Abstract

Do regional differences matter for firm survival across native and immigrant entrepreneurs? We investigate this question applying a unique data derived from the Chamber of Industrial and Commercial Matters in Munich, Germany. The data consist of 110,250 companies either founded or liquidated during the period 1997–2004. We develop a Gompertz-Makeham hazard model to predict the chances of firm survival. After controlling for individual and environmental characteristics, we found that the performance of German and foreign companies do differ across administrative districts. Indicators such as tax trade collection rate and unemployment rate lead to significant increase in the hazard rate, while the population density and share of foreign population enhance the survival chances. The relationship between survival and agglomeration versus founder’s age show an inverted U-shaped pattern.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The regional differences in the number of newly established enterprises have been subject of interest to many social science researchers for some time (Armington and Acs 2002). Most of the conducted studies were published in the early 1990s based on data from the 1980s applying different indicators and accomplishing for different industrial sectors, countries and units of analysis. They found significant regional variation in new firm formations and investigated a set of regional determinants to explain this variation (see for review the special issue of Regional Studies 28(4), 1994).

Nevertheless, insufficient attention has been paid to regional variations in the survival performance as indicator of economic success. This is rather unexpected as entrepreneurship is seen as crucial for regional economic growth and structural change, and has been, therefore, the aim of numerous policy implications at a federal and regional level.

Additionally, most research and policy literature on organisational failure does not adequately take into account the well-known ‘liability of newness’ (Fichman and Levinthal 1991; Brüderl 1992). One reason is the fact that there are hardly any suitable longitudinal data sets that can provide reliable information on the regional differences of survival chances. Moreover, there exists evidence of a strong relationship between entry and exit, which has been proved at three levels: space, time and industry. The explanation for this positive relationship is twofold. First, there are factors inherent in newly established enterprises that limit their average life expectation (Schutjens and Wever 2000), and lead to the ‘revolving door’ regime described by Audretsch and Fritsch (1992). Second, newly founded companies compete with existing firms and force them to adapt or even to close, although closures of established enterprises are less frequent than the displacement of young firms by new ones. However, exit rates do not allow us to distinguish between the above-described effects. It remains open how long an enterprise existed before closure. As a consequence, little can be concluded about the regional differences of the success of newly founded businesses. Hence, this paper fills this gap by providing an empirical analysis on the regional characteristics and determinants of firm survival while contrasting German and foreign entrepreneurs. More precisely, we aim to answer the following research questions related to the likelihood of firm survival:

-

(i)

Are there regional differences in the survival rates across native and immigrant entrepreneurs?

-

(ii)

If there are differences, how can they be explained?

-

(iii)

Are enterprises founded by foreigners more or less likely to survive in comparison to these established by German entrepreneurs?

Using a unique representative data set derived from the Chamber of Industrial and Commercial Matters in Munich and applying a Gompertz-Makeham hazard model, we seek to provide significant evidence on the survival performance of companies established in Upper Bavaria at a regional level. The applied data set is briefly discussed in Sect. 3 after outlining the theoretical framework. Section 4 provides descriptive analysis on the regional and industry-specific differences in the survival performance of companies founded by Germans and foreigners. Section 5 presents the estimated parametric hazard model, followed by interpretation of the obtained results and some conclusions.

2 Theoretical framework and hypotheses

Establishing a new enterprise and being a successful entrepreneur in a new economic, social and regional environment after overcoming the start-up stage are two considerably different subject matters. When overviewing the theoretical and empirical literature that has been devoted to the identification of success factors of new firms, in particular the survival, three groups of indicators affecting success or failure can be distinguished: (i) individual characteristics of the founding person (Preisendörfer and Voss 1990; van Praag 2003; van Praag and Cramer 2001; Honig 2001), (ii) characteristics of the new firm itself (Reynolds 1997; Brüderl 1992), and (iii) characteristics of the environment of the firm (Fritsch and Falck 2003). The latter are often categorised into three classes: indicators of the level of regional demand; indicators of the regional reservoir of entrepreneurs (supply-side) and finally, indicators of structural differences. In this article, the emphasis will be predominantly on the third group of indicators due to the specific structure of the data employed. The entrepreneur’s origin (foreign versus native), age and gender as individual characteristics are also taken into consideration.

2.1 Indicators of regional demand

Regional demand is of significant importance for newly established enterprises as they trade predominantly on regional and local markets. It is determined by a combination of factors including such as economic development, globalisation and stage of technological change. These factors influence the industrial structure and the diversity in market demand leading to entrepreneurial opportunities. As an indicator of regional demand during the analysed period only the change in the number of employees is available at regional level.

The change in employment can stimulate or hinder the development of newly established companies (Keeble and Walker 1994). A positive trend fosters regional demand and improves the economic prospects of a new firm. This improves the motivation of entrepreneurs to establish new businesses and raises consequently the chances of survival. If a growing number of employees is associated with an increase in population (for instance, in-migration, immigration), the supply-side might improve as well. Additionally, young and well-educated individuals tend to migrate more frequently than older people. Consequently, the number of potential entrepreneurs increases even more.

