Abstract

This paper estimates the effect of the closure and relocation of chemical enterprises along the Yangtze River on housing prices in China. With a difference-in-differences (DiD) model and detailed data on polluting enterprises, house transactions, and environmental complaints, we find that environmental regulation led to a 1.7% increase in housing prices and a 43.3% reduction in perceived environmental risks, as measured by environmental complaints from surrounding residents. In addition, we observe a greater change in property values among taller buildings than among shorter buildings. This paper elucidates how developing countries can benefit from environmental regulation by influencing residents’ risk perceptions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In 2017, based on an unprecedented determination to enhance environmental protection, the Chinese government promulgated a policy mandating the closure or relocation of chemical enterprises along the Yangtze River. The provinces affected by this policy accounted for more than 40% of the national total population and GDP. This implies that conducting a benefit analysis for this extensive environmental policy is crucial for the welfare of the majority of people in China, the largest developing country. The modern hedonic property value model is a premier approach for measuring the benefits of a change in environmental amenities (e.g., air quality, park proximity, and environmental risks) resulting from environmental regulation (Palmquist and Smith 2002; Bishop et al. 2020). This situation occurs primarily because homebuyers select properties based on housing characteristics and the risks associated with location-specific amenities, such as environmental risks. Therefore, environmental risks are considered environmental (dis)amenities that could influence residential real estate decisions. In general, environmental risks could reduce housing prices in the vicinity (Kim et al. 2003; Hansen et al. 2006; Tang et al. 2018). However, actual environmental risks do not affect housing prices unless residents perceive such risks themselves (Freybote and Fruits 2015; Tanaka and Zabel 2018; Bernstein et al. 2019).

In fact, the public faces several barriers to accessing information and knowledge related to environmental risks (Greenstone and Jack 2015; Barwick et al. 2019); thus, not every individual can perceive environmental risks in practice. When a person has a lower perception of environmental risk in a given area, even if the actual environmental risk is at a much higher level than that perceived by him or her, he or she might have a relatively greater willingness to pay for housing in that area than a fully informed person. This indicates that perceived environmental risks, rather than actual environmental risks, affect housing transactions. However, the measurement of perceived environmental risks often encounters difficulties in terms of identification and data acquisition.

By using environmental complaints to measure residents’ perceptions of environmental risks, we examine the “environmental risk perception” channel through which environmental regulation affects residential real estate decisions. Several researchers have investigated the effect of risk perception on residents’ behavior and found that residents who perceive a greater number of risks are more motivated to take risk-mitigation steps than those who perceive fewer risks (Ban et al. 2017; Wang et al. 2019; Dawson 2018; Libarkin et al. 2018; Wang et al. 2020a, b). We interpret environmental complaints as proxies for perceptions of environmental risk. Residents can protest environmental deterioration or suggest solutions to environmental authorities via letters, emails, complaint hotlines, or related websites (Zhang et al. 2017). Environmental complaints generally indicate changes in residents’ perceptions of environmental concerns in their surroundings.

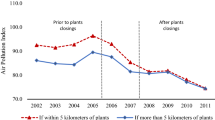

Empirical studies have extensively examined the impact of environmental regulation on housing prices in developed countries, including environmental regulations regarding air pollution (Chay and Greenstone 2005; Bento et al. 2015), hazardous waste sites (Greenstone and Gallagher 2008; Gamper-Rabindran and Timmins 2013), contaminated lands (Haninger et al. 2017), information disclosure (Mastromonaco 2015; Frondel et al. 2020), and plant openings and closings (Currie et al. 2015; Farah et al. 2019). Research on the relationship between plant locations and housing prices has shown that the proximity of houses to plants negatively affects property values (Blomquist 1974; Nelson 1981; Davis 2011), consistent with the greater perceived environmental risk in locations closer to plants. Several studies have shown that plant closures or relocations can reduce the degree of local environmental risk and increase the WTP among potential buyers of houses around plants, thus leading to an increase in housing prices (Deng et al. 2020). However, plant closures or relocations may also fail to affect housing prices due to persistent visual disamenities, local contamination concerns, or expectations that the plants will reopen. Therefore, plants continue to negatively influence housing prices even after they cease operations (Currie et al. 2015; Hite et al. 2001). Although the different conclusions drawn from these studies all have reasonable explanations, the underlying reasons for these inconsistent findings call for a more in-depth discussion.

In this paper, we estimate the effect of the closure and relocation of chemical enterprises along China’s Yangtze River on housing prices. In 2017, the Ministry of Ecology and Environment (MEE) of China enacted a regulation to close or relocate chemical enterprises within one kilometer of the Yangtze River to reduce the degree of environmental risk. Using a difference-in-differences (DiD) model and detailed data on polluting enterprises and housing transactions, we find that the closure and relocation of chemical enterprises led to a 1.7% increase in property value and that the aggregate benefit was approximately 7 billion CNY (approximately 1 billion USD). We also directly estimate the impact of this environmental regulation on residents’ risk perceptions using environmental complaint data. We find that the number of environmental complaints from surrounding residents decreases by a statistically significant 43.3% after the closure and relocation of enterprises, suggesting that residents’ degree of perceived risk decreases, which in turn contributes to an increase in housing prices. Furthermore, we observe positive capitalization exclusively in areas where the number of environmental complaints has decreased, and the positive capitalization effect arises primarily from improvements in air pollution. Moreover, we find a larger change in property values among taller buildings than among shorter buildings.

This paper contributes to the literature on environmental regulation and housing prices in two ways. First, by evaluating residents’ perceptions of environmental risks, we explain how the closure and relocation of chemical enterprises drive up housing prices. In the hedonic framework, variation in environmental amenities (e.g., environmental risks) resulting from environmental regulation can be capitalized into housing prices, but doing so requires the existence of the strict premise that environmental risks can be perceived by homebuyers. However, there is a gap between actual environmental risk and that perceived by homebuyers, and not every individual can observe or perceive actual environmental risk due to incomplete information (Barwick et al. 2019; Hino and Burke 2021); additionally, estimates of the demand for environmental quality that assume full information may be significantly underestimated (Madajewicz et al. 2007; Jalan and Somanathan 2008; Tu et al. 2020). Although perceived environmental risks, rather than actual environmental risks, affect housing transactions, the measurement of the “environmental risk perception” channel often suffers from difficulties in terms of identification and data acquisition. Our study adopts a distinct approach to assessing environmental risk perception, in contrast to Davis (2004), who evaluated perceived risk through the cumulative count of leukemia cases and the number of newspaper articles referencing “leukemia”. We provide a more direct measurement by using the main way by which the public responds to perceived environmental risks, namely, environmental complaints about polluting activities, as a proxy for residents’ perceptions of environmental risks. We find that housing prices increase only in areas where the number of environmental complaints has decreased, suggesting that housing prices respond to changes in perceived environmental risks and not to legislation or to plant closures that do not improve perceived environmental quality. Therefore, we contribute to the literature by providing further evidence that plant closure capitalizes positively only when closing leads to an improvement in environmental risk perception. These findings could inform the interpretation of papers that have not observed positive capitalization, such as Hite et al. (2001), Greenstone and Gallagher (2008), and Currie et al. (2015).

