Abstract

Much research has examined the positive effects of legitimacy spillover. However, negative events may reduce the extent of legitimacy, which may in turn spillover to affect the legitimacy of important stakeholders including alliance partners. This study examines incidents of regulative legitimacy violation and focuses on the effect such incidents have on the alliance partners of the perpetrating organizations. We specifically examine three types of such violations—administrative law, criminal law, and civil law—to show that the loss of regulative legitimacy negatively influences the stock market performance of alliance partners. More interestingly, not all corrective actions and repair efforts are equally impactful. We show that the effect of repair efforts by the perpetrating firm on the alliance partner differ depending on the nature of those violating incidents.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In 2008, the District of Columbia sued Bank of America (BoA) for over $105 million for its role in the largest and longest-running embezzlement scheme in the city’s history, commonly known as the “Mother Harriette” fraud case (Southall, 2009). Harriette Walters, a midlevel tax office manager for the District of Columbia, used her job to issue nearly $50 million in bogus property tax refunds to herself and co-conspirators, including a manager at BoA. The lawsuit stated that BoA would “make the whole District suffer losses because of the Defendant Bank’s wrongful hiring, inadequate training and inadequate supervision” of its employees (Moyer, 2016). On October 25, 2016, BoA agreed to pay a $13 million settlement to the District of Columbia (Moyer, 2016). Walter R. Jones, assistant branch manager, was fired for violating the bank’s standards of conduct months before federal authorities made any arrests related to the case. Interestingly, consequences of this fraud spread beyond BoA. Following the announcement of the lawsuit in 2008, several of BoA’s alliance partners, including Chase Manhattan Bank and Hewlett-Packard, were negatively impacted as their stock prices slid.

This is not the only example of the involvement of a well-established organization in some highly visible wrongdoing, misconduct, or even criminal activity that can cause serious damage to its legitimacy. Such legitimacy is a key driver of an organization’s viability and success (Bitektine, 2011; Scott, 1995; Suchman, 1995) but is sometimes beyond its own control. The firm can suffer losses if one of the firm’s key stakeholders, such as an alliance partner, has committed wrongdoing or misconduct (Jensen, 2006; Norheim-Hansen & Meschi, 2020). In the example above, Chase Manhattan Bank and Hewlett-Packard also suffered legitimacy losses when their alliance partner (BoA) was involved in fraud.

While several forms of legitimacy exist, we focus on the violation of regulative legitimacy (Scott, 1995; Suchman, 1995) because such violations are influential and highly noticeable. Regulatory pressures often come as legal mandates that require organizations to abide by regulations, rules, and norms. When a firm is charged with such a violation, legitimacy loss often spills over to its alliance partners (Norheim-Hansen & Meschi, 2020), creating a stigmatizing effect as stakeholders seek to distance themselves from the perpetrating organization (Devers et al., 2009; Goffman, 1963). Although much research has examined spillover among alliance partners, legitimacy loss associated with regulative violations has received scant attention in prior studies. In this paper, we examine the following research questions: (1) When regulative violations occur, how does the perpetrator firm’s loss of legitimacy affect the stock market performance of its alliance partners? and (2) When the perpetrating firm seeks to repair its reputational loss, how do such repair efforts affect the stock market performance of its alliance partners?

We examine these research questions with a sample of 29 events gathered from Fortune 100 firms. Using an event-study methodology and random-effects GLS regression, we examine how the market valuation of 178 alliance partners is affected by the spillover of social judgments that result in legitimacy loss for perpetrating firms. We also examine how repair efforts for violations impact such spillover. We find that repair efforts by the focal firm following criminal and civil lawsuits are more likely to be successful than are repair attempts for violations of administrative law, since fewer repair actions are needed to resolve the negative spillover. To effectively repair spillover damage following administrative violations, however, more repair actions (i.e., actions that are broader in scope) are required to address the level of complexity of these events.

This study contributes to the growing literature on spillover of legitimacy loss in at least two ways. First, we provide a typology of regulative violations and distinguish among criminal, civil, and administrative violations based on the nature of such violations and their different strategic, organizational, and legitimacy implications. Second, a novel finding that contributes nuances and complexities to the literature is that not all repairs to legitimacy by the perpetrator firm can be equally effective, and that the three specific types of regulative violations moderate the effects of repair attempts in the process of spillover to alliance partners.

Theory and Hypotheses

Three Types of Regulative Violations and Spillover to Alliance Partners

Scott (2014) suggests that legitimacy includes regulative, normative, and cultural-cognitive dimensions. In this paper, we concentrate on regulative legitimacy, which is conferred through conformity to expectations, rules, and regulations set by regulators, government, accrediting associations, and other powerful evaluators of the organization and its activities (Scott, 1995; Suchman, 1995; Zimmerman & Zeitz, 2002). Regulatory systems constrain and regulate behavior, and usually involve sanctions and penalties from regulative or governing administrative bodies (usually the state or authorized private agencies). We focus on violations of regulative legitimacy for several reasons. First, such violating events are often highly publicized in the media and their spillover effects can have strong and important implications for stakeholders such as alliance partners. Second, entities involved in regulative violations are easily identifiable. Regulative violations are often identified by legal authorities, including (but not limited to) the Securities and Exchange Commission (SEC), the Federal Trade Commission (FTC), the Equal Employment Opportunity Commission (EEOC), and the Environmental Protection Agency (EPA). These legal authorities send notifications to perpetrator organizations, which are highly visible events that can be and frequently are reported by the media. Legal authorities such as the SEC and the FTC become entities that confer or deny perpetrators’ legitimacy. Since legitimacy is “in the eyes of the beholder” (Bitektine, 2011), the public in general and the investment community specifically can observe the legitimacy of the perpetrators as well as that of their alliance partners. In this context, investors are the primary audience for the assessment process as they revise their valuation of the affected organizations.

