Abstract

Green fiscal policy is crucial for achieving green economic recovery and improving green total factor productivity (GTFP). Based on this, using panel data from 30 regions in China from 2009 to 2020, this paper analyzes the impact of green fiscal policy on GTFP. The results show that: (1) Green fiscal policy can improve GTFP, thus achieving green economic recovery. After a series of robustness tests, the conclusion is still valid; (2) Green fiscal policy can have a stronger improvement effect on GTFP in regions with high levels of both public environmental concerns and economic development; (3) Green fiscal policy mainly improves GTFP by promoting green technology innovation and upgrading industrial structure. These findings not only enrich the literature on green fiscal policy and green recovery but also serve as a reference for governmental departments. The government should promote green technology innovation through green fiscal policy and raise public environmental concerns to help achieve green economic recovery.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Climate change and environmental degradation caused by rapid economic development are important global issues and have posed a serious threat to the survival and development of human society (Muhammad 2019). These ecological and environmental issues have gradually become an imminent challenge for countries around the world (Hao et al. 2018; Chiu and Lee 2020). In order to address global warming and environmental pollution, countries around the world have begun to pay attention to green economic recovery and have announced economic recovery plans. As an important standard for measuring a given country’s environmental performance and sustainable economic development, green total factor productivity is of great significance for achieving green economic recovery (Qiu et al. 2021; Lee et al. 2022). As the world’s largest carbon emitter and energy consumer, China has also encountered serious environmental and energy problems during its rapid economic development (Jiang 2015). To address these issues, China has implemented a series of green fiscal policies and made some contributions to addressing environmental pollution and climate change. Therefore, improving green total factor productivity plays a key role in achieving green economic recovery.

Green technology innovation and the upgrading of industrial structure are important ways to achieve green economic recovery (Su and Fan 2022; Chen et al. 2023). In the past, different industries’ green research and development as well as resource allocation have been affected by environmental regulations, lack of funds, and other reasons, which cannot effectively promote technological innovation and the upgrading of industrial structure. However, green fiscal policy provides financial support for green innovation activities and industrial transformation, thus improving green innovation capability and upgrading industrial structure. On the other hand, green technology innovation and industrial upgrading play a key role in improving green total factor productivity, helping to achieve green economy and sustainable development. Green fiscal policy effectively connects supply and demand in green innovation activities through tools such as green finance and credit, thereby promoting the effective allocation of green research and development funds while ultimately achieving green technology innovation and the upgrading of industrial structure. Therefore, green fiscal policy plays a crucial role in environmental governance and green economic recovery.

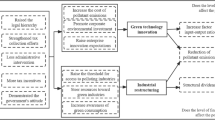

Prior research mainly examines how to achieve green economic recovery from the perspectives of green finance, natural resource utilization efficiency, and carbon reduction. This paper analyzes the impact of green fiscal policy on green total factor productivity and its transmission mechanism, which is a supplement to the literature on green economic recovery. This paper focuses on answering the following questions: Can green fiscal policy improve green total factor productivity and achieve green economic recovery? What is the mechanism required to achieve this goal? Are the effects of green fiscal policy impacted by other factors? Firstly, this paper theoretically analyzes the impact mechanism of green fiscal policy on green total factor productivity, such as green technology innovation and industrial structure upgrading. Secondly, considering the regional differences in terms of the effectiveness of policy implementation, such as economic development level and public environmental concern, this paper specifically analyzes the heterogeneous impact of different factors. Finally, based on theoretical analysis, we empirically test the impact mechanism of green fiscal policy on green total factor productivity. This paper studies the impact of green fiscal policy on green total factor productivity while providing theoretical explanations and empirical tests aimed at improving green total factor productivity via green fiscal policy.

The marginal contributions of this paper are as follows: First, the literature mainly discusses how to promote green economic recovery from the perspective of green finance, natural resource utilization efficiency, and carbon reduction but, as we know, there is no research on how green fiscal policy can improve green total factor productivity. This paper expands the scope and depth of research in the field of green fiscal policy and green economic recovery, and is a useful supplement to the literature. Secondly, this paper analyzes differences in the impact of green fiscal policy on green total factor productivity from the perspectives of regional economic development level and public environmental concern. Therefore, the environmental and economic effects of green fiscal policy can be assessed more accurately. Thirdly, from the perspective of green technology innovation and industrial structure, we explain the internal mechanism of green fiscal policy in terms of improving green total factor productivity while exploring how green fiscal policy promotes green technology innovation and the upgrading of industrial structure, thus affecting green total factor productivity. This study helps clarify the mechanisms through which green fiscal policy affects green total factor productivity and expands the theoretical basis for promoting green total factor productivity by green fiscal policy, thereby providing theoretical explanations and empirical tests for China’s green economic recovery.