As a second insight, we provide rigorous and comprehensive empirical evidence regarding the impact of environmental regulation on housing prices in the largest developing country, China, complementing the current body of literature, which is largely limited to the United States and Europe (Greenstone and Gallagher 2008; Gamper-Rabindran and Timmins 2013; Farah et al. 2019). With two exceptions, Deng et al. (2020) and Mei et al. (2021) investigate the effect of environmental regulation on housing prices in a single Chinese city. Unlike previous hedonic studies, our study focuses on large-scale environmental regulation, which has the potential to impact a substantial population. This study provides crucial guidance for the formulation and benefit assessment of environmental policies in developing countries. By precisely connecting the geographic locations of chemical enterprises and houses, we are able to accurately identify those houses exposed to corporate environmental risks.

The remainder of this paper is organized as follows. Section 2 provides background information on the closure or relocation policy of chemical enterprises within one kilometer of the Yangtze River in China. Section 3 describes the empirical strategy and data used. Section 4 presents the main results and heterogeneity analyses. In Sect. 5, we conduct several robustness checks. Finally, Sect. 6 concludes the paper.

2 Background

2.1 Environmental Risks of the Yangtze River

The provinces along the Yangtze River cover an area of approximately 2.05 million square kilometers, with a population and GDP exceeding 40% of the national total. However, the degree of environmental risk in the Yangtze River Economic Belt is enormous, as indicated by the following two facts.

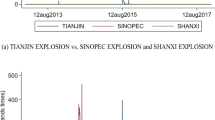

First, there were approximately 15,000 chemical enterprises in the Yangtze River basin before 2017, posing numerous environmental and safety concerns. Safety and environmental risk issues are important considerations in the chemical industry (Wang et al. 2017). According to relevant reports, there were 28 chemical explosion accidents and 82 chemical explosion deaths in China in 2018 (Wang et al. 2020b). Therefore, there are many potential safety hazards along the Yangtze River. At the same time, the Yangtze River serves as a pivotal waterway for China’s heavy industry, including the energy, chemical, and metallurgy sectors. The annual throughput of hazardous chemicals in ports along the Yangtze River has reached 170 million tons, with more than 250 different types of chemicals, and the transportation volume continues to grow at an annual average rate of nearly 10%.Footnote 1 Therefore, there has been an increase in the degree of environmental risk due to the leakage of hazardous chemicals and shipping traffic accidents.

Second, chemical firms in the Yangtze River basin emit a substantial amount of harmful pollutants into the environment each year, accounting for 40% of the nation’s total chemical sector emissions.Footnote 2 In addition, the Yangtze River Economic Belt has a substantial amount of highly intense pollution discharge, with emission intensities per unit area for chemical oxygen demand, ammonia nitrogen, sulfur dioxide, nitrogen oxides, and volatile organic compounds being 1.5 to 2 times the national average. The Yangtze River Economic Belt discharges more than 40% of the total wastewater discharged throughout the country, which causes severe water pollution and even negatively affects the safety of drinking water because the Yangtze River now provides drinking water for almost 500 million people (Chen et al. 2018).

2.2 Chemical Enterprise Closure and Relocation Policy

Over the past several years, the Chinese government has paid close attention to the issues of ecological and environmental protection (Liu et al. 2017, 2021; Wang et al. 2018; He et al. 2020). In September 2013, President Xi Jinping proposed an idea, translated as “lucid waters and lush mountains are invaluable assets”, which aims to strengthen the degrees of ecological protection and management of major rivers such as the Yangtze River and Yellow River, as well as important lakes and wetlands. On this basis, the Chinese government has implemented unprecedented measures to address pollution in the Yangtze River.

The MEE, National Development and Reform Commission, and Ministry of Water Resources jointly issued the Yangtze River Economic Belt Ecological and Environmental Protection Plan in July 2017, which requires the closure or relocation of chemical enterprises located within one kilometer of the Yangtze River. Translations of the relevant paragraphs of the policy document are provided in Appendix 1. Numerous strict requirements are outlined in the policy for the evaluation and assessment of the closure or relocation of chemical enterprises. To ensure effective policy implementation, the MEE, together with the State Council and local governments, conducted midterm and final assessments of the implementation of the policy at the end of 2018 and 2020, respectively. Appendix 2 provides the translations of those documents used by local governments for policy implementation. According to the press conference held by the MEE in March 2021, by the end of 2020, 80% of the enterprises listed in the plan had completed their rectification tasks. Furthermore, more than 8000 chemical enterprises in 27 cities along the river were closed or relocated.Footnote 3

During the sample period of this paper, the policy was still in the process of being implemented. However, changes in housing prices often depend on homebuyers’ expectations for the future (Hanushek and Quigley 1979; Kiefer 2011). Although policy implementation is not yet complete, such a policy may lead to new expectations among potential homebuyers that the environmental risks along the Yangtze River will be reduced in the future once the policy begins to be implemented, thus increasing the demand for houses along the Yangtze River. Then, under the influence of market forces, housing prices increase.

3 Method

Applying the difference-in-differences (DiD) method to rich data on chemical enterprises, housing transactions and environmental complaints, we identify how the closure and relocation of chemical enterprises along the Yangtze River affect housing prices in China.

3.1 Empirical Strategy

In the literature on the hedonic model, environmental regulation may reduce the degree of environmental risk owing to individuals living near polluted sites (Greenstone and Gallagher 2008). Unlike previous research that has focused on the impact of objective variation in environmental risks on housing prices, this paper accounts for individual perceptions of environmental risks, which is a crucial determinant of the purchase decisions of homebuyers. Therefore, by measuring residents’ perceptions of environmental risks and how they are affected by environmental regulations, we examine the impact of risk perceptions on residential real estate decisions.

To solve the endogeneity problems caused by unobservable factors, we use differences in the spatial distance between polluted areas and houses to construct the treatment and control groups for this study. The assumption is that geographically adjacent houses have similar location characteristics and that the only difference between them is whether they are affected by pollution (we conduct a parallel trends test to ensure that this assumption is satisfied in Sect. 4.2). Using the DiD approach, we compare changes in property values and the levels of perceived environmental risk of the public along the Yangtze River before and after the policy with the corresponding changes in the control group.

Specifically, as shown in Fig. 1, 401 chemical enterprises (those that must close or move after being affected by the policy) are identified based on their longitude and latitude information. Considering the distance over which toxic pollutants diffuse (Currie et al. 2015), we consider the area near the enterprise and located within two kilometers of the Yangtze River as the polluted area (dark gray area in Fig. 3). Figure 3 depicts the area polluted by a single enterprise and clusters of multiple enterprises. If there are no other enterprises within one kilometer of the river, then we define the polluted area as the 2-km-by-2-km area with a single enterprise as the center. In the case of clusters of multiple enterprises, the areas polluted by different enterprises are combined into a single polluted area. The treatment group is composed of houses in polluted areas, and the control group is composed of houses in more distant areas (light gray areas in Fig. 3). Our baseline specification specifies a control group that is 2–3 km away from the Yangtze River. A robustness check is conducted using houses with distances between 2 and 4 km, 2 and 5 km, and 2 and 6 km from the river as the control group in Appendix 3. A total of 14,359 houses are identified within polluted and more distant areas, for a total of 55 polluted areas.