However, prospering regions with high in-migration are likely to offer attractive employment alternatives to possible entrepreneurs. It can be expected that each individual who considers setting up a business of his own takes into account the employment opportunities the region offers to him. In regions with a prospering labour market, there would be presumably more attractive jobs available for possible entrepreneurs. Therefore, the opportunity costs of setting up a new business increase as the economic success of a region grows.

Additionally, it is observed that since the 1980s, per capita income impact positively the self-employment rate in most developed countries (Storey 1999; Wennekers and Thurik 1999). Increasing wealth, for instance, leads to higher consumer needs. The demand for a variety of products and services increases and small firms are well equipped to supply these new and specialised goods. In this context, we expect that

Hypothesis 1:

There exists rather a positive relationship between the survival rate and the economic development in a particular region.

2.2 Indicators of regional reservoir of entrepreneurs

The state of the regional labour market is important for two main reasons. It not only has an influence on the number of potential entrepreneurs but it also characterises the environment, in which the setting-up of new businesses takes place.

In this context, the unemployment rate is generally seen as a sign of quantitative and structural problems on the labour market (Fritsch 1992; Storey 1994; Armington and Acs 2002). Problems on the regional labour markets lead to lower level of spending power and consequently to lower levels of demand. Hence, a negative influence on the value of the regional share can be expected. Additionally, it is argued that an unfavourable labour market is associated with low opportunity costs because of a lack of job alternatives. This might result in ‘entrepreneurs of need’ (Gerlach and Wagner 1994), which means that people set up their own businesses because they see no other choice of getting paid work. However, empirical studies did not prove this relationship; there was no evidence for a larger share of entrepreneurs among the unemployed individuals (Fritsch and Falck 2003; Armington and Acs 2002). Nevertheless, it can be expected that there are more cases of such ‘entrepreneurs of need’ in times of rising unemployment; hence we assume that

Hypothesis 2:

There exists a negative relationship between the survival rate and the unemployment in a particular region.

2.3 Indicators of structural differences between regions

Both theoretical considerations and the existing literature suggest that location, in particular agglomeration advantages and sectoral structure of regions, figures prominently across the factors important in influencing start-up activities and firm survival.

An important structural indicator is the population density of a particular region, which gives rise to the ‘urban incubator hypothesis’ (Tödling and Wanzenböck 2003). According to this theory, the most newly founded firms start in urban areas. For instance, Littunen (2000) found for the Finish case while distinguishing along four types of firm’s location (capital area, service centres, industrialised urban area, and rural area) that a lot of newly founded companies were located in service centre regions where the production and vocational structure are varied. Even though the environment offers good entrepreneurial opportunities, the survival was clearly shorter in those regions relative to the others. Hence, their study indicates that a more developed production structure lowers the entry barriers and thus economic agents who lack entrepreneurial skills are more likely to establish companies in these compared to other regions.

Moreover, geographical level municipalities operationalised by explanatory variables referring to the level of city specialisation for every industrial sector, population density and diversity of the productive structure of the city were employed to explain the firm location (Costa et al. 2000). The authors found that an increase of 1,000 inhabitants in a small city has a significant greater impact on the capacity to attract new activities compared to these in a larger city. However, they concluded that the number of jobs created in absolute numbers is always higher in the larger-sized cities.

Given the above-stated evidence, the effect of agglomeration should also be researched when studying the survival performance of newly established companies. Hence, we expect that

Hypothesis 3:

There exists a positive relationship between the survival rate and the agglomeration in a particular region.

3 Data

The survival analysis is based upon representative longitudinal data from the Chamber of Industry and Commerce in Munich, Germany. The initial data set consists of 117,423 companies that were either founded or liquidated in the region of Upper Bavaria. The data on enterprise registrations are available for the period 1997–2001, and on deregistrations for 1997–2004. Due to the specific structure of the empirical data, the survival time is the only measurement of entrepreneurial performance. Additionally, we have constructed a variable measuring the number of years that a firm has been operating, as the business registrations are specified by actual date. Besides the survival period, the data provide information on: (i) administrative district (‘Landkreis’) of enterprise establishment; (ii) cause and mode of liquidation; (iii) first name, date of birth and nationality of the entrepreneur, which gives us also the opportunity to ascertain the gender of the founder in 92.3% of the cases; and finally (iv) industrial sector, in which the enterprise operates.

In addition to the fundamental variables stated above, we collected a series of context-specific parameters such as: (i) number of companies in various industrial sectors according to administrative district at different points in time; (ii) population at different points in time; (iii) unemployment rates; (iv) real gross domestic product; and (v) number of resident foreign population.

The data set described above is fascinating, but there are some problems due to process-specific matters, which we will explicitly stress in this section. In 173 start-up cases, for instance, the year of liquidation was before 1997 or after 2004. Since it was impossible for us to reconstruct at which point in time the company was actually liquidated, these cases were treated as missing values. Additionally, in 7,000 cases, the date of liquidation was before that of establishment, and therefore these companies as well as those where the reason of liquidation was ‘doubly documented’ were excluded from the empirical analysis. As a result, the further econometric analysis is based on 110,250 registrations and liquidations.

