Abstract

The green credit policy (GCP), which serves as the focal point of the green finance system in China, helps devote credit resources to projects that promote preservation of the environment while limiting the inflow of bank credit funds to enterprises that are high polluting, high energy consuming, or have surplus capacity (two high and one surplus). GCP limits the risk of “Greenwashing” because of the application of financial technology and tight policy implementation criteria, and the mandatory effect of the policy is extremely noticeable. As micro-entities for green development, “two high and one surplus” enterprises are also important subjects for research and development (R&D) activities and the reshaping of China’s economy. Whether “two high and one surplus” enterprises can achieve transformation and upgrading through R&D activities is critical to China’s high-quality development. This study employs the difference-in-difference (DID) model to investigate the effect and mechanism of GCP on R&D of “two high and one surplus” enterprises, using the launch of “Green Credit Guidelines” (GCG) in 2012 as an external event and A-share listed enterprises from 2009 to 2019 as the study’s object. The results are as follows: (1) GCG’s implementation severely inhibits R&D in “two high and one surplus” enterprises. After the robustness test, such as replacing proxy variables and removing the interference of related samples, the findings still hold, and the dynamic test results indicate that the inhibitory effect has the feature of accumulation; (2) the mediating effect test results indicate that GCG can lower the debt financing scale, thus inhibiting “two high and one surplus” enterprises’ R&D; however, the cost of debt financing does not play a mediating role between the implementation of GCG and the R&D of “two high and one surplus” enterprises. (3) The heterogeneity test findings suggest that state-owned enterprises (SOEs) have a greater inhibitory impact. (4) The heterogeneity test findings reveal that the inhibitory impact is greater in non-banking-enterprise association enterprises. Based on a comprehensive focus on the restricted loan granting objects required by GCP, this study enriches the literature in areas such as research about the effects of green finance policies by providing evidence on practical explanations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economic growth has an important impact on the environmental development (Alola et al., 2023). At a critical period when economic development model is turning from “factor driven” to “innovation driven” in China, green finance policies have emerged. As the focus of green finance system, the strategy of sustainable development relies heavily on the implementation of GCP, as it is essential for safeguarding the natural environment. GCP is used to control credit flows, promote green businesses’ development, and reduce polluting industries’ emissions (Lei et al., 2021).

Sustainable development is gaining popularity (Awan et al., 2018). In 2007, the Opinions on Implementing Environmental Protection Policies and Regulations to Prevent Credit Risks were issued in China; firstly, the loan giving behavior of commercial banks is clearly linked with the performance of enterprises’ social responsibilities such as the conservation of energy, environmental preservation and emission reduction of companies. And it has become the symbol of the official launch of China’s GCP. In February 2012, the GCG was issued in China, which clarified the norms and concepts of GCP. The policy requires active adjustment of the credit structure and effective prevention of environmental and social risks such as energy consumption, pollution, health and ecological protection. It is an important sign that the GCP has been further strengthened. Moreover, according to the empirical results, the introduction of GCG is indeed conducive to form a green credit constraint. In 2014, in order to implement the GCG and other regulatory provisions, the Key Evaluation Indicators for Green Credit Implementation was introduced, which explicitly listed “the implementation of the policy of curbing two high and one surplus, and eliminating backward production capacity” as one of the key evaluation indicators. The “two high and one surplus” enterprises have become specific targets of the policy.

Although the concept of green development is being strengthened, “greenwashing” has become a barrier to the growth of green financing. The term “greenwashing” is the practice of financiers using money gained through green finance for non-green programs that fail to provide the anticipated advantages (Jones et al., 2020). The business of GCP effectively reduces the presence of information asymmetry during the approval and supervision process and safeguards against the risk of deceptive environmental claims, also known as “greenwashing,” by relying on financial technology penetration in critical areas such as operation management and information evaluation as well as strict policy implementation standards. In particular, in July 2018, the Tianjin Banking Regulatory Commission, for the first time, imposed penalties on Ping An Bank under the GCG for non-compliance in providing financing to enterprises that did not meet the policy requirement of environmental protection, reflecting the determination of the policy regulator to strengthen the mandatory nature of the implementation of the GCG in practice. It is evident that through the introduction of the GCG, the spirit of the policy has been effectively implemented and put into practice.

In China, enterprises occupy a dominant position in the realm of R&D. For the improvement of the productivity of the whole society and sustainable economic development, the R&D of enterprise is an indispensable force. “Two high and one surplus” enterprises are the economic stock coexisting with the traditional economic development mode, the improvement of their technological innovation ability is also essential to China’s industrial technological advancement and superior economic growth.

Regarding “two high and one surplus” enterprises themselves, under a competitive environment, the backward production capacity with low efficiency is being gradually eliminated by the market. So carrying out innovation R&D and developing advanced production technology is firstly conducive to improving the productivity level of enterprises and, secondly, under multiple regulations such as the central government strengthening environmental regulation and local governments reducing subsidies, if enterprises can internalize the negative externality of pollution by using new low-pollution and sustainable energy sources in their production, or by environmentally friendly technological innovation. It is conducive for eco-friendly enterprises to obtain economic incentives and innovation compensation such as government subsidies and preferential interest rates on loans; especially for enterprises with overcapacity, the current investment has created excessive production capacity relative to the objective market demand, and the phenomenon of massive idle capacity and fierce price competition coexist, resulting in increased losses for enterprises, increased non-performing assets for banks, and damage to investors in enterprises. But in fact, technological innovation will greatly improve the capacity utilization rate. Therefore, it is urgent for “two high and one surplus” enterprises to improve innovation through R&D investment to break through the current development difficulties.

Enterprise research and development cannot be done without continuous and stable financial support. There is a bank-led financial system in China. As a type of debt financing, bank credit is a part of external financing for enterprises, accounting for more than all other financing methods. In practice, the supporting role of external financing in the R&D of listed enterprises has been fully affirmed. Therefore, the majority of the funding sources for innovation projects at Chinese businesses come from bank loans. It can be said that the probability and intensity of R&D will increase if an enterprise’s R&D is supported by bank credit.

Green credit businesses are also exposed to general credit risk and some other specific financial risks. For the purpose of risk control, faced with the “two high and one surplus” enterprises’ capital requirements, banking financial institutions are bound to impose financial constraints on enterprises that do not meet the loan policies or violate environmental laws, so as to choke the “lifeblood” of polluter enterprises and restrain their blind expansion, thus having a profound impact on their enterprise scale and capital structure. The products and services provided by “two high and one surplus” enterprises are closely related to public production and life. China’s economic structure will be severely harmed by a one-sided focus on the transition from energy-intensive, high-pollution industries to clean, sustainable industries, and the feasibility is low. So improving production efficiency and reducing pollution emissions is an optimal solution for “two high and one surplus” enterprises to transform into a kind of development strategy which is green, low carbon, sustainable, and of high quality. As a result, it is still unknown whether the “two high and one surplus” enterprises’ R&D practices, which are subject to GCP, can be effectively implemented as they are actually under pressure from bank credit and other debt financing. It is also uncertain if there is a notable variability in the impact of GCP on “two high and one surplus” enterprises’ R&D, while various enterprises have different perspectives toward the risks involved in R&D activities and the ease of access to financial support in the credit market environment. The introduction of the GCG is an exogenous event that offers an excellent “quasi-natural experimental” setting for analyzing the influence of GCP “two high and one surplus” enterprises’ R&D.

