Abstract

The urgency of recognizing the substantial impacts of climate risks on economic and financial systems is increasingly emphasized among regulators and investors. By constructing the news-based climate physical risk (CPR), climate transition risk (CTR), and climate policy uncertainty (CPU) indexes for China, we adopt TVP-VAR-SV models and apply it to various economic sectors in a climate-sensitive scenario. We obtain this result that the significant heterogeneity of climate risk exposures and its different effects on climate-sensitive sectors. CPR emphasizes the immediate effect of operating and bankruptcy costs, thus not causing large variations across sectors. The differences in CTR exposure among these sectors are largely influenced by energy transition and climate policy. In addition, climate policy timing matters. CPU shock shows that a disorderly and ambitious climate policy could have adverse consequences for economic sectors over time approximation, especially for the related sectors within the energy chain. Noticeably, the response in the finance sector illustrates that the transition to low-carbon finance could also have net positive effects. Therefore, our results provide important implications for the low-carbon actors dealing with a ‘green’ or a ‘brown’ investing and transition strategy in China’s “carbon peak, carbon neutrality” target.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Climate change, as a pivotal uncertainty factor in the global transition of the recent century, has already presented numerous severe and enduring challenges to economic development, and global financial stability. China’s “Climate Change Blue Book” indicates that the warming trend persists, extreme events are becoming more frequent and intense, and the climate risk index is rising. In fact, economic sectors often serve as the first line of defense against climate risks, and the external shocks to an economic sector will spread across other sectors through various channels, potentially threatening financial stability. As a sensitive and important region in global climate change, China has clearly set the target of a “carbon peak” by 2030 and “carbon neutrality” by 2060, thus the entire economic system may be facing the dual pressure of achieving the low-carbon transition of economic sectors and maintaining financial stability. Climate risks have become an important obstacle to sustainable development. However, a systematic climate risk assessment framework has not been formed at present, and how to assess climate risk and its impact quantitatively also has become a key issue in current research. Therefore, this paper attempts to construct a news-based climate risk index using text analysis to further explore the nonlinear impact of climate risk on economic sectors.

Climate risks are generally divided into climate physical risks and climate transition risks (Chenet et al. 2021; Battiston et al. 2021). Climate physical risk (CPR) is driven by the frequency of climate-related events, leading to direct losses for climate catastrophes (Campiglio et al. 2018). Climate transition risk (CTR) refers to the fact that the economic and financial system could suffer adverse shocks due to factors such as climate policy adjustment and low-carbon technology innovation. For example, climate policy has adversely affected the fossil fuel sector through carbon pricing and emission restrictions, and then financial stability has also faced challenges (Battiston et al. 2017; Diluiso et al. 2021); Low-carbon technological innovation brings new investment opportunities for climate investment and financing, such as green stocks or renewable energy (Sautner et al. 2023; Santi 2023). In addition, the uncertainty related to the timing and speed of climate policy has greatly affected the implementation and effectiveness of climate policies. The unexpected introduction of climate-related policies will trigger changes in investor preferences, and increase uncertainty in market expectations and carbon-intensive assets, thereby indirectly posing a threat to financial stability (Diluiso et al. 2021; Dunz et al. 2021). Obviously, climate policy uncertainty (CPU) could be a more prominent risk among climate transition risks. Therefore, it is essential to further differentiate between different climate risk indexes and conduct relevant research on climate risk exposures and its impact on economic sectors.

The academic community has reached a broad consensus on the adverse effects of climate risks on the economic and financial systems, and numerous studies have been conducted on climate risk exposures and its impacts. Previous studies had mainly measured the adverse losses of climate risk on economic sectors through direct statistical indicators (Ilhan et al. 2021; Yang et al. 2023), and indirectly assessed its impact on the financial system through the impact on real economy asset prices, which could be one of the pathways through which climate risk contagion spreads (Plantinga and Scholtens, 2021; Carattini et al. 2023). In recent research, text analysis has been used to measure and quantify climate risk. The earliest application of text analysis to climate risk disclosure was by Gavriilidis (2021), who measured climate policy uncertainty by capturing keywords retrieved from climate-related news. His research built on text analysis of economic policy uncertainty (Baker et al. 2016) and climate news attention (Engle et al. 2020). Subsequently, Sautner et al. (2023) used machine learning to identify climate-related topics among earnings call participants to capture climate risk exposure. Bua et al. (2024) further constructed two different climate change terms to distinguish between physical risks and transitional risks. Therefore, text analysis has been proven to be an effective method for climate risk measurement and quantification.

According to studying the impact of climate risk, the existing literature focuses more on the specific impacts of climate risks on economic activities, energy markets, and financial markets (Engle et al. 2020; Bouri et al. 2022; Pan and Li, 2024), and less attention is paid to the impact of climate risks on different economic sectors from different sectoral perspectives (Lv and Li, 2023). King (1966) believed that sector-specific factors can significantly influence stock prices, and various sectors also offered a clearer understanding of the overall national economic performance (Lu et al. 2022). Especially, in the process of low-carbon transition, stocks of carbon-intensive industries such as fossil fuels, electricity, and housing are directly exposed to climate policy risks (Choi et al. 2020; Pastor et al., 2021), the impact would be transmitted to the stock prices of carbon-intensive industries such as traditional fossil energy and energy-intensive industries, thereby indirectly harming financial stability. Obviously, due to the core inspiration of climate policy is to mitigate climate risk, it is inextricably linked to the activities of the economic and financial systems (Lee et al. 2022; Tedeschi et al. 2024). Therefore, considering the impact of climate risks on the economic and financial system, especially on climate-sensitive sectors, has important theoretical and practical implications (Battiston et al. 2017; Wang et al. 2023). At the same time, as the world’s largest carbon emitter and coal consumer, China also plays an important role in global climate governance, energy structure optimization, and climate policy implementation. Inspired by the above research considerations, this paper uses text analysis to measure China’s climate risk exposure from three climate risk aspects, based on Chinese news data from January 2008 to August 2023. Meanwhile, we consider reclassifying economic sectors into seven subsectors, with six climate-sensitive sub-sectors. We explore and analyze the climate risk exposure of three climate risk indexes and its effects on different climate-sensitive sectors.

The marginal contribution of this paper is as follows. Firstly, we use the text analysis method to measure three types of climate risk indexes based on mainstream newspapers in China, which expands the relevant literature on exploring climate risk pricing and measurement (Huang and Luk, 2020; Xu et al. 2023). Secondly, by comprehensively considering three types of climate risk exposure, we provide direct empirical evidence for the nonlinear impact of climate risks on China’s climate-sensitive sectors from multi-dimensional perspectives, thus improving the relevant literature that only focused on the impact of a single climate risk (Ren et al., 2022a; b; Siddique et al. 2023). Thirdly, based on the segmentation of climate-sensitive sectors, we use the TVP-VAR-SV model to analyze the nonlinear and dynamic impact of climate risk shocks on climate-sensitive sectors, which enriches the relevant research on the impacts of climate risk shocks from the perspectives of different sectors (Andersson et al. 2016; Chen et al. 2023).

