Abstract

The vital role that digital transformation plays in reducing carbon emissions has been made clear by the exponential growth of digital technology. Consequently, figuring out how to effectively employ digital transformation to improve carbon performance is both a significant issue for businesses and a chance for sustainable development. This research investigates the relationship between corporate digital transformation and corporate carbon performance using unbalanced panel data from A-share listed companies in Shanghai and Shenzhen from 2012 to 2020, as well as the moderating effect of the strength of local low-carbon policies. It is found that: (1) there is a significant U-shaped relationship between corporate digital transformation and carbon performance; (2) the strength of local low-carbon policies positively moderates the relationship between corporate digital transformation and carbon performance; and (3) heterogeneity analysis reveals that the U-shaped relationship between digital transformation and corporate carbon performance is more prominent among large firms, firms in heavily polluting industries, and firms with high R&D intensity, and state-owned enterprises. This study adds to the body of knowledge on the studies of carbon reduction enabled by digital transformation and serves as a guide for the development of local low-carbon policies.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

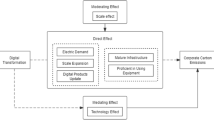

Digital transformation is a crucial aspect of the global wave of technology and industrial revolution. It not only drives economic and social changes worldwide but also plays a vital role in promoting high-quality development of China’s modernized economy (Liu et al., 2020), as shown in Fig. 1. Enterprises, as major contributors to market economy development, have the primary responsibility for digital economic transformation and development (Wu et al., 2021). With policy guidance and practical development as driving forces, digital transformation has become an inevitable choice for enterprises seeking high-quality growth (Autio et al., 2018). Enterprise digital transformation involves efficiently integrating information technology, communication networks, and artificial intelligence technologies while optimizing resource allocation. This process leads to transformative restructuring in production methods, business processes, organizational structures, and commercial models. Its goal is to drive systematic innovation upgrades within enterprises with the aim of enhancing value creation (Vial, 2019; Hanelt et al., 2021). The adoption of digital transformation is crucial for enterprises to improve their competitiveness, and it is a necessary strategy for their survival and growth. China, the world’s largest developing country, is facing increasingly severe environmental problems due to rapid economic development. This has led to a significant increase in energy consumption and carbon emissions, surpassing the USA as the largest emitter of carbon dioxide (Wang et al., 2014; Irfan et al., 2021; Su et al., 2014). To address these issues, President Xi Jinping announced at the 75th session of the United Nations General Assembly in September 2020 that China aims to peak its carbon emissions before 2030 and achieve carbon neutrality by 2060. This “dual-carbon” goal holds global significance as it encourages countries worldwide to prioritize energy conservation and emission reduction for effective environmental governance. Therefore, focusing on how Chinese enterprises can reduce their carbon footprint will contribute not only to China’s efforts but also to global initiatives in reducing carbon emissions. Wu Hequan, a member of the Chinese Academy of Engineering, stressed the importance of digitalization in reducing carbon emissions in 2021 at the first China Digital Carbon Neutrality Summit Forum (Zhu, 2021). He stated that established sectors may be persuaded to use digital technology to reduce emissions and conserve energy to assist them meet the double carbon objective.

Most recent study focuses on the effect of the digital economy on the intensity and effectiveness of carbon emission production at the macro- and meso-levels, e.g., countries, regions, and cities. However, consistent research findings have not yet been made. The majority of academic research have found that digital empowerment significantly increases the ability of nations, regions, and cities to reduce their carbon emissions. For instance, some scholars found that the digital economy can greatly cut the carbon emission intensity of cities and regions while simultaneously increasing the carbon emission efficiency (Yi et al., 2022; Wang et al., 2022; Ma et al., 2022). For another example, Dong et al. (2022) demonstrated that advancements in the digital economy can contribute to reductions in carbon emissions by using panel data from 60 different countries. However, some studies assumed that carbon emissions and regional digital economy growth have an inverted U-shaped relationship with the evolution of the digital economy development stage (Li & Wang, 2022; Cheng et al., 2023).

Few studies in recent years have recognized digital transformation as an antecedent factor for boosting the carbon performance of businesses at the level of business, but Sheng et al. (2022) and Shang et al. (2023). The existing literature on the study of antecedent factors contributing to corporate carbon performance focuses on the following aspects. Firstly, many studies explored the impact of institutional environmental factors such as environmental regulations and pilot policies on corporate carbon performance (Shen et al., 2020; Xuan et al., 2020), green finance experimental reform policies (Ren et al., 2020; Meo & Abd, 2022), and environmental regulatory frameworks (Haque & Ntim, 2018; Du & Li, 2020). Secondly, some studies have explored the corporate social responsibility (He et al., 2023a, 2023b) on the carbon performance based on the social role of enterprises.

Corporate carbon performance is also closely related to the external policy environment (Ashraf et al., 2020; Luo, 2019). However, in the existing research, there is a dearth of a well-organized set of low-carbon policies to achieve the “dual-carbon” goal. In addition, there have only been a handful of studies that have attempted to quantify the effect that local low-carbon policy measures have on the carbon performance of corporations. Therefore, this paper aims to explain the contextual conditions that impact enterprise digital transformation on their carbon performance by making use of the strength of local low-carbon policies as a moderating variable.

The following is a summary of the major contributions that can be drawn from reading this article. Firstly, there is a dearth of evidence at the micro-level in the existing body of academic work concerning the connection in digital transformation and corporate carbon performance. Although there have been some studies on this topic, they primarily focus on the macro level of countries, industries, or regions. Therefore, the value of this paper rests in its ability to provide micro-level evidence on how digital transformation affects the carbon performance of businesses. By doing so, the paper fills a relatively unexplored research field and consequently can be used as a useful reference for relevant scholars and practitioners. Secondly, the digital transformation of businesses is taken as an influential factor to investigate the nonlinear effect that it has on corporate carbon performance combining from the digital empowerment theory. This will help to enrich the research on the antecedent conditions of corporate carbon performance. Thirdly, this study introduces local low-carbon policy strength as a moderating variable based on institutional theory. Through an analysis of the influence that the strength of local low-carbon policy has on the connection between digital transformation and carbon performance, the purpose of this paper is to provide a description of the background factors of digital transformation on the carbon performance of companies. The findings of this research will assist in gaining insight into the boundary influence of digital transformation on corporate carbon performance as well as the implementation effect of low-carbon policies.

2 Literature review and hypotheses development

2.1 Digital transformation and enterprises’ carbon performance

Strategic transformation theory refers to the adjustment and transformation of the existing strategy of an enterprise in the process of operation as the internal and external environment changes (Mintzberg & Westley, 1992; Johnson et al., 2012; Davis et al., 2010). This theory places a strong emphasis on the idea that strategic transformation is an ongoing process that involves the interaction between an organization’s internal resources and capabilities and its external environment. The theory of strategic transformation recognizes that strategic transformation is not a one-time event or a linear process but rather a continuous evolutionary process that involves feedback loops, learning, and adaptation (Davis et al., 2010; Mintzberg & Westley, 1992).