There are three types of regulative violations—criminal, civil, and administrative—depending on the nature of the incidents and those involved. Criminal law is the body of law that regulates social conduct and prescribes whatever is threatening, harmful, or otherwise endangering to people’s property, health, safety, and moral welfare and includes the punishment of people who violate such laws (Williams, 1983). For example, some executives of Tyson Foods were arrested in 2001 and later indicted for smuggling illegal immigrants across the US-Mexico border (Barboza, 2001).

Civil law refers to non-criminal law in common law countries such as the UK and the US. Individuals or organizations violate civil laws when they fail to comply with contracts. Civil proceedings serve the purpose of obtaining compensation for injury, and may thus be distinguished from criminal proceedings, whose purpose is to inflict punishment (Rogowski, 1996). For example, competitors filed a civil suit against Johnson & Johnson seeking compensation for antitrust violations (Walsh, 2003).

Administrative law directs the activities of government administrative agencies. Government agency action can include rulemaking, adjudication, or the enforcement of a specific regulative agenda. Administrative law is considered a branch of public law. In the US, the actions of executive and independent agencies are the primary focus of administrative law (Davis, 1975). For example, the SEC launched an investigation of Home Depot to determine whether stock-option backdating had violated accounting standards (Zimmerman, 2006).

Regulative violations often create stigmatizing events. Goffman (1963) was one of the first to codify the construct of stigma as the devaluation or even destruction of an individual’s social identity. Devers et al. (2009) define organizational stigma as “a label that evokes a collective stakeholder group-specific perception that an organization possesses a fundamental, deep-seated flaw that deindividuates and discredits the organization” (p. 155). While stigma is socially defined and involves perceptions of deviance, more general and negative attributions can be extended to the individual (Heathertonet al., 2003). Because a stigmatizing event is a socially perceived blemish that produces a negative evaluation, those suffering from a stigma lose their status and connection with others in the environment (Link & Phelan, 2001). Pozner (2008) suggests that stigmatization causes “contamination” of an actor’s social identity which, in the corporate world, often results in negative stock price returns for a perpetrating firm. Stigmatizing events such as EPA violations, unethical behavior, and SEC investigations are examples of events that often harm firm performance and, consequently, the stock price of the focal organization (Bosch et al., 1998; Gunthorpe, 1997).

The negative effects of stigma transfer through social ties to other stakeholder firms. Even though stakeholder firms may not be directly involved in the negative events, judgments can be contagious on the viability, credibility, and even survival prospects of those firms (Comyns & Franklin-Johnson, 2018; Jonsson et al., 2009). Negative legitimacy spillovers often affect stakeholders because investors and other onlookers of these events may consider these firms to be “painted with the same brush” (Barnett and Hoffman, 2008). Some stakeholders, such as creditors, employees, or customer firms, may seek to defect from the organization so that they do not become stigmatized themselves (Jensen, 2006). For example, when Enron filed for bankruptcy in the midst of its scandal, JP Morgan was thrown into negative light in the press because the bank provided $2.6 billion to Enron (Atlas, 2002). Thus, the tie between the two entities became a heavy liability that threatened the legitimacy, not only of Enron, but JP Morgan as well.

Regulative violation events by perpetrators provide useful information not only about the perpetrators themselves, but also about other firms with whom they have ties, a scenario which is often referred to as “guilt by association” (Suchman, 1995). Because organizations tend to associate with like others in terms of status (Podolny & Phillips, 1996), an alliance can be an effective conduit for one firm to attain status and legitimacy in the market (Gulati & Higgins, 2003). If affiliations with other firms can engender legitimacy and access to important resources for the organization enjoying these ties, an affiliation with a perpetrator firm can similarly lead to a loss of legitimacy when a stigmatizing event occurs to one of the affiliated organizations. In the context of alliances, Norheim-Hansen and Meschi (2020) show that negative reputation spillover can occur to its alliance partners when a firm is accused of environmental misconduct. We therefore expect that events that damage a perpetrator’s regulative legitimacy would affect its alliance partners as the negative performance of the focal firm spills over to firms within the alliance network. Hence,

H1a

The effects of criminal law violations by a firm will negatively spill over to its alliance partners.

H1b

The effects of civil law violations by a firm will negatively spill over to its alliance partners.

H1c

The effects of administrative law violations by a firm will negatively spill over to its alliance partners.

Repair Efforts and Spillover

Legal violations are serious charges and must be dealt with carefully. While the necessity of repairing a firm’s legitimacy is almost a given, not all repair efforts are equal (Cianci et al., 2019) and the effects of repair may differ depending on the nature of regulative violations. Although the effectiveness of repair is a relatively recent research topic (Cianci et al., 2019; Rhee & Hadwick, 2011; Shu & Wong, 2018), most studies have limited their attention to how repair efforts affect the focal firm. For example, Hersel et al. (2019) found that “when a firm dismisses an executive following an instance of fraud…the corrective action may increase its effectiveness in terms of restoring firm legitimacy among investors and producing a favorable stock market reaction.”

This study builds upon those findings and focuses on the indirect effects of repair, i.e., how the focal firm’s repair efforts impact the performance of alliance partners. It is well established that partner legitimacy can spill over from a focal organization to allies, resulting in higher market performance after certain events (Norheim-Hansen, 2015; Stuart et al., 1999). Similarly, following a stigmatizing event, as the perpetrator organization seeks to repair damage from its loss of regulative legitimacy, the effects of those repair activities can spill over, positively impacting the alliance partner’s market performance.

We take a contingency approach in our study to focus on the ease of isolating the stigmatizing event (Norheim-Hansen & Meschi, 2020). Effects of repair efforts may differ due to their underlying mechanisms. When the perpetrator firm can easily dissociate the firm’s processes and structure from the violation by focusing on specific individuals or actions, repair efforts can be more effective, and the spillover effect would consequently be stronger on alliance partners. By contrast, however, when the stigmatizing event reveals systemic issues or flaws in the perpetrator firm, the effects of spillover of repair efforts would be weaker.

