Abstract

This study seeks to empirically examine the effects of demographic change on economic growth in Middle East countries. As a further step, the working-age population is disaggregated by age and gender to investigate their effects on economic growth. The study employs static linear panel data models for ten Middle East countries for the 5-year period from 1996 to 2016. The findings indicate that young workers, middle-aged workers, senior workers, population growth rate, and old dependency ratio positively affect economic growth, while the youth dependency ratio negatively affects economic growth. Analysis by gender reveals that the male working-age population contributes more to economic growth than the female working-age population. These findings confirm that governments should formulate policies that will encourage women to engage actively in the labor market to enhance their productivity and enable them to contribute to achieving a high-income economy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Although the relationship between demographic change and economic growth has been widely studied for several decades, the relationship is still under debate, with the argument centering on whether demographic change hampers or reinforces economic growth. Furthermore, while earlier studies addressed the relationship between population size and economic growth, the later studies focused on the relationship between age structure and economic growth.

The dynamics of age structure positively influence the economic growth and general standard of living (Bloom et al. 2001; Choudhry and Elhorst 2010; Uddin et al. 2016). The development impact of changes in age structure is obtained through several paths. Firstly, a rise in the share of the working-age population means that more people are able to work. In other words, the working-age population produces more than its consumption, so the per capita output is increased. The second path is a rise in the savings. The working-age population produces and saves more, which causes a higher level of investment and an increase in the output. The third path, which is the most important, is the rise in human capital due to the change in age structure. Therefore, this paper focuses on how a change in age structure may affect the GDP per capita.

This study is among the few studies that investigate the effects of demographic change on economic growth in the Middle East. The objective of this study is to examine the effects of the share of the working-age population disaggregated by age and gender, and dependency ratios on the economic growth in Middle East countries. This study provides a significant contribution to the existing literature and may be distinct from previous studies as it includes disaggregated age groups based on age and gender. The working-age population is classified into six age groups: young male workers, young female workers, middle-aged male workers, middle-aged female workers, senior male workers, and senior female workers. Based on this classification of the working-age population, potentially, the various age groups have various impacts on economic growth (Wongboonsin and Phiromswad 2017).

The rest of the paper is organized as follows: Sect. 2 presents a review of the related studies. Section 3 provides the demographic trends of the Middle East countries covered in the study. Section 4 explains the model specifications and variables. Section 5 discusses the results of the study. Lastly, Sect. 6 presents the conclusions.

2 Literature review

2.1 Demographic change and economic growth

Early studies addressed the correlation between population growth and economic growth. One such study is Bucci (2008) who highlighted three views that analyzed the effect of population growth on economic growth. The first view is the pessimistic view. Based on this approach, population growth hampers economic growth. Malthus (1798) noted that humans were limited in their birthrates due to a shortage of resources. Hence, an increasing population growth coupled with lowering technological progress leads to the creation of famine, which reduces the population growth as well as economic growth. In the research by Kelley and Schmidt (1995), the result shows that population growth has a negative effect on economic growth.

The second view is the optimistic view that assumes that population growth reinforces economic growth. Kuznets (1967) documented that population growth promotes economic growth through various channels, including the rising stock of knowledge, increasing savings, and the growth of the labor force. In addition, Kremer (1993) built a simple model that demonstrates a positive relationship between population growth and economic growth. He assumed that a rise in output per capital increases population growth and that population growth contributes to increased total research output by providing resources to create new technologies. Kremer’s model reveals that the increasing population is due to technological progress that enables rapid population growth.

Galor and Weil (1999) assumed that there is a direct relationship between population size and technological progress rate. The demographic transition is created by relating population growth to investment in human capital and technological progress. Moreover, Jones (2001) developed a model that links population size and technological progress, which increases the population leading to an increase in new ideas. He suggested that the established institutions to support innovation and create new ideas may result in an explosion of economic growth.

The unified growth theory suggests that the transition from stagnation to growth is attributed to the interaction between population and technology and its effect on the demand for human capital, thereby resulting in the onset of the demographic transition (Galor 2005). Furthermore, in the study by Galor and Moav (2002), it was shown that sustained economic growth is due to the presence of individuals of the “quality type” in the population, which supports technological progress and growth. They confirmed that population increase induces technological progress and a demographic transition, and, therefore, achieves sustained economic growth. According to Hansen and Prescott (2002), technological progress plays a vitally important role in the transition from a land intensive to a modern industrial economy.

The third view is the neutralism view. Thirlwall (1972), Dawson and Tiffin (1998) emphasized that no significant association was found between population growth and income per capita. Similarly, when the control variables were added into the regression model, Bloom et al. (2003) revealed that there is no association between population growth and economic growth.

Regarding fertility, Doepke (2004) showed that education and child labor policies significantly affect the decline in fertility. When comparing the impact of the two policies, the results reveal that child labor policies are more crucial to the fertility transition than education. In addition, Hondroyiannis and Papapetrou (2002), together with Hondroyiannis and Papapetrou (2004), examined the relationship between the demographic changes and the real output in Greece. The results show that a lower infant mortality rate leads to a decline in the fertility rate, resulting in a decrease in the population, while an increase in real GDP per capita leads to higher fertility implying a positive income effect. Similarly, for a sample of European countries, Hondroyiannis and Papapetrou (2005) concluded that an increase in real output per capita is associated with higher fertility.