Digital transformation refers to the process whereby businesses or organizations reshape their business processes, innovate their business models, improve their organizational efficiency, and create greater value through the utilization of digital technology. This process can bring fundamental organizational changes, impacting the enterprises’ capabilities (Vial, 2019). Digital transformation is viewed as a strategic transformation that seeks to achieve organizational change through digital projects, initiatives, and strategies (Rachinger et al., 2018). Because enterprise digital transformation is a complex process that requires coordination across all aspects of an organization, the strategic transformation process theory can offer helpful insights into the motivation and capability requirements of businesses at every stage of digital transformation. When companies are just getting started with digital transformation, they frequently run into significant obstacles and have a low success rate, which can result in higher costs and additional responsibilities (Liu et al., 2021). Moreover, they frequently focus more of their attention on investments in digital infrastructure. In this situation, it is simple to fall into the trap of digital transformation and harm businesses in several ways, including by causing digital growth to stagnate, making digital construction a “cost center,” and using digital capital in an ineffective manner (Kane et al., 2015). Additionally, it is essential to bear in mind that digital transformation can also result in an increase in the amount of carbon pollution. Although the fast growth of digital technology has made it possible for various industries to experience significant improvements, it has additionally brought about an upsurge in energy utilization, particularly to produce electrical power, which has, in consequently, given an enormous rise in carbon dioxide emissions (Jones, 2018). Therefore, enterprises must effectively and efficiently use digital transformation to achieve refined operation management, rather than treating it as a technical tool. Companies relying too heavily on technology investments can lead to high costs and expenses and hinder carbon performance improvements.

Digital empowerment aims to enhance the capabilities of individuals and communities as influential actors through better networking, communication, and collaboration opportunities (Makinen, 2006). The theory of digital empowerment emphasizes using digital technology and tools to acquire or improve the capabilities of empowered entities (Ying et al., 2018). In other words, despite the detrimental consequences of digital transformation, once digital transformation of enterprises achieves a certain level, it can enable enterprises to benefit from savings on energy usage, decreased emissions, and economic benefits. The core of digital transformation lies in adding value to businesses. Only when digital transformation develops to a new stage can companies transform their thinking beyond technology investment and instead place greater emphasis on integrating digital technology with business. Digital transformation highlights the importance of fully utilizing digital technology to support digital business’s realization, operation, and continuous innovation, thereby empowering companies to achieve refined operation, realize high-quality development, and ultimately improve their carbon performance. The adoption of digital transformation has been demonstrated to be an efficient strategy for cutting carbon pollution and fostering the growth of a green economy with less greenhouse gas emissions. According to the conclusions of a few studies that have already been carried out, digital transformation may be able to hasten the reduction of the release of greenhouse gases, along with fostering technological innovation and the research and development of environmentally friendly technologies (Lerman et al., 2022; Li et al., 2023). Moreover, enterprise digital transformation has the potential to facilitate energy and cost optimization of companies through digital technology, which establishes a technological foundation for reducing energy and resource consumption in key carbon-emitting sectors to help enterprises achieve the goal of carbon performance improvement (Kunkel & Matthess, 2020). Combined with the theory of digital empowerment, when enterprise digital transformation reaches a certain “turning point,” enhancing the degree to which it has undergone digital transformation can help reconstruct the energy supply system, comprehensively improve the refinement and operational level of enterprise operation management, and provide real empowerment for the improvement of corporate carbon performance, forming internal driving forces.

As a result, the following hypothesis is one that we propose:

H1

It appears that there is a positive U-shaped relationship between corporate digital transformation and carbon performance. It is indicated by the fact that as the degree to which enterprises are undergoing digital transformation improves, the carbon performance of enterprises initially diminishes and then increases.

2.2 The effect of local low-carbon policy

In a field of organizational analysis, the institutional theory has been recognized as a significant perspective that sheds light on why many organizations share similar features (Struckell et al., 2022). According to institutional theory, organizational decisions are not solely driven by rational decision-making processes aimed at maximizing efficiency but are also influenced by the administrative setting within which the organization performs its activities (Heikkilä, 2013). Institutional theory holds that the institutional environment effectively constrains the behavior of enterprises, and external institutions will have a substantial influence on the process for making choices, behavior, and structure of the organization (Dunning & Lundan, 2008; Peng et al., 2009). According to the findings of Yang et al. (2021), firms do not exist in a vacuum, and the political and economic structures in place will both constrain and direct the behavior of the businesses they operate within. Some studies have found that government-issued low-carbon policies can induce firms to adopt low-carbon awareness and behavior in response to external pressures (Liu et al., 2018). Hence, while a firm’s level of digital transformation plays an internal driving force in shaping its carbon performance, the external environment also exerts a significant impact.

The effectiveness of local policy laws is reflected by the strength of local low-carbon policies, which indicates the government’s attitude toward policy implementation (Guoxing et al., 2015). The institutional theory considers external institutional pressure as a significant factor in encouraging enterprises to undertake green innovation (Chu et al., 2018), with government policy being a prominent source of such pressure.

Firstly, strict local low-carbon policies can regulate the behavior of enterprises effectively. The stronger the low-carbon policy strength, the more robust policies, and strict laws and regulations the government has put forward. Under the strict regulations and constraints of the government, enterprises can feel the institutional pressure of the external environment and develop a strong awareness of low-carbon practices, thereby complying with policy requirements and actively engaging in low-carbon behaviors. Moreover, the punishment for non-compliant companies becomes more severe as the strength of local low-carbon policies increases, which raises the cost of non-compliance for enterprises. With such institutional pressure, enterprises are strongly motivated to align with the government to avoid administrative penalties (Dai et al., 2021).

Secondly, high levels of local low-carbon policy strength usually led to enterprises receiving more environmental subsidies and tax incentives, thereby reducing the cost of low-carbon behavior for businesses. The ability of companies to improve carbon performance solely through digital transformation is limited. However, a strong low-carbon policy strength indicates that the government will provide the necessary financial support for technological updates and cooperative research of enterprises, helping them overcome difficulties and invest in technological transformation. As a result, the strength of low-carbon policies has a positive correlation with the influence digital transformation has on carbon performance.

Consequently, the first half of the U-shaped curve can be flattened by a strong high-low-carbon policy strength. Also, the stronger the low-carbon policy strength, the more it can stimulate low-carbon awareness among enterprises and help them obtain more government-provided resources, thereby amplifying the effect on carbon performance improvement. Because of the mentioned changes, the point at which the U-shaped curve is at its lowest will appear earlier. To provide further clarity, the point of transition on the positive U-shaped curve that is currently located at its lower right will move to the higher left of its current location. To summarize, the following hypothesis is put forward for consideration:

H2

The strength of local low-carbon policies acts as a positive moderator and positively affects the U-shaped relationship that exists between digital transformation and carbon performance. When local low-carbon policies are strong, the first half of the U-shaped curve flattens out, while the second half becomes steeper. Additionally, as local low-carbon policies become stronger, the turning point in the U-shaped curve shifts to the higher left side of the graph.