Violations of criminal and civil law have different implications for the focal organization than do those of administrative law violations. Violations of criminal law often involve criminal activities of the organization’s individual executives against lower-level employees, e.g., importing illegal immigrants or internal spying. Resolving such violations often involves firing the individuals who committed those crimes, without threatening the fundamental stability or viability of the organization (Suchman, 1995). For example, after an executive of Gen Re, a subsidiary of Berkshire Hathaway, invoked Fifth-Amendment rights during an SEC hearing regarding participation in fraudulent activities, Berkshire Hathaway tried to limit their association with such criminal activities by firing the executive (O’Brien, 2005). These repair efforts can bring clear and immediate resolution of the violation issues, which benefits alliance partners since an important part of their environment can be stabilized. We therefore expect that repair efforts addressing criminal violations would result in positive legitimacy spillover from the focal firm to its alliance partners. Hence,

H2a

Following criminal law violations, repair effects by the focal firm will positively spill over to alliance partners.

Similarly, civil law violations also involve limited, non-systematic issues where the focal firm can easily isolate its processes and structure from the violation. In many cases, civil law violations may involve debt that the perpetrating organization has failed to pay or antitrust charges by competitors. Resolution of civil violations often requires firms to expend financial resources but does not typically require systemic change. Repair efforts following civil law violations often seek to increase transparency while simultaneously demonstrating that the organization is acting to resolve the issues internally. Negative repercussions on alliance partners would be limited since repair efforts by the perpetrating organization would not threaten the stability or appropriateness of the alliance relationship. Thus, repair efforts addressing civil violations would result in positive legitimacy spillover from the focal firm to its alliance partners. Hence,

H2b

Following civil law violations, repair effects by the focal firm will positively spill over to alliance partners.

By contrast, administrative violations represent systematic issues that are often central to the operation of the organization. These violations involve perpetrator firms violating some rules or laws that governmental institutions oversee and, as such, are more difficult to correct or remedy than are civil or criminal violations because they often involve firm-specific routines (Desai, 2011). Routines are repeated patterns of behavior (Nelson & Winter, 1982) and represent a collective, firm-specific understanding of how to conduct business (Desai, 2011). When governmental institutions such the SEC, FTC, or the EEOC announce violations, perpetrator firms may have some routines in place that do not fit with the regulatory environment, such as how they date stock options or how they enforce age limits on employees. While such administrative violations call for some systemic adjustments to internal routines, the latter are often difficult to change due to organizational inertia (Hannan & Freeman, 1984). Massive efforts are often required to change people’s collective understanding of routines. To change old routines, a firm must engage in an organizational search for improvement, which can be costly, time-consuming, and conceptually challenging to corporate management (Desai, 2011). Furthermore, such repair actions can be difficult for outsiders to observe and evaluate. Therefore, due to the depth and scope required to make appropriate adjustments, we expect that administrative violations will be more difficult to remedy than civil and criminal violations.

As the primary audience for such events, investors would feel a higher level of uncertainty that these administrative violations could be successfully resolved in the absence of sufficient scope of repair efforts. For example, in 2006, investigators of administrative violations at UnitedHealth Group concluded that internal controls were “inadequate,” and a senior management team failed to set appropriate guidance from the top. The solution, by the board of UnitedHealth Group, was to replace all directors on its compensation committee within three years, as well as to create new posts for senior executives to oversee ethics and compensation (Dash & Freudenheim, 2006). There was no immediate or one-shot solution (such as firing a single employee) to resolve the issues; rather, this administrative violation required several different and fundamental repair actions that impacted multiple areas of the firm. Thus, for a perpetrator organization, engaging in repair efforts that are too limited in scope will not be sufficient to reduce the negative spillover facing alliance partners, and such negative spillover will be not diminished until repair efforts reach an appropriate level. Thus, we predict a curvilinear (U-shaped) relationship between repair effort and financial performance for an administrative violation, i.e., until a threshold of repair scope has been achieved, negative spillover will not be attenuated. Hence,

H2c

Following administrative law violations, repair effects by the focal firm will have a curvilinear (U-shaped) relationship with the performance of an alliance partner.

Methods

Sample

We collect data for our study in two stages. In the first stage, we create the focal firm sample by identifying perpetrating firms whose organizational misconduct resulted in sanctions that negatively impacted the firm’s performance. We define an “event” as the first time the organization’s misconduct was mentioned in The Wall Street Journal (WSJ), The New York Times (NYT) and/or The Washington Post (TWP) between 1999 and 2009 (Carberry et al., 2018). To avoid duplicate information within the Associated Press news distribution, we choose these media sources, since all three outlets publish original news and information. We select top-performing Fortune 100 firms as these firms are most likely to be of similar reputation and size. Using a two-step process to ensure the accuracy of our sample of events, we first search the designated media sources using a broad set of search terms, then narrow our search to those terms that produce the most accurate results. The final list of search terms includes “investigation,” “violation,” and “lawsuit” (Mishina et al., 2010). Once we identified a list of potentially damaging events, two of this paper’s co-authors read each article and categorized each event as a criminal, administrative, or civil violation. We calculate an inter-rater reliability score at 0.916 for categorizing these events.

Since we are primarily interested in stock market reactions to violating incidents, we use abnormal returns to measure the performance of alliance partners. The selection of these events follows guidelines from prior research. Johnston (2007) suggested that three assumptions must be met to ensure that abnormal returns are valid, i.e., market efficiency, that the event is unanticipated, and that the data are not contaminated by other effects. Accordingly, we attempt to eliminate confounding effects by removing events from the focal firm sample if (1) more than one event overlapped during the estimation and/or event window, or (2) the announcement date could not be clearly identified. If we identify more than one event within a one-year period, we include only the first event (Johnston, 2007). Finally, due to the financial crisis in 2008, we removed three confounding events. This process resulted in a final sample of 29 announcements of organizational misconduct.