4 Survival performance in Upper Bavaria

4.1 Dimension of survival by founder’s nationality

For the period under empirical investigation, Germans in Upper Bavaria established 97,383 enterprises out of 110,250, while Non-Germans registered the remaining 12,867 enterprises. However, Table 1 depicts only the distribution of the 10 most entrepreneurial nationalities in absolute and relative numbers.

According to Table 1, German founders account for 91.77% of the enterprise registrations in Upper Bavaria, followed by those from Austria and Turkey. Among the foreign entrepreneurs almost every fourth was holding Austrian citizenship. One possible explanation for this development may be the lower transaction costs associated with the establishment process as Austria is a neighbouring country of Upper Bavaria, and both places have the German language in common and similar institutional regulations pertaining to the foundation process. Overall, the companies listed in the table account for 97.78% of all business establishments during the period 1997–2001.

By the end of the period, only 35.75% of the registered companies in Upper Bavaria were still operating on the market. The enterprise survival on average amounts to 4.41 (4 years and 5 months) measured by the median. An inspection of the cumulative survival (see Fig. 1) provides a number of interesting points. First, the differences between German and Non-German entrepreneurs hold true throughout the time span considered in the analysis. At any time during the period covered, foreign entrants experience a higher risk to failure than do German, and the initial differences seems to increase over time. Second, in both cases, the survival rates exhibit a decreasing pattern over time.

The lower survival rates of the foreign counterparts in comparison to the German founders may be explained by the ‘liability of foreignness’ effect (Hymer 1976; Zaheer 1995). Indeed, foreign firms have inherent disadvantages of engaging into business activities abroad. As they are not familiar with the foreign market and its modus operandi, the cost of doing business does increase relative to the local enterprises. However, the liability of foreignness could not be confirmed for the Portuguese case (Mata and Portugal 2002). The authors did not find significant differences in the failure probabilities of the two types of firms. Being a foreign entrepreneur does not decrease the chances of failure, does not imply different effects on the variables affecting the survival performance. Contrariwise, Colombo and Delmastro (2000) found while distinguishing between state-owned plants, plants that belong to Italian private groups, and plants owned by foreign multinational enterprises that failure rates of plants in both the Italian private group and foreign multinational categories were substantially larger in comparison to the independent plant category. In addition, the likelihood of survival would seem to be larger and less sensitive to plant size for foreign-owned units than for establishments of Italian groups due to the larger exit and re-entry sunk costs associated with the plant closure.

In sum, the liability of foreignness might be a significant cause for the different survival rates found for native and foreign entrepreneurs in Upper Bavaria but it is not the only one explaining these results.

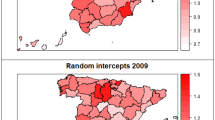

4.2 Regional differences in survival performance

It is not surprising at all that the most registrations (36.31%) out of total enterprise establishments were carried out in the largest city, Munich. The Munich region (8.01%) is ranked second, followed by the Rosenheim region (5.34%), Fuerstenfeldbruck (5.41%), Freising (3.64%), Starnberg (3.51%), and Traunstein (3.14%). The remaining registrations are distributed across the other administrative districts in Upper Bavaria, which account for less than 3% in each case. To study the differences in regional size, we computed an index that links the number of foundations to the average population in a particular district during the period 1997–2001. As a result of this indexing, we found that the least entrepreneurial activity featured Eichstaett with 1.70 registrations per 100 inhabitants, and the most active was the population of Starnberg with 3.47 registrations per 100 residents. The so computed mean value amounts to 2.73 registrations per 100 inhabitants with a median of 2.78.

The enterprise foundations of foreigners in Upper Bavaria were located strongly in Munich, that is, 56.76% of the Non-German founders were resident in the city of Munich contrasted with only 33.52% of the German founders. Almost all other administrative districts featured a lower proportion of Non-German to German foundations. However, this is less surprising when taking into consideration that 55.77% of the resident population of Upper Bavaria lives in Munich.

The survival performance of German and foreign enterprises for comparative purposes differs across the administrative districts in Upper Bavaria. Table 2 indicates the survival time for either group of founders in years as well as the total survival time during the period 1997–2004.

Enterprises established in the administrative district ‘Traunstein’, for instance, indicate the longest survival measured by the median even though only 3.14% of the companies founded in Upper Bavaria were registered there. The highest mortality rate can be expected in the district ‘Ingolstadt’. Companies established in this particular region survive 3.17 years on average. Entrepreneurs operating in the city of Munich (4.12 years for Germans and 3.28 years for Non-Germans) exhibit worse chances of survival despite the higher proportion of firms set up there. In this context, the data do support the competition thesis and can be rated as evidence for the existence of a ‘revolving door effect’ (Audretsch and Fritsch 1992).

Overall, two conclusions can be drawn: first, the survival performance shows a relatively large range across all administrative districts in Upper Bavaria, and second, enterprises founded by Non-Germans have lower survival duration than those established by native Germans. The difference between the survival of enterprises established by Germans and that of the total is relatively minor, while the sequence is approximately the same. Pertaining to the foreign founders, the sequence is not in accordance with that of the Germans. For instance, companies registered by Non-Germans in Traunstein, where the total survival time is comparatively high, have a poorer chance of being successful than those in the Munich region. However, not only characteristics of the region, where the company is located, but also the industrial sector can have an impact on the entrepreneurial success, which in turn might explain the above stated differences.