3 Research methods

3.1 Data

The businesses listed on the A-share markets of Shanghai and Shenzhen between the years 2012 and 2020 make up the study’s initial sample. The frequency of the keywords on “digital transformation” in these companies is evaluated using the method developed by Wu Fei et al. (2021), which entails collecting keyword frequency data from company annual reports using crawler technology. The “China Energy Statistical Yearbook” issued by the National Bureau of Statistics (http://www.stats.gov.cn/) is the source for the collected information on the industry carbon emissions. In addition, the data on local low-carbon policy come from the Peking University Fabao Database (http://www.pkulaw.com). This database is presently the domestic legal community’s go-to resource for retrieving authoritative and widely used legal information. The CSMAR database is searched in order to retrieve the control variables. Several principles are applied to the sample before it is analyzed. Firstly, ST, ST*, PT, and period delisting samples are excluded. Secondly, samples from the financial sector are excluded. Finally, samples with missing variables are eliminated. The resulting dataset comprises 7086 observations from 1213 listed companies. In addition, all continuous variables were shrunk-tailed at the levels of 1% and 99% with the aim to reduce the influence that extreme anomalies had on the outcomes of the investigation.

3.2 Econometric model

The Hausman test is what we use to decide which model is the most appropriate to use when analyzing the influence that digital transformation would have on carbon performance. The findings suggest that the null hypothesis of random effects should be discarded in support of the fixed effects regression model, which has been proven to be the most appropriate statistical model (p = 0.000). Second, we determine the significance of the relationship between the year dummy variables by using the Wald test, and the outcome is statistically significant (p = 0.000). As a result of this, the authors of this study made the decision to include enterprise fixed effects and year fixed effects within the equation in order to control the endogenous problems that were caused by the absence of individual and year variables. In addition, cluster robust standard errors were utilized in order to investigate and regulate the issues that were associated with model heteroscedasticity. The following outlines both the primary effect model and the moderating effect model that were utilized in the research project.

Main effect model:

Moderating effect model:

In these two regression equations, the subscript \(i\) represents the enterprise, \(t\) represents time; \({\mu }_{i}\) and \({\eta }_{t}\), which stand for the fixed effect of the company and the fixed effect of the year, respectively, control the influence of factors that do not change with time at the level of the company while also controlling the influence of macrofactors that do change with time; \({\epsilon }_{i,t}\) is the random disturbance item.

3.3 Measures

-

(1)

Corporate carbon performance (\(\text{CP}_{i,t}\))

The academic research that was carried out on the carbon performance of corporations is not particularly perfect; furthermore, the evaluation index system, weight, and evaluation methodologies do not agree with one another. For example, Haque (2017) utilized two different indicators for the purpose of evaluating the corporate carbon performance. The first indicator was the carbon emission reduction initiative index to measure the process-oriented carbon performance, and the second indicator was the natural logarithm of greenhouse gas emissions to serve as the result-oriented carbon performance. While the calculation of carbon performance by Ashraf et al. (2020) was based on the sum of carbon credits obtained by enterprises in registered carbon offset projects divided by sales. In another study, Hou et al. (2022) employed questionnaire surveys to investigate papermaking enterprises’ carbon performance qualitatively. To account for data availability at the micro-level, this paper utilizes the operating income per ton of carbon emissions as the carbon performance indicator of the enterprise (Clarkson et al., 2008). If this indicator has a greater value, it indicates that the carbon performance is better. Due to the lack of access to direct data, this study makes use of the total operating expenses and the carbon emissions associated with the industry as a whole in order to provide an estimate of the carbon emissions produced by Chinese companies. The calculations used to determine the industry’s carbon emissions start with the utilization of eight different types of fossil fuels and energy carbon emission reference coefficients taken from the “China Energy Statistical Yearbook.” Energy carbon emission coefficients are determined using the “2006 IPCC Guidelines for National Greenhouse Gas Inventories” by multiplying the energy heating value by the carbon oxidation factor. The carbon emissions of each enterprise are then obtained by weighting their total operating costs by the total operating costs of the industry. The following equation can be used to calculate the enterprise’s carbon performance:

-

(2)

Enterprise digital transformation (\(\text{DI}_{i,t}\))

We first count the length of the yearly reports of publicly traded companies and construct a dictionary of digital transformation terms. This vocabulary is expanded into the Python jieba library, and stop words are removed. The next step is to count how many times each of these terms appears throughout the entire yearly report. The level of digitalization (DI) in a company can be calculated by taking the number of times the digital transformation-related vocabulary appears in the MD&A section of the yearly report and multiplying it by 1000. A greater value for this metric suggests that the company is further along in its digital transformation (Wu et al., 2021).

-

(3)

Strength of local low-carbon policies (\(\text{PO}_{i,t}\))

Policy strength refers to the level of trust in a policy. Its influence depends on the issuing agency’s administrative level and whether the document is consistent with the central government’s development policy. Therefore, this is measured based on the issuing institution’s administrative level and policy style (Wang & Chang, 2014). This paper adopts Zhang Guoxing et al.’s (2015) method to assess the strength of low-carbon policies in different provinces. Based on the policy document’s type and issuing agency, each policy is assigned a value of 4, 3, 2, or 1 to describe its policy effect’s magnitude. In Peking University’s Fabao database, policy documents are limited to local regulations. The title is searched with the keywords “low carbon,” “carbon emission reduction,” “carbon reduction,” “carbon emission,” “carbon reduction,” “energy saving and emission reduction,” “carbon dioxide,” “carbon neutrality,” and “carbon peak.” The total downloads and scores are calculated, and variables are formed to measure the strength of low-carbon policies.

In the formula (4): \(\text{PO}_{jt}\) represents the policy strength of province j in year t; \({W}_{jtk}\) denotes the weight of the k policy in province j during year t, while \(N\) indicates the total amount of policies promulgated by each province in that year. The assigned points for each policy type are multiplied by the number of policies of a particular province in that year and then summed up to obtain the policy strength value.

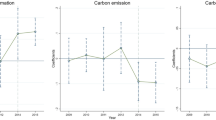

Through the collection and organization of low-carbon policy texts and calculations, the intensity of low-carbon policies in China’s major provinces and cities from 2012 to 2020 is shown in Fig. 2.

-

(4)

Control variable (\(\text{control}_{i,t}\))

Building on previous studies (Goud, 2022; Lee & Min, 2015; Sheng et al., 2022), we included control variables that may impact corporate carbon performance, including asset-liability ratio (LEV), the shareholding ratio of the largest shareholder (LHR), net profit (NP), company age (AGE), the proportion of fixed assets (FA), nature of property rights (PR), Tobin’s Q (TQ), whether the company is in the heavy polluting industry (WR), and research and development intensity (RD). Additionally, our model accounts for individual firm- and year-fixed effects. In Table 1, we list all the variables and their measurement.

