Abstract

The current study assesses the impact of CSR on corporate environment sustainability taking energy intensity as the measure of the latter. We consider the Indian manufacturing firms as our sample for analysis for the period 2015 through 2022. We employ fixed effect regression, Driscoll–Kraay standard errors and the feasible GLS method for our empirical analysis. Interestingly, we find CSR does not depict firms’ sustainable practices in true sense. While the Indian manufacturing firms keep spending on CSR, they apparently fail to heed their energy intensity level, which is suspected as greenwashing. Among other variables, we underline that firms investing in R&D can effectively optimize their energy intensity. Similarly, larger firms and firms with better profitability are found to be less energy intensive. Oppositely, firms with higher asset tangibility and higher financial leverage are more energy intensive. The findings of the study can further guide Indian firms to evaluate their CSR practices. It can also guide social activists, researchers and policymakers to understand the importance of the environmental concerns of CSR. The findings of our empirical analysis endorse regular assessment of environmental legislation and regulatory mechanism.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

With the aim of ensuring sustainability and giving back to the society, the concept of corporate social responsibility (henceforth CSR) has been infused into the core business practices (Williamson et al., 2006). Under the purview of CSR, the society and the environment are considered as important stakeholders of a company (Pradhan & Nibedita, 2021). While many scholars observe that CSR is linked to sustainability (Bux et al., 2020), others have ignored the environmental aspect of CSR in its core understanding (Prasad & Mishra, 2017). Remarkably, Aguinis (2011) and Pogutz (2008) firmly assert that CSR ensures sustainable practices by firms and elevates environmental values; Baron (2001) opine that CSR is conceived as an altruistic phenomenon. Nevertheless, scholars have pointed out several reasons for corporate preference to implement environmental CSRFootnote 1 practices. From consumption side, new generation of consumers are more aware of the detrimental impact of environmental degradation of consumable goods; and therefore, are now willing to pay more for clean products (Lyon & Maxwell, 2008). Thus, increase in demand for cleaner products incentivizes the producers to adopt “green” and sustainable environmental practices (Bagnoli & Watts, 2003). Additionally, the producers transform to certain shifts because environmental degradation is indicative to production inefficiencies (Lyon & Maxwell, 2008). Hence, engaging in CSR and prioritizing environmental aspect helps corporates stand out in the competitive market (Vollero et al., 2016).

CSR practices have been very popular in contemporary times, however, several researchers have found the speculative use of CSR phenomenon. Evidently, Balluchi et al., (2020) state that firms attempt to achieve corporate legitimacy through CSR by exaggerating their environmental performance, which is termed as “greenwashing” in the extant literature. As per Delmas and Burbano (2011), greenwashing can be defined as “poor environmental performance and positive communication about environmental performance”. Lyon and Montgomery (2015) state that any communication about environmental practices, performance or products of an organization that misleadingly conveys a false positive belief among people is termed as greenwashing. In other words, when a firm does not address the concerns related to ecology and environment; rather, demonstrates itself as a pioneer of sustainability through sustainable reporting, then the firm can be seen as practicing greenwashing (Mahoney et al., 2013). Therefore, scholars opine that greenwashing activities violates truthfulness and sincerity (Balluchi et al., 2020) and disrupts sustainability.

In connection to corporate sectors’ quest for being sustainable, companies can also adopt sustainable practices by reducing the energy intensity (henceforth EI) (Prasad et al., 2019; Samargandi, 2019) and enhancing energy efficiency of the production units which subsequently reduces industrial emissions as well as the overall fuel costs (Soni et al., 2017). EI is defined as the amount of energy consumed per unit of output in an industry (Soni et al., 2017). While energy is regarded as the engine of economic growth (Kumar et al., 2022), its over consumption elicits several concerns, viz., energy scarcity, harmful gas emissions and environmental degradation (Sahu & Narayanan, 2009). Nonetheless, such concerns can be addressed simultaneously by raising energy efficiency or minimizing EI (Kumar, 2003).

The industrial energy use practices lead to emissions of CO2 and other greenhouse gases, and thus, are identified as major threats to environmental sustainability by researchers worldwide (Chalvatzis et al., 2019). Moreover, it is observed that the current energy demands are primarily met through fossil fuels for which the world has now reached onto the edge of serious environmental threats (Chu & Le, 2022). In this connection, the United Nation’s SDG Report (2021) remarks, “promoting renewable energy deployment and reducing EI will be the key strategies to reduce greenhouse gas emissions”. However, looking at the current energy needs of India, replacing fossil fuels by renewable sources appears to be a tough chore. Reportedly, coal and crude oil account for 56.13% and 33.40%, respectively, of the current total energy supply in India.Footnote 2 As the country also commits to reduce its carbon emissions up to 45% by the year 2030,Footnote 3 such high dependence on fossil fuel makes the commitment gainsaying. Therefore, a thorough study on EI is essential to deal with the urgent environmental needs. Furthermore, the industrial sector is the highest consumer of energy using 50.59% of India’s total energy usage2. Hence, we choose the industrial units, specifically, the manufacturing firms as the potential examinee for our research.

Several studies have largely discussed about EI and ways to reduce it in Indian context (Kumar et al., 2022; Jain & Kaur, 2021; Kumar, 2003 etc.), however, there are dearth of the empirical literature emphasizing on the integration of corporate environmental sustainability (henceforth, CES) and CSR. Many scholars have provided their views in support of the integration of ecological sustainability and CSR (DesJardins, 2007; Stern, 2006). Notably, whether manufacturing firms are environmentally sustainable or not; we believe, it can be better examined when their energy use customs are looked into; because, as mentioned earlier, they are the top consumers of commercial energy (Kumar et al., 2022). Arguably, the instances of probable greenwashing can also be located in such firms when their sustainable practices are evaluated through CSR. However, there is hardly any study that evaluates firms’ CSR custom from the angle of CES. As we stress upon environmental concerns, it is necessary to check whether firms are able to hit the nail on the head by truly addressing the same; or are just beating the bush by merely reporting the CSR expenditure.

Such factors on sustainability concerns motivate us to look into the environmental perspective of CSR. Given this, the objective of the current study is to investigate whether there exists a statistically significant relationship between CSR and EI in the context of Indian manufacturing firms. In this regard, we examine the following research questions (RQs):

-

RQ1. Are CSR activities actually effective in addressing CES in Indian manufacturing firms?

-

RQ2. Do firm-specific factors have any role in reducing EI in Indian manufacturing firms?

By answering to the above questions, we presume that our empirical work will have manifold contributions. First, the analysis tries to establish an association between the two primarily discussed sustainable channels i.e., CSR and EI. While both CSR and EI are separately discussed as measures of environmental sustainability, we attempt to find the nexus between the two, which makes our work distinct from the existing studies. We consider EI as the measure of CES and empirically assess the impact of CSR on EI. In this regard, our study attempts to unfold the possibility of greenwashing practices in Indian manufacturing sector with regards to CSR and energy usage. Notably, unfolding greenwashing behavior in terms of EI and related environmental performance of Indian firms can help locating the loopholes and fill them through effective policymaking. Moreover, the study will also assist in formulating sustainable policies for manufacturing firms in India, as the country looks up to curb carbon emissions to reach net zero targets by 2070.

