs for large stocks (low information asymmetry), while return continuation accompanied by high illiquidity occurs for small stocks (high information asymmetry). Our empirical results are remarkably consistent with our hypothesis.Footnote 6 For example, after the NTS Reform, the relation between market capitalization and the influence of illiquidity on return continuations (reversals) is negative (positive). In particular, return autocorrelations are strongly associated with the extent of speculative trading for high-illiq_zero portfolios.

The rest of the paper is organized as follows. Section 2 provides the data description in this study. Section 3 presents our empirical results for the relation between illiquidity, turnover, and portfolio returns. Section 4 presents our regression results of information asymmetry and the illiquidity–return relation obtained from Sect. 3. Section 5 provides concluding comments.

2 Description of Data

The China Stock Market and Accounting Research (CSMAR) database is the main source of data for this study. We obtained individual daily returns and trading volume data for all common stocks traded on the Shanghai A Share Stock Exchange over the period Dec 2000–Jan 2013.Footnote 7 In Mainland China, there are two large stock exchanges, the Shanghai Stock Exchange and the Shenzhen Stock Exchange. Furthermore, stocks traded on the two stock exchanges are divided into the A Share market and the B Share market. We focus on Shanghai A Share market since the NTS Reform is operated only for A Share market. Moreover, the tradable-share market value on the Shanghai A Share market is a multiple of that on the Shenzhen A Share market (see Table 1). Therefore, we can expect that investigation of the Shanghai A Share market will indicate what happened in the Chinese stock market.

This table presents basic information on the Chinese stock market for the period 2001–2012. Market value consists of both tradable-share market value and untradeable-share market value. The unit of measurement is ten million.

Figure 1 shows the market value of tradable shares from Jan 2001 to Dec 2012. Except for the period Dec 2007–Oct 2008, it can be seen that the market value of tradable shares continued to increase from the end of 2006, reaching a peak in March 2011 and remaining stable thereafter.

This figure presents the tradable-share market value of the Shanghai A Share stock market from Jan 2001 to Dec 2012. On the Chinese stock market, all stocks are divided into two types based on their tradability. On 29 April 2005, the Chinese government launched an economic reform of this split share structure by converting nontradable shares into tradable shares through the NTS Reform. The unit of measurement is one million yuan.

Following Avramov et al. (2006), we employ two liquidity measures that reflect different dimensions of liquidity in this study. The first liquidity measure, turnover, can be calculated as follows:

where \({\textit{number of shares traded}}_{i,d,t}\) is the number of shares of stock \(i\) traded on day \(d\) of month \(t\), and \({\textit{number of shares outstanding}}_{i,d,t}\) is the number of shares of stock \(i\) outstanding on day \(d\) of month \(t\).Footnote 8 We use the average value of daily turnover ratio within month \(t\) to be the monthly turnover ratio of stock \(i\). As Zhang and Liu (2006) mention, the turnover measure captures the trading quantity dimension but not the real liquidity of the Chinese market.

Amihud (2002) develops a measure of illiquidity that can be interpreted as the daily stock price impact of a dollar of trading volume. However, if the return of stock \(i\) on a particular day is zero, the illiquidity measure is zero. Lesmond et al. (1999) argue that, on average, a zero return is observed if the expected return does not exceed the transaction cost threshold. Therefore, high transaction costs result in zero-return days.Footnote 9 Considering that there have been many zero-return days because of high transaction costs in the Chinese stock market, we construct a new illiquidity measure, \(Illiq\_Zero\), as the second (il) liquidity measure, as follows:

where \(N_{i,t}\) is the number of days on which stock \(i\) is traded in month \(t\), \(\left| {R_{i,d,t}} \right| \) is the absolute value of returns on stock \(i\) on day \(d\) in month \(t\), and \({\textit{VOLD}}_{i,d,t}\) is the trading volume of stock \(i\) on day \(d\) in month \(t\). Footnote 10 \({\textit{NT}}\%_{i,t}\) is the percentage of zero-return days within a month. Therefore, if the stock return on day \(d\) is not zero, the new illiquidity measure is the logarithm of the Amihud illiquidity measure, whereas if the stock return on day \(d\) is zero, the new illiquidity measure will be the same as that of Lesmond et al. (1999). This new illiquidity measure captures the price reaction to trading volume as well as the trading cost. The higher the new illiquidity measure, the lower the stock liquidity.