Spatial distribution of chemical enterprises within 1 km of the Yangtze River. Notes: This figure presents the spatial distribution of chemical enterprises within one kilometer of the Yangtze River. The details at the bottom right show the section of the Yangtze River that flows through Yichang and Jingzhou (two cities in China’s Hubei Province)

Spatial distribution of houses in 27 cities along the Yangtze River. Notes: This figure shows the spatial distribution of houses in 27 cities along the main stream of the Yangtze River. The details at the bottom right show the section of the Yangtze River that flows through Yichang and Jingzhou (two cities in China’s Hubei Province)

To investigate the impact of the closure and relocation policy for chemical enterprises within one kilometer of the Yangtze River on the perceived environmental risk of the public, this paper uses the number of environmental complaints about polluting activities as a proxy for residents’ perceptions of environmental risks. This proxy is used because when residents have greater perceptions of environmental risks, they are more likely to file environmental complaints. Such complaints can help protect individuals’ environmental interests and mitigate their perceived risks (Wang et al. 2020a), which in turn can also reflect the level of perceived environmental risks. A total of 6767 complaints are identified within the 55 polluted areas and the more distant areas where housing transactions occurred. Among the 27 cities along the Yangtze River, the polluted areas along the Yangtze River are selected as the treatment group, and the more distant areas away from the riverside are selected as the control group. Using the difference in the number of environmental complaints received by the reported object of the polluted areas in the treatment group and those of the more distant areas in the control group before and after the policy, we evaluate the impact of the policy on the perceived environmental risks of the public.

3.2 Empirical Model

To analyze the impact of the closure and relocation policy for chemical enterprises within one kilometer of the Yangtze River on property values, we construct the following DiD model:

where \(i\) indexes the house and \(t\) indexes the period (month). \(\ln (Price_{it} )\) is the logarithm of the average transaction price per square meter. \(Treat_{i}\) is the treatment group dummy variable. For houses in polluted areas (treatment group), \(Treat_{i} = 1\); for houses in more distant areas (control group), \(Treat_{i} = 0\). The time dummy variable \(Post_{t}\) equals 1 after the closure and relocation policy for chemical enterprises within one kilometer of the Yangtze River was issued (July 2017); otherwise, it equals 0.Footnote 4 The coefficient \(\beta\) on the interaction term between \(Treat_{i}\) and \(Post_{t}\) is the causal effect of interest. \(\beta\) measures the difference between the change in property values for the treatment group and the corresponding change for the control group before and after policy implementation. \(X_{it}\) is a series of control variables at the house level, including the living area, house age, floor (the floor of the house), total floors (the total number of floors in a building), house layout, decoration, and orientation. We mitigate the effects of time-invariant and time-variant confounding factors by controlling for neighborhood fixed effects \(\gamma_{c}\) and time fixed effects \(\delta_{t}\). \(\varepsilon_{it}\) is the random error term.

Furthermore, to estimate whether the policy of closing and relocating chemical enterprises within one kilometer of the Yangtze River affects the degree of perceived environmental risk of the public, we construct the following DiD model:

where \(d\) indexes the area, \(t\) indexes the period (month), and \(Complaint_{dt}\) is the number of environmental complaints. \(Treat_{d}\) is the treatment group dummy variable. For polluted areas (treatment group), \(Treat_{d} = 1\); for more distant areas (control group), \(Treat_{d} = 0\). \(Post_{t}\) equals 1 after the policy was issued (July 2017); otherwise, it equals 0. The coefficient \(\alpha\) on the interaction term between \(Treat_{d}\) and \(Post_{t}\) is the DiD effect on which this paper focuses. \(\alpha\) measures the difference between the change in the number of environmental complaints for the treatment group and the corresponding change for the control group before and after the policy. We control for area fixed effects \(\gamma_{d}\) and time fixed effects \(\delta_{t}\). \(\varepsilon_{dt}\) is the random error term.

3.3 Data Sources

3.3.1 Chemical Enterprise Data

We obtain data on chemical enterprises from China’s Key Emission Units List (CKEUL), which is screened by governments according to local environmental quality improvement requirements and the environmental risks of local enterprises. CKEUL includes enterprises with a large degree of environmental risk, such as large amounts of pollutant emissions and emissions of toxic and hazardous pollutants. The data contain detailed information on a variety of enterprise characteristics, including enterprise name, enterprise address, and an enterprise’s industrial classification. We use Baidu and Gaode maps (the most widely used and most trusted maps in China) to obtain the exact geographic coordinates of the enterprises. With this information, we are able to determine the location of each chemical enterprise, enabling us to identify which chemical enterprises are located within one kilometer of the Yangtze River, as environmental regulation requires such enterprises to close or relocate. Figure 1 shows the spatial distribution of those chemical enterprises within one kilometer of the Yangtze River.

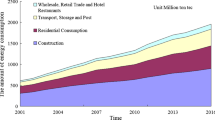

3.3.2 Housing Transaction Data

The housing data in this paper come from the second-hand housing transaction data owned by Lianjia, Shell and Anjuke (the largest real estate companies in China). The data include more than 400,000 housing transactions in 27 cities along the main stream of the Yangtze River from January 2016 to July 2019 (from 18 months before to 24 months after the policy was implemented). Figure 2 shows the spatial distribution of houses in 27 cities along the main stream of the Yangtze River. The data include information on the date of the transaction, total price, average price, name of the neighborhood,Footnote 5 address, living area, house age, floor (the floor of the house), total floors (the total number of floors in a building), house layout, orientation and decoration. We use Baidu and Gaode maps to obtain the longitude and latitude of the houses. Based on this information, we use ArcGIS to filter out a total of 14,359 houses located in polluted and more distant areas from a pool of more than 400,000 houses.

3.3.3 Environmental Complaint Data

To measure the degree of perceived environmental risk of the public, we use the public’s environmental complaints about polluting activities as a proxy. The environmental complaint data, which are unique nonpublic data, come from the records of the “12369” national eco-environmental complaint and reporting platform set up by the MEE to facilitate the collection of public complaints. To solve outstanding environmental problems, the MEE officially opened the “12369” environmental complaint and reporting hotline in June 2009.Footnote 6 Since this hotline was established much earlier than the sample period of this paper, the impact of the learning effect of a new tool on the number of complaints can be excluded. When citizens discover environmental pollution or ecological damage, they can complain through the “12369” platform, as this is the main channel for complaints. There are many ways in which to complain: residents can contact the “12369” hotline, complain through WeChat (the largest social media platform in China) or complain online. Environmental complaints require the complainant to clearly specify the address or name of the subject of the complaint. When the name of the subject is unclear, it is permissible for an individual to file a complaint based solely on a specific location. Therefore, residents’ complaints about firms will not be terminated if the firms are closed or relocated. If abandoned firm facilities continue to annoy nearby residents, then they can still file environmental complaints about these firm locations. In general, environmental complaints are a good indicator of changes in residents’ perceptions of environmental risks. The data contain more than 20,000 complaints for each year and include the time of the complaint, its object, its content, etc. Due to data privacy issues, we do not have the addresses of the complainants, but we have information on those enterprises about which complainants are complaining. Then, we use Baidu and Gaode maps to obtain the exact geographic coordinates of these enterprises. In our study, we count the number of environmental complaints at the area-month level.

3.4 Summary Statistics

Table 1 shows the descriptive statistics for the variables. During the sample period, the average transaction price for a house is 8075 CNY per square meter, and 0.88 complaints are reported on average per area per month. The average living area is 101 square meters. The overall distribution of housing ages is uniform, and there are slightly more houses that are less than ten years old. Exquisite decoration is the largest decoration type category. The distributions of the floor (the floor of the house), total floors (the total number of floors in a building), house layout, and orientation are also presented in Table 1.

4 Results

In this section, we begin by reporting the main results. We then conduct a parallel trend test. The next section discusses the “environmental risk perception” channel through which environmental regulation affects housing prices. In the last part, we conduct heterogeneity analyses.

