Abstract

We apply a land-use approach to biodiversity conservation (BC) by assuming that the global public good ‘biodiversity’ is positively correlated with the share of land protected by land-use restrictions against the deterioration of habitats, ecosystems, and biodiversity. The willingness to pay for BC is positive in developed countries (North), but very low in developing countries (South). Taking the no-policy regime as our point of departure, we analyze two concepts of BC: the northern countries’ financial support of BC in the South, and the coordination of northern countries’ BC efforts. In each regime, governments may either take prices as given or may act strategically by seeking to manipulate the terms of trade in their favor. Our numerical analysis yields results with unexpected policy implications. If northern countries support BC financially in the South without coordinating their actions, the protected land, biodiversity and welfare increase so slightly that this BC policy is almost ineffective. The BC concept with a Coaseian flavor—in which northern countries support BC financially in the South and coordinate their action—is efficient if governments act non-strategically. Otherwise, the concept is an ineffective BC policy instrument, because the incentives for expanding the protected land the BC policy creates are so strong that biodiversity actually becomes excessive.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 The Problem

There is mounting evidence of rapid human-induced losses of biodiversity over the past few centuries (Butchart et al. 2010) with indications of mass extinction of species (Ceballos et al. 2015). The Convention on Biological Diversity (1992) that entered into force some 20 years ago considers biodiversity conservation, BC for short, “a common concern of humankind”. However, the substantial efforts made under the convention’s umbrella to enhance BC have been insufficient to halt the loss of biodiversity. In developing countries, where the leading biodiversity hotspots are located, the ongoing biodiversity loss is particularly serious, but declining biodiversity is also a serious threat in developed countries.Footnote 1 The Convention on Biological Diversity urges both developed countries, referred to here as the North and developing countries, the South, to step up their conservation efforts. The convention also stipulates in Article 20 that the “...developed country Parties shall provide new and additional financial resources to enable developing country Parties to meet the agreed full incremental costs to them of implementing measures ...” to conserve their domestic biodiversity. In practice, the North provides funds for BC in the South through various channels, in particular through the Global Environment Facility. However, that facility’s current scale of operations is too small to avoid biodiversity loss in the South (Panayotou 1994, p. 102, Mee et al. 2008).Footnote 2

In view of the bleak prospects for global BC, it is important to scrutinize further the suitability of policies and institutions aimed at promoting BC. Specifically, we focus on two BC concepts that are closely related to the spirit of the Convention on Biological Diversity: (i) compensation payments from the North for additional conservation efforts of the South that (also) benefit the North and (ii) the coordinated action of all northern countries to raise the North’s BC efforts both at home and in the South. Our goal is to analyze the effectiveness and the distributional consequences of these concepts. We investigate how they affect BC and the welfare of North and South in the presence of international trade with governments that seek—or do not seek—to manipulate the terms of trade in their countries’ favor.

The analysis is based on the land-use approach to BC, which suggests that the conversion of natural land deteriorates or even destroys species-rich habitats and is therefore a major cause of the biodiversity loss (e.g. Panayotou 1994; Montero and Perrings 2011; Perrings and Halkos 2015).Footnote 3 In our simple setup, each country divides its total land into a protected and a non-protected area.Footnote 4 The protected area is land dedicated to the protection of fauna, flora and ecosystems and it provides ecosystem services. It is favorable for biodiversity, because appropriate land-use restrictions are implemented and only those kinds and levels of economic activities are admitted, which leave natural habitats and ecosystems (almost) unimpaired. The non-protected area is subject to low regulation and therefore hosts all economic activities that are detrimental to biodiversity. More specifically, we consider unprotected land as an input in producing the bulk of manufactured and agricultural consumption goods. Protected land is an input in the production of those marketable ecosystem services called green goods, whose production is compatible with sustained biodiversity on that land.

In sum, we assume that biodiversity is positively correlated with the protected area, that the global community attaches a positive non-market value to global biodiversity, and that the willingness to pay for biodiversity is higher in the North than in the South. The low valuation of biodiversity in the South appears also to be the rationale of the Convention on Biological Diversity (1992) for calling on the North to compensate the South for extra conservation efforts. We simplify by assuming that the southern countries’ non-market value of biodiversity is zero. This simplification allows decomposing all biodiversity externalities into two types. The South’s protected land generates external biodiversity benefits in all northern countries (South–North externalities) and each northern country’s protected area generates external biodiversity benefits in all fellow northern countries (North–North externalities).

The two BC concepts alluded to above, i.e. coordinated action of all northern countries and the North’s financial support of BC in the South, are designed to move the economy towards internalizing these externalities. The compensation payments from the North for additional conservation efforts of the South, called ‘North–South compensation’, are modeled as an international competitive BC market.Footnote 5 The items traded on that market are land-use rights or land-use restrictions on areas of land that qualify as a protected area after the transaction. The BC market is an externality-internalizing institution satisfying the beneficiaries-pay principle. The coordinated action of all northern countries, called ‘North–North coordination’, raises the North’s conservation efforts of internalizing the North–North externalities and raises its willingness to step up the North–South compensation.Footnote 6

‘North–North coordination’ and ‘North–South compensation’ can be absent altogether, they can stand alone, or they can be applied in combination. Here, we focus on the three regimesFootnote 7 listed in Table 1.

Suppose first the only possible distortion in the world economy is caused by un-internalized BC benefits. Benchmark Regime 1 is then obviously inefficient, because it leaves both kinds of biodiversity externalities un-internalized. Regime 2 is also inefficient, because the North–North externalities are still un-internalized and because the internalization incentives the BC market provides are too weak when the individual northern countries act non-cooperatively on the BC market. Regime 3 generates the correct internalization incentives. It fully internalizes both kinds of biodiversity externalities and thus constitutes a perfect Coaseian solution to BC. Suppose, however, the northern countries’ governments exert market power in the sense that they seek to manipulate the terms of trade in their favor rather than taking prices as given. The additional distortions resulting from that kind of strategic action change the outcome of the non-strategic BC policy discussed so far. In order to assess the impact of market power we consider two versions of each regime, one in which governments take prices as given and one in which governments act strategically. We take the laissez-faire scenario Regime 1 as our point of departure and determine the impact of the world economy’s move from that regime to Regimes 2 or 3. We investigate how the shift from Regime 1 to Regime \(k = 2 \) or 3 changes BC efforts and welfareFootnote 8 and to what extent the impact depends on whether governments take prices as given or act strategically.

Although our analytical framework is very simple, it is not possible to gain specific information about the equilibrium allocations of the regimes in the model with general or parametric functional forms. To make progress, we compute numerical solutions in a parametric version of the model and obtain, among other things, the following policy-relevant results. The introduction of the BC market without coordination among northern countries (Regime 2) increases the protected land and welfare compared with Regime 1. However, the improvement over laissez-faire is very small, such that North–South compensation without North–North coordination is an ineffective BC instrument.Footnote 9 When governments turn from the (first-best) Regime 3 with price taking to Regime 3 with strategic action, global protected land and global biodiversity become excessive and all countries suffer a welfare loss.

Our paper contributes to the literature on trade and BC and to the literature on biodiversity as an international public good. Brander and Taylor (1997, 1998) analyze the welfare effects of trade liberalization in partial and general equilibrium with open access resources. Trade liberalization makes the resource-rich country worse off. Smulders et al. (2004) extend Brander and Taylor (1998) by a habitat-dependent natural resource. The traded good requires land and a renewable resource as inputs, and land is also needed as a habitat for the renewable resource. Smulders et al. (2004) show that the effects of trade liberalization critically depend on the role of habitats. Polasky et al. (2004) investigate a two-country model where each type of land is an input in production and causes a biodiversity loss measured by the species-area relationship. If countries are symmetric, trade reduces biodiversity. However, none of these papers considers compensation payments or a market for BC. As for the second strand of literature, Barrett (1994), Sandler (1993) and Montero and Perrings (2011) consider biodiversity without explicitly modeling land use and its opportunity cost. Barrett (1994) analyzes coalition formation aimed at conserving biodiversity and finds that the net benefits of a stable coalition are only slightly larger than in the absence of cooperation. In Sandler (1993), the countries’ BC produces private goods, country-specific public goods and global public goods. Markets are inefficient due to the externalities associated with the public good BC. In simple matrix games, Montero and Perrings (2011) study whether the unilateral action of a small (given) coalition of countries make sufficiently large voluntary contributions to an environmental global public good.