Secondly, we also include other crucial variables to find their statistical significance over EI; such as profitability, firm size and research and development etc. Third, our study is based on India, which is the largest populous country of the worldFootnote 4 and is also being counted among the leading emerging economies.Footnote 5 Such an economy always intends to climb along the growth ladder in terms of developmental activities yet commits to reduce its emission intensity by 2030.Footnote 6 Fourth, our study period captures post CSR implementation mandates in Indian context. Hence, it is likely to evaluate the effectiveness of CSR practices of Indian firms specifically from the environmental perspective. Finally, based on our findings we sought to prescribe policy suggestions for better sustainable practices. To foreshadow the key findings, regrettably, CSR is inducing a surge in EI for the studied sample firms in Indian context. It posits a serious menace to both environment and the CSR phenomenon as the latter is meant to retrieve the former. Furthermore, the findings of the control variables are faithful to the theoretical literature.

The rest of the paper is drafted as follows—we highlight the statutory obligations related to EI and CSR in India in the following section. Section two provides an overview of the literature followed by the theoretical framework in the third section. The fourth section deals with data collection and description of variables. In the fifth section, the results and findings are discussed and the final section concludes the study.

1.1 Statutory obligations for EI

The concentration over EI and efficient use of energy in Indian industries compounds with the implementation of Energy Conservation Act, 2001 (or the EC Act, 2001). In this connection, Bureau of Energy Efficiency (BEE) was set up under the EC Act as a statutory body to implement the provisions of the latter.

The EC Act, 2001 was further amended in the year 2010. The EC (Amendment) Act, 2010 includes certain essential policies such as—issuing energy saving certificates (or ESCerts); identifying industry-wise energy intensive firms, called designated consumers (DCs); increasing penalty for offences committed under the Act; and prescribing the value of per metric ton of oil equivalent of energy to be consumed by industries etc. Following the EC (Amendment) Act, 2010, the BEE launched the novel ‘Perform, Achieve and Trade’ (PAT) scheme in July 2012. PAT is a market-based theme, which aims at improving cost effectiveness and cutting down EI of the DCs (Oak & Bansal, 2017). Under the PAT scheme, the ESCerts are issued by the government to the industries meeting the prescribed energy efficiency levels. The ESCerts can also be traded between firms and the DCs who fail to achieve the prescribed efficiency level are directed to buy those ESCerts from the energy-efficient firms.

Recently, a fresh amendment has been introduced to the EC Act in 2022. The EC (amendment) Act, 2022 specifies a ‘carbon credit trading’ scheme, wherein firms will be issued a ‘carbon credit certificate’ upon complying with the emission norms set by the government. The certificate restricts the holder to produce carbon dioxide (CO2) and other greenhouse gasses (GHGs) within a permissible limit. Similar to the ESCerts, the carbon credits can also be traded between entities. The amendment also includes that the DCs may be asked to meet a specified share of energy requirements from nonfossil sources. Non-compliance with any of the above standards may be penalized up to Rs.10 lakh as per the amendment.

1.2 Statutory obligations for CSR

The statutory obligations of CSR in India were enforced with the infusion of CSR provisions under section 135 and schedule VII of the Indian Companies Act, 2013. The CSR operational framework was also prescribed under the Companies (CSR Policy) Rules, 2014. Schedule VII of the Indian Companies Act, 2013 lists down a number of activities that are included under CSR and ‘ensuring environmental sustainability’ is one among them. Furthermore, the Companies (CSR Policy) Rules, 2014 prescribes the companies’ compliance procedures with CSR provisions of the Act. The content of CSR policies, reporting requirements and disclosure of CSR, impact assessment etc., has been included in the Companies (CSR Policy) Rules, 2014. Both the Act and the Rule are enforced with effect from April 1, 2014.

2 Review of the literature

2.1 Energy intensity and environmental sustainability

It is evident that unsustainable production and consumption has caused environmental impairment globally (Kautish et al., 2021). Sachan et al. (2023) advocate for deploying renewable energy to restrain environmental degradation. Regrettably, the current industrial energy demands cannot instantly be shifted to renewables and thus, reducing EI and improving energy efficiency is the key to deal with current environmental upset (Samargandi, 2019). EI is the pivotal element of environmental degradation and needs to be addressed for a sustainable environment (Khan et al., 2022). Moreover, Chu and Le (2022) have empirically proven that high EI leads to worsening the environmental quality to a large extent. Therefore, EI appears to be a substantial factor that needs to be addressed on an urgent basis and also, it can be admitted for assessing environmental degradation (Samargandi, 2019; Soni et al., 2017).

For Indian manufacturing firms, Sahu et al., (2022) comment that India needs a sustainable energy policy which can deal with both energy demand and ecological imbalance. In this regard, the authors suggest curbing down EI, which can be done through R&D and technological development. In a developing nation, R&D and technological advancement are highly essential, as also evident from Zhang et al., (2020) for China and Samargandi, (2019) for OPEC countries. Veritably, a firm needs funds for investing in advanced technologies. Hence, firms which gain high profit margin and those who have ample resources to spend, especially firms larger in size, can become energy efficient (Jain & Kaur, 2021; Sharma et al., 2019). Although larger firms consume high amount of energy, after a threshold level they start gaining the benefit of economies of scale as they produce at large scales (Sahu & Mehta, 2018). Given the significance of above discussed factors, we attempt to explore the impact of these variables on EI and suggest possible ways to reduce EI.

2.2 CSR and CES

The concept of CSR can be initially attributed to Bowen (1953). The concept arose significantly following the contributions made by Mason (1959); McGuire, (1963); and Cheit, (1964). The concentration and meaning of CSR witnessed a transformational change over the time from profit maximization (Friedman, 1962) to going over and above profit maximization (Backman, 1975; Davis, 1960).

The term CSR has been interpreted in several ways by different authors in the extant literature. Freeman (2010) defined CSR as the company’s commitment toward the larger group of stakeholders, not being confined only to the shareholders’ interest. According to Aguinis (2011), CSR includes the economic, social and environmental aspects dedicated to all stakeholders’. Apart from employees, shareholders, customers and the society, environment must also be considered at par with other stakeholders by the business firms (Aguinis, 2011). Given the fact that the industrial activities pose hazardous impacts over environmental sustainability, firms have to gently deal with the environmental issues (Prasad et al., 2019).