Based on how macro-policy changes will affect micro-enterprises, “two high and one surplus” enterprises are regarded as experiments in the event study approach, while the others serve as a control, this study aims to analyze the particular impact of GCP on R&D and conducts a comprehensive investigation on the mechanism of this effect, specifically:

-

(1)

How is “two high and one surplus” enterprises’ R&D affected by the implementation of GCP?

-

(2)

Is there a mediating effect of the scale and cost of debt financing between GCP and “two high and one surplus” enterprises’ R&D?

-

(3)

Depending on the nature of ownership and the background of the bank-enterprise relationship, is there any obvious heterogeneity effect of the implementation of GCP on “two high and one surplus” enterprises’ R&D?

Based on above problems, the article holds significant value in terms of its research implications: Theoretically, it enriches the study on the impact of GCP by considering the “two high and one surplus” enterprises’ R&D requirements, and by considering the changes in debt financing environment caused by GCP, it helps to validate the impact of enterprise debt financing on enterprises’ R&D, which further complements the theory of enterprise innovation financing. In practice, we can clarify the specific effect that GCG has on “two high and one surplus” enterprises and also provide a certain reference for the long-term production and operation decision-making of the relevant enterprises. The study’s remaining contents are categorized into several sections as follows: The second section is a literature review, the third section conducts a theoretical investigation and proposes the study’s hypothesis, the fourth section discusses the study design, the fifth section evaluates empirical data, and the sixth section concludes and makes suggestions.

2 Literature review

Currently, most of the micro-level studies on GCP are empirical, and they are mostly conducted based on the position of commercial banks, analyzing the significance (Lian et al., 2022), operational mechanisms (Xu, 2020), problems (Zhou et al., 2022), and system construction (Zhu et al., 2021) of GCP. The focus of research on GCP using a sample of non-financial firms has been on the impacts of policy. Regarding the regulatory effects of GCP, i.e., the policy effects in the restrictive credit granting loop, considering corporate credit financing, according to some academics, GCP has prevented the debt of highly polluting firms. For example, for listed enterprises in industries that are highly polluting, the issuing of GCG has greatly lowered the quantity, shortened the duration, and increased the cost of debt capital (Li et al., 2022; Peng et al., 2022). Take the long view, this has greatly restricted the investment behavior of high-polluting or high-energy-consuming firms (Zhang et al., 2021a, 2021b).

Some scholars have suggested that among the study findings on the effects of GCP on enterprises’ R&D, when focusing on firms in polluting industries, the release of the GCG led to a decrease of these enterprises’ long-term debts; as a result, there was a significant reduction in their investment in R&D (Hao et al., 2020). That is, the experimental group’s R&D expenditure is negatively impacted by the GCP, which also has a detrimental effect on innovation production. Similarly, using high-energy-consuming enterprises as the experimental group, the empirical results of Wen et al. (2021) show that the experimental group’s businesses’ R&D intensity is significantly impacted negatively by the issuing of GCG. However, there are also data results showing that the GCG’s implementation has no appreciable influence on high-polluting enterprises’ innovation inputs but significantly improves their innovation output (Liu et al., 2020). Based on a green innovation-driven perspective, credit restrictions imposed by the GCG can encourage high-polluting enterprises to innovate more sustainably, encouraging both overall and incremental environmentally friendly innovation and facilitating the realization of environmentally friendly transformation in emerging economies (Hu et al., 2021; Zhang et al., 2022a, 2022b). Additional empirical research also has further validated the release of GCP help to promote innovation, i.e., the implementation of GCP expands the scale of innovation, enhances innovation efficiency, and aids in achieving an all-win scenario between commercial and ecological goals (Wang et al., 2021). Therefore, the financing penalty effect and investment restriction effect of GCP have been highlighted in terms of restrictive loan disbursements based on the existing regulatory conditions of GCP.

However, there is still uncertainty as to whether the policy has achieved its expected effect in terms of promoting R&D innovation and the greening of regulated enterprises. As the parties subjected to regulations, the internal motivation for “two high and one surplus” enterprises’ R&D extends beyond the need for green technological innovation, and it also includes the demand for changes in product quality, production efficiency, and production dynamics. In summary, the influence of GCP on “two high and one surplus” enterprises’ R&D should not be restricted to the development of green technology by high-polluting businesses but should also include R&D innovation to improve the advanced production technology, production efficiency, and capacity utilization of enterprises. In the existing research, combined with corporate debt financing, empirical research on how green financing policies affect “two high and one surplus” enterprises’ R&D is relatively lacking. Moreover, several investigations have demonstrated that GCP can indeed play the role of a pricing mechanism and incentive through the financial system to enhance the extent of regional technological innovation in green, resulting in an “innovation compensation” effect, thus achieving harmonious growth in both the economy and the ecosystem. However, in the practice of enterprises, there is no shortage of enterprises with serious pollution that have suffered a decline in profits due to the passive reduction of production. And the financial constraints have reduced the long-term investment behavior of enterprises; meanwhile, there is a possibility that GCP may have a detrimental influence on R&D (Zhang & Kong, 2022).

Therefore, there are no clear findings regarding whether GCP will force “two high and one surplus” enterprises to boost the amount they spend on R&D or whether it will decrease their long-term inclination for investing in R&D based on existing research results and theoretical foundations.

In summary, given the context of China’s innovation-driven economic growth, it is crucial to research whether the launch of GCP can have an influence on “two high and one surplus” enterprises’ R&D and what the detailed mechanism is. At the same time, the introduction of the GCG has given the study a good exogenous impact scenario.

So, a quasi-natural experiment was created by implementing GCG and, firstly, analyzes how green credit affects “two high and one surplus” enterprises’ R&D and how it works from a theoretical perspective, and proposes a relevant theoretical hypothesis, and then validates the theoretical hypothesis by constructing the DID model to effectively exclude the endogeneity problem. This study is intended to expand and complement the research on the effects of GCP. When compared to earlier research, the primary areas where this study adds are outlined below:

-

(1)

This study extends and supplements the existing research results. Firstly, we must focus intently on the restricted loan granting objects based on the requirements of GCP. A substantial percentage of the literature emphasizes on the implementation of environmentally friendly innovations by high-polluting companies but overlooks the R&D innovation needs of businesses with substantial consumption of energy and surplus capacity. This study considers “two high and one surplus” enterprises as a whole as the study’s focal focus to test the influence of GCP on their R&D activities. Secondly, this article contributes to the body of knowledge on the implementation effects of GCP. There are limited pieces of literature that establish a connection between GCP’s impact on the credit sourcing of “two high and one surplus” enterprises and its effect on long-term R&D. This article highlights the vital importance of GCP in influencing R&D and fostering real economic activity in China. It also examines the role of debt financing in hindering the R&D of enterprises and expands on existing literature discussing the implications of GCP’s operation.

