Abstract

Taking the green credit policy in 2012 as a quasi-natural experiment, this paper uses the difference-in-differences method to explore the impact of green credit policy on enterprises’ financial asset allocation and the moderating effect of government subsidy. We find that green credit policy significantly promotes the financial asset allocation of heavy-polluting enterprises, which is mainly reflected in short-term liquid financial investment, thus supporting the precautionary motivation of holding financial assets. The mechanism analysis shows that green credit policy promotes the financial asset allocation of heavy-polluting enterprises by reducing the scale of debt financing and increasing the financing cost. Government subsidy can significantly weaken the promoting effect of green credit policy on enterprises’ financial asset allocation, and there is heterogeneity due to the regional environmental regulation intensity and financial development level. Further analysis shows that the negative moderating effect of government subsidy on green credit policy and enterprises’ financial asset allocation significantly promotes the “shifting form virtual to real” of heavy polluting enterprises by reducing financial asset allocation. This paper discusses the impact of green credit policy on financial asset allocation of heavy-polluting enterprises in China and further clarifies the significant role of government subsidy in the process, so as to provide suggestions for government to control the “shifting from real to virtual” of enterprises. The results also provide an important reference for countries, especially developing countries, to implement green credit policy and government subsidy to achieve sustainable economic development.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Recently, under the pressure of downward investment returns in the real economy and induced by the high return in the financial sector, it has become more common for Chinese enterprises to invest in financial assets (Du et al. 2017; Acharya et al. 2019). This will not only lead to the decline in fixed asset investment and insufficient impetus for the development of the real economy (Demir 2009a; Tori and Onaran 2018), but also cause excessive expansion of the virtual economy and the instability of the financial system (Barradas and Lagoa 2017; Tori and Onaran 2018; Wang 2019). The 20th National Congress of the Communist Party of China emphasized that the focus of economic development should stick to the real economy. Therefore, China’s government attaches great importance to the “shifting from real to virtual” of economy and actively manages it by establishing relevant institutions (Du et al. 2019).

Since the reform and opening policy, the rapid development of China’s economy has been accompanied by the increasingly prominent problem of environmental pollution, which has seriously hindered the sustainable development of economy (Wang et al. 2020; Lai et al. 2022; zhang et al. 2022). China’s government has repeatedly stressed to accelerate low-carbon and environment-friendly development so as to promote green transformation of the economy. Under this context, the Green Credit Guidelines (hereinafter referred to as green credit) issued by China Banking Regulatory Commission in 2012 has a non-negligible impact on the realization of green and sustainable economic development through the allocation of financial resources. Green credit policy aims to restrict loans to heavily polluting enterprises and force them to shift to low-carbon and environment-friendly operations to achieve green transformation (Fan et al. 2021). Recent studies have found that the green credit policy in China aggravates the credit constraints of heavy polluting enterprises by reducing the scale of debt financing and increasing the financing cost (Su and Lian 2018; Liu et al. 2019; Xu and Li 2020; Li et al. 2022); it also has an impact on its business activities and investment behaviors. Then, under the background that financial investment has generally become the major investment activities, how does green credit policy affect the financial asset allocation of enterprises? This problem deserves attention.

In addition to green credit policy, capital subsidies from the government also play an increasingly important role in the green transformation of enterprises and the related investment behaviors caused by it (Hu and Liu 2019). As an important fiscal policy instrument of the Chinese government, more than 90% of China’s A-share listed companies receive government subsidies every year (from China Securities Times), so the role of government subsidy cannot be underestimated. The green credit policy aims to promote the green transformation of heavily polluting enterprises. However, the transformation process has great risks and uncertainties, and the appropriate financial support from the government can effectively promote the innovation of enterprises and achieve green transformation (Liu et al. 2020), thus affecting the financial asset allocation of enterprises. Government subsidy in the process of green transformation is common around the world, so the role of government subsidy must be considered when studying the impact of environmental policies on enterprises (Hu and Liu 2019; liu et al. 2020). However, the existing research only analyzes this issue from a single policy perspective, and few studies have incorporated government subsidy and green credit policy into a unified framework to discuss their impact on enterprises. Therefore, this paper focuses on financial asset allocation of enterprises and analyzes what results arise when government subsidy and green credit policy act on the financial asset allocation of enterprises at the same time, which has important theoretical value and practical significance for the better play of policy effect and the “shifting from virtual to real” of enterprises.

Existing research on the micro-effects of green credit policy mainly focuses on the enterprises’ physical investment (Su and Lian 2018; Wang et al. 2020), debt financing (Su and Lian 2018; Liu et al. 2019; Xu and Li 2020), and innovative activities (Ling et al. 2020; Hu et al. 2021; Wang et al. 2022; Li and Dong 2022). The driving factors of enterprises’ financial asset allocation and the governance of shifting from real to virtual are mainly carried out from the aspects of capital profit-seeking caused by the difference in returns between real investment and financial investment (Demir 2009a; Tang and Zhang 2019), shareholder value orientation (Modell and Yang 2018), executives’ background (Du et al. 2019), and policy uncertainty (Duong et al. 2020; Huang et al. 2019). With the deepening of research, more and more scholars have paid attention to the impact of environmental regulation policies on enterprises’ financial asset allocation (Xie et al. 2022; Liu and Liu 2022; zhang et al. 2022). However, most of the literature mainly started from the perspective of the unilateral environmental regulation, such as command-type or market-type, and the research conclusions failed to reach a consensus. As an environmental regulation with bilateral characteristics of command-type and market-type, green credit policy has received little attention. In addition, the role of the government subsidy has not been paid attention to, so further exploration is necessary.

Therefore, under the background that China’s economy is faced with the dual obstacles of shifting from real to virtual and environmental pollution, how does the implementation of green credit policy affect the financial asset allocation of enterprises? What is the role of government subsidy? Answering these questions not only enriches the relevant literature on the effects of green credit policy and government subsidy, but also has important significance for formulating effective regulation policies and government support policies from the perspective of policy complement thus realizing sustainable economic development. The possible contributions are as follows: First, it further enriches the micro-economic effect of green credit policy from the perspective of enterprises’ financial asset allocation. Second, based on the perspective of green credit policy, this paper explains the policy motivation of enterprises’ financial asset allocation and further expands the research on the influencing factors of financial asset allocation of enterprise. Third, based on the perspective of enterprises’ financial asset allocation, this paper examines the impact of government subsidy on the micro-effects of green credit policy, which has important theoretical value and practical significance for better exerting the policy effect, and promotes the enterprises shifting from virtual to real.

Different from the study of Zhang et al. (2022), this paper is a quasi-natural experiment based on the green credit policy in 2012. Compared with the green credit policy in 2007, the green credit policy in 2012 has overcome the shortcomings of previous green credit policies; it is more standardized and institutionalized (Li et al. 2022). More importantly, government subsidy serves a significant role in the relationship between green credit policy and financial investment decisions of enterprises, so this paper considers the moderating effect of government subsidy, which is more in line with the realistic situation, and the conclusion is more accurate. In addition, it is worth noting that most of the previous literature regards the inhibition of enterprises’ financial asset allocation as the realization of shifting from virtual to real. However, the decrease of financial investment does not mean the net increase of real investment (the real realization of shifting from virtual to real), and this paper attempts to solve this problem by constructing an index of shifting from the virtual to real.

The remainder of this paper proceeds as follows. “Literature review” introduces the Institutional background and literature review; “Hypothesis development” proposes the hypothesis development; “Research design” presents research samples, measures of the main variables, and model design; “Empirical results and analysis” reports the results of the main test, mechanism test, heterogeneity analysis, robustness test, and the further analysis; “Conclusions and implications” is the conclusion and policy implications.