4.3 Industrial sectors

The data include the industrial sectors following the five- and six-digit classification of the German Federal Statistic Office. We pooled the given information into 10 groups and our subsequent analysis is predominantly based on the so generated industrial sectors. However, Table 3 illustrates the distribution of companies in percentage of each group, German versus Non-German founders, operating in the respective industrial sector.

Accordingly, the sector ‘other services’ accounts for by far the largest group (34.87%) in Upper Bavaria, followed by companies from the retail industry (26.99%). There are major differences between German and Non-German founders with respect to the distribution of enterprises by industrial sector. In this context, the industrial sectors ‘other services’ and ‘catering and hotels’ are the most interesting. While 36.25% of the companies founded by Germans are operating in the ‘other services’ sector, this holds true only for 24.90% of those established by Non-Germans. Hence, the German entrepreneurs are over-represented in this industrial sector making up 91.77% of all founders considered, 99.92% of all companies in the sector ‘other services’ were registered by German nationals.

The Non-German entrepreneurs, on the other hand, are operating in the sector ‘catering and hotels’, namely 16.19% in contrast to 5.61% of the Germans. Moreover, Non-German entrepreneurs are more likely than German founders to register a company in the sector ‘communication and transport’. The aforementioned differences between the two groups of entrepreneurs are statistically highly significant.Footnote 1

The survival performance between German and Non-German entrepreneurs varies across industrial sectors. Table 4 represents the median of the survival duration by the 10 industrial sectors re-grouped for the purposes of our analysis. The highest chance of survival for Non-Germans is in the ‘paper, print and publishing’ sector, whereas for Germans this is the second best. Within this industrial sector, 62.5% of the companies established by Non-German founders venture in the ‘print business’, followed by ‘publishing’ (25.0%), and ‘paper-, cardboard- and paperboard processing’ (12.5%).

Furthermore, while the sector ‘animal farming and agriculture’ offers the best chance of survival for Germans, it is the hardest sector for Non-Germans. This tendency may be due to differences in cultural habits and agricultural methods. The ranking of the ‘retail sector’ is nearly identical for all founders: ranking three for Germans and four for Non-Germans according to their survival in years.

Again, Non-Germans venturing in Upper Bavaria have a poorer chance of survival across all industrial sectors compared with Germans. On the one hand, such variations in survival performance across industrial sectors can be explained by the existence of scale economies and capital intensity.Footnote 2 Moreover, the nature of technology is an essential factor impacting the survival performance of firms. For instance, Celis and Marsili (2005) classifying the industrial sectors according to the Pavitt’s taxonomy (Pavitt 1984) found that science-based sectors showed the longest survival relative to the reference group (supplier dominated). In this line of research, Ortega-Argilés and Moreno (2005) studied the impact of technological opportunity (low, medium and high) on firm survival. Their results for the Cox model indicated that firms with medium technological level had better survival compared to the reference group (low opportunities). Finally, Mata and Portugal (2004) found for the Portuguese case that foreign and domestic firm also have different sectoral entry pattern. In particular, foreign entrepreneurs establish companies where the previous presence of foreign firms is significantly more important and where the entry barriers (for instance, greater concentration and large economies of scale) are higher in comparison to these entered by domestic firms.

4.4 Reasons for liquidation

When analysing the enterprise’s survival, the causes for liquidation should be taken into consideration. Pertaining to the mode of liquidation, we distinguish between liquidation resulting from the entrepreneur himself or ex officio. More precisely, a voluntary liquidation after a period of time is due to a lack of willingness or motivation to continue in business. A better outside option is encountered on the labour market, evidently before the entrepreneur is forced to exit. A compulsory (ex officio) liquidation, though, is cause by a lack of sufficient (financial) opportunity to continue in business. In this context, 64,998 out of 110,250 companies were liquidated by the end of the observation period and 22.01% of those took place officially.

In the case of Non-German founders, this number is notably higher, i.e. 29.08% or 2,410 companies, whereas only 21.36% of German enterprises were liquidated ex officio. Table 5 depicts the five most frequent reasons for liquidation in absolute and relative numbers for either group of founders in Upper Bavaria although with ‘other reasons’ (for instance, transfer of enterprise, death of the founder, personal reasons, unprofitable enterprise, and trade not carried on) applying to less than 1% of the liquidations.

Accordingly, there exist differences between German and Non-German founders, which are statistically highly significant, but on the other hand, complex to interpret due to the specific structure of the data. Definitely, we are not surprised that the fraction of enterprises liquidated because of unknown address of the owner is higher for Non-German (20.56%) than for German (15.26%) entrepreneurs in Upper Bavaria. To a certain extent, this might be ascribed to returns to the country of origin, and thus a voluntary exit, which cannot be associated with failure but rather with better employment alternatives as in their occupational choice individuals are assumed to compare the expected utility of financial and non-pecuniary rewards of employment alternatives (Grilo and Thurik 2004). In addition to rewards, economic agents compare the risk of occupational alternatives. Consequently, the risk-reward profile of self-employment versus other types of activities encompasses the evaluation of expected net rewards.