-

(2)

Green financing imposes a favorable impact on ecological quality (Jahanger et al., 2023). In the establishment of a green financial policy framework, GCP has been steadily developed. GCP regulation is generally intended to restrict credit, and the required impact of the policy’s execution has been outstanding since the inception of the GCG. Based on the implementation of GCG, employing the DID and mediating effect model to assess the effect and mechanism of GCP on the R&D of “two high and one surplus” enterprises, this paper provides evidence to explain the practice and provides a new approach and paradigm for the effectiveness test of GCP.

3 Theoretical analysis and research hypotheses

3.1 The theoretical hypothesis that green credit affects “two high and one surplus” enterprises’ R&D

For “two high and one surplus” enterprises, the launch of the GCP has reduced the amount of bank loans available to them and shortened their debt maturity, thus forcing them to scale down production or undergo industrial transformation (Liu et al., 2017). Under the influence of environmental regulation policies, as rational decision makers, enterprises tend to choose the appropriate investment and financing strategy to achieve optimal capital allocation based on profit maximization. In the institutional context of implementing GCP, increased environmental protection funding helps enterprises obtain more new loans with longer maturities (Ji et al., 2021). As Porter hypothesis says, by implementing suitable environmental regulations, it can contribute to the advancement of enterprise innovation and boost the competitiveness of enterprises. And the implementation of GCP will change the traditional competitive environment by raising manufacturing costs of the “two high and one surplus” enterprises and incentivizing them to choose technological upgrading to get “innovation compensation” (Liu et al., 2020, 2021; Lorente et al., 2022). Moreover, due to the release of policies, high-polluting firms face tougher monitoring and punitive measures, and the public’s acceptance of environmental compliance requirements under policy advocacy will also motivate enterprises to raise their level of R&D and accelerate the pace of transformation. As a result, there is a real incentive for the “two high and one surplus” enterprises to focus on solving ecological problems, reduce their production emissions, innovate in environmental technology and seek green transformation by developing new products and technologies. It can be assumed that regarding the “two high and one surplus” enterprises, the GCP will help stimulate their demand for pollution reduction and treatment, meet the new threshold for green credit, and force them to change from passive to active in pollution treatment and emission reduction, and promote research and development and upgrade environmental protection technology.

Clean technologies contribute to sustainable development (Shaheen et al., 2022). Notwithstanding the fact that enterprises can gain from compensating technological innovation, the Porter hypothesis suggests that enterprises will only choose to invest in R&D if innovation’s compensating advantages may outweigh the costs of compliance. The hypothesis of environmental regulation cost may match the truth in China, as the results of tests on the strategic response of high-polluting enterprises to GCP show that constrained enterprises are mainly affected by the policy effect is particularly pronounced in the sample of SOEs (Yao et al., 2021). It can be seen that while “two high and one surplus” enterprises are subject to credit constraints, they also face high environmental regulation costs and insufficient incentives to innovate and may still be faced with limited external financing and insufficient internal surpluses to obtain stable long-term funding to support their R&D behavior. Consequently, GCP is probably going to hurt “two high and one surplus” enterprises’ R&D. Given this information, the theoretical hypothesis H1 is put up for consideration.

H1

All other things being equal, after the release of the GCG, “two high and one surplus” enterprises’ R&D is significantly inhibited compared with those without “two high and one surplus.”

3.2 The hypothesis of the mechanism of green credit on the R&D of enterprises with “two high and one surplus”

Banks have a preponderant role in China’s monetary system, and bank credit remains the primary source of funding for innovative business endeavors in China (Ho, 2018). According to the theory of enterprise innovation financing, due to the problem of high agency costs, debt financing has a relatively high financing efficiency and can effectively protect the information of innovative projects; therefore, in practice, bond financing represented by bank loans shows its unique superiority in financing innovative projects. Financial policy reform often has a significant effect on debt financing (Shi et al., 2022). The GCP, which is an essential part of the regulatory plan for the environment, performs the role of credit resource allocation. Therefore, green credit may have an impact on corporate R&D activities based on its impact on enterprises’ access to credit funds such as credit support from banks. That is, the reason why green credit exerts a restraining effect on R&D may be the intermediary role of corporate debt financing. Specifically, it can be interpreted as the GCP leads to the “two high and one surplus” enterprises no longer being used to “new loans to pay back old loans,” which is directly reflected in the decline of short-term bank loans for enterprises. Meanwhile, it increases the prudence of bank loans. In addition, to the need for hedging, the number of long-term loans that banks are willing to give out will decrease, and the interest rates on loans that are given to “two highs and one surplus” enterprises will climb (Wang et al., 2020; Zhang et al., 2022a, 2022b). Incorporated into the risk aversion demand of other potential creditors in the market, for “two high and one surplus” enterprises, the overall debt financing environment will change. However, referring to the capital market in China, debt finance is still the primary method of obtaining funding. Consequently, the implementation of the GCG may result in alterations to the scale and expense associated with debt funding and consequently impact R&D endeavors.

3.2.1 The hypothesis of the mechanism of green credit on the R&D of “two high and one surplus” enterprises

(1) Mediating effect hypothesis of debt financing scale

After the release of the GCG, the ability to obtain financing in the debt markets of “two high and one surplus” enterprises was strictly restricted, and their debt financing scale was significantly reduced. The averse investment hypothesis and the positive investment hypothesis explain the link between debt finance and R&D. The averse investment hypothesis view is that, firstly, as the outputs of R&D inputs are intangible assets, they are difficult to use as security for debt financing, and secondly, the rigidity of debt financing repayment requirements can have a knock-on effect on the ongoing cash flow requirements of innovative projects. Thus, there is a prominent contradiction between the risk-averse characteristics of creditors and investment in R&D. The positive investment hypothesis argues that, on the one hand, debt financing, through its oversight and governance effects, guides managers to control risk when investing in innovative projects (Wang & Thornhill, 2010). In particular, under the influence of the ‘big lender’ effect, banks can play a greater regulatory role, which is conducive to more efficient investment in innovative projects (Diamond, 1984). On the other hand, the introduction of debt financing has increased the size of firms’ innovation resources and supported their R&D activities (Jensen & Meckling, 1976; Diamond, 1984).

Based on the aforementioned findings, the “two high and one surplus” may lower R&D spending for these reasons: Firstly, the GCG will make it harder for the “two high and one surplus” to get bank loans, so that the overall financing difficulty has increased. The shortage of funds due to long-term financing difficulties will threaten the normal operation of the enterprises. Therefore, the “two high and one surplus” enterprises may give priority to raise funds for stable production and operation; to a certain extent, this squeezes out corporate R&D activities. On the contrary, when enterprises are restricted in financing, once the funds are used for R&D, the risk of liquidity increases significantly, which may lead to greater liquidity pressure on the “two high and one surplus,” causing financial risks even subsequently increasing their bankruptcy possibility; as a result, the motivation for businesses to invest in R&D is diminished. Hence, this paper puts forward H2.