Theories of exogenously given technological change imply that higher growth should be associated with higher fertility. This means that technological change becomes a source of sustained growth in population growth as well as living standards (Lucas 2002). The study by Strulik and Weisdorf (2008) showed how fertility responds differently to productivity and income growth by employing the agriculture and industry sectors. They evidenced that fertility varies inversely with the relative price of food. In European countries, Hondroyiannis (2010) showed that the decline in fertility is due to the reduction in the nuptiality rate, increase in female employment, decrease in infant mortality rate, and rise in child-rearing costs.

Recently, several studies have been conducted to investigate the effect of demographic change on the economic growth of different economies and groups of economies. Bloom and Williamson (1998) investigated the effect on the share of the working-age population on economic growth. They concluded that the working-age population has a positive effect on economic growth. A decline in the mortality rate without a similar decrease in the fertility rate leads to an increase in the growth rate of the population, in particular, the young population. When the young people become old enough to join the labor market, the labor force increases and thereby achieves faster economic growth. For developing countries, Crenshaw et al. (1997) found that the increase in the adult population promoted economic growth from 1965 to 1990. They noted that many countries achieved positive economic growth rates while increasing the dependency ratios. Baby boomers may slow economic growth, but do not prevent economic development. Moreover, Kelley and Schmidt (2005) developed a flexible model to examine the role of population in economic growth. They explained that low birth and death rates result in the growth of GDP per capita and that the ratio of youth dependency is negatively related to the output per worker growth.

Kögel (2005) established that the youth dependency ratio has a negative effect on the total factor productivity. The empirical analysis by Choudhry and Elhorst (2010) noted that the GDP per capita is significantly correlated with the population of working age, but insignificantly correlated to the children and aging dependency ratios. They found that population dynamics explained 46% of economic growth in GDP per capita in China over the period 1961–2003, 39% in India, and 25% in Pakistan. They also discovered that the decline in child dependency was the major contributor to GDP per capita growth.

According to Lee and Mason (2010), slower population growth and low fertility give rise to increasing capital intensity and higher per capita income. In addition, Bloom and Canning (2011) discovered that population growth and age structure have a significant impact on economic growth. They reported that children between 15 and 20 years are of working age and, thus, enabled the nations to have a chance to grow rapidly. In China, Wei and Hao (2010) revealed that a significant contribution of the demographic structure to economic growth is largely attributed to the lower youth dependency ratio resulting from a decline in fertility. In India, Aiyar and Mody (2013) concluded that the working-age population growth rate has a large impact on economic growth. The research conducted by Song (2013) showed that the population growth rate has a negative effect on economic growth while the working-age population growth rate has a positive impact. These results support that the fast-economic growth in Asia may be attributed to the positive demographic change that happened there.

Moreover, Menike (2014) showed that the population growth rate was an important determinant of economic growth in Sri Lanka from 1963 to 2007. According to Zhao and Zhu (2016), the contribution of a demographic factor for economic growth in Japan, South Korea, and Taiwan of China was 8%, and for the Chinese Mainland, it was 6.3%. For developing countries, Ahmad and Khan (2018a) stressed that, although a change in age structure and human capital has a significant positive impact on economic growth in developing countries, the impact differs for different regions and income groups. In the study by Ahmad and Khan (2018b), they reported that the working age population ratio and labor force growth rate have a positive effect on the economic growth in developing economies. Based on their study, further research for developing countries can be extended by adding disaggregated age groups by age and gender.

2.2 Economic growth in Middle East countries

Many researchers have addressed the economic growth of the Middle East countries. Makdisi et al. (2006), for example, found that the growth performance of the region has been notably volatile and low compared with other developing countries. The notable features of most of the Middle East countries are that they are heavily dependent on oil and have a weak economic base, a high growth rate of population and unemployment, and a low rate of return on investment in human and physical capital. The research by Abed (2003) addressed the economic growth of MENA countries in the 1980s and 1990s. He noted that the weak performance in the MENA region was mainly due to a number of major factors: public-sector domination, low level of institutional quality, undeveloped financial markets, inappropriate exchange rate policies, and restrictive trade practices.

In addition, Dasgupta et al. (2005) concluded that the economic performance of the Middle East and North Africa (MENA) countries, especially in the 1990s, was not satisfactory compared to many other economies or regions of the world. Similarly, Hakura (2004) empirically examined the poor performance of MENA economies covering the period 1980–1990. The findings showed that the economic growth was influenced by several factors that vary from one country to another. In the Gulf Cooperation Council countries, which are heavily dependent on oil, the public-sector size restricts the private sector’s growth and impedes the economic diversity, while, in other countries, political instability hampers the economic growth. Moreover, Abdelbary and Benhin (2019) clearly emphasized the significance of human capital and governance in order to create a brighter economic development in the Arab region.