Institutional background and literature review

Institution background

Green credit policy aims to guide enterprises to carry out green transformation by exerting the role of financial resources allocation. In 2007, several central government departments in China jointly issued the “Opinions on Implementing Environmental Protection Policies and Regulations to Prevent Credit Risks,” marking the green credit policy as a potential tool for environmental protection, energy conservation, and emission reduction. However, as the first green credit policy in China, this document lacks specific implementation rules and cannot guide the banking financial institutions to carry out the green credit policy. Subsequently, in 2012, the China Banking Regulatory Commission officially issued the “Green Credit Guidelines” as the new foundation of the green credit policy in China. In this paper, the green credit policy of 2012 is used as a quasi-natural experiment, instead of the green credit policy in 2007. The reason is that the green credit policy in 2007 was in its infancy, there was a lack of perfect supporting measures between the environmental protection part and financial institutions, the details of the policy were not clearly defined, and the implementation of the policy also lacks of evaluation plans. As a result, the green credit policy in 2007 has not been effectively implemented in China (Guo 2014). Compared with the green credit policy issued in 2007, the green credit policy in 2012 has overcome the shortcomings of previous green credit policy and is more standardized and institutionalized (Li et al. 2022). It provides specific guidance for financial institutions on how to implement green credit policy and promote the green transformation of enterprises. Specifically, the green credit policy in 2012 requires financial institutions to incorporate environmental risk factors into loan access conditions and restrict loans to heavy-polluting enterprises, thus leading them to green transformation. This also affects the financial asset holding of heavy-polluting enterprises. The incentive measures for environmentally friendly enterprises are providing them with preferential credit conditions and high-quality credit resources. At the same time, financial institutions are also required to strictly examine the use of credit funds after issuing loans to ensure that credit funds are invested in green transformation activities.

Literature review

The impact of green credit policy

The existing research mainly discusses the effects of green credit policy from the macro level and micro level. At the macro level, scholars have mainly focused on the role of green credit policy in economic growth, industrial structure, and green development. The implementation of green credit policy will strengthen the intensity of environmental regulation, and strict environmental regulation will reduce the competitive advantage of pollution-intensive products and hinder economic growth (Cole et al. 2010; Hering and Poncet 2014). Some studies have also found that green credit policy provide capital factors for green investment through differentiated pricing, thus promoting economic growth (Soundarrajan and Vivek 2016). As for the research on the relationship between green credit policy and industrial structure, some scholars have found that green credit policy mainly affects industrial structure through capital and financing channels, and the effect varies among regions (Hu et al. 2020). Xu et al. (2018) also confirmed that green credit policy has a significant positive impact on the modernization of industrial structure. In addition, some scholars have discussed the impact of green credit policy on the green and sustainable development of economy. These studies believe that green credit policy can adjust industrial structure and promote environmental governance, thus playing an important role in promoting green and sustainable development (Zhang et al. 2021; Wang et al. 2021). Specifically, green credit policy restrict banks from providing credit to high-pollution projects and support green projects through incentive policy such as preferential interest rates and re-lending (Xing et al. 2021), thus guiding the flow of credit resources from industries with high energy consumption and high pollution to green industries, fundamentally improve environmental quality, and realize the coordinated development of economy and environment (Tian et al. 2022; Mamun et al. 2022). In addition, green credit policy can not only improve the local green economy, but also have spatial spillover effect, which can promote the development of green economy in surrounding areas (Lei et al. 2021).

Micro-level research mainly focuses on the impact of green credit policy on banks and enterprises. From the perspective of banks, studies have explored the impact of green credit policy on banks’ financial performance and operating costs. In the short term, the implementation of green credit policy makes banks face the rising marginal costs and risks as well as lower returns, thus weakening the short-term financial performance, especially for small- and medium-sized banks (Yin 2021). However, in the long run, green credit policy not only shows a positive impact on the future financial performance of banks, but also helps to control credit risks and enhance long-term competitive advantages (Scholtens and Dam 2007). From the perspective of enterprises, scholars mainly discussed the impact of green credit policy on enterprises’ investment and financing as well as green innovation. Many scholars have confirmed that green credit policy greatly reduces the debt financing scale and increases the financing cost of heavily polluting enterprises by restricting credit support, thus affecting the financing and investment decisions of heavily polluting enterprises (Su and Lian 2018; Lemmon and Roberts 2010; Li et al. 2022; Peng et al. 2021). Zhang et al. (2021) believes that although green credit policy can promote short-term financing of heavily polluting enterprises, they have a negative impact on long-term financing and investment behaviors. The green innovation of enterprises is often faced with the problems of large capital demand, long investment cycle, and high return risk. Therefore, green credit policy will significantly inhibit the green innovation behavior of heavy-polluting enterprises through the intensification of credit constraints (Yang and Zhang 2022; Wen et al. 2021). Some studies hold the opposite conclusion, that is, the implementation of green credit policy promotes the green innovation of heavily polluting enterprises by reducing the agency cost and improving investment efficiency (Wang and Wang 2021). In addition, green credit policy can change the decision-making behavior of enterprises (Zhang et al. 2021), improve enterprise performance (Yao et al. 2021), and ultimately promote the green transformation of enterprises.

Influencing factors of enterprises’ financialization

The influencing factors of enterprises’ financialization mainly include internal factors and external factors. The research on internal factors mainly focuses on the reduction of profit of real investment, shareholder value orientation, and executive background. Scholars have found that when the gap between real investment and financial investment returns continues to expand, the profit-seeking characteristic of capital makes enterprises tend to invest funds in the financial market with higher profits (Demir 2009b; Tang and Zhang 2019; Krippner 2005). Based on the shareholder value orientation, the existing research points out that the modern enterprise governance concept with the maximization of shareholder value as the business goal will enhance the short-term speculation of the management, thus aggravating the allocation of financial assets of the enterprise, which will further crowd out the real investment of the enterprise (Krippner 2005; Milberg 2008; Davis 2014). In addition, the different backgrounds of senior executives will also affect the financial investment behavior of enterprises. Du et al. (2019) found that CEO’s financial background has a significant positive impact on corporate financialization, and the positive effect of non-bank financial background is stronger. As for the external influencing factors, scholars have focused on the impact of economic policy uncertainty on enterprises’ financialization. The study found that the rise of economic policy uncertainty significantly inhibited the trend of corporate financialization, indicating that the main motivation of corporate financialization was profit pursuit rather than precautionary savings (Huang et al. 2019). Duong et al. (2020) pointed out that when policy uncertainty increases, enterprises will continuously increase their cash holdings, which indicates that cash holdings are an important channel to alleviate the negative impact of policy uncertainty on enterprises’ real investment activities.

With the deepening of research, more and more scholars have paid attention to the impact of environmental regulation policies on the financial asset allocation of enterprises. Cai et al. (2021) found that environmental regulation significantly strengthened enterprises’ financialization, and the strengthening effect was more obvious in enterprises with high regional environmental regulation pressure and enterprises with strong pollution. In a quasi-natural experiment based on the New Environmental Protection Law, Xie et al. (2022) found that this policy significantly promoted the financialization behavior of enterprises by increasing their costs, reducing commercial credit financing capacity, and hindering innovation. However, Liu and Liu (2022) confirmed that the implementation of the new environmental protection law has a negative impact on financial asset allocation by increasing enterprises’ environmental investment. In addition, taking the green credit policy promulgated in 2007 as a quasi-natural experiment, Zhang et al. (2022) pointed out that the green credit policy significantly inhibited the financialization of heavily-polluting enterprises, especially the financialization under speculative motives. The above studies provide a basis for understanding the relationship between environmental regulatory policies and financial asset allocation of enterprises. However, most studies mainly start from the perspective of command-type environmental regulation, and the research conclusions cannot reach consensus; moreover, the role of government subsidy has not been paid attention to. Therefore, this provides a good research opportunity for the study of this paper.