H2

The scale of debt financing mediates the correlation that GCP inhibits “two high and one surplus” enterprises’ R&D.

(2) The mediating effect hypothesis of debt financing cost

Following GCG’s implementation, banks and other financial organizations, out of concern for the environment and consideration for their own safety and profitability, avoided environmental risks in loan issuance while raising “two high and one surplus” enterprises’ loan costs. When companies are able to finance at a relatively low cost, they are likely to allocate funds from general productive investments to R&D projects, stimulating innovation, in the same way that higher financing costs discourage innovation. Accordingly, “two high and one surplus” enterprises’ rising expenses of debt financing caused by the issuance of the GCG may lead enterprises to invest more in non-technological investment activities, and the high debt financing costs may partially erode enterprises’ profits and aggravate their financial burden, which in turn may discourage enterprises’ R&D vitality and is inhibited. Then, theoretical hypothesis H3 is proposed in this paper:

H3

The cost of debt financing mediates the correlation that GCP inhibits “two high and one surplus” enterprises’ R&D.

3.2.2 Heterogeneity hypothesis of the impact of green credit on R&D of “two high and one surplus” enterprises

(1) Heterogeneity hypothesis of enterprise ownership nature.

The samples were categorized into two groups according to the different ownership structures of enterprises: SOEs and non-SOEs. Because of the credit discrimination faced by non-SOEs, the debt of SOEs constitutes the main part of China’s macro debt. According to a point of view of the regulatory impact of GCP, the influence of SOEs’ financing penalties is greater than that of non-SOEs (Li et al., 2022). Additionally, they encounter heightened financial stress, including the timely payment of principal and interest. On the other hand, when enterprises face credit constraints and their own operating efficiency has not improved, blindly increasing R&D investment will only further increase their cost burden. The findings show that although GCG has little effect on green technology breakthroughs made by non-SOEs, it has a significant influence on those made by SOEs (Zhang et al., 2021a, 2021b). SOEs often have a greater percentage of debt financing than non-SOEs, so the formal introduction of GCG weakens their relationship with banks and has a stronger punishment effect on them. In order to balance the overall risk of enterprises, SOEs may be more inclined to reduce R&D investment to reduce the financial risk caused by the uncertainty of R&D activities. To sum up, this paper proposes theoretical hypothesis H4:

H4

Other things being equal, after the GCG’s implementation, the correlation that GCP inhibits “two high and one surplus” enterprises’ R&D within the group of SOEs was higher than that of non-SOEs.

(2) Heterogeneity hypothesis of bank-enterprise correlation.

Information asymmetry is an important factor in the process of debt financing influencing firms’ R&D (Czarnitzki& Kraft, 2009; Milani et al., 2022). Between banks and bank-enterprise correlation enterprises, there is a lower level of information asymmetry, compared to non-bank-enterprise correlation enterprises. Additionally, the influence of financial organization behavior on R&D activities of different firms may vary after the implementation of GCP.

Executive linkage, i.e., the appointment of executives who have held positions in banks, is a form of bank-enterprise correlation. Executives with bank backgrounds understand the risk probability of the company’s R&D investment and can use their private channels to communicate effective information to the bank in time, thus reducing the bank-enterprise information asymmetry (Duqi et al., 2018). In particular, corporate executives with a banking background have an information advantage in understanding the regulatory needs of banks under macro-environmental governance policies and are more familiar with bank loan approval processes and criteria, which can effectively help enterprises get loans approved for R&D projects. Therefore, in the context of the GCP, “two high and one surplus” enterprises within the non-bank-enterprise correlation may face greater policy constraints and find it harder to get credit financing for R&D. The above analysis leads to the theoretical hypothesis H5.

H5

Other things being equal, after the GCG’s implementation, the correlation that GCP inhibits “two high and one surplus” enterprises’ R&D within the group of no-bank-enterprise was higher than that of bank-enterprise.

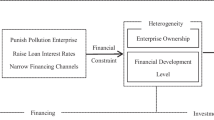

According to the above hypotheses, the figure below illustrates the theoretical research model used in this study (Fig. 1).

4 Research design

4.1 Data and samples

The GCG was released in 2012, and China started its green credit experiment in 2007. To avoid the initial policy shock, the initial year of the sample data was postponed to 2009. Taking into account the influence of the COVID-19 pandemic on R&D such as the automobile manufacturing industry and the pharmaceutical industry, this paper chose to conduct an empirical study between 2009 and 2019. The study conducted by Liu et al. in 2020 utilized Chinese A-share listed companies as the empirical sample, with a focus on categorizing the sub-sectors of thermal power generation, iron making, steel making, steel rolling, and cement manufacturing, which were covered in the “Classified Management List of Environmental Protection Verification Industries of Listed Companies” issued by the General Office of the former Ministry of Environmental Protection in 2008. Then the samples were classified based on the 2001 “Industry Classification Guidelines for Listed Companies” of the China Securities Regulatory Commission (CSRC), listed enterprises’ business scope was used as the basis for more detailed classification. Finally, the treatment group was selected consisting of the enterprises listed as “two high and one surplus” for this empirical investigation, while the remaining listed businesses were put into the role of the control group.

The following data were excluded:

(1) The samples with special treatment (ST) or those with delisting risk (*ST); (2) companies with serious missing financial data; (3) the financial industry sample.

The sample used for analysis consists of 2739 listed companies from 2009 to 2019, making a total of 14,402 observations. The panel is unbalanced. The database of China Stock Market Accounting Research (CSMAR) was searched to gather the financial data of listed enterprises as well as the scope of activities of such enterprises. Data processing was completed using Excel 2016 with Stata 15.0 software. In conducting the multiple regression analysis, the continuous variables were adjusted by winsorizing them at the 1% and 99% quartiles. This was done to eliminate the impact of outliers.

4.2 Variable definitions

4.2.1 Explanatory variables: variables in the model of DID

Treat × Post is a variable in the model of DID whose coefficient measures the impact of the GCG’s implementation on “two highs and one surplus” enterprises. The specific variables that make up the cross-multiplication term are explained as follows:

(1) Policy year.

Post is a dummy variable that is applied to define the policy shock. It is constrained by the release date of GCG in February 2012, taking a value of 0 before 2012, and 1 in 2012 and beyond.

(2) Treatment group.

If the enterprise in question is one of the “two high and one surplus” enterprises, the value of Treat dummy variable for it is given the value 1; if not, the variable is assigned the value 0.

4.2.2 Explained variable: level of enterprise R&D

The RD ratio is a measure utilized to evaluate the level of investment in R&D by a company in comparison with its operational revenue, usually known as R&D intensity. The R&D mentioned in this paper focuses on the costs incurred by enterprises in technological innovation activities, such as the salary and interest costs of R&D.

4.2.3 Mediating variable

Mediator. This study contains two mediator variables, which are as follows:

(1) Scale of debt financing.

DebtScale, the scale of debt financing. Measured by the ratio of total borrowings to total assets. Total borrowing data are from the statistics table of bank borrowings of listed companies in the database of CSMAR.

(2) Cost of debt financing.