4.1 Main Results

If consumers value the environmental quality of the neighborhood where they plan to reside, then we should expect an increase in housing prices near the Yangtze River. The overall effect of the closure and relocation of chemical enterprises on housing prices along the Yangtze River is evaluated through a DiD design following Eq. (1). The regression results for Eq. (1) are shown in Table 2. Column (1) of Table 2 controls only for neighborhood fixed effects and month fixed effects, whereas Columns (2) to (3) add housing characteristics as control variables. These characteristics include the living area, house age, level of decoration, floor, total floors, house layout, and orientation. Considering the possible temporal trend in regional housing prices, we control for county-by-month fixed effects in Column (3). Table 2 shows that the coefficient on \(Treat_{i} \times Post_{t}\) is always positive and statistically significant.Footnote 7 Following the implementation of the policy to close and relocate chemical enterprises within one kilometer of the Yangtze River, the property values along the Yangtze River increased significantly. Thus, the closure and relocation policy for chemical enterprises within one kilometer of the Yangtze River reduces the degree of environmental health risk of exposure to pollution in houses near those chemical enterprises and increases housing prices through capitalization. According to the results in Column (3), after chemical enterprises along the Yangtze River are closed or moved, housing prices increase by a statistically significant 1.7%. Notably, the regression coefficient is based on the strict assumption that the prices of houses two kilometers away from the Yangtze River are not affected by the policy. In fact, if the housing prices in the control group also increase due to the closure and relocation policy, then the estimated impact reported in this paper would be a lower bound.

4.2 Parallel Trend Test

The identification assumption of DiD estimation is the existence of parallel trends between the treatment and control groups; that is, the treatment and control groups should exhibit similar time trends. Considering that one cannot test or directly observe whether the parallel trends assumption is satisfied, we rely on the existence of parallel pretrends as suggestive evidence that the assumption would hold. To examine the pretrends in the treatment and control groups, we construct the following event study model:

where \(Period_{t}\) is a series of dummy variables. \(Period_{t}\) equals 1 if the transaction occurs in month \(t\) and 0 otherwise. The other variables have the same definitions as those in Eq. (1). Figure 4 shows the results of the parallel pretrends test. Taking July 2017 as the base period, it is evident that there are no statistically significant differences in housing prices between the treatment and control groups before the policy. In the period following policy implementation, i.e., from August 2017 to July 2019, the coefficients \(\beta_{t}\) are positive and statistically significant, suggesting that the policy of closing and relocating chemical enterprises within one kilometer of the Yangtze River has a sustained positive impact on housing values.

Parallel pretrend test of property values in the treatment and control groups. Notes: This figure presents the coefficients and 95% confidence intervals for \(Treat_{i} \times Period_{t}\) interactions from Eq. (3)

4.3 Environmental Risk Perception Channel

As discussed above, there is a gap between actual environmental risks and those perceived by homebuyers. The factors that truly affect housing transactions, however, are perceived environmental risks, which have not been measured well in the literature. Therefore, this section examines “environmental risk perception” as the channel through which environmental regulation may affect housing prices.

We hypothesize that the closure and relocation of chemical enterprises reduce the degree of perceived environmental risk, thus further expanding local housing demand and leading to an increase in housing prices. To test this hypothesis, we use the number of environmental complaints about polluting activities as a proxy for environmental risk perceptions because the public is more likely to file environmental complaints when the degree of perceived environmental risk is greater (Wang et al. 2020a).

4.3.1 Difference-In-Differences Estimates

We begin with a difference-in-differences (DiD) model to examine whether the public’s perceived environmental risks are affected by the closure and relocation of chemical enterprises along the Yangtze River. The regression results for Eq. (2) are shown in Table 3. In Column (1), we control for area fixed effects and month fixed effects. Considering the possible temporal trend in regional environmental complaints, we control for province-by-month fixed effects, city-by-month fixed effects and county-by-month fixed effects in Columns (2) to (4), respectively. The coefficients on \(Treat_{d} \times Post_{t}\) are all negative and statistically significant, which shows that after the implementation of the policy to close and relocate chemical enterprises, the number of environmental complaints in polluted areas along the Yangtze River decreased significantly relative to those in more distant areas. The results indicate that the policy significantly reduces the degree of perceived environmental risk.Footnote 8 According to the regression results in Column (4), the number of environmental complaints decreases by 0.463 per month, which accounts for approximately 43.3% of the average number of monthly complaints prior to the policy (the average number of monthly complaints prior to the policy is 1.07).

Therefore, we provide suggestive evidence that our findings of a positive price premium are likely attributable to the reduction in the degree of perceived environmental risk following the closure and relocation of chemical enterprises, which is reflected in the 43.3% reduction in the number of environmental complaints from surrounding residents.

4.3.2 Triple-Difference Estimates

We further examine the “environmental risk perception” channel through which environmental regulation may affect housing prices. If it is true that the “environmental risk perception” channel leads to a change in housing prices, then housing prices in areas with greater decreases in residents’ degree of risk perception experience larger increases. To test this hypothesis, we add \(Treat \times Post \times Complaintless\) to Eq. (1). \(Complaintless\) is a dummy variable that indicates whether there has been a reduction in the number of environmental complaints in the polluted areas in which the house is located after policy implementation. Specifically, we calculate the number of environmental complaints of each polluted area before and after policy implementation, followed by the associated changes. Considering the different lengths of sample periods before and after the policy (18 months before the policy and 24 months after the policy), to enhance the comparability of environmental complaints in a polluted area before and after the policy, we standardize the number of complaints after the policy by multiplying the cumulative complaints over the subsequent 24 months by 3/4. Therefore, the change in the number of complaints for each polluted area before and after the policy is calculated as the cumulative complaints over the initial 18 months before the policy minus 3/4 multiplied by the cumulative complaints over the subsequent 24 months after the policy. If the house is located in a polluted area with a reduction in the number of environmental complaints, then the dummy variable \(Complaintless\) is equal to 1; otherwise, it is equal to zero.

The regression results are shown in Table 4. In Column (2), the coefficient on \(Treat \times Post \times Complaintless\) is 0.025 and statistically significant, which means that housing prices increase by a statistically significant 2.5% in areas where the number of environmental complaints decreases compared to areas where they do not. We find that capitalization is greater in areas with a reduction in the number of environmental complaints than in other areas with no reduction in environmental complaints, implying that housing prices in areas with greater decreases in residents’ degree of risk perception experience greater increases. Therefore, we provide suggestive evidence that our findings of a positive capitalization effect are likely attributable to the reduction in the degree of perceived environmental risk. The results also indicate that the policy only capitalizes if it leads to fewer environmental complaints, suggesting that the expectations of future environmental improvements, ceteris paribus, do not capitalize while present environmental improvements do.

4.3.3 Instrumental Variable (IV) Estimates

In the estimation regarding environmental complaints, the DiD estimation reveals a causal relationship between environmental regulation and risk perceptions but does not directly examine the impact of environmental risk perceptions on housing prices. Although the triple-difference estimation reveals that housing prices in areas with greater decreases in residents' degree of risk perception experience greater increases, it is unable to examine the extent to which residents’ perceived risks affect property value. In this section, to directly identify the causal relationship between residents’ perceived risks and housing prices, we analyze how property values respond to plausibly exogenous shocks to those environmental risk perceptions that are tied to policy changes. We leverage these quasi-experimental research designs to derive a causal relationship between environmental risk perceptions and property values using the instrumental variable (IV) approach.