Hypothesis development

Green credit policy and financial asset allocation of enterprises

Empirical evidence from China indicates that there may be a negative correlation between debt and financial asset allocation (Hu et al. 2017). Therefore, credit restrictions imposed by green credit policy on heavily polluting enterprises may prompt them to increase their holdings of financial assets. This paper discusses this issue based on the precautionary motive and speculative motive of financial asset allocation. From the perspective of the precautionary motivation, enterprises under the credit constraints of green credit policy will increase the allocation of financial assets to cope with the possible cash flow risk and financial crisis in the future. On the one hand, financial assets are more liquid and have lower adjustment costs than real investment (Gamba and Triantis 2008; Brown and Petersen 2011; Ding et al. 2021). Under the credit constraints of green credit policy, heavy-polluting enterprises will increase their holdings of financial assets when they realize the possible liquidity risks in the future. On the other hand, for heavy-polluting enterprises, the implementation of green credit policy reduces the access to debt financing and increases the financing cost through credit restrictions (Su and Lian 2018; Liu et al. 2019; Xu and Li 2020; Li et al. 2022). At this time, they tend to allocate more financial assets when facing debt financing difficulties (Duchin et al. 2017). Therefore, the green credit policy enhances the financial asset holdings of heavily polluting enterprises by strengthening the precautionary motive.

From the perspective of the speculative motivation, enterprises under the credit constraints of green credit policy will obtain more interest returns by increasing financial asset allocation. On the one hand, the green credit policy raises the environmental protection requirements for enterprises’ production and increases the “compliance cost” of production, which reduces enterprises’ operating performance and the return on its real investment (Yao et al. 2021). At this time, faced with the decrease of real investment returns and the increase of financing costs, enterprise managers tend to invest in the financial sector to obtain high returns (Demir 2009a). On the other hand, the process of green transformation has the characteristics of high investment, high risk, and long cycle (Huang et al. 2019), which may make enterprises lose their transformation motivation and invest in the financial sector to obtain more profits and thus strengthen the financial speculative motivation under green credit policy.

In addition, the existing research shows that when facing the impact of environmental policies, managers are more inclined to increase the short-term liquid financial assets to reduce the negative impact on enterprises. Compared with long-term financial assets such as held-to-maturity investment and investment real estate, short-term financial assets such as cash and transactional financial assets have a strong precautionary reserve function due to their liquidity, while holding long-term financial assets is more for speculative motives, which will inevitably crowd out real investment and hinder the development of enterprises in the long run (Becker and Ivashina 2015; Kliman and Williams 2015; Huang et al. 2019). Therefore, in order to alleviate the financing constraints and the uncertainty of future cash flow caused by environmental regulation policies, enterprise managers will choose to allocate more short-term liquid financial assets (Bloom et al. 2007; Almeida et al. 2004). Thus, Hypothesis 1a is proposed.

Hypothesis 1a: Compared with other enterprises, the implementation of green credit policy promotes the financial asset allocation of heavily polluting enterprises, especially the short-term liquid financial asset allocation under precautionary motivation.

However, green credit policy may also inhibit the financial asset allocation of heavy-polluting enterprises. Firstly, according to the porter hypothesis, reasonable environmental regulation can promote the innovation transformation of enterprises, so as to offset the cost caused by environmental regulation and exert the innovation compensation effect (Porter and Linde 1995). Green credit policy can also promote the technological innovation and green transformation of enterprises (Hu et al. 2021; Tian et al. 2022), thus decreasing financial asset holding. Secondly, green credit policy requires financial institutions to provide differentiated loan to enterprises based on their environmental risks. Preferential credit terms and credit resources are provided to environmentally friendly enterprises, which motivates the green transformation of heavy-polluting enterprises. However, green transformation requires not only green innovation but also the purchase of environmental protection equipment, which requires a large amount of capital investment; enterprises have to liquidate and reduce their financial assets. Finally, there is a substitution relationship between commercial credit and bank credit (Fisman and Love 2003). The implementation of green credit policy not only reduces the debt financing of heavily polluting enterprises, but also promotes their commercial credit channel financing. Moreover, in the long run, the “creditors” of commercial credit will gradually take environmental risks as a consideration, so enterprise managers will choose to carry out green transformation and reduce their financial asset allocation. Thus, Hypothesis 1b is proposed.

Hypothesis 1b: The implementation of green credit policy inhibits the financial asset allocation of heavily polluting enterprises.

Mechanism analysis of green credit policy and enterprises’ financial asset allocation

Green credit policy requires all financial institutions to take environmental risk information as a condition for providing loans and restrict the credit of environmental risk enterprises. Heavy-polluting enterprises’ debt financing will be affected accordingly, which may further change their financial asset allocation. On the one hand, from the perspective of supply, green credit policy encourages financial institutions to raise the credit threshold with environmental protection, so the debt financing scale of heavily polluting enterprises will decrease. Green credit policy may also cause heavy-polluting enterprises to bear greater public pressure and moral condemnation through the exposure of negative environmental information, and even face the risk of environmental litigation, which will lead to the withdrawal or refusal of external creditors to provide loans, and further reduce heavy-polluting enterprises’ debt financing scale (Su and Lian 2018). On the other hand, green credit policy may cause heavy-polluting enterprises to face higher operating risks and reduce their operating performance through financing restrictions (Yao et al. 2021). Based on modern contract theory, the principal-agent cost between financial institutions as creditors and enterprises will rise with the increase of project risk. In order to compensate creditors for the losses caused by the possible default risk in the future, heavy-polluting enterprises will pay higher credit costs. Therefore, green credit policy may aggravate the credit constraints of heavily polluting enterprises by reducing the scale of debt financing and increasing financing costs. In order to cope with the possible cash flow crisis and financial risks in the future, enterprises will gradually increase the holding of financial assets, thus stimulating the financial asset allocation under the precautionary motivation. Based on the above analysis, hypothesis 2 is proposed.

Hypothesis 2: Green credit policy strengthens the financial asset allocation of heavily polluting enterprises with precautionary motivation by reducing the scale of debt financing and increasing the financing cost.

The moderating effect of government subsidy on green credit policy and financial asset allocation of enterprises

As one of the important fiscal policy instruments of the Chinese government, when enterprises face the financing constraints generated by green credit policy and change their holdings of financial assets, government subsidy can provide capital sources through direct and indirect ways to affect their financial asset allocation. Therefore, government subsidy has a certain impact on the relationship between green credit policy and enterprises’ financial asset allocation. First, the direct capital allocated of government subsidy replaces the debt financing to provide necessary capital supplement for enterprises and further weakens the negative impact of green credit policy on debt financing of heavily polluting enterprises (Guo et al. 2016). Thus, it reduces the enterprises’ holding financial assets for precautionary motives under the constraints of green credit policy. Second, as a positive signal, government subsidy can convey information about the good operation of enterprises to investors and enhance the external financing capacity of enterprises (Lach 2002; Kleer 2010; Sung 2019; Chen et al. 2019). Thus, it weakens the financing constraint effect caused by the green credit policy on debt financing restrictions of heavily polluting enterprises and alleviates their financing difficulties. Based on the “financing” motivation of financial asset holding, enterprises will reduce their financial investment after obtaining government subsidy. Finally, as a means for local governments to promote investment-driven economic growth, government subsidy aims to encourage enterprises to invest in fixed assets and reduce external investment such as financial assets (Chen et al. 2011). The debt financing constraint of green credit policy on heavy-polluting enterprises increases their willingness to obtain government subsidy, so they increase real investment and reduce financial investment. Therefore, government subsidy can significantly weaken the promoting effect of green credit policy on enterprises’ financial asset allocation, which also verifies the conclusion that government subsidy can alleviate the negative impact of environmental regulation (Lach 2002; Falk 2006; Hu and Liu 2019).