DebtCost, debt financing cost measured by the enterprise financial index files in the CSMAR database; debt interest expense to total borrowings ratio provides the data on debt interest expenditure.

4.2.4 Grouping variables

(1) State-owned enterprises.

Soe is a dummy variable, taking a value of 1 for state-owned enterprises and 0 for non-state-owned enterprises.

(2) Bank-enterprise association.

The bank-enterprise relationship is described by the dummy variable Bea. If the enterprise has directors, supervisors, or senior executives with a banking work backgrounds, the enterprise is considered to have a bank-enterprise association. In this case, Bea is set as 1, otherwise it is 0.

4.2.5 Control variables

The Control. There are many factors affecting enterprise R&D. Based on the existing research on R&D, Size, Lev, Growth, Cash, Tangible, Board, Mshares, and Age were selected as control variables.

Table 1 displays the meanings of the key variables used in this essay.

4.3 Model setting

(1) To test the theoretical hypothesis H1, i.e., the effect of GCG’s implementation on “two high and one surplus” enterprises’ R&D, the subsequent econometric model is developed in this section.

The introduction of the GCG is an exogenous event for enterprises, and this regulation mandates that financial institutions have oversight over the environmental hazards associated with their lending activities. “Two high and one surplus” enterprises’ R&D is expected to be significantly affected by this, whereas the impact on other businesses is relatively minor and can be seen as a quasi-natural experiment.

The policy effect test is typically not plagued by the issue of endogeneity that arises from bidirectional causality, and to a certain degree, the utilization of the DID model along with fixed effect estimation can potentially mitigate missing variable bias. For this study, the treatment group consists of “two high and one surplus” enterprises. To verify theoretical hypothesis H1, DID model is constructed as follows:

\({RD}_{it}\) is the R&D level of enterprise i in year t. Here,\({\gamma }_{1}\) will be the focus of attention. \({Control}_{it}\) is a set of characteristic factors of enterprises, and uit is the stochastic error term. In addition, industry characteristics (Industry) and Year (Year) are also controlled in this study to control non-time-varying industry characteristics and unobservable factors with time-varying characteristics. Simultaneously testing the fixed effects of Industry and Year, Treat and Post no longer appear separately in model (1) to avoid collinearity problems.

(2) To examine the theoretical hypotheses H2 and H3, a mediating effect analysis is conducted.

The test for mediating effects in this study consists of three steps:

Firstly, model (1) is tested to test whether the coefficients of regression of Treat × Post and RD (\({\gamma }_{1}\)) are significant. If \({\gamma }_{1}\) is significant, it can be further tested.

Secondly, after the test of model (1), model (2) is established based on the establishment of H1.

The mediators established in this study are DebtScale and DebtCost. When the regression coefficient of Treat × Post and the Mediator (\({\alpha }_{1}\)) is significant, the test continues.

Finally, model (3) is established based on model (1), to test whether the regression coefficient of \({Treat}_{i}\times {Post}_{t}\) (\({\eta }_{1}\)) is significant.

If \({\eta }_{1}\) is significant in model (3), then whether the regression coefficient of \({Mediator}_{it}\) (\({\eta }_{2}\)) is significant is further analyzed. If \({\eta }_{2}\) is not significant in model (3), there is a complete mediation effect; while \({\eta }_{2}\) is of significance, there exists a partial mediation effect. If \({\eta }_{1}\) is not of significance, then there is no mediating effect.

In the above regression analysis,\({\gamma }_{1}\), \({\alpha }_{1},\) and \({\eta }_{2}\) are used to judge the mediating effect, and \({\eta }_{1}\) is utilized for assessing the direct effect.

(3) To test the heterogeneous influence of GCG on “two high and one surplus” enterprises’ R&D, model (1) continues to be used. Based on the setting of grouping variables, the theoretical hypotheses H4 and H5 will be verified in turn.

5 Empirical analysis

5.1 Descriptive statistics

5.1.1 Descriptive statistics of the whole sample

The descriptive data with a total of 14,402 observed values in this study are presented in Table 2. This observation suggests that there are variations in the R&D capabilities across various enterprises.

One of the key explanatory factors, the mean of Treat, is 0.238, suggesting that around 23.8% of the samples are categorized as “two high and one surplus” enterprises. The mean of Post is 0.949, showing that approximately 94.9% of the samples included in the analysis were collected after the year 2012, inclusive of the year 2012 itself, and the remaining 5.1% are from the data of 2009 and 2010. The statistical findings obtained subsequent to the deployment of the GCG demonstrate a high degree of reasonableness and alignment with empirical observations, owing to the substantial sample size used.

Regarding the control variables, the mean values of Size (22.219), Lev (0.435), and Growth (0.321) are generally consistent with the literature, and there are no outliers.

5.1.2 Univariate analysis

Table 3 presents the analytical findings pertaining to the disparities in R&D levels between two different groups before and after GCG’s practice during the whole duration of the sample period. From the grouping of the sample, regardless of whether the GCG was implemented or not, the R&D of treatment group was found to be considerably lower compared. Furthermore, after GCG’s release, the disparity in R&D levels between the two groups further increased.

When comparing the R&D levels of control group, it can be observed that whether or not the GCP is implemented, there is a general upward tendency. Preliminary evidence suggests the practice of the GCG leads to a constraining effect on “two high and one surplus” enterprises’ R&D. To further test this, a multivariate regression model needs to be constructed below.

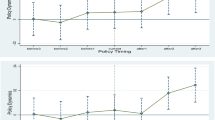

5.2 Parallel trend hypothesis test

Figure 2 demonstrates that prior to the formal implementation of the GCG, i.e., from 2009 to 2011, the average R&D level in diffident groups had a similar shifting pattern, so confirming the hypothesis of a parallel trend and aligning with the underlying assumption of the DID model. According to the specific change trend, in 2012, the average R&D level in both groups exhibited a notable fall, with the treatment group seeing a much higher decline. Subsequently, the R&D proficiency in the control group has shown a consistent upward trend, surpassing the baseline value seen in 2009 by a substantial margin. Contrary to expectations, the R&D level in the treatment group exhibited an overall increase subsequent to 2012. However, this increase was characterized by fluctuations and volatility. By 2018, the growth in R&D level in the treatment group not only significantly lagged behind that of enterprises in the control group, but also fell considerably below the R&D level observed in 2009. The results indicate that enterprises classified as “two high and one surplus” have not achieved positive results in their research and development efforts despite the implementation of the GCG.

5.3 Correlation analysis

To avoid the problem of multiple co-linearities relationships between variables affecting the accuracy of this study, Pearson correlation analysis and VIF (variance inflation factor) calculations between the main variables were carried out. The Pearson correlation analyses are shown in Table 4.

According to Table 4, with the exception of Post, the independent variables, including the control variables, have a significant relationship with RD. Specifically, Treat was significantly negatively correlated with RD, indicating that experimental group’s R&D level was significantly lower than control group, but the correlation coefficient between Post and RD was not significant. The net effect of GCP on “two high and one surplus” enterprises’ R&D needs further regression analysis. All the control variables showed significant correlations with RD, and the control variables were selected appropriately. According to the main variables’ Pearson correlation coefficient, it can be seen that, except for very few variables whose correlation coefficients exceed 0.5, the majority of the variables have relatively low correlation coefficients (Table 4).