2 Data & methodology

2.1 Construction of climate risk indexes

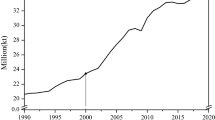

Following the research contributions of Baker et al. (2016), Huang and Luk (2020), and Xu et al. (2023), this paper explores how news coverage can serve as a direct source for citizens to update their concerns about climate risk, particularly during significant domestic events related to climate risk (Choi et al. 2020; Engle et al. 2020; Yan and Cheung, 2023). By analyzing the frequency of articles discussing climate risks in major domestic newspapers and media, we construct three climate risk indexes from January 2008 to August 2023. Our indexes are selected from ten leading Chinese newspapers: Beijing Youth Daily, Guangzhou Daily, Jiefang Daily, People’s Daily Overseas Edition, Shanghai Morning Post, Southern Metropolis Daily, The Beijing News, Today Evening Post, Wen Hui Daily, and Yangcheng Evening News. These ten newspapers are more focused on market fluctuations and investor reactions, which can reduce the bias of government censorship to some extent (Huang and Luk, 2020). Considering the one-year policy lag effect, we take the period after the Chinese government released the report “China’s Policies and Actions on Climate Change” in 2007 as the data interval for constructing the climate risk index (Ren et al., 2022a; b; Dai and Zhang, 2023). During this period, the text data from the ten newspapers remains relatively complete, ensuring the reliability and reproducibility of the constructed indexes. The relevant newspapers are determined based on the climate keywords in the digital archives of the Wisers Information Portal.

Unlike the existing literature, our primary inspiration is to develop CPR, CTR, and CPU indexes using a unified data source to avoid potential biases in indicator types. To address this, we synthesize the existing literature on climate risk measurement (Xu et al. 2023; Lee and Cho, 2023; Yan and Cheung, 2023), and take the annual report “China’s Policies and Actions on Climate Change” as an important reference for key phrases, and construct three types of climate risk index phrases respectively. As is shown in Appendix Table 4, The CPR index is primarily considered from three aspects: acute risks such as typhoons, extreme precipitation, floods, and high temperatures; chronic risks such as sea level rise and average temperature increase, and ecological environment damage (Zscheischler et al. 2018; Somanathan et al. 2021; Tang et al. 2021; Yang et al. 2023; Sautner et al. 2023; Zhu et al. 2023). The CTR index is considered from the perspectives of climate policies (Diluiso et al. 2021), technological progress (Reyseliani and Purwanto, 2021), and investor preferences (Stolbova et al. 2018; Reyseliani and Purwanto, 2021; Dunz et al. 2021; Diluiso et al. 2021). As is shown in Appendix Table 5, The CPU index reflects the impact of uncertainty related to climate policy on the economic and financial system. Following Huang and Luk (2020), and Gavriilidis (2021), this index is divided into three dimensions: climate, policy, and uncertainty.

Based on the previous construction about climate risk keywords, following the methodology of Gavriilidis (2021), the sum of climate-related articles appearing in each newspaper is calculated as a monthly index. These indexes are then standardized and adjusted using standard deviation. Finally, the standardized indexes are weighted and averaged to obtain different climate risk indexes respectively: climate physical risk (CPR), climate transition risk (CTR), and climate policy uncertainty (CPU).

2.2 Classification of climate-sensitive sectors

Climate physical risk resulting from climate change can affect the stranding of carbon-intensive assets, leading to lower equity returns in carbon-intensive industries (Bua et al. 2024). Yet, climate transition risks triggered by assessing the possibility of the introduction of climate policies may affect the revenues and costs of economic sectors and have indirect effects on the finance sector holding assets of these sectors (Battiston et al. 2017). Clearly, it is inevitable that the national economic sectors, especially climate-sensitive sectors, will be significantly affected by a series of climate risks. In addition, these economic sectors will also be subject to a comprehensive effect from various types of policies, resulting in a more complex situation. In order to minimize the impacts of other policies on climate-sensitive sectors, we need to exclude the interference of other policies in the classification of climate-sensitive sectors. A particular approach created by Battiston et al. (2017) provides some inspiration for us. Like Battiston et al. (2017), we use the approach to identify climate-sensitive sectors in China, based on criteria such as GHG emissions, their role in carbon-related assets, and the existence of climate policy agencies in most countries. This approach effectively excludes the effects of other policies on economic sectors, which gives us an effective way to exclude other policy effects and classify climate-sensitive sectors in China. In addition, we further estimate the impulse response of climate risks on climate-sensitive sectors at different time points of major event shocks, thus verifying the possibilities of being affected by other policies through comparative analysis.

Specifically, according to the relevance of economic sectors to climate mitigation policies, Battiston et al. (2017) established a mapping between economic sectors classified at the NACE Rev2 4-digit level and seven climate-policy-relevant sectors (fossil fuel, energy-intensive, housing, utilities, transport, finance, and other sectors). Combined with the research of Battiston et al. (2017) and Wang et al. (2023), we define the correspondence between the “Guidelines for the Industry Classification of Listed Companies” in China and the NACE rev2 4-digit codes in the EU, and China’s economic sectors are mainly reclassified into six climate-sensitive sectors: fossil fuel, energy-intensive, housing, utilities, transport, and finance. The mapping relationship between the industry classification of listed companies in China and the climate-policy-relevant sector classification in Battiston et al. (2017) forms the classification of climate-sensitive sectors, as shown in Table 1.

We used the secondary industry index compiled monthly by Eastmoney to construct proxy variables for climate-sensitive sectors, with data from the Choice financial terminal. The sample period spans from August 2014 to August 2023, which was selected based on the availability of the secondary industry index. Eastmoney constructs these indices using securities data from all listed companies and classifies them to reflect the overall performance in specific markets or industries. After excluding the compiled indices with incomplete data or other issues, we further construct the corresponding climate-sensitive sector indexes by weighting their current market values.

2.3 TVP-VAR-SV model

Climate risk is a typical systemic risk (Centeno et al. 2015), its systemic and time series structure can lead to time-varying and nonlinear impacts on economic and financial activities (Ren et al., 2022a; b). Therefore, we attempt to explore the nonlinear effects of climate risk shocks on climate-sensitive sectors in the simultaneous and lagged periods. Different from the traditional constant parameter VAR model, the time-varying parameter VAR model with stochastic volatility (TVP-VAR-SV) takes the time-varying characteristics into account, which means that this model can account for predictable component changes in the dynamic relationships between climate risks and climate-sensitive sectors, and unpredictable component changes in the climate risk shocks or its impacts on climate-sensitive sectors (D'Agostino et al. 2013).

The existing research used this model to investigate the nonlinear effects of climate policy uncertainty and financial speculation on global oil and gas prices (Guo et al. 2022). Therefore, considering the time-varying characteristics of the climate risk index, we adopt the TVP-VAR-SV model to accurately locate the time-varying parameters and capture its effects through the time-varying covariance, thus realizing the impulse response of climate risks on climate-sensitive sectors. Following Nakajima et al. (2011) and Ye (2022), a basic VAR model of climate risk shocks is defined as:

where A is \(4 \times 4\) dimensional coefficient matrix, \(\varepsilon_{t} \sim N\left( {0,I_{k} } \right)\). \(Y_{t} = \left[ {{\text{climate risks}}_{t} ,{\text{sectors}}_{t} } \right]^{\prime }\) is composed of various variables of climate risks and climate-sensitive sectors, \({\text{climate risks}}_{t}\)\(\in\)\(\left\{ {CPR_{t} ,CTR_{t} ,CPU_{t} } \right\}\), \({\text{sectors}}_{t} = \left( {{\text{fossil fuel}}_{t} {\text{,energy - intensive}}_{t} {\text{, housing}}_{t} {\text{,utilities}}_{t} {\text{,transport}}_{t} {\text{,finance}}_{t} } \right)^{\prime }\),