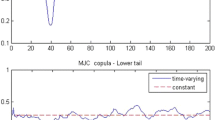

The figure presents turnover and illiq_zero for the period Jan 2001–Dec 2012. The turnover ratio is the number of shares traded to the number of shares outstanding. Illiq_zero is calculated by \(\hbox {Illiq}\_{\textit{Zero}}_{i,t} =\left[ {\ln \left( \frac{1}{N_{i,t}} \sum _{t=1}^{N_{i,t}}\left| {R_{i,d,t}}\right| /{\textit{VOLD}}_{i,d,t}\right) }\right] +{\textit{NT}}\%_{i,t}\), where \(N_{i,t}\) is the number of trading volume days of stock \(i\) in month \(t\), \(\left| {R_{i,d,t}}\right| \) is the absolute return on stock \(i\) on day \(d\), and \({\textit{VOLD}}_{i,d,t}\) is the trading volume of stock \(i\) on day \(d\) in month \(t\), which is divided by \(10^{10}\). \({\textit{NT}}\%_{i,t}\) is the percentage of zero-return days within a month.

Figure 2 plots the time-varying turnover and illiq_zero measure during the entire sample period. First, the turnover measure for the Chinese stock market varies from 0.057 to 387.672 and has a mean of 21.390 (see Panel A of Table 2), which is substantially larger than the result for the US stock market.Footnote 11 One possible interpretation is that in China, especially prior to the NTS Reform, individual investors generally accounted for the majority of the tradable share market. Additionally, these individual investors have little knowledge of investment and are in hot pursuit of short-term profits (see Mei et al. 2009; Zhang and Liu 2006). The turnover measure, therefore, is high because of the frequent trading of individual investors.

Second, the new measure, illiq_zero, has a flat distribution with a mean of 2.959 (see Panel A of Table 2). From Fig. 2 as well as Panel B and Panel C of Table 2, we can clearly see that after the NTS Reform, the mean of illiq_zero declines from 3.541 to 2.537, which indicates that the NTS Reform raised the liquidity of the Chinese stock market.Footnote 12

The table reports the statistics of variables for the full sample period (Panel A), before the NTS Reform (Panel B) and after the NTS Reform (Panel C). The return and tradable-share market value (mv) are available daily for all common stocks on the Shanghai A Share market. The turnover ratio is the number of shares traded to the number of shares outstanding. Illiq_zero is calculated by \(\hbox {Illiq}\_{\textit{Zero}}_{i,t} =\left[ {\ln \left( \frac{1}{N_{i,t}}\sum _{t=1}^{N_{i,t} } \left| {R_{i,d,t} } \right| /{\textit{VOLD}}_{i,d,t}\right) }\right] +{\textit{NT}}\%_{i,t}\), where \(N_{i,t}\) is the number of trading volume days of stock \(i\) in month \(t\), \(\left| {R_{i,d,t}}\right| \) is the absolute return on stock \(i\) on day \(d\), and \({\textit{VOLD}}_{i,d,t}\) is the trading volume of stock \(i\) on day \(d\) in month \(t\), which is divided by \(10^{10}\). \({\textit{NT}}\%_{i,t}\) is the percentage of zero-return days within a month. Before the NTS Reform (Jan 2001–Apr 2005), the total number of firms in our analysis is 615 firms, and increased to 733 firms after the NTS Reform (Jan 2007–Dec 2012).

Table 3 presents the time-series averages of the cross-sectional correlation of the main variables in this study. For all common stocks on the Shanghai A Share stock market, the correlation between returns and turnover is positive at 0.361. The correlation between returns and our new measure, illiq_zero, is negative at \(-0.171\), which is greater than the correlation between returns and the illiquidity measure of Amihud (\(-0.124\)). This suggests that our new illiq_zero measure has more information on liquidity and returns than the Amihud measure. Furthermore, the correlation between illiq_zero and market-trading value is \(-0.240\).

The return and tradable-share market value (mv) is available daily for all common stocks on the Shanghai A Share market. The turnover ratio is the number of shares traded to the number of shares outstanding. Illiq_zero is calculated by \(\hbox {Illiq}\_{\textit{Zero}}_{i,t}=\left[ {\ln \left( \frac{1}{N_{i,t}}\sum _{t=1}^{N_{i,t}} \left| {R_{i,d,t}}\right| /{\textit{VOLD}}_{i,d,t}\right) }\right] +{\textit{NT}}\%_{i,t}\), where \(N_{i,t}\) is the number of trading volume days of stock \(i\) in month \(t\), \(\left| {R_{i,d,t}}\right| \) is the absolute return on stock \(i\) on day \(d\), and \({\textit{VOLD}}_{i,d,t}\) is the trading volume of stock \(i\) on day \(d\) in month \(t\), which is divided by \(10^{10}\). \({\textit{NT}}\%_{i,t}\) is the percentage of zero-return days within a month. Illiquidity, measured following Amihud (2002), is the average across stocks of the daily ratio of absolute stock return to trading volume. Significance at the 1%, 5% and 10% level is given by \({}^{***}\), \({}^{**}\) and \({}^{*}\), respectively.