4 Empirical results

4.1 Descriptive statistics and correlation analysis

In Table 2, we provide the descriptive statistics as well as the findings of the correlations that were performed on the important variables in our research. According to the information presented in Table 2, the enterprise digital transformation (DI) can have a number as low as 0 and as high as 0.593, with 0.089 being the value that serves as the average. Based on these findings, the overall level of digital transformation that has been accomplished by China’s A-share publicly traded businesses has been somewhat inadequate, and there are substantial distinctions among companies. In addition, there are significant disparities between companies with regard to both their corporate carbon performance (CP) and local low-carbon policy strength (PO). In addition, the association coefficients between the primary variables are all lower than 0.5, which suggests that multicollinearity may not be an issue of concern with our model. As stated in the findings of the analysis of correlation, digital transformation and local low-carbon policy strength are both substantially and favorably correlated with the corporate carbon performance. The fact that the control variables that were taken into account in the current investigation had substantial correlations with carbon performance demonstrates how important it is to account for these variables when carrying out research. It is worth noting that correlation coefficients only reflect the strength of the relationship between variables, and additional research ought to be done to explore the deterministic functional relationship between these variables.

4.2 Regression analysis

-

(1)

The influence of digital transformation on carbon performance

The outcome results of the regression analysis are presented in Table 3. The outcomes of regressions that the control variables may have had on the dependent variable are reported using Model 1. In the second model, the influence of digital transformation on carbon performance in businesses is investigated by adding the independent variable as well as the square term of the independent variable based on the control variables. From the data, we can deduce that the primary term (DI) of business digital transformation has a negative regression coefficient (= − 0.436, p < 0.01), while the quadratic term (DI2) has a positive regression coefficient (= 0.957, p < 0.01). Based on these results, we can make a first guess that the effect of DI on CP follows a U-shaped parabola.

The calculation results of Model 2 yield the marginal utility (\(\partial \text{C}\text{P}/\partial \text{DI}={\beta }_{1}+2{\beta }_{2}\times \text{DI}=-0.436+2\times 0.957\times \text{DI}\)). This result indicates that the marginal utility (\(\partial \text{C}\text{P}/\partial \text{DI}\)) rises in line with increasing levels of digital transformation in enterprises. When DI is lower than 0.228, the marginal utility (\(\partial \text{C}\text{P}/\partial \text{DI}\)) remains negative, indicating a negative relationship between DI and CP. At the inflection point of DI around 0.228, the marginal utility (\(\partial \text{C}\text{P}/\partial \text{DI}\)) becomes zero, and the carbon performance (CP) reaches its lowest level. When the digital transformation (DI) is greater than 0.228, the marginal utility begins to turn positive, and the “restraining effect” begins to turn into a “promoting effect.“ This means that increasing digital transformation on the left side of the turning point inhibits the corporate carbon performance, whereas increasing digital transformation on the right side of the turning point will improve the carbon performance of enterprises.

The results of Model 2 of Table 3 do not provide a clear indication of a positive U-shaped relationship, nor does it confirm whether the entire curve falls within the range of the sample data. Therefore, to further confirm the objective existence of the U-shaped curve relationship between DI and CP in Model 2, this study employs Stata software to conduct a U-Test. The findings are outlined in Table 4, which demonstrates that the value of the t test is 2.63 (p < 0.01), with the extreme point included in the sample interval, thus verifying the authenticity of the U-curve relationship. In conclusion, Hypothesis 1 is established.

-

(2)

Moderating effect of local low-carbon policies

This research incorporates the strength of local low-carbon policy with a one-period delay so that it can account for the time lag that occurs when policies are put into effect. Model 3 and model 4 build on the main effect of digital transformation on corporate carbon performance by adding local low-carbon policy strength as a moderating variable with a one-period lag. In Models 3 and 4, local low-carbon policy strength is multiplied by the first and second order terms of digital transformation, respectively. The results indicate that local low-carbon policy strength has a significant moderating effect on the primary effect of the main effect, while the moderating effect of the secondary term is not significant. These findings suggest that the strength of local low-carbon policies can moderate the inflection point and symmetry axis of the U-shaped curve for the main effect but does not impact the steepness or opening and closing direction of the curve.

This paper has created a moderation plot to illustrate the moderating effect of local low-carbon policy strength. As shown in Fig. 3, as the strength of low-carbon policies increases, U-shaped curve’s turning point has moved forwards by a large amount, which prolongs the positive effect of digital transformation on carbon performance. Moreover, enterprises with high local low-carbon policy strength can achieve higher carbon performance than those with low-level local low-carbon policy strength. Strengthening the strength of local low-carbon policies can make the inflection point of corporate digital transformation from reducing to improving corporate carbon performance come earlier, resulting in earlier harmonious development and a significant improvement in carbon performance. Thus, the strength of local low-carbon policies positively moderates the relationship between the main effect of enterprise digital transformation and enterprise carbon performance, verifying Hypothesis 2.

This paper presents two hypotheses regarding the impact of digital transformation on corporate carbon performance, and the test results are shown in Table 5.

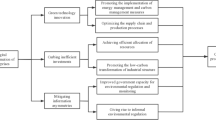

4.3 Heterogeneity analysis

This research further examines the impact of digital transformation on corporate carbon performance by considering factors such as firm size, heavy-pollution industry attributes, R&D intensity, and the nature of ownership. Table 6 displays the findings obtained from conducting the research.

-

(1)

Firm size heterogeneity

In this study, the median of the asset size in the sample is used as a benchmark for group regression. Companies with assert size that are greater than the median are referred to as large enterprises, whereas companies with assert size that are lower than or equal to the median are referred to as small- and medium-sized businesses. According to the information provided in columns (1) and (2) of Table 6, enterprise size has a heterogeneous effect on digital transformation and carbon performance. Large company samples may be better suited to examine the U-shaped relationship between digital transformation and carbon performance because large businesses typically have more diverse carbon emissions sources. As a result, carbon performance may initially decline during the early stages of digital transformation. Additionally, large enterprises typically possess greater resources and capabilities to facilitate digital transformation, enabling them to achieve economies of scale more quickly (Fischer et al., 2020). Furthermore, large enterprises generally have more intricate supply chains and production processes, and digital transformation can assist them in managing these processes more efficiently, optimizing resource utilization and enhancing carbon performance further. Conversely, small- and medium-sized businesses may not be equipped to deal with the expenses and difficulties of digital transformation due to a dearth of resources and technology (Li et al., 2018). Therefore, the U-shaped connection in digital transformation and carbon performance is more readily observable in samples of large enterprises.