In this context, the term CES has emerged in the extant literature as a significant business concern. CES is defined as environment friendly practices carried out by the corporates (Donald, 2009). Cowan et al. (2010) connected the term CES to energy and resource management and product sustainability. CES is also attributed to firms’ practices to improve the environmental quality in the long run (Zoogah, 2014). To underline, one of the key factors discussed in the extant literature in determining firms’ CES practices is EI (Ferreira et al., 2019; Prasad et al., 2019).

The interaction of the two terms, CSR and CES, leads to the promotion of ‘environmental CSR’. In order to be sustainable, Pogutz (2008) opined that admitting environment, as part of CSR is necessary. In this regard, environmental CSR drives firms to go beyond compliances and enlists certain environment friendly activities (Lyon & Maxwell, 2008). The extent of environmental CSR is influenced by a number of factors, viz., competition level, pressure from international market, morality of the employees and socially responsible investors (De Roeck & Delobbe, 2012; Jamali & Karam, 2018; Lyon & Maxwell, 2008). Other factors such as government regulations and company’s aim to achieve energy efficiency for reducing cost also influence environmental CSR (Lyon & Maxwell, 2008). In the context of promoting environmental CSR, it can be seen that both CSR and CES are being discussed by researchers. Nonetheless, the two concepts are yet to be bridged in order to achieve a robust sustainable framework at the industry level.

2.3 CSR and greenwashing

The concept of greenwashing has evolved as a widespread practice over the last few decades (Yang et al., 2020). There is a growing concern that companies exaggerate their activities and make false claims about their environmental practices (Yu et al., 2020). A company may declare falsely that its products are more environment friendly than they actually are; such practices are called greenwashing (Netto et al., 2020). As per Szabo and Webster (2021), firms while applying green marketing strategies to gain competitive advantage, sometimes overstate their efforts and commit greenwashing. Guo et al., (2014) indicate greenwashing as decoupling behavior, which is explained as symbolic communication about CSR practices of corporates without any substantial change in their organizational method (Bothello et al., 2023). Similarly, Seele and Gatti (2017) relate greenwashing to the pragmatic corporate legitimacy theory whereby the key stakeholders of an organization seek to derive personal benefit from corporate activities. Contradictorily, such practices can mislead the sense of corporate responsibility and may restrain firms from exhibiting adequate actions toward environmental issues (Sharma & Choubey, 2022).

Ongoing environmental threats need fair environmental practices in the industrial sector (Prasad et al., 2019). In case of the carbon neutral concerns, the board of directors should ensure business plans that are compatible with making the net zero transmission and should avoid any greenwashing related to carbon neutral commitments (Grove & Clouse, 2021). Similarly, we suppose attentions toward reducing EI should be focused as merely doing CSR is not adequate for being environmentally sustainable.

After assessing the existing literature, we find that there are limited studies that focus on examining the role of CSR in ensuring CES. Concisely, several other dimensions of CSR, such as adhering to organizational ethics and laws and environmental conservation, are often overlooked as important areas of corporate responsibilities (Mohr et al., 2001).

Although there is a plethora of the literature examining EI and CSR separately, studies establishing an association between the two concepts are scarce. Since the incorporation of CSR provisions as a mandate in India, it is assumed that the gap between the corporate world and the environment is adequately filled up; nevertheless, studies empirically investigating this aspect are few. Studies are also lacking to evaluate whether, there has been any change in the firms’ operational behavior other than the CSR reporting practices after the implementation of the CSR mandates. In other words, assessments are missing whether the firms are reporting their CSR commitments only to abide by the law, which is suspected as greenwashing (Balluchi et al., 2020), or they have genuine interest toward environmental sustainability. Moreover, it is also important to keep an eye if firms are using the concept of CSR in a strategic manner to maximize profit, as remarked by Baron (2001). Furthermore, with regards to the determinants of EI, we do not find factors such as asset tangibility and financial leverage being discussed in the existing literature, which we have included in our study. Such gaps in the existing literature make our study stand out and foreground.

3 Theoretical framework

In this section, we describe about the variables considered in our empirical model and explain about the theoretical linkage. EI (dependent variable) is a measure of CES and we presume that CSR practices should have a significant impact on the firms’ EI either positively or negatively. The aim of the firms ought to be bringing down the EI. Thence, if firms’ CSR activities are intended to achieve CES, then CSR should have a negative association with EI, which is backed by the findings of Prasad et al., (2019). Given this, we formulate the following hypothesis:

H1

CSR practices help reduce the EI of Indian manufacturing firms.

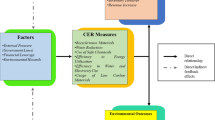

Howsoever, when companies exercise CSR practices due to institutional compulsion or to meet regulatory environmental standards (Bothello et al., 2023), then the aforesaid association may not be negative. In addition, it is notable that an increase in CSR activities enhances brand reputation (Sarkar et al., 2021) and thereby boosts up demand for the goods and services (Wu & Wang, 2014). It further drives firms to increase their productions to meet the increasing demand for their products, which eventually raises their energy requirements. In such a case, the association between CSR and EI can be positive. The presumed theoretical scenario related to CSR, EI and CES can be seen in Fig. 1, where the possibility of greenwashing can also be found. The evidence of greenwashing is detected when firms pretermit the environmental aspect of CSR (Gillan et al., 2021).

When the aim is to optimize EI, a firm has to take care of certain other crucial factors, namely its R&D activities, profitability, size of business etc. For instance, R&D related to clean energy is highly recommended for reducing CO2 emissions worldwide (Pradhan et al., 2022). R&D can also bring up product and process innovation (Kumar, 2003), and thus, can help optimizing the EI. Hence, we hypothesize that:

H2

R&D can help reduce the EI of Indian manufacturing firms.

Further, investment in R&D requires funds, which are easy to generate for a profit-making firm (Kumar, 2003). A profit-making firm can also invest in acquiring energy-efficient technology and that can further result in cutting down the firm’s EI (Sharma et al., 2019). Therefore, we assume that:

H3

Profitable firms can effectively control their EI.

Howsoever, it is also possible that a firm with surplus retained earnings, may opt for increasing productions with a view to maximize sales. Expanding production is further supplementary to higher energy consumption (Sahu et al., 2022), and hence, the EI will be magnified. In the similar fashion, the size of firm can also affect EI in either of the two ways. When a manufacturing firm expands in terms of total asset possessions, it is likely to amplify its production and productivity (Sahu & Narayanan, 2009), which will lead to an increase in EI. Therefore, we theorize that:

H4

Firms larger in size are energy intensive.

On the contrary, with the expansion of business operations a firm attains economies of scale (Kumar, 2003) and that can further lead to a decline in the per unit energy consumption. Additionally, we have included other factors, namely asset tangibility and financial leverage in our study. In manufacturing firms, huge machinery and equipment are employed in the production process, which need power and fuel for their operations (Kumar et al., 2022). In this sense, we assume that an addition to the fixed or physical asset can enhance the EI of the firms. Thus, we presume that:

H5

Firms having more tangible assets are energy intensive.