The exclusion restriction of IV estimation is that the policy-driven shock influences housing prices only through changes in environmental risk perceptions that are captured by the measure of the number of environmental complaints. Our research design leverages regulatory policy to implement a quasi-experiment in which residents’ environmental risk perceptions experience a negative shock, as estimated by the DiD model in Eq. (2). Here, we go a step further and ask how exogenous changes in environmental risk perceptions affect house prices. Table 5 summarizes the results. Column (1) reports the first-stage result, which shows that environmental regulation shock reduces the level of environmental risk perceptions. Column (2) shows that with a one-unit decrease in the number of monthly environmental complaints in areas, house prices within these areas increase by a statistically significant 2.1%. Therefore, we find evidence of the negative effects of environmental risk perceptions on housing prices.

4.4 Heterogeneity Analyses

To explore the underlying mechanisms that explain the changes in property values, we conduct heterogeneity analyses in this section.

4.4.1 Heterogeneous Capitalization Effects by Changes in Air Pollution

According to the hedonic property value model, buyers choose properties based on housing attributes and location-specific amenities (e.g., air quality, park proximity, education, and degree of environmental risk). In the absence of market frictions, improvements in amenities triggered by environmental regulations are expected to be capitalized into property values, which means that houses with greater degrees of improvement in residents’ perceived environmental risks experience greater degrees of positive capitalization. To explore the underlying mechanisms that explain the improvement in perceived environmental risk and the capitalization effect resulting from chemical enterprise closure and relocation policy, we examine whether the positive capitalization effect arises from improvements in air pollution or water pollution.

Wind direction provides us with opportunities to identify the heterogeneous capitalization effects by changes in pollution. Since the dispersal of atmospheric pollutants is affected by wind direction, houses located downwind of polluted areas are exposed to more severe air pollution than those located upwind before policy implementation. If the capitalization effect arises primarily from improvements in air pollution, then we should be able to observe houses located downwind of polluted areas experiencing more positive capitalization. Conversely, if the capitalization effect arises primarily from improvements in water pollution, then both upwind and downwind houses experience positive capitalization and do not exhibit a significant difference in their degrees of capitalization.

To explore the underlying mechanisms, we categorize the houses in the sample into two groups, upwind houses and downwind houses, which we define based on the location of the polluted areas, the location of the houses, and major wind directions. Specifically, we calculate the angle formed by the connection between a polluted area and a house as well as the wind direction. In this paper, houses corresponding to an angle within the range of 0–90° are defined as downwind houses, and houses corresponding to an angle within the range of 90–180° are defined as upwind houses. The results are presented in Table 6. The closure and relocation policy for chemical enterprises within 1 km of the Yangtze River significantly increases the value of downwind houses by 2.6%, while the value of upwind houses does not change significantly. This finding shows that the positive capitalization effect arises primarily from improvements in air pollution. Therefore, the chemical enterprise closure and relocation policy improves air pollution, leading to a decrease in the degree of perceived environmental risk, which in turn boosts property value.

4.4.2 Heterogeneous Capitalization Effects by Building Height

It is unclear whether heterogeneity in housing attributes affects the degree to which housing prices increase. Building height is an important property attribute. To investigate whether housing prices change differently across buildings of different heights, we divide the sample into two groups based on the median total floors for all houses, namely, shorter buildings and taller buildings. The results are shown in Columns (1) to (2) in Table 7. The closure and relocation policy for chemical enterprises within 1 km of the Yangtze River increases the value of taller buildings by a statistically significant 2%, while the value of shorter buildings does not change significantly. This finding shows that environmental quality changes capitalize in taller buildings but not in shorter buildings.

A possible explanation for this difference is that it stems from differences in the views associated with building height. In general, taller buildings usually offer superior views, and a better perspective of an ecologically improved river would enhance capitalization. Even if the residents of these buildings cannot see the river, residents of taller buildings have better views than residents of shorter buildings, and these views improve as air quality improves due to the policy, which would also result in greater capitalization of environmental quality changes in taller buildings.

5 Robustness Checks

5.1 Eliminating the Influence of Distance-Related Factors

In the benchmark regression, the treatment and control groups are selected based on their distance from the Yangtze River. It is possible that the positive effect on housing prices identified in the benchmark regression is caused by unobservable factors associated with distance. Moreover, a small number of enterprises may have relocated to the vicinity of the control group, which may bias our estimates. To ensure the reliability of the regression results, we use an alternative strategy in which we select only houses within one kilometer of the river. The distribution of the houses in the treatment and control groups is shown in Fig. 5. With the enterprise as the center of the area, the houses within one kilometer of the upper and lower reaches of the Yangtze River compose the treatment group (dark gray area), while those within 1–2 km of the enterprise compose the control group (light gray area).

The results are shown in Table 8. According to the results in Column (1), after chemical enterprises along the Yangtze River are closed or moved, housing prices increase by a statistically significant 3.9%, which means that the impact of environmental regulation on property values is robust, even after the effect of distance-related factors is removed.

5.2 Excluding Noncommercial Houses

In China, there are several types of housing: commercial houses, villas, government-guaranteed affordable houses, demolition compensation houses, hotel apartments, etc. Among noncommercial houses, property values are often not a direct reflection of market equilibrium. As a robustness check, we focus only on the subsample of commercial houses. The results are shown in Column (2) of Table 8. We find that the coefficients are still positive and statistically significant for commercial houses and that the coefficients are larger than those from the benchmark regression. This finding indicates that due to the power of the market, environmental regulation increases property values, which is consistent with our main results. According to Column (2), the closure and relocation policy for chemical enterprises within one kilometer of the Yangtze River increases the value of commercial houses by a statistically significant 2.2%.

5.3 Placebo Test: Pseudo Policy Timing

To further our argument that the increase in housing prices is indeed due to environmental regulation rather than to seasonal fluctuations or other factors, we construct the pseudo policy promulgation in July 2016 (12 months before the actual promulgation of the policy) and January 2016 (18 months before the actual promulgation of the policy). The period from January 2015 to July 2017 (prior to the actual promulgation of the policy) is chosen as the sample period for investigating whether property values increase before policy implementation. The estimated results are shown in Columns (3) and (4) in Table 8 and demonstrate that the estimated coefficient on \(Treat_{i} \times Post_{t}\) is not statistically significant, indicating that the influence of other potential unobservable factors on property values can be excluded.

5.4 Placebo Test: Random Selection of the Treatment Group

Another possible concern is the omission of variables at the neighborhood-time level. Following the literature (La Ferrara et al. 2012; Cai et al. 2016), we randomly select neighborhoods from the sample as the treatment group and then apply the same specification as that in Eq. (1) to estimate whether the randomly selected treatment group is affected. This approach assumes that if unobserved variables at the neighborhood-time level determine the change in property values, then even if the group is defined as having been treated by policy changes, we obtain the same results as those from estimating Eq. (1). However, if the same results are not obtained after several simulations, then the change in property values can be attributed to environmental regulation. Because the fake treatment group is generated randomly, in theory, the core explanatory variables should not affect housing prices; that is, \(\beta^{random} = 0\). Figure 6 reports the kernel density of the estimation coefficients and the distribution of the corresponding p values for 500 randomly generated treatment groups, and the vertical line represents the actual estimated coefficients. Clearly, the estimated coefficients from the placebo test follow a normal distribution with zero as the mean, which is in line with our expectations. Overall, the estimation results are not biased by missing variables.