-

(2)

Industry heterogeneity

Based on Pan Ailing et al.’s (2019) classification standard for highly polluting industries, we categorized the sample of publicly traded businesses that we looked at into heavily polluting and non-heavily polluting industries according to the characteristics of each industry. This was done in order to investigate the heterogeneous effect that digital transformation has on the carbon performance of corporations, taking into account the various attributes of different industries. The findings are shown in (3) and (4) columns in Table 6. The U-shaped relationship was only observed in the samples of heavily polluting industries. This indicates that carbon performance is more likely to be affected by digital transformation in high-polluting businesses than in low-polluting businesses. This could be because highly polluting enterprises need to change their extensive development models urgently. There is more pressure to reduce carbon emissions from heavy-polluting industries because they use more energy and emit more carbon during production (Xiong et al., 2022). The digital transformation of these industries can enhance operational efficiency, optimize supply chains, and reduce energy consumption and emissions, allowing for finer control and management of carbon emissions (Chen et al., 2022; He et al., 2023a, 2023b). Heavy-polluting industries have more carbon emission points and links in production, making digital transformation an effective tool to control and manage these points and links, which in turn can positively impact their carbon performance. Companies in highly polluting industries are, therefore, more likely to pursue opportunities for digital transformation in order to improve their carbon performance compared to those in non-heavy polluting industries.

-

(3)

R&D intensity heterogeneity

To investigate how different R&D intensities affect the effect that corporate digital transformation has on carbon performance, we used the ratio of R&D investment to operating income to measure R&D intensity. Companies with an R&D intensity that was higher than the median were categorized as having high R&D intensity, whereas companies with an R&D intensity that was lower than the median had low R&D intensity. The findings presented in columns 5 and 6 of Table 6 indicate that businesses that have a high R&D intensity have a relationship that is more significantly U-shaped, with a coefficient that is more significant than that of businesses that have a low R&D intensity. This could be due to the fact that businesses that place a high emphasis on R&D have a greater availability of funds for activities related to R&D, which could support their efforts to digitally transformation. Moreover, companies that have a high R&D intensity typically have more innovative capabilities and technological innovations in the manufacturing process (Lin et al., 2006), and as a result, these businesses place a greater emphasis on the application of digital technology. Digital transformation can enable companies to use resources and energy more efficiently, reduce their carbon emissions, and companies with high R&D intensity can better apply digital technology to product and service innovation in the digital transformation process, making products and services greener and more sustainable (Mina et al., 2014; Ceipek et al., 2021). Because of this, companies that have a high R&D intensity are better able to benefit from the influence that digital transformation has on carbon performance than companies that have a low R&D intensity.

-

(4)

Ownership heterogeneity

The research sample was split into two groups, one consisting of state-owned enterprises and the other of non-state-owned enterprises, so that the researchers could investigate the effect of digital transformation on carbon performance under different property rights. A presentation of the outcomes of the group regression test can be found in Table 6, columns 7 and 8, respectively. According to the conclusions, the U-shaped relationship is only significant in state-owned enterprises. State-owned enterprises in China play a significant role in digital transformation and carbon reduction efforts for several reasons. Firstly, these enterprises are more proactive in responding to the country’s call for sustainable development. They actively participate in digital transformation practices and take responsibility for reducing carbon emissions (Pan et al., 2021). Secondly, state-owned enterprises have access to abundant capital and information resources due to their unique political resource of “state ownership” in China. This enables them to obtain government subsidies, secure loans from banks, and access reliable information (Zhuo & Chen, 2023; Guan & Yam, 2015). Acquiring political resources helps alleviate funding difficulties and information asymmetry faced by these enterprises (Xu et al., 2023). Thirdly, the importance of “state ownership” is rooted in China’s distinctive economic system where state-owned economy drives national growth. To ensure the consolidation and development of this sector, various measures are taken that differ significantly from other western countries’ economic systems. Consequently, companies based on “state ownership” may not experience a similar impact trend on corporate carbon performance through digital transformation as seen in other countries.

According to a study by Tihanyi et al. (2019), state ownership can have a slight negative impact on firm performance. The researchers analyzed 210 research summaries from 139 countries to reach this conclusion. The role of state-owned enterprises varies across different countries in terms of their contribution to economic output and industry distribution. According to data analysis from Wind (https://www.wind.com.cn/), in 2020, the proportion of China’s state-owned enterprises’ GDP was around 40%, whereas the proportion was only around 5% in the UK and even lower at 1.6% in the USA. China has a significant number of state-owned enterprises operating across various sectors including energy, finance, telecommunications, manufacturing, defense, and transportation. Conversely, the UK and USA have fewer state-owned enterprises primarily focused on industries such as energy, transportation, defense, and healthcare. Furthermore, each country’s economic system plays a crucial role in determining the prestige or influence associated with being a “state-owned” enterprise. China has developed a unique economic system known as the socialist market economy, which combines elements of socialism with a market-based approach. This sets it apart from countries such as the USA, where the economy is purely driven by market forces.

4.4 Robustness test

With the purpose to validate the authenticity of the findings, a regression analysis was performed after the independent variable was given a one-period lag. The findings are summarized in Table 7, and they indicate that there is a relationship that is curved like a U between digital transformation and corporate carbon performance.

5 Discussion

This article investigated the influence that digital transformation has on the carbon performance of corporations as well as the moderating effect that local low-carbon policy strength has.

The following are the conclusions obtained in this paper. Firstly, there is a positive U-shaped nonlinear relationship between digital transformation and enterprises’ carbon performance. This finding aligns with Xiong et al.’s (2022) research, which also identified a U-shaped curve relationship between Chinese enterprises’ digital transformation and their reduction in carbon emissions pollution when considering agglomeration effects. Furthermore, studies at the city level conducted by Li and Wang (2022) and Cheng et al. (2023) have found an inverted U-shaped pattern between China’s digital economy development and carbon emissions, supporting this study’s conclusion that digitization empowers corporate-level carbon performance.

Compared with the enterprises in western countries, it is evident that these countries possess advanced digital technology and well-established digital infrastructure, resulting in a high level of digital transformation. The national-level strategic guidance plays a crucial role in influencing the technological path chosen by enterprises (Leyva de la Hiz, 2019). The digital development goals set by a country guide enterprise in their pursuit and exploration of digital transformation. For European companies, Chatzistamoulou (2023) discovered that digital transformation has a positive impact on promoting low-carbon sustainable development for small- and medium-sized enterprises (SMEs), serving as an important pathway toward achieving a green sustainable economy. Similarly, Ionaşcu et al. (2022), analyzing EU-listed companies as samples, found that digital intelligent technologies effectively utilize natural resources to reduce pollution emissions and improve carbon performance and environmental outcomes. As for American companies, Bendig et al. (2023) found that the digitization orientation of Fortune 500 companies significantly enhances environmental performance, contributing to the establishment of a green low-carbon business environment. Overall, the digital transformation of enterprises in western countries has a significant positive impact on their environmental performance.

