Abstract

We study household decision making in a high-stakes experiment with a random sample of households in rural China. Spouses have to choose between risky lotteries, first separately and then jointly. We find that spouses’ individual risk preferences are more similar the richer the household and the higher the wife’s relative income contribution. A couple’s joint decision is typically very similar to the husband’s preferences, but women who contribute relatively more to the household income, women in high-income households, and women with communist party membership have a stronger influence on the joint decision.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Many important economic decisions—e.g., labor supply, residential location, buying insurance or a new car, investing in stocks and bonds or in children’s education—are often made by households rather than by individuals. This implies that the decisions will be a function of the preferences of the household members and the decision making process. In particular, it has been shown that decisions and outcomes in a household—such as child health, nutrition, and expenditures for different goods and services (e.g., tobacco versus child care)—depend strongly on whether its income is controlled by the husband or the wife (see Thomas 1994; Lundberg et al. 1997; Phipps and Burton 1998; Duflo 2003). Qian (2008), for instance, reports that the relative female income (as a share of total household income) in Chinese rural households has had significantly positive impacts on the survival rates for girls and on the educational attainment of children.

In this paper we present an experiment that was run in the homes of 117 randomly selected married couples in rural China. Wives and husbands had to choose between different lotteries first individually and then jointly. Our aim is to provide controlled experimental evidence on two important aspects of household decision making. First, we address how similar the two spouses’ individual decisions are when decisions are made separately, and which socioeconomic factors influence the level of similarity. Second, we study how a couple’s joint decision relates to the spouses’ separate decisions, and which conditions are related to a stronger influence of the wife on the joint decision. Thus, we can study the circumstances that determine the outcome of an implicit bargaining process that is assumed to take place in many household decisions.

We find that spouses in richer households have more similar individual risk attitudes. In general, a couple’s joint decision is closer to the husband’s individual decision. However, we show that the preferences of women are better reflected in joint decisions if women contribute relatively more to household income, live in households of higher joint income, or are communist party members.

Recently, experiments have become increasingly popular as a method for gaining deeper insights into household behavior by carefully controlling—and varying—the conditions under which household members can make decisions (see, e.g., Peters et al. 2004; Bateman and Munro 2005; Ashraf 2009; de Palma et al. 2011; Abdellaoui et al. 2011). These experiments are a result of a shift in the theoretical modeling of decision making in a household from using unitary models, which assume a unique decision-maker, to collective models (see, for instance, Lundberg and Pollak 1996; Vermeulen 2002; de Palma et al. 2011). Our paper is most closely related to contributions by Bateman and Munro (2005) and de Palma et al. (2011). Bateman and Munro (2005) examine whether decisions made by couples conform more or less to the axioms of expected utility theory compared to decisions made by spouses individually. To do this, they invited 76 couples and let the spouses make risky decisions both separately and jointly. Their results suggest that couples exhibit the same kinds of departures from expected utility theory as individuals. Furthermore, they find joint decisions to be typically more risk averse than the spouses’ individual decisions. de Palma et al. (2011) focus on the question of which spouse has more influence on joint decisions. Based on observations from 22 couples, they conclude that husbands generally have a stronger influence on joint decisions than wives, although wives gain influence if they control the computer keyboard while entering the joint decisions in the experiment. Contrary to Bateman and Munro (2005), de Palma et al. (2011) also report that the joint decision of a couple tended to be less risk averse than the spouses’ individual decisions.

Our paper distinguishes itself from these important contributions in several dimensions: First, the subject pools are completely different. While Bateman and Munro (2005) and de Palma et al. (2011) ran their experiments in highly developed countries, ours was conducted in the field in a rather poor area of China, which by many accounts is still a developing country. The experiment was run in the Guizhou province in the southwest of China. This is the poorest province in China. The average yearly per-capita income of the couples participating in our experiment was 570 US-Dollars and they had on average only 4.8 years of schooling, allowing us to study household decision making in a very different environment than in the studies of Bateman and Munro (2005) and de Palma et al. (2011).Footnote 1 Second, our sample is random. This means that the subjects were not invited through flyers or newspaper ads to participate in an experiment, which might give rise to endogeneity effects as to who is going to participate. Instead the participants in our experiment were randomly selected by the village council (as described in more detail in Sect. 3) and then approached by the experimenters in their homes. Although participation was voluntary, no couple refused the invitation to participate. Third, our experiment involves considerably higher stakes than those used in the UK by Bateman and Munro (2005) or in Germany by de Palma et al. (2011). In our experiment, the average earnings from participating in the experiment were roughly equivalent to the average income earned from three days of off-farm work.Footnote 2 Fourth, our research focus is different. Unlike Bateman and Munro (2005), we are not interested in whether couple decisions exhibit more or less so-called anomalies in decision making than decisions made individually; instead we examine the socio-demographic conditions under which (i) a couple’s separate decisions are more similar and (ii) a couple’s joint decision is more likely to be driven by the wife’s individual preferences. Although de Palma et al. (2011) did address item (ii), they only took account of who was holding the computer mouse when entering the joint decision, while we consider a set of socio-demographic variables to estimate how individual decisions of spouses relate to the couple’s joint decision.