3 Empirical Results

3.1 Illiquidity, Turnover and Portfolio Returns

Based on Avramov et al. (2006), each month, we sort stocks based on their monthly returns in month \(t-1\). In our analysis, we exclude stocks if their number of trading days is \(<\)10 days each month. We further sort negative- and positive-return portfolios into extreme and nonextreme portfolios. That is, we form four portfolios: the first is the extreme-negative-return portfolio, which will be called the ‘loser portfolio’; the second is the medium-negative-return portfolio; the third is the medium-positive-return portfolio; and the fourth is the extreme-positive-return portfolio, which will be called the ‘winner portfolio’. As Avramov et al. (2013) argue that the extreme-return portfolios are highly associated with market illiquidity, we focus on extreme-return portfolios to examine the cross-sectional relation between portfolio returns and liquidity in this study.

We form a total of 32 portfolios by sorting independently on turnover and illiquidity within winner and loser portfolios. The turnover and illiquidity portfolio numbered 1 (4) has the lowest (highest) turnover and illiquidity, respectively. As we noted in Sect. 2, the turnover ratio for the Chinese stock market is typical and highly correlated with illiquidity as well as stock returns (see Table 3). Here we use both of these two measures to examine the cross-sectional relations between (il) liquidity and returns.

In the formation period, we find that for the winner portfolios, for any illiq_zero (turnover) portfolio, the equally weighted average return for month t \(-\)1 increases with turnover (illiq_zero). In particular, for any turnover (illiq_zero) portfolio, the return difference between illiq_zero (turnover) portfolios 1 and 4 is positive, and this difference becomes more positive as turnover (illiq_zero) increases. In the same way, for the loser portfolios, the equally weighted average return for month t \(-\)1 decreases with illiq_zero and turnover. The most negative return is obtained from the highest illiq_zero as well as turnover portfolio 4. Figure 3 shows these return patterns for the three-way sorted portfolios.

This figure shows portfolio returns in the preformation month. Portfolios are formed every month during the period Jan 2001 to Dec 2012. The sorts are based on returns, turnover, and the illiq_zero measure. The turnover ratio is the number of shares traded to the number of shares outstanding. Illiq_zero is calculated as follows: \(\hbox {Illiq}\_{\textit{Zero}}_{i,t} =\left[ {\ln \left( \frac{1}{N_{i,t}}\sum _{t=1}^{N_{i,t}}\left| {R_{i,d,t}}\right| /{\textit{VOLD}}_{i,d,t}\right) } \right] +{\textit{NT}}\%_{i,t}\), where \(N_{i,t}\) is the number of days on which stock \(i\) is traded in month \(t\), \(\left| {R_{i,d,t}}\right| \) is the absolute value of the return on stock \(i\) on day \(d\) in month \(t\), and \({\textit{VOLD}}_{i,d,t}\) is the Chinese yuan trading volume of stock \(i\) on day \(d\) in month \(t\), which is divided by \(10^{10}\). \({\textit{NT}}\%_{i,t}\) is the percentage of zero-return days within a month. Return portfolio 1 (4) is the loser (winner) portfolio. The turnover and illiquidity portfolio numbered 1 (4) has the lowest (highest) turnover and illiquidity, respectively.

During the formation period, the impact of price pressure increases with illiquidity and turnover. Furthermore, the largest price changes occur in the high- illiq_zero (turnover) portfolios. However, the price impact in winner portfolios is a little stronger than that in loser portfolios.

This table reports postformation monthly returns and t-statistics (in parentheses) during the period Jan 2001 to Dec 2012. Portfolios are formed by returns, turnover, and the illiq_zero measure every month. The turnover ratio is the number of shares traded to the number of shares outstanding. Illiq_zero is calculated as follows: \(\hbox {Illiq}\_{\textit{Zero}}_{i,t} =\left[ {\ln \left( \frac{1}{N_{i,t}}\sum _{t=1}^{N_{i,t}}\left| {R_{i,d,t}}\right| /{\textit{VOLD}}_{i,d,t}\right) } \right] +{\textit{NT}}\%_{i,t}\), where \(N_{i,t}\) is the number of days on which stock \(i\) is traded in month \(t\), \(\left| {R_{i,d,t}}\right| \) is the absolute value of the return on stock \(i\) on day \(d\) in month \(t\), and \({\textit{VOLD}}_{i,d,t}\) is the Chinese yuan trading volume of stock \(i\) on day \(d\) in month \(t\), which is divided by \(10^{10}\). \({\textit{NT}}\%_{i,t}\) is the percentage of zero-return days within a month. Return portfolio 1 (4) is the loser (winner) portfolio. The turnover and illiquidity portfolio numbered 1 (4) has the lowest (highest) turnover and illiquidity, respectively. The row labeled (4–1) reports the return differential between highest illiquidity (turnover) and lowest illiquidity (turnover) portfolios.