Some researchers have shown that a skilled labor shortage is one of the factors that limit the growth in the Middle East countries. Sala-i-Martin and Artadi (2003), for example, studied the economic growth in the Arab economies over the last four decades. They confirmed that the poor quality of human capital in the region would not be able to promote investment opportunities in the Arab countries since investment requires skilled workers. The study conducted by Pissarides and Ange Veganzones-Varoudakis (2006) documented that the skilled labor shortage is one of the distinguishing characteristics of the MENA labor markets compared with other developing countries with similar levels of income.

The reviewed literature confirms that demographic change plays an important role in promoting economic growth. However, the relationship between them for Middle East countries is lacking in the literature. Moreover, it is observed that the nature of the relationship between demographic change and economic growth varies from one country to another, which may be due to differences in the method of analysis, the socioeconomic nature of the economies, and the stage of economic development. The literature is insufficient in disaggregated studies. This study bridges the gap by examining the effects of demographic change disaggregated by age and gender on the economic growth in Middle East countries.

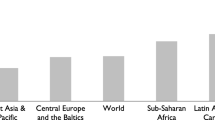

3 Demographic trends in the Middle East

This section analyzes the evolution of population growth in the Middle East countries. During the twentieth century, particularly in the second half, the population in the Middle East increased rapidly due to early marriages and high fertility. The demographic weight of Middle East countries differs virtually. The region includes two small countries (Bahrain and Qatar, with around 4 Million inhabitants). The three countries with the largest populations are Egypt, Iran, and Turkey, with more than 79 million inhabitants, and, together, account for 62% of the region’s total population. The population growth in the Middle East countries increased rapidly between 1950 and 1980. In the mid-1980s, it reached more than 3% a year, followed by a stable drop reaching less than 2% in 2015. In 2016, the region totaled 413 million inhabitants, representing 5.55% of the world population. Overall, the population of the Middle East grew by around 414% from 1950 to 2016. In respect of the fertility rates, all of the countries mentioned in this study saw their fertility rates drop between 1996 and 2016. This can be attributed to the growing education and job opportunities for women.

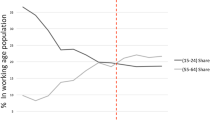

Moreover, a major change occurred in the working age population ages from 15 to 64. Since 1980, the working-age population has risen quickly, reaching 63% in 1996, and further increasing to 75% in 2016. The working-age population in this study is divided into three categories: young workers (15–24 years), middle-aged workers (25–44 years), and senior workers (45–64 years), which are also disaggregated by gender (male and female). Thus, it is important to have an overview of the individual components of the working age population. Figures 1, 2, and 3 illustrate these working-age groups from 1996 to 2016 in the Middle East countries.

Source: World Bank (2017)

Young workers (15–24 years) share of working-age population in the Middle East (1996–2016).

Source: World Bank (2017)

Middle-aged workers (25–44 years) share of working-age population in the Middle East (1996–2016).

Source: World Bank (2017)

Senior workers (45–64 years) share of working-age population in the Middle East (1996–2016).

As shown in Fig. 1, the young workers aged 15–24 declined marginally from 18% in 1996 to 15% in 2016. The young male workers’ ratio decreased to 8% in 2016, compared to 9.5% in 1996. Nevertheless, the young male workers’ ratio remained higher than that for the females over the same period. The young female workers’ ratio has decreased marginally since 1996. The period from 1996 to 2016 witnessed a decrease in the young female workers’ ratio from 8.3 to 6.5%.

Figure 2 shows the middle-aged workers aged 25–44 in the Middle East countries from 1996 to 2016. Overall, the middle-aged workers’ ratio has increased over the years. This figure clearly shows that there is a significant disparity between the middle-aged male workers’ ratio and the middle-aged female workers’ ratio. Meanwhile, middle-aged male workers remained higher than the middle-aged female workers over the same period, with the difference remaining fairly constant.

Figure 3 shows that the senior workers’ ratio increased consistently over the years. Overall, the average senior workers’ ratio in the Middle East increased from 11% in 1996 to 16.7 in 2016. Meanwhile, during the same period, the average senior male workers’ ratio was at 8%, and the senior female workers’ ratio was at 5%. It is clearly seen that there is a large and persistent difference between the senior male workers and senior female workers’ ratio. This gap has not diminished, and the senior male workers have remained higher than that for the senior female workers throughout.

In terms of trends, the young workers’ ratio showed a gradual decline from 18% in 1996 to 15% in 2016. The middle-aged workers’ ratio continued to remain high averaging at about 38.6%. In contrast, the senior workers’ ratio increased consistently from 11% in 1996 to 14% in 2010 and further increased to 16.6% in 2016. This increasing trend for the senior workers’ ratio and declining ratio for young workers is similar to the trends in developed countries that experience an aging population.