In the second stage, we identify the sample of alliance partners, which includes all publicly traded firms that had formed an alliance with the perpetrating firm. Strategic alliances, defined as “voluntary interfirm co-operative arrangements,” take a variety of forms, including (but not limited to) joint ventures, minority equity alliances, R&D contracts, joint R&D, joint production, joint marketing and promotion, enhanced supplier partnership, distribution agreements, and licensing agreements (Das & Teng, 2001; Yoshino & Rangan, 1995). Using the Securities Data Corporation (SDC) Platinum Database, we create a sample of alliance partners by identifying all publicly traded firms that had formed a strategic alliance with the perpetrating firm within ten years prior to the misconduct. We focus on publicly traded organizations since performance measures for private firms were often unavailable. While not all alliance deals may be included, the SDC database is currently among the most comprehensive sources for this type of information (Anand & Khanna, 2000). We confirm each alliance and announcement date using Lexis-Nexis (Rosenkopf et al., 2001) to improve the reliability of our observed sample.

We match our sample with firms listed in the CRSP database to enable us to gather CUSIP numbers, stock-ticker data, and total assets for each firm. Finally, one outlier firm was excluded due to a large number of alliances. Our final sample of alliance partners includes 178 companies in 30 different industries. Table 1 provides a list of events and their categorization.

Analytic Method

To test our hypotheses, we conduct several event studies to identify the abnormal returns for each firm in the sample. We then use a random-effects GLS estimation model to test the ability of our model to predict these abnormal returns. A random-effects model allows for variability among both the intercept and the slope of the regression. Furthermore, the use of this model accommodates data that may be clustered around each event, thereby allowing us to observe the random intercepts needed to mitigate both unobserved heterogeneity and potential heteroscedasticity among alliances and events. This model not only provides a means of estimating event-specific measures of abnormal returns, but also adjusts standard errors to reflect variability in the negative abnormal returns both within and between events.

We employ short-term cumulative abnormal returns (CAR) to analyze abnormal returns both on the day of and the day following the event, and used as the control variable, Focal AR, in the study. We calculate CAR as the sum of the differences between the expected returns of a firm’s stock and the firm’s actual return. By calculating the focal firm’s cumulative abnormal returns, we are able to account for its financial performance prior to the event, as this not only provides the abnormal or unexpected (negative) returns as a result of the event, but also allows us to see the immediate market response to the announcement of an organization’s misconduct. It also confirms that our sample of focal firms is representative of organizational misconduct and stakeholder disapproval.

We calculate long-term, buy-and-hold abnormal returns for each alliance partner 30 days following the event. Buy-and-hold abnormal returns (BHAR) are based on a size and book-to-market matched-firm approach (Barber & Lyon, 1997). BHAR reflects the average return that an investor would earn from holding the stock for a longer time, using compounded interest (Barber & Lyon, 1997). If a firm performs better (worse) than its peer group, then this measure will be positive (negative). One of the main advantages of the BHAR method is that this measurement of performance better resembles investors’ actual investment experience (Barber & Lyon, 1997). Since this is a key element of our study, we choose to employ BHAR but also conduct a robustness check using long-term CAR. When calculating BHAR, we again use equally weighted returns so that results of the analysis are consistent for every firm. We estimate BHAR and CAR for each alliance partner for the month following the event. We employ the traditional t test in the BHAR measure and the patell Z in the CAR measure for long-term analysis. Since the BHAR analysis does not allow us to control for additional factors, we use calculations of abnormal returns as the dependent and control variable in the random-effects model to test our hypotheses.

Independent and Control Variables

Our independent variables include the categorization of the type of regulative violation event, and the repair efforts by the focal (perpetrating) firm to remedy the violation. In general, we categorize events as Administrative when the investigation or lawsuit was led by a federally recognized organization or state department, such as the SEC or the EEOC. We categorize events as Civil when charges were filed by non-regulative agencies, such as employee or stockholder-led class actions lawsuits, or lawsuits generated by competitors, such as antitrust suits. Finally, we categorize violation events as Criminal when charges of illegal behavior were filed against a firm, or individuals within a firm, e.g., criminal investigations for fraudulent behavior.

We then create our independent variable for repair by measuring media reports that described the focal firm’s efforts to repair the firm’s legitimacy. We create Repair as a count variable calculating the total number of “repair” activities within each of the 592 newspaper articles in the New York Times, Wall Street Journal and The Washington Post. We calculate Repair based on information released by the focal firm that described the remedial steps taken to resolve the negative event during the 30-day period following the event. By focusing on the number of unique repair activities, we can capture the scope of the repair. A narrow scope, for example, would involve a single response (e.g., firing the CEO). However, a broader scope would involve multiple ways to address the violations, such as releasing more details, working with inspectors, focusing on the core values of the firm, replacing directors on the board, and/or creating new positions focused on ethics (such as hiring a Chief Ethics Officer). Remediation efforts could also entail discussing the number of ways the company was addressing the issue, such as reevaluating their accounting policies and releasing settlement information related to the event. As the number of repair actions increases, the scope of repair becomes broader.

The media play an important role in shaping social evaluation of corporate behavior (Carberry et al., 2018; Goodstein et al., 2014). Therefore, it was thus necessary to account for effects media tenor and the degree to which the media had emphasized the relationship between the perpetrating firm and alliance partners (alliance visibility). We follow Deephouse (2000) to calculate media tenor. To operationalize alliance visibility, we used Lexis-Nexis to search for all articles, from the inception of the alliance, in which both the focal firm and its alliance partners were mentioned together. We include the logged aggregation of all published articles from the inception of the alliance until the day before the event to capture the cumulative media attention and visibility of the alliance prior to the event (Pollock et al., 2008).

We control for the magnitude of the event via cumulative abnormal returns of the focal firm (AR Focal). It is important to note that this control accounts for the magnitude of the valuation loss for the focal firm and creates a standard baseline for us to measure legitimacy spillover through the alliance network. We control for the historical covariance of stock prices between the focal firm and its alliance partner(s) to rule out any normal trading relationship between shares of both firms, thus controlling for the financial or economic co-dependence between the alliance partners 240 days prior to the event window. We measure relative size as the ratio of the total assets of the focal firm divided by the total assets of the alliance partner (Swaminathan & Moorman, 2009). We include alliance age to rule out both a recency effect for newer alliances and market perceptions of embeddedness due to the length of association. Additionally, since organizational misconduct could contaminate a similar group of peers (Jonsson et al., 2009), we use a dummy variable to control when firms are in a similar industry. Furthermore, since the type of relationship may impact perceptions of involvement and increase (or decrease) negative spillover, we review each alliance relationship and categorize them as either vertical or horizontal and control for alliance type. We also include a control for the media source by including a dummy variable for The Washington Post and The Wall Street Journal.