Finally, alterations of the legal form as well as dissolutions were seldom the reason for enterprise liquidations, while the category summarised by the Chamber of Industry and Commerce in Munich, as ‘other reasons’ cannot be interpreted at all. For the further analysis, however, the cancellations of business are treated as no longer existent, i.e. as right-censored observations.

5 Method of econometric estimation

The techniques of survival analysis (Blossfeld and Rohwer 1995) are used to test the outlined theoretical arguments as they surmount the problems that arise from the straightforward application of OLS and binary dependent regression models. The variable of interest in the duration analysis is the length of time that elapses from the beginning of a particular event (firm foundation) either until its end (liquidation) or until the measurement is taken into consideration (censoring), which may precede termination. The process under observation may have begun at different points in time; therefore, censoring is a pervasive and usually unavoidable problem in the analysis of duration data.

In modelling survival likelihood of business foundations, the quantity of fundamental interest is the so-called hazard rate, which can be defined variously as:

where t denotes time, T is the random variable for the time of the event and f(t), F(t) and S(t) depict the density, cumulative distribution, and the so-called survival probability, respectively. The quantity \(\hbox{Pr} ({T\le t+\Updelta t|T\ge t})\) in Eq. 1 gives the probability of having the event (firm liquidation) between time t and \(t+\Updelta t, \) conditional on yet being accoutred. Hence, this quantity provides the probability that the event will emerge between ‘now’, as indexed by t, and some time in the future, as indexed by \(t+\Updelta t. \) For event appearing in conditional time, it is desirable to define over all possible positive t denoted by the limit in (1).

5.1 The Gompertz-Makeham hazard model

Various model specifications of the hazard rate (non-parametric, semi-parametric, and parametric) can be applied for this purpose. In many cases, theory does provide grounds to lean toward a particular choice, but more often practical considerations underlie these choices. Unfortunately, estimated effects of covariates can sometimes vary noticeably across different functional forms, complicating matters for the analysis.

One reason for this sensitivity is that the models differ considerably in their specification of the time variation in the baseline hazard, h 0 (t). For instance, some models assume that the baseline hazard increases or decreases monotonically (the Weibull, Gompertz, and Makeham models), while others presume a unimodal shape for the baseline hazard, with the rate rising and then declining (the log-logistic, and log-Gaussian models). In addition, some specifications yield a distribution of event times that integrate to unity, implying all entrepreneurs will experience the event of interest if observed for a sufficiently long period of time (the exponential, Weibull, Makeham, log-logistic, and log-Gaussian models), while other models, in some cases, yield a so-called defective distribution in which some individuals will never experience the event of interest, even if they are observed for an arbitrarily long time. As a result, the questions arise: how should we model the hazard rate and where should the covariates be attached?

As already discussed above, the hazard rate can be modelled in such a way that it remains either constant or varies over time t. The assumption of a constant rate seems to be rather unrealistic as it implies that the risk for a particular enterprise to fail at any time of its existence is identically high. Hence, the question about the lapse of the hazard rate arises. The existing literature, however, gives support to different concepts, which we will briefly state below, in order to explain why we should favour the Gompertz-Makeham model over the other parametric models.

‘The liability of newness’ preposition traces back to Stinchcombe (1965) and it describes the different risks of an enterprise to die during its course of life. This phenomenon states that at the time of founding of a company the risk of dying is the highest and decreases with growing age of the company. There are basically three reasons why this might be the case. First, new enterprises, which are operating in new areas, demand for new tasks to be performed by their members. The learning process takes time and leads to economic inefficiencies. Second, trust among the enterprise members has yet to be developed since in most of the cases, the new employees of a firm do not know each other when the enterprise is launched. And third, new companies have not yet built stable portfolios of clients, which do not hold true for age-old companies. A recent wave of studies has emerged consistently showing that the likelihood of firms to survive tends to increase along with age of the firm (Fichman and Levinthal 1991; Brüderl 1992; Audretsch and Mahmood 1994). This finding holds true across different industrial sectors, time periods and even countries (Audretsch 1991).

Additionally, Brüderl (1992) used the arguments of organisational ecology, in which he modified ‘the liability of newness’ proposition. He suggested that the company’s hazard rate actually follows rather an inverted U-shape pattern than continuously declining with increasing age. This argument is associated with ‘the liability of adolescence’ proposition. The reasons for this are cognitive, emotional, and financial. First, it will only become clear after some period of time that the firm, or the firm’s performance, is not reaching expectations. It takes the entrepreneur time to acquire insight into the financial figures. A second reason why a firm is closed down after a few years is the presence of an emotional barrier. It is often difficult to admit to oneself and one’s immediate circle that establishing the new enterprise was not really a success. A third factor is that it can take some time to use up the start capital.