Studying decision making in couples is also related to a recent strand of literature that addresses how groups make decisions in risky choices. The evidence with randomly formed groups is quite mixed.Footnote 3 There are, however, important differences between randomly formed groups in the laboratory and married couples, making it difficult to draw direct comparisons. Married couples do have a history with repeated interactions, while randomly formed groups in the laboratory only meet for a very short period for a specific (experimental) task, after which they separate immediately. The process of sharing information, the degree of potential altruism and willingness to find compromises are most likely different in real couples than in ad hoc groups as a consequence of repeated interaction in couples. The closest paper on groups and risk taking to our approach is He et al. (2012) who ran risk-taking experiments with student couples to bridge the gap between ad hoc created groups and (long-married) couples, and they find that student couples are more risk neutral than the choices of individual students.

The rest of the paper is organized as follows. Section 2 provides background information on our subject pool and on the Chinese province where the experiment was conducted. Section 3 introduces the experimental design and procedure. Section 4 presents the experimental results, and Sect. 5 concludes the paper.

2 Location of the experiment and background information on sampling and the actual sample

The experiment was conducted in rural communities in the Guizhou province, which is the 16th largest out of 32 provinces in China and is located in the southwest part of the country. Guizhou’s total population is 39 million, and its main industries are mining, timber, and forestry. The gross domestic product per capita was around 6,700 Chinese Yuan in 2007.Footnote 4 This figure—the lowest among all provinces—corresponds to approximately 34 % of the national average (20,000 Chinese Yuan in 2007; see NBS 2008).

The University of Gothenburg supports a research program at Peking University. The Guizhou province is one of the regions where this program conducts research on issues related to the environment and resource use, both of which are inherently linked to risky decision making, which is the reason for choosing this province for our experiment.

The sampled region is Majiang, located in the eastern part of Guizhou and around 100 kilometers away from the province’s capital city. The local forestry bureau officials provided us with a list of villages and townships in this region, from which they then randomly selected seven villages from five different townships. In each village, the local village council randomly selected from the household registration list—which includes all officially married couples—between 10 and 24 households, depending on the size of the village in order to sample roughly the same fractions of households in each village. Together with one member of the village cadre (i.e., a local official), two interviewersFootnote 5 were then accompanied by one member of the village cadre to these randomly selected households. If one of the spouses was not at home at the time of the interviewers’ visit, the household next door was approached.Footnote 6 Once the two interviewers had met a couple, the member of the village cadre left again. Upon entering the homes, the couples were first surveyed by the interviewers on several issues concerning farming and forestry (as part of the Environment for Development project at the University of Gothenburg), and were then invited to participate in an experiment on decision making under risk. In total, 117 households were interviewed, and all of them participated voluntarily in the experiment.

Table 1 reports background statistics of the sampled households. The average yearly income per capita is 3,919 Chinese Yuan, which is about 40 % lower than the Guizhou province yearly average, but close to the Majiang region average.Footnote 7 Forty-two percent of the household income is generated from off-farm sources, and 36 % from agriculture. The remaining income originates from forestry, remittances, and other sources. Women contribute on average 42 % of the total household income. Among the couples in our sample, only one had been married for less than one year. The maximum length of marriage was 52 years, and the average was 27 years. It is important to note that many families in this region are not affected by the official one-child policy, and therefore the average number of children is larger than one. The reason for this is that the one-child policy is mainly for Han Chinese, and in our sampled region more than one-third of the inhabitants belong to other ethnic groups. The level of education is very low in our sample; the average number of years of schooling is 6.09 for husbands and 3.62 for wives. The overall average in the Guizhou province is 6.75 years of schooling, which indicates that the Majiang region is relatively underdeveloped. Eight percent of the women are party members, while 18 percent of men are.Footnote 8

3 Experimental design and procedure

3.1 The experimental task

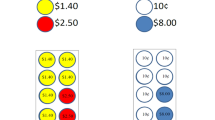

We used the choice list introduced by Holt and Laury (2002) to let subjects make risky decisions. Table 2 shows the ten pairwise choices. In each choice task, subjects had to choose either Option A (which can be regarded the relatively safe option) or Option B (the relatively risky option). While the possible payoffs in both options were fixed in all ten choices, the probability for the high payoff in each option increased in steps of 10 percentage points from 10 % to 100 %. Consequently, the probability for the low payoff decreased by 10 percentage points from 90 % to 0 %. For example, in the first decision the respondents had to choose between an Option A of earning either 20 Chinese Yuan with a probability of 10 % or 16 Chinese Yuan with a probability of 90 %, and an Option B of earning either 38.5 Chinese Yuan with a 10 % probability or 1 Chinese Yuan with a 90 % probability.