And according to the results of the VIF (Variance Inflation Factor, Table 5) calculation, the VIF values are all less than 2 and far less than 10; therefore, there is no significant multi-collinearity among the variables.

5.4 Regression analysis

5.4.1 Benchmark test of the impact of GCP on R&D of “two high and one surplus” enterprises

After constructing the treatment and control group, the primary objective of this study is to examine the theoretical hypothesis H by assessing the presence of a statistically significant disparity in enterprises’ R&D activities of the different groups, both before and subsequent to the practice of the GCP. For this purpose, we use a DID model, specifically constructing model (1). Moreover, we use ordinary least squares (OLS) approach for the regression statistics, further enhancing the robustness of our results. The regression findings can be seen in Table 6.

In Table 6, with industry and yearly effects being taken into account, the results of fixed effect model regression can be observed in column (1). Upon doing further control for other control variables, the results are displayed in column (2). Columns (3) and (4) display the outcomes of the OLS regression. The statistical significance of the regression coefficient for Treat × Post remains unchanged at a 5% level, confirming its robustness and significant negative impact. The findings indicate that the implementation of the GCG leads to a notable decrease in “two high and one surplus” enterprises’ R&D. At this point, after the release of the GCG, the research hypothesis regarding the significant hindrance of “two high and one surplus” enterprises’ R&D was tested, resulting in the verification of theoretical hypothesis H1.

5.4.2 Robustness test of the impact of green credit on R&D of “two high and one surplus” enterprises

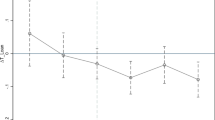

(1) Dynamic effect test.

Following the introduction of GCG, the GCP system is still in the process of continuous improvement. To assess the dynamic effect on “two high and one surplus” enterprises’ R&D after its implementation, on the basis of model (1), this paper replaces \({Treat}_{i}\times {Post}_{t}\) of Eq. (1) with the cross-multiplication term of classification dummy variable \({Treat}_{i}\) and dummy variable \({Year}_{t}\) of 2012 and subsequent years and establishes the marginal effect model as shown in Eq. (4):

Test results for dynamic impact can be observed in columns (1) and (2) of Table 7, as outlined by model (4). The coefficient of the Treat × Post is significantly negative, with the magnitude of the effect increasing. It indicates that as time goes by, the overall inhibitory effect shows an upward trend, that is, there is a cumulative effect of the policy. The dynamic results verify the theoretical hypothesis H1 again.

(2) Replace the main explanatory variables.

Using the method of measuring enterprise R&D mentioned in the variable design of this paper, considering the characteristics of R&D activities such as high failure rates and strong uncertainty, compared with R&D investment intensity, enterprise R&D output more intuitively reflects enterprise R&D level. Since the invention patents of enterprises have higher requirements on a scientific and technological level, they can better represent the ability of enterprises to support R&D innovation, this study assesses R&D output by utilizing the number of enterprise invention patent applications. Specifically, the variable Invia is used as a proxy for enterprise R&D in the regression analysis. The index of Invia is measured by the logarithmic value of the number of enterprise invention patent applications in the current year plus 1. The results in columns (1) and (2) of Table 8 show that the coefficient of the Treat × Post regression is still significantly negative. Therefore, based on the test results from substituting the main explanatory variables, the theoretical hypothesis H1 remains valid.

(3) Removal of interference from relevant samples.

The GCG requires financial institutions to effectively manage environmental risks in their credit operations, and also encourages them to strengthen their support for the green economy, this could cause the GCG to not only affect heavily polluting firms but also energy-saving and environmental protection firms, thereby potentially yielding biased estimation outcomes. Therefore, this paper excludes samples whose core business comprises energy conservation and environmental protection, recycling, new energy, and other industries from the initial sample. On this basis, to eliminate the interference of “capacity” policy in recent years, according to 2013 promulgated by the State Council “Guiding Opinions on Resolving severe overcapacity problems,” and further to belong to the steel, cement, electrolytic aluminum inside sample, flat glass, the ship to capacity in key industries such as enterprise, and shall be carried out in accordance with the model (1) the benchmark return. As can be seen in columns (3) and (4) of Table 8, the coefficient of Treat × Post regression remains significantly negative at the level of 5%. Therefore, based on the test results of eliminating relevant interference samples, the theoretical hypothesis H1 is still valid.

5.4.3 An examination of the intermediary transmission mechanism of the impact of green credit on “two high and one surplus” enterprises’ R&D

According to column (2) in Table 6 above, the aggregate policy effect of model (1) is significant (\({\upgamma }_{1}\)= − 0.448, p < 0.05), the theoretical hypothesis H1 is tested and the findings are robust, laying the foundation for exploring the mediating effect.

In Table 9, from columns (1) to (2), Treat × Post has a significant effect on DebtScale, but not on DebtCost. Specifically, the regression coefficient of Treat × Post is -0.0191 for column (1) with DebtScale as the explanatory variable, and is significant at the 1% level of significance. The theoretical hypothesis H3 was not tested. The next test was carried out by substituting the scale of debt financing into model (3). The results are in column (3):

In model (3), the outcomes presented in column (3) of Table 9 indicate the regression coefficient between Treat × Post and R&D is significantly negative (\({\eta }_{1}\) = – 0.423, p < 0. 05), and the positive correlation between DebtScale and R&D is also significant (\({\eta }_{2}\) = 1.301, p < 0.01). It indicates the existence of a partial mediating effect of the scale of debt financing. That is to say, GCP not only has the effect of directly inhibiting “two high and one surplus” enterprises’ R&D, but can also inhibit enterprises’ R&D with “two high and one surplus” enterprises by reducing the scale of debt financing.

5.4.4 Heterogeneity test of the impact of green credit on “two high and one surplus” enterprises’ R&D

(1) Heterogeneity test of the nature of enterprise ownership.

Using model (1), further tests show the net effect of GCP on “two high and one surplus” enterprises in SOEs and non-SOEs, respectively, and Table 10 shows the results.

The subsample test found that the “two high and one surplus” firms in the SOEs sample were more inhibited in R&D than the non-SOEs sample, and the theoretical hypothesis H4 was tested. The cause of this may be that SOEs have secured the majority of credit resources of financial institutions, the share of debt financing involved in SOEs is usually high. This will have a further impact on the business performance of the enterprise and threaten the safety of bank credit facilities. As a result, the operation objectives of banks will be consistent with the national green development objectives, reducing their lending. Similarly, the SOEs of “two high and one surplus” enterprises are encountering more rigid credit constraints limitations and heightened financial perils. Consequently, they are inclined to decrease their investment in R&D in an effort to minimize the risks associated with innovation and maintain a balanced overall risk level for the enterprise.

(2) Heterogeneity test of bank-enterprise association.