However, government subsidy may also strengthen the promoting effect of green credit policy on enterprises’ financial asset allocation. On the one hand, government subsidy has alleviated the financing constraints of heavily polluting enterprises under the green credit policy, and puts them in a relatively loose capital environment, which lays a solid foundation for financial investment (Du et al. 2019). Facing with the strong market speculation atmosphere in China and the declining attraction of real investment, the heavily polluting enterprises are more likely to hold financial asset for the motive of speculation. On the other hand, China’s government subsidy has obvious property right and scale bias. In heavy polluting industries such as steel and cement, state-owned and large enterprises are in the majority, which is in line with the allocation bias of government subsidy. Such subsidy bias will not only weaken the “forcing effect” of green credit policy on the green transformation of heavily polluting enterprises, but also encourage heavily polluting enterprises to act as “investment intermediary” out of profit-seeking motives and transfer subsidy to other enterprises to obtain profits, thus deepening their own financialization (Du et al. 2017). Therefore, government subsidy will strengthen the promoting effect of green credit policy on enterprises’ financial asset allocation. In summary, competitive hypothesis 3 is proposed.

Hypothesis 3a: Government subsidy significantly weakens the promoting effect of green credit policy on enterprises’ financial asset allocation.

Hypothesis 3b: Government subsidy significantly strengthens the promoting effect of green credit policy on enterprises’ financial asset allocation.

Research design

Sample

A-share listed enterprises of China from 2007 to 2020 are selected as the initial sample in this paper, to ensure the data quality, the following processing is carried out: (1) excluding listed companies in the financial and real estate industries; (2) excluding firms with financial abnormalities, such as ST, *ST, and PT; (3) listed companies and samples with missing data of main variables are deleted. Through the above processing, total 15,585 observations year-firm are obtained. The data all comes from CSMRA, in order to avoid the influence of outliers; all continuous variables are winsorized at the 1% in each tail.

According to the classification standard of Listed Companies’ Environmental Protection Verification Industry Classification Management List issued by the Ministry of Environmental Protection in 2008 and the Guidelines for Industry Classification of Listed Companies issued by the China Securities Regulatory Commission in 2012. Listed companies including coal, oil, and mining industries are classified as heavily polluting industries (experimental group), and other industries are classified as non-heavy pollution industries (control group).

Variables

Dependent variables

The dependent variables of this research are enterprises’ financial asset allocation, including total financial asset allocation (Fin), short-term liquid financial asset allocation (Fins), and long-term speculative financial asset allocation (Finl). According to the study of Demir (2009b), financial assets include monetary funds, trading financial assets, financial assets available for sale, held-to-maturity investments, long-term equity investments, investment real estate, interest receivable, and dividends receivable. Total financial asset allocation is the proportion of financial assets in total assets. Short-term liquid financial asset allocation is the proportion of monetary funds, trading financial assets, interest receivable, and dividends receivable in total assets. Long-term speculative financial asset allocation is measured by the proportion of financial assets available for sale, financial assets held to maturity, net long-term equity investment, and net investment real estate in total assets except short-term financial assets.

Independent variables

The main independent variables in this paper are composed of two dummy variables: treat and after. Treat is the grouping dummy variable, with heavily polluting enterprises taking 1 and non-heavily polluting enterprises taking 0. After is the time dummy variable, since the Green Credit Guidelines were officially promulgated and implemented in 2012, after is equal to 1 if the sample period is after 2012, and is equal to 0 otherwise.

Control variables

According to the existing research (Wang et al. 2021; Zhang et al. 2022), we controls a set of variables that may affect the financial asset allocation, including firm size (Size), ownership nature (Soe), profitability (Roa), financial leverage (Lev), enterprise growth (Oig), the size of the enterprises’ board (Board), and salary incentive (Salary). In addition, firm fixed effects (Firm) and year fixed effects (Year) are controlled, and Table 1 shows the detailed definitions and descriptive statistics of all variables. The mean value of Fin is 0.266, the minimum value is 0.03, and the maximum value is 0.792, indicating that the financial asset allocation level of different heavily polluting enterprises varies greatly. The mean value of Fins is 0.208, and the mean value of finl is 0.052, indicating that enterprises hold much more short-term financial assets than long-term financial assets. The average value of Treat is 0.399, indicating that about 40% of the sample enterprises belong to heavy pollution industries, and the rest are non-heavy pollution enterprises. The mean value of After is 0.589, indicating that more than 50% of the samples are in the policy period. In addition, the mean value of Sub is 0.012, the minimum value is 0, and the maximum value is 0.115, indicating that the amount of government subsidy received by different enterprises varies greatly. Other control variables are consistent with related studies.

Model

Referring to Wen et al. (2021), we construct the following two-way fixed effects DID model to test the impact of green credit policy on financial asset allocation:

where FINit is the level of investment in financial assets of firm i in year t, including total financial asset allocation, short-term liquid financial asset allocation, and long-term speculative financial asset allocation. Treati is the grouping dummy variable, equals 1 for the treatment group, and 0 otherwise. Aftert is the time dummy variable, equals 1 for years at or after the implementation of the Green Credit Guidelines, and 0 otherwise. Xit is a group of control variables. σi is the firm fixed effect, λt is the year fixed effect, and εit is the residual term. This paper focuses on the estimated coefficient of Treati*Aftert; when α1 is significantly positive, it indicates that green credit policy promotes enterprises’ financial asset allocation.

To examine the transmission mechanism of debt financing scale and financing cost, according to Baron and Kenny (1986), the mediating model is established as follows:

where Medit is the variable of intermediary mechanism, including the scale of debt financing (FS) and financing cost (FC) respectively. The scale of debt financing is the ratio of the sum of long-term and short-term borrowings to total assets, and the financing cost is the ratio of interest payable to total liabilities. The coefficient β1 in formula (2) is the total effect of green credit policy on enterprises’ financial asset allocation; the coefficient β2 in formula (3) is the effect of green credit policy on enterprises’ debt financing scale or financing cost, and the coefficient β4 in formula (4) is the effect of enterprises’ debt financing scale or financing cost on enterprises’ financial asset allocation. In this paper, the stepwise regression test coefficient method is adopted. If the coefficients β1, β2, and β4 in the model are all significant, then the mediating transmission mechanism exists.

The analysis above indicates that the relationship between green credit policy and financial investment decisions of enterprises will also be affected by government subsidy. Thus, we further test the moderating effect of government subsidy on green credit policy and financial asset allocation of enterprises, and add the interaction term of government subsidy variable (Sub) and Treat* After on the basis of formula (1), and the model is constructed as follows:

where Subit is the government subsidy, if the main coefficient α3 is negative, it indicates that government subsidy has a significant negative moderating effect on green credit policy and enterprises’ financial asset allocation.