In the similar fashion, we seek to examine the impact of financial leverage on EI by taking the debt to total assets ratio. Higher financial leverage denotes the availability of sufficient funds in the form of debt, which can be used to finance firm assets (Hongli et al., 2019). Greater access to debt assist firms to invest in new projects which eventually increase its production. Under such a scenario, the EI is expected to surge up with high financial leverage. Hence, we hypothesize that:

H6

Leveraged firms are energy intensive.

Additionally, a brief description of the selected variables and their expected impacts on EI are provided in Table 1.

4 Data collection, variable description and methodology

For the empirical analysis, we use a panel data consisting of 2843 Indian manufacturing companies commenced from 2015 through 2022. The data has been sourced from Center for Monitoring Indian Economy (CMIE) prowess IQ database consisting the financial information of 11,766 Indian manufacturing firms. Out of the above population of companies, we have filtrated 2843 companies based on the availability of information for the variables of our interest. Eventually, companies with net sales figures available for a minimum of 4 years are retained and the rest are cast off. The figures of the variables are taken in INR (in million).

As mentioned before, the CSR mandate came into effect from the financial year 2014–15 (MCA, India). Therefore, we looked for financial data of companies from the financial year ending in March, 2015 up to March, 2022. The empirical analysis is carried out using STATA 17.0 software. Considering the list of variables provided in Table 1, we formulate the following econometric model:

where EI, the regressand represents energy intensity, which is the proportion of expenditure on power and fuel to net sales. Among the regressors, CSRI denotes CSR intensity, which is the proportion of ‘total expenditure incurred on account of donations, charity, social expenses and toward environment and pollution control measures’ to net sales. RDI symbolizes the ratio of Research and Development expenditure to net sales. PATI indicates profitability, which is calculated by taking the proportion of profit after tax upon net sales. FIRMSIZE is the logarithmic transformation of total assets and denotes the size of firm. ASST implies asset tangibility, which is computed as the proportion of net fixed assets to total assets. FL specify financial leverage and is calculated as the proportion of debt to total assets. β is the parameter of respective regressors while α is the constant term. µt is explained as the unobserved time-specific effect, while νi is used for unobserved firm-specific affect. φit symbolizes the overall random disturbance term with variance σv2.

We have measured EI in economic terms taking references from the previous studies viz., Sahu et al. (2022); Kumar et al. (2022) and Sharma et al. (2019). Measuring EI based on the physical units of energy consumed may not be appropriate for a time series analysis for manufacturing firms producing different units of output (Kumar et al., 2022). Preferably, adjusting the energy expenses to the net sales of the concerned firm makes the comparison feasible for firms varying in terms of size, turnover or profitability. Given that EI is reciprocal to energy efficiency, a reduction in the former improves the efficiency of firms in terms of energy consumption, which also results in lowering fuel costs and helps eliminate energy waste. Thus, in order to attain CES, it is necessary to cut down the EI.

In the present study, we use three econometric approaches for empirical analysis. As per Bai et al., (2021), the problems of heteroskedasticity and autocorrelation can be addressed either by using the ordinary least squares (OLS) estimator with a robust standard error or by using the generalized least squares estimator (GLS). Thus, among OLS estimators, we choose to employ the fixed effect regression (FE) and the Driscoll–Kraay (1998) standard errors estimation method (henceforth DK method). The DK method is a nonparametric approach that addresses the problems of heteroskedasticity, autocorrelation and endogeneity as well as cross-sectional dependence; and provides reliable results (Haldar & Sethi, 2022). Furthermore, we use the feasible GLS (henceforth FGLS) method which is evidently more efficient than the OLS estimators in the presence of autocorrelation and heteroskedasticity (Bai et al., 2021; Miller & Startz, 2018). FGLS, as the name suggests, is the feasible form of GLS (Miller & Startz, 2018) and directly considers autocorrelation and heteroskedasticity in the estimation (Bai et al., 2021).

5 Results and findings

5.1 Summary statistics

We start this section with descriptive or summary statistics which are presented in Table 2. The table provides additional insights of the data which include mean, standard deviation, skewness and kurtosis. All the variables depict positive mean values, and the lower standard deviations denote that the variables do not deviate highly from their mean values. Concerning the measures of skewness, PATI is the only variable that holds a negative skewness and thus, the distribution skews to the left as compared to a normal distribution. The positive values of remaining variables exhibit that the distributions skew to the right than that of a normal distribution.

Kurtosis is a measure of deviation from normality and facilitates understanding about the multivariate normality of the variables (Kim, 2015). As per the results of kurtosis, ASST is the only variable that follows a platykurtic distribution (as the value is less than 3) and rest of the variables follows leptokurtic distribution (as the values are more than 3). The variables having very high kurtosis values are often more susceptible to extreme events and have more peaked curves than a normal distribution curve. For instance, the profitability of a firm (measured through PATI) depends on a number of internal and external factors and market behavior. Furthermore, the proportion of CSR expenditure largely depends on the profitability of the firms and may vary across firms.

Table 3 presents the correlation among the variables included in the Eq. 1. As per the results, the variables exhibit lower degrees of correlations, which signify the absence of multicollinearity in the dataset. The mean VIF also confirms that there is no perfect linear relationship among the independent variables.

5.2 Stationarity Check

We present the results of panel unit root test in Table 4. As we are dealing with an unbalanced panel dataset with time gaps, we employ the Fisher-type (Choi, 2001) panel unit root test based on augmented Dickey–Fuller test and Phillips–Perron test. We present the modified inverted chi-squared values derived from the test. As per the results, all variables are stationary in their level forms {i.e., I(0)} under both with and without trend components.

5.3 Model robustness

Before proceeding with the empirical analysis, it is crucial to check econometric issues in the dataset. In this regard, we employed the Breusch–Pagan (1979) test for heteroskedasticity, Born and Breitung (2016) HR test for detecting autocorrelation and Hausman test for endogeneity. As per the results of these tests, we found the presence of heteroskedasticity, autocorrelation and endogeneity in our dataset.Footnote 7 Additionally, our dataset contains 2843 cross-sectional units belonging to the Indian manufacturing industry. In an economy, the distinctive sectors are evidently interdependent on each other due to the circular flow of economy and other potential macroeconomic phenomenon. Thus, the presence of cross-sectional dependence is obvious in our longitudinal dataset.

5.4 Model implication

Under Table 5 we provide the results of the three empirical models used in the analysis, namely fixed effect regressions (FE), the DK standard errors estimation and the FGLS estimates. The results of all three models are quite in sync providing robust estimates of the variables.