Continuing with model (1), this paper further tests the grouping of firms according to whether they have a banking association or not, and Table 11 shows the result. The theoretical hypothesis H5 was tested by a subgroup test, which found that the “two high and one surplus” enterprises in the non-bank-enterprise association sample were more inhibited in R&D than the bank-enterprise association sample.

6 Conclusions and suggestions

6.1 Research conclusions

A number of studies have shown that bank loans and other debt financing are important sources to support R&D. The GCG issued in 2012 put forward more explicit and specific requirements for banks’ credit granting. The execution of the policy has successfully limited the inflow of credit funds to “two high and one surplus” enterprises. Whether “two high and one surplus” enterprises can realize the technological innovation and upgrading are of great significance to market economy construction. Focusing on GCP’s impact on “two high and one surplus” enterprises’ R&D, this study conducts empirical analysis. Here are the main findings:

Firstly, after GCG’s introduction, “two high and one surplus” enterprises’ R&D is greatly inhibited, confirming GCP’s regulatory constraint effect. The dynamic effect test results show a cumulative effect that the GCP has on the inhibition effect of “two high and one surplus” enterprises’ R&D.

Second, the scale of debt financing can be reduced as a means to achieve this type of inhibitory effect. It shows the existence of a partial mediation effect. However, the cost of debt financing does not play an intermediary role.

Third, compared with non-SOEs samples, the inhibitory effect of GCG on “two high and one surplus” enterprises’ R&D is more significant in SOEs samples.

Fourthly, compared with the samples of bank-enterprise association enterprises, after the release of the GCG, the R&D inhibitory effect of non-bank-enterprise association enterprises is greater than that of bank-enterprise association enterprises.

6.2 Suggestions

According to the above research conclusions, GCP, as a core component of green finance policy, can affect the actual R&D decisions of “two high and one surplus” enterprises at the micro level. GCG can inhibit the inflow of debt funds, such as bank credit to “two high and one surplus” enterprises, and result in a greatly inhibitory effect on “two high and one surplus” enterprises’ R&D. This study offers a practical foundation for the improvement of pertinent policies and presents novel empirical findings for academic research on the impact of GCP on the enduring conduct of companies. Drawing from outcomes of this research, recommendations are proposed as follows:

-

(1)

The implementation of green credit policies should involve a targeted and hierarchical approach in selecting the enterprises to be regulated by the policy. Enterprise research and development is the first step of enterprise innovation. Studies also support the idea that when the scale of debt financing is constrained, “two high and one surplus” enterprises will make the decision to reduce R&D expenditure based on the goal of maximizing their own interests. The role of green credit is influenced by the diversity of enterprise ownership or bank-enterprise association. Therefore, in selecting enterprises to be regulated under the policy, relevant departments and institutions should take into account various factors such as the nature of ownership, availability of credit funds, and stock of debts of enterprises and give priority to listed companies with low efficiency in the use of corporate funds and insufficient motivation for innovation and transformation. In the process of restraining “two high and one surplus” enterprises’ investment in accordance with the GCP, their innovation and transformation projects should also be supported so as to get remarkable results.

-

(2)

The management of green credit funds should incorporate a system where incentives and penalties are interconnected and continuously monitored. By limiting the access of credit funds to sectors characterized by high pollution, excessive energy consumption, and overcapacity, GCP should not only focus on the current environmental performance of enterprises, but also look at the efforts made by the “two high and one surplus” enterprises to improve their performance in terms of environment friendly technology innovation, avoiding the “one-size-fits-all” regulatory policy hindering enterprise R&D innovation, transformation, and development.

7 Research deficiencies and prospects

Given the experimental design and results provided above, there remain certain restrictions in this research, including the data availability and other constraints:

-

(1)

The research content is not comprehensive. The specific effect of policy changes on corporate R&D is interfered by complex internal and external factors, and the mechanism of action is by no means static and single. This study utilizes the release of GCG to evaluate the impact of GCP on “two high and one surplus” enterprises’ R&D activities. It accomplishes this by constructing a DID model and examining the mechanism through which GCP operates. However, it is important to note that various factors, such as the life cycle of the enterprise and the competitive market environment, can potentially have an impact on R&D efforts. In particular, due to the availability of data and the inadequacy of the construction of relevant measurement indicators, the sample cannot be further divided in this study based on whether the “two high and one surplus” enterprises have achieved green transformation, in order to study the variance in policy effects. Therefore, the research in this study is not comprehensive.

-

(2)

As no literature or report that specifies the specific sub-sectors or the list of enterprises in the “two high and one surplus” category, this study primarily utilizes the pertinent industry policies and literature as the basis for identifying the enterprises in the “two high and one surplus” category. On this basis, the treatment group’s sample was compiled manually by drawing on the experience of relevant literature research and supplemented by the main business and scope of operation of the enterprises, so there is a certain degree of error.

Data availability

The datasets used during the current study are available from the corresponding or first author on reasonable request.

References

Alola, A., Çelik, A., Awan, U., Abdallah, I., & Obekpa, H. (2023). Examining the environmental aspect of economic complexity outlook and environmental-related technologies in the Nordic states. Journal of Cleaner Production, 408, 137154. https://doi.org/10.1016/j.jclepro.2023.137154

Awan, U., Kraslawski, A., & Huiskonen, J. (2018). Governing Interfirm Relationships for Social Sustainability: The relationship between governance mechanisms, sustainable collaboration, and cultural intelligence. Sustainability, 10, 1–20. https://doi.org/10.3390/su10124473

Czarnitzki, D., & Kraft, K. (2009). Capital control, debt financing and innovative activity. Journal of Economic Behavior & Organization, 71(2), 372–383. https://doi.org/10.1016/j.jebo.2009.03.017

Diamond, D. W. (1984). Financial intermediation and delegated monitoring. The Review of Economic Studies, 51(3), 393–414. https://doi.org/10.2307/2297430

Duqi, A., Tomaselli, A., & Torluccio, G. (2018). Is relationship lending still a mixed blessing? A review of advantages and disadvantages for lenders and borrowers. Journal of Economic Surveys, 32(5), 1446–1482. https://doi.org/10.1111/joes.12251

Hao, F., Xie, Y., & Liu, X. (2020). The impact of green credit guidelines on the technological innovation of heavily polluting enterprises: A quasi-natural experiment from China. Mathematical Problems in Engineering, 2020(2020), 1–13. https://doi.org/10.1155/2020/8670368

Ho, V. H. (2018). Sustainable finance & China’s green credit reforms: A test case for bank monitoring of environmental risk. Cornell International Law Journal, 51(3), 609–681.