Empirical results and analysis

Baseline estimation

Table 2 reports the regression results for the influence of the green credit policy on financial asset allocation of heavy-polluting enterprises. When the dependent variables of columns (1)–(4) of Table 2 are total financial asset allocation and short-term liquid financial asset allocation, the regression coefficients of green credit policy are all significantly positive. While in columns (5) and (6), when the dependent variables are long-term speculative financial asset allocation, the coefficients of green credit policy are not significant, which indicates that green credit policy has significantly promoted the financial asset allocation of heavy-polluting enterprises. Furthermore, the promotion effect is mainly reflected in short-term liquid financial asset allocation, indicating that the implementation of green credit policy has prompted heavy-polluting enterprises to increase their financial asset holdings under precautionary motivation. The possible reason is that the implementation of green credit policy makes it more difficult for heavily polluting enterprises to obtain loans from financial institutions. In addition, compared with long-term speculative financial assets, short-term financial assets have stronger liquidity. In order to alleviate the external financing constraints and the uncertainty of cash flow caused by the green credit policy, rational managers will choose to allocate more short-term liquid financial assets, which verifies hypothesis 1a in this paper.

Mechanism test

According to the previous analysis, this paper tests the mechanism of green credit policy affecting the financial asset allocation of heavily polluting enterprises based on the debt financing scale and financing cost channels. The regression results are shown in Table 3. Columns (1)–(3) in the table are the mechanism test results of the debt financing scale channel, and columns (4)–(6) are the mechanism test results of the debt financing cost channel. It can be seen that the coefficient of green credit policy in column (1) is significantly negative at the level of 1%, and the regression coefficient in column (4) is positive at the significance level of 1%, which indicates that green credit policy significantly reduces the debt financing scale and increases the financing cost of heavily polluting enterprises. Meanwhile, the coefficients of debt financing scale and financing cost in columns (2), (3), (5), and (6) with green credit policy are all significant at the level of 1%. It indicates that green credit policy promotes the financial asset allocation of heavily polluting enterprises by reducing the scale of debt financing and increasing the financing cost, especially the short-term liquid financial asset allocation under precautionary motivation. Hypothesis 2 is verified.

The moderating effect test

Table 4 shows the moderating effect of government subsidy on green credit policy and financial asset allocation of heavily polluting enterprises. We find that the estimated coefficients of treat*after are all significantly negative at the 1% level, which indicates that government subsidy significantly weakens the promotion effect of green credit policy on the financial asset allocation of heavily polluting enterprises, especially the short-term financial asset allocation under precautionary motivation. That is, government subsidy has a significant negative moderating effect on green credit policy and financial asset allocation of heavily polluting enterprises. It shows that government subsidy can alleviate the financing restrictions of green credit policy on heavily polluting enterprises and reduce their holding of financial assets for precautionary motives in response to possible liquidity risks and financial crises in the future. Therefore, hypothesis 3 of this paper is verified.

Heterogeneity analysis

Intensity of environmental regulation

As an environmental regulation with bilateral characteristics of command-type and market-type, the effect of green credit policy will be affected by the strength of regional policy implementation and the intensity of environmental regulation, so the moderating effect of government subsidy on green credit policy and financial asset allocation of enterprises also varies in different areas. Specifically, compared with enterprises in areas with low environmental regulation intensity, the negative moderating effect of government subsidy on green credit policy and enterprises’ financial asset allocation is more significant in areas with high environmental regulation intensity. The reason is that enterprises located in areas with high environmental regulation intensity will hold financial assets with stronger precautionary motivation when facing green credit policy, and government subsidy has a more significant impact on green credit policy and financial asset allocation.

In order to test the above analysis, the intensity of environmental regulation is the proportion of investment in the treatment of industrial pollution sources in the main business cost of industrial enterprises above designated size in each area. And the median of the above indicators is used as the critical point; the whole sample is divided into the high and the low environmental regulation area group for regression. Table 5 presents the results of the group test. In columns (1) and (3), the coefficients of Treat*After*Sub are significantly positive at the 5% level, while in columns (2) and (4), the coefficients are not significant, which indicates that the negative moderating effect of government subsidy on green credit policy and enterprises’ financial asset allocation is more significant in areas with high environmental regulation intensity. It also shows that the difference of environmental regulation intensity between areas is an important reason for the different effects of the moderating effect of government subsidy on green credit policy and enterprises’ financial asset allocation.

Regional financial development level

The moderating effect of government subsidy on green credit policy and enterprises’ financial asset allocation may also be affected by the level of external financing environment. On the one hand, the higher the level of regional financial development is, the greater the financing opportunities that enterprises can obtain, so they are less affected by green credit policy on their financial asset allocation under precautionary motives, and the negative impact of government subsidy on green credit policy and financial asset allocation is also weak. On the other hand, the spatial agglomeration of financial institutions brought about by regional financial development will increase information dissemination and sharing among financial institutions. Therefore, the negative environmental risk information of the heavily polluting enterprises will make them face less financing. In this case, the credit restriction of green credit policy on heavily polluting enterprises will greatly stimulate their financial asset allocation under precautionary motivation, and the negative effect of government subsidy on green credit policy and financial asset allocation of heavily polluting enterprises will be more significant.

Based on the above analysis, the ratio of loans of financial institutions to GDP in each province is selected to measure the regional financial development (Héricourt and Poncet 2015). And the median of regional financial development level is used as the critical point, we separate sample into the following two subgroups: high-level regional financial development group and low-level regional financial development level group. Table 6 presents the results of the group test. Compared with the group of regions with low level of financial development in columns (2) and (4), the estimated coefficients of Treat*After*Sub are larger in the group of regions with high level of financial development in columns (1) and (3), which indicates that the negative moderating effect of government subsidy on green credit policy and enterprises’ financial asset allocation is more significant in areas with high environmental regulation intensity. It also shows that the difference in the level of financial development between areas is also an important reason for the different effects of the moderating effect of government subsidy on green credit policy and enterprises’ financial asset allocation.

Robustness test

Parallel trend test

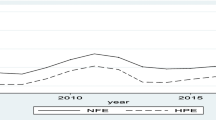

The application premise of the DID model is that the treatment group and the control group need to meet the parallel trend test; we use the event study method for testing. With 2012 as the bench mark year, the interaction items with group dummy variable (Treat) in each year before and after 2012 are introduced into the model, and then we define as Before3, Before2, Before1, Current, After1, After2, and After3, respectively. The regression results are shown in column (1) and (2) of Table 7. The estimated coefficients of before1, before2, and before3 in the table are not significant, indicating that the results satisfy the parallel trend assumption. The coefficient estimates are significantly positive in the last 2 years of 2012, indicating that the green credit policy does promote the financial asset allocation of heavily polluting enterprises. The coefficients of 2012 and the year after 2012 are not significant; the reason is that after the implementation of the green credit policy, it is a long process for banks to formulate and implement the differentiated credit policy and then affect the financial asset allocation of enterprises. Therefore, there is a certain lag in the effect of the policy, which is shown in this study as a significant impact from the last 2 years after the implementation of the policy.

In addition, Fig. 1 shows the estimated coefficients of the regression results in Table 7 at the 95% confidence level. The regression coefficients of berore3, before2, and before1 are not significant (not significantly different from 0), while the regression coefficients of after2 and after3 are significantly positive. It proves that the introduction of green credit policy promotes the financial asset allocation of heavy-polluting enterprises.