The paper is organized as follows. Section 2 develops the model and derives the allocation rules for Regimes 1–3. Against the efficiency benchmark of Regime 3, it identifies weak incentives to internalize BC benefits and/or distortionary strategic action as the reasons for inefficiency in all other regimes. Section 3 presents, compares, and interprets the results of three numerically specified examples. Section 4 summarizes and concludes.

2 The Model

2.1 The Analytical Framework

Let \(\Omega \) be the set of all countries in the world economy, and divide \(\Omega \) into the subsets \(\mathcal{N}\) (for North) and \(\mathcal{S}\) (for South). Each country \(h \in \Omega := \mathcal{N}\cup \mathcal{S}\) has an endowment of land, \(\ell _h\), and its government divides \(\ell _h\) into the areas \(b_h\) and \(e_h\),

The area \(b_h\) is protected land, i.e. land with effective land-use restrictions to secure sustainable ecosystem services and biodiversity. The area \(e_h\) is non-protected land, i.e. land used intensively for commercial and industrial purposes. It comprises towns with artificial surfaces, business districts, industrial zones, residential areas (urban sprawl), traffic infrastructure (such as sealed roads), ecologically detrimental agriculture and forestry etc. The protected area comprises nature reserves, national parks and, more generally, areas with stringent land-use regulation banning all economic production and consumption activities that deteriorate or destroy habitats and ecosystems in that area. By assumption, the protected land provides ecosystem services and is the predominant home of fauna and flora. Ecosystem services and biodiversity increase with the size of the protected area.Footnote 10

There are three different composite goods, denoted good X, good Y and green good, that are produced, consumed and traded internationally in the world economy. In northern countries, the non-protected land \(e_i\) is an input for producing good X (quantity \(x_i\)), and in southern countries, the non-protected land \(e_j\) is an input for producing good Y (quantity \(y_j\)).Footnote 11 The goods X and Y may be interpreted as industrial and non-industrial goods, respectively, and their strictly increasing and concave production functions areFootnote 12

The green good represents marketable ecosystem services that each country \(h \in \Omega \) obtains from its protected land. The quantity \(g_h\) of the green good is produced on land \(b_h\) according to the strictly increasing and concave production function

Equations (2) and (3) represent a land-use approach to biodiversity and ecosystem services that is very stylized, because in the real world, biodiversity and ecosystem services are not assigned exclusively to protected land.

The utility of each country’s representative consumer is given byFootnote 13

Functions V, U and B are strictly increasing and concave, and utility is linear in the green good. The only reason for that linearity and for the additivity of all components of welfare is tractability. \(B_i'\left( \sum _{\Omega } b_h \right) \) is country i’s non-use value of, and the willingness-to-pay for, worldwide biodiversity (conservation). The dependence of function \(B_i\) on \(\sum _{\Omega } b_h\) characterizes biodiversity as a public good to which all countries contribute through their protected domestic land. In (4), the major difference between the consumers of northern and southern countries is that the former value biodiversity conservation (BC), but the latter do not. Southern countries attach a very low (here: zero) value to BC, which is meant to approximate developing countries with low per capita income.

Since each country’s government splits up total land into protected and unprotected land, there is a separate domestic market for each kind of land. When both domestic land markets are in equilibrium,Footnote 14 the budget constraint of the representative consumer is

where \(p_x\), \(p_y\) and \(p_g=1\) are the market prices for good X, good Y and the green good, respectively.

The consumer in country \(h \in \Omega \) maximizes utility (4) subject to (5) to obtain the demand functions

The division of land into protected and non-protected land fully determines all firms’ inputs and outputs. Invoking Eqs. (1), (2) and (6), we characterize the equilibrium in the markets for good X and good Y byFootnote 15

Equations (7) determine the equilibrium prices \(p_x\) and \(p_y\) as functions of the protected land in North and South, respectively.

Next, we consider benchmark Regime 1, the ‘laissez-faire’ regime, in which the North refrains from financial support of BC in the South. We model Regime 1 as a Nash game in which each country determines its protected land, taking that of all other countries as given. As pointed out in the introduction, we wish to consider two versions of each regime, one in which governments take prices as given and one in which they act strategically. We begin with the latter case, that is, we assume that governments account for the dependence of the equilibrium prices (8) on their policy variables \(\left( b_i\right) _{i \in \mathcal{N}}\) and \(\left( b_j\right) _{j \in \mathcal{S}}\), respectively. To describe the Nash game formally, we combine (4) and (5), to rewrite the countries’ welfare functions as

The land-zoning decision of country \(i \in \mathcal{N}\)\([j \in \mathcal{S}]\) is the solution to maximizing \(W_i\)\([W_j]\) from (9) with respect to \(b_i\)\([b_j]\) subject to (8). The respective first-order conditions are

The Nash equilibrium rules (10) and (11) require balancing costs (right-hand side) and benefits (left-hand side) of a marginal increase in protected land. The cost consists of the value of a marginal reduction in the production of good X [good Y]. The benefits consist of (i) raising the value of exports via strategic manipulation of the terms of trade,Footnote 16 (ii) increasing the consumption of green goods and (iii) increasing biodiversity, which is a welfare component in North only. The Nash equilibrium allocation determined by (10) and (11) is obviously distorted, because each country not only seeks to manipulate the terms-of-trade in its own favor, but also disregards the external BC benefits that its own protected area generates in other countries. In the second version of Regime 1, in which all governments take prices \(p_x\) and \(p_y\) as given, the allocation rules (10) and (11) are satisfied, with the important modification that \(\partial P^x/ \partial b_i = \partial P^y/ \partial b_j=0\). Hence, that version of Regime 1 is also inefficient, because each country still disregards the external BC benefits its own protected area generates in other countries.

2.2 North–South Compensation Without and With North–North Coordination

In the Nash equilibrium of Regime 1 we discussed in the preceding section, all positive biodiversity externalities are un-internalized. The southern countries ignore the benefits their protected areas generate in North (‘South–North externalities’), and the northern countries ignore the benefits their protected areas generate in their fellow northern countries (‘North–North externalities’). There are additional distortions, if the countries manipulate the terms of trade. In this section, we investigate Regimes 2 and 3, each of which addresses one kind of externality. Our focus is on strategically acting governments, but we also compare the outcome with the special case of price-taking governments.

To internalize the South–North externalities, North may offer South financial compensation for expanding its protected areas (North–South compensation), as recommended by the biodiversity convention. This internalization strategy follows the ‘beneficiaries-pay principle’ and will be introduced here in the form of an international market for biodiversity conservation, called the BC market. Obviously, the amount of North–South compensation, i.e. the volume of trade on the BC market, depends on whether the individual northern countries coordinate their demands and supplies on the BC market with their fellow northern countries (North–North coordination). In terms of the formal model, we interpret North–North coordination as meaning that the North acts as a single agent on the BC market whose objective function is the aggregate welfare of all northern countries. As suggested in Table 1, we therefore distinguish between Regimes 2 and 3 according to whether North–South compensation takes place with or without North coordination. In both cases, the benchmark Regime 1 serves the role of assessing the performance of Regimes 2 and 3 with regard to the allocation rules that characterize their equilibrium. For linguistic simplicity, we denote Regime \(k = 1, 2, 3\) as Regime \(k^*\), if governments act non-strategically, as Regime \(k^s\), if they act strategically, and as Regime k (without superscript) if both types of that regime are addressed.