5.5 Discussion of results

As per the results, our central explanatory variable i.e., CSRI derives a significant p value with positive coefficient. It asserts that the CSR practices of Indian manufacturing firms positively affect the firm level EI. In other words, an increase in CSR practices leads to an incline in firms’ EI. The result is, however, in contrast to the findings of Prasad et al., (2019). The authors evidenced a significant but negative impact of CSR expenditure on EI specifically for pollution intensive firms. Contrastingly, based on our findings, the H1 is rejected as CSR initiatives do not help in limiting the firm level EI; instead, they lead to intensifying the EI.

As per Sarkar et al. (2021) CSR initiatives facilitate enhancing the brand reputation of the company in the society. Any business that undertakes CSR allures customers to buy its products (Wu & Wang, 2014). Companies spending on CSR, gain goodwill in the market, which helps in attracting more consumers toward their goods and services (Asemah et al., 2013). It is because the CSR practices lead to a positive orientation among consumers about a firm’s product and can influence their purchase intentions (Jamali & Karam, 2018). As the consumer demand for goods increases, the companies will start producing more, and the increased productions will genuinely demand more energy inputs (Sahu et al., 2022). Thus, interestingly, CSR practices are ultimately leading to increased energy consumption. As evident from our findings, while the Indian manufacturing firms keep spending on CSR, they apparently fail to heed their EI level. Under such a scenario, the CES seems to be at stake.

Conceptually, CSR is the outer approachFootnote 8 toward the stakeholders of a company, whereas EI is the internal affair of a firm as the latter is related to the expenses made on power and fuel used for production. Thus, it evokes a query against the firms’ management that while firms are able to address their outer obligations in the form of CSR, they fail to address the internal affairs of energy use practices. It implicitly supports the idea of greenwashing, whereby firms exercise CSR practices only to comply with the prescribed legal framework and do not genuinely get dedicated toward achieving sustainability (Balluchi et al., 2020). The results also appear to be aligning with the signaling mechanism in greenwashing as shown by Mahoney et al., (2013). Through CSR reporting, companies are able to pose themselves as ‘good’ and gain stronger environmental and social recognition (Mahoney et al., 2013); while on the other hand, the EI level keeps increasing. It also refers to the decoupling behavior as explained by Bothello et al., (2023), i.e., pursuing symbolic communications without making considerable change in the organizational method.

Moreover, it leads to information asymmetry, which occurs when the negative aspects are not signalized to outsiders (Connelly et al., 2011). Based on our findings, when CSR itself results in soaring up the EI, we suspect that the CSR phenomenon is being used strategically for profit maximization as exhibited by Bagnoli and Watts (2003). As supported by Marquis and Qian, (2014), firms involve themselves in CSR in order to create a positive image. Companies link themselves to social causes under the frame of CSR with the aim of portraying their corporate picture (Luo & Bhattacharya, 2006). It helps the companies to posit themselves as socially and environmentally responsible brands (Nurunnabi et al., 2020). However, if a firm is not able to maintain sustainable practices in its internal business processes then it is not environmentally responsible in true sense (Kumar et al., 2022). Theoretically, Carroll (1979) segregates CSR into four different domains, namely legal, economic, discretionary and ethical responsibilities. Notably, when CSR is considered only as a legal compliance or is seen from the economic perspective then the ethical and discretionary angle of CSR cannot be justified.

Nonetheless, the spending toward CSR activities should not be compromised because CSR encircles a large number of stakeholders outside the firm (Fan et al., 2017). Thus, it is at the discretion of the management that the production process and the energy use practices should also be made sustainable. Firms need to invest in acquiring energy-efficient technology in order to improve their EI level (Soni et al., 2017). Additionally, Prasad et al., (2019) suggest that firms should be incentivized to invest toward environment friendly productions.

Among other explanatory variables, R&D provides comparative advantages for business in a highly competitive environment. R&D improves production process and product quality, enhances technical and technological know-how and facilitates mitigating EI (Zhang et al., 2020). The FGLS model depicts a significant and negative impact of RDI on EI, which is in line with our second hypothesis (H2) as well as the findings of Sahu et al., (2022) and Sahu and Mehta (2018). Apparently, firms spending more on R&D are energy efficient because the continuous quests for innovative ways can improve their energy consumption practices (Sahu & Mehta, 2018). Innovation further plays a healthy role in improving efficiency and reducing EI (Hille & Lambernd, 2020).

The variable PATI holds a significant but negative impact on EI. The result is in line with Kumar et al., (2022); Sharma et al. (2019); Sahu and Mehta (2018) and Kumar (2003) and also aligns with our stated H3. A profit-making firm can avail the earnings to plough back into the mainstream business, which can facilitate acquiring updated energy-efficient machineries (Kumar et al., 2022) and also undertaking R&D (Kumar, 2003). While finding similar result for profit margin, Sahu et al., (2022) assume that better profit margin may also alleviate green investments at the firm level. Supported by this rationale, we assert that firms with better profitability will be able to confine their EI by means of investments in energy-efficient technologies and green projects.

The similar assertion is also applicable for FIRMSIZE as the variable posits a significant and negative impact on the regressand as per the FE and DK approach. The results denote that an increase in the size of firm can reduce the EI significantly, which oppose the H4. The inverse relation is supported by Sharma et al. (2019) and Kumar (2003) as the authors opine that larger firms find the advantage of economies of scale for large scale productions. Sharma et al. (2019) exclaim that with growth and expansion, a firm brings forth more resources and produce more, which ultimately declines the per unit energy consumption. Therefore, firms which strive for growth and expansion can optimize their EI with efficient management of resources.

The result derived from the FGLS method, however, contrasts with the above discussion and supports H4 and the findings of Prasad et al., (2019) and Sahu and Mehta, (2018). It is possible that larger firms can become energy intensive if they tend to expand in terms of total asset possessions, which amplifies their production and productivity (Prasad et al., 2019). The fixed asset possessions and increased productions will genuinely demand more energy inputs (Sahu et al., 2022) and hike up the EI. Such argument can also be supported by looking at the impact of the variable ASST on EI. ASST, which stands for asset tangibility, appears to have a significant and direct relation with EI, which is in line with our prior assumption (H5).

Increase in asset tangibility also reflects increment in fixed assets of the firm (Pradhan & Nibedita, 2021), which may be in the form of plant and machineries. Veritably, such machineries and other equipment used in the manufacturing process demand more power and fuel for functioning (Soni et al., 2017). Hence, we affirm that an increase in asset tangibility in the manufacturing industry will give rise to the firm level EI. It is, therefore, advisable that the firms should seek to acquire modern and energy-efficient machineries, which will help in saving energy and improve efficiency (Wang et al., 2023). By investing in advance and innovative green technologies, firms can overcome their environmental load and become environmentally responsible (Nassani et al., 2023).

The coefficient sign of the variable FL is also found to be in aligning with the theory. We find a significant p value and positive coefficient of the variable FL on EI. It indicates that the H6 holds true, i.e., leveraged firms are energy intensive. Financial leverage denotes the usage of debt in the capital structure of a company. Accessibility to debt financing provides the firms with additional capital (Njenga & Jagongo, 2019), which can be used to expand business operations and boost up productions.