Table 4 presents the equally weighted average returns for the three-way sorted portfolios in month \(t\) over the full sample period. Focusing on the loser portfolios, the returns of each of the 16 turnover-illiq_zero-sorted portfolios are positive, consistent with a reversal in returns. For any turnover portfolios, the return differences between illiq_zero portfolios 1 and 4 are all positive. On the other side, for any illiq_zero portfolios, except for illiq_zero portfolio 3, the returns of turnover portfolio (4–1) are negative, while almost are insignificant. Moreover, the largest return occurs in illiq_zero portfolio 4 (0.0246) but with the lowest turnover. These results imply that return reversal is highly correlated to illiquidity, which is different from Avramov et al. (2006), who show that the largest return reversal occurs in the highest turnover and illiquidity portfolios. This difference may arise because the turnover ratio for the Chinese stock market reflects market features that are different from those for developed markets.

Turning to winner portfolios, we demonstrate that 14 of the 16 turnover-illiq_zero portfolios’ returns are positive, and return continuations are stronger in illiq_zero 4 portfolios. For instance, for turnover portfolios 1, 3 and 4, the return differences against illiq_zero (4–1) are 0.0085, 0.0104, and 0.0140, respectively. On the contrary, for all illiq_zero portfolios, the returns of turnover portfolio 1 exceed those of turnover portfolio 4. For instance, for illiq_zero portfolio 4, the return of turnover portfolio 1 is 0.0130, which is larger than that of turnover portfolio 4; i.e. 0.0115. Hence, return continuations for winner portfolios are stronger among high-illiq_zero and low-turnover portfolios. Figure 4 plots the returns of loser portfolios and winner portfolios during the postformation period.

See the caption for Fig. 3. This figure shows postformation portfolio monthly returns during the period Jan 2001 to Dec 2012.

To summarize, in the loser portfolios, return reversals are highly correlated to illiquidity. In the winner portfolios, return continuations occur in high-illiquidity portfolios and low-turnover portfolios. In particular, both types of return autocorrelations are concentrated in high illiq_zero portfolios.

3.2 NTS Reform (29 April 2005)

In this section, we divide the sample period into two parts: the first part is the period before the NTS Reform (i.e. from Jan 2001 to Apr 2005), and the second part is the period after the NTS Reform (i.e. from Jan 2007 to Dec 2012). In the second part, we choose the period from Jan 2007 because the NTS Reform was not implemented for all firms simultaneously.

3.2.1 Results Before NTS Reform

Table 5 presents the returns of the three-way sorted portfolios in the postformation period before the NTS Reform. Before the NTS Reform, almost all of the returns for both loser portfolios and winner portfolios are negative. For loser portfolios, only for turnover portfolios 1 and 4, the differential returns between illiq_zero portfolios 1 and 4 are negative. The larger negative return occurs in high-illiq_zero portfolio 3, and all these results are statistically significant; i.e \(-0.0136\,(-3.346)\). For illiq_zero portfolios, the return differences between turnover portfolios 1 and 4 are mixed. In contrast, all of the winner portfolios clearly reversed. Here, the contribution of turnover is clear, because the return differences of turnover portfolios 1 and 4 are all negative, whereas the returns of illiq_zero portfolios 1 and 4 are only negative for turnover portfolios 1 and 2. This implies that the reversals for winner portfolios are more correlated to high-turnover portfolios. However, return reversals on all illiq_zero 4 portfolios are more statistically significant than on other illiq_zero portfolios.

See the caption for Table 4. The sample period here is from Jan 2001 to Apr 2005.

See the caption for Fig. 3. This figure shows postformation portfolio monthly returns during the period Jan 2001 to Apr 2005.

Figure 5 illustrates the above results for the two extreme portfolios. For loser portfolios, return continuations are concentrated among high-illiq_zero portfolios, while for winner portfolios, return reversals are concentrated mainly among high-turnover portfolios. Before the NTS Reform, individual investors accounted for the majority of all tradable share market. Holders of winner stocks seek short-term profits and will tend to sell their winner stocks if they can realize a profit. As numerous individual investors are trading winner stocks frequently, reversals are concentrated on turnover.

3.2.2 Results After NTS Reform

Table 6 presents the similarly sorted portfolios after the NTS Reform. First, almost all the returns for both the loser portfolios and the winner portfolios are positive.Footnote 13 Furthermore, recalling the results of Table 4, we find that the results for the full sample are similar to the results from the period after the NTS Reform.