Regime 2: North–South Compensation Without North–North Coordination To formalize Regime 2, we make use of Regime 1 as the fallback that prevails in the absence of the BC market, and we denote by  the protected land of country \(h \in \Omega \) in Regime 1. The BC market implements the Coaseian spiritFootnote 17 as follows:

the protected land of country \(h \in \Omega \) in Regime 1. The BC market implements the Coaseian spiritFootnote 17 as follows:

(12) states that given the fallback land zones  , \(z_h> 0\), is the domestic area that country h offers for protection, in addition to the protected land it would choose in the absence of the BC market.Footnote 18 Hence, \(z_h\) is country h’s offer of BC, and \(z_h^d>0\) is country h’s demand for land to be protected in addition to the protected area country h or any other country would choose in the absence of the BC market. We refer to \(z_h^d\) as h’s demand for BC. Equation (13) is the condition for clearing the BC market. With the introduction of the BC market, the governments’ policy parameters change from protected area \(\left( b_h \right) _{h \in \Omega }\), to supply and demand of BC, \(\left( z_h, z^d_h\right) _{h \in \Omega }\).

, \(z_h> 0\), is the domestic area that country h offers for protection, in addition to the protected land it would choose in the absence of the BC market.Footnote 18 Hence, \(z_h\) is country h’s offer of BC, and \(z_h^d>0\) is country h’s demand for land to be protected in addition to the protected area country h or any other country would choose in the absence of the BC market. We refer to \(z_h^d\) as h’s demand for BC. Equation (13) is the condition for clearing the BC market. With the introduction of the BC market, the governments’ policy parameters change from protected area \(\left( b_h \right) _{h \in \Omega }\), to supply and demand of BC, \(\left( z_h, z^d_h\right) _{h \in \Omega }\).

The equilibrium of the economy in Regime 2 is characterized by the market clearing conditions (1), (13) and

Correspondingly, the equilibrium price functions (8) turn into

In order to investigate how the BC market operates in the absence of North–North coordination, we assume that all southern and northern countries consider \((z_h, z_h^d)\) as their strategy parameters and play Nash. In that case, country \(i \in \mathcal{N}\) maximizes with respect to \(z_i\) and \(z_i^d\) its welfare

and country \(j \in \mathcal{S}\) maximizes with respect to \(z_j\) and \(z_j^d\) its welfare

subject to (1), (2), (3), (6), (12) and (15). In (16) and (17), \(p_z \ge 0\) is the price per unit of BC offered or demanded. For Regime \(2^s\) the first-order conditions yield

As expected, southern countries supply \(\left( z_j > 0 \right) \) but do not demand \(\left( z_j^d = 0 \right) \) protected land in addition to their laissez-faire protected area,  . In northern countries, supply and demand may both be positive. Comparing (18), (19) and (20) with the allocation rules (10) and (11) of Regime \(1^*\) and \(1^s\) reveals that for northern countries the marginal condition (10) is unchanged, but the BC market induces southern countries to expand their protected land, and thus they partly internalize the positive externality their protected land creates.

. In northern countries, supply and demand may both be positive. Comparing (18), (19) and (20) with the allocation rules (10) and (11) of Regime \(1^*\) and \(1^s\) reveals that for northern countries the marginal condition (10) is unchanged, but the BC market induces southern countries to expand their protected land, and thus they partly internalize the positive externality their protected land creates.

Regime 3: North–South Compensation with North–North Coordination Since the southern countries’ behavior is the same in Regimes 2 and 3, the allocation rule (18) still applies for all \(j \in \mathcal{S}\). The northern countries’ supply and demand of BC result from maximizing with respect to \(\left( z_i, z_i^d \right) _{i \in \mathcal{N}}\) the aggregate welfare of North,

subject to (1), (2), (3), (6), (12) and (15). The pertaining first-order conditions yield (18) and

The comparison of (19) with (22) shows that North has stronger strategic incentives in Regime \(3^s\) than in Regime \(2^s\) due to coordination. With regard to the externality, the decisive difference between Regimes 2 and 3 is (20) versus (23). The price for the marginal unit of BC equals a small fraction of the marginal external benefit of BC in Regime 2 \((p_z = B_i')\), while it equals the full marginal external benefit in Regime 3 \((p_z = \sum _{\mathcal{N}} B_i')\). In the absence of strategic effects, the strong internalization term \(\sum _{\mathcal{N}} B_i'\) in the allocation rule (23) suggests that the BC market is an effective instrument for the promotion of BC, if the North acts as a single agent.

In order to confirm this, we consider the social planner’s problem of maximizing the sum of the welfares of North and South, subject to the resource constraints (1), (13) and (14). The corresponding Lagrangian is

The “Appendix B” shows that solving (24) with respect to \(x_h^d\), \(y_h^d, g_h^d, z_h^d\) and \(z_h\) yields the allocation rules (6), (18), (19) and (23), modified by setting \(\frac{\partial P^x}{\partial z_i} = \frac{\partial P^y}{\partial z_j} =0\), all \(i \in \mathcal{N}\), \(j \in \mathcal{S}\) and after having decentralized the social planner’s solution by prices. Hence, the equilibrium allocation in Regime \(3^*\) is socially optimal.

Table 2 summarizes the supply-side allocation rules of Regimes \(1^s\)–\(3^s\) and allows for a straightforward comparison of the regimes. All regimes share three features. First, all countries put aside some protected area for the production of green goods (term \(G_h'\) in Table 2). Second, each northern country accounts for the positive effect of its own protected area on BC (term \(B_i'\) in the first column of Table 2). Third, each country seeks to manipulate the terms of trade in its own favor (terms in Table 2 with partial derivatives of the equilibrium prices \(p_x\) or \(p_y\)). In the northern countries, the difference between coordination and independent action is also clear. Without [with] coordination, the northern countries disregard [regard] the positive externality posed by their protected area on their fellow northern countries. If the BC market operates in Regimes 2 and 3, it induces the southern countries to take into account, partially (Regime 2) or fully (Regime 3), the impact of the positive externalities of their own protected area on the northern countries’ welfare. If these countries fail to coordinate their action, their allocation rule is the same as in Regime 1, but in contrast to Regime 1, the southern countries make some internalization effort in Regime 2 in return for financial support from the North. However, the combination of North–North coordination and North–South compensation in Regime 3 results in the internalization term \(\sum _{\mathcal{N}} B_i'\) which is much stronger than the term \(B_i'\) in Regime 2. We summarize our findings in

Result 1

In our model of the world economy, each northern country’s protected area generates a positive externality in all fellow northern countries (North–North externalities) and each southern country’s protected area generates a positive externality in all northern countries (South–North externalities). In addition, countries have strategic incentives to manipulate the terms of trade in their favor.

-

(i)

Suppose all countries act non-strategically and consider the regimes listed in Table 1.

-

(a)

The laissez-faire Regime \(1^*\) is inefficient, because neither the North–North externalities nor the South–North externalities are internalized.

-

(b)

Regime \(2^*\) is inefficient, because the North–North externalities are not internalized and the South–North externalities are only partly internalized.

-

(c)

Regime \(3^*\) is efficient (or socially optimal), because it fully internalizes all externalities.

-

(a)

-

(ii)

Suppose all countries act strategically. Then the Nash equilibria of Regimes \(1^s\)–\(3^s\) are distorted by both the non-internalized externalities of (ia)–(ic) and the strategic effects.