\(X_{t} = I_{k} \otimes \left( {y^{\prime}_{t - 1} , \cdots ,y^{\prime}_{t - p} } \right)\) in which \(\otimes\) is the Kronecker product. The formula (1) of the traditional VAR model can be transformed into:

In this case, the coefficients \(\beta\), \(A^{ - 1}\), and \(\Sigma\) in the traditional model are all constant parameters, we consider that the impact of climate risks on climate-sensitive sectors may vary significantly over time, and further adopts the structure of the TVP-VAR model with stochastic volatility:

, where the introduction of time-varying parameters \(\beta_{t}\), \(A_{t}^{ - 1}\) and \(\Sigma_{t}\) endows the nonlinear structure of the model. Therefore, let the lower triangular elements of the matrix \(A_{t}\) be rearranged into column vectors \(a_{t} = \left( {a_{21,t} ,a_{31,t} ,a_{32,t} , \cdots ,a_{kk - 1,t} } \right)^{\prime }\), and the column vectors \(h_{t} = \left( {h_{1,t} ,h_{2,t} , \cdots h_{k,t} } \right)^{\prime }\) with \(h_{jt} = \log \sigma_{jt}^{2}\) where \(j = 1,2, \cdots k\) and \(t = s + 1, \cdots ,n\). The TVP-VAR-SV model follows the following random walk process:

, where the parameters \(\Sigma_{\beta }\), \(\Sigma_{a}\) and \(\Sigma_{h}\) need to be estimated to satisfy the innovation of the time-varying parameters. and the Markov Monte Carlo method (MCMC) is used for this parameter estimation (Nakajima et al. 2011). In addition, in the subsequent estimation, the optimal lag selected is one based on the Schwarz Criterion (SC) and Hannan-Quinn Criterion (HQ).

3 Empirical results

3.1 Descriptive statistics

We developed three model systems: the CPR model, the CTR model, and the CPU model. Each of these models incorporates six endogenous sectors: Fossil Fuel, Energy-Intensive, Housing, Utilities, Transport, and Finance. Subsequently, Table 2 presents descriptive statistics and stationarity test results about model systems. The results show that the majority of the original series are statistically non-stationary. However, after taking the first logarithmic differences, all series reject the null hypothesis, suggesting that all variables are stationary at the 1% significance level. Considering the model’s requirements for stability, we use the first logarithmic difference for all original series, which establishes their suitability for further analysis.

3.2 Estimation of the TVP-VAR model

Table 3 presents the estimation results from the MCMC estimation. All Geweke statistics are below the critical value of 1.96 at the 5% significance level, indicating stable parameters and sufficient presimulated samples for Markov chain convergence. Additionally, the number of invalid coefficients for each parameter is less than 100, demonstrating effective estimation of model parameters and state variables through sampling. Consequently, the sampling results of the three models are valid and can be used for subsequent impulse response analysis. Furthermore, the fixed random seeds in this paper ensure that the parameter settings and sampling results of the three model systems are consistent.

3.3 Time-varying analysis of climate physical risk

Given the model parameters change over time, the nonlinear impacts of climate risk shocks on climate-sensitive sectors will vary both in their time dimension and impact scale (Nakajima, 2011). Firstly, we use the three-dimensional impulse response to effectively illustrate the nonlinear changes of climate risk shocks on climate-sensitive sectors in scale and time. Secondly, taking the lag effects of climate risk shocks into account, we analyze the effects of specific lag periods at intervals of one month, three months, and six months ahead, representing short, medium, and long-term effects respectively. In addition, we chose six time points to compare the impact of different major event shocks. The specific time point is as follows: December 2015 (Paris Agreement), October 2018 (18 central banks including China issued warnings on climate change), September 2019 (United Nations Climate Action Summit), January 2020 (The impact of the COVID-19 epidemic), and October 2021 (The Carbon Peak Action Plan is released before 2030), and August 2022 (Frequent Climate Disasters: High-temperature, heatwaves, droughts, and floods).

Figure 1 shows the three-dimensional impulse response of CPR shock on the fossil-fuel, energy-intensive, housing, utilities, transport, and finance sectors, in which the X-axis, Y-axis, and Z-axis represent the period durations, time point durations, and impulse response values respectively. The results indicate that the direct effects of CPR shock on the economic system are relatively consistent in the short-term. Specifically, these sectors affected by the initial impact of CPR shock show a positive impact, but quickly declined to a negative impact and then gradually recovered to a stable state. A reasonable explanation is that the impact of climate physical shock has a hysteretic effect, and the losses of various economic sectors are gradually increased in the short-term, and gradually recover after taking countermeasures (De Guindos 2021).

Furtherly, Figs. 2 and 3 show the two-dimensional impulse response of the impact of CPR shocks on climate-sensitive sectors. Among them, Fig. 2 corresponds to the impulse response results across different lag periods, and Fig. 3 corresponds to the time-varying effects of CRP shock on climate-sensitive sectors at six major time points. According to Fig. 2, we find that the impulse response of different lag periods varies greatly in which the short-term effects are consistently negative, while they tend to be stable in other periods. Notably, the fossil fuels sector exhibits a fluctuation from negative to positive in the medium-term. Meanwhile, according to Fig. 3, it can be found that the impulse response curves of the six major time points are remarkably similar. The curve is initially positive, generally declining before gradually increasing again, and the duration of the influence is short.

Based on the above analysis results, CPR shock has general dynamic effects on climate-sensitive sectors in the short-term, and these effects weaken rapidly in the medium and long-term (Zhu et al. 2023). Simultaneously, there are significant differences in the impact of CPR shock on climate-sensitive sectors. Energy-intensive and finance sectors, with their relatively advanced technology and equipment, demonstrate greater resilience to CPR shock, consequently, the negative impact of CPR shock on both sectors has weakened over time. Other sectors, such as fossil fuel, housing, utilities, and transport, are increasingly negatively affected. Extreme climate disasters may incur operating costs associated with operational disruptions, production adjustments, and supply chain changes in the industry, as well as insolvency costs related to the impact of bankruptcies (Ginglinger and Moreau, 2023). In addition, extreme climate shocks, which damage infrastructure and disrupt economic activity, can also explain the heterogeneous effects of CPR shock (Zhai et al. 2018; Bua et al. 2024; Li and Wu, 2023).

3.4 Time-varying analysis of climate transition risk

Figure 4 illustrates the three-dimensional impulse response of CTR shock on climate-sensitive sectors. Figures 5 and 6 present the two-dimensional effects of CTR shock on various sectors over different lag periods and time points. Overall, the impact of CTR shock on climate-sensitive sectors shows significant time-varying and heterogeneous characteristics. The time-varying impulse response of different sectors shows significant positive effects in the short-term, gradually weakening and fluctuating in the medium-term until it goes to zero in the long-term.