5.5 Excluding Neighborhoods that Straddle the Boundary

Our baseline specification specifies treatment and control groups based on the latitudes and longitudes of neighborhood center points, but there is a concern that some neighborhoods may straddle the boundary between treated and control areas, indicating the potential presence of neighborhoods that contain houses in both areas. Therefore, considering these boundary-straddling neighborhoods solely as either treatment or control groups in our baseline specification may lead to biased estimation results. To address this concern, we exclude neighborhoods that straddle the boundary between treated and control areas. According to the Standards for Planning and Design of Urban Residential Areas released by the Chinese Ministry of Housing and Urban–Rural Development, each neighborhood in China typically comprises approximately 300 to 1000 houses, with a land area ranging from 20,000 to 40,000 square meters, implying that the typical side length of a neighborhood does not usually exceed 200 m. Therefore, we exclude neighborhoods within a 100-m range on both sides of the boundary (totaling 200 m).

The results are shown in Column (5) of Table 8. We find that the coefficients are still positive and statistically significant, which means that the impact of environmental regulation on property values is robust, even after excluding neighborhoods that straddle the boundary between treated and control areas.

5.6 Replacing the Dependent Variable with the Transaction Price

In the benchmark regression, the dependent variable is the logarithm of the average transaction price per square meter. To prevent unobservable factors associated with living area from biasing the regression results, we replace the dependent variable with the logarithm of the transaction price. The results are shown in Column (6) of Table 8. We find that the closure and relocation policy for chemical enterprises within one kilometer of the Yangtze River increases property values by a statistically significant 1.7%, which is consistent with the main results in the benchmark regression. Therefore, the impact of environmental regulation on property values is robust, even after the dependent variable is replaced with the transaction price.

5.7 Replacing the Distance Cutoff with the Continuous Distance

Our baseline specification specifies treatment and control groups based on the distance over which toxic pollutants diffuse, but it is subject to subjectivity concerns. One might worry that the distance we choose artificially does not reflect the real distance cutoff. To avoid errors caused by subjectively setting the distance cutoff, we use an alternative strategy in which we replace the dummy variable \(Treat_{i}\) with the continuous variable \(Distance_{i}\), the distance between house \(i\) and the Yangtze River. The coefficient on the interaction term of \(Distance_{i} \times Post_{t}\) is the effect on which this paper focuses. The coefficient on the interaction term measures the linear variation in property values according to the distance from the Yangtze River. Moreover, according to the results in Columns (1) to (4) in Table 9, as the distance of a house from the Yangtze River increases, the property value increases less after the chemical enterprises along the Yangtze River close or move.

We further provide some descriptive evidence that property values are in fact affected by the proximity of houses to chemical enterprises. We draw on a strategy similar to that employed by Muehlenbachs et al. (2015), which determines the point where a localized (dis)amenity no longer has localized impacts. For our application, this method compares the prices of houses sold after the policy on the closure and relocation of chemical enterprises to those of houses sold prior to the policy, and identifies the distance beyond which the chemical enterprise no longer has an additional effect.

To conduct this test, we use the sample of houses located in polluted areas and more distant areas, as shown in Fig. 3. We estimate two price functions based on distance to the nearest chemical enterprise: one using a sample of property sales that occur prior to the policy and the other using a sample of property sales that occur after the policy. The price functions are estimated using local polynomial regressions, with the dependent variable being the residual from a regression that controls for neighborhood fixed effects, county-by-month fixed effects, and property characteristics.

Figure 7 shows the results from the local polynomial regression. We see a sharp increase in the prices of houses located within 1.2 km of a chemical enterprise after the policy; however, the prices of houses farther than 1.2 km from the nearest chemical enterprise remain the same both before and after the policy. This exercise validates our usage of polluted areas less than 2 km in terms of their distance to the river (since the chemical enterprises are within 1 km of the river, the distance from the houses within the polluted area to enterprises is approximately their distance from the river minus 1 km).

Price gradient of the distance from the nearest chemical enterprise. Notes: This figure depicts the results from local polynomial regressions used to estimate two price functions based on the distance to the nearest chemical enterprise, with dependent variables being the residuals from a regression that controls for neighborhood fixed effects, county-by-month fixed effects, and property characteristics. The solid line represents the residuals from houses sold before the policy, while the dashed line represents the residuals from houses sold after the policy

5.8 Effects of Environmental Regulation on Property Values at the Quarterly Level

In the benchmark regression, we estimate the DiD effect at the monthly level. However, there are months when no housing transactions occur in the areas along the river, which may be a possible concern in terms of the benchmark regression result. To ensure the reliability of the regression results, we use an alternative strategy in which we estimate the DiD effect at the quarterly level. The results are shown in Table 10. According to the results in Column (3), after chemical enterprises along the Yangtze River are closed or moved, housing prices increase by a statistically significant 1.4%, which means that the impact of environmental regulation on property values is still robust at the quarterly level.

5.9 Assigning Treatment and Control Groups Through Radius

In the baseline strategy, we establish treatment and control groups based on the distance from the Yangtze River. This takes into account the potential improvement in overall riverbank environmental conditions due to the policy requiring the closure or relocation of chemical enterprises within 1 km along the Yangtze River. However, as a robustness check, we also divide the control and treatment groups using the conventional method which considers the distance from the enterprise's radius (Currie et al. 2015), given that the relocation of enterprises has the greatest impact on residents within a certain radius around them. Figure 7 suggests that the distance threshold between enterprises and houses is 1.2 km, so we draw a 1.2-km circle around each chemical enterprise. Residences within this radius form the treatment group, while those outside this radius but within a 3 km range are designated as the control group. According to the findings in Column (3) of Table 11, the closure and relocation policy for chemical enterprises along the Yangtze River increased property prices significantly, which is consistent with our baseline specifications.

6 Conclusions

This paper estimates the degree of capitalization of the closure and relocation of chemical enterprises along the Yangtze River in property values. After applying the difference-in-differences (DiD) method to rich data on housing markets, we find that the closure and relocation of chemical enterprises leads to a 1.7% increase in property values. We provide suggestive evidence that our findings of a positive price premium are likely attributable to the reduction in the degree of perceived environmental risk following the closure and relocation of chemical enterprises, which is reflected in a 43.3% reduction in the number of environmental complaints from surrounding residents. The heterogeneity analyses reveal that the positive capitalization effect arises primarily from improvements in air pollution, and the impact of environmental regulation on housing prices is heterogeneous across buildings of different heights. Changes in environmental quality capitalize in taller buildings but not in shorter buildings.

On the basis of our estimation results, we further calculate the economic benefits of the policy of closing and relocating chemical enterprises within one kilometer of the Yangtze River. A total of 443 neighborhoods encompassing approximately 680,000 houses are located within two kilometers of the Yangtze River. Given the average transaction price for houses in each neighborhood, the total value of houses within two kilometers of the Yangtze River is estimated to be approximately 411.4 billion CNY. After policy implementation, the total value of the houses along the Yangtze River increased by 1.7%, which means that China’s efforts to protect the Yangtze River significantly increased the total value of houses by approximately 7 billion CNY (approximately 1 billion USD). Furthermore, as mentioned above, our results are based on the strict assumption that the prices of houses more than two kilometers away from the Yangtze River are not affected by the policy. However, houses two kilometers away may also be affected and experience a price increase. If this is the case, then the above-estimated 7 billion CNY (approximately 1 billion USD) would be a lower bound.

Notes

See “the Yangtze River Economic Belt Ecological and Environmental Protection Plan”, https://www.mee.gov.cn/gkml/hbb/bwj/201707/t20170718_418053.htm.

See “Blue Book of Ecological Governance: China's Ecological Governance Development Report (2020–2021)”.

We lack information that is more granular regarding each enterprise’s timing of closure/relocation to carry out a Callaway-Santanna staggered DiD analysis.