For all loser portfolios among the set of turnover portfolios, the returns of illiq_zero portfolio 4 are larger than illiq_zero portfolio 1, which generate significantly positive returns for illiq_zero portfolios (4–1). Similarly, for any illiq_zero portfolios, the differential returns between turnover portfolios 1 and 4 are negative except illiq_zero portfolio 2. However, these results for turnover portfolio (4–1) are insignificant. For winner portfolios, for any turnover portfolios, the return differences between illiq_zero portfolios 1 and 4 are all significantly positive. While the differential returns for turnover portfolios (4–1) show no clear trend across illiq_zero portfolios. This implies that return continuations for winner portfolios are stronger among the higher illiq_zero portfolios.

See the caption for Table 4. The sample period here is from Jan 2007 to Dec 2012.

As shown by Fig. 6, almost all winner and loser portfolios show positive returns after the NTS Reform.Footnote 14 Moreover, all these positive returns are concentrated in the highest illiq_zero portfolios after controlling for turnover ratio.

See the caption for Fig. 3. This figure shows postformation portfolio monthly returns during the period Jan 2007 to Dec 2012.

4 Illiquidity, Portfolio Returns and Proxies for Information Asymmetry

In this section, we investigate the reason for illiquidity-return autocorrelations for winner and loser portfolios before and after the NTS Reform, especially whether this relation is related to information asymmetry. We also test the robustness of our results by examining the relations for high- versus low-illiquidity portfolios.

Following proposition 3 of the LMSW model, when there is information asymmetry, informed investors trade for both hedging and speculative reasons. Return reversals occur when informed investors trade for hedging accompanied by high illiquidity, whereas return continuations occur when informed investors trade for speculative reasons accompanied by high illiquidity.Footnote 15 The LMSW model illustrates that the relations between current returns, volume and future returns depends on the relative significance of speculative trading versus hedging trading. Furthermore, they use market capitalization as a measure of information asymmetry because larger firms have a low degree of information asymmetry and tend to be traded for hedging reasons.Footnote 16 Thus, they test proposition 3 by estimating the following relation for each individual stock:

where \(R_{it+1}(R_{it})\) represents the return on stock \(i\) in month \(t+1(t)\), \(V_{it}\) is the monthly volume on stock \(i\) and \(ORDCAP_i\) is a variable that represents the ordinal scale of market capitalization on stock \(i\). As predicted by the LMSW model, stocks that are subject to significant speculative trading should have significant and positive \(C2\) coefficients, while clearly negative \(C2\) coefficients are associated with significant hedging trading. Moreover, higher \({\textit{ORDCAP}}_i\) is associated with a lower degree of information asymmetry, so the \(b\) coefficients should be negative.

Following estimation of the LMSW model, we use Eq. (5) for the 16 turnover-illiq_zero \(j\left( {\textit{winner or loser}}\right) \) portfolios that were formed in Sect. 3 to find the relations between current return, illiquidity, and future returns. Then, as shown in Eq. (6), we use market capitalization as a measure of the degree of information asymmetry for \(j\) portfolios to examine the relation between the extent of information asymmetry and the \(C2\) coefficients:Footnote 17

where \(R_{i,j,t+1}(R_{i,j,t})\) presents the return on stock \(i\), which belongs to the 16 turnover-illiq_zero \(j\) portfolios in month \(t+1(t)\), \(\hbox {Illiq}\_{\textit{zero}}_{i,j,t}\) is the illiquidity on stock \(i\) within the 16 turnover-illiq_zero \(j\) portfolios in month \(t\). \(lnmv_j\) is the logarithm of market capitalization on all stocks within the 16 turnover-illiq_zero \(j\) portfolios. We expect that the \(C2\) coefficients for winner portfolios before the NTS Reform and loser portfolios after the NTS Reform that are associated with hedging should be negative, while for loser portfolios before the NTS Reform and winner portfolios after the NTS Reform that are associated with speculative trading should be positive. Moreover, \(b\) coefficients should be positive (negative) for winner (loser) portfolios before the NTS Reform, while \(b\) coefficients should be negative (positive) for winner (loser) portfolios after the NTS Reform.

Table 7 presents the results for winner and loser portfolios before the NTS Reform. The table shows that the \(C2\) coefficient is negative for winner portfolios (\(-0.1052\)) and positive for loser portfolios (0.1737), which is consistent with our results in Sect. 3.2 showing that return reversal occurs in winner portfolios and return continuation occurs in loser portfolios. As we expected, \(b\) coefficient is positive for winner portfolios (0.0030) and negative for loser portfolios (\(-0.0045\)). However, most of these results are statistically insignificant because the majority of shares were nontradable before the NTS Reform, which results in a weak relation between market capitalization and illiquidity–return coefficients.