Finally, to control for the announcement of new or unexpected negative financial information related to the focal firm and the event, we control for instances when new information about the focal firm’s misconduct is released to the media, to ensure that the original event that caused the legitimacy loss was the key factor of our analysis. To calculate this variable, we conduct a Lexis-Nexis search to identify all newspaper articles published during the window following the event in which the focal firm and the event were mentioned. We then analyze the identified articles to discover any additional, new, or unexpected financial ramifications or negative information directly related to the event.

Results

Regarding the alliance partner range, each focal firm had a minimum of one alliance partner and a maximum of 23. The average number of alliance partners per focal firm was 7.10, with a standard deviation of 5.19. Among the 178 alliance partners, 26% were categorized as relating to criminal violations, 22% were related to civil violations, and 52% were associated with administrative violations. Our sample included 10 focal firm industries and 30 alliance partner industries (matched at the 2-digit SIC).

Event Study

We conduct two short-term event studies. The first study focuses on the impact of the event on the focal firm and provides the control variable AR Focal. We use the general Z statistic test to control for outliers, as it tests whether the proportion of positive to negative returns exceeds what is expected from the market model (Johnston, 2007). Both the general sign and Z test statistics should be significant to suggest positive or negative abnormal returns.

We report abnormal returns as occurring on the days surrounding the announcement of the event to find when the event held significance. Abnormal returns (ARs) and cumulative abnormal returns (CAR) are reported for the day of the event (t = 0) and the day following the event (t = + 1). The results indicate that the focal firm experienced an average decline in CAR of − 1.57% following the announcement the organization’s misconduct. Both the general sign (p < 0.05) and patell Z (p < 0.001) were significant.

The second event study examines the impact of legitimacy loss on the alliance partner during the same two-day window. Our results show a devaluation of alliance partners starting on the event day. For the two-day window (t = 0, 1) we find a negative abnormal return significant both with the patell Z score (p < 0.001) and the general Z score (p < 0.05). The average decline in cumulative abnormal returns for the alliance partners is − 0.45%. To further test our findings, we check the robustness of our results by calculating the value-weighted index for both the focal and the alliance partner. Our results remain significant, confirming that alliance partners suffer negative abnormal returns due to their association with the focal firm after the announcement of a perpetrating firm’s regulative legitimacy violation.

Next, we conduct an event study to gather buy-and-hold abnormal returns the month following the event and found significant negative abnormal returns. However, due to the long-term nature and empirical limitations of the BHAR technique, as discussed above, we focus on the results of the GLS models as these provide additional controls that cannot be accounted for with the BHAR technique.

GLS Models

Since firms within our sample are part of specific alliance networks and are influenced by a delegitimizing event in similar ways, they are likely to have correlated standard errors. Therefore, we employ a GLS model to eliminate the expected inefficiencies of utilizing a set of predictors with correlated standard errors. We utilize the random-effects model since the size and impact of the alliance/event clusters vary across different groups (Cameron & Trivedi, 2010).

For all our models, the Wald chi-square test, showing that at least one of the predictors’ regression coefficients is not equal to zero in the model, is significant (p < 0.000). After centering the variables, to test for the presence of multicollinearity, we examine the variance inflation factors and all are within the accepted threshold of 10 (Neter et al., 1985). Table 2 includes the correlation table, including the mean, standard deviation, and minimum and maximum for each variable.

We report the main effects on different legitimacy violations (Hypothesis 1a–c) and interactions (Hypothesis 2a–c) in Table 3, where BHAR represents the average difference in returns between an alliance partner and the market, as a result of the event. Thus, negative BHAR represents an alliance partners’ average diminished value, as a result of the event.

Hypothesis 1 posits that regulative violations would result in negative spillover to alliance partners. In Model 2 of Table 3, we find that 30 days following the event, criminal violations resulted in alliance firm valuation 10.74% below the market (b = − 10.74; p < 0.001). Alliance partners associated with an organization that committed a civil violation faced diminished valuation 7.68% below the market (b = − 7.68; p < 0.001). Administrative violations decreased alliance partner valuation by 6.07% compared to the market (b = − 6.07; p < 0.01). Thus, we find that negative spillover from all three types of regulative violations has significant negative effects on alliance partners’ valuation, supporting Hypothesis 1a–c. Our results indicate diminished valuation from 6.07 to 10.74% below the market. Considering that the market capitalization of firms in our alliance sample ranges from approximately $100 million to $200 billion, such decreases could be equated to a significant loss of shareholder value. Thus, our findings are both statistically and economically significant.

Hypothesis 2 examines the impact of repair on the negative abnormal returns of the alliance partner. We posit that repair efforts by the focal firm would have a positive impact for breach of civil and criminal legitimacy, while administrative violations would have a curvilinear (U-shaped) impact on financial performance. Repair attempts that are narrow in scope negatively impact firm performance; however, as those repair attempts broaden, such attempts have a positive impact.

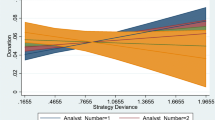

The results in Model 4 support H2a that repair efforts by the focal firm to address criminal violations positively impacts the BHAR of associated firms (b = 6.80; p < 0.01). When the event is based on a civil violation of regulative legitimacy (H2b), repair efforts help to diminish negative spillover, as seen in Model 5 (b = 3.04; p < 0.01). In Model 6, we show a curvilinear impact on alliance partners’ valuation when the focal firm engaged in repair efforts following an administrative violation (H2c) as repair initially has a negative impact on alliance firm performance (b = 11.79; p < 0.001) and becomes positive only when broader repair efforts are initiated (b = 1.69; p < 0.05).