Although the preceding analysis provided some important insights, it leaves many questions unanswered. Is the intuition correct that the move from Regime 1 to Regimes 2 and 3 increases the size of the protected areas in northern and southern countries? We know that the move from Regime \(1^*\) to Regime \(3^*\) increases aggregate welfare, because Regime \(1^*\) is inefficient and Regime \(3^*\) is socially optimal. It is not clear, however, how aggregate welfare, the welfare of North and South, and biodiversity change, when moving from Regime \(1^*\) to Regime \(2^*\). When switching from price taking to strategic action, the combined distortions from biodiversity externalities and monopoly power are all the more unclear. Are the strategic effects small or is their impact on biodiversity and welfare substantial?

3 Parametrization and Numerical Analysis

In the preceding section, we characterized the allocation rules that govern laissez-faire (Regime 1) and the policy regimes of North–South compensation without and with North–North coordination, when countries do or do not act strategically. We now investigate in more detail the impact of these policies on the allocation of the world economy. Although our model of Sect. 2 consists of a few building blocks only, it is not possible to derive informative results on the move from Regime 1 to the Regimes 2 and 3 with the general functional forms \(B_i\), \(G_h\), \(U_h\), \(V_h\), \(X_i\) and \(Y_j\). To make progress, we therefore introduce the following simplifications.

-

(i)

Within their groups \(\mathcal{N}\) and \(\mathcal{S}\), all countries are alike, so that we write \(b_i = b_\mathcal{N}\) for all \(i \in \mathcal{N}\), \(b_i = b_\mathcal{S}\) for all \(i \in \mathcal{S}\) etc.

-

(ii)

We employ the parametric model

$$\begin{aligned}&n=s=50, \quad \ell _h= \ell , \quad G_h (b_h) = \alpha _{g} b_h, \quad V_h (x^d_h) = a_x x^d_h - \frac{\beta _x}{2} (x^d_j)^2, \nonumber \\&U_h (y^d_h) = a_y y^d_h - \frac{\beta _y}{2} (y^d_h)^2, \quad h =\mathcal{N}, \mathcal{S}, \nonumber \\&X_\mathcal{N}(e_\mathcal{N}) = 2 \alpha _{x} \sqrt{e_\mathcal{N}}, \quad Y_\mathcal{S}(e_\mathcal{N}) = 2 \alpha _{y} \sqrt{e_\mathcal{S}}, \quad B_\mathcal{N}\left( \sum _{\Omega }b_j\right) = \gamma \sum _{\Omega } b_h. \end{aligned}$$(25)

In (25), \(a_x, a_y, \alpha _{x}, \alpha _{y}, \alpha _g, \beta _x, \beta _y, \gamma \) and \(\ell \) are positive parameters. In the parametric model, we restrict our attention to symmetric Nash equilibria. Despite the model’s simplicity, we are not able to derive closed-form solutions of the parametric model (25) for strategic action.Footnote 19 Therefore, we resort to numerical analysis, which we organize as follows.

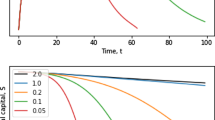

We will study three numerical examples of the parametric model (25). Example 1 analyzes the case in which all countries’ demand for good X is stronger than for good Y. The underlying conjecture is that the North’s (composite) good X conforms better to the consumers’ preferences than good Y in design, quality, and/or functionality. Example 2 differs from Example 1 only in that we lower the productivity of good Y in the South, which we consider a plausible modification. Example 3 reduces the substantial difference in demand between the goods X and Y that we assumed in Example 1. The discussion of our examples will focus on the allocative changes that occur when moving from Regime 1 to Regimes 2 and 3, and we will investigate how the impact of these moves differs when governments do or do not act strategically.

3.1 Internalization of BC Benefits in Example 1

We denote as Example 1 the numerical specification

For each regime, we have computed—and listed in Table 8 of “Appendix D”—the equilibrium values needed to determine the allocative displacement effects of moving from Regime 1 to Regimes 2 and 3.

Regime\(1^*\)and\(1^s\) Before we discuss the outcome of the Regimes 2 and 3 in Example 1, we describe the allocation in Regime 1 (laissez-faire) with an emphasis on the difference between the cases of strategic or non-strategic action.Footnote 20

As Table 3 shows, Regime \(1^s\) is welfare-superior to Regime \(1^*\), and all countries provide more protected land in the former than in the latter. Although the differences in allocation without and with strategy are small, the increase in protected land in Regime \(1^s\) calls for an explanation. The allocation rule (10) [(11)] for the strategically acting country \(i \in \mathcal{N}[j \in \mathcal{S}]\) contains the term \(\left( x_i -x_i^d \right) \frac{\partial P^x}{\partial b_i} \left[ \left( y_j -y_j^d \right) \frac{\partial P^y}{\partial b_j} \right] \). Since \(i \in \mathcal{N}[j \in \mathcal{S}]\) exports good X [good Y] and since the partial derivatives \(\frac{\partial P^x}{\partial b_i}\) and \(\frac{\partial P^y}{\partial b_j}\) are positive, strategically acting governments have an incentive to raise the price for their export good above the price in Regime \(1^*\) by increasing the size of their protected land.Footnote 21 More protected land means less unprotected land and less production and supply of goods X and Y. Rising prices  and

and  lower the demand for good X and Y and thus re-equilibrate the markets for both goods. The superior performance of strategic action appears to be a general feature in Regime 1, since Regime \(1^*\) is characterized by too little protected land and the strategic incentives are unambiguously directed towards expanding protected land in North and South.

lower the demand for good X and Y and thus re-equilibrate the markets for both goods. The superior performance of strategic action appears to be a general feature in Regime 1, since Regime \(1^*\) is characterized by too little protected land and the strategic incentives are unambiguously directed towards expanding protected land in North and South.

Green goods play an important role in our approach, but for reasons of tractability, we included them in the parametric model in the simplest possible way. The production of and preferences for green goods are linear and identical across countries, which implies that the equilibrium price of green goods is technologically determinedFootnote 22 (and set equal to one), and the demand of all consumers for green goods is perfectly elastic. Moreover, we have chosen the parameters of Example 1 such that northern countries import green goods.Footnote 23 That seems plausible, because many northern consumers go on safaris, are eco-tourists or bird watchers etc. in the South. North keeps importing green goods in all other examples and regimes to be discussed below.Footnote 24

No Strategic Action (\(1{\text{ st }}\)and\(2{\text{ nd }}\)Rows of Table 4) When governments take prices as given, the move from Regime \(1^*\) to Regime \(2^*\) leads to the allocative changes displayed in the first row of Table 4. Interestingly, these changes are very similar in qualitative terms, to the changes from Regime \(1^*\) to Regime \(1^s\) in Table 3.Footnote 25 Since the welfares of all countries increase when we move from Regime \(1^*\) to Regime \(2^*\), financial support of North for BC in South is a Pareto-improving instrument for fostering BC in cases of non-strategic action. However, in order to assess the effectiveness of that instrument, we wish to know the magnitude of the relative improvement of Regime \(2^*\) over Regime \(1^*\), and the magnitude of the efficiency gap between Regimes \(2^*\) and \(3^*\). To compute relative changes in the move from Regime \(1^*\) to Regime \(2^*\), we invoke Table 8 in the “Appendix D” and find that the relative improvement over Regime \(1^*\) is almost negligible. For example, the absolute increase in total protected land, \(\Delta _2 (\sum _\Omega b_h^*)=7.85\), corresponds to a relative increase of about 0.5 %, and the absolute increase in aggregate welfare, \(\Delta _2 (\sum _\Omega w_h^*)=30\), corresponds to a relative increase of about 0.002 %. It is striking that all numbers in the second row of Table 4 are significantly larger than those in the first row. Hence, the efficiency gap between the Regimes \(2^*\) and \(3^*\) is large, not only large in absolute terms, as Table 4 shows, but also in relative terms. For example, in Regime \(2^*\) the total protected land is only about two thirds the size of the efficient, such that the BC policy of Regime 2 is far from implementing the efficient level of protected land.Footnote 26 In sum, the effectiveness of North–South compensation without North–North coordination (Regime \(2^*\)) is very low.