Placebo test

In order to exclude that the main results of this paper may be affected by other non-observed missing variables, the placebo test is conducted by randomly selecting the treatment group. We draw a random sample of 1178 enterprises (equal to the number of treated enterprises in baseline regression) as the treatment group and the rest as the control group. Based on these “pseudo” treatment and control groups, we rerun the regressions using model (1) and then repeat this procedure 1000 times. Figure 2 shows the probability density distribution of coefficient estimates and the scatter distribution of corresponding P values. The results show that after the treatment group is randomly selected, the estimated coefficients of Treat*After are concentrated around 0, and the vast majority of the estimated values have a large P value, which indicates that the empirical conclusion of this paper is not an accidental result.

PSM-DID

In order to mitigate potential selection bias and enhance the comparability between the treatment group and the control group. In this paper, propensity score matching and the combination of difference-difference method are used for robustness analysis. Specifically, the enterprise size (Size), ownership nature (Soe), profitability (Roa), financial leverage (Lev), enterprise growth (Oig), board structure (Board), and compensation incentive (Salary) are selected as characteristic variables. The logit model is used to estimate the probability of each sample being selected into the treatment group and then match enterprises by the radius matching method. Table 8 shows the balance test results of PSM. It can be seen that there is no significant difference in the characteristic variables between the treatment group and the control group after PSM. In addition, according to the results in columns (3) and (4) of Table 7, the estimated coefficients of Treat*After are still significantly positive, which are consistent with the main results.

Replace the explained variable

Replacing financial assets with monetary funds, trading financial assets, financial assets available for sale, held-to-maturity investments, investment real estate, and dividends receivable and dividends receivable and re-estimated. The regression results are shown in columns (5)–(7) of Table 7. It can be seen that when the dependent variables are overall financial asset allocation and short-term liquid financial asset allocation, the regression coefficient of Treat*After is significantly positive, which is consistent with the previous conclusions.

Exclude the influence of other external environments

In order to test whether the promotion effect on enterprises’ financial asset allocation is caused by the green credit policy, rather than the impact of other external environments. We consider the possible impact of the introduction of the New Environmental Protection Law in 2015, the financial crisis in 2008, the pilot policy of carbon trading market in 2011, and green finance reform and innovation pilot zones respectively. First, for the possible impact of the New Environmental Protection Law issued in 2015, the time dummy variable is defined: for the year is 2015 and later is 1, otherwise it is 0, and it is added to the model for regression as an interaction term after multiplying with the group dummy variable. Second, in order to exclude the possible impact of the 2008 global financial crisis on enterprises’ financial asset holding, the samples of 2008 are excluded for estimation. Third, in 2011, the National Development and Reform Commission launched carbon emission trading pilot programs in Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong, and Shenzhen. In order to exclude the possible influence of this factor on the results, we re-run the regression using the sample excluding the pilot provinces and cities. Finally, we further exclude the possible impact of green finance reform and innovation pilot zones on financial asset allocation of enterprises. The five provinces of Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang, which have established green finance reform and innovation pilot zones, are used as the treatment group, and the other provinces are taken as the control group. The establishment time of the Green Finance Reform and Innovation Pilot Zone is 2017, so the value of 2017 and subsequent years is 1, and the value of the years before 2017 is 0. Then, the interaction term of the group dummy variable and the time dummy variable mentioned above are added into the model as a control variable for regression. Table 9 shows the regression results for the first three external environments, and the columns (1) to (2) of Table 10 show the regression results after excluding the possible impact of green finance reform and innovation pilot zones on enterprises’ financial asset allocation. It can be seen that the estimated coefficient of Treat*After is still significantly positive, indicating that after controlling other external environmental factors, green credit policy still significantly promotes the financial asset allocation of heavily polluting enterprises.

Change industry definition standards

The industry definition standards of the experimental group and the control group are further changed for regression. According to the Green Credit Guidelines issued in 2012, the former China Banking Regulatory Commission (CBRC) defined the types of environmental and social risks in the Key Evaluation Indicators for the Implementation of Green Credit Policy. Referring to the research of Wang and Wang (2021), this paper identifies whether listed enterprises are heavy pollution industries according to the industries of enterprises with environmental and social risks of class A and class B. Specifically, the industries of class A enterprises belong to nine industries, including nuclear power generation, hydropower generation, coal mining, and washing industry. The industries of class B enterprises include 25 industries such as cotton printing and dyeing finishing, wool dyeing and finishing, hemp dyeing, and finishing. If the listed enterprises belong to the above industries, then identify it as a heavy pollution industry; otherwise, it is identified as a non-heavy pollution industry. The regression results are shown in columns (3) to (4) of Table 10. It can be seen that the relationship between green credit policy and financial asset allocation of enterprises is still robust after changing the industry definition standard.

Further analysis

The above empirical results demonstrate that the green credit policy promotes the financial asset allocation of heavily polluting enterprises, especially the holding of short-term liquid financial assets under precautionary motivation. Then, how does the increase of financial investment affect the “shifting from virtual to real” of heavy-polluting enterprises? And what is the role of government subsidy? In order to verify these questions, we refer to the research of Baron and Kenny (1986) for further testing. It is worth noting that most of the previous literature regards the inhibition of enterprises’ financial asset allocation as the realization of “shifting from virtual to real.” However, the reduction of financial investment does not mean the real realization of shifting from virtual to real (net increase of real investment), which depends on the difference value between real investment and financial investment. Therefore, it is particularly important to further explore the green credit policy for enterprises to reverse the situation of shifting from real to virtual and truly realize the shifting from virtual to real.

We construct the index of enterprise shifting from virtual to real (VTR) and defined it as follows: if the real investment rate of the enterprise in the current year increases and the financial investment rate decreases (real increase and virtual decrease) compared with the previous year, VTR is the sum of the absolute value of the increase in the real investment rate and the absolute value of the decrease in the financial investment rate. If the real investment rate of the enterprise in the current year decreases and the financial investment rate increases (real decrease and virtual increase) compared with the previous year, then VTR is expressed as the sum of the absolute value of the decrease in the real investment rate and the absolute value of the increase in the financial investment rate with a negative sign. The real investment rate of enterprises is the proportion of the net amount of fixed assets, construction in progress, engineering materials, productive biological assets, oil and gas assets, intangible assets, development expenses, and long-term deferred expenses to the total assets. VTR includes both positive and negative values. If the value of VTR is positive, it means that the enterprise is shifting from virtual to real, and if it is negative, it means that the enterprise is shifting from real to virtual. In addition, the larger the absolute value of VTR is, the greater the degree of shifting from virtual to real (or shifting from real to virtual). Therefore, if the regression coefficient between green credit policy and VTR is significantly positive, it indicates that green credit policy can promote enterprises shifting from virtual to real. While it is significantly negative, it indicates that green credit policy can inhibit enterprises shifting from virtual to real. In addition, in order to make the measurement of VTR more concise and accurate, the definition range in this paper only includes “real increase and virtual decrease” and “real decrease and virtual increase.”

Table 11 shows the regression results. The estimated coefficient of Treat*After in column (1) is not significant, which indicates that the implementation of green credit policy does not promote enterprises shifting from virtual to real. The results in column (4) show that the coefficient of Treat*After*Sub is significantly positive, indicating that under the constraint of green credit policy, the implementation of government subsidy will promote enterprises shifting from virtual to real. The results in column (5) and (6) show that the coefficient of Treat*After*Sub and financial asset allocation are both significantly negative at the level of 1%, which indicates that the negative moderating effect of government subsidy on green credit policy and enterprises’ financial asset allocation significantly promotes the shifting from virtual to real of heavy-polluting enterprises by reducing financial asset allocation. The possible reason is that the government subsidy weakens the promoting effect of green credit policy on the financial asset allocation of heavy-polluting enterprises under the precautionary motive through direct and indirect financial support and further improves the real investment, thus promoting the shifting from virtual to real of heavy-polluting enterprises.