The far-right column of Table 2 indicates the difference in expected payoffs. In the first four (final six) rows, Option A (Option B) has a higher expected payoff. Therefore, a risk neutral subject would choose Option A in the first four decisions and Option B in the last six decisions. Subjects who switch to Option B after the fifth choice can be classified as risk averse, whereas subjects switching to Option B prior to the fifth choice are considered risk loving.

3.2 Procedure

In total, there were several stages in the experiment.Footnote 9 Each stage was explained only after the previous stage had been finished. Before Stage 1, spouses were separated into two different rooms, each of them accompanied by an interviewer (henceforth called experimenter).Footnote 10 This was done to avoid that the answers of one spouse would be influenced by the presence of the other spouse. In Stage 1, each spouse had to answer a detailed questionnaire on socio-demographic characteristics, health status, and social capital individually. In Stage 2, each spouse made individual decisions in the choice task of Holt and Laury (2002). In Stage 3, the two spouses were reunited and had to give joint answers regarding the financial situation of the household and some additional household characteristics. In this stage and the following, the spouses could talk to each other. Stage 4 was identical to Stage 2, except that the spouses had to make a joint decision, which means that they had to agree on which option to choose in the ten choice tasks. In the introduction to Stage 4, the participants were informed that the amounts in each option would be paid to each of the spouses. This procedure was chosen to keep each spouse’s incentives constant across Stage 2 and Stage 4. The experimenters were present in the same room to be able to answer any questions immediately, and they recorded a joint decision as fixed only after both spouses had given their consent. Both in Stage 2 and Stage 4, participants were instructed that one of the ten decisions in each stage would be played out for real at the end of the experiment. Thus, at Stage 4 the participants still did not know the outcome of Stage 2. Furthermore, in Stage 2 it was stressed that the payment for Stage 2 would be done separately for husbands and wives in different rooms at the end of the whole experiment.

Given the generally low educational level of our participants, we took great care to explain the rules of the experiment as clearly as possible. To do so, the task at hand was first explained orally and then demonstrated visually both in Stage 2 and Stage 4. The probabilities for the high and low payoff in a given option were illustrated by using white and black chips on two separate boards that illustrated an Option A and an Option B. On the left-hand side of each board, we wrote down the high amount and on the right-hand side the low amount. For example, for the first decision (see Table 2), we placed one white chip next to the high amount and nine black chips next to the low amount. Then we put all chips in a bag and told the participants that at the end of the experiment they would be able to draw one chip from such a bag, and that drawing a white (black) chip would yield the high (low) payoff in the chosen option.

At the end of the experiment, the spouses were sent to two separate rooms again. There each spouse had to draw one card from a deck of ten numbered cards to determine which Stage 2 decision would be played for real. Then, as described above, he/she got to draw a chip from a bag with the corresponding distribution of white and black chips. Since this procedure was executed in two separate rooms, each spouse could receive his/her income privately, which means that spouses could hide their earnings from their partner if they wished to (earnings from Stage 2 were not disclosed to the other spouse by the experimenters). To determine Stage 4 payoffs, the couple was brought together again. Then, one spouse had to draw one card from the deck, and the other picked one chip from a bag that contained a corresponding distribution of chips. In total, executing the four stages took about 1.5 hours. On average, participants earned 37 Yuan, which equals roughly 1 % of an average yearly income, or three days of off-farm work.

Before proceeding to the results, it seems important to note that our design implies that individual decisions were always made before joint decisions. We did not consider the reverse order since we are interested in how the individual decisions of each spouse are reflected in the joint household decision. We assume, thus, that the starting point in a household bargaining process is how a spouse would decide him-/herself. It seems realistic that a spouse takes into account his or her own preferences when a joint decision has to be made in the household. This calls for an observation of individual decisions first to identify them properly. We think it is reassuring to note in addition that Baker et al. (2008) did not find any order effects with respect to sequential decision making individually or in (ad hoc) teams in a risky choice task.

4 Results

4.1 Analysis of aggregate data

Table 3 shows the relative frequency with which husbands, wives, and couples chose the safer Option A over the more risky Option B. We report only consistent choices, meaning that we exclude all observations where a decision maker switched back at least once to Option A after having chosen Option B earlier, or where Option A was chosen in the tenth decision (i.e., preferring 20 Chinese Yuan for sure over 38.5 Chinese Yuan for sure). In total, 105 (out of 117) husbands, 108 wives, and 105 couples made consistent decisions. Hence, 318 out of 351 choice sets (90.5 %) are fully consistent. This fraction of inconsistent choices is well in the range reported in the literature, despite the low educational level in our sample.Footnote 11

The bottom row of Table 3 indicates the average number of safe choices. Recall that a risk-neutral decision maker would choose the relatively safer Option A four times, and then switch to Option B. On average, however, we observe 5.52 safe choices, indicating risk aversion in the aggregate data. The large fraction of extremely risk-averse husbands (25 % chose Option A nine times and only then switched to Option B) and wives (17 %) might seem unusual at first sight. However, these fractions are in the range of extremely risk-averse choices reported in Holt and Laury (2002) for their treatments with relatively high stakes.Footnote 12