4 Theoretical framework

This study utilizes the growth model of Mankiw et al. (1992), which is the Solow (1956) neoclassical growth model augmented with human capital as a factor of production. This model confirms the value of knowledge in determining economic growth. Labor is not determined exogenously by the growth of population, but is determined by the accumulation of skills whereby households have invested their savings in human capital. Using the Cobb–Douglas function, the production function is expressed as:

Dividing by L:

The equation shows that the income per worker is determined by two factors: physical capital per worker \( \left( {\frac{K}{L}} \right) \) and human capital per worker \( \left( {\frac{H}{L}} \right) \). The rate of change for the physical and human capital is given as follows:

where δ is the proportionate depreciation for both physical and human capital, \( s_{k} \) is the part of income invested in the physical capital, and \( s_{h} \) is the part that is invested in human capital, and which is supposed to stay constant over time. To solve the steady-state solutions \( \dot{k} \) and \( \dot{h} \), MRW uses the steady-state income equation.

The equation shows how income per capita is related to population growth and the accumulation of human and physical capital.

To examine the impact of demographic change on economic growth, we begin with the following specification:

where \( Y_{it} \) is the real GDP per capital and \( {\text{Demo}}_{it} \) is a set of demographic variables. \( Z_{it} \) denotes the economic variables, and i and t indicate the country and time, respectively.

4.1 Model specifications and estimation approach

Following the theoretical models, the econometric analysis for economic growth could be estimated as follows:

where \( Y_{it} \) is the log of real GDP per capita, \( {\text{YW}}_{it} \) denotes the log of young workers aged 15–24, \( {\text{MW}}_{it} \) shows the log of middle-aged workers aged 25–44, \( {\text{SW}}_{it} \) is the log of senior workers aged 45–64, and \( {\text{PG}}_{it} \) is the log of population growth. Moreover, \( {\text{LFPR}}_{it} \) represents the log of labor force participation ratio, \( {\text{GLF}}_{it} \) is the log of the growth rate of the total labor force, \( {\text{SEC}}_{it} \) represents the log of secondary school enrolment ratio, \( {\text{EE}}_{it} \) is the log of education expenditures, \( {\text{AYS}}_{it} \) is the log of average years of schooling, \( {\text{FDI}}_{it} \) is the log of foreign direct investment, \( {\text{RL}}_{it} \) shows the log of the rule of law, \( {\text{RQ}}_{it} \) represents the log of regulatory quality, and \( w_{it} \) is decomposed into two composite error terms: \( w_{it} = u_{it} + e_{it} \); \( u_{it} \) is called the individual-specific effect (unobserved heterogeneity), and \( e_{it} \) is the remainder error term (regular error term). In the following models, the working-age population variables are disaggregated by age and gender (male and female). The first model contains the male working-age population variables and the other female working-age population variables.

In model (8), \( {\text{M}} . {\text{YW}}_{it} \) represents the log of young male workers aged 15–24, \( {\text{M}} . {\text{MW}}_{it} \) is the log of middle-aged male workers aged 25–44, and \( {\text{M}} . {\text{SW}}_{it} \) denotes the log of senior male workers aged 45–64.

where \( {\text{F}} . {\text{YW}}_{it} \) is the log of young female workers aged 15–24, \( {\text{F}} . {\text{MW}}_{it} \) denotes the log of middle-aged female workers aged 25–44, and \( {\text{F}} . {\text{SW}}_{it} \) is the log of senior female workers aged 45–64. In the next model, the working-age population variables are replaced by the youth dependency ratio and old-age dependency ratio.

In model (10), \( {\text{YD}}_{it} \) is the log of the youth dependency ratio (the population ages below 15 years divided by the population ages 15 and 65 years) and \( {\text{OD}}_{it} \) denotes the log of old dependency ratio (the population ages above 65 years divided by the population ages 15–65 years).

There are many benefits of using panel data. Some of the benefits are to control individual heterogeneity, reduce the problems of data multicollinearity, and obtain more precise estimates of micro-relations. The three alternative models of panel data are pooled ordinary least squares, random effects, and fixed effects, which will be employed to examine the impact of the working-age population on economic growth.

The pooled OLS will lead to heterogeneity bias. As a result, panel data models provide the random effects models and fixed effects models to deal with individual heterogeneity. The fixed effects will be tested by the F test to compare a fixed effects model and pooled OLS to see how much the fixed effects model can improve the goodness of fit. If the null hypothesis of the F test is rejected, a fixed effects model is favored. Then, the Hausman test will be applied to choose between the random and the fixed effects model. If the null hypothesis is rejected, the fixed effects model will be favored over the random effects model. Otherwise, the random effects model will be favored.

After obtaining a convenient model, the analysis will proceed with the diagnostic tests. Firstly, the variance inflation factor (VIF) will be employed to check for multicollinearity. If the mean of the estimated VIF is less than 10, this means that there is no multicollinearity. Secondly, when the fixed effects model is favored, the Modified Wald test for group-wise heteroskedasticity will be applied to check for heteroskedasticity. If the p value is less than 0.05, then heteroskedasticity is an issue. In this study, the autocorrelation test is not performed because the time dimension of data is very short. This test is applied to the macro-panels with long time series.