Conclusions and implications

As an important environmental regulation with bilateral characteristics of command-type and market-type, green credit policy aims to achieve green and sustainable economic development through the reallocation of financial resources. After the implementation of green credit policy in 2012, whether the financial resources can finally return to the real sector? Whether the government subsidy can cooperate with the green credit policy to truly realize the shifting from virtual to real of enterprises? These are undoubtedly important factors for the realization of green and sustainable economic development. Therefore, this paper mainly analyzes the impact of green credit policy in 2012 on enterprises’ financial asset allocation and the moderating effect of government subsidy in order to provide some thoughts for the final realization of low-carbon and environment-friendly development and achieve green transformation of economic. The conclusions are as follows:

First, we find that the implementation of China’s Green credit policy significantly promotes the financial asset allocation of heavy-polluting enterprises, and this promotion effect is mainly reflected in the short-term liquid financial asset allocation, thus supporting the precautionary motivation of holding financial assets. Second, the mechanism analysis shows that green credit policy promotes the financial asset allocation of heavy-polluting enterprises by reducing the scale of debt financing and increasing the financing cost. Third, government subsidy can significantly weaken the promoting effect of green credit policy on enterprises’ financial asset allocation, and there is heterogeneity due to the regional environmental regulation intensity and financial development level. Finally, further analysis shows that the negative moderating effect of government subsidy on green credit policy and enterprises’ financial asset allocation significantly promotes the shifting from virtual to real of heavy-polluting enterprises by reducing financial asset allocation. Based on the above conclusions, the policy implications of this paper are as follows:

Firstly, the implementation of green credit policy should be targeted to avoid “one size fits all.” The results of this paper confirm that the implementation of green credit policy will promote the financial asset allocation under the precautionary motivation of heavy-polluting enterprises, which is not conducive to the real investment and the realization of policy goals. The main reason is that most of China’s heavily polluting enterprises are still in the stage of being forced to accept green credit policy, and they lack the willingness and motivation to take the initiative in green transformation. On the one hand, they are limited by the financial constraints of green transformation. On the other hand, they are faced with technical difficulties and the uncertainty of the results in the transformation process. Therefore, the government should fully consider the financial and technical problems faced by some enterprises in the process of green transformation, and take appropriate assistance measures for enterprises with the willingness to transform but limited ability. At the same time, environmental policy regulatory tools should be continuously enriched to fully stimulate the autonomy and enthusiasm of enterprises in the process of transformation.

Secondly, the policy mix should be used to promote the enterprises shifting from virtual to real and green transformation. Effective environmental policy is a highly unified constraint and incentive. While implementing green credit policy, effective subsidy incentives should also be taken into account, so as to build an environmental policy system with green credit policy as the main and government subsidy as the auxiliary. The implementation of green credit policy will promote the financial asset holding of enterprises under the precautionary motive through financing restrictions, but reasonable government subsidy will encourage enterprises to reduce financial investment and increase real investment. Therefore, giving full play to the complementary advantages of different policy combinations is of great significance for promoting enterprises shifting from virtual to real and achieves sustainable economic development. In addition, for regions with high intensity of environmental regulation and high level of financial development, the implementation of policy mix should be moderately increased to promote local heavy-polluting enterprises to accelerate real investment and complete green transformation. In the process of implementation of government subsidy, government should also pay attention to the negative impact brought by the misallocation of subsidy resources while giving full play to the guiding role of government subsidy.

Finally, enterprises themselves should also be clear in the face of increasingly stringent environmental regulation and increasingly fierce market competition in the future. Only by reducing investment in the financial sector, increasing investment in the real sector, and finally realizing green transformation can they ultimately enhance their core competitiveness and achieve long-term sustainable development.

The research results of this paper are based on the analysis and testing of Chinese enterprises as samples. Therefore, the research results have certain reference significance for countries around the world, especially developing countries with similar development backgrounds to China, to further clarify the effect and internal mechanism of green credit policy on financial asset allocation of enterprises as well as the moderating effect of government subsidy, so as to promote enterprises from virtual to real and achieve sustainable economic development.

Data availability

The datasets used or analyzed during the current study are available from the corresponding author on reasonable request.

References

Acharya V, Qian J, Yang Z (2019) In the shadow of banks: wealth management products and issuing banks’ risk in China. SSRN working paper, No. 3401597

Almeida H, Campello M, Weisbach MS (2004) The cash flow sensitivity of cash. J Finance 59(4):1777–1804

Baron RM, Kenny DA (1986) The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51(6):1173–1182

Barradas R, Lagoa S (2017) Financialization and Portuguese real investment: a supportive or disruptive relationship? J Post Keynes Econ 40:413–439

Becker B, Ivashina V (2015) Researching for yield in the bond market. J Finance 70(5):1863–1902

Bloom N, Bond S, Van Reenen J (2007) Uncertainty and investment dynamics. Rev Econ Stud 74(2):391–415

Brown JR, Petersen BC (2011) Cash holdings and R&D smoothing. J Corp Finance 17:694–709

Cai HJ, Xie QX, Zhang HM (2021) Contingency or profit: institutional logic of inancialization of entity enterprises from the perspective of environmental regulation. Account Res Stud 4:78–88 ((in chinese))

Chen SM, Sun Z, Tang S, Wu DH (2011) Government intervention and investment efficiency: evidence from China. J Corp Finan 17(2):259–271

Chen X, Li ML, Zhang ZZ (2019) Environmental regulation, government subsidies and green technology innovation——empirical research based on the mediation effect model. J Ind Technol Econ 38:18–25 ((In Chinese))

Cole MA, Elliott RJR, Okubo T (2010) Trade, environmental regulations and industrial mobility: an industry-level study of Japan. Ecol Econ 69(10):1995–2002

Davis JS (2014) Financial integration and international business cycle co-movement. J Monet Econ 64:99–111

Demir F (2009a) Capital market imperfections and financialization of real sectors in emerging markets: private investment and cash flow relationship revisited. World Dev 37(5):953–964

Demir F (2009b) Financial liberalization, private investment and portfolio choice: financialization of real sectors in emerging markets. J Dev Econ 88(2):314–324

Ding S, Guariglia A, Knight J, Yang J (2021) Negative investment in China: financing constraints and restructuring versus growth. Econ Dev Cult Change 37:1490–1507

Du Y, Xie J, Chen J (2019) CEO’s financial background and the financialization of entity enterprises. China Ind Econ 5:136–154 ((in Chinese))

Du J, Li C, Wang Y (2017) A comparative study of shadow banking activities of non-financial firms in transition economies. China Econ Rev 46:S35–S49 (in Chinese)

Duchin R, Gilbert T, Harford J, Hrdlicka C (2017) Precautionary savings with risky assets: when cash is not cash. J Financ 72(2):793–852

Duong HN, Nguyen JH, Nguyen M, Rhee SG (2020) Navigating through economic policy uncertainty: the role of corporate cash holdings. J Corp Finan 62:101607

Falk M (2006) What drives business research and development (R&D) intensity across Organisation for Economic Cooperation and Development (OECD) countries? Appl Econ 38:533–547

Fan HC, Peng YC, Wang HH, Xu ZW (2021) Greening through finance? J Dev Econ 152:102683

Fisman R, Love I (2003) Trade credit, financial intermediary development, and industry growth. J Finance 58(1):353–374

Gamba A, Triantis AJ (2008) The value of financial flexibility. J Finance 63:2263–2296

Guo P (2014) Financial policy innovation for social change: a case study of China’s green credit policy. Int Rev Sociol 24(1):69–76