The average number of safe choices made by couples is between the corresponding figures for husbands and wives. Although the data in Table 3 might look as if the decisions of couples were less extreme than individual decisions (perhaps because of a willingness to compromise), Kolmogorov-Smirnov tests do not reveal any significant distributional differences in terms of number of safe choices between couples and husbands, respectively wives.Footnote 13

Before attending to our main research questions about what makes spouses’ individual decisions similar and which spouse has more influence on a couple’s joint decision, we analyze individual subjects’ risk attitudes. Table 4 presents results from a negative binominal regression model to allow for the fact that the dependent variable, number of safe choices, is only a non-negative integer number. As explanatory variables we include a set of variables that have been shown to be correlated with risk attitudes, including income, age and gender (see, e.g., Dohmen et al. 2011).Footnote 14 In addition we include a variable indicating if the individual spouse is a member of the communist party. The main reason for including it here is that we wish to test later on if this variable is correlated with the influence on the joint decision. The table shows a few marginally significant results (at the 10 %-level). Belonging to the ethnic majority of the Han-group is associated with more safe choices. Somewhat surprisingly, men are estimated to be more risk averse by making more safe choices (while most of the literature suggests that women are more risk averse; see Croson and Gneezy 2009). Given that the significance is marginal, however, one should not put too much weight on this finding. Other variables such as education, as found to be significant in Dohmen et al. (2011), are insignificant in our case.

After examining the determinants of risk attitudes at the individual level, we now turn to an analysis of data at the household level. In the following we report data only for those households in which all three sets of decisions (those of the husband, of the wife, and of the couple) were fully consistent. Recall that twelve husbands and nine wives made inconsistent choices in the individual decision making part of Stage 2. Out of these, there were three couples where both the husband and the wife made inconsistent choices, implying a total of 18 households where at least one spouse made inconsistent choices. In addition, four couples made inconsistent choices while at the same time none of the spouses made any inconsistent decisions individually. Hence, the total sample of 117 households is reduced by 18 households with individual inconsistencies and four households where the joint decisions were inconsistent. This yields a total of 95 households with fully consistent choices to be considered in the following.Footnote 15

4.2 Analysis of data at the household level

4.2.1 Similarity of spouses in individual decisions

The husband and the wife made the same number of safe choices in the individual decision making part in only six out of 95 households (6 %). Hence, we observe substantial heterogeneity in risk preferences between spouses. In 48 households (51 %), the husband is more risk averse, and in 41 households (43 %) the wife. If we look at the difference in the number of safe choices between wives and husbands, the mean value is −0.5 (standard deviation 3.66), the maximum +7, and the minimum −9. The average absolute difference in the number of safe choices between wives and husbands is +3.0 (standard deviation 2.13).

We will now analyze the conditions under which the spouses’ individual decisions are more similar. We estimate a model with the absolute difference in the number of safe choices between the husband and the wife in a given household as the dependent variable.Footnote 16 This is estimated as a negative binominal regression model to allow for the fact that the dependent variable is only a non-negative integer number. Table 5 reports the results.

Household income has a significantly negative effect on the absolute difference in the number of safe choices; i.e., the higher the household income, the more similar the spouses’ individual choices with respect to risk taking. The share of household income contributed by the wife has a strong and significant effect as well; an increase in this share by 10 percentage points reduces the absolute difference in the number of safe choices by 0.29.

We also find a significant effect of communist party membership. In households where both spouses are members of the communist party, the absolute difference in the number of safe choices is reduced by approximately one unit. None of the other variables we considered to be potentially important has any significant effect on the similarity of risk preferences. Among these, it seems particularly noteworthy that length of marriage does not have an effect. In addition, there is no significant influence of number of children, absolute difference in age (in years), or difference in years of education.

4.2.2 The relative influence of each spouse on a couple’s joint decision

To analyze which spouse’s risk preferences are better reflected in a couple’s joint decision, we distinguish three possible cases: (i) The number of safe choices made by the couple is in the range of safe choices made by the husband and the wife individually. (ii) The couple makes more safe choices, i.e., is more risk averse, than each of the spouses individually. (iii) The couple makes fewer safe choices, i.e., is more risk loving, than the husband and the wife individually. If the couple’s decision is closer to the husband’s (wife’s) individual decisions, we interpret this as the husband (wife) having a stronger influence on the joint decision since the other spouse accepted a larger deviation from her (his) individually preferred number of safe choices. Table 6 summarizes the three cases introduced above and indicates how the decisions of the couple relate to the spouses’ individual decisions. In order to check whether the relationship between a couple’s decisions and those of each spouse is different depending on how far apart the spouses’ individual decisions are, Table 6 also splits the full sample at the median absolute difference of the number of safe choices (which is 2) and the subsamples are presented in Columns [B] and [C].