We consider the impact of CTR shock on different climate-sensitive sectors. Specifically, parts (a) of Figs. 5 and 6 show the impulse responses of CTR shock on the fossil fuel sector. The response drops sharply from positive to negative in the short-term, while there is a slight decrease in the medium-term, and the impact is zero in the long-term. In addition, the impact on the fossil fuel sector in December 2015 is more significant than at other time points. Obviously, the dynamic effects of CTR shock are more concentrated in the short-term, and the signing of the Paris Agreement in December 2015 significantly promotes the positive impact of CTR shock on the fossil fuel sector. The possible explanation is that the large amount of carbon emissions generated by the fossil fuel sector, and the sector undertaken by the positive impact of CTR shock faces greater transition pressure in the short-term to reduce the use of fossil fuels. However, due to the carbon-intensive industries are still an important driving force for China’s current economic development, the positive impact on the fossil fuel sector will gradually diminish or even be zero in the medium and long-term, which is also one of the prominent issues facing the current low-carbon economic transition. In addition, since the Paris Agreement aims to address the global challenge of climate change through international cooperation and independent national actions, the impact of CTR shock could be more significant at this time point.

Parts (b) of Figs. 5 and 6 illustrate the dynamic impact of CTR shock on the energy-intensive sector. The impulse curve is time-varying and consistently positive in the short-term, with a peak in 2020. The medium-term impact of CTR shock has turned negative and has approached zero in recent years. Additionally, the impulse effect at different time points is all positive and tends to zero quickly after two consecutive turning points, and the impact of the Paris Agreement in December 2015 remains the most significant. A possible explanation for these results is that the energy-intensive sectors under transition risk pressure could reduce their investment in fossil fuels and high-carbon assets, and actively improve their energy mix (Liu and Wang, 2017; Ardia et al. 2023), so that the positive impact of CTR shock on the energy-intensive sector is gradually increasing in the short-term. However, as a result of the low-carbon transition and inadequate market tools, carbon-intensive sectors could then experience a medium-term pain period that will eventually lead to negative feedback on the impact of CTR shock. In addition, the occurrence of the short-term peak in 2020 of the impulse response is closely related to the impact of the COVID-19 pandemic, and Fig. 6 also clearly shows that except for the impact of the Paris Agreement in December 2015, January 2020 (COVID-19 pandemic impact) is the most significant.

Parts (c) of Figs. 5 and 6 demonstrate the influence of CTR shock on the housing sector. The housing sector experiences small fluctuations from decrease to increase over time in the short-term, with the turning point being 2020, but the impact size is limited in the medium-term and remains stable at zero in the long-term. In addition, the impact trends observed at six different time points are generally consistent, with the time point in December 2015 standing out as particularly significant. The possible reasons for these results are that with the release of the “Climate Change Green Paper” by the China Meteorological Administration in 2013, China has begun reviewing green buildings and the evaluation projects for these buildings have shown strong growth. As the first area to be affected by climate change shocks, transition pressures may affect the growth and demand in the housing sector in the short-term. Furthermore, after the impact of COVID-19 in 2020, the housing sector could experience a late shift in energy demand, without further rational guidance from climate policies (Levesque et al. 2018).

Parts (d) of Figs. 5 and 6 reveal that CTR shock has an obvious impact on the utilities sector. The short-term response hits a negative peak in 2021 over different lag periods, the medium-term response remains consistently negative and relatively stable, and the long-term response is stable at zero. the impact trend of CTR shock on the utilities sector is generally uniform across different time points, with only minor changes noted in the early time point of December 2015. What’s obvious is that the negative impact of CTR shock on the utilities sector is the largest compared to other sectors, mainly reflected in the fluctuation scale of short-term response. Therefore, Consistent with the exposure results of Sautner et al. (2023), we find higher climate risk exposures in the utilities sector. The reason behind this conclusion could be that the utilities sector shoulders the long-term task of promoting the transition of social responsibility, and probably faces a greater CTR impact. In addition, the negative impact of CTR shock on the utilities sector is limited, and the sector also faces opportunities and challenges during the transition process, so the negative impact will reverse after 2021.

Parts (e) of Figs. 5 and 6 show the impact of CTR shock on the transport sector. We find that the impulse response on the transport sector is similar to that on the housing sector, with the main differences only in impact size and peak delay. Compared with other sectors, the performance of the transport sector seems to be positive in the short and medium-term. The transport sector has consistently been a significant contributor to China’s carbon emissions, accounting for approximately 10% of the total emissions. Nevertheless, it’s important to recognize that this sector is at the end of energy consumption, with its carbon emissions stemming not only from its own but also from the entire energy chain. Since, the Paris Agreement in December 2015, the impact of CTR shock gradually decreased from a high level, indicating that China’s transport sector has significantly advanced in environmental sustainability through low-carbon initiatives. However, with the increase of CTR impact, the transition speed of the transport sector gradually weakened, and the positive response decreased over time until 2021. Furthermore, the decreasing response of CTR shock at different time points indicates that advancements in clean energy and new energy alleviate the impact of CTR shock on the transport sector.

Parts (f) of Figs. 5 and 6 show the impact of CTR shock on the finance sector. The impact of CTR is positive and remains relatively stable throughout the sample period in different lag periods. The dynamic impacts at different time points are also quite similar, starting positively in the current period and gradually approaching zero over time, and the impact is more significant under the time point of the Paris Agreement in December 2015. Intuitively, a stronger CTR shock affects the loan quality, consequently creating higher credit risk, while the impact of CTR shock on the finance sector is the opposite. We explore more about the reasons behind this, CTR shock is closely related to related policies aimed at reducing GHG emissions, and the positive or negative impact of CTR shock depends on green or brown asset allocation in the finance sector (Zhang et al. 2024). Under the impact of CTR shock, the practice of low-carbon transition reduces the operational performance of brown enterprises or increases their risk-taking, and the finance sector with a brown asset portfolio may face greater transition risks, while the finance sector with a green asset portfolio may also benefit from these enterprises (Huang et al. 2022). Therefore, the response of CTR shock on the finance sector could have net positive effects, which also indicates that a series of addressing climate risk measures taken by China’s finance sector are favorable.

3.5 Time-varying analysis of climate policy uncertainty

Figure 7 shows the three-dimensional impulse response of CPU shock on climate-sensitive sectors. Figures 8 and 9, respectively illustrate the impact of CPU shock on climate-sensitive sectors at different lag periods and various time points. Overall, the impact of CPU shock indicates obvious time variation and effectiveness in the short-term. The fossil fuel sector is mainly negatively affected and shows sharp fluctuations. The energy-intensive sector also faces negative impacts and the impact decreases over time. The housing sector is mainly positive and its fluctuation range is not large. Conversely, the utilities and transport sectors suffer relatively significant negative impacts, the former maintains significant time-varying effects, and the latter presents a negative impact that decreases rapidly and fluctuates significantly. The impulse response of the finance sector shows a generally positive impact.

Specifically, parts (a) of Figs. 8 and 9 show the impulse response of CPU shock on the fossil fuel sector. The time-varying impact of CPU shock is more obvious in the short-term, experiencing a trend that shifts from positive to negative over time. Given different time points, it is intuitive that the United Nations Climate Action Summit in September 2019, the release of China’s Carbon Peak Action Plan in October 2021, and Frequent Climatic Disasters in August 2022 all urge the further adjustment of the carbon-intensive industrial structure, thereby reducing the demand for fossil energy. This result could be attributed to China’s announcement of its target to achieve a ‘carbon peak’ by 2030 and ‘carbon neutrality’ by 2060. This target prompts the low-carbon transition of the fossil fuel sector, thereby reducing the demand for carbon-intensive energy. As a result, the CPU shock is gradually having a negative impact on the fossil fuel sector. In addition, while the negative impact on the fossil fuel sector is gradually diminishing in the medium and long-term, both the transition of energy structure and the adoption of low-carbon technologies still require ongoing mitigation and adaptation efforts.