The findings of this paper are as follows: (1) Green fiscal policy improves GTFP, thus achieving green economic recovery. After a series of robustness tests, the conclusion is still valid. (2) Green fiscal policy can have a stronger improvement effect on GTFP in regions with high public environmental concern and economic development levels, respectively. (3) Green fiscal policy mainly improves GTFP by promoting green technology innovation and upgrading industrial structure. Based on the above conclusions, this paper has the following policy recommendations. First, government departments should increase investment in environmental governance and ecological protection through green fiscal policy, especially in underdeveloped regions. Second, the government should increase financial support for green technology research and development through green fiscal policy to achieve its low-carbon emissions, energy conservation and environmental protection goals. Finally, the government should try to deepen the public attention to the green ecological environment and involve the public in environmental protection and green recovery.

The remainder of this paper is structured as follows. Section 2 is a literature review. Section 3 presents the theoretical hypotheses. Section 4 presents the methodology and data. Section 5 analyzes the regression results. The last part are the conclusion and policy recommendations.

2 Literature review

With the increase in global carbon emissions, environmental degradation and climate warming are becoming increasingly prominent, therefore achieving a green economic recovery is crucial for countries around the world (Goenka et al. 2021). Financial institutions play a key role in supporting green economic recovery and can provide financing channels for achieving sustainable economic development (Chen et al. 2022; Ge and Zhu 2022). The existing research has found that green finance can help reduce carbon emissions, and this effect is more evident in emerging countries. Therefore, reducing carbon emissions can help to achieve green economic recovery (Wan et al. 2022). As a mode of green finance, green bonds are the main financing channels for energy efficiency improvement projects, which can promote green economic recovery at an annual rate of 17%. At the same time, green bonds can also improve energy efficiency and economic growth by investing in public and private funds (Zhao et al. 2022a). In addition, green bonds achieve green economic recovery by strengthening enterprises’ internal green innovation and external social reputation (Tan et al. 2022b). The evidence that green finance and industrial structure upgrading are important for green economic recovery was also found in Vietnam (Huang 2022). After the COVID-19 outbreak, energy conservation and emissions reduction play a key role in promoting green economic recovery. The literature finds that sustainable development goals can help reduce enterprises’ energy consumption intensity and carbon emissions, thus achieving green economic recovery (Zhang et al. 2023). On the other hand, natural resource utilization efficiency promotes green economic growth, which also plays a crucial role in green economic recovery (Zhang and Dilanchiev 2022; Zhao and Rasoulinezhad 2023; Wang et al. 2023a).

As an important channel to promote green economic recovery, the existing literature does not pay substantial attention to the effect of green fiscal policy. Research has found that green fiscal policy can help promote economic growth, increase employment and tax revenue, while reducing carbon emissions in the energy and construction industries (Scholtens 2001). Some scholars have found that government subsidies and tax rebates in green fiscal policy have a significant positive effect on enterprise investment efficiency while the effect of government subsidies is more obvious (Chang et al. 2020). Some studies have found an inverse U-shaped relationship between government subsidies and renewable energy enterprise market value, however R&D investment can strengthen the positive effect (Chang et al. 2022). In addition, studies have found that green fiscal policy exhibits higher wealth distribution effects (Monasterolo and Raberto 2018). Innovation is a strategy for achieving economic recovery and gaining market share. Tax reduction policy can alleviate enterprise financing constraints, increase innovation investment, and promote innovation activities (Zhang 2021). Some studies have found that government expenditure increases carbon emissions based on evidence from BRICS while tax revenues reduce carbon emissions (Li et al. 2023).

As an important means to address climate change and environmental degradation, green technology innovation plays a key role in improving green total factor productivity (Chen et al. 2023). Studies have also found that green innovation has the effect of promoting green total factor productivity while its impact on non-resource-based cities is more obvious (Zhao et al. 2022b). Some scholars have found that the effect of green innovation on green total factor productivity is heterogeneous and dependent on patent type and enterprise characteristics (Wu et al. 2022). At the same time, studies have found that different types of green technology innovation have different effects on green total factor productivity (Luo et al. 2022). Renewable energy technology innovation—an important way to promote renewable energy development—contributes to improving green total factor productivity. The improvement effect of hydropower technology innovation, solar energy technology innovation, geothermal and marine energy technology innovation is more obvious (Wang et al. 2023b). However, some studies have found that the role of renewable energy technology innovation is significant only when regional income levels reach a certain level (Yan et al. 2020). Upgrading the industrial structure means that resource factors flow from capital intensive and labor intensive industries to technology intensive ones (Feng et al. 2019). These industries tend to be cleaner and low-carbon, thereby mitigating their impact on the environment and climate. Upgrading industrial structure has a positive impact on green economic recovery (Du et al. 2021).