First note from panels [1] and [1′] in Table 6 that 74 out of 95 couples agree on a number of safe choices that is in the range of the husband’s and the wife’s number of safe choices. For the remaining 21 couples we observe more extreme decisions (in either direction) than made by the spouses individually (see panels [2] and [3]).Footnote 17 Within each panel, we classify the joint decisions in relation to the spouses’ individual decisions as follows: (a) The number of safe choices made by the couple is identical to the husband’s number of safe choices, but different from the wife’s; (b) it is closer to the husband’s number of safe decisions; (c) it is of equal distance to both spouses; (d) it is closer to the wife’s number of safe choices; or (e) it is identical to the wife’s number of safe choices, but different from the husband’s. We use a χ 2 test to examine the null hypothesis that the couple’s joint decision has the same probability of belonging to any of the five categories (a) to (e).Footnote 18 For panel [1], which covers the large majority of cases, we can clearly reject the null hypothesis (p-value =0.007). Rather, Table 6 reveals that the couple’s decision is significantly more often closer to the husband’s decision. This raises the question about under what circumstances a couple’s decision is more strongly influenced by the wife’s preferences.

4.2.3 Econometric analysis of joint decisions

For the econometric analysis we estimate two different models for robustness reasons. In the first model, we use three categories of how the number of safe choices made by a couple relates to the number of safe choices made by the husband and the wife separately: (1) couple is closer to husband, (2) couple is equally distant from husband and wife, and (3) couple is closer to wife. We estimate the probability that the decision of the couple falls into one of the three categories with an ordered probit model.

In the second model we construct a measure (λ) of the weight put on the wife’s preferences in the joint decision, where

When the number of safe choices is the same for the husband and the wife, then λ is set to 0.5. Note that a higher λ indicates that the couple’s joint decision is relatively closer to the wife’s individual decision. If λ exceeds 1 or is negative, then the couple’s risk aversion is more extreme than the individual choices. This measure of weight put on the wife’s preferences is used as the dependent variable in a simple OLS regression model.

The marginal effects of the ordered probit and the OLS model are presented in Table 7. For dummy variables, we report the discrete change of the variable from 0 to 1. The independent variables are intended to capture factors that influence both the absolute and the relative bargaining strength of the husband and the wife. With respect to age and education, we include variables measuring the difference in age and education years between the husband and the wife.Footnote 19

Using model I and calculating the predicted probabilities for the three categories at sample means shows that the joint decision is closer to the husband’s decision with a predicted probability of 56 %, but closer to the wife’s decision with a predicted probability of only 28 %.Footnote 20 Hence, a couple’s joint decision is to a larger extent influenced by the husband. Concerning the factors that increase the influence of wives, the two models yield largely similar results with respect to significance.Footnote 21 The only major difference between both models is found for the variables household income and women’s income contribution, which is insignificant in model II, while significant in model I. However, we also estimated the second model using different specifications by (i) removing five observations with a λ higher than 2 or less than −2, and (ii) truncating negative values at zero, and values higher than one at unity. These estimations show that the coefficient of the household income is sensitive to outliers, since in these models the household income coefficient is positive and significant. If we remove the same outliers in the ordered probit model, the coefficient of household income is still significant.

Our models identify the following variables that have a robust and significant relation to the wife’s influence on the couple’s decision: relative female contribution to the household income and party membership. It should be noted that there is a low correlation between household income and relative female contribution as well as party membership. Thus, relative female income contribution and party membership are important and independent of the magnitude of household income.

If the wife contributes relatively more to the household income, then the couple’s number of safe choices is more likely to reflect the wife’s risk preferences. Recall that this variable had also been found to make husbands and wives more similar with respect to their individual choices. The estimations in Tables 5 and 7 show that the relative income contribution of the wife has, in fact, two effects: one on individual similarity in risk attitudes, and one on the wife’s influence on a couple’s joint decision.

If the wife is a member of the communist party, the joint decision is closer to her individual preferences (increasing ceteris paribus the likelihood of the joint decision being closer to the wife’s decision from 24 % without party membership to 76 % with party membership, or increasing λ by almost 0.78 units). A similar effect is not found for men, as their party membership does not shift the couple’s decision significantly in their favored direction. It is interesting that communist party membership affects both the similarity of the spouses’ individual decisions (when both are party members) and the closeness of the joint decision to the wife’s individual decision. Although we can only speculate about the importance of party membership for the wife’s influence on the joint decision there are at least two potential explanations. The first one is that women who are strong, self-confident and hold strong opinions, are more likely to become members of the party. The second one is that party meetings and education may help women to become stronger. It seems plausible that both explanations are valid.

We also find that in households where the wife is better educated than the husband, the wife has a stronger influence on the joint decision. The explanation of this is likely similar to the explanations of the importance of party membership.