4.2 Variables and data sources

In this paper, the dataset is the panel data of ten Middle East countries (Bahrain, Egypt, Iran, Jordan, Kuwait, Oman, Qatar, Saudi Arabia, Turkey, and the United Arab Emirates) for a 5-year period from 1996 to 2016. Due to the lack of data for the desired time period for all Middle East countries, this study was limited to ten countries. Data were obtained from the World Development Indicators (WDI) and the Worldwide Governance Indicators (WGI) of the World Bank. The dependent variable is the real GDP per capita as a proxy for economic growth, while the explanatory variables are young workers, middle-aged workers, and senior workers, which are also disaggregated by gender (Wongboonsin and Phiromswad 2017); youth dependency ratio; old dependency ratio; population growth; labor force participation ratio; and growth rate of the total labor force. This study used three different proxies for human capital: secondary school enrollment ratio, average years of schooling, and government expenditure on education. In addition, control variables are included, namely foreign direct investment, rule of law, and regulatory quality, as a proxy for governance and institutions (Kaufmann and Kraay 2003). Table 1 reports the descriptive statistics for all the variables in the analysis for Middle East countries.

5 Empirical results

First, it is important to conduct unit root tests for the series data in this study. “Appendix” shows the results based on the panel unit root tests—Levin Lin Chu test and PP-Fisher Chi-square. The results reveal that the tests are statistically significant at the 1 and 5% levels. This means that there is no unit root and that the data are stationary. This allows the researchers to run the regressions for analyzing the empirical results of this study.

The analysis runs the panel data techniques: pooled OLS model, fixed effects model, and random effects model for the purpose of checking the robustness of the results. The empirical estimations are reported in Tables 2, 3, 4, and 5 as follows: First, Table 2 displays the demographic change impact on economic growth. Then, Tables 3 and 4 provide the impact of the working-age population variables disaggregated by age and gender (male and female) on economic growth. Finally, Table 5 focuses on the effect of youth and old-age dependency ratios on economic growth. The tables comprise the results of all four model specifications expressed in Eqs. (7), (8), (9), and (10).

Table 2 shows the results of how the demographic variables affect the economic growth. Based on the results, the F test favors the fixed effects model to the pooled OLS technique in that the model is more appropriate since the p value for the estimated test statistic is less than 0.01. In addition, the Hausman test reveals that the fixed effects model is better than the random effects because the p value is less than 0.05. The following step is to run diagnostic tests. The result of the variance inflation factor (VIF) shows that the mean VIF is less than 10. This denotes that multicollinearity is not a problem. Besides, the results display that the null hypothesis is rejected (p value less than 0.01) for the heteroskedasticity test. This indicates that there is a heteroskedasticity problem. In further analysis, since there is a heteroskedasticity problem, the fixed effects model with robust standard errors is applied to obtain the accurate regression standard error value.

The results of the robust fixed effects model in Table 2 reveal that young workers, middle-aged workers, and senior workers have a positive and significant impact on economic growth. This result is consistent with the findings of Bloom and Williamson (1998), and Wongboonsin and Phiromswad (2017) who revealed that there is a positive correlation between the share of the working-age population and economic growth. The population growth rate affects economic growth positively and significantly, thus confirming the optimist’s approach (population growth rate has a positive effect on economic growth).

The labor force participation rate and growth rate of the labor force have a negative impact on economic growth. This may be due to the unskilled labor force in Middle East countries (Pissarides and Ange Veganzones-Varoudakis 2006); and means that unskilled workers do not obtain high productive jobs that promote economic growth. This negative effect reveals the fact that economic research asserts that an increase in labor force participation is negatively correlated with productivity growth (Dew-Becker and Gordon 2008; McGuckin and van Ark 2005). Regarding human capital proxies, the results show that government education expenditure has no effect on economic growth. This might be due to the allocated funds for the education sector development not being properly utilized (Nurudeen and Usman 2010). Similarly, the secondary enrolment ratio and average years of schooling have no effect on economic growth. These results confirm the conclusions of Makdisi et al. (2006), and Amaghouss and Ibourk (2013) who revealed that the education in the MENA region does not contribute to economic growth.

The results indicate that the foreign direct investment negatively influences economic growth. This may be due to the weakness of FDI inflows captured by Middle East countries. This result is consistent with Meschi (2006) who found a negative relationship between foreign direct investment and economic growth in MENA Countries.

For the governance and institutions proxies, regulatory quality has no effect on economic growth since the coefficients are insignificant. The coefficient for the rule of law is positive and significant. The results are consistent with Emara and Chiu (2016) who found that per capita GDP would rise by about 2% if the governance index increases by one unit in the case of Middle Eastern and North African countries.

Table 3 displays the results of the effect of the male working-age population on economic growth. The F test and the Hausman test reveal that the fixed effects model is the most appropriate since the p value for both estimated tests is less than 0.05. Moreover, it is required to check for multicollinearity and heteroskedasticity problems in the fixed effects model. The results of the variance inflation factor (VIF) reveal that there is no multicollinearity problem since the mean VIF is less than 10. Unfortunately, the results of the heteroskedasticity test display that the null hypothesis is rejected (p value less than 0.01). This means that there is a heteroskedasticity problem. Therefore, the fixed effects model with robust standard errors is used to rectify the heteroskedasticity problem.