The existing research mainly examines how to achieve green economic recovery from the perspectives of green finance, natural resource utilization efficiency, and carbon reduction. Green technology innovation and upgrading industrial structure, as important ways to address climate change and environmental degradation, have received a lot of attention from scholars. However, as an important channel for promoting green economic recovery, the existing literature does not pay attention to the effect of green fiscal policy on green total factor productivity. Does green fiscal policy have the same effect in different regions? What is the transmission mechanism required for green fiscal policy to improve green total factor productivity? The literature does not answer these questions. Therefore, using panel data from 30 regions in China from 2009 to 2020, this paper explores the impact of green fiscal policy on green total factor productivity and the reasons behind it.

3 Theoretical hypotheses

Green technology innovation and upgrading industrial structure are key ways to achieve green economic recovery (Su and Fan 2022; Chen et al. 2023). With the increase in global carbon emissions and energy consumption, climate and environmental problems are becoming increasingly apparent, and green economic recovery is crucial (Goenka et al. 2021). However, in the past, given that the influence of COVID-19 green R&D activities and industrial resource allocation were restricted. With the implementation of green fiscal policy, this has provided financial support for green innovation projects and industrial resource allocation (Hu et al. 2023). Firstly, green fiscal policy can provide R&D funds for technological innovation, especially for green technology, thereby improving the latter’s innovation capabilities (Wei et al. 2023). On this basis, green technology development can change traditional production methods, promote green transformation, and improve green total factor productivity, thereby achieving green economic recovery (Hasan and Du 2023). Secondly, capital intensive and labor intensive industries often exhibit high pollution characteristics. Upgrading industrial structure means that resource factors flow from capital or labor intensive industries to technology intensive ones, thereby helping to reduce pollution emissions and achieve green economic recovery (Huang 2022). Green fiscal policy provides a powerful method to achieve industrial factor allocation, which can improve green resource allocation efficiency among industries, thereby improving green total factor productivity. Therefore, this paper proposes the first hypothesis.

Hypothesis 1

Green fiscal policy can improve green total factor productivity, thus achieving green economic recovery.

Through what channels does the green fiscal policy improve green total factor productivity? The first channel is to promote green technology innovation. Existing research has found that green technology innovation is a key factor in improving green total factor productivity and achieving green economic recovery (Hasan and Du 2023). Green technology innovation mainly affects green total factor productivity in two ways. On the one hand, green technology innovation can change traditional production methods, reduce energy consumption and pollution emissions, contribute to improving environmental quality and achieving green recovery (Xie et al. 2021). On the other hand, green technology innovation can promote energy transformation, improve environmental governance using more renewable energy, and thereby affect green total factor productivity (Yan et al. 2020). Therefore, green technology innovation plays an important role in promoting total factor productivity. As a policy to achieve energy conservation, emissions reduction, and environmental protection, green fiscal policy can provide financial support for enterprises’ green R&D and innovation activities, thereby accelerating green technology development while improving green technology innovation capabilities and achieving green economic recovery (Hu et al. 2023). For high pollution areas, local governments will increase green fiscal expenditure and promote technology innovation activities under the influence of environmental regulations. Ultimately, this will reduce pollution emissions and energy consumption, improve green total factor productivity, and achieve green recovery. Therefore, this paper proposes the second hypothesis.

Hypothesis 2

Green fiscal policy improves green total factor productivity by promoting green technology innovation.

Upgrading industrial structure is the second mechanism driving the impact of green fiscal policy on green total factor productivity. Realizing industries’ rational flow and allocation of resource factors are key ways to improve green total factor productivity and achieve green recovery (Xie et al. 2022). The study has found that, due to the restrictions on factors flow between industries, there is a significant resource mismatch phenomenon among industries, resulting in low efficiency and insufficient allocation. In fact, green fiscal policy provides a more diversified approach to industrial upgrading, helping to achieve resources allocation among different industries. Green fiscal policy provides more reliable support for industrial transformation, accelerates green resources flow among industries, promotes the development of clean and low-carbon industries, and upgrades industrial structure. Therefore, green fiscal policy can promote industrial structure upgrading. On this basis, the development of green and low-carbon industries can reduce fossil fuels consumption, increase the use of renewable energy, and promote energy transformation. This will help reduce pollution emissions, improve environmental performance, and achieve green economic recovery (Guo and Liu 2022). Therefore, this paper proposes the third hypothesis.

Hypothesis 3

Green fiscal policy improves green total factor productivity by upgrading industrial structure.

4 Methodology and data

To test the effect of green fiscal policy on GTFP, the following econometric model is set:

where i is the region, t is time, \(GTFP\) is green total factor productivity, \(GFIS\) is green fiscal policy, and \(X\) represents control variables which are economic development level (EDL), population density (POD), government intervention (GOI), energy consumption structure (ECS), and foreign direct investment (FDI).\({\mu }_{i}\) and \({\delta }_{t}\) denote the fixed effects of the region and time, respectively, and \({\varepsilon }_{it}\) is a random error term.