The two econometric models have also controlled for other possibly important factors, such as the difference in age, ethnic background, the number of children, the length of the marriage, and the difference in the number of safe choices between wives and husbands. However, none of these has a significant influence on whether a couple’s joint decision is closer to the husband’s or the wife’s number of safe choices. Motivated by the insights from Ashraf (2009)—whose study shows that the allocation of control over household savings has a strong influence on spouses’ joint financial decisions—we included in a post-experimental questionnaire some questions on who makes decisions in three different types of situations. Table 8 reports the three questions and the answers of the 95 couples. The responses to Question 1 reveal that women are ascribed a stronger influence on daily decisions, while men are indicated to have more influence in small investment decisions (Question 2). Concerning big investment decisions (Question 3), a large majority of couples report making joint decisions. The distribution of answers is significantly different across the three questions (p-value<0.001, χ 2-test). However, including the answers to these questions in the regressions reported in Table 7 shows that none of them has a significant impact on how the couple’s joint decision relates to the husband’s or wife’s number of safe choices.

5 Conclusion

In this paper we have investigated household decision making by running an experiment on Chinese couples’ decision making under risk. We have studied the decision making of 117 randomly sampled couples in a poor rural area in the southwest of China. The average earnings from the experiment was equivalent to about 1 % of the average yearly income of participants, making it a high-stakes experiment on decision making under risk. We were particularly interested in examining (i) the conditions under which the individual decisions of spouses are similar and (ii) the main factors that are associated with a stronger influence of wives on joint decisions.

We found that spouses have more similar individual risk preferences the richer the household, the larger the income share contributed by the wife, or when both spouses are members of the communist party. However, these findings should not cover up the fact that the spouses’ individual risk preferences were identical in only 6 % of the households. Hence, there is a large degree of heterogeneity within households.

We also found that a couple’s joint decision is typically closer to the individual preferences of the husband, which is similar to what de Palma et al. (2011) report. However, we were also able to identify factors that go along with joint decisions being closer to wives’ individual preferences. An increase in the relative share of household income contributed by the wife shifts the couple’s joint decision in the direction of the wife’s risk preferences. Furthermore, if the wife is a member of the communist party or if the wife has a higher education than the husband, then the husband’s risk preferences are less reflected in the couple’s joint decision.

These findings provide controlled evidence of factors that let joint decisions be more similar to wives’ individual decisions, thus probably indicating a stronger influence of wives in the intra-household decision-making process. Note that we did not set up a structured bargaining procedure in our experiment since that could have been perceived as artificial by the participants. Rather, we asked couples to discuss the experimental task and come up with a joint decision on each lottery choice. This seems to be a natural environment for making decisions in a household. Contrary to earlier experiments on the decision making of couples, our experiment was run in the homes of the participating couples rather than in an external place like a bank or town hall in order to observe household decision making where it usually takes place, namely at home. By using high stakes, we wanted to make the decisions very salient, such that it is in the best interest of any participant to make a decision that fits his or her preferences best.

In sum, our experiment identified several important factors that are aligned with an increase in the decision-making power of wives. Historically, Chinese women have had very little say in household decisions, in particular in rural areas. They have also been discriminated against when it comes to access to education. For example, educating sons has been seen as an investment in old-age support since it has been regarded as more likely that sons will get paid work, therefore leaving women to work on the farmland (Hannum 2005). Our results, however, suggest that policy measures that improve the education and, consequently, labor force participation of women may go hand in hand with increasing the power of women in households through increasing their relative contribution to household income.

Notes

The experiment of Ashraf (2009) was also run in a developing country (the Philippines). She showed that financial decisions of spouses are influenced by whether the (experimental) income is known to the other spouse and whether spouses communicate about how to spend the experimental earnings before making a final decision on how to use them. Hence, the focus of Ashraf’s (2009) study is clearly different from ours.

Kachelmeier and Shehata (1992) also ran a high-stakes experiment on risky decision making in China. They focused on the question of how the level of incentives affects revealed risk preferences. The experiment was run with students from Peking University, and is thus unrelated to household decision making. Tanaka et al. (2010) studied individual risk and time preferences in households in Vietnam, but were not interested in the joint decisions of couples and their determinants.

For instance, Baker et al. (2008) and Masclet et al. (2009) report that groups are more risk averse in lottery choices than individuals, while Harrison et al. (2005) find no significant difference between individuals and groups, and Zhang and Casari (2011) find that groups are less risk averse than individuals. Shupp and Williams (2008) seem to offer some reconciliatory evidence by reporting that the average group is more risk averse than the average individual in high-risk situations, but groups tend to be less risk averse in low-risk situations. There is also research investigating whether (randomly formed) groups violate expected utility theory to the same degree as individuals do (e.g., Bone 1998: Bone et al. 1999, 2004, Rockenbach et al. 2007). While no clear-cut bottom line has resulted from this strand of literature, it seems fair to conclude that groups are not considerably better in avoiding violations of axioms of rationality than individuals.