Several hazard rate models can represent the aforementioned theoretical arguments. The ‘liability of newness’ hypothesis, for instance, can be modelled applying the Gompertz-Makeham model, whereas the ‘liability of adolescence’ using the log-logistic hazard model. According to our data, an ‘adolescence’-phase employing the log-logistic model can be found, but this is too short (less than month), and thus, can be regarded as negligible. Consequently, this speaks for the application of the Gompertz-Makeham model as already argued above.

In the single transaction case, the Gompertz-Makeham-model is based on the assumption that the baseline hazard rate increases or decreases monotonically. The hazard rate is denoted as follows (Blossfeld and Rohwer 1995)Footnote 3:

The parameters in the model specified by Eq. 2 can be interpreted as follows. Setting t = 0 gives the hazard rate at enterprise establishment:

Setting t = ∞ gives the asymptotic hazard rate, the rate that applies to age-old firms:

Thus β determines the amount by which the initial hazard rate exceeds the asymptotic rate α. Finally, γ governs the speed at which the hazard rate falls with a company’s age, the rate at which the liability of newness wears off. Accordingly, large negative values of γ will imply that the liability of newness diminishes rapidly.

5.2 Where should the covariates be attached?

The covariates entered into the Gompertz-Makeham function must be introduced to the specific vectors α, β, and γ, each of which has a different substantive interpretation. We specify, however, that

where a′, b′, and c′ are transposed vectors of parameters, and x is a matrix of covariates. Substituting these specifications into Eq. 3 yields the following model of hazard rates:

Note that the hazard rate at the enterprise establishment equals

and the asymptotic rate is

Thus, we have to specify in advance not only which exogenous variables influence the survival performance of the entrepreneurs, but also which component of the hazard rate will be affected. Attempts to disentangle the relevant components empirically by entering covariates into all vectors simultaneously are usually unsuccessful due to multi-collinearity problems in estimation.

In the conducted survival analysis, we inserted the covariates of interest into the β vector. This decision partly reflects the substantive problems we have chosen to study, partly mirrors the view of selection processes among companies. Moreover, we argue that since most enterprises die at early ages, selection processes are most intense as they operate on the initial rate of a firm’s death. Early selection processes probably also account for the greatest variation in hazard rates across populations of firms. By this reasoning, the β vector of the Gompertz-Makeham model should reflect the selection processes most clearly. In addition, previous empirical research as discussed above also gives support to this assertion.

In total, we model the survival performance based on the Gompertz-Makeham hazard model. The hazard rate is represented as a function of a set of exogenous covariates, which entered the model into the β vector, so that

where b′ is a vector of parameters, x is a matrix of regional and entrepreneur-specific covariates, and β i = exp (b′x). We estimate the so specified model by applying the maximum-likelihood-method, and we discuss the obtained results comprehensively in the following section.

6 Empirical results

When studying the differences in survival performance among newly established businesses by founder’s nationality, the industrial structure pertaining to the administrative districts needs to be assessed. For this purpose, we first carried out a cluster analysis including variables such as unemployment rate, GDP per capita, trade tax collection rate, population density (proxy for urban and rural area), and share of industrial sectors out of the total number of firms as a reference to whether it concerns rather an agricultural, an industrial or a service region.

We used average values over the observed time period, and the K-mean algorithm clustered the established enterprises into four groups.Footnote 4 The main characteristics of each regional cluster are depicted in Table 6.

In addition, we undertook a number of non-parametric tests of equality of the survival functions including various independent variables, which are subsequently used in the Gompertz-Makeham model in order to investigate the significance of the differences in the survival functions of German and Non-German entrepreneurs. The tests analysed are the Long-rank test, the Wilconxon-Breslow test and the Tarone-Ware test, which are based on the χ2 distribution (see Table 7). According to the results of the non-parametric tests, the differences in survival between German and foreign founders are statistically highly significant. This evidence does not hold true only for the variables age-group of the founder ‘26–35’ and ‘56 and above’, respectively.

How does the industrial structure in a particular administrative district influence the survival chances of newly founded companies? We estimated different specifications of the Gompertz-Makeham hazard model. In the first hazard model, we included only the generated clusters, in order to examine the survival chances of companies operating in the particular cluster. Indicators pertaining to the personality of the founder such as age, gender and nationality are also taken into account. The obtained estimates (see Table 8) show that companies founded in regional cluster 1 have the best possibilities to operate longer on the market in comparison to cluster 3. The remaining regional clusters (cluster 2 and cluster 4) offer worse survival chances.

Moreover, model 2 confirmed the inverted U-shaped relation between age of founder and success. Being a male and establishing an enterprise in Upper Bavaria leads to a 18.2% decrease in the hazard rate. Finally, foreign founders have worse chances of survival compared with the Germans taken as reference group.

In the second model specification, we incorporated covariates such as tax trade collection rate, unemployment rate, population density and share of foreign population. We also tested for the inverted U-shape relationship (see Table 9). The level of unemployment rate reflects the economic development of a region. The amount of unemployment does have a clear negative impact on the chances of surviving. For instance, 1% point increase in the unemployment rate (follow model 1, Table 9) leads to a 12.16% increase in the hazard rate. The unemployment rate tends to have a negative impact on the chances of survival in all models estimated. Hence, we found empirical evidence for hypothesis two and therefore we cannot reject it.