We provide figures that graphically describe the significant interaction effects. Figure 1 demonstrates the interaction effects of criminal law violations on the relationship between repair attempts and alliance partners’ BHAR. When repair is at one, criminal violations are nearly 4% higher than non-criminal activities. When repair attempts increase to four, BHAR increases to nearly 25% higher than non-criminal violations. Results for civil law violations also show the positive impact of repair on firm performance. Figure 2 demonstrates the interaction effects of civil law violations on the relationship between repair attempts and alliance partners’ BHAR. When repair attempts are at one, alliance partners’ BHAR following a civil law violation are more than 10% less than alliance partners’ BHAR following a non-civil law violation. When repair attempts increase past two, we see that the positive impact of repair efforts begins to surpass non-civil law violations, and by four repair attempts, alliance partners’ BHAR following a civil law violation are nearly 6% higher than alliance partners’ BHAR following a non-civil law violation.

Figure 3 shows the U-shaped curvilinear relationship as repair attempts moderate the relationship between administrative law violations and alliance partners’ BHAR, using coefficients from Model 6. All variables in Model 6, except repair attempts, are mean-centered. Initial repair actions following administrative violations decrease firm performance. This follows our assumption that when the scope of repair is narrow, repair actions exacerbate the negative impact on alliance partner following such violations; however, as repair broadens in scope, firm performance improves. Following an administrative law violation, when repair attempts increase from 1 to 3, alliance partners’ BHAR decreases 5% (from just below -5% to -10%). However, as the scope of repair increases, demonstrating multiple forms of repair, performance steadily improves by nearly 15%. This clearly demonstrates that the scope of repair is an important consideration for repair to be effective following administrative violations.

Discussion

This study focuses on legitimacy loss resulting from regulative violations. Using a dataset of alliance partners and stigmatizing events, we show that alliance relationships can act as conduits of negative spillover, i.e., when a perpetrator firm commits a regulative violation, its loss of legitimacy can spill over to alliance partners. Furthermore, we differentiate regulative violations into three types: criminal, civil, and administrative law violations. Our study shows that when the perpetrator firm seeks to repair damage from violations, the effects of repair efforts vary, depending on the specific types of regulative violations.

We make several contributions to the literature. First, our study joins the emerging stream of research that examines alliance relationships as potential conduits of negative spillover (Norheim-Hansen & Meschi, 2020). Much research has examined positive spillover of alliance relationships such as establishing and enhancing the legitimacy of alliance partners (Norheim-Hansen, 2015; Stuart et al., 1999). Recent research, however, has highlighted the other side of interfirm alliances as conduits through which negative spillovers can spread from the focal firm to alliance partners (Laufer & Wang, 2018; Norheim-Hansen & Meschi, 2020). When a perpetrator organization violates laws and such incidents are reported in the media, alliance partners of the perpetrator organization suffer from spillover from such loss of legitimacy, or suffer guilt by association (Suchman, 1995). The audiences for these stigmatizing events, such as investors seeking to avoid negative impacts, react to legitimacy losses that have spilled over to alliance partners and sell their shares, which drives down stock prices of alliance partners.

Second, this study goes beyond current research on loss of legitimacy spillover by exploring contingency effects of different types of violating incidents and the effectiveness of repair attempts (Cianci et al., 2019; Rhee & Hadwick, 2011; Shu & Wong, 2018). We offer contingency explanations regarding how different regulative legitimacy violations (i.e., of administrative, civil, and criminal laws) would have different effects on alliance partners. This distinction among different types of violations centers on the nature of different violating incidents. For example, isolated failures and incidences of misconduct are relatively easy to dismiss (Suchman, 1995), whereas other incidents are more systemic, and legitimacy may become more difficult to rebuild. As the perpetrator organization tries to repair its loss of legitimacy, it would be easier to repair violations of both criminal and civil law as those violations can be resolved with more local actions, often targeting specific individuals or specific amounts of compensation. In contrast, violations of administrative law are more difficult to resolve because they require more systemic solutions and greater repair efforts. Therefore, organizations would benefit from a careful analysis of the nature of regulative violations to understand whether systematic or relatively isolated solutions would be needed to restore legitimacy.

Finally, we add to the literature on organizational stigma by examining the negative effects transmitted to stakeholders through social ties beyond the boundaries of the offending organization as they create indirect negative social and economic consequences. For example, when an organization suffers an event stigma, stakeholders will “cognitively disidentify” not only with the stigmatized organization (Devers et al., 2009) but also with alliance partners and other firms embedded within a network of organizations. When this occurs, we find that investors withdraw financial support from alliance partners, even when innocent, because they are considered guilty by association.

Limitations and Future Research

While our research focuses on the impact of legitimacy loss on alliance partners, the effects of such events can be bi-directional. Future research may explore how the efforts of alliance partners to remedy a loss of legitimacy feed back to the perpetrator firm. It is possible that when some alliance partners seek to clear themselves from the effects of a violation, the information revealed in the process may impact the perpetrator firm in return.

The relationship between alliance partners can be multidimensional in that alliance partners cooperate and compete at the same time: they cooperate within the scope of the alliance but compete beyond the alliance. Future research may thus explore these multidimensional relationships among alliance partners in the context of legitimacy loss. Many alliance partners are competitors in the same industry and their alliance formation can be strategic in the sense that temporary cooperation within the alliance is aimed at enhancing competitive advantage in the long run. Future research may investigate the implications of such multifaceted dyadic relationships on legitimacy linkage and spillover.

Moreover, type of alliance relationship may moderate the negative spillover relationship. While we broadly control for alliance type (vertical or horizontal), we do not examine how different types of alliance relationships (e.g., license, R&D, marketing, distribution) or how the motivation of the alliance (competency-based versus legitimacy-based) impact spillover (Lin & Darnall, 2015). The level of involvement between the two organizations will differ depending on the type of alliance. For example, license agreements may have less spillover than R&D-based alliances since the latter require a high level of cooperation. We suggest that future research further explore these nuances.