1 US Dollar corresponded to 7.42 Chinese Yuan at the time of running the experiment (November 2007).

In order to prevent villagers from spreading the word about the experiment within a village, we employed 20 interviewers. All interviewers were selected and their training was supervised by one of the authors, a native Chinese. Among the 20 interviewers, 12 were recruited from a local university, Guizhou University. They were able to understand and speak local village dialects, and one of them was present in each pair of interviewers. Three of the interviewers had worked in a similar risk experiment project before and were therefore chosen to give a two hour-training lecture for all other interviewers. After this lecture, two of them came to a stage to simulate an experiment and how it should be conducted (e.g., how to explain the experimental task, how to respond to questions and which questions interviewers should expect). Then all other interviewers had to come to the stage as well and simulate a real experiment. Those who made mistakes (such as, e.g., being unclear or suggestive) received more training until they could properly conduct the experiment.

This happened in around 20 cases, probably because some households were engaged in the rice harvest at that time.

The regional average in Majiang is around 3,500 Yuan (according to information from local cadres).

This fraction is higher than the national average party membership of about 6 %, however there is significant volatility of party membership, which is often heavily influenced by local traditions (Guo and Bernstein 2004).

The experiment also included two stages on the elicitation of time preferences. They are analyzed separately in a companion paper (see Carlsson et al. 2012), for which reason we do not report these data here.

Note that we randomly reshuffled the pairs of experimenters each day in the field to avoid any experimenter effects. Furthermore, we balanced the genders of the two experimenters in each household and instructed the experimenters to switch back and forth between interviewing the wife and interviewing the husband when moving from one household to the next.

Note that the fraction of inconsistent choices ranged from 5 % to 13 % in Holt and Laury (2002), depending upon treatment. Between 9 % and 23 % of all choices were inconsistent in de Palma et al. (2011). In Bateman and Munro (2005), 6 % of the participants chose strictly dominated options. It is also noteworthy that in our experiment making decisions as a couple did not affect the rate of consistent choices, most likely because individual consistency rates are already at a high level.

When the high payoff from the safe (risky) option was 100 USD (192.50 USD), 15 % of all subjects in Holt and Laury (2002) chose the safe option nine times and only shifted to the risky option in the final, tenth choice (when there is no longer risk involved). In their treatment with very high stakes—with the high payoff in the safe (risky) option yielding 180 USD (346.50 USD)—Holt and Laury (2002) observed that even 40 % of their subjects chose the safe option nine times.

All tests reported in the paper are double-sided unless otherwise stated.

There are also a number of variables that we do not have information about that could explain differences in risk attitudes, such as height and subjective health.

We did some robustness checks in which we included all inconsistent choices (by assigning the median switching point between the first and the last time a subject switched as an inconsistent subject’s switching point). The results presented in Sect. 4 are robust to such an approach. In order to be conservative (and because it is not unambiguous how to extract a switching point from inconsistent choices) we report in the paper only data for consistent choices.

The dependent variable is between zero and nine, since the maximum difference in the number of safe choices is nine.

A model by Mazzocco (2004) can explain how differences in the spouses’ individual risk attitudes can lead to more extreme choices of the household than those made by either of the spouses. Hence, couples that make more extreme decisions than either spouse individually can not simply be dismissed as having made a mistake. A paper by Eliaz et al. (2006) also shows that decisions in groups (like families) can lead to choice shifts that yield more extreme outcomes than the decisions of individual group members.

Given the discrete choice set, it is clear that with an odd difference in the number of safe choices between the husband and the wife, category (c) is not feasible. When applying the χ 2 test, we therefore correct for the possibility of different probabilities of the five possible categories.

We also estimated a model with years of marriage replaced by age of females since there is high correlation between age of females and length of marriage, but results remain robust to such a change.

Using model II yields similar results.

We also ran a third model (an ordered probit like model I) in which we transformed the number of safe choices into ranges of relative risk aversion r for the utility function U(x)=x 1−r(1−r) of monetary payoff x (see Holt and Laury 2002, for more details on the transformation) and then defined the dependent variable as the couple’s joint relative risk aversion being (1) closer to the husband’s relative risk aversion, (2) equally distant from both spouses’ relative risk aversion, or (3) closer to the wife’s relative risk aversion. The results of such a specification remain qualitatively (with respect to signs and significances) identical to model I.

References

Abdellaoui, M., L’Haridon, O., & Paraschiv, C. (2011). Individual vs. collective behaviour: an experimental investigation of risk and time preferences in couple. Working Paper at Group HEC, France.

Ashraf, N. (2009). Spousal control and intra-household decision making: an experimental study in the Philippines. American Economic Review, 99, 1245–1277.

Baker, R. J., Laury, S. K., & Williams, A. W. (2008). Comparing group and individual behavior in lottery-choice experiments. Southern Economic Journal, 75, 367–382.

Bateman, I., & Munro, A. (2005). An experiment on risky choice amongst households. Economic Journal, 115, C176–C189.

Bone, J. (1998). Risk-sharing CARA individuals are collectively EU. Economics Letters, 58, 311–317.

Bone, J., Hey, J., & Suckling, J. (1999). Are groups more (or less) consistent than individuals? Journal of Risk and Uncertainty, 8, 63–81.