The estimated hazard model two suggests that a 1% point increase in the foreign population share yields a 4.31% decrease in the hazard rate. While including the squared share of the foreign population into the model three in order to account for the inverted U-shape relation between agglomeration and survival, the effect of the foreigners even increases. In other words, a 1% point increase in the share leads to a 5.28% decline of the hazard rate whereas the squared share causes a 0.21% increase of the same. However, it is extremely difficult to estimate the level at which the still positive effect of the increasing share reverses the impact on the hazard rate. The same is true for the population density in a particular administrative district. Therefore, we can conclude that the level of agglomeration does impact the survival performance of newly founded businesses in Upper Bavaria. The relationship between the level of agglomeration and survival performance is a non-linear one.

Additionally, we took into consideration the migration process in our survival analysis operationalised by share of resident foreign population, as Bavaria is among the federal states in Germany accounting for a high share of Non-Germans. In this context, we regard the percentage of Non-Germans as small when it averages below 7%, as medium-range when it is between 7% and 12%, and as high when it exceeds 12% for the period 1997–2004. Accordingly, administrative districts such as Ingolstadt, Munich city and Rosenheim city have a high proportion; the Berchtesgaden region, Bad Toelz, Dachau, Ebersberg, Freising, Fuerstenfeldbruck, Garmisch-Partenkirchen, Miesbach, Munich region and Starnberg have a medium-range proportion; and the regions of Altoetting, Eichstaett, Erding, Landsberg am Lech, Muehldorf, Neuburg-Schrobenhausen, Pfaffenhofen, Rosenheim region, Traunstein and Weilheim-Schongau have the smallest proportion of foreign population. In our view, it would be more precise to incorporate the share of each particular nationality into the analysis when investigating the impact on survival, but unfortunately these data are not available.

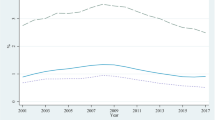

When investigating the survival performance of German entrepreneurs by percentage of foreign population that resides in a certain administrative district, we encounter that the survival performance is notably greater in districts with a medium or high percentage of foreigners living there. The obtained patterns for Non-German founders are slightly different. Figures 2 and 3 show the estimated survival duration for either group of entrepreneurs by share of resident foreign population in the region.

According to Fig. 2, German companies founded in administrative districts with share of foreign population up to 12% have better survival chances compared with those in districts with share higher than 12%.

As for the foreign companies, the cumulative survival curves are steeper and the best chances to operate longer on the market indicate enterprises established in regions with a share between 7% and 12%. Consequently, we can conclude that migration does impact survival chances of newly establishes companies in Upper Bavaria.

7 Conclusion

The main focus of interest in the current study was to investigate a broad range of regional factors influencing the mortality process of newly founded businesses by Germans and Non-Germans in Upper Bavaria during the period 1997–2004, and to provide an answer to the question: do regional differences matter for firm survival?

The main finding of our empirical analysis suggests that survival chances do vary not only between German and Non-German founders, but also across administrative districts in Upper Bavaria. We uncovered that the relationship between level of agglomeration and survival is non-linear and shows an inverted U-shaped pattern. More precisely, the positive impact of population density on the survival chances is not as strong as is the share of foreign population resident in the particular administrative district.

Finally, the economic development of an administrative district also influences the survival performance of new firms operating there. Measured by the unemployment rate as well as the tax trade collection rate, we found a positive relationship between these two indicators and the estimated hazard rate.

In total, characteristics of the regional environment of the firm have a strong impact on the survival performance of German and Non-German companies established in Upper Bavaria. Consequently, the regional structural policy should focus not only on encouraging the creation of as many new businesses as possible but also on ensuring that the newly established enterprises have the best regional environment to succeed in the long run.

Notes

The computed χ 2-statistics accounts for 2,967.47 with nine degrees of freedom and is statistically significant at the 1% level.

The survival function is denoted as \(S\left( t \right)=\hbox{exp} \left\{ {-\alpha t-\beta/{\gamma \left[ {\hbox{exp} \left( {\gamma t} \right)-1} \right]}} \right\}, \) whereas the density is specified by f(t) = exp {−αt − β/γ [exp (γ t) − 1]} · { β exp [γt]}.

Cluster 1: Berchtesgaden Region, Bad Toelz, Dachau, Ebersberg, Erding, Fuerstenfeldbruck, Garmisch-Partenkirchen, Landsberg am Lech, Miesbach, Muehldorf, Neuburg-Schrobenhausen and Rosenheim Region; Cluster 2: Munich City and Munich Region; Cluster 3: Ingolstadt, Rosenheim City, Altoetting and Pfaffenhofen, and Cluster 4: Eichstaett, Freising, Starnberg, Traunstein and Weilheim-Schongau.