More specific information on repair efforts, such as the type of repair activity or the magnitude of the repair, may add further nuances to this research stream. While we do not include a financial measure to assess the magnitude of repair, we believe that our count measure captures the scope of the repair event. Nonetheless, future research may wish to explore how different types of repair efforts impact negative spillover to alliance partners. While we find that alliance partners are themselves susceptible to negative legitimacy transfer, it would be interesting to investigate how far these effects spread through extended alliance networks. In other words, if negative legitimacy is contagious among first-party connections, it may also transfer to second-party connections. Such ripple effects in the network of firm alliances await future research.

Practical Implications

While many studies have focused on identifying the hazards of alliances, these risks are often related to problems associated with partner selection and potential acts of opportunism (Oxley, 1997). By extending the literature on negative legitimacy spillover to alliances, we can show additional hazards of alliances for firms. Our paper demonstrates that other problems can arise from such relationships, even when no malfeasant (or other opportunistic) behavior is directed at an alliance partner. Managing interfirm alliances, therefore, can be more complicated and challenging than previously thought.

Second, this paper has practical implications when an organization is considering repair initiatives following a negative event. Given that exiting alliance relationships is often a difficult process, understanding how organizational ties impact both the focal and alliance firms is especially important following organizational misconduct. When a firm experiences negative legitimacy spillover following a regulative violation, managers would want the focal firm to pursue repair initiatives only if the violation was criminal or civil in nature. If a firm is connected (via an alliance) to an administrative violation, narrow scope repair efforts by the focal firm may cause greater damage to the alliance and managers of partner firms may need to consider more direct actions such as distancing themselves from the perpetrating firm. However, when broad-scope repair efforts are initiated, alliance partners experience positive spillover resulting from repair efforts by the focal firm.

Conclusion

In conclusion, this study builds upon recent research on the negative spillover of interfirm alliances. Specifically, we develop a typology of three types of regulative violations: criminal, civil, and administrative law violations. Our empirical findings show that, when a perpetrator organization violates these laws, its alliance partners will be negatively affected in the stock market. Furthermore, when the perpetrator seeks to repair such legitimacy loss, such repair efforts can spill over to alliance partners, depending on the specific types of violation. Repair efforts on the part of the perpetrator firm in response to criminal and civil law violations can enhance alliance partners’ stock market performance; however, spillovers of repair attempts for administrative law violations can be less straightforward and less helpful to alliance partners.

Change history

27 December 2021

A Correction to this paper has been published: https://doi.org/10.1007/s10551-021-05024-7

References

Anand, B. N., & Khanna, T. (2000). Do firms learn to create value: The case of alliances. Strategic Management Journal, 21(3), 295–315.

Atlas, R. D. (2002). Enron's collapse: The bank; Ties to Enron leave banker in awkward spot. The New York Times, 11 January.

Barber, B. M., & Lyon, J. D. (1997). Detecting long-run abnormal stock returns: The empirical power and specification of test statistics. Journal of Financial Economics, 43(3), 341–372.

Barboza, D. (2001). Tyson Foods indicted in plan to smuggle illegal workers. The New York Times, December, 20.

Bitektine, A. (2011). Toward a theory of social judgments of organizations: The case of legitimacy, reputation, and status. Academy of Management Review, 36(1), 151–179.

Bosch, J. C., Eckard, E. W., & Lee, I. (1998). EPA Enforcement, firm response strategies, and stockholder wealth: An empirical examination. Managerial and Decision Economics, 19(3), 167–177.

Cameron, A. C., & Trivedi, P. K. (2010). Microeconometrics using Stata. Stata Press.

Carberry, E. J., Engelen, P. J., & Van Essen, M. (2018). Which firms get punished for unethical behavior? Explaining variation in stock market reactions to corporate misconduct. Business Ethics Quarterly, 28(2), 119–151.

Cianci, A. M., Clor-Proell, S. M., & Kaplan, S. E. (2019). How do investors respond to restatements? Repairing trust through managerial reputation and the announcement of corrective actions. Journal of Business Ethics, 158(2), 297–312.

Comyns, B., & Franklin-Johnson, E. (2018). Corporate reputation and collective crises: A theoretical development using the case of Rana Plaza. Journal of Business Ethics, 150(1), 159–183.

Das, T. K., & Teng, B. S. (2001). A risk perception model of alliance structuring. Journal of International Management, 7(1), 1–29.

Dash, E., & Freudenheim, M. (2006). Chief executive at health insurer is forced out in options inquiry. The New York Times, 16 October A1.

Davis, K. C. (1975). Administrative Law and Government. St. Paul, MN: West Publishing.

Deephouse, D. L. (2000). Media reputation as a strategic resource: An integration of mass communication and resource-based theories. Journal of Management, 26(6), 1091–1112.

Desai, V. M. (2011). Mass media and massive failures: Determining organizational efforts to defend field legitimacy following crises. Academy of Management Journal, 54(2), 263–278.

Devers, C. E., Dewett, T., Mishina, Y., & Belsito, C. A. (2009). A General Theory of Organizational Stigma. Organization Science, 20(1), 154–171.

Goffman, E. (1963). Stigma: Notes on the management of spoiled identity. Prentice-Hall.

Goodstein, J., Butterfield, K. D., Pfarrer, M. D., & Wicks, A. C. (2014). Guest Editors, introduction individual and organizational reintegration after ethical or legal transgressions: Challenges and opportunities. Business Ethics Quarterly, 24(3), 315–342.

Gulati, R., & Higgins, M. C. (2003). Which ties matter when? The contingent effects of interorganizational partnerships on IPO success. Strategic Management Journal, 24(2), 127–145.

Gunthorpe, D. L. (1997). Business ethics: A quantitative analysis of the impact of unethical behavior by publicly traded corporations. Journal of Business Ethics, 16(5), 537–543.

Hannan, M. T., & Freeman, J. (1984). Structural inertia and organizational change. American Sociological Review, 49, 149–164.