This table shows the relation between market capitalization (information asymmetry proxy) and the influence of illiq_zero on the autocorrelation of portfolio returns. Portfolios are sorted by returns, turnover, and the illiq_zero measure every month during the period Jan 2001 to Apr 2005. For each portfolio, the parameter C2 from the following regression measures the influence of illiq_zero on the autocorrelation of portfolio returns:

where \(\hbox {R}_{\mathrm{i,j,t}+1} (\hbox {R}_{\mathrm{i,j,t}})\) represents the return on stock i within the \(16\,\hbox {j}\) portfolios in month \(\hbox {t}+1\,(\hbox {t})\), and \(\hbox {Illiq}\_\hbox {zero}_{\mathrm{i,j,t}}\) is the illiquidity on stock i within the \(16\,\hbox {j}\) portfolios in month \(\hbox {t}\). Panel A reports the mean value of each parameter for the \(\hbox {j}\) portfolio. In panel B, we provide regression analysis using the following equation:

where \(\hbox {lnmv}_{\mathrm{j}}\) is the logarithm of market capitalization for each \(\hbox {j}\) portfolio. Significance at the 1%, 5% and 10% level is given by \({}^{***}\), \({}^{**}\) and \({}^{*}\), respectively.

Contrary to the results before the NTS Reform, Table 8 reports regression coefficients for winner and loser portfolios after the NTS Reform. The illiquidity–return coefficient \(C2\) is 0.1654 for winner portfolios and \(-0.1490\) for loser portfolios, and all coefficients are highly significant. The coefficient b is \(-0.0750\) for winner portfolios and 0.1152 for loser portfolios, indicating that illiquidity–return reversals are related to large stocks (low information asymmetry) and illiquidity–return continuations are related to small stocks (high information asymmetry). After the NTS Reform, winner and loser portfolios have different return autocorrelations because of changes in the nature of market participants and an increase in the proportion of tradable shares.

See the caption for Table 7. The sample period here is from Jan 2007 to Dec 2012.

Next, we conduct robustness tests for the results presented above. From the 16 winner (loser) portfolios, we select the four lowest-illiquidity portfolios, and the four highest-illiquidity portfolios in month \(t-1\) to form low-illiq_zero portfolios and high-illiq_zero portfolios. Thus, we have two illiquidity portfolios within both the winner and loser portfolios each month. Then, we apply a similar approach to results from both before and after the NTS Reform to examine these relations.

Table 9 reports the results for low-illiq_zero versus high-illiq_zero winner (loser) portfolios before the NTS Reform. The coefficient of illiquidity–return autocorrelation for high-illiq_zero winner portfolios is more negative than low-illiq_zero portfolios.Footnote 18 Furthermore, the relation between the interaction coefficient \(C2\) and market capitalization is more positive (negative) for high-illiq_zero winner (loser) portfolios.

In this analysis, we select four lowest illiq_zero portfolios and four highest illiq_zero portfolios as the low-illiq_zero j portfolio and high-illiq_zero j portfolio from the 16 j portfolios, respectively. See the rest caption for Table 7.

Turning to the results for the period after the NTS Reform, Table 10 presents regression coefficients similar to those shown in Table 9. The illiquidity–return coefficient \(C2\) for high-illiq_zero winner (loser) portfolios is more positive (negative) than low-illiq_zero portfolios. However, the results are insignificant for both low- and high-illiq_zero loser portfolios. Additionally, the coefficient b for high-illiq_zero winner (loser) portfolios is more significantly negative (positive) than low-illiq_zero winner (loser) portfolios, indicating that higher-illiquidity portfolios are strongly associated with return reversals and return continuations.

See the caption for Table 9. The sample period here is from Jan 2007 to Dec 2012.

Under information asymmetry, winner portfolios before the NTS Reform and loser portfolios after the NTS Reform experience return reversals accompanied by high illiquidity because trading is motivated by the desire to rebalance portfolios; while loser portfolios before the NTS Reform and winner portfolios after the NTS Reform experience return continuations accompanied by high illiquidity because trading is speculative. And all of these effects are stronger for high-illiquidity portfolios. In particular, the results after the NTS Reform are more significant than the results before the NTS Reform. Those results imply that efficiency in the Chinese stock market has increased significantly following the NTS Reform.

5 Conclusion

In this study, we used data on all common stocks on the Shanghai A Share stock market over the period Jan 2001 to Dec 2012 to analyze the relationship between liquidity and stock returns while considering the NTS Reform. First, we developed a new illiquidity measure, illiq_zero, which is a combination of the price reaction to trading volume and the percentage of zero-return days. This new measure moves differently from the turnover ratio, which implies this measure contains new information on illiquidity in the Chinese market.

Second, prior to the NTS Reform, winner portfolios exhibit return reversals, and loser portfolios exhibit return continuations, while following the NTS Reform, winner portfolios exhibit return continuations, and loser portfolios exhibit return reversals. Furthermore, the results after the NTS Reform are similar to those for the full sample period.