References

Armington C, Acs ZJ (2002) The determinants of regional variations in new firm formation. Region Stud 35:33–45

Audretsch DB (1991) New-firm survival and the technological regime. Rev Econ Stat 60:441–450

Audretsch DB, Fritsch M (1992) Market dynamics and regional development in the Federal Republic of Germany. Discussion Paper FS IV 92-6, Wissenschaftszentrum Berlin

Audretsch DB, Mahmood T (1994) The Rate of hazard confronting new firms and plants in U.S. manufacturing. Rev Ind Organ 9:41–56

Audretsch DB, Mahmood T (1995) New firm survival: new results using a hazard function. Rev Econ Stat LXXVII:97–103

Blossfeld HP, Rohwer G (1995) Techniques of event history modelling – new approach to causal analysis. Lawrence Erlbaum Associates, Mahwah, New Jersey

Brüderl J (1992) Organizational mortality and the liability of adolescence. Institut für Soziologie, Universität München (mimeo)

Colombo MG, Delmastro M (2000) A note on the relation between size, ownership status and plant’s closure: sunk costs versus strategic size liability. Econ Lett 69:421–427

Celis E, Marsili O (2005) A matter of life and death: innovation and firm survival. LEM Working Paper Series 2005/01, Sant’Anna School of Advanced Studies, Pisa

Costa MT, Segarra A, Viladecans E (2000) Business dynamics and territorial flexibility. Paper presented at the 40th European Regional Science Association Congress, August 29–September 1, Barcelona

Fichman M, Levinthal DA (1991) Honeymoons and the liability of adolescence: a new perspective on duration dependence in social and organizational relationships. Acad Manage Rev 16:442–468

Fritsch M (1992) Regional differences in new formation: evidence from West Germany. Region Stud 25:233–241

Fritsch M, Falck O (2003) New business formation by industry over space and time: a multi-dimensional analysis. Discussion Paper 322. German Institute for Economic Research, Berlin

Gerlach K, Wagner J (1994) Regional differences in small firm entry in manufacturing industries: Lower Saxony, 1979–1991. Entrepreneur Region Dev 6:63–80

Geroski PA, Schwalbach J (1991) Entry and market contestability: an international comparison. Oxford, Basil Blackwell

Grilo I, Thurik R (2004) Determinants of entrepreneurship in Europe. Discussion papers on entrepreneurship, growth and public policy, 30-2004, Max Planck Institute of Economics, Group for Entrepreneurship, Growth and Public Policy, Jena

Honig B (2001) Human capital and structural upheaval. A study of manufacturing firms in the West Bank. J Bus Ventur 16:575–594

Hymer SH (1976) The international operations of national firms: a study of direct investment. Cambridge, MIT Press

Keeble D, Walker S (1994) New firms and dead firms: spatial patterns and determinants in the United Kingdom. Region Stud 28(4):411–427

Littunen H (2000) Networks and local environmental characteristics in the survival of new firms. Small Bus Econ 15:59–71

Mata J, Portugal P (2002) The survival of new domestic and foreign-owned firms. Strat Manage J 23:323–343

Mata J, Portugal P (2004) Patterns of entry, post-entry growth and survival. Small Bus Econ 22:283–298

Ortega-Argiles R, Moreno R (2005) Firm competitive strategies and the likelihood of survival. The Spanish case. Discussion papers on entrepreneurship, growth and public policy, 0507, Max Planck Institute of Economics, Group for Entrepreneurship, Growth and Public Policy, Jena

Pavitt K (1984) Sectoral patterns of technical change: towards a taxonomy and a theory. Res Policy 13:343–373

van Praag CM (2003) Business survival and success of young small business owners: an empirical analysis. Small Bus Econ 21:1–17

van Praag CM, Cramer JS (2001) The roots of entrepreneurship and labor demand individual ability and low risk aversion. Economica 269:45–62

Preisendörfer P, Voss T (1990) Organizational mortality of small firms: the effects of entrepreneurial age and human capital. Organ Stud 11:107–129

Reynolds P (1997) Who starts firms? Preliminary explorations of firms in gestation. Small Bus Econ 9:449–462

Schutjens VA, Wever E (2000) Determinants of new firm success. Region Sci 79:135–159

Stinchcombe AL (1965) Social structure and organizations. In: March JG (ed) Handbook of organizations. Chicago, Rand McNally, pp 153–193

Storey DJ (1994) Understanding the small business sector. Routledge, London, New York

Storey DJ (1999) Six steps to heaven: evaluating the impact of public policies to support small business in developed countries. In: Sexton DL, Landström H (eds) Handbook of entrepreneurship. Oxford, Blackwell, pp 176–194

Tödling F, Wanzenböck H (2003) Regional differences in structural characteristics of start-ups. Entrepreneur Region Dev 15:351–370

Wennekers ARM, Thurik AR (1999) Linking entrepreneurship and economic growth. Small Bus Econ 13:27–55

Zaheer S (1995) Overcoming the liability of foreignness. Acad Manage J 32:341–364

Acknowledgements

The author would like to thank the anonymous referees, as well as the participants of the workshop ‘Entrepreneurship, Firm Demography and Industrial Location’ (2006) held at the Austrian Institute for Economic Research.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fertala, N. The shadow of death: do regional differences matter for firm survival across native and immigrant entrepreneurs?. Empirica 35, 59–80 (2008). https://doi.org/10.1007/s10663-007-9051-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-007-9051-2