In China, a neighborhood is a gated apartment complex containing strictly controlled entrances for pedestrians, bicycles, and automobiles and often characterized by a closed perimeter of walls and fences.

To show that the results are not sensitive to the selection of the control group, we use alternative distance ranges to define the control group, namely, 2–4 km, 2–5 km, and 2–6 km. The results presented in Table C1 in Appendix C indicate that the coefficients are still statistically significant after expanding the range of the control group, indicating that our main results are robust to changes in the distance of the houses in the control group from the Yangtze River.

The result remains when treatment takes place at the county level. Among 27 cities along the Yangtze River, 132 counties along the Yangtze River are selected as the treatment group, and 116 counties away from the riverside are selected as the control group. The regression results for the DiD estimation are shown in Table C2 in Appendix C.

References

Ban J, Zhou L, Zhang Y, Anderson GB, Li T (2017) The health policy implications of individual adaptive behavior responses to smog pollution in urban China. Environ Int 106:144–152

Barwick PJ, Li S, Lin L, Zou E (2019) From fog to smog: The value of pollution information (No. w26541). National Bureau of Economic Research.

Bento A, Freedman M, Lang C (2015) Who benefits from environmental regulation? Evidence from the clean air act amendments. Rev Econ Stat 97(3):610–622

Bernstein A, Gustafson MT, Lewis R (2019) Disaster on the horizon: the price effect of sea level rise. J Financ Econ 134(2):253–272

Bishop KC, Kuminoff NV, Banzhaf HS, Boyle KJ, von Gravenitz K, Pope JC, Timmins CD (2020) Best practices for using hedonic property value models to measure willingness to pay for environmental quality. Rev Environ Econ Policy

Blomquist G (1974) The effect of electric utility power plant location on area property value. Land Econ 50(1):97–100

Cai X, Lu Y, Wu M, Yu L (2016) Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J Dev Econ 123:73–85

Chay KY, Greenstone M (2005) Does air quality matter? Evidence from the housing market. J Polit Econ 113(2):376–424

Chen Z, Kahn ME, Liu Y, Wang Z (2018) The consequences of spatially differentiated water pollution regulation in China. J Environ Econ Manag 88:468–485

Currie J, Davis L, Greenstone M, Walker R (2015) Environmental health risks and housing values: evidence from 1,600 toxic plant openings and closings. Am Econ Rev 105(2):678–709

Davis LW (2004) The effect of health risk on housing values: evidence from a cancer cluster. Am Econ Rev 94(5):1693–1704

Davis LW (2011) The effect of power plants on local housing values and rents. Rev Econ Stat 93(4):1391–1402

Dawson IG (2018) Assessing the effects of information about global population growth on risk perceptions and support for mitigation and prevention strategies. Risk Anal 38(10):2222–2241

Deng G, Hernandez MA, Xu S (2020) When power plants leave town: environmental quality and the housing market in China. Environ Resource Econ 77(4):751–780

Farah, N., Boslett, A., & Hill, E. (2019). The king is dead, long live the king? the effects of power plants on housing prices in the age of coal-switching. Unpublished Manuscript.

Freybote J, Fruits E (2015) Perceived environmental risk, media, and residential sales prices. J Real Estate Res 37(2):217–244

Frondel M, Gerster A, Vance C (2020) The power of mandatory quality disclosure: evidence from the German housing market. J Assoc Environ Resour Econ 7(1):181–208

Gamper-Rabindran S, Timmins C (2013) Does cleanup of hazardous waste sites raise housing values? Evidence of spatially localized benefits. J Environ Econ Manag 65(3):345–360

Greenstone M, Gallagher J (2008) Does hazardous waste matter? Evidence from the housing market and the superfund program. Q J Econ 123(3):951–1003

Greenstone M, Jack BK (2015) Envirodevonomics: a research agenda for an emerging field. J Econ Literat 53(1):5–42

Haninger K, Ma L, Timmins C (2017) The value of brownfield remediation. J Assoc Environ Resour Econ 4(1):197–241

Hansen JL, Benson ED, Hagen DA (2006) Environmental hazards and residential property values: evidence from a major pipeline event. Land Econ 82(4):529–541

Hanushek EA, Quigley JM (1979) The dynamics of the housing market: a stock adjustment model of housing consumption. J Urban Econ 6(1):90–111

He G, Wang S, Zhang B (2020) Watering down environmental regulation in China. Q J Econ 135(4):2135–2185

Hino M, Burke M (2021) The effect of information about climate risk on property values. Proc Natl Acad Sci 118(17):e2003374118

Hite D, Chern W, Hitzhusen F, Randall A (2001) Property-value impacts of an environmental disamenity: the case of landfills. J Real Estate Financ Econ 22(2):185–202

Jalan J, Somanathan E (2008) The importance of being informed: experimental evidence on demand for environmental quality. J Dev Econ 87(1):14–28

Kiefer H (2011) The house price determination process: Rational expectations with a spatial context. J Hous Econ 20(4):249–266

Kim CW, Phipps TT, Anselin L (2003) Measuring the benefits of air quality improvement: a spatial hedonic approach. J Environ Econ Manag 45(1):24–39

La Ferrara E, Chong A, Duryea S (2012) Soap operas and fertility: evidence from Brazil. Am Econ J Appl Econ 4(4):1–31

Libarkin JC, Gold AU, Harris SE, McNeal KS, Bowles RP (2018) A new, valid measure of climate change understanding: associations with risk perception. Clim Change 150:403–416

Liu M, Shadbegian R, Zhang B (2017) Does environmental regulation affect labor demand in China? Evidence from the textile printing and dyeing industry. J Environ Econ Manag 86:277–294

Liu M, Tan R, Zhang B (2021) The costs of “blue sky”: Environmental regulation, technology upgrading, and labor demand in China. J Dev Econ 150:102610

Madajewicz M, Pfaff A, Van Geen A, Graziano J, Hussein I, Momotaj H, Sylvi R, Ahsan H (2007) Can information alone change behavior? Response to arsenic contamination of groundwater in Bangladesh. J Dev Econ 84(2):731–754

Mastromonaco R (2015) Do environmental right-to-know laws affect markets? Capitalization of information in the toxic release inventory. J Environ Econ Manag 71:54–70

Mei Y, Gao L, Zhang W, Yang FA (2021) Do homeowners benefit when coal-fired power plants switch to natural gas? Evidence from Beijing, China. J Environ Econ Manag 110:102566

Muehlenbachs L, Spiller E, Timmins C (2015) The housing market impacts of shale gas development. Am Econ Rev 105(12):3633–3659

Nelson JP (1981) Three Mile Island and residential property values: empirical analysis and policy implications. Land Econ 57(3):363–372

Palmquist RB, Smith VK (2002) The use of hedonic property value techniques for policy and litigation. Int Yearb Environ Resourc Econ 2003:115–164

Tanaka S, Zabel J (2018) Valuing nuclear energy risk: evidence from the impact of the Fukushima crisis on US house prices. J Environ Econ Manag 88:411–426

Tang C, Heintzelman MD, Holsen TM (2018) Mercury pollution, information, and property values. J Environ Econ Manag 92:418–432

Tu M, Zhang B, Xu J, Lu F (2020) Mass media, information and demand for environmental quality: evidence from the “Under the Dome.” J Dev Econ 143:102402

Wang F, Gao Y, Dong W, Li Z, Jia X, Tan RR (2017) Segmented pinch analysis for environmental risk management. Resour Conserv Recycl 122:353–361

Wang C, Wu J, Zhang B (2018) Environmental regulation, emissions and productivity: evidence from Chinese COD-emitting manufacturers. J Environ Econ Manag 92:54–73

Wang S, Wang J, Ru X, Li J (2019) Public smog knowledge, risk perception, and intention to reduce car use: Evidence from China. Hum Ecol Risk Assess Int J 25(7):1745–1759

Wang S, Jiang J, Zhou Y, Li J, Zhao D, Lin S (2020a) Climate-change information, health-risk perception and residents’ environmental complaint behavior: An empirical study in China. Environ Geochem Health 42:719–732

Wang F, Wang J, Ren J, Li Z, Nie X, Tan RR, Jia X (2020b) Continuous improvement strategies for environmental risk mitigation in chemical plants. Resour Conserv Recycl 160:104885

Zhang X, Geng G, Sun P (2017) Determinants and implications of citizens’ environmental complaint in China: integrating theory of planned behavior and norm activation model. J Clean Prod 166:148–156

Acknowledgements

This research is supported by the National Natural Science Foundation of China (Grant No. 71825005, 72161147002, and 72374044). Zhiren Hu and Ziao Zhu provided excellent research assistance.