The results of the robust fixed effects model in Table 3 show that young male workers, middle-aged male workers, and senior male workers have a positive effect on economic growth. The results are supported by Bloom et al. (2004), and Bloom and Williamson (1998) who concluded that the share of the working-age population has a positive impact on economic growth. In addition, Song (2013) reported that the rapid economic growth in the East, South-east, and South Asian economies is attributed to the working-age population and growth of the working-age population. In the research by Ahmad and Khan (2018b), they showed the positive contribution of the working age population on the economic growth in developing economies.

The coefficients of population growth rate and rule of law positively affect economic growth, whereas the coefficients of the labor force participation ratio and growth rate of the labor force negatively affect economic growth. Meanwhile, the secondary enrolment ratio, education expenditures, average years of schooling, foreign direct investment, and regulatory quality have no effect on economic growth.

Table 4 offers the results of the impact of female working-age population on economic growth. Based on the results, the F test and the Hausman test indicate that the fixed effects model is favored because the p value for both estimated tests is less than 0.05. The next step is to run diagnostic tests. The result of the variance inflation factor (VIF) shows that the mean VIF is less than 10. This denotes that multicollinearity is not a problem. Besides, the result of the heteroskedasticity test displays that there is a heteroskedasticity problem since the null hypothesis is rejected (p value less than 0.01). In further analysis, the fixed effects model with robust standard errors is applied to obtain the accurate regression standard error value.

The results of the robust fixed effects model in Table 4 present that young female workers have a negative effect on economic growth. This may be due to the fact that young female workers (15–24) leave school prior to completing higher education and enter into the labor market early. This means that the skills of pre-university education are not enough to obtain high productive jobs. This is consistent with the argument indicating that firms in developing countries tend to employ more female workers for relatively unskilled occupations (Fakih and Ghazalian 2015). In contrast, middle-aged female workers and senior female workers have no effect on economic growth. This may be due to the low rate of female labor force participation rate in the Middle East region (World Bank 2017). Based on the research by Cuberes and Teignier (2016), it is found that the Middle East region reports the largest income loss due to gender gaps in the labor market, with an average income loss of 38% in the long run.

The coefficients of population growth rate and rule of law have a positive impact on economic growth, whereas the coefficient of the labor force participation ratio and growth rate of the labor force have a negative impact on economic growth. Meanwhile, the secondary enrolment ratio, education expenditures, average years of schooling, foreign direct investment, and regulatory quality have no effect on economic growth.

Table 5 presents the results of the effect of dependency ratios on economic growth. The F test and the Hausman test favor the fixed effects model to the pooled OLS and random effects model since the p value for the estimated tests is less than 0.05. Consequently, it is necessary to test for the existence of multicollinearity and heteroskedasticity problems in the fixed effects model. The result of the variance inflation factor (VIF) reveals that there is no multicollinearity problem since the mean VIF is less than 10. Unfortunately, the result displays that the null hypothesis is rejected (p value less than 0.01) for the heteroskedasticity test. This indicates that there is a heteroskedasticity problem. Therefore, the fixed effects model with robust standard errors is used to rectify the heteroskedasticity problem.

The results of the robust fixed effects model in Table 5 display that the youth dependency ratio has a negative effect on economic growth. This is consistent with the findings of Bloom et al. (2001), and Kögel (2005) who showed a negative correlation between the dependency ratios and economic growth, while the old-age dependency ratio has a positive effect on economic growth. This reveals the fact that the old-age dependency ratio is low with less than 10% in most Middle East countries. This indicates a huge surge in the working-age population in the Middle East as the demographic force affects the economic growth. The results are supported by Song (2013) who concluded that the old-age dependent group is insignificant and positive because the old population is not yet a predominant demographic force in most Asian economies.

The population growth rate has a positive and significant effect on economic growth confirming the optimist’s approach. The labor force participation ratio and growth rate of the total labor force affects the economic growth negatively and significantly. These results are consistent with Dew-Becker and Gordon (2008), and McGuckin and van Ark (2005). The secondary enrolment ratio, education expenditures, average years of schooling, foreign direct investment, and regulatory quality have no effect on economic growth, whereas the rule of law has a positive impact on economic growth.

Overall, when comparing the impact of working-age population groups, the results evidence that young workers, middle-aged workers, and senior workers for both sexes are significant and contribute positively to economic growth. Moreover, analysis by gender shows that the male working-age population (young male workers, middle-aged male workers, and senior male workers) contributes more to the economic growth compared to the female working-age population (young female workers, middle-aged female workers, and senior female workers). This may be due to the fact that women constitute 48% of the Middle Eastern working-age population, but only 20% of the labor force (Word Bank 2017). Based on the research by Sanghi et al. (2015), the gender gaps in the labor force participation are highest in the Middle East region, where men’s participation rates exceed women’s rates by over 50% points. In addition, in the report by the IMF (2018), it is shown that over the past three decades, there has been a general trend toward more women entering the labor force in all regions except for the Middle East region where it has plateaued.