In summary, the impact of digital transformation on carbon emissions differs between China and western countries. The reasons for this difference are as follows. First, China has actively pursued digital technology reform and green low-carbon transformation in recent years. This has made it a driving force for synergistic development of digitization and greening. However, due to the long-standing extensive economic growth characterized by “high input, high consumption, low output,“ which still has far-reaching effects, most Chinese enterprises are still in the early stages of digital transformation. Consequently, the effect of digital empowerment on carbon reduction exhibits a U-shaped relationship with an initial decrease followed by an increase. Only after reaching a certain threshold can digital transformation have a positive impact on carbon performance. Second, enterprises in western countries have consistently invested in technological advancements for digital transformation. They possess advanced digital intelligent technologies and well-established infrastructure with high rates of industrial digitization penetration. The process of digital construction in western countries has transitioned to mid-to-late-stage digitization where enterprise-level digitization has generally taken shape at higher levels. As a result, the digital transformation of enterprises in western countries linearly improves environmental performance and significantly enhances their carbon performance levels while promoting low-carbon sustainable development.

It is important to note that the differences in conclusions among the mentioned studies can be attributed to the fact that carbon emissions, which are considered as dependent variables in this study, are just one of several environmental issues. The digital industry has made significant advancements and has had an impact on the automotive sector by transforming traditional production models (Llopis-Albert et al. 2021). However, while electric vehicles have emerged as a solution for reducing pollution emissions, they have also introduced new environmental challenges. In the manufacturing process of electric vehicles, lithium batteries play a crucial role in digital transformation. Although these batteries effectively reduce air pollution, they create new adverse impacts on urban environments when they become waste (Dunn et al., 2022). Issues related to handling and disposal of used batteries still pose challenges to sustainable development (Tang et al., 2023).

Secondly, when the intensity of local government’s low-carbon policies is high, it positively influences the relationship between digital transformation and carbon performance of enterprises. Under this circumstance, the negative impact of digital transformation on carbon performance weakens while the positive impact strengthens. Empirical results indicate that with higher policy intensity, the inflection point of digital transformation’s positive U-shaped impact on corporate carbon performance shifts to an earlier stage.

The greater the intensity of local low-carbon policies, the more resources and funds local governments allocate to incentivize enterprises to adopt low-carbon technologies and measures to reduce carbon emissions. Local governments can also encourage continuous low-carbon transformation of enterprises through tax incentives and reward policies (Xu et al., 2022). Strengthening the intensity of these policies can mitigate the negative impact on enterprise carbon performance during early stages of digital transformation, while promoting its positive effects. This highlights the positive regulatory role played by local low-carbon policies in shaping the relationship between digital transformation and enterprise carbon performance. The findings support previous studies by Kou and Xu (2022) and Chen et al. (2022), which emphasize that government policy intervention and regulation in China optimize external conditions, supervise corporate carbon reduction behavior, and drive improvements in carbon performance. Obviously, the diversity and richness of China’s low-carbon policy measures, as well as the large-scale government investment, effectively address the needs of carbon reduction activities by Chinese enterprises. Overall, this study further confirms that environmental policies have significant emission reduction effects in government-led and strong intervention eastern countries like China (Xu et al., 2022).

Meanwhile, studies comparing the environmental policy effects of other countries around the world show that governments worldwide highly recognize and advocate for low-carbon policies. These policies have a positive promoting effect on enhancing carbon performance through digital technology empowerment in enterprises. For example, Albitar et al. (2023) used London-listed companies as samples and found that government environmental policies can effectively enhance the governance effect of pollution through corporate environmental technological innovation.

Lastly, as demonstrated by the findings of a heterogeneity analysis, the U-shaped connection in digital transformation and corporate carbon performance is more significant in large enterprises, enterprises of heavily polluting industries, enterprises with high R&D intensity, and state-owned businesses.

In conclusion, this study employs institutional theory to find out the extent to which local low-carbon policies can moderate the influence that digital transformation has on carbon performance. This approach not only broadens the evaluation of the implementation of local low-carbon policies that are related to corporate carbon performance, but it also makes a contribution to the enrichment of the research that has already been carried out on the external drivers of corporate carbon performance.

The management implications for policy formulation based on this paper’s key findings are as follows: Firstly, in order to achieve better carbon performance, the strength of local low-carbon policy is an essential factor to consider. Therefore, local governments should increase their support for low-carbon development initiatives undertaken by businesses, aggressively explore low-carbon policy options, and provide assistance to businesses endeavoring to achieve low-carbon development. Additionally, governments can leverage relevant preferential policies to alleviate the economic burden of enterprises and employ government subsidies or incentive policies to help enterprises enhance their carbon performance. Secondly, this research offers the findings that enterprises must delve deeply into their digital transformation journey to reap the benefits of a more sustainable future. Therefore, local governments should actively promote the in-depth implementation of digital transformation in enterprises. For example, local governments should establish a digital service platform to provide enterprises with services related to digital transformation, such as digital consulting, technical support, and training. For another example, local governments should establish digital industry alliances to furtherly promote digital cooperation between enterprises. In addition, local governments should strengthen the supervision and protection of digital transformation, such as formulating relevant policies and regulations to protect the legitimate rights and interests of enterprises in digital transformation.

The present investigation has a few of shortcomings, all of which ought to be addressed in subsequent research. First, the paper has not yet conducted a mechanism analysis to explore how digital transformation impacts corporate carbon performance. Second, the carbon performance of enterprises is estimated based on industry carbon emissions, which may differ from the actual carbon performance of the enterprises. Third, given that digital transformation is a complex and multi-dimensional process, this study only measured it through word frequency analysis without a more detailed exploration of its different stages. Lastly, due to objective limitations such as the scope of sampling and level of information acquisition, this study only selected samples from Chinese enterprises, which are important participants in global carbon reduction. However, the process of twin transition (i.e., digital and green transitions) varies among different countries. The different impacts of digital transformation on carbon emission performance in other countries’ enterprises still need further research.

Moving forward, we can build upon this research by incorporating intermediary variables to investigate the specific pathways through which digital transformation influences corporate carbon performance. Additionally, we can explore more diverse methods for measuring carbon performance. Lastly, based on practical implementation, we can identify and examine the various stages of enterprise digital transformation as well as the effect that each stage has on carbon performance.

Data availability

The data that support the findings of this study are available on request from the corresponding author,upon reasonable request.

References

Albitar, K., Borgi, H., Khan, M., & Zahra, A. (2023). Business environmental innovation and CO2 emissions: The moderating role of environmental governance. Business Strategy and the Environment, 32(4), 1996–2007.

Ashraf, N., Comyns, B., Tariq, S., & Chaudhry, H. R. (2020). Carbon performance of firms in developing countries: The role of financial slack, carbon prices and dense network. Journal of Cleaner Production, 253, 119846.

Autio, E., Nambisan, S., Thomas, L. D., & Wright, M. (2018). Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 72–95.

Bendig, D., Schulz, C., Theis, L., & Raff, S. (2023). Digital orientation and environmental performance in times of technological change. Technological Forecasting and Social Change, 188, 122272.

Ceipek, R., Hautz, J., De Massis, A., Matzler, K., & Ardito, L. (2021). Digital transformation through exploratory and exploitative internet of things innovations: The impact of family management and technological diversification. Journal of Product Innovation Management, 38(1), 142–165.

Chatzistamoulou, N. (2023). Is digital transformation the Deus ex Machina towards sustainability transition of the european SMEs? Ecological Economics, 206, 107739.