Green total factor productivity (GTFP): According to the Tone (2002), this paper uses the Slacks-Based Measure (SBM) model to calculate GTFP. At the same time, the GTFP is calculated by the Data Envelopment Analysis (DEA) model, which is used as part of a robustness test. The desirable output is GDP while the undesirable output consists of sulfur dioxide, industrial wastewater and industrial soot emissions. The input includes labor, capital and energy consumption.

Green fiscal policy (GFIS): Given the outbreak of COVID-19, climate and environmental problems pose a serious threat to human survival. Improving environmental quality is crucial to achieving green economic recovery. Government investment in environmental governance can help improve the quality of the environment, thereby promoting green economic development. Therefore, this paper selects environmental governance investment in government fiscal expenditure as the proxy variable for green fiscal policy.

Control variables: Economic development level (EDL): In this paper, GDP per capita is chosen to represent economic development level. Population density (POD): This paper chooses the population per unit area to represent population density. Government intervention (GOI): This paper uses the proportion of government expenditure in GDP to represent government intervention. Energy consumption structure (ECS): This paper selects the proportion of fossil fuel consumption in total energy consumption to represent the energy consumption structure. Foreign direct investment (FDI): This paper selects the proportion of FDI in GDP to represent foreign direct investment. See Table 1 for descriptions of variables.

This paper selects panel data from 30 regions in China from 2009 to 2020 to study the impact of green fiscal policy on green total factor productivity. The original data are derived from China Statistical Yearbook and China Energy Statistical Yearbook. Descriptive statistics of major variables are shown in Table 2.

5 Results and discussion

5.1 (1) Benchmark regression

This paper empirically tests the impact of green fiscal policy on green total factor productivity based on model (1) and the results are shown in Table 3. Column (1) is the regression result when there are no control variables, and columns (2)–(6) are the regression results when the control variables are gradually added. The regression results show that green fiscal policy significantly improves green total factor productivity at the level of 1%. Specifically, for each 1% increase in environmental governance investment, green total factor productivity will increase by 0.763%. Firstly, green fiscal policy provides financial support for R&D and innovation activities, accelerates green technology development for enterprises, and promotes green technology innovation capability. Green technology innovation can change traditional production methods, reduce energy consumption and pollution emissions, contributing to improving environmental quality and the achievement of green recovery (Xie et al. 2021). Secondly, green fiscal policy provides more reliable support for industrial transformation, accelerates green resources flow between industries, promotes the development of clean and low-carbon industries, and achieves the upgrading of industrial structure. The development of green and low-carbon industries can reduce fossil fuels’ consumption, increase the use of renewable energy, and promote energy transformation. This will help reduce pollution emissions, improve environmental performance, and achieve green economic recovery (Guo and Liu 2022).

The regression results of the control variables basically meet expectations. EDL, POD, ECS and FDI are significantly positive while GOI is significantly negative. This means that economic development, population density, energy consumption structure, and foreign direct investment can improve green total factor productivity while government intervention shows a negative effect.

5.2 (2) Robustness test

Benchmark regression results show that green fiscal policy can improve green total factor productivity. To further verify the robustness of regression results, this paper adopts the following methods for robustness tests.

First, this paper uses the SBM model to measure green total factor productivity in benchmark regression. To further eliminate the impact of measurement method, this paper uses DEA method to measure green total factor productivity and conducts regression. Column (1) in Table 4 shows the regression results of replacement of the green total factor productivity indicator measurement method. There is a significant positive relationship between green fiscal policy and green total factor productivity while the regression coefficient of green fiscal policy is 0.704.

Second, regarding adding the time trend of the control variable, the existing research suggests that taking this method can control the time trend of factors that affect the explained variable, which will help alleviate regression bias (Angrist and Pischke 2009). Therefore, in order to avoid bias in the regression results caused by missing variables, this paper adds the cross term of control variables and time trend to the regression model to solve the problem of missing variables caused by control variables varying over time. In Table 4, column (2) shows the regression results of adding the control variable time trend term. The results show that there is still a significant positive relationship between green fiscal policy and green total factor productivity.

Third, this paper adds control variables. First, carbon emissions trading policy can affect green total factor productivity. Research has found that carbon emissions trading policy will affect green total factor productivity, however this impact only has short-term effects (Li et al. 2022). Secondly, Tian and Feng (2022) have found that there is a non-linear relationship between different types of environmental regulations and green total factor productivity while market-based and voluntary environmental regulations show a negative effect. Therefore, this paper adds carbon emissions trading policy and environmental regulation variables to test the robustness of benchmark regression results. As is shown in Table 4, column (3), the previous analysis conclusions are still robust.