Third, all of the return autocorrelations for both winner and loser portfolios are stronger for high-illiquidity portfolios, even after controlling for turnover. Before the NTS Reform, larger return continuations (reversals) for the 16 turnover-illiq_zero loser (winner) portfolios are among higher illiq_zero portfolios. Similarly, after the NTS Reform, return reversals (continuations) for the 16 turnover-illiq_zero loser (winner) portfolios increase with illiq_zero.

Finally, we assume that return reversal accompanied by high illiquidity occurs in large stocks, while return continuation accompanied by high illiquidity occurs in small stocks. Our empirical results are consistent with our hypothesis, both before and after the NTS Reform. In particular, all these results are stronger for high-illiq_zero portfolios.

Notes

Easley and O’Hara (2004) also study the effect of asymmetric information on expected returns.

Chordia and Subrahmanyam (2004) propose a model and test a theory of short-term reversals based on how market makers accommodate traders’ autocorrelated order imbalances.

Other related works such as Pastor and Stambaugh (2003) and Rinne and Suominen (2010) provide price reversals as liquidity measures based on the idea that market makers’ returns to providing liquidity equal the costs of immediacy to other investors. Vayanos and Wang (2012) propose a theoretical model to show the relation between price reversal measures and returns.

On 29 April 2005, the Chinese government launched the NTS Reform, aimed at overcoming split share structures by converting nontradable shares into tradable shares.

The results before the NTS Reform support our hypothesis; however, most of them are insignificant.

The daily return includes reinvestment of the cash dividend.

Datar et al. (1998) show that the turnover ratio has often been used as a measure of liquidity.

Bekaert et al. (2007) use the number of zero-return days as a liquidity measure in examining liquidity and expected returns in emerging markets, and they find that this measure is able to predict future returns accurately.

The trading volume for each stock is estimated in Chinese yuan and divided by \(10^{10}\).

Datar et al. (1998) show that the turnover ratio for the US stock market varies from 0.0013 to 110 %, with a mean of 3.6 %.

This excludes the results for the three winner portfolios, which show negative returns but lack statistical significance.

Following the NTS Reform, holders of nontradable shares, such as state governments and legal entities, also became holders of tradable shares. These stockholders are informed investors and hold the majority of shares, which explains why both winner and loser portfolios can earn positive returns. However, individual investors can make substantial losses because of poor information.

Lo and MacKinlay (1990) show that larger firms have a low degree of information asymmetry, while smaller firms have a high degree of information asymmetry.

Here, we use the average value of market capitalization of stocks included in each of the 16 turnover-illiq_zero winner or loser portfolios in each month.

The illiquidity–return coefficient \(C2\) for high-illiq_zero loser portfolios is less positive than low-illiq_zero portfolios.

References

Amihud, Y. (2002). Illiquidity and stock returns: Cross-section and time-series effects. Journal of Financial Markets, 5(1), 31–56.

Avramov, D., Cheng, S., & Hameed, A. (2013). Time-varying momentum payoffs and illiquidity. Working paper, http://ssrn.com/abstract=2289745

Avramov, D., Chordia, T., & Goyal, A. (2006). Liquidity and autocorrelations in individual stock returns. The Journal of Finance, 61(5), 2365–2394.

Bekaert, G., Harvey, C. R., Lundblad, C., & Siegel, S. (2007). Global growth opportunities and market integration. The Journal of Finance, 62(3), 1081–1137.

Beltratti, A., & Bortolotti, B. (2006). The nontradable share reform in the Chinese stock market. Working paper, http://ssrn.com/abstract=944412

Beltratti, A., Bortolotti, B., & Caccavaio, M. (2011). The stock market reaction to the 2005 non-tradable share reform in China. Working paper series No. 1339.

Campbell, J. Y., Grossman, S. J., & Wang, J. (1993). Trading volume and serial correlation in stock returns. The Quarterly Journal of Economics, 108(4), 905–939.

Chordia, T., & Subrahmanyam, A. (2004). Order imbalance and individual stock returns: Theory and evidence. Journal of Financial Economics, 72(3), 485–518.

Conrad, J. S., Hameed, A., & Niden, C. (1994). Volume and autocovariances in short-horizon individual security returns. The Journal of Finance, 49(4), 1305–1329.

Cooper, M. (1999). Filter rules based on price and volume in individual security overreaction. Review of Financial Studies, 12(4), 901–935.

Datar, V. T., Naik, N. Y., & Radcliffe, R. (1998). Liquidity and stock returns: An alternative test. Journal of Financial Markets, 1(2), 203–219.

DeBondt, W. F., & Thaler, R. (1985). Does the stock market overreact? The Journal of Finance, 40(3), 793–805.

Easley, D., & O’Hara, M. (2004). Information and the cost of capital. The Journal of Finance, 59(4), 1553–1583.