Parts (b) of Figs. 8 and 9 show that the impulse response of CPU shock on the energy-intensive sector exhibits an obvious negative time-varying effect. The negative response is generated quickly in the short-term and then gradually weakens over time. Also, the overall trend of the impulse response remains consistent across different time points. This result shows that burdened with multiple pressures such as low-carbon energy transition and clean energy development, the energy-intensive sector responds more strongly to CPU shock, resulting in a sharp increase in the negative impact on the energy-intensive sector in the short-term. Meanwhile, as the demand side of the energy chain downstream, the energy-intensive sector incorporates energy into its production, and the consequential effects of CPU shock are more evident in changes to carbon emissions and energy costs (Ren et al., 2022a; b). In addition, there are some general problems such as insufficient emission potential and emission efficiency in China’s energy-intensive sector hindering the low-carbon transition of the carbon-intensive sector (Lin and Wang, 2015; Lin and Tan, 2017).

Parts (c) of Figs. 8 and 9 show that CPU shock has an initially sustained negative impact on the housing sector, which gradually transitioned into a positive impact over time. Ostensibly, unlike carbon-intensive enterprises, the housing sector seems more susceptible to the uncertain signals related to climate policies. The real estate part of the housing sector, as a pillar industry in China, has a stronger driving force on upstream and downstream industries, and it is easier to catch anomalies and changes in policy signals. The impact of CPU shock can negatively affect the housing sector in the short-term, due to its sensitivity to policy signals, the housing sector could take proactive measures to support the transition to a low-carbon economy, ultimately benefiting from CPU impact. Furthermore, compared with the recent time points of the release of China’s Carbon Peak Action Plan in October 2021 and Frequent Climate Disasters in August 2022, the impact at early time points is more volatile. This finding demonstrates that China’s housing sector can swiftly adapt to and mitigate the impacts of climate policies, thereby reducing the uncertainty associated with negative impacts and enhancing its understanding of the positive signals.

Parts (d) of Figs. 8 and 9 illustrate a clear negative dynamic impact of CPU shock on the utilities sector over time, which has slightly weakened in recent years. The possible reason is that CPU shock could significantly affect the stock market volatility of the utilities sector (Lv and Li, 2023). Due to the welfare subsidy effect of the utilities sector, the impulse of CPU shock also shows a fluctuating trend (Peng et al. 2023). The utilities sector is a government-led public welfare, and its development and transition are associated with climate policies. Therefore, the green transition of the utilities sector requires an adaptation period, and although the CPU shock appears to be a negative impact in the short-term, it does not lead to sharp fluctuations in the utilities sector (Wang et al. 2023). In addition, the utilities sector has a similar energy chain to the energy-intensive sector, resulting in a similar impulse response to CPU shock.

Parts (e) of Figs. 8 and 9 show that the positive nonlinear impact of CPU shock on the transport sector has been trending upward in recent years, and the effects at various time points show a fluctuating trend, with the initial negative impacts gradually diminishing over time. This result partially explains the process of low-carbon transition in the transport sector under the impact of CPU shock. In particular, in recent years, the emergence of concepts such as environmental protection and new energy vehicles has accelerated the transition towards green and low-carbon practices in the transport field. Consistent with energy market trends, market investors transfer funds from brown stocks to green stocks (Bouri et al. 2022). However, in terms of climate events such as the Paris Agreement in December 2015 and the climate change warning in October 2018, we find that CPU shock has a stronger negative impact on the transport sector during both time points. This could be because the transition effect is not obvious in the early stage of the low-carbon transition, a series of decarbonization action policies and climate change shocks may have a more significant negative impact on the transport sector.

Parts (f) of Figs. 8 and 9 show the impulse response of CPU shock on the finance sector. Intuitively, the impulse response of the finance sector has small and positive values before 2016, and it shows a significant and gradually increasing positive impact after 2016. In addition, the performance of the finance sector remains relatively consistent across other time points, except for the time point in December 2015. On the one hand, this result could be due to the high enthusiasm of the finance sector for CPU shock (Xue et al. 2022; Tedeschi et al. 2024), China’s financial stability depends largely on the macro-prudential supervision and the adoption of financial green instruments. In response to climate policies, the finance sector has often adapted green credit criteria based on the carbon emission profiles of various sectors, thus facilitating the transition of the finance sector to a low-carbon economy (Dunz et al. 2021). On the other hand, the negative impact of CPU shock on these sectors such as the fossil fuel sector and energy-intensive sector could lead investors to shift their attention to the sectors less affected by climate policies, such as the finance sector (Cepni et al. 2022).

It is worth noting that despite there being similar policy factors between CTR and CPU indexes, the impacts of both shocks on climate-sensitive sectors are asymmetric. There are two perspectives to explain the differences: 1) The CTR index measures the progress in low-carbon transition concerning climate action, climate conferences, energy transition, environmental protection, etc. In contrast, the CPU index primarily tracks climate policy news that could introduce uncertainty (Gavriilidis 2021). 2) Our results show that the impacts of CTR and CPU on different sectors are significant variations. This variation in climate risk exposure between climate-sensitive sectors could mask differences within each sector (Sautner et al. 2023), resulting in heterogeneity in the overall exposure of these sectors (Battiston et al. 2017).

4 Robustness analysis

4.1 Alternative climate risk index

To strengthen the robustness of the empirical results, we also construct three alternative climate risk indexes by analyzing the frequency of articles discussing climate risks sourcing from three official newspapers: People’s Daily, Guangming Daily, and Economic Daily. Unlike the market-focused newspapers, these three newspapers have strong official attributes and are usually used to publish important theoretical and policy articles, which are the main platforms for the release of important policies and theoretical viewpoints of governmental agencies.

We re-analyze the previous empirical analysis using alternative three climate risk indexes, and the corresponding impulse responses are shown in Appendix Fig. 10–12. Firstly, the impulse responses of alternative CPR shock are shown in Appendix Fig. 10. This result indicates that the impacts of CPR shock on climate-sensitive sectors are robust, with only minor differences in impact scale. The current impacts of CPR shock are stronger than the lag periods, and the lagged effects of other sectors remain relatively stable, except for the fossil fuel sector continuing to experience an increasingly negative effect. Secondly, the impulse responses of alternative CTR shock are shown in Appendix Fig. 11. This result also ensures the robustness of CTR shock effects. Compared to CPR shock, there are significant differences in the climate transition risk exposure in climate-sensitive sectors, regardless of whether different lag periods or various time points are considered. Lastly, the impulse responses of alternative CPU shock are shown in Appendix Fig. 12. Interestingly, the impact of alternative CPU shock on the fossil fuel sector always shows a positive downtrend, which has an obvious deviation from the above analysis, whereas other results can guarantee relative robustness. Overall, the alternative climate risk indexes validate the robustness of the empirical results.

4.2 Alternative econometric model

We further use the alternative VAR-BEKK-GARCH model to verify the robustness of conclusions about the nonlinear dynamic effects of climate risk shocks on climate-sensitive sectors. The previous research has confirmed that the VAR-BEKK-GARCH model can estimate the volatility spillover effects and dynamic correlations among multiple variables (Chen et al. 2022), thus effectively simulating and predicting the dynamic changes of financial time series over time. We establish the following VAR-BEKK-GARCH model to only analyze the volatility spillover effects of climate risk shocks on climate-sensitive sectors:

Matrix C is a constant 7 × 7 lower triangular matrix, and A and B are unrestricted 7 × 7 matrices. Matrix A captures the short-term ARCH effect of fluctuations between both variables, in which the element \(a_{ij}\) represents the extent to which variable i affects variable j. matrix B captures the long-term GARCH effect of fluctuations between both variables, in which the element \(b_{ij}\) represents the persistence in dynamic conditional volatility from variable i to variable j.