The BC market in Regime 2 is ineffective, because in essence, North–South compensation without North–North coordination is an approach to BC in which each individual northern country makes a voluntary contribution to the public good BC. The standard result in the theory of voluntary contributions is that the provision of the public good is decreasing in the number of contributors. In our parametric model, North is assumed to consist of 50 countries, and this relatively large number renders the contributions of individual non-cooperative northern country to BC very small.

It is surprising that the northern countries choose the same size of protected land in Regimes \(1^*\) and \(2^*\) (\(\Delta _2 b_\mathcal{N}^*=0\) in the first row of Table 4) and that \(\Delta _2 b_\mathcal{N}^*=0\) also holds in all other examples that we studied. This property is unlikely satisfied in more general models, because it is a consequence of our simplifying assumptions that the non-use value of biodiversity, \(B_\mathcal{N}\left( \sum _\Omega b_h \right) \), is linear in \(\sum _\Omega b_h\) and that the demand for good X depends on the price of good X only. The southern countries’ protected land is larger in Regime 2 than in Regime 1, because these countries turn some of their unprotected into protected land in exchange for appropriate compensation from North. This obviously decreases their unprotected land and reduces their production of good Y. To clear the world market for good Y, the price must rise, so as to lower total demand until it matches the reduced supply.

Regime \(3^*\) represents the efficient Coaseian approach to BC. We conclude from the second row of Table 4 and our preceding discussion that adding North–North coordination to North–South compensation (i.e. moving from Regime \(2^*\) to Regime \(3^*\)) substantially boosts the protected area and welfare in all countries. The reason is clearly evident from comparing the applicable allocation rules in Table 2 (after setting \(\frac{\partial P^x}{\partial z_i} = \frac{\partial P^y}{\partial z_j}=0\)),

In (27), the terms \(B_i' = \gamma =0.1\) and \(\sum _\mathcal{N}B_i' = 50 \gamma =5\) represent the relevant incentives to internalize the BC externalities. The first two equations relate to Regime \(2^*\). The term N2 indicates that country \(i \in \mathcal{N}\) accounts for the non-use value of its own protected land (as in Regime \(1^*\)). The term NS2 is associated with the non-use value of the protected area in country \(j \in \mathcal{S}\) that is created by country i’s purchase of BC. The third and fourth equation in (27) relate to Regime \(3^*\). The term NN3 covers N2 and indicates that country \(i \in \mathcal{N}\) accounts for the non-use value of its own and of all other northern countries’ protected land. The term NS3 accounts for the non-use value generated by North’s purchase of BC, with North acting as a single agent. In sum, (27) demonstrates that in Regime \(3^*\), the incentives in all northern and southern countries to increase protected land are 50 times larger than in Regime \(2^*\).

Strategic Action (\(3{\text{ rd }}\)and\(4{\text{ th }}\)Rows of Table 4) When moving from Regime \(1^s\) to Regimes \(2^s\) and \(3^s\), the magnitude of the allocative changes with strategic action is similar as in the case of price-taking governments. This conclusion follows from comparing the first with the third row and the second with the fourth row of Table 4 and from the observation made in Table 3 that the difference between the allocations of the baseline Regime 1, with and without strategic action, is small. Apart from these similarities, the crucial point is of course that Regime \(3^*\) is efficient, while Regime \(3^s\) is not. Table 5 displays the allocative distortions in Regime \(3^s\).

Since the manipulation of the terms of trade is distortionary, it is clear that in Regime \(3^s\) the aggregate welfare falls short of the socially optimal level (\(1{\text{ st }}\) entry of Table 5). We also find that the welfare of all countries is suboptimally low (\(2{\text{ nd }}\) and \(3{\text{ rd }}\) entry of Table 5), which is not obvious, because excessively high welfare in some subset of countries could be compatible with excessively low aggregate welfare. A remarkable and unexpected result is that in Regime \(3^s\) all countries choose excessively large protected areas (\(6{\text{ th }}\)–\(8{\text{ th }}\) row of Table 5), whereas these areas are too small in Regime \(2^s\). The difference is great, because the incentives for internalization and price manipulation differ substantially between both regimes. Since our discussion of Eq. (27) also applies to regimes with strategic action, the internalization incentives are about 50 times greater in Regime \(3^s\) than in Regime \(2^s\), although these strong incentives now fail to induce full internalization, due to the interference with strategic action. We showed above that all strategic incentives in the allocation rules of Table 2 are directed towards expanding protected land. In Regime \(3^s\), these strategic incentives are equal to \(\frac{\partial P^x}{\partial z_i} \sum _\mathcal{N}\left( x_i -x_i^d \right) \) in North and \(\frac{\partial P^y}{\partial z_j} \left( y_j -y_j^d \right) \) in South, whereas in Regime \(2^s\), they are equal to \(\frac{\partial P^x}{\partial z_i} \left( x_i -x_i^d \right) \) in North and \(\frac{\partial P^y}{\partial z_j} \left( y_j -y_j^d \right) \) in South. That is, the strategic incentives in South are of the same order of magnitude in both regimes, but North’s strategic incentives are about 50 times greater in Regime \(3^s\) than in Regime \(2^s\). It is this significant difference in strategic and internalization incentives to protect land, which explains that Regime \(2^s\) provides too little and Regime \(3^s\) too much protected land. The preceding discussion also made clear that the extent, to which protected land is over-provided in Regime \(3^s\), crucially depends on the total number of countries and on the share of northern and southern countries.

We conclude the discussion of Example 1 with a few remarks on the remaining entries of Table 5. To see why the differences  and

and  are positive, recall that all countries’ protected land is inefficiently large. Hence, their unprotected land is too small, and so too is their production of good X and good Y. To prevent excess demand, which the first-best prices

are positive, recall that all countries’ protected land is inefficiently large. Hence, their unprotected land is too small, and so too is their production of good X and good Y. To prevent excess demand, which the first-best prices  and

and  would create, the prices for goods X and Y need to rise. Finally, North’s import of green goods is inefficiently small, because both countries supply inefficiently large quantities of green goods but the deviation from the efficient level is more pronounced in North than in South.

would create, the prices for goods X and Y need to rise. Finally, North’s import of green goods is inefficiently small, because both countries supply inefficiently large quantities of green goods but the deviation from the efficient level is more pronounced in North than in South.

3.2 Internalization of BC Benefits in the Examples 2 and 3

Example 2 In Example 1, we chose the productivity parameters \(\alpha _x= \alpha _y=1\) for the production functions of goods X and Y, respectively. Now we set \(\alpha _y=0.9\), but keep \(\alpha _x=1\) along with all other parameters of Example 1, and denote that as Example 2. The motivation for Example 2 is the proposition that South is less productive than North and that it owns less human capital and uses less advanced technologies. The question we wish to answer is how the change from \(\alpha _y =1\) to \(\alpha _y=0.9\) changes the results we reported in Sect. 3.1.

For Example 2, the equivalent of Table 3 consists of the first and fourth rows of Table 9 in “Appendix D”. Comparing these rows largely confirms the result that Table 3 provides for Example 1: Regime \(1^s\) is slightly welfare-superior to Regime \(1^*\), and the protected land of all countries is slightly larger with than without strategy. The difference between the Examples 1 and 2 regarding the allocations in Regime \(1^s\) and Regime \(1^*\) is straightforward and as expected. The shift from \(\alpha _y=1\) to \(\alpha _y=0.9\) is advantageous for northern countries but reduces the welfare in southern countries and induces them to increase their protected land.