Chen, S., Mao, H., & Sun, J. (2022). Low-carbon city construction and corporate carbon reduction performance: Evidence from a quasi-natural experiment in China. Journal of Business Ethics, 180(1), 125–143.

Cheng, Y., Zhang, Y., Wang, J., & Jiang, J. (2023). The impact of the urban digital economy on China’s carbon intensity: Spatial spillover and mediating effect. Resources, Conservation and Recycling, 189, 106762.

Chu, Z., Xu, J., Lai, F., & Collins, B. J. (2018). Institutional theory and environmental pressures: The moderating effect of market uncertainty on innovation and firm performance. IEEE Transactions on Engineering Management, 65(3), 392–403.

Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting Organizations and Society, 33(4–5), 303–327.

Dai, J., Xie, L., & Chu, Z. (2021). Developing sustainable supply chain management: The interplay of institutional pressures and sustainability capabilities. Sustainable Production and Consumption, 28, 254–268.

Davis, E. B., Kee, J., & Newcomer, K. (2010). Strategic transformation process: Toward purpose, people, process and power. Organization Management Journal, 7(1), 66–80.

Dong, F., Hu, M., Gao, Y., Liu, Y., Zhu, J., & Pan, Y. (2022). How does digital economy affect carbon emissions? Evidence from global 60 countries. Science of the Total Environment, 852, 158401.

Du, W., & Li, M. (2020). Influence of environmental regulation on promoting the low-carbon transformation of China’s foreign trade: Based on the dual margin of export enterprise. Journal of Cleaner Production, 244, 118687.

Dunn, J., Kendall, A., & Slattery, M. (2022). Electric vehicle lithium-ion battery recycled content standards for the US–targets, costs, and environmental impacts. Resources, Conservation and Recycling, 185, 106488.

Dunning, J. H., & Lundan, S. M. (2008). Institutions and the OLI paradigm of the multinational enterprise. Asia Pacific Journal of Management, 25, 573–593.

Fischer, M., Imgrund, F., Janiesch, C., & Winkelmann, A. (2020). Strategy archetypes for digital transformation: Defining meta objectives using business process management. Information & Management, 57(5), 103262.

Goud, N. N. (2022). Corporate governance: Does it matter management of carbon emission performance? An empirical analyses of indian companies. Journal of Cleaner Production, 379, 134485.

Guan, J., & Yam, R. C. (2015). Effects of government financial incentives on firms’ innovation performance in China: Evidences from Beijing in the 1990s. Research Policy, 44(1), 273–282.

Guoxing, Z., Xiulin, G., Yingluo, W., & Ju, G. (2015). Effectiveness of the coordination of energy conservation and emission reduction policies in China: From 1997 to 2011. Management Review, 27(12), 3.

Hanelt, A., Bohnsack, R., Marz, D., & Marante, A. (2021). A systematic review of the literature on digital transformation: Insights and implications for strategy and organizational change. Journal of Management Studies, 58(5), 1159–1197.

Haque, F. (2017). The effects of board characteristics and sustainable compensation policy on carbon performance of UK firms. The British Accounting Review, 49(3), 347–364.

Haque, F., & Ntim, C. G. (2018). Environmental policy, sustainable development, governance mechanisms and environmental performance. Business Strategy and the Environment, 27(3), 415–435.

He, X., Jiang, J., & Hu, W. (2023a). Cross effects of government subsidies and corporate social responsibility on carbon emissions reductions in an omnichannel supply chain system. Computers & Industrial Engineering, 175, 108872.

He, Z., Kuai, L., & Wang, J. (2023b). Driving mechanism model of enterprise green strategy evolution under digital technology empowerment: A case study based on Zhejiang Enterprises. Business Strategy and the Environment, 32(1), 408–429.

Heikkilä, J. P. (2013). An institutional theory perspective on e-HRM’s strategic potential in MNC subsidiaries. The Journal of Strategic Information Systems, 22(3), 238–251.

Hou, N., Zhu, Q., Zhao, W., Luo, Y., & Liu, W. (2022). Study on the impact of green management of paper enterprises on carbon performance in the background of carbon peaking and carbon neutrality. Energy Reports, 8, 10991–11002.

Ionaşcu, I., Ionaşcu, M., Nechita, E., Săcărin, M., & Minu, M. (2022). Digital transformation, financial performance and sustainability: Evidence for European Union listed companies. Amfiteatru Economic, 24(59), 94–109.

Irfan, M., Elavarasan, R. M., Hao, Y., Feng, M., & Sailan, D. (2021). An assessment of consumers’ willingness to utilize solar energy in China: End-users’ perspective. Journal of Cleaner Production, 292, 126008.

Johnson, G., Yip, G. S., & Hensmans, M. (2012). Achieving successful strategic transformation. MIT Sloan Management Review, 53(3), 25.

Jones, N. (2018). How to stop data centres from gobbling up the world’s electricity. Nature, 561(7722), 163–166.

Kane, G. C., Palmer, D., Phillips, A. N., Kiron, D., & Buckley, N. (2015). Strategy, not technology, drives digital transformation. MIT Sloan Management Review.

Kou, J., & Xu, X. (2022). Does internet infrastructure improve or reduce carbon emission performance?—A dual perspective based on local government intervention and market segmentation. Journal of Cleaner Production, 379, 134789.

Kunkel, S., & Matthess, M. (2020). Digital transformation and environmental sustainability in industry: Putting expectations in Asian and African policies into perspective. Environmental science & policy, 112, 318–329.

la Leyva-de, D. (2019). Environmental innovations andpolicy network styles: The influence of pluralism and corporativism. Journal of Cleaner Production, 232, 839–847.

Lee, K. H., & Min, B. (2015). Green R&D for eco-innovation and its impact on carbon emissions and firm performance. Journal of Cleaner Production, 108, 534–542.

Lerman, L. V., Benitez, G. B., Müller, J. M., de Sousa, P. R., & Frank, A. G. (2022). Smart green supply chain management: A configurational approach to enhance green performance through digital transformation. Supply Chain Management: An International Journal, 27(7), 147–176.

Li, L., Su, F., Zhang, W., & Mao, J. Y. (2018). Digital transformation by SME entrepreneurs: A capability perspective. Information Systems Journal, 28(6), 1129–1157.

Li, Z., & Wang, J. (2022). The dynamic impact of digital economy on carbon emission reduction: Evidence city-level empirical data in China. Journal of Cleaner Production, 351, 131570.

Li, G., Jin, Y., & Gao, X. (2023). Digital transformation and pollution emission of enterprises: Evidence from China’s micro-enterprises. Energy Reports, 9, 552–567.

Lin, B. W., Lee, Y., & Hung, S. C. (2006). R&D intensity and commercialization orientation effects on financial performance. Journal of Business Research, 59(6), 679–685.

Liu, S., Yan, J., Zhang, S., & Lin, H. (2021). Can corporate digital transformation promote input-output efficiency? Management World, 37(05), 170. printed in Chinese.