6 Conclusion

The main purpose of this study is to examine the effects of demographic change on economic growth in Middle East countries. For this purpose, an economic growth model has been used for the shares of the working-age population disaggregated by age and gender, and dependency ratios to empirically assess their effects on economic growth. The study employed the static linear panel data models for ten Middle East countries for a 5-year period from 1996 to 2016.

The findings of this study explain that young workers, middle-aged workers, and senior workers for both sexes, and population growth rate positively influence economic growth. In terms of gender, the results show that the male working-age population contributes more to economic growth than the female working-age population. For the human capital proxies and regulatory quality, the results show that they have no effect on economic growth, whereas the rule of law has a positive and significant effect on economic growth in all models. The youth dependency ratio appears to have a negative effect on economic growth, while the old-age dependency shows a positive impact on economic growth. This is mainly because the old-age dependency ratio is low with less than 10% and that it is not yet a predominant demographic force in Middle East economies.

Based on the results, a huge surge in the young population in the Middle East as a demographic force offers a historic opportunity that countries must seize. The opportunity to get benefits due to a change in age structure is not forever, and the aging population will ultimately constrain economic growth. Therefore, this rising tide of the young population needs to create the opportunity for jobs in order to absorb those joining the labor market to make their contributions to the economy. In addition, governments should formulate policies that will encourage and facilitate women to engage actively in the labor market in order to enhance their productivity and enable them to contribute to achieving a high-income economy.

There are numerous suggested aspects for further research that can investigate the role of demographic change in economic growth. Further studies should extend the sample size to other countries. It may be expanded further by using disaggregated samples by income group. Moreover, empirical studies are required to examine the nature of the relationship between demographic change and economic growth to establish more comprehensive causality between them.

References

Abdelbary I, Benhin J (2019) Governance, capital and economic growth in the Arab Region. Q Rev Econ Finance 73:184–191

Abed GT (2003) Unfulfilled promise: why the Middle East and North Africa region has lagged in growth and globalization. Finance Dev 40(March):10–14

Ahmad M, Khan REA (2018a) Age-structure, human capital and economic growth in developing economies: a disaggregated analysis. Pak J Commer Soc Sci 12:229–252

Ahmad M, Khan REA (2018b) Does demographic transition with human capital dynamics matter for economic growth? A dynamic panel data approach to GMM. Soc Indic Res 142:753–772

Aiyar S, Mody A (2013) The demographic dividend: evidence from the Indian States. In: India policy forum, 2013, vol 1. National Council of Applied Economic Research, pp 105–148

Amaghouss J, Ibourk A (2013) Education and economic growth in the MENA region: some new evidence. J Econ Sustain Dev 4:34–45

Bloom DE, Canning D (2011) Demographics and development policy. Dev Outreach 13:77–81

Bloom DE, Williamson JG (1998) Demographic transitions and economic miracles in emerging Asia. World Bank Econ Rev 12:419–455

Bloom DE, Canning D, Sevilla J (2001) Economic growth and the demographic transition. National Bureau of Economic Research, Cambridge

Bloom D, Canning D, Sevilla J (2003) The demographic dividend: a new perspective on the economic consequences of population change. Rand Corporation, Santa Monica

Bloom DE, Canning D, Sevilla J (2004) The effect of health on economic growth: a production function approach. World Dev 32:1–13

Bucci A (2008) Population growth in a model of economic growth with human capital accumulation and horizontal R&D. J Macroecon 30:1124–1147

Choudhry MT, Elhorst JP (2010) Demographic transition and economic growth in China, India and Pakistan. Econ Syst 34:218–236

Crenshaw EM, Ameen AZ, Christenson M (1997) Population dynamics and economic development: age-specific population growth rates and economic growth in developing countries, 1965 to 1990. Am Sociol Rev 62:974–984

Cuberes D, Teignier M (2016) Aggregate effects of gender gaps in the labor market: a quantitative estimate. J Hum Cap 10:1–32

Dasgupta D, Keller J, Srinivasan T (2005) Reform and elusive growth in the Middle East-what happened in the 1990s. Trade Policy Econ Integr Middle East N Afr Econ Bound Flux 1:13

Dawson PJ, Tiffin R (1998) Is there a long-run relationship between population growth and living standards? The case of India. J Dev Stud 34:149–156

Dew-Becker I, Gordon RJ (2008) The role of labor market changes in the slowdown of European productivity growth. National Bureau of Economic Research, Cambridge

Doepke M (2004) Accounting for fertility decline during the transition to growth. J Econ Growth 9:347–383

Emara N, Chiu I (2016) The impact of governance on economic growth: the case of Middle Eastern and North African countries. Top Middle Eastern N Afr Econ 18:126–144

Fakih A, Ghazalian PL (2015) Female employment in MENA’s manufacturing sector: the implications of firm-related and national factors. Econ Change Restruct 48:37–69