Next, we consider Table 6, which contains the information for Example 2 that we provided in Table 4 for Example 1. Closer inspection shows that the allocative changes associated with the moves from Regime 1 to Regimes 2 and 3 are not significantly different from these moves in Example 1. This is true for the scenarios with and without strategy. Therefore, our discussion of Table 4 in the last section applies to Table 6 as well. In view of these similarities, it is no surprise that the deviation of the allocation in Regime \(3^s\) from the efficient allocation is also very similar in both examples. That is, similar numbers (in black and bold) as in Table 5 also characterize the inefficiency of Regime \(3^s\) in Example 2.Footnote 27

Example 3 Having observed that a productivity disadvantage of South does not change the results significantly, we proceed with investigating another modification of Example 1 that relates to the difference in the preferences for North’s good X. In (26) the preference parameters for Example 1 are (\(a_x =950\), \(\beta _x=0.1\)) and (\(a_y=900\), \(\beta _y=1\)). Example 3 retains all parameters in (26) except \(\beta _x\). We assume that \(\beta _x\) rises from \(\beta _x=0.1\) to \(\beta _x=0.5\). With this modification, the preferences for good X are still higher than for good Y in all countries, but now consumer h’s benefit \(V_h (x_h^d)\) is smaller than in Example 1 for all \(x_h^d\).

For Example 3, the equivalent of Table 3 consists of the first and fourth rows of Table 10 in the “Appendix”. Comparing these rows with Table 3 confirms the result we obtained for Example 1. That is, Regime 1 with strategy is slightly welfare-superior to Regime 1 without strategy, and the protected land of all countries is slightly larger with than without strategy. Hence, in that regard, the differences between Examples 1 and 3 are negligible.

Next, we consider Table 7, that is, the equivalent of Table 4 for Example 1 and Table 6 for Example 2. We find that the allocative changes associated with the moves from Regime 1 to Regime 2 with and without strategy and to Regime 3 without strategy do not differ significantly from the changes in the Examples 1 and 2. Accordingly, our discussion of Table 4 in the last section applies. However, a remarkable allocative change occurs when moving from Regime \(1^s\) to Regime \(3^s\). In that case, the pressure of the northern countries’ strategic action towards enlarging the protected land is so great that the total protected land increases by far more than in the other examples. The total protected land,  , exceeds its efficient level by 221.39 units in Example 1, by 209.93 in Example 2 and by 847.22 in Example 3. The excessive size of protected land in Example 3 represents a severe distortion that is larger in northern than in southern countries. As the last row of Table 7 shows, the welfare implications of the severe land zoning distortion are economically devastating. In Regime \(3^s\) of Example 3 the welfare of all northern countries is lower than in the benchmark Regime \(1^s\), \(\Delta _3 w_\mathcal{N}= -\mathbf{75.4 }\), while southern countries enjoy a ‘normal’ modest welfare increase, \(\Delta _3 w_\mathcal{S}=12.5\). Due to the northern countries’ low welfare, the aggregate level in Regime \(3^s\) is far lower than the efficient aggregate welfare,

, exceeds its efficient level by 221.39 units in Example 1, by 209.93 in Example 2 and by 847.22 in Example 3. The excessive size of protected land in Example 3 represents a severe distortion that is larger in northern than in southern countries. As the last row of Table 7 shows, the welfare implications of the severe land zoning distortion are economically devastating. In Regime \(3^s\) of Example 3 the welfare of all northern countries is lower than in the benchmark Regime \(1^s\), \(\Delta _3 w_\mathcal{N}= -\mathbf{75.4 }\), while southern countries enjoy a ‘normal’ modest welfare increase, \(\Delta _3 w_\mathcal{S}=12.5\). Due to the northern countries’ low welfare, the aggregate level in Regime \(3^s\) is far lower than the efficient aggregate welfare,  .

.

To understand the reason for the substantial distortion in Regime \(3^s\) of Example 3, recall that the only difference between Examples 3 and 1 is the shape of the demand functions for good X. The efficient protected land in northern countries is  in Example 1 and

in Example 1 and  in Example 3. The very small difference in the size of

in Example 3. The very small difference in the size of  between Examples 1 and 3 suggests that it is the difference in the shape of the demand functions, combined with strategic action, which constitute the driving force of the severe distortion. To make this point rigorous, observe that the price effect

between Examples 1 and 3 suggests that it is the difference in the shape of the demand functions, combined with strategic action, which constitute the driving force of the severe distortion. To make this point rigorous, observe that the price effect  , which follows from differentiating (C7) in “Appendix C”, is increasing in \(\beta _x\). Hence, enhancing \(\beta _x\) from 0.1 in Example 1 to 0.5 in Example 3 quintuples North’s market power with respect to influencing the price of good X. As a consequence, North pushes up the protected land in each northern country from 18.30 to 22.05 in Example 1, but from 18.91 to 35.18 in Example 3. The substantial expansion of protected land also affects North’s import of green goods,

, which follows from differentiating (C7) in “Appendix C”, is increasing in \(\beta _x\). Hence, enhancing \(\beta _x\) from 0.1 in Example 1 to 0.5 in Example 3 quintuples North’s market power with respect to influencing the price of good X. As a consequence, North pushes up the protected land in each northern country from 18.30 to 22.05 in Example 1, but from 18.91 to 35.18 in Example 3. The substantial expansion of protected land also affects North’s import of green goods,  . In Example 1 [Example 3] imports are equal to 809.49 units [45.63] in Regime \(3^s\), such that it exceeds the efficient level by 163.41 units in Example 1, but is below that level by 862.34 units in Example 3. North’s imports drop sharply in Example 3, because the increase in its production of green goods exceeds the increase in its demand for green goods.

. In Example 1 [Example 3] imports are equal to 809.49 units [45.63] in Regime \(3^s\), such that it exceeds the efficient level by 163.41 units in Example 1, but is below that level by 862.34 units in Example 3. North’s imports drop sharply in Example 3, because the increase in its production of green goods exceeds the increase in its demand for green goods.

4 Summary and Concluding Remarks

The paper focuses on biodiversity conservation (BC) in a stylized model of the world economy with the following characteristics:

-

Northern countries value global biodiversity, while southern countries do not.

-

There is international trade in two different consumption goods and in green goods; non-protected land is an input in producing the former, and protected land in the latter; biodiversity is positively correlated with protected land.

-

Governments divide their countries’ total land into protected and unprotected.

-

When governments determine the size of protected land, they either take prices as given or act strategically in the sense that they seek to manipulate the terms of trade in their favor.

-

BC policy takes the form of a ‘BC market’, in which governments demand and supply protected land, created in addition to the protected land in laissez-faire Regime 1.

-

On that BC market, either the northern countries act non-cooperatively (Regime 2), or they cooperate, aiming to maximize North’s aggregate welfare (Regime 3).

We identify un-internalized BC benefits and strategic action as the reasons for inefficiency in the economy without a BC market (Regime 1) and show, as expected, that Regime \(3^*\) achieves efficiency.Footnote 28 From the comparison of that benchmark regime with Regime 2, it follows that the internalization incentives Regime 2 adds to the allocation rules in Regime 1 are inefficiently weak, irrespective of whether governments act strategically or not. Numerical examples yield the following more specific results.

-

(A)

Strategic action (slightly) increases protected land and welfare in Regime 1, because it works towards strengthening the weak internalization incentives of price-taking governments.

-

(B)

The BC market without coordination among northern countries (Regime 2) increases the protected land and welfare compared with Regime 1. However, the protected land secured in Regime 2 is still far below the efficient level. With minor differences, this result holds in Regimes \(2^*\) and \(2^s\).