We re-estimate the nonlinear relationship across climate risks and climate-sensitive sectors using the alternative VAR-BEKK-GARCH model, and some of the estimates are shown in Appendix Table 6, in which the numbers 1–7 correspond to climate risk shock and the fossil fuel, energy-intensive, housing, utilities, transport, and finance sectors, respectively. The estimated results show that the three types of climate risk shocks all have significant nonlinear dynamic effects on climate-sensitive sectors, and the overall conclusion is consistent with our above findings. Specifically, firstly, through the impact of CPR shock on climate-sensitive sectors, we find that the ARCH effects of CPR shock on climate-sensitive sectors are significant at the 1% level except for the energy-intensive sector, indicating that all sectors are affected by the short-term effects of CPR shock. Meanwhile, the GARCH effects of CPR shock on all sectors are also significant at the 1% level, indicating that CPR shock has significant long-term effects on these sectors. Secondly, the short-term and long-term effects of CTR shock on climate-sensitive sectors are significant at the level of 1% and 5% respectively, indicating that CTR shock has significant nonlinear dynamic effects on these sectors. However, the short-term ARCH effects of CTR shock on the fossil fuel and utilities sectors are not significant. In particular, the short-term effects of CTR shock on the finance sector are significantly positive, but the long-term effects are significantly negative. Finally, we find that the short-term effects of CPU shock on climate-sensitive sectors are generally negative, which is consistent with our empirical results. However, in terms of coefficients, the short-term effect of CPU shock on the finance sector (\(A_{17}\)) is not significant, and the long-term effect of CPU shock on the fossil fuel sector (\(B_{12}\)) is not significant. In addition, for each sector shocked by different climate risks, we find that the absolute value of the short-term effect coefficient in each sector is greater than the absolute value of the long-term effect coefficient. Therefore, the short-term effects of climate risk shocks on climate-sensitive sectors are greater than the long-term effects, which is highly consistent with our empirical results. Overall, although the nonlinear dynamic effects of climate risk shocks on climate-sensitive sectors have slight variations, our empirical results are robust.

5 Conclusion and discussion

This paper uses text analysis to simultaneously construct three news-based climate risk indexes based on China’s monthly news data, namely climate physical risk (CPR), climate transition risk (CTR), and climate policy uncertainty (CPU) indexes. Meanwhile, we also adopt a specialized classification method associated with climate policies to classify six climate-sensitive sectors: fossil fuel, energy-intensive, housing, utilities, transport, and finance sectors. Further, we use the TVP-VAR model to investigate the nonlinear and dynamic effects of climate risk shocks on climate-sensitive sectors in China. As for different lag periods and various time points, the impulse responses of climate risk shocks on climate-sensitive sectors have been compared and analyzed, respectively. In addition, our results remain robust and reproducible after using an alternative climate risk index and econometric model. The conclusion and discussion of this paper are as follows:

Firstly, CPR shock has dynamic effects on climate-sensitive sectors in the short-term, and its effects tend to be stable in the medium and long-term. In terms of different lag periods and various time points, the impact of CPR shock has significant variations, with the fossil fuel, housing, utilities, and transport sectors being the most negatively affected. Our finding indicates that CPR shock emphasizes the immediate impact of addressing extreme climate disasters on climate-sensitive sectors, which could result in the short-term costs associated with operational disruptions, production adjustments, and supply chain changes, as well as the long-term costs associated with the recovery of economic sectors from disasters. Meanwhile, the impact of CPR shock may be more reflected in the physical assets and infrastructure of these sectors, especially the physical loss of fossil energy will directly affect the development of industries along the energy chain, resulting in a stronger response to CPR shock for the fossil fuel, utilities, and transport sectors in the same energy chain.

Secondly, the impact of CTR shock on climate-sensitive sectors has significant time-varying characteristics. The impulse responses of various sectors show significant positive effects in the short-term, and its positive effects gradually weaken or even show negative in the medium-term until it stabilizes in the long-term. Meanwhile, the estimations under different lag periods and time points further illustrate the differential results. In terms of the energy chain, the dynamic impact on the utilities sector bears the brunt in impact scale, the fossil fuel and energy-intensive sectors also have experienced large fluctuations, mainly because the former could be affected by carbon taxes or regulations, and the latter could be key innovators in the energy transition. Compared with the above sectors, the impact of CTR shock on the housing, transport, and finance sectors is mainly positive. The response to the housing sector fluctuates greatly but is always positive, possibly because the sector could be one of the first to make a green transition addressing CTR shock within the sample period. As for the positive impact on the transport sector, the positive signals released by transition risks are actively promoting the energy transition of this sector, but its effect is gradually diminishing over time. Furthermore, the response of CTR shock on the finance sector in China appears to be favorable, suggesting that the transition to low-carbon finance could also have net positive effects, and the reform of green finance policy will be more conducive to the realization of China’s “carbon peak, carbon neutrality” target.

Lastly, the results of CPU shock reveal significant differences between different climate-sensitive sectors. One notable premise is that the CPU captures the uncertain and unexpected factors associated with climate policies. The empirical results show that the responses of CPU shock on the fossil fuel, energy-intensive, and utilities sectors have been dominated by a significant dynamic negative effect. This indicates that, unlike CTR shock, the uncertain factors thwart the positive effects on these sectors within the similar energy chain, while disorder and ambitious climate policies exacerbate the uncertain factors for carbon-intensive assets over the sample period. Therefore, the fossil fuel sector is expected to be more negatively affected by stranded fossil assets, the energy-intensive sector is moving forward slowly under multiple pressures such as energy structure transition and energy technology transition, and the utilities sector facing higher climate risk exposure needs to hedge the negative effect with government-led welfare subsidies. However, the impact of CPU shock on the transport and finance sectors is mostly positive, and the response of the housing sector has gradually turned positive in recent years, indicating that the transportation energy, pillar industries, and financial system can effectively respond to the positive signal of climate policy uncertainty, thereby facilitating the progress of low-carbon transition in related industries.

We explore climate risk shocks and its heterogeneous impacts on climate-sensitive sectors through the empirical results, and our conclusions could to some extent provide the following possible policy and application suggestions for low-carbon actors.

For industry regulators, the heterogeneous exposures of climate risk shocks emphasize the importance of identifying and measuring various types of climate risks. Our results demonstrate that text analysis techniques can provide a useful approach to climate risk disclosure for China’s climate-sensitive sectors. Full identification of climate risk shocks will also help climate-sensitive sectors to recognize and take advantage of the various challenges and opportunities related to climate change over time. Therefore, regulators should help climate-sensitive sectors to increase the measurement and identification of various climate risk exposures in different periods, which not only helps to provide practical application value for industrial structure transition and climate policy adaptation but also has important practical significance for promoting the realization of China’s “carbon peak, carbon neutrality” target.