Hu, G., Wang, X., & Wang, Y. (2021). Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Economics. https://doi.org/10.1016/j.eneco.2021.105134

Jahanger, A., Lorente, D., Hulio, M., Samour, A., Abbas, S., & Tursoy, T. (2023). Going away or going green in ASEAN countries: Testing the impact of green financing and energy on environmental sustainability. Energy & Environment.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1007/978-94-009-9257-3_8

Ji, L., Jia, P., & Yan, J. (2021). Green credit, environmental protection investment and debt financing for heavily polluting enterprises. Plos One. https://doi.org/10.1371/journal.pone.0261311

Jones, R., Baker, T., Huet, K., Murphy, L., & Lewis, N. (2020). Treating ecological deficit with debt: The practical and political concerns with green bonds. Geoforum, 114, 49–58. https://doi.org/10.1016/j.geoforum.2020.05.014

Lei, X., Wang, Y., Zhao, D., & Chen, Q. (2021). The local-neighborhood effect of green credit on green economy: A spatial econometric investigation. Environmental Science & Pollution Research, 28(46), 65776–65790. https://doi.org/10.1007/s11356-021-15419-8

Li, W., Cui, G., & Zheng, M. (2022). Does green credit policy affect corporate debt financing? Evidence from China. Environmental Science & Pollution Research, 29(4), 5162–5171. https://doi.org/10.1007/s11356-021-16051-2

Lian, Y., Gao, J., & Ye, T. (2022). How does green credit affect the financial performance of commercial banks? Evidence from China. Journal of Cleaner Production. https://doi.org/10.1016/j.jclepro.2022.131069

Liu, J., Xia, Y., Fan, Y., Lin, S., & Wu, J. (2017). Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. Journal of Cleaner Production, 163, 293–302. https://doi.org/10.1016/j.jclepro.2015.10.111

Liu, Q., Wang, W., & Chen, H. (2020). A study of the impact of Green Credit Guidelines implementation on innovation performance in heavy polluting enterprises. Science Research Management, 41(11), 100–112.

Liu, S., Xu, R., & Chen, X. (2021). Does green credit affect the green innovation performance of high-polluting and energy-intensive enterprises? Evidence from a quasi-natural experiment. Environmental Science & Pollution Research, 28(46), 65265–65277. https://doi.org/10.1007/s11356-021-15217-2

Lorente, D., Mohammed, K., Cifuentes Faura, J., & Shahzad, U. (2022). Dynamic connectedness among climate change index, green financial assets and renewable energy markets: Novel evidence from sustainable development perspective. Renewable Energy. https://doi.org/10.1016/j.renene.2022.12.085

Milani, S., Neumann, R., Houser, D., & Puzzello, D. (2022). R&D, patents, and financing constraints of the top global innovative firms. Journal of Economic Behavior & Organization, 196, 546–567.

Peng, B., Yan, W., Elahi, E., & Wan, A. (2022). Does the green credit policy affect the scale of corporate debt financing? Evidence from listed companies in heavy pollution industries in China. Environmental Science & Pollution Research, 29(1), 755–767. https://doi.org/10.1007/s11356-021-15587-7

Shaheen, F., Lodhi, S., Rosak-Szyrocka, J., Zaman, K., Awan, U., Asif, M., Ahmed, W., & Siddique, M. (2022). Cleaner technology and natural resource management: An environmental sustainability perspective from China. Clean Technologies, 4, 584–606. https://doi.org/10.3390/cleantechnol4030036

Shi, J., Yu, C., Li, Y., & Wang, T. (2022). Does green financial policy affect debt-financing cost of heavy-polluting enterprises? An empirical evidence based on Chinese pilot zones for green finance reform and innovations. Technological Forecasting & Social Change. https://doi.org/10.1016/j.techfore.2022.121678

Wang, T., & Thornhill, S. (2010). R&D investment and financing choices: A comprehensive perspective. Research Policy, 39(9), 1148–1159. https://doi.org/10.1016/j.respol.2010.07.004

Wang, Y., Lei, X., Long, R., & Zhao, J. (2020). Green credit, financial constraint, and capital investment: Evidence from China’s energy-intensive enterprises. Environmental Management, 66(6), 1059–1071. https://doi.org/10.1007/s00267-020-01346-w

Wang, Y., Lei, X., Zhao, D., Long, R., & Wu, M. (2021). The dual impacts of green credit on economy and environment: Evidence from China. Sustainability. https://doi.org/10.3390/su13084574

Wen, H., Lee, C. C., & Zhou, F. (2021). Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Economics. https://doi.org/10.1016/j.eneco.2021.105099

Xu, S. (2020). International comparison of green credit and its enlightenment to China. Green Finance, 2(1), 75–99. https://doi.org/10.3934/gf.2020005

Yao, S., Pan, Y., Sensoy, A., Uddin, G. S., & Cheng, F. (2021). Green credit policy and firm performance: What we learn from China. Energy Economics. https://doi.org/10.1016/j.eneco.2021.105415

Zhang, D., & Kong, Q. (2022). Credit policy, uncertainty, and firm R&D investment: A quasi-natural experiment based on the green credit guidelines. Pacific-Basin Finance Journal. https://doi.org/10.1016/j.pacfin.2022.101751

Zhang, K., Wang, Y., & Huang, Z. (2021a). Do the green credit guidelines affect renewable energy investment? Empirical research from China. Sustainability. https://doi.org/10.3390/su13169331

Zhang, S., Wu, Z., Wang, Y., & Hao, Y. (2021b). Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. Journal of Environmental Management. https://doi.org/10.1016/j.jenvman.2021.113159

Zhang, Y., Li, X., & Xing, C. (2022a). How does China’s green credit policy affect the green innovation of high polluting enterprises? The perspective of radical and incremental innovations. Journal of Cleaner Production. https://doi.org/10.1016/j.jclepro.2022.130387

Zhang, Z., Duan, H., Shan, S., Liu, Q., & Geng, W. (2022b). The impact of green credit on the green innovation level of heavy-polluting enterprises-evidence from China. International Journal of Environmental Research & Public Health. https://doi.org/10.3390/ijerph19020650

Zhou, X. Y., Caldecott, B., Hoepner, A. G. F., & Wang, Y. (2022). Bank green lending and credit risk: An empirical analysis of China’s green credit policy. Business Strategy & the Environment, 31(4), 1623–1640. https://doi.org/10.1002/bse.2973

Zhu, Q., Zheng, K., & Wei, Y. (2021). Three-Party stochastic evolutionary game analysis of reward and punishment mechanism for green credit. Discrete Dynamics in Nature & Society. https://doi.org/10.1155/2021/5596015

Funding

This work was supported by the Ministry of Education of the People’s Republic of China Humanities and Social Sciences Youth Foundation (Grant No. 22YJC910014), the Social Sciences Planning Youth Project of Anhui Province (Grant No. AHSKQ2022D138). The authors sincerely appreciate funding from Researchers Supporting Project number (RSP2024R58), King Saud University, Riyadh, Saudi Arabia.

Author information

Authors and Affiliations

Contributions

WM contributed to data curation, methodology, software, literature review, and writing—original draft preparation. CZ contributed to investigation, visualization, and supervision. XZ contributed to writing—reviewing and editing, supervision, validation, and investigation. XM contributed to conceptualization, visualization, and writing—reviewing and editing. SK contributed to supervision, validation, and investigation.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Ethics approval and consent to participate

Not applicable.

Consent to publish

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ma, W., Zheng, C., Zhao, X. et al. Impact of green finance on R&D of “two high and one surplus” enterprises against the greenwashing background: exploring the role of green credit. Environ Dev Sustain (2024). https://doi.org/10.1007/s10668-023-04348-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-023-04348-w