Bone, J., Hey, J., & Suckling, J. (2004). A simple risk-sharing experiment. Journal of Risk and Uncertainty, 28, 23–38.

Carlsson, F., He, H., Martinsson, P., Qin, P., & Sutter, M. (2012). Household decision making in rural China. Using experiments on intertemporal choice to estimate the relative influence of spouses. Journal of Economic Behavior and Organization. doi:10.1016/j.jebo.2012.08.010.

Croson, R., & Gneezy, U. (2009). Gender differences in preferences. Journal of Economic Literature, 47, 1–27.

de Palma, A., Picard, N., & Ziegelmeyer, A. (2011). Individual and couple decision behavior under risk: evidence on the dynamics of power balance. Theory and Decisions, 70(1), 45–64.

Dohmen, T., Falk, A., Huffman, D., Sunde, U., Schupp, J., & Wagner, G. G. (2011). Individual risk attitudes: measurement, determinants and behavioral consequences. Journal of the European Economic Association, 9, 522–550.

Duflo, E. (2003). Grandmothers and granddaughters: old age pension and intra-household allocation in South Africa. World Bank Economic Review, 17, 1–25.

Eliaz, K., Raj, D., & Razin, R. (2006). Choice shifts in groups: a decision-theoretic basis. American Economic Review, 96, 1321–1332.

Guo, Z. L., & Bernstein, T. P. (2004). The impact of election on the village structure of power: the relation between village committees and the party branches. Journal of Contemporary China, 13, 257–275.

Hannum, E. (2005). Market transition, educational disparities, and family strategies in rural China: new evidence on gender stratification and development. Demography, 42, 275–299.

Harrison, G. W., Morten, I. L., Rutström, E. E., & Tarazona-Gómez, M. (2005). Preferences over social risk. Unpublished Manuscript.

He, H., Martinsson, P., & Sutter, M. (2012). Group decision making under risk: An experiment with student couples. Economics Letters, 117, 691–693.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 92, 1644–1655.

Kachelmeier, S., & Shehata, M. (1992). Examining risk preferences under high monetary incentives: experimental evidence from the People’s Republic of China. American Economic Review, 82, 1120–1141.

Lundberg, S., Pollak, R. A., & Wales, T. J. (1997). Do husbands and wives pool their resources? Evidence from the U.K. child benefit. Journal of Human Resources, 22, 463–480.

Lundberg, S., & Pollak, R. A. (1996). Bargaining and distribution in marriage. Journal of Economic Perspectives, 10(4), 139–158.

Masclet, D., Colombier, N., Denant-Boemont, L., & Loheac, Y. (2009). Group and individual risk preferences: a lottery-choice experiment with self-employed and salaried workers. Journal of Economic Behavior & Organization, 70, 470–484.

Mazzocco, M. (2004). Savings, risk sharing and preferences for risk. American Economic Review, 94, 1169–1182.

NBS (2008). China statistical yearbooks. Beijing: China Statistical Publishing House.

Peters, E. A., Ünür, S., Clark, J., & Schulze, W. D. (2004). Free-riding and the provision of public goods in the family: a laboratory experiment. International Economic Review, 45, 283–299.

Phipps, S., & Burton, P. (1998). What’s mine is yours? The influence of male and female income on pattern of household expenditure. Economica, 65, 599–613.

Qian, N. (2008). Missing women and the price of tea in China: the effect of sex-specific earnings on sex imbalance. Quarterly Journal of Economics, 123, 1251–1285.

Rockenbach, B., Sadrich, A., & Mathauschek, B. (2007). Teams take the better risks. Journal of Economic Behavior & Organization, 63, 412–442.

Shupp, R. S., & Williams, A. W. (2008). Risk preference differentials of small groups and individuals. Economic Journal, 118, 258–283.

Tanaka, T., Camerer, C. F., & Nguyen, Q. (2010). Risk and time preferences: experimental and household survey data from Vietnam. American Economic Review, 100, 557–571.

Thomas, D. (1994). Like father, like son: like mother, like daughter: parental resources and child height. Journal of Human Resources, 29, 950–988.

Vermeulen, F. (2002). Collective household models: principles and main results. Journal of Economic Surveys, 16(4), 533–564.

Zhang, J., & Casari, M. (2011). How groups reach agreement in risky choices: an experiment. Economic Inquiry, 50(2), 502–515.

Author information

Authors and Affiliations

Corresponding author

Additional information

We have received valuable comments from four anonymous referees, the editor (Jordi Brandts), and Francisco Alpizar, Dinky Daruvala, Jintao Xu, and seminar participants at the University of Gothenburg. Financial support from Sida to the Environmental Economics Unit at the University of Gothenburg is gratefully acknowledged.

Rights and permissions

About this article

Cite this article

Carlsson, F., Martinsson, P., Qin, P. et al. The influence of spouses on household decision making under risk: an experiment in rural China. Exp Econ 16, 383–401 (2013). https://doi.org/10.1007/s10683-012-9343-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-012-9343-7