5.3 (3) Endogeneity test

Regarding the possible endogeneity problem between green fiscal policy and green total factor productivity, this paper uses the instrumental variable and two-stage least square method (2SLS) to solve this problem. First, this paper uses government environmental preference as an instrumental variable for green fiscal policy. Government environmental preference represents the government’s concern for environmental governance while green fiscal policy is closely related to the government’s preference for environmental governance. The results are shown in Table 5, columns (1) and (2). From the first stage of regression results, there is indeed a significant positive correlation between the endogenous and instrumental variables. The results of the second stage show that green fiscal policy improves green total factor productivity, verifying the robustness of previous regression results. The F value of the weak instrumental variable test is 39.566 which exceeds the critical value, indicating that there is no weak instrumental variable. Secondly, this paper chooses air velocity as an instrumental variable for green fiscal policy. Air velocity is an important indicator of regional environmental quality and green fiscal policy is closely related to regional environmental quality. At the same time, air velocity is exogenous relative to green total factor productivity. Therefore, the instrumental variable satisfies the second condition. The results are shown in Table 5, columns (3) and (4). The results show that green fiscal policy contributes to improving green total factor productivity, verifying the robustness of previous regression results. The F value of the weak instrumental variable test is 41.802 which exceeds the critical value, indicating that there is no weak instrumental variable. Thirdly, this paper adds the first two instrumental variables to examine the problem of over-identification. From the regression results of the first and second stage in columns (5) and (6), the conclusions are still robust. The P-value of the over identification test is 0.236, indicating that there is no over-identification problem.

5.4 (4) Heterogeneity analysis

On the one hand, public environmental concern reduces air pollution by strengthening government regulation (Yu et al. 2023). On the other hand, they also enhance investors’ green preferences and environmental responsibilities while expanding green financing (He and Shi 2023). Therefore, there may be differences in terms of the impact of green fiscal policy on green total factor productivity in different public environmental concern regions. This paper uses the Baidu Index to measure public environmental concern, and searches for environment-related keywords. According to the mean value of public environmental concerns, the sample is divided into a high public environmental concern group and a low public environmental concern group.

The regression results of the heterogeneity analysis based on public environmental concern are shown in Table 6, columns (1) and (2). Column (1) is the regression results of high public environmental concern regions while column (2) is the regression results of low public environmental concern regions. The results show that the green fiscal policy coefficient in high public environmental concern regions is significantly positive, consistent with benchmark results. However, for low public environmental concern regions, the coefficient is not significant. This indicates that increasing public environmental concern has strengthened the effect of green fiscal policy.

On the one hand, there are differences in transportation infrastructure development between different economic development regions. Existing research has found that transportation infrastructure can help achieve green and sustainable development goals (Tan et al. 2022a). On the other hand, some scholars have found that green finance significantly improves green total factor productivity and its effect is more significant in higher economic development regions (Lee and Lee 2022). The development level of both transportation and green finance depends highly on regional economic development levels. Therefore, there may be significant differences in the effects of green fiscal policy on green total factor productivity between regions with different levels of economic development. This paper divides the sample into a high economic development group and a low economic development group based on the mean value of economic development level.

The heterogeneity analysis results of different economic development levels are shown in Table 6, columns (3) and (4). Column (3) shows the regression results for regions with higher economic development levels while column (4) shows the regression results for regions with lower economic development levels. The results show that the coefficient of green fiscal policy in regions with a high economic development level is significant at a 1% level with a coefficient of 1.794. The coefficient of green fiscal policy in regions with low economic development levels is not statistically significant. This means that economic development has strengthened the effect of green fiscal policy in relation to promoting green total factor productivity.

5.5 (5) Mechanism analysis

Theoretical analysis has expressed that green technology innovation and industrial structure upgrading are the transmission mechanisms of green fiscal policy' impact on green total factor productivity. In order to test these transmission mechanisms, this paper uses a mediation model for analysis with the following specific settings:

MED represents mediated variables used for mechanism testing, including green technology innovation (GTE) and industrial structure upgrading (INU).

This paper uses green patents to measure green technology innovation, and the results are shown in Table 7, columns (1) and (2). In addition, this paper uses green invention patents to measure green technology innovation, and the results are shown in Table 7, columns (3) and (4). In column (1), the regression coefficient of green fiscal policy to green technology innovation is positive, and significant at a 1% level. Green fiscal policy can provide financial support for clean, energy-saving, and environmental protection projects and accelerate green technology research and development, thereby enhancing green technology innovation capability. Displayed in column (2), with green total factor productivity as the dependent variable, the regression coefficient of green technology innovation is significantly positive, while the regression coefficient of green fiscal policy is significantly positive as well. The results show that green technology innovation is the transmission mechanism for green fiscal policy to improve green total factor productivity. Green fiscal policy can accelerate the financial support of green research and development projects, promote green technology innovation, thereby enhancing green total factor productivity and achieving green recovery. At the same time, the results in Table 7, columns (3) and (4) indicate that the regression results are still robust.