As per the theory given by Modigliani and Miller (1963), by increasing debt financing in the capital structure, a company can gain the advantage of tax-deductible interest payments. Thus, debt financing, which can be in the form of issue of bond and debentures or long-term borrowings from banks and financial institutions, is widely used to finance new projects and assets (Hongli et al., 2019). Apparently, in a manufacturing firm, the new projects will push up productions, which will ultimately require more energy consumption (Kumar et al., 2022). Furthermore, the risk of repayment of debt may refrain firms from investing in enhancing energy efficiency or on renewable energy sources. Therefore, it is advisable for firms to opt for equity financing or green bonds as the latter is rising up as a healthy option for environment friendly investments.

At a crucial stage of human development, where the world is in a hunt for sustenance and sustainability, it is important to hit the nail on the head rather than just beating the bush, wherein the Indian firms are way behind.

Concerning the validity checks, the within R squared values confirm that the models are good fit for the analysis. The significant F-statistic and Wald chi2 values show that the regressors are well able to define the best variations in the regressand.

6 Conclusion and policy implications

The current study centers on assessing the impact of CSR practices over the firm level EI of Indian manufacturing industry. We posit EI as a sustainable measure for firms and CSR as a determinant of EI. Our empirical analysis brings out that CSR does not depict firms’ sustainable practices in true sense, which we see as firms beating the bush in the name of legal compliances. Acting contrarily, CSR results in requiring higher energy consumption by the firms. Seemingly, CSR helps companies gain goodwill and competitive advantage in the market. With enhanced reputation and better brand value created through CSR, the companies attract new customers for which they subsequently increase their productions to meet future demand. As productions step up, a firm’s energy consumption also rises, and hence, the EI surges up. From the CES viewpoint, it is quite questionable that even if firms meet their CSR obligations, they fail to efficiently use energy at the firm level. In a manufacturing firm, with increased energy consumption, adequate provisions must also be made to optimize the EI. In case firms do not look upon the real cause of environmental abjection, their behavior implicitly depicts the signs of greenwashing and decoupling. It can also be asserted that firms may be reporting their CSR activities only to meet the statutory compulsion without heeding the actual theme of CSR.

The responsibility vests upon the management to confirm efficient use of energy to defuse environmental hazards resulting from industrial emissions. With regards to CSR mandates, emphasizing on CSR reporting or compelling firms to spend toward CSR is not adequate as far as the environment is concerned. Instead, environment ought to be considered as an integral part of the corporate practices and the business plans have to be formulated keeping an eye on the environmental edge.

Among other explanatory variables, we find that larger firms and firms with better profitability are able to minimize their EI. However, larger firms can also be energy intensive when the firms aim at increasing production and productivity. Moreover, firms investing in R&D are less energy intensive as they can quest for innovative ways through R&D to optimize their EI. The variable asset tangibility leads to higher EI as the installed machineries require power and fuel to operate. Advisably, firms need to acquire modern and energy-efficient machineries. Furthermore, increase in financial leverage also pushes up EI. Hence, leveraged firms are suggested to source finance through equity or green bonds.

Being a rapid advancing economy with limited resources, India requires policies and control measures that ensure effective use of energy. Experts opine that India features a sound legal framework for environmental regulations; however, there is a need to exercise the control measures effectively. It needs to be assessed on a regular basis that the companies are not just following the given rules to show on paper; rather the impact of the measures undertaken has to be visible. Because CSR activities made by firms is an intangible reflection of firms responsibility toward the societal development, we recommend setting up of CES rating agencies to rate such activities and trace the visible qualitative impact of such practices. Furthermore, we recommend a robust ESG rating frameworkFootnote 9 in the country, wherein the EI levels of firms should also be checked. Additionally, frequent amendments should be made to the EC Act, 2001 and fresh plan of actions should be brought in that fit the current business scenario. Novel strategies such as the PAT scheme, ought to be fairly and transparently implemented.

The current research work, however, possesses some limitations as it deals with an overall study of the manufacturing sector in India. It does not take into account sector-specific versatilities. A further study can be made by identifying energy intensive industries, viz., the iron and steel industry and their CSR practices can be evaluated. The sector-specific dynamics can also be incorporated to examine environmental performance of firms belonging to that industry. Further, the theoretical linkages between CSR and ESG can also be discovered as ESG is also gaining popularity in modern days.

Data availability

Data will be made available on demand.

Notes

We use the term, environmental corporate social responsibilities, corporate environment sustainability, and corporate sustainability interchangeably throughout the manuscript to reduce ambiguity.

As per energy statistics India report—Energy Statistics India 2023 | Ministry of Statistics and Program Implementation | Government Of India (https://mospi.gov.in/).

Results of the checks are provided under appendix.

In the sense that activities undertaken in the normal course of business do not form part of CSR as per the Companies (CSR Policy) Rules, 2014: getdocument (https://mca.gov.in/).

The ESG rating framework is still at the incipient stage in India. CRISIL has recently started providing ESG scores to Indian companies in 2021. For further details please check: CRISIL launches ESG scores of 225 companies.

References

Aguinis, H. (2011). Organizational responsibility: Doing good and doing well.

Asemah, E. S., Okpanachi, R. A., & Olumuji, E. O. (2013). Communicating corporate social responsibility performance of organisations: A key to winning stakeholders’ goodwill. AFRREV IJAH: An International Journal of Arts and Humanities, 2(4), 27–54.

Bagnoli, M., & Watts, S. G. (2003). Selling to socially responsible consumers: Competition and the private provision of public goods. Journal of Economics and Management Strategy, 12(3), 419–445.

Bai, J., Choi, S. H., & Liao, Y. (2021). Feasible generalized least squares for panel data with cross-sectional and serial correlations. Empirical Economics, 60, 309–326.

Balluchi, F., Lazzini, A., & Torelli, R. (2020). CSR and Greenwashing: A Matter of Perception in the Search of Legitimacy. Accounting, Accountability and Society: Trends and Perspectives in Reporting, Management and Governance for Sustainability, 151–166.

Baron, D. P. (2001). Private politics, corporate social responsibility, and integrated strategy. Journal of Economics and Management Strategy, 10(1), 7–45.

Born, B., & Breitung, J. (2016). Testing for serial correlation in fixed-effects panel data models. Econometric Reviews, 35(7), 1290–1316.

Bothello, J., Ioannou, I., Porumb, V. A., & Zengin‐Karaibrahimoglu, Y. (2023). CSR decoupling within business groups and the risk of perceived greenwashing. Strategic Management Journal.

Bowen, H. R. (1953). Social responsibility of the businessman. Harper and Row.

Breusch, T. S., & Pagan, A. R. (1979). A simple test for heteroscedasticity and random coefficient variation. Econometrica: Journal of the econometric society, 1287–1294.