For climate-sensitive sectors, the large variation in impacts on various sectors, especially possibly exposed to the climate policy cycle, implies that climate-related information disclosure and differentiated responses for different sectors are important. Given the important heterogeneity within each sector, enhancing climate-related information disclosures is crucial to accurate climate risk assessment, which contributes to revealing ex-ante probabilities of these sectors facing climate risk shocks. For example, the fossil fuel, energy-intensive, and utilities sectors should improve its climate policy risk disclosures, especially identifying the uncertain parts about the timing and speeding of climate policies, while the housing, transport, and finance sectors should capture their climate policy opportunities. In addition, assessing the physical costs and ex-ante probabilities for each sector could contribute to improving its risk management.

For financial actors, market investors still need to maintain a broad diversification of climate risk disclosures and market investments. All climate risk measures show sizeable variation within these sectors and are potentially vulnerable to government censorship, which may mask important differences within each sector. Meanwhile, climate policy timing and speeding matters, the uncertain signals released by climate policies can greatly interfere with rational judgment, thus leading to “winners” or “losers” among market investors. As a result, our climate risk measures and their heterogeneous impacts on climate-sensitive sectors could help hedge investment strategies and strengthen risk management for financial actors.

References

Andersson M, Bolton P, Samama F (2016) Hedging climate risk. Financ Anal J 72(3):13–32. https://doi.org/10.2469/faj.v72.n3.4

Ardia D, Bluteau K, Boudt K, Inghelbrecht K (2023) Climate change concerns and the performance of green vs. brown stocks. Manag Sci 69(12):7607–7632. https://doi.org/10.1287/mnsc.2022.4636

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131(4):1593–1636. https://doi.org/10.1093/qje/qjw024

Battiston S, Dafermos Y, Monasterolo I (2021) Climate risks and financial stability. J Financ Stab 54:100867. https://doi.org/10.1016/j.jfs.2021.100867

Battiston S, Mandel A, Monasterolo I, Schütze F, Visentin G (2017) A climate stress-test of the financial system. Nat Clim Chang 7(4):283–288. https://doi.org/10.1038/nclimate3255

Bouri E, Iqbal N, Klein T (2022) Climate policy uncertainty and the price dynamics of green and brown energy stocks. Financ Res Lett 47:102740. https://doi.org/10.1016/j.frl.2022.102740

Bua G, Kapp D, Ramella F, Rognone L (2024) Transition versus physical climate risk pricing in European financial markets: a text-based approach. Eur J Financ. https://doi.org/10.1080/1351847X.2024.2355103

Campiglio E, Dafermos Y, Monnin P, Ryan-Collins J, Schotten G, Tanaka M (2018) Climate change challenges for central banks and financial regulators. Nat Clim Chang 8(6):462–468. https://doi.org/10.1038/s41558-018-0175-0

Carattini S, Heutel G, Melkadze G (2023) Climate policy, financial frictions, and transition risk. Rev Econ Dyn 51:778–794. https://doi.org/10.1016/j.red.2023.08.003

Centeno MA, Nag M, Patterson TS, Shaver A, Windawi AJ (2015) The emergence of global systemic risk. Ann Rev Sociol 41:65–85. https://doi.org/10.1146/annurev-soc-073014-112317

Cepni O, Demirer R, Rognone L (2022) Hedging climate risks with green assets. Econ Lett 212:110312. https://doi.org/10.1016/j.econlet.2022.110312

Chen Y, Xu J, Hu M (2022) Asymmetric volatility spillovers and dynamic correlations between crude oil price, exchange rate, and gold price in BRICS. Resour Policy 78:102857. https://doi.org/10.1016/j.resourpol.2022.102857

Chen Z, Zhang L, Weng C (2023) Does climate policy uncertainty affect Chinese stock market volatility? Int Rev Econ Financ 84:369–381. https://doi.org/10.1016/j.iref.2022.11.030

Chenet H, Ryan-Collins J, Van Lerven F (2021) Finance, climate-change and radical uncertainty: towards a precautionary approach to financial policy. Ecol Econ 183:106957. https://doi.org/10.1016/j.ecolecon.2021.106957

Choi D, Gao Z, Jiang W (2020) Attention to global warming. Rev Financ Stud 33(3):1112–1145. https://doi.org/10.1093/rfs/hhz086

D’Agostino A, Gambetti L, Giannone D (2013) Macroeconomic forecasting and structural change. J Appl Economet 28(1):82–101. https://doi.org/10.1002/jae.1257

Dai Z, Zhang X (2023) Climate policy uncertainty and risks taken by the bank: evidence from China. Int Rev Financ Anal 87:102579. https://doi.org/10.1016/j.irfa.2023.102579

De Guindos L (2021) Shining a light on climate risks: the ECB’s economy-wide climate stress test. ECB Blog

Diluiso F, Annicchiarico B, Kalkuhl M, Minx JC (2021) Climate actions and macro-financial stability: the role of central banks. J Environ Econ Manag 110:102548. https://doi.org/10.1016/j.jeem.2021.102548

Dunz N, Naqvi A, Monasterolo I (2021) Climate sentiments, transition risk, and financial stability in a stock-flow consistent model. J Financ Stab 54:100872. https://doi.org/10.1016/j.jfs.2021.100872

Engle RF, Giglio S, Kelly B, Lee H, Stroebel J (2020) Hedging climate change news. Rev Financ Stud 33(3):1184–1216. https://doi.org/10.1093/rfs/hhz072

Gavriilidis K (2021) Measuring climate policy uncertainty. Available at SSRN 3847388. https://doi.org/10.2139/ssrn.3847388

Ginglinger E, Moreau Q (2023) Climate risk and capital structure. Manage Sci 69(12):7492–7516. https://doi.org/10.1287/mnsc.2023.4952

Guo J, Long S, Luo W (2022) Nonlinear effects of climate policy uncertainty and financial speculation on the global prices of oil and gas. Int Rev Financ Anal 83:102286. https://doi.org/10.1016/j.irfa.2022.102286

Huang HH, Kerstein J, Wang C, Wu F (2022) Firm climate risk, risk management, and bank loan financing. Strateg Manag J 43(13):2849–2880. https://doi.org/10.1002/smj.3437

Huang Y, Luk P (2020) Measuring economic policy uncertainty in China. China Econ Rev 59:101367. https://doi.org/10.1016/j.irfa.2022.102286

Ilhan E, Sautner Z, Vilkov G (2021) Carbon tail risk. Rev Financ Stud 34(3):1540–1571. https://doi.org/10.1093/rfs/hhaa071

King BF (1966) Market and industry factors in stock price behavior. J Bus 39(1):139–190

Lee CC, Li X, Yu CH, Zhao J (2022) The contribution of climate finance toward environmental sustainability: new global evidence. Energy Econ 111:106072. https://doi.org/10.1016/j.eneco.2022.106072

Lee K, Cho J (2023) Measuring Chinese climate uncertainty. Int Rev Econ Financ 88:891–901. https://doi.org/10.1016/j.iref.2023.07.004

Levesque A, Pietzcker RC, Baumstark L, De Stercke S, Grübler A, Luderer G (2018) How much energy will buildings consume in 2100? A global perspective within a scenario framework. Energy 148:514–527. https://doi.org/10.1016/j.energy.2018.01.139

Li S, Wu X (2023) How does climate risk affect bank loan supply? Empirical evidence from China. Econ Change Restruct 56:2169–2204. https://doi.org/10.1007/s10644-023-09505-9

Lin B, Tan R (2017) China’s CO2 emissions of a critical sector: evidence from energy intensive industries. J Clean Prod 142:4270–4281. https://doi.org/10.1016/j.jclepro.2016.11.186