This paper selects advanced industrial structure to measure industrial structure upgrading, and the results are shown in Table 8, columns (1) and (2). The advanced industrial structure indicator is measured by the ratio of tertiary industry output value to secondary industry output value. In addition, this paper uses industrial structure rationalization to measure industrial structure upgrading, and the results are shown in Table 8, columns (3) and (4). The regression coefficient of green fiscal policy on industrial structure upgrading is positive and significant at a 1% level. Green fiscal policy provides more reliable support for industrial transformation, accelerates green resources flow between industries, promotes the development of clean and low-carbon industries, and achieves industrial structure upgrading. Taking green total factor productivity as the dependent variable, the coefficient of industrial structure upgrading is significantly positive while the coefficient of green fiscal policy is significantly positive too, indicating that the industrial structure upgrading is a transmission mechanism. Green fiscal policy can help promote industrial structure upgrading. The development of green and low-carbon industries can reduce fossil fuels consumption, increase the use of renewable energy, and promote energy transformation. This will help reduce pollution emissions, improve environmental performance, and achieve green economic recovery (Guo and Liu 2022).

6 Conclusion and policy recommendations

6.1 Conclusion

Improving green total factor productivity is crucial for green economic recovery. Prior research mainly examines how to achieve green economic recovery from the perspectives of green finance, natural resource utilization efficiency, and carbon reduction. Based on this, using panel data from 30 regions in China from 2009 to 2020, this paper analyzes the impact of green fiscal policy on GTFP. The results show that: (1) Green fiscal policy improves GTFP. After a series of robustness tests, the conclusion is still valid; (2) Green fiscal policy can have a stronger improvement effect on GTFP in regions with respectively high levels of public environmental concerns and economic development; (3) Green fiscal policy mainly improves GTFP through promoting green technology innovation and the upgrading of industrial structure. These findings not only enrich the literature on green recovery and green total factor productivity but also serve as a reference for governmental departments as they optimize their strategy for developing green fiscal policy and achieving green economic recovery.

6.2 Policy recommendations

Based on the conclusions above, this paper proposes the following policy recommendations: (1) Government departments should use green fiscal policy to promote green economic recovery. The research conclusion shows that green fiscal policy plays a crucial role in promoting total factor productivity and achieving green recovery. We should increase investment in environmental governance and ecological protection through green fiscal policy, especially in undeveloped regions; (2) Government departments should increase financial support for green technology research and development, thereby promoting the transformation of production methods. We have found that green technology innovation can help achieve a green economic recovery, especially concerning the development of clean and energy-saving technologies. Therefore, the government should increase financial support for green technology research and development through green fiscal policy to achieve the goals of low-carbon emissions, energy conservation and environmental protection; (3) The government should increase the public’s attention to the environment and promote joint public and governmental efforts to solve environmental governance and ecological issues. This paper finds that increasing the public attention paid to the environment can strengthen the role of green fiscal policy in relation to the recovery of the green economy. We should strengthen public consciousness of the green ecological environment and involve it into environmental protection and green recovery.

References

Angrist JD, Pischke JS (2009) Mostly harmless econometrics: an empiricist’s companion. Princet Univ Press, Princeton

Chang K, Wan Q, Lou Q, Chen Y, Wang W (2020) Green fiscal policy and firms’ investment efficiency: new insights into firm-level panel data from the renewable energy industry in China. Renew Energy 151:589–597. https://doi.org/10.1016/j.renene.2019.11.064

Chang K, Xue C, Zhang H, Zeng Y (2022) The effects of green fiscal policies and R&D investment on a firm’s market value: new evidence from the renewable energy industry in China. Energy 251:123953. https://doi.org/10.1016/j.energy.2022.123953

Chen J, Abbas J, Najam H, Liu J, Abbas J (2023) Green technological innovation, green finance, and financial development and their role in green total factor productivity: empirical insights from China. J Clean Prod 382:135131. https://doi.org/10.1016/j.jclepro.2022.135131

Chen Z, Mirza N, Huang L, Umar M (2022) Green banking—can financial institutions support green recovery? Econ Anal Policy 75:389–395. https://doi.org/10.1016/j.eap.2022.05.017

Chiu YB, Lee CC (2020) Effects of financial development on energy consumption: the role of country risks. Energy Econ 90:104833. https://doi.org/10.1016/j.eneco.2020.104833

Du K, Cheng Y, Yao X (2021) Environmental regulation, green technology innovation, and industrial structure upgrading: the road to the green transformation of Chinese cities. Energy Econ 98:105247. https://doi.org/10.1016/j.eneco.2021.105247