Liu, T., Wang, Y., Song, Q., & Qi, Y. (2018). Low-carbon governance in China–Case study of low carbon industry park pilot. Journal of Cleaner Production, 174, 837–846.

Liu, Y., Dong, J., & Wei, J. (2020). Digital innovation management: Theoretical framework and future research. Management World (Printed in Chinese), 36(07), 198–217.

Llopis-Albert, C., Rubio, F., & Valero, F. (2021). Impact of digital transformation on the automotive industry. Technological Forecasting and Social Change, 162, 120343.

Luo, L. (2019). The influence of institutional contexts on the relationship between voluntary carbon disclosure and carbon emission performance. Accounting & Finance 59(2), 1235–1264.

Ma, Q., Tariq, M., Mahmood, H., & Khan, Z. (2022). The nexus between digital economy and carbon dioxide emissions in China: The moderating role of investments in research and development. Technology in Society, 68, 101910.

Mäkinen, M. (2006). Digital empowerment as a process for enhancing citizens' participation. E-learning and Digital Media, 3(3), 381–395.

Meo, M. S., & Abd Karim, M. Z. (2022). The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanbul Review, 22(1), 169–178.

Mina, A., Bascavusoglu-Moreau, E., & Hughes, A. (2014). Open service innovation and the firm’s search for external knowledge. Research Policy, 43(5), 853–866.

Mintzberg, H., & Westley, F. (1992). Cycles of organizational change. Strategic Management Journal, 13(S2), 39–59.

Pan, A., Liu, X., Qiu, J., & Shen, Y. (2019). Can green M&A of heavy polluting enterprises achieve substantial transformation under the pressure of media. China Industrial Economics, 2, 174–192. printed in Chinese.

Pan, X., Pan, X., Wu, X., Jiang, L., Guo, S., & Feng, X. (2021). Research on the heterogeneous impact of carbon emission reduction policy on R&D investment intensity: From the perspective of enterprise’s ownership structure. Journal of Cleaner Production, 328, 129532.

Peng, M. W., Sun, S. L., Pinkham, B., & Chen, H. (2009). The institution-based view as a third leg for a strategy tripod. Academy of Management Perspectives, 23(3), 63–81.

Rachinger, M., Rauter, R., Müller, C., Vorraber, W., & Schirgi, E. (2018). Digitalization and its influence on business model innovation. Journal of Manufacturing Technology Management, 30(8), 1143–1160.

Ren, X., Shao, Q., & Zhong, R. (2020). Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. Journal of Cleaner Production, 277, 122844.

Shang, Y., Raza, S. A., Huo, Z., Shahzad, U., & Zhao, X. (2023). Does enterprise digital transformation contribute to the carbon emission reduction? Micro-level evidence from China. International Review of Economics and Finance, 86, 1–13.

Shen, J., Tang, P., & Zeng, H. (2020). Does China’s carbon emission trading reduce carbon emissions? Evidence from listed firms. Energy for Sustainable Development, 59, 120–129.

Sheng, H., Feng, T., & Liu, L. (2022). The influence of digital transformation on low-carbon operations management practices and performance: does CEO ambivalence matter? International Journal of Production Research, 1–15.

Struckell, E., Ojha, D., Patel, P. C., & Dhir, A. (2022). Strategic choice in times of stagnant growth and uncertainty: An institutional theory and organizational change perspective. Technological Forecasting and Social Change, 182, 121839.

Su, Y., Chen, X., Li, Y., et al. (2014). China׳ s 19-year city-level carbon emissions of energy consumptions, driving forces and regionalized mitigation guidelines. Renewable and Sustainable Energy Reviews, 35, 231–243.

Tang, Y., Tao, Y., Wen, Z., Bunn, D., & Li, Y. (2023). The economic and environmental impacts of shared collection service systems for retired electric vehicle batteries. Waste Management, 166, 233–244.

Tihanyi, L., Aguilera, R. V., Heugens, P., Van Essen, M., Sauerwald, S., Duran, P., & Turturea, R. (2019). State ownership and political connections. Journal of Management, 45(6), 2293–2321.

Vial, G. (2019). Understanding digital transformation: A review and a research agenda. The Journal of Strategic Information Systems, 28(2), 118–144.

Wang, J., Dong, K., Dong, X., & Taghizadeh-Hesary, F. (2022). Assessing the digital economy and its carbon-mitigation effects: The case of China. Energy Economics, 113, 106198.

Wang, N., & Chang, Y. C. (2014). The development of policy instruments in supporting low-carbon governance in China. Renewable and Sustainable Energy Reviews, 35, 126–135.

Wang, S., Fang, C., Guan, X., Pang, B., & Ma, H. (2014). Urbanisation, energy consumption, and carbon dioxide emissions in China: A panel data analysis of China’s provinces. Applied Energy, 136, 738–749.

Wu, F., Hu, H., Lin, H., & Ren, X. (2021). Enterprise digital transformation and capital market performance Empirical evidence from stock liquidity. Management World, 37(7), 130–144. printed in Chinese.

Xiong, L., Ning, J., & Dong, Y. (2022). Pollution reduction effect of the digital transformation of heavy metal enterprises under the agglomeration effect. Journal of Cleaner Production, 330, 129864.

Xu, Q., Li, X., & Guo, F. (2023). Digital transformation and environmental performance: Evidence from chinese resource-based enterprises. Corporate Social Responsibility and Environmental Management. https://doi.org/10.1002/csr.2457

Xu, T., Kang, C., & Zhang, H. (2022). China’s efforts towards carbon neutrality: Does energy-saving and emission-reduction policy mitigate carbon emissions? Journal of Environmental Management, 316, 115286.

Xuan, D., Ma, X., & Shang, Y. (2020). Can China’s policy of carbon emission trading promote carbon emission reduction? Journal of Cleaner Production, 270, 122383.

Yang, Y., Jia, F., Chen, L., Wang, Y., & Xiong, Y. (2021). Adoption timing of OHSAS 18001 and firm performance: An institutional theory perspective. International Journal of Production Economics, 231, 107870.

Yi, M., Liu, Y., Sheng, M. S., & Wen, L. (2022). Effects of digital economy on carbon emission reduction: New evidence from China. Energy Policy, 171, 113271.

Ying, W., Jia, S., & Du, W. (2018). Digital enablement of blockchain: Evidence from HNA group. International Journal of Information Management, 39, 1–4.

Zhuo, C., & Chen, J. (2023). Can digital transformation overcome the enterprise innovation dilemma: Effect, mechanism and effective boundary. Technological Forecasting and Social Change, 190, 122378.

Zhu, B. (2021). China explores digital path toward carbon neutrality goal. Retrieved 9 September 2021 from https://m.china.com.cn/wm/doc_1_29302_2043871.html

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yu, F., Mao, J. & Jiang, Q. Accumulate thickly to grow thinly: the U-shaped relationship between digital transformation and corporate carbon performance. Environ Dev Sustain (2023). https://doi.org/10.1007/s10668-023-03959-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-023-03959-7