Author information

Authors and Affiliations

Corresponding authors

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Translation of Policy Documents Relevant to the Closure and Relocation of Chemical Enterprises Along the Yangtze River

In this Appendix, we summarize and review policy documents from both the central and local governments in China, with a focus on the policy for the closure and relocation of chemical enterprises within one kilometer of the Yangtze River. The relevant paragraphs of these policy documents have been translated. The purpose of this exercise is to provide additional qualitative evidence that supports the empirical findings in the paper. To narrow the focus, we extract chapters that are most relevant to the closure and relocation of chemical enterprises within one kilometer of the Yangtze River. To better understand the policy, we show the policies issued by the two levels of government in China (central and provincial governments) as follows. Section A summarizes the policies issued by the central government in 2017. Section B provides a province-level example (Jiangsu). To implement the policies issued by the central government, the Jiangsu provincial government issues more detailed policies according to the specific conditions of the province.

1.1 A. Policy Documents from the Central Government in China.

1.1.1 Title: Notice on Printing and Distributing the "Eco-environmental Protection Plan for the Yangtze River Economic Belt" Footnote 9

Date: July 13th, 2017.

Issuing agency: Ministry of Ecology and Environment, Development and Reform Commission, Ministry of Water Resources.

Notified agencies: People’s governments of Shanghai, Jiangsu, Zhejiang, Anhui, Jiangxi, Hubei, Hunan, Chongqing, Sichuan, Guizhou, Yunnan, Ministry of Industry and Information Technology, Ministry of Finance, Ministry of Land and Resources, Ministry of Housing and Urban‒Rural Development, Ministry of Agriculture, General Administration of Quality Supervision, Inspection and Quarantine, Forestry Administration, Energy Administration, Oceanic Administration, and Three Gorges Office.

To implement the major decisions and deployments of the Party Central Committee and the State Council on promoting the development of the Yangtze River Economic Belt, the Ministry of Ecology and Environment, the Development and Reform Commission, and the Ministry of Water Resources, together with relevant departments, have compiled the "Eco-Environmental Protection Plan for the Yangtze River Economic Belt."

The Office of the Leading Group for Promoting the Development of the Yangtze River Economic Belt by Doing Business hereby prints and distributes the "Eco-Environmental Protection Plan for the Yangtze River Economic Belt" to you. Please implement it conscientiously.

Attachment: Eco-environmental Protection Plan for the Yangtze River Economic Belt.

1.1.2 Extracted Relevant Chapters

All economic activities along the Yangtze River must be based on the premise of not damaging the ecological environment. In addition to those projects under construction, new heavy chemical parks within one kilometer of the shoreline of the main stream and major tributaries are strictly forbidden, and the construction of new petrochemical and coal chemical projects in the mid-upstream coastal areas is strictly controlled. Industries that do not meet the requirements for occupying shorelines, river sections, land and layouts must close unconditionally.

1.2 B. Policy Documents from Provincial Governments in China.

1.2.1 Title: Notice on Printing and Distributing the Jiangsu Province Chemical Industry Safety and Environmental Protection Improvement Plan Footnote 10

Date: April 27th, 2019.

Issuing agency: General Office of Jiangsu Provincial Committee of the Communist Party of China, General Office of Jiangsu Provincial People's Government.

Notified agencies: The party committees and people's governments of all cities and counties (districts), the ministries and commissions of the provincial party committee, the offices and bureaus of the provincial committees, and the units directly under the province.

The Jiangsu Province Chemical Industry Safety and Environmental Protection Improvement Plan has been reviewed and approved by the Standing Committee of the Provincial Party Committee and is now issued to you. Please implement it carefully in light of the actual situation.

1.2.2 Extracted Relevant Chapters

The number of chemical production enterprises along the Yangtze River should be reduced. In principle, all chemical production enterprises within one kilometer of both sides of the main river and tributaries of the Yangtze River and outside the chemical park will close or relocate before the end of 2020. It is strictly forbidden to build or expand chemical parks and chemical projects within one kilometer of the main river and tributary streams of the Yangtze River.

Appendix 2: Policy Implementation at the Prefectural Level

In this Appendix, we review policy documents from prefectural governments in China, with a focus on the implementation of policies for the closure and relocation of chemical enterprises within one kilometer of the Yangtze River. We provide an example related to policy implementation at the prefectural level (Zhenjiang). Relevant policy documents are translated as follows:

2.1 Title: Notice on Holding the City's Chemical Industry Safety and Environmental Protection Improvement Work Conference Footnote 11

Date: May 28th, 2019.

Issuing agency: Zhenjiang Chemical Industry Safety and Environmental Protection Improvement Leading Group and Office, Zhenjiang Bureau of Industry and Information Technology.

Notified agencies: Relevant departments and units of the city.

To implement the document requirements of the Jiangsu Province Chemical Industry Safety and Environmental Protection Improvement Plan (Su Ban [2019] No. 96) and the spirit of the Provincial Government General Office's video conference on the province's chemical industry safety and environmental protection improvement work, after this research, it was decided to hold the city's chemical industry safety and environmental protection improvement work conference and to deploy the recent improvement work first. The relevant matters of the meeting are noted here as follows:

Meeting time: May 31, 2019, 9:15 am.

Meeting place: Conference Room 1, 7th Floor, Building 1, Municipal Administration Center.

Participants:

-

1.

The leaders in charge of major relevant departments such as the Municipal Development and Reform Commission, Bureau of Industry and Information Technology, Public Security Bureau, Ecological Environment Bureau, Transportation Bureau, Emergency Management Bureau, Market Supervision Administration, Statistics Bureau, Fire Rescue Detachment and the main person in charge of the business department.

-

2.

The main leaders, leaders in charge and the main person in charge of the business department of the Economic Development Bureau of each city (district), Jurong City Industry and Information Technology Bureau, Zhenjiang New District Science and Information Bureau, and Zhenjiang High-tech Zone Science and Technology Development Bureau.

Relevant requirements: All departments and units are requested to submit the list of participants to the Material Industry Department of the Municipal Bureau of Industry and Information Technology before 18:00 on May 29th (Wednesday). Contact: Sun Panqin, Fax: 80822128, Tel: 15262913603.

Appendix 3

See Tables

12 and

13.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Fan, X., Liu, M., Zhang, B. et al. The Green Premium: Environmental Regulation, Environmental Risk and Property Value. Environ Resource Econ 87, 1061–1096 (2024). https://doi.org/10.1007/s10640-024-00848-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-024-00848-z