Bux, H., Zhang, Z., & Ahmad, N. (2020). Promoting sustainability through corporate social responsibility implementation in the manufacturing industry: An empirical analysis of barriers using the ISM-MICMAC approach. Corporate Social Responsibility and Environmental Management, 27(4), 1729–1748.

Carroll, A. B. (1979). A three-dimensional conceptual model of corporate performance. Academy of Management Review, 4(4), 497–505.

Chalvatzis, K. J., Malekpoor, H., Mishra, N., Lettice, F., & Choudhary, S. (2019). Sustainable resource allocation for power generation: The role of big data in enabling interindustry architectural innovation. Technological Forecasting and Social Change, 144, 381–393.

Cheit, E. F. (Ed.). (1964). The business establishment. Wiley.

Choi, I. (2001). Unit root tests for panel data. Journal of International Money and Finance, 20(2), 249–272.

Chu, L. K., & Le, N. T. M. (2022). Environmental quality and the role of economic policy uncertainty, economic complexity, renewable energy, and energy intensity: The case of G7 countries. Environmental Science and Pollution Research, 29(2), 2866–2882.

Companies Act, 2013. (n.d.). Available at https://www.mca.gov.in/content/mca/global/en/acts-rules/companies-act/companies-act-2013.html

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2011). Signaling theory: A review and assessment. Journal of Management, 37(1), 39–67.

Cowan, D. M., Dopart, P., Ferracini, T., Sahmel, J., Merryman, K., Gaffney, S., & Paustenbach, D. J. (2010). A cross-sectional analysis of reported corporate environmental sustainability practices. Regulatory Toxicology and Pharmacology, 58(3), 524–538.

Davis, K. (1960). Can business afford to ignore social responsibilities? California Management Review, 2(3), 70–76.

De Freitas Netto, S. V., Sobral, M. F. F., Ribeiro, A. R. B., & Soares, G. R. D. L. (2020). Concepts and forms of greenwashing: A systematic review. Environmental Sciences Europe, 32(1), 1–12.

De Roeck, K., & Delobbe, N. (2012). Do environmental CSR initiatives serve organizations’ legitimacy in the oil industry? Exploring employees’ reactions through organizational identification theory. Journal of Business Ethics, 110, 397–412.

Delmas, M. A., & Burbano, V. C. (2011). The drivers of greenwashing. California Management Review, 54(1), 64–87.

DesJardins, J. R. (2007). Business, ethics, and the environment: Imagining a sustainable future. Pearson/Prentice Hall.

Donald, S. (2009). Green management matters only if it yields more green: An economic/strategic perspective. Academy of Management Perspectives, 23(3), 5–16.

Driscoll, J. C., & Kraay, A. C. (1998). Consistent covariance matrix estimation with spatially dependent panel data. Review of Economics and Statistics, 80(4), 549–560.

Ec act | bureau of energy efficiency, government of India, ministry of power. (n.d.). Available at https://beeindia.gov.in/en/about-us/ec-act

Fan, L. W., Pan, S. J., Liu, G. Q., & Zhou, P. (2017). Does energy efficiency affect financial performance? Evidence from Chinese energy-intensive firms. Journal of Cleaner Production, 151, 53–59.

Ferreira, A., Pinheiro, M. D., de Brito, J., & Mateus, R. (2019). Decarbonizing strategies of the retail sector following the Paris Agreement. Energy Policy, 135, 110999.

Freeman, R. E. (2010). Strategic management: A stakeholder approach. Cambridge University Press.

Friedman, M. (1962). Capitalism and freedom. University of Chicago Press.

Gillan, S. L., Koch, A., & Starks, L. T. (2021). Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance, 66, 101889.

Grove, H., & Clouse, M. (2021). Renewable energy commitments versus greenwashing: Board responsibilities. Corporate Ownership & Control, 18(3), 423–437.

Guo, R., Tao, L., Yan, L., & Gao, P. (2014). The effect path of greenwashing brand trust in Chinese microbiological industry from decoupling view. Indian J, 10(7), 1827–1831.

Haldar, A., & Sethi, N. (2022). Environmental effects of information and communication technology-exploring the roles of renewable energy, innovation, trade and financial development. Renewable and Sustainable Energy Reviews, 153, 111754.

Hille, E., & Lambernd, B. (2020). The role of innovation in reducing South Korea’s energy intensity: Regional-data evidence on various energy carriers. Journal of Environmental Management, 262, 110293.

Hongli, J., Ajorsu, E. S., & Bakpa, E. K. (2019). The effect of liquidity and financial leverage on firm performance: evidence from listed manufacturing firms on the ghana stock exchange. Research Journal of Finance and Accounting, 10(8), 91–100.

Jain, M., & Kaur, S. (2021). Determinants of energy intensity trends in indian metallic industry: A firm-level analysis. Vision, 09722629211004293.

Jamali, D., & Karam, C. (2018). Corporate social responsibility in developing countries as an emerging field of study. International Journal of Management Reviews, 20(1), 32–61.

Backman, J. (Ed.). (1975). Social responsibility and companies in Bangladesh. Journal of Asia-Pacific Business, 10(2), 130–accountability. New York University Press.

Kautish, P., Sharma, R., Mangla, S. K., Jabeen, F., & Awan, U. (2021). Understanding choice behavior towards plastic consumption: An emerging market investigation. Resources, Conservation and Recycling, 174, 105828.

Khan, I., Hou, F., Zakari, A., Irfan, M., & Ahmad, M. (2022). Links among energy intensity, non-linear financial development, and environmental sustainability: New evidence from Asia Pacific Economic Cooperation countries. Journal of Cleaner Production, 330, 129747.

Kim, N. (2015). Tests based on skewness and kurtosis for multivariate normality. Communications for Statistical Applications and Methods, 22(4), 361–375.

Kumar, A. (2003). Energy intensity: a quantitative exploration for Indian manufacturing.

Kumar, A., Mittal, A., & Pradhan, A. K. (2022). Magnitude and determinants of energy intensity: evidence from Indian firms. Environmental Science and Pollution Research, 1–12.

Luo, X., & Bhattacharya, C. B. (2006). Corporate social responsibility, customer satisfaction, and market value. Journal of Marketing, 70(4), 1–18.

Lyon, T. P., & Maxwell, J. W. (2008). Corporate social responsibility and the environment: A theoretical perspective.

Lyon, T. P., & Montgomery, A. W. (2015). The means and end of greenwash. Organization and Environment, 28(2), 223–249.

Mahoney, L. S., Thorne, L., Cecil, L., & LaGore, W. (2013). A research note on standalone corporate social responsibility reports: Signaling or greenwashing? Critical Perspectives on Accounting, 24(4–5), 350–359.

Marquis, C., & Qian, C. (2014). Corporate social responsibility reporting in China: Symbol or substance? Organization Science, 25(1), 127–148.

Mason, E. S., & Mason, E. S. (Eds.). (1959). The corporation in modern society (Vol. 86). Harvard University Press.