Heatherton, T. F., Kleck, R. E., Hebl, M. R., & Hull, J. G. (2003). The social psychology of stimga. Guliford Press.

Hersel, M. C., Helmuth, C. A., Zorn, M. L., Shropshire, C., & Ridge, J. W. (2019). The corrective actions organizations pursue following misconduct: A review and research agenda. Academy of Management Annals, 13(2), 547–585.

Jensen, M. (2006). Should we stay or should we go? Accountability, Status anxiety, and client defections. Administrative Science Quarterly., 51, 97–128.

Johnston, M. A. (2007). A review of the application of event studies in marketing. Academy of Marketing Science Review, 11(4), 1–31.

Jonsson, S., Greve, H. R., & Fujiware-Greve, T. (2009). Undeserved loss: The spread of legitimacy loss to innocent organizations in response to reported corporate deviance. Administrative Science Quarterly, 54(2), 195–228.

Laufer, D., & Wang, Y. (2018). Guilty by association: The risk of crisis contagion. Business Horizons, 61(2), 173–179.

Lin, H., & Darnall, N. (2015). Strategic alliance formation and structural configuration. Journal of Business Ethics, 127, 549–564. https://doi.org/10.1007/s10551-014-2053-7

Link, B. G., & Phelan, J. C. (2001). Conceptualizing stigma. Annual Review of Sociology, 27(1), 363–385.

Mathis, S. (2009). Former B of A manager gets 6 ½ years in tax office scam. DCist Daily. January 5.

Mishina, Y., Dykes, B. J., Block, E. S., & Pollock, T. G. (2010). Why “good” firms do bad things: The effects of high aspirations, high expectations, and prominence on the incidence of corporate illegality. Academy of Management Journal, 53(4), 701–722.

Moyer, J.W. (2016). Bank of America to pay $13 million to D.C. in settlement of ‘Mother Harriette’ fraud case. The Washington Post. October 25. Public Safety.

Nelson, R. R., & Winter, S. G. (1982). An evolutionary theory of economic change. Belknap Press/Harvard University Press.

Neter, J., Wasserman, W., & Kutner, M. (1985). Applied linear statistical models: Regression. Analysis of Variance, and Experimental Design.

Norheim-Hansen, A. (2015). Are ‘green brides’ more attractive? An empirical examination of how prospective partners’ environmental reputation affects the trust-based mechanism in alliance formation. Journal of Business Ethics, 132(4), 813–830.

Norheim-Hansen, A., & Meschi, P. X. (2020). De-escalate commitment? firm responses to the threat of negative reputation spillovers from alliance partners’ environmental misconduct. Journal of Business Ethics, 1–18.

O'Brien, T. L. (2005). 'Target in S.E.C. investigation identified'. The New York Times, 9 May, C1.

Oxley, J. E. (1997). Appropriability hazards and governance in strategic alliances: A transaction cost approach. Journal of Law, Economics, and Organization, 13, 387–409.

Podolny, J. M., & Phillips, D. J. (1996). The dynamics of organizational status. Ind Corp Change, 5(2), 453–471.

Pollock, T. G., Rindova, V. P., & Maggitti, P. G. (2008). Market watch: Information and availability cascades among the media and investors in the US IPO market. Academy of Management Journal, 51(2), 335–358.

Pozner, J. E. (2008). Stigma and settling up: An integrated approach to the consequences of organizational misconduct for organizational elites. Journal of Business Ethics, 80(1), 141–150.

Rhee, M., & Hadwick, R. (2011). Repairing damages to reputations: A relational and behavioral perspective. In G. Martin, R. J. Burke, & C. L. Cooper (Eds.), Corporate reputation: Managing opportunities and threats (pp. 305–325). Gower Publishing Limited.

Rogowski, R. (1996). Civil law. New York Univ. Press.

Rosenkopf, L., Metiu, A., & George, V. P. (2001). From the bottom up? Technical committee activity and alliance formation. Administrative Science Quarterly, 46(4), 748–772.

Scott, W. R. (1995). Institutions and organizations (2nd ed.). Sage Publications.

Scott, W. R. (2014). Institutions and organizations. Ideas, interests and identities (4th ed.). Sage Publications.

Shu, H., & Wong, S. M. L. (2018). When a sinner does a good deed: the path-dependence of reputation repair. Journal of Management Studies, 55(5), 770–808.

Southall, A. (2009). 17-Year term for official in tax scam. New York Times. June 30.

Stuart, T. E., Hoang, H., & Hybels, R. C. (1999). Interorganizational endorsements and the performance of entrepreneurial ventures. Administrative Science Quarterly, 44(2), 315–349.

Suchman, M. C. (1995). Managing legitimacy: Strategic and institutional approaches. Academy of Management Review, 20(3), 571–610.

Swaminathan, V., & Moorman, C. (2009). Marketing alliances, firm networks, and firm value creation. Journal of Marketing, 73(5), 52–69.

Walsh, M. W. (2003). Johnson & Johnson is sued by rival over sales methods. The New York Times, 8 November.

Williams, G. (1983). Textbook of criminal law. Stevens and Sons.

Yoshino, M., & Rangan, S. (1995). Strategic alliances: An entrepreneurial approach to globalization. Harvard Business School Press.

Zimmerman, A. (2006). Home Depot backdated options from 1981 to 2000. The Wall Street Journal, 7 December.

Zimmerman, M. A., & Zeitz, G. J. (2002). Beyond survival: Achieving new venture growth by building legitimacy. Academy of Management Review, 27, 414–431.

Funding

No funding was received for conducting this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflicts of interest to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original version of this article was revised: Hypothesis H2c was corrected to: Following administrative law violations, repair effects by the focal firm will have a curvilinear (U-shaped) relationship with the performance of an aliance partner.

Rights and permissions

About this article

Cite this article

Galloway, T.L., Miller, D.R. & Liu, K. Guilty by Association: Spillover of Regulative Violations and Repair Efforts to Alliance Partners. J Bus Ethics 182, 805–818 (2023). https://doi.org/10.1007/s10551-021-05006-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-021-05006-9