Feng Y, Zhong S, Li Q, Zhao X, Dong X (2019) Ecological well-being performance growth in China (1994–2014): from perspectives of industrial structure green adjustment and green total factor productivity. J Clean Prod 236:117556. https://doi.org/10.1016/j.jclepro.2019.07.031

Ge Y, Zhu Y (2022) Boosting green recovery: green credit policy in heavily polluted industries and stock price crash risk. Resour Policy 79:103058. https://doi.org/10.1016/j.resourpol.2022.103058

Goenka A, Liu L, Nguyen MH (2021) COVID-19 and a green recovery? Econ Model 104:105639. https://doi.org/10.1016/j.econmod.2021.105639

Guo W, Liu X (2022) Market fragmentation of energy resource prices and green total factor energy efficiency in China. Resour Policy 76:102580. https://doi.org/10.1016/j.resourpol.2022.102580

Hao Y, Zhu L, Ye M (2018) The dynamic relationship between energy consumption, investment and economic growth in China’s rural area: new evidence based on provincial panel data. Energy 154:374–382. https://doi.org/10.1016/j.energy.2018.04.142

Hasan MM, Du F (2023) The role of foreign trade and technology innovation on economic recovery in China: the mediating role of natural resources development. Resour Policy 80:103121. https://doi.org/10.1016/j.resourpol.2022.103121

He X, Shi J (2023) The effect of air pollution on Chinese green bond market: the mediation role of public concern. J Environ Manag 325:116522. https://doi.org/10.1016/j.jenvman.2022.116522

Hu H, Qi S, Chen Y (2023) Using green technology for a better tomorrow: how enterprises and government utilize the carbon trading system and incentive policies. China Econ Rev 78:101933. https://doi.org/10.1016/j.chieco.2023.101933

Huang SZ (2022) Do green financing and industrial structure matter for green economic recovery? Fresh empirical insights from Vietnam. Econ Anal Policy 75:61–73. https://doi.org/10.1016/j.eap.2022.04.010

Jiang Y (2015) Total factor productivity, pollution and ‘green’ economic growth in China. J Int Dev 27(4):504–515. https://doi.org/10.1002/jid.2944

Lee CC, Lee CC (2022) How does green finance affect green total factor productivity? Evidence from China. Energy Econ 107:105863. https://doi.org/10.1016/j.eneco.2022.105863

Lee CC, Zeng M, Wang C (2022) Environmental regulation, innovation capability, and green total factor productivity: new evidence from China. Environ Sci Pollut Res 29(26):39384–39399. https://doi.org/10.1007/s11356-021-18388-0

Li C, Qi Y, Liu S, Wang X (2022) Do carbon ETS pilots improve cities’ green total factor productivity? Evidence from a quasi-natural experiment in China. Energy Econ 108:105931. https://doi.org/10.1016/j.eneco.2022.105931

Li S, Samour A, Irfan M, Ali M (2023) Role of renewable energy and fiscal policy on trade adjusted carbon emissions: evaluating the role of environmental policy stringency. Renew Energy 205:156–165. https://doi.org/10.1016/j.renene.2023.01.047

Luo Y, Lu Z, Salman M, Song S (2022) Impacts of heterogenous technological innovations on green productivity: an empirical study from 261 cities in China. J Clean Prod 334:130241. https://doi.org/10.1016/j.jclepro.2021.130241

Monasterolo I, Raberto M (2018) The EIRIN flow-of-funds behavioural model of green fiscal policies and green sovereign bonds. Ecol Econ 144:228–243. https://doi.org/10.1016/j.ecolecon.2017.07.029

Muhammad B (2019) Energy consumption, CO2 emissions and economic growth in developed, emerging and Middle East and North Africa countries. Energy 179:232–245. https://doi.org/10.1016/j.energy.2019.03.126

Qiu S, Wang Z, Geng S (2021) How do environmental regulation and foreign investment behavior affect green productivity growth in the industrial sector? An empirical test based on Chinese provincial panel data. J Environ Manag 287:112282. https://doi.org/10.1016/j.jenvman.2021.112282

Scholtens B (2001) Borrowing green: economic and environmental effects of green fiscal policy in The Netherlands. Ecol Econ 39(3):425–435. https://doi.org/10.1016/S0921-8009(01)00235-X

Su Y, Fan QM (2022) Renewable energy technology innovation, industrial structure upgrading and green development from the perspective of China’s provinces. Technol Forecast Soc Change 180:121727. https://doi.org/10.1016/j.techfore.2022.121727

Tan R, Pan L, Xu M, He X (2022a) Transportation infrastructure, economic agglomeration and non-linearities of green total factor productivity growth in China: evidence from partially linear functional coefficient model. Transp Policy 129:1–13. https://doi.org/10.1016/j.tranpol.2022.09.027