-

(C)

When governments turn from Regime \(3^*\) to Regime \(3^s\), the protected land becomes inefficiently large, and hence, welfare is inefficiently low in all countries. The protected land may become so large in Regime \(3^s\) that the welfare in northern countries, and the aggregate welfare, drop below the welfare level in Regime \(1^s\).Footnote 29

The following policy implications are evident from the results (A), (B) and (C).

-

(i)

The BC market is an almost ineffective instrument for fostering BC when northern countries fail to coordinate their actions in that market (Regimes \(2^*\) and \(2^s\)). By acting non-cooperatively, they have an incentive to free ride, since they benefit from the additional protected area that their fellow northern countries provide at home or ‘purchase’ in South. In the real world, North supplies some financial support for BC in South, but the prevailing institutional arrangements do not amount to a regime in which North acts as an individual agent in the BC market. Therefore, we can interpret the poor BC performance of Regime 2 in our model as an explanation of the poor BC support of South that we observe in practice.

-

(ii)

If northern countries fully coordinate their actions in the BC market and if governments take prices as given (Regime \(3^*\)), the BC market is a first-best BC instrument. In that case, the BC market fully internalizes all positive BC externalities in the Coaseian spirit following the beneficiaries-pay principle. The crucial precondition is that governments act non-strategically. If they do not (Regime \(3^s\)), the BC market is an inefficient BC instrument, because global protected land and global biodiversity are excessive. When moving from Regime \(1^s\) to \(3^s\) in our Example 3, the substantial increase in protected land makes the northern countries worse off than in Regimes \(1^s\) and \(2^s\), but the southern countries better off than in Regimes \(1^s\) and \(2^s\). Consequently, it would be rational for North in that case to refrain from coordination and from entering the BC market.

The results (A), (B) and (C) listed above hold in Examples 1, 2 and 3 and in the large number of additional numerical simulations we computed without having documented them here. We take this as an indication of robustness, although it would be desirable to substantiate the robustness by simulations over large intervals of various model parameters. Unfortunately, the parametrization that we need for reasons of tractability severely limits the feasibility of such exercises, because many parameter variations, even small ones, turn out to violate economic non-negativity constraints or produce implausible corner solutions. Nonetheless, our analysis identifies channels of market and non-market interdependencies between countries and economic drivers of BC that have not yet been explored, to the best of our knowledge. In that way, the analysis contributes to our understanding of how regime changes affect protected land and welfare directly via BC benefits or losses and indirectly via markets, via opportunity costs of land-use changes and via changing terms of trade.

It would be desirable to both deepen and extend our analysis in various directions. We need to know how robust the results are when countries are less alike and functional forms are less restrictive. We assumed North–North coordination in Regime 3, without an analysis of how a comprehensive binding agreement among all northern countries would solve the intricate issues of free-riding and self-enforcement that are familiar in the literature on international environmental agreements. The premise that the non-market benefits from BC are linear in the aggregate protected area, and the same for all northern countries provides analytical relief, but limits generality. This also holds for the restrictive assumptions that preferences for and the production of green goods are linear and that there is complete specialization on good X in North and on good Y in South.

To obtain informative results under more general assumptions, large-scale CGE models are indispensable, with a realistic calibration to identify empirically relevant results in the set of possible outcomes. Not least, our static model cannot offer insights into the dynamics of irreversible biodiversity loss that is currently occurring or at least pending in the real world. There is some work on the dynamics of BC, e.g. on landscape heterogeneity that affects species growth and biodiversity (Brock et al. 2010) or on BC in a Hotelling model with a non-renewable resource (Perrings and Halkos 2012). However, tractability usually requires a difficult choice between dynamic modeling with considerably reduced complexity on the one hand, and a static analysis with more complexity and sharp results on the other hand.

Notes

In its recent Fifth Report to the Convention on Biological Diversity (European Commission 2014), the European Union states that extensive areas of agriculture, grasslands and wetlands continue to decline across Europe, while artificial surfaces continue to expand.

Ferraro and Simpson (2002) have investigated the cost-effectiveness of payments for ecosystem conservation.

In ecology, a large literature applies the “species area curve”, which describes the relationship between the area of a habitat and the number of species found within that area. A reduction in the size of a habitat reduces biodiversity in terms of the species area relationship (e.g. Kinzig and Harte 2000; May et al. 1995), which is also used in economic papers on land use and biodiversity conservation (e.g. Barbier and Schulz 1997; Polasky et al. 2004).

For a more realistic land-use approach based on the new economic geography with centrifugal-centripetal forces in economic and ecological systems, see Rauscher and Barbier (2010).

Since the North is willing to pay more for biodiversity than the South, it is in the North’s interest to compensate the South for expanding its protected area. Panayotou (1994) describes a similar market concept without providing a formal analysis.

In the Coaseian spirit, we refrain from providing an institutional structure for the North–North coordination such as a North–North BC market or a self-enforcing North–North agreement (as e.g. Barrett 1994) to focus on the North–South issue without unnecessary analytical complexity.

We disregard the fourth regime characterized by ‘North–North coordination’ without ‘North–South compensation’, because we find it less relevant than the three regimes listed in Table 1.

We know that the aggregate welfare rises, if we move from Regime 1 with or without strategic action to Regime 3 without strategic action, because Regime 1 is inefficient and Regime 3 without strategic action is efficient.

The Convention on Biological Diversity combined with the Global Environment Facility does not fit precisely into any of the three regimes, but may come close to Regime 2.

It is obvious that the real world exhibits all kinds of intermediate forms of land use. Nonetheless, the partition of land into protected and non-protected areas captures the essence of the allocation problem for the purpose of our conceptual analysis and secures tractability at the same time.

The subscript i [j] denotes an element of the set \(\mathcal{N}\)\([\mathcal{S}]\), and the subscript h represents an element of the set \(\Omega \).

We denote by \(g_h, x_i, y_j\) the supply of goods and by \(g_h^d, x_h^d, y_h^d\) their demand.

For details on ‘degenerate’ profit maximization and land market equilibrium, see “Appendix A”.

Note that (7) defines equilibrium in the markets of protected and unprotected land, and implies clearance of the market for green goods via Walras’ Law.

Observe that all prices are related to the price of the green good, which has been chosen as a numeraire. Hence, \(\frac{\partial P^x}{\partial b_i}\) captures the strategic action of manipulating the terms of trade \(\frac{p_x}{p_g}\).

The information in (12) about the size of the protected area in the fallback Regime 1 is important, in order to rule out the offer of protected areas in the BC market that would already be protected areas in Regime 1.

The first-order conditions of Regimes 1–3 for the parametric model are given in “Appendix C”. The closed-form solutions for non-strategic action are presented in “Appendix D”.

In Table 3,

is the value of the variable \(v_h= b_h, w_h\) etc. of country h in Regime \(k = 1, 2, 3\). In addition, we use the superscripts s and \(*\) to indicate the allocation and prices of regimes with and without strategic action, respectively.

is the value of the variable \(v_h= b_h, w_h\) etc. of country h in Regime \(k = 1, 2, 3\). In addition, we use the superscripts s and \(*\) to indicate the allocation and prices of regimes with and without strategic action, respectively.As a consequence, strategic manipulation of the price of green goods is impossible.

In the following tables, we use the notation

for the variable \(v=b, w, p_x, p_y\) with \(k= 2, 3 \) and \(h= \mathcal{N}, \mathcal{S}\).

for the variable \(v=b, w, p_x, p_y\) with \(k= 2, 3 \) and \(h= \mathcal{N}, \mathcal{S}\).The absolute aggregate-welfare gap between Regimes 2 and 3 is small, but almost as large as between Regimes \(1^*\) and \(3^*\).

For the interested reader, we provide in “Appendix C” the relevant results of Example 2, along with those of the Examples 1 and 3, to allow for a row-by-row comparison.