Galor O (2005) From stagnation to growth: unified growth theory. Handb Econ Growth 1:171–293

Galor O, Moav O (2002) Natural selection and the origin of economic growth. Q J Econ 117:1133–1191

Galor O, Weil DN (1999) From Malthusian stagnation to modern growth. Am Econ Rev 89:150–154

Hakura MD (2004) Growth in the Middle East and North Africa, vol 4–56. International Monetary Fund, Washington

Hansen GD, Prescott EC (2002) Malthus to solow. Am Econ Rev 92:1205–1217

Hondroyiannis G (2010) Fertility determinants and economic uncertainty: an assessment using European panel data. J Fam Econ Issues 31:33–50

Hondroyiannis G, Papapetrou E (2002) Demographic transition and economic growth: empirical evidence from Greece. J Popul Econ 15:221–242

Hondroyiannis G, Papapetrou E (2004) Demographic changes and economic activity in Greece. Rev Econ Househ 2:49–71

Hondroyiannis G, Papapetrou E (2005) Fertility and output in Europe: new evidence from panel cointegration analysis. J Policy Model 27:143–156

IMF (2018) Pursuing women's economic empowerment. Paper presented at the meeting of G7 ministers and central bank governors, Whistler, Canada, June 1-2, 2018

Jones CI (2001) Was an industrial revolution inevitable? Economic growth over the very long run. Adv Macroecon 1

Kaufmann D, Kraay A (2003) Governance and growth: causality which way? Evidence for the world, in brief. World Bank, Washington

Kelley AC, Schmidt RM (1995) Aggregate population and economic growth correlations: the role of the components of demographic change. Demography 32:543–555

Kelley AC, Schmidt RM (2005) Evolution of recent economic-demographic modeling: a synthesis. J Popul Econ 18:275–300

Kögel T (2005) Youth dependency and total factor productivity. J Dev Econ 76:147–173

Kremer M (1993) Population growth and technological change: one million BC to 1990. Q J Econ 108:681–716

Kuznets S (1967) Population and economic growth. Proc Am Philos Soc 111:170–193

Lee R, Mason A (2010) Fertility, human capital, and economic growth over the demographic transition. Eur J Popul 26:159–182

Lucas RE (2002) Lectures on economic growth. Harvard University Press, Cambridge

Makdisi S, Fattah Z, Limam I (2006) Determinants of growth in the MENA countries. Contrib Econ Anal 278:31–60

Malthus T (1798) An essay on the principle of population. Printed for J. Johnson St Paul’s churchyard, London, pp 1–126

Mankiw NG, Romer D, Weil DN (1992) A contribution to the empirics of economic growth. Q J Econ 107:407–437

McGuckin R, van Ark B (2005) Productivity and participation: an international comparison. University of Groningen, GGDC Research Memorandum 200578

Menike HA (2014) The impact of demographic transition on the economicgrowth and development in Sri Lanka from 1963 to 2007. J Soc Rev 2:45–58

Meschi E (2006) FDI and growth in MENA countries: an empirical analysis. In: The fifth international conference of the Middle East Economic Association, Sousse, 2006, pp 10–12

Nurudeen A, Usman A (2010) Government expenditure and economic growth in Nigeria, 1970–2008: a disaggregated analysis. Bus Econ J 4:1–11

Pissarides CA, Ange Veganzones-Varoudakis M (2006) Labor markets and economic growth in the MENA region. In: Explaining growth in the Middle East. Emerald Group Publishing Limited, pp 137–157

Sala-i-Martin X, Artadi EV (2003) Economic growth and investment in the Arab world UPF economics and business working paper

Sanghi S, Srija A, Vijay SS (2015) Decline in rural female labour force participation in India: a relook into the causes. Vikalpa 40:255–268

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

Song S (2013) Demographic changes and economic growth: empirical evidence from Asia honors projects paper 121

Strulik H, Weisdorf J (2008) Population, food, and knowledge: a simple unified growth theory. J Econ Growth 13:195

Thirlwall AP (1972) A cross section study of population growth and the growth of output and per capita income in a production function framework. Manch Sch 40:339–356

Uddin GA, Alam K, Gow J (2016) Population age structure and savings rate impacts on economic growth: evidence from Australia. Econ Anal Policy 52:23–33

Wei Z, Hao R (2010) Demographic structure and economic growth: evidence from China. J Comp Econ 38:472–491

Wongboonsin K, Phiromswad P (2017) Searching for empirical linkages between demographic structure and economic growth. Econ Model 60:364–379

World Bank (2017) World development indicators. World Bank, Washington, DC

Zhao W, Zhu X (2016) The impact of the transformation of age structure on economic growth. Chin J Urban Environ Stud 4:1650031

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Bawazir, A.A.A., Aslam, M. & Osman, A.F.B. Demographic change and economic growth: empirical evidence from the Middle East. Econ Change Restruct 53, 429–450 (2020). https://doi.org/10.1007/s10644-019-09254-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-019-09254-8