Tan X, Dong H, Liu Y, Su X, Li Z (2022b) Green bonds and corporate performance: a potential way to achieve green recovery. Renew Energy 200:59–68. https://doi.org/10.1016/j.renene.2022.09.109

Tian Y, Feng C (2022) The internal-structural effects of different types of environmental regulations on China’s green total-factor productivity. Energy Econ 113:106246. https://doi.org/10.1016/j.eneco.2022.106246

Tone K (2002) A slacks-based measure of super-efficiency in data envelopment analysis. Eur J Oper Res 143:32–41

Wan Q, Qian J, Baghirli A, Aghayev A (2022) Green finance and carbon reduction: implications for green recovery. Econ Anal Policy 76:901–913. https://doi.org/10.1016/j.eap.2022.09.022

Wang J, Dong X, Dong K (2023) Does renewable energy technological innovation matter for green total factor productivity? Empirical evidence from Chinese provinces. Sustain Energy Technol Assess 55:102966. https://doi.org/10.1016/j.seta.2022.102966

Wang J, Xue Y, Han M (2023) Impact of carbon emission price and natural resources development on the green economic recovery: fresh insights from China. Resour Policy 81:103255. https://doi.org/10.1016/j.resourpol.2022.103255

Wei L, Lin B, Zheng Z, Wu W, Zhou Y (2023) Does fiscal expenditure promote green technological innovation in China? Evidence from Chinese cities. Environ Impact Assess Rev 98:106945. https://doi.org/10.1016/j.eiar.2022.106945

Wu J, Xia Q, Li Z (2022) Green innovation and enterprise green total factor productivity at a micro level: a perspective of technical distance. J Clean Prod 344:131070. https://doi.org/10.1016/j.jclepro.2022.131070

Xie F, Zhang B, Wang N (2021) Non-linear relationship between energy consumption transition and green total factor productivity: a perspective on different technology paths. Sustain Prod Consum 28:91–104. https://doi.org/10.1016/j.spc.2021.03.036

Xie R, Yao S, Han F, Zhang Q (2022) Does misallocation of land resources reduce urban green total factor productivity? An analysis of city-level panel data in China. Land Use Policy 122:106353. https://doi.org/10.1016/j.landusepol.2022.106353

Yan Z, Zou B, Du K, Li K (2020) Do renewable energy technology innovations promote China’s green productivity growth? Fresh evidence from partially linear functional-coefficient models. Energy Econ 90:104842. https://doi.org/10.1016/j.eneco.2020.104842

Yu C, Long H, Zhang X, Tan Y, Zhou Y, Zang C, Tu C (2023) The interaction effect between public environmental concern and air pollution: evidence from China. J Clean Prod 391:136231. https://doi.org/10.1016/j.jclepro.2023.136231

Zhang D (2021) Does a green-designed fiscal policy optimal firm innovation scheme on volatility? A firm level evidence in the Post-Covid-19 era. Resour Policy 74:102428. https://doi.org/10.1016/j.resourpol.2021.102428

Zhang S, Anser MK, Peng MYP, Chen C (2023) Visualizing the sustainable development goals and natural resource utilization for green economic recovery after COVID-19 pandemic. Resour Policy 80:103182. https://doi.org/10.1016/j.resourpol.2022.103182

Zhang Y, Dilanchiev A (2022) Economic recovery, industrial structure and natural resource utilization efficiency in China: effect on green economic recovery. Resour Policy 79:102958. https://doi.org/10.1016/j.resourpol.2022.102958

Zhao L, Chau KY, Tran TK, Sadiq M, Xuyen NTM, Phan TTH (2022a) Enhancing green economic recovery through green bonds financing and energy efficiency investments. Econ Anal Policy 76:488–501. https://doi.org/10.1016/j.eap.2022.08.019

Zhao L, Rasoulinezhad E (2023) Role of natural resources utilization efficiency in achieving green economic recovery: evidence from BRICS countries. Resour Policy 80:103164. https://doi.org/10.1016/j.resourpol.2022.103164

Zhao X, Nakonieczny J, Jabeen F, Shahzad U, Jia W (2022) Does green innovation induce green total factor productivity? Novel findings from Chinese city level data. Technol Forecast Soc Change 185:122021. https://doi.org/10.1016/j.techfore.2022.122021

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper. The authors declare no relevant financial or non-financial interests to disclose.

Ethical approval

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhao, X., Guo, Y., Liu, Z. et al. Boosting green recovery: the impact of green fiscal policy on green total factor productivity. Econ Change Restruct 56, 2601–2619 (2023). https://doi.org/10.1007/s10644-023-09516-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-023-09516-6

Keywords

- Green recovery

- Green fiscal policy

- Green total factor productivity

- Green technology innovation

- Industrial structure upgrading