Recall that we denote Regime \(k = 1, 2, 3\) as Regime \(k^*\), if governments act non-strategically, as Regime \(k^s\), if they act strategically, and as Regime k (without superscript) if both types of that regime are addressed.

Items (A)–(C) imply that moving from price-taking to strategic action increases total protected land in all regimes. This feature is reminiscent of the famous observation Hotelling made in a different context, that “the monopolist is the conservationist’s best friend.”

References

Barbier E, Schulz C (1997) Wildlife, biodiversity and trade. Environ Dev Econ 2(2):145–172

Barrett S (1994) The biodiversity supergame. Environ Resour Econ 4:111–122

Brander J, Taylor MS (1997) International trade and open access renewable resources: the small open economy case. Can J Econ 30:526–552

Brander J, Taylor MS (1998) Open access renewable resources in a two-country model. J Int Econ 30:526–552

Brock W, Kinzig A, Perrings C (2010) Modeling the economics of biodiversity and environmental heterogeneity. Environ Resour Econ 46:43–58

Butchart S et al (2010) Global biodiversity: indicators of recent declines. Science 328:1164–1168

Ceballos G, Ehrlich PR, Barnosky AD, Garcia A, Pringle RM, Palmer TM (2015) Accelerated modern human-induced species losses: entering the sixth mass extinction. Sci Adv 1:e1400253. https://doi.org/10.1126/sciadv.1400253

Coase R (1960) The problem of social cost. J Law Econ 3:1–44

Convention on Biological Diversity (CBD) (1992) United Nations

European Commission (2014) Fifth Report of the European Union to the Convention on Biological Diversity

Ferraro PJ, Simpson RD (2002) The cost-effectiveness of conservation payments. Land Econ 78:339–353

Kinzig AP, Harte J (2000) Implications of endemics-area relationships in estimates of species extinctions. Ecology 81:3305–3311

May RM, Lawton JH, Stork NE (1995) Assessing extinction rates. In: Lawton JH, May RM (eds) Extinction rates. Oxford University Press, Oxford

Mee LD, Dublin HT, Eberhard AA (2008) Evaluating the global environment facility: a goodwill gesture or a serious attempt to deliver global benefits? Glob Environ Change 18:800–810

Montero JT, Perrings C (2011) The provision of international environmental public goods. Working Paper Series Environment for Development, The United Nations Environment Programme, Division of Environmental Policy Implementation Paper No. 16

Panayotou T (1994) Conservation of biodiversity and economic development: the concept of transferable development rights. Environ Resour Econ 4:91–110

Pearce DW (2004) Environmental market creation: savior or oversell? Port J Econ 3:115–144

Perrings C, Halkos G (2012) Who cares about biodiversity? Optimal conservation and transboundary biodiversity externalities. Environ Resour Econ 52:585–608

Perrings C, Halkos G (2015) Agriculture and the threat to biodiversity in sub-saharan Africa. Environ Res Lett 10:095015

Polasky S, Costello C, McAusland C (2004) On trade, land use and biodiversity. J Environ Econ Manag 48:911–925

Rauscher M, Barbier EB (2010) Biodiversity and geography. Resour Energy Econ 32:241–260

Sandler T (1993) Tropical deforestation: markets and market failures. Land Econ 69:225–233

Smulders S, van Soest DP, Withagen C (2004) International trade, species and habitat conservation. J Environ Econ Manag 48:891–910

Author information

Authors and Affiliations

Corresponding author

Additional information

Helpful comments from Charles Perrings and two anonymous reviewers are gratefully acknowledged. Remaining errors are the authors’ sole responsibility.

Appendix

Appendix

1.1 Appendix A: Protected and Unprotected Land Markets

For simplicity, we treat the protected area \(b_h\) as the governments’ policy parameter assuming that the land zones are imposed in a command and control fashion. It is straightforward to introduce competitive domestic markets, one for protected and one for unprotected land, to allocate the land to domestic firms. We determine the equilibrium on these markets as follows. After the government of country \(h \in \Omega \) has divided total land into protected and unprotected land, the equilibrium prices for the goods X and Y are determined by (8). Denote by \(p_{e}^i\) and \(p_{e}^j\) the price of unprotected land use in the production of good X, \(i \in \mathcal{N}\) and good Y, \(j \in \mathcal{S}\), respectively. Consider the first-order conditions of profit maximization \(p_x X_i'(e_i) =p_{e}^i\) and \(p_y Y_i'(e_i) =p_{e}^j\), respectively. The first-order conditions clearly define the land prices, \(p_{e}^i= p_x X_i'(e_i) \) and \(p_{e}^j= p_y Y_i'(e_i) \).

Next, consider the market for ecosystem services in country h and define the prices \(p_g=1\), \(p_b^h\) and the profit of the firm in country h that produces green goods, \(G_h(b_h) - p_b^h b_h\). The first-order condition of profit maximization determines the equilibrium price of protected land in country h: \(p_b^h{:=} G_h'(b_h)\).

Finally, observe that the income of country \(i\in \mathcal{N}\) and \(j \in \mathcal{S}\), respectively, is given by

1.2 Appendix B: Social Optimum

Maximizing the Lagrangian (24) yields the first-order conditions

The standard procedure of equating shadow prices with prices on perfectly competitive markets yields \(\lambda _x = p_x\), \(\lambda _y = p_y\), \(\lambda _g =p_g\) and \(\lambda _z = p_z\), and proves that the allocation in Regime \(3^*\) is efficient.

1.3 Appendix C: Parametric Functions and Numerical Examples

Regime 1 The consumer’s demand for good X and Y is given by

Inserting the demands (C1), (C2) and the supplies \(x_h =2 \alpha _{x} \sqrt{\ell - b_{\mathcal{N}}}\) and \(y_h =2 \alpha _{y} \sqrt{\ell - b_{\mathcal{S}}}\) into the equilibrium conditions \((n+s) x^d = n x_{\mathcal{N}} \) and \((n+s) y^d = sx_{\mathcal{S}}\) we obtain

Inserting the parametric functions (25) into (10) and (11) we get

for non-strategic action and

for strategic action.

Regime 2 In Regime 2 the consumer’s demands are given by \(x^d = \frac{a_x - p_x}{\beta _x}\), \(y^d = \frac{a_y - p_y}{\beta _y}\) and the price functions by

For the parametric functions (25) the first-order conditions (18)–(20) turn into

for non-strategic action and

for strategic action.

Regime 3 In Regime 3 the first-order conditions (18), (22) and (23) turn into

for non-strategic action and

for strategic action.

1.4 Appendix D: Closed-Form Solution for Non-strategic Action

For non-strategic action we get the following closed-form solutions.

Regime 1 Solving (C4) we get

where  and

and  . The welfare levels of northern and southern countries are given by

. The welfare levels of northern and southern countries are given by

Regime 2 Solving (C9) one gets

where  and

and  . Inserting (D1) and (D2) into (D8) and (D9) and solving for

. Inserting (D1) and (D2) into (D8) and (D9) and solving for  and

and  yields

yields

The welfare levels are

where  and

and  .

.

Regime 3 Solving (C12) and (C13), we obtain

where  and

and  . Inserting (D2) and (D3) into (D18) and (D19) and solving for

. Inserting (D2) and (D3) into (D18) and (D19) and solving for  and

and  yields

yields

The welfare levels are given by

where  and

and  .

.

Rights and permissions

About this article

Cite this article

Eichner, T., Pethig, R. Coaseian Biodiversity Conservation and Market Power. Environ Resource Econ 72, 849–873 (2019). https://doi.org/10.1007/s10640-018-0225-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-018-0225-0

is the value of the variable

is the value of the variable  exceeds price

exceeds price  by an amount that is too small to be captured in Table

by an amount that is too small to be captured in Table  for the variable

for the variable