Lin B, Wang X (2015) Carbon emissions from energy intensive industry in China: evidence from the iron & steel industry. Renew Sustain Energy Rev 47:746–754. https://doi.org/10.1016/j.rser.2015.03.056

Liu W, Wang Z (2017) The effects of climate policy on corporate technological upgrading in energy intensive industries: evidence from China. J Clean Prod 142:3748–3758. https://doi.org/10.1016/j.jclepro.2016.10.090

Lu X, Ma F, Wang J, Dong D (2022) Singlehanded or joint race? Stock market volatility prediction. Int Rev Econ Financ 80:734–754. https://doi.org/10.1016/j.iref.2022.03.007

Lv W, Li B (2023) Climate policy uncertainty and stock market volatility: evidence from different sectors. Financ Res Lett 51:103506. https://doi.org/10.1016/j.frl.2022.103506

Nakajima J, Kasuya M, Watanabe T (2011) Bayesian analysis of time-varying parameter vector autoregressive model for the Japanese economy and monetary policy. J Japan Int Econ 25(3):225–245. https://doi.org/10.1016/j.jjie.2011.07.004

Pan Z, Li S (2024) Environmental emergencies and economic growth: evidence from China. Econ Chang Restruct 57:3. https://doi.org/10.1007/s10644-024-09581-5

Pástor Ľ, Stambaugh RF, Taylor LA (2021) Sustainable investing in equilibrium. J Financ Econ 142(2):550–571. https://doi.org/10.1016/j.jfineco.2020.12.011

Peng F, Zhou S, Ding T et al (2023) Impact of fiscal expenditure stress on green transformation risk: evidence from China education authority reform. Econ Chang Restruct 56:4565–4601. https://doi.org/10.1007/s10644-023-09567-9

Plantinga A, Scholtens B (2021) The financial impact of fossil fuel divestment. Climate Policy 21(1):107–119. https://doi.org/10.1080/14693062.2020.1806020

Ren X, Shi Y, Jin C (2022a) Climate policy uncertainty and corporate investment: evidence from the Chinese energy industry. Carbon Neutrality 1(1):14. https://doi.org/10.1007/s43979-022-00008-6

Ren X, Zhang X, Yan C, Gozgor G (2022b) Climate policy uncertainty and firm-level total factor productivity: evidence from China. Energy Econ 113:106209. https://doi.org/10.1016/j.eneco.2022.106209

Reyseliani N, Purwanto WW (2021) Pathway towards 100% renewable energy in Indonesia power system by 2050. Renew Energy 176:305–321. https://doi.org/10.1016/j.renene.2021.05.118

Santi C (2023) Investor climate sentiment and financial markets. Int Rev Financ Anal 86:102490. https://doi.org/10.1016/j.irfa.2023.102490

Sautner Z, Van Lent L, Vilkov G, Zhang R (2023) Firm-level climate change exposure. J Financ 78(3):1449–1498. https://doi.org/10.1111/jofi.13219

Siddique MA, Nobanee H, Hasan MB, Uddin GS, Hossain MN, Park D (2023) How do energy markets react to climate policy uncertainty? Fossil vs. renewable and low-carbon energy assets. Energy Econ 128:107195. https://doi.org/10.1016/j.eneco.2023.107195

Somanathan E, Somanathan R, Sudarshan A, Tewari M (2021) The impact of temperature on productivity and labor supply: evidence from Indian manufacturing. J Polit Econ 129(6):1797–1827. https://doi.org/10.1086/713733

Stolbova V, Monasterolo I, Battiston S (2018) A financial macro-network approach to climate policy evaluation. Ecol Econ 149:239–253. https://doi.org/10.1016/j.ecolecon.2018.03.013

Tang Y, Cai H, Liu R (2021) Farmers’ demand for informal risk management strategy and weather index insurance: evidence from China. Int J Disaster Risk Sci 12:281–297. https://doi.org/10.1007/s13753-021-00335-9

Tedeschi M, Foglia M, Bouri E, Dai PF (2024) How does climate policy uncertainty affect financial markets? Evid Eur Econ Lett 234:111443. https://doi.org/10.1016/j.econlet.2023.111443

Wang H, Li S, Ma Y (2023) Climate policy and financial system stability: evidence from Chinese fund markets. Clim Policy 23(4):395–408. https://doi.org/10.1080/14693062.2022.2104790

Xu X, Huang S, Lucey BM, An H (2023) The impacts of climate policy uncertainty on stock markets: comparison between China and the US. Int Rev Financ Anal 88:102671. https://doi.org/10.1016/j.irfa.2023.102671

Xue C, Shahbaz M, Ahmed Z, Ahmad M, Sinha A (2022) Clean energy consumption, economic growth, and environmental sustainability: what is the role of economic policy uncertainty? Renew Energy 184:899–907. https://doi.org/10.1016/j.renene.2021.12.006

Yan WL, Cheung A (2023) The dynamic spillover effects of climate policy uncertainty and coal price on carbon price: evidence from China. Financ Res Lett 53:103400. https://doi.org/10.1016/j.frl.2022.103400

Yang S, Li S, Pan Z (2023) Climate transition risk of financial institutions: measurement and response. Appl Econ Lett 30(17):2439–2449. https://doi.org/10.1080/13504851.2022.2097630

Ye L (2022) The effect of climate news risk on uncertainties. Technol Forecast Soc Chang 178:121586. https://doi.org/10.1016/j.techfore.2022.121586

Zhai P, Zhou B, Chen Y (2018) A review of climate change attribution studies. J Meteorol Res 32(5):671–692. https://doi.org/10.1007/s13351-018-8041-6

Zhang D, Wu Y, Ji Q, Guo K, Lucey B (2024) Climate impacts on the loan quality of Chinese regional commercial banks. J Int Money Financ 140:102975. https://doi.org/10.1016/j.jimonfin.2023.102975

Zhu B, Hu X, Deng Y, Zhang B, Li X (2023) The differential effects of climate risks on non-fossil and fossil fuel stock markets: evidence from China. Financ Res Lett. https://doi.org/10.1016/j.frl.2023.103962

Zscheischler J, Westra S, Van Den Hurk BJ, Seneviratne SI, Ward PJ, Pitman A, Zhang X (2018) Future climate risk from compound events. Nat Clim Change 8(6):469–477. https://doi.org/10.1038/s41558-018-0156-3

Acknowledgements

The authors thank the anonymous reviewers for helpful comments and suggestions. Meanwhile, the authors especially thank Dr. Sitong Yang for outstanding contribution in the aspects of revision, validation, writing – review & editing and funding acquisition in this work, whose contribution is equivalent to that of other authors.

Funding

This work was supported by the Fundamental Research Funds for the Central Universities (No. 2242024S30033); the Major Projects of Philosophy and Social Science Research in Colleges and Universities of Jiangsu Province (2023SJZD023); the General Program of Social Science Foundation of Jiangsu Province (23GLB009); the National Cultural Excellence Cultivation Project Special Funding Program.

Author information

Authors and Affiliations

Contributions

Wenqiang Zhu: Conceptualization, Validation, Methodology, Software, Data, Visualization, Writing—Original Draft, Revision. Shouwei Li: Supervision Writing—Review & Editing, Funding Acquisition, Revision.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhu, W., Li, S. Nonlinear effects of climate risks on climate-sensitive sectors. Econ Change Restruct 57, 167 (2024). https://doi.org/10.1007/s10644-024-09751-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10644-024-09751-5