Guo D, Guo Y, Jiang K (2016) Government-subsidized R&D and firm innovation: evidence from China. Res Policy 45(6):1129–1144

Héricourt J, Poncet S (2015) Exchange rate volatility, financial constraints, and trade: empirical evidence from Chinese firms. World Bank Econ Rev 29(2):550–578

Hering L, Poncet S (2014) Environmental policy and exports: evidence from Chinese cities. J Environ Econ Manag 68(2):296–318

Hu S, Liu S (2019) Do the coupling effects of environmental regulation and R&D subsidies work in the development of green innovation? Empirical evidence from China. Clean Technol Environ Policy 21(9):1739–1749

Hu Y, Wang X, Zhang J (2017) The motivation for financial asset allocation: reservoir or substitution?——evidence from Chinese listed companies. Econ Res J 52(1):181–194 ((in Chinese))

Hu Y, Jiang H, Zhong Z (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysisc. Environ Sci Pollut Res 27(10):10506–10519

Hu GQ, Wang XQ, Wang Y (2021) Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ 98:105134

Huang JL, Luo Y, Peng YC (2019) Corporate financial asset holdings under economic policy uncertainty: precautionary saving or speculating? Int Rev Econ Financ 76:1359–1378

Kleer R (2010) Government R&D subsidies as a signal for private investors. Res Policy 39(10):1361–1374

Kliman A, Williams S (2015) Why financialization hasn’t depressed U.S. productive investment. Camb J Econ 39(1):67–92

Krippner GR (2005) The financialization of the American economy. Soc Econ Rev 3(2):173–208

Lach S (2002) Do R&D subsidies stimulate or displace private R&D? Evidence from Israel. J Ind Econ 50:369–390

Lai H, Wang F, Guo C (2022) Can environmental awards stimulate corporate green technology innovation? Evidence from Chinese listed companies. Environ Sci Pollut Res 29(10):14856–14870

Lei X, Wang Y, Zhao D, Chen Q (2021) The local-neighborhood effect of green credit on green economy: a spatial econometric investigation. Environ Sci Pollut Res 28:65776–65790

Lemmon M, Roberts MR (2010) The response of corporate financing and investment to changes in the supply of credit. J Financ Quant Anal 45:555–587

Li Q, Dong B (2022) How does China’s green credit policy affect the green innovation of heavily polluting enterprises? The perspective of substantive and strategic innovations. Environ Sci Pollut Res 29:77113–77130

Li WA, Cui GY, Zheng MN (2022) Does green credit policy affect corporate debt financing? Evidence from China. Environ Sci Pollut Res 29(4):5162–5171

Ling SX, Han GS, An D et al (2020) The impact of green credit policy on technological innovation of firms in pollution-intensive industries: evidence from China. Sustainability 12(11):4493

Liu X, Liu FZ (2022) Environmental regulation and corporate financial asset allocation: a natural experiment from the new environmental protection law in China. Financ Res Lett 47:102974

Liu XH, Wang EX, Cai DT (2019) Green credit policy, property rights and debt financing: quasi-natural experimental evidence from China. Financ Res Lett 29:129–135

Liu JJ, Zhao M, Wang YB (2020) Impacts of government subsidies and environmental regulations on green process innovation: a nonlinear approach. Technol Soc 63:101417

Mamun MA, Boubaker S, Nguyen DK (2022) Green finance and decarbonization: Evidence from around the world. Financ Res Lett 46:102807

Milberg W (2008) Shifting sources and uses of profits: sustaining US financialization with global value chains. Econ Soc 37(3):420–451

Modell S, Yang CL (2018) Financialisation as a strategic action field: an historically informed field study of governance reforms in Chinese state-owned enterprises. Crit Perspect Account 54:41–59

Peng B, Yan W, Elahi E, Wan A (2021) Does the green credit policy affect the scale of corporate debt financing? Evidence from listed companies in heavy pollution industries in China. Environ Sci Pollut Res 29:755–767

Porter ME, van der Linde C (1995) Toward a new conception of the environment competitiveness relationship. J Econ Perspect 9(04):97–118

Scholtens B, Dam L (2007) Banking on the equator-are banks that adopted the equator principles different from non-adopters? World Dev 35(8):1307–1328

Soundarrajan P, Vivek N (2016) Green finance for sustainable green economic growth in India[J]. Agric Econ 62(1):35–44

Su D, Lian L (2018) Does green credit policy affect corporate financing and investment? Evidence from publicly listed firms in pollution-intensive industries. J Financ Res 12:123–137 ((in Chinese))

Sung B (2019) Do government subsidies promote firm-level innovation? Evidence from the Korean renewable energy technology industry. Energy Policy 132:1333–1344

Tang HQ, Zhang CS (2019) Investment risk, return gap, and financialization of non-listed non-financial firms in China. Pac Basin Financ J 58:101213

Tian C, Li X, Xiao L (2022) Exploring the impact of green credit policy on green transformation of heavy polluting industries. J Clean Prod 335:130257

Tori D, Onaran Ӧ (2018) The effects of financialization on investment: evidence from firm-level data for the UK. Camb J Econ 42(5):1393–1416

Wang C (2019) A literature review on corporate financialization. Am J Ind Bus Manag 9:647–657

Wang X, Wang Y (2021) Green credit policy promotes green innovation research. Manag World 37(6):173–188 ((in chinese))

Wang Y, Lei X, Long R, Zhao JJ (2020) Green credit, financial constraint, and capital investment: evidence from China’s energy-intensive enterprises. Environ Manag 66(6):1059–1071

Wang H, Wang W, Alhaleh SEA (2021) Mixed ownership and financial investment: evidence from Chinese state-owned enterprises. Econ Anal Policy 70:159–171

Wang HT, Qi SZ, Zhou CB, Zhou JJ, Huang XY (2022) Green credit policy, government behavior and green innovation quality of enterprises. J Clean Prod 331:129834

Wen H, Lee CC, Zhou F (2021) Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ 94:105099

Xie G, Yang Y, Jiang K (2022) The effect of the new environmental protection law on corporate financialization in China. Environ Sci Pollut Res 29:83596–83611

Xing C, Zhang Y, Tripe D (2021) Green credit policy and corporate access to bank loans in China: the role of environmental disclosureand green innovation. Int Rev Financ Anal 77:101838

Xu XK, Li JS (2020) Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J Clean Prod 264:121574

Xu S, Zhao X, Yao S (2018) Analysis of the effect of green credit on the upgrading of industrial structure. J Shanghai Univ Financ Econ 20:59–72

Yang LY, Zhang ZY (2022) The influence of green credit policy on enterprise green innovation. Sci Res 40(02):345–356 ((in chinese))

Yao SY, Pan YY, Sensoy A, Uddin GS, Cheng FY (2021) Green credit policy and firm performance: What we learn from China. Energy Econ 101:105415

Yin X (2021) Research on the impact of green credit on the financial performance of commercial banks. Financ Mark 6:71

Zhang SL, Wu ZH, Wang Y, Hao Y (2021) Fostering green development with green finance: an empirical study on the environmental effect of green credit policy in China. J Environ Manag 296:113159

Zhang Y, Xie H, Li J (2022) Does green credit policy mitigate financialization? Evidence from Chinese heavily polluting enterprises. Environ Sci Pollut Res 30(3):7380–7401

Funding

This work is supported by the Humanities and Social Science Research Foundation Project of Yunnan University (number 2022YNUGSP28) and the Scientific Research Fund Project of Education Department of Yunnan Province (number 2023J0063).

Author information

Authors and Affiliations

Contributions