Gagnon, L., Karolyi, G. A., & Lee, K.-H. (2006). The dynamic volume-return relationship of individual stocks: The international evidence. AFA 2008 New Orleans Meetings Paper, http://ssrn.com/abstract=968672

Groenewold, N. (2004). Autocorrelation and volume in the Chinese stock market. Review of Pacific Basin Financial Markets and Policies, 7(02), 289–309.

Jegadeesh, N. (1990). Evidence of predictable behavior of security returns. The Journal of Finance, 45(3), 881–898.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. The Journal of Finance, 48(1), 65–91.

Kang, J., Liu, M.-H., & Ni, S. X. (2002). Contrarian and momentum strategies in the China stock market: 1993–2000. Pacific-Basin Finance Journal, 10(3), 243–265.

Kyle, A. S. (1985). Continuous auctions and insider trading. Econometrica: Journal of the Econometric Society, 53(6), 1315–1336.

Lee, C., & Swaminathan, B. (2000). Price momentum and trading volume. The Journal of Finance, 55(5), 2017–2069.

Lehmann, B. N. (1990). Fads, martingales, and market efficiency. The Quarterly Journal of Economics, 105(1), 1–28.

Lesmond, D. A., Ogden, J. P., & Trzcinka, C. A. (1999). A new estimate of transaction costs. Review of Financial Studies, 12(5), 1113–1141.

Li, L., & Feng, Y. (2013). The research of liquidity risk measurements in China stock market. Procedia Computer Science, 17, 647–655.

Llorente, G., Michaely, R., Saar, G., & Wang, J. (2002). Dynamic volume-return relation of individual stocks. Review of Financial Studies, 15(4), 1005–1047.

Lo, A. W., & MacKinlay, A. C. (1990). When are contrarian profits due to stock market overreaction? Review of Financial Studies, 3(2), 175–205.

Mei, J., Scheinkman, J. A., & Xiong, W. (2009). Speculative trading and stock prices: Evidence from Chinese AB share premia. Annals of Economics & Finance, 10(2), 225–255.

Narayan, P. K., & Zheng, X. (2010). Market liquidity risk factor and financial market anomalies: Evidence from the Chinese stock market. Pacific-Basin Finance Journal, 18(5), 509–520.

Pastor, L., & Stambaugh, R. F. (2003). Liquidity risk and expected stock returns. Journal of Political Economy, 111(3), 642–685.

Rinne, K., & Suominen, M. (2010). Short term reversals, returns to liquidity provision and the costs of immediacy. Working paper, http://ssrn.com/abstract=1537923

Shanghai Stock Exchange. (2008). Statistics Annual Shanghai Stock Exchange. Shanghai: Shanghai People’s Publishing House.

Shen, Y., & Wu, S. (1999). Is there an overreaction in China’s security market? Economic Research Journal, 34(2), 21–26.

Su, D., & Mai, Y. (2004). Liquidity and asset pricing: An empirical exploration of turnover and expected returns on Chinese stock markets. Economic Research Journal, 2(11), 95–105.

Vayanos, D., & Wang, J. (2012). Liquidity and asset returns under asymmetric information and imperfect competition. Review of Financial Studies, 25(5), 1339–1365.

Wang, C., Hao, P., Fang, Z., & Liang, W. (2009). Research on the reversal strategy based on the perspective of liquidity under the market conditions of China. Journal of Systems Engineering, 24(6), 666–672.

Wang, J. (1994). A model of competitive stock trading volume. Journal of Political Economy, 102(1), 127–168.

Wu, Y. (2011). Momentum trading, mean reversal and overreaction in Chinese stock market. Review of Quantitative Finance and Accounting, 37(3), 301–323.

Wu, Y., & Song, F. (2007). Liquidity risk and stock return. Proceedings of the Operations Research and Management Science, 16(2), 117–122.

Zhang, F., Tian, Y., & Wirjanto, T. S. (2009). Liquidity risk and cross-sectional returns: Evidence from the Chinese stock markets. Finance Research Letters, 6(4), 219–229.

Zhang, Z., & Liu, L. (2006). Turnovers and stock returns: Liquidity premium or speculative bubbles? China Economic Quarterly, 5(3), 871–892.

Acknowledgments

This research is financially supported by the KOKUSAITEKI Research Fund of Ritsumeikan University. I appreciate greatly helpful suggestions and comments by Shinsuke Ikeda, Keiichi Hori, Yuichi Fukuta, Akiko Yamane, the editor, an anonymous referee, and seminar participants at Osaka University, and the 2014 Japanese Economic Association Spring meetings.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yang, C. An Empirical Study of Liquidity and Return Autocorrelations in the Chinese Stock Market. Asia-Pac Financ Markets 22, 261–282 (2015). https://doi.org/10.1007/s10690-015-9203-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-015-9203-5