McGuire, J. W. (1963). Business and society. McGraw-Hill.

Miller, S., & Startz, R. (2018). Feasible generalized least squares using machine learning. Available at SSRN 2966194.

Modigliani, F., & Miller, M. H. (1963). Corporate income taxes and the cost of capital: A correction. The American Economic Review, 53(3), 433–443.

Mohr, L. A., Webb, D. J., & Harris, K. E. (2001). Do consumers expect companies to be socially responsible? The impact of corporate social responsibility on buying behavior. Journal of Consumer Affairs, 35(1), 45–72.

Nassani, A. A., Yousaf, Z., Radulescu, M., Balsalobre-Lorente, D., Hussain, H., & Haffar, M. (2023). Green innovation through green and blue infrastructure development: Investigation of pollution reduction and green technology in emerging economy. Energies, 16(4), 1944.

Njenga, R., & Jagongo, A. (2019). Board characteristics, firm size and financial leverage of manufacturing firms listed at Nairobi Security Exchange, Kenya: Theoretical review. International Academic Journal of Economics and Finance, 3(3), 418–426.

Nurunnabi, M., Esquer, J., Munguia, N., Zepeda, D., Perez, R., & Velazquez, L. (2020). Reaching the sustainable development goals 2030: Energy efficiency as an approach to corporate social responsibility (CSR). GeoJournal, 85(2), 363–374.

Oak, H., & Bansal, S. (2017). Perform-achieve-trade policy: A case study of cement industry for energy efficiency (No. 17–05). Centre for International Trade and Development, Jawaharlal Nehru University.

Pesaran, M. H. (2015). Testing weak cross-sectional dependence in large panels. Econometric Reviews, 34(6–10), 1089–1117.

Pogutz, S. (2008). Sustainable development, corporate sustainability and corporate social responsibility: The missing link. In Corporate accountability and sustainable development (pp. 34–60). Oxford University Press.

Pradhan, A. K., & Nibedita, B. (2021). The determinants of corporate social responsibility: Evidence from Indian Firms. Global Business Review, 22(3), 753–766.

Pradhan, A. K., Sachan, A., Sahu, U. K., & Mohindra, V. (2022). Do foreign direct investment inflows affect environmental degradation in BRICS nations? Environmental Science and Pollution Research, 29, 690–701.

Prasad, M., & Mishra, T. (2017). Low-carbon growth for Indian iron and steel sector: Exploring the role of voluntary environmental compliance. Energy Policy, 100, 41–50.

Prasad, M., Mishra, T., & Bapat, V. (2019). Corporate social responsibility and environmental sustainability: Evidence from India using energy intensity as an indicator of environmental sustainability. IIMB Management Review, 31(4), 374–384.

Sachan, A., Sahu, U. K., Pradhan, A. K., & Thomas, R. (2023). Examining the drivers of renewable energy consumption: Evidence from BRICS nations. Renewable Energy, 202, 1402–1411.

Sahu, S., & Narayanan, K. (2009). Determinants of Energy Intensity: A preliminary investigation of Indian manufacturing.

Sahu, S. K., Bagchi, P., Kumar, A., & Tan, K. H. (2022). Technology, price instruments and energy intensity: a study of firms in the manufacturing sector of the Indian economy. Annals of Operations Research, 1–21.

Sahu, S. K., & Mehta, D. (2018). Determinants of energy and Co2 emission intensities: A study of manufacturing firms in India. The Singapore Economic Review, 63(02), 389–407.

Samargandi, N. (2019). Energy intensity and its determinants in OPEC countries. Energy, 186, 115803.

Sarkar, S., Chatterjee, M., & Bhattacharjee, T. (2021). Does CSR disclosure enhance corporate brand performance in emerging economy? Evidence from India. Journal of Indian Business Research, 13(2), 253–269.

Sdg indicators. (n.d.). Available at https://unstats.un.org/sdgs/report/2021/

Seele, P., & Gatti, L. (2017). Greenwashing revisited: In search of a typology and accusation-based definition incorporating legitimacy strategies. Business Strategy and the Environment, 26(2), 239–252.

Sharma, A., Roy, H., & Dalei, N. N. (2019). Estimation of energy intensity in indian iron and steel sector: A panel data analysis. Statistics, 20, 107.

Sharma, M., & Choubey, A. (2022). Green banking initiatives: A qualitative study on Indian banking sector. Environment, Development and Sustainability, 24(1), 293–319.

Soni, A., Mittal, A., & Kapshe, M. (2017). Energy Intensity analysis of Indian manufacturing industries. Resource-Efficient Technologies, 3(3), 353–357.

Stern, N. (2006). Stern Review: The economics of climate change.

Szabo, S., & Webster, J. (2021). Perceived greenwashing: The effects of green marketing on environmental and product perceptions. Journal of Business Ethics, 171, 719–739.

Vollero, A., Palazzo, M., Siano, A., & Elving, W. J. (2016). Avoiding the greenwashing trap: Between CSR communication and stakeholder engagement. International Journal of Innovation and Sustainable Development, 10(2), 120–140.

Wang, J., Dong, K., Hochman, G., & Timilsina, G. R. (2023). Factors driving aggregate service sector energy intensities in Asia and Eastern Europe: A LMDI analysis. Energy Policy, 172, 113315.

Williamson, D., Lynch-Wood, G., & Ramsay, J. (2006). Drivers of environmental behaviour in manufacturing SMEs and the implications for CSR. Journal of Business Ethics, 67, 317–330.

Wu, S. I., & Wang, W. H. (2014). Impact of CSR perception on brand image, brand attitude and buying willingness: A study of a global café. International Journal of Marketing Studies, 6(6), 43.

Yang, Z., Nguyen, T. T. H., Nguyen, H. N., Nguyen, T. T. N., & Cao, T. T. (2020). Greenwashing behaviours: Causes, taxonomy and consequences based on a systematic literature review. Journal of Business Economics and Management, 21(5), 1486–1507.

Yu, E. P. Y., Van Luu, B., & Chen, C. H. (2020). Greenwashing in environmental, social and governance disclosures. Research in International Business and Finance, 52, 101192.

Zhang, C., Su, B., Zhou, K., & Sun, Y. (2020). A multi-dimensional analysis on microeconomic factors of China’s industrial energy intensity (2000–2017). Energy Policy, 147, 111836.

Zoogah, D. B. (2014). Ingenuity spirals and corporate environmental sustainability. In Handbook of organizational and entrepreneurial ingenuity (pp. 57–83). Edward Elgar Publishing.

Funding

No funding details available.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sahu, U.K., Pradhan, A.K. Hitting the nail on the head instead of beating the bush: Does corporate social responsibility actually address corporate environmental sustainability?. Environ Dev Sustain (2024). https://doi.org/10.1007/s10668-024-04